Abstract

This paper studies the impacts of risk inequity averse factor on supply chain performance in the newsvendor context. We apply a downside-risk approach to depict the risk caused by market demand uncertainty and develop the newsvendor model with a risk inequity averse agent. Contrary to the prior literature, we extend inequity averse profits to a broader range by including risk inequity aversion, and we find that risk inequity aversion has large impact on supply chain agents performance. Moreover, we attempt to consider the situation which a risk inequity averse retailer’s information is neglected by the supplier and performed a comparative analysis on different scenarios. If the supplier is only concerned with the risk inequity averse retailer while making decisions, the results range from worsening to improving. To mitigate the negative utilities caused by the factor of risk inequity aversion, we propose a mechanism that the risk-sharing parameter could achieve a better performance for a certain range. Several observations and managerial insights on risk inequity-averse newsvendor models are gathered.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recently, the issue of risk generated from the market demand uncertainty examined under an operation management lens has become popular. In the presence of uncertainty, an individual has risk preferences or attitudes, including risk-averse, risk-seeking and risk-neutral. Furthermore, most research indicates that people often exhibit risk-averse preferences when facing risk (Arrow 1971). This finding is also verified in real world practices; companies pursue profit maximization and have different degrees of aversion to risk at the same time. In particular, some studies indicate that the risk-averse preference has great impacts on decision making in supply chain management. Eeckhoudt et al. (1995) give some examples of how risk-averse retailers would not stock items due to high demand uncertainty. From the study of Schweitzer and Cachon (2000), the experimental evidence suggests that decision makers exhibit risk-averse behavior for some high-profit products. These examples are theoretical evidence of the risk-averse factor influence on supply chain profits.

Additionally, some experimental studies explore the issue of risk aversion and inequity. Cappelen et al. (2013) investigate the inner relationship between risk aversion and inequality aversion under risky circumstances through the use of an experimental study on Dictator and Ultimatum game. The experiment results indicate that the individual behavior of risk-averse participants deviates from theoretical predictions if these participants notice that risk-undertaking is inequitable. The authors conclude that if the participants are more risk-averse, then they will be more averse to inequity. This point of view is also confirmed in practical cases. In real life, most companies follow a simple wholesale price contract in the context of supply chain management. Due to the channel structure, retailers undertake all the operational risk, and the suppliers decide the wholesale price that maximizes their own profits which causes retailers order less quantity (Spengler 1950). It would be disadvantageous to the supply chain profit and performance if the retailers had risk aversion and inequity in mind. For instance, the seafood industry’s product is considered as delicate and highly perishable which generates huge risk in the supply chain. To promote sustainable industrial development, the seafood industry’s upstream and downstream enterprises could sign a treaty on risk-sharing, which would reduce the loss and mitigate the inequitable risk undertaken by retailers. Real-world examples in which risk equity concerns also exist include the automotive supply chain. Toyota sells their automobiles all over the world, mainly in the American, European and Chinese markets. As an automobile company, quality and safety problems usually cause huge crises. For example, Toyota recalled cars in all of markets for potential accelerator pedal issues to minimize risk and remain fair, even if these problems did not exist in some markets.

Motivated by the previous research, studying both risk-averse preference and fairness behavior is meaningful. We propose the concept of risk inequity aversion as a behavioral factor, which would affect the decision making of supply chain members. In contrast with risk-averse, risk inequity-averse is generated by combining both risk aversion and inequity aversion if one is thinking of the risk undertaking on behalf of others. We assume that the supply chain member would not only be risk-averse but also very concerned that risk-sharing is equitable. In terms of results, it is hard to tell whether the ultimate outcome is fair or not. Even if the monetary payoffs might be evenly split, unequal risk allocation still exists for both sides. Therefore, the risk inequity-averse factor cannot be ignored. In addition, we will investigate the effects of this behavioral factor on supply chain members decisions makings and the influence on profits and the overall performance of supply chain system.

Despite the fact that the importance of risk-averse behavior and fairness are well-studied, our understanding is limited on the impacts of risk inequity-averse behaviors considered in the existing literature. To fill this research gap, our research goal is to investigate how the risk inequity-averse behavior influences the decision making between a risk-neutral supplier and a risk inequity-averse retailer in the context of the newsvendor problem, with a particular emphasis on the following research questions. First, how does risk inequity aversion affect supply chain performance and each members profit? The methods of capturing the practical risk and the risk inequity-averse behavior are important in the modeling part. Second, compared to the benchmark model, what impacts would bear on the supply chain system if the risk inequity-averse factor is neglected by supply chain members? Two cases are proposed and comparative analysis is conducted. Third, how can we achieve a Pareto improvement of supply chain performance by proposed a risk-sharing mechanism?

To address these research questions, we develop an analytical model to examine the impact of the risk inequity-averse factor. We study a two-echelon supply chain by applying a Stackelberg game with the supplier as the leader to investigate his optimal wholesale price, and with the retailer as the follower to decide the optimal order quantity in the context of a newsvendor problem. The methods of capturing risk and inequity characterization are the theoretical foundation. First, we concentrate on modelling the inequity. Numerous studies focus on modelling inequity or fairness in operation contexts (Rabin 1993; Fehr and Schmidt 1999; Bolton and Ockenfels 2000). Our model setting is in the spirit of the research work on inequity aversion by Fehr and Schmidt (1999), which is more consistent with the supply chain background. Thus, we model risk inequity aversion in the utility function and negative utility would be yield if risk-taking is unequal.

Additionally, the method of risk capture is also vital in modeling. Previous research captures the risk of demand uncertainty in the context of newsvendors, which refer to it as the overstock and understock perspectives. However, we would apply the semi-deviation measurement to depict downside-risk for the following reasons. On the one hand, it is known that risk generates favorable and unfavorable outcomes; the favorable outcome is considered to be an actual gain and the unfavorable is a loss, both of which are asymmetric (Tversky and Kahneman 1991). Experimental studies also verify this point that participants focus more on the losses deviate from the mean. On the other hand, using downside risk measurement is more realistic than former approaches. In reality, the supply chain members cannot precisely distinguish between different types of risk, such as overstock and understock risk. They believe that the overall risk generates unfavorable outcomes by deviating from expected profits. In view of this, we will apply a downside risk measurement to investigate a risk inequity averse newsvendor problem in the model section.

In summary, we develop a model with risk inequity aversion by applying a downside risk measurement and inequity aversion model in the utility functions. This analytical model explicitly captures the unfavorable risk in reality, and also illustrates how this behavior factor impacts on the decision making. We explore the existence of a unique optimal order quantity for decentralized retailer and a best-response wholesale price for supplier. Moreover, the risk inequity-averse factor can result in a centralized supply chains utility and profit becoming worse, while the decentralized supplier and retailers utilities become even worse off than the centralized one. If the retailer is more risk inequity-averse, the optimal quantity will be less ordered. Nevertheless, the relationship between the best-response wholesale price and risk inequity is implicit. We propose two cases in the following study; one is where the supplier knows the retailer has risk inequity aversion, which would influence the decision making. The other one is neglected by the supplier. Interestingly, in the latter case, we find that the retailer will reduce optimal order quantity. Meanwhile, the supplier will increase his best-response wholesale price, which induces worse supply chain performance than in the prior case. To solve this problem, we propose a risk-sharing mechanism which realizes Pareto improvement of supply chain performance.

