Abstract

This paper aims to develop a comprehensive hierarchical performance measurement model. The proposed model not only determines a manufacturing company’s overall performance within its industry but also obtains its strengths and weaknesses in critical activities. It lets one to combine a company’s performance scores in seventeen critical activities with important industry-specific objectives to obtain a single overall performance score by using a 4-Point Fuzzy Scale and a modified fuzzy version of the Technique for Order Preference by Similarity to Ideal Solution approach. The calculated overall performance scores provide a ranking order among manufacturing companies within their industry. In addition, it also enables each company to compare its performance in critical activities with respect to other companies in its industry. Furthermore, the performance measurement model has the capability to determine what a company should do to improve its performance in critical activities. This paper provides an example to illustrate the application of the proposed model.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Manufacturing companies implement innovative managerial practices, respond to their customers’ needs properly and timely, invest in advanced manufacturing technologies, and are involved in performance improvement activities in order to achieve success in their markets (Kaplan 1983; Banker et al. 1993; IFAC 1998; Maksoud et al. 2005).

A key enabler for manufacturing companies to have success in their markets is to establish proper performance measurement systems. Moullin (2003) defines performance measurement as ‘evaluating how well organizations are managed and the value they deliver for customers and other stakeholders.’ Traditional performance measurement approaches commonly employ financial measures in their models (Babic and Plazibat 1998; Yurdakul and Ic 2005; Ertugrul and Karakasoglu 2009; Ic and Yurdakul 2010; Ic 2014). However, Striteska (2012) notes that ‘financial measures are not enough’ in the business environment today and there is a ‘growing emphasis laid on using non-financial criteria.’ Similarly, in Kagioglou et al. (2001), Kennerley and Neely (2002), Ittner et al. (2003) and Epstein and Manzoni (1997), financial measures are considered inadequate in dynamic business environments, and non-financial measures are recommended instead for assessment of company activities.

However, both non-financial and financial measures quantify the results of the companies’ past actions (Neely 2002; Moullin 2003). Accordingly, performance measurement models based on financial and non-financial measures only are not sufficient in evaluation of performance of manufacturing companies. They are found to be ‘undermining manufacturing competitiveness (Hayes and Abernathy 1980) through encouraging short-termism (Banks and Wheelwright 1979; Hayes and Garvin 1982), lacking strategic focus (Skinner 1974), encouraging local optimization (Hall 1983; Fry and Cox 1989) and encouraging minimization of variance rather than continuous improvement (Lynch and Cross 1991)’ (Melnyk et al. 2010).

Melnyk et al. (2010) states that various models such as ‘the S.M.A.R.T. Pyramid (Lynch and Cross 1991), the Results/Determinants Matrix (Fitzgerald et al. 1991) and the Balanced Scorecard (Kaplan and Norton 1992)’ eliminate the weaknesses of the traditional performance measurement models. This paper also aims to eliminate the weaknesses of the traditional performance models in developing its own performance measurement model.

In this paper, the proposed performance measurement model presents best practicesFootnote 1 (sources of competitiveness) through a list of statements (“Appendix 1” provides a sample of statements). The statements provide a decision structure and prevent assignment of performance scores randomly in critical activities. A manufacturing company can determine the level of similarity between its practices, actions and infrastructures with the list of statements and assign a performance score accordingly for each critical activity.

In the paper, Sect. 2 introduces the developed three-level performance measurement model. Section 3 describes the proposed model, whereas Sect. 4 provides an illustrative example. Section 5 includes the final thoughts and conclusions.

2 Determination of the structure of the performance measurement model

The authors’ literature survey on performance measurement models reveals that a complete performance measurement model without any weaknesses is not available in the literature. Still, various studies provide essential characteristics of a performance measurement model such as:

-

Anderson et al. (1995), Flynn et al. (1995), Choi and Liker (1995), Forza and Flippini (1998), Dow et al. (1999), Samson and Terziovski (1999), Das et al. (2000), Cua et al. (2001), Matsui (2002), Kaynak (2003), Yeung et al. (2005), Parast et al. (2006), Ahmad and Zabri (2016), Toklu and Taşkın (2017), and Rawat et al. (2018) identify various practices that positively improve performance of a manufacturing company. The practices include leadership commitment, human motivation and development, new product design, process management, quality information and customers and supplier relations.

