Abstract

A system dynamics-based evolutionary game theoretical analysis is proposed to examine the impact of policy incentives, i.e., price subsidy and taxation preference on electric vehicles (EVs) industry development. Two case scenarios were used to distinguish policy performance by dividing it into a static and dynamic incentive. The result reflected that the game in implementation of the static incentive policy did not achieve stable equilibrium, indicating that such a policy is not effective for driving the development of the EVs industry. However, the game had stable equilibrium when dynamic incentive policy was implemented. The taxation preference had better performance in incentivizing EVs production than the direct subsidy. The study is expected to provide insight into policy making in the industrial transition toward low-carbon consumption. Limitations are given to indicate opportunities for further research.

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Electric vehicles (EVs) are indicated as a promising alternative to fossil fuel-based vehicles (FVs), which provide a direct path for carbon emissions reduction (Teixeira et al. 2015; Du et al. 2019). However, the EVs industry development is still in progress, including extending the life span of rechargeable batteries, improving the one-charge driving range, and so on, which results in limited market shares (Plötz et al. 2014; Junquera et al. 2016; Kim et al. 2018). For example, the sales of EVs were 0.77 million by 2017, which only accounted for 2.7% of total vehicle sales in China (CAAM 2018). China intends to increase the sale of EVs to 5 million by 2020, indicating that there is still a huge market gap (Hao et al. 2017). In terms of supporting the development of the EVs market, there is little dispute that government plays a key role through enacting incentive policies. For instance, since 2012, China’s central government has implemented a direct price subsidy policy for consumers who purchase EVs (Liu et al. 2017). However, the government may face uncertainties in terms of incentive policy performance if EVs manufacturers do not actively respond.

Game theory is powerful to investigate interactions among players with conflicts, and their decisions may affect others (Zhao et al. 2013; Gao et al. 2018). The solution of a game is to help players determine their own most favorable strategic actions by predicting those of others based on their expectations of maximized payoff (Zhao et al. 2012). In such a context, this study employs an evolutionary game theoretical analysis to examine the possible impacts of policy incentives on EVs enterprises and consumers. System dynamics (SD) is used to simulate the created game scenarios. The results may provide insight into optimal policy making in regard to the promotion of EVs industry development, while helping enterprises to seek for an equilibrium between economic and environmental performance.

The rest of the paper is constituted as follows: The “Literature review” section presents the relevant literature to highlight the gap regarding incentive policies for EVs industry development and game theoretical application in regard to green supply chain management. The game theoretical analysis and its associated system dynamics simulation are introduced in the “Game theory applications to green supply chain management” section. The “An illustrative case example” section gives a case example to demonstrate the model application. The results of the game simulation and their implications are shown in the “Results and discussion” section. The “Conclusions” section gives the conclusions and lays out limitations to indicate opportunities for further research.

Literature review

Overview of incentive policies for EVs industry development

There are a number of studies focusing on the possible impacts of incentive policies on EVs industry development, including EVs production and consumption. Gallagher and Muehlegger (2011) predicted the production of hybrid powered vehicles under state tax incentives. Additionally, Hirte and Tscharaktschiew (2013) measured the optimal rate of subsidies for the purchase of EVs by consumers. Zhang (2014) investigated the individual influence of subsidies and consumer demand on strategic actions in regard to EVs production. Hao et al. (2015) conducted a cost comparison between conventional and battery power-driven vehicles in China and found that the latter was cost competitive due to introduction of a subsidy policy. Similarly, Noori and Tatari (2016) developed an agent-based model to predict the marketing share of five different vehicles, in which governmental subsidy was considered as an important variable. Furthermore, Bjerkan et al. (2016) compared the performance of two typical incentives, i.e., exemptions from purchase tax or value-added tax, to identify which was critical for the purchase of EVs by consumers. Liu et al. (2017) presented an evolutionary game to show that subsidy plays a key role in stimulating EVs industry development. Yang et al. (2018) applied a two-stage optimization model to identify that there was a positive relationship between governmental subsidy scheme and consumers’ acceptance of battery electric vehicles (BEVs).

These above-mentioned studies mainly focused on examining the performances of individual policy incentives on EVs industry development. Few of them investigated the synergetic impacts of combined policies. Moreover, these studies mainly described the response from the perspective of EVs enterprises, but paid little attention to their interactions with other stakeholders. This study thus considers a game between enterprise and consumer. Furthermore, a price subsidy and preferential taxation are selected as the main policy incentives in order to investigate their synergetic influences on the EVs industry.

Game theory applications to green supply chain management

There are a number of stakeholders involved in a supply chain network, including supplier, manufacturer, retailer, and consumer, who may face conflicting objectives in their decision making (Ji et al. 2015). In this context, game theory is a useful tool for addressing this dilemma and reinforcing coordination among the stakeholders. A number of studies have discussed the application of game theory to supply chain management. For example, Sheu and Chen (2012) proposed a three-stage game-theoretic model to investigate how governmental financial intervention acts on green supply chain competition. A similar study was conducted by Hafezalkotob et al. (2016), who established a game in stimulating supply chains by imposing governmental taxation and subsidies. Hu et al. (2014) developed an oligopoly game to investigate competition among the sectors of manufacture in a supply chain. Furthermore, Chen and Xiao (2015) presented a game with uncertainties to measure cooperation efficiency of the players involved in a supply chain. Guo et al. (2016) applied game theory to analyzing the influence of governmental subsidies on the distribution of social profits of supply chain stakeholders. Lastly, Yang and Xiao (2017) further created a game model to examine interactions among multi-stakeholders, i.e., government, manufacturer, and retailer, to enhance their coordination.

