Abstract

Reverse factoring, a financial scheme in which established retailers facilitate financing for suppliers, is becoming an increasingly important tool in the industry. Normally, an SME supplier, a core retailer and a bank participate in the reverse factoring scheme. A three-level Stackelberg game is proposed in this study to investigate the interaction of the participants. The closed-form equilibria of the retailer’s replenishment decision, the supplier’s payment term decision and the bank’s financing decision are derived from the theoretical model. To our knowledge, this study is the first attempt which takes banks into account and endogenises their interest rates in the modelling of reverse factoring. The reverse factoring scheme is compared with commercial loans and traditional factoring. Compared to commercial loans, the introduction of factoring can lower credit risk, but fraud risk still exists. Reverse factoring solves this fraud problem and further decreases the financing cost for the supplier. Consequently, reverse factoring benefits the retailer through a significantly increased payment extension granted by the supplier. The numerical results also indicate that the utility of the bank significantly improves by 8–50% under varying levels of default risk compared with traditional factoring. Our study provides incentives and guidelines for supply chain participants to adopt such schemes when faced with capital constraints and the credit risk of the supplier.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Small- and medium-sized enterprises (SME) are regarded as one of the driving forces of the economy in most countries, especially in developing countries. However, SMEs are facing a huge credit gap which hinders their development. On the one hand, many banks consider SMEs to be high risk clients and thus limit their lending to such firms (Owens & Wilhelm, 2017; Zhu et al., 2019). On the other hand, accounts receivable, which is a major component of a firm’s assets, squeezes the liquidity of SMEs. According to the National Bureau of Statistics of China (2020),Footnote 1 by the end of 2019, notes receivable and accounts receivable of industrial enterprises above a certain size in China had reached $2.45 trillion.

When the SME is a supplier, factoring, that is, selling the account receivable to a financial institution, is one of the solutions to its huge credit gap. The financial institution provides immediate financing to SMEs at a predetermined discount rate after receiving their receivable, so SMEs can quickly cover their temporary liquidity shortage. However, the frequent occurrence of fraudulent cases has sounded an alarm with respect to traditional factoring. The most recent case in China involved the Hong Kong-listed company Camsing Global and the Chinese wealth fund Nuoya Fortune. Nuoya Fortune provided $480 million in financing to the company on its receivables through the Chinese e-commerce platform Jingdong, but Jingdong claimed that Camsing Global forged the contract and receivables.

Reverse factoring is considered to be a possible solution to tackle the fraud problem in factoring. Under an arrangement of reverse factoring, the core retailers, which are mostly established companies, use their own credit reputation to help facilitate a financing contract between their suppliers and the bank. Unlike traditional factoring, the reverse factoring is initiated by the retailer (Dello Iacono et al., 2015). The retailer recommends its supplier to the bank and pays back the loan principal to the factor when the payment term is due while the supplier covers the interest.

The arrangement of reverse factoring could bring dual benefits to small- and medium-sized suppliers. As SMEs, the suppliers usually have a much higher financing cost than do established companies, and the reverse factoring arrangement allows them to take advantage of the credit rating of established companies and save on financing cost. In addition, this arrangement provides an additional financing source for SMEs to enable their production (Grüter & Wuttke, 2017). As a result, retailers can also use this supply chain arrangement to lure suppliers into a longer payment term (van der Vliet et al., 2015). It is also possible for a bank to benefit from such an arrangement. Certainly, the bank’s interest rate for the SME will be lower under this circumstance, but the decrease in the default risk and the increase in discounted account receivables could have positive effects on the profits of the bank. For the above reasons, reverse factoring has been increasingly popular in the industry. From the annual review of FCI (2019),Footnote 2 the domestic and international reverse factoring turnover has increased 79% and 70%, respectively, from 2018 to 2019. Big companies, such as Volvo, Scania and Caterpillar, are all using this arrangement to finance their upstream suppliers (Lekkakos & Serrano, 2016).

There are plenty of studies that have investigated operational and financial decision making in the arrangement of reverse factoring (Grüter & Wuttke, 2017; Lekkakos & Serrano, 2016; van der Vliet et al., 2015). These studies have also tried to figure out what additional value this arrangement would bring to the supply chain. It is intuitive that a successful arrangement of reverse factoring depends on the interplay of the three participants in the supply chain. However, few studies have considered the interaction and how this would affect the participants’ optimal decisions.

In addition, most of the previous studies in supply chain finance have taken the interest rate of the bank as an exogenous variable (Jing et al., 2012; Tunca & Zhu, 2018). However, in an imperfect financial market, the bank is not just a price taker but can also decide the interest rate based on the responses of the other two participants. The interest rate is also an important factor in the adoption of reverse factoring. If its level is too high, the supplier will be reluctant to accept such an arrangement, and this will also affect the decision of the retailer through the transmission of the supply chain. Therefore, it is necessary to consider the interest rate from the bank as an endogenous variable.

Our work aims to fill this research gap and mainly addresses the following research questions: (1) What are the optimal decisions of the participants when their interactions are considered? (2) How much utility improvement does reverse factoring bring about? The main contributions of this paper are as follows:

-

1.

The interaction of the bank with other players is taken into account. To our knowledge, this is the first study that considers the bank and endogenises its interest rate in the analysis of reverse factoring. A three-level Stackelberg game model is proposed to capture the interactions among the bank, the retailer and the supplier in reverse factoring.

-

2.

Closed-form expressions are derived for the optimal replenishment quantity, payment term and interest rate in the scheme of reverse factoring. These are compared with the scheme of commercial loans and traditional factoring in order to better assess the performance of reverse factoring in improving supply chain efficiency.

-

3.

The impacts of capital constraints, demand volatility, supplier’s profit margin and risk preference of the bank on the performance of supply chain finance is analysed. Managerial insights are generated to provide incentives and guidelines for the adoption of a financial programme to enhance supply chain coordination.

The rest of this paper is organised as follows. Section 2 reviews the literature. Section 3 proposes the models for three different conditions. Sections 4 compares the optimal solutions and the utility of the participants in the different models. Section 5 conducts the numerical analysis. Conclusions and future works are presented in Sect. 6.

2 Literature review

Our work lies in the interface of operation and finance. According to Babich and Kouvelis (2018), the interface of finance, operation and risk management investigates better integration of physical and financial flows by endogenising not only the operational choices of the firm and its agents but also their financial decisions. Babich and Kouvelis (2018) pointed out that supply chain finance is among the most frequently addressed issues in this field. Xu et al. (2018) provided an excellent review of supply chain finance, and they identified four research clusters, namely deteriorating inventory models under trade credit policy based on the EOQ/EPQ model; inventory decisions about trade credit policy under more complex situations; interactions between replenishment decisions and delay payment strategies; and the role of financing services in the supply chain. Our work falls in the third and fourth research cluster and tries to answer how the retailer’s replenishment decision, the supplier’s payment term decision and the bank’s financing decision interact with each other under reverse factoring and what additional value this scheme could bring.

Reverse factoring has received more and more attention in academia and industry. However, research in this field is still relatively new and fragmented (Liebl et al., 2016). A study by Klapper (2006) which studied the role of factoring in the financing of SMEs in emerging markets was among the first to analyse the effects of reverse factoring. Klapper (2006) showed that reverse factoring may mitigate the problem of borrowers’ informational opacity if only receivables from high-quality buyers are factored. Seifert and Seifert (2011) found that buyers can reduce net working capital by 13% through reverse factoring. In recent years, more modelling work has been done in this area. Tanrisever et al. (2012) presented an analytic model for a single period with deterministic and stochastic demand and showed how application of reverse factoring influences the operational and financial decisions of these firms. They also presented how the value of reverse factoring results from and is conditioned by the spread in external financing costs, the operating characteristics of the supplier and the risk-free interest rate. van der Vliet et al. (2015) developed a periodic review inventory model with the objective function of minimising the supplier’s cost. They explored what payment extension would also benefit the supplier and found that the size of the payment term extension a supplier can accommodate under reverse factoring depends on demand uncertainty and the cost structure of the supplier. Lekkakos and Serrano (2016) presented a multi-period model with the objective function of maximising the supplier’s expected profits. They showed that a working capital-dependent base-stock policy is optimal, and the optimal policy specifies the sell-up-to level of the account receivables with regard to their time to maturity. Grüter and Wuttke (2017) assumed that the liquidity needs of the supplier would follow a geometric Brownian motion and provided closed-form expressions of the benefits from interest arbitrage and the potential option to enable the production of suppliers. Most of the previous studies focused on one supply chain participant with the objective of minimising the supplier’s cost or maximising the supplier’s profit. Tanrisever et al. (2012) and Grüter and Wuttke (2017) considered both the profit/cost of the supplier and retailer, but they analysed the participants separately and neglected the interactions among the supply chain participants. Wu et al. (2019) captured the interaction in the reverse factoring mechanism between the supplier and retailer by using a two-stage Stackelberg model. However, they considered the interest rate as an exogenous variable and did not include the bank as a major player.

