Abstract

It is not uncommon that supply chain partners carry out cooperative advertising in green production involving green and dirty products (i.e., substitute products). Besides the advertising decisions, they need to jointly make many other decisions, such as substitute products’ production quantities, wholesale prices, and retail prices. Practice and literature have shown that manufacturers-retailers’ joint decision-making is of paramount importance yet challenging. This decision-making difficulty is compounded by governments’ carbon tax policies and financial subsidies. To facilitate firms in making decisions, this study examines the joint decision-making mechanism involving local governments’ carbon taxes and subsidies. To overcome the limitations of the relevant literature addressing one product and relatively fewer decisions, we include both dirty and green products and consider diverse decisions, including technology selection, production quantities, wholesale prices, and retail prices for both products. Additionally, we consider the retailers’ advertising investment decisions for both products and the manufacturers’ ratios of advertising investment paid to retailers. Capitalizing on decision interactions, we develop a Stackelberg game-based bilevel optimization model. Caused by the large number of decisions and their interactions, solving the game model analytically is barely possible. Consequently, we propose an algorithm of nested particle swarm optimization (NPSO). We perform numerical examples to show how the game model and the NPSO can help firms make complex joint decisions with many interactions. We also carry out sensitivity analysis based on which managerial insights are drawn.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent several decades, industrial activities have been increasing significantly. As a by-product, more and more carbon dioxide emissions and other greenhouse gas emissions are being released, causing various environmental damages (e.g., droughts, floods). These damages threaten seriously not only the human’s normal life but also economic activities in the whole globe (e.g., logistics and transportation). Consequently, manufacturers worldwide have been making efforts to release less emissions, in attempting to reduce environmental damages and ultimately improve human’s life. Among all, manufacturers carry out green production (Baines et al., 2012; Li et al., 2016). Seeing the positive effects on social image and reputation, environment, and profits, more and more manufacturers regard green production as a strategy to increase their competitive strength and to improve the environment (Seuring, 2013; Serrano-García et al., 2023).

Many governments capitalize on various approaches to stimulate green production. Two approaches, including implementing emission reduction policies and providing manufacturers with financial support, have been well examined in both literature and practice. Regarding emission reduction policies, the carbon tax has been rated as one of the most effective policies (Li et al., 2017; Lin & Jia, 2018; Fremstad & Paul, 2019). It is applied to the carbon emissions released from producing products. In practice, governments determine a tax rate (also called price in the literature) per each unit emission. Accordingly, if manufacturers emit more emissions, they must pay more tax. In terms of financial support, many local or regional governments offer manufacturers subsidies to encourage them to carry out green production (Ma et al., 2021b; Lv et al., 2023). Both the literature and practice have demonstrated the positive effect of governments’ offering subsidies on green production (Bigerna et al., 2019). In general, there are two forms of subsidies, including (i) the one-off subsidy and (ii) a unit subsidy for each green product produced (Li et al., 2021). In the first type, the government pays a manufacturer a lump sum to encourage him to perform green production. In the second type, the government pays a fixed amount for each green product produced. The total amount of subsidy is determined by the production volume of green products.

Even with the subsidies, in practice, many manufacturers invest in green technologies to replace partially, instead of all, their traditional technologies (i.e., dirty technologies) due to the huge investment costs (Huang et al., 2020). In this regard, it is not uncommon that both green and dirty technologies co-exist on shopfloors. With both types of technologies, manufacturers produce green/non-green (or dirty) products using green/dirty technologies. As highlighted in (Shen et al., 2019), even though green products are more environmentally friendly than their dirty counterparts, two kinds of products compete and substitute for each other. Since firms possess both green and dirty technologies, they need to select either one or both in production.

The literature has shown that the technology selection decision is rather challenging (Drake et al., 2016; Fiorello et al., 2023). Several reasons contribute to this decision-making difficulty. First, there are various interactions between technology selection decisions and other operations decisions. Adopting green technologies in production will highly likely demand updated decisions on production quantities of both green and dirty products. Production decision changes, in turn, affect seriously total production costs and further profits. Additionally, because of production quantity changes, manufacturers must re-examine and determine their wholesale prices. Second, adopting or not green technology in production and the corresponding production quantities will affect retailers’ selling prices. The retail price changes, to a large degree, will lead to demand changes. Likewise, the demand changes will affect manufacturers’ green production decisions and production quantity decisions. Third, the carbon tax imposed and subsidies offered are closely related to production quantities of green and dirty products, and thus technology selection decisions. To conclude, in green production, the technology selection decision interacts with many other operations decisions from both manufacturers and retailers. Thus, it should be made jointly with other interacting decisions (Xu et al., 2017a). Such joint decision-making presents itself as a realistic, timely, and challenging issue for manufacturers and retailers (Yi & Li, 2018). This is especially true when governments’ subsidies and carbon tax are involved. Though some research on joint operations decision-making has been published (e.g., Sepehri et al., 2021), more models and solution methodologies, are called for to provide manufacturers with more practical support to select technologies and make many other operations decisions in green production.

In stimulating more demand for green or dirty products, manufacturers and the independent retailers perform cooperative advertising (Aust & Buscher, 2012). Cooperative advertising is the promotional support provided by manufacturers to retailers to induce extra promotional activities (Karray et al., 2022a). In practice, a manufacturer pays a ratio of the advertising expenses incurred by a retailer for promoting the products (Jørgensen & Zaccour, 2014). The popularity of cooperative advertising has dramatically grown over the past few years (Lu et al., 2019). While cooperative advertising indeed induces more demand, it is challenging to determine the retailer’s total advertising investment and the manufacturer’s ratio (Chutani & Sethi, 2012). This is because the ratio affects the manufacturer’s costs and profits through interacting with other decisions, such as technology selection and production quantities. Additionally, it also influences the retailer’s advertising investment and retail price. In fact, our literature review suggests that when making cooperative advertising decisions, the pricing decisions from retailers are often examined jointly. Nevertheless, in the published articles (Bhattacharyya & Sana, 2019), many operations decisions from manufacturers (e.g., adopting or not green technology, production quantities, wholesale prices) are not considered although they also interact with the manufacturer’s ratio of advertising investment to be paid to retailers.

To this end, we explore the joint operations decision-making for manufacturers and retailers. Built on top of the relevant literature (e.g., Hong et al., 2017; Pan et al., 2021), we include a comprehensive list of decisions, including technology selection, production quantities, wholesale prices, retail prices, cooperative advertising investment and the ratios for both green and dirty products. Our earlier work (Ma et al., 2024) is closely related to this study in the sense that it also addresses joint decision-making involving technology selection. Nevertheless, there are differences. In (Ma et al., 2024), green and dirty products have the same wholesale (or retail) price, whilst in this study they have different ones. Moreover, it does not include decisions on cooperative advertising. To summarize, fewer decisions were considered in (Ma et al., 2024). In this regard, this study might be the first one examining jointly such a comprehensive list of interacting decisions from manufacturers and retailers. We expect that our results can provide realistic decision-making support to firms.

The Stackelberg game theory is very powerful for describing interactive decision-making (Yang et al., 2015; Ferrara et al., 2017; Pakseresht et al., 2020; Sardar & Sarkar, 2020). We, therefore, apply it to examine the joint operations decision-making by developing a game model in this study. In line with the large number of interacting decisions, the game model developed is bilevel in nature and very complicated. Because of the complexity, it cannot be solved analytically. In literature, particle swarm optimization (PSO) has been recognized as a powerful technique for solving bilevel models in diverse problem contexts (Wan et al., 2013; Zhang et al., 2017). Thus, we adopt PSO by developing a specific nested PSO (NPSO) to solve our game model in this study. Moreover, we conduct numerical analysis to showcase how the game model and the NPSO are applied. Finally, we conduct an analysis to evaluate the impacts of several parameters on both profits and values of decision variables. With the analysis results, we further derive managerial insights.

