Abstract

Estimating earthquake losses is an important issue for many private and public bodies. As a major stakeholder, insurers need realistic probable maximum loss (PML) values to foresee the possible losses they would face after a major earthquake and also to calculate optimal insurance premiums. Insurers generally use fragility curves to manage their portfolio by calculating overall PML values. There are, however, serious impacts of risk based PML estimation on earthquake insurance rates, and in this respect fragility curves, which represent regional losses rather than individual losses, could lead to suboptimal decisions. In this study, a rapid earthquake loss estimation methodology, which can be used even by the non-experts in earthquake engineering without conducting comprehensive structural analyses, is proposed for single-storey reinforced concrete industrial buildings based on parameters determined after investigating more than 80 industrial building projects in Turkey. 384 analytical structural loss estimation curves were obtained via the non-linear structural performance analysis method proposed in the 2007 Turkish Seismic Design Code. To provide a detailed evaluation of the proposed methodology’s performance, fragility curves representative of the structural types and the design levels of the buildings investigated were also developed. Finally, total insurance premiums corresponding to PML values of the inventory buildings were calculated, using the two aforementioned estimation methods and others previously published, by addressing issues such as reinsurance cost, capital cost and profit. Results reveal considerable differences in PML values and eventually earthquake insurance rates for the buildings investigated between the risk based structural loss estimation method and the existing methods, indicating possibilities for improved portfolio analysis and management tools.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent destructive earthquakes of the last two decades have resulted in considerably high economical losses for industrial buildings designed for the “Life Safety” performance similar to ordinary residential buildings. The insured losses of the 1999 Kocaeli Earthquake and the 2011 Tohoku Earthquake were estimated as 1.5–3.5 billion USD (RMS 2000) and 20–30 billion USD (AIR 2011), respectively. Recent earthquakes have demonstrated that industrial buildings are additionally subject to collateral losses such as fire following earthquakes, sprinkler leakage, hazardous materials release and business interruption. On the other hand, for low-rise industrial facilities, structural damage is still the primary cause for direct and indirect losses in earthquakes.

Site investigations performed after Adana-Ceyhan (1998), Kocaeli (1999) and Düzce (1999) earthquakes have already revealed that seismic performances of precast buildings, which are the predominant structural type for the industrial buildings, are inadequate (Kayhan and Senel 2010a). The issue is even more pressing for the Marmara Region, a highly industrialized area with a very high seismic hazard measured at 2 % annual probability of occurrence of a magnitude 7+ earthquake on the main Marmara Fault (Durukal et al. 2008).

There is a significant concern for insurers about their potential insolvency due to catastrophic risks (Goda and Yoshikawa 2012). Earthquake risk is placed at the top of these catastrophic, so called Nat Cat (Natural Catastrophes) risks. The first study of earthquake insurance in Turkey dates back to 1978 (Deniz and Yucemen 2009) with the consideration of obligatory earthquake insurance feasibility. But only after the 1999 earthquakes could the obligatory insurance system be put into regulation. In 2000, with the formation of the Turkish Catastrophe Insurance Pool (TCIP) earthquake insurance was made compulsory. Although it was a major breakthrough for the Turkish Insurance Sector, the coverage was, and still is, limited to residential buildings and industrial buildings were left out.

In this respect, insurance companies have to use well calibrated loss estimation models to be able to foresee possible losses they could face after a major earthquake and also to calculate the optimal premium. This brings about the need for more realistic earthquake probable maximum loss (PML) values, especially for industrial buildings which constitute a very high portion of the overall portfolio in terms of total values insured. PML can be simply defined as the expected maximum earthquake loss to the building systems in terms of monetary loss, generally expressed in currency or as a percentage of the insured value (Yao 1981). Although the American Society for Testing and Materials (ASTM 2007) has published a Standard Guide for the Estimation of Probable Loss to Buildings from Earthquakes (1999, revised in 2007), currently there is no unequivocally accepted standard for the definition of terms and analysis steps in PML estimation.

PML estimates were initially used by the insurance companies to quantify their risks, especially after the 1925 Santa Barbara Earthquake, at a time insurance coverage against earthquakes was rare and only with considerably high premiums. Historically, the PML is based on a deterministic analysis, using an event on the controlling fault for a site having a magnitude that is not expected to occur more than about once in every 475 years (i.e., 475-year return period). On the way to becoming more systematic, PML estimation studies have received considerable help from structural engineers. One of the first seismic building codes was the by-product of John Freeman’s well known book (Freeman 1932) in which earthquake loss estimation was mentioned possibly for the first time. In the 1980s, two landmark documents were published. Earthquake, Volcanoes, and Tsunamis: An anatomy of Hazards, in which an earthquake PML calculation method was introduced for the first time by Karl Steinbrugge, was published in 1982 (Steinbrugge 1982; Kircher et al. 1997a). The second study, Earthquake Damage Evaluation Data for California by the Applied Technology Council, appeared in 1985. This influential study, commonly called ATC-13 (1985), was developed for estimating earthquake losses using Modified Mercalli Intensity (MMI) based (qualitative) damage probability matrices determined via expert opinions for various building and occupational classes (78 existing facility classes in California including 36 building structure classes; Kircher et al. 1997a). Following ATC-13, FEMA published the first edition of Rapid Visual Screening of Buildings for Potential Seismic Hazards: A Handbook (FEMA 2002) also known as FEMA-154 or ATC-21; the methodology followed therein employed a scoring system based on the damage probability matrices of ATC-13. In 1989, FEMA published the National Academy of Sciences report Estimating Losses from Future Earthquakes, a valuable contribution listing guidelines for conducting loss estimation studies (Whitman et al. 1997). The last major effort to improve vulnerability assessment was undertaken by the National Institute of Building Sciences. The result was HAZUS, a comprehensive loss assessment software program first released in 1997. It was aimed to reduce the uncertainty, especially in the vulnerability assessment, by replacing MMI with objective measures of ground motion such as spectral displacement and spectral acceleration. For this purpose, fragility curves were constructed for each building type by using the capacity spectrum method similar to NEHRP Guidelines for the Seismic Rehabilitation of Buildings and Seismic Evaluation and Retrofit of Concrete Buildings, known as ATC 40 (1996). This approach classifies buildings in terms of their use (occupancy class) and their structural system (building type). Twenty-eight occupancy classes and 36 model building types are defined (FEMA 2001; Kircher et al. 1997b). In 2002, the second edition of FEMA 154 Report, Rapid Visual Screening of Buildings for Potential Seismic Hazards: A Handbook, was published with a new scoring system based on the HAZUS Methodology and fragility curves, replacing the expert-opinion Damage Probability Matrices of ATC-13 (FEMA 2002).

