Abstract

We have identified eight sub-dimensions of patient access to pharmaceuticals: marketing approvals, time of marketing approval, coverage, cost sharing, conditions of reimbursement, speed from marketing approval to reimbursement, extent to which beneficiaries control choice of their drug benefit, and evenness of the availability of drugs to the population. For a sample of commonly used best-selling drugs in the United States (US), we measured these eight access sub-dimensions across four health systems: France, the Netherlands, the United Kingdom (UK), and the US. Although the US approved between 15 and 18% more drugs than the other three countries, the US was slower than France and the UK to approve drugs licensed in all four countries. The percentage of drugs covered is approximately the same for all four countries. For covered drugs, we observe the least cost sharing by patients in the Netherlands. The Netherlands imposes conditions of reimbursement on a much larger percentage of drugs. France seems to be the slowest in respect of speed from marketing approval to reimbursement. The US is the most flexible in terms of the extent to which beneficiaries control their choice of drug benefit but it is the least universal in terms of evenness of the availability of drugs to the population. Our study confirms the frequently cited problems of access in European countries: lag between marketing approval and reimbursement, and inflexibility in respect of the extent to which beneficiaries control their choice of drug benefit. At the same time, our study confirms, qualitatively, different kinds of access problems in the US: relatively high patient cost sharing for pharmaceuticals, and wide variation in coverage.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the United States (US) and Europe the objective of policymakers is to improve patient access to safe and effective medicines while maintaining affordable growth in drug spending. This balancing act requires that difficult choices be made with regard to reimbursement of drugs competing for scarce resources. These choices may be easiest for lifesaving drugs: cover all lifesaving drugs as long as safety, efficacy, and quality of manufacturing practices have been demonstrated. Even with these, however, payers must establish appropriate conditions of use and must make choices with regard to patient cost sharing. Restrictive conditions and high cost sharing may limit access. A delay in access may also occur during the time it takes a payer to make its reimbursement decision after marketing approval.

In the 1980s and 1990s, discussions about access to newly approved drugs focused on the time lag between application for approval and granting of marketing authorization [1]. This delay was identified as the first barrier to patient access to new medications. The first barrier refers to the traditional three hurdles: safety, efficacy, and quality of manufacturing practices. An additional barrier has since been identified that relates to pricing and reimbursement based on cost-effectiveness assessment, burden of disease, and budget impact analysis: the so-called fourth hurdle [2, 3].

Our research examines both barriers, with an emphasis on drug reimbursement policy and its implications for patient access to pharmaceuticals. Here, we will compare a “system” of reimbursement that is relatively unregulated (US) to three that are highly regulated (France, the Netherlands, the United Kingdom). Specifically, our study will compare drug reimbursement policy and its implications for patient access to drugs on the list of 100 top-selling drugs in the US in 2004 [4].

For our US analysis we chose a sample of three-tier formularies used by nine of the ten largest private third-party payers in terms of enrollment. Three-tier formularies are the most prevalent formulary design in the US, comprising approximately 65% of all payer formularies [5]. For our European analysis we chose national formularies in France and the Netherlands, and the drug-reimbursement system in the United Kingdom (UK).

We use a novel conceptual and operational measure of access that incorporates eight sub-dimensions:

-

1.

numbers of drugs approved by the respective drug-regulatory agencies;

-

2.

time of marketing authorization for approved drugs;

-

3.

percentage of approved drugs covered by US, French, Dutch, and UK third-party payers;

-

4.

extent to which insurers defray costs of covered drugs;

-

5.

percentage of covered drugs with conditions of reimbursement;

-

6.

time period between marketing approval and reimbursement;

-

7.

extent to which beneficiaries control choice of their drug benefit;

-

8.

evenness of the availability of drugs to the population.

The section after the introduction provides Background information on the formulary management systems in each of the four countries included in the analysis. The next section describes Methods used to measure access sub-dimensions. The section following this reports Results. The concluding section is a Discussion.

Background

We acknowledge certain perils of comparative analysis, particularly when comparing drug-reimbursement systems that are so qualitatively different. This should not, however, deter us from pursuing such analysis, if we contextualize the comparison and the results.

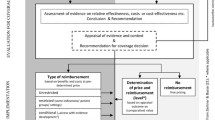

In all four countries analyzed there is a sequential two-stage process before drug reimbursement [6]. The first stage relates to the first three hurdles of safety, efficacy, and quality. These hurdles are reviewed by drug-regulatory agencies in the respective countries. The second stage relates to the fourth hurdle of pricing and reimbursement. In all four countries, third party payers use a variety of tools to rationalize prescribing patterns or help providers choose appropriate, safe, and cost-effective drug therapies. Widely used tools include drug formulary management and clinical practice guidelines [7, 8].

The trend toward increased use of such tools is mainly due to high growth rates in prescription drug spending. Such high growth rates are ubiquitous, although there is wide variation in the four countries. France has the highest per capita drug spending in Europe [9] and pharmaceuticals account for approximately 20% of total health-care spending in France. In the Netherlands, UK, and US, the percentage spent on drugs is about half that in France [7]. Table 1 illustrates inter-country variation in prescription drug spending, the private/public spending ratio, and out-of-pocket spending. There are large differences in the percentage of public sector spending, with the UK having the highest proportion of public sector spending [10], and the US the lowest. Likewise, there is wide variation in out-of-pocket spending.

