Abstract

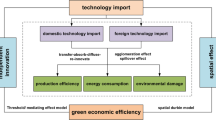

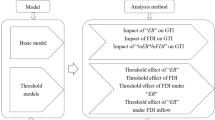

Over the years, foreign direct investment (FDI) has not only promoted rapid economic growth in China, but also affected the country’s environmental quality through technology spillover. This paper tests the variables that may affect the ability of green innovation by using the Granger causality test. It extracts the variables passed the test as input variables, selects the number of patents as output variable, and evaluates the efficiency of various provinces in mainland China by examining their yearly technological progress variables. At the same time, technological progress is defined and divided into capital and environmental factors, and then panel data using the variable coefficients model was used to fit influencing factors to obtain impact coefficients of capital and environment. On this basis, this paper makes the determination of membership to replace the general sense of ‘threshold’ value by using fuzzy theory and proposes the concept of the ‘comprehensive threshold’ of economic development and environmental protection. The results show that less than a quarter of China’s provinces have crossed the comprehensive threshold. Finally, based on the conclusions of quantitative analysis, some suggestions are proposed that the Chinese government ought to enact different strategies for the introduction of FDI according to different development situations of different provinces.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In last several decades, China has pushed forward the inflow of international capital and the rapid development of FDI through gradual reforms and promoted the rapid growth of the national economy. According to the data released by the Chinese Ministry of Commerce on January 18, 2011, the FDI absorbed by China has reached US $105.74 billion in 2010, increasing by 17.4 %, thus reaching the highest level ever. According to the data released by the United Nations Trade and Development (UNCTAD), the amount of FDI in China ranked second in the world in 2010, just followed the United States, and ranked first among developing countries (see Fig. 1).Footnote 1 However, at the same time, this has led to various contradictions and problems which attract widespread attention around the world. First, the cost of domestic labor is gradually rising in China, which will stimulate the growth of domestic consumption directly and promote the corresponding increase of overall consumer demand in international market. This will facilitate a smooth recovery in the global economy, but in the mean time the possibility to make profit from the comparative advantage of Chinese labor is becoming smaller and smaller. Second, FDI always leads corporations to relocate their plants and factories to states that are at the bottom of the economic chain, such as China and other developing countries. Therefore, it becomes one of the main powers to promote technological progress in those places; however, in the post-crisis era, this investment pattern may be reversed to some extent, thus breaking the inherent division of labor mechanism based upon comparative advantages between China and developed countries. This helps foreign trade become more balanced, especially between China and the United States, and pushes forward the re-balance of the global economy in the future for a long period of time. Third, in order to minimize the cost of polluting production, some multinational companies transfer pollution-intensive industries from developed countries and regions. These industries are usually transferred from countries with high environmental cost to lower cost countries and regions, including China. The problem is often exacerbated by local governments in some parts of China reducing the environmental control standards in order to attract FDI to meet this shift. Though boosting the local economy, this can present a threat to the local environment as well.

As for the above problems, different scholars have different views on whether sustainable development of host countries, including China, are promoted or hindered by this situation. Some scholars believe that there is a positive correlation between FDI and the labor cost of the host country, and its inflows determines the extent of its affect upon the per capita income growth of said host country (Kamalakanthan and Laurenceson 2005), which is inconsistent with Webber et al. (2002). For the second problem, the Chinese scholars Zhang and Jiang (2007), who have different views, believe that technology spillover effect caused by FDI is the most important factor that affects the technological progress of host country. As for the environmental protection of the host country, although some scholars have proposed that the effects of FDI are not entirely negative (Harold and Runge 1993), most scholars believe that FDI raises environmental policy stringency where the number of legislative units are large, while reduces it where the legislative units are few (Matthew et al. 2009). We believe that FDI may have different impact in different countries and regions due to the labor costs of host country, technological progress and environmental protection. Sometimes FDI even have the opposite impact in two countries and regions. In China, the inflow of FDI is a double-edged ‘sword’, which brings the high economic growth through high investment and high consumption on one hand while brings the high discharge and high pollution on the other hand. In addition, because of the vast territory of China, there is a huge difference among eastern, middle and western regions, and even in adjacent provinces the impact of inflows of FDI may be different. This may be because there are several differences in the economic development level, technology level, openness, policy orientation and so on among different provinces; inflows of FDI could promote the local industrial structure and technological progress in some provinces, while in some other provinces it had a huge negative impact on the local economic development, and may even lead to a greater destructive effect on the environment (Song and Wang 2010).