We review the relevant literature in Sect. 2 and describe the problem context and notation in Sect. 3. Sect. 4 presents the Stackelberg game-based model and Sect. 5 the NPSO. In Sect. 6, we discuss numerical examples and sensitivity analysis. We end the paper in Sect. 7 by outlining the potential avenues for future research.

2 Related work

In accordance with the critical role of decision interactions, joint operations decision-making has been attracting lasting interest from both academics and practitioners. Authors have extensively examined it by involving various decisions in diverse contexts. Below we review the relevant literature on joint decision-making involving green production decisions, pricing, and/or cooperative advertising.

In literature, researchers have delved into diverse concerns about production technology selection. For example, Ma et al. (2021b) examined the mechanisms of rewards and punishments with a focus on the selection of green technologies. Some other researchers, such as Gong and Zhou (2013) and Hong et al. (2016, 2017), studied the conditions for selecting green technologies. Some addressed technology selection in different cases (Chen et al., 2016) or considered environmentally friendly consumption choices (Pan et al., 2021). Additionally, authors studied joint decisions related to green production and other operational aspects. In (Nouira et al., 2014), the authors concurrently made selections of technologies and raw materials in a production system. With the results, they found that product greenness seriously affects technology selection. Bhattacharyya and Sana (2019) simultaneously optimized multiple decisions, such as selecting green technology, allocating start-up capital, and determining service levels in a production network. Likewise, Sepehri et al. (2021) aimed to identify multiple decision variables, including technology selection and production process duration, in a manufacturing network. To summarize, recognizing its significance, we also address technology selection jointly with other operations decisions.

To increase market share and capture sales in today’s competitive marketplace, firms must compete with pricing (Rasti-Barzoki & Moon, 2020). In view of its importance, authors have explored pricing in different contexts. Hua et al. (2011) adopted the classic economic order quantity model to optimize a retailer’s order lot size and retail price. Xu et al. (2016) derived the optimal production volumes and prices of several products considering carbon tax policies. In a related study, Xu et al. (2017b) determined the manufacturer’s wholesale prices and production volumes and the retailer’s order quantities. Su et al. (2012) applied a nonlinear mathematical model to optimize product price and quality level.

Considering the interactions between supply chain partners, some authors addressed the manufacturer’s wholesale price and emission reduction level together with the retailer’s order volume and/or selling price (Yu & Han, 2017; Cao et al., 2018; Yi & Li, 2018). Besides the manufacturer’s wholesale pricing, the authors also took into account diverse other operations decisions, including (i) the retailer’s order quantities and the manufacturer’s investment cost proportion and emission reduction level (Yang & Chen, 2018); (ii) the retailer’s gross margin ratio and order volumes (Wang et al., 2017); and (iii) the eco-friendliness level of the manufacturer, along with the pricing issues and low-emission advertising level of the retailer (Liu et al., 2017). Cheng et al. (2018) analyzed pricing strategies and emission reduction levels within both a centralized supply chain and a decentralized one. Yang et al. (2017) discussed the optimal prices and emission reduction levels in vertical and horizontal cooperation. While in the literature above, the authors included a manufacturer and a retailer, Zhang et al. (2018) examined two competitive manufacturers’ carbon emission reduction rates and pricing decisions. Different from the above studies dealing with pricing, Matsui (2020) explored the optimal time point for supply chain partners to negotiate the wholesale price.

As pointed out in (Ma et al., 2021a), advertising including cooperative advertising largely determines a firm’s market performance and its competitiveness. Along with pricing, cooperative advertising decisions have been claimed as the essential decisions for supply chain partners (Zhao et al., 2016; Jamali & Rasti-Barzoki, 2018). In fact, cooperative advertising has received countless attention (Chaab & Rasti-Barzoki, 2016). As a result, numerous investigations have been carried out to examine cooperative advertising along with various practical considerations. While the readers are referred to (Aust & Buscher, 2014), for an in-depth review of cooperative advertising, below we present some studies optimizing pricing jointly with cooperative advertising decisions.

Considering retail price stickiness, Lu et al. (2019) optimized wholesale prices of the manufacturer and the order quantities and advertising level of the retailer by analyzing the situations where the two players can realize the Pareto optimality. Different from the above work, in (Szmerekovsky & Zhang, 2009; Yan, 2010; Seyed Esfahani et al., 2011; Aust & Buscher, 2012; Karray, 2013; Karray & Amin, 2015; Zhao et al., 2016; Chaab & Rasti-Barzoki, 2016; Karray et al., 2022a, b), the authors investigated the wholesale price and cooperative advertising ratio for the manufacturer together with the selling price and promotion investment for the retailer. Though they addressed four common decisions, they had different focuses and explored diverse issues and considerations. For example, Seyed Esfahani et al. (2011) and Aust and Buscher (2012) considered four distinct types of relationships between a manufacturer and his independent retailer and identified the relationship allowing the two players to gain the highest profits. Unlike most of the authors, Karray and Amin (2015) and Karray et al. (2022a) considered competition when optimizing the decisions. While Karray and Amin (2015) included competition at the retailer level, the latter involved competition at levels of the manufacturer and the retailer. Szmerekovsky and Zhang (2009) discovered that the cooperative advertising program does not lead to better results in a price-sensitive marketplace. Based on the results, they suggested that manufacturers should offer a reduced wholesale price to the dealer, instead of engaging in the cooperative advertising. At last, while most authors assumed the simultaneous decision-making made by a manufacturer and his independent dealer in the studies mentioned above, Karray (2013) examined the optimal sequence of moves to be made by the two players. To summarize, considering decision interactions, much of the extant literature examined joint decisions on pricing strategy and cooperative advertising program.

In conclusion, the available studies explored joint decision-making involving, e.g., technology selection and pricing, pricing and cooperative advertising. Built on top of them, we explore joint decision-making by considering a comprehensive list of operations decisions for manufacturers and retailers in the context of carbon tax policies and government subsidies. The decisions are production technology selection, production volumes, wholesale prices, retail prices, and cooperative advertising for producing green and/or dirty products. Table 1 summarizes the differences between the relevant literature and our study.

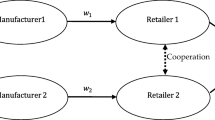

3 Problem description

There are both green and dirty technologies in the manufacturer’s production system. During his planning horizon containing \(\:I\) periods, he can produce either dirty or green products or both, using dirty and/or green technology. The local government offers the manufacturer a subsidy of \(\:\varphi\:\) per unit for producing green products to encourage him to carry out green production. Additionally, in line with his emission tax policy, the local government levies a price at a rate of \(\:\tau\:\) per unit of emission (in tons). The manufacturer earns revenue from selling the retailer dirty products at the wholesale price \(\:{w}^{D}\) and green products at \(\:{w}^{G}\).

Producing a unit of green products emits less than the dirty ones, but costs more in production. During each production period, the manufacturer pays \(\:{s}^{D}\) or \(\:{s}^{G}\) (\(\:{s}^{D}<{s}^{G}\)) for the dirty or green technology deployment, called fixed setup cost. (In comparison with dirty technologies, deploying green technologies demands a longer duration and/or a greater number of engineers/technicians, thus incurring higher setup expenses.). Besides, he pays a variable unit production cost \(\:{v}^{D}\) or \(\:{v}^{G}\) (\(\:{v}^{D}<{v}^{G}\)) for manufacturing dirty or green products. It is quite intuitive to assume \(\:{v}^{D}<{v}^{G}\). Take a hybrid vehicle as an example. the variable operating cost, excluding fuel-related costs, is higher compared to a conventional car, caused by the numerous additional components and devices present in a hybrid car. Carbon emissions for producing a green/dirty product are denoted as \(\:{e}^{G}\) /\(\:{e}^{D}\) (\(\:{e}^{D}>{e}^{G}\)). In each planning period \(\:i\), the manufacturer pays a holding cost of \(\:h\) for each inventory \(\:{k}_{i}^{D}\) /\(\:{k}_{i}^{G}\) of dirty/green products. Additionally, he pays a unit transportation cost: \(\:l\) for delivering products. See the notation in Table 2.