A conventional game is usually premised upon the assumption that the involved players are perfectly rational and strive to maximize their utilities by considering all possibilities and choosing the optimal action, which may deviate from actual decision making (Liu et al. 2015). Evolutionary game theory fills such gaps by hypothesizing that players have bounded rationality according to their available information and cognitive limitations in order to observe the probability of change in regard to their strategic actions (Jiang et al. 2018a). Barari et al. (2012) proposed an evolutionary game to analyze interplay between producer and retailer in triggering green practices while maximizing their economic profits. Similarly, Tian et al. (2014) examined the managerial performance of green supply chain by using evolutionary game theoretical analysis. Zhao et al. (2016) further combined evolutionary game theory and system dynamics to investigate the possible responses of key enterprises within an air conditioner’s supply chain network to a carbon labeling scheme. Additionally, Mahmoudi and Rasti-Barzoki (2018) applied evolutionary game theory to modeling behavioral variation related to the Indian textile supply chain stakeholders under different government financial interventions.

The above-mentioned studies were the typical cases to demonstrate the applications of evolutionary game theoretical analysis, which are insightful to highlight our method. A game is solved by seeking for Nash equilibrium, indicated as a unique prediction from possible strategic actions among players with a best response (Zhao et al. 2015). However, such equilibrium indicates a static state, by which its formation has been omitted, i.e., the dynamic process for seeking such an equilibrium state has been omitted by classical game solution (Zhao et al. 2018). System dynamics fill such gap by using visual simulation to help the game players better understand how a game evolves (Zhao et al. 2016). This study thus applies SD to simulating the created game scenario, to seek for optimal policy making on sustainable development of EVs industry.

The evolutionary game

Construction of game theoretical model

From a supply chain perspective, enterprise and consumers play the key roles of production and consumption in regard to driving EVs development. In this case, the game incorporates these two players who are hypothesized as having bounded rationality, whose decision making is limited by information, cognition, and time (Safarzyńska and Van den Bergh 2018). For instance, consumers may lose trust in new products due to their purchasing experiences, resulting in certain degrees of risk perception (Wang et al. 2018). Second, rational individuals are intended to maximize their self-interests (Jiang et al. 2018b). This further indicates that enterprises and consumers do not have an enforceable commitment, as the former prefers making business decisions based on controlled resources rather than cooperation with the latter (Dinner et al. 2014). Enterprise has two strategic options: One is to produce electric vehicles (EI); another is to produce fossil fuel-based vehicles (EC); the enterprise’s payoffs corresponding to these two options are denoted as \(\varPi_{\text{e}}^{g}\) and \(\varPi_{\text{e}}^{c}\), respectively. The consumer has two strategic options: One is to buy an electric vehicle (BE), while another is to buy a fossil fuel-based vehicle (BC). The consumer’s payoffs corresponding to these two options are denoted as \(U_{\text{c}}^{g}\) and \(U_{\text{c}}^{n}\), respectively.

According to the consumers’ payoffs defined by Liu et al. (2017), the payoffs related to the purchase of electric and fossil fuel-based vehicles are adjusted respectively, given as follows:

If \(U_{\text{c}}^{g} = U_{\text{c}}^{n}\), then a boundary is determined, indicating that consumer obtains the same utility from the purchase of the EVs or the FVs. Let this boundary be denoted as \(g_{gn}\), and \(g_{gn} = \frac{{P_{g} - P_{n} }}{{\lambda_{g} - \lambda_{n} }}\). When \(U_{\text{c}}^{n} = 0\), the indifference point (\(g_{nn}\)) between buying a FV and buying nothing is obtained, which is expressed by \(g_{nn} = \frac{{P_{n} }}{{\lambda_{n} }}\).

Consumer’s attitude to EVs and FVs is hypothesized as symmetric (Tian et al. 2014). The corresponding functions of market demand for EVs and FVs are given as follows (Liu et al. 2017):

Thus, enterprise’s payoffs functions for producing EVs and FVs are defined as follows:

A payoff matrix is constructed on account of the above assumptions, as shown in Table 1.

Let x represent the proportion of enterprises that select the strategy EI, while 1 − x be the proportion of enterprises that select the strategy EC. Similarly, y represents the proportion of consumers who choose the strategy BE, and 1 − y is the proportion of consumers who choose the strategy BC. Thus, (x, y) ∈ [0, 1] × [0, 1].