In this paper, we chose the impact of FDI and compared it to the environmental quality in the host country and the problems associated with technological progress as the research emphasis, focusing on the FDI among different provinces in China, and on the basis of quantitative analysis of how FDI promotes and/or hinders the ability to innovate in a developing green economy in each province of China. Taking the availability of data into account, we collected as much data as possible and analyzed the index affecting green innovation by using Granger causality test (Granger 1969; Hatemi-J 2012), selecting the variables by testing in order to construct the input and output index system, and then evaluating the environment efficiency of the provinces by output-BCC approach, obtaining the yearly index data of technological progress and dividing the data into capital and environmental factors. Finally, panel data variable coefficient models were used to fit the two factors to obtain coefficients of capital and environment factors. We also constructed ‘comprehensive thresholds’ taking the technological progress and environmental protection into account, and set a ‘comprehensive threshold’ value, by which we can analyze quantitative effect of FDI inflows on green innovation in the different provinces and make a contribution to the strategy of introducing FDI. The rest paper is organized as follows. The second section briefly reviews the related literature, and the third section builds the index system for evaluation, the fourth section is the empirical analysis, and finally the fifth section presents conclusions and policy implications.

2 Literature reviews

MacDougall (1960) proposed FDI spillover effects firstly when he studied the general welfare effects of FDI. Since then, many scholars began to study: (1) the motives and determinants of FDI; (2) how to evaluate the multinational enterprises; (3) the impact of multinational enterprise activities; and (4) policy implications for the host countries (Fetscherin et al. 2010). Kokko (1994) believed that the spillover can be considered as that FDI inflows itself has a positive impact on productivity and economic growth and sustainable development of the host country, which means FDI promotes and accelerates the progress of the industrial technology process of the host country through indirect effects. However, many scholars have come to opposite conclusions of the technology spillover effects of FDI, which may be because of the prerequisites of FDI spillover that the host should had the capacity to absorb advanced technology of multinational enterprises. Only in this way can FDI promote the increasing of production efficiency of host country and technological progress in the host enterprises, which ultimately enhances the indigenous innovation capability of host enterprises. In other words, the positive impact of FDI on growth ‘emerging’ only after the host countries’ financial market development exceeds a threshold level. Until then, the benefit of FDI is non-existent (Azman-Saini et al. 2010). China’s experience proved that, if the host enterprises themselves had no indigenous innovation, the technology spillover effects of FDI affecting the economic development of host country was not significant (Chen and Liu 2006). Moreover, the role of the FDI spillover effect in a country like China is different in different regions. Some scholars (Cheung and Lin 2004) have confirmed that relative to the coastal and central regions in China, the spillover effects of FDI are stronger in the western region where FDI inflow is spatially more concentrated. These studies explain that the technical spillover effect, only appearing in the host country and the region which has the better economic and technological level, may hinder the technological advances in the region of economic and technological backwardness to some extent.

Some scholars (Borensztein et al. 1998) coined the term for the above phenomenon the economic ‘threshold effect’, that is, only when the economic and technological development level of the host is reached or exceeded a certain threshold value, the FDI is likely to promote local technological levels. Because there is a high correlation between technical progress and research and development investment levels, when the economic development level of nation or region is higher, a better investment environment will be formed to attract more FDI and technological spillovers will arise. Thus, the level of technological progress in the host country or region will be generated, which is also the main reason of economic ‘threshold effect’.

On the other hand, despite of the economic ‘threshold effect’, if we take the positive and negative impact of FDI inflows on host country environmental protection into account, we can set an environment ‘threshold effect’. After Grossman and Krueger (1991) proposed and defined the Environmental Kuznets Curve (EKC), some Chinese scholars believe that the point of it can be seen as the ‘threshold’ that separates environmental quality from degradation to improvement; many countries, including China, have experienced the so-called ‘threshold effect’ in the course of economic and social development and change (Han and Lu 2008). For example, in the initial stage of industrialization of some developed countries, there were once environmental deteriorations, like the destruction of the environment and the pollution of air and water. However, after the economy of these countries developed to a certain level, with the gradual increase in the per capita GDP, the quality of the environment improved with economic growth. Therefore, a large number of high energy consumption and high pollution industries in these countries were transferred to the developing host countries through the input of FDI. Walter (1982) and Walter and Ugelow (1979) attributed it to the ‘pollution haven hypothesis (PHH)’. Despite being highly controversial, PHH has still subsequently proven to be correct by many scholars. Some scholars even go on to propose that, if the developing countries as the host implemented lower environmental standards for FDI, they will become prime locations of polluters (Baumol and Oates 1988). In addition, because of the worry that capital is flowing to countries with lower environmental standards (usually developing countries), causing their pollution-related industries to be less competitive, the counties with strict environmental standards are likely to compete to decrease their own environmental standards, resulting in a decline of level of the world’s environmental protection (a.k.a., a ‘race to the bottom’).

These judgments have been confirmed by several recent scholars. Jorgenson (2009) used panel regression analyses to examine the effects of FDI on industrial organic water pollution intensity in less-developed countries, and his results indicated that industrial water pollution is positively associated with FDI in the manufacturing sector within less-developed countries. However, we still can not determine the negative correlation between FDI inflows and environmental protection in the host county. Some Chinese scholars have come to the opposite conclusion. Through an empirical study of the effect of FDI on industrial wastewater and other pollutants, Bao and Lv (2010) came to the results that there was a significant negative correlation between FDI inflows and the level of per capita emissions, and then they denied that the PHH existed in China.

