Abstract

Cryptocurrencies have been historically characterised by large price swings and inherent volatility at a much higher scale than traditional financial assets. Understanding the underlying mechanisms and whether, or how, these are priced in through possible risk premia is crucial to bringing cryptocurrencies closer to mainstream financial markets. Using data on 1982 cryptocurrencies form January 1, 2015 till September 30, 2020 and a combination of models involving portfolio-level and Fama–MacBeth analyses, while accounting for cryptocurrency sample selection, we show that the additional risk measured by idiosyncratic volatility is well priced in cryptocurrencies and investors are being paid a risk premium for their holdings. However, a deeper inspection of the dynamics reveals that such a trade-off is mostly valid for the most illiquid cryptocurrencies, which are susceptible to microstructure noise.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Idiosyncratic volatility (IVOL) refers to the part of return volatility that cannot be explained by the asset-pricing model. It was first identified by Roll (1988) as being suggestive of either “informed trading” or “occasional frenzy”. Later studies indicate that stocks with higher IVOL have lower average returns,Footnote 1 suggesting the presence of IVOL anomalies in stock markets (e.g., Ang et al., 2006, 2009). The negative relationship between IVOL and stock returns (negative volatility risk premium) remains significant after taking into account the impacts of size, value, momentum, liquidity, and trading volume.Footnote 2 While a vast amount of research surrounds the IVOL anomaly in stock markets (e.g., Babenko et al., 2016; Bozhkov et al., 2018; Chen et al., 2020; Zaremba & Maydybura, 2019) the related debate extends to other assets and markets such as commodities (Fernandez-Perez et al., 2016), bonds (Chung et al., 2019), currencies (Guo & Savickas, 2008), and more recently the provocative cryptocurrency markets (Zhang & Li, 2020).

Conducting analyses based on portfolio-level data and the Fama–MacBeth regression, Zhang and Li (2020) find a positive relationship between IVOL and cryptocurrency returns. They indicate that their results are not affected by size, momentum, liquidity, trading volume, or price and remain approximately the same when different weighting schemes and sample sizes are used. However, the association between IVOL and returns can be subject to portfolio formation (Chen et al., 2020), which reflects the impact of microstructure noise on IVOL anomalies. This is relevant to the cryptocurrency markets, given that many investors prefer not to invest in cryptocurrencies with high microstructure noise, which has practical implications for whether IVOL anomalies are significant in cryptocurrency markets and can be exploited by cryptotraders within a market timing framework. While Chen et al. (2020) extend the literature on IVOL anomalies in stock markets by accounting for the impact of market microstructure noise on IVOL, the evidence for this impact remains embryonic in the cryptocurrency markets, which leaves room to examine whether the findings of Zhang and Li (2020) are driven by cryptocurrency sample selection.

In this paper, we extend the academic literature on IVOL anomalies in cryptocurrency markets by examining the impact of microstructure noise on IVOL anomalies using a combination of models involving portfolio-level and Fama–MacBeth analyses, while accounting for cryptocurrency sample selection. Unlike Zhang and Li (2020), we disentangle IVOL anomalies based on microstructure proxies in the cryptocurrency markets such as market size (small and big, with a small cryptocurrency being below the 20th percentile of market capitalization), price (penny and non-penny cryptocurrencies, with a penny cryptocurrency being equal to or below $1), variance ratio, bid-ask spread, dollar volume, and frequency of zero returns. In fact, small cryptocurrencies, penny cryptocurrencies, and cryptocurrencies with a large bid-ask spread are more susceptible to market microstructure effects, which further motivates our decision to examine the impact of market microstructure noise on the IVOL anomaly in the cryptocurrency markets and thereby assess whether the results of Zhang and Li (2020) are driven by cryptocurrency sample selection. Our main results clearly show that the crypto-markets are not prone to the same anomalies as the standard financial markets. Quite the opposite, the additional unexplained risk is priced in and a risk premium is paid in the form of positive expected returns with this growing risk. However, we show that this relationship is mostly valid for the cryptocurrencies susceptible to the market microstructure effect.

The rest of the paper is structured as follows: Sect. 2 reviews the related literature on microstructure in the cryptocurrency markets and the volatility of cryptocurrencies. Section 3 describes the data and methodology employed. Section 4 presents and discusses the empirical results. Section 5 summarizes the main findings and provides some concluding remarks.

