Abstract

This paper provides empirical evidence regarding the effect of energy based taxes on economic growth. The analysis is based on a panel dataset of 31 OECD (Organisation for Economic Co-operation and Development) member countries from 1994 to 2013, using multiple imputation algorithm to address missingness pattern. Employing the instrumental variables with two-stage least squares instrumental variable estimator, we found that energy based taxes have a negative effect on economic growth rate. This effect may rely significantly on the level of the economy’s dependence on polluting energy use as a share of total energy used in the production process. In addition, our study shows that an increase in energy based taxes can enhance significantly the economic growth rate, as the initial level of country’s richness increases.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

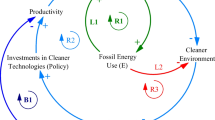

How environmental taxation affects economic growth is a central and controversial issue in environmental economics. Although the literature is quite abundant on the subject, it is worth noting that most contributions are theoretical and do not lead to a consensus on the effects of environmental taxes on economic growth. Endogenous growth models have been used to analyze the effects of environmental taxes on growth rate.Footnote 1 An environmental tax can potentially operate through different mechanisms such as investment, education and R&D. Overall, to generate a positive growth effect, many studies incorporate environmental quality into the firm’s production function, as an externality, by assuming that a clean environment would improve the productivity of inputs or the efficiency of the educational system (Ligthart and van der Ploeg 1994; Bovenberg and Smulders 1995; Bovenberg and Heijdra 1998; Grimaud 1999; Hart 2004; Nakada 2004; Chen et al. 2009; Pautrel 2008; Aloi and Tournemaine 2011). By developing an endogenous growth model, in which pollution affects human capital depreciation and worker’s productivity, Gradus and Smulders (1993), Smulders and Gradus (1996), Van Ewijk and Van Wijnbergen (1994) and Pautrel (2008) show that a tax on emissions, via its effect on learning abilities, promotes long-run growth. Using a similar framework, Oueslati (2002) also highlights that labor–leisure choice plays a role in the transmission of the environmental tax effect in a two-sector model of endogenous growth. In more recent studies, Nong (2018) assesses the effects of energy taxes on the Vietnamese economy using a computable general equilibrium model. He shows that if the taxes on petroleum products and coal are increased jointly, a real GDP, exports and imports will decline at relatively high rates. The country will also experience relatively high inflation rates. In the same context, Lin and Jia (2018) study the impact of carbon tax on the Chinese economy by constructing the same model. However, they find that China can impose a high tax rate on energy industries and energy-intensive industries without significantly harming economic growth. They confirm that this policy will maximize emissions reductions and only have a small impact on China’s GDP. On the other side, and in the light of the wave of environmental tax reforms that started in the early 1990s in a number of OECD countries, the majority of theoretical researches assume that these reforms will generate a positive impact on environmental tax on economic growth (see Goulder 1995; Bovenberg and De Mooij 1997; Fullerton and Metcalf 1997; Bosquet 2000; Markandya 2005; Freire-González and Puig-Ventosa 2019). The basic idea is that a switch from different taxes to taxes on polluting goods can achieve a ‘double dividend’: (1) an improvement in the environment and (2) an economic benefit. They assume that the revenues generated from environmental taxes could be used to cut distorting taxes on labor and capital and thus reduce the excess burden of the tax system, with positive consequences for employment and investment and thus for economic growth.

The empirical examination of the nature of the relationship between environmental tax and economic growth is an important issue for OECD countries, as it shows whether the use of tax as an instrument for environmental policy has any correlation and whether it will have a positive or negative correlation with economic growth. Despite the existence of numerous papers that focus on the use of theoretical models to examine the effects of environmental taxes on economic growth, there is a surprising lack of empirical work exploring these effects. According to our knowledge, only three econometric studies investigate the impact of environmental taxation on economic growth. They are presented in Appendix (A) with conflicting findings. While Morley (2010) finds that total environmental taxation is negatively associated with growth, Dökmen (2012) observes a positive relationship between those variables. On the other hand, Abdullah and Morley (2014) uses Granger causality tests to study the causal relationship between environmental taxes and economic growth. The results are shown in Appendix (A).

The lack of structured data on environmental taxation may explain the scarcity of empirical studies on the subject. The data provided by the OECD contains only statistics about the revenue generated from environmentally related taxes but not about their rates. These revenues are measured in four units: millions of USD, a share of total tax revenues, per capita, and percent of GDP. However, these methods of measurement consider the revenue from taxes without taking into account the variations in the tax base. This may weaken the role that environmental taxation can play in the economy and does not reflect its real impact on the economic variables. This study proposes an alternative approach taking into account not only the revenue generated but also the variations in the tax base. Environmentally related taxes include seven categories: energy; motor vehicles and transport; ozone-depleting substances; water and wastewater; waste management; mining and quarrying, and other environmentally related taxes. This implies that environmentally related taxes are imposed on different tax bases. Therefore, it is difficult to construct a common base for these factors. For this reason and to apply our new approach, we focus our analysis on the most important category among them: energy taxes (see Sect. 2). The total final consumption of polluting energy productsFootnote 2 is considered as a base of these taxes. Therefore, the proxy that we construct to measure energy taxes is calculated as follows: energy tax revenues measured in million American dollars divided by the total final consumption of polluting energy products measured in ton of oil equivalent. This proxy is then used to achieve two objectives: First, examining the nature of the relationship between energy taxes and economic growth rate in the short term. The second objective is to test whether the effect of energy taxes on the economic growth rate is sensitive to the level of other variables, such as the initial level of a country’s richness, polluting energy use (as internal factors in the economy) and commercial openness of goods (as external factor in the economy).