In each planning period \(\:i\), the manufacturer determines whether to adopt dirty or green technology by \(\:{x}_{i}\) and \(\:{y}_{i}\). He must also determine the quantities of both dirty/green products (\(\:{q}_{i}^{D}\) /\(\:{q}_{i}^{G}\)) to produce in order to fulfill the retailer’s orders during each planning period. Moreover, the manufacturer establishes a wholesale price for dirty/green products (\(\:{w}^{D}\) /\(\:{w}^{G}\)). To spur demand, the manufacturer and his independent retailer conduct cooperative advertising for both products. As pointed out in (Ji et al., 2017), when retailers promote eco-friendly products alongside manufacturers, both parties can achieve better results. Regarding this, the manufacturer needs to identify the ratio of advertising investment \(\:\delta\:\) that he needs to pay to the retailer. Due to the inherent complexity, it is rare for manufacturers to offer cooperative advertising programs featuring a dynamically changing participation ratio over time (Nagler, 2006). In line with the literature, we keep \(\:\delta\:\) fixed. The manufacturer’s objective is to optimize his total profit \(\:{F}_{prof}\).

The retailer purchases the dirty/green products at \(\:{w}^{D}\) /\(\:{w}^{G}\) and sells them at the price \(\:{p}^{D}\) /\(\:{p}^{G}\) in his price- and environment-sensitive market. He has to decide \(\:{p}^{D}\) /\(\:{p}^{G}\) and the amount of investment \(\:{A}_{i}^{D}\) /\(\:{A}_{i}^{G}\) for promoting the dirty/green products in each period. Similarly, the retailer’s objective is to optimize his total profit \(\:{f}_{prof}\).

4 Stackelberg game model

In accordance with decision iterations (see Sect. 3), the game model developed is a bilevel optimization programming. The upper-level (or lower-level) sub-model describes the decision-making of the manufacturer (or retailer). In each one’s decision-making, the decisions from the other party are involved. Specifically, some of the manufacturer’ decisions are involved in the objective function and constraints of the sub-model describing the retailer’s decision problem. Likewise, some of the retailer’s decisions are included in the objective function and constraints of the upper-level sub-model describing the manufacturer’s decision problem. Including the decision variables of one player in the other player’s objective function and constraints allows simultaneously optimizing all decision variables of two players.

4.1 Upper-level sub-model describing the manufacturer’s decision-making

Involving carbon tax policies and subsidies, the upper-level sub-model supports the decision-making of the manufacturer related to technology selection and production quantities, pricing, and cooperative advertising ratio. The manufacturer’s profits are gained by deducting all the costs incurred from the total revenue. His total revenue (\(\:MR\)) consists of (i) the revenue from selling products to the retailer and (ii) the subsidies for green production. Accordingly, we formulate Eq. (1) to calculate his \(\:MR\), and the second term in Eq. (1) denotes the subsidies offered by the local government.

The total cost (\(\:MTC\)) includes a total production cost (\(\:{MC}^{M}\)), a total inventory cost (\(\:{MC}^{K}\)), a total transportation cost (\(\:{MC}^{L}\)), a total carbon emission cost (\(\:{MC}^{E}\)), and a total cooperative advertising investment (\(\:{MC}^{A}\)) paid to the retailer. The \(\:{MC}^{M}\) can be formulated as Eq. (2), whilst the \(\:{MC}^{K}\) and \(\:{MC}^{L}\) are calculated using Eqs. (3) and (4), respectively. The \(\:{MC}^{E}\) is formulated as Eq. (5), and the \(\:{MC}^{A}\) is shown as Eq. (6).

The first/second term in Eq. (2) denotes the setup/total variable production cost. Equation (5) contains carbon emission costs corresponding to both dirty and green products. Equation (6) describes the manufacturer’s investment in cooperative advertising for both products. With the equations above, we calculate the total cost \(\:MTC\) using Eq. (7).

With Eqs. (1)–(7), the upper-level sub-model is provided below.

Equation (8) indicates the manufacturer’s objective function of maximizing the total profit. Constraints (9) and (10) ensure that production quantities respect the capacities of dirty and green technologies. Constraint (11) embodies the core principle of carbon mitigation regulation: emissions in the next period cannot exceed those in the proceeding period. Constraints (12) and (13) balance inventory and demand for both products. Constraints (14) and (15) guarantee that production only occurs when related technologies are selected. Constraint (16) denotes the inventory level to be non-negative. Constraints (17) - (19) indicate that decision variables must be non-negative. Constraint (20) enforces that the decision variables related to technology selection should be 0–1 variables.

4.2 Lower-level sub-model describing the retailer’s decision-making

The lower-level sub-model is to facilitate the retailer in making decisions. To realize the highest profit, the retailer needs to optimize retail prices and advertising investment for both dirty and green products. His total profit is gained by deducting the total cost from the total revenue that he receives. His total cost has two parts, including the purchasing cost for buying the products from the manufacturer and the total advertising investment that he pays. For analysis simplicity, we assume that the retailer does not pay any costs for selling products, which is commonly adopted (Zhou et al., 2018; Li et al., 2018). Similarly, the retailer’s total revenue has two components: (i) the revenue from selling products in his market and (ii) the partial advertising investment paid to him by the manufacturer.

As highlighted in (Hong et al., 2015; Xu et al., 2016; Bairagi et al., 2021), product demand is determined by a few major influences, such as the selling price, promotion investment, and product’s greenness level. Moreover, substitute products have a negative cross-advertising elasticity on demand (Carlton & Perloff, 2004; Keat & Young, 2009). Drawing upon the aforementioned literature, in this study, we formulate the demand for green/dirty product \(\:{o}_{i}^{G}\) /\(\:{o}_{i}^{D}\) in Eq. (21)/(22). As implied by the fourth term in each equation, the additional benefit gained from the increase in advertising investment becomes progressively smaller. This indicates a decline in the effectiveness of the advertising investment, which is well-recognized in literature (Hong et al., 2015). The last term indicates a negative cross-advertising impact on demand. The retailer’s total revenue (RR) and total cost (RTC) can be calculated using Eqs. (23) and (24), respectively. In Eq. (23), the two terms are the revenue earned from marketing products and the cooperative advertising investment paid by the manufacturer, respectively. In Eq. (24), the first term indicates the total purchasing cost whilst the second one is the total advertising investment.

With Eqs. (21)–(24), this sub-model is provided below.

The objective function: Eq. (25) maximizes the retailer’s total profit. Constraints (26) and (27) ensure that the wholesale prices are smaller than the retail prices. Constraints (28) and (29) guarantee that product promotion takes place only when products are produced. Constraints (30) and (31) indicate that decision variables must be non-negative.

4.3 Leader-follower joint optimization model

According to the above two sub-models, the complete bilevel optimization model is formulated below.

where for given \(\:{x}_{i},{y}_{i},{q}_{i}^{D},{q}_{i}^{G},{w}^{D},{w}^{G},\:\text{a}\text{n}\text{d}\:\delta\:\), the variables \(\:{p}^{D},\:\:{p}^{G},\:{\:A}_{i}^{D},{\text{a}\text{n}\text{d}\:\:A}_{i}^{G}\) solve:

In the game, the manufacturer and the retailer act as the leader and the follower, respectively. With the leader-follower relationship, the sequence of the decision-making is as follows. Considering the carbon tax rate and subsidy the government offered, firstly the manufacturer (i) selects one technology or both in the \(\:i\) th planning period using \(\:{x}_{i}\) and \(\:{y}_{i}\) and (ii) determines the quantities regarding each technology using \(\:{q}_{i}^{D}\) and \(\:{q}_{i}^{G}\). Subsequently, He decides the wholesale prices for both the dirty and green products by \(\:{w}^{D}\) and \(\:{w}^{G}\). At last, the manufacturer determines the cooperative advertising investment ratio \(\:\delta\:\) offered to the retailer to induce him to pay more for local promotion.