The expected payoffs of enterprises for taking actions EI and EC are defined as \(f_{\text{EI}}\) and \(f_{\text{EC}}\), respectively, expressed as follows:

Similarly, the expected payoffs of consumers for taking actions BE and BC are defined as \(f_{\text{BE}}\) and \(f_{\text{BC}}\) respectively, expressed as follows:

The average expected payoffs of the enterprises (\(f_{\text{E}}\)) and consumers (\(f_{\text{B}}\)) are given as follows:

The rate of change of a selected strategy is equal to its expected payoffs subtracting the average expected payoffs (Friedman 1991). Thus, the replicator dynamic equations corresponding to the enterprises and consumers are:

Construction of SD model

In an evolutionary game, players constantly learn from other players by comparing their payoffs with others to adjust their strategic actions, which is described as feedback system behavior (Liu et al. 2015). SD is capable of simulating this type of complex system behavior by using a stock flow diagram to reflect the causal loop feedback structure (Aslani et al. 2014). Figure 1 shows the causal loop diagram of the SD model. The feedback loops are constituted by the reinforcing and balancing loops, in which the former acts on the propagation effects of the involved variables to result in growth or decrease, while the latter counters such a change to push into an opposite direction (Teng et al. 2018). There are three feedback loops in the study:

-

①

Reinforcing loop Enterprise’s economic profits of producing electric vehicle → probability of producing electric vehicle → electric vehicle production → enterprise’s economic benefit from incentive policy → enterprise’s economic profits of producing electric vehicle.

When there are profits for the enterprise to produce electric vehicle, the probability of enterprise’s producing electric vehicle may be increased to result in expansion of the production. With the increase in production, the enterprise may receive more benefits from governmental incentives, which further increases enterprise’s profits.

-

②

Balancing loop Subsidy → probability of consumer purchasing electric vehicle → sales of electric vehicle → subsidy.

The increase in price subsidy may give rise to a high probability that consumer purchases electric vehicle, and thus increase the sales of the electric vehicle. Consequently, the government intends to reduce the subsidy gradually to alleviate the financial pressure.

-

③

Balancing loop Subsidy → probability of consumer purchasing fossil fuel-based vehicle → sales of fossil fuel-based vehicle → subsidy.

As the price subsidy to consumer increases, the probability of purchasing fossil fuel-based vehicle decreases, which further reduces sales of fossil fuel-based vehicle. Consequently, the government intends to reduce the subsidy gradually.

The Vensim PLE software package was used to construct a SD model for the proposed evolutionary game between enterprise and consumer, as shown in Fig. 2. All the involved variables and their attributive information are given in Table 2.

An illustrative case example

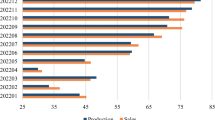

An illustrative case example based on China’s electric vehicle industry is given to demonstrate how the game evolves with implementation of different policy incentives. In the last decade, China’s electric vehicles industry has experienced rapid development (Wang et al. 2017). Nevertheless, the marketing share of EVs is in its infancy and accounted for less than 3% (Du and Ouyang 2017). To further incentivize the development of the EVs industry, a series of interrelated policies has been implemented by China’s government. Currently, there are 175 policies promulgated from various levels during the period 2006 to 2016, including national, regional, and local, among which national policies make up 29.71%, regional 6.29%, and local 64.00% (Zhang and Bai 2017). The performance of these policy incentives still needs to be examined.

Table 3 gives the primary data of the input parameters for the SD model, which are mainly sourced from Ministry of Finance of the People’s Republic of China, the China Association of Automobile Manufacturers, and similar studies (Zhao et al. 2016, 2018). Midsize cars in an average price of 0.2 million RMB were taken as the target vehicles for the game theoretical analysis. The average market price of EVs is approximately 25% more than FVs (Tian et al. 2014).

A series of policies has been enacted by China’s central government to incentivize EVs marketing development. In 2012, the government provided price subsidies to the consumers who purchased EVs based on their travel distance (Liu et al. 2017). Four years later, the central government decided to reduce the subsidies at a rate of 20% every 2 years during the period from 2017 to 2020 (Zhang and Bai 2017). The current standard of subsidy is derived from the Ministry of Finance of the People’s Republic of China (2018), indicating that consumers may receive a price subsidy varying from 15,000 RMB to 50,000 RMB according to the driving range of their purchased EVs. For common driving ranges related to midsize cars, the subsidy is set as 30,000 RMB per car. The existing subsidy given to consumers is a one-off price subsidy, which only aims to compensate the consumer’s direct expenditure on the EVs purchase. In this context, this study assumes that the subsidies are provided by enterprises to consumers and then reimbursed by the government, while the subsidy to enterprises is consistent with that to consumers.

In addition, the government has proposed policies on tax abatement to encourage the production of EVs (Zheng et al. 2018). The general taxation rate is 25% on an enterprise’s income (Zhao et al. 2016). For the high-tech industries, including the EVs industry, the Central Government implements a taxation rate of 15% on an enterprise’s income (MOST 2016). This study thus takes the difference between the general taxation rate and the taxation rate of high-tech industries as the preferential taxation rate for further simulation. In this context, γ is set as 15%.

