Abstract

This paper reports the results of dictator experiments in which the context is varied between a loss and gain frame. In some treatments, individuals have the possibility to sort and self-select the frame they prefer. We demonstrate that higher shares are transferred to the recipient in the loss frame compared to the gain frame when the situation occurs naturally, while the opposite result holds when the participants provoke themselves the situation. Our main result can be attributed primarily to a gender effect, i.e. female participants acting more generously in loss frames.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The dictator game (DG) is a traditional workhorse intended to measure generosity or altruism (since Kahneman et al. 1986; Forsythe et al. 1994; Hoffman et al. 1994). In this game, a first player (the dictator) decides how to share an endowment (e.g., $10) with a passive second player, who is a simple recipient of what the dictator leaves. The rational prediction for the self-interested dictator is to keep all the endowment in order to maximize his/her payoff. Nevertheless, although this does happen for a sizeable fraction of dictators, a significant proportion gives away an amount worth up to 50% of the endowment (Engel 2011). This is interpreted as a proof that individuals are inevitably influenced by other-regarding preferences such as altruism, fairness and reciprocity concerns (Fehr and Schmidt 2006), which challenges the classical assumptions of rationality and selfishness.

Several variants of the dictator game have been studied, mainly to investigate the effects of various situational and geographical parameters (Engel 2011; Brañas-Garza et al. 2017). In all these papers, individuals share money from an endowment, which can be considered as a gain at the expense of the experimenter. Most papers address situations in which the dictator basically splits gains among him and a recipient, which is a situation of giving or of receiving gains. As to paraphrase Kvaløy et al. (2017), [giving] is an active decision, while not [giving]/no receiving is a passive one, an act of “omission”. However, one point has rarely been addressed. Indeed, a very frequent real-life situation is the one where individuals or entities are incurring losses (e.g., being stolen, being fired, providing mandatory contribution to a resources-consuming situation such as receiving refugees, or experiencing a financial crisis) and it seems crucial to understand how people behave in this kind of situation. Imagine a business suffering from the economic crisis and incurring a significant loss, due to circumstances independent of its business operations (e.g., loss of a lucrative contract with Russia because of the Ukrainian conflict). Suppose the CEO of a company has some discretion regarding how to split this loss between him and his subordinates. What will he do? Transferring all the loss to his subordinates could be an option, while dividing it among him and the subordinates could be another.Footnote 1 The boss might as well decide to incur the totality of the loss while keeping his subordinates unaffected.

This specific question, of whether similar sharing results can be observed in the gain and in the loss domains has, to our knowledge, rarely been studied. Our contribution aims at filling this gap and addresses the following main questions: How do individuals share in the loss domain as compared to the gain domain? Are other-regarding preferences affected by the gain or the loss context? Does sharing a loss offset the effect of other-regarding preferences?

Our paper extends the study of sharing preferences by covering the whole spectrum of decision situations, i.e. as in “real” life, by including the loss domain. However, as to closely mimic real-life situations, we need to consider that some of the gain or loss situations occur naturally and people are somehow “forced” to take part at them and take decisions, and some of the gain or loss situations are provoked/avoided on purpose by the individuals. Decisions will, therefore, be different. Naturally occurring situations will exacerbate more norm following behavior and display “expected to be” behavior, while provoked situations will exacerbate more active behavior corresponding to self-selection and strong preferences. In the first situation, a vast strand of literature (cited hereafter) reveals a strong role of gender and therefore, we specifically examine whether men and women behave similarly in loss and gain framed dictator gamesFootnote 2. In the second situation, self-selection may mitigate effects of gender and frame, by focusing solely on active decision making. We specifically investigate this situation as well.

We therefore introduce in this paper a dictator game in the loss domain and compare it with the traditional dictator game (hereafter called the gain-framed DG). In our variant, both the dictator and the recipient have an initial endowment and an external loss is incurred, so an amount of money equivalent to this loss has to be returned to the experimenter. The dictator decides how this loss will impact each of them, i.e. how to split the losses between them. We thereafter call our variant of the DG the loss-framed dictator game.