The novelty in this work lies in three aspects. First, we propose a new approach to measure energy taxes. Second, we provide the first empirical evidence on the sensibility of the effects of energy taxes on the economic growth rate for the level of other variables in the economy. Third, the analysis is based on a balanced dataset for a large sample of OECD countries, where the multiple imputation method was used to complete the missing data. This method has improved data quality and inferences validity.

The rest of the paper is organized as follows. Section 2 lays out the motivation for this study by providing an overview of trends in energy taxes revenues, total final consumption of polluting energy products, and GDP per capita growth rate in OECD countries over the last two decades. Section 3 presents the empirical model. Section 4 describes the data used. In Sect. 5, we discuss the empirical results. The last section concludes the paper by summarizing the main findings.

2 Trends in OECD countries

Data on energy tax revenues are taken from the OECD Database on “Instruments used for Environmental Policy and Natural Resources Management”. Energy taxes can be broadly defined as compulsory, unrequited payments to general government levied on energy products (OECD 2010). Compared to other tax revenues, the revenues raised by energy taxes are the most important over the period (1994–2013) (see Fig. 1).

Figure 2 shows the evolution of the OECD average of energy tax revenues measured in billions United States Dollars (USD), the share of total final consumption of polluting energy products in total final consumption of energy (in %) (TFCPEP_sh) and GDP per capita growth rate over the period of study (1994–2013)Footnote 3. On average, the energy tax revenues show a slow rising trend over the period 1994–1996, and then it continues without showing great changes over the period 1997–2001. In 2002, energy tax revenues are starting to take an upward trend until 2008. It increased from 8.2 billion in 2001 to 14.11 billion in 2008. After that, it decreased to 13.4 billion in 2009. Then it restarts an increasing trend between 2010 and 2013. In general, revenues of energy taxes measured in billions USD had an increasing trend from 2002 (8.2 billion) until the end of period study (15.22 billion). This trend was accompanied by a reduction in (TFCPEP_sh) which decreased from 75.17% in 2003 to 70.17% in 2012, while it maintained almost the same level over the period 1994–2002. This implies that there was an expansion in the types of energy taxes imposed or an increasing in their rates over the period 2002–2012.

The average GDP per capita growth rate shows many fluctuations during the period of study with a rising trend appearing from 1994 to 2000 and reaching 4.18% in 2000, from which it declined from 2001 to 2003 and stabilized at 1.8% in 2003. After that, we can see an increase to 3.57% percent in 2007, falling sharply in 2008 to stabilize at—4.57% in 2009, to due to the latest world financial crisis in the USA. In 2010 it recovered, but once again decreased to—0.17% in 2012. In 2013 it increased to 0.38.

3 The empirical model

To explore the link between economic growth and energy based taxes, the equation of GDP per capita growth rate, \(g\), is assumed to take the following form:

where ET represents a proxy of energy taxes, \(\varsigma\) are the conditioning variablesFootnote 4; \(H\) represents the stock of human capital; \(\Delta H\) denotes the changes in human capital stock; \(X\) refers to fiscal variables; \(\varOmega\) is a vector of other macroeconomic control variables. With this equation, we consider variables that are considered to have a significant effect on economic growth rate, according to the empirical growth literature. Consequently, the baseline specification of the growth model is described in Eq. (1).

The subscript i indicates country i; subscripts t indicate year; \({\text{gr}}_{\text{it}}\) is the annual percentage growth rate of gross domestic product (GDP) per capita in country i and year t; \({\text{ET}}_{\text{it}}\) refers to the proxy of energy taxes. It is defined as the total revenues from energy taxes divided by the total final consumption of coal and coal products, oil products, natural gas and polluting electricity. It measures tax revenue from energy taxes per unit of fossil fuel energy use, in US $ per ton of oil equivalent. This variable is expected to have a negative relationship with growth rate in the short term. The other explanatory variables (\(W_{\text{it}} )\) are as follows: \(\ln y_{i0}\) denotes the natural logarithm of GDP per capita for each country in the year 1994, the coefficient of this variable representing the rate of convergence. Due to the conditional convergence effect, lnyi0 is expected to have a negative relationship with growth. In the standard growth models, Barro and Sala-i-Martin (2004) relate the growth rate of real per capita GDP to the initial level of real GDP per capita, predicting ‘conditional convergence’ of income (output) per capita. This means, a country with a low level of initial income per capita relative to its own long-run (or steady-state) will grow faster than a country that is already closer to its long-run potential level of output per capita. Therefore, poor countries should have a higher return to capital (physical and human) and a faster growth, in transition to the steady-state, than rich countries. \(k_{\text{it}}\) represents gross fixed capital formation as a percent of GDP (investment ratio) with an expected positive coefficient. \({\text{TLF}}_{\text{it}}\) is the total labor force growth rate. \(y_{i0}\), \(k_{\text{it}}\) and \({\text{TLF}}_{\text{it}}\) are called the conditioning variables of economic growth.

\(\ln H_{t - 1}\) is the natural logarithm of the initial level of human capital. The human-skill index is used as a proxy of human capital. \(\Delta H\) denotes the change in human capital from year \(t - 1\) to year \(t\). Whereas the stock of human capital affects productivity growth, changes in human capital reflect an adjustment in the level of a productive input (e.g. educated labor) (Baldacci et al. 2008). Romer (1986, 1990) argues that the stock of human capital drives growth mainly via innovation, whereas Lucas (1988) emphasizes that changes in human capital boost growth and Lucas confirms in 1993 that the accumulation of human capital plays the role of “the main engine of growth” (Lucas 1993). On the other hand, Baldacci et al. (2008) empirical study found that the initial stock and changes in education capital have a positive effect on economic growth. Therefore, we include two human capital variables: the natural logarithm of the initial level of human capital and the annual change of human capital.

The following variables are fiscal policy variables that affect growth rate:

The variable \(\exp_{\text{it}}\) is a productive expenditure, defined as the sum of general governmentFootnote 5 spending on education, health, housing, public order and safety, and defense as a percentage of GDP.