Results and discussion

Two scenarios have been built to investigate how an enterprise responds to the governmental incentive policies, in which Scenario 1 mainly investigates enterprise’s response to the static incentive policies, while Scenario 2 focuses on the impact of dynamic incentive polices. By taking subsidy as an example, two categories were defined, namely static and dynamic subsidies, to investigate their influences on EVs enterprises’ responses. Since a one-off financial subsidy that aims to compensate for the consumer expenditure on the purchase of EVs has been widely adopted in developing economies (Du et al. 2019), Scenario 1 considers the subsidy as a fixed price subsidy per electric vehicle purchase. Since EVs development may be slow to respond to a flat rate subsidy policy (Liu et al. 2017), Scenario 2 considers a dynamic subsidy policy, i.e., the government aims to incentivize rapid development of EVs industry by giving a higher subsidy during the initial simulation period, and gradually reduces its intensity during the rest period of simulation. Specifically, the subsidies were provided to compensate the cost for the EVs enterprises and for the consumers to purchase EVs, respectively. The taxation rate was set by analogy to the subsidy to assess the enterprises’ responses. To verify the simulation results, game theoretical analysis regarding the evolutionary equilibrium stability was performed and was given in “Appendix.”

Simulation results of Scenario 1

By substituting the data of input parameters in Eq. (13), 4 pure equilibria and 1 mixed equilibrium were obtained:

By taking X5 as an example, the default probabilities that an enterprise takes action in regard to EVs production were \(x = 0.3\;{\text{and}}\;x = 0.8\), respectively. As shown in Fig. 3, the probability that an enterprise chooses strategic action EI fluctuated during the simulation period, indicating that there was no stable state. As the game iterated, the amplitude increased. For different initial values, the amplitude varied. For example, the amplitude corresponding to \(x = 0.8\) was greater than that corresponding to \(x = 0.3\).

Simulation results of Scenario 2

As previously mentioned, government in the scenario intends to provide subsidies to incentivize EVs production and consumption during the initial period of the simulation, followed by a gradual decrease in the subsidy. Similarly, the government also implements a dynamic preferential taxation policy to incentivize the production of EVs by enterprises. In regard to this premise, the utilities of the subsidy and preferential taxation are presented as follows:

where \(W_{\text{e}}^{\prime }\) represents the subsidy to enterprises under the dynamic incentive policies; \(W_{\text{e}}\) represents the subsidy to enterprises under the static incentive policies; \(W_{\text{c}}^{\prime }\) represents the subsidy to consumers under the dynamic incentive policies; \(W_{\text{c}}\) represents the subsidy to consumers under the static incentive policies; \(T_{\text{e}}\) represents the taxation preference on enterprises under the static incentive policies; \(T_{\text{e}}^{\prime }\) represents the taxation preference on enterprises under the dynamic incentive policies; x represents the proportion of enterprises that take the strategic action EI; and y represents the proportion of consumers who choose the strategic action BE.

At the same time, the SD model was adjusted accordingly, as shown in Fig. 4.

Figure 5 shows enterprises’ responses to the two dynamic incentive policies. It is clear that the probability that enterprises choose the strategic action EI fluctuates in a smaller amplitude, which ultimately converges, reflecting that there is an evolutionary stable strategy (ESS). An ESS is deemed as a strategy that cannot be invaded by any other alternative strategy, which is self-enforcing and no player can possess more benefits unilaterally (Smith and Price 1973).

Further, these two incentive policies give rise to the same equilibrium value, but the dynamic preferential taxation policy results in faster convergence and smaller amplitude. Zhao et al. (2016) obtained similar results through an analysis of policies and identified that preferential taxation was more effective than direct subsidy to facilitate clean technology diffusion.

Figure 6 shows EVs enterprises in response to the direct subsidy given to different stakeholders. Comparing the subsidy to enterprises with that to consumers, the latter has a faster convergence rate to generate equilibrium, indicating that enterprises prefer taking the strategic action EI. This result indicates that the direct subsidy to consumers may be better than that to enterprises for the EVs industry development. One possible reason is that consumer may actively drive market demand, by which it is critical to affect business operations (Zhou et al. 2009). The subsidy to consumers may encourage their purchasing behavior; this is generally reflected in China’s policy incentives which have transitioned in focus from producer-orientated to consumer-orientated (Xu and Su 2016).

Figure 7 shows enterprises’ response to the combination of subsidies and preferential taxation. It is clear that the designed policy combination achieves a larger equilibrium in a short period. In such case, it is implied that the combination of policy incentives may have a positive impact on the EVs industry development.

Discussion

The EVs industry development generally involves the coordination of three main stakeholders, namely enterprises, consumers, and governments (Zheng et al. 2018). Government is responsible in developing appropriate policies to lead the EVs industry toward sustainability. Specifically, the price subsidy is considered as a key governmental policy tool (Du and Ouyang 2017). Currently, this measure mainly targets EVs consumers, to exempt their vehicle and vessel tax (Zhang and Bai 2017). However, such mechanisms are stubborn, which may restrict EVs development not only in production but also in consumption (Liu et al. 2017). This phenomenon has also been verified by our SD simulation results, which call for an improvement. Thus, dynamic incentives are proposed to fill such a gap, which help both players to maximize their payoffs and achieve equilibrium in a short period according to the SD simulation results. But even the dynamic incentives is still a continuous incentive mechanism, which may not only incur a financial risk posed to the government, but also result in enterprises’ dependence on incentives for their survival (Zhao et al. 2016). Additionally, incremental innovation is the common response of enterprises to policy incentives through investment on technologies with short-term paybacks (Oltra and Jean 2009). To prevent such dependence, the simulation results imply that governmental policy needs to be designed flexibly, ultimately to arouse radical innovation in the EVs industry.

