Abstract

The airline decision-making process is intended to solve complex operations planning problems sequentially. As computational power increases so do integrated approaches to solving major airline optimisation problems. In general, network carriers encounter more complex integrated problems of fleet planning, aircraft routing and increasing connectivity in the airline network. Bank optimisation problem addresses creating competitive advantage for airline network carriers, by providing better connectivity to passengers via improving their flight schedules in the airline bank structure. The aim of this study is to determine the optimal fleet to cover all flights in a flight schedule which is designed to improve connectivity in the network. The objective function takes account of the overall fleet allocation profitability on the flight schedule, the total worth of passenger connections, route profits, and the penalty cost for using excess slot. We propose a mixed integer linear programming model for the integrated bank optimisation-fleet assignment problem which can be defined as a specific flight scheduling model. To test the model, we have utilised a dataset from a Turkish carrier. The results from the integrated model show that small changes in the bank structure create more efficient schedule and fleet assignment could increase profitability at the same time. The findings imply that network and schedule planners are able to solve two major problems, simultaneously. Advances in the optimisation techniques will increase the application of the integrated models in the other parts of airline planning world, such as operations, crew planning, revenue management.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Circular Economy (CE) provides a modern perspective for businesses to ensure progress in three pillars of sustainable development goals: achieving economic, environmental, and social benefits. In this context, the idea of transforming the traditional business perspective, which is based on the linear economy, towards circularity and adopting contemporary approaches to processes that can produce economically and socially valuable, environmentally conscious products/services are raised. The incorporation of CE paradigm into the business is a challenging task, as it stipulates readjustments in organizational structure, stakeholder management and, specifically resource management. (Stewart & Niero, 2018).

The aviation industry is a primary sector for assessing circular economy opportunities because of its operations in the manufacturing and service sectors. There are numerous reasons to investigate CE applications in the aerospace industry, including high investment requirements in science and technology, the number of components required to build a large aircraft with various potentially polluting materials, and only 1% of the energy used being renewable (Dias et al., 2022). Circular models have been used in the design and manufacturing applications in aviation industry since the middle of the 1970s to incorporate eco-design features that minimize waste production and raw material consumption (Salesa et al., 2022). In service sector field of aviation, airline industry has engaged sustainability issues to deal with waste management and energy efficiency. Although the service sector lacks a standardized circularity model, CE offers a clear path toward cleaner production and better resource management and its principles are currently being developed, adopted, and applied by a wide variety of knowledge streams in service sector (Salesa et al., 2022). Despite an increase in the number of scientific studies in the field, methodological and technological developments in business model development, performance measurement, and evaluation have yet to reach an adequate level for implementation.

Strategic airline operations planning should be designed to be resilient and sustainable as the aviation industry's competitive market dynamics compel companies to create evolving business models. Airline business model summarizes the major objectives for strategic and tactical decisions. The structure of flight network, the composition of aircraft fleet and the determination of target markets involve the key decisions in strategic operations planning in airline industry. The strategic leads tactical business planning to maximise efficient use of resources, create competitive advantage, increase profitability regarding environmental and social concerns. While the goals for environmental and social dimensions are generally considered in the strategic planning phase, resource management, waste management and crew planning decisions are investigated in the tactical and operational level. The consequences of the airline business model directly interact with the network strategy and aircraft fleet design. Two main business models exist in real-world applications: network carrier and low-cost carrier. Network carriers provide service across a broad area with a hub strategy, while low-cost carriers fly between specific destinations. Low-cost carriers prefer to fly to secondary airports in cities using only one type of aircraft. Network carriers, on the other hand, have a variety of aircraft in their fleet and operate from primary airports throughout their network. As part of a long-term strategy, network strategy specifies the level of service to be provided in which markets and regions and focuses on revenue maximization, which requires decisions such as route and frequency planning. Unlike the network strategy, low-cost carrier model focuses on cost minimisation rather than revenue maximisation.