This study differs from previous works by including the bank as a major player in reverse factoring and analysing how it interacts with the supplier and the retailer. The decision of the bank is widely considered in areas like the capital-constrained newsvendor problem and asset-based financing. Buzacott and Zhang (2004) presented a deterministic model to understand how asset-based financing affects the ability of a firm to grow, while considering the lender’s decision making on the interest rate and the loan limit. Dada and Hu (2008) built a Stackelberg game model to analyse how banks determine their interest rates when the newsvendor is capital-constrained and needs to borrow from the bank to finance its procurement. They showed that the interest rate decreases with the newsvendor’s equity. However, studies in reverse factoring have mostly treated the interest rate of the bank as an exogenous variable. These studies (e.g., Jing et al., 2012; Tunca & Zhu, 2018) have assumed that in a competitive market, the bank can earn no extra profit from a loan than it would get from investing in a risk-free asset. However, the financial market is usually not perfectly competitive, especially in emerging markets, and the bank can get extra profits from a proper interest rate when interacting with the other players. Therefore, it is necessary to relax the assumption that the financial market is perfectly competitive and include the bank as a major player in the model.

Another topic that is particularly relevant to our study is trade credit. Trade credit has been extensively investigated in finance and operations management (Babich & Kouvelis, 2018). Seifert et al. (2013) has identified the major research areas in this field, which include trade credit motives, order quantity decisions and credit term decisions. The trade credit motives refer to the reasons firms offer trade credit. One of the most frequently mentioned motives is to increase order quantity. Schwartz (1974) was among the first to point out that firms can leverage the capital access of the buyers to induce them to increase purchases. Fabbri and Klapper (2008) pointed out that trade credit is a competitive gesture to maintain or increase sales, which is usually extended after new product introductions or price decreases. The second research question is the decision of order quantity, which is highly correlated with trade credit motives. Jaggi et al. (2007) proposed an economic order quantity model under which the retailer receives trade credit from a supplier and offers trade credit to its customers and, at the same time, customer demand is dependent on the payment term. It suggests that the optimal order quantity of the retailer decreases as the credit elasticity of customer demand increases. The third question referred to by the credit term decision is the decision on prices and delivery and payment conditions for which the optimal length of the payment delay is the core concern. Du et al. (2013) found that a coordinating policy that incorporates both a quantity discount and a credit payment option can benefit both parties by increasing total supply chain profitability.

Our study is an extension of the current trade credit literature. It is different from the previous studies in that it is focused on financially constrained suppliers instead of financially constrained retailers. From the perspective of retailers, the existence of trade credit is equal to a cost-free loan. This is especially useful for the financially constrained retailer, as some of them may not have enough funds to order the products. Hence, trade credit is frequently related to the financial constraints of retailers. One important research question in trade credit is whether the arrangement of trade credit could improve the efficiency of the supply chain with a capitally constrained retailer (see, e.g., X. Chen & Wang, 2012; Jing et al., 2012; J. Chen et al., 2017). The studies in the mentioned trade credit literature usually assume that the suppliers have no financial constraints and that they provide supplier financing for the retailer.

However, in real life, many suppliers could be financially constrained. For example, small- and medium-sized suppliers are currently facing a serious issue of capital constraint. SMEs always find it hard to obtain bank financing for their operations (Huang et al., 2020) due to the conflict between risk control by banks and the poor credit rating of SMEs. As a result, the SMEs become financially constrained and their growth is limited. According to the World Bank,Footnote 3 access to finance is the second most-cited obstacle SMEs face in growing their businesses in emerging markets and developing countries. Though financially constrained, these suppliers could still set up trade credit for reasons such as price discrimination and market promotion (Fabbri & Klapper, 2016). In some circumstances, the capital-constrained supplier could even be forced by its retailer to extend the payment term (van der Vliet et al., 2015). Our study extends the trade credit literature by providing additional insights into the case of capital constrained suppliers.

3 The models

We consider the case in which the supplier is an SME looking for financing schemes, and the retailer is an established company engaged in transactions with the SME. When a small enterprise faces a liquidity need, a common solution is to obtain commercial loans from the bank or to sell its accounts receivable to the bank. SMEs usually lack access to commercial loans as it is widely accepted that they represent default risks. It is easier for SMEs to sell their receivables to the bank, as the receivables will be removed from the bankruptcy estate of the SMEs and become the property of the factor (Klapper, 2006). This sort of scheme when initiated by the supplier is usually called traditional factoring. However, even when SMEs manage to obtain financing either through commercial loans or traditional factoring, their financing cost can be prohibitively expensive. Smaller enterprises can receive an interest rate as high as 18%, while larger enterprises can receive an interest rate as low as 4% (Wu et al., 2019).

The introduction of reverse factoring can partly alleviate the financing difficulty of SMEs. If their downstream retailers are established companies, the retailers can recommend that they use this scheme to obtain short term funds and thus access the capital in an easier and cheaper way. In this paper, we mainly discuss the operational and financial decision making in reverse factoring. To fully understand the performance of reverse factoring, we also compare it with the scheme of commercial loans and traditional factoring.

The main objective of a supply chain is the maximisation of the overall profits of the participants. Optimisation methods are thus widely used in the modelling of supply chain problems. Considering the operational constraints and the nonlinearity of the objective function in the supply chain problem, the mixed integer nonlinear programming (MINLP) model is one of the most frequently used models to capture the decision-making process in the supply chain (see, e.g., Duan et al., 2018; Gharaei et al., 2019a, 2019b, 2020a, 2020b). The advances and developments in algorithms, such as outer approximation, make it possible to solve this sort of large scale and complicated mathematical problem (see, e.g., Hoseini Shekarabi et al., 2019; Gharaei et al., 2019a, 2019b, 2020a, 2020b).

However, this sort of optimisation model, like mixed integer nonlinear programming, fails to capture the interaction of participants in the supply chain. As the supply chain coordination becomes more critical, it is increasingly important to introduce theoretical models to capture the interactions among supply chain participants. Game theory, which is capable of analysing the situation of multiple agents with conflicting objectives, becomes an essential tool in supply chain analysis (Cachon & Netessine, 2006). Among others, the Stackelberg game is the kind of theoretical game model that contains a leader–follower decision structure in which the leader makes the first move and followers observe the leader’s move and make their own decisions. It has been widely used in the field of supply chain to model the interplay between a supplier and a retailer (see, e.g., Yin et al., 2016; Zhao et al., 2017; Zhang et al., 2018; Y. Chen et al., 2020). In this study, the Stackelberg game models are proposed to describe the decision-making process in different financing schemes. The use of the Stackelberg game allows us to capture how different players, namely, the bank, supplier and retailer, are influencing each other in their decision making so as to achieve an interactive optimisation result.

The uniform distribution is frequently used to describe the demand in the supply chain (e.g., Vörös, 1999; Wanke, 2008). In order to gain formulas in a more explicit form, the market demand D faced by the retailer is assumed to follow the uniform distribution of U[a,b]. Following Yan et al. (2019), without loss of generality, the retail price per unit p is normalised to 1. In addition, the whole price per unit w is less than the retailer price p, and the supplier’s production cost per unit c is less than the wholesale price, that is, c < w < p = 1. The retailer’s financing cost θ is supposed to be less than the supplier’s interest rate \({r}_{j}\), that is, θ≦ \({r}_{j}\), as the established companies’ capital cost is normally lower than the SMEs’.

3.1 The benchmark model

We start with the case in which the supplier can only obtain funds from commercial loans. In this case, the retailer places orders with its supplier, and the supplier produces within the funds that it can control. The supplier first uses its own funds to support production. When its own funds are not enough to support production, the supplier will try to get loans from a bank at interest rate α. The sum of the supplier’s own funds and its commercial loans is denoted as L here, representing the funds that the supplier can control. When L is too small, the supplier has a financial constraint. This is possible as the bank will usually set a loan limit for the SMEs (Buzacott & Zhang, 2004).