The variable \({\text{tax}}_{\text{it}}\) is the distortionary taxation.Footnote 6 It represents the sum of the taxes on income, profits and capital gains; payroll and workforce; as well as social security contributions. All of these are measured relative to GDP. This value is expected to be negatively related to the economic growth rate.

The classification of other revenues, which consist of taxation on international trade, non-tax revenues and other tax revenues, may contain environmental tax revenues. In this case, if our model includes other revenues and at the same time the environmental taxes are treated as separate variables, this will lead to a linear correlation between them. For this reason, the other revenues are not included in the specification.

The variable \({\text{balance}}_{\text{it}}\) represents the fiscal balance (surplus/deficit).

From the existing literature especially macroeconomic theory, the following variables constitute macro control variables:

\({\text{INF}}_{\text{it}}\) which is the inflation rate which proxies macroeconomic stability and is expected to be negatively related to economic growth rate.

\({\text{OPENG}}_{\text{it}}\) denotes trade openness of goods,Footnote 7 which measures the extent to which a country is integrated with the rest of the world. In general, trade liberalization promotes economic performance and it is expected to have a positive correlation with the economic growth rate. \(\lambda_{\text{t}}\) is a vector of aggregate time effects (time dummies for years); \(\eta_{\text{i}}\) is the unobserved effects (heterogeneity) and \(\varepsilon_{\text{it}}\) indicates an error term.

To test whether the effect of energy taxes on growth rate depends on the levels of polluting energy use, a country’s richness, and commercial openness of goods; we estimate a second regression equation with a similar specification to model (1) but one that additionally includes interaction terms between energy taxes and each of the total final consumption of polluting energy products as a share of total energy use, natural logarithm of initial value of GDP per capita, and trade openness of goods, respectively. This second model is described by Eq. (2) below.

To estimate the parameters of Eqs. (1) and (2), the fixed effect estimator was employed. Baltagi (2008) shows that when a study focuses on a specific set of N countries, the fixed effects specification is more appropriate than random effects. As this study focuses exclusively on a sample of OECD countries, we chose to treat individual effects as fixed.

In addition, the instrumental variables with two-stage least squares IV (2SLS) approach developed by Lewbel (2012) was used to handle with endogeneity problem. To verify the validity of the instrumental variables, we implemented three tests: (1) a statistical test proposed by Roodman and Morduch (2014); (2) a weak identification test and (3) a Hansen’s J statistic which is a test of over-identifying restrictions. The results of these tests confirm that all generated and external instruments are valid. Appendix (G), which is a supplementary material, presents details about endogeneity treatment in this model. As the IV (2SLS) approach can treat endogeneity problems using instrumental variables, the estimated coefficients could be used to capture the causal effect of energy taxes on economic growth rate. Heckman (2008) shows that the models that use particular methods of estimation (e.g., matching or instrumental variable estimation) are associated with a “causal inference”.

4 Data

This study is based on panel data sets covering 31 OECD countriesFootnote 8 over the period 1994–2013 to examine the nature of the relationship between energy based taxes and economic growth.Footnote 9 The choice of the period is governed by the availability of data on environmental tax revenues that are newly introduced in most OECD countries, and about explanatory variables.Footnote 10

We use annual data obtained from five main sources: (a) World Development Indicators (WDI) published by the World Bank; (b) the Organization for Economic Co-operation and Development (OECD); (c) Government Finance Statistics (GFS) published by the International Monetary Fund (IMF); and (d) International Energy Agency (IEA). Data on Human capital stock are performed by the Laboratory of Applied Economics in Development (LAED) from the University of Toulon (France). The data source for each variable is listed in Appendix (B). The description and justification for selecting variables are as follows:

-

The dependent variable

The GDP per capita growth rate used in this study is defined as the annual percentage growth rate of GDP per capita based on purchasing power parity (PPP) at constant 2005 U.S. dollars. This definition is preferred because it enables international comparison. In this paper, we use the growth rate instead of the level of GDP for two reasons. First, the endogenous growth models, that have developed to study the impact of environmental taxation on economic growth, have investigated the impact of these taxes on economic growth rate. Second, one of the main objectives of this paper is to explore whether the effect of energy tax on economic growth is sensitive to the initial level of a country’s richness which is measured by the initial level of real GDP per capita. In the standard growth models of Barro and Sala-i-Martin (2004), the initial level of real GDP per capita is predicted to affect the economic growth rate.

The explanatory variables are divided as follows:

-

Energy taxes proxy

As we mentioned earlier, in this paper we propose a new approach to measure energy taxes. This approach takes into account not only the revenue generated but also the variation in the tax base. In line with OECD (2006) the energy taxes are levied on petrol and diesel for transport purposes and on fossil fuels and electricity for stationary purposes. Therefore, to account for the variation in the use of energy products that are harmful to the environment, the total final consumption of energy products that pollute the environment through carbon emissions is considered as a proxy of energy taxes’ base. The energy products include coal and coal products, oil products, natural gas and electricity. Electricity is different from other energy products as it is a secondary energy generated through a primary energy, which can be polluting (e.g. coal, oil, natural gas) or clean (e.g. hydro, nuclear, solar, tides, wind…etc.). To ensure that only the electricity generated by a polluting fuel was included, the total final consumption of electricity was multiplied by the rate of total final consumption of electricity generated from oil, gas and coal sources (% of total electricity generated) for a given year. Thus, the electricity category used in the energy taxes’ base shows the energy content or pollutant emissions, of underling primary fuel used to generate electricity, rather than electricity itself. We call it “polluting electricity”. We then computed the energy tax revenue per unit of total final consumption of polluting energy products, expressed in USD per ton of oil equivalent. It was considered as a proxy of energy taxes. The elements of this proxy are presented in Appendix (B).