Within the last decade, both private and public efforts have been spent and new organizations, such as Organization for Economic Co-operation and Development (OECD) have been established especially for enhancing public awareness which is the prerequisite for effective catastrophic risk management and disaster risk reduction and also for providing additional protection methods to traditional insurance and reinsurance industry (OECD 2011). Several earthquake loss estimation methodologies and computer programs based on deterministic or probabilistic approaches have also been developed by third party companies. Such efforts are generally tailored to the insurance sector and governmental programs, aiming to bridge the gap between technical engineering evaluations and non-technical decision-makers. Most of these existing models, however, are focused on regional earthquake loss estimation instead of individual structural analysis, and the structural parameter on which the fragility curves are based is generally the load bearing system, without much significant attention being given to other structural parameters that may adversely affect structural performance.

Another important reason to show interest in individual seismic analysis is that design criteria of industrial buildings in Turkey, most of which are precast reinforced concrete, has changed considerably in parallel with modifications in earthquake design codes. As an example, the earthquake load reduction factor was decreased from 5 of the 1998 code to 3 of the existing Turkish Seismic Design Code (2007) (TSDC07).

The aim of this study is to discuss a new analytical methodology which provides fast, easy and reliable earthquake loss estimation for single-storey reinforced concrete industrial buildings, and to assess its impact on earthquake insurance rates derived from such risk based PML assessments. The risk based PML estimation refers to individual seismic performance analysis conducted for each building within the inventory instead of conducting portfolio loss estimation. The structural assessment method used is the non-linear static pushover analysis as per described in TSDC07. The main steps followed in the study can be summarized in Fig. 1.

The results indicate that the proposed methodology is quite sensitive to structural properties and can be used for determining optimal insurance premium rates in order to overcome a potential insolvency.

2 Building inventory analysis

The building inventory used in this study comprises pin-connected precast and cast-in-place reinforced concrete industrial buildings which have reinforced concrete columns with square cross-sections. This inventory was constructed after evaluating the structural projects of more than 80 reinforced concrete industrial buildings in Turkey and interviews with producers of precast structural members to decide on representative structural properties.

2.1 Classification of the reinforced concrete industrial buildings in Turkey

Most of the industrial buildings in Turkey are single-storey precast concrete frame structures or reinforced concrete structures with single columns (precast or cast-in-place) carrying lightweight roof structures because of the short duration of construction period and respectively low investment prices (Karaesmen 2001). There exist comprehensive studies performed after the Adana-Ceyhan (1998), Kocaeli (1999) and Düzce (1999) earthquakes, in which structural properties and seismic performances of such precast buildings were documented (Kayhan and Senel 2010a). On the other hand, structural properties of such buildings built after TSDC07 was published would show significant differences; it is worth mentioning, for example, that the cross-sections of the columns have increased with the new regulations.

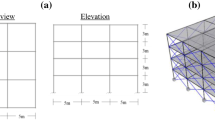

These buildings generally have symmetrical plans and have a few spans in one direction whereas several more in the other. The lateral and vertical loads acting on the frame are carried by the cantilever columns which have rigid joints at the bottom (foundation) and pin connections at the top. Since the roofs (precast roof beams, gutter beams or the steel truss) are connected to the columns with hinge joints, the use of independent frames in structural analyses is generally considered acceptable (Kayhan and Senel 2010a). Details of a typical single-storey reinforced concrete industrial building in Turkey are shown in Fig. 2.

Based on site investigations, interviews and questionnaires, minimum and maximum values of the architectural and structural parameters were determined. According to the data gathered, almost all columns have square cross-sections varying between \(35\times 35\) and \(70\times 70\ \hbox {cm}\) for the precast structures, whereas the dimensions vary between \(50\times 50\) and \(80\times 80\ \hbox {cm}\) for the cast-in-place reinforced concrete structures; column heights vary between 6 m and 12 m for both types of buildings. Span lengths (transverse bay widths) vary between 10 m and 30 m for the precast structures whereas they vary between 10 m and 24 m for the cast-in-place ones. While the longitudinal bay widths of the precast structures vary between 6 m and 12 m, they may increase up to 24 m for the cast-in-place buildings. S 420 steel bars (hot rolled ribbed reinforcement with yield strength \(f_{yk}= f_{ywk} = 420\ \hbox {MPa}\)) are used for both longitudinal and transverse reinforcement. The reinforcement ratio generally varies between 1.6 and 2 % and rarely equals to 3 % for the precast buildings (heavy roof structures) whereas this ratio is generally equal to 1 %, the minimum reinforcement ratio according to the TSDC07, for the cast-in-place, light roof structures. Almost in every column, stirrups have diameters of 8 mm and their spacing is generally 10 cm within the critical regions. Concrete class of C 30 (characteristic compressive strength \(f_{ck} = 30\ \hbox {MPa}\)), with relatively high levels of quality control, is most frequently encountered in the columns. Precast beams and purlins are preferred at the roof in precast structures, whereas steel space truss systems are employed in cast-in-place structures. It was observed that sandwich panels isolated with polyurethane or rockwool are often preferred as roof cover. Based on available data, 24 different column types, with square cross-sections changing between \(35\times \)35 cm and 80\(\times \)80 and three different reinforcement ratios (minimum, moderate, high) have been defined for the analyses. In order to perform earthquake premium calculations, a building inventory composed of 80 single-storey reinforced concrete industrial buildings has been constructed. Figures 3, 4, and 5 are showing the distribution of the inventory buildings in terms of location, seismic zone, and construction year, respectively.