2 Literature review

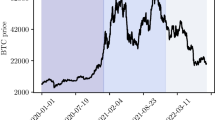

Following the release of Bitcoin as a peer-to-peer payment system in 2008, Bitcoin became the first cryptocurrency contingent on blockchain technology and mass collaboration, and thus independent of monetary policy. Many decentralized cryptocurrencies have followed. Cryptocurrencies are mostly not associated with any physical asset or firm, unlike stocks. However, they constitute a digital asset class that has attracted the attention of investors and speculators and quickly moved into the universe of innovative financial products. In fact, many funds and portfolio managers consider investment in cryptocurrency-related assets. Recently, MicroStrategy invested more than US$1 billion in Bitcoin as a way to hedge inflation risk, while Tesla bought $1.5 billion worth of Bitcoin and indicated its willingness to sell Tesla cars and other products against Bitcoin. Furthermore, the Norwegian central bank has indicated its plan to introduce its own cryptocurrency.

Cryptocurrencies outperform all conventional assets as reflected in their high returns, although their risk is extremely high and they are subject to market manipulation, withdrawal fees, and hacking risks (Ferreira et al., 2020). Several studies consider the return and volatility properties of cryptocurrencies, highlighting their speculative behaviour (e.g., Baur et al., 2018), without ignoring their hedging and safe haven properties against the risk of equities (Shahzad et al., 2020) and various measures of economic uncertainty (Demir et al., 2018; Mokni et al., 2021). Some studies explore the forces that drive cryptocurrency returns such as attractiveness (Ciaian et al., 2016; Ladislav, 2015), market forces (Ciaian et al., 2016), behavioural heterogeneity of market participants in the cryptocurrency markets (Koutmos & Payne, 2021), momentum and investor attention (Liu & Tsyvinski, 2021). Some other studies consider uncertainty and herding in the cryptocurrency market (Arsi et al., 2021) and try to forecast Value-at-Risk of Cryptocurrencies with RiskMetrics models (Liu et al., 2020). Furthermore, Ahmed (2020) uses various realized volatility proxies and finds a significant but negative contemporaneous relation with Bitcoin returns.

Other studies consider a comparison of cryptocurrency volatility with that of conventional assets such as stocks and gold, revealing evidence of a significant dissimilarity between Bitcoin and gold regarding their volatility behaviour (Baur et al., 2018; Klein et al., 2018) and reaction to macroeconomic news (Al-Khazali et al., 2018). The volatility linkages among various cryptocurrencies have been examined, showing evidence that Bitcoin is at the centre of volatility linkages (Yi et al., 2018), although the importance of smaller cryptocurrencies such as Ethereum, Ripple, and Litecoin cannot be ignored (Corbet et al., 2018; Antonakakis et al., 2019; Ji et al., 2019). Linkages seem to change across frequencies (e.g., Qureshi et al., 2020). Ferreira and Pereira (2019) provide evidence of contagion among cryptocurrencies. Interestingly, Baur and Dimpfl (2018) show that in cryptocurrencies, unlike equities, positive shocks increase the volatility more than negative shocks of the same magnitude, which points to a potential safe haven property (Bouri et al., 2017).

While a large amount of literature exists on the return and volatility of cryptocurrencies, driven by the puzzling extreme volatility in the cryptocurrency markets, limited studies examine the microstructure of cryptocurrency markets. Dyhrberg et al. (2018) consider intraday data on Bitcoin price against the US dollar, and provide evidence that the bid-ask spread display is negatively related to number of trades and volatility and that trading patterns persist over weekends. Koutmos (2018) find evidence of bidirectional relationships between Bitcoin returns and transaction activity, suggesting the possibility of predicting Bitcoin returns on microstructure variables. Alexander et al. (2020) highlight the role of informed traders in the Ethereum market while showing that the introduction of the Ether perpetual swap led to a decrease in volatility and an increase in Ethereum market efficiency. Apergis et al. (2020) examine the convergence behaviour of cryptocurrency closing prices. Using data from eight large cryptocurrencies, they show that some microstructure characteristics such as range volatility, market capitalization, and mining fees can drive convergence. Dimpfl and Peter (2020) reveal evidence for the existence of differences in the levels of microstructure noise across Bitcoin exchanges and their effects on the contribution to price discovery. Aleti and Mizrach (2021) study the microstructures of Bitcoin spot and futures markets, revealing evidence that the market trade size is much higher in the futures market and that large trade sizes, above one million US dollars, can move prices. Zhang and Li (2020) provide evidence that IVOL is priced into the returns of cryptocurrencies, but leave room for a comprehensive study covering the effect of microstructure on the pervasiveness of IVOL anomalies.

We extend the above strands of literature dealing with cryptocurrency returns, cryptocurrency volatility, and market microstructure by examining the pervasiveness of IVOL anomalies in cryptocurrencies and the impact of market microstructure noise. We do this while accounting for the cryptocurrencies most susceptible to market microstructure (such as small or penny cryptocurrencies), variance ratio, bid-ask spread, dollar volume, and frequency of zero returns, which reveals the puzzling impact of IVOL on cryptocurrency returns in the presence of microstructure noise.