The remainder of the paper is structured as follows. Section 2 provides a short literature overview and Sect. 3 presents a model and formulates hypotheses. In Sect. 4, we conduct dictator game experiments and test whether dictators share differently in the gain and loss domains. First, we conduct experiments in which participants are randomly assigned to the gain or loss environments. Second, we remove this condition by leaving to participants the choice of the environment in which they would play, either a gain or loss environment (with same possible earnings). Section 5 is devoted to a general synthesis, concludes the paper and provides directions for further research.

2 Literature overview

As a reminder, the framing of decision situations has been found to impact both beliefs and behavior (see Ellingsen et al. 2012). Since the original work by Tversky and Kahneman (1981), loss aversion as a behavioral tendency has been applied to numerous economic contexts to explain inconsistent empirical behavior with regard to the expected utility theory (e.g., Herweg et al. 2010; Herweg and Schmidt 2014). Unlike the initial result showing that losses loom larger than gains in lottery choices, we consider a simpler decision-making situation in which no risk is involved. Keeping the underlying outcomes and incentives identical, we examine the differences in splitting a certain amount of money in gain and loss contexts.

Several previous studies (Baquero et al. 2013; Antinyan 2014; Neumann et al. 2018) compare the dictator’s offers between a loss and a gain context. However, their designs differ and have limitations calling for an additional and more rigorous study. For instance, in Baquero et al. (2013), the dictator game is implemented with a low number of subjects (68 subjects played one-shot dictator games) in a within-subjects “strategy method” design (every subject was confronted with both frames).Footnote 3 Antinyan (2014) has a close, yet different question related to losses and other-regarding preferences of decision makers. He considers a scenario implemented on Amazon Mechanical Turk in which a dictator faces a loss that has occurred to an endowment before he has to determine a hypothetical split, which boils down to splitting a reduced endowment after incurring a loss.Footnote 4 Neumann et al. (2018) also examine dictators’ decisions in a context in which losses occur in sequential sessions. The number of participants is nevertheless rather low—respectively 29 and 25 dictators.

Baquero et al. (2013) find that dictators offer slightly but significantly more in the loss context than in the gain context (on average 41% vs. 37%). Antinyan (2014) shows that other-regarding motives of the dictators do not vanish when losses are introduced before the sharing decision. Results from Neumann et al. (2018) reveal no significant difference between gains and losses, but also suggest that females behave less selfishly than males (though this gender effect is not always statistically significant).

Our experiment is also related to a modified version of the dictator game, the “taking” game, in which the dictator has to split money owned by the recipient as in List (2007) and Bardsley (2008). As stated by List (2007), “the simple manipulation of the action set leads to drastic changes in behavior: many fewer agents are willing to give money when the action set includes taking”. The situation is similar to ours in the sense that money from another person has to be taken, however, our situation is symmetric (while the situation in the taking game is not), since the Dictator has the possibility to take money both from himself and the Recipient. The authors emphasize the role of the “situation” in decision making, and not only of participants’ preferencesFootnote 5.

Several other related studies about splitting situations in loss contexts are experimentally more distant, because they use other games such as ultimatum games (UG). For instance, Buchan et al. (2005) compare behaviors in the UG depending on whether gains or losses are at stake using a within subject design. They find that both proposers’ offers and receivers’ demands are larger in losses than in gains. These results are robust across various countries, namely the United States, China and Japan. Leliveld et al. (2009) found supporting evidence that participants make higher offers in an UG with a loss context compared to a gain context. They argue that people consider inflicting a loss to the other party as more harmful than withholding a gain and are therefore less motivated to maximize their own outcomes in a negatively valenced bargaining. Lusk and Hudson (2010) used a modified version of the UG with a between-design and found that when individuals bargain over losses, they make more aggressive offers, in terms of their own monetary well-being, as compared to when they bargain over gains. Interestingly, Zhou and Wu (2011) used a variant of the UG (within and between design), but focused only on recipients’ decisions and found that rejection rates and thus demand for fairness is higher in loss situations, i.e. “unfairness in losses looms larger than unfairness in gains” (Buchan et al. 2005). More recently, using an UG with a within design, Baquero et al. (2013) found that proposers become significantly more generous by taking the largest share of the loss for themselves while responders play significantly tougher in the loss domain. However, in the UG, the behavior of the proposer may however be driven by a strategic reaction to a change in the receiver’s behavior. Does the proposer offer more in the loss domain because he anticipates that the receiver will be more demanding or because he is intrinsically pleased to offer more? This is the reason why we investigate the effect of losses in a dictator game where strategic issues are absent.