As discussed by Zhou et al. (2009), market demand plays a critical role in business operations. The sale of EVs is strongly dependent on consumers’ acceptance (Rezvani et al. 2015). Although there are some barriers to the diffusion of EVs, including driving range, coverage of charging infrastructures and battery recharging, a large market demand still exists (Egbue et al. 2017). For example, a survey revealed that 37.2% of the US consumers are willing to buy an electric vehicle regardless of its price (Tan et al. 2014). The potential market demand may bring business opportunities to automobile enterprises. In such case, it is crucial that consumers’ concerns should be incorporated into design of policy incentive instruments to facilitate EVs industry development.

The study contributes policy-making implications to the transition toward low-carbon consumption. From a life cycle perspective, electric vehicle is efficient in reducing direct carbon emissions in its usage (Girardi et al. 2015). For example, purchase of an electric vehicle is expected to reduce 6.75 kg of direct carbon emissions per 100 km of driving, compared to that of a fossil fuel-based vehicle (Zhang and Han 2017). Our results thus indicate governmental incentives (e.g., a price subsidy) are necessary and efficient to guide consumers to purchase EVs instead of FVs, ultimately to change their purchasing behaviors toward low-carbon consumption. With increasing demand of electric vehicles, enterprises call for incentive policies to facilitate EVs marketization. Our results further propose to apply dynamic incentives to market development, due to their flexibilities in implementation. For example, enterprises are encouraged to trigger market vitality through research and development to avoid excessive reliance on the incentives (Lieven 2015; Liu et al. 2017).

Conclusions

This study constructs an evolutionary game to examine enterprises’ response to incentive policies in facilitating EVs industry development. System dynamics is used in the simulation of the created game scenarios: one with static policy incentives and one with dynamic policy incentives. The simulation results show that the dynamic policy incentives have better performance in regard to the development of the EVs industry and that preferential taxation is more efficient than the price subsidy to the enterprises. These results offer insight into the formulation of appropriate policies in incentivizing the development of EVs industry.

However, there is still room for future improvement. First, there are some model parameters derived from similar studies, through which the characteristics of the EVs industrial dilemma may not holistically be indicated. In addition to the incentive mechanisms, sanction measures have been omitted for the reason that China’s EVs industry is still in its infancy of development. Third, although government is an important stakeholder, its interaction with consumers has been omitted. Future research may focus on improvement of the game theoretical analysis, to examine the cooperative effect of the combination of both incentive and punitive policies, and investigate interactions among government, enterprise, and consumer.

Abbreviations

- \(P_{g}\) :

-

The price of an electric vehicle

- \(P_{n}\) :

-

The price of a fossil fuel-based vehicle

- \(C_{g}\) :

-

The unit cost of an electric vehicle

- \(C_{n}\) :

-

The unit cost of a fossil fuel-based vehicle

- \(G_{g}\) :

-

Consumer’s attitude toward purchasing an electric vehicle

- \(G_{n}\) :

-

Consumer’s attitude toward purchasing a fossil fuel-based vehicle

- \(\lambda_{g}\) :

-

The environmental performance of an electric vehicle

- \(\lambda_{n}\) :

-

The environmental performance of a fossil fuel-based vehicle

- \(U_{\text{c}}^{g}\) :

-

The consumer’s payoffs from purchasing an electric vehicle

- \(U_{\text{c}}^{n}\) :

-

The consumer’s payoffs from purchasing a fossil fuel-based vehicle

- \(W_{\text{e}}\) :

-

The subsidy to enterprise that produces an electric vehicle

- \(W_{\text{c}}\) :

-

The subsidy to consumer who purchases an electric vehicle

- \(T_{\text{e}}\) :

-

The tax preference on the electric vehicle enterprise

- \(\gamma\) :

-

The preferential tax rate

- \(\varPi_{\text{e}}^{g}\) :

-

The enterprise’s payoffs from producing an electric vehicle

- \(\varPi_{\text{e}}^{c}\) :

-

The enterprise’s payoffs from producing a fossil fuel-based vehicle

- \(Q_{g}\) :

-

The market demand for electric vehicles

- \(Q_{n}\) :

-

The market demand for fossil fuel-based vehicles

- \(R_{g}\) :

-

The consumer’s perceived benefits from purchasing an electric vehicle

- \(R_{n}\) :

-

The consumer’s perceived benefits from purchasing a fossil fuel-based vehicle

References

Aslani A, Helo P, Naaranoja M (2014) Role of renewable energy policies in energy dependency in Finland: system dynamics approach. Appl Energy 113:758–765

Barari S, Agarwal G, ZhangWJ Mahanty B, Tiwari MK (2012) A decision framework for the analysis of green supply chain contracts: an evolutionary game approach. Expert Syst Appl 39(3):2965–2976

Bjerkan KY, Norbech TE, Nordtomme ME (2016) Incentives for promoting battery electric vehicle (BEV) adoption in Norway. Transp Res D Transp Environ 43:169–180

CAAM (China Association of Automobile Manufactures) (2018) The data of Chinese car sales in 2017. http://news.bitauto.com/hao/wenzhang/548812. Accessed 19 Sept 2018