2.2 Building models used in the existing loss estimation methods

Single-storey precast concrete structures are generally represented by a single class of building type in the existing methodologies except for HAZUS (1997) in which two classes exist based on design code level. Table 1 summarizes the building type classes defined in various methodologies to address single-storey reinforced concrete industrial buildings.

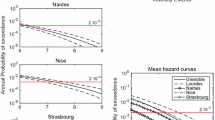

3 Structural loss estimation

As the main objective of this study is to evaluate the impact of risk based PML calculation on earthquake insurance rates, a rapid analytical method for individual building loss estimation under a specific seismic hazard was developed. In order to achieve this, analytical structural loss estimation curves were drawn via the non-linear structural performance analysis method proposed in TSDC07, for all seismic zones and soil classes defined by using two main variables, namely the height of the column and axial load for each cross-section within the building inventory. As the lateral column stiffness depends on the height, axial load and the column height were taken as the main parameters to base the loss estimation curves on. The probability of the seismic hazard was taken as equal to a severe earthquake with a 475 years return period (10 % probability of exceedance in 50 years), which is the commonly accepted risk level for earthquake PML in the insurance sector (Durukal et al. 2006). As an alternative, fragility curves, which have been employed as a tool for loss estimation in various studies (Kircher et al. 1997b; Kayhan and Senel 2010b), were developed, in which structural types and design levels of the buildings were taken explicitly into account.

3.1 Structural models

Making use of the expected behavior due to the pin connections between beams and columns at the roof level, analytical studies were carried out by reducing three-dimensional building models into Single Degree of Freedom (SDOF) systems; this simplification has previously been used by various researches (Kayhan and Senel 2010a). Since the columns within the building inventory have square cross-sections, the loading direction has no effect. Similar SDOF models may be used for both cast-in-place and precast concrete structures since their load bearing systems are similar, with hinge joints at the top and rigid joints at the bottom.

In the idealized models the mass of the structure is lumped at the roof level. The axial load \(W\) on the critical column of the structure includes the weight of the main frame members, such as the roof beam/truss and its covers along with the insulation, and it is determined according to the number of spans and both longitudinal and transverse bay widths.

Column capacity is modeled by a bilinear moment-curvature relationship that takes into account hardening effects for the reinforcement steel. The yield curvature \(\phi _{y}\) of the cross-section was calculated by using yield moment \(M_{y}\) and effective flexural stiffness \({\textit{EI}}_{eff}\) with the following equation:

Effective flexural stiffness for the cracked section was calculated by decreasing the uncracked flexural stiffness (EI) \(_{o}\) as per described in TSDC07. Inelastic behavior of the column is modeled via a plastic hinge, which has a length \(L_{p}\) equal to half of the width of the cross-section in the loading direction; although there exist certain number of studies (Zhao et al. 2011) about the length of plastic hinge region for reinforced concrete columns, the choice employed here is that proposed by TSDC07.

3.2 Structural damage states

In recent seismic events such as the Ceyhan (1998) and the Kocaeli (1999) earthquakes, severe damage was observed in industrial buildings in Turkey, and the large displacements caused by insufficient stiffness of the columns were cited as the main reason for the poor performance (Posada and Wood 2002; Kayhan and Senel 2010a). Based on such observations, the scope of this study has been limited to damage caused by the lateral displacements of columns; this choice, which was previously employed in other studies (Kayhan and Senel 2010a), stems in part from the key performance issues identified based on analytical studies and field observations, and in part from the lack of data on acceleration sensitive data. The methodology discussed below may easily be extended to include other sources of failure once sufficient data is available.

The damage tresholds are classified as Minimum Damage Limit (MN), Safety Limit (SF), and Collapse Limit (CL), based on limit deformations provided in TSDC07 for concrete and steel (Table 2). Strain limits for concrete depend on the volumetric ratio of the confinement reinforcement present at the critical section \((\rho _{sm})\) and the minimum code requirement of this ratio \((\rho _{s})\). The strain limits given in Table 2 were used in the pushover analyses to find the limit displacement values corresponding to different damage threshold for each column cross-section analyzed. These damage thresholds are used to determine the damage states if the structural performance exceeds these limits or not. The damage states are designated as Slight (SDS), Moderate (MDS), Extensive (EDS) and Complete (CS), similar to the classification in HAZUS (1997).

One other important issue related with structural loss estimation is the problem of relating a damage state to monetary loss. A measure used in this context is the replacement cost, often defined as the ratio of the cost of repair to the cost of reconstruction (Durukal et al. 2006). The replacement costs used in this study are taken from the damage probability matrix for reinforced concrete buildings based on empirical observations conducted by Gürpınar et al. (1978) since the central damage ratios are compatible with the real structural earthquake damage ratios observed after 1999 Kocaeli and Düzce Earthquakes (Deniz 2006). Table 3 summarizes the central damage ratios used in various studies.

3.3 Capacity (pushover) analysis

A building capacity curve, also called a pushover curve, is a plot of a building’s lateral load resistance \(F\) as a function of a characteristic lateral displacement \(\Delta \). Pushover curves may generally be idealized as bilinear based on observations of rectangular reinforced concrete cantilever columns subjected to cyclic lateral load tests (Fischinger et al. 2008).

The elastic (yield) displacement \(\Delta _{y}\) and the plastic displacement \(\Delta _{p}\) can be calculated as follows (see also Fig. 6):

The relationship between the plastic curvature capacity \(\phi _{p}\) and the plastic rotation capacity \(\theta _{p}\) is given by

where \(\phi \) is a curvature value beyond the elastic limit.

After finding elastic and plastic displacements, total top displacement, yield lateral load capacity \(V_{y}\) and ultimate lateral load capacity \(V_{u}\) are evaluated using the following equations:

Reinforced concrete columns with high ductility are subject to second-order moments under high axial loads. To take into account these so-called \(\hbox {P}-\Delta \) effects, both the initial bending stiffness \(k\) and the strength must be appropriately reduced. New values of bending stiffness \(k\prime \), yield lateral load capacity \(V_{y}\prime \) and ultimate lateral load capacity \(V_{u}\prime \) may be evaluated as:

where \(f_{s}\) is the equivalent static load (Kwak and Kim 2007). In order to take into account the strength degradation caused by \(\hbox {P}-\Delta \) effects, the ultimate displacement is taken to be the value of the top displacement corresponding to a strength degradation of 20 % (Fig. 7), a value that complies with results of experiments conducted on precast concrete columns (Fischinger et al. 2008).