We introduce a two-stage Stackelberg model with the supplier as the leader and the retailer as the follower to capture the interaction in this case. Since getting loans from the bank is a common practice of the supplier, we denote the model in this case as the benchmark model. In the benchmark model, both the supplier and retailer act under the objectives of profit maximisation. The supplier will first determine the payment term to grant to its retailer. Based on the supplier’s decision, the retailer will decide its own order quantity. The benchmark model does not take the account receivable into consideration. The decision of interest rate is exogenous in the benchmark model as its decision does not interact with the decisions of the retailer and supplier. The decision variables in this model are the payment term T and order quantity q. Accordingly, the objective function of the supplier is shown by Eq. (1),

The supplier’s profit function consists of three parts. The first part is the revenue that the supplier receives from the retailer, the second part \(c{q}_{B}\) is the production cost of the supplier and the third part \(w{q}_{B}{T}_{B}\) α is the opportunity cost of the credit period that the supplier grants to the retailer. Financial practices usually take the capital cost of a firm as its opportunity cost for the credit period (Brealey et al., 2010). We use the supplier’s interest rate on commercial loans as its opportunity cost. Similar to X. Chen et al. (2019) and Wu et al. (2019), we use 1 + Tα as the approximation of \({(1+\alpha )}^{T}\) to describe money’s time value.Therefore, the opportunity cost of the payment term can be expressed as \(w{q}_{B}{T}_{B}\) α.

The objective function of the retailer is shown by Eq.(2),

The retailer’s profit also consists of three parts. The first part \(pEmin\left( {q_{B} ,D} \right)\) is the revenue that the retailer received from selling products to the customers, and the second part \(w{q}_{B}\) is the purchase cost of the retailer. The receipt of a payment term by the retailer is equivalent to receiving interest revenue, as the retailer can use that amount of money instead of borrowing from the bank. So the third part \(w{q}_{B}{T}_{B}\theta \) can be seen as the interest revenue that the retailer receives.

Using the method of backward induction, we can obtain the equilibrium of the benchmark model as shown in Proposition 1.

Proposition 1

In the benchmark model, the equilibrium (\({T}_{B}^{*}\),\({q}_{B}^{*}\)) can be obtained under the mild condition of \(\alpha <\frac{(b-a)\theta (w-c)}{b-(b-a)w}\). Specifically, when there is no financial constraintFootnote 4, \(T_{B}^{*} = T_{BU} = \frac{w - c}{{2w\alpha }} + \frac{1}{2\theta } - \frac{b}{{\left( {b - a} \right){*}2w\theta }}\), \({q}_{B}^{*}\)=\({q}_{BU}\)=b–w(1–TB*θ)(b–a). When L constitutes a financial constraint, and c(\(b-(b-a)w\)) > L, meaning the supplier is unable to satisfy the retailer’s minimum ordering request, \({T}_{B}^{*}\)=\({T}_{BLL}\)=0, \({q}_{B}^{*}\)=\({q}_{BLL}\)=L/c. When L constitutes a financial constraint but c(\(b-(b-a)w\)) < L, meaning the supplier is able to satisfy the retailer’s minimum ordering request,

and \({q}_{B}^{*}\)=\({q}_{BL}\)=b–w(1–TBLθ)(b–a). The comparisons of the equilibrium under three circumstances are: \({T}_{BLL}\)<\({T}_{BL}\)<\({T}_{BU}\), \({q}_{BLL}\)<\({q}_{BL}\)<\({q}_{BU}\).

Proof of Proposition 1. See “Appendix A1”.

Proposition 1 indicates that the existence of the financial constraints could limit the payment term level granted by the supplier. When it does not have enough funds, the supplier has to choose a suboptimal term \({T}_{BL}\) instead of \({T}_{BU}\). If its funds are too limited, the supplier’s payment term may end up being \({T}_{BLL}\)=0. Consequently, the financial constraints could also limit the order quantity of the retailer, which could decrease to a level as low as L/c. In other words, financial constraints not only affect the optimal decision of suppliers but also lead to their inability to meet the retailer's minimum order quantity which directly affects the retailer's operation. Therefore, from a retailer’s perspective, they also have an incentive to solve the problem of supplier financial constraints. The condition \(\alpha <\frac{(b-a)\theta (w-c)}{b-(b-a)w}\) is a term describing the opportunity cost of the supplier to grant the payment term. This implies that the interest rate \(\alpha \) cannot be too large, otherwise it will be too costly for the supplier to set up any credit term.

3.2 The traditional factoring model

We next study the case of a traditional factoring (TF) programme. The sequence of events in a TF programme is shown in Fig. 2. In a TF programme, the supplier sells products to the retailer and grants the retailer a credit period. The sales will then form into account receivables, and the supplier can discount them to the bank at an interest rate rTF to get immediate funds. When the payment term is due, the retailer will transfer the payments for the goods to the bank. It is noteworthy that the TF programme is merely a contract between the supplier and the bank. The supplier can make use of the credibility of the retailer in this circumstance and obtain the financing in an easier way. However, the retailer does not assure the authenticity of the transaction, and thus, the risk of fraud exists.

To study the decision-making process in the TF programme, we introduce a three-stage Stackelberg model with the bank as the leader, the supplier as the follower and the retailer as the second follower. In this model, all participants act under the objectives of utility maximisation. The bank first determines its discount rate to the supplier, the supplier decides on its payment term based on the bank’s decision and, finally, the retailer chooses its order quantity based on the supplier’s decision.

From the bank’s perspective, it is possible that the supplier could forge the contract and try to fraudulently obtain supply chain financing, which is a big problem in the TF programme. As a result, banks usually assess the default risk of the supplier using different financial indicators. Suppose the repayment probability assessed by the bank is η, 0 < η < 1. η is a default risk factor, that is, the banks have the probability of (1−η) to fail to recover the loans. If the loan cannot be recovered, it will cause a huge loss to the bank. Following the relevant literature (Huang & Chen, 2020), we assume the bank is loss-averse, and its loss aversion coefficient is λ > 1. The loss aversion coefficient is put forward by Daniel Kahneman and Amos Tversky (1979) in prospect theory. λ > 1 indicates people tend to attribute excessive weight to the loss with low probability.

Account receivables usually make up the bulk of the assets. If the supplier can discount its receivables, the shortage of funds can be greatly relieved. With a powerful downstream retailer, the supplier can discount its receivables in previous periods in the TF model, and we assume the supplier will not face financial constraints in this model.

Accordingly, the objective function of the bank is shown by Eq. (3),

The utility of the bank comes from the interest spread revenue. The utility of the bank is also equal to its profit when there is no default risk involved. When there is default risk, the utility of the bank needs to consider the loss aversion level of the bank and is not merely decided by the expected profit. The bank has the probability of η to recover the loan, and in this case, its revenue would be \(w{q}_{TF}{T}_{TF}({r}_{TF}-\theta )\eta \). The bank also has the probability of 1-η not to recover the loan, and in this case, its revenue would be \(w{q}_{TF}{T}_{TF}(-\theta )(1-\eta )\). Considering the effect of the loss aversion coefficient, the utility of the latter one would be \(w{q}_{TF}{T}_{TF}(-\theta )(1-\eta )\lambda \).

The objective function of the supplier and retailer is shown by Eqs.(4) and (5),

The objective functions of the supplier and the retailer are similar to the forms in the benchmark model. The only difference is that the opportunity cost to suppliers of holding the account receivables becomes the receivables discounting rate instead of the interest rate for commercial loans.

Using the method of backward induction, we can obtain the equilibrium in Proposition 2.

Proposition 2

In the TF model, we can obtain the equilibrium (\({{r}_{TF}^{*} , T}_{TF}^{*}\),\({q}_{TF}^{*}\)) under the mild condition of\(\frac{(b-a)(w-c){/[\eta /(\eta +\lambda -\lambda \eta )]}^\frac{1}{2}}{b-(b-a)w}>1\).

Proof of Proposition 2. See “Appendix A2”.

Proposition 2 indicates that the optimal interest rate \({r}_{TF}^{*}\) of the bank in the TF program depends on four factors: retailer’s demand range (b–a), supplier’s profit margin (w–c), retailer’s financing cost θ and supplier’s default risk indicator \(\eta \). The optimal payment term \({T}_{TF}^{*}\) and optimal order quantity \({q}_{TF}^{*}\) are negatively related to \({r}_{TF}^{*}\). The interest rate brings triple effects to the profit of the bank. A higher interest rate leads to a higher spread, but it could result in a decrease in payment terms and order quantity. The bank needs to balance among these effects and determine the optimal interest rate to maximise its utility.