Based on timeline, the airline planning framework can be examined in three clusters: long-term, medium-term, and short-term. The strategic, tactical, and operational plans and corresponding problems are summarized in Fig. 1. Within the context of circularity, the framework is made up of complex sub-problems that seek to optimize the use of specific resources over a given time horizon. In the long-term planning phase, the vision and mission statements address potential growth and market position in terms of economic, social, and environmental perspectives. In the medium-term planning phase, questions arise in network planning, fleet planning and schedule design within sustainability concerns. The economic objectives seek a revenue-generating schedule design to cover demand at each destination by increasing flight frequencies and adjusting timings, whereas the environmental objectives seek a schedule design that reduces flight frequencies while increasing flight occupancy to achieve low carbon emissions and fuel consumption. The airline schedule design problem is a complex optimization problem that requires internal inputs (historical data on. slot capacities/timings, revenue/cost structure, flight/ground times, demand, occupancy/spill rates etc.) and external inputs (government incentives, flight frequency rights, airport slot capacities, market demand etc.) with a variety of challenging objectives. Finally, using the schedule as a guide, analytical techniques are employed in the short-term planning phase to resolve fleet assignment, aircraft routing, and crew scheduling problems while taking updated demand, swappable aircrafts, minor shifts in flight times and crew allocation requirements into account. For airlines that have different business models, these problems are diversified, and the need arises to develop new models with different perspectives. In order to summarise the main CE issues in airline operations planning, Table 1 provides the sustainability dimensions for three different planning perspective.

In this study, we contribute to the literature by exploring potential benefits of incorporating fleet assignment and bank optimisation problems. In the airline industry, we concurrently incorporate a specific flight scheduling problem with a strategic airline planning problem. Our research question is how can we integrate the fleet assignment problem and airline bank optimization problem to reduce the overall carbon footprint of airlines? This research aims to analyse the impacts of integrating the two problems and develop an efficient and effective solution to optimize the resource allocation at the airports and to enhance the # of available itineraries for passengers. We formulate a mixed-integer linear programming model that optimises the flight schedule of an airline based on the bank structure to incorporate hub-and-spoke operations entirely with fleet assignment decisions. Thereby, we propose to design the optimal bank with the best arrival and departure times while assigning the most profitable rotations to the predetermined fleet of aircrafts. To the best of our knowledge, this is the first work that combines fleet assignment with an airline bank structure concentrating on connectivity under airport slot constraints. Finally, we present a real-world case study using data from a major Turkish carrier to demonstrate the integrated model’s ability to generate schedules that outperform existing schedules.

Airlines with a global network strategy typically have a hub airport where a large number of aircraft arrive/depart in short periods of time, allowing for short connecting times for flights and passengers. In contrast to traditional resource allocation problems that strive for steady utilization of resources, this strategy strives to maximize the utilisation of aircrafts during certain peak time periods. The main contribution of this study is to reveal the potential benefits of solving fleet assignment in the airline bank structure. The remainder of the paper is organised as follows. Section 2 provides relevant literature on airline fleet scheduling and identifies the gaps in the airline fleet assignment under network strategy. In Sect. 3, we formulate the mixed integer programming model for integrated bank optimisation and fleet assignment problem. Section 4 provides a case study of a real-world problem in Turkey. Finally, in Sect. 5, we conclude with our findings and discussion.

2 Related works

Advances in technology and better understanding of airline operations planning problems have prompt operations research scientists to focus on integrated solutions (Lohatepanont & Barnhart, 2004), since the problems in airline industry are complex, dynamic, and interdependent, especially at tactical and operational level. Therefore, the problem of airline operations planning has generally been addressed with specific sub-problems that can be solved sequentially. Due to high ownership costs, aircraft and crew-related issues are critical among airline planning challenges. Operations research-based approaches are gaining popularity as the airline sector expands and competition intensifies, in order to find better ways to allocate shared resources, reduce consumption and increase efficiency.

In the context of environmental awareness, CE promotes the effective and efficient use of resources (Tütüncü et al. 2023). To generate new demand and/or satisfy existing demand, airline companies are currently focusing only on growth to dominate the market by increasing the number of flights and enhancing in-flight catering service. This strategy contradicts with principles of sustainability. By adjusting the times in flight schedule rather than increasing the frequency of flights for a destination, it is possible to generate more connections between flights and increase flight occupancy rates. Thus, there is a significant opportunity to decrease the emission rate per passenger as well as the resources used per passenger. In this context, airline re-scheduling and airline bank optimisation problems arise, as both investigate the impact of minor changes in the flight schedule.

Airline bank optimisation can be seen as a re-scheduling problem that focuses on flight activity and hub constraints. Efficient bank structure design is critical for hub-and-spoke carriers because it directly affects passenger demand at both origin and destination, as well as revenue and fleet utilization. Bank optimisation problem aims to create valuable connections by changing departure and arrival times of the flights in the bank structure while considering slot capacity of the airport (Çiftçi & Özkır, 2020). To incorporate the main features of airline networks, integrated models with increasing complexity have been developed and various solution algorithms have also been suggested to accommodate real-life airline operations (Birolini et al., 2021). The re-scheduling problem in airline operations planning literature is generally associated with disruption (Yang et al., 2021), resilience (Cardillo et al., 2013) and aircraft/crew recovery (Herekoglu & Kabak, 2023; Zhang et al., 2015). Since we focus on designing a flight schedule with bank structure, we provide relevant literature on integrated flight scheduling and re-scheduling problems in Table 2.