Upon receiving the decisions from the manufacturer, the retailer decides (i) the retail prices of dirty and green products by \(\:{p}^{D}\) and \(\:{p}^{G}\) and (ii) the advertising investments for dirty and green products by \(\:{\:A}_{i}^{D}\) and \(\:{\:A}_{i}^{G}\). As indicated in Eqs. (21) & (22), retail prices and advertising investments affect demand, which is crucial for the manufacturer to make decisions. With demand, the manufacturer further adjusts his technology selection, production volumes, wholesale prices, and cooperative advertising ratio in attempting to maximize the total profit. The above process iterates until it arrives at a Stackelberg equilibrium where two players do not prefer to change their decisions. At this point, the manufacturer and the retailer obtain optimal values of their decisions and profits.

5 Solution method based on PSO

Due to the inclusion of the manufacturer’s decision variables (i.e., \(\:{x}_{i}\), \(\:{y}_{i}\), and ) in the lower-level sub-model (see Eqs. (23, 24, 25–29) and the inclusion of the retailer’s decision variables (e.g., \(\:{p}^{D}\) and \(\:{p}^{G}\)) in the upper-level sub-model (see Eqs. (4, 6, 8, 12, 13), the game model is bilevel programming. Additionally, it contains both 0–1 decision variables (i.e., \(\:{x}_{i}\) and ) and continuous variables (e.g., \(\:\delta\:\)). At last, the game model contains non-linear relationships in the two objective functions and multiple constraints. Thus, the developed model is a 0–1, bilevel, mixed nonlinear programming. Compared to single-level programming, bilevel programming, in particular nonlinear version, is very difficult to be solved (Liu et al., 2017).

Some commonly used traditional methods for solving nonlinear bilevel models include branch and bound methods, penalty function methods, and trust-region methods (Colsonet al., 2007). When traditional solution approaches are applied, the models need to hold certain properties, e.g., differentiation, continuity (Zhang et al., 2017). Our game model is nonconvex, involving discrete, instead of continuous, decision variables and, thus, does not have the above properties. Consequently, it is impossible to apply the above traditional approaches to obtain equilibriums in closed-form formulas, as pointed out in (Yang et al., 2015; Luo et al., 2016). PSO is an evolutionary computation method (Kuo & Huang, 2009) and has been recognized as a powerful technique for solving bilevel optimization models in diverse problem contexts (Wan et al., 2013; Zhang et al., 2017). In this study, we, thus, develop a specific nested PSO (NPSO) to solve our game model. In the NPSO, optimizing the lower sub-model is nested in the solving of the upper one, as shown in Fig. 1. We summarize the flow of the NPSO in Fig. 1 and provide the algorithm details below.

Step 1: Initialization the scheme. Initialize the population size \(\:T\), the maximal velocity \(\:{V}_{max}\), two random parameters \(\:{r}_{1}\) and \(\:{r}_{2}\), two learning factors \(\:{c}_{1}\) and \(\:{c}_{2}\), and the inertia weight \(\:\omega\:\).

Step 2: Initialize the ith particle \(X_{i}(i=1,2,3,\ldots,T)\) of the upper-level variables randomly with the initial position and the associated velocities \(V_{x_i}\). Initialize the loop counter k = 0; set the maximum number of iterations (K) as the termination condition of this algorithm.

Step 3: Execute lower-level optimization in Sub-steps 3.1 to 3.7.

Sub-step 3.1: Substitute the upper-level’s feasible particle (\(X_{i}(i=1,2,3,\ldots,T)\)) into the lower-level and initialize the corresponding velocity \(V_{y_i}\).

Sub-step 3.2: For each particle \(\:{X}_{i}\) (\(\:i=\text{1,2},3,\dots\:,T\)), initialize a random lower-level particle \(\:{Y}_{i}\) (\(\:i=\text{1,2},3,\dots\:,T\)); set the lower-level’s loop counter \(\:n=0\). Further, set the maximum number of iterations: \(\:N\) as the termination condition.

Sub-step 3.3: Evaluate the fitness value of the particle using Eq. (34) and record it.

Sub-step 3.4: Update the best previously visited position and the current best position of the swarm. If the ith particle’s fitness value is better than, set the current value as, and if the ith particle’s fitness value is better than, set the current value as \(p^{l}_{g}\).

Sub-step 3.5: Update the positions and the velocities of particles using Eqs. (36) & (37).

Sub-step 3.6: Evaluate termination conditions. If the number of iterations exceeds the predetermined, move to Sub-step 3.7. Otherwise, let \({n}=n+1\), and move back to Sub-step 3.3.

Sub-step 3.7: Record the optimal solutions and send them to the upper-level and move to Step 4.

Step 4: Evaluate the fitness value of the upper-level using Eq. (32) and record it.

Step 5: Update the best previously visited position and the current best position of the swarm. If the ith particle’s fitness value is better than, set the current value as, and if the ith particle’s fitness value is better than, set the current value as.

Step 6: Update the positions and velocities of particles using Eqs. (38) & (39).

Step 7: Evaluate termination conditions. If the number of iterations exceeds the predetermined, move to Step 8, else, let \(k=k+1\), and move back to Step 2.

Step 8: Output the optimal solutions and objectives for both levels.

In literature, a time-varying inertia weight mechanism is often applied in a PSO to increase its model-solving performance (Kennedy & Eberhart, 2001). Among all, the linearly varying inertia weight technique is widely adopted in such a mechanism (Shami et al., 2022). Thus, we adopt this technique in our NPSO and formulate \(\:\omega\:\left(k\right)\) in Eqs. (40) & (41) for the upper- and lower-level optimization, respectively.

where \(\:{\omega\:}_{max}\in\left[\text{0,1}\right]\) and \(\:{\omega\:}_{min}\in\left[\text{0,1}\right]\) denote the maximum value and minimum value of the inertia weight, respectively.

6 Numerical examples

We carry out numerical examples to showcase the application of the proposed game model and NPSO in facilitating complex joint decision-making. We equally examine the influence of some parameters on both profits and the values of decision variables through sensitivity analysis. The game model and the NPSO are applied to a type of robot vacuum cleaner produced in China. The manufacturer sells his products to the retailer, and the planning horizon spans one year, divided into two periods. The data was gathered from multiple sources, including two Chinese e-retailers (JD.com and Tmall), two robot vacuum manufacturers (ECOVACS: https://www.ecovacs.cn/ and Roborock: https://cn.roborock.com/), the China Emissions Trading website (http://www.tanpaifang.com/), and the China Emissions Management and News website (https://daqi.bjx.com.cn/), for the period from Nov 2022 to Mar 2023. See the parameters below: \(\:T=2\), \(\:\varphi\:=20\), \(\:h=4.5\), \(\:l=14\), τ = 0.16, \(\:{B}^{D}=12,000\), \(\:{B}^{G}=10,000\), \(\:{e}^{D}=739\), \(\:{e}^{G}=510\), \(\:{s}^{D}=7200\), \(\:{s}^{G}=8400\), \(\:{v}^{D}=246\), \(\:{v}^{G}=368\), \(\:M=12,500\), \(\:\alpha\:=0.75\), \(\:\beta\:=0.55\), \(\:{\beta\:}^{c}=0.1\), and \(\:\gamma\:=0.63\).

To avoid premature convergence and attain best convergence performance, we set the parameters according to related studies (Zhao & Wei, 2019; Marichelvam et al., 2020; Shami et al., 2022). The population size is set as 100, and the maximum number of iterations as 100 for two sub-models. The two learning factor values are set as \(\:{c}_{1}={c}_{2}=2\), and the inertia weight \(\:{\omega\:}_{max}=0.9\) and \(\:{\omega\:}_{min}=0.1\). The NPSO was coded in MATLAB 2016b on an Apple M2 and a 16GB RAM.