In short, the available studies are far from reaching consensus regarding the effect of a loss situation on giving in conventional dictator games. Most experimental designs have some limitations such as inadequate operationalization of the loss situation, low number of participants, inconsistent results, contagion effect of previous experiments and so forth. We therefore suggest stepping back to the simplest possible strategic situation, and to design carefully a clean experiment involving no other strategic consideration than the division of gains or losses.

3 Theoretical model and hypotheses

Our main question is at the crossroads of two theoretical backgrounds. On the one hand, prospect theory (Kahneman and Tversky 1979) suggests that losses loom larger than gains. The decrease of expected utility from a monetary loss is higher than the increase of expected utility derived from a similar monetary gain. Thus a dictator in the gain-framed DG, whose reference point is zero, will get a lower marginal utility from each monetary unit he allocates to himself than will the dictator in the loss-framed DG (whose reference point is the endowment). Moreover, a growing literature supports that agents in loss contexts tend to be more selfish (De Dreu et al. 1994; De Dreu 1996; Poppe and Valkenberg 2003) and less concerned with ethics than individuals in gain contexts (Kern and Chugh 2009; Grolleau et al. 2016). Thus, due to loss aversion, we can expect the dictator to be less generous in loss frames than in gain frames when splitting a monetary loss between the recipient and himself.

On the other hand, the vast literature on other-regarding preferences suggests that the dictator might also be more generous in the loss than in the gain context. First, the social exchange theory (Emerson 1962; Blau 1964) and resulting empirical studies (Greenberg 1978) suggest that power imbalance can lead to feelings of moral responsibility. They would induce the more powerful person to act in a socially responsible manner, by sacrificing his own incomes in order to help powerless other(s). Handgraaf et al. (2008) stress the fact that the powerlessness of the recipient could convince dictators to act pro-socially. Second, apart from moral responsibility, the context of loss may also trigger a form of “compassion” from the dictator towards the recipient (Baquero et al., 2013).Footnote 6 As emphasized above, social concerns are still present and may be even amplified in a loss-framed DG as compared to a gain-framed DG. For instance, in an ultimatum game, Buchan et al. (2005), Leliveld et al. (2009) and Zhou and Wu (2011) showed that unequal offers were perceived as being more unfair in the loss context than in the gain context by the recipients. This could plausibly be explained by the fact that participants tend to associate loss with “unfair” and gain with “fair” (Zhou and Wu 2011). Third, the gain and the loss contexts are based on different reference or defaults points. In a gain frame, giving is the active altruistic choice, and not giving is the passive choice (the default). In the loss frame, not taking anything, i.e. the default, is the altruistic choice. By contrast, the active choice, i.e. taking something from the other participant, is the choice inducing a loss to the recipient. Therefore, the reference points or defaults matter: perceptions of an outcome differ if the outcome resulted from “an act of omission rather than an act of commission” (see Kahneman and Tversky 1982, and Baron and Ritov 1994). As in Kvaløy et al. (2017), the absence of altruism “feels more severe in the loss domain” when full altruism is the default than in the gain domain when no altruism is the default. In a nutshell, feelings like moral responsibility or compassion towards the recipient might lead to greater generosity in the domain of losses, and would imply that in the loss-framed DG, the dictator might adopt a behavior that offsets the loss aversion effect with other-regarding preferences.