Our study contributes to existing the literature on risk inequity averse supply chain members in the context of the newsvendor problem in three aspects. First, we propose risk inequity averse behavior and extend the analysis of the unfairness of risk-taking; the existing research on fairness or equity only considers the monetary payoff and not the risk taking. Second, a different method of capturing risk is applied in our study. It is more reasonable to employ downside-risk measurement to depict unfavorable outcomes, since the retailer cannot intuitively and explicitly distinguish the risk generated from either overstock or understock in practical cases. Third, we clarify the importance of risk inequity-averse behavior and design a risk-sharing mechanism which can achieve supply chain coordination and Pareto improvement under certain conditions.

The rest of this paper is organized as follows. In Sect. 2, we elaborate a literature review in three aspects. In Sect. 3, we present the benchmark model and risk inequity averse model and perform comparative analysis under different scenarios. In Sect. 4, we study the risk-sharing mechanism. In Sect. 5, we analyze some numerical results by validating the model and discuss some managerial implications. Finally, in Sect. 6, we conclude our study and provide avenues for future research.

2 Literature review

Our study considers the supply chain members that have risk inequity-averse behavior and the impact on their decision makings as well as the systems performance. There are three streams of literature most closely related to our work are briefly reviewed below.

2.1 The risk-averse newsvendor problem

Recently, numerous studies have addressed the risk aversion issue in the context of the newsvendor, such as Lau (1980), Chen and Federgruen (2000), Tsay (2002), Gan et al. (2004), Wei and Choi (2010), Chiu and Choi (2016) and Asian and Nie (2014). For example, Lau (1980) first studied a supply chain system with risk-averse agents on mean-variance objectives and achieved coordination by applying return contracts. After that, Gan et al. (2004) considered a supply chain with risk-averse agents and designed a contract to achieve a set of Pareto-optimal solutions. Observe that the prior studies apply various approaches to explore modeling of a risk-averse newsvendor problem. Among all the risk measurement methods, expected utility criterion (Eeckhoudt et al. 1995; Agrawal and Seshadri 2000), or the mean-variance objective function (Chen and Federgruen 2000; Wu et al. 2009) are the most employed. However, the expected utility method is widely used in theoretical studies and is not applicable in practical situations. While, some research considers that using the mean-variance(MV) model to capture risk by employing the variance of profit is more reasonable (Choi et al. 2008a, b; Choi and Chiu 2012). For instance, Wu et al. (2009) investigate a risk-averse newsvendor model with the application of a mean-variance objective function by considering stock-out costs and this consideration significantly affected the optimal decisions of supply chain agents. Nevertheless, there is an inevitable inherent theoretical flaw associated with the MV model because risk is characterized with the both upside and downside deviations from the mean. As we know, in the asymmetric distribution newsvendor case, the real risk is generated from the downside semi-deviations of mean rather than the upside part. The upside risk is regarded as favorable outcomes which would not bring about negative effects. Therefore, our research mainly concentrates on the characterization of risk perception rather than risk aversion from supply chain members and the impacts on system performance. Unlike the MV model, we focus on the unfavorable outcomes generated from downside risk, and thus we capture the real risk by applying the downside deviations from the mean and this is a more realistic measurement.

2.2 Supply chain contracts and coordination

In supply chain management, contract design is a critical research issue to achieve coordination mechanisms in both theoretical and practical aspects. As the centralized supply chain transaction tends to evolve toward decentralized patterns, rational members pursue their own profitable maximization which leads to double marginalization and inefficiency (Spengler 1950). In a simple wholesale price contract, the retailer undertakes all the risk, and the maximized wholesale price of the supplier causes the retailer to order less quantity. To avoid this situation, various contracts are designed to achieve coordination mechanisms as incentives for the decentralized supply chain members to make optimal decisions and maximize supply chain profits, which behave the same as the centralized circumstance. Here we refer to Cachon (2003) for a review of various supply chain contracts. In addition, over the past decade, many research efforts have been devoted to exploring the contract mechanisms between supplier and retailer through the use of methods, such as buyback contracts (Pasternack 1985), revenue-sharing contracts (Cachon and Lariviere 2005), quantity flexibility contracts (Tsay 1999) and quantity discount contracts (Weng 1995). However, we focus our analysis on the wholesale price contract for two reasons. On the one hand, the wholesale price contract is commonly used in the real world and to study the newsvendor problem. On the other hand, compared to other contracts, the wholesale price contract has an inherent feature that all the risk is undertaken solely by the retailer, which is more intuitive to investigate for the impacts of risk-sharing inequity on the supply chain.

2.3 Fairness in the supply chain context

Many recent experimental studies and observations of decision-making in the supply chain context show that managers are boundedly rational and their behaviors concerning fairness deviate from the theoretical predictions of self-interested profit maximization. Fairness has been long recognized as one of the most important factors guiding human interactions in everyday life (Adams 1965; Kahneman et al. 1986). In a supply chain context, fairness concern (also known as inequity aversion) is the main cause of failure in channel coordination, which was recently studied in supply chain modeling. Fehr and Schmidt (1999) introduce fairness as self-centered inequity aversion into the supply chain model, which indicates that a retailer is willing to give up some monetary payoff for more equitable outcomes. After that, Cui et al. (2007) employ Fehr and Schmidts analytical model to investigate the supply chain and achieved coordination with fairness-concerned members in a dyadic channel. Caliskan-Demirag et al. (2010) replace Cui’s model into the situation of nonlinear demand and compare these results with the linear results. Further, Du et al. (2014) employ the Nash bargaining solution as the fairness reference point and study the impacts of fairness concern on equilibrium decisions in a newsvendor context. Chen et al. (2017) also introduce the Nash bargaining solution as the fairness reference point and formulate a fairness utility function to investigate the influence on supply chain performance. Generally, previous studies built analytical models to achieve channel coordination by considering fairness concerns in simple supply chain settings. Some other studies extend the issue by investigating more complex situations. For example, Ho and Su (2009) consider two peer retailers with peer-induced fairness concerns, and Ho et al. (2014) extend prior studies by investigating both distributional fairness and peer-induced fairness. However, we focus on risk fairness, which neither belongs to the distributional nor peer-induced groups and is considered as risk inequity aversion in the following study.

Some recent studies focus on fairness concerns from an experimental and information perspective. For instance, Pavlov and Katok (2011) developed a model of coordinating contracts with fairness preferences, and their major finding is that rejections result from incomplete information about fairness preferences. Pavlov and Katok (2015) also extended Cui’s model but reset the assumptions to incomplete information by setting with inequity aversion preferences and explaining the rejections of channel coordination. Katok and Pavlov (2013) designed laboratory experiments to study contract performance, and the three main factors affecting human behavior in this study are inequity aversion, bounded rationality and incomplete information. Unlike in previous work, we establish two different scenarios of risk fairness. Thus, in our model the risk fairness information could either be ignored or not by the supplier, and we obtain some comparative results.