-

Braz et al. (2011) states that a performance measurement system should provide data not only for predicting future performance but also for benchmarking and reinforcing organizational strategies. In another study, Al-Tit (2017) suggests that a performance measurement model should provide data for organizational culture also. The findings of Al-Tit’s (2017) study indicate that organizational culture in a company is more influential than the supply chain management on performance.

-

Striteska (2011) emphasizes importance of evaluation of ‘how well companies are managed and the value they deliver for customers’ in development of a performance measurement model. On the other hand, Böhm et al.’s (2017) study demonstrates that an increasing focus on services could lead to success for manufacturing companies.

-

Taylor and Taylor (2013), Esmaeel et al. (2018) and Sardana et al. (2016) point out the importance of inclusion of strategic objectives into a performance measurement model. In addition, Sangwa and Sangwan (2018) proposed an integrated performance measurement framework to measure the effect of lean implementation throughout all functions of an organization. In total, they identified 26 dimensions and 119 key performance indicators under seven categories (manufacturing process, new product development, human resource management, finance, administration, customer management and supplier management) in their study.

-

Rao et al. (2018) presented a simple profit-linked performance measurement model. The model can evaluate performance of a company in three measures—profitability, productivity and price recovery.

-

Yeo and Grant (2017) proposed a decision tree approach to explore the effects of information and communication technologies (ICTs) on manufacturing companies’ sales performance.

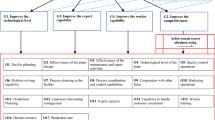

The characteristics listed above indicate that a performance measurement model must have a multi-level framework in which strategic objectives should guide the performance scoring process. In addition, the model must measure companies’ achievement levels in activities, which are necessary for the companies to be successful in their markets against their competitors in the long term. Such a model is developed and provided in Fig. 1.

2.1 The description of the developed performance measurement model

The developed performance measurement model uses a fuzzy version of Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) approach to obtain overall performance scores of manufacturing companies. TOPSIS is a widely used MCDM technique because of its simplicity, ability to yield an indisputable ranking order and programmable nature (Chen and Hwang 1992; Yurdakul and Ic 2009a, b; Ic and Yurdakul 2010; Chamodrakas et al. 2011; Eraslan and İç 2011; Ic 2012; Kundu et al. 2014).

Regular applications of TOPSIS approach are limited to single-level decision hierarchies. Since this study proposes a multi-level decision hierarchy (Fig. 1), it is necessary to modify TOPSIS approach to obtain performance scores of manufacturing companies with respect to the overall goal. The modified TOPSIS approach calculates the weights of critical activities with respect to the overall goal by combining the weights of the four objectives with respect to the overall goal and the weights of the seventeen critical activities with respect to each objective. The modified TOPSIS approach requires formation of a decision matrix and a weight vector as inputs (see Fig. 1).

For the development of the decision matrix, performance scores of manufacturing companies at critical activities (\( \tilde{x}_{ij} \); i = 1,2,…,n (number of manufacturing companies); j = 1,2,…, 17 (number of critical activities)) are assigned and placed in matrix form as shown in Eq. (1). In the assignment of performance scores in the critical activities, a company can receive one of the four fuzzy scores given in the fourth column of Table 1 corresponding to its level of similarity with the list of statements.

The weights of the seventeen critical activities with respect to the overall goal (\( \tilde{w}_{j} \) is the fuzzy weight of critical activity j with respect to the overall goal) form the second input (the weight vector, \( \tilde{w} \)) for the modified TOPSIS approach. The weight vector is calculated using Eqs. (2-5). In the equations, \( \tilde{c}_{ij} \) and \( \tilde{g}_{i} \) are fuzzy weights of critical activity j with respect to the objective i and of objective i with respect to the overall goal, respectively.

When the decision matrix and the weight vector are available, the decision matrix is normalized and weighted. From the weighted normalized decision matrix, one can obtain ideal and negative-ideal solutions, distance measures and finally overall performance scores of the companies as explained in ‘Appendix 2.’

3 Illustrative example

In the illustrative example, overall performance scores of eight companies from the machinery and components sector (cluster) located in Ivedik Organized Industrial Zone, Ankara, Turkey, are calculated and compared. The selected eight companies manufacture and sell components, parts, modules and systems fitting the machineries and are denoted C1-C8 in the paper. The eight companies cooperate with not only national but also foreign companies as their suppliers. A general evaluation of the eight companies shows that the companies’ manufacturing facilities are highly automated and computerized and they use automated internet-based communication and ordering and payment systems with their customers and suppliers. The computer-aided engineering, design and manufacturing programs are very common in all companies. In terms of advanced management practices, the companies have established programs to improve the quality of their products and customer service and to reduce time delays in manufacturing and designing products.