In the literature, the integration of fleet assignment and flight scheduling problems is rarely studied. Cadarso and Marin (2013) propose a robust integrated approach to solving the airline scheduling problem, in which schedule design and fleet assignment problems are solved concurrently. They obtain passenger flows through various itineraries and account for expected misconnected passengers. Sherali et al. (2013) investigate the benefits of solving the integrated airline operations planning problem, which includes schedule design, fleet assignment, aircraft routing, and crew scheduling, all of which are interconnected within the overall framework. The schedule design and fleet assignment problems are incorporated in an airline hub-and-spoke network by Jiang and Barnhart (2013), and mathematical models are provided to increase potential connections of itineraries in a dynamic environment. Sa et al (2020) also incorporate stochastic nature of the demand for the fleet planning and assignment methodology. Their model optimises the allocation of the fleet portfolio based on the ownership cost of the fleet and operating profit of the fleet assignment problem. For further literature review of integrated airline scheduling problems, we refer the readers to the recent study of Eltoukhy et al. (2017).

The re-scheduling perspective is primarily studied by Cadarso and de Celis (2017), the uncertainty in passenger demand and operational environment is incorporated into the integrated airline planning model in order to update the base schedule with consideration of fleet assignments and timing. Cacchiani and Salazar-González (2020) propose a mixed integer linear programming model and four heuristics for schedule retiming decisions based on integrated fleet assignment, aircraft routing and crew pairing problem. On a real-world data from a regional airline carrier, they demonstrate how even small schedule adjustments could result in significant cost savings.

Integrated schedule solutions are essential for future research in the airline industry, according to Barnhart et al. (2012) and Birolini et al. (2021). Although the literature provides numerous methods to incorporate airline fleet assignment into the solution of other problems, no method for incorporating fleet assignment with airline bank optimisation, which aims to create valuable connections between flight legs in a bank structure for network carriers, has been considered.

3 Airline bank optimisation problem

The bank optimisation problem determines the arrival and departure times of flights within a predefined bank, subject to available slot capacities, in order to minimise connection times between arrival and departure flights. With the motivation provided by prior studies, we broaden the airline schedule planning problem within a bank structure by incorporating fleet assignment decisions.

The demand, revenue and profitability of hub carriers are directly influenced by bank and schedule design. In the bank structure of the hub airport, any change in timing of flights may cause a breakdown on an existing connection in the passenger flow, and this can trigger substantial revenue and demand losses (Goedeking, 2010). Given the projected demand and revenue for the itineraries, reducing connection times within the itineraries may cause imbalanced utilisation of slots, aircrafts, and airport resources. Goedeking (2010) explains that forcing all possible connections to be built for the best connectivity causes a decrease in aircraft productivity due to the different stage length of arrivals or departures in the banks. Goedeking (2010) has investigated the relationship between hub connectivity and aircraft utilisation, emphasising that increasing hub connectivity for profitability purposes can lead to low utilisation of aircrafts and vice versa. Therefore, there are two conflicting concerns to be considered simultaneously: (i) profit maximising of fleet assignments, and (ii) maximising demand by providing lower connection times on available itineraries. Also, another concern is that short connection times increases risk of delays and missed connections, thus airline schedules are becoming less and less reliable, making it difficult to operate daily schedule.

In order to manage the passenger transfer flow, airlines create flight clusters in a bank structure in their hub airports. Bank structures in airline schedules can offer a number of advantages for passengers and airline companies. Therefore, network carriers rely heavily on bank structures to optimize their flight schedules. By organizing flights into banks, airline carriers can ensure better flight times for departing and arriving in order to maximize aircraft utilization and flight occupancy. Airline bank structures have typically three to five hours block time, where multiple flights are operated and connected, respectively. Airlines can also coordinate their flights and manage their resources more efficiently by utilizing banking structures.