Dutch national formulary

In the Netherlands, a drug must first receive marketing authorization from either the Dutch drug-regulatory agency (CBG), or the European Medicines Evaluation Agency (EMEA). The CBG and EMEA assess each drug on the basis of efficacy, safety and quality of manufacturing practices as determined in clinical trials [11]. In 1995, the European union (EU) established the EMEA, which offers a centralized EU-wide authorization process as an alternative to going through each country’s own regulatory authority. The centralized procedure is required for biotechnology drugs, but is optional for others. An alternative under the auspices of the EMEA is the mutual recognition procedure: the drug sponsor submits the new chemical entity (NCE) application for approval in one country and files for mutual recognition in other countries. When this so-called rapporteur country grants approval, the drug is automatically approved in the other countries unless they object within 90 days. EMEA accounts for approximately 20% of all marketing approvals in the Netherlands [6]. When approved, a drug can be marketed at a price chosen by the manufacturer, provided it is set below the price ceiling established by the Medicine Price Act of 1996. Drug manufacturers are not permitted to charge more for each drug than the average price charged in the four neighboring countries of Belgium, France, Germany, and the UK [12].

Outpatient drugs are not subject to global drug budget capitation, nor are prescribing caps imposed on health-care providers. Footnote 1 During the past 20 years, however, the government has implemented policies to curb growth in outpatient drug spending. Since the 1980s, clinical practice guidelines have been developed and implemented voluntarily to rationalize prescribing patterns [13]. Most importantly, in 1991 the Netherlands Ministry of Health, Welfare, and Sport (VWS) established a national drug formulary—a positive list of reimbursable pharmaceuticals [14]. Licensed pharmaceuticals are not automatically placed on the national formulary. The Board of Insurers (CVZ) maintains the national formulary and is responsible for reimbursement appraisals of all licensed prescription drugs. CVZ reviews each newly approved drug’s (comparative) safety, efficacy, and convenience, the severity of the disease, and availability of treatment alternatives. After its reimbursement appraisals, CVZ reports its recommendations to the VWS, which makes the ultimate reimbursement decision. In most instances private insurance plans defer to the national formulary in their reimbursement decisions.

The formulary is divided into two parts: Section 1A (85% of total), which contains therapeutically interchangeable drugs that are considered similar in mechanism of action, therapeutic indication, and route of administration. Section 1B (15% of total) contains drugs that are considered “innovative” and form their own class. In addition, approximately 250 out of the 1,000 drugs on the formulary are conditionally reimbursed. Conditions include “step therapy” and indication restrictions. Step therapy requires that lower cost alternatives be prescribed before the higher-cost medication.

Section 1A drugs are reference-priced whereas those in Section 1B are not. This implies that Section A drugs may have co-payments; that is, if the retail price of a drug is above the reference price or reimbursement limit (average price per therapeutic class), the beneficiary pays the difference [15]. In practice, fewer than 20% of 1A drugs have co-payments, ranging from nominal fees of less than €1 per prescription to larger co-payments of more than €30 per prescription. This is mainly because the reimbursement limit serves as a de facto price for each cluster of 1A pharmaceuticals. The Netherlands has the lowest drug cost sharing in the European Union [16].

Since January 2005, all newly approved drugs for which 1B status is sought are subject to formal cost-effectiveness and budgetary impact evaluations. To gain 1B status, hence premium prices, newly approved medications must be shown to be therapeutically superior to existing treatment alternatives.

CVZ requires drug sponsors to opt for either 1A or 1B status when applying for reimbursement. As a drug sponsor, other things being equal, there is a better chance at formulary placement, when applying for 1A status, because more than 95% of 1A applicants get approval whereas 80% get 1B approval [17].

French national formulary

In France, each drug must first be licensed by the French drug-regulatory agency, L’Agence Française de Securité Sanitaire des Produits de Santé (AFSSAPS) or the EMEA to receive marketing authorization. AFSSAPS or EMEA assesses each drug on the basis of efficacy, safety, and quality of manufacturing practices as determined in clinical trials. The EMEA has approved approximately 20% of drugs in France [33]. After approval a drug can be marketed at a price chosen by the manufacturer although it is not yet covered by public insurance and, furthermore, is not authorized for sale to public or private hospitals until it is registered on the positive list of reimbursable medicines—the national formulary [18].

Besides implementation of fixed budgets at the hospital and physician level [19], and mandatory adherence to certain clinical practice guidelines, the formulary is the most important tool used in France to rationalize prescribing patterns. The French national formulary applies to the publicly insured population of France—public health insurance covers 90% of the population [20]. The remainder has private health insurance. Ninety percent of the population has supplementary private insurance that covers cost sharing, for example, of pharmaceuticals. This supplemental insurance (offered by the so-called “Mutuelles”) is comparable with MediGap coverage in the US [21]. In most instances, as in the Netherlands, private insurers defer to the national formulary when making reimbursement decisions [22].