3 Data and methodology

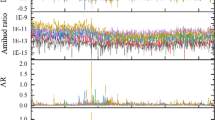

This study uses daily data on 1982 cryptocurrencies form January 1, 2015 till September 30, 2020, collected from coinmarketcap.com. Following Chen et al., (2020), IVOL is calculated for each month for each cryptocurrency using daily data. The IVOL is computed as the standard deviation of residuals (\(\sqrt {var\left( {e_{i,t} } \right)}\)) obtained from the three-factor pricing model of cryptocurrencies (Shahzad et al., 2021; Shen et al., 2020):

where \(r_{i,t}\) stands for the daily return of a cryptocurrency i at time t, MKT stands for the daily return of a market portfolio for whole crypto-market, small minus big (SMB) and winners minus losers (WML) represent the size and momentum factors, and \(e_{i,t}\) denotes the residuals. The factors are constructed following the study of Shahzad et al. (2021). For a cryptocurrency to be included in our sample, it must have a trading record of at least six years. Because the IVOL is estimated on the monthly basis, any cryptocurrency that has less than 15 observations in a month is not included in the sample for that specific month. Furthermore, any cryptocurrency with no market capitalization data is excluded.

We further disentangle IVOL anomalies based on microstructure proxies such as market size of cryptocurrency, price of cryptocurrency, variance ratio, bid-ask spread, dollar volume and frequency of zero returns. Cryptocurrencies are divided into small and big based on whether they are above or below the 20th percentile of market capitalization. Similarly, closing prices are used to divide cryptocurrencies into penny and non-penny cryptocurrencies. A cryptocurrency having a closing price equal to or below $1 is categorized as penny, and one having a closing price above $1 is categorized as non-penny. Variance ratio (VR) is calculated as daily cryptocurrency return variance divided by weekly return variance, multiplied by five: \(\left( {VR = \frac{{5 \sigma^{2} \left( {r_{t} } \right)}}{{\sigma^{2} \left( {r_{t - 4,t} } \right)}}} \right)\).

Following the idea that a high frequency of zero return days indicates high transaction costs (e.g., Lesmond et al., 1999), we construct a measure of frequency of zero return days. The frequency of zero returns is calculated for each cryptocurrency for each month, and portfolios are formed on the basis of cryptocurrencies having high or low zero returns. Cryptocurrencies with higher zero return frequencies have higher transaction costs and hence higher microstructure noise. Furthermore, we use the effective bid-ask spread to measure the direct transaction cost. The effective bid-ask spread is a better measure of transaction cost than quoted bid-ask spread (Roll, 1984). It is calculated following Roll (1984) as:

The effective bid-ask spread (S) is calculated on monthly basis and cryptocurrencies are divided into tercile portfolios based on the spread. Cryptocurrencies with higher bid-ask spread have higher direct transaction costs.

The indirect costs of trading have an adverse price impact on the trade and delay the processing of the transaction. A transaction that is completed quickly has less chance of causing an adverse price effect, i.e. a thinly traded stock would have a cost of adverse price effect attached to it. For very liquid (high dollar volume of trading) cryptocurrencies, large trades can be accomplished without any delay and without much adverse price impact. We use the dollar trading volume as a measure of indirect transaction cost. We use the monthly volume in dollars as a measure of indirect cost and cryptocurrencies are divided into tercile portfolios. Cryptocurrencies with lower dollar trading volumes have higher indirect transaction costs and hence higher microstructure noise.Footnote 3

The above combination of methods are suitable to provide an in-depth analysis on the impact of microstructure noise on IVOL anomalies in the cryptocurrencies while accounting for various microstructure proxies and the potential impact of cryptocurrency sample selection.

4 Analysis and discussion

Table 1 gives the summary statistics of the average number of cryptocurrencies in the whole sample, and the subsamples based on size, price, variance ratio (VR), zero-return frequency, dollar-volume and effective bid-ask spread, along with their respective shares of market capitalization. As stated, there are, on average, 1982 cryptocurrencies in each month, and 1588 of these are categorized as big (i.e. non-penny). These cryptocurrencies account for approximately 80% of the entire sample by number, and 99.9% by market capitalization. There are 394 small (i.e. penny) cryptocurrencies, on average, accounting for 20% by number and only 0.02% by market capitalization. There are 128 cryptocurrencies with a price equal to or higher than $1, on average. These cryptocurrencies account for 6.5% of our entire sample in terms of number, but 89% by market capitalization. Finally, there are, on average, more cryptocurrencies in the low variance ratio (VR), zero returns, dollar volume and B/A spread subsample. We also present the time-series average of IVOL, the time-series average of equal-weighed (EW) and value-weighed (VW) monthly cryptocurrency returns for various subsamples. Big cryptocurrencies have higher IVOL. The cryptocurrencies most susceptible to market microstructure noise—penny cryptocurrencies, and cryptocurrencies with high variance ratios, high zero-return frequencies, high dollar volumes and effective spreads—have, on average, higher IVOLs than their respective counterparts.