6.1 Results and analysis

The NPSO reached convergence at the 48th iteration where both the optimal upper-level decisions and optimal lower-level decisions are obtained (see Fig. 2). As highlighted in the solution in Table 3, the manufacturer engages both types of technologies in production in each period. Although the green technology has a higher set-up cost, the manufacturer is motivated to use it thanks to the subsidies from the local government. Besides, it is reasonable to use green technology because of the lower unit emissions, which lead to lower total emission costs. It is interesting that the production volume using dirty technology is higher in each period. There are two possible reasons, including (i) the limited green production capacity and (ii) the higher variable unit green production cost. In this regard, increasing robot vacuum cleaner production from green technology arguments the total variable production costs, which hinders the manufacturer from engaging in green production. To conclude, appropriate decision-making on technology deployment and related production volume is important, yet challenging. This result is consistent with that we have found in our earlier work (Ma et al., 2024). Additionally, the cooperative advertising ratio is 0.31. This indicates that the manufacturer returned 31% of the advertising investment to the retailer for both products, as shown in Table 3. Regarding this, in comparison with (Ma et al., 2024), this study makes more contributions to the literature with respect to optimizing supply chain partners’ cooperative advertising decisions while dealing jointly with other related decisions in the context of sustainable operations management. Moreover, this study optimizes different wholesale (or retail) prices for green (or dirty) products.

The retailer’s optimal prices (in RMB) for the green and dirty products are 3156 and 3298, respectively. His advertising investment amount (in RMB) for the dirty product in the two periods are around 3 × 105 and 2 × 105 and for the green products around 2.9 × 105 and 3 × 105. Thanks to the cooperative advertising program, the retailer, in fact, receives 31% of his investment back. Compared with (Ma et al., 2024), this study provides additional insights into optimizing the retailer’s decisions on advertising investment for both green and dirty products. Compared with other relevant studies addressing (i) technology selection and production quantities (or service levels) (Hong et al., 2017; Bhattacharyya & Sana, 2019), (ii) technology selection and wholesale price (or retail price) (Sepehri et al., 2021; Pan et al., 2021), (iii) wholesale price, retail price, and emission reduction level (Yu & Han, 2017; Yi & Li, 2018; Yang & Chen, 2018), and (iv) wholesale price, retail price and cooperative advertising in a dyadic supply chain (Chaab & Rasti-Barzoki, 2016; Lu et al., 2019; Karray et al., 2022a, b), this study solves a comprehensive list of decisions related to production of substitute products in the context of a carbon tax policy and government subsidies.

6.2 Performance of the NPSO

Robustness is commonly taken as a performance indicator for solution algorithms (Bertsimas & Sim, 2004; Xu & Mannor, 2012). We also use it as the indicator for the performance evaluation of the NPSO. We conduct 10 trials in performance evaluation, each of which includes 20 randomly generated particles in the initial population and identical input data.

The results are shown in Fig. 3, including the two partners’ profits. In seven tests, including Test 2, 3, 4, 6, 7, 9, and 10, the manufacturer’s objective values of profits are the same. The situation of the retailer is the same. Considering the manufacturer, the average value of profits is 6.8661*107, the largest at 6.8891*107, and the smallest at 6.8370*107. The percentage increase (or decrease) in profits from the average to the largest (or smallest) is 0.33% (or 0.42%). Similarly, for the retailer, the increase (or decrease) percentage is 0.98% (or 0.56%). The NPSO is robust, as indicated by these small percentage changes.

In addition, the NPSO convergence performance of 10 trials is presented in Fig. 4. As demonstrated, all 10 trials reached convergence within 100 generations, and 5 of them reached within 60 generations. To conclude, the convergence of the NPSO is proved.

6.3 Sensitivity analysis

In sensitivity analysis, we examine the following parameters, including the tax rate per unit of emissions (\(\tau\)), the carbon emission elasticity (\(\:\gamma\:\)), the subsidy from the local government (\(\:\varphi\:\)), and the price elasticity (\(\:\alpha\:\)).

Tax rate (\(\tau\)).

We change \(\tau\) values from 0.16 to 1.06 in increments of 0.1. Figure 5 shows results pertaining to profit, production quantity, and cooperative advertising. We also obtain the results regarding the wholesale and retail price changes. The retail price remains stable despite \(\tau\) changes, whilst the wholesale price increases till \(\tau\) reaches 0.26 and remains stable when \(\tau \) continuously increases. While this result contradicts that in (Xu & Yue, 2021), it is consistent with practice. In practice, frequent changes to the retail price are not preferred by supply chain partners (Zhang et al., 2013). The reason for the manufacturer to increase the wholesale price at the beginning is to make the profit non-zero or positive when seeing the total cost increase. Knowing the continuous increase of wholesale price may ultimately cause demand loss, the manufacturer, on one hand, keeps the wholesale price stable. On the other hand, he increases the ratio of the cooperative advertising investment, as shown in Fig. 5(c). This result confirms with most of the available studies: Cooperative advertising programs can induce retailers to invest more in promoting products.

As depicted in Fig. 5(a), the changes in \(\tau\) impact the manufacturer’s profit, particularly before \(\tau\) reaches 0.86. The manufacturer’s profit exhibits an overall downward trend. This decrease might be caused by the increase of (i) advertising investments paid to his retailer and (ii) the total green production cost. \(\tau\) increase leads to the increase in retailer’s advertising investments for both products and the manufacturer’s cooperative advertising, as displayed in Fig. 5(c). Such increases, in turn, increase the manufacturer’s advertising investments paid to the retailer. Along with \(\tau\) increase, production volume of the green product increases (see Fig. 5(b)). Thus, the total green production cost increases. When \(\tau\) exceeds 0.86, the manufacturer’s profit is barely affected. This is because of the stable production volumes of both technologies (see Fig. 5(b)). The stable green production volume may be attributed to the limited production capacity. Contrary to the manufacturer’s profit, the retailer’s profit constantly increases in \(\tau\), as indicated by Fig. 5(a). There are two reasons for the increase, including (i) the increase in production volume of the green product and (ii) the increase of partial advertising investment paid back to him.

The above results and analysis emphasize the need for local governments to act with caution when determining \(\tau\) values. Suitable \(\tau\) values can enable manufacturers to improve financial gains without increasing emissions. In this study, the manufacturer can increase green production volume to optimize his profit within a specific range of \(\tau\) values (i.e., 0.16 to 0.26). Retailers, according to our study, could benefit from green production and cooperative advertising when \(\tau\) changes.

Carbon emission elasticity (\(\:\gamma\:\)).

We change \(\:\gamma\:\) values in increments of 0.1. Overall, the manufacturer’s objective value has an increasing trend though the increase is not striking, as illustrated in Fig. 6(a). The slight increase is caused by the green production increase (see Fig. 6(b)) and the general increase of the advertising investment for the green product (see Fig. 6(c)). In reaction to the increase in \(\:\gamma\:\), the manufacturer increases green production while simultaneously reducing dirty production (see Fig. 6(b)), in attempting to improve his profit. When \(\:\gamma\:\) reaches 0.73, the production quantity approaches the capacity limit of the green technology. Consequently, the production volume of the green product remains stable, which subsequently results in a stable profit for the manufacturer.

Similar as the manufacturer, the retailer’s profit, overall, tends to increase in \(\:\gamma\:\). When \(\:\gamma\:\) reaches 0.73, the retailer’s profit remains stable. This is understandable. As mentioned above, in response to \(\:\gamma\:\) changes, the manufacturer increases green production and his cooperative advertising ratio. These increases contribute to the retailer’s profit increase. After \(\:\gamma\:\) becomes 0.73, the retailer’s profit remains stable, see Fig. 6(a). This is because the production volume of the green product keeps the same. The manufacturer’s cooperative advertising ratio and the retailer’s advertising investment for both products change in \(\:\gamma\:\) in a similar fashion (see Fig. 6(c)). Nevertheless, the retailer should invest less promotion for the dirty product than the green one.

To conclude, when \(\:\gamma\:\) increases, the manufacturer should reduce the dirty production volume and, meanwhile, increase the production volume of his green product to increase, or at least remain, his profit. In addition, he needs to increase the ratio of the cooperative advertising. For the retailer, he needs to increase the advertising investment to stimulate more demand, in particular for green products.

Subsidy (\(\:\varphi\:\)).

