Abstract

Recently, there has been much talk of impact investing. Around the world, specialized intermediaries have appeared, mainstream financial players and governments have become involved, renowned universities have included impact investing courses in their curriculum, and a myriad of practitioner contributions have been published. Despite all this activity, conceptual clarity remains an issue: The absence of a uniform definition, the interchangeable use of alternative terms and unclear boundaries to related concepts such as socially responsible investment are being criticized. This article aims to contribute to a better understanding of impact investing, which could help foster this specific investment style and guide further academic research. To do so, it investigates a large number of academic and practitioner works, highlighting areas of similarity and inconsistency on three levels: definitional, terminological, and strategic. Our research shows that, on a general level, heterogeneity—especially definitional and strategic—is less pronounced than expected. Yet, our research also reveals critical issues that need to be clarified to advance the field and increase its credibility. First and foremost, this includes the characteristics required of impact investees, notably whether they need to be (social sector) organizations that prioritize their non-financial mission over the business side. Our results indicate that there may be different schools of thoughts concerning this matter.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The term impact investing was coined in 2007, when the Rockefeller Foundation invited leaders in finance, philanthropy, and development to its Bellagio Center in Italy to discuss the need for and means of building a global industry striving for investments with a positive social and environmental impact (Harji and Jackson 2012). Like conventional investing, impact investing involves the provision of financial resources for a financial return (Global Impact Investing Network, or GIIN 2013a; Louche et al. 2012). Yet, the financial return is not the sole objective; impact investing also aims to have social and environmental impact (GIIN 2013a; Louche et al. 2012). As such, impact investing combines philanthropic objectives with mainstream financial decision making. While the explicit goal to yield a financial return differentiates impact investing from grant funding and philanthropy, the explicit focus on some level of non-financial impact delimits it from traditional investments (Addis et al. 2013; Wong 2012).

Although impact investing may be a new term, the concept of using investments to yield social outcomes is not (Nicholls 2010; O’Donohoe et al. 2010). Historic examples include development finance institutions such as the Commonwealth Development Corporation in the UK or the World Bank’s International Finance Corporation, established in 1948 and 1956, respectively (O’Donohoe et al. 2010). Lately, however, efforts to build a formal impact investing market have increased (O’Donohoe et al. 2010; Saltuk 2011). “Disparate and uncoordinated innovation in a range of sectors and regions [has been] converging to create a new global industry” (Freireich and Fulton 2009, p. 11). In a recent survey of 125 international impact investors, the respondents indicated that they were currently managing $46 billion in impact investmentsFootnote 1 (Saltuk et al. 2014). For the European context, the European Sustainable Investment Forum estimates the current European impact investing market to stand at €8.75 billion (Eurosif 2012).Footnote 2 According to Freireich and Fulton (2009), the market could even grow to $500 billion worldwide over the next years, while a report co-authored by J.P. Morgan, the Rockefeller Foundation, and the GIIN estimates the potential for impact investments in five specific sectors serving the so-called Bottom of the Pyramid (BoP) to be in the range of $400 billion to nearly $1 trillion by 2020 (O’Donohoe et al. 2010).

New impact investment funds have been created at an unprecedented rate. In 2011 alone, roughly 60 new funds were established, compared with 44 in 2010 and 20 in 2009 (Clark et al. 2012a). A number of mainstream financial players have been entering the field, launching funds (e.g., Deutsche Bank’s Impact Investment Fund I), engaging as investors (e.g., Goldman Sachs is invested in the Rikers Island Social Impact Bond), or researching the market (especially J.P. Morgan with its Social Finance Research division). An ecosystem has been developing, including investor networks such as the GIIN, reporting standards such as the Impact Reporting and Investment Standards (IRIS), rating agencies such as the Global Impact Investing Ratings System (GIIRS), and searchable online databases of investment products such as ImpactBase. Renowned universities such as Columbia University have launched impact investing initiatives and have included impact investing courses in their curriculum. A myriad of practitioner reports, articles, websites, and so forth are devoted to impact investing; a simple Google search resulted in nearly 650,000 hits at the time of this writing. Impact investing has also attracted increased attention from the public sector: Governments around the world have been actively supporting industry development,Footnote 3 with the UK leading the way (Brown 2012; Brown and Norman 2011).Footnote 4 In June 2013, the UK government hosted a G8 conference on social impact investing in London that was paralleled by the establishment of a taskforce on social impact investment by the G8 (Cohen 2013; Tozzi 2013).

The rise of impact investing is in line with and part of “a broader movement gaining momentum in contemporary market economies, one demanding a more ethical and socially inclusive capitalism” (Dacin et al. 2011, p. 1204). This movement manifests itself, for example, in the emergence and growth of ethical consumerism (Bucic et al. 2012; Carrington et al. 2010; Dacin et al. 2011; Nilsson 2008), the business ethics and corporate social responsibility (CSR) movement (Boulouta and Pitelis 2014; Erhemjamts et al. 2013; Pedersen and Gwozdz 2014; Schwartz 2003), and socially responsible investment (SRI; Michelson et al. 2004; Nilsson 2008; Renneboog et al. 2008; Scholtens and Sievänen 2013; Schwartz 2003). The blending of the social/environmental and economic/financial spheres and the blurring of the for-profit and non-profit sectors is further illustrated by the recent surge in social entrepreneurship activity (Austin et al. 2006; Nicholls 2009) and the increased attention the phenomenon has received from policymakers and academia (Hoogendoorn et al. 2010; Nicholls 2009; Santos 2012; Short et al. 2009; Zahra et al. 2009).

Despite all this interest and activity, a uniform definition of impact investing is reportedly lacking (Eurosif 2012), as is a clear understanding of what the term stands for (Mendell and Barbosa 2013). What is more, there seems to be a lack of clarity at a terminological level. Alternative terms are being used “interchangeably … and sometimes incorrectly” (Harji and Jackson 2012, p. 7). In addition, the boundaries to related concepts, especially (socially) responsible investment, are not clear-cut (Addis et al. 2013). Consequently, the question of what qualifies as an impact investment—particularly with a view to the impact dimension—also remains to be determined (Rockefeller Foundation 2010). In general, any investment can have a positive social impact, yet “some are closer to the action than others” (Bugg-Levine and Emerson 2011, p. 9).

Although this lack of definitional, conceptual, and terminological clarity is explainable—since it is also typical for related, nascent research domains such as social entrepreneurship (Dacin et al. 2011; Hoogendoorn et al. 2010; Short et al. 2009) or SRI (Berry and Junkus 2013; Sandberg et al. 2009)—it is nevertheless problematic. First, a fuzzy concept jeopardizes the credibility of the entire idea, as well as that of associated organizations (Erickson 2011; Rockefeller Foundation 2010) and could lead to so–called “impact washing” (Harji and Jackson 2012, p. 41).

Second, a lack of definitional, conceptual, and terminological clarity may hinder the market growth and broad adoption of impact investing (Clark et al. 2012b; Conway et al. 2012), since it makes it difficult for mainstream investors to understand what it is and form an opinion about it (Sandberg et al. 2009). Knowledge and expertise currently rest with a few experienced actors; to engage a broader audience, new actors must be able to locate themselves along the spectrum of practices and performance goals, which, in turn, will facilitate co-investments and the identification of funding sources for entrepreneurs (Clark et al. 2012b). In addition, without a specific framing of the concept, government actors cannot provide targeted support to build the necessary market ecosystem.