Chen K, Xiao T (2015) Outsourcing strategy and production disruption of supply chain with demand and capacity allocation uncertainties. Int J Prod Econ 170:243–257

Dinner IM, Van Heerde HJ, Neslin SA (2014) Driving online and offline sales: the cross-channel effects of traditional, online display, and paid search advertising. J Mark Res 51(5):527–545

Du JY, Ouyang DH (2017) Progress of Chinese electric vehicles industrialization in 2015: a review. Appl Energy 188:529–546

Du Z, Lin B, Guan C (2019) Development path of electric vehicles in China under environmental and energy security constraints. Resour Conserv Recy 143:17–26

Egbue O, Long S, Samaranayake VA (2017) Mass deployment of sustainable transportation: evaluation of factors that influence electric vehicle adoption. Clean Technol Environ Policy 19(7):1927–1939

Friedman D (1991) Evolutionary games in economics. Econometrica 59(3):637–666

Gallagher KS, Muehlegger E (2011) Giving green to get green? Incentives and consumer adoption of hybrid vehicle technology. J Environ Econ Manag 61(1):1–15

Gao Y, Li Z, Wang F, Wang F, Tan RR, Bi J, Jia X (2018) A game theory approach for corporate environmental risk mitigation. Resour Conserv Recycl 130:240–247

Girardi P, Gargiulo A, Brambilla PC (2015) A comparative LCA of an electric vehicle and an internal combustion engine vehicle using the appropriate power mix: the Italian case study. Int J Life Cycle Assess 20(8):1127–1142

Guo D, He Y, Wu Y, Xu Q (2016) Analysis of supply chain under different subsidy policies of the government. Sustainability 8(12):1290

Hafezalkotob A, Alavi A, Makui A (2016) Government financial intervention in green and regular supply chains: multi-level game theory approach. Int J Manag Sci Eng 11(3):167–177

Hao H, Wang M, Zhou Y, Wang HW, Ouyang MG (2015) Levelized costs of conventional and battery electric vehicles in china: Beijing experiences. Mitig Adapt Strateg Glob 20(7):1229–1246

Hao H, Cheng X, Liu Z, Zhao F (2017) Electric vehicles for greenhouse gas reduction in China: a cost-effectiveness analysis. Transp Res D Transp Environ 56:68–84

Hirte G, Tscharaktschiew S (2013) The optimal subsidy on electric vehicles in German metropolitan areas: a spatial general equilibrium analysis. Energy Econ 40:515–528

Hu GP, Wang LZ, Chen YH, Bidanda B (2014) An oligopoly model to analyze the market and social welfare for green manufacturing industry. J Clean Prod 85:94–103

Ji P, Ma X, Li G (2015) Developing green purchasing relationships for the manufacturing industry: an evolutionary game theory perspective. Int J Prod Econ 166:155–162

Jiang ZZ, He N, Qin X, Ip WH, Wu CH, Yung KL (2018a) Evolutionary game analysis and regulatory strategies for online group-buying based on system dynamics. Enterp Inf Syst 12(6):695–713

Jiang H, Zhao S, Yuan Y, Zhang L, Duan L, Zhang W (2018b) The coupling relationship between standard development and technology advancement: a game theoretical perspective. Technol Forecast Soc 135:169–177

Junquera B, Moreno B, Alvarez R (2016) Analyzing consumer attitudes towards electric vehicle purchasing intentions in Spain: technological limitations and vehicle confidence. Technol Forecast Soc 109:6–14

Kim MK, Oh J, Park JH, Joo C (2018) Perceived value and adoption intention for electric vehicles in Korea: moderating effects of environmental traits and government supports. Energy 159:799–809

Lieven T (2015) Policy measures to promote electric mobility—a global perspective. Transp Res A Policy 82:78–93

Liu QL, Li XC, Hassall M (2015) Evolutionary game analysis and stability control scenarios of coal mine safety inspection system in China based on system dynamics. Saf Sci 80:13–22

Liu C, Huang W, Yang C (2017) The evolutionary dynamics of China’s electric vehicle industry—taxes vs subsidies. Comput Ind Eng 113:103–122

Mahmoudi R, Rasti-Barzoki M (2018) Sustainable supply chains under government intervention with a real-world case study: an evolutionary game theoretic approach. Comput Ind Eng 116:130–143

Ministry of Finance of the People’s Republic of China (2018) Notice on the adjustment and improvement of the subsidy policy for the promotion of new energy vehicles. http://jjs.mof.gov.cn/zhengwuxinxi/zhengcefagui/201802/t20180213_2815574.html. Accessed 10 May 2018

MOST (Ministry of Science and Technology of the People’s Republic of China) (2016) Notice on revising and publishing the measures for the identification of high-tech enterprises. http://most.gov.cn/tztg/201602/t20160204_123994.html. Accessed 15 Jan 2019

Noori M, Tatari O (2016) Development of an agent-based model for regional market penetration projections of electric vehicles in the United States. Energy 96:215–230

Oltra V, Jean MS (2009) Sectoral systems of environmental innovation: an application to the French automotive industry. Technol Forecast Soc 76(4):567–583

