Abstract

Microfinance rapidly developed and commercialized, exacerbating competition and the attention paid to profits. In response, many governments have capped microcredit interest rates. Using unique data on interest rate caps and a dataset comprising 1115 microfinance institutions over 2015–2018, we investigate the effect of such regulatory measures on loan sizes, with fixed-effect and two-stage residual inclusion regressions. Going further with a moderation analysis and multiple measurements of competition, we investigate whether market conditions affect this relationship. We find that microfinance institutions facing interest rate caps are associated with larger loans and financial exclusion, and that competition emphasizes this adverse effect. We suggest two mechanisms explaining such results: the deterioration of cross-subsidization possibilities and the exacerbation of risk-taking strategies of microfinance institutions, both favored by competition. Therefore, we argue against interest rate restrictions, and for the adoption of a more systemic analysis of regulatory outcomes integrating market conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Microfinance institutions (MFIs) provide financial services to poor, unbanked individuals, and small businesses, and concomitantly pursue financial sustainability. Although the industry was marginal four decades ago, it has substantially developed, taking an important place in the financial inclusion and development landscapes (Beck 2020). Yet, severe crises emerged, revealing mission drift, ethical debates, and mitigated social outcomes (Armendáriz and Szafarz 2011; Hudon and Sandberg 2013; Guérin et al. 2018). Looking back on how microfinance evolved, two trends have had a significant influence.

On the one hand, regulation has intensified and helped MFIs develop and formalize (Arun, 2005). Yet, research shows that regulation is not always correlated with better financial nor social outcomes (Hartarska and Nadolnyak 2007). When it is maladapted or inappropriate, it may destabilize the industry (Ménard 1998), and even contribute to crises (Guérin et al. 2018). Especially, more and more governments, concerned about potential drawbacks of a quest for profits, have considered limiting interest rates (Christen et al. 2012). However, despite their a priori honorable motivations, interest rate caps are often considered as detrimental. Based on case studies, scholars argue that caps may force MFIs to drop their costliest clients, often among the most marginalized (Acclassato 2008; Ferrari et al. 2018). Yet, grey areas remain about whether this can be confirmed from a general, cross-country angle, and whether market conditions matter.

On the other hand, microfinance drew the attention of for-profit actors, who developed substantially. Moreover, MFIs increasingly represent an opportunity for commercial investors, often paying special attention to financial performance (Mersland and Urgeghe 2013). This commercialization led to increased competition, with benefits but also worrying effects. Although competition encourages efficiency, reduced lending rates, and innovation (Al-Azzam and Parmeter 2021), scholars alerted on undesired effects related to information asymmetry and risk-taking (McIntosh et al. 2005). Overall, the literature highlights ambiguous outcomes of competition in financial inclusion contexts (Assefa et al. 2013).

In this context, we first take a step back to study how interest rate caps affect financial inclusion. With unique data on interest rate caps and 1115 MFIs over 2015–2018, we assess how these affect the loan size, a proxy for MFIs’ outreach. Our results show that MFIs subjected to caps are associated with larger loans, a sign of the financial exclusion of the poorest. Second, we study whether competition alters this relation via a moderation analysis. Using fixed-effect regressions and the Herfindahl–Hirschman and Lerner indexes, our findings suggest that competition amplifies this detrimental effect of caps. Our results are supported by various robustness checks, including the use of a two-stage residual inclusion, and the percentage of women clients as dependent variable.

We bring two contributions to the development and financial inclusion literature. First, although caps have been discussed, empirical—and even more quantitative—evidence of their effects are scarce. Studies are conceptual, centered on case studies, or constituted of taxonomies. This is mainly due to the lack of centralized information (Ferrari et al. 2018). We combined multiple sources including initiatives analyzing regulation in financial inclusion schemes, case studies, legal documents, press releases, country reports from field actors, and contacts with central bankers and networks. Doing so, we suggest a more global and quantitative analysis and explore the cross-country effect of interest rate caps. Second, studies on regulation focus on regulation itself, leaving aside market circumstances (Karimu et al. 2021). Yet, competition heavily influences MFIs, inducing that regulation is likely to have different outcomes in different markets. By connecting interest rate caps and competition, we contribute through a more systemic analysis of such instruments. While MFIs and competition proliferated, sometimes leading to saturation (Cull et al. 2014), the literature is almost silent on the implications for regulatory outcomes. However, studying whether and how these outcomes depend on competition in financial inclusion contexts broadens regulatory analyses.

The paper is structured as follows: Sect. 2 presents a literature review on interest rate caps and competition in microfinance contexts. Section 3 describes our empirical approach. Section 4 presents the data. Section 5 details our results. Section 6 concludes.

2 Microfinance and interest rate caps: theoretical framework

2.1 The implications of interest rate caps in microfinance

As microfinance developed and commercialized, the industry drew regulatory attention (Kirkpatrick and Maimbo 2002). Today, most microfinance markets present at least some form of regulation, with as common perspective that there is no unique framework fitting all markets but some consensual, core principles (Rosengard 2011). These guide regulators and prevent damaging interventions and have been supported by the Consultative Group to Assist the Poor (CGAP).Footnote 1 Among these principles, Christen et al. (2012 p:56) point that interest rate caps “can restrict access by making it impossible to serve small or remote borrowers”. Compared to mainstream credit, microcredit indeed typically implies higher costs per unit. For reasons due to the socio-economic conditions of the clients served, MFIs employ distinct methodologies than traditional banks (Brihaye et al. 2019), and must face additional costs as they mobilize numerous contacts with the field, close relationships with clients, costly non-financial services, and sometimes higher default risk. Therefore, serving poor clients sustainably requires rates that may seem excessive, if compared to those charged by banks (Sandberg 2012). These, however, often appear much more favorable when compared to those of informal markets. Still, concerned about potentially excessive interests, regulators have increasingly limited MFIs’ lending rates (Ferrari et al. 2018). The main argument is that caps attenuate market failures by forcing cost reductions and efficiency and, thereby, protect clients from excessive pricing (Mitra 2009; Benmelech and Moskowitz 2010). From an economic theory standpoint, however, caps can alter not only credit price, but also quantity. More precisely, they can lead to shortages, with financial service providers reducing credit and focusing on clients requiring the legal rate (Vandenbrink 1982).

Although a cap could theoretically be set at a sustainable level, the diversity and specificities of MFIs make it particularly arduous to identify such a level practically. Therefore, caps often result in inappropriate one-size-fits-all approaches (Zetzsche and Dewi 2018). Additionally, Helms and Reille (2004) argue that banking rates are typically considered as a reference for setting binding caps. All in all, caps can thus drive MFIs to exclude clients requiring rates higher than the limit to cover associated costs and risk premium, making it impossible for numerous MFIs to viably provide microcredits to the most excluded (Acclassato 2008). The costliest clients are indeed mostly the poorest, since they contract small loans relative to their income (Schreiner 2001; Hermes and Hudon 2018). Cutting in the smallest loans due to a cap thus boils down to exacerbating financial exclusion (Hudon 2007).