-

Interaction terms

As previously mentioned, the purposes of this study are to examine the nature of the relationship between energy tax and economic growth rate, and to explore whether this relationship is sensitive to the level of other variables in the economy. As energy is an essential input of the production process, especially in the industrial sector, and as energy taxes are oriented toward polluting energy, we expect that economies that are more heavily dependent on polluting energy for production than clean energy, to be more sensitive to energy taxes. To control this effect, the proxy of energy taxes is interacted with the proxy of the dependency of production on energy use targeted by energy taxes. The later proxy is measured by the total final consumption share of coal and coal products, oil products, natural gas and polluting electricity in the total final consumption of energy. Coal and coal products, oil products, natural gas and polluting electricity are considered as polluting energy products.

The effect of energy taxes on growth may depend also on the initial level of a country’s richness for two reasons. On the one hand, according to the notion of ‘conditional convergence’, a country with a low initial income per capita, relative to its own long-run income per capita, is expected to grow faster than a country that is already close to its long-run potential level of output per capita (Barro and Sala-i-Martin 2004). This growth in poor countries usually depends on accumulating physical capital more than human capital, whereas the situation is the opposite in rich countries.Footnote 11 As physical capital accumulation requires an investment in machinery and infrastructure, the level of polluting energy use in production processes is expected to be greater in the first type of country compared with the second. Since we expect that economies heavily depend on polluting energy use in their production to be more sensitive to energy taxes, the impact of energy taxes on growth is expected to be more sensitive in poor countries than riche ones. On the other hand, the efficiency and improvement in energy use usually require investments in high technology, R&D and renewable energy. Richer countries have a greater ability to realize these investments than poorer ones. For these two reasons, the energy taxes impact on economic growth would be expected to depend on the initial level of a country’s richness. For controlling this effect, the proxy of energy taxes has interacted with the natural logarithm of the initial value of the GDP per capita in each country in the year 1994.

Due to an increased environmental tax, the relative prices of final consumption goods and production inputs increase with the increasing of prices of electricity, fuel, and in fact all inputs whose price strongly depends on transportation costs (see also Fullerton and Heutel 2007; Martinez Vázquez et al. 2012). This will increase the costs of produced goods, especially in the short term. Therefore, the domestic firms’ export competitiveness in international markets decreases, leading to reduction in their export and thus in the economic growth. On the other side, trade liberalization gives rise to severe competition with foreign firms in the domestic market through importation (Ulph 2007). In this case, a small cost increase caused by energy taxes may lead to big losses of domestic firms’ profit and thereby weakening economic growth. Consequently, we suppose that the economic growth impacts of energy taxes may depend on the degree of a country’s trade openness toward goods. To test this proposition, an interaction term between energy taxes and the index of openness to international goods’ trade has been used in this study. The calculations of the variables TFCPEP, lny0 and OPENG are presented in Appendix (B).

-

Conditioning variables

The conditioning variables are the natural logarithm of initial value of GDP per capita in each country in the year 1994; gross fixed capital formation as a percent of GDP (investment ratio) and total labor force growth rate.

-

Human capital

Two human capital variables were included in the model: the natural logarithm of initial level of human capital and annual change in human capital. The human-skill index, published by LAED is used to measure human capital. Literacy rate, enrolment in tertiary education, and mean years of schooling of adults were used to construct this index. The available data of this index is annual, which allows us to include the annual change of human capital in the model.

-

Fiscal variables

With respect to non-environmental fiscal policy, we have three variables: productive expenditure, distortionary taxation, and fiscal balance. The elements of general government spending included in the first variable are considered as productive expenditure following the criteria that are used by Kneller et al. (1999), Adam and Bevan (2005), Teles and Mussolini (2014) and Alcántar-Toledo and Venieris (2014) who classify this expenditure as productive, because it is used to form physical and human capital. A “residual” expenditure category consisting of social protection, economic services, recreation, and culture as well as “unclassified” spending, are not included in the specification because these categories of spending are considered growth neutral (Barro 1990; Kneller et al. 1999; Teles and Mussolini 2014). The data of productive expenditure is cited mainly from OECD statistics and completed from the Government Finance Statistics (GFS).

The distortionary taxation is defined as the sum of the taxes on three specific measures: income, profit and capital gains; payroll and workforce; as well as social security contributions. These variables are used because they are the main distortionary forms of taxation. In most of the countries that have implemented environmental tax reform, the increase in environmental tax revenues has been used to reduce one or more of these three distorted taxes, hence any rise in environmental taxes should facilitate a reduction in these taxes, according to the ‘double dividend’ approach. The presence of distortionary taxes in the model is very important when we study the effect of energy taxes on the economy because this reflects the level of pre-existing tax distortions (Bovenberg and De Mooij 1994; Metcalf 2003). The non-distortionary taxation (tax on domestic goods and services) was not used in this model, because it is also assumed to have negligible growth effects according to Barro (1990) and Kneller et al. (1999).

The fiscal balance “also referred to net lending (+) or net borrowing (−) of general government, calculated as total general government revenues minus total general government expenditure. Revenues encompass social contributions, taxes other than social contributions, and grants and other revenues. Expenditure comprises intermediate consumption, compensation of employees, subsidies, social benefits, other current expenditure (including interest spending), capital transfers and other capital expenditure” (OECD 2013).

-

Macroeconomic control variables

We also select other determinants of GDP per capita growth rate which are often found in the literature, especially in macroeconomic theory. These are inflation rate and trade openness of goods. Appendix (B) includes the definitions of these variables. Many of the studies that explore the effect of fiscal policy on growth consider trade openness (Afonso and Alegre 2010; Checherita-Westphal and Rother 2012) and inflation (Lundberg and Squire 2003) as additional controls to fiscal variables.