Plötz P, Schneider U, Globisch J, Dütschke E (2014) Who will buy electric vehicles? Identifying early adopters in Germany. Transp Res A Policy 67:96–109

Rezvani Z, Jansson J, Bodin J (2015) Advances in consumer electric vehicle adoption research: a review and research agenda. Transp Res D Transp Environ 34:122–136

Safarzyńska K, van den Bergh JC (2018) A higher rebound effect under bounded rationality: interactions between car mobility and electricity generation. Energy Econ 74:179–196

Sheu JB, Chen YMJ (2012) Impact of government financial intervention on competition among green supply chains. Int J Prod Econ 138(1):201–213

Smith JM, Price GR (1973) The logic of animal conflict. Nature 246(11):5

Tan QL, Wang MN, Deng YM, Yang HP, Rao R, Zhang XP (2014) The cultivation of electric vehicles market in China: dilemma and solution. Sustainability 6(8):5493–5511

Teixeira ACR, da Silva DL, Neto LDVBM, Diniz ASAC, Sodré JR (2015) A review on electric vehicles and their interaction with smart grids: the case of Brazil. Clean Technol Environ Policy 17(4):841–857

Teng J, Xu C, Wang W, Wu X (2018) A system dynamics-based decision-making tool and strategy optimization simulation of green building development in China. Clean Technol Environ Policy 20(6):1259–1270

Tian YH, Govindan K, Zhu QH (2014) A system dynamics model based on evolutionary game theory for green supply chain management diffusion among Chinese manufacturers. J Clean Prod 80:96–105

Wang N, Pan H, Zheng W (2017) Assessment of the incentives on electric vehicle promotion in China. Transp Res A Policy 101:177–189

Wang Y, Huscroft JR, Hazen BT, Zhang M (2018) Green information, green certification and consumer perceptions of remanufactured automobile parts. Resour Conserv Recycl 128:187–196

Weinstein MI (1986) Lyapunov stability of ground-states of nonlinear dispersive evolution-equations. Commun Pur Appl Math 39(1):51–67

Xu L, Su J (2016) From government to market and from producer to consumer: transition of policy mix towards clean mobility in China. Energy Policy 96:328–340

Yang DY, Xiao TJ (2017) Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J Clean Prod 149:1174–1187

Yang J, Dong J, Hu L (2018) Design government incentive schemes for promoting electric taxis in China. Energy Policy 115:1–11

Zhang X (2014) Reference-dependent electric vehicle production strategy considering subsidies and consumer trade-offs. Energy Policy 67:422–430

Zhang X, Bai X (2017) Incentive policies from 2006 to 2016 and new energy vehicle adoption in 2010–2020 in China. Renew Sustain Energy Rev 70:24–43

Zhang Y, Han Q (2017) Development of electric vehicles for China’s power generation portfolio: a regional economic and environmental analysis. J Clean Prod 162:71–85

Zhao R, Neighbour G, Han J, McGuire M, Deutz P (2012) Using game theory to describe strategy selection for environmental risk and carbon emissions reduction in the green supply chain. J Loss Prev Process 25(6):927–936

Zhao R, Neighbour G, McGuire M, Deutz P (2013) A software based simulation for cleaner production: a game between manufacturers and government. J Loss Prev Process 26(1):59–67

Zhao R, Peng DP, Li Y (2015) An interaction between government and manufacturer in implementation of cleaner production: a multi-stage game theoretical analysis. Int J Environ Res 9(3):1069–1078

Zhao R, Zhou X, Han JJ, Liu CL (2016) For the sustainable performance of the carbon reduction labeling policies under an evolutionary game simulation. Technol Forecast Soc 112:262–274

Zhao R, Han JJ, Zhong SZ, Huang Y (2018) Interaction between enterprises and consumers in a market of carbon-labeled products: a game theoretical analysis. Environ Sci Pollut Res 25:1394–1404

Zheng X, Lin H, Liu Z, Li D, Llopis-Albert C, Zeng S (2018) Manufacturing decisions and government subsidies for electric vehicles in China: a maximal social welfare perspective. Sustainability 10(3):672

Zhou KZ, Brown JR, Dev CS (2009) Market orientation, competitive advantage, and performance: a demand-based perspective. J Bus Res 62(11):1063–1070

Acknowledgements

This study is sponsored by National Natural Science Foundation of China (No. 41571520), Sichuan Provincial Key Technology Support (No. 2019JDJQ0020), Sichuan Province Circular Economy Research Center Fund (No. XHJJ-1802), the Fundamental Research Funds for the Central Universities (No. 2682014RC04), Guangxi Key Laboratory of Spatial Information and Geomatics (No. 17-259-16-11).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Evolutionary equilibrium stability analysis

-

(1)

Scenario 1

The stability analysis is to verify the SD simulation. By substituting the original values (Table 3) in Eq. (13), the replicated dynamic equations under the static policies are obtained as follows:

Let X = [F(x) F(y)] = 0; the equilibrium points of the game are:

The stability of equilibrium strategy is derived from the Jacobian matrix. Any equilibrium point that satisfies detJ > 0 and trJ < 0 is considered as asymptotically stable, which is deemed as an evolutionary stable strategy (Weinstein 1986). The Jacobian matrix J is given as follows:

The stability of the five strategic pairs derived from the Scenario 1 is given in Table 4. There are four unstable equilibrium points and one center point, indicating that no evolutionary stable strategy(ESS) exists.