Empirically, case studies have documented this adverse effect. CGAP (2004) observed in Nicaragua that micro-borrowers had less access to credit after the imposition of caps. In France, restrictions have constrained the supply of (micro)credit for long and when these were removed in early 2000s, no sign of increased interest rates was observed (Attuel-Mendès and Ashta 2008). Via a natural experiment study, Roa et al. (2021) show that restrictions implemented in Bolivia in 2014 curtailed the supply of microcredit and loans to SMEs and, thereby, inhibited financial inclusion. Studying Latin America and the Caribbean, Campion et al. (2010) find that caps damage MFIs’ outreach to women and rural clients, who generally concentrate poverty.Footnote 2 Recently, Ferrari et al. (2018) and Samreth et al. (2021) observed a substantial increase in the Cambodian loan sizes after a cap was set below market rates. Additionally, as part of the general monetary policy, interest rate caps may also affect the risk profile and funding costs of MFIs. For example, in their qualitative study carried out in the Cambodian market, Caballero-Montes et al. (2021) show that commercial banks, as the main funders of Cambodian MFIs, have raised interest rates when lending to MFIs after the cap was set. Although this was not anticipated by the regulatory authority, this shows how monetary policy decisions of a sub-sector can also indirectly imply responses from financial actors, in this case to the detriment of MFIs’ margins, at the end of the day. In developed countries, usury limits are used to a non-negligible extent, but they do not generate more enthusiasm (Goudzwaard 1968; Villegas 1989; Zinman 2010; Rigbi 2013).

Yet, to the best of our knowledge, the intrinsic effect of interest rate caps has surprisingly not been confirmed through a quantitative, cross-country analysis focused on financial inclusion schemes. In light of the above review, we thus formulate the following initial hypothesis:

H1 : MFIs subjected to interest rate caps are associated with larger loans

2.1.1 Microfinance and competition

Beside regulatory evolutions, microfinance has rapidly commercialized, bringing in formalization, the quest for financial sustainability, and increased competition. Yet, the literature highlights contrasted outcomes of competition (Assefa et al. 2013).

With the entrance of for-profit actors, competition has encouraged adaptability (Porteous 2006). Referring to traditional financial institutions, competitive pressure is seen as promoting better functioning microfinance markets (Claessens and Laeven 2005). Especially, the classical economic theory paradigm considers competition as enhancing allocative and technical efficiency (Motta 2004). Doing so, competition would help MFIs reduce costs and prices, stimulate innovation, and enhance product quality and diversity to meet clients’ needs and to adapt to evolving markets (Rhyne and Christen 1999). Studying Uganda, Bangladesh, and Bolivia, three competitive markets, Porteous (2006) explains that most operators adapted interest rates and services as new entrants arrived. Competition favored the diversification of lending methods and funding sources, the reduction of costs and interest rates, and the comparability of offers. Overall, the recent literature confirms that competition encouraged the reduction of lending rates and adaptation of microfinance services (Al-Azzam and Parmeter 2021). Therefore, competition has often been seen as an alternative to interest rate caps (Miller 2013).

From an outreach perspective, Vanroose and D’Espallier (2013) show that competition from purely commercial actors leads socially oriented MFIs to adapt and to reach niche markets, like poorer or less accessible segments. Using loan size as a proxy for depth of outreach, Cull et al. (2014) confirm that downscaling commercial banks encourage MFIs to target poorer clients and to offer smaller loans. Recently, Karimu et al. (2021) pointed that competition pushes MFIs to adopt riskier lending strategies. To some extent, additional risks may be associated with smaller loans and marginalized clients (Rosengard 2004), as these often lack financial literacy, identification pieces, and collateral options.

The above arguments follow a classical view defending that competition allows MFIs to better adapt to evolving markets (Baquero et al. 2018). Coming back to interest rate caps, this suggests that competition may help MFIs face such restrictions and attenuate their socially counter-productive outcome. Therefore, we highlight the following hypothesis:

H2a : competition attenuates the effect of interest rate caps

Still, literature also documents less beneficial outcomes of competition (Kar and Swain 2018), suggesting that interest rate caps could be more harmful in competitive contexts. A first drawback is to find in the deterioration of cross-subsidization, a mechanism helping MFIs serve the poor viably. Cross-subsidization consists in providing larger, more profitable loans to better-off clients while delivering smaller loans, associated with higher costs, to poorer beneficiaries (Armendáriz and Szafarz 2011). As a profitable business, however, microfinance increasingly attracts profit-oriented operators. As these enter the market, they jeopardize cross-subsidization possibilities by reducing the basket of available better-off clients (Morduch 1999; Navajas et al. 2003; McIntosh and Wydick 2005) and deteriorate the ability of socially oriented MFIs to serve clients requiring the smallest loans (Kar and Swain 2018). While, in such instances, very small loans would necessarily entail greater interest rates to deal with higher costs and risks, this is typically impossible when interest rates are legally constrained. Thereby, the deterioration of cross-subsidization in competitive markets may render caps even more binding.Footnote 3

Furthermore, competition favors information asymmetry and riskier lending strategies, particularly when credit information platforms are not efficient (McIntosh et al. 2005; Karimu et al. 2021). Facing competition, MFIs may loosen screening and monitoring standards, resulting in increased multiple lending and indebtedness, as shown in Bolivia (Vogelgesang 2003) and Uganda (McIntosh et al. 2005). While riskier borrowers increase default risk and require higher rates (Stiglitz and Weiss 1981; De Quidt et al. 2018), this may not be possible with caps in place. Consequently, clients may be pushed through risky refinancing policies—and sometimes with aggressive marketing practices—to contract larger loans allowing MFIs to cope with pricing restrictions, but triggering over-indebtedness (Kar and Swain 2018). In saturated areas where competition is often exacerbated (Cull et al. 2014), this is accentuated as new clients are scarce and as providing larger loans is the only option to grow (Schicks and Rosenberg 2011).

Contrarily to what hypothesis H2a suggests, these arguments imply that competition may render interest rate caps more binding and detrimental. Overall, financial sustainability may be even more pressurized due to competition than what a cap already implies, which may exacerbate its financial exclusion effect. Hence, our last hypothesis is an alternative to H2a:

H2b : competition amplifies the effect of interest rate caps

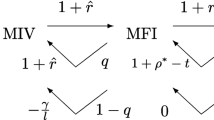

With H2a and H2b reflecting the ambivalent outcomes of competition, our rationale suggests that interest rate caps may interact with competition (Fig. 1), and that regulatory outcomes can be conditioned by market circumstances. However, to date, the study by Karimu et al. (2021) is the only one to analyze the combined effect of regulation and competition in microfinance, but with a focus on credit risk. Studying Sub-Saharan Africa, they build an interaction variable combining a measure of competition and a dummy indicating whether MFIs are “regulated” or “non-regulated”. The core logic of microfinance regulation is that deposit-taking MFIs follow prudential and non-prudential rules, whereas credit-only institutions are subjected to non-prudential rules only (Rosengard 2011). Doing so, they show that being regulated reduces credit risk when competition is low, whereas it does not in competitive markets. They argue that competition prevents regulation from helping MFIs adopt reasonable risk-taking strategies. Yet, apprehending how regulation and competition interact requires a more precise regulation variable since, when imposed, caps typically apply to all MFIs, regardless of whether they follow prudential rules. Analyzing regulatory outcomes based on a broad dichotomic view is thus too wide an approach to grasp the influence of competition on the effect of instruments like interest rate caps. Therefore, using a more specific variable is required, which is what we suggest.

3 Empirical approach

Our empirical approach investigates the framework from Fig. 1. To do so, we use a linear regression model specified as follows:

where ALSi,t is the average loan size offered by MFI i in year t; RATECAPij,t is a dummy indicating whether MFI i faces an interest rate cap in year t; COMPij,t is a variable assessing the degree of competition of MFI i in the country j; Xi,t and Zij,t are vectors of common organization- and country-level control variables; and ηi and μt represent MFI- and time-specific fixed effects, respectively.