We believe that, although the above arguments have certain rationality, we can not simply generalize the effect of FDI on the host country’s technology and the environment. For example, in terms of the environment, environmental quality not only relates to the participation of FDI to the host country’s pollution-intensive industries, but also has a close relationship with the authenticity and effectiveness of multinational companies carrying out environmental management, and the advances in clean production technologies. Multinational companies generally hold the relatively advanced and cleaner production technologies and also have a stronger technical innovation capability in environmental protection. Under certain conditions, they are likely to have positive effects on the environmental quality in the host country through technology spillovers and promotion of the sustainable development of the host country. Of course, this requires the active promotion of the host country. At present, China’s per capita GDP was just over US $3,000, which is still far away from reaching the threshold of improving environmental quality. However, environmental quality in China has reached a serious situation which cannot be ignored. As a result, if we achieve rapid economic development in the price of environmental damage, it is neither true development nor sustainable development. Therefore, China must not only provide the necessary platform for FDI technology spillover to promote indigenous innovation and the technological progress of domestic enterprises, but also take active and strong measures regarding the inflows of FDI technology spillover to promote green innovation of FDI being widely used in China without damaging the environment further, such as the construction of infrastructure. Such comprehensive goals will also be laudable themselves of course, setting a new benchmark for development and managing FDI in other developing host countries. Therefore, this paper attempts to analyze quantitatively the doubled impact of FDI inflows on Chinese environmental protection and technological progress. We will combine economic ‘threshold effect’ and the environmental ‘threshold effect’, proposing a ‘Comprehensive threshold effect’ to measure comprehensively the quantitative relationship, quantitative characteristics and quantitative limits in economic development, technological progress and environmental protection.

In an effort to assess various measures of knowledge diffusion, Nelson (2009) compared patent data about recombinant DNA technology to licenses and publications building on the same technology. He suggested that the evaluation of these measures highlights the errors of both omission and over-representation in each step, and revealed potential biases tied to organizational age and location. Recent studies have generally set the panel data model to estimate the effect of FDI on technological progress of the host country. Kemeny (2010) used panel data and applied a system GMM estimator that provides efficient estimates of the exogenous contributions of FDI and social capability to technological upgrade. He pointed out that FDI has a disparate impact depending on an economy’s level of development and social capability. In addition, some other scholars (Qi et al. 2009; Banker et al. 2010) also used non-parametric statistics, such as the efficiency analysis based on Data Envelopment Analysis (DEA), to study this topic and achieved some better results. But only two inputs, capital and labor, and one output are used in their DEA model, which affects the accuracy of evaluation results. Therefore, it is necessary to evaluate the impact of individual variables on technology by choosing an appropriate method, and then on this basis by using DEA and the panel data model to test the technology spillover effect of FDI. From this, we will get a more accurate measurement result.

3 Input and output variables selecting

As innovation is a relatively abstract concept, so far there is no uniform conclusion for the selection of innovation evaluation index. Although in recent years some researchers have constructed many evaluation index systems (Cao and Xiang 2009), they still cannot confirm that those systems are able to achieve an accurate evaluation of innovation. In the international arena, Pakes and Griliches (1984) had studied the quantitative relationship between patents granted in different industries and research and development expenditures using a regression analysis, finding a high correlation between the two. In this paper, we select patent grants to measure innovation ability so that we preserve generality and make our results easily comparable to the conclusions of the previous references. As to the input variables, this paper preliminarily selects all the indexes that may affect the patents granted, which includes the amount of FDI, wage levels, technology promotion expenditures, industrial added value, net fixed assets, labor variables data, and the total consumption of social retail goods. In addition, it also includes the number of manufacturing jobs, the total scientific and technical personnel, the domestic and foreign investment in fixed assets and data from other variables.

FDI can reflect the influence of foreign capital on local technology. Generally speaking, FDI can improve the technology level, management ability and environment construction in local area. More FDI will bring more improvement of the local country’s technology level, technology innovations and increase of patent licenses. As to wage level, increase of workers’ wage can encourage workers to work positively and increase their satisfaction with life, which can bring more innovations and patent licenses in return. Industrial added-value and net value of fixed assets are closely linked to the wage level and can affect the patents indirectly as well. Total social retail product consumption indexes and employment are main indexes of life happiness. Happiness of life has close relationship with independent innovation ability. The higher level of happiness, the more innovation ability will be brought out. Moreover, science and technology expenditures, gross science and technology personnel were also introduced here because they have directly function on the index of the patent granted. The data of these factors are available from statistic year book and can be used in our efficiency analysis after through Granger causality test.