4.1 Full sample results

The overall picture of the relationship between IVOL and returns is presented in Table 2. The sample is split into quintiles ordered with respect to IVOL. In each of the five quintiles, two types of portfolios are constructed—equally weighted and value weighted. For both types of portfolio, we find a positive relationship between IVOL and average returns. In the two lowest quintiles in the equally weighted portfolios there is even a negative average return, statistically significant for the lowest quintile. The difference between the lowest and the highest quintile with respect to average returns is slightly above 9% (statistically significant at the 90% level). When we control for the basic factors with the capital asset pricing model (CAPM) and the three-factor model, the results change quite markedly for the three-factor model and the models’ alpha is even negative with a negative, statistically significant (at the 99% level) difference between the highest and lowest IVOL quintiles. The two additional factors of the three-factor model thus likely play an important role in explaining the relationship between IVOL and returns. When we turn to the value weighted portfolio, the results remain qualitatively similar, even though the differences are much more pronounced. The difference in average returns between the high and low IVOL quintiles jumps to 43% and an even higher magnitude, represented by higher the t-statistic, is observed for the CAPM alpha. However, the gap between the two extremes is strongly reduced when controlling for the factors of the three-factor model. Keeping in mind that these are value-weighted portfolios, the SMB factor should be at least partially controlled for by the construction of the portfolio so that the additional factor of WML keeps the relationship between IVOL and the model alpha in check. Either way, there still remains a positive connection between the two which is still statistically significant (close to the 95% level). The separation into two types of portfolio turns out to be a crucial driver of the results here and nicely adds to the solely-presented value-weighted portfolios of Zhang and Li (2020). This is not surprising for the crypto-markets, as giving an equal weight to tiny cryptocurrencies might lead to huge swings in value as a rather small capital inflow into such cryptocurrencies can drive their price hundreds of percent up. In addition, the present study covers a wider range of cryptocurrencies making the differences between extreme quintiles of IVOL more pronounced. Based on this observation, we expect that the microstructure effects controlled for by the features we have defined (small caps, penny cryptocurrencies, and highly illiquid) can help explain the IVOL relationship in cryptocurrencies.

4.2 Feature group comparison

We further study the relationship between IVOL and returns with respect to, or after controlling for, features selected as proxies for microstructure noise—size, price, variance ratio, zero returns, dollar volume, and spread. The representation within the groups and their general connection to IVOL quintiles is presented in Table 3. Here we see that not only are the cryptocurrencies not uniformly distributed across settings, which would suggest no relationship between IVOL and returns, but the representation in the portfolio weights is highly skewed across groups. For all groups, most of the portfolios are concentrated in the low IVOL quintile. For the size effect, as much as 91% of the portfolio value is condensed in the large cap cryptocurrencies in the lowest IVOL quintile. Around 80% or more are present in the lowest IVOL quintile of low variance ratio, low zero returns, low dollar volume and high spread. The lowest value is reported for the price measure, where around 70% of the portfolio value is condensed in the lowest quintile of IVOL for the cryptocurrencies priced above $1.

Results for the specific groups are presented in Tables 4, 5, 6, 7, 8 and 9. In each table, we show the relationship between IVOL and returns (as well as model alphas for the CAPM and three-factor models) for the given feature and that for both equally-weighted and value-weighted portfolios. For each of these settings, we first split the sample with respect to the feature, e.g., low 20% market cap and top 80% market capitalization for the size effect, then within these two groups, we split the sample into five quintiles with respect to IVOL, and finally in these quintiles, we calculate average returns and alphas for the CAPM and three-factor models with either equal weights or value-based weights.

Going through the various combinations, several important findings emerge. First and foremost, the positive relationship between IVOL and expected returns seems to prevail in most of the scenarios presented, which validates the general results of Zhang and Li (2020) and highlights the separation of cryptocurrencies from standard financial assets where the opposite relationship has been reported. Ironically, this puts cryptocurrencies within the standard paradigm of financial economics where investors are compensated for taking additional risk with a premium. Secondly, the relationship is much more pronounced for the value-weighted portfolios. We attribute this to characteristics of the crypto-markets where a large proportion of the market is formed by highly illiquid assets that may experience both positive and negative shocks which are scarcely observed for standard financial assets. In the crypto-markets, daily gains of hundreds and sometimes even thousands of percent are not unheard of. This is more likely to be the case with a widening of the portfolio, as in the present study with almost 2000 cryptocurrencies considered. Such abrupt and frequent extreme events can completely invalidate the results for equally-weighted portfolios, as forming such portfolio in practice is rather unrealistic and would lead to a rocketing price of such a small or illiquid asset by itself. Thirdly, the relationship between IVOL and expected returns is often weakened when the alphas of the three-factor model are considered. This does not occur for the single-factor CAPM, which implies that it is the other two factors—size and winners/losers—that explain parts, and in some scenarios even enough to eradicate the positive IVOL-returns relationship completely. However, it does not cover and thus does not explain the premium for all settings. It is thus important to explore how such factors interact.