As a measure of depth of outreach, the average loan size is the most common proxy (Cull et al. 2007, 2014; Mersland and Strøm 2010; Kar and Swain 2014; Arrassen 2017; Hermes and Hudon 2018; Reichert 2013). As often, we divide ALS by the GDP per capita, to use comparable measures across countries (Cull et al. 2007). In a second step,Footnote 4 we also mobilize the percentage of women clients served as an additional dependent variable. Indeed, as detailed later, serving women has historically been viewed as a way for MFIs to address deeper poverty, contribute to empowerment, and, generally, to target more vulnerable clients (Trivedi and Petkova 2021).

RATECAPij,t is our main independent variable. Given the variety of our information sources, the variety of caps and objects they refer to (Maimbo and Henriquez Gallegos 2014), and the wide range of interest rates and cost structures across regions (Kneiding and Rosenberg 2008), using a level variable did not seem relevant in this case. Since there is a lack of centralized data on interest rate caps around the world, we had to collect information on the presence (or absence) of a cap country by country, and we had to use multiple sources of information, as detailed in Sect. 4. Therefore, we could identify with confidence that there was or not a cap for every country included in the dataset, but we could not always identify the level or type of cap. Additionally, during the period of interest, some countries used blanket, fixed rates as caps; while others used variable or relative caps, sometimes depending on different kinds of objects (rates of reference like central bank rates, for instance), which vary from a country to another; and still others used multi-level caps for different types of financial institutions. In such a context, where data are not comprehensive and where the nature of interest rate caps can significantly differ from a country to another, we considered that it would be more relevant to stick to investigating the “intrinsic effect” of the presence (or absence) of a cap for MFIs across countries.

Rather than using a level-variable, following Baquero et al. (2018), we thus specified a dummy accounting for the presence of a legal restriction faced by MFIs. This allows to investigate the potential cross-country effect inherent to interest rate caps, (Maimbo and Henriquez Gallegos 2014). Additionally, we distinguish between “hard” and “soft” (or “de facto”) caps. Whereas the former are imposed by laws or official controls, the latter result from pressures of public operators or public opinion to draw prices down, political declarations from regulators threatening to regulate prices, or as conditional requirements to access funding (Helms and Reille 2004; Kneiding and Rosenberg 2008). Yet, due to their nature, documented data are typically not available. Therefore, our study focuses on hard caps, based on a thorough information collection carried out considering interest rate caps as legal constraints.

COMPi,t represents the degree of competition, and RATECAPij,t*COMPi,t is an interaction variable capturing the combined effect of an interest rate cap and competition. We first measure competition based on a “structural”, market-based approach (Kar and Swain 2018). This consists in observing market structures to apprehend competition and boils down to considering market concentration as proxy of market power or competition. In this perspective, the Herfindahl–Hirschman Index (HHI) is one of the most used indicators, including in the microfinance literature (Wagner and Winkler 2013; Kar and Swain 2014; Baquero et al. 2018; Dannon et al. 2019; Al-Azzam and Parmeter 2021). Compared to other concentration ratios, it considers all the firms of an industry, not only the largest ones, and allows to better account for their size by penalizing large market shares via squared weights (Purkayastha et al. 2017). The HHI is calculated as:

where MSi,t is the market share of MFI i (using loan portfolio) in year t. We compute the HHI for each country and each year to account for both cross-sectional and time variations (Kar and Swain 2014). The HHI takes values between 0 (perfect competition) and 1 (monopoly). To ease interpretation, we multiply it by − 1 so that an increase in HHI indicates an increase of competition (Assefa et al. 2013). In the robustness analysis (Sect. 5), we also use the Lerner Index to apprehend competition from a firm-based perspective.

Finally, we include common controls. First, we consider variables characterizing MFIs. We control for size (ASSETS), whether MFIs collect savings (SAVINGS, dummy), operational efficiency (OER, operating expense ratio), financial sustainability (OSS, operational self-sufficiency), and credit risk (PAR30, portfolio at risk, 30 days). We also include common country-level variables characterizing the economic environment, including the GDP growth rate (GROWTH), the inflation rate (INFLATION), the population density (POP), the percentage of labor force in the population (LABOR), and the amount of remittances received in percentage of GDP (REMITTANCES). These have been used in major cross-country studies analyzing the determinants of loan size or using it as dependent variable to proxy depth of outreach (Conning 1999; Olivares-Polanco 2005; Cull et al. 2007; Hartarska and Nadolnyak 2007; Mersland and Strøm 2010; Ahlin et al. 2011; Assefa et al. 2013). Moreover, we include the credit to GDP ratio (CREDIT) and the number of ATMs per 100,000 inhabitants (ATM), as variables describing the financial sector development, since it may condition MFIs’ outreach (Assefa et al. 2013; Vanroose and D’Espallier 2013; Cull et al. 2014). Table 5 provides details on all variables.

As for the estimation method, we use panel data, and performed a Breusch-Pagan test which revealed that panel regressions are more appropriate than pooled-OLS regressions. Running a Hausman Test (Hausman 1978), we failed to reject the absence of individual time-invariant effects, indicating that fixed-effects (FE) regressions are more appropriate. As additional check, especially for misspecification errors related to non-linear functional relationships, we used the classical Ramsey Regression Equation Specification Error Test (RESET) or Omitted Variables (OV) test for detecting potential specification errors related to non-linearities (Ramsey 1969). This test consists in regressing our dependent variable on all independent variables and predicting fitted values. Then, the squared and cubed fitted values are integrated into the regression, and finally tested for joint significance. If their coefficient is significantly different from zero, the test suggests that there can be a misspecification related to non-linearities. In our case, the p-value of the joint significance test is 0.3429, which indicates that we fail to reject the null hypothesis of correct specification of the model. In a final step, we control for endogeneity problems caused by potential reverse causality between ALS and RATECAP with a two-stage residual inclusion (2SRI) approach, as suggested by Hausman (1978) and used for instance by Terza et al. (2008) and Karimu et al. (2021).

4 Data and descriptive statistics

Our dataset was built out of multiple sources. First, detailed information on microfinance regulation is scarce (Trujillo et al. 2014), and data on interest rate caps in microfinance schemes are not centralized (Ferrari et al. 2018). We thus gathered data on interest rate caps through multiple channels for this research, especially. We started with the Global Microscope on Financial InclusionFootnote 5 and MFTransparency,Footnote 6 analyzing regulatory environments in multiple developing countries. We double-checked and complemented this with Maimbo and Henriquez Gallegos (2014), Sinha (2016), Ferrari et al. (2018), and Zetzsche and Dewi (2018), which provide international inventories of caps. We also reviewed national legal documents, websites of central banks and press releases, and had contacts with central bankers, microfinance networks, and international support organizations. Although we collected information for 101 countries, only 83 remained after consolidating with our other data sources for 2015–2018. As detailed in Table 6, 36 countries had caps during the whole period, and 40 had none. Still, caps are not static: 6 countries set a cap during the period, while 1 removed one.

Second, we used MFI-level data from the MIX Market. The MIX is still to date the largest effort to collect microfinance data and has been used in major studies (Cull et al. 2007; Hartarska and Nadolnyak 2007; Ahlin et al. 2011; Roberts 2013; D’Espallier et al. 2017).

Third, we used the World Bank’s open data for broad economic and country variables. On this basis, we built a consolidated dataset comprising 1124 MFIs over 2015–2018, for a total of 3135 observations. Due to punctual errors related, among others, to currency conversion, we winsorized observations at the top and bottom 5% for our loan size variable. We also removed observations with a HHI equal to 1, as they reflected a lack of data, rather than perfectly monopolistic markets. After all adjustments, the final dataset includes 1115 MFIs and 3091 MFI-year observations.