3.3 The reverse factoring model

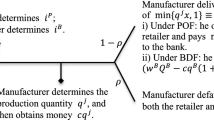

Different from traditional factoring, reverse factoring is initiated by the retailers. According to China Ping An bank (2020),Footnote 5 the sequence of events of a reverse factoring (RF) programme is as shown in Fig. 3. At the start of the programme, the retailer signs a contract with the bank and recommends its supplier to the bank. This is different from the traditional factoring programme, and it guarantees the authenticity of the transaction and reduces the risk of fraud. Next, the retailer places an order with its supplier and forms the information for the accounts receivable. The supplier can apply for receivable discounting. Upon receiving the supplier’s application, the bank releases the funds to the supplier at a discount. When the payment term is due, the retailer will transfer payment for the goods directly to the bank. Therefore, in an RF programme, the supplier applies for a loan in the form of receivable discounting and the retailer promises to pay the principal of the loan back to the bank. As the retailer also signs a contract with the bank in an RF programme, the repayment probability of the supplier can be deemed to be at the same level as its retailer’s.

To study the decision-making process in the RF programme, we introduce another three-stage Stackelberg model with the bank as the leader, the supplier as the follower and the retailer as the second follower. Different from the TF model, we suppose in the RF model that the bank's assessment of the repayment probability of the core buyer is 100%, that is, η = 1. The core retailer as an established company, such as Walmart, has a trivial default risk, so we consider the bank to be able to recover 100% of its loan.

Accordingly, the objective function of the bank is shown by Eq. (6):

The objective functions of the supplier and retailer are similar to the forms in the TF model, and they are shown by Eqs.(7) and (8), respectively:

Using the method of backward induction, we can obtain the equilibrium in Proposition 3.

Proposition 3

In the RF model, we can obtain the equilibrium (\({{r}_{RF }^{*}, T}_{RF}^{*}\), \({q}_{RF}^{*}\)) under the mild condition of 2w–c > \(\frac{b}{b-a}\).

The Proof is similar to Proposition 2, and it is omitted here.

4 Comparison of benchmark model, TF model and RF model

This section compares the optimal solution of the RF model with that of the benchmark model and the TF model, respectively. We also explore whether the participants can achieve a greater utility in the RF model than in the other two models.

4.1 Comparison between RF model and TF Model

Firstly, we make a comparison between the RF and the TF model. The results are shown in Proposition 4.

Proposition 4

The utility of the bank, supplier and retailer in the RF model are all greater than that in the TF model. Compared with traditional factoring, reverse factoring can reduce the financing cost of suppliers. The relation between the equilibrium results of the models is shown in Table 2.

Proof of Proposition 4. See “Appendix A3”.

Reverse factoring reduces the credit risk, which makes the optimal interest rate in the RF model lower than that in the TF model. However, the bank utility in the RF model is still greater than that in the TF model. This is because the lower interest rate makes it possible for the supplier to extend its payment term, which will lead to a further increase in the retailer's order quantity. In other words, the positive effect of the extended payment term and increased order quantity is greater than the negative effects caused by the decline in the interest rate, thus enabling the bank to benefit from the reverse factoring. This explains the incentive for banks to carry out reverse factoring.

Reverse factoring also reduces the supplier’s financing cost and enlarges its orders from the retailer. Therefore, the profit of the supplier in the RF model is greater than that in the TF model. The profit of the retailer in the RF model is also greater than that in the TF model because of the extended payment term. This suggests that the supplier will extend the credit period on its own initiative and explains the motivation for the retailer to carry out reverse factoring.

4.2 Comparison between RF model and Benchmark Model

Since the core buyer's credit rating is relatively high and the credit rating of small- and medium-sized suppliers is relatively low, it is reasonable to set α > \({r}_{RF}^{*}\), that is, in reverse factoring, the financing cost of commercial loans to small- and medium-sized suppliers is higher than the interest rate.

Proposition 5

The relation between the equilibrium of the models is as shown in Table 3.

Proof of proposition 5. See “Appendix A4”.

The profits of the retailer and the supplier are both greater in the RF model than in the benchmark model, as reverse factoring lowers the financing cost. Due to the difference in the interest rates, the optimal payment term in the RF model is longer than that in the benchmark model under the condition of no capital constraints. When financial constraints exist, the credit period set by the supplier in the benchmark model will be forced to further decrease. As the degree of capital shortage increases, the supplier may even be unable to meet the minimum order quantity, and the payment term will continue to decrease to a level as low as TBLL = 0. Depending on the degree of the capital constraints, the effect of reverse factoring could be extremely large.

5 Numerical analysis

This section aims to figure out the factors that could affect the benefits of the supply chain participants in the RF scheme. Reverse factoring brings benefits to the supplier under these two channels. It can provide an additional financing source for suppliers and can also reduce the financing cost of suppliers. How significant are the two effects and which one is more important? What is the impact of the exogenous factors, such as demand volatility, supplier’s profit margin and risk preference of the bank, on these effects? In addition, a reduction in financing cost is often accompanied by a rise in the payment term. How much will suppliers adjust their payment term after the financing cost is reduced? A numerical analysis is conducted to answer the above questions.

We have the following settings for the parameters in order to conduct the numerical analysis. The settings of our parameters are in line with the real world practice and the existing literature. As mentioned in Sect. 3, we have c < w < p = 1. Similar to Wu et al. (2019), here we set w = 0.85, c = 0.50, meaning the wholesale price and production cost of the supplier is 85% and 50% of the retailer price, respectively. The uniform distribution is frequently used to model the distribution of demand in a supply chain study (e.g., Vörös, 1999; Wanke, 2008). The demand in this study is also set to follow the uniform distribution U[0, 5000]. According to the People's Bank of China, the recent one-year loan LPR is 4.05 percent.Footnote 6 A bank’s interest rate for different firms can be decided based on this level, so we set the interest rate of commercial loans for the established firms as 5.5%. This is about 30% above the current LPR, which is a normal risk premium in business practice. We set the interest rate of commercial loans to the supplier as 11%, which is twice the financing cost of established firms. Accordingly, the daily financing cost θ of the retailer and α of the supplier can be roughly estimated as 0.015% and 0.030%, respectively. According to the China Banking and Insurance Regulatory Commission, the non-performing loan ratio of the commercial banks in China at the end of 2019 is 1.86%. Based on this, we set the default possibility assessed by the bank as 2%, that is, η = 98%. If the supplier fails to repay the loan, the banks will suffer a huge loss. The loss aversion coefficient λ of the bank is settled at 3, which is close to the median level in the literature (e.g., Kahneman & Tversky, 1979; Tanaka et al., 2010). With the above parameter settings, we can derive the following numerical results.

5.1 Numerical results

The equilibrium of the three modelsFootnote 7 can be derived as shown in Figs. 4 and 5.

The introduction of factoring decreases the interest rate by 25% for the supplier, while reverse factoring decreases it a further 2.7%. Factoring removes the account receivables from the bankruptcy estate of the SMEs. In this way, the credit risk is transferred from the high risk supplier to the low risk buyers, thereby reducing the credit risk of the financing. In accordance with a lower credit risk, the cost of the financing facilitated by such arrangement will also be less. It is noteworthy that the arrangement of factoring still contains the risk of fraud. In other words, the SMEs could forge the contract with a high-profile retailer and obtain the financing from the bank in a fraudulent way. Reverse factoring solves this problem because in such an arrangement, it is the retailer that recommends its supplier to the bank. From the perspective of the bank, the arrangement of reverse factoring further decreases the credit risk. For this reason, reverse factoring could also further decrease financing cost. The decrease in the interest rate leads to the increase in payment terms in TF and RF models, which are respectively 2.3 times and 2.7 times higher than in the benchmark model. This implies that the decrease in financing cost has a scale-up effect, that is, a small decrease in the financing cost could lead to a huge increase in the credit period. This further increases the order quantity of the retailer in the latter two models, which is respectively 17.8% and 20.6% higher than that in the benchmark model.