After identifying the variables used in this study and collecting their data, we used a multiple imputation procedure to treat missing data. Appendices (C, D) provide the details about this procedure. Table 1 shows the descriptive statistics of the variables before and after multiple imputation process.

To check the robustness of the model used in this study, first, using the QIC program, we verified whether certain or all the four categories of control explanatory variables should be included in the CRE model. Appendix (E) shows this program. Second, in Appendix (F), we employed the Variance Inflation Factor (VIF) test to verify the absence of multicollinearity. Appendices (C, D, E, F and G) present supplementary material. We found that all the four categories of control explanatory variables should be included in the CRE model and there is absence of multicollinearity.

5 Results and discussion

The results from estimating Eqs. (1) and (2), before and after multiple imputations, are presented in column (1) and (2), respectively, in Table 2. First, we focus our discussion on the estimations results that we have obtained from the regressions after implementing multiple imputations process, then we compare these results with those obtained from the regressions estimations before the multiple imputations process.

At the beginning, the estimation results report information about the fitted multiple imputation model. The number of Largest FMI (Fraction of Missing Information), displayed in the last row of the Table 2, can be used to give us an idea of whether the specified number of imputations is sufficient for the analysis. The rule is that “\(M \ge 100 \times {\text{FMI}}\) provides an adequate level of reproducibility of MI analysis” (StataCorp 2013: 48). In our study, the largest FMI is 0.22; 0.21 for Eqs. (1) and (2), respectively, and the number of imputations, 100, exceeds the required number of imputations: \(22 ( = 100 \times 0.22)\); \(21 = (100 \times 0.21)\). Therefore \(M = 100\) is sufficient for the analysis.

Now we return to explain the results associated with analysis models. The results in column (1), after MI, indicate that energy taxes are negatively associated with economic growth rate in the short term. A 1 US $ increase per ton of oil equivalent of fossil fuel energy use is associated with a 0.006 percentage point decrease in growth rate over the year. Moreover, when energy taxes interact with TFCPEP_sh, lny0 and OPENG in column (2), After MI, the coefficient of energy taxes increases from 0.005 to 0.051. This means that the magnitude of the correlation between economic growth rate and energy taxes is sensitive to the interaction of energy taxes with other variables in the economy.

The results of the model with the interaction terms, reported in column (2), After MI, also show that an increase in energy taxes leads to lower economic growth as the share of total final consumption of polluting energy products in the energy mix increases. This result suggests that the use of energy taxes in economies, which depend more heavily on polluting energy for production processes than cleaner energies, harms the economic growth rate. We can conclude from this result that the switch to clean energies and improving the efficiency of polluting energy use could have a positive impact on growth rate in countries that receive high revenue from energy taxes per ton of oil equivalent. The trend towards clean energy production and investing in new technology to increase the efficiency of polluting energy use may help reduce the proportion of polluting energy consumption in the overall energy mix of the economy and thus reduce the negative impact of energy taxes on economic growth. We also find that the interaction of energy taxes with the natural logarithm of initial GDP per capita was positive and significant, indicating that an increase in energy taxes leads to an increase in the economic growth rate as the initial level of a country’s richness rises. This result allows us to say that the more the initial level of country’s richness is higher, the more its ability to impose energy taxes and to bear its burdens increases. The last term of interaction between energy taxes and trade openness of goods appears to be slightly negatively associated with growth rate but without statistical significance. The control variables are consistent with the findings of previous empirical studies. To know which equation we should use to interpret the findings of control variables, we ran QIC program for Eqs. (1) and (2), and as we mentioned in Appendix (E), the best fitting model is the one that has the smallest value of the average of QIC. Table 3 reports the descriptive statistics of QIC values.

The best equation to interpret the results in Eq. (2) which has the least value of the mean of QIC (266301.8). Thereby, column (2), After MI, in Table 2 is used to explain the effects of selected control variables on growth rate.

The total final consumption share of polluting energy products in the total final consumption of energy has a positive association with the economic growth rate. The openness to international trade of goods is also appeared to be positively correlated with the economic growth rate. This result is consistent with the finding of Checherita-Westphal and Rother (2012). In the same context, and as Barro and Sala-i-Martin (2004) predicted, real gross fixed capital formation (%GDP) is positively correlated with the economic growth rate. The level of initial GDP per capita and total labor force growth rate were found to have negative effect on growth rate but were statistically non-significant. The variables that have the largest magnitude of positive and significant influence on growth rate are those of human capital. A 1% increase of the initial level of human capital causes a 7.8% increase in growth rate, whereas a rise of 1% of annual change in human capital results in 25.6% increase in growth rate. These results are consistent with the findings of Baldacci et al. (2008), and with the expectations of Romer (1986, 1990) and Lucas (1988). This can be explained by the dominance of the services sector, which depends mainly on human capita, on the total output of developed countries. We can see this in Appendix (H). Beginning in 1995, the value added in the service sector represents, on average, more than 60% of GDP in our sample of OECD countries.

Concerning financial policy variables, productive expenditure is appeared to be negatively correlated with economic growth rate. This result consistent with the finding of Barro (1990) and with some empirical studies that found that government spending can undermine economic performance due to inefficient use of money (Alesina et al. 2002) and/or due to “resource displacement” (Ramey 2011). When the government spends money, it uses labor and/or capital and those resources no longer are available for private sector uses. The distortionary taxation does not have a significant correlation with economic growth while the fiscal balance is positively associated with it. The tax variable is used as a control variable; therefore, we had not fully commented the magnitude of the coefficient. Interestingly recent researches do not find the same canonical results as Kneller et al. (1999) of a negative impact of (distortionary) taxes on economic growth for OECD countries. A recent paper by Durusu-Ciftci et al. (2018) shows that only consumption tax has a (small) statistically significant negative effect. Arin et al. (2017) find also no effect of distortionary taxes or other expenditures on economic growth using the same database. An explanation proposed by Durusu-Ciftci et al. (2018) is the hysteresis effect of taxation on income “due to various economic, social and political conditions, different taxation policies have evolved in each economy, to which taxpayers have adjusted over time”. Our model doesn’t allow us to take into account this heterogeneous effect. An extension with a more flexible econometric model (quantile regression or finite mixture model) may be worthwhile for future studies. Finally, inflation rate is negatively related to the economic growth rate. This result is in line with Lundberg and Squire (2003).