3.4 Structural performance analysis

The performance point is determined by simply intersecting the line, which has the same slope as the initial tangent of the building capacity curve, with the elastic response spectrum of an earthquake which has 10 % probability of exceedance in 50 years (return period of 475 years) as defined in TSDC07 (Fig. 8).

3.5 Structural parameters investigated

A sensitivity analysis was conducted to determine those parameters which have high impact on seismic performance; these parameters were identified as column cross-section dimensions, longitudinal reinforcement ratio, height of the column, mass (or axial load), seismic zone, and soil type. Although the diameter and the spacing of the stirrups have considerable impact on the seismic performance, it was observed that the spacing of the stirrups was almost the same in all instances and the diameter changed in correlation with the cross-sectional dimensions for the inventory buildings used in this study. The concrete class, which is generally a very important parameter for seismic performance, also played no significant part for the inventory buildings (Eren 2014). Table 4 shows the structural parameters used to calculate PML values in this study.

3.6 Construction of structural loss estimation curves

The initial step in drawing the proposed structural loss estimation curves is to identify the critical mass values which will lead to the top displacements \((\Delta _{Damage})\) corresponding to all three damage thresholds; these values are obtained from the non-linear structural performance analysis method as described in Sect. 3.4. Once the critical value of natural vibration period is found, the corresponding axial load is recorded as the critical weight. For a system of which the natural vibration period \(T\) is longer than the spectrum characteristic period \(T_{S}\), the critical vibration period is calculated as follows:

where \(S_{ae}\) is the elastic spectral acceleration calculated according to TSDC07, and \(\omega \) is the natural frequency.

While calculating the performance point, Equal Displacement Rule was applied for these systems, and the elastic spectral displacement \(S_{de}\) was assumed equal to the inelastic spectral displacement \(S_{di}\). For systems of which the natural vibration period is shorter than the limit vibration period, it was accepted that the inelastic spectral displacement is bigger than the elastic spectral displacement by an amount defined in TSDC07.

These critical mass values were used to draw structural loss estimation curves together with the corresponding column heights after converting these values to the critical weight values (Fig. 9). Using the same procedure, column height-axial load couples were calculated separately for all 24 types of column cross-sections, for 4 different seismic zones and 4 soil classes. As the result, 384 different structural loss estimation curves were obtained (Eren 2014).

The main steps followed during the procedure of constructing structural loss estimation curves are summarized in Fig. 10.

3.7 Drawing fragility curves

Fragility curves are lognormal functions that describe the probability of reaching or exceeding a damage state for a given ground motion indicator as, for example, peak ground acceleration, spectral acceleration \(S_{a}\) or spectral displacement \(S_{d}\), here the spectral displacement is used as the input parameter. These curves take into account the variability and uncertainty associated with the capacity curve properties, damage states and ground shaking (Kircher et al. 1997b).

The fragility curves generally distribute structural damage among Slight, Moderate, Extensive and Complete damage states. For any given spectral displacement, the probability of being in a specific damage state can be calculated as the difference of the exceedance probabilities of successive damage states. The sum of the probabilities corresponding to the various damage states for a given spectral displacement will be 100 % (FEMA 2001).

FEMA (2001) defines the conditional probability of being in, or exceeding, a particular damage state, ds, given the spectral displacement \(S_{d}\) as:

where \(S_{dm,ds}\) is the median value of spectral displacement at which the building reaches the threshold of damage state, \(\hbox {d}s\); \(\beta _{ds}\) is the standard deviation of the natural logarithm of spectral displacement for damage state, ds and \(\Phi \) is the standard normal cumulative distribution function.

In this study, the median spectral displacement values and lognormal standard deviation values for the Minimum Damage Limit, Safety Limit, and Collapse Limit were calculated based on the results obtained via the pushover analyses, as per explained in Sect. 3.3, of all the buildings in the portfolio. Since fragility curves are tailored for the assessment of the damage potential for a given set of buildings instead of precise individual risk assessment, various fragility curves have been produced according to the type of the structure and also the reinforcement level in order to improve their reliability for individual building risk assessment. Table 5 summarizes the structural fragility curve parameters of single-storey reinforced concrete industrial buildings in Turkey for two different design levels, minimum and high-code as per defined in HAZUS (1997) and also for the mixed level which defines all different kinds of reinforcement ratios for the entire building inventory. While ‘’Minimum” design level stands for the cross-sections which have minimum reinforcement ratio (1 %) according to TSDC07, ‘’High-Code” defines the cross-sections which have reinforcement ratios that are higher than the minimum requirement of TSDC07.

While Fig. 11 shows sample fragility curves drawn according to the parameters calculated for the entire portfolio, Figs. 12 and 13 show the diversified fragility curves according to more granular structural information, such as type of the structure and seismic design level.

3.8 Comparison of results obtained using structural loss estimation curves and fragility curves

PML estimation analyses are conducted in order to measure the speed, which means how fast the PML estimation is, and the reliability of the proposed structural loss estimation curves for 4 different industrial buildings which were selected from the building inventory; the properties of these structures are summarized in Table 6. The selected buildings are all in the 1st Seismic Zone (PGA = 0.4 g), with two of them (1 and 2) built on Z3 type soil whereas the other two (3 and 4) are built on Z2 type soil according to TSDC07.

After the axial loads on the critical columns are calculated, structural loss estimation curves specific to the type of the column cross-sections, seismic zone and soil class is used to estimate the structural damage state. This is easily done by finding the intersection point of the curve parameters, height of the column and axial load (Fig. 14). The central damage ratios corresponding to the damage states estimated were accepted as the PML values.