Prior to regressions, we ran mean-comparison tests on portfolio yield, average loan size, and operating expense ratio. Portfolio yield proxies the cost to borrowers and, since we use MFI-level data, this is the most common way for approaching the effective interest rates charged by MFIs (Roberts 2013). We applied mean-comparison tests to both the nominal and real portfolio yields and observed similar results. These tests point at statistically significant differences between countries with capped rates and those where rates are freely determined (Table 1). While MFIs in countries where rates are not capped charge around 31% (real terms), those facing a cap charge around 18%, which corroborates previous research suggesting that caps constrain interest rates (Baquero et al. 2018; Al-Azzam and Parmeter 2021). As hypothesized, MFIs with capped rates are also associated to larger loans, with a difference of USD 394, on average. This is also supported by the higher operating expense ratio faced by MFIs operating in markets where rates are not legally constrained (29.5%, against 17.2%). Moreover, Table 2 shows that the average HHI is 0.276, suggesting a relatively moderate competition in the microfinance sector, globally (Kar and Swain 2014). Overall, values from Table 2 for portfolio yield, average loan, and HHI corroborate other studies (Cull et al. 2007; Assefa et al. 2013; Roberts 2013; Kar and Swain 2014; Baquero et al. 2018; Dannon et al. 2019; Al-Azzam and Parmeter 2021).

5 Results

Table 3 displays regressions of Eq. 1 for pooled-OLS (Regressions 1 and 2) and fixed-effect estimations (Regressions 3 and 4). For both, we present models with and without interactions. We use standard errors (SEs) that are robust to heteroskedasticity and serial correlation, and clustered at the MFI-level.

In all regressions from Table 3, we observe a positive and highly significant coefficient of RATECAP. All things being equal, this indicates that MFIs operating in markets where interest rates are capped are associated with larger loans. Given MFIs’ business model, high operational costs are generally inevitable. The poorest clients typically generate additional costs due to their remoteness or as they require very small loans and complementary, costly non-financial services. This result thus suggests that by constraining interest rates, caps jeopardize financial sustainability. To maintain profit steady or to keep breaking even, MFIs may offer larger loans and target less costly clients. This is supported by the earlier-detailed t-tests, which suggested that MFIs operating in capped markets tend to charge lower prices and to face lower costs than those operating with free rates (Baquero et al. 2018; Al-Azzam and Parmeter 2021). From a risk perspective, it could also be argued that MFIs adapt clients’ risk profile to the newly, legally set interest rate by focusing on better-off, less risky clients who access larger loans and lower rates (Stiglitz and Weiss 1981; Acclassato 2008). As loan size is a proxy for depth of outreach (Schreiner 2002), this suggests that MFIs facing caps are associated with better-off clients than MFIs operating with free rates, a typical sign of a drift away from their financial inclusion mission (Armendáriz and Szafarz 2011), as hypothesized by H1.

Then, integrating HHI into the rationale, our regressions first suggest unclear findings.Footnote 7 The coefficient of HHI is negative and only slightly significant in Regression 1, using pooled OLS and excluding the interaction with RATECAP. However, the positive and significant coefficient of HHI in Regression 3 using fixed effects indicates that, all things being equal, the higher HHI, the larger ALS. Although the direct effect of competition is not our focal point, this suggests that less concentrated—more competitive—markets are associated with MFIs providing larger loans. This corroborates previous research showing that competition deteriorates outreach (Navajas et al. 2003; Vogelgesang 2003; McIntosh and Wydick 2005; McIntosh et al. 2005; Assefa et al. 2013; Kar and Swain 2018). Additionally, Regression 4 using fixed effects indicates a positive conditional effect of HHI. However, this coefficient is not significant. This may be explained by the fact that the effect of competition might be more perceptible in capped markets. This is not surprising, since caps are sometimes set with the argument of cooling down “overheating” markets (Zetzsche and Dewi 2018; Caballero-Montes et al. 2021).

Furthermore, we consider the interaction between RATECAP and HHI, via Regressions 2 and 4 in Table 3. The positive and significant coefficient of RATECAP*HHI suggests that as HHI increases, the effect of RATECAP on ALS increases too. This suggests that competition is associated to an amplification of the initial effect attributed to RATECAP, which confirms H2b. This result may be explained by two mechanisms which render interest rate restrictions even more binding in more competitive markets. A first mechanism refers to how competition affects cross-subsidization. When competition increases, the basket of better-off, more profitable clients is shared among more operators, reducing cross-subsidization possibilities for socially oriented MFIs to finance smaller, costlier loans (Navajas et al. 2003). Consequently, to keep providing smaller loans, charging greater interest rates on these loans and widening the interest rate spread across different profiles of clients would be required (McIntosh and Wydick 2005). When interest rates are legally constrained, however, this becomes harsher, or even impossible. In increasingly competitive markets, caps thus appear as even more binding as they make it impossible for MFIs to overcome the deterioration of cross-subsidization.Footnote 8

A second mechanism then refers to the risk side of the coin. Research shows that competition encourages riskier lending strategies (Karimu et al. 2021), including relaxing lending requirements (Vogelgesang 2003; McIntosh et al. 2005), and targeting more marginalized clients (Vanroose and D’Espallier 2013; Cull et al. 2014). Doing so, however, requires charging higher interest rates, to cope with additional risk or increased defaults (Stiglitz and Weiss 1981; De Quidt et al. 2018). Following this second rationale, competition may render interest rate caps even more binding once again, since it is harsher or even impossible to increase rates when these are capped. MFIs facing competition may thus provide poor clients with adapted terms and conditions, including larger loans with lower interest rates aligning on the maximum rates allowed (Kneiding and Rosenberg 2008), which raises concerns as for transparency and over-indebtedness risk. This is illustrated by the evolution of some saturated markets, such as Cambodia, where competition is exacerbated and where loan sizes increased after a cap was set recently (Ferrari et al. 2018; Caballero-Montes et al. 2021).

5.1 Probing the moderation effect

Once identified, we must then analyze for which levels of competition this interaction manifests. We thus “probe” the marginal effect of RATECAP and its significance for different values of the moderating variable (Hayes, 2018), namely HHI. As Fig. 2 shows, the 95% confidence interval comprises 0 for values from – 1 to – 0.57. This indicates that the moderation effect is not significant between – 1 and – 0.57 HHI. Hence, in markets characterized by such concentration levels, the moderation effect of HHI tends to be statistically insignificant. However, Al-Azzam and Parmeter (2021) suggest that HHI values above 0.25 already indicate market concentration. From a theoretical perspective, one could hypothesize that such concentrated, monopolistic markets may be less affected by interest rate caps, as they leave more room for making profits or improving efficiency (Motta 2004). Yet, the cumulative frequency of the HHI distribution shows that observations with values between – 1 and – 0.57 only represent 12.7% of our sample. In other words, 87.3% of observations present values closer to 0, for which the moderation effect is significant. Besides, as MIX Market is based on self-reported data, the observations included in this interval may also suffer from a lack of data collection, pushing upwards the HHI, rather than reflecting monopolistic situations. Contrarily to these markets, the moderation effect for competition levels included between – 0.57 and 0 in Fig. 2 are in the 95% confidence interval. All in all, with caution as for mono/oligopolistic markets where interest rate caps could be less constraining, the identified moderation effect thus seems to be relevant for most market structures observed in our data.