Last, definitional, conceptual, and terminological clarity is also vital for academics. Scientific research requires a clear understanding of a concept and its different components to allow for precise discussions (Leonard 2012; Sandberg et al. 2009). In the absence of definitional and terminological clarity, it is difficult for a concept to gain legitimacy (Short et al. 2009) and for respective theories to be developed. Pfeffer (1993) supports the need for a high level of paradigm development by linking it to a number of outcomes that are important to scholars, including journal acceptance rates, review times, and patterns of citation, as well as resource allocation decisions by external funding agencies and universities. The author further argues that a higher level of consensus allows for more efficient communication and cooperation among researchers. Consequently, conceptual clarity is a key requirement for knowledge development: Paradigmatically developed fields can be expected to attract more and better talent and will tend to develop more quickly and consistently, while there is a risk that underdeveloped fields will remain comparatively underdeveloped (Pfeffer 1993).

Hence, it is not surprising that there have been repeated calls for academic research on impact investing.Footnote 5 Emerson and Spitzer (2007), for instance, note that peer-reviewed contributions by independent academic researchers are rare and would be beneficial. Moore et al. (2012) and Nicholls (2010) confirm that, except in the subfield of microfinance, academic research in impact investing is at a very early stage of development.

This article is a first step to clarifying the prominent concept of impact investing. By analyzing a large number of impact investing understandings by academics and practitioners as they stand today, it is the goal of this research to lay out similarities (i.e., the fundamentals and central elements on which there is general agreement) and inconsistencies on three levels: definitional, terminological, and strategic. Specifically, we identify the core definitional elements around which impact investing is commonly defined and examine how impact investing overlaps with and is delineated from related concepts, notably social investment and SRI. Furthermore, we investigate the range of strategic options that are generally available to impact investors. Our research gives a first indication that there may be different schools of thought concerning the characteristics required of an impact investee.

The remainder of this article is organized as follows. The second section describes the data and methodology. The third section analyzes the impact investing understandings retrieved from the academic and practitioner works, with a view to their definitional, terminological, and strategic similarities and differences. The fourth section provides a critical discussion of the main findings. Section 5 concludes the study, highlighting areas for future research.

Data and Methodology

Data

Given the paucity of academic research and the fact that the impact investing discourse is mainly driven by practitioners, the research at hand draws upon academic as well as practitioner contributions.Footnote 6 The academic contributions were identified through a systematic literature search on the premier research databases ABI/INFORM Complete (ProQuest 2014), EBSCO Business Source Complete (EBSCO 2013), JSTOR (JSTOR 2014), and Web of Knowledge (Thomson Reuters 2013). The search was conducted in June 2013Footnote 7 and included all contributions published before June 1, 2013. No limitations were placed on the year of publication, since impact investing is a nascent field and the term is relatively new. For quality reasons, the review focuses on scholarly (peer-reviewed) journals only. Since the purpose of the literature review is to study the use of the term impact investing, the search term used was impact invest* Footnote 8 in the title, topic/subject headings/subject terms,Footnote 9 and abstract. The different searches were combined and the resulting list was cleaned up manually. Publications without any apparent relationship to the concept of impact investing were excluded from the analysis. To ensure a comprehensive list, the titles listed in the references of the identified academic papers were screened for the search term impact invest*, but no additional peer-reviewed academic contributions were identified. The final sample used for the subsequent analysis consisted of 16 contributions. The analyzed academic contributions are indicated by use of a pound sign in the references.

With regard to the practitioner literature, we chose to use the 140 research reports the GIIN listed in its website’s research section on June 1, 2013.Footnote 10 The GIIN was conceived in the Bellagio meeting that coined the term impact investing (GIIN 2013c) and can be considered the “de facto impact investment industry body, promoting standardized reporting, transparency and advancement of the industry” (Arosio 2011, p. 36). It is a truly global network, with a large number of members covering many sectors and geographies (GIIN 2013b). The publications in its website’s research section comprise third party research as well as GIIN-authored publications. They can be expected to be relevant, varied and of high quality given that the GIIN diligently aggregates research that provides credible information about the impact investing industry from various types of institutions. The analyzed practitioner contributions are indicated by use of an asterisk in the references.

Methodology

Using content analysis, the academic and practitioner contributions were analyzed regarding definitional, terminological, and strategic similarities and differences in the usage of the term impact investing. To that end, the contributions were first screened for paragraphs that described impact investing in general terms so that someone not knowledgeable in the field would understand what impact investing comprises and what it does not. Oftentimes, this description made up a separate section or was provided in a glossary. An inductive open coding procedure along the lines of Mair et al. (2012) was employed to identify recurring definitional core elements. This approach allowed categories to emerge during the content analysis rather than drawing upon pre-defined categories. Despite being iterative, the coding procedure followed three phases. In a first step, the texts were read repeatedly to generate first-order codes. The codes were taken directly from the texts (i.e., in vivo codes). In a second step, these first-order codes were aggregated with conceptually similar ones into increasingly abstract categories, first provisional categories and then final overarching categories. At last, the original data were re-coded based on the resulting categories to ensure that all texts fit the category to which they were assigned. If a text could not be categorized, the coding scheme was amended. We thus combined a bottom-up with a top-down approach. Appendix 1 shows the final coding scheme, including categories, definitions, provisional categories, and first-order codes.

The analysis at the terminological level focused on two terms that proved to be most critical to discuss based on a preliminary analysis of the impact investing descriptions identified: social investment and SRI. We went back to the full texts to examine how these terms are described in relation to and set apart from impact investing. Based on the identified sections, we decided whether the two terms were used as synonyms (i.e., alternative terms being used for impact investing), superordinate concepts (i.e., umbrella terms under which impact investing can be subsumed), subordinate concepts (i.e., sub-forms of impact investing), or related but distinct concepts (i.e., concepts that are similar in nature but not congruent with impact investing) with regard to impact investing. Appendix 2 provides an overview of the resulting classification.

Lastly, heterogeneity at the strategic level was assessed based on a combination of a closed and an open coding scheme. The categories were taken from a framework of Schwartz (cited in Nicholls and Schwartz, forthcoming), which was chosen because it specifically addresses different dimensions of social value creation. We slightly amended the framework to better suit our objectives and acknowledge the fact that impact investing aims not only for social and/or environmental impact but also for a financial return. This resulted in five final categories for the closed coding: demography and geography, organizational processes, sector and impact objective, financial or organizational structure, and asset classes and financial instruments. Using in vivo codes, we coded the general impact investing descriptions already employed for the analysis at the definitional level and assigned the codes to the relevant categories. An open coding scheme was applied that allowed sub-categories to emerge based on the in vivo codes. An overview of the resulting coding scheme can be found in Appendix 3.

Definitional, Terminological, and Strategic Similarities and Differences

This chapter looks for similarities and differences in the impact investing understandings across academic and practitioner contributions. We distinguish heterogeneity at the definitional, terminological, and strategic levels following the framework of Sandberg et al. (2009).Footnote 11

Definitional Level

This section addresses the core definitional elements around which impact investing is commonly defined. Although a number of texts point to the lack of definitional clarity (Arosio 2011; Harji and Jackson 2012), there actually seems to be quite a high level of agreement at a very general level. The predominant approach to defining impact investing centers around two core elements: financial return and some sort of non-financial impact, although the vocabulary varies (see Appendix 1). Naturally, this consent could be the result of sampling bias; it is possible that the GIIN lists only such reports on its website that comply with its understanding of the term impact investing. Moreover, the GIIN was involved in the writing of a number of the analyzed texts. However, this agreement mirrors the observation of Harji and Jackson (2012), who attest to a growing consensus of impact investing understandings in the developed world, especially the United States, UK, Australia, Canada, and the Netherlands. Moreover, it is a logical consequence, given the history of the term impact investing. The term was brought into being and defined in the team effort of a number of players orchestrated by the Rockefeller Foundation. What is more, these definitional core elements can also be identified in a number of academic contributions (e.g., Louche et al. 2012), which follow a different sampling strategy. Last, this agreement at a very general definitional level is consistent with the SRI research of Sandberg et al. (2009), who observe that “although different terms are often used, and academic commentators frequently talk of ‘definitional ambiguities’, there is actually, at least on a general level, a good deal of agreement … when it comes to definitions of … ethical or socially responsible investing” (p. 521).