In the following, we develop a simple model of decision making for the dictator, integrating those two dimensions. We rely on the model of Fehr and Schmidt (1999) to integrate inequality aversion in the dictator’s preferences. We denote as \(m_{D}\) the dictator’s payoff, and \(m_{R}\) the recipient’s payoff. Let \(u_{D}\) denote the dictator’s utility function. We have:

where \(\alpha\) is the parameter of aversion to disadvantageous inequality, while \(\beta\) is the parameter of aversion to advantageous inequality. It is assumed that \(\beta \le \alpha\) and \(0 \le \beta \le 1\). In our framework, the final total payoff will be a fixed amount \(w\), so that \(m_{D} + m_{R} = w\). This model predicts that if \(\beta < \frac{1}{2}\), then the dictator’s offer will be equal to 0, corresponding to a final payoff \(m_{D} = w\) for the dictator, while if \(\beta > \frac{1}{2}\), the dictator will share equally, so that \(m_{D} = \frac{w}{2}\)Footnote 7 For concision, since disadvantageous inequality (\(m_{D} < m_{R}\)) is very rare for a dictator,Footnote 8 we assume throughout the model that \(m_{D} \ge m_{R} \text{ }({\text{hence}}, \frac{w}{2} \le m_{D} \le w ) ,\) so that the dictator’s utility function simplifies to:

We now introduce loss aversion. To do so, we refer to the model of prospect theory developed by Kahneman and Tversky (1979). Let \(r_{D}\) denote the dictator’s reference payoff. Let \(x_{D}\) be the dictator’s payoff relative to this reference point: \(x_{D} = m_{D} - r_{D}\). For the sake of simplicity, we consider the linear form of the model.Footnote 9 The utility \(v_{D}\) (or value function) associated with a gain or a loss is:

where \(\theta > 1\) is a preference parameter measuring the size of loss aversion.

In our setting, the difference between the gain context and the loss context is a pure framing effect, which is supposed to change the subjects’ reference point. In the gain domain, the dictator is asked to share an amount \(w\), but this initial endowment is not individually attributed to the dictator nor to the recipient. Thus, we can assume that both subjects consider that their reference payoff is zero. In particular, for the dictator: rD = 0. In contrast, in the loss domain, the dictator and the recipient are told that they have each an initial endowment \(w\); then, the dictator has to share a loss \(- w\) as he pleases by picking from these two endowments (thus, they end with a total wealth of \(w\) as in the gain context). Hence, in the loss context, it seems reasonable to assume that the subjects have a reference payoff equal to their endowment (see Ariely et al. 2003). In particular, for the dictator: \(r_{D} = w\). As a result, we have \(x_{D} = m_{D} - r_{D} = m_{D} \ge 0\)in the gain context, whereas we have \(x_{D} = m_{D} - r_{D} = m_{D} - w \le 0\)in the loss context. A natural extension of the Fehr-Schmidt utility function (similar to Buchan et al. 2005) is then:

where the first term is the prospect theory value function of the dictator’s relative payoff \(x_{D}\) and the second term is the inequality aversion term.Footnote 10 Thus, we obtain the following utility function for the dictator in the gain domain (this is the standard one):

and in the loss domain:

with \(m_{D} \ge m_{R}\) and \(m_{D} + m_{R} = w\) under both domains. In the gain domain, we have already determined the optimal decision. In the loss domain, we conclude that \(m_{D} = \frac{w}{2}\) if \(\beta > \frac{\theta }{2}\) and \(m_{D} = w\) if \(\beta < \frac{\theta }{2}\). Because of loss aversion (\(\theta > 1\)), it turns out that the condition for equal sharing \(\beta > \frac{\theta }{2}\) is harder to achieve in the loss than in the gain domain \((\beta > \frac{1}{2})\). The higher loss aversion, the lower the probability a dictator will share equally.