5.2 Collecting savings as a resistance factor Footnote 9

Deepening our understanding of the moderation effect of competition, we divided our data into two sub-samples: credit-only and deposit-taking MFIs. We regressed our main model using these two sub-samples, and we saw that providing savings could be considered as a factor helping MFIs face competitive pressure, but not interest rate caps.Footnote 10

On the one hand, both sub-samples still face the effect of caps (highly significant coefficient in columns 1–4, Table 10). This means that caps affect both deposit-taking and credit-only MFIs relatively similarly. This makes sense since, although deposit-taking MFIs may face different costs and performances, their margins and profit are still affected when facing constraints on lending rates. We could assume that, since caps are often set too low for typical MFIs to generate sustainable profits (Helms and Reille 2004), the spread between savings and lending rates may still be affected by caps, inducing that MFIs adjust their strategy by providing larger loans.

On the other hand, deposit-taking MFIs seem to be less subject to competitive pressure. In a way, this confirms our main results and one of the mechanisms through which MFIs typically react to higher competition when interest rate are capped. Indeed, the non-significant coefficient of the interaction term in columns 3 and 4 (Table 10), suggests that competition does not exacerbate the effect of interest rate caps for deposit-taking MFIs. These MFIs could be less subject to additional risk taking when competitive pressure increases, since they are typically obliged to follow prudential regulations (Rosengard 2011). Moreover, credit-only MFIs can face increased funding costs when caps are set, since commercial funders may raise their interest rates when lending to MFIs, just like in Cambodia (Caballero-Montes et al. 2021). Therefore, credit-only MFIs may face more difficulties to find cheap funds in a competitive environment, and may be tempted to increase lending rates, whereas—all things being equal—deposit-taking MFIs may not face such a pressure thanks to the availability of cheap funds collected through savings. This is supported by Parmeter and Hartarska (2022), who mention that competition can lead to offer higher returns on external funds which, at the end of the day, may be replicated on lending interest rates. In such a context, caps are, again, more constraining in a competitive environment, for credit-only MFIs. Here, collecting savings may thus appear as a factor of resistance to competitive pressure, in a context where interest rates are capped.

Finally, we observe significant controls corroborating previous research. First, larger MFIs are associated with larger loans, which corroborates Assefa et al. (2013). This may indicate potential signs of a drift towards better-off clients although, all things being equal, such institutions may also mobilize cross-subsidization. Then, labor force participation and remittances seem to positively affect loan sizes. As shown by Ahlin et al. (2011), this may reflect rivalries between domestic economic activity and microfinance, or the fact that households with additional earnings opportunities access larger loans.Footnote 11 Especially, when labor force participation increases, this may allow households to access larger loans. Results are ambiguous as for the effect of financial sector depth, especially regarding the number of ATMs per 100,000 inhabitants and the credit to GDP ratio, although the latter is only significant at 90% in our Regression 4.

5.3 Robustness analysis

We applied several robustness checks. First, we used an alternative, firm-based approach to competition, consisting in observing how firms behave as an indication of the competition they face (Kar and Swain 2018). Although market concentration is essential, it may not be the only factor influencing competition. Especially, it may not perfectly account for geographical dispersion (Van Leuvensteijn et al. 2007), meaning that HHI may imperfectly capture the effect of local mono/oligopolies, for instance. In this perspective, we use the Lerner Index, which has often been used in the financial and microfinance literatures (Koetter et al. 2012; Assefa et al. 2013; Dannon et al. 2019; Al-Azzam and Parmeter 2021; Karimu et al. 2021). It is computed as:

where Pi,t is the output price, namely the ratio of revenues from loans to gross portfolio, and MCi,t is the marginal cost. To compute MC, we define a translog cost function (Al-Azzam and Parmeter 2021):

where Ci,t is the total cost (total expenditures to gross portfolio), and Qi,t is the output (gross portfolio). We consider the cost of three inputs (Wk): cost of labor (W1, personnel expenses to gross portfolio), cost of physical capital (W2, administrative expenses to net fixed assets), and cost of financial capital (W3, financial expenses to liabilities). We also include the PAR30, total assets, and a dummy for the collection of savings to account for differences in risk strategies, size, and service offers, respectively (Assefa et al. 2013; Al-Azzam and Parmeter 2021). A time trend is also included to account for changes in performance induced by technological change (Karimu et al. 2021). Finally, we add vectors of dummies to capture potential country and time effects influencing cost structures (Al-Azzam and Parmeter 2021). The first derivative of lnCi,t with regard to lnQi,t is then defined as:

Equation 5 represents the elasticity of Ci,t with regard to Qi,t. The first term of the product (derivative of Ci,t with regard to Qi,t) is the marginal cost. Isolating MC and deriving Eq. 5, MCi,t is obtained by using the parameters estimated when regressing Eq. 4 (Table 7):

Once generated, MCi,t is reinjected in Eq. 3 to compute the Lerner Index for each MFI-year observation. Table 9 shows summary statistics of the variables used for the estimation of the cost function and the calculation of the index. The index ranges between 0 and 1.Footnote 12 The intuition is that firms in highly competitive markets (index close to 0) are price takers, inducing that P is close to MC. Conversely, firms in mono/oligopolies set prices above the marginal cost, inducing values closer to 1 (Elzinga and Mills 2011). The mean value for LERNER is 0.67 (Table 9), which corroborates Assefa et al. (2013), among others. Moreover, Table 4 shows that the results are close to those obtained with HHI for both the direct effect of RATECAP and the interaction variable.Footnote 13

As complementary robustness checks, we ran additional fixed-effect regressions with other dependent variables (Table 8), including with ALS adjusted with the gross national income (GNI) per capita, as well as without any adjustment. We observed very similar results as those obtained with the GDP per capita adjustment.

We also used the percentage of women clients reached as indicator of depth of outreach (Reichert, 2018; Hermes and Hudon 2018). Targeting women has always been at the heart of microfinance. Women have typically been considered as concentrating deeper poverty and represent an opportunity for MFIs to contribute to empowerment through the access to financial and non-financial services (Trivedi and Petkova 2021). Targeting more women thus usually refers to a better achievement of the social mission of MFIs, while a reduction is generally considered as a deterioration (Hermes and Hudon 2018).

On average, Table 2 shows that around 63% of clients are women. Therefore, using the percentage of women may refine our findings regarding interest rate caps. As shown in Table 8, we find a negative and significant coefficient. This suggests similar results than when using the average loan size. In particular, facing a limit on interest rates tends to negatively affect the proportion of women clients served by MFIs and it confirms, with an additional dependent variable, that such a regulatory measure deteriorates their ability to reach clients among the most vulnerable. Additionally, we note that the interaction effect of competition is not significant. This does not alter our ealier-detailed findings. Indeed, research shows that women clients are discriminated based on loan sizes, rather than based on the possibility to contract loans (Agier and Szafarz 2013). Therefore, although increased competition may encourage MFIs to discriminate based on the size of the loans offered, to focus on larger, more profitable loans, it would not necessarily lead to a reduction of the percentage of women clients. This way, competition would amplify the effect of interest rate caps without materializing in the percentage of women clients, but in the average loan size offered, as we argued.