Demonstration of PML estimation for the sample buildings selected by using analytical structural loss estimation curves developed. a Loss estimation curve of the column that has \(60\times 60\) cm cross-section with 1 % reinforcement ratio (E1 Z3), b loss estimation curve of the column that has \(50\times 50\) cm cross-section with 1 % reinforcement ratio (E1 Z2)

In order to use the fragility curves as a PML estimation tool, it is essential to know the average natural vibration period of the buildings since the spectral displacement demand is calculated via this information. Therefore, such fragility curves can be used for PML estimation only if the corresponding natural vibration periods are provided as well. Table 7 shows the average natural vibration periods of the buildings used to draw the aforementioned fragility curves. These values were determined as taking the average of the period values of each building using the cracked section stiffness properties of the columns.

For PML estimation via fragility curves, inelastic spectral displacement demands for each of the selected buildings are calculated using the design spectrum defined in TSDC07 and the periods given in Table 7. Then the exceedance probabilities corresponding to each damage state for each of the given spectral displacements are read from the fragility curves (Fig. 15). For the buildings 1 and 2, which were located in the 1st Seismic Zone and are subject to Z3 Soil Class conditions, the PML values were calculated by using the exceedance probabilities and corresponding damage states as below;

Fragility curves for the single-storey reinforced concrete industrial buildings (at minimum design level) located in the 1st seismic zone and are subject to Z3 soil class conditions. a Single-storey precast concrete (heavy roof) structures, b single-storey reinforced concrete (light roof) structures

For the buildings 3 and 4, which were located in the 1st Seismic Zone and are subject to Z2 Soil Class conditions, the PML values were calculated by using the exceedance probabilities and corresponding damage states similarly (Fig. 16) as below;

3.9 Comparing results with existing loss estimation methods

For comparison purposes, the following methods, which were previously proposed, are employed to calculate the PML values for the four selected buildings:

-

A.

According to John Freeman’s pioneering study of structural loss estimation (Freeman 1932), PML values change between 10 and 20 % for reinforced concrete industrial buildings, with 20 % being the conservative proposal.

-

B.

According to the approach proposed by Karl Steinbrugge (Steinbrugge 1982), PML values of the four selected buildings, all of which would be classified as Class 4C, may be calculated using damage factors as :

$$\begin{aligned} \hbox {PML} = 60\times [1+(-10+5+10)/100] = 63\,\% \end{aligned}$$ -

C.

In FEMA 154, the final score of the sample buildings selected, all of which have base score = 2.4 (PC2) is calculated as 2.0, with the decrease of 0.4 caused by soft soil conditions. This score leads to the PML value of 60 %, which is the limit value for “Complete Damage” state (FEMA 2002).

-

D.

In the ATC-13 Method, loss estimation curves are assumed to follow the beta distribution whose parameters depend on MMI and damage probability matrices, which are themselves determined by expert opinion. In order to draw the loss estimation curves for the selected buildings, first the beta distribution parameters are determined according to the type of the building and the Seismic Zone. As an example, for MMI IX (1st Seismic Zone) and for standard and low-rise precast concrete buildings with facility class 81, the beta distribution parameters are 7.16 and 24.4 (ATC 1985). When the loss estimation curve is drawn by the beta variables, the median value, which is to be accepted as the PML value, is estimated as 22 % (Fig. 17).

To apply the HAZUS Method, which provides an analytic approach to earthquake loss estimation, the first step is to draw the fragility curves using the median and beta variables defined for precast concrete buildings (PC2L, the building type corresponding to the inventory buildings). Then, the inelastic displacement demands for the scenario earthquake (depending on the seismic zone and soil class) are calculated by using the vibration period values defined in the HAZUS Manual (FEMA 2001) for this class of buildings and the design spectrum provided in TSDC07. The exceedance probabilities corresponding to each damage state are read from the fragility curves (Fig. 18). PML values for the selected buildings are finally calculated by using the exceedance probabilities and corresponding damage states as follows:

The results, which are shown in Table 8, show considerable differences among the PML values calculated with the proposed method and other existing loss estimation methods. The damage states of the sample buildings selected can change from ‘’Slight” to ‘’Complete (Collapse)” when the proposed structural loss estimation curves are used. On the other hand, there are no major differences observed in the seismic performances of the selected buildings according to the existing loss estimation methods since their load bearing systems are the same. Another important result of this comparison is that the PML values calculated via the fragility curves drawn based on data from the same inventory buildings, could be significantly different from the ones calculated by using structural loss estimation curves developed.

4 Earthquake insurance rate calculation

As for the other types of the risks, the insurance rates against earthquake risk could be calculated based on the frequency and the severity of the risk. This corresponds to a conditional probability of damage given a range of earthquake hazard levels. The frequency of earthquakes at a site will be the same for all structures. However the severity of damage will change depending on the structural properties of the building. Hence, severity of damage to different building classes should be considered separately (Deniz and Yucemen 2009).

4.1 Estimating earthquake insurance rate of a real portfolio comprising single-storey reinforced concrete industrial buildings

In order to calculate the earthquake insurance premium, the possible amount of loss and the probability of occurrence of the scenario event need to be estimated. Multiplying the seismic hazard (SH) by the structural loss estimate (PML) gives the base rate (BR) (Yucemen 2005; Yucemen et al. 2008; Deniz and Yucemen 2009);

where SH = annual probability of an earthquake occurring at the site.

In this study, SH value is taken as equal to the annual probability of an event with a return period of 475 years, which is the seismic demand considered during the PML estimation studies. It was also assumed that the scenario earthquake follows a homogeneous Poisson process (Faber 2007);

The pure risk premium (PRP) of a property can be calculated by multiplying the base rate (BR) with the building insured value (IV), calculated as the product of the net floor area and the pre-defined reconstruction cost per square meter. For simplicity, the insured values of the buildings analyzed in the scope of this study have been considered as equal to 1,000,000 TL.