Now we return to compare our results before and after implementing the multiple imputation process. This will help us to understand the information and features we have obtained through the use of this missing data treatment. To accomplish this objective, we estimated the same models as before using an unbalanced database (data with missing observations). The estimations of Eqs. (1) and (2) are presented in Table 2, (before MI), column (1) and (2), respectively. After comparing the results obtained before and after MI, we note that a negative and significant relationship between energy taxes and growth rate has been captured using imputed database in regression (1) and (2), whereas this relationship was statistically insignificant with an unbalanced dataset. We also found that the interaction term between energy taxes and the share of total final consumption of polluting energy products in the energy mix, presented in Eq. (2), loses its significance when we use the incomplete database. This difference in findings can be explained as follows: when the sample contains missing values, the list-wise deletion—a method used by most statistical packages for handling missing data—removes any row that contains a missing value from the analysis (Honaker et al. 2011). Since statistical power relies partly on a large sample size, list-wise deletion will reduce the statistical power of the tests conducted (Olinsky et al. 2003), which is the reason why the results were insignificant with the reduced database (17.1% reduction in the size of the database). On the other side, when the multiple imputation process was run on our incomplete data, the size of the sample and the statistical power of the test increased, allowing us to observe significant effects. Thus we can say that the imputation improved data quality and contributed to obtaining reliable estimates.

We draw attention to that the long-term effect of energy taxes on economic growth rate was also examined, but we didn’t find a significant impact. It is possible that the available data do not allow a significant long-term effect. That is why short-term analysis is only taken into consideration in this study.

6 Conclusions

In this paper, we have provided empirical evidence of the macroeconomic relationship between energy based taxes and economic growth rate in the short term. We have focused our analysis on this category of environmentally related taxes for two reasons: first, energy taxes constitute the largest proportion in terms of the number of taxes imposed and the revenues achieved; and second, to be able to take into account for not only the revenue generated through taxes but also variations in the tax base. The multiple imputation method with an Expectation Maximization Bootstrapped algorithm was implemented to complete an un-balanced data set of 31 OECD countries over 20 years, improving data quality and inferences validity. The instrumental variables with two-stage least squares IV (2SLS) approach developed by Lewbel (2012) was used to estimate the effects. Empirical results reveal that energy taxes seem to have a negative effect on economic growth rate in the short term and this effect relies significantly on the level of economic dependence on polluting energy use as a share of the mix energy, and insignificantly on commercial openness of goods. On the other hand, this study shows that an increase in energy taxes can significantly enhance economic growth, as the initial level of a country’s richness increases. We believe that these results could be insightful to policymakers, especially after COP21 (the agreement signed in Paris in 2015 concerning climate changes). Governments having introduced energy taxes or planning to increase these taxes to curb emissions, should at the same time work to encourage the shift toward clean energy use and to increase the efficacy of polluting energy use, because this could reduce the negative effect of energy taxes on economic growth. On the other side, this study found that the effect of energy taxes on the economic growth rate is positively sensitive to the initial level of a country’s richness. This means that introducing these taxes in countries having a low level of initial GDP per capita (poor countries) will damage the economic growth rate, while these taxes could promote the economic growth rate when the initial level of GDP per capita is very high (“very” rich countries). Therefore, only “very” rich countries can achieve the two goals, stricter environmental policy and higher economic growth, simultaneously. Consequently, this finding validates the argument made by developing countries during the negotiations of the Paris Agreement (2015). The developing countries consider that using the tax as an instrument of environmental policy may constitute a barrier to the economic growth of which they are just beginning to reap its benefits. In this case, very rich countries can provide financial and technological assistance to developing countries to help them reduce the negative effects of these taxes on their economies. More precisely, the rich countries can provide support in the form of direct funding for research projects provided by industrial enterprises in developing countries to invest in environmentally friendly technology or in clean energy use. The support can also take the form of knowledge and technical consulting to develop human capital and the efficiency of energy use. Finally, this paper showed that the missing data is an important issue and it can change the implications of public policy. Consequently, we propose to use a balanced database for evaluating the effect of energy taxes on economic growth.

Notes

See Ricci (2007) for a comprehensive survey on impacts of environmental policy on growth.

Polluting energy products include coal and coal products, oil products, natural gas and electricity. More details are provided in the Sect. 4.

Our sample includes 31 countries member in the OECD. Chile, Mexico, USA was excluded because they don’t have data for the productive expenditure variable. We explain this in Sect. 4.

Variables used in the Barro-type regression are called the conditioning variables (Kneller et al. 1999).

“General government consists of central government, state government, local government and social security funds” (OECD 2013: 62).

Barro (1990) suggests that the effects of taxes on economic growth depend on whether tax is distortionary or non-distortionary. Distortionary taxes in this context are those which affect the investment decisions of agents and hence distort the steady-state rate of growth. Conversely, non-distortionary taxation does not affect saving/investment decisions and hence has no effect on the rate of growth.

Since energy taxes are expected to affect the production of goods more than services and as we later aim to explore whether growth impacts of energy taxes depend on the level of trade openness of goods and services has been excluded from trade openness index.

Because of completely missingness patterns of data for the productive expenditure variable, Chile, Mexico, USA countries were excluded from our sample.