Regarding the financial dimension, the return of the invested principal appears to be a minimum requirement for an impact investment. This is explicitly mentioned in a number of academic and practitioner texts (e.g., Ashta 2012; Freireich and Fulton 2009). A few practitioner texts expressly note that the demand for a deliberate financial return distinguishes impact investing from grant funding (e.g., Addis et al. 2013) and philanthropy (e.g., Wong 2012). While two practitioner texts define impact investing around adequate, competitive, or reasonable financial returns (Chua et al. 2011; Niggemann and Brägger 2011), in his academic journal article Ashta (2012) associates impact investing with “some low rate of return to cover inflation” (p. 74).Footnote 12 However, the vast majority of academic and practitioner texts either leave the expected level of financial return undefined (e.g., Clark et al. 2012a; Louche et al. 2012) or specifically state that the financial return can range from below-market-rate to market-rate (e.g., Evenett and Richter 2011) or even above-market-rate returns (e.g., Best and Harji 2013). This would depend on the circumstances of the investment (Narain et al. 2012) and the investor’s strategy (Arosio 2011). Despite these differences, the requirement of a financial return (including the mere preservation of the invested principal) appears to be ubiquitous.Footnote 13

As to the debate on the weighting between financial versus non-financial concerns, only a few (academic and practitioner) texts explicitly mention a general priority of a non-financial impact over financial return on the part of the investor (e.g., Europe: SRI 2012; Ruttmann 2012 Footnote 14), comprising a commercial player like the Credit Suisse. The majority of the analyzed impact investing understandings leave this question open or address it by segmenting impact investors into financial first and impact first investors, as suggested by Freireich and Fulton (2009): While the former prioritize the financial return with a floor to the non-financial impact, the latter do the opposite. Alternative terms are used as substitutes for financial first investor, including finance first investor (Dalberg Global Development Advisors 2011).

In terms of non-financial impact, impact investing is typically defined around a social and/or environmental impact in the academic and practitioner literature (e.g., Ashta 2012; Partridge 2010). In some instances, the term social may be defined and interpreted more broadly, also spanning an environmental or even cultural impact (e.g., Hehenberger et al. 2013). A few practitioner texts stand out by explicitly defining impact investing around a cultural (Addis et al. 2013), a developmental (Dalberg Global Development Advisors 2011; Wong 2012), an economic (Dalberg Global Development Advisors 2011), or a governance (Kubzansky et al. 2011) impact, besides a social and/or environmental one. Along the same lines, an academic text by Boerner (2012) describes impact investing as “using the AUM [assets under management] to have a defined impact with consideration of not just risk and return, but also the ESG [(environmental, social, and governance)] effects” (p. 32). The content analysis did not reveal clear criteria for judging the impact hurdle an impact investment needs to pass. This appraisal appears to be largely subjective, to be defined by the individual investor for each individual investment. Current efforts to develop standardized metrics, benchmarks, and ratings may provide more objectivity in the near future, however.

Besides the two core elements of financial return and non-financial impact, two other aspects are noteworthy. First, several academic and practitioner texts stress that the non-financial impact must be intentional (e.g., Addis et al. 2013; Boerner 2012). That is, it cannot be an “incidental side-effect of a commercial deal” (Brown and Swersky 2012, p. 3). Second, the non-financial impact should be measured (O’Donohoe et al. 2010). A number of initiatives, in particular, the GIIN’s IRIS, were formed to help fulfill this requirement and a number of practitioner reports are dedicated to impact measurement (e.g., Best and Harji 2013).

To summarize, impact investing is generally defined around two core elements: financial return and some sort of non-financial impact. The return of the invested principal appears to be a minimum requirement. Generally, however, there are no limitations with regard to the expected level of financial return, that is, whether it must be below, at, or above market rates. With regard to the non-financial impact, impact investing is typically defined around a social and/or environmental impact. In addition, a number of definitions further require that the non-financial return be intentional and measurable or measured, respectively.

Terminological Level

This section addresses terminological heterogeneity, which is “probably the kind that … stands out most to the casual observer” (Sandberg et al. 2009, p. 520). Our analysis focuses on two terms that prove to be most critical to discuss based on a preliminary analysis of the identified impact investing descriptions: social investment and socially responsible investment. The latter concept is addressed using the SRI label in the following. We analyzed the entire contributions to examine how social investment and SRI are described in relation to and set apart from impact investing. Appendix 2 gives an overview of which contributions use these two terms in what regard, that is, as a synonym, a superordinate concept, a subordinate concept, or a related but distinct concept.

Social Investment

Our analysis shows that the term social investment is commonly mentioned as a synonym for impact investment and vice versa. This is true for the academic (Ashta 2012) as well as the practitioner literature (e.g., Martin 2010). At the same time, social investment is also mentioned as both a broader concept (e.g., Laing et al. 2012), of which impact investing is a sub-form or strategy, in practitioner texts, and a narrower concept, where social investment forms a subfield of impact investing, in academic (Ashta 2012) and practitioner (e.g., Hill 2011) texts. Lastly, a practitioner contribution by Imbert and Knoepfel (2011, p. 10) uses the term impact investment to refer to “a collection of terms with related but slightly different meanings”, including social investment.

The group of texts that refers to social investment as a superordinate concept commonly describes it as the broad incorporation of non-financial considerations—including social or environmental ones—into the investment decision-making process, comprising negative and/or positive screening strategies and/or shareholder activism (e.g., Laing et al. 2012; Richter 2011). This is in line with Schueth (2003), who explains that the term social investing is often used as a synonym for SRI.

Confusingly, Laing et al. (2012) introduce two very similar terms, that is, social finance and social enterprise investment, which are synonymous and involve the provision of capital to entrepreneurs or entities working to have a social impact. The authors consider social finance/social enterprise investment one of three common sub-forms of impact investing besides clean tech and microfinance, tying the definition to the investee. Along the same lines, Hill (2011) also thinks of a social (impact) investment—which the author also refers to as social enterprise investment, like Laing et al. (2012)—as a sub-category of impact investing. As Laing et al., Hill (2011, p. 15) defines it as “investments made into social enterprises and social purpose businesses designed for the purpose of creating social impact” and delimits it from other forms of impact investing, such as clean tech microfinance.

Palandjian et al. (2010) mention that social investment would be oftentimes equated with impact first investments, that is, a sub-group of impact investments that prioritizes mission. Similarly, in his academic article Ashta (2012, p. 74) argues that social investors are impact investors who aim for “some low rate of return to cover inflation” rather than “near commercial returns”. In fact, both Hill (2011) and Laing et al. (2012) define social enterprises as organizations that principally reinvest their profits into the business or cause rather than distributing them. As such, social enterprise investments are likely to be associated with below-market-rate financial returns.