Additionally, as this paper concerns green innovation, we must introduce certain variables related to environmental protection. Taking the availability of data into account, we will try to enlarge the range of variables, including industrial wastewater, industrial emissions, industrial solid waste, energy consumption, oil, natural gas and hydropower and other variables. Among these variables, industrial wastewater and waste gas are both undesirable outputs variables, the value of which should be as little as possible due to their negative effect on environmental protection. Similarly, when DEA is used to analyze the input variables, it requires the redundancy of input variables to be as little as possible. At this point, the two variables motioned above reached a consensus; as a result we classify environmental pollution variables as an input index, which can simplify the analysis procedure. We collect and collate national data of the above variables first. We also believe that, although there is a gap in production efficiency values in China’s provinces, the evaluation of the input and output variables on environmental efficiency are applicable for the same period. Therefore, for convenience, we assume that the input and output variables from all provinces are applicable to the nation’s general situation. In this way, the conclusions we achieve in quantitative analysis using the national data can also apply to provinces. The data we use are derived from the ‘New China’s 55 Years of Statistical Data Compilation’ and ‘China Statistical Yearbook’ from the year of 2006 to 2012.

As different selections of input and output variables can produce different evaluation effects, how to build a more reasonable target system will be very important for the evaluation of FDI green innovation. This paper selects several variables that seem to be more comprehensive to reflect the research, but the evaluation of the explanatory power of these variables on subjects on which we focus by empirical quantitative analysis on the successive relationship of input and output variables that affect each other are still needed. From a statistical viewpoint, if there is a significant Granger causality in the two stationary series, then causality is also bound in the economic sense, which may not be established conversely. Thus, we use the Granger causality test for variables to confirm the interaction causality in various variables. Before conducting the test, we should first conduct a stationary test and co-integration in various variables, including the number of patents. The results of the stability test show that the index series are second-order stationary I (2) sequence, and co-integration test results show that there is a long-run equilibrium co integration relationship in various variables, except changes in natural gas and energy consumption and the number of patents. Therefore, natural gas and energy consumption variables should be removed, then the Granger causality test is used to analyze the influence of the rest variables on the number of patents.

It should be noted in Table 1 that ‘∗∗∗’ stands for the estimated coefficient significant at 1 % level, ‘∗∗’ represents the estimated coefficient significant at the 5 % level, ‘∗’ represents the estimated coefficient of 10 % level significantly. The more the number of stars is, the more significant the results are. In terms of selecting the lag phases, we choose the annual data, of which the impact on innovation capability will not lag a significant number of years, so the impact of the index data after two years on output can be ignored. As a result, we only analyzed the impact of Lag phase I and II on the number of patents Y. Some of the variables were removed as they had no explanation for the number of patents in the two lag intervals. Thus the remaining five variables are FDI Lag phase II, industrial waste water Lag phase I, Industrial solid waste Lag phase II, research and development Lag phase I and Lag phase II, as shown in Table 1. Data in the table is gained by the P value of the Granger causality test. We set the significance level 0.05, so when P≤0.05, X i is the Granger cause of Y. The co-integration test of FDI on the number of patents proved that it had a long-term stability and equilibrium relationship with China’s innovation capability and FDI spillover effects exist in China. Additionally, there is a Lag phase II impact of FDI on the number of patents.

4 Empirical analyses

At first, we evaluated the DEA technical progress for the selected variables, obtained the frontier values of production technology, and calculated the average rate of technological progress. Then on this basis, the average rate of technical progress is broken down into capital and environmental factors, and then we quantify the effect of technological progress respectively in the capital and the environment, and combined with data from various provinces and cities we calculate the impact of capital and environmental on technological progress respectively, as the theoretical basis of policy recommendations.

4.1 DEA assessment of technical progress

In this paper, we introduce the Malmquist productivity index based on DEA approach. The index is used to measure the technical progress of China’s provinces because it has an outstanding advantage that other productivity indexes don’t have, such as Luenberger index, Hicks-Moorsteen productive index and Törnqvist productive index, (Diewert and Fox 2010). Zweifei (2010) illustrated the different kinds of productivity indexes in details. Grosskopf (1993) pointed that the Malmquist productivity index based on DEA can be used to measure the productivity growth and productivity efficiency of the system with multiple inputs and multiple outputs. It is known that the economic development and environmental protection system is a complex system with multiple main input and output factors. Therefore, we choose Malmquist productivity index as our productivity index where DEA approach is applied to determining the production frontiers of different periods.

The basic idea of DEA analysis is to take the DMUs with the best performance in the economies as benchmark and to determine the efficiency or technical level of other DMUs through these efficient DMUs on the frontier (Cook and Seiford 2009; Lozano and Villa 2010). In DEA analysis, the determination of the potential technological frontier level in different periods is the basis for further calculation of productivity. We put the output-oriented efficiency as the basis.