All the above-mentioned studies attempt to explain how fairness in profit allocation influences channel coordination, which leads to less than optimal profits for each agent. The existing literature, however, fails to investigate the influence of risk fairness or risk inequity aversion between supply chain members. To fill this gap, we try to identify approaches on modeling the behavior factor of risk inequity aversion and explore ways to improve supply chain performance. In our study, we contribute to the literature by studying risk inequity aversion in the context of a two-echelon supply chain with stochastic demand. We apply downside-risk measurement to characterized risk generated from the disadvantageous outcomes which generally cannot be distinguished explicitly in practical cases.

3 Model formulation

3.1 Assumptions and notations

In this paper, we study a two-echelon supply chain consisting of a single supplier (he) and a single retailer (she) which is the fundamental newsvendor problem.The retailer faces the newsvendor problem wherein she sells a seasonal product and faces an uncertain market demand. The supplier produces the products with a unit cost of c and sells it to the retailer with announced unit wholesale price of w. The retailer sells the products with a unit selling price of p. Generally we have \( w>c>0 \), and \( p>w \). In this supply chain, we assume that the retailer decides on an order quantity before a single selling season with stochastic market demand. To avoid trivial cases, we assume the retailers order quantity can always be fulfilled and there is no salvage at the end of each selling season. Let the market demand faced by the retailer be x with a probability density function \( f\left( \cdot \right) \) and a corresponding cumulative distribution function \( F\left( \cdot \right) \). We assume that F is differentiable, strictly increasing and there is one-to-one mapping between \( F\left( \cdot \right) \) and its argument. Additionally, we denote \( 1-{\bar{F}}\left( \cdot \right) \) as the complementary cumulative distribution function of \( F\left( \cdot \right) \). Let \( F\left( \cdot \right) =1-{\bar{F}}\left( \cdot \right) \) and \( F(0)=0 \).

In order to simplify those notations, we use the short expression as shown in the following part (Table 1).

3.2 Benchmark model

In this subsection, centralized and decentralized supply chain models are demonstrated without taking risk into consideration in the context of wholesale price contract. In the Stackelberg game, the follower retailer will take the wholesale price as the given value, and they make decision of order quantity by this given wholesale price. As the leader in this game, the supplier takes the retailers response into consideration and makes the optimal decision. In the centralized supply chain, the systems decision that needs to be made is optimal order quantity. However, both agents pursue the profit maximization in the decentralized supply chain circumstance, and this generates double marginalization which influences the performance of the supply chain system. From the above assumption, we can express and derive the profits of a risk-neutral supply chain agents as follows:

Proof

The expected profits of risk-neutral individual agents are as follows. See the detailed derivation process in “Appendix A”. \(\square \)

The supplier is the first mover and conditional on a wholesale price offer w, \(E({\pi _s})\) is strictly concave in q, and the retailer obtains the optimal order quantity by figuring out the first derivative of expected profit is

In the decentralized supply chain, the status of coordinating means the optimal order quantity of the retailer is the same as the condition of the centralized supply chain, and the optimal order quantity of the retailer is

The optimal wholesale price of the supplier is \( {w^*} = p{q^*}f({q^*}) + c \). And the equilibrium solution \(({q^*},{w^*}) \) of the decentralized supply chain system can be obtained in the set of equations \( p{\bar{F}}({q^*}) = p{q^*}f({q^*}) + c \) and Eq. (6).

The expected profit of supply chain system is as follows.

And the optimal order quantity is

Lemma 1

The traditional supply chain cannot be coordinated under the wholesale price contract, and the optimal order quantity of a supply system is greater than the decentralized one.

From the results above, the decentralized supply chain cannot be coordinated unless \( {q^o}={q^*} \), which makes \( w=c \), and this is contrary to the previous assumption. In addition,the supplier could not accept the condition of earning no profit from this transaction. Comparing this to the equilibrium solutions of decentralized and centralized supply chain systems, two relation equations can be obtained: \({q^*}<{q^o} \) and \( {w^*}>w \). An individual agent pursues their own profit maximization and leads to double marginalization, and the optimal decision of the decentralized supply chain is inferior to the centralized system.

Proof

See “Appendix A” for proofs of the Lemma 1. \(\square \)

3.3 Newsvendor model with risk inequity aversion agent

As we mentioned previously, a newsvendor model with risk inequity aversion assumes that agents are not only concerned about their material payoff maximization; they also think about equitable risk sharing with other members. In the light of this, we employ the theory of inequity aversion proposed by Fehr and Schmidt (1999) to captures the main aspects of risk inequity averse behavior. The utility function of risk inequity averse agent is given by

where \( i\ne j \), \( E(\pi _i) \) represents the expected monetary payoff for supply chain agents, \( \alpha \) denotes the risk inequity parameter which captures the strength of risk inequitable aversion and measures the utility loss from disadvantageous inequitable outcomes, while the parameter \( \beta \) measures advantageous inequality. Each agent has a different degree of inequity aversion. Some previous research suggests that a subject suffers more from inequality that is to their disadvantage than advantage, and the coefficient relationship is \( \beta _i \le \alpha _i, 0<\beta _i<1 \). \( S({\pi _i}), S({\pi _j}) \) represent the risks are undertaken by supply chain members i and j, respectively. However, our model is different from the Fehr and Schmidt (1999)’s model in two ways. On the one hand, we study the risk inequity aversion instead of payoff fairness. Taking the newsvendor problem as an example, the risk is generated from market demand uncertainty, and the retailer undertakes all the risk in the wholesale price contract. We consider the inequity aversion from risk comparison while the retailer undertakes more risk than the supplier. On the other hand, for a simplification without a loss of generality, we only focus on the disadvantageous inequitable outcomes since some recent studies on fairness have found no evidence of the impact of advantageous inequity (Ho and Su 2009; Katok and Pavlov 2013; Pavlov and Katok 2015). In terms of this, we simplify the model in a tractable way and it is given by

As mentioned previously, we only consider the unfavorable outcomes generated from downside risk which bring about real losses and apply the semi-deviation measurement in the following model. \( S\left[ {\pi \left( . \right) } \right] \) represents the semi-deviation of downside risk and the equation is as follows.

In this subsection, we study the newsvendor problem with risk inequity-averse consciousness in a decentralized supply chain system. We assume that the retailer has risk inequity aversion which produces the negative utility in her utility function. As a consequence, the utility function with a risk inequity-averse retailer can be formulated as follows.

The suppliers utility function is given by

In the circumstance of wholesale price contract, the retailer decides the order quantity before the selling season, and she bears all of the risk stemming from stochastic demand. The utility function for the retailer can be simplified as \( U(\pi _{r,f}) = E(\pi _r) - \alpha S(\pi _{r,f}) \). We assume \( \alpha \ge 0 \), which denotes the retailers risk inequity-averse parameter. When \( \alpha = 0 \), the utility function reduces back to the benchmark newsvendors model. We assume that F(x) is continuous, differentiable and strictly increasing. To apply some algebraic manipulation, we let \( g(q) = \int _0^q {{\bar{F}}(x)} dx \).