In general, usage of the term social investment seems to be more common in Europe (especially in the UK) than in the United States. Out of 10 contributions that use the term in their title (Achleitner et al. 2011; Brown and Swersky 2012; Cabinet Office 2013; Commission on Unclaimed Assets 2007; Hill 2012; Laing et al. 2012; Martin and Ernst 2010; Trelstad 2009 Footnote 15; West 2009; Worthstone 2013), six stem from the UK, in that only UK organizations are affiliated with the contribution (Brown and Swersky 2012; Cabinet Office 2013; Commission on Unclaimed Assets 2007; Hill 2012; West 2009; Worthstone 2013). Only two reports are affiliated with US organizations (Laing et al. 2012; Trelstad 2009). The preference for the term social investment also becomes apparent when looking at some of the key UK institutions in the sector. For instance, Big Society Capital’s (2013, p. 13) vision is to help develop “a vibrant, diverse, well capitalised sustainable social investment market.” Yet, it must be noted that the term impact investing has also found its way into the UK. This can be seen by the fact that contributions by UK organizations also have the term impact investment in their title (e.g., Puttick and Ludlow 2012). Recently, there have been efforts to “bring together social investment, as it is known in the UK, and its global name of impact investing” in the term social impact investment (Evenett and Richter 2011, p. 11). A few reports have adopted this term (e.g., Woelfel et al. 2012).

It is also worth noting that the terms social investment and social finance are sometimes understood to include so-called investments without a financial return expectation, such as grants. Although this claim cannot be supported by our content analysis, it becomes apparent in some of the scholarly work on social investment/social finance cited in the introduction (Moore et al. 2012; Nicholls 2010).

To summarize, social investment is commonly mentioned as a synonym for impact investing. Nevertheless, it is also referred to as a broader concept along the lines of SRI. Moreover, there appears to be a worldview that considers social investment a particular sub-form of impact investing focusing on social enterprises and social purpose businesses or on investments with a higher priority on non-financial impact compared with financial considerations (i.e., impact first impact investments).

SRI

One particular aspect of concern is the boundaries and overlap with the broader and more established field of SRI (see also Addis et al. 2013). On a general level, the impact investing and SRI definitions do not differ dramatically. Sandberg et al. (2009, p. 521) show that SRI is “often defined as the integration of certain nonfinancial concerns, such as ethical, social or environmental, into the investment process.” The United Nations Principles for Responsible Investment defines responsible investment as the “’integration of environmental, social and governance criteria into mainstream investment decision-making and ownership practices’” (Sandberg et al. 2009, p. 522). Yet, there appears to be a bias toward corporate governance aspects (Sandberg et al. 2009), which is certainly not the case for impact investing, as shown in the section on definitional heterogeneity.

Given the similar definitions, one could assume that impact investing is considered an SRI strategy. Surprisingly, however, we only identified one text that expressly refers to impact investing as a type of SRI (Tides 2011). Radjy and Cejnar (2010) only state that impact investing could be considered a type of SRI and, while Hill (2011) acknowledges an overlap with SRI, she points out that for impact investment the “driver of engagement is the impact that an investment can create” (p. 14). Where the boundaries to SRI are addressed, most academic and practitioner texts conclude that impact investing is distinct from SRI (e.g., Dalberg Global Development Advisors 2011; Stanfield 2011) or that impact investing goes beyond SRI (e.g., Freireich and Fulton 2009). A detailed explanation as to why this is the case is sometimes missing, however. When a response is given, SRI is sometimes (primarily) associated with negative screening (e.g., Thornley et al. 2011) or negative screening and shareholder activism (e.g., Palandjian et al. 2010). Although negative screening is the traditional form of SRI (Renneboog et al. 2008; Sandberg et al. 2009) and prevalent in SRI mutual funds (Berry and Junkus 2013), such a distinction misses out on the possibility of positive screening, which is another popular SRI strategy (Michelson et al. 2004; Renneboog et al. 2008).

Some texts do mention positive screening as an SRI strategy (e.g., Evenett and Richter 2011; Fleming 2012). In these texts, impact investing is described as somewhat more proactive and targeted in terms of social objectives. It would require “more than the negative or positive screening of traditional investments” (Evenett and Richter 2011, p. 14) or the alignment of corporate practices with ESG standards (Hill 2011). This is in line with the observation that for impact investees, the delivery of a positive social impact is fundamental to the organization’s existence (Simon and Barmeier 2010) rather than a “corollary of the primary business purpose” (Europe: SRI 2012, p. 76). Although some of the texts acknowledge positive screening as an SRI strategy, they fail to delimit impact investing from sustainability-themed investments, which “inherently contribute to addressing social and/or environmental challenges such as climate change … and health” and are considered an SRI strategy (Eurosif 2012, p. 10).

Another difference cited between SRI and impact investing is “the nature and size” of investments (cKinetics 2012, p. 5). SRI funds would focus on large corporations (Chua et al. 2011), while a typical impact investment structure would target small enterprises (Fleming 2012). Moreover, SRI is argued to be typically associated with investments in publicly traded bonds, stocks, or funds, while impact investing would be generally linked to direct investments using private debt or equity (Conway et al. 2012; Fleming 2012). This view is supported by data: Currently, private equity and debt investments are most common among impact investors (Saltuk et al. 2013). Moreover, the vast majority of impact investors prefer to invest in growth-stage businesses, followed by venture-stage businesses; investments in mature publicly traded companies are rare (Saltuk et al. 2013).

One last difference to delineate impact investing from SRI regards the expected level of financial return (Ashta 2012). While SRI investors would expect “near commercial returns,” impact investors would aim for a low financial return to offset inflation effects according to the academic journal article by Ashta (2012, p. 74). Similarly, the academic contribution Europe: SRI (2012) argues that impact investing prioritizes non-financial impact over financial considerations. In their practitioner contribution, Achleitner et al. (2011) explain that impact investments are typically made in organizations that are not yet deemed commercially attractive. Simon and Barmeier (2010) go a step further in their practitioner contribution and make unattractiveness to commercial investors a qualifying criterion; if commercial capital were not unavailable or at least limited, impact investing would not be required. In principle, the authors state, this lack of attractiveness can be due to two factors: Either the risk of the investment is perceived to be too great (e.g., because it involves a developing country) or the investment will never be able to yield risk-adjusted competitive returns due to the investee’s business model.

To summarize, across the texts analyzed, impact investing is typically seen to be distinct from or to go beyond SRI. The reasons cited include a greater proactiveness of impact investing to solve social and/or environmental challenges (rather than improving corporate practices in terms of ESG criteria), differences in the size and nature of the investments (small versus large investees, investments in publicly listed companies versus direct investments in the form of private debt or equity), as well as differing return expectations and risk–return profiles, respectively.

Strategic Level

In this section, we investigate what strategic options are generally available to impact investors according to the literature. We do so by describing the spectrum of strategic options from which impact investors can principally choose. The analysis is based upon the general impact investing understandings already used for the analysis at the definitional level.

As highlighted above, impact investors invest for some sort of non-financial impact—typically social and/or environmental—as well as some level of financial return. According to Schwartz (cited in Nicholls and Schwartz, forthcoming), “social value creation is best understood in terms of the outputs and impacts of organizational action identified as ‘social’ or ‘environmental’ in terms of normative … assessments of their positive effects across five dimensions”: demography and geography, organizational processes, goods and services produced, sector, and financial or organizational structure. We slightly adapted this framework for our analysis. The dimension of goods and services produced was replaced by impact objective, given that impact investing strategies appear to be mostly defined and discussed around impact objectives and sectors rather than specific goods or services. Since the impact objective is oftentimes closely linked to the sector in which the impact investment is made, both are discussed together.

To acknowledge the fact that impact investing aims not only for non-financial impact but also for a financial return (or at least the preservation of the principal), we include an additional dimension in the analysis. This financial dimension addresses the spectrum of asset classes and financial instruments available to impact investors. A discussion of the financial return expectation was already provided above and will therefore not be part of this section.