Now, our hypothesis is that subjects may be more inequality averse in the loss domain, meaning that \(\beta\) may be context-dependent (Buchan et al. 2005). As explained previously, this may be due to an increased feeling of responsibility or to a form of empathy towards the recipient, the dictator expecting the recipient to suffer more in the loss than in the gain domain. For the sake of convenience, let us refer to this effect as “compassion”. Denoting \(\beta^{Gain}\) as the inequality aversion parameter in the gain domain and \(\beta^{Loss}\) the inequality aversion parameter in the loss domain, this means that: \(\beta^{Gain} \le \beta^{Loss}\). If this is the case, the condition for sharing equally becomes \(\beta^{Gain} > \frac{1}{2}\) in the gain domain and \(\beta^{Loss} > \frac{\theta }{2}\) in the loss domain. Because of the increase in inequality aversion in the loss domain, the condition for sharing equally is not necessarily harder to achieve as compared to the gain domain. For convenience, let us write \(\beta^{Loss} = \rho \beta^{Gain}\), with \(\rho \ge 1\) denoting the increase in inequality aversion due to the loss context. Then, the condition for sharing equally in the loss domain becomes \(\beta^{Gain} > \frac{1}{2}\frac{\theta }{\rho }\). It follows that if \(\theta > \rho\) (the effect of loss aversion is larger than the effect of compassion), then the condition for sharing equally is harder to achieve in the loss than in the gain domain and the opposite is true if \(\theta < \rho\).

We can now make several hypotheses regarding the behavior of the dictator in either context. We formulate the hypotheses in terms of “amount offered” by the dictator to the recipient, which is equal to the recipient’s payoff \(m_{R}\). Strictly speaking, the dictator does not “offer” any money in the loss context. However, the recipient’s final payoff \(m_{R}\) is clearly mathematically equivalent to an offer from the dictator, so we use this variable for the sake of comparison with the gain context.

On the basis of past studies, there is mixed evidence regarding the effect of gain or loss on the dictator’s behavior. The compassion effect seems to be larger than the loss aversion effect in some studies (Baquero et al. 2013; Antinyan 2014) but not in others (Hillenbrand 2016; Neumann et al. 2018). Thus, we formulate the following null hypothesis based on \(\theta = \rho\):

H1. The dictators’ average offers are similar in the gain and in the loss domain, i.e. \(\varvec{m}_{\varvec{R}}^{{\varvec{Loss}}} = \varvec{m}_{\varvec{R}}^{{\varvec{Gain}}}\).

However, the literature suggests that there might be gender differences. According to several authors (e.g. Bolton and Katok 1995; Eckel and Grossman 1998; Engel 2011), women tend to be more generous than men in a gain-framed DG, because they are more socially-oriented and less efficiency-oriented compared to men (Eckel and Grossman 2008). In addition, Andreoni and Vesterlund (2001), and Carlsson et al. (2005), among others, found that women tend to be more inequality-averse than men. This is also the case in Chen et al. (2014) and Davis (1980).Footnote 11 Let the index M denote males and F denote females. We therefore assume \(\beta_{F}^{Gain} > \beta_{M}^{Gain}\), and formulate the following hypothesis:

H2. In the gain domain, females offer on average more than males, i.e. \(\varvec{m}_{{\varvec{R}_{\varvec{F}} }}^{{\varvec{Gain}}} > \varvec{m}_{{\varvec{R}_{\varvec{M}} }}^{{\varvec{Gain}}}\).