Since the pure risk premium reflects only the risk of damage, the total insurance premium (TP) or the commercial insurance premium that will be charged by an insurance company should be determined to allow for recovery of expenses and profit. For this purpose, in classical studies, the PRP is increased by some margin. In the previous studies carried out in Turkey, the corresponding factor was taken as 1.67 (Deniz and Yucemen 2009). However, the insurance rate charged by a company is a function of its capital and demand from the public and also reinsurance rates which are generally controlled by the foreign reinsurance firms and market conditions (Deniz and Yucemen 2009). Moreover, the size of the portfolio comprising buildings of a single class is also an important factor in calculating the risk based earthquake insurance premium. Therefore in this study, the reinsurance cost, capital cost and profit are also included in the premium calculations. The formulation used in calculating the earthquake insurance rate can be summarized as follows;

-

The amount of annual loss (AL) or pure risk premium is calculated for each building by simply multiplying the insured values (IV) and the base rates (BR):

$$\begin{aligned} AL=BR\times IV \end{aligned}$$(13) -

The total annual loss of the portfolio is calculated by adding up annual loss amounts calculated separately for each building.

-

Before calculating the reinsurance cost (RC), a deductible amount \((D)\) was determined. The deductible amount is the limit above which the reinsurance company would be responsible to pay the loss (minus the deductible); it should be kept in mind that there is no need to reinsure if the annual loss is less than the deductible.

-

In order to find out the total reinsurance cost, first the pure reinsurance cost (PRC) is calculated by subtracting annual loss amounts of each risk which are below the annual deductible amounts from the total annual loss:

$$\begin{aligned} PRC=\left\{ {\begin{array}{ll} 0&{}\quad AL\le D\times P_A , \\ \sum \nolimits _{Portfolio} {\left[ {AL-\left( {D\times P_A } \right) } \right] } &{}\quad AL>D\times P_A \\ \end{array}} \right. \end{aligned}$$(14) -

Capital cost (CC) and some profit \((P)\) for the reinsurance company are added to find the total reinsurance cost (TRC):

$$\begin{aligned} TRC=\left[ {{\textit{PRC}}\times \left( {1+{\textit{CCE}}} \right) } \right] \times \left[ {1+P} \right] \end{aligned}$$(15) -

The total reinsurance cost is distributed to each building according to the risk based PML values by also paying attention to the loss amount (if it is smaller or higher than the deductible of 10 % of insured value):

$$\begin{aligned} RC=\left\{ {\begin{array}{ll} 0&{}\quad AL\le D\times P_A , \\ TRC\times \left[ {\frac{AL-\left( {D\times P_A } \right) }{\sum \nolimits _{Portfolio} {\left[ {AL-\left( {D\times P_A } \right) } \right] } }} \right] &{}\quad AL>D\times P_A \\ \end{array}} \right. \end{aligned}$$(16) -

The capital cost (CC) is calculated by loading certain percentage (CCE), namely 10 % in this study, to the annual loss amount of each risk. During these calculations if the annual loss amount is higher than the reinsurance deductible, this time the deductible amount was used as the annual loss amount which will be loaded by the capital cost effect since the loss amount above the deductible would be directly transferred to the reinsurance company:

$$\begin{aligned} {\textit{CC}}=\left\{ {\begin{array}{ll} \left[ {\left( {AL} \right) \times \left( {{\textit{CCE}}} \right) } \right] &{}\quad AL\le D\times P_A, \\ \left[ {\left( {DxP_A } \right) \times \left( {{\textit{CCE}}} \right) } \right] &{}\quad AL>D\times P_A \\ \end{array}} \right. \end{aligned}$$(17) -

Finally, the total premium (TP) is calculated for each building by applying a certain amount of profit \((P)\), namely 10 % in this study, after adding both reinsurance cost and capital cost to the base premium:

$$\begin{aligned} {\textit{TP}}=\left[ {{\textit{PRP}}+RC+CC} \right] \times \left[ {1+P} \right] \end{aligned}$$(18) -

Then, the earthquake insurance rate (EIR) for each building is calculated by simply dividing the total premium by the building insured value. Note that if there exists also accumulation risk in a specific region, special loadings determined by the reinsurance agreements could be made by using the same methodology.

$$\begin{aligned} {\textit{EIR}}=\frac{{\textit{TP}}}{{\textit{IV}}} \end{aligned}$$(19)

Table 9 summarizes sample calculations conducted by using analytical PML estimation tool recently developed to find out the earthquake insurance rates for the portfolio consists of 80 different single-storey reinforced concrete industrial buildings in Turkey.

4.2 Comparing the earthquake insurance rates calculated by using different PML estimation methods

Clearly one of the most important inputs for estimating earthquake insurance rate is the structural loss estimates (PML). In order to analyze the impacts of risk based PML estimation versus portfolio based PML estimation on earthquake insurance rates, the calculations summarized in Sect. 4.1 have been repeated with all other PML estimation methods. The results indicate that the average earthquake insurance rates obtained from the PML estimates by the fragility analyses and the risk based approach are similar but that there is a huge deviation for the individual earthquake insurance premiums of the same buildings. As an example; while the rate of risk based PML estimation is 1.28 \(\permille \) for the risks which are at ‘’Moderate Damage” state, the rates of fragility based PML estimation can change from 0.26 to 2.55 \(\permille \). The rates of the fragility based PML estimation (0.72–2.55 \(\permille \)) for the risks which are at ‘’Complete Damage (Collapse)” state are quite low compared to risk based PML estimation rate \((4.86\,\permille )\). The analysis results of the risk based PML estimation were also compared with Turkish Catastrophe Insurance Pool (TCIP), the compulsory insurance system, which has five tariff zones and also charges different premium rates depending on the construction type (steel, reinforced concrete, masonry and others). The scheme has a deductible of 2 % of the insured value for each property (Deniz and Yucemen 2009). When the results were compared with the maximum possible insurance rate for the reinforced concrete residential buildings (2.20 per 1000 units of insured property) in TCIP (2014), it was determined that the earthquake insurance rates defined in TCIP is very low for the buildings which have ‘’Extensive” and ‘’Complete” damage states according to the risk based loss estimation method, although TCIP was designed only for residential buildings.