Finally, we control for potential endogeneity associated to reverse causality between ALS and RATECAP. We use a two-stage residual inclusion approach (Hausman 1978). As mentioned by Karimu et al. (2021:483), it allows to “deal with issues of endogeneity when there are no suitable available instruments”. This consists in estimating a second-reduced-form equation for RATECAP, which residuals are generated from and added to the original equation as an additional covariate, and which “are substituted for the unobserved confounders” (Terza et al. 2008:534). This leads to estimate Eq. 7:

where RATECAP is the dependent variable, and where ALS controls for potential reverse causality in our original model. As suggested by Karimu et al. (2021), we included competition and explanatory variables from Eq. 4 (Xi,t), as competition and firm characteristics can influence the definition of regulation. Additionally, we included variables characterizing regulatory contexts (GOVij,t), as political motivations are likely to influence regulation, and so the implementation of interest rate caps (Miller 2013; Gul et al. 2017). We used the aggregate World Governance Indicators (WGI) of control of corruption, government effectiveness, and rule of law, extracted from the World Bank. We then generated residuals from Eq. 7 and included them in Eq. 1, using both HHI (Table 3) and LERNER (Table 4). Our results, suggest that the relationships identified earlier between RATECAP, ALS, HHI, and LERNER, hold with this approach. We note that the size of the coefficients is logically sensitive to the inclusion of these residuals, given their negative coefficient, inducing a slightly less significant interaction coefficient.

6 Conclusion

Interest rate restrictions have sparked debates in microfinance. Yet, studies have been mostly conceptual, centered on case studies, or made of taxonomies. Besides, while regulatory outcomes are likely to depend on market conditions, the combined effect of regulation and competition has surprisingly almost not been studied. However, as microfinance develops – up to saturation in some areas – questioning which regulation and market dynamics are desirable to support the industry becomes essential.

Thanks to unique, multi-source data, we investigated the relationship between interest rate caps on loan size which, to the best of our knowledge, had not been studied from a quantitative and cross-country perspective. We show that MFIs facing caps are associated with larger loans, suggesting that they tend to serve better-off, less marginalized clients. This finding argues against the use of caps in microfinance, due to their adverse effect resulting from the one-size-fits-all approach they typically rest upon. Going further, we argue that competition amplifies this phenomenon, since interest restrictions may be even more binding in competitive markets. They may indeed prevent MFIs from increasing rates to overcome the deterioration of cross-subsidization, or to cope with additional credit risk, both favored by competition. Additionally, we show that collecting savings may be, in such an environment, a resistance factor to the exacerbation effect of competition.

Regulatory measures are intrinsically constraining and always imply (political and economic) trade-offs. Yet, in some instances, i.e. in competitive industries, inappropriate measures may be more harmful than beneficial, and might encourage undesirable social outcomes, like financial exclusion or over-indebtedness. In this respect, our paper shows the importance of adopting a systemic approach when studying the outcomes of regulatory choices, especially when these address financially distressed individuals. Doing so, we hope that this research brings insights helping policy-makers make better informed decisions.

Further research may still refine our analyses. First, although the MIX is still to date the largest effort to collect cross-country microfinance data, it relied on self-reported information. This may induce missing data or punctual errors. Consequently, further research may benefit from other data to confirm or extend our analyses. Second, using the loan size to proxy depth of outreach is the most common approach (Hermes and Hudon 2018) but poverty is a multi-faceted concept. Although discussing the role of competition allowed to investigate that increased loan sizes may also refer to risky refinancing strategies and not only financial exclusion, further research may mobilize additional indicators. We mobilized the percentage of women clients, another typical indicator of depth of outreach in the microfinance literature. We found a negative effect of imposing of interest rate caps on the percentage of women clients, but no interaction with the level of competition. This may be due to the fact that financial exclusion and discrimination of women can materialize via the size of the loan they receive, rather than the provision of a loan itself (Agier and Szafarz 2013). Third, competition in microfinance comes not only from MFIs but also from informal lenders, commercial banks, and, recently, digital or mobile operators. This possibly induces contrasted outcomes for MFIs. Although some authors approached this issue (Vanroose and D’Espallier 2013; Cull et al. 2014), it is still understudied. Further research may thus address how the natures and sources of competition affect traditional MFIs, with a view to better integrating all sorts of operators into regulators’ reflections, and optimizing regulatory decisions.

Data availability

“The data that support the findings of this study are available from the corresponding author upon request.”

Notes

Building on this idea, we use the percentage of women clients as additional dependent variable in our robustness analysis.

Although cross-subsidization is a theoretically intuitive concept, it is hard to identify. Armendáriz and Szafarz (2011) suggest theoretical models, but empirical results remain scarce. This is mainly due to the diversity of cross-subsidization options (through the size of loans, the types of services, the profile of clients and the type of industries financed,…) and the difficulty to isolate cross-subsidization from other causes (mission drift, progressive lending,…).

See robustness checks.

Ambiguous results can suggest multicollinearity. However, the Variance Inflation Factors (VIFs) are all very close to 1, suggesting no multicollinearity (Kleinbaum et al. 1988).

Although this is intuitive as a mechanism to explain how market conditions is related to the outcome of interest rate caps, isolating the effect of cross-subsidization is relatively complicated, given the multiplicity of causes of cross-subsidization and phenomena that look like it, as explained earlier.

We particularly thank the reviewers for making possible this insightful adaptation of the paper.

Although credit-only and deposit-taking MFIs are typically different types of MFIs, we assume that our MFI-level control variables (assets, OSS, etc.) can control for these differences, and make it possible to discuss conclusions on the roles of interest rate caps and competition.

Still, this may be nuanced since REMITTANCES is significant in Regression 1 only.

We observed 17 negative observations, which we treated as outliers as a negative value can be observed only if the marginal cost is greater than the marginal return, which would indicate a heavily subsidized MFI (Assefa et al. 2013). We ran regression while computing LERNER with and without these observations, and this did not affect the results. We removed these observations from the dataset to remain with values between 0 and 1.

The correlation between RATECAP and LERNER is relatively weak (8.90%) and all Variance Inflation Factors (VIFs) are very close to 1, suggesting no multicollinearity issue (Kleinbaum et al. 1988).

References

Acclassato, D.H.: Les plafonnements de taux d’intérêt en microfinance servent-ils réellement les pauvres et petits opérateurs économiques ? Mondes En Développement 1(141), 93–109 (2008). https://doi.org/10.3917/rtm.225.0077

Agier, I., Szafarz, A.: Microfinance and gender: Is there a glass ceiling on loan size? World Dev 42, 165–181 (2013)

Ahlin, C., Lin, J., Maio, M.: Where does microfinance flourish? Microfinance institution performance in macroeconomic context. J Dev Econ 95(2), 105–120 (2011). https://doi.org/10.1016/j.jdeveco.2010.04.004

Al-Azzam, M., Parmeter, C.: Competition and microcredit interest rates: international evidence. Empir Econ 60, 829–868 (2021). https://doi.org/10.1007/s00181-019-01766-6

Arrassen, W.: The determinants of MFIs’ social and financial performances in sub-Saharan Africa: has mission drift occurred? Ann Finance 13(2), 205–235 (2017). https://doi.org/10.1007/s10436-017-0296-x

Armendáriz, B., Szafarz, A.: On mission drift in microfinance institutions. In: Armendáriz, B., Labie, M. (eds.) The handbook of microfinance, pp. 341–366. World Scientific (2011)

Arun, T.: Regulating for development: the case of microfinance. Q Rev Econ Finance 45, 346–357 (2002). https://doi.org/10.1016/j.qref.2004.12.008

Assefa, E., Hermes, N., Meesters, A.: Competition and the performance of microfinance institutions. Appl Financial Econ 23(9), 767–782 (2013). https://doi.org/10.1080/09603107.2012.754541

Attuel-Mendès, L., Ashta, A.: French legislation and the development of credit availability for microenterprise. Glob J Business Res 2(2), 123–137 (2008)