The utility function of retailer, supplier and supply chain system are as follows.

Proposition 1

Under the risk inequity aversion scenario, the retailer has unique optimal order quantity \( q^*_{r,f} \), and the best-response wholesale price of supplier \( w ^*_{r,f} \). We prove the existence and uniqueness of solution \((q ^*_{r,f}, w ^*_{r,f})\) satisfies the equations are as follows.

Proof

See “Appendix B” for some detailed proofs and for a further discussion of the existence and uniqueness of the solutions. \(\square \)

We then take the first and second derivatives of a retailers utility function \( U(\pi _{r,f})\). There exists the retailers optimal order quantity \( q^*_{r,f} \), which maximizes his utility function and satisfies the equation \(\frac{\partial E({\pi _r})}{ \partial q}=0 \). The retailers utility function is strictly concave for q and there exists a unique maximum order quantity \( q^*_{r,f} \), which satisfies the following equation:

In a decentralized supply chain, the supplier considers the risk inequity averse retailers optimal order quantity \( q^*_{r,f} \) and, in response, decide his optimal wholesale price. We employ backward induction to solve the Stackelberg game by taking the first derivatives of \( U(\pi _{s,f})\) with respect to the wholesale price \( w^*_{r,f} \). Therefore, the optimal strategy \((q^*_{r,f}, w^*_{r,f})\) the Stackelberg-like game satisfies the optimal solution of both supplier and retailer.

Corollary 1

Compared with the traditional newsvendor, the outcomes of the decentralized supply chain with risk inequity aversion perform worse. This reflects mainly on two aspects: (i) the optimal order quantity of the risk inequity averse retailer is smaller than the benchmark retailer \( q^*_{r,f} < q^*\) and (ii) the optimal order quantity of the supply chain system is also smaller than the benchmark model \( {q^o_{sc,f}} < q^o\), which indicates that there is space to achieve performance improvement.

Proof

As computed previously, the optimal order quantities of a risk inequity-averse retailer and supply chain system satisfy the following equations:

From the above formula, the optimal order decisions of a decentralized retailer \(q_{r,f}^*\) and the supply chain system \( q_{sc,f}^o \) can be derived, respectively. The condition of a supply chain with a risk inequity averse retailer can be coordinated unless \( q^*_{r,f} = q^o_{sc,f} \), which is inconsistent with the assumption that \( w>c \). We assumed above that the \( F\left( \cdot \right) \) is strictly increasing and differentiable. Therefore, let \(F\left( x \right) = 1 - {\bar{F}}\left( x \right) \). The utility functions of the retailer and the system are strictly concave with q, and we can acquire the computed relation \( q^*_{r,f} < q^o_{sc,f} \). Identically, the optimal quantities of the risk-neutral retailer and the supply chain are \( {q^*} = {F^{ - 1}}(\frac{{p - w}}{p}) \) and \( {q^o} = {F^{ - 1}}(\frac{{p - c}}{p}) \), and we have \( q^*< q^o \). From the above properties, the relation equations can prove that \(q_{r,f}^* < q^*\) and \(q^o_{sc,f} < q^o\). This indicates that risk inequity aversion factor leads to a reduction in the optimal order quantity in our study. Compared to the benchmark model, it has negative impacts on the utility function of supply chain members. Therefore, this shows that the order quantity of a risk inequity averse retailer can be improved to achieve better performance of a supply chain system. \(\square \)

Corollary 2

The relationships with any risk-inequity averse parameter \( \alpha \) are as follows: for any are \( \alpha \ne 0 \), the optimal order quantity \( q^*_{r,f} \) decreases with \( \alpha \), while the relationship between wholesale price \( w^*_{r,f} \) and \( \alpha \) is non-monotonic.

Proof

By applying the implicit function theorem, we can obtain the internal relations of a retailers order quantity and the risk inequity aversion parameter.

The internal relation of wholesale price and the risk inequity aversion parameter is as follows.

The optimal order quantity \( q^*_{r,f} \) decreases with \( \alpha \), this relation equation implies that if the retailer pays more attention to risk inequity aversion, she tends to take a more conservative strategy and decreases the optimal order quantity. However, we cannot prove the accurate relationship between the optimal wholesale price \( w^*_{r,f} \) and risk inequity aversion parameter \( \alpha \); the numerical analysis will obtain the specific outcomes. This corollary indicates the risk inequity aversion influences the decision behavior of both the retailer and the supplier. \(\square \)

3.4 Cases with different risk inequity averse factor information

In this subsection, two comparative cases of decentralized supply chains with risk inequity averse agents are presented. In the first case, we assume that the information about a retailers risk inequity aversion is known by the supplier, which affects the optimal decision of both agents. In the second case, we consider a different situation in which the supplier ignores this risk inequity aversion information, and this information does not have any impacts on the optimal decisions. The reasons for proposing the above two scenarios are as follows. On one hand, compared to the benchmark model, we explore the idea that the optimal decisions and supply chain performance become worse if both parties consider the risk inequity averse factor. This motivates us to consider what happens if the supplier neglects the relevant information from the retailer, and how it affects the supply chain members’ optimal decision and system performance. On the other hand, some cases exist of ignoring the retailer in reality, especially when the supplier occupies a dominant position in the entire supply chain system. For example, a large supplier such as P&G Co. has cooperative relationships with multiple small retailers and there exist a situation where some small retailers risk inequity averse preference would be neglected.

Proposition 2

Comparing two cases with risk inequity aversion factors, we obtain the following statement: (i) the retailer in the second case reduces her optimal order quantity, which is smaller than the optimal order quantity for the first case (\( q_n< q^*_{r,f} \)), (ii) on the contrary, the second case suppliers best-response wholesale price is is the same as the benchmark wholesale price \(w^*\), (iii) the utilities and expected profits of supply chain agents are worse than the agents in the first case.

Proof

This proposition investigates the impacts on the optimal decisions and supply chain performance if the risk inequity averse factor is omitted. We assume two scenarios and compare the outcomes to explore the importance of studying the risk inequity averse factor. One scenario is the risk inequity averse newsvendor problem which we mentioned in Sect. 3.3; the other scenario studies in this subsection examines what happens if the supplier neglects the information of the risk inequity averse minded retailer. In this case, the best-response wholesale price should be the same as the optimal wholesale price \( w^* \) under the benchmark model. In the Stackelberg game process, by taking the first and second derivatives of a retailers utility function with a given benchmark wholesale price \( w^* \), there exists the retailers optimal order quantity \( {q_n} \) which maximizes her utility function and satisfies the equation:

\(\square \)

Under this circumstance, the equilibrium solution for the second case \((q_n, w^*)\) is the worst result among all the conditions proposed in this paper. The main reasons are analyzed as follows. First of all, the risk inequity averse retailer tends to be more conservative while she knows the supplier neglects her aversion to risk inequity ex ante. Additionally, the supplier only considers how to maximize his own profits if the retailers risk inequity aversion information is neglected, and this leads to his optimal decision of wholesale price equaling the benchmark wholesale price. Ultimately, the utility and expected profits of the retailer deviates much more from the benchmark model and the first case because of the substantial decrease in the order quantities while wholesale price remains constant. Inspired by these findings, we consider the risk inequity aversion factor as having apparent impacts on the decision making of supply chain agents which cannot be ignored. Therefore, we propose a risk-sharing mechanism to mitigate the negative utility of supply chain agents generated from the risk inequity aversion and how to achieve supply chain performance improvement become the main issue in our following study.