Figure 19 shows the comparison of the earthquake insurance rates of the entire portfolio comprising 80 different single-storey reinforced concrete industrial buildings in Turkey calculated by using different PML estimation methods.

Table 10 shows the comparison of the earthquake rates calculated by using the PML values of the results of using different PML estimation methods for the four buildings described in Table 6. Other important parameters, such as total reinsurance costs, the average and total values of PML and earthquake insurance premium of the same building inventory calculated by using all different PML estimation methods are summarized in Table 11.

4.3 A note on expected loss and the base rate

Before closing, it should be emphasized that the BR represents not the expected loss but rather a PML. The calculation of the expected loss requires a convolution of all seismic hazard and the corresponding damage and loss, taking into account also renewal models if and when available. BR calculations considered here, however, take into account a single event and its probability; the scenario earthquake used was assumed to represent the seismic hazard level corresponding to a return period of 475 years. This choice stems from the conventionally accepted definition of the PML as the damage ratio (the ratio of the cost of repairing earthquake damage to the replacement cost of the building) calculated for the seismic hazard level corresponding to a return period of 475 years (Durukal et al. 2006; ASTM 2007). Note that this hazard is also the one used in the Turkish Seismic Design Code (TSDC07) for building design.

The expected loss that would be calculated by summing over all hazard levels could be expected to exceed the BR, both with the Poisson and the renewal models. Although this discrepancy may seem to represent a significant risk for the insurance company, there are various issues to be considered: using a single event clearly implies a risk, but this is a risk the insurer is willing to take. The current practice in the insurance sector does not, and perhaps can not, use the expected loss at its face value, for very high base rates would not be attractive for customers and possibly lead to a small and therefore vulnerable portfolio to begin with. In addition, one should consider the high variability in the hazard estimation itself and also the difficulty in finding a reliable map between hazard, damage and the corresponding monetary loss. In practice, the risk thus faced by the insurance company is partially transferred to the reinsurers by reinsurance and partially to the owners by deductibles. The precise value of the risk, although most probably calculated by the insurance company for assessing expectations, is nevertheless not taken into consideration in calculating the BR which is based on a single scenario event (Yucemen 2005; Yucemen et al. 2008; Deniz and Yucemen 2009). The variability of the hazard as reflected in a renewal model is not addressed directly in the BR either; instead, a Poissonian recurrence is assumed, based on the expectation that the variability would be averaged out in the long run.

A simple partial improvement could be obtained by changing the scenario event for the buildings that are expected to reach the “Complete Damage” state for the 475-year event. In such cases, one could try to determine the event for which the building reaches the “Complete Damage” state for the first time; as the return period of this event may be shorter than 475 years, its annual probability of exceedance would be bigger, leading to a higher BR. Such a modification would better address the risks associated with poor construction.

5 Conclusion

Estimating expected major losses due to a large magnitude earthquake has been a major concern for the insurance sector. Over the last two decades considerable efforts have been spent by the insurers to tackle the problem of how to conduct reliable estimates of future earthquake losses and eventually how to overcome a potential insolvency. Recent destructive earthquakes reiterated the need by the insurance companies to obtain reliable estimates of potential seismic losses not only for having sufficient reserves but also for calculating the right premiums to survive in the competitive market.

In this study, a rapid, analytical earthquake loss estimation (PML) methodology, which can be used even by the ones who are not experts in earthquake engineering, has been developed for single-storey reinforced concrete industrial buildings in order to find out the impact of risk based PML estimation on earthquake insurance rates.

Based on detailed analyses the parameters which affect the seismic performance have been identified as column cross-sectional dimensions, longitudinal and transverse reinforcement, stirrup spacing, column height, axial load, seismic zone, and soil class. For the specific buildings contained in the inventory, the concrete class did not differ significantly to cause any appreciable effect.

Structural loss estimation curves used were drawn based on the structural performance evaluation procedure proposed in TSDC07 and by taking \(\hbox {P}-\Delta \) effects into consideration. In addition, detailed fragility curves were also drawn by considering the structural types and the design levels of the buildings investigated as an alternative PML estimation tool.

The total insurance premiums corresponding to PML values of the inventory buildings for each loss estimation method discussed were calculated by also paying attention to the reinsurance cost, capital cost and the profit that will be charged by the insurance companies.

It was observed that the PML values of the industrial buildings in the inventory varied significantly between the proposed risk based approach and the existing loss estimation methods. This variance had a significant impact on the earthquake insurance rates since these rates are sensitive to structural loss estimates. Similar variances were also obtained between the fragility based and the risk based approaches. Although fragility curves have been employed for different structural classes within the last decade, the use of these curves for individual risk assessment is somewhat controversial since they are tailored to represent the general damageability of a given set of buildings. As such, the earthquake insurance rates calculated by using the PML values obtained via the fragility based and the risk based loss estimates led to significantly different results for the same buildings within the inventory.

Based on the results obtained, the use of risk based PML estimations rather than regional loss estimations including structural fragility curves may be expected to have a significant impact in determining the optimum insurance premium. Such an approach would decrease the risk of a potential insolvency by identifying the particular buildings susceptible to high seismic hazard and increase the ability of the insurer to compete in the market by identifying those buildings susceptible to low seismic hazard by allowing the calculation of optimum insurance premiums in all cases.