3.1 Application of the modified fuzzy TOPSIS approach in calculation of the companies’ overall performance scores

The application of the modified fuzzy TOPSIS approach requires two inputs, namely the decision matrix and fuzzy weight vector of the critical activities with respect to the overall goal. Tables 2, 3, 4 and 5 present the results of calculation steps described in Sect. 3.

With the application of the modified fuzzy TOPSIS, the decision matrix is first normalized, weighted and defuzzified (Table 6). The last two rows of Table 6 (A* and A−) provide the best and worst values at the seventeen critical activities. The overall performance scores of companies are obtained using the differences between their performance scores and the best and worst values at the seventeen critical activities (di* and d − i ) (Table 7). Finally, overall performance scores and rankings of the eight manufacturing companies are calculated.

Figure 2 provides the application results. The average overall performance score is 0.604, and the highest ranked manufacturing company is C5 with the overall performance score of 0.6721. On the other hand, the lowest ranked manufacturing company is C4 with a score of 0.2495. With the results of the proposed model, the companies can compare their overall performance scores with the industry average, maximum and minimum scores. An overall performance score close to the industry minimum should increase the urgency and importance of performance improvement programs in the corresponding company (Yurdakul and Ic 2005).

While selecting critical activities for performance improvement programs, the companies can use their performance scores in critical activities (Table 2) along with the critical activities’ weights with respect to the overall goal (Table 5) also. Relative importance of a critical activity is directly proportional to its weight value. Table 8 is prepared to present the necessary related information for performance improvement in a simplified form. The first column of Table 8 lists the critical activities with respect to their weights in descending order. The critical activity with the highest weight value is A8 so that the first row of Table 8 belongs to A8. On the other hand, the last row of Table 8 contains the least important critical activity (A16). The last column of the table contains average performance scores of the listed seventeen critical activities. In selecting a certain number of critical activities from Table 8 for performance improvement, the companies can compare their performance scores with the average performance score in each activity starting with the first row and moving below. A performance score lower than the industry average indicates a candidate activity for performance improvement. The total number of selected activities for performance improvement may change from one company to another depending on many factors such as allocated resources.

3.2 Checking the accuracy of the proposed performance measurement model’s ranking results

The proposed performance measurement model’s ranking results are compared with the ones obtained with XBANK credit experts and COSEL model developed in Ic and Yurdakul’s (2010) paper to check the accuracy of the proposed model. The credit experts use private and public information of the companies and industries in making their credit decisions. They may use various models and rules for their decisions, but personal and institutional expertise gained by making similar credit decisions and observing their results over the years is still the most important tool in their credit decisions. On the other hand, COSEL uses seven financial ratios, namely current ratio, liquidity ratio, ratio of total liabilities to total assets, total liabilities/total assets, ratio of bank debt to equity, ratio of operating profits to net sales, ratio of net earnings to net sales and ratio of net earnings to equity. In the application of COSEL, the user enters the weights for the seven ratios. The summation of the multiplications of the seven financial ratios’ values with their weights provides overall performance score for a company.

For comparison of the ranking results, the statistical significance of the differences between the rankings obtained by the proposed model and the ones obtained by the bank credit experts and COSEL developed in Ic and Yurdakul (2010) is determined using Spearman’s rank-correlation test (Table 9). Spearman’s rank-correlation test is recommended when ‘the actual values of paired data are substituted with the ranks which the values occupy in the respective samples’ (Parkan and Wu (1999)). In the application of Spearman’s test, to test the null hypothesis (H0: There is no similarity between the two rankings), a test statistic, Z, is calculated using Eqs. (6-7) and compared with a pre-determined level of significance α value. In this study, 1.645, which corresponds to the critical Z-value at the level of significance of α = 0.05, is selected. If the test statistic computed by Eq. (7) exceeds 1.645, the null hypothesis is rejected and it is to be concluded that ‘H1: The two rankings are similar’ is true. In Eqs. (6) and (7), di is the ranking difference of company i, and nmc is the number of companies to be compared. rs represents the Spearman’s rank-correlation coefficient in Eqs. (6) and (7) (Ic and Yurdakul 2010).