Demography and Geography

This first dimension, demography and geography, addresses the end beneficiaries of impact investments and their geographic location (Schwartz cit. in Nicholls and Schwartz, forthcoming). In his practitioner contribution, Arosio (2011) notes that some impact investing definitions would “place the focus on the end beneficiaries, notably people at the bottom of the pyramid (BoP)” (p. 18).Footnote 16 Our analysis gives no indication that impact investments must necessarily focus on poor, marginalized, or vulnerable populations, however. Although it was true that many impact investments would target underserved populations, impact investments aiming for an environmental impact could offer benefits to a broader population according to a report co-authored by J.P.Morgan, the Rockefeller Foundation and the GIIN (O’Donohoe et al. 2010).

Regarding the geographic location of the beneficiaries, a reportedly common view would associate impact investing mainly with investments in developing and emerging markets (Harji and Jackson 2012). Our content analysis does not support such a view. In contrast, a number of practitioner texts explain that impact investing can span geographies (e.g., Addis et al. 2013) or explicitly state that it can also target beneficiaries in the developed world (e.g., Narain et al. 2012). Underserved populations also exist in developed countries (O’Donohoe et al. 2010), such as low-income households, individuals with disabilities, and other minorities, and environmental projects can benefit society at large, independent of a person’s socioeconomic status. On a practical level, however, it is reportedly not uncommon for impact investors to focus on either emerging or developed markets, partly because those markets require different expertise and partly because of personal preferences and values (O’Donohoe et al. 2010).

Lastly, there is debate about whether an investment in a poor area constitutes, by definition, an impact investment (Addis et al. 2013). While this would be a common view in Africa, Asia, and the Americas, Harji and Jackson (2012) claim that such a definition was “unacceptably imprecise.” This is in line with Freireich and Fulton (2009), who make it clear that an investment does not automatically qualify as an impact investment simply because it is made in a poor country. However, it may be easier for an impact investment to pass the required impact hurdle in a developing country or an underdeveloped area, given the magnitude and severity of social and environmental problems and the lack of basic infrastructure, quality jobs, access to capital, and so forth. Bridges Ventures’ Sustainable Growth Funds, for instance, make investments in private, commercially motivated businesses in deprived areas (Brown and Swersky 2012). Some of these investments may not be labeled impact investments if they took place in developed regions.

Organizational Processes

The organizational processes dimension deals with the mechanisms through which value is generated for the beneficiaries and key stakeholders, an example being the work integration of excluded groups (Schwartz, cited in Nicholls and Schwartz, forthcoming). Little is said regarding this dimension in the general impact investing descriptions under analysis. Two practitioner texts mention that social or environmental impact can be delivered by the impact investee through business operations and processes (e.g., the provision of quality jobs to a traditionally underrepresented group or the unemployed or sourcing from BoP suppliers), as well as the marketed products or services (e.g., solar lamps that provide affordable access to light to those without access to electricity; see Dalberg Global Development Advisors 2011; O’Donohoe et al. 2010).

Sector and Impact Objective

Any impact investment is made in a specific sector and is meant to fulfill one or more impact objectives (O’Donohoe et al. 2010). Sometimes the impact objective (e.g., to enhance health) is deeply ingrained in a specific sector (in this case health services; see O’Donohoe et al. 2010). In other cases, the impact objective (e.g., supporting the BoP in earning an income and accruing assets) can be achieved through investments in a number of different sectors (e.g., financial or health services; see O’Donohoe et al. 2010).

Although impact investments are particularly common in certain sectors, the analyzed impact investing descriptions give no indication that impact investing is limited to certain sectors. Instead, several practitioner reports note that impact investing can take place in a wide range of sectors (e.g., Addis et al. 2013). Commonly cited sectors include agriculture, clean tech/energy, education, healthcare, financial services for the poor/microfinance, housing, and water. Similarly, O’Donohoe et al. (2010) cite financial services (i.e., microfinance), clean tech and energy (i.e., renewable energy delivery), housing, and agriculture as more developed impact investing sectors.

Along the same lines, impact investing does not appear to be limited to certain impact objectives but can pursue a wide spectrum of objectives (e.g., Niggemann and Brägger 2011). Broader impact objectives cited that are not directly related to a particular sector include providing access to technology, job creation, and community/international development.

Rubin’s (2009) conceptual work on developmental venture capital makes an interesting distinction between venture capital funds with corrective and additive objectives. According to Rubin’s (2009, p. 336) framework, “funds with corrective objectives are designed to address inadequate access to traditional venture capital by specific geographies and populations,” while “funds with additive objectives are meant to further specific social goals, such as fighting poverty or environmental degradation.” Corrective development venture capital funds thus provide capital to populations and geographies that are not served by traditional venture capital funds; additive developmental venture capital funds, on the other hand, invest in companies that manufacture or distribute socially beneficial products and encourage their investees to employ progressive employee and environmental processes (Rubin 2009). Lastly, developmental venture capital funds that combine additive and corrective objectives invest in enterprises in distressed geographies that simultaneously generate additional social impact, for example, by producing environmentally friendly products (Rubin 2009).

If this framework were transferred to the broader field of impact investing, microfinance investments would qualify as corrective impact investments, in that they provide underserved populations and geographies with capital. Depending on the purposes for which the recipient uses the investment capital, microfinance investments can also have both corrective and additive objectives. Impact investments in clean tech, affordable healthcare, and so forth, on the other hand, would qualify as additive investments or a combination of corrective and additive investments, depending on the availability of alternative capital. This approach could be a meaningful way to specify further impact investing strategies.

Financial or Organizational Structure

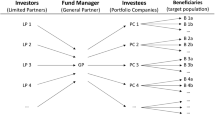

The dimension of financial or organizational structure addresses the financial and organizational structure of the recipients of impact investments. There are different perspectives concerning what characterizes an impact investee and an impact investment, respectively (Dalberg Global Development Advisors 2011). Based on our analysis, we identify three broad groups: The first group does not explicitly mention the recipient of the investment capital when defining and explaining impact investing in general terms and, instead, exclusively refers to the impact investor’s motivation to achieve (social and/or environmental) impact while generating a financial return. The second group does mention the impact investee when defining and explaining impact investing in general terms, but does not place any explicit limitations regarding its organizational or financial structure. It typically refers broadly to businesses or non-enterprise structures that generate social and/or environmental good. The third group provides some more detail around the impact investee and its financial or organizational structure. Within this group, two kinds of specifications can be identified: (1) the explicit requirement of mission primacy or the indication thereof by reference to social enterprises, social-purpose organizations and the like, and (2) a (primary) association of impact investing with private, that is, unlisted, organizations.

As already mentioned, the first group of texts—comprising both academic and practitioner works—does not explicitly mention the recipient of the investment capital when describing and explaining impact investing in general terms. These texts settle for defining impact investing around the investor’s motivation to make an impact (social and/or environmental): for example, “impact investors seek to enhance social benefits or environmental health as well as achieving financial returns” (Mac Cormac and Haney 2012, p. 54) or “investment with the intent to create measurable social or environmental benefit in addition to financial return” (Wood et al. 2012, p. 7).

The second group of academic and practitioner texts describes impact investing by broadly referring to investees that (are designed to) generate (social and/or environmental) impact: for example, “actively placing capital in businesses and funds that generate social and/or environmental good and at least return nominal principal to the investor” (Freireich and Fulton 2009, p. 11) or “impact investing … focuses on investing solely in initiatives, projects or companies that have a clear and direct positive social and environmental impact” (Louche et al. 2012, p. 307). In these definitions, the investee is, inter alia, cited as a business, company, enterprise, organization, fund, project, program, and/or (infrastructure) initiative. Similarly to the first group of texts, these impact investing descriptions remain quite general and leave ample room for interpretation. The intent or capacity to bring about (social and/or environmental) impact seems enough to qualify an organization or other structure (e.g., a project) as an impact investee.