Suppose in each period t, DEA model has n DMUs, each DMU has m inputs and s outputs. The input variables vector X j =(x 1j ,x 2j ,…,x mj )T>0 and output variables vector Y j =(y 1j ,y 2j ,…,y sj )T>0 represent the input and output of DMU j respectively, where j=1,2,…,n. Because there is no evidence that output increase proportionally with the increase of inputs in economic, this paper uses the model Output−BC 2 which is under the variable returns to scale (VRS) assumption.

Here, we use the data of Chinese provinces as the DMUs for analysis. As the lagging effect of investments, we select the number of patents from 2002 to 2011 as output variables, industrial wastewater and research and development expenditures from 2001 to 2010, and FDI and industrial solid waste and research and development from 2000 to 2009 as input variables. For example, industrial wastewater and research and development expenditures in 2001, FDI and industrial solid waste and research and development in 2000 produce the outputs of patents in 2002. As the data from Tibet is incomplete, it should be removed. Therefore, the Chinese mainland is divided into thirty provinces. Sources of variables are the ‘Statistical Yearbook of Science and Technology of China 2001–2012’ and ‘China Statistical Yearbook 2001–2012’.

This paper extracts the DMU i of Pareto optimal (i=1,…,n 0) in period 1 by using the Output−BC 2 evaluation method, and merges it in period 2, then evaluates the efficiency of DEA Output−BC 2 in the second stage. At this time the DMUs that are Pareto optimal in period 1 may not become the same again.

Assume \(\mathit{DMU}_{j_{0}}\) (l=0) is the Pareto optimal in l=0, but it fell to below the production frontier in l=t, and became an inefficient unit. Changes in the production frontier mean the advances of production technology. Comparing the two efficiency evaluation value of DMU i (i=1,…,n 0) in the first phase, we extract the DMU j in the production frontier in l=t, and the efficiency values are \(Z_{j}^{0} = \lambda_{j}\), \(Z_{j}^{t} = 1\). Extracting the variables in the production frontier in both evaluations can better reflect the advances of production technology. According to the technological progress function that was defined by Solow (1957),

where a represents the average progress rate. Then the average progress rate of production technology is:

The time span is one year, therefore t=1.

According to formulae (1), (2) and (3), the calculated average rates of technical progress are shown in Fig. 2.

For some variables which are not in the production frontier in both evaluations, there is also technical progress in the changes of period. This paper uses the annual technical progress indicator to measure technical progress, by which we can transfer the difficult quantitative variables effectively, in T in the Solow production function. The annual technical progress T can be measured by:

If some DMUs are not on the production frontier in period 1 but in period 2, it implies that the DMU finishes the technical progress and remains above it during this time span, which means the technological progress years are longer than the time span. At this time, t>0; quite to the contrary, t<0. Technological progress years of provinces are shown in Table 2.

4.2 The factor of decomposition of technology progress

The next step is to conduct further analyses on the factors affecting technological progress. Input factors promoting the progress of technology are divided into capital factors and environmental factors. Capital factors to consider are FDI and research and development funds indices. Environmental factors to consider are industrial wastewater and solid wastes emissions. The output index is a patent license number index. Using the DEA method, one can obtain the annual progress rate of each factor, as illustrated in Fig. 3.

From Fig. 3, we can see the technological progress rate and the environment progress rate have a significantly positive correlation, and the correlation coefficient is 0.8641. However, the capital progress rate and the environment progress rate have a negative correlation relationship, which shows that environmental factors hinder the progress of economic development. Now, many provinces are pursuing economic development by destroying the environment, and this does not align with the requirements of sustainable development. Therefore, the coordinated development of economy and environment should be correctly handled, which becomes the primary thing in today’s society.

As to tests for the factors affecting the innovation ability, the variable coefficient test model can be set as formulation (5) according to the panel data collected.

In the model, μ i is the random disturbance term, Tec is years of technology progress, liq is the capital progressive factor, Env is an environmental progressive factor, and C is a constant item. θ i and γ i are capital and environment influence coefficients, respectively, which show the degree of influence that capital and the environment make on the progress of technology. If the coefficient is positive, it indicates that it has a positive influence on the progress of technology; conversely, it shows a negative side effect to technological progress. In addition, if the regression coefficient is not significant, then it means that capital and environment produced no apparent effect on technical advancement. Referring to variable coefficient model, Eviews6.0 is applied to estimate the panel data model consisting of all samples. The results are shown in Table 3.