To qualify for reimbursement the Transparency Commission, which reports to the French Ministry of Health and Social Insurance, assesses each licensed drug’s (comparative) safety, efficacy, and ease of use. The Commission also takes into account the severity of the disease being targeted by each specific drug and the availability of alternative therapies. Notably, the Commission does not review a drug’s cost-effectiveness [23].

The Commission subsequently ranks each drug according to the service medical rendu (SMR) scale. This is a three-point scale:

-

1.

for drugs regarded as “major” or “important”;

-

2.

for drugs regarded as having “moderate” or “weak” significance;

-

3.

for drugs regarded as having “insufficient” therapeutic value.

Only drugs with an SMR ranking of 1 or 2 are ultimately reimbursed. According to aggregate statistics complied by the Transparency Commission, 62% of all drugs on the French formulary have been assigned the rank of 1, 19% the rank of 2, and 19% the rank of 3 [24, 25]. The Commission also compares new and existing drugs and assigns an amelioration du service medical rendu (ASMR) rating from 1 to 5 (1—major therapeutic advance, breakthrough; 2—important advance; 3—modest improvement; 4—minor, weak improvement; 5—no improvement). Each drug is then placed in one of three reimbursement tiers: 100% reimbursement for “irreplaceable” drugs, 35% reimbursement for drugs treating disorders that are not considered “serious,” and 65% for all other drugs. Note that patients suffering from some chronic illnesses, for example HIV/AIDS and diabetes are exempted from cost sharing for drug treatments. A small percentage of drugs on the positive list (<10%) are conditionally reimbursed.

After the Commission determines whether a new drug should be reimbursed, a separate entity called the Economic Committee on Health Products negotiates prices with drug sponsors. In its price negotiations it takes into account a drug’s budget impact, which refers to the financial consequences that drug use and reimbursement will have on one part of the health-care system, pharmaceutical care, or on the health-care system as a whole.

Only drugs that have been assessed by the Commission as yielding added therapeutic value over existing therapy can be granted a price higher than comparator drugs and drugs for which the Commission has not recognized added value can only be reimbursed if they are priced cheaper than comparators. Pricing decisions are a function of the ASMR rating, prices of therapeutic alternatives, the size of the target patient population, expected sales volume, and associated budget impact. Price controls, mostly in the form of price/volume agreements, apply to all drugs, except a small percentage of “major” drugs (<5%) [26].

Overview of UK system of reimbursement

In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) or the EMEA approve drugs for marketing. The EMEA accounts for approximately 15% of marketing approvals in the UK [31]. Once licensed, manufacturers may market drugs at any price they choose, subject to profit controls [27]. If the Department of Health regards profits as too high in relation to a pre-determined threshold, profit controls and mandatory price reductions may be implemented. Profits are regulated by the pharmaceutical pricing regulation scheme (PPRS), a cooperative venture between the drug industry and the Department of Health. PPRS fixes a threshold for profits—currently a profit margin threshold of 21% [20].

Besides profit controls, two other main measures aimed at curbing growth in drug spending are budgets and clinical practice guidelines. Local budgets are fixed at the primary care trust level, of which there are 300. Trusts are each responsible for their prescribing budgets—allocated to them from the Department of Health, under the aegis of the National Health Service (NHS). It is common practice for UK health-care providers to refer to clinical practice guidelines. They may not be used to mandate, authorize, or outlaw treatment options, however [28].

Unlike France and the Netherlands, the UK does not have a positive list that applies at the national level. Virtually all approved drugs are covered by public insurance through the National Health Service (NHS). The few drugs that are not reimbursed or subject to indication restrictions are drugs on the so-called black and gray lists. Most of these drugs are over-the-counter or lifestyle medications.

In the UK, public insurance covers 93% of the population. The remainder has private insurance. Private insurers defer to the NHS for most drug reimbursement and use decisions [29]. The NHS imposes a flat fee per prescription, equal to £6.60. Low-income households, pregnant women, and the elderly are exempt from this fee.

For a group of drugs selected by the NHS, the National Institute for Health and Clinical Excellence (NICE), which reports to the NHS, conducts appraisals which incorporate the drugs’ clinical and cost-effectiveness. The NHS tends to appraise newly approved drugs that have the potential for both high clinical and economic impact. On the basis of each appraisal, NICE produces recommendations regarding each drug’s reimbursement and use [3]. The outcome of the NICE appraisal process falls into three broad recommendation categories:

-

1.

the drug is recommended for routine use for all licensed indications;

-

2.

the drug is recommended for routine use for specific indications, or subgroups only, or as step therapy;

-

3.

the drug is not recommended for use for any group of patients for specified reasons relating to lack of clinical or cost effectiveness.

A statutory link has been established between issuance of a positive guidance for a new drug and the budget allocated for its reimbursement [30]. NICE guidance does not have the power to force a doctor to prescribe in a certain way. But in practice, if NICE chooses to reject a drug, this results in prescriptions being choked off. “That’s because most doctors are employees of local units (trusts) of the NHS. These local units must keep costs down within an annual budget. When NICE says a drug does not pass muster, doctors are under pressure to avoid it and let the local funds be used elsewhere” [31].