A representative bank structure of a hub airport is illustrated in Fig. 2, where the boxes below the timeline axis reflect arrival flights and the boxes above the timeline axis represent departure flights. There are two types of flows connected to each other in any bank: the flows of passengers travelling with connected flight legs and the flows of aircrafts in the physical network. While the passenger flows can be linked by many-to many relationships, the flow of an aircraft is sustained by a one-to-one relationship in a bank structure. Two banks are identified in Fig. 2, where the passenger flows are shown in the first bank and the aircraft flows are shown in the second bank. There are four connections in terms of aircraft rotations (\({a}_{10}-{d}_{7}, {a}_{9}-{d}_{8}, {a}_{8}-{d}_{9}, {a}_{7}-{d}_{10}\)). However, in the first bank, any passenger in any of these arriving flights may transfer to any of the departure flights (\({d}_{1}, {d}_{2}, {d}_{3}, {d}_{4}\)). Furthermore, any passenger in any of the arriving flights (ie, \({a}_{1}\)) may also be connected a departure flight (ie, \({d}_{5}\)) which is outside of the first bank.

The first integer programming model for fleet assignment problem is introduced by Abara (1989) within a connection network structure and the problem is formulated as a multi-commodity flow on a time-expanded network by Hane et al. (1995). For a comprehensive review, we refer Sherali et al. (2006). Dumas et al. (2009) incorporate additional revenues created by multileg itineraries to improve the objective function of the fleet assignment problem. Ialongo and Desalniers (2014) propose heuristic branch-and-bound algorithm to solve fleet assignment problem by periodically reassessing revenues of flight legs via the passenger flow model.

4 Mathematical model

Mixed integer linear programming models are particularly well-suited to solving airline scheduling problems, as they provide an efficient method of determining the optimal combination of flight paths to meet a given set of constraints. These models are capable of taking into account the cost of routes, the availability of aircraft and crew, the restrictions of airports, and the preferences of customers. Additionally, the models could be used to determine the best time to introduce new flights, adjust existing schedules, or shift resources to optimize the use of resources. The ability to consider the varying constraints and preferences of a complex airline scheduling problem means that the integer linear programming model is the ideal choice for solving airline scheduling problems.

We propose a novel fleet assignment problem within a bank structure that allocates various types of aircraft to the flight legs in a bank with consideration of airline-related and hub-related constraints. Inspired by previous studies highlighting the benefits of integration, we propose a new mathematical model that incorporates fleet assignment decisions into the bank optimisation problem.

The objective of proposed model is to maximise the total connection value of connected flights and the total profitability of the fleet allocation on the flight schedule. Çiftçi and Özkır (2020) define the connection value parameter \({V}_{ijkl}\) that encourages shorter connection times, taking into account the revenue and demand of the itinerary \(\left(i,k\right).\) In the calculation of this parameter, Let \(I\) be set of flights, \(S\) be set of slots, \(F\) be set of fleets, \({T}_{jl}\) denote connection time between arrival slot \(j\) and departure slot \(l\), \({D}_{ik}\) be demand of passengers and \({R}_{ik}\) be revenue per passenger from destination i to destination k. The connection value between arrival flight \(i\) arriving at slot \(j\) and departure flight \(k\) departing at slot \(l\) is determined in Eq. 1.

The overall profitability of the fleet allocation on the flight schedule is assessed in terms of revenue and the cost of assigning fleet type \(f\) to a rotation covering arrival flight \(i\) and departure flight \(k\), as shown in Eq. 2. For all possible aircraft rotation combinations, we subtract the cost of assigning the fleet to feasible rotations from the revenue calculated at the flight level,

where \(Y_{f}\) denotes passenger capacity of fleet \(f\), \(L_{i}\) denotes flight length of flight \(i\), \(J_{i}\) denotes revenue per available seat kilometre of flight \(i\) (namely, RASK) and \({U}_{f}\) denotes cost per available seat kilometre of fleet \(f\) (namely, CASK). In Eq. 2, the revenue component is calculated by multiplying revenue per available seat kilometre of the route, aircraft capacity and distance of flights \(i\) and \(k\), while the cost component is calculated by multiplying aircraft capacity, cost per available seat kilometre of the aircraft type \(f\) and total distance of flight \(i\) and flight \(k\).

The slot capacities at the spoke cities are not considered in the proposed model. Since airline carriers can only dominate their own hub airport(s), the slot capacity constraint is only defined for the hub airport. Also, we employ extra slot capacity to allow flexibility in the mathematical model for the practical considerations of real-world applications. The mathematical model also assumes that the revenues from business and economy passengers are aggregated to a single passenger type as a weighted average. For simplicity, flight frequency of the target airline for each route is assumed to be one per day as an input to the model. A list of notations is provided in Table 3 to facilitate the description of the proposed model.

The objective function of the model maximises the total worth of passenger connections and route profits and penalises exceeding slot capacity in Eq. 3.