Table 9 presents the test results between the three models. The last row in Table 9 shows Spearman’s correlation coefficients (Z-value) for the ranking differences. Both Z-values, 1.858 and 2.047, are higher than 1.645, which implies that the differences are statistically insignificant. Based on the test results, it can be concluded that the rankings obtained by the proposed model are statistically similar to the rankings obtained using credit expert opinions and COSEL.

4 Conclusions

The developed performance measurement model not only provides a ranking of a company within its industry, but also compares its performance with its competitors’ performances in critical activities. It also provides a structure to develop performance improvement programs to close the performance gap between the company and higher-ranked companies.

However, the proposed model in this paper is limited to determine performance scores in a specific industry. In its application in another industry type, the user has to search and gather all necessary information about the new industry and modify the list of statements and objectives of the decision hierarchy accordingly. As a further study, one may try to determine a robust decision hierarchy. Such a study requires development of a common list of critical activities and objectives. Another further study can use other fuzzy logic techniques, such as hesitant fuzzy or intuitionistic fuzzy approaches for modeling the uncertainties in the decision environment. As the level of uncertainty in the decision environment increases, other fuzzy logic techniques may provide results that are more realistic.

Notes

References

Ahmad K, Zabri SM (2016) The application of non-financial performance measurement in malaysian manufacturing firms. Procedia Econ Financ 35(2016):476–484

Anderson JC, Rungtusanatham M, Schroeder RG, Devaraj S (1995) A path analytic model of a theory of quality management underlying the deming management method: preliminary empirical findings. Decis Sci 26(5):637–658

Babic Z, Plazibat N (1998) Ranking of enterprises based on multicriterial analysis. Int J Prod Econ 56–57:29–35

Banker RD, Potter G, Schroeder RG (1993) Reporting manufacturing performance measures to workers: an empirical study. J Manag Acc Res 5:33–53

Banks RL, Wheelwright SC (1979) Operations versus strategy—trading tomorrow for today. Harvard Bus Rev 57(3):112–120

Böhm E, Eggert A, Thiesbrummel C (2017) Service transition: a viable option for manufacturing companies with deteriorating financial performance? Ind Mark Manag 60:101–111

Braz GT, Scavarda LF, Martins RA (2011) Reviewing and improving performance measurement systems: an action research. Int J Prod Econ 133(2011):751–760

Bromiley P, Rau D (2016) Operations management and the resource based view: another view. J Oper Manag 41:95–106

Chamodrakas I, Leftheriotis I, Martakos D (2011) In-depth analysis and simulation study of an innovative fuzzy approach for ranking alternatives in multiple attribute decision making problems based on TOPSIS. Appl Soft Comput 11:900–907

Chen S-J, Hwang C-L (1992) Fuzzy Multiple Attribute Decision Making. Springer, Berlin

Cheng C-H, Lin Y (2002) Evaluating the best main battle tank using fuzzy decision theory with linguistic criteria evaluation. Eur J Oper Res 2002(142):174–186

Chiarini A, Vagnoni E (2015) World-class manufacturing by Fiat. Comparison with Toyota production system from a strategic management, management accounting, operations management and performance measurement dimension. Int J Prod Res 53(2):590–606

Choi TY, Liker JK (1995) Bringing Japanese continuous improvement approaches to US manufacturing: the roles of process orientation and communications. Decis Sci 26(5):589–616

Cua KO, McKone KE, Schroeder RG (2001) Relationships between implementation of TQM, JIT, and TPM and manufacturing performance. J Oper Manag 19(6):675–694

Das A, Handfield RB, Calantone RJ, Ghosh S (2000) A contingent view of quality management—the impact of international competition on quality. Decis Sci 31(3):649–690

De Felice F, Petrillo A (2015) Optimization of manufacturing system through world class manufacturing. IFAC Papers On-line 48(3):741–746

Dow D, Samson D, Ford S (1999) Exploding the myth: do all quality management practices contribute to superior quality performance? Prod Oper Manag 8(1):1–27

Eisenhardt KM, Martin JA (2000) “Dynamic Capabilities: what are they? Strateg Manag J 21:1105–1121

Epstein MJ, Manzoni J (1997) The balanced scorecard and tableau de board, Translating strategy into action. Manag Account 8:28–36