We change \(\:\varphi\:\) values in increments of 10 in the analysis (see the results in Fig. 7). The increase in \(\:\varphi\:\) has insignificant effect on the retailer’s profit (see Fig. 7(a). This implies that the increase in subsidy does not provide striking benefits to the retailer. This confirms the findings of Li et al. (2021): Governmental subsidies do not directly increase retailers’ profits.

The manufacturer’s profit increases in \(\:\varphi\:\), on the contrary. However, it remains roughly unchanged when the subsidy is lower than 50. This may be attributed to a decrease in demand, evidenced by the stable green production and the reduction of dirty production (see Fig. 7(b)). Regarding this, the manufacturer may decide not to increase green production if the subsidy is not high enough. This is because a low subsidy is insufficient to compensate for the high unit variable cost associated with green production. When \(\:\varphi\:\) exceeds 50, there is a notable rise in the manufacturer’s profit. Figure 7(b) shows that an increase (or decrease) in the production volume of the green (or dirty) product results in a reduction in emissions, leading to a decrease in total emission costs. In turn, a reduction in total emission costs results in an increase in profits. In summary, the manufacturer might opt to increase green production if the increase in subsidy offsets the high unit variable cost associated with green production.

As shown in Fig. 7(c), when \(\:\varphi\:\) increases to reach 90, the manufacturer increases his ratio of the cooperative advertising. In accordance with this increase, the retailer increases his advertising investments for both the green and dirty products. In addition, he invests in more promotion activities for the green product than for the dirty product.

Retail Price elasticity (\(\:\alpha\:\)).

In the analysis, we change \(\:\alpha\:\) values in increments of 0.05. The manufacturer’s profit, in general, decreases in \(\:\alpha\:\) (see Fig. 8(a)). This is the same for the retailer. In detail, first, both profits decrease until \(\:\alpha\:\) reaches 0.7. Such profit decrease is caused by the reduced demand, which is due to the increased price elasticity. When \(\:\alpha\:\) ranges from 0.7 to 0.8, both profits increase slightly. The slight profit increase might be caused by the increasing cooperative advertising investment (see in Fig. 8(c)), which, in turn, leads to demand increase. At last, when \(\:\alpha\:\) is larger than 0.85, both profits remain stable. This might be due to the stable demand, which is reflected by the stable total production volume of the green and dirty products (see in Fig. 8(b)). As dipicted in Fig. 8(a), in general, the retailer’s profit is more sensitive to the price elasticity.

In general, production volumes of the green and dirty products decrease in \(\:\alpha\:\) (see Fig. 8(b). They decrease until \(\:\alpha\:\) reaches 0.7. The main reason for the volume decrease is because of the reduced demand. To stimulate demand, the manufacturer enhances his cooperative advertising ratio, and the retailer augments his advertising investment for both products (see Fig. 8(c). The advertising investment increase gradually contributes to demand increase and further production quantity increase (when \(\:\alpha\:\) is between 0.7 and 0.8, see Fig. 8(b). The percentage of increased production volume of the green product (average 0.79%) is larger than that of the dirty one (average 0.30%), as shown in Fig. 8(b). This result is following that in (Chan et al., 2012; Zhang et al., 2020): Advertising can enhance demand, in particular, for green products. When\(\:\alpha\:\) reaches 0.85, the production volume of the green product slightly decreases, whilst that of the dirty product slightly increases, as displayed in Fig. 8(b). The slight increase in production volume of the green product compensates for the slight decrease in production volume of the dirty product. Thus, the total market demand remains relatively stable when \(\:\alpha\:\) reaches 0.85.

To summarize, in response to \(\:\alpha\:\) changes, both the manufacturer and the retailer must modify their decisions to obtain higher profits. When \(\:\alpha\:\) value is relatively low, they should slightly increase their cooperative advertising decisions to stimulate more demand. When \(\:\alpha\:\) value becomes larger, they should determine the optimal participation ratio and advertising investment. Regarding this, our model can facilitate such decision making.

7 Conclusions

Because of the interactions among various operations decisions in a supply chain, it is crucial to make decisions jointly. In fact, joint operations decision-making has been attracting increasing attention and lasting interest from both literature and practice. As a result, countless investigations have been conducted to address it. In the extant literature, the authors considered various contexts. In addition, they developed either optimization models for which near-optimal solutions were obtained or analytical models for which exact solutions were obtained. In comparison with optimization models, analytical models involve very few constraints and parameters.

Built on top of the available studies (e.g., Ma et al., 2024), we examined joint operations decision-making by including (i) a comprehensive list of decision variables and (ii) diverse, yet realistic parameters and constraints involved in the production and selling of two substitute products (i.e., a green product and a dirty product). Moreover, we considered both carbon tax and subsidies from local governments, the combination of which is not uncommon in practice. The decision variables included technology choice, production planning, wholesale price, cooperative advertising ratio, retail price, and advertising investment. Bearing in mind the interactions among these decisions, we put forward a Stackelberg game model to describe (i) the manufacturer’s decision-making involving technology selection, production volumes, wholesale prices, and cooperative advertising ratios and (ii) the retailer’s decision-making addressing retail prices and advertising investments for substitute products. Caused by the large number of decision variables and their interactions, the game model was mixed 0–1, nonlinear, and bilevel, thus being very complex. It cannot be solved analytically. To address this issue, we further proposed a specific nested PSO (NPSO) to solve it. We conducted numerical examples involving green production of robot vacuum cleaners to demonstrate how the game model and the algorithm can be applied to facilitate joint operations decision-making. We performed a sensitivity analysis to investigate the impacts of several parameters on both profits and values of decision variables.

This study has both theoretical and practical significance. First, we included in the problem context (i) carbon tax, (ii) governmental subsidies, (iii) cooperative advertising, and (iv) two substitute products. On one hand, such a complex context increases difficulties in problem modeling and solving. On the other hand, it is closer to practice, thus providing realistic decision-making support. Second, in the above problem context, we examined a comprehensive list of operations decisions, their interactions, and the corresponding joint decision-making. This study can serve as an initial exploration for an examination of such a comprehensive list of interacting decisions within one framework. Third, we analyzed the joint decision-making problem through the lens of a Stackelberg game and put forward the mixed 0–1, bilevel, nonlinear programming. We then developed the specific NPSO to solve our game model. Fourth, we conducted numerical examples to show how the game model and solution algorithm are applied to facilitate firms in making joint operations decisions. Finally, we offered several managerial insights (see below).

First, the reduction in the carbon tax rate does not always have a positive effect on manufacturers’ profits. Thus, local governments must exercise caution when setting the carbon tax rate to ensure that manufacturers can make more profits without increasing their emissions. Second, manufacturers can decide to either increase or maintain the green production quantity to achieve higher profits, depending on the varied carbon tax rates. Third, in accordance with the subsidy changes, manufacturers need to increase both green production quantity and cooperative advertising ratio for the green product (until the green production capacity is reached) to obtain higher profits. Fourth, there are “optimal” ranges of carbon emission elasticity that can result in higher profits for manufacturers. Therefore, manufacturers should be cautious when selecting such “optimal” ranges. Fifth, retailers can increase investment in advertising for both green and dirty products to improve profits when the carbon tax rate (or government’s subsidy, or carbon elasticity, or price elasticity) increases. In addition, retail prices can be determined regardless of changes in the carbon tax rate, carbon elasticity, and government’s subsidy.