Overview of US formulary management

In the US each drug must be approved for marketing by the Food and Drug Administration (FDA), which bases its decisions on clinical trial data, safety, efficacy, and quality of manufacturing practices. When a drug is approved, drug sponsors are essentially free to market drugs at a price of their choosing, though exceptions exist, particularly with regard to government health care programs such as the federal-state Medicaid Footnote 2 and the federal veterans affairs (VA) programs. Footnote 3 [32].

Some health plans employ incentives targeted at health-care providers to reduce drug spending. These include capitation and voluntary compliance with clinical practice guidelines. Their most important cost containment tool is the formulary, however. There is no national formulary, other than the formulary employed within the VA hospital and pharmacy system. Hundreds of private and public payers employ a wide variety of formularies. The most prevalent formulary is the three-tier formulary. Approximately 70% of US plans have a three-tier structure: [33, 34]

-

1.

low co-pay for generics;

-

2.

medium co-pay for brand name, single-source drugs;

-

3.

high co-pay for brand names with generic equivalent.

A small percentage of plans have closed formularies in which drugs are either on formulary and fully reimbursed (although perhaps with a nominal co-payment) or off-formulary and not reimbursed at all. A very small number of plans have an open formulary in which every FDA-approved drug is reimbursable.

Payers negotiate prices for drugs with manufacturers, in addition to rebates for preferred drugs, which are drugs given preferential placement on formularies. Negotiations often result in rebates being paid by manufacturers to payers in exchange for the prospect of a certain percentage of market-share for the preferred drug.

Although there is no standardized approach to formulary management in the US, the establishment of guidelines for formulary submission dossiers by the Academy of Managed Care Pharmacy (AMCP) is the closest thing to a standardized approach [35]. The guidelines lay out requirements for sponsors of newly approved drugs to abide by when submitting requests to third party payers for reimbursement. Part of the requirements includes submission of pharmacoeconomic data for assessment by health plans. Approximately 70% of US health plans subscribe to the AMCP format [36]. The AMCP format for formulary submissions mirrors requirements laid out for reimbursement, pricing, and formulary listing in the Netherlands for 1B drugs. In stark contrast, however, to the situation in other countries, AMCP is not a standard setting organization. The format is therefore a template or guide, not a mandate. It is up to individual plans to decide how they will implement the format and how they will operate their formulary review processes. For example, a plan may only require dossiers for new molecular entities. Another may require dossiers for all new drugs at launch, and also for existing drugs through therapeutic class reviews. Others may exempt certain drugs or drug classes from review.

Table 2 summarizes the four systems we analyze in this paper, in terms of their pricing and reimbursement and their implementation of fourth hurdles.

Methods

We chose to analyze access to and reimbursement practices associated with the 2004 list of 100 top-selling drugs in the US because of the high impact many of these medications have on prescription drug spending in all four countries [37].

Our concept of access is multi-dimensional. We identify operational measures for eight access sub-dimensions:

-

1.

numbers of drugs approved by drug-regulatory agencies;

-

2.

time of marketing authorization for approved drugs;

-

3.

percentage of approved drugs covered by US, French, Dutch, and British third party payers;

-

4.

extent to which insurers defray costs of covered drugs;

-

5.

percentage of covered drugs with conditions of reimbursement;

-

6.

time period between marketing approval and reimbursement;

-

7.

extent to which individuals control choice of their drug benefit;

-

8.

evenness of the availability of drugs to the population.

In determining sub-dimension 1 we took formulation and dosing into consideration when examining drug approvals. We only counted a drug as approved in all four countries if the drug was approved for the same active ingredient, formulation, and dosing in all four countries Footnote 4 [38–41]. We found that of the 100 drugs, 79 were approved by all four regulatory agencies for the same active ingredient, formulation, and dosing. Footnote 5 We also calculated the percentage of the drugs approved for marketing by each drug-regulatory agency.

In determining sub-dimension 2, for the subset of 79 drugs, we performed bivariate paired t-tests to find differences in approval dates between the four drug-regulatory agencies. We then calculated sub-dimension 3 by determining the percentage of approved drugs reimbursed by our subset of three-tier formularies administered by nine leading US third party payers, [42, 43] the French Transparency Commission, the UK’s NHS, and the Dutch CVZ [44–47]. The US payers are: Aetna, Anthem, Blue Choice (Blue Cross Blue Shield), Cigna, Health Net, Humana, Kaiser, Pacificare, and United Health Care.

For covered drugs, we then collected cost-sharing data (access sub-dimension 4) and numbers of drugs with conditions of reimbursement (access sub-dimension 5). We counted the conditions: prior authorization, Footnote 6 step therapy, indication restrictions, and limitations on settings in which drugs can be prescribed.

We determined sub-dimension 6—time between marketing approval and decision to reimburse—using primary data from both the French Transparency Commission and the British MHRA and NICE agencies, and secondary evidence from The US and the Netherlands.