From the data in Table 3, the goodness-of-fit of this model is quite high, and the value of R 2 is 0.9523 after adjustment. Overall, the model is significant and could be used to the next step on the basis of this analysis. The results of the test showed that the capital progress has a significant effect on the technological progress in almost all provinces, which indicates that the present technological progress still depends mainly on the attraction of capital. Among them, capital progress coefficients in Liaoning, Fujian, Shandong and Guangxi are all above 2, which explain that the capital investment has great influence on the rising of innovation ability in these regions—one year of progress in capital will lead to two years of progress in technology. On the other hand, in many regions with negative environmental progress, such as Inner Mongolia, Fujian and Guangxi, environment progress has a negative effect on technological progress, and this indicates that capital investment in these areas has caused damages to environment to a certain extend. In general, test coefficients of environmental factors in most provinces are not significant, which suggests that most provinces and cities are more concerned about environmental protection and have better environmental pollution control. Liaoning and Shanghai do much better along these lines. The capital progress influence coefficient and an environmental factor influence coefficient in Liaoning are 2.4580 and 0.6287 respectively, and in Shanghai are 1.2974 and 0.0366 respectively. Both are acceptable at a 1 % significance level. In comparison, capital progress in Liaoning is superior to that in Shanghai, while environmental progress slightly inferior. Compared to other provinces, Guizhou’s method of technological progress is unique. The investment of capital has no effect on the province’s innovation ability, while environmental progress has significant effect on it.

In view of the fact that capital progress and environmental progress influence technological progress at a different degree and that in the same year capital progress and environmental progress bring different effects, in order to manifest that the capital and the environment have the same important position, this paper normalizes the capital progress and environmental progress of thirty provinces and cities in mainland China:

where, \(\tilde{\theta}^{i}\) represents normalized capital influence coefficients, \(\tilde{\gamma}^{i}\) is normalized environmental impact coefficient, σ θ and σ γ are standard deviation of capital influence and the environmental influence respectively. In this paper, using the varying coefficient model to estimate out capital and environmental impact coefficient still fails to eliminate the variance effect, but normalized coefficients eliminate the variance effect, making the influence weight of capital and environmental variation on the progress of technology the same. In the following table, standard progress levels can be obtained by adding the normalized capital and environmental impact coefficients. Table 4 shows the size of its summation after sorting provinces of capital influence and environmental impact coefficient and standard progress.

Normalized technique can be used for capital and environment influence effective division. We classify Chongqing, Jiangxi, Qinghai and certain other provinces, in which the environmental factor has a positive impact on the total progress, into one cluster. Fujian and Inner Mongolia, et al., which have negative impacts on total progress, are classified into one cluster. Also, Shanxi, Guangdong and Xinjiang, whose coefficients are not significant, are clustered into the same cluster.

The test results within the regions showed that, due to the geographical location, natural conditions, economic base and policy inclination as well as certain other reasons, partial regions with better economic development can endure the negative impact of FDI inflows in the local market and make good use of the technology spillovers of FDI by relying on its strong economic and technical basis and absorption ability. This can not only promote the development of innovation, but also protect and refine the environment effectively along with the investment of research capital in these regions, such as Liaoning, Shanghai and Beijing. However, in some other less-developed regions such as Fujian, Guangxi and Inner Mongolia, when FDI flows in, environmental quality and the spillover effect are counterproductive, although their innovative ability is improved. There are also some much less developed areas where the capital influence coefficient was not significant, while the environmental impact coefficient was significant, and this explains why capital investment cannot help to improve technology, but the environmental progress can help local technological progress.

4.3 Measurement of the spillover effect ‘threshold’ value

Since the threshold effect was proposed, many scholars have misunderstood the threshold value. Many Chinese scholars think that only when economic development reaches a certain level, the foreign technology spillover effect can be acknowledged, and this is a result of the study of the ‘threshold’ value problem. This paper doesn’t deny the existence of the ‘threshold’ effect, but it is against a particular set of figures for the so-called ‘threshold value’. As mentioned above, there are many factors influencing the technological progress, all of which are closely linked, so we cannot separate or extract some indices to explain the size of threshold value. Zhang and Jiang (2007) extracted threshold values from economic development level, openness degree and regional structure factors, and found that part of the provinces and cities has passed the economic development degree threshold, but not the openness ones, or have passed the openness threshold, but not the regional structure threshold. The results of the policy implications are not very strong; therefore, we are unable to draw any guiding conclusion.

This paper holds that the threshold is a fuzzy set function, and the final determination is the probability of passing the threshold at some point. If the probability is larger, it means the area has greater possibilities to cross the economic development threshold, and will also have a great possibility to resist FDI inflows when absorbing it. At the same time, this can improve the indigenous innovation ability as well. According to fuzzy theory (Gottwald 2006a, 2006b), the following membership functions are chosen:

where, μ belongs to the probability of ‘crossing the threshold’, and x is the total progress index. This paper chooses yearly data, and this illustrated that when x≤1, the total progress is slower than the time development, so we can’t say it has already crossed the threshold; when x>1, we introduced the Sigmoid function moved an unit right, because the index function has many advantages that other functions do not have. It is one of the neural network’s classic effect functions, with its function image according with economic development of dynamic movements. In this step, we eliminate Xinjiang, Qinghai and Guangdong, determine the fuzzy threshold of the remaining twenty-seven provinces, and judge total progress index through membership functions. The results can be seen in Table 5.