Eraslan E, İç YT (2011) A multi-criteria approach for determination of investment regions: Turkish case. Ind Manag Data Syst 111(6):890–909

Ertugrul I, Karakasoglu N (2009) Performance evaluation of Turkish cement firms with fuzzy analytic hierarchy process and TOPSIS methods. Expert Syst Appl 36:702–715

Esmaeel RI, Zakuan N, Jamal NM, Taherdoost H (2018) Understanding of business performance from the perspective of manufacturing strategies: fit manufacturing and overall equipment effectiveness. Procedia Manuf 22:998–1006

Ezzabadi JH, Saryazdi MD, Mostafaeipour A (2015) Implementing Fuzzy Logic and AHP into the EFQM model for performance improvement: a case study. Appl Soft Comput 36:165–176

Fitzgerald L, Johnston R, Brignall TJ, Silvestro R, Voss C (1991) Performance measurement in service businesses. The Chartered Institute of Management Accountants, London

Flynn BB, Schroeder RG, Sakakibara S (1995) The impact of quality management practices on performance and competitive advantage. Decis Sci 26(5):659–691

Forza C, Flippini R (1998) TQM impact on quality conformance and customer satisfaction: a causal model. Int J Prod Econ 55(1):1–20

Fry TD, Cox JF (1989) Manufacturing performance; local versus global measures. Prod Inven Manag J 30(2):52–56

Hall RW (1983) Zero inventories. Dow, Jones-Irwin, Homewood

Hayes RH, Abernathy WJ (1980) Managing our way to economic decline. Harvard Bus Rev 62:95–101

Hayes RH, Garvin DA (1982) Managing as if tomorrow mattered. Harvard Bus Rev 60(3):70–79

Hayes RH, Wheelwright SC (1984) Restoring our competitive edge: competing through manufacturing. Wiley, New York

Ic YT (2012) Development of a credit limit allocation model for banks using an integrated fuzzy TOPSIS and linear programming. Expert Syst Appl 39(2012):5309–5316

Ic YT (2014) A TOPSIS based design of experiment approach to assess company ranking. Appl Math Comput 227:630–647

Ic YT, Yurdakul M (2010) Development of a quick credibility scoring decision support system using fuzzy TOPSIS. Expert Syst Appl 37:567–574

IFAC (1998) International management accounting practice statement: management accounting concepts. International Federation of Accountants, New York

Ittner C, Larcker D, Randall T (2003) Performance implications of strategic performance measurement in financial service firms. Acc Organ Soc 28(7/8):715–741

Kagioglou M, Cooper R, Aouad G (2001) Performance management in construction: a conceptual framework. Constr Manag Econ 19(85):95

Kaplan RS (1983) Measuring performance: a new challenge for managerial accounting research. Acc Rev 18(4):686–705

Kaplan RS, Norton DP (1992) The balanced scorecard—measures that drive performance. Harvard Bus Rev 70(1):71–79

Kaynak H (2003) The relationship between total quality management practices and their effects on firm performance. J Oper Manag 21(4):405–435

Kennerley M, Neely A (2002) A framework of the factors affecting the evolution of performance measurement systems. Int J Oper Prod Manag 22(11):1222–1245

Kundu P, Kar S, Maiti M (2014) A fuzzy MCDM method and an application to solid transportation problem with mode preference. Soft Comput 18:1853–1864

Lynch RL, Cross KF (1991) Measure up – the essential guide to measuring business performance. Mandarin, London

Maksoud A, Dugdale D, Luther R (2005) Non-financial performance measurement in manufacturing companies. Br Acc Rev 37:261–297

Matsui Y(2002) An empirical analysis of quality management in Japanese manufacturing companies. In: Proceedings of the seventh annual meeting of the asia-pacific decision sciences institute, APDSI, pp 1–18

Melnyk SA, Davis EW, Spekman RE, Sandor J (2010) Outcome-driven supply chains. MIT Sloan Manag Rev 51(2):33–38

Moullin M (2003) Defining performance measurement. Perspect Perform 2(2):3

Neely A (2002) Business Performance Measurement: Theory and Practice. Cambridge University Press, Cambridge

Parast MM, Adam SG, Jones EC, Rao SS, Raghu-Nathan TS (2006) Comparing quality management practices between the United States and Mexico. Qual Manag J 13(4):36–49