We inferred both the extent to which individuals control their choice of drug benefit (sub-dimension 7) and the evenness of availability (sub-dimension 8) from knowledge of characteristics of the four health-care systems.

Results

Approvals

Our analysis of marketing approvals in all four countries shows that France, the Netherlands, and the UK approved fewer of the top 100 drugs than the US. This is in part an artifact of the fact that we examined the list of 100 top-selling drugs in the US. Nevertheless, this result is somewhat surprising, because these are important products of the drug industry—33 of the 100 drugs have over $1 billion annual sales—drugs one would expect the industry to want to launch in more than just the US market (Table 3).

Time of approval

To determine time of approval we conducted bivariate paired t-tests (using SAS, version 9.1) comparing the approval dates in the United States with the dates in France, the Netherlands, and the UK, for all 79 drugs approved by all four drug-regulatory agencies. We found the US was slower than both France and the UK, while faster than the Netherlands (Table 4).

Coverage and cost sharing

Of the sub-set of 79 drugs approved by all four regulatory agencies, an average of 94% were placed on the US formularies we analyzed, 97% were on the Dutch formulary, 95% on the French formulary, and 93% qualified for NHS reimbursement in the UK, that is, were not on a negative or gray list or given negative advice by NICE.

US

On average, the US formularies covered 95% of the drugs in our sample, ranging from 87% in the most restrictive formulary to 99% in the least restrictive. The enrollee cost sharing for a given covered drug varied substantially across the nine payers. None of the drugs was placed in tier 1. On average, 64% were placed in tier 2, and 30% in tier 3. Tier 2’s co-payment range is $15–$35 per prescription, and tier 3’s co-payment range is $30–$70 per prescription. NF means not on formulary (Fig. 1)

.

UK

The NHS imposes a flat fee per prescription of £6.60. Approximately 50% of NHS beneficiaries are exempt from the prescription fee (Fig. 2).

Netherlands

The Netherlands has the largest percentage of covered drugs with no cost sharing compared with the other three systems. There are very few drugs with co-payments (four drugs, 5%). The few drugs that have co-payments have a wide range in co-payments, varying from € 8–€ 30 per prescription. Two drugs (3%) are not covered. Nineteen of the remaining 76 (25%) covered drugs are innovator (1B) drugs. Fifty-seven of the 76 (75%) covered drugs are therapeutically interchangeable (1A) drugs. NF means not on formulary (Fig. 3).

France

Six percent of covered drugs have no co-payment; they are fully reimbursed and assigned either “major” or “important”. Seventy-seven percent were assigned to the medium co-insurance tier (consumers pay 35% of drug costs); over 90% of these are “important” drugs. Thirteen percent of covered drugs were assigned to the highest co-insurance tier (consumers pay 65% of drug costs); most of these drugs are “moderate.” Ninety percent of French beneficiaries carry supplemental health insurance that covers most, if not all cost sharing for drugs. NF means not on formulary (Fig. 4).

Conditions of reimbursement

The Netherlands have the highest percentage of drugs with conditions of reimbursement, followed by the US, UK, and France. For the US, we calculated that for the nine plans, on average percentage of drugs have conditions of reimbursement (Fig. 5).

Speed from marketing approval to reimbursement

Our primary data analysis reveals that the UK’s NICE evaluated nine of the 79 drugs. For this sub-set, we found that the mean number of days between marketing approval and the first date of NICE guidance is 32 months. In France, for a subset of 69 drugs for which we could find reliable data, the mean number of days between marketing approval and reimbursement is 16 months.

The European Federation of Pharmaceutical Industries and Associations approached IMS to prepare a database to analyze delays in market access for drugs in Europe. The database measures total time delays between marketing approval and decision to reimburse. Footnote 7 The average time delay between marketing authorization and effective market access for drugs approved between 30 June 2000 and 30 June 2004 is: [48]

-

431 days in France, for a sample of 55 approved drugs for which data could be obtained, with a maximum time delay of 1,393 days and a minimum of 58

-

259 days in the Netherlands, for a sample of 58 approved drugs for which data could be obtained, with a maximum time delay of 1,201 and a minimum of 56

-

0 days in the US, for a sample of 100 approved drugs

-

0 days, in the UK, for a sample of 86 approved drugs.

IMS reports no time delay in the US because at least one of the hundreds of third party payers will reimburse a drug immediately after marketing approval. Anecdotal evidence from observers of the pharmaceutical benefit industry indicates, however, that insurers in the US “routinely exclude from coverage for up to 6 months new brand-name drugs that are therapeutically similar to existing drugs” [42]. The Centers for Medicare and Medicaid Services (CMS) are, moreover, known to delay reimbursement of certain newly approved products, including pharmaceuticals, by as much as 270 days after launch [49].

IMS reports no delay in the UK because when a drug is licensed in the UK it is, by default, reimbursable. For a small number of drugs, however, there is well-documented evidence of so-called “NICE blight”—delays in reimbursement by NHS primary care trusts during the period of appraisal by NICE [50]. It takes, on average, approximately 13 months for NICE to complete its assessment of drugs selected for appraisal. Footnote 8 It should be noted that NICE blight applies only to the comparatively small number of licensed drugs selected for NICE appraisal. Only nine of the 79 drugs in our subset were appraised by NICE. For this small sample, we found the period between marketing approval and NICE’s final determination in respect of reimbursement and use to be particularly long—32 months on average (Table 5).