The constraints of the integrated problem are presented below. Equation 4 ensures that exactly one arrival slot can be allocated to each arrival flight, and exactly one departure slot can be assigned to each departure flight in Eq. 5.

Equation 6 connects inbound and outbound flights unless the smallest connection time limit is not exceeded. The binary parameter \({K}_{jl}\) is 1 if the connection time between arrival slot \(j\) and departure slot \(k\) is greater than the required minimum connection time; it is 0 otherwise. Thus, \({z}_{ijkl}\) may have non-zero values only in the case of feasible connections being available. In Eq. 7 in conjunction with Eq. 6, an arrival flight \(i\) and a departure flight \(k\) are connected if and only if they are in appropriate slots in the bank. Thus, the pre-defined minimum connection time limitation is satisfied at the hub airport.

Equations 8 and 9 limit the slot capacity usage at the hub airport for departure and arrival flights.

The cover constraints are provided in Eqs. 10 and 11 that ensure all flights arriving at the hub must be connected to a departure flight in terms of aircraft rotation and vice versa.

The availability constraint ensures that the number of rotations cannot exceed the number of available aircrafts in each fleet type as given in Eq. 12. The upper limit of exceeding slot capacity is defined in Eq. 13. Since rotation continuity is satisfied with the rotation decision variable of the hub airport, balance constraint is not defined. The types of decision variables are provided in Eq. 14.

In summary, the integrated mathematical model is designed to satisfy the desired network and frequency with the available fleet and maximises profitability on routes by fleet assignment. It also decreases connection times on connected itineraries to increase passenger preference for the airline.

5 Case study

A modest real-world case study is provided as proof of the proposed model's viability. The study includes the steps of operations research methodology that includes problem definition, data acquisition, modelling, solution and obtaining results. This section presents the case study, in which problem data was obtained from a Turkish airline company. The flight network under consideration is a hub-and-spoke network, with Sabiha Gokcen Airport (SAW) serving as the hub. Because the slot limitation is more restrictive for international flights and the international fleet is planned separately from the domestic fleet, only international flight data have been collected for this study. The international network has 23 destinations, as shown in Fig. 3.

In the hub-and-spoke network, 10 of the 23 destinations are eastern destinations and the remaining 13 are western destinations. The eastern flights are to Tel Aviv, Kuwait, Bahrain, Dubai, Jeddah, Medina, Riyadh, Tehran, Tbilisi, and Doha, whereas western flights are to London, Paris, Brussels, Amsterdam, Berlin, Barcelona, Rome, Milano, Vienna, Munich, Frankfurt, Stuttgart, and Dusseldorf. In this bank structure, the direction of passenger flow is east to west during the morning hours which represents the first bank and west to east during the evening hours, which is in the last bank.

5.1 Problem data

This section provides flight data, airport data and commercial data for the real case problem. For the flights in the first bank, we present relevant data for arrival flights in Table 4. We provide only a view for the data in order to facilitate data representation for the mathematical model.

Table 5 presents the data depicting flight numbers, slot timings, existing fleet assignments, RASKs and distances from hub location for departure flights.

Slot is a specific permission with certain time limits that is given to airlines to use the airport, runway and navigation services. There are 144 slot times per day, and slot times represent 10-min time intervals in each hour of clock time. There are 33 slot timings that have been defined in the morning bank. A sample of data for number of available slots is shown in the Table 6.

Table 7 shows a sample of data which include passenger demand for a summer season and average unit passenger revenue information between arrival and departure flights on origin–destination (OD) pairs.

In our network, the minimum connection time is defined as 60 min, which is modelled as a 6-slot difference between an arrival and departure. Additional data for the fleet assignment problem is described as follows. There are four types of aircraft available. Table 8 summarises the capacity and CASK information of the fleet based at the SAW airport.

The problem is solved on an Intel(R) Core (TM) i5-3317U CPU @ 1.70GHz and 12.0 GB RAM computer. To improve the computation time, CPLEX is initialized with current schedule as initial basic feasible solution. Run processes are set to stop after a 24-h limit is reached. Optimality gap is less than 0.1%.

5.2 Results

We present the results of our findings in this section. The current bank structure and connection times between flights are given in Table 9. There are 4 misconnected origin–destination pairs, Tel Aviv—Amsterdam, Tel Aviv- Brussels, Tel Aviv—Paris and Tel Aviv -London.

In practice, disconnected flights incur a 720-min penalty. The average connection time within the current bank is computed ~ 195 min, approximately 3 h.