Compared with the benchmark model, the utility of the retailer in the RF and TF models increased by 39% and 46%, respectively. Both the arrangement of traditional factoring and reverse factoring reduce the financing cost of the supplier, though to a different extent. The reduction of the financing cost enables the supplier to set up a longer payment term so as to enlarge the order quantity from the retailer. As a result, the optimal order quantity of the retailer also increases. Both the payment term extension and optimal order quantity increase contribute to a higher expected utility of the retailer. The increase in the utility of suppliers is 4% and 5%, respectively. This result implies that traditional factoring and reverse factoring could bring benefits to both the supplier and retailer. It is also noteworthy that the RF scheme can significantly improve the utility of retailers but only add a small value for suppliers. As the core of the supply chain and the key factor that supports reverse factoring, the retailer in absolute terms actually benefits the most from such a scheme. The supplier obtains a smaller utility growth rate compared to the retailer and the bank mainly because the benefits it derives from cheaper financing are offset by the increase in the payment term. In traditional factoring, the supplier will extend the credit period to enlarge retailers’ order quantities in order to maximise its expected profit. As for reverse factoring, this arrangement is initiated by the retailer. As a relatively less powerful player in the supply chain, the supplier will have to extend the payment term in such an arrangement so as to motivate the retailer to carry out such a financing scheme. Though it enjoys a smaller utility growth, the supplier still has a reasonable utility increase in absolute terms. So the supplier is still incentivized to participate in such supply chain finance schemes.

The above results are obtained when suppliers do not face financial constraints in the benchmark model. Next, we will show how the supplier’s capital constraint affects the equilibrium results.

5.2 The impact of capital constraints

In the benchmark model, as the supplier’s controlling fund L becomes smaller, the supplier becomes more and more financially constrained. Therefore, the level of L can be seen as an indicator of the capital constrained level. An important function of reverse factoring is that it brings an additional financing channel to the suppliers. The following analysis varies the level of the supplier’s controlling fund L to explore the impact of financial constraints. Specifically, the level of L is varied within [100,525]Footnote 8 to see how it affects the utility enhancement effect of reverse factoring relative to commercial loans.

As can be seen from Fig. 6, the profit enhancement effect increases with the severity of the capital constraint. When there is no capital constraint, reverse factoring will only increase the total profit of the supplier by 5%. However, when the supplier is extremely short of funds, for example, when L = 100, the profit enhancement effect could be as high as 300%. All these indicate that if we merely consider the interest arbitrage effect and ignore its function as an additional financing source, the effect of reverse factoring will be greatly underestimated. This is especially important for start-up companies. These companies often fall into a situation of capital shortage as they usually have a low credit rating, and, as a result, they have a small credit line and are not eligible for the factoring business. Reverse factoring allows the bank to merely evaluate their retailer’s credibility and save them from capital shortages.

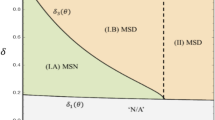

5.3 The impact of risk factors

The effect of reverse factoring also lies in the aspect of interest arbitrage, which means lower interest rates from the bank. We can compare the utility in the TF and RF models to estimate the interest arbitrage effect. In this circumstance, the profit of the bank is closely related to its risk indicator η and loss aversion coefficient λ. We vary the level of risk indicator η within [0.95, 0.99] to see its impact on the profit enhancement effect of reverse factoring. We also divide the analysis into three scenarios with different levels of loss aversion coefficient λ.

Scenario 1: λ = 5. Banks which belong to this group are usually large commercial banks. These banks attach much significance to risk control, and they are extremely conservative. They have a wide range of existing business and clients, so they are not inclined to take the risk from SME customers.

Scenario 2: λ = 3. Most of the banks belong to this category.

Scenario 3: λ = 1.5. These banks have less existing business and fewer stable sources of customers. They may lessen their risk control requirements to expand their business.

As shown in Fig. 7, the profit enhancement effect is most obvious for banks. The utility of most banks can improve 8%–50% under varying levels of default risk compared with traditional factoring. This implies that the banks benefit most from the arrangement of reverse factoring in relative terms, and thus, they should be most motivated to carry out such schemes. By comparing the three scenarios, we can see that the effect of reverse factoring becomes more and more significant with an increase in banks' loss aversion coefficients. For instance, when η = 0.98, the utility increased by 4.5% with λ = 1.5; the utility increased by 28.6% with λ = 5. This indicates that reverse factoring is especially beneficial to the conservative large banks as they always have a high degree of loss aversion. The profit enhancement effect of reverse factoring for other supply participants also increases with the degree of the bank's loss aversion coefficient. This implies that reverse factoring can play a greater role in a period in which there is bond default and a stock market that is tumbling because the overall loss aversion level of the bank sector in such periods is likely to be high.

In addition, as shown in Fig. 7, with η declining, the growth rate of utility quickly picks up. This indicates reverse factoring is especially useful for companies with little credit history. There are many emerging firms who do good business but have little credit history. In the traditional factoring programme, with such scant information about these companies, banks tend to be more prudent and will give them a low score on η. This decreases the bank’s expected profit on these suppliers and increases its interest rate in the programme. Reverse factoring solves this problem, which is mainly caused by information opacity, and increases the utility. To summarise, the impact of reverse factoring increases with the degree of information opacity.

5.4 The impact of demand uncertainty and profit margin

Demand uncertainty and profit margin varies within industries. For example, the luxury industry tends to have a high profit margin as well as high demand uncertainty, while the food industry tends to have a lower profit margin along with a lower demand uncertainty. Here we put the production cost at a fixed level and vary the level of the wholesale price of the supplier as an indicator of its profit margin. In addition, we divide the analysis into two scenarios with different levels of standard deviation to estimate the impact of retailer demand uncertainty. We obtain the utility differences in absolute terms between the TF model and the RF model with the variation in profit margin and demand uncertainty.

Scenario 1: high standard deviation σ = 1443, that is, higher demand uncertainty.

Scenario 2: low standard deviation σ = 1327, that is, lower demand uncertainty.

As we can see from Fig. 8, most of the absolute utility increase brought about by reverse factoring belongs to the retailer, and its level is quite stable. However, the absolute utility of the bank and supplier increase with the profit margin. In the scenario of high demand uncertainty, as the wholesale price varies from 0.78 to 0.85, the increase in utility for the bank moves from 0.92 to 2.94, and the increase for the supplier moves from 0.52 to 2.36. When we further compare the two scenarios, we find that the sum of the absolute increases of the three participants increases with the standard deviation. This implies that the scheme of reverse factoring plays a bigger role as compared to traditional factoring when the supplier’s profit margin and the retailer’s demand uncertainty is at a higher level. The supplier is more likely to grant a long payment term as its profit margin rises to maximise its profits. Its opportunity cost for the payment term tends to be a higher portion of its cost, so reverse factoring, which can help lower unit opportunity cost, will have a bigger effect. As for banks, the interest rate that a bank can accept becomes higher when the supplier’s profit margin is higher, thereby increasing the interest revenue of the bank. This indicates reverse factoring is more beneficial in industries with high demand uncertainty and profit margin from the perspectives of the bank and supplier.

5.5 The relation between financing cost reduction and payment term extension

Reverse factoring can reduce supplier financing costs, but this is usually accompanied by an extension of the payment term. What is the relation between a financing cost reduction and a payment term extension? In the following context, we try to provide insights with respect to this question.

As the interest rate on the commercial loans of suppliers, α can be regarded as the supplier’s original financing cost. As the interest rate in the RF model, \({r}_{RF}^{*}\) can be regarded as the supplier’s new financing cost. Then (\({r}_{RF}^{*}- \alpha )/\alpha \) is denoted as the unit financing cost reduction brought by the reverse factoring. Next, we compare the payment term in RF and the benchmark model to obtain the payment term extension. Similarly, we denote \(({T}_{RF}^{*}-{T}_{BU})/{T}_{BU}\) as the rate of payment term extension. To investigate the relation between payment term extension and financing cost reduction, we let the supplier’s original financing cost α vary within the range of [0.025%,0.034%].

From Fig. 9, we can see that the unit financing cost reduction and payment term extension increase with supplier’s original financing cost α. However, the payment extension and financing cost reduction do not change in the same proportion. For instance, when the unit financing cost reduces by 15%, the payment term extension increases by 54%; when the unit financing cost reduces by 57%, the payment term extension increases by as much as 19.9 times. The first implication is that a small decrease in financing cost could lead to a much bigger payment term extension. Second, an economic scale effect exists. As the payment extension increases, the same level of payment extension requires a smaller and smaller financing cost reduction. In other words, as the reduction in unit financing cost increases, the payment extension increases in an exponential way. This implies that the retailer can expect a huge payment term extension after the reverse factoring scheme is adopted if their supplier has a high initial financing cost.