Flexibility or extent to which beneficiaries control their choice of drug benefit

With regard to reimbursement, it is not appropriate to characterize the Dutch, French, and British systems as one-size-fits-all. On occasion, in the UK, NHS trusts can each make different funding decisions; in France and the Netherlands there are slight differences between the private insurance plan offerings. Usually, however, decisions are made at the national level and apply across all third-party payers and consequently all beneficiaries. Contrast this with the individualized US approach to formulary management. If one US insurer does not provide coverage for a particular drug, a person can (theoretically) go elsewhere for coverage. In our sample, we observe, for example, that drugs not recommended for reimbursement and use in the UK, or not on formulary in the Netherlands and France, are on at least one of the US formularies we examined.

Evenness of the availability of drugs to the population

Availability of the vast majority of approved pharmaceuticals is guaranteed to all British, French, and Dutch citizens irrespective of ability to pay. This is not so in the US. Even in public sector programs, for example Medicare, enrollment is voluntary and does not include all Medicare-eligible beneficiaries [51]. Furthermore, as seen in our dataset, there is wide variation in coverage and cost sharing of pharmaceuticals across US plans.

Table 6 gives an ordinal ranking of the extent to which each access sub-dimension is met across the four countries. A higher ranking indicates a higher degree of access with regard to that sub-dimension.

One limitation of the study is that the access sub-dimensions we measured do not completely determine prescribing behavior or the rates of adoption of pharmaceuticals. In addition to the eight access sub-dimensions above, differences between consumption of pharmaceuticals may also be attributed to (cultural) differences in prescribing behavior, differences in disposable income, and the willingness on the part of patients to spend money on prescription drugs.

Discussion, policy implications

For a sample of 100 commonly used best-selling drugs we identified and measured eight access sub-dimensions for four health systems: approvals, speed to approval, coverage, cost sharing, conditions of reimbursement, speed from marketing approval to reimbursement, flexibility, and evenness of drug availability to the population. The US approved more drugs than the other three countries: between 15 and 18% more than France, the Netherlands, and the UK. It was surprising to find that the US was slower than France and the UK in licensing drugs that all four regulatory agencies approved. The percentage of covered drugs is approximately the same across all four countries. For covered drugs, however, we observe the least cost sharing by patients in the Netherlands, followed by the UK, France, and the US. The Netherlands imposes conditions of reimbursement on a relatively large 29% of drugs, or between \( 2\raise.5ex\hbox{$\scriptstyle 1$}\kern-.1em/ \kern-.15em\lower.25ex\hbox{$\scriptstyle 2$} \) and three times the percentage in France, the UK, and the US. Looking at the entire sub-set of covered drugs, France seems to be the slowest in speed to reimbursement after marketing approval, followed by the Netherlands, the UK, and the US. A caveat is in order: for the nine drugs NICE evaluated we found it took NICE an average of 990 days to make its appraisal. This has led to delays in reimbursement and use of these drugs in the UK. Besides personal communications and anecdotal evidence, we could not find independently verifiable evidence of delays imposed by third party payers in the US in respect to reimbursement of drugs in our sample. The US is the most flexible in terms of the extent to which individuals control their choice of drug benefit, and it is the least universal in terms of evenness of drug availability to the population.

In Europe, observers emphasize speed to reimbursement after marketing approval as the greatest impediment to patient access to pharmaceuticals. This was pointed out in the former FDA Commissioner McClellan’s December 2003 speech at the European Federation for Pharmaceutical Sciences conference in Basel, Switzerland [52]:

“The process by which European governments set reimbursement rates can take up to a year, delaying patients’ access ... A report by the G10 Medicines Group ... recommended reducing the time between granting marketing authorization and pricing and reimbursement decisions.”

Our study confirms this problem of access in European countries. At the same time, our study confirms a qualitatively different kind of access problem in the US, namely, relatively high patient cost sharing for pharmaceuticals, and large variation of availability. There is significant variation in cost sharing, from comparatively little cost sharing among well-insured beneficiaries to full costs for uninsured patients [53].

In the US and Europe, hundreds of billions of dollars are being spent to address these patient access concerns. To tackle the issue of how best to spend these huge sums, policymakers are resorting to a variety of methods to facilitate a more efficient drug approval process while establishing incentives for more cost-effective ways of spending money on prescription drugs. In Britain, for example, NICE has implemented a fast-track initiative to accelerate appraisals of some “clinically essential” medicines. The objective of this initiative is to reduce the delay between marketing approval and reimbursement. The EU also has implemented a timeline of 180 days in which new drugs are supposed to be made available commercially after marketing approval [54]. In the US, recent implementation of the Medicare prescription drug benefit addresses inadequate and highly variable drug availability among Medicare beneficiaries. CMS has imposed regulations similar to those in the EU on plans serving Medicare beneficiaries, mandating a maximum 180-day period after marketing approval for making reimbursement decisions [55]. It remains to be seen whether such policy measures are adequate to the task of closing the access gap in both the US and Europe.