Table 10 provides the proposed bank structure resulting from the integrated model. In the proposed bank structure, the average connection time is ~ 86 min which is nearly 50% better than the previous schedule. The mathematical model has improved connection times so that they all fall between 60 and 120 min. Also, there are 4 new connections are produced that which did not exist in the previous structure and they are highlighted as bold in the Table 10.

Table 11 shows the connection time difference between the existing bank structure and the proposed bank structure. There are 4 new connection, 3 decreased connection time and 123 improved connection times. Average improvement is ~ 109 min.

Figure 4 and 5 compares the average connection times for each arrival and departure flight, respectively. Proposed method improves connection times significantly for each of the flights.

A comparison between the previous fleet assignment and the result of the integrated mathematical model is provided in Fig. 6. The figure numbers are in terms of thousand USDs per week. Although there is a slight decrease in the revenue, there is a significant cost reduction associated with the new fleet assignment. Figure 6 shows a potential cost savings of 4.5%. Profit and loss are affected as well. Savings due to reduction in loss is even greater than that of cost reductions, with a 27% decrease in loss.

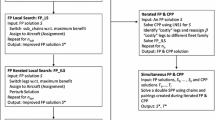

Furthermore, we provide comparative results to show the potential benefit of solving the integrated bank optimization and fleet assignment problem rather than solving them sequentially. Figure 7 depicts the results of the integrated model and sequential approach in terms of objective function value.

Integrated mathematical model performs better than the two phased classical approach. It provides better results both for the bank optimization and fleet assignment problems. The comparison graph clearly illustrates the superiority of the integrated model for both bank optimization and fleet assignment problems (Fig. 7).

The convergence graph allows us to track gap progress over iteration count. After 24 h and more than 1 million iterations, gap is less than 0.1% (Fig. 8).

6 Discussions and policy implications

The circular economy is an economic system that focuses on eliminating waste and promoting the use of renewable energy sources. It is based on the principles of preserving resources, reducing environmental impacts, and increasing efficiency. CE system has become increasingly important in recent years due to its potential to reduce greenhouse gas emissions and tackle the global climate crisis. In the airline industry, the adoption of circular economy principles could have far-reaching implications. Airlines could strive for more efficient operations by increasing the use of digital technologies and data analytics to optimize resource allocations, minimize delays, and minimize waste. By implementing these strategies, airlines would not only be reducing their carbon footprint but also becoming more efficient and reducing their overall environmental impact. A mathematical model that increases flight connectivity is important for aviation industry under circular economy model as it operates to reduce the carbon emissions associated with flights. By optimizing the existing flights, existing aircraft and creating efficient flight connections, less fuel is wasted, and fewer carbon emissions are produced. Our mathematical model optimizes the current connected flight demands via hub by making the complex network of air traffic more connected and efficient. Therefore, fewer flights are ultimately required to service the network which is leading to a reduction in overall carbon emissions, fuel consumption and pollution from aircrafts.

The proposed assignment model provides slightly less revenue when it is compared to that of current schedule. Given that the assigned aircrafts have different operational costs (CASK) and that the proposed mathematical model is profit-oriented, the model focuses on cost minimization by sacrificing revenue. The mathematical model ignores the dynamic nature of demand by assuming that demand is static and deterministic, and instead prioritizes cost reduction and profit maximization strategies.

7 Conclusions

The aviation industry is characteristically regulated as a highly competitive and global industry that requires high capital investment and has a very thin profit margin. Although the long-term trend seems to be toward deregulation, there are still many countries with highly regulated skies. This framework increases both the complexity and importance of the planning process.

The airline planning process generally aims to meet the passenger demand and manage capacity supply in the long term. In contrast, flight scheduling is the focal point of mid-term planning, which aims to maximise passenger utility and flight revenue and minimise cost by utilising the optimal departure times and deploying the right fleet. However, there are major limitations for bank optimisation like airport slot constraints. Slots are also used like barriers for market competition by authorities in the countries that have highly regulated skies. Therefore, slots are becoming critical elements for schedule building processes in bank optimisation.

Fleet assignment models commonly include objective functions to minimise operating cost, fuel cost, maintenance cost and spill cost or to maximise fare revenues. The main goal of these models is to cover all flights using the available fleet within a set of constraints. Fleet assignment directly affects the profitability of the routes and the entire network of the airline.

In current industry practise, these two processes are structured to follow each other: once schedule timings are tuned, then the fleet assignment process starts. While there are mathematical models to guide the fleet assignment, bank optimisation is a relatively new topic in the literature. In theory, solution methods are available for integrated problems of network modelling, scheduling and fleet assignment. However, these methods may not be feasible in business practise (Belobaba et al, 2015). Some of the challenges are as follows:

-

Data may not be available as needed to optimise the entire schedule.