Baquero, G., Hamadi, M., Heinen, A.: Competition, loan rates, and information dispersion in nonprofit and for-profit microcredit markets. J Money, Credit, Bank 50(5), 893–937 (2018). https://doi.org/10.1111/jmcb.12472

Bauchet, J., Morduch, J.: Is micro too small? microcredit vs. SME finance. World Develop. 43, 288–297 (2013). https://doi.org/10.1016/j.worlddev.2012.10.008

Beck, T.: Finance, institutions and development. In: Baland, J.-M., Bourguignon, F., Platteau, J.-P., Verdier, T. (eds.) The handbook of institutions and economic development, pp. 218–251. Princeton University Press, Princeton, Oxford (2020)

Benmelech, E., Moskowitz, T.J.: The political economy of financial regulation: evidence from US state usury laws in the 19th century. J Financ 65(3), 1029–1073 (2010). https://doi.org/10.1111/j.1540-6261.2010.01560.x

Brihaye, T., Pril, J.D., Labie, M., Périlleux, A.: Positive versus negative incentives for loan repayment in microfinance: a game theory approach. Rev Dev Econ 23(2), 577–597 (2019). https://doi.org/10.1111/rode.12563

Caballero-Montes, T., Godfroid, C., Labie, M.: Are interest rate caps a relevant tool to cooldown overheating microfinance markets? Strategy Change 30(4), 319–330 (2021). https://doi.org/10.1002/jsc.2426

Campion, A., Ekka, R. K., and Wenner, M.: Interest rates and implications for microfinance in Latin America and the Caribbean. IDB Working Paper Series, n°IDB-WP-177 (2010)

CGAP: The impact of interest rate ceilings on microfinance. CGAP Donor Brief, N°18 (2004)

Christen, R.P., Lauer, K., Lyman, T.R., and Rosenberg, R.: A guide to regulation and supervision of microfinance. (2012)

Claessens, S., Laeven, L.: Financial dependence, banking sector competition, and economic growth. J Eur Econ Assoc 3(1), 179–207 (2005). https://doi.org/10.1162/1542476053295322

Conning, J.: Outreach, sustainability and leverage in monitored and peer-monitored lending. J Dev Econ 60, 51–77 (1999). https://doi.org/10.1016/S0304-3878(99)00036-X

Cull, R., Demirgüç-Kunt, A., Morduch, J.: Financial performance and outreach: a global analysis of leading microbanks. Econ J 117(517), F107–F133 (2007). https://doi.org/10.1111/j.1468-0297.2007.02017.x

Cull, R., Demirgüç-Kunt, A., Morduch, J.: Banks and microbanks. J Finan Serv Res 46, 1–53 (2014). https://doi.org/10.1007/s10693-013-0177-z

D’Espallier, B., Goedecke, J., Hudon, M., Mersland, R.: From NGOs to banks: Does institutional transformation alter the business model of microfinance institutions? World Dev 89, 19–33 (2017). https://doi.org/10.1016/j.worlddev.2016.06.021

Dannon, H., Bangaké, C., Egguh, J.: Structure de marché et performance économique des institutions de microfinance dans l’UEMOA : cas du Bénin et du Togo. Mondes En Développement 1(185), 29–44 (2019). https://doi.org/10.3917/med.185.0029

De Quidt, J., Fetzer, T., Ghatak, M.: Market structure and borrower welfare in microfinance. Econ J 128(610), 1016–1046 (2018). https://doi.org/10.1111/ecoj.12591

Elzinga, K., Mills, D.E.: The Lerner index of monopoly power: origins and uses. Am Econ Rev: Papers Proc 101(3), 558–564 (2011). https://doi.org/10.1257/aer.101.3.558

Ferrari, A., Masetti, O., and Ren, J.: Interest rate caps: the theory and practice. Policy Research Working Paper, N°8398 (2018)

Goudzwaard, M.B.: Price ceilings and credit rationing. J Financ 23(1), 177–185 (1968). https://doi.org/10.2307/2325317

Guérin, I., Labie, M., Morvant-Roux, S.: Inadequate growth, over-indebtedness, and crises in microcredit: what have we learned? Enterpr Develop Microfinanc 29(2), 118–132 (2018). https://doi.org/10.3362/1755-1986.17-00013

Gul, F.A., Podder, J., Shahriar, A.Z.M.: Performance of microfinance institutions: does government ideology matter?. World Dev 100, 1–15 (2017). https://doi.org/10.1016/j.worlddev.2017.07.021

Hartarska, V., Nadolnyak, D.: Do regulated microfinance institutions achieve better sustainability and outreach? cross-country evidence. Appl Econ 39(10), 1207–1222 (2007). https://doi.org/10.1080/00036840500461840

Hausman, J.A.: Specification tests in econometrics. Econometrica 46(6), 1251–1271 (1978). https://doi.org/10.2307/1913827

Hayes, A.F.: Introduction to mediation, moderation, and conditional process analysis: a regression-based approach. The Guilford Publications (2014)

Helms, B., and Reille, X.: Interest rate ceilings and microfinance: The story so far. CGAP Occasional Papers, N°9 (2004)

Hermes, N., Hudon, M.: Determinants of the performance of microfinance institutions: a systematic review. J Econ Surv 32(5), 1483–1513 (2018). https://doi.org/10.1111/joes.12290

Hudon, M.: Fair interest rates when lending to the poor. Ethics and Econ 5(1), 1–8 (2007)

Hudon, M., Sandberg, J.: The ethical crisis in microfinance: Issues, findings, and implications. Bus Ethics Q 23(4), 561–589 (2013). https://doi.org/10.5840/beq201323440

Kar, A.K., Swain, R.B.: Competition in microfinance: does it affect performance, portfolio quality, and capitalization? In: Mersland, R., Strøm, R.O. (eds.) Microfinance institutions financial and social performance. Palgrave (2014)

Kar, A.K., Swain, R.: Competition, performance and portfolio quality in microfinance markets. Eur J Develop Res 30, 842–870 (2018). https://doi.org/10.1057/s41287-018-0135-6

Karimu, A., Salia, S., Hussain, J.G., Tingbani, I.: Are competitive microfinance services worth regulating? Evidence from microfinance institutions in Sub-Saharan Africa. Int J Financ Econ 26(1), 476–492 (2021). https://doi.org/10.1002/ijfe.1800

Kirkpatrick, C., Maimbo, S.M.: The implication of the evolving microfinance agenda for regulatory and supervisory policy. Develop Policy Rev 20(3), 293–304 (2002). https://doi.org/10.1111/1467-7679.00172

Kleinbaum, D.G., Kupper, L.L., Muller, K.E.: Applied regression analysis and other multivariable methods. PWS Kent Publishing (1988)

Kneiding, C., and Rosenberg, R.: Variations in microcredit interest rates. CGAP Brief (2008)

Koetter, M., Kolari, J.W., Spierdijk, L.: Enjoying the quiet life under deregulation: evidence from adjusted Lerner indices for US banks. Rev Econ Stat 94(2), 462–480 (2012). https://doi.org/10.2139/ssrn.1996806

Maimbo, S. M., and Henriquez Gallegos, C. A.: Interest rate caps around the world: Still popular, but a blunt instrument. Policy research working paper, No. 7070 (2014)

McIntosh, C., Wydick, B.: Competition and microfinance. J Dev Econ 78(2), 271–298 (2005). https://doi.org/10.1016/j.jdeveco.2004.11.008

McIntosh, C., de Janvry, A., Sadoulet, E.: How rising competition among microfinance institutions affects incumbent lenders. Econ J 115, 987–1004 (2005). https://doi.org/10.1111/j.1468-0297.2005.01028.x