From Table 5, it can be seen that provinces with a high membership degree are all in eastern China, which shows that most provinces in the eastern area can effectively attract FDI and defend against its impulse. They also make efforts on protecting the environment, which prevents the negative influence upon environmental quality that goes along with FDI spillover. The inspection coefficient of environmental factors in most of these provinces was not significant except Liaoning and Shanghai, where the inspection coefficient has a positive impact as a result of their attention to the ecological environment. Provinces with lower membership are mostly from the middle-west area of China. FDI in these areas has a much smaller influence than on those of the eastern area, and can easily create strong environmental damage. In the provinces with 0 memberships, it is not the fact that foreign investment has no influence in these areas, but that in some areas, the capital progress is offset by the environment destruction, making the technology progress stagnant. For example, in Fujian, the capital of progress can make technology a 3.6-year progress, as well as a 2.6-year environmental regress. See Fig. 4.

5 Conclusions

Based upon data from Statistical Yearbook of Science and Technology of China, this paper builds a data support index system by the Granger causality test method, and then it quantitatively analyzes their returns to scale, input redundancy and output insufficient condition by using the output-BCC model to distinguish between the capital factor and the environmental factor. Then we use a variable coefficient model to quantify the degree of influence of impact factors and use the membership function to determine the threshold value. The results show that China’s current economic development level in total can trigger certain technology spillover effects, and that there are about five to seven provinces which have crossed the threshold value. Especially in some rapidly economically developing areas, FDI inflows can exert a positive role in local economic and technological development.

According to the results, China should actively guide more FDI to Beijing, Liaoning and Shanghai, because they have crossed the threshold value and can withstand the impacts that FDI brings to the local environmental quality. The provinces, for which the environment has not been influenced by FDI inflows, should vigorously develop local economic construction, attract investment (while considering environment protection) and promote harmonious economic and social development. At the same time, China should also put special funds for environmental protection into Jiangxi, Fujian and Guangxi provinces, so that when the FDI flows in, those provinces can build more effective pollution control facilities, reducing the waste water and solid waste discharges, so that environment will not be greatly damaged and sustainable development can be realized. For Guizhou province, it should make more effort in the infrastructure construction and education; meanwhile, the government should also help implement preferential policies and adjust the industrial structure in order to promote local economic development and boost the FDI spillover effect.

It is important to emphasize that when evaluating the effect of FDI inflows of China, one should pay attention to the effect on economy as well as sustain development in order to balance the economic development and environmental protection. This paper puts forward the ‘comprehensive threshold effect’, which can not only effectively resolve the economic and environment double evaluation problem, but it also give the government a point of reference, so that it can introduce FDI in one dimension. In addition, it has certain reference value for China’s macroeconomic control and environmental expenditure flow. It can lead FDI inflows to place with a great deal of marginal capital and better environmental management as well, and this can not only bring more profits to foreigners, but also improve the environment in China and leads to a ‘win-win’ situation for all parties.

Notes

Data are derived from “Global and Regional FDI Trends in 2010” issued by UNCTAD on January 17, 2011. The data are not including the financial sector, being US $101.10 billion and lower than the data released by the Chinese Ministry of Commerce on January 18, 2011.

References

Azman-Saini, W. N. W., Law, S. H., & Ahmad, A. H. (2010). FDI and economic growth: new evidence on the role of financial markets. Economics Letters, 107, 211–213.

Banker, R. D., Cao, Z. W., Menon, N., & Natarajan, R. (2010). Technological progress and productivity growth in the U.S. mobile telecommunications industry. Annals of Operations Research, 173, 77–87.

Bao, Q., & Lv, Y. (2010). FDI and Environmental pollution in China: an empirical study by China’s panel data of manufacturing sectors. Nankai Journal (Philosophy and Social Sciences), (3), 93–103.

Baumol, W. J., & Oates, W. (1988). The theory of environmental policy (pp. 20–38). Cambridge: Cambridge University Press.

Borensztein, E., Gregorio, J. D., & Lee, J.-W. (1998). How does foreign direct investment affect economic growth? Journal of International Economics, 45, 115–135.

Cao, H., & Xiang, Z. (2009). Research on assessment system of enterprise’s independent innovation capability. China Industrial Economy, 258, 105–114.

Chen, L., & Liu, Z. B. (2006). Local innovation capacity FDI spillover and economic growth. Nankai Economic Research, 3, 90–101.

Cheung, K. Y., & Lin, P. (2004). Spillover effects of FDI on innovation in China: evidence from the provincial data. China Economic Review, 15, 25–44.

Cook, W. D., & Seiford, L. M. (2009). Data envelopment analysis (DEA)—thirty years on. European Journal of Operational Research, 192, 1–17.