4 Risk sharing mechanism

Considering the context of the risk inequity-averse supply chain agents under wholesale price contract, we explore the idea that the performance of a decentralized supply chain declines, since the negative utility of the retailer is generated from risk inequity aversion. In reality, to mitigate the negative effects of risk inequity aversion, some suppliers undertake the downstream enterprises risk to achieve supply chain integration. For instance, Aucksun is a company located in the Yangtze River delta that integrates raw materials procurement, warehousing and transportation in the IT industry. IT industry products have a fast update speed, which leads to significant changes in demand and produces huge risk. In light of this, Aucksun integrates orders from multiple downstream companies and predicts market demand in advance. Moreover, the risks generated by downstream enterprises due to demand uncertainty are being shifted by means of unified procurement and production. Aucksun successfully reduces entire risk of the supply chain system and establishes long-term cooperative relationships with many downstream enterprises. Motivated by this real case, we explore the idea that the supply chain performance could be improved if the risk is shared by both parties. Therefore, the key issue in this section is to propose a mechanism by which the supplier can implement risk-sharing to improve the low efficiency caused by the risk inequity behavior of the retailer.

Our model investigates a risk-sharing mechanism wherein a supplier undertakes a part of the risk inequity aversion for the retailer and would be compensated with a payment to achieve Pareto improvement of supply chain performance. Before selling season, the supply chain members agree on the risk-sharing mechanism, which comprises two parts: a risk-sharing parameter and an incentive payment from the retailer to the supplier. Our study assumes that the supplier undertakes \(\lambda \) share of negative utility from risk inequity aversion, the retailer would compensate T as an incentive payment which can be monetary payoff, stable cooperation strategy or commitment. The remaining share of the risk inequity aversion undertaken by retailer is \((1-\lambda )\). We also assume that \( 0<\lambda <1 \), which means the supplier would always undertake some part of the risk in this circumstance.

Specifically, \( {U(\pi _{s,RS})} \), \( {U(\pi _{r,RS})} \) and \( {U(\pi _{sc,RS})} \) denote the expected utility of the supplier, the retailer and the supply chain system under the risk-sharing mechanism, respectively. The utility function of the decentralized supplier, retailer and centralized supply chain system are as follows.

Proposition 3

The risk sharing mechanism can be designed through a suitable risk sharing parameter: \( \lambda =1 - {\frac{{q_{sc,RS}^*f( {q_{sc,RS}^*})}}{{\alpha q_{sc,RS}^*[ {f( {g( {q_{sc,RS}^*} )}){{( {{\bar{F}}({q_{sc,RS}^*} )} )}^2} - F( {g( {q_{sc,RS}^*})} )f( {q_{sc,RS}^*})} ]}}} \), and the supply chain performance achieves Pareto improvement with the compensatory payment satisfying: \( T \in \left[ {{T_{\min }},{T_{\max }}} \right] \). Where \( {T_{\max }} = {E( {{\pi _r}(q_{sc,RS}^*)} )} - E( {{\pi _r}(q_{r,f}^*)}) - (1 - \lambda )\alpha {S(\pi (q_{sc,RS}^*))} + \alpha S(\pi (q_{r,f}^*))\) and \({T_{\min }} = E( {{\pi _s}(q_{r,f}^*)} ) - {E( {{\pi _s}(q_{sc,RS}^*)} )} + \lambda \alpha {S(\pi (q_{sc,RS}^*))} \)

Proof

As we proved previously, by taking the first and the second-order conditions of a retailers utility with respect to the order quantity, there exists a strictly concave utility function of the retailer with respect to q. We obtain the optimal order quantity \( {q^*_{r,RS}} \) by solving the following equation: \( {\frac{{\partial U({\pi _{r,RS}})}}{{\partial q}}} = 0 \). (Calculation process see in “Appendix C”).

The optimal order quantity for the retailer is \({ q^*_{r,RS}} \), which satisfies the equation as follows.

We obtain the best-response wholesale price \({w^*_{r,RS}}\) by taking the first order derivative of \({U(\pi _{s,RS})} \) with respect to the wholesale price. And the wholesale price can be substituted from Eq. (27) into equation Eq. (24), and the optimal order quantity \({q^*_{r,RS}} \) can be satisfied by the following condition.

From the perspective of the supply chain system, we derive the optimal order quantity of the supply chain system from the robust efficiency by giving the first derivative of Eq. (26)

To achieve performance improvement in the decentralized context, let \( q^*_{r,RS}=q^*_{sc,RS} \), and and the shares of risk parameter \( \lambda \) can be figured out by simultaneously solving a set of Eqs. (28) and (29). The risk sharing parameter is obtained as follows.

In the risk-sharing context, there exists the above proportion \(\lambda \) that mitigates the negative utility from the risk inequity-averse retailers and the optimal order quantity of decentralized retailer equals to the centralized supply chain system. To achieve Pareto improvement in each supply chain member performance, the utility should be better than the risk inequity averse newsvendor model. Therefore, the incentive payment T should satisfy the following conditions:

Additionally, we obtain the reasonable range of payment by solving the equations above, which are given by \( T \in \left[ {{T_{\min }},{T_{\max }}} \right] \) and the range result is given as follows.

\(\square \)

From the Eq. (30), we notice that the risk-sharing parameter is an expression with respect to the risk inequity-averse parameter \( \alpha \). It is interesting to investigate how the risk inequity-averse factor impacts on how much risk the supplier will undertake. Therefore, we derive the relationship between two variables by taking the first derivatives of \( \alpha \).

However, as the monotonicity of this equation cannot be directly determined by the complexity of implicit and compound function, we attempt to illustrate the relationship with the numerical analysis.

5 Numerical analysis and observations

In this section, to better illustrate the models proposed previously, we validate the theoretical framework by applying numerical analysis. Suppose that a supplier produces a product with a unit production cost \( c=15 \), while the retailer sells these products with a unit selling price \( p=60 \). To make numerical analysis problem tractable and realistic, we take a normal distribution to depict the market demand \( D\; \sim N[1000,{500^2}] \).

Example 1

We use this example to illustrate the impacts of a risk inequity averse newsvendor problem on the optimal decisions for the centralized and decentralized systems. We give three numerical assignments to obtain the relations of \( \alpha , q^o_{sc,f}, q^*_{r,f} \) and \( w^*_{r,f}\), respectively.