References

Air Worldwide (AIR) (2011) Damage survey report, Tohoku, Japan Earthquake, http://www.airworldwide.com/Publications/Presentations/AIR-Surveys-Damage-from-the-Tohoku- Earthquake-and-Tsunami-(Summary-and-Slideshow)

Applied Technology Council (ATC) (1985) Earthquake damage evaluation for California, ATC 13. Redwood City, California

Applied Technology Council (ATC) (1996) Seismic evaluation and retrofit of concrete buildings, ATC 40. Redwood City, California

ASTM (2007) ASTM E2026–07, Standard guide for the estimation of probable loss to buildings from earthquakes, American Society for Testing and Materials, West Conshohocken, Pennsylvania

Bommer J, Spence R, Erdik M, Tabuchi S, Aydinoglu N, Booth E, Del Re D, Peterken O (2002) Development of an earthquake loss model for Turkish catastrophe insurance. J Seismol 6:431–446

DEE-KOERI (2003) Earthquake risk assessment for the Istanbul metropolitan area, Report prepared by Deparment of Earthquake Engineering. Kandilli Observatory and Earthquake Research Institute, Bogazici University Press, Istanbul, Turkey

Deniz A (2006) Estimation of earthquake insurance premium rates based on stochastic methods, MSc Thesis, Middle East Technical University, Ankara, Turkey

Deniz A, Yucemen MS (2009) Assessment of earthquake rates for the Turkish Catastrophe Insurance Pool. Georisk 3(2):67–74

Durukal E, Erdik M, Sesetyan K, Fahjan Y (2006) Building loss estimation for earthquake insurance pricing. In: Proceedings of the 1906 earthquake conference, CD, paper no: 1311, EERI, Oakland

Durukal E, Erdik M, Uçkan E (2008) Earthquake risk to industry in İstanbul and its management. Nat Hazards 44:199–212

Eren C (2014) Rapid loss estimation methodology for single storey reinforced concrete industrial buildings. Techn J Turk Chamb Civ Eng 25(2): 6275–6756 (in Turkish)

Faber MH (2007) Lecture notes: statistics and probability theory, exercises tutorial 7. http://www.ibk.ethz.ch/emeritus/fa/education/ss_statistics/07Statistik/Exercise_tutorial_7_SS07_web.pdf, Swiss Federal Institute of Technology Zurich, EZTH

Federal Emergency Management Agency (FEMA) (2001) HAZUS 99, earthquake loss estimation methodology, technical and user’s manual, Washington, DC

Federal Emergency Management Agency (FEMA) (2002) Rapid visual screening of buildings for potential seismic hazards: a handbook, FEMA 154, 2nd edn. Washington, DC

Fischinger M, Kramar M, Isakovic T (2008) Cyclic response of slender RC columns typical of precast industrial buildings. Earthq Eng 6:519–534

Freeman JR (1932) Earthquake damage and earthquake insurance: studies of a rational basis for earthquake insurance, also studies of engineering data for earthquake-resisting construction. McGraw-Hill, New York

Goda K, Yoshikawa H (2012) Earthquake insurance portfolio analysis of wood-frame houses in south western British Columbia, Canada. Earthq Eng 10:615–643

Gurpinar A, Abali M, Yucemen MS, Yesilcay Y (1978) Feasibility of obligatory earthquake insurance in Turkey, METU/ EERI Report No. 78-05, Ankara (in Turkish)

Karaesmen E (2001) Prefabrication in Turkey: facts and figures. Middle East Technical University, Ankara

Kayhan AH, Senel SM (2010a) Fragility curves for single story precast industrial buildings. Tech J Turk Chamb Civ Eng 21(4): 5161–5184 (in Turkish)

Kayhan AH, Senel SM (2010b) Fragility based damage assessment in existing precast industrial buildings: a case study for Turkey. Struct Eng Mech 34(1): 39–60

Kircher CA, Reitherman RK, Whitman RV, Arnold C (1997a) Estimation of earthquake losses to buildings. Earthq Spectra 13(4):703–720. Earthquake Research Institute, Oakland, California

Kircher CA, Nassar AA, Kustu O, Holmes WT (1997b) Development of building damage functions for earthquake loss estimation. Earthq Spectra 13(4). Earthquake Research Institute, Oakland, California

Kwak H, Kim J (2007) \(\text{ P }-\Delta \) effect of slender RC columns under seismic load. Eng Struct 29:3121–3133

National Institute of Building Science (NIBS), HAZUS (1997) Earthquake loss estimation methodology, HAZUS97: technical manual, report prepared for Federal Emergency Management Agency, Washington, DC

OECD (2011) Risk awareness, capital markets and catastrophic risks, policy issues in insurance, no. 14, OECD Publishing. doi: 10.1787/9789264046603-en

Posada M, Wood SL (2002) Seismic performance of precast industrial buildings in Turkey. In: 7th U.S. national conference on earthquake engineering, Boston

RMS (2000) Event report, Kocaeli, Turkey earthquake. http://www.rms.com/Publications/Turkey_Event.pdf

Steinbrugge KV (1982) Earthquake, volcanoes, and tsunamis: an anatomy of hazards. Skandia America Group, New York

Turkish Catastrophe Insurance Pool (TCIP) (2014) Tariffs and premium. http://www.tcip.gov.tr/zorunlu-deprem-sigortasi-tarife-ve-primler.html

Turkish Seismic Code (TSDC07) (2007) Specifications for structures to be built in seismic areas. Ministry of Public Works and Settlement, Ankara (in Turkish)

Whitman RV, Anagos T, Kricher CA, Lagorio HJ, Lawson RS, Schneider P (1997) Development of a national earthquake loss estimation methodology. Earthq Spectra 13(4). Earthquake Research Institute, Oakland, California

Yao TPJ (1981) Probabilistic methods for the evaluation of seismic damage of existing structures. Purdue University, West Lafayette

Yucemen MS (2005) Probabilistic assessment of earthquake insurance rates for Turkey. Nat Hazards 35:291–313

Yucemen MS, Yilmaz C, Erdik M (2008) Probabilistic assessment of earthquake insurance rates for important structures: application to Gumusova–Gerede motorway. Struct Saf 30:420–435

Zhao X, Wu Y, Leung A, Lam HF (2011) Plastic hinge length in reinforced concrete flexural members, the twelfth east Asia-Pacific conference on structural engineering and construction. Proc Eng 14:1266–1274

Acknowledgments

The authors are grateful to Professor Kutay Orakçal (Boğaziçi University), to Professor Alper İlki (İstanbul Technical University), and to Dr. Cüneyt Tüzün for their valuable contributions. The authors would also like to thank Tarık Tufan who has helped with structural simulations.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Eren, C., Luş, H. A risk based PML estimation method for single-storey reinforced concrete industrial buildings and its impact on earthquake insurance rates. Bull Earthquake Eng 13, 2169–2195 (2015). https://doi.org/10.1007/s10518-014-9712-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10518-014-9712-z