Figure 8 shows the evolutionary game process under the implementation of the static policy incentives. Such process shows a periodic circle, indicating that enterprises and consumers may be easily impacted by the policies to adjust their strategies. This phenomenon has verified the SD simulation results of the Scenario 1.

-

(2)

Scenario 2

The simulation results of the Scenario 2 indicate that the dynamic incentive policies have better performance than that of the static ones. The replicated dynamic equations and the corresponding Jacobian matrix under the dynamic incentive policies are obtained as follows:

-

i.

The dynamic subsidy to enterprises

The replicated dynamic equation set is obtained by substituting \(W_{\text{e}}^{\prime }\) for \(W_{\text{e}}\) in Eq. (13).

Consequently, the equilibrium are obtained as follows:

Similarly, the corresponding Jacobian matrix J is:

where \(A = C_{g} + C_{n} + \varPi_{\text{e}}^{g} + \varPi_{\text{e}}^{c} + W_{\text{e}}^{\prime } + T_{\text{e}}\); B = \(\varPi_{\text{e}}^{c} + C_{g}\); C = \(W_{\text{e}}\); \(D = U_{\text{c}}^{g} + W_{\text{c}} + U_{\text{c}}^{n} - R_{n} - R_{g}\); E = \(R_{n} - U_{\text{c}}^{n}\).

-

ii.

The dynamic subsidy to consumers

The replicated dynamic equation set is obtained by substituting \(W_{\text{c}}^{\prime }\) for \(W_{\text{c}}\) in Eq. (13).

Consequently, the equilibrium are obtained as follows:

Similarly, the corresponding Jacobian matrix J is:

where \(A^{c} = C_{g} + C_{n} + \varPi_{\text{e}}^{g} + \varPi_{\text{e}}^{c} + W_{\text{e}} + T_{\text{e}}\); \(B^{c} = \varPi_{\text{e}}^{c} + C_{g}\); \(C^{c} = W_{\text{c}}\); \(D^{c} = U_{\text{c}}^{g} + W_{\text{c}}^{\prime } + U_{\text{c}}^{n} - R_{n} - R_{g}\); \(E^{c} = R_{n} - U_{\text{c}}^{n}\).

-

iii.

The dynamic preferential tax on enterprises

The replicated dynamic equation set is obtained by substituting \(T_{\text{e}}^{\prime }\) for \(T_{\text{e}}\) in Eq. (13).

Consequently, the equilibrium are obtained as follows:

Similarly, the corresponding Jacobian matrix J is:

where \(A^{\text{T}} = C_{g} + C_{n} + \varPi_{\text{e}}^{g} + \varPi_{\text{e}}^{c} + W_{\text{e}} + T_{\text{e}}^{\prime }\); \(B^{\text{T}} = \varPi_{\text{e}}^{c} + C_{g}\); \(C^{\text{T}} = T_{\text{e}}\); \(D^{\text{T}} = U_{\text{c}}^{g} + W_{\text{c}} + U_{\text{c}}^{n} - R_{n} - R_{g}\); \(E^{\text{T}} = R_{n} - U_{\text{c}}^{n}\).

-

iv.

The combination of dynamic policy incentives

The replicated dynamic equation set is obtained by substituting \(W_{\text{e}}^{\prime }\), \(W_{\text{c}}^{\prime }\) and \(T_{\text{e}}^{\prime }\) for \(W_{\text{e}}\), \(W_{\text{c}}\) and \(T_{\text{e}}\) in Eq. (13), respectively.

Consequently, the equilibrium are obtained as follows:

Similarly, the corresponding Jacobian matrix J is:

where \(A^{\theta } = C_{g} + C_{n} + \varPi_{\text{e}}^{g} + \varPi_{\text{e}}^{c} + W_{\text{e}}^{\prime } + T_{\text{e}}^{\prime }\); \(B^{\theta } = \varPi_{\text{e}}^{c} + C_{g}\); \(C^{\theta } = W_{\text{e}} + T_{\text{e}}\); \(D^{\theta } = U_{\text{c}}^{g} + W_{\text{c}}^{\prime } + U_{\text{c}}^{n} - R_{n} - R_{g}\); \(E^{\theta } = R_{n} - U_{\text{c}}^{n}\); \(F^{\theta } = W_{\text{c}}\).

The stability of the five strategic pairs under the different dynamic incentive policies is given in Table 5. There is an ESS existed (x, y), which verifies the simulation results of the Scenario 2. Figure 9 shows evolutionary process of the game under the different dynamic incentive policies. As the rounds of the game increase, the trend of the curves gradually reaches an equilibrium point, which indicates that the game has asymptotic stability under the dynamic incentive policies.

Rights and permissions

About this article

Cite this article

Zhou, X., Zhao, R., Cheng, L. et al. Impact of policy incentives on electric vehicles development: a system dynamics-based evolutionary game theoretical analysis. Clean Techn Environ Policy 21, 1039–1053 (2019). https://doi.org/10.1007/s10098-019-01691-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-019-01691-3