An econometric analysis of panel data was chosen to study the nature of relation between energy based taxes and growth for two reasons. First, the available data about environmental taxation ranges according to OECD statistics from 1994 to 2013. This series is not long enough for using time-series econometrics. Employing panel data will allow us to cover more observations and thus raise the statistical power and inference of the model. Second, Temple (1999) and Baltagi (2001) argue that panel estimators are the most appropriate choices for growth regression.

OCED statistics provide data of environmental tax revenues for the period 1994–2014. But as the available data on total final consumption of polluting energy products and on capital human are available only until 2013, we decided to restrict our study from 1994 to 2013.

In highly developed countries with a high income, the tertiary sector (services sector) dominates the total output of the economy.

References

Abdullah S, Morley B (2014) Environmental taxes and economic growth: evidence from panel causality tests. Energy Econ 42:27–33. https://doi.org/10.1016/j.eneco.2013.11.013

Adam CS, Bevan DL (2005) Fiscal deficits and growth in developing countries. J Public Econ 89(4):571–597. https://doi.org/10.1016/j.jpubeco.2004.02.006

Afonso A, Alegre JG (2010) Economic growth and budgetary components: a panel assessment for the EU. Empir Econ 41(3):703–723. https://doi.org/10.1007/s00181-010-0400-9

Alcántar-Toledo J, Venieris YP (2014) Fiscal policy, growth, income distribution and sociopolitical instability. Eur J Polit Econ 34(June):315–331. https://doi.org/10.1016/j.ejpoleco.2014.03.002

Alesina A, Ardagna S, Perotti R, Schiantarelli F (2002) Fiscal policy, profits, and investment. Am Econ Rev 92(3):571–589. https://doi.org/10.1257/00028280260136255

Aloi M, Tournemaine F (2011) Growth effects of environmental policy when pollution affects health. Econ Model 28(4):1683–1695. https://doi.org/10.1016/j.econmod.2011.02.035

Arin KP, Elias B, Doppelhofer G (2017) Revisiting the growth effects of fiscal policy: a Bayesian model averaging approach. In: 2017. CAMA working papers. Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University. https://ideas.repec.org/p/een/camaaa/2017-68.html. Accessed 13 June 2019

Baldacci E, Clements B, Gupta S, Cui Q (2008) Social spending, human capital, and growth in developing countries. World Dev 36(8):1317–1341. https://doi.org/10.1016/j.worlddev.2007.08.003

Baltagi B (2001) The econometrics of panel data, 2nd edn. Wiley, New York

Baltagi B (2008) Econometric analysis of panel data. Wiley, New York

Barro RJ (1990) Government spending in a simple model of endogeneous growth. J Polit Econ 98(5): S103–S125. http://www.jstor.org/stable/2937633

Barro RJ, Sala-i-Martin X (2004) Economic growth. MIT Press, Cambridge

Bosquet B (2000) Environmental tax reform: does it work? A survey of the empirical evidence. Ecol Econ 34:19–32

Bovenberg AL, De Mooij RA (1994) Environmental levies and distortionary taxation. Am Econ Rev 84(4):1085–1089. http://www.jstor.org/stable/2118046

Bovenberg AL, De Mooij RA (1997) Environmental tax reform and endogenous growth. J Public Econ 63(2):207–237

Bovenberg AL, Heijdra BJ (1998) Environmental tax policy and intergenerational distribution. J Public Econ 67(1):1–24. https://doi.org/10.1016/S0047-2727(97)00064-9

Bovenberg A, Smulders S (1995) Environmental quality and pollution-augmenting technological change in a two-sector endogenous growth model. J Public Econ 57(3):369–391. https://doi.org/10.1016/0047-2727(95)80002-Q

Checherita-Westphal C, Rother P (2012) The impact of high government debt on economic growth and its channels: an empirical investigation for the euro area. Eur Econ Rev 56(7):1392–1405. https://doi.org/10.1016/j.euroecorev.2012.06.007

Chen JH, Shieh JY, Chang JJ, Lai CC (2009) Growth, welfare and transitional dynamics in an endogenously growing economy with abatement labor. J Macroecon 31(3):423–437. https://doi.org/10.1016/j.jmacro.2008.10.004

Dökmen G (2012) Environmental tax and economic growth: a panel VAR analysis. http://dergipark.ulakbim.gov.tr/erciyesiibd/article/view/5000119372. Accessed 13 June 2019

Durusu-Ciftci D, Gokmenoglu KK, Yetkiner H (2018) The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach. Econ Syst 42(3):503–513

Freire-González J, Puig-Ventosa I (2019) Reformulating taxes for an energy transition. Energy Econ 78:312–323

Fullerton D, Heutel G (2007) The general equilibrium incidence of environmental taxes. J Public Econ 91(3–4):571–591. https://doi.org/10.1016/j.jpubeco.2006.07.004

Fullerton D, Metcalf GE (1997) Environmental taxes and the double-dividend hypothesis: did you really expect something for nothing? In: Working paper no. 6199. National Bureau of Economic Research. http://www.nber.org/papers/w6199. Accessed 13 June 2019

Goulder LH (1995) Environmental taxation and the double dividend: a reader’s guide. Int Tax Public Financ 2(2):157–183. https://doi.org/10.1007/BF00877495

Gradus R, Smulders S (1993) The trade-off between environmental care and long-term growth—pollution in three prototype growth models. J Econ 58(1):25–51. https://doi.org/10.1007/BF01234800

Grimaud A (1999) Pollution permits and sustainable growth in a Schumpeterian model. J Environ Econ Manag 38(3):249–266. https://doi.org/10.1006/jeem.1999.1088

Hart R (2004) Growth, environment and innovation—a model with production vintages and environmentally oriented research. J Environ Econ Manag 48(3):1078–1098. https://doi.org/10.1016/j.jeem.2004.02.001

Heckman JJ (2008) Econometric causality. Int Stat Rev 76(1):1–27. https://doi.org/10.1111/j.1751-5823.2007.00024.x