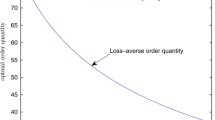

Figures 1 and 2 present the results for the impacts of the risk inequity-averse parameter \(\alpha \) on the optimal order quantity of the centralized system \( q^o_{sc,f} \) and the decentralized retailer \( q^*_{r,f} \) respectively. Figure 1 shows that the optimal order quantity for the supply chain system decreases as \( \alpha \) increases. In the decentralized situation, Fig. 2 exhibits the same trend. Compared with the benchmark scenario \((\alpha =0)\), it is obvious that the optimal order quantities reduce a considerable amount by taking account of a retailers risk equity concern. Figure 3 illustrates that the wholesale price of the supplier \(w^*_{r,f}\) is affected by changes in this parameter \(\alpha \). However, the monotonicity of wholesale price versus \(\alpha \) is implicit, the figure indicates the wholesale price decreases as \(\alpha \) increases when compared to the optimal wholesale price.

Observations: We attempt to explain these results from a realistic perspective, and some phenomena are consistent with our findings. In reality, if the retailer realizes that she is not treated fairly on the risk being undertaken, this might lead her to be more conservative and decrease the optimal order quantity which ultimately reduces expected profits and utility. Additionally, when the supplier realizes the risk aversion factor cannot be ignored, he would reveal reciprocity by decreasing the wholesale price to promote the efficiency of supply chain members. As the risk inequity aversion increases, the retailers orders are significantly reduced and this stimulates the supplier keep reducing his wholesale price to improve the utility. These results are in accordance with Proposition 1.

Example 2

In this example, we set up two cases with numerical examples as proposed in Proposition 2 and compare them under different scenarios. Case 1 demonstrates that the risk inequity averse information is completely transparent which would influence the decision makings of both members. However, case 2 explores what happens if the supplier ignores the information. As proven previously, the decision makings in these two circumstances are different. We continue to apply the previous numerical assignment in this example and all the equations are simplified only related to \(\alpha \).

Figure 4 illustrates utility changes of agents in two circumstances. Case 1 shows that the utilities of the supply chain system and members decrease as the risk inequity averse parameter \(\alpha \) increases. And gaps exist between the utility of centralized supply chain and decentralized supply chain members under two different circumstances; each supply chain members utility decreases because of risk inequity averse factors. Compared with case 1, if the supplier ignores the information about risk inequity aversion of the retailer, the wholesale price in case 2 is larger than case 1 as we demonstrated in Proposition 2. The magnitude of order quantity decline is larger than the growth of wholesale price, and this means the utility of case 2 is always less than case 1.

Observations: Figure 4 illustrates that the supplier derives more utility than the retailer in both cases and this confirms that the risk equity behavioral factor has a vital impact on the retailer, while only slightly influencing the supplier. Moreover, the performance of the supplier, retailer and the supply chain are worse than the situation if supply chain member has risk equity concerns. This fact explains why the risk inequity aversion factor lead retailer to order conservatively in practice even though this decreases both agents utilities. If the aversion factor is ignored by the supplier, this means the performance of supply chain members gets worse and is detrimental to supply chain cooperation.

Example 3

We use this example to demonstrate the expected profit changes in two scenario proposed above with different optimal decisions. Moreover, this example illustrates the expected profits changes are also related to the risk inequity aversion factor.

From Fig. 5, we can see that as the retailers risk inequity aversion factor increases, the expected profits of the suppliers in both scenarios decrease. Furthermore, the degree of reduction of the suppliers expected profit in case 1 is greater than in case 2. Contrary to the changes in suppliers expected profits, the retailers expected profit has stable incremental changes as risk inequity aversion increases in case 1. However, the retailers expected profit has a rapid decline if the factor of risk inequity aversion is neglected by the supplier in case 2. This comparative analysis indicates that taking the risk inequity aversion into consideration is meaningful.

Observations: The phenomenon of Fig. 5 can be explained from a realistic perspective. As a retailer, a higher \(\alpha \) means a higher degree of aversion to risk inequity, and this induces the retailer to order less and, consequently, receive a smaller expected profit. For the supplier, if the information about the retailers risk inequity aversion is known and also considered while making decision, he will give up a apart of the profits to the retailer by reducing the wholesale price. Therefore, the retailers expected profit rises as risk inequity aversion increases. On the contrary, if some self-interested suppliers dominate the supply chain and are likely to ignore the retailers risk inequity aversion, this triggers a significant reduction in order quantity by the retailer and both members expected profit decreases rapidly. This indicates that before the cooperation of supply chain members, it is wise for the supplier to consider the risk inequity aversion factor of the retailer while making decisions.

Example 4

This example aims to exhibit the piecewise effect of risk inequity aversion \(\alpha \) on risk-sharing parameter \(\lambda \) in a risk-sharing mechanism. From numerical analysis, we derive a relationship where the risk-sharing parameter increases with the risk inequity-averse factor.

In Fig. 6, the supplier is willing to undertake some negative utility from risk inequity aversion if \(\alpha \) is high. When the retailer becomes more risk inequity averse under feasible domain of our mechanism \((i.e., 0<\alpha <1)\), the more shares of risk the supplier undertakes. If the retailer is less risk inequity averse, the supplier shares no risk and the risk-sharing mechanism is not taken into consideration in our study.

Observation: This example can be explained in reality. When the supplier realizes that the retailer is more risk inequity averse, to maintain the efficiency of the supply chain, the supplier is willing to undertake more shares of risk to mitigate the negative effects of risk for the retailer. This strategy promotes the performance of both supply chain members in practice.

6 Concluding remarks and future research

In this paper, we mainly investigate how risk inequity aversion influences the decision making for the newsvendor problem and supply chain performance. We have developed an analysis of the risk inequity averse factor for the two-stage newsvendor model, and the risk is characterized by applying a downside-risk measurement. The optimal decisions and performance of supply chain agents are compared in two different scenarios which inspired the development of a risk-sharing mechanism. This mechanism is an extension of sharing the negative utility of risk inequity aversion where the supply chain performance can achieve Pareto improvement.

In contrast to existing studies, we explore the behavior issue from a risk inequity aversion perspective. First, we set up a benchmark model without considering any behavioral factors. Then, we study the newsvendor problem as it takes risk inequity averse factor into consideration under a wholesale price contract. The situations of the traditional supply chain and risk equity concerned retailer are studied as a benchmark model and a comparative model, respectively. The results show that the supply chain system efficiency would decrease in the case of risk inequity averse concerns. The decline in the supply chain system is caused by the following two factors: (i) the risk inequity aversion influences the retailers decision as the optimal order quantity decreases; (ii) the suppliers decision making is also affected by this behavioral factor in a complicated way. In addition, we investigate the effects on a supply chain system when the supplier ignores the information of the retailers risk inequity aversion.

Through the analysis, we find that the retailer would be more conservative and decreases the optimal order quantity if she realizes to be treated unfairly regarding risk undertaking. The outcomes of this situation deviate a lot from the traditional supply chain performance. In addition, when the supplier notices the retailer has a risk inequity aversion preference and takes it into consideration while making decision. To mitigate the inefficiency of supply chain, the supplier would reveal his reciprocity by decreasing the wholesale price to stimulate the retailers order quantity. In contrast, if the supplier ignores the information of risk inequity averse retailer, the expected profits and performance of both agents become worse than the in the prior case.