Overall, our results suggest variation among the eight access sub-dimensions. With regard to approvals, speed to reimbursement, and flexibility, the US scores well, while it performs less well in others, most notably speed to marketing approval, cost sharing, and evenness of distribution. Because we have identified access as composed of eight sub-dimensions, to compare overall access across the four countries we would need to be able to assess preference weights given by stakeholders to each access sub-dimension. In other words, how important are numbers of approvals or speed to marketing approval relative to coverage, cost sharing, speed to reimbursement, and evenness of availability?

This indicates a topic for future research involving discrete choice experiments to elicit stakeholder preferences [56]. These experiments would facilitate investigation of the importance stakeholders attach to each sub-dimension, and potential trade-offs between extents to which different access sub-dimensions are met.

Notes

Inpatient drugs may be subject to hospital budget caps.

The Omnibus Budget Reconciliation Act of 1990 requires manufacturers to pay a rebate to the Medicaid program. For brand-name drugs, the rebate is equal to the greater of 15.1% of the average price paid to a manufacturer for the drug and the difference between this price and the lowest price paid by any private-sector purchaser for the drug.

All direct federal purchasers of health care services, for example the Department of Veterans Affairs (VA), can purchase drugs at prices listed in the Federal Supply Schedule (FSS) for pharmaceuticals. The VA negotiates FSS prices with manufacturers on the basis of the prices that manufacturers charge their most-favored commercial customers. These prices are usually up to 50% off of the average wholesale price.

We filled gaps in our database of drug approvals by means of personal communications with officials at the respective drug-regulatory agencies.

Note that of the 100 drugs all four regulatory agencies approved 87 with the same active ingredient, but only 79 with the same formulation and dosing in addition to same active ingredient.

Prior authorization requires that some drugs be pre-authorized before their being dispensed to be eligible for reimbursement.

Note, the IMS database does not take into account delays because of launch delays.

Personal communication [Lucy Betteron, NICE, October 10, 2005].

References

Association for the British pharmaceutical industry 2003 report: competitive task force—competitive and performance indicators 2003. See http://www.abpi.org.uk/publications, accessed June 1, 2006

Buchmueller, T., Couffinhal, A.: Private health insurance in France. OECD Health working paper No. 12. 2004. See http://www.oecd.org/els/health/workingpapers, accessed April 5, 2006

Civitas. Are the NHS reforms working? NHS: is the extra money working? 2003. See http://www.civitas.org.uk/nhs/nhsmoney.php, accessed April 2, 2006

Cohen, J., Paquette, C., Cairns, C., Faden, L.: Comparing UK and US pharmacoeconomic assessments: case study of 38 NICE technology appraisals. Appl. Health Econ. Health Policy 5(3), 1–11 (2006)

Colombo, F., Tapay, N.: Private health insurance in OECD countries: the benefits and costs for individuals and health systems. OECD working paper 2005. See http://www.oecd.org/dataoecd/34/56/33698043.pdf, accessed March 10, 2006

Danzon, P.: Welfare effects of supplementary insurance: a comment. J. Health Econ. 21, 923–926 (2002)

Danzon, P., Ketcham, J.: Reference pricing of pharmaceuticals for medicare: evidence from Germany, the Netherlands, and New Zealand. NBER working paper series. See http://www.nber.org/papers/w1007, accessed March 7, 2006

Danzon, P., Wang, R., Wang, L.: The impact of price regulation on the launch delay of new drugs—evidence from 25 major markets in the 1990s. Health Econ. 14, 269–292 (2005)

Docteur, E., Oxley, H.: health-care systems: lessons from the reform experience. OECD working paper 2005. See http://www.oecd.org/dataoecd/5/53/22364122.pdf, accessed on march 10, 2006

Drug topics: top brand-name drugs by retail sales in 2005. See http://www.drugtopics.com/drugtopics/article/articleDetail.jsp?id=104561, accessed on April 1, 2006

Fox, P.: Prescription drug benefits: cost management issues for Medicare. See http://www.cms.hhs.gov/apps/review/03_04winter/03_04winterpg7.pdf, accessed on April 5, 2006

Heffler, S., Smith, S., Keehan, S., Borger, C., Clemens, M., Truffer, C.: Trends: US health spending projections for 2004–2014. Health Affairs 2005 web exclusive. See http://content.healthaffairs. org/content/vol0/issue2005/images/data/hlthaff.w5.74/DC1/Heffler05_E.5. gif, accessed on April 19, 2006

Hoadley, J., Hargrave, E., Cubanski, J., Neuman, T.: An in-depth examination of formularies and other features of Medicare drug plans. See http://www.kff.org/medicare/7489.cfm, accessed on May 29, 2006

Hoadley, J.: Cost containment strategies for prescription drugs – assessing the evidence in the literature, March 2005, http://www.kff.org, accessed on January 12, 2006

Hurwitz, B.: Legal and political considerations of clinical practice guidelines. BMJ 318, 661–664 (1999)