Even though the general results of the relationship between expected returns and idiosyncratic volatility go against what we observe in the standard financial markets, the importance of the dataset construction and the role of assets with small capitalizations and low liquidity have been reported as well. Bali et al. (2005) dispute the results of Goyal and Santa-Clara (2003), who actually found a positive relationship between returns and volatility, i.e., going against the puzzle narrative of the later results. However, Bali et al. (2005) argue that the findings are not only very dependent on the selected period but are also driven by inclusion of smaller stocks in the broader NASDAQ index. The differences between different portfolio construction approaches, namely the equal-weighted and value-weighted portfolios, are pointed out as important factors, which goes well in hand with our empirical results. After controlling for these factors, Bali et al. (2005) argue that there are no idiosyncratic premia in the stock market returns. Some newer results suggest similarly (Umutlu, 2019), and Vidal-Garcia et al. (2019) argues for the negative risk premium () but many others focusing on extremely risky assets find the positive risk premium (An et al., 2019; Begin et al., 2020; Chabi-Yo et al., 2018) and bring our results much closer to the standard financial assets in the sense that most of the risk premium lays within the extreme types of assets.

4.3 Fama–MacBeth regression

Besides the obvious advantages of portfolio analysis presented above, one of the major disadvantages is that in such analyses we cannot control for multiple factors simultaneously. Therefore, for further robustness analysis, we use Fama and MacBeth’s (1973) regression. In addition to IVOL, there are certain cryptocurrency-specific factors that affect returns, which have been added into the Fama–MacBeth analysis to control for their effect. These factors include size, dollar volume, price, momentum and illiquidity. Size is measured as the log of market capitalization, dollar volume is calculated as the average logarithm of dollar trading volume for a given cryptocurrency for each month, price is log of price at the end of each month, momentum is measured as the cumulative stock return of the previous 3 months, and illiquidity is defined as the average ratio of the daily absolute return to the (dollar) trading volume.

Table 10 summarizes the results of the Fama–MacBeth regressions for the same subgroups as in the previous section. We are mostly interested in the sign and significance of the IVOL effect with respect to specific subgroups. For the whole sample, we see a positive and statistically significant relationship between IVOL and returns, even after controlling for other factors. However, it needs to be noted that most of these factors are on the edge of statistical significance. What is more important though, is the split into the subgroups that proxy the microstructure noise in the pricing mechanism. Here, apart from the size where the effect is insignificant for both small and big market capitalizations and traded volumes, we always report positive and statistically significant relationships between IVOL and returns for one of the two groups. The two groups with insignificant results may have data reporting issues as it is well known that many centralized exchanges artificially boost their trading volumes to attract new listings and investors seeking liquid markets where trades apparently occur, but outside the live order-book dynamics. For market capitalization, the issue often lies with initially misreported total and/or circulating supplies, mostly for newly listed cryptocurrencies. This issue usually goes away, and the data becomes valid once the asset starts trading on more exchanges and the project’s founders deliver the precise values of the coin or token supplies. This explains why the relationship is close to being significant for the cryptocurrencies with large market capitalizations, as these are already well represented and reported while the data for assets with low market capitalization might be lacking.

The relationship is intuitive for the price groups, where we see a positive and significant relationship for currencies with prices below $1 as well as for the spread measure where the significant relationship is identified for illiquid currencies with high market spreads. Similarly, a positive connection between IVOL and returns is found for assets with low traded volumes in US dollar terms, although with lower significance. However, there are two puzzling subgroups—based on variance ratio and zero returns count—where a positive connection is found for groups with low values of the given measures. In the variance ratio case, one can imagine an inverse behaviour of the ratio for cryptocurrencies compared to traditional financial assets. In the crypto-markets, specifically for very risky assets, the weekly period as a base for the ratio could be too long. The recurrent pump and dump scenario, where a coin is pumped hundreds of percent in a day or less and then either abruptly or slowly goes back close to its initial levels can cause the variance ratio to be low and not scale with the time window as more standardly behaving highly capitalized and less risky cryptocurrencies do. For the zero returns measure, we attribute the behaviour to the fact that cryptocurrencies are rarely if ever delisted from the coinmarketcap.com repository, even if they are practically dead. In standard markets, when a company goes bankrupt, it is usually delisted from the exchanges. Even though delisting from exchanges does happen in crypto-markets, this does not mean that the assets get delisted from the data providers. As long as there is at least one exchange (either centralized or decentralized) that still lists the cryptocurrency, there will be a price record with the data provider. Such assets are thus not risky in the sense that their holders would need to be paid a risk premium, the projects are just dead and the investors are the so-called bag holders with possibly millions of worthless coins. As the dataset ranges over the boom period of initial coin offerings, these worthless projects can easily form a large part of the portfolio, and when we focus on zero returns assets only, their prominence drags the results for this subgroup in this counterintuitive way. Luckily, this does not seem to affect the logical inference for the other subgroups where these projects are diluted by other features.