Nevertheless, several limitations (see below) in this study could be addressed in future work. We focused on the scenario involving a single manufacturer and retailer in this initial study. A manufacturer’s supply chain often involves two or more independent and competing retailers. In this context, future studies might focus on developing models and algorithms for scenarios comprising multiple competing retailers and substitute products. It is interesting to observe how manufacturers and retailers address decision-making in such scenarios. Besides, in a multi-manufacturer-and-multi-retailer supply chain in practice, there might be two or more competing manufacturers and retailers. The competitions exist among manufacturers, among retailers, and between manufacturers and retailers. Thus, it might be both interesting and relevant to investigate how competition can influence sustainable operations decision-making in supply chains. Moreover, this paper considered a traditional indirect sales channel including a manufacturer and an independent retailer. In practice, in addition to such indirect sales channels, manufacturers adopt direct sales channels (i.e., manufacturers sell directly products to consumers). It might be interesting to examine different pricing strategies for green and dirty products in dual channels. Based on our assumption, a local government provides a unit of subsidy for one unit of green products. Regarding this, it is necessary to explore the joint decision-making involving a full-one subsidy (i.e., manufacturers bear the same one-off investment cost as the dirty technology, whilst the additional costs are covered by local governments). In this research, we took the carbon tax rate as a given parameter. Considering the important impact of carbon tax rates on emission reduction levels and social welfare, future investigations may be made to explore how a local government together with manufacturers and retailers can optimize carbon tax rates in joint decision-making.

References

Aust, G., & Buscher, U. (2012). Vertical cooperative advertising and pricing decisions in a manufacturer-retailer supply chain: A game-theoretic approach. European Journal of Operational Research, 223(2), 473–482.

Aust, G., & Buscher, U. (2014). Cooperative advertising models in supply chain management: A review. European Journal of Operational Research, 234(1), 1–14.

Baines, T., Brown, S., Benedettini, O., & Ball, P. D. (2012). Examining green production and its role within the competitive strategy of manufacturers. Journal of Industrial Engineering and Management, 53–87. ISSN 2013– 0953.

Bairagi, N., Bhattacharya, S., Auger, P., & Sarkar, B. (2021). Bioeconomics fishery model in presence of infection: Sustainability and demand-price perspectives. Applied Mathematics and Computation, 405, 126225.

Bertsimas, D., & Sim, M. (2004). The price of robustness. Operations Research, 52(1), 35–53.

Bhattacharyya, M., & Sana, S. S. (2019). A mathematical model on eco-friendly manufacturing system under probabilistic demand. RAIRO-Operations Research, 53(5), 1899–1913.

Bigerna, S., Wen, X., Hagspiel, V., & Kort, P. M. (2019). Green electricity investments: Environmental target and the optimal subsidy, 279(2), 635–644.

Cao, K., Xu, B., He, Y., & Xu, Q. (2018). Optimal carbon reduction level and ordering quantity under financial constraints. International Transactions in Operational Research, 26(2), 1–24.

Carlton, D. W., & Perloff, J. M. (2004). Modern industrial organization (4th ed.). Addison-Wesley.

Chaab, J., & Rasti-Barzoki, M. (2016). Cooperative advertising and pricing in a manufacturer-retailer supply chain with a general demand function; a game- theoretic approach. Computers & Industrial Engineering, 99, 112–123.

Chan, H. K., He, H., & Wang, W. Y. C. (2012). Green marketing and its impact on supply chain management in industrial markets. Industrial Marketing Management, 41(4), 557–562.

Chen, X., Chan, C. K., & Lee, Y. C. E. (2016). Responsible production policies with substitution and carbon emissions trading. Journal of Cleaner Production, 134, 642–651.

Cheng, Y., Xiong, Z., & Luo, Q. (2018). Joint pricing and product carbon footprint decisions and coordination of supply chain with cap-and-trade regulation. Sustainability, 10(2), 1–24.

Chutani, A., & Sethi, S. P. (2012). Optimal advertising and pricing in a dynamic durable goods supply chain. Journal of Optimization Theory and Applications, 154(2), 615–643.

Colson, B., Marcotte, P., & Savard, G. (2007). An overview of bilevel optimization. Annals of Operations Research, 153(1), 235–256.

Drake, D., Kleindorfer, P. R., & Van Wassenhove, L. (2016). Technology choice and capacity portfolios under emissions regulation. Production and Operations Management, 25(6), 1006–1025.

Ferrara, M., Khademi, M., Salimi, M., & Sharifi, S. (2017). A dynamic Stackelberg game of supply chain for a corporate social responsibility. Discrete Dynamics in Nature and Society, 2017. Article 8656174.

Fiorello, M., Gladysz, B., Corti, D., Wybraniak-Kujawa, M., Ejsmont, K., & Sorlini, M. (2023). Towards a smart lean green production paradigm to improve operational performance. Journal of Cleaner Production, 413, 137418.

Fremstad, A., & Paul, M. (2019). The impact of a carbon tax on inequality. Ecological Economics, 163, 88–97.

Gong, X., & Zhou, S. X. (2013). Optimal production planning with emissions trading. Operations Research, 61(4), 908–924.

Hong, X., Xu, L., Du, P., & Wang, W. (2015). Joint advertising, pricing and collection decisions in a closed-loop supply chain. International Journal of Production Economics, 167, 12–22.

Hong, Z., Chu, C., & Yu, Y. (2016). Dual-mode production planning for manufacturing with emission constraints. European Journal of Operational Research, 251, 96–106.

Hong, Z., Chu, C., Zhang, L., & Yu, Y. (2017). Optimizing an emission trading scheme for local governments: A Stackelberg game model and hybrid algorithm. International Journal of Production Economics, 193, 172–182.

Hua, G., Han, Q., & Li, J. (2011). Optimal order lot sizing and pricing with carbon trade. SSRN eLibrary. Available at SSRN: https://doi.org/10.2139/ssrn.1796507.

Huang, Y. S., Fang, C. C., & Lin, Y. A. (2020). Inventory management in supply chains with consideration of logistics, green investment and different carbon emissions policies. Computers & Industrial Engineering, 139, 106207.

Jamali, M. B., & Rasti-Barzoki, M. (2018). A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. Journal of Cleaner Production, 170(1), 1029–1043.

Ji, J., Zhang, Z., & Yang, L. (2017). Carbon emission reduction decisions in retail-dual-channel supply chain with consumers’ preference. Journal of Cleaner Production, 141, 852–867.

Jørgensen, S., & Zaccour, G. (2014). A survey of game-theoretic models of cooperative advertising. European Journal of Operational Research, 237(1), 1–14.

Karray, S. (2013). Periodicity of pricing and marketing efforts in a distribution channel. European Journal of Operational Research, 228(3), 635–647.

Karray, S., & Amin, S. H. (2015). Cooperative advertising in a supply chain with retail competition. International Journal of Production Research, 53(1), 88–105.

Karray, S., Martín-Herrán, G., & Sigué, S. P. (2022a). Cooperative advertising in competing supply chains and the long-term effects of retail advertising. Journal of the Operational Research Society, 73(10), 2242–2260.

Karray, S., Martín-Herrán, G., & Sigué, S. P. (2022b). Managing advertising investments in marketing channels. Journal of Retailing and Consumer Services, 65, Article 102852.

Keat, P. G., & Young, P. K. Y. (2009). Managerial Economics (6th ed.). Prentice-Hall.

Kennedy, J., & Eberhart, R. (2001). Swarm Intelligence. Morgan Kaufmann.

Kuo, R., & Huang, C. (2009). Application of particle swarm optimization algorithm for solving bi-level linear programming problem. Computers and Mathematics with Applications, 58, 678–685.

Li, Y., Lu, Y., Zhang, X. Y., & Liu, L. P. (2016). Propensity of green consumption behaviors in representative cities in China. Journal of Cleaner Production, 133, 1328–1336.

Li., J., Su, Q., & Ma, L. (2017). Production and transportation outsourcing decisions in the supply chain under single and multiple carbon policies. Journal of Cleaner Production, 141, 1109–1122.

Li, W., Chen, J., Liang, G., & Chen, B. (2018). Money-back guarantee and personalized pricing in a Stackelberg manufacturer’s dual-channel supply chain. International Journal of Production Economics, 197, 84–98.

Li, Z., Pan, Y., Yang, W., Ma, J., & Zhou, M. (2021). Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Economics, 101, Article 105426.

Lin, B., & Jia, Z. (2018). The energy, environmental and economic impacts of carbon tax rate and taxation industry: A CGE based study in China. Energy, 159, 558–568.

Liu, X., Du, G., & Roger, J. (2017). Bilevel joint optimisation for product family architecting considering make-or-buy decisions. International Journal of Production Research, 55(20), 5916–5941.