6 Managerial implication and insights

In this section, we discuss how our results provide managerial insights for the decision makers in the supply chain. To begin with, our theoretical model provides an important tool for decision makers in the supply chain to understand how their decisions will impact on other participants’ decisions. It is important for the supply chain participants to understand such a process if they want to achieve an interactive result and improve the overall supply chain efficiency.

At the same time, our results from the theoretical and numerical study provide specific implications for managers. For participants in the reverse factoring, there are two central questions: Who will benefit from reverse factoring? What factors could affect these benefits? Our study compares reverse factoring with traditional factoring and commercial loans, and provides answers to these questions.

First, both our theoretical results and numerical study indicate that the utility of all three parties will increase. The utility of most banks can improve 8%–50% under varying levels of default risk as compared to traditional factoring. This is because reverse factoring relieves the problem of default risk and information opacity. Reverse factoring benefits the supplier by lowering its financing cost and adding another financing channel. When the supplier is in an extreme capital shortage, reverse factoring can improve the profit of the supplier as much as 300%. As for retailers, they benefit from a significantly increased payment extension granted by the supplier. When their supplier has a high initial financing cost, the retailer can expect a large payment term extension after the reverse factoring scheme is adopted. In fact, our numerical study finds that reverse factoring benefits the retailer the most in absolute terms, even though this scheme is initially designed to solve the financing difficulty of the supplier. These results provide incentives to decision makers in the supply chain, especially retailers, to carry out such a supply chain finance arrangement.

Second, our result indicates that capital constraints, demand volatility, supplier’s profit margin and risk preference of the bank could affect the benefits. Generally speaking, the profit enhancement effect for suppliers and retailers increases with the severity of the capital constraint. When there is no capital constraint, reverse factoring will only increase the total profit of the supplier by 5%. However, when the supplier is extremely short of funds, the profit enhancement effect could be as high as 300%. This indicates that reverse factoring is especially useful in a case in which there are severe capital constraints. This result has particular indications for decision makers in start-up companies which are usually short of funds. Capital shortage significantly suppresses their profitability. If they can utilise reverse factoring through their retailer’s credibility and receive the financing at a reasonable cost, their profitability will greatly improve. In terms of demand volatility and profit margin, our results suggest reverse factoring is more valuable in industries with a high demand uncertainty and profit margin from the perspective of the bank and supplier. This indicates that decision makers in these industries should pay special attention to reverse factoring. As for risk preference, our results indicate that the profit enhancement effect of reverse factoring increases with a banks’ risk aversion. In other words, the more conservative the commercial banks, the more the banks will benefit from such a supply chain finance arrangement.

Our study has significant implications for managers as reverse factoring continues to become a prominent tool in supply chain finance, enabling them to enhance the supply chain coordination and improve the overall efficiency of the supply chain.

7 Conclusion and future work

As reverse factoring is increasingly popular in the industry, it is important to investigate the decision processes and benefits to the participants from adopting such a scheme. In the present study, a three-level Stackelberg model is proposed to capture the interactions among participants in the supply chain. We examine the benefits of such a scheme by comparing it with commercial loans and traditional factoring. Our analytical and numerical results provide insights for supply chain participants.

-

(i)

As retailers are the core of the supply chain and the key factor that supports reverse factoring, they actually benefit the most in absolute terms. Though reverse factoring directly lowers the financing cost of the supplier, it has a bigger effect on the retailer. This implies that large retailers should help facilitate this financing scheme for their suppliers.

-

(ii)

As reverse factoring lowers the default risk, the utility of the bank improves significantly. For instance, with a medium level of default risk and loss aversion attitude (i.e., η = 98% and λ = 3), reverse factoring could improve the utility of the bank by 17% relative to commercial loans. The improvement will be even more obvious for a large conservative bank that has a higher loss aversion coefficient.

-

(iii)

The effect of reverse factoring on the supplier is highly dependent on the supplier’s capital constraint. When there is no capital constraint, reverse factoring only increases the total profit of the supplier by 5%. However, when the supplier is extremely short of funds, the profit enhancement effect could be as high as 300%. The sensitivity analysis also indicates that reverse factoring is more beneficial to suppliers with a higher demand uncertainty and profit margin.

-

(iv)

Reverse factoring’s financing cost reduction effect and payment term extension effect are also estimated and compared. A small decrease in financing cost could lead to a much bigger payment term extension, implying that the retailer can expect a large payment term extension if their supplier has a high initial financing cost.

-

(v)

Reverse factoring plays an important role in a volatile market in which the risk appetite of the whole society is low, such as a period with bond default or tumbling stocks. Reverse factoring also has a bigger effect in an environment with high information opacity. Emerging SMEs that have little credit history, high financing costs and high levels of capital constraint can significantly benefit from the RF scheme.

There are some limitations in the current study. The present study mainly focused on the payment term decision of the supplier. The decision on wholesale price is a traditional question in the newsvendor problem. A future study could consider wholesale price as another decision variable and analyse the supplier’s joint decision on payment term and wholesale price. This paper also did not consider the situation of returned purchases. When the product is defective, the retailer will return the product to the supplier, which could affect the supplier’s loan repayment ability. A future study could take this circumstance into consideration.

Notes

http://www.stats.gov.cn/english/PressRelease/202002/t20200204_1725014.html (accessed 30 August 2020).

https://fci.nl/en/annual-review (accessed 30 August 2020).

https://www.worldbank.org/en/topic/smefinance (accessed 15 May 2021).

Subscript BU/BL/BLL here represents the three circumstances of the financial constraints: without financial constraints, with financial constraints but can meet the minimum ordering request and with financial constraints and fails to meet the minimum ordering request

http://bank.pingan.com/gongsi/rongzi/guonei/fanxiangbaoli.shtml (accessed 30 August 2020).

http://english.www.gov.cn/policies/policywatch/202002/21/content_WS5e4f4bcbc6d0595e03c21296.html (accessed 30 August 2020).

The equilibrium in the benchmark model here is under the condition of no capital constraint. The interest rate α in the benchmark model is an assumption instead of the equilibrium result. To provide a clear comparison, it is presented here together with the equilibrium results of the other two models.

With the current parameter settings, the capital of the supplier to support the optimal order quantity is equal to (\(c{q}_{BU}+w{q}_{BU}{T}_{BU}\) α) = 426.5625. When the supplier’s controlling capital L is lower than 426.5625, the supplier cannot support the optimal decisions and a capital constraint exists. The minimum order quantity of the retailer would be = b-w(b-a) = 750. To support the production, the funds of the supplier need to be above 375. If L is lower than 375, the supplier fails to afford the minimum order quantity from retailers.

References

Babich, V., & Kouvelis, P. (2018). Introduction to the Special Issue on Research at the Interface of Finance, Operations, and Risk Management (iFORM): Recent Contributions and Future Directions. Manufacturing & Service Operations Management, 20(1), 1–18. https://doi.org/10.1287/msom.2018.0706

Brealey, R. A., Myers, S. C., & Allen, F. (2010). Principles of Corporate Finance, Concise. McGraw-Hill Education.

Buzacott, J. A., & Zhang, R. Q. (2004). Inventory Management with Asset-Based Financing. Management Science, 50(9), 1274–1292. https://doi.org/10.1287/mnsc.1040.0278

Cachon, G. P., & Netessine, S. (2006). Game Theory in Supply Chain Analysis. Models, Methods, and Applications for Innovative Decision Making (pp. 200–233, INFORMS TutORials in Operations Research): INFORMS, https://doi.org/10.1287/educ.1063.0023

Chen, J., Zhou, Y.-W., & Zhong, Y. (2017). A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. International Journal of Production Research, 55(18), 5287–5304. https://doi.org/10.1080/00207543.2017.1308571

Chen, X., Cai, G., & Song, J.-S. (2019). The Cash Flow Advantages of 3PLs as Supply Chain Orchestrators. Manufacturing & Service Operations Management, 21(2), 435–451. https://doi.org/10.1287/msom.2017.0667

Chen, X., & Wang, A. (2012). Trade credit contract with limited liability in the supply chain with budget constraints. Annals of Operations Research, 196(1), 153–165. https://doi.org/10.1007/s10479-012-1119-0

Chen, Y., Chung, S.-H., & Guo, S. (2020). Franchising contracts in fashion supply chain operations: Models, practices, and real case study. Annals of Operations Research, 291(1), 83–128. https://doi.org/10.1007/s10479-018-2998-5

Dada, M., & Hu, Q. (2008). Financing newsvendor inventory. Operations Research Letters, 36(5), 569–573. https://doi.org/10.1016/j.orl.2008.06.004

Dello Iacono, U., Reindorp, M., & Dellaert, N. (2015). Market adoption of reverse factoring. International Journal of Physical Distribution & Logistics Management, 45(3), 286–308. https://doi.org/10.1108/ijpdlm-10-2013-0258

Duan, C., Deng, C., Gharaei, A., Wu, J., & Wang, B. (2018). Selective maintenance scheduling under stochastic maintenance quality with multiple maintenance actions. International Journal of Production Research, 56(23), 7160–7178. https://doi.org/10.1080/00207543.2018.1436789

Du, R., Banerjee, A., & Kim, S.-L. (2013). Coordination of two-echelon supply chains using wholesale price discount and credit option. International Journal of Production Economics, 143(2), 327–334. https://doi.org/10.1016/j.ijpe.2011.12.017

Fabbri, D., & Klapper, L. (2008). Market Power and the Matching of Trade Credit Terms. The World Bank, http://hdl.handle.net/10986/6913.