Inspired by the previous study, we discover that risk inequity aversion does have great impacts on supply chain members profits and performance. To mitigate the negative utility and promote the efficiency, we propose a risk-sharing mechanism in which the supplier would induce the retailer to order more products by sharing a part of the negative utility generated from the risk and receive a payment in return. Specifically, we gain the precise risk-sharing parameter and achieve Pareto improvement for a certain interval. Our numerical analysis demonstrates that if the degree of a retailers risk inequity aversion increases, then more shares of risk are undertaken by the supplier. This mechanism improves the performance of both supply chain agents and is also adopted in practice.

To summarize, our paper studies the impacts of the risk inequity averse preference on the resulting order quantity, wholesale price and supply chain members performance. Moreover, a risk-sharing mechanism is proposed and analyzed, which provides some managerial insights and suggestions on improving system performance. However, our study has some limitations, and it could be extended in future research. In this paper, for simplification, we only concern about if the retailer has risk inequity aversion. In reality, the suppliers risk preference should be considered as well. Additionally, we concentrate our research on the newsvendor background and focus on the wholesale price contract because it has the unique characteristic that all the risk is undertaken by the retailer, which is far from the practical requirement. Various and complex contracts should be investigated in future studies. Moreover, sustainability has been an important issue for supply chain management, it could be interesting to study the measurement of sustainability to improve operation performance and achieve goals. Finally, prospect theory can be examined by exploring risk inequity aversion behavior of the newsvendor problem in future studies, as the inequity aversion of upside and downside risk is different to subjects and this will be a dynamic variety of circumstances as the risk changes.

References

Adams, J. S. (1965). Inequity in social exchange. In Advances in experimental social psychology, vol 2 (pp 267–299). Elsevier.

Agrawal, V., & Seshadri, S. (2000). Impact of uncertainty and risk aversion on price and order quantity in the newsvendor problem. Manufacturing & Service Operations Management, 2(4), 410–423.

Arrow, K. J. (1971). The theory of risk aversion. Essays in the theory of risk-bearing pp 90–120.

Asian, S., & Nie, X. (2014). Coordination in supply chains with uncertain demand and disruption risks: Existence, analysis, and insights. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 44(9), 1139–1154.

Bolton, G. E., & Ockenfels, A. (2000). Erc: A theory of equity, reciprocity, and competition. American Economic Review, 90(1), 166–193.

Cachon, G. P. (2003). Supply chain coordination with contracts. Handbooks in Operations Research and Management Science, 11, 227–339.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 51(1), 30–44.

Caliskan-Demirag, O., Chen, Y. F., & Li, J. (2010). Channel coordination under fairness concerns and nonlinear demand. European Journal of Operational Research, 207(3), 1321–1326.

Cappelen, A. W., Konow, J., Sørensen, E. Ø., & Tungodden, B. (2013). Just luck: An experimental study of risk-taking and fairness. American Economic Review, 103(4), 1398–1413.

Chen, F., & Federgruen, A. (2000). Mean-variance analysis of basic inventory models. Working paper, Columbia University

Chen, J., Zhou, Y. W., & Zhong, Y. (2017). A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. International Journal of Production Research, 55(18), 5287–5304.

Chiu, C. H., & Choi, T. M. (2016). Supply chain risk analysis with mean-variance models: A technical review. Annals of Operations Research, 240(2), 489–507.

Choi, T. M., & Chiu, C. H. (2012). Mean-downside-risk and mean-variance newsvendor models: Implications for sustainable fashion retailing. International Journal of Production Economics, 135(2), 552–560.

Choi, T. M., Li, D., & Yan, H. (2008a). Mean-variance analysis of a single supplier and retailer supply chain under a returns policy. European Journal of Operational Research, 184(1), 356–376.

Choi, T. M., Li, D., Yan, H., & Chiu, C. H. (2008b). Channel coordination in supply chains with agents having mean-variance objectives. Omega, 36(4), 565–576.

Cui, T., Raju, J. S., & Zhang, Z. J. (2007). Fairness and channel coordination. Management Science, 53(8), 1303–1314.

Du, S., Nie, T., Chu, C., & Yu, Y. (2014). Newsvendor model for a dyadic supply chain with Nash bargaining fairness concerns. International Journal of Production Research, 52(17), 5070–5085.

Eeckhoudt, L., Gollier, C., & Schlesinger, H. (1995). The risk-averse (and prudent) newsboy. Management Science, 41(5), 786–794.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Gan, X., Sethi, S., & Yan, H. (2004). Supply chain coordination with a risk-averse retailer and a risk-neutral supplier. Productions and Operations Management, 13(2), 135–149.

Ho, T. H., & Su, X. (2009). Peer-induced fairness in games. American Economic Review, 99(5), 2022–49.

Ho, T. H., Su, X., & Wu, Y. (2014). Distributional and peer-induced fairness in supply chain contract design. Production and Operations Management, 23(2), 161–175.

Kahneman, D., Knetsch, J. L., & Thaler, R. (1986). Fairness as a constraint on profit seeking: Entitlements in the market. The American Economic Review, 76, 728–741.

Katok, E., & Pavlov, V. (2013). Fairness in supply chain contracts: A laboratory study. Journal of Operations Management, 31(3), 129–137.

Lau, H. S. (1980). The newsboy problem under alternative optimization objectives. Journal of the Operational Research Society, 31(6), 525–535.

Pasternack, B. A. (1985). Optimal pricing and return policies for perishable commodities. Marketing Science, 4(2), 166–176.

Pavlov, V., & Katok, E. (2011). Fairness and coordination failures in supply chain contracts. Working Paper, available online at https://ssrn.com/abstract=262382.

Pavlov, V., & Katok, E. (2015). Fairness and supply chain coordination failures. Working Paper, available online at https://www.researchgate.net/publication/292374227.pdf.

Rabin, M. (1993). Incorporating fairness into game theory and economics. The American Economic Review, 83, 1281–1302.

Schweitzer, M. E., & Cachon, G. P. (2000). Decision bias in the newsvendor problem with a known demand distribution: Experimental evidence. Management Science, 46(3), 404–420.

Spengler, J. J. (1950). Vertical integration and antitrust policy. Journal of Political Economy, 58(4), 347–352.

Tsay, A. A. (1999). The quantity flexibility contract and supplier-customer incentives. Management Science, 45(10), 1339–1358.

Tsay, A. A. (2002). Risk sensitivity in distribution channel partnerships: Implications for manufacturer return policies. Journal of Retailing, 78(2), 147–160.

Tversky, A., & Kahneman, D. (1991). Loss aversion in riskless choice: A reference-dependent model. The Quarterly Journal of Economics, 106(4), 1039–1061.

Wei, Y., & Choi, T. M. (2010). Mean-variance analysis of supply chains under wholesale pricing and profit sharing schemes. European Journal of Operational Research, 204(2), 255–262.

Weng, Z. K. (1995). Channel coordination and quantity discounts. Management Science, 41(9), 1509–1522.

Wu, J., Li, J., Wang, S., & Cheng, T. (2009). Mean-variance analysis of the newsvendor model with stockout cost. Omega, 37(3), 724–730.