Parkan C, Wu M-L (1999) Decision making and performance measurement models with applications to robot selection. Comput Ind Eng 36:503–523

Petrillo A, De Felice F, Zomparelli F (2018) Performance measurement for world-class manufacturing: a model for the Italian automotive industry. Total Qual Manag Bus Excell. https://doi.org/10.1080/14783363.2017.1408402

Phan AC, Abdallah AB, Matsui Y (2011) Quality management practices and competitive performance: empirical evidence from Japanese manufacturing companies. Int J Prod Econ 133:518–529

Prybutok V, Zhang X, Peak D (2011) Assessing the effectiveness of the Malcolm Baldrige National Quality Award model with municipal government. Socio-Econ Plan Sci 45:118–129

Rao M, Chhabria R, Gunasekaran A, Mandal P (2018) Improving competitiveness through performance evaluation using the APC model: a case in micro-irrigation. Int J Prod Econ 195(2018):1–11

Rawat GS, Gupta A, Juneja C (2018) Productivity measurement of manufacturing system. Mater Today Proc 5:1483–1489

Samson D, Terziovski M (1999) The relationship between total quality management practices and operational performance. J Oper Manag 17(4):393–409

Sangwa NR, Sangwan KS (2018) Development of an integrated performance measurement framework for lean organizations. J Manuf Technol Manag 29(1):41–84

Sardana D, Terziovski M, Gupta N (2016) The impact of strategic alignment and responsiveness to market on manufacturing firm’s performance. Int J Prod Econ 177:131–138

Schroeder RG, Flynn BB (2001) High performance manufacturing: global perspectives. Wiley, New York

Skinner W (1974) The decline, fall and renewal of manufacturing. Indus Eng 52(5):32–38

Striteska M (2012) Key features of strategic performance management systems in manufacturing companies. Procedia Social Behav Sci 58:1103–1110

Taylor A, Taylor M (2013) Antecedents of effective performance measurement system implementation: an empirical study of UK manufacturing firms. Int J Prod Res 51(18):5485–5498

Teece DJ (2007) Explicating dynamic capabilities: the nature and micro foundations of (sustainable) enterprise performance. Strateg Manag J 28(13):1319–1350

Teece DJ (2009) Dynamic capabilities and strategic management: organizing for innovation and growth. Oxford University Press, Oxford

Teece DJ, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strateg Manag J 18(7):509–533

Toklu MC, Taskin H (2017) Performance evaluation of small-medium enterprises based on management and organization. Acta Phys Pol A 132(3):994–998

Yeo B, Grant D (2017) Exploring the factors affecting global manufacturing performance. Inf Technol Dev. https://doi.org/10.1080/02681102.2017.1315354

Yeung ACL, Cheng TCE, Lai KH (2005) An empirical model for managing quality in the electronic industry. Prod Oper Manag 14(2):189–204

Yurdakul M, Ic YT (2005) Development of a performance measurement model for manufacturing companies using the AHP and TOPSIS approaches. Int J Prod Res 43(21):4609–4641

Yurdakul M, Ic YT (2009a) Analysis of the benefit generated by using fuzzy numbers in a TOPSIS model developed for machine tool selection problems. J Mater Process Technol 209:310–317

Yurdakul M, Ic YT (2009b) Application of correlation test to criteria selection for multi criteria decision making (MCDM) models. Int J Adv Manuf Technol 40:403–412

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Communicated by A. Genovese, G. Bruno.

Appendices

Appendix 1

Objectives:

-

O1. Improve the products’ technological level and increase value added portions in their prices

-

O2. Improve the manufacturing capability and competitiveness

-

O3. Improve the customers’ profile and increase the percentage of the export revenues

-

O4. Improve the personnel quality

Critical activities:

Activities | The list of statements |

|---|---|

A1. Location selection | (1) The manufacturing company is close to several research institutes, technical universities and educational facilities (2) Various industrial zones and manufacturing companies exist near the company (3) The company can hire skilled labor and engineers easily (4) The company is close to multiple transportation ways. The company can reach to its customers using multiple transportation way (5) The location of the company is close to its customers. The delivery distance time to customers is short. Transportation occurs with low carrying costs (6) The personnel is happy with the location of the company. There is no relocation request from the company personnel |