Fabbri, D., & Klapper, L. F. (2016). Bargaining power and trade credit. Journal of Corporate Finance, 41, 66–80. https://doi.org/10.1016/j.jcorpfin.2016.07.001

Gharaei, A., Hoseini Shekarabi, S. A., & Karimi, M. (2020a). Modelling and optimal lot-sizing of the replenishments in constrained, multi-product and bi-objective EPQ models with defective products: Generalised Cross Decomposition. International Journal of Systems Science: Operations & Logistics, 7(3), 262–274. https://doi.org/10.1080/23302674.2019.1574364

Gharaei, A., Hoseini Shekarabi, S. A., Karimi, M., Pourjavad, E., & Amjadian, A. (2019a). An integrated stochastic EPQ model under quality and green policies: Generalised cross decomposition under the separability approach. International Journal of Systems Science: Operations & Logistics. https://doi.org/10.1080/23302674.2019.1656296

Gharaei, A., Karimi, M., & Hoseini Shekarabi, S. A. (2020b). Joint Economic Lot-sizing in Multi-product Multi-level Integrated Supply Chains: Generalized Benders Decomposition. International Journal of Systems Science: Operations & Logistics, 7(4), 309–325. https://doi.org/10.1080/23302674.2019.1585595

Gharaei, A., Karimi, M., & Hoseini Shekarabi, S. A. (2019b). An integrated multi-product, multi-buyer supply chain under penalty, green, and quality control polices and a vendor managed inventory with consignment stock agreement: The outer approximation with equality relaxation and augmented penalty algorithm. Applied Mathematical Modelling, 69, 223–254. https://doi.org/10.1016/j.apm.2018.11.035

Grüter, R., & Wuttke, D. A. (2017). Option matters: Valuing reverse factoring. International Journal of Production Research, 55(22), 6608–6623. https://doi.org/10.1080/00207543.2017.1330564

Hoseini Shekarabi, S. A., Gharaei, A., & Karimi, M. (2019). Modelling and optimal lot-sizing of integrated multi-level multi-wholesaler supply chains under the shortage and limited warehouse space: Generalised outer approximation. International Journal of Systems Science: Operations & Logistics, 6(3), 237–257. https://doi.org/10.1080/23302674.2018.1435835

Huang, J., & Chen, Z. (2020). Optimal risk asset allocation of a loss-averse bank with partial information under inflation risk. Finance Research Letters. https://doi.org/10.1016/j.frl.2020.101513

Huang, J., Yang, W., & Tu, Y. (2020). Financing mode decision in a supply chain with financial constraint. International Journal of Production Economics, 220, 107441. https://doi.org/10.1016/j.ijpe.2019.07.014

Jaggi, P. C., Aggarwal, K., & Goel, S. (2007). Retailer’s optimal ordering policy under two stage credit financing. AMO - Advanced Modeling and Optimization, 9, 67–80.

Jing, B., Chen, X., & Cai, G. G. (2012). Equilibrium Financing in a Distribution Channel with Capital Constraint. Production and Operations Management, 21(6), 1090–1101. https://doi.org/10.1111/j.1937-5956.2012.01328.x

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263–291. https://doi.org/10.2307/1914185

Klapper, L. (2006). The role of factoring for financing small and medium enterprises. Journal of Banking & Finance, 30(11), 3111–3130. https://doi.org/10.1016/j.jbankfin.2006.05.001

Lekkakos, S. D., & Serrano, A. (2016). Supply chain finance for small and medium sized enterprises—the case of reverse factoring. International Journal of Physical Distribution & Logistics Management. https://doi.org/10.1108/IJPDLM-07-2014-0165

Liebl, J., Hartmann, E., & Feisel, E. (2016). Reverse factoring in the supply chain: Objectives, antecedents and implementation barriers. International Journal of Physical Distribution & Logistics Management, 46(4), 393–413. https://doi.org/10.1108/ijpdlm-08-2014-0171

Owens, J. V., & Wilhelm, L. (2017). Alternative Data Transforming SME Finance. Working Paper, http://documents.worldbank.org/curated/en/701331497329509915/Alternative-data-transforming-SME-finance

Schwartz, R. A. (1974). An Economic Model of Trade Credit. Journal of Financial and Quantitative Analysis, 9(4), 643–657. https://doi.org/10.2307/2329765

Seifert, D., Seifert, R. W., & Protopappa-Sieke, M. (2013). A review of trade credit literature: Opportunities for research in operations. European Journal of Operational Research, 231(2), 245–256. https://doi.org/10.1016/j.ejor.2013.03.016

Seifert, R. W., & Seifert, D. (2011). Financing the Chain. International Commerce Review, 10(1), 32–44. https://doi.org/10.1007/s12146-011-0065-0

Tanaka, T., Camerer, C. F., & Nguyen, Q. (2010). Risk and Time Preferences: Linking Experimental and Household Survey Data from Vietnam. American Economic Review, 100(1), 557–571. https://doi.org/10.1257/aer.100.1.557

Tanrisever, F., Cetinay, H., Reindorp, M., & Fransoo, J. (2012). Value of Reverse Factoring in Multi-stage Supply Chains. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2183991

Tunca, T. I., & Zhu, W. (2018). Buyer Intermediation in Supplier Finance. Management Science, 64(12), 5631–5650. https://doi.org/10.1287/mnsc.2017.2863

van der Vliet, K., Reindorp, M. J., & Fransoo, J. C. (2015). The price of reverse factoring: Financing rates versus payment delays. European Journal of Operational Research, 242(3), 842–853. https://doi.org/10.1016/j.ejor.2014.10.052

Vörös, J. (1999). On the risk-based aggregate planning for seasonal products. International Journal of Production Economics, 59(1), 195–201. https://doi.org/10.1016/S0925-5273(98)00100-5

Wanke, P. F. (2008). The uniform distribution as a first practical approach to new product inventory management. International Journal of Production Economics, 114(2), 811–819. https://doi.org/10.1016/j.ijpe.2008.04.004

Wu, Y., Wang, Y., Xu, X., & Chen, X. (2019). Collect payment early, late, or through a third party’s reverse factoring in a supply chain. International Journal of Production Economics, 218, 245–259. https://doi.org/10.1016/j.ijpe.2019.04.040

Xu, X., Chen, X., Jia, F., Brown, S., Gong, Y., & Xu, Y. (2018). Supply chain finance: A systematic literature review and bibliometric analysis. International Journal of Production Economics, 204, 160–173. https://doi.org/10.1016/j.ijpe.2018.08.003

Yan, N., He, X., & Liu, Y. (2019). Financing the capital-constrained supply chain with loss aversion: Supplier finance vs. supplier investment. Omega, 88, 162–178. https://doi.org/10.1016/j.omega.2018.08.003

Yin, S., Nishi, T., & Zhang, G. (2016). A game theoretic model for coordination of single manufacturer and multiple suppliers with quality variations under uncertain demands. International Journal of Systems Science: Operations & Logistics, 3(2), 79–91. https://doi.org/10.1080/23302674.2015.1050079

Zhang, T., Choi, T.-M., & Zhu, X. (2018). Optimal green product’s pricing and level of sustainability in supply chains: Effects of information and coordination. Annals of Operations Research. https://doi.org/10.1007/s10479-018-3084-8

Zhao, Y., Choi, T.-M., Cheng, T. C. E., & Wang, S. (2017). Mean-risk analysis of wholesale price contracts with stochastic price-dependent demand. Annals of Operations Research, 257(1), 491–518. https://doi.org/10.1007/s10479-014-1689-0

Zhu, Y., Zhou, L., Xie, C., Wang, G.-J., & Nguyen, T. V. (2019). Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. International Journal of Production Economics, 211, 22–33. https://doi.org/10.1016/j.ijpe.2019.01.032

Acknowledgements

The authors would like to express their gratitude to the guest editor and two anonymous referees for their valuable comments and suggestions which contributed to a significant improvement of the original version of this paper. The authors would also like to thank Xiaoyi Mu for his helpful comments and suggestions regarding this work. Financial support from the National Natural Science Foundation of China (Grant No. 71804188) and the Science Foundation of China University of Petroleum, Beijing (Grant No. 2462020YXZZ038) are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Appendix A1: Proof of Proposition 1.