Honaker J, King G, Blackwell M (2011) Amelia II: a program for missing data. J Stat Softw 45(7):1–47

Kneller R, Bleaney MF, Gemmell N (1999) Fiscal policy and growth: evidence from OECD countries. J Public Econ 74(2):171–190. https://doi.org/10.1016/S0047-2727(99)00022-5

Lewbel A (2012) Using heteroscedasticity to identify and estimate mismeasured and endogenous regressor models. J Bus Econ Stat 30(1):67–80. https://doi.org/10.1080/07350015.2012.643126

Ligthart JE, van der Ploeg F (1994) Pollution, the cost of public funds and endogenous growth. Econ Lett 46(4):339–349. https://doi.org/10.1016/0165-1765(94)90155-4

Lin B, Jia Z (2018) The energy, environmental and economic impacts of carbon tax rate and taxation industry: a CGE based study in China. Energy 159:558–568

Lucas RE Jr (1988) On the mechanics of economic development. J Monetary Econ 22(1):3–42. https://doi.org/10.1016/0304-3932(88)90168-7

Lucas RE Jr (1993) Making a miracle. Econom J Econom Soc 251–272. http://www.jstor.org/stable/2951551

Lundberg M, Squire L (2003) The simultaneous evolution of growth and inequality. Econ J 113(487):326–44. http://www.jstor.org/stable/3590323

Markandya A (2005) Chapter 26 Environmental implications of non-environmental policies. In: Maler KG, Vincent JR (eds) Handbook of environmental economics, vol 3. Elsevier, pp 1353–1401. https://doi.org/10.1016/S1574-0099(05)03026-3

Martinez-Vázquez JM, Vulovic V, Moreno-Dodson B (2012) The impact of tax and expenditure policies on income distribution: evidence from a large panel of countries. Hacienda Pública Española 200:95–130. http://dialnet.unirioja.es/servlet/articulo?codigo=3961194. Accessed 13 June 2019

Metcalf GE (2003) Environmental levies and distortionary taxation: Pigou, taxation, and pollution. J Public Econ 87(2):313–322. https://doi.org/10.1016/S0047-2727(01)00116-5

Morley B (2010) Environmental policy and economic growth: empirical evidence from Europe. Unpublished results. http://opus.bath.ac.uk/21167/. Accessed 13 June 2019

Nakada M (2004) Does environmental policy necessarily discourage growth? J Econ 81(3):249–275. https://doi.org/10.1007/s00712-002-0609-y

Nong D (2018) General equilibrium economy-wide impacts of the increased energy taxes in Vietnam. Energy Policy 123:471–481

OECD (2006) The political economy of environmentally related taxes. OECD Publishing, Paris

OECD (2010) Linkages between environmental policy and competitiveness. OECD Environment Working Papers 13. http://www.oecd-ilibrary.org/environment/linkages-between-environmental-policy-and-competitiveness_218446820583. Accessed 13 June 2019

OECD (2013) Government at a glance 2013. Government at a Glance. OECD Publishing. http://www.oecd-ilibrary.org/governance/government-at-a-glance-2013_gov_glance-2013-en. Accessed 13 June 2019

Olinsky A, Shaw C, Lisa H (2003) The comparative efficacy of imputation methods for missing data in structural equation modeling. Eur J Oper Res 151(1):53–79. https://doi.org/10.1016/S0377-2217(02)00578-7

Oueslati W (2002) Environmental policy in an endogenous growth model with human capital and endogenous labor supply. Econ Model 19(3):487–507. https://doi.org/10.1016/S0264-9993(01)00074-8

Pautrel X (2008) Reconsidering the impact of the environment on long-run growth when pollution influences health and agents have a finite-lifetime. Environ Resour Econ 40:37–52

Ramey VA (2011) Identifying government spending shocks: it’s all in the timing. Q J Econ 126(1):1–50. https://doi.org/10.1093/qje/qjq008

Ricci F (2007) Channels of transmission of environmental policy to economic growth: a survey of the theory. Ecol Econ 60(4):688–699. https://doi.org/10.1016/j.ecolecon.2006.11.014

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037. http://www.jstor.org/stable/1833190

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5):S71–S102. http://www.jstor.org/stable/2937632

Roodman D, Morduch J (2014) The impact of microcredit on the poor in Bangladesh: revisiting the evidence. J Dev Stud 50(4):583–604. https://doi.org/10.1080/00220388.2013.858122

Smulders S, Gradus R (1996) Pollution abatement and long-term growth. Eur J Polit Econ 12(3):505–532. https://doi.org/10.1016/S0176-2680(96)00013-4

StataCorp (2013) Stata: Release 13. Statistical software. College Station, StataCorp LP

Teles VK, Mussolini CC (2014) Public debt and the limits of fiscal policy to increase economic growth. Eur Econ Rev 66:1–15. https://doi.org/10.1016/j.euroecorev.2013.11.003

Temple J (1999) The new growth evidence. J Econ Lit 37(1):112–156. https://doi.org/10.1257/jel.37.1.112

Ulph A (2007) Climate change—environmental and technology policies in a strategic context. Environ Resour Econ 37:159–180

Van Ewijk C, Van Wijnbergen S (1994) Can abatement overcome the conflict between environment and economic growth? De Econ 143(2):197–216. https://doi.org/10.1007/BF01384535

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflict of interest.

Ethical statements

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

Hassan, M., Oueslati, W. & Rousselière, D. Exploring the link between energy based taxes and economic growth. Environ Econ Policy Stud 22, 67–87 (2020). https://doi.org/10.1007/s10018-019-00247-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-019-00247-5

Keywords

- Environmental tax

- Economic growth

- Instrumental variables with two-stage least squares IV (2SLS) approach

- Multiple imputation