Diewert, W. E., & Fox, K. J. (2010). Malmquist and Törnqvist productivity indexes: returns to scale and technical progress with imperfect. Journal of Economics, 101(1), 73–95.

Gottwald, S. (2006a). Universes of fuzzy sets and axiomatizations of fuzzy set theory. Part I: model-based and axiomatic approaches. Studia Logica, 82(2), 211–244.

Gottwald, S. (2006b). Universes of fuzzy sets and axiomatizations of fuzzy set theory. Part II: category theoretic approaches. Studia Logica, 84, 23–50.

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37(3), 424–438.

Grosskopf, S. (1993). Efficiency and productivity. In H. O. Fried, C. A. Knox Lovell, & S. S. Schmidt (Eds.), The measurement of productivity efficiency: technique and application (pp. 160–194). New York: Oxford University Press.

Grossman, G. M., & Krueger, A. B. (1991). Environmental impacts of a North American free trade agreement. NBER Working Paper.

Han, Y. J., & Lu, Y. (2008). Threshold effect, economic growth and environmental quality. Statistical Research, 9, 24–31.

Harold, C., & Runge, C. F. (1993). GATT and the environment: policy research needs. American Journal of Agricultural Economics, 75, 789–793.

Hatemi-J, A. (2012). Asymmetric causality tests with an application. Empirical Economics, 43(1), 447–456.

Jorgenson, A. K. (2009). Foreign direct investment and the environment, the mitigating influence of institutional and civil society factors, and relationships between industrial pollution and human health. Organization & Environment, 22, 135–157.

Kamalakanthan, A., & Laurenceson, J. (2005). How important is foreign capital to income growth in China and India? EAERG Discussion Paper Series with number 0405, East Asia Economic Research Group, School of Economics, University of Queensland, Australia.

Kemeny, T. (2010). Does foreign direct investment drive technological upgrading? World Development, 38, 1543–1554.

Kokko, A. (1994). Technology, market characteristics and spillovers. Journal of Development Economics, 43, 279–293.

Lozano, S., & Villa, G. (2010). Gradual technical and scale efficiency improvement in DEA. Annals of Operations Research, 173, 123–136.

MacDougall, G. D. A. (1960). The benefits and costs of private investment from abroad: a theoretical approach. Economic Record, 36, 13–35.

Marc Fetscherin, M., Voss, H., & Gugler, P. (2010). 30 years of foreign direct investment to China: an interdisciplinary literature review. International Business Review, 19, 235–246.

Matthew, A., Colea, M. A., & Fredriksson, P. G. (2009). Institutionalized pollution havens. Ecological Economics, 68, 1239–1256.

Nelson, A. J. (2009). Measuring knowledge spillovers: what patents, licenses and publications reveal about innovation diffusion. Research Policy, 38, 994–1005.

Pakes, A., & Griliches, Z. (1984). Patents and R&D at the firm level: a first look. In Z. Griliches (Ed.), R&D, patents and productivity, Chicago (pp. 55–71).

Qi, J. H., Zheng, Y. M., Laurenceson, J., & Li, H. (2009). Productivity spillovers from FDI in China: regional differences and threshold effects. China & World Economy, 17, 18–35.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39(3), 312–320.

Song, M. L., & Wang, S. H. (2010). Analysis of green innovation capability based on panel data in China. China Soft Sciences, 5, 143–151.

Walter, I. (1982). Environmentally induced industrial relocation to developing countries. In S. J. Rubin & T. R. Graham (Eds.), Environment and trade (pp. 67–101). Totowa, London: Allenheld Osman & Francis Pinter.

Walter, I., & Ugelow, J. L. (1979). Environmental policies in developing countries. Ambio, 8, 102–109.

Webber, M., Wang, M., & Zhu, Y. (2002). China’s transition to a global economy. New York: Palgrave Macmillan.

Zhang, Y., & Jiang, D. C. (2007). Regional difference and threshold effects of FDI technology spillovers. World Economy, 9, 101–111.

Zweifei, A. (2010). Productivity indices. Munich: GRIN Publishing GmbH. http://www.grin.com/en/e-book/154733/productivity-indices.

Acknowledgements

We would like to thank the supporting of Program for New Century Excellent Talents in University (No. NCET-12-0595), National Natural Science Foundation of China (71171001), Humanity and Social Science Youth Foundation of Ministry of Education of China (10YJC630208), Key Foundation of Natural Science for Colleges and Universities in Anhui, China (KJ2011A001), Soft Science Foundation of Anhui, China (12020503063), and Key Foundation of National research in Statistics of China (2011LZ023).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Song, M., Tao, J. & Wang, S. FDI, technology spillovers and green innovation in China: analysis based on Data Envelopment Analysis. Ann Oper Res 228, 47–64 (2015). https://doi.org/10.1007/s10479-013-1442-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1442-0