The third group of academic and practitioner texts provides some more detail around the impact investee and its financial or organizational structure. Within this group, one kind of specification is the (explicit or implicit) requirement of mission primacy. Texts refer to either “companies whose primary goal is delivering social and environmental good” (Chua et al. 2011, p. 19) or concepts such as social enterprises, mission-driven organizations, and/or social purpose organizations, which may imply—but, depending on the school of thought, not necessarily— such a mission primacy. In some cases, these concepts are defined and described in more detail as explicitly requiring mission priority (e.g., Asia Pacific 2012; Hornsby 2012). In other cases, besides a quest for (social or environmental) impact, no detailed information is provided on what characterizes such an organization (i.e., the underlying school of thought), especially whether a primacy of mission is required or not. Some academic and practitioner texts explicitly state that the investee can be organized as either not-for-profit or for-profit (e.g., Asia Pacific 2012; Tides 2011). Moreover, some texts mention exemplary—but not conclusively—organizational forms available to investee organizations, including charities, community interest companies (CICs), non-profit organizations, and cooperatives (e.g., Bouri et al. 2011a; Hornsby 2012). Among these texts, a text by the Boston Consulting Group prepared for Big Society Capital (Brown and Swersky 2012) probably provides the most pointed definition. According to them, social investment—for which impact investing is mentioned as a synonym—is conventionally defined around investor motivation and the investee’s organization type. As such, social investments are investments made by socially motivated investors in socially motivated organizations; entirely commercial for-profit enterprises are excluded (Brown and Swersky 2012). According to this view, investees are typically social organizations (e.g., charities, CICs, or community benefit societies) but private companies can also qualify as social investment investees if they have an explicit social purpose and a limit on the profit distribution to shareholders. To summarize, according to Brown and Swersky (2012), organizations qualify as impact/social investment investees only if they place social objectives over profit maximization and surpluses are accordingly primarily reinvested to further the organization’s mission; investees are not restricted to a specific legal form, but must comply with the aforementioned requirements. Worthstone (2013) put forth a few additional requirements for social investment investees, including a commitment to protect the social mission if the business is sold and that the mission be reflected in the governance structure. The absence of constraints regarding the legal structure but the existence of a limited constraint on profit distribution is in line with the UK approach to defining social entrepreneurship (Hoogendoorn et al. 2010). Similarly, Nicholls (2010, p. 73) suggests that, besides other aspects, “a distributive focus on the beneficiary rather than the owner … sometimes legally formalized … in the non-distribution constraint typical of charities … can be used to identify a clear core of social investment.”

The second specification within the third group of texts regards the (primary) association of impact investing with private, that is, unlisted, organizations, which can be found sporadically in the practitioner texts (e.g., Bouri et al. 2011a; Niggemann and Brägger 2011). This is already implied in the section on boundaries to SRI and is briefly discussed in the next section.

Asset Classes and Financial Instruments

In general, there appears to be no limitation regarding the asset classes and financial instruments available for impact investing. A number of practitioner texts explicitly state that impact investing can occur across asset classes (e.g., Addis et al. 2013). Examples of asset classes and financial instruments mentioned include debt, equity, guarantees, and deposits (e.g., O’Donohoe et al. 2010). More innovative structures, such as so-called social impact bonds (SIBs), first launched in the UK, are also cited (e.g., O’Donohoe et al. 2010).

Above, we briefly touched upon whether impact investing is limited to private debt and equity. This view is supported by an impact investing definition by the Rockefeller Foundation cited by Niggemann and Brägger (2011, p. 1), according to which an impact investment is “capital that is placed outside of public equities markets.” Two other practitioner texts relate impact investing (primarily) to private debt or equity (Conway et al. 2012) and venture capital investments (Trelstad 2009), respectively. While it is true that private equity and debt investments are most commonly used for impact investments according to a survey among 99 impact investors, public debt and equity investments do exist (Saltuk et al. 2013). O’Donohoe et al. (2010) expect that, as the market matures, more publicly traded investment opportunities will become available.

Another point of discussion is whether impact investing constitutes an asset class on its own (Addis et al. 2013). In 2010, a groundbreaking report published by J.P. Morgan together with the Rockefeller Foundation and the GIIN postulated that “impact investments are emerging as an alternative asset class” (O’Donohoe et al. 2010, p. 5). The report claims that, although certain impact investments can be classified within traditional investment classes (e.g., debt, equity, and venture capital), they exhibit features that make them different. According to the authors, an asset class must not only be defined by the nature of the underlying assets alone but also “how investment institutions organize themselves around it” (O’Donohoe et al. 2010, p. 5). Impact investing would thus present an asset class on its own, since it calls for different investment and risk management skills and organizational structures, is serviced by industry organizations, associations, and education, and drives the development and use of specialized metrics, benchmarks and/or ratings (O’Donohoe et al. 2010). While a few adopt this view (e.g., Evenett and Richter 2011), others explicitly state that impact investing can span asset classes, as noted above.

To summarize, an impact investor can choose from many strategic options: Impact investing does not appear to be limited to certain demographies or geographies, sectors, or impact objectives, asset classes, or financial instruments. We find that the greatest dissent and lack of clarity appears to surround the characteristics of the impact investee, notably its organizational and financial structure. Interestingly, a number of texts define impact investing without referring to the recipient of the investment capital or remain very vague with regard to what characterizes an impact investee. Our research indicates there may be different worldviews as to whether impact investees should be private, that is, unlisted, organizations and/or need to express a primacy of their mission over the business side.

Discussion

This research aims to clarify the concept of impact investing by assessing the definitional, terminological, and strategic similarities and differences in the field. It provides new insights and contributes to the literature on impact investing in three ways: (1) It highlights the agreement on the fundamentals of impact investing, notably the two definitional core elements of non-financial impact and financial return; (2) it clarifies terminological aspects with regard to synonymous terms, such as social investment, and similar concepts such as SRI; and (3) it illustrates the various strategic options for impact investing described in the analyzed literature. Our work helps focus future academic research, since it can build upon our analysis rather than having to review the extensive body of (practitioner) literature anew, and is directed to the critical aspects of disagreement and confusion that need further elaboration.

As to the definitional aspects of impact investing, the typical definition centers around two core elements: non-financial impact, typically in the form of social and/or environmental impact, and financial return, which requires at least the preservation of the invested principal but can allow for market-beating returns. Some of the definitions further require that the non-financial impact be intentional and/or measurable/being measured. The general primacy of the non-financial impact over the financial return on the part of the impact investor does not seem to be a common requirement. Rather, impact investors may either optimize impact with a floor to financial returns (so-called impact first investors) or vice versa (so-called financial first investors) according to a number of practitioner contributions.

At a terminological level, views differ with regard to the usage of the term social investment and the boundaries and overlap of impact investing and SRI. The term social investment is commonly used as a synonym for impact investing and vice versa. Nevertheless, it is also referred to as a broader concept, along the lines of SRI, as well as a particular sub-form of impact investing focusing on social enterprises and social purpose businesses and/or impact first investments. It appears that the term social investment is more common in Europe (especially in the UK) than in the United States. Recent efforts have been made to bring together the terms impact investing and social investment in the term social impact investing.

Across the academic and practitioner contributions, impact investing is typically considered distinct from or as going beyond SRI. Yet, the explanations for this view remain somewhat incomplete. Some texts provide no detailed explanation at all. Other texts (primarily) limit SRI to negative screening and shareholder advocacy, ignoring the fact that positive screening also constitutes a popular SRI strategy. Where the existence of positive screening as an SRI strategy is acknowledged, impact investing is usually understood to be more targeted in terms of social objectives. While we agree that impact investing goes beyond traditional positive screening approaches where companies need to comply with certain minimum ESG criteria, the texts analyzed fail to delimit impact investing from sustainability-themed investments, which also form part of the SRI field.