-

Building a new schedule from 0 is operationally impractical.

-

Incremental schedules can create significant changes in the schedule; however, planners prefer to have consistency over the seasons.

In our model, commercial data is available however we do not know the operational impact of tightening the connection times in the bank structure. It could have side effects on the hub such as pressure on turnaround times, busy gates in the peak hours etc. Also, our model does not change departure times from morning to evening as it can make changes only within the bank limits. Therefore, passengers, operation departments and planners are able to maintain consistency over schedule seasons.

Using newly available big data sources along with quantitative optimisation models will present a major strategic challenge for network and schedule planners. We address these challenges by presenting a novel mathematical model for integrating the schedule development and fleet assignment processes without changing the schedule drastically. Our model contributes to the literature by providing a method to solve two major airline industry problems simultaneously.

Our model has following limitations. Demand is given and assumed that is fixed for a change in the schedule. Flight frequencies are assumed one per day for each destination for the simplicity of the model. Slots at the spoke cities assumed always available. However, there are highly slot constrained airports for minor schedule changes. These airports can be simply assumed as frozen in the schedule as an alternative approach. Potential topics for future research could be to formulate the model as a multi-objective optimisation problem and to develop new heuristics to decrease the computation times. Furthermore, the interaction between different flight banks and spill/recapture affects in multiple flight banks in a day are interesting research problems.

References

Abara, J. (1989). Applying integer linear programming to the fleet assignment problem. Interfaces, 19(4), 20–28.

Ahmed, M. B., Hryhoryeva, M., Hvattum, L. M., & Haouari, M. (2022). A matheuristic for the robust integrated airline fleet assignment, aircraft routing, and crew pairing problem. Computers & Operations Research, 137, 105551.

Ahuja, R. K., Liu, J., Orlin, J. B., Goodstein, J., & Mukherjee, A. (2004). A neighborhood search algorithm for the combined through and fleet assignment model with time windows. Networks: an International Journal, 44(2), 160–171.

Barnhart, C., Fearing, D., Odoni, A., & Vaze, V. (2012). Demand and capacity management in air transportation. EURO Journal on Transportation and Logistics, 1(1–2), 135–155.

Belobaba, P., Odoni, A., & Barnhart, C. (Eds.). (2015). The global airline industry. John Wiley & Sons.

Birolini, S., Antunes, A. P., Cattaneo, M., Malighetti, P., & Paleari, S. (2021). Integrated flight scheduling and fleet assignment with improved supply-demand interactions. Transportation Research Part b: Methodological, 149, 162–180.

Cacchiani, V., & Salazar-González, J. J. (2020). Heuristic approaches for flight retiming in an integrated airline scheduling problem of a regional carrier. Omega, 91, 102028.

Cadarso, L., & de Celis, R. (2017). Integrated airline planning: Robust update of scheduling and fleet balancing under demand uncertainty. Transportation Research Part c: Emerging Technologies, 81, 227–245.

Cadarso, L., & Marín, Á. (2013). Robust passenger oriented timetable and fleet assignment integration in airline planning. Journal of Air Transport Management, 26, 44–49.

Cardillo, A., Zanin, M., Gómez-Gardenes, J., Romance, M., García del Amo, A. J., & Boccaletti, S. (2013). Modeling the multi-layer nature of the European air transport network: Resilience and passengers re-scheduling under random failures. The European Physical Journal Special Topics, 215(1), 23–33.

Çiftçi, M. E., & Özkır, V. (2020). Optimising flight connection times in airline bank structure through simulated annealing and Tabu search algorithms. Journal of Air Transport Management, 87, 101858.

Dias, V. M. R., Jugend, D., de Camargo Fiorini, P., do Amaral Razzino, C., & Pinheiro, M. A. P. (2022). Possibilities for applying the circular economy in the aerospace industry: Practices, opportunities and challenges. Journal of Air Transport Management, 102, 102227.

Dong, Z., Chuhang, Y., & Lau, H. H. (2016). An integrated flight scheduling and fleet assignment method based on a discrete choice model. Computers & Industrial Engineering, 98, 195–210.

Dumas, J., Aithnard, F., & Soumis, F. (2009). Improving the objective function of the fleet assignment problem. Transportation Research Part b: Methodological, 43(4), 466–475.

Eltoukhy, A. E., Chan, F. T., & Chung, S. H. (2017). Airline schedule planning: A review and future directions. Industrial Management & Data Systems., 117(6), 1201–1243.