Apart from the central relationship between the idiosyncratic volatility and expected returns, there are several other findings emerging from the Fama–MacBeth regression in Table 10. First, there is a negative relationship between size and returns across all specifications, albeit with a varying level of significance. The negative effect is most prominent, i.e., there is a penalty in a sense of lower returns for higher size, for large market caps, assets with price below $1, low VR groups, low volume groups, and low bid-ask spreads. However, we do not observe premia for the opposite groups as these are mostly insignificant and still with a negative sign. We have already discussed the reasons of volume not being well reported for illiquid assets, so we turn directly to the effect of price. There we see that in the assets, there is significant penalty directing towards holding very low-price assets when one chooses to go this direction (i.e., penny assets). These findings are well in hand with the general idea that investors are mostly being compensated or even motivated towards highly risky cryptocurrencies.

5 Conclusion

We have examined the relationship between idiosyncratic volatility (IVOL) and expected returns in the cryptocurrency market to see how, or whether, they are priced in or whether the same situation as for standard financial markets applies. Curiously, the cryptocurrency markets turn out to behave more like the theoretical expectation that additional risk will be compensated for in a risk premium, as we find a clear positive relationship between IVOL and returns (as well as the alphas of the CAPM and the three-factor model of asset returns). However, when the sample is divided with respect to features proxying possible microstructure noise, the relationship is mostly found only for those cryptocurrencies prone to, or characterised by, illiquidity or other features connected to microstructure noise. We present an in-depth explanation of crypto-market specifics that might have unexpected or even counterintuitive results. Inspection of the technical details of the crypto-market structure, the underlying mechanics, and how these differ from standard financial markets is thus crucial for understanding the outcoming dynamics and interconnections therein.

For practitioners and traders, our results provide an important guide to which types of cryptocurrencies might be worth additional risk which is, on average, compensated for through the risk premium. Our findings imply, firstly, that it is not worth risking speculation in apparently dead projects the price of which has already stabilized. Even though there might be exceptions when some such projects either come to life or go through one or two pump and dump runs, such a gamble does not pay off on average. Secondly, pump and dump cryptocurrencies are not worth the additional risk, on average. Thirdly, there are additional risk premia paid for highly illiquid and lowly priced cryptocurrencies. Based on our analysis, these cryptocurrencies might be worth the additional risk in the sense of increased expected returns. Thus, cryptocurrencies have once again shown their uniqueness and specificity compared to tradition financial markets. Detailed knowledge of crypto-market function and structure can help identify potentially highly profitable assets. However, it must be noted that one angle of investing into highly risky cryptocurrencies remains hidden away from the available data—projects that never made it to the cryptocurrency databases such as CoinMarketCap, CoinGecko, LiveCoinWatch, and others. Making it to these lists can be seen as a success, at least for the very risky projects with possibly very low liquidity at the very beginning, so that any analysis using such data sources omits the projects that had failed. Frankly, this is any analysis into cryptocurrencies that tries to cover a larger portfolio than simply the topmost capitalized cryptocurrencies. Although, one must admit that it is practically impossible to include all projects that have ever came up and never made it to the point of listing on these services, specifically with current alternative blockchains (most prominently the Binance Smart Chain) that make it easy, simple, and cheap to come up with a new project within minutes and hours and “try your luck.” The compensation or premium for idiosyncratic risk for the highly risky assets will thus be biased upwards as the ones that had not survived, i.e., had a return of a complete loss, never made it to the dataset. Therefore, when utilizing results of the current study, one should not interpret it as an invitation to a reckless investment into the riskiest projects there are, but mostly covers only the ones that have already survived their very initial and thus the riskiest phases of existence.

Cryptocurrencies thus remain a fascinating field of research with atypical characteristics. However, the knowledge of these specifics is crucial for understanding results of purely statistical studies as one might easily get burned if applying the standard approach as if towards the standard financial assets. Future studies building on our results can consider the utility of applying arbitrage strategies for cryptocurrency return anomalies. Another line of research can examine a potential link between IVOL and gambling preference in the cryptocurrency market.