Jonsson, B., Wilking, N.: A pan-European comparison of patient access to cancer medications. See http://ki.se/content/1/c4/33/52/Cancer_Report.pdf, accessed on April 4, 2006

Lancry, P., et al.: Using health outcomes data to inform decision-making: healthcare payer perspective. Pharmacoeconomics 19(2), 39–47 (2001)

Le Pen, C.: Drug pricing and reimbursement in France: towards a new model? Pharmacoeconomics 10(Suppl. 3), 26–36 (1996)

Mossialos, E., Walley, T., Mrazek, M. (eds.) Regulating pharmaceuticals in Europe: an overview, striving for efficiency, equity, and quality. Open University Press, London (2004)

Neumann, P.: Why don’t Americans use cost-effectiveness analysis. Am. J. Manag. Care 10(5), 308–312 (2004)

OECD Health Data 2005. See http://www.oecd.org, accessed on May 21, 2006

PDUFA, FDA and stakeholders public meeting. See http://www.fda.gov/ohrms/dockets/05n0410/05n-0410-tr0001-vol2.pdf, accessed on March 24, 2006

Prescription drug coverage, spending, utilization, and prices. See http://www.aspe.hhs.gov, accessed on November 29, 2005

Pronk, M., Bonsel, G.: De budgetbeheersende functie van het geneesmiddelenvergoedingssysteem, 10 jaar GVS. Nederlands Tijdschrift voor de Geneeskunde. 146(37) (2002)

Rodwin, V., Sandier, S.: Health care under French national health insurance. See http://www.nyu.edu/projects/rodwin/french.html, accessed on January 11, 2006

Ryan, M.: Discrete choice experiments in health care. BMJ 328, 382 (2004)

See http://www.drugtopics.com/drugtopics/data/articlestandard/drugtopics/082006/309440/article.pdf, accessed on November 29, 2005

See http://www.cbg-meb.nl, accessed on March 1, 2006

See http://www.cbo.nl/home_html, accessed on June 1, 2006

See http://www.euro.who.int/Document/Obs/EuroObserver6_3.pdf, accessed on March 10, 2006

See http://www.irpp.org/events/archive/sep02/willison.pdf, accessed on March 25, 2006

See http://www.has-sante.fr, accessed on March 11, 2006

See http://afssaps-prd.afssaps.fr/html/has/sgt/htm/smr/indsmr.htm, accessed April on 19, 2006

See http://europa.eu.int/comm/enterprise/phabiocom/docs/tse/usa.pdf, accessed on March 25, 2006

See http://www.pbmi.com, accessed on January 31, 2006

See http://www.cbo.gov/ftpdocs/64xx/doc6481/06-16-PrescriptDrug.pdf, accessed on March 8, 2006

See http://www.amcp.org, accessed on March 10, 2006

See http://www.fda.gov, accessed on January 15, 2006

See http://www.mhra.gov.uk, accessed on February 23, 2006

See http://www.cbg-meb.nl, accessed on April 2, 2006

See http://www.afssaps.fr, accessed on March 3, 2006

See https://online.epocrates.com, accessed on May 31, 2006

See http://www.cvz.nl, accessed on March 1, 2006

See https://online.epocrates.com, accessed on May 29, 2006

See http://www.nice.org.uk, accessed on March 1, 2006

See http://www.has-sante.fr, accessed on March 23, 2006

See http://www.cms.hhs.gov/CapMarketUpdates/Downloads/hcimu120503.pdf, accessed on April 3, 2006

See http://www.pbmi.com, accessed on June 15, 2006

See http://www.fda.gov/oc/speeches/2003/eufeps1208.html, accessed on April 19, 2006

See http://www.who.int/intellectualproperty/studies/Lanjouw_Price&LaunchFinal.pdf, accessed on April 5, 2006

Stolk, E., Brouwer, W., Busschbach, J.: Rationalizing rationing: economic and other considerations in the debate about funding of Viagra. Health Policy 59(1), 53–63 (2002)

Syrett, K.: A technocratic fix to the “legitimacy problem”? The Blair Government and Health Care Rationing in the United Kingdom. J. Health Polit. Policy Law 28, 715–746 (2003)

Ten leading nationwide 3-tier formularies, in terms of enrollment. See http://www.aishealth.com, accessed May on 23, 2006

Towse, A.: The efficient use of pharmaceuticals: does Europe have any lessons for a Medicare drug benefit? Health Aff. 22(3), 42–45 (2003)

Varkevisser, M., van der Geest, S.: “Price Competition Among Dutch Sickness Funds”, Erasmus University Research Centre For Economic Policy Research Memorandum 0112, (2001). See http://www.ocfeb.nl, accessed on March 7, 2006

Whalen, J.: Britain stirs outcry by weighing benefits of drugs versus price. The Wall Street Journal, November 22, 2005

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Table 7

Rights and permissions

About this article

Cite this article

Cohen, J., Faden, L., Predaris, S. et al. Patient access to pharmaceuticals: an international comparison. Eur J Health Econ 8, 253–266 (2007). https://doi.org/10.1007/s10198-006-0028-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-006-0028-z