Lu, F., Tang, W., Liu, G., & Zhang, J. (2019). Cooperative advertising: A way escaping from the prisoner’s dilemma in a supply chain with sticky price. Omega, 86, 87–106.

Luo, X., Li, W., Kwong, C. K., & Cao, Y. (2016). Optimisation of product family design with consideration of supply risk and discount. Research in Engineering Design, 27(1), 37–54.

Lv, C., Fan, J., & Lee, C. C. (2023). Can green credit policies improve corporate green production efficiency? Journal of Cleaner Production, 397, 136573.

Ma, S., He, Y., & Gu, R. (2021a). Dynamic generic and brand advertising decisions under supply disruption. International Journal of Production Research, 59(1), 188–212.

Ma, Y., Wan, Z., & Jin, C. (2021b). Evolutionary game analysis of green production supervision considering limited resources of the enterprise. Polish Journal of Environmental Studies, 30(2), 1715–1724.

Ma, S., Zhang, L. L., & Cai, X. (2024). Optimizing joint technology selection, production planning and pricing decisions under emission tax: A Stackelberg game model and nested genetic algorithm. Expert Systems with Applications, 238, 122085.

Marichelvam, M., Geetha, M., & Tosun, Ö. (2020). An improved particle swarm optimization algorithm to solve hybrid flowshop scheduling problems with the effect of human factors - a case study. Computers and Operations Research, 114, Article 104812.

Matsui, K. (2020). Optimal bargaining timing of a wholesale price for a manufacturer with a retailer in a dual-channel supply chain. European Journal of Operational Research, 287, 225–236.

Nagler, M. G. (2006). An exploratory analysis of the determinants of cooperative advertising participation rates. Marketing Letters, 17, 91–102.

Nouira, I., Frein, Y., & Hadj-Alouane, A. B. (2014). Optimization of manufacturing systems under environmental considerations for a greenness-dependent demand. International Journal of Production Economics, 150, 188–198.

Pakseresht, M., Shirazi, B., Mahdavi, I., & Mahdavi-Amiri, N. (2020). Toward sustainable optimization with stackelberg game between green product family and downstream supply chain. Sustainable Production and Consumption, 23, 198–211.

Pan, Y., Hussain, J., Liang, X., & Ma, J. (2021). A duopoly game model for pricing and green technology selection under cap-and-trade scheme. Computers & Industrial Engineering, 153, 107030.

Rasti-Barzoki, M., & Moon, I. (2020). A game theoretic approach for car pricing and its energy efficiency level versus governmental sustainability goals by considering rebound effect: A case study of South Korea. Applied Energy, 271, Article 115196.

Sardar, S. K., & Sarkar, B. (2020). How does advanced technology solve unreliability under supply chain management using game policy? Mathematics, 8, 1191.

Sepehri, A., Mishra, U., & Sarkar, B. (2021). A sustainable production-inventory model with imperfect quality under preservation technology and quality improvement investment. Journal of Cleaner Production, 310, 127332.

Serrano-García, J., Llach, J., Bikfalvi, A., & Arbeláez-Toro, J. (2023). Performance effects of green production capability and technology in manufacturing firms. Journal of Environmental Management, 330, Article117099.

Seuring, S. (2013). A review of modeling approaches for sustainable supply chain management. Decision Support Systems, 54(4), 1513–1520.

Seyed Esfahani, M. M., Biazaran, M., & Gharakhani, M. (2011). A game theoretic approach to coordinate pricing and vertical co-op advertising in manufacturer-retailer supply chains. European Journal of Operational Research, 211(2), 263–273.

Shami, T., et al. (2022). Particle swarm optimization: A comprehensive survey. Ieee Access: Practical Innovations, Open Solutions, 10, 10031–10061.

Shen, B., Liu, S., Zhang, T., & Choi, T. M. (2019). Optimal advertising and pricing for new green products in the circular economy. Journal of Cleaner Production, 233, 314–327.

Su, C., Wang, L., & Ho, C. (2012). The impacts of technology evolution on market structure for green products. Mathematical and Computer Modelling, 55(3), 1381–1400.

Szmerekovsky, J. G., & Zhang, J. (2009). Pricing and two-tier advertising with one manufacturer and one retailer. European Journal of Operational Research, 192(3), 904–917.

Wan, Z., Wang, G., & Sun, B. (2013). A hybrid intelligent algorithm by combining particle swarm optimization with chaos searching technique for solving nonlinear bilevel programming problems. Swarm and Evolutionary Computation, 8, 26–32.

Wang, C., Wang, W., & Huang, R. (2017). Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. Journal of Cleaner Production, 152, 271–280.

Xu, H., & Mannor, S. (2012). Robustness and generalization. Machine Learning, 86, 391–423.

Xu, G., & Yue, D. (2021). Pricing decisions in a supply chain consisting of one manufacturer and two retailers under a carbon tax policy. Ieee Access: Practical Innovations, Open Solutions, 9, 18935–18947.

Xu, X., Xu, X., & He, P. (2016). Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. Journal of Cleaner Production, 112(5), 4093–4106.

Xu, X., He, P., Xu, X., & Zhang, Q. (2017a). Supply chain coordination with green technology under cap-and-trade regulation. International Journal of Production Economics, 183, 433–442.

Xu, X., Zhang, W., He, P., & Xu, X. (2017b). Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega, 66, 248–257. Part B.

Yan, R. (2010). Cooperative advertising, pricing strategy and firm performance in the e-marketing age. Journal of the Academy of Marketing Science, 38(4), 510–519.

Yang, H., & Chen, W. (2018). Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus cost-sharing. Omega, 78, 179–191.

Yang, D., Jiao, J. R., Ji, Y., Du, G., Helo, P., & Valente, A. (2015). Joint optimization for coordinated configuration of product families and supply chains by a leader-follower Stackelberg game. European Journal of Operational Research, 246(1), 263–280.

Yang, L., Zhang, Q., & Ji, J. (2017). Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. International Journal of Production Economics, 191, 286–297.

Yi, Y., & Li, J. (2018). The effect of governmental policies of carbon taxes and energy-saving subsidies on enterprise decisions in a two-echelon supply chain. Journal of Cleaner Production, 181, 675–691.

Yu, W., & Han, R. (2017). Coordinating a two-echelon supply chain under carbon tax. Sustainability, 9, 1–13.

Zhang, J., Gou, Q., Liang, L., & Huang, Z. (2013). Supply chain coordination through cooperative advertising with reference price effect. Omega, 41, 345–353.

Zhang, T., Chen, Z., & Chen, J. (2017). A cooperative coevolution PSO technique for complex bilevel programming problems and application to watershed water trading decision making problems. Journal of Nonlinear Sciences and Applications, 10, 2115–2132.

Zhang, L., Zhou, H., Liu, Y., & Lu, R. (2018). The optimal carbon emission reduction and prices with cap and trade mechanism and competition. International Journal of Environmental Research and Public Health, 15(11), 2570.

Zhang, J., Cao, Q., & Yue, X. (2020). Target or not? Endogenous advertising strategy under competition. IEEE Transactions on Systems Man and Cybernetics: Systems, 50(11), 4472–4481.

Zhao, L., & Wei, J. (2019). A nested particle swarm algorithm based on sphere mutation to solve bi-level optimization. Soft Computing, 23, 11331–11341.

Zhao, L., Zhang, J., & Xie, J. (2016). Impact of demand price elasticity on advantages of cooperative advertising in a two-tier supply chain. International Journal of Production Research, 54(9), 2541–2551.

Zhou, Y., Guo, J., & Zhou, W. (2018). Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. International Journal of Production Economics, 196, 198–210.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Grant No. 72201030, 72025101, 71729001) and the Humanities and Social Sciences Youth Foundation of Ministry of China (Grant No. 21YJCZH104).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ma, S., Zhang, L.L. Optimizing joint operations decision-making involving substitute products: a Stackelberg game model and nested PSO. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-06171-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-06171-6