Notes

Precisely, stocks in the lower quantiles of the idiosyncratic volatility distribution tend to outperform stocks in the upper quantiles by around 1% per month.

The finance literature argues that the most liquid securities have lower noise and that higher transaction costs is often associated with lower trading volume.

References

Ahmed, W. M. (2020). Is there a risk-return trade-off in cryptocurrency markets? The case of Bitcoin. Journal of Economics and Business, 108, 105886.

Aleti, S., & Mizrach, B. (2021). Bitcoin spot and futures market microstructure. Journal of Futures Markets, 41(2), 194–225.

Alexander, C., Choi, J., Massie, H. R., & Sohn, S. (2020). Price discovery and microstructure in ether spot and derivative markets. International Review of Financial Analysis, 71, 101506.

Al-Khazali, O., Bouri, E., & Roubaud, D. (2018). The impact of positive and negative macroeconomic news surprises: Gold versus Bitcoin. Economics Bulletin, 38(1), 373–382.

An, L., Wang, H., Wang, J., & Yu, J. (2019). Lottery-Related Anomalies: The Role of Reference-Dependent Preferences. Management Science, 66(1), 473–501.

Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2019). Cryptocurrency market contagion: market uncertainty, market complexity, and dynamic portfolios. Journal of International Financial Markets, Institutions and Money, 61, 37–51.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. The Journal of Finance, 61(1), 259–299.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2009). High idiosyncratic volatility and low returns: International and further US evidence. Journal of Financial Economics, 91(1), 1–23.

Apergis, N., Koutmos, D., & Payne, J. E. (2020). Convergence in cryptocurrency prices? The role of market microstructure. Finance Research Letters, 40, 101685.

Arsi, S., Guesmi, K., & Bouri, E. (2021). Herding behavior and liquidity in the Cryptocurrency Market. Asia-Pacific Journal of Operational Research. https://doi.org/10.1142/S0217595921400212

Babenko, I., Boguth, O., & Tserlukevich, Y. (2016). Idiosyncratic cash flows and systematic risk. The Journal of Finance, 71(1), 425–456.

Bali, T. G., Cakici, N., Yan, X., & Zhang, Z. (2005). Does Idiosyncratic Risk Really Matter? The Journal of Finance, 60(2), 905–929.

Baur, D. G., & Dimpfl, T. (2018). Asymmetric volatility in cryptocurrencies. Economics Letters, 173, 148–151.

Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 54, 177–189.

Begin, J.-F., Dorion, C., & Gauthier, G. (2020). Idiosyncratic jump risk matters: Evidence from equity returns and options. The Review of Financial Studies, 33(1), 155–211.

Bouri, E., Azzi, G., & Dyhrberg, A. H. (2017). On the return-volatility relationship in the bitcoin market around the price crash of 2013. Economics: the Open-Access, Open-Assessment E-Journal, 11(1), 1–16.

Bozhkov, S., Lee, H., Sivarajah, U., Despoudi, S., & Nandy, M. (2018). Idiosyncratic risk and the cross-section of stock returns: the role of mean-reverting idiosyncratic volatility. Annals of Operations Research, 294(1), 419–452.

Chabi-Yo, F., Ruenzi, S., & Weigert, F. (2018). Crash sensitivity and the cross section of expected stock returns. Journal of Financial and Quantitative Analysis, 53(3), 1059–1100.

Chen, L. H., Jiang, G. J., Xu, D. D., & Yao, T. (2020). Dissecting the idiosyncratic volatility anomaly. Journal of Empirical Finance, 59, 193–209.

Chung, K. H., Wang, J., & Wu, C. (2019). Volatility and the cross-section of corporate bond returns. Journal of Financial Economics, 133(2), 397–417.

Ciaian, P., Rajcaniova, M., & Kancs, D. A. (2016). The economics of BitCoin price formation. Applied Economics, 48(19), 1799–1815.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28–34.

Demir, E., Gozgor, G., Lau, C. K. M., & Vigne, S. A. (2018). Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Finance Research Letters, 26, 145–149.

Dimpfl, T., & Peter, F. J. (2020). Nothing but noise? Price discovery across cryptocurrency exchanges. Journal of Financial Markets, 54, 100584.

Dyhrberg, A. H., Foley, S., & Svec, J. (2018). How investible is Bitcoin? Analyzing the liquidity and transaction costs of Bitcoin markets. Economics Letters, 171, 140–143.

Fernandez-Perez, A., Fuertes, A. M., & Miffre, J. (2016). Is idiosyncratic volatility priced in commodity futures markets? International Review of Financial Analysis, 46, 219–226.