Ménard, C.: Maladaptation of regulation to hybrid organizational forms. Int Rev Law Econ 18(4), 403–417 (1998). https://doi.org/10.1016/S0144-8188(98)00021-0

Mersland, R., Strøm, R.O.: Microfinance mission drift? World Dev 38(1), 28–36 (2010). https://doi.org/10.1016/j.worlddev.2009.05.006

Mersland, R., Urgeghe, L.: International debt financing and performance of microfinance institutions. Strategy Change 22(1–2), 17–29 (2013). https://doi.org/10.1002/jsc.1919

Miller, H.: Interest rate caps and their impact on financial Inclusion. Economic and private sector professional evidence and applied knowledge services (2013)

Mitra, S.K.: Exploitative microfinance interest rates. Asian Soc Sci 5(5), 87–93 (2009)

Morduch, J.: The role of subsidies in microfinance: evidence from the Grameen Bank. J Dev Econ 60(1), 229–248 (1999). https://doi.org/10.1016/S0304-3878(99)00042-5

Motta, M.: Competition policy: theory and practice. Cambridge University Press (2004)

Navajas, S., Conning, J., Gonzalez-Vega, C.: Lending technologies, competition and consolidation in the market for microfinance in Bolivia. J Int Dev 15(6), 747–770 (2003). https://doi.org/10.1002/jid.1024

Olivares-Polanco, F.: Commercializing microfinance and deepening outreach: Empirical evidence from Latin America. J Microfinanc 7(2), 47–69 (2005)

Parmeter, C.F., Hartarska, V.: Performance of microfinance institutions: a Review. In: Ray, S.C., Chambers, R.G., Kumbhakar, S.C. (eds.) The handbook of production economics. Springer (2022)

Porteous, D.: Competition and microcredit interest rates. CGAP Focus Note, N°33 (2006)

Purkayastha, D., Tripathy, T., Das, B.: Market structure and state of competition in microfinance: an empirical examination in India. Int J Appl Bus Econ Res 15(22), 35–46 (2017)

Ramsey, J.B.: Tests for specification errors in classical linear least-squares regression analysis. J R Stat Soc: Ser B (Methodol) 31(2), 350–371 (1969)

Reichert, P.: A meta-analysis examining the nature of trade-offs in microfinance. Oxford Dev Stud 46(3), 430–452 (2013). https://doi.org/10.1080/13600818.2018.1427223

Rhyne, E., Christen, R.P.: Microfinance enters the marketplace. Microenterprise Publications (1999)

Rigbi, O.: The effects of usury laws: evidence from the online loan market. Rev Econ Stat 95(4), 1238–1248 (2013). https://doi.org/10.1162/REST_a_00310

Roa, M.J., Villegas, A., Garrón, I.: Interest rate caps on microfinance: evidence from a natural experiment in Bolivia. J Develop Effective (2021). https://doi.org/10.1080/19439342.2021.1968934

Roberts, P.: The profit orientation of microfinance institutions and effective interest rates. World Dev 41, 120–131 (2013). https://doi.org/10.1016/j.worlddev.2012.05.022

Rosengard, J.: Banking on social entrepreneurship: the commercialization of microfinance. Mondes En Développement 2(126), 25–36 (2004). https://doi.org/10.3917/med.126.0025

Rosengard, J.: Oversight is a many-splendored thing: choice and proportionality in regulating and supervising microfinance institutions. In: Armendáriz, W., Labie, M. (eds.) The handbook of microfinance. World Scientific (2011)

Samreth, S., Aiba, D., Oeur, S., and Vat, V.: Impacts of the Interest Rate Ceiling on Microfinance Sector in Cambodia: Evidence from a Household Survey. JICA Working Paper, No. 219 (2021)

Sandberg, J.: Mega-interest on microcredit: are lenders exploiting the poor? J. Appl. Philos. 29(3), 169–185 (2012). https://doi.org/10.1111/j.1468-5930.2012.00560.x

Schicks, J., and Rosenberg, R.: Too much microcredit? A survey of the evidence on over-indebtedness. CGAP Occasional Papers, No. 19 (2011)

Schreiner, M.: Seven aspects of loan size. J Microfinanc 3, 27–47 (2001)

Schreiner, M.: Aspects of outreach: a framework for discussion of the social benefits of microfinance. J Int Dev 14(5), 591–603 (2012). https://doi.org/10.1002/jid.908

Sinha, S.: Impact of restrictions on interest rates in microfinance. ADB Sustainable Development Working Papers Series, N°45 (2016)

Stiglitz, J., Weiss, A.: Credit rationing in markets with imperfect information. Am Econ Rev 71(3), 393–410 (1981)

Terza, J., Basu, A., Rathouz, P.: Two-stage residual inclusion estimation: addressing endogeneity in health econometric modeling. J Health Econ 27(3), 531–543 (2008). https://doi.org/10.1016/j.jhealeco.2007.09.009

Trivedi, S.K., Petkova, A.P.: Women entrepreneur journeys from poverty to Emancipation. J Manag Inq (2021). https://doi.org/10.1177/10564926211017667

Trujillo, V., Rodriguez-Lopez, F., Muriel-Patino, V.: Microfinance regulation and market development in Latin America. BE. J Econ Anal Policy 14(4), 1615–1644 (2014). https://doi.org/10.1515/bejeap-2013-0145

Van Leuvensteijn, M., Bikker, J.A., Van Rixel, A., and Sørensen, C.K.: A new approach to measuring competition in the loan markets of the euro area. European Central Bank Working Paper Series, No. 768. (2007)

Vandenbrink, D.: The effect of usury ceilings. Economic Perspectives – Federal Reserve Bank of Chicago (Mid-year), 44–55 (1982)

Vanroose, A., D’Espallier, B.: Do microfinance institutions accomplish their mission? Evidence from the relationship between traditional financial sector development and microfinance institutions’ outreach and performance. Appl Econ 45(15), 1965–1982 (2013). https://doi.org/10.1080/00036846.2011.641932

Villegas, D.J.: The impact of usury ceilings on consumer credit. South Econ J 56(1), 126–141 (1989). https://doi.org/10.2307/1059061

Vogelgesang, U.: Microfinance in times of crisis: the effects of competition, rising indebtedness, and economic crisis on repayment behavior. World Dev 31(12), 2085–2114 (2003). https://doi.org/10.1016/j.worlddev.2003.09.004

Wagner, C., Winkler, A.: The vulnerability of microfinance to financial turmoil – evidence from the global financial crisis. World Dev 51, 71–90 (2013). https://doi.org/10.1016/j.worlddev.2013.05.008

Zetzsche, D., and Dewi, T.R.: The paradoxical case against interest rate caps – and: how fintech and regtech resolve the dilemma. Law Working Paper Series, N°2018–003 (2018) doi: https://doi.org/10.2139/ssrn.3159202

Zinman, J.: Restricting consumer credit access: household survey evidence on effects around the Oregon rate cap. J Bank Financ 34(3), 546–556 (2010). https://doi.org/10.1016/j.jbankfin.2009.08.024

Funding

Funding was provided by Fonds De La Recherche Scientifique - FNRS (Grant No. FRESH PhD Grant).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 5, 6, 7, 8, 9, and 10.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Caballero-Montes, T. Integrating market conditions into regulatory decisions on microfinance interest rates: does competition matter?. Ann Finance 19, 201–232 (2023). https://doi.org/10.1007/s10436-022-00417-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-022-00417-8