Besides a greater proactiveness of impact investing to solve social and/or environmental challenges, two other distinctions from SRI are proposed in the texts: the size and nature of investments and the expected level of financial return. With regard to the former, impact investments are primarily associated with smaller investees and private debt or equity rather than investments in publicly listed companies. Yet, this claim is subject to debate; according to some, this may simply reflect the status quo rather than a necessary requirement. Further research should determine whether impact investors—and other actors in the field—place limits on the size and ownership structure of investees. With regard to expected financial returns, SRI is seen to aim for (near) competitive returns, while impact investors are expected to be willing to relax return expectations for (additional) non-financial impact. The problem with this distinction, however, is that academic research has shown that SRI investors may be willing to accept a lower financial yield in return for investing responsibly (e.g., Barreda-Tarrazona et al. 2011; Glac 2009). One could argue, however, that some (impact first) impact investors deliberately accept no or below-market financial returns from the outset, which should not be the intention of the typical SRI investor (Sparkes 2001). The financial return perception has been shown to be an “important explanatory factor for SR-investment behavior” (Nilsson 2008, p. 320).

With regard to the strategic options available to impact investors, practically anything seems possible. According to the prevailing view, impact investing is not limited to certain demographies, geographies, impact objectives, sectors, asset classes, or financial instruments. Although they oftentimes target underserved populations, impact investments, especially environmental ones, can benefit a broader population. Impact investing is also not limited to developing countries and can occur in the developed world. The impact sought can be generated in a number of sectors (including education, healthcare, housing, and water) through business operations/processes and/or the marketed products and services. A number of impact objectives can be pursued that are either closely linked to a particular sector or that can be achieved in a number of sectors. Although impact investments mainly come in the form of private equity or debt, to date, the general view does not appear to limit impact investing to certain asset classes or financial instruments by definition. We acknowledge, however, that this question may involve different worldviews.

Overall, our results reveal less heterogeneity than expected, especially at the definitional and strategic levels. However, this is primarily due to the broadness of the definitions and the wide range of strategic options. A possible explanation for the broadness of the definitions is that impact investing is a movement driven by practitioners who care more about the ultimate impact than precise definitions. Another explanation could be the fear that “too narrow a definition will limit viable deal flow and make it harder for all but the most socially-focused capital to be deployed” (Rockefeller Foundation 2010, p. 1). Nevertheless, broad definitions and unclear boundaries to related fields can create significant risks to the academic and practical advancement and credibility of the field.

The greatest issues with regard to conceptual clarity relate to the characteristics required of an impact investee, that is, whether impact investing is limited to a certain type of organization (Addis et al. 2013). In this context, an important question is whether impact investees have to be social sector organizations (Addis et al. 2013), that is, organizations that exist primarily to create social rather than economic value (Big Society Capital, n.d.; Center for the Advancement of Social Entrepreneurship 2003) and thus reinvest most of their profits to support their mission (Big Society Capital, n.d.). A few texts explicitly demand the general primacy of the investee’s mission. Interestingly, however, a number of texts define impact investing without referring to the recipient of the investment capital or remain vague with regard to what characterizes an impact investee. The intent or capacity for social impact seems to be a sufficient criterion for many. Based on this definition, however, any global healthcare company that defines its mission as preventing and curing illness in its mission statement and reports on its non-financial impact in its annual report should qualify as an impact investee.

Our research indicates two broad schools of thought: one that limits impact investing to certain organization types—for example, unlisted organizations and/or organizations that place the mission above the business side, potentially legally formalized in a (limited) distribution constraint—and one that ignores organizational characteristics completely and considers only the ultimate impact to be achieved with the investment. According to Brown and Swersky (2012), the latter view would increase the opportunities for social/impact investments and, for example, allow investments to be made in the social projects of entirely commercial companies; however, this would require the rigorous definition of social impact targets from the outset. In the authors’ view, however, an impact investing understanding that is completely detached from objective (organizational) criteria makes it more difficult to identify and label impact investments. The decision of whether a financial product should be considered an impact investment or not—that is, the “standards for social impact” (Clark et al. 2013, p. 38)—is then largely subjective, lacking “empirical value” (Benijts 2010, p. 53). What is deemed social and who is eligible for social help requires normative judgment (Santos 2012). As such, it is not surprising that Eurosif (2012) refers to impact investing as an investment philosophy rather than a distinct investment process. Future research should investigate in more detail whether—and what—organizational requirements are placed on impact investees, whether different schools of thought exist concerning this matter, and what constitutes the motivation of the respective arguments.

Conclusion

To the best of our knowledge, this article provides the first comprehensive and stringent academic review of the prominent concept of impact investing. It is a first attempt toward providing more clarity in the field by investigating understandings of impact investing, highlighting areas of consensus as well as inconsistencies. We show that the definitional and strategic heterogeneity across the analyzed texts is less pronounced than expected. This allows for better communication about impact investing, since, apparently, the essential assumptions on the topic do not diverge significantly. Nevertheless, our research reveals critical issues that need clarification to advance the field and increase its credibility. First and foremost, this includes the characteristics required of an impact investee, notably whether impact investees need to be (social sector) organizations that place primacy on the non-financial mission over the business side. Our research indicates that there may be different schools of thoughts. Future research should investigate in more detail whether and what organizational requirements are placed on impact investees and whether different schools of thought indeed exist. The views may differ depending on the sector (public, private, non-profit) and/or geographic location of the market actors.

At the terminological level, we highlight delimiting aspects as well as overlaps with similar concepts, such as sustainability-themed investments. Further analysis is needed, however, to clearly distinguish the concepts and elaborate on a wider or narrower understanding of the respective investment philosophies.

While our analysis addresses similarities and differences in impact investing understandings at the definitional, terminological, and strategic levels, it left out the practical perspective, including essential challenges such as effective impact assessment and investable business models. Further analyses could thus investigate impact investing practices and related obstacles.

Since the scope of the academic literature on the topic is still very limited, we mainly based our analysis on practitioner reports, compiled by one organization, the GIIN. While this organization constitutes the largest and most influential platform in the field of impact investing at the moment, to consult it as the main source for our review certainly constitutes selection bias. Future research could thus replicate our work using a different set of articles and reports and/or enrich it with primary research in the form of interviews or surveys. The latter could also help investigate whether differences in impact investing understandings do exist across different types of stakeholders and geographies.

Notes

One of the respondents did not provide information on the total assets under management. Accordingly, the $46 billion represent only 124 respondents.

Eurosif (2012) points out that this figure is probably understated due to the fact that not all organizations did respond to their survey or could be included based on other data sources. Eurosif (2012) also stresses the challenges with regard to estimating the size of the (European) impact investing market given that differing views of impact investing do exist and that there are many small independent market players.

See Saltuk (2011) for more information.

In April 2012, the UK government launched Big Society Capital, an independent financial institution with the mission to support the growth of a sustainable social investment market in the UK (Big Society Capital 2013; Brown 2012). Note that the term social investment is used in the UK to refer to impact investing (Evenett and Richter 2011). Big Society Capital has access to up to £600 million (Brown 2012) and provides financing to social investment finance intermediaries, which, in turn, make available affordable capital and support to social sector organizations (Big Society Capital 2013). Moreover, the UK also was the first to introduce an innovative new financing instrument called social impact bond (Warner 2013). Social impact bonds are a type of outcome-based contract where private investors finance social interventions; the investors receive a financial return from the public authorities if the predefined social outcome (e.g., the rehabilitation of offenders) is achieved (Warner 2013).