Ferreira, P., Kristoufek, L., & Pereira, E. J. D. A. L. (2020). DCCA and DMCA correlations of cryptocurrency markets. Physica a: Statistical Mechanics and Its Applications, 545, 123803.

Ferreira, P., & Pereira, É. (2019). Contagion effect in cryptocurrency market. Journal of Risk and Financial Management, 12(3), 115.

Garcia, R., Mantilla-Garcia, D., & Martellini, L. (2014). A model-free measure of aggregate idiosyncratic volatility and the prediction of market returns. Journal of Financial and Quantitative Analysis, 49(5–6), 1133–1165.

Goyal, A., & Santa-Clara, P. (2003). Idiosyncratic risk matters! The Journal of Finance, 58, 976–1008.

Guo, H., & Savickas, R. (2008). Forecasting foreign exchange rates using idiosyncratic volatility. Journal of Banking & Finance, 32(7), 1322–1332.

Huang, W., Liu, Q., Rhee, S. G., & Zhang, L. (2010). Return reversals, idiosyncratic risk, and expected returns. The Review of Financial Studies, 23(1), 147–168.

Ji, Q., Bouri, E., Lau, M. C. K., & Roubaud, D. (2019). Dynamic connectedness and integration in cryptocurrency markets. International Review of Financial Analysis, 63, 257–272.

Klein, T., Thu, H. P., & Walther, T. (2018). Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis, 59, 105–116.

Koutmos, D. (2018). Bitcoin returns and transaction activity. Economics Letters, 167, 81–85.

Koutmos, D., & Payne, J. E. (2021). Intertemporal asset pricing with bitcoin. Review of Quantitative Finance and Accounting, 56(2), 619–645.

Kristoufek, L. (2015). What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS ONE, 10(4), e0123923.

Lesmond, D. A., Ogden, J. P., & Trzcinka, C. A. (1999). A new estimate of transaction costs. The Review of Financial Studies, 12(5), 1113–1141.

Liu, W., Semeyutin, A., Lau, C. K. M., & Gozgor, G. (2020). Forecasting value-at-risk of cryptocurrencies with riskmetrics type models. Research in International Business and Finance, 54, 101259.

Liu, Y., & Tsyvinski, A. (2021). Risks and returns of cryptocurrency. The Review of Financial Studies, 34(6), 2689–2727.

Mokni, K., Bouri, E., Ajmi, A. N., & Vo, X. V. (2021). Does Bitcoin hedge categorical economic uncertainty? A quantile analysis. SAGE Open. https://doi.org/10.1177/21582440211016377

Qureshi, S., Aftab, M., Bouri, E., & Saeed, T. (2020). Dynamic interdependence of cryptocurrency markets: An analysis across time and frequencies. Physica A - Statistical Mechanics and Its Applications, 559, 125077.

Roll, R. (1984). A simple implicit measure of the effective bid-ask spread in an efficient market. The Journal of Finance, 39(4), 1127–1139.

Roll, R. (1988). R2. Journal of Finance, 43(2), 541–566.

Shahzad, S. J. H., Bouri, E., Ahmad, T., Naeem, M. A., & Vo, X. V. (2021). The pricing of bad contagion in cryptocurrencies: A four-factor pricing model. Finance Research Letters, 41, 101797.

Shahzad, S. J. H., Bouri, E., Roubaud, D., & Kristoufek, L. (2020). Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling, 87, 212–224.

Shen, D., Urquhart, A., & Wang, P. (2020). A three-factor pricing model for cryptocurrencies. Finance Research Letters, 34, 101248.

Umutlu, M. (2019). Does idiosyncratic volatility matter at the global level? The North American Journal of Economics and Finance, 47, 252–268.

Vidal-Garcia, J., Vidal, M., Boubaker, S., & Manita, R. (2019). Idiosyncratic risk and mutual fund performance. Annals of Operations Research, 281, 349–372.

Yi, S., Xu, Z., & Wang, G. J. (2018). Volatility connectedness in the cryptocurrency market: Is Bitcoin a dominant cryptocurrency? International Review of Financial Analysis, 60, 98–114.

Zaremba, A., & Maydybura, A. (2019). Idiosyncratic volatility and the cross-section of anomaly returns: Is risk your Ally? Applied Economics, 51(49), 5388–5397.

Zhang, W., & Li, Y. (2020). Is idiosyncratic volatility priced in cryptocurrency markets? Research in International Business and Finance, 54, 101252.

Acknowledgements

Ladislav Kristoufek gratefully acknowledges the support from the Czech Science Foundation (project 20-17295S).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bouri, E., Kristoufek, L., Ahmad, T. et al. Microstructure noise and idiosyncratic volatility anomalies in cryptocurrencies. Ann Oper Res 334, 547–573 (2024). https://doi.org/10.1007/s10479-022-04568-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04568-9