Acknowledgements

We are grateful for the editor’s and anonymous reviewers’ constructive comments and suggestions which have improved the quality of this paper. We acknowledge the USTC Modern Logistics Research Centre for its data-driven practical platform. This research was supported by the National Natural Science Foundation of China (Grant Nos. 71571171, 71801210, 71631006), the Youth Innovation Promotion Association, CAS (Grant No. 2015364) and the Fundamental Research Funds for the Central Universities (Grant No. WK2040160028).

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by National Natural Science Foundation of China (Grant Nos. 71571171, 71801210, 71631006).

Appendices

Appendices

Appendix A: The derivation process and proofs of the benchmark model

1.1 The derivation processes of expected profits are as follows:

Given retailer order quantity q and uncertainty demand x, the notation \(min\left( q,x \right) \) denotes the minimum of the two. Therefore, the expected sales can be derived as follows:

The derivation process is calculated separately are as follows.

The expected profit of the risk-neutral retailer and supply chain system can be derived as follows:

Proof

We first discuss the benchmark model that the supply chain agents without risk inequity aversion.

1.2 Step 1: Solve the supply chain members profit maximization problem

In the decentralized system, the profit function of retailer and supplier are given in Eqs. (1) and (2). The first-order conditions of the utility function with respect to q and w respectively are as follows.

Then we obtain the stationary point of the equations.

Next, we take the second-order conditions of the utility function with respect to order quantity q:

Thus, there exists the critical point \(q^*\) which is a local maximum, and this stationary point is the optimal order decision strategy. And the equilibrium solution \((q^*,w^*)\) can be obtained by solving the following equations.

1.3 Step 2: Solve the supply chain systems profit maximization problem

In the supply chain system, we have derived the equation of the supply chain system’s expected profit function. Thus, the first-order condition of utility function with respect to supply chain order quantity q is as follows.

The process of obtaining the stationary point and solving the optimal order quantity of centralized supply chain system is the same as previous. Thus, the optimal order decision strategy \( q^o \) is expressed as follows.

The assumption we proposed previously that \( w>c \), and we assume that \(F\left( \cdot \right) \) is strictly increasing and differentiable with the stochastic market demand is finite. Finally, the optimal order quantity of decentralized supply chain member is smaller than the centralized system: \( q^* < q^o \).

Appendix B: The risk inequity averse newsvendor model, proof of Proposition 1

Proof

We discuss the model that considering the risk inequity aversion factor of the retailer under the wholesale price contract. The decentralized supply chain members play a Stackelberg game, the supplier is a leader while the retailer is a follower. \(\square \)

1.1 Step 1: Solve the supply chain members profit maximization problem

In the decentralized system, the profit function of retailer and supplier are given in Eqs. (15) and (16). To make the equation is tractable, we let \( g(q) = \int _0^q {{\bar{F}}(x)} dx \), the first-order conditions of the utility function with respect to q and w respectively are as follows.

Then we obtain the stationary point of the equations.

Next, we take the second-order conditions of the utility function of risk-inequity averse retailer with respect to q:

We can obtain the simplified equation \( 1 - \alpha F\left( {g\left( q \right) } \right) = \frac{w}{{p{\bar{F}}\left( q \right) }} \) and substitute into the equation of second-order conditions of the risk inequity averse retailer utility function with respect to q. Finally, the equation above can be simplified as: \( \frac{{{\partial ^2}U\left( {{\pi _{r,f}}} \right) }}{{\partial {q^2}}} = - \frac{{wf\left( q \right) }}{{{\bar{F}}\left( q \right) }} - \alpha pf\left( {g\left( q \right) } \right) \cdot {( {{\bar{F}}\left( q \right) } )^2} < 0 \).

Therefore, there exists a stationary point \( q^*_{r,f} \) to be the local maximum point, and this is the optimal decision strategy of the retailer. And \((q^*_{r,f}, w^*_{r,f} )\) is the unique optimal decision strategy of the decentralized supply chain members by solving the set of equations as follows.

Appendix C: Risk-sharing mechanism, Proof of Proposition 3

Under the risk-sharing mechanism, as we proved previously, the optimal order decision can be obtained by taking the first and second-order derivatives of the retailers utility [Eq. (24)] with respect to the order quantity \(q^*_{r,RS}\). The equations are given as follows.

The equation can be derived by simplifying the equation of the first-order derivatives of the retailer’s utility.

By substituting the above equation into the equation of the second-order derivatives of the retailer’s utility, then the second-order condition can be proved less than zero. Due to \( 0< \lambda <1 \) and \( 0<(1-\lambda )<1 \). The equation can be derived as follows.

Then, we take the derivatives of suppliers utility [Eq. (24)] with respect to the wholesale price w. The equation can be given by:

This indicates that there is the stationary point \((q^*_{r,RS}, w^*_{r,RS})\) of the decentralized supply chain members can be calculated through simultaneous \(p{\bar{F}}\left( q \right) \left[ {1 - \left( {1 - \lambda } \right) \alpha pF\left( {g\left( q \right) } \right) } \right] = w\) and \(\frac{{\partial E({\pi _{s,RS}})}}{{\partial w}} = \left( {w - c} \right) \cdot \frac{{\partial q}}{{\partial w}} + q - \;\alpha \cdot \frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial w}} = 0\).

To make the equation tractable, we multiply both sides of \(\frac{{\partial E({\pi _{s,RS}})}}{{\partial w}} = \left( {w - c} \right) \cdot \frac{{\partial q}}{{\partial w}} + q - \;\alpha \cdot \frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial w}} = 0\) with \(\frac{{\partial w}}{{\partial q}}\). The equation could be derived as follows.

The first order condition of w with respect to q and first derivation of \( S\left( {\pi \left( q \right) } \right) \) regarding q respectively are:

The \(\frac{{\partial E({\pi _{s,RS}})}}{{\partial w}} = \left( {w - c} \right) + q\cdot \frac{{\partial w}}{{\partial q}} - \alpha \cdot \frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial q}} = 0\) can be simplified by substituting the equations \(\frac{{\partial w}}{{\partial q}}\) and \(\frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial q}}\) we calculate above, respectively. And the optimal order quantity \( q^*_{r,RS}\) of decentralized retailer is:

As we proved previously, the optimal order quantity of the supply chain system is \( q^*_{sc,RS}\), which satisfies the equation \( \frac{{\partial U\left( {{\pi _{sc,ic}}} \right) }}{{\partial q}} = 0 \). And the equation is given by:

To achieve the channel coordination and performance improvement, let the optimal order quantity of decentralized supply chain members equals to that of the centralized system: \(q^*_{r,RS}=q^*_{sc,RS}\), and we work out the shares of risk parameter \(\lambda \) by simultaneously solving above two equations. The risk sharing parameter is obtained as follows.

Rights and permissions

About this article

Cite this article

Yan, X., Du, S. & Hu, L. Supply chain performance for a risk inequity averse newsvendor. Ann Oper Res 290, 897–921 (2020). https://doi.org/10.1007/s10479-018-3038-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3038-1