Goedeking, P. (2010). Networks in aviation: Strategies and structures. Springer-Verlag.

Gürkan, H., Gürel, S., & Aktürk, M. S. (2016). An integrated approach for airline scheduling, aircraft fleeting and routing with cruise speed control. Transportation Research Part c: Emerging Technologies, 68, 38–57.

Hane, C. A., Barnhart, C., Johnson, E. L., Marsten, R. E., Nemhauser, G. L., & Sigismondi, G. (1995). The fleet assignment problem: Solving a large-scale integer program. Mathematical Programming, 70(1), 211–232.

Herekoglu, A., & Kabak, Ö. (2023). Spectral clustering approximation for large scale crew disruption data of an airline company for intelligent crew recovery. Journal of Soft Computing and Decision Analytics, 1(1), 139–160. https://doi.org/10.31181/jscda11202315

Ialongo, D. L., & Desaulniers, G. (2014). Airline fleet assignment with internal passenger flow reevaluations. EURO Journal on Transportation and Logistics, 3(2), 121–142.

Jamili, A. (2017). A robust mathematical model and heuristic algorithms for integrated aircraft routing and scheduling, with consideration of fleet assignment problem. Journal of Air Transport Management, 58, 21–30.

Jiang, H., & Barnhart, C. (2013). Robust airline schedule design in a dynamic scheduling environment. Computers & Operations Research, 40(3), 831–840.

Kenan, N., Jebali, A., & Diabat, A. (2018). An integrated flight scheduling and fleet assignment problem under uncertainty. Computers & Operations Research, 100, 333–342.

Khanmirza, E., Nazarahari, M., & Haghbeigi, M. (2020). A heuristic approach for optimal integrated airline schedule design and fleet assignment with demand recapture. Applied Soft Computing, 96, 106681.

Kiarashrad, M., Pasandideh, S. H. R., & Mohammadi, M. (2021). A mixed-integer nonlinear optimization model for integrated flight scheduling, fleet assignment, and ticket pricing in competitive market. Journal of Revenue and Pricing Management, 20(5), 596–607.

Lohatepanont, M., & Barnhart, C. (2004). Airline schedule planning: Integrated models and algorithms for schedule design and fleet assignment. Transportation Science, 38(1), 19–32.

Papadakos, N. (2009). Integrated airline scheduling. Computers & Operations Research, 36(1), 176–195.

Sa, C. A., Santos, B. F., & Clarke, J. P. B. (2020). Portfolio-based airline fleet planning under stochastic demand. Omega, 97, 102101.

Salesa, A., León, R., & Moneva, J. M. (2022). Airlines practices to incorporate circular economy principles into the waste management system. Corporate Social Responsibility and Environmental Management, 30(1), 443–458.

Sherali, H. D., Bae, K. H., & Haouari, M. (2013). An integrated approach for airline flight selection and timing, fleet assignment, and aircraft routing. Transportation Science, 47(4), 455–476.

Sherali, H. D., Bish, E. K., & Zhu, X. (2006). Airline fleet assignment concepts, models, and algorithms. European Journal of Operational Research, 172(1), 1–30.

Stewart, R., & Niero, M. (2018). Circular economy in corporate sustainability strategies: A review of corporate sustainability reports in the fast-moving consumer goods sector. Business Strategy and the Environment, 27(7), 1005–1022.

Tütüncü, K. A., Bölükbaş, U., Güneri, A. F., & Gül, N. N. (2023). Integer Linear Programming Approach for the Personnel Shuttles Routing Problem in Yıldız Campus in Istanbul. Journal of Soft Computing and Decision Analytics, 1(1), 303–316. https://doi.org/10.31181/jscda11202326

Yan, S., Chen, S. C., & Chen, C. H. (2006). Air cargo fleet routing and timetable setting with multiple on-time demands. Transportation Research Part e: Logistics and Transportation Review, 42(5), 409–430.

Yang, Y., Xu, K. J., & Hong, C. (2021). Network dynamics on the Chinese air transportation multilayer network. International Journal of Modern Physics C, 32(05), 2150070.

Zhang, D., Lau, H. H., & Yu, C. (2015). A two stage heuristic algorithm for the integrated aircraft and crew schedule recovery problems. Computers & Industrial Engineering, 87, 436–453.

Funding

The funding was provided by Türkiye Bilimsel ve Teknolojik Araştirma Kurumu (Grant No. 2211).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ciftci, M.E., Özkır, V. Integrated optimisation model for airline bank structure and fleet assignment problem. Ann Oper Res (2023). https://doi.org/10.1007/s10479-023-05615-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05615-9