We use the method of backward induction to obtain the optimal solution. First, the retailer decides its own order quantity \({q}_{B}\) based on the existing payment term \({T}_{B}\). As f(x) follows a uniform distribution U[a, b], \(f(x)=\frac{1}{b-a}\). At the same time, the retail price per unit p is normalised to 1, that is, p = 1.

Equation (1) can be rewritten as

Taking the first derivative of \({q}_{B}\) in Eq. (1), we have:

Taking the second derivative of \({q}_{B}\) in Eq. (1), we have:

As \(\frac{{d}^{2}{\pi }_{B}^{r}}{d{q}_{B}^{2}}=-\frac{1}{b-a}\) <0, the objective function \({\pi }_{B}^{r}\) is concave in \({q}_{B}\).

-

A.

When a supplier has no financial constraint, we can obtain the optimal solution of \({q}_{B}\)

by solving \(\frac{{d\pi }_{B}^{r}}{{dq}_{B}}=0\):

To make the problem nontrivial, we suppose T≧ 0. Under this condition, the minimum order quantity of the retailer is qbmin=b–w(b–a)≦ b–w(1–TBθ)(b–a). The retailer will choose the minimum order quantity when the supplier does not grant it any payment term, that is, \({T}_{B}\)=0.

-

B.

When the supplier has a financial constraint but \({cq}_{B}^{min}\)<L, i.e., c(b–w(b–a)) < L, the supplier is able to meet the minimum order quantity of the retailer. The supplier can still set up a \({T}_{B}\)>0 to stimulate the demand from the retailer. The optimal solution is \({q}_{B}^{*}\)=\({q}_{BL}=\) b–w(1–\({T}_{B}\) θ)(b–a), obtained by solving \(\frac{{d\pi }_{B}^{r}}{{dq}_{B}}=0\).

-

C.

When a supplier has a financial constraint and \({cq}_{B}^{min}\)>L, that is, c(b–w(b–a)) > L, the supplier is unable to meet the minimum order quantity \({q}_{B}^{min}\) of the retailer. The order quantity that the supplier can meet is no more than L/c. It is obvious that the retailer’s profit is increasing in [0, L/c]. Hence, the order quantity of the retailer in this circumstance is \({q}_{B}^{*}\)=\({q}_{BLL}\)=L/c, and \({q}_{BLL}\)<\({q}_{B}^{min}\)<\({q}_{BL}\).

Second, the supplier decides its payment term for the retailer while considering the impact of its decision on the retailer.

Taking the first derivative of \({T}_{B}\) in Eq. (2), we have:

Taking the second derivative of \({T}_{B}\) in Eq. (2), we have:

As \(\frac{{d}^{2}{\pi }_{B}^{s}}{d{T}_{B}^{2}}=\frac{{dq}_{B}}{{dT}_{B}}*(-2w\alpha )<0\), the objective function \({\pi }_{B}^{s}\) is concave in \({T}_{B}\).

-

A.

When there is no financial constraint, solving \(\frac{{d\pi }_{B}^{s}}{{dT}_{B}}=0\) gives us:

At the same time, the order quantity of the retailer is \(q_{B}^{*} = q_{BU} = b - w\left( {1 - T_{BU} \theta } \right)\left( {b - a} \right)\).

For \({T}_{B}^{*}\geqq 0\), the condition \(\alpha \leqq \frac{(b-a)\theta (w-c)}{b-(b-a)w}\) should be met. This implies that the interest rate on commercial loans cannot be too high; otherwise, it will be too costly for the supplier to set up any credit term.

-

B.

When there is a financial constraint but c \({q}_{B}^{min}\)<L, i.e., c(b–w(b–a)) < L, the optimal solution remains as \({q}_{B}^{*}\)=\({q}_{BL}\)=b–w(1–\({T}_{B}\) θ)(b–a); however, the supplier does not have enough funds to afford the original optimal payment term \({T}_{BU}=\frac{w-c}{2w\alpha }+\frac{1}{2\theta }-\frac{b}{(b-a)*2w\theta }\). We denote the maximum payment term that the supplier can afford in this circumstance as TBL. In this case, \({T}_{BL}<{T}_{BU}\). It is obvious that the supplier’s profit is increasing in [0, TBL]. Hence, the optimal payment term \({T}_{B}^{*}\) in this circumstance would be TBL.

The production cost of the supplier is equal to cqBL + wqBLTBLα. By solving cqBL + wqBLTBLα = L, we have:

At the same time, the order quantity of the retailer is \({q}_{B}^{*}\)=qBL=b–w(1–\({T}_{BL}\) θ)(b–a).

In addition, \({q}_{B}^{*}\)=qBL=b–w(1–\({T}_{BL}\) θ)(b–a) < b–w(1–\({T}_{BU}\) θ)(b–a) = qBU.

-

C.

When there is a financial constraint and \({cq}_{B}^{min}\)>L, i.e., c(b–w(b–a)) > L, the supplier is unable to meet the minimum order quantity of the retailer and \({q}_{B}^{*}\)=qBLL < \({q}_{B}^{min}\)<qBL<qBU. There is no reason for the supplier to set up any payment term to stimulate the order quantity. Hence, we have \(T_{B}^{*} = T_{BLL} = 0,\) and \({T}_{BLL}\)<\({T}_{BL}\)<\({T}_{BU}\).

Appendix A2: Proof of Proposition 2

We use the method of backward induction to obtain the optimal solution. First, the retailer decides on its order quantity based on the payment term \({T}_{TF}\). In this circumstance, there is no financial constraint. Similar to the proof of proposition 1, by solving \(\frac{{d\pi }_{TF}^{r}}{{dq}_{TF}}\)=0, we obtain the optimal solution q*TF(TTF)=b–w(1–TTFθ)(b–a).

Next, by solving \(\frac{{d\pi }_{TF}^{s}}{{dT}_{TF}}=0\), we have: \(T_{TF}^{*} = \frac{w - c}{{2wr_{TF}^{*} }} + \frac{1}{2\theta } - \frac{b}{{\left( {b - a} \right)*2w\theta }}\).

Since we assume \(T_{TF}^{*}\)≧0, the condition \(r_{TF} { \leqq }\frac{{\left( {b - a} \right)\theta \left( {w - c} \right)}}{{b - \left( {b - a} \right)w}}\) should be met.

Finally, the bank decides on \({r}_{TF}\). Taking the first derivative of Eq. (3), we have:

It can be proved that there exists one point x. \(\frac{d{ lnU( \pi }_{TF}^{b})}{dr}\)>0 when \({r}_{TF}\) is inside [0, x], \(\frac{d{ lnU( \pi }_{TF}^{b})}{dr}\)<0 when \({r}_{TF}\) is inside [x,\(\frac{(b-a)\theta (w-c)}{b-(b-a)w}\)], under the condition of \(\frac{(b-a)(w-c){/[\eta /(\eta +\lambda -\lambda \eta )]}^\frac{1}{2}}{b-(b-a)w}>1\).

By solving \(\frac{d{ lnU( \pi }_{TF}^{b})}{dr}=\) 0, we have

where.

It can be proved that \({0\leqq r}_{TF}^{*}\leqq \frac{(b-a)\theta (w-c)}{b-(b-a)w}\) at the current condition. Therefore, \({r}_{TF}^{*}\) is the equilibrium result.

Similar to the proof of proposition 1, we can obtain:

“Appendix A3”: Proof of Proposition 4

As \(\eta \)<1 and \(\lambda \)<1, it is obvious that \(\eta /(\eta +\lambda -\lambda \eta )\) <1.