A2. Effectiveness of the plant design and part flow in the plant | (1) The layout plan is developed using a proper methodology (2) The transportation distances of the parts are low (3) Keeping track of the parts on the material handling system is not considered a problem (4) There is no pile of materials waiting between machines, and the parts completed on the machines are moved on the planned time (5) Necessary areas are available for support activities such as maintenance and tooling placement (6) The layout can easily be expanded or modified when product variety and production volumes of product types change (7) The machines do not stay idle because of the delays in arrivals of parts, tooling and equipment |

A3. Effectiveness of the maintenance and repair activities | (1) There is a maintenance and repair department in the plant. Necessary personnel and financial resources are allocated to the department to perform its activities (2) The maintenance department prepares maintenance and repair plans of the resources in the plant (3) The maintenance and repair activities are performed according to the developed maintenance plans (4) Prevention of the machine and system failures is considered more important than other objectives by the plant management (5) Modifications and improvements are performed on the resources to improve effectiveness and useful lives of them in addition to the routine maintenance and repair activities 6) Breakdowns of the resources are rare and total repaid time is not considered as significant in the plant |

A4. Technological level of the plant | (1) An economic and technological evaluation is performed in the purchase of new resources (2) A comparison of the requirements of the customers and products are compared with the capabilities of new technologies are compared before their purchase (3) New technologies and machineries are preferred over conventional ones by plant management and widely used in the company (4) Implementation plans are prepared during the application of the new technologies to maximize their contribution to the competitiveness of the company (5) The company regularly attends exhibitions and visits builders and suppliers of the machine tools and other equipment (6) Benchmarking is routinely performed to observe and selectively adopt new technologies and practices being used in different industries’ best performing plants and competitors |

A5. Quality improvement activities | (1) The planning of the quality improvement studies starts with the strategic goals of the company and ends with the implementation activities on the shop floor (2) Measurement and feedback of the results of the programs are included and considered important in quality improvement studies (3) Personnel from all levels of the hierarchy contribute to the quality improvement studies (4) Personnel are aware of the importance of taking quality certifications to improve company’s reputation in the eyes of its customers (5) Several quality certificates are already taken, and their requirements are implemented throughout the plant (6) The personnel show no resistance to the new improved ways of doing things and see them as necessary for the company’s long-term survival |

Appendix 2: Calculation of the overall performance scores of the companies

Step 1 The members of the decision matrix (\( \tilde{x}_{ij} \)’s) and weights of the critical activities with respect to the overall goal can be expressed as \( \tilde{x}_{ij} = \left( {a_{ij} ,b_{ij} ,c_{ij} ,d_{ij} } \right) \) and \( \tilde{w}_{j} = \, (\alpha_{j} ,\beta_{j} ,\gamma_{j} ,\delta_{j} ) \), respectively. For normalization, the highest decision matrix member in each ‘critical activity’ column (denoted as \( \tilde{x}_{j}^{*} = \left( {a_{j}^{*} ,b_{j}^{*} ,c_{j}^{*} ,d_{j}^{*} } \right) \)) must first be determined using Eq. (8).

Then, the normalized decision matrix is constructed using Eq. (9) (Chen and Hwang 1992).

Step 2 The normalized decision matrix \( (\tilde{V}) \) is weighted next using Eq. (10).

where

Step 3 Each fuzzy component of the weighted normalized decision matrix is defuzzified using Eq. (12) (Cheng and Lin 2002; Chen and Hwang 1992). The obtained crisp value of a trapezoidal fuzzy number (\( v_{ij} = (a,b,c,d) \)) is denoted as vij.

Step 4 The ideal solution vector, A*, and the negative-ideal solution vector, \( A_{{}}^{ - } \), include the best and the worst performance scores, respectively, and are calculated using Eqs. (13–16).

Step 5: Calculation of distance measures The distances of company i to the ideal solution (d * i ) and from the negative-ideal solution (d − i ) are calculated using Eqs. 17 and 18, respectively.

Step 6 The overall performance score (C * i ) is calculated using Eq. 19. A higher score corresponds to a better performance (Chen and Hwang 1992).

Rights and permissions

About this article

Cite this article

Yurdakul, M., İç, Y.T. Development of a multi-level performance measurement model for manufacturing companies using a modified version of the fuzzy TOPSIS approach. Soft Comput 22, 7491–7503 (2018). https://doi.org/10.1007/s00500-018-3449-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-018-3449-6