The following contributions call for more academic research on social capital markets/social finance/social investment rather than impact investing. Although social finance, social investment, and impact investment are commonly used as synonyms (e.g., Evenett and Richter 2011), as used by Moore et al. (2012) and Nicholls (2010) social finance and social investment are not perfectly congruent with impact investing, since they also comprise grants, which is not the case for impact investing as this research shows. Instead, these authors consider impact investing a sub-type of social finance/investment.

We refer to all texts retrieved from the GIIN’s website as practitioner texts—although some of them might have been authored or co-authored by academics—to distinguish them from texts that were published in scholarly (peer-reviewed) journals.

The search on ABI/INFORM Complete and JSTOR was conducted in June 2014.

Using the asterisk as a truncation symbol allows searching for different endings of the word invest, as in the words investment and investing. Given that JSTOR does not allow the use of wildcard characters within an exact phrase search, the search terms used were “impact investing”, “impact investment”, “impact investor”, “impact investors”, and “impact invest”.

JSTOR does not allow searching subject terms.

One report was excluded from the analysis owing to its prohibitive cost.

Sandberg et al. (2009) also mention a fourth level, namely, the practical level, which we excluded from our analysis.

This is in line with the observation that “some believe that impact investments should earn a pure market rate of return while others believe they should earn a so-called muted return” (Asia Pacific 2012, p. 78).

An exception seems to be Hill (2011), who states that the floor for financial returns for an impact investor could be approaching −100 %, as for a grant. At the same time, however, the author describes impact investing using the definition of Freireich and Fulton (2009), which requires at least the return of the invested principal.

Ruttmann et al. (2012, p. 55) acknowledge, however, that impact investors can also “apply different priorities to an impact investment’s expected social return relative to its expected financial return” but this does not mirror the particular Credit Suisse understanding.

Trelstad (2009) uses the term social investor instead of social investment.

However, the author himself works on the basis of a broader definition that does not limit impact investing to the BoP or lower middle-income groups (Arosio 2011).

Abbreviations

- BoP:

-

Bottom of the Pyramid

- CIC:

-

Community Interest Company

- CSR:

-

Corporate social responsibility

- ESG:

-

Environmental, social, and governance

- GIIN:

-

Global Impact Investing Network

- IRIS:

-

Impact Reporting and Investment Standards

- SRI:

-

Socially responsible investment

References

£ The analyzed academic contributions are indicated by use of a pound sign. * The analyzed practitioner contributions are indicated by use of an asterisk

*Abrams, J. (2011). Risky business: An empirical analysis of foreign exchange risk exposure in microfinance. Washington, DC: MFX Solutions.

*Achleitner, A.-K., Spiess-Knafl, W., Heinecke, A., Schöning M., & Noble, A. (2011). Social investment manual: An introduction for social entrepreneurs. Cologny: Schwab Foundation for Social Entrepreneurship.

*Addis, R., McLeod, J., & Raine, A. (2013). Impact—Australia: Investment for social and economic benefit. Canberra: Department of Education, Employment and Workplace Relations.

*Agrawal, A., Ganesh, U., Kulkarni, N. K., Allen, S., & Bhatt, A. (2012). Understanding human resource challenges in the Indian social enterprise sector. Hyderabad: Intellecap.

*Akinola, L. (Ed.). (2010). Special Report: Impact investing. This is Africa.

*Al-Yahya, K., & Airey, J. (2013). Small and medium sized enterprises in MENA: Leveraging growth finance for sustainable development. Reston, VA/New York, NY/London: Heart + Mind Strategies/Citi Foundation/Shell Foundation.

*Annibale, R. (2006). Microfinance: Building domestic markets in developing countries. Insights, (4), 49–50.

*Arabella Advisors. (2012a). Use your investments: Generating impact and returns in Chicago. Chicago, IL: Arabella Advisors.

*Arabella Advisors. (2012b). Use your investments: Generating impact and returns in New York. New York, NY: Arabella Advisors.

*Arabella Advisors. (2012c). Use your investments: Generating impact and returns in San Francisco. San Francisco, CA: Arabella Advisors.

*Arabella Advisors. (2012d). Use your investments: Generating impact and returns in Washington D.C. Washington, DC: Arabella Advisors.

*Arosio, M. (2011). Impact investing in emerging markets. Singapore: Responsible Research.

£Ashta, A. (2012). Co-creation for impact investment in microfinance. Strategic Change, 21(1/2), 71–81.

£Asia Pacific. (2012). Asia Pacific: A new bottom line. International Financial Law Review, 31(10), 78.

Austin, J., Stevenson, H., & Wei-Skillern, J. (2006). Social and commercial entrepreneurship: Same, different, or both? Entrepreneurship Theory and Practice, 30(1), 1–22.

*Bairiganjan, S., Cheung, R., Delio, E. A., Fuente, D., Lall, S., & Singh, S. (2010). Power to the people: Investing in clean energy for the base of the pyramid in India. Chennai/Washington, DC: Centre for Development Finance/World Resources Institute.

Barreda-Tarrazona, I., Matallin-Saez, J. C., & Balaguer-Franch, M. R. (2011). Measuring investors’ socially responsible preferences in mutual funds. Journal of Business Ethics, 103(2), 305–330.

Benijts, T. (2010). A framework for comparing socially responsible investment markets: An analysis of the Dutch and Belgian retail markets. Business Ethics: A European Review, 19(1), 50–63.

Berry, T. C., & Junkus, J. C. (2013). Socially responsible investing: An investor perspective. Journal of Business Ethics, 112(4), 707–720.

*Best, H., & Harji, K. (2013). Guidebook for impact investors: Impact measurement. Toronto, ON: Purpose Capital.

Big Society Capital. (2013). Annual report and financial statements 2012. London: Big Society Capital.

Big Society Capital. (n.d.). Glossary. Retrieved August 19, 2013, from http://www.bigsocietycapital.com/glossary.

*Bleiberg, R., Cacace, A., DeCastro, B., Perkins, A., Sheng Hui Tan, A., Toomer, C., & Wirth, S. (2010). $650 million ain’t what it used to be (A): The Meyer Memorial Trust considers mission related investing. Cambridge, MA: Harvard Kennedy School.

£Boerner, H. (2012). The corporate ESG beauty contest continues: Recent developments in research and analysis. Corporate Finance Review, 17(3), 32–36.

Boulouta, I., & Pitelis, C. N. (2014). Who needs CSR? The impact of corporate social responsibility on national competitiveness. Journal of Business Ethics, 119(3), 349–364.

*Bouri, A. et al. (2011a). Data driven: A performance analysis for the impact investing industry. New York, NY: Global Impact Investing Network (GIIN).

*Bouri, A. et al. (2011b). Impact-based incentive structures: Aligning fund manager compensation with social and environmental performance. New York, NY: Global Impact Investing Network (GIIN).

*Bouri, A. et al. (2011c). Improving livelihoods, removing barriers: Investing for impact in Mtanga farms. New York, NY: Global Impact Investing Network (GIIN).

*Bridges Ventures. (2013). Bridges Ventures ten year report: A decade of investing for impact and sustainable growth. London: Bridges Ventures.

Brown, A. (2012). How governments are harnessing the power of social investment. London: The Boston Consulting Group.

Brown, A., & Norman, W. (2011). Lighting the touchpaper. Growing the market for social investment in England. London: The Boston Consulting Group.

*Brown, A., & Swersky, A. (2012). The first billion: A forecast of social investment demand. London: The Boston Consulting Group, Big Society Capital.