Regarding the possible differential effect of a loss frame, some research supported that females tend to be more empathetic than males (e.g. Willer et al. 2015; Mestre et al. 2009; Toussaint and Webb 2005; Macaskill et al. 2002; Gault and Sabini 2000; Lennon and Eisenberg 1987). Based on the prediction above that “unfairness in losses looms larger than unfairness in gains”, we can infer that the compassion effect will be larger for female dictators than for male dictators: \(\rho_{F} > \rho_{M}\), implying \(\beta_{F}^{Loss} = \rho_{F} \beta_{F}^{Gain} > \rho_{M} \beta_{M}^{Gain} = \beta_{M}^{Loss}\). Thus, females are a fortiori more inequality averse than males in the loss than in the gain domain. However, we also have to take into account the gender differences in loss aversion. To date, there is no conclusive evidence of gender differences regarding loss aversion. Experimental studies on gender differences in loss aversion yield mixed results. For instance, Gächter et al. (2007) did not find any gender difference in loss aversion whereas Rau (2014) found that females are more loss averse than males in investment decisions and Anbarci et al. (2017) found that males exhibit more loss aversion. Bouchouicha et al. (2019 and references therein) recently reviewed many studies investigating a possible gender effect in loss aversion and concluded that “definitions [of loss aversion] commonly employed in the literature (…), can result in very different conclusions on gender effects—no effect, women being more loss averse than men, or women being less loss averse than men.” We therefore assume \(\theta_{F} = \theta_{M} = \theta\). Recalling that the condition for sharing equally in the loss domain is \(\beta^{Gain} > \frac{1}{2}\frac{\theta }{\rho }\), that \(\beta_{F}^{Gain} > \beta_{M}^{Gain}\) and \(\frac{1}{2}\frac{\theta }{{\rho_{M} }} > \frac{1}{2}\frac{\theta }{{\rho_{F} }}\), we obtain \(\beta_{F}^{Gain} - \frac{1}{2}\frac{\theta }{{\rho_{F} }} > \beta_{M}^{Gain} - \frac{1}{2}\frac{\theta }{{\rho_{M} }}\), meaning that the condition for equal sharing in the loss context is easier to achieve for females than for males. Hence, we make the following hypothesis:

H3. In the loss domain, females offer on average more than males, i.e. \(\varvec{m}_{{\varvec{R}_{\varvec{F}} }}^{{\varvec{Loss}}} > \varvec{m}_{{\varvec{R}_{\varvec{M}} }}^{{\varvec{Loss}}}\).

4 Gain and loss frame experiments and results

To investigate how people behave in loss-framed DG, we perform two experiments. In the first, we conduct a conventional DG with students in the lab. Rather than being randomly assigned to a loss or gain situation, the second experiment gives participants the choice between choosing to participate into the loss or the gain-framed DG.

4.1 First experiment

A total of 796 students participated in a laboratory paper and pen experiment conducted in Besançon and Dijon (two close medium-sized cities in the East of France) between December 2015 and January 2016Footnote 12. All participants were drawn from the same subjects’ pool, i.e., freshmen undergraduate business students from the University of Bourgogne Franche-ComtéFootnote 13. Subjects were recruited thanks to public announcement in classes and ads at the campus. We implemented a “two-treatment between-subjects” design, one for the gain-framed DG and one for the loss-framed DG. More precisely, 390 students participated in a gain-framed DG, and 406 in a loss-framed DG. Numerous sessions (up to 4) were run by the same experimenter during the day, at spaced intervals and in distant locations on the campus (experimental laboratories on different floors), as to avoid participants from one session to meet participants from another. In order to ensure that treatments were similar in distribution by age, gender and region, students were recruited on a same procedure and only at their arrival, they were randomly assigned to one of the treatments. The general sample is relatively gender balanced with 46% females and 54% males. Each participant was involved in one single session (and thus in one single treatment). Participants were informed that on a random basis they either played the role of Dictator or the role of Recipient (labelled as Player A and Player B in the instructions). As to avoid other strategic interactions than the splitting situation (e.g., strategic thinking about the double roles), each participant played only the role that was randomly attributed to him/her (i.e. not all of our participants played the dictator role). The experiment consisted of a one-shot decision and lasted for about 20 min. The average final payments of the experiment were € 7.36 for dictators and € 2.64 for recipients. All parameters of the experiment were common knowledge. The content and instructions for both treatments were identical in all respects, with the exception of the description of the gain and loss-framed DG. Participants were told that the pairings were anonymous; neither participant would ever know the identity of the other. Detailed experimental instructions are provided in Online Appendix 1.

4.1.1 Treatment 1: The gain-framed DG

We consider the standard Dictator game (Forsythe et al. 1994; Hoffman et al. 1994). A first player, the dictator, decides how to split an amount w (10 euros) between himself and the second player. The second player (the recipient) has a passive role and can only accept the decision of the dictator, who can choose to offer nothing to him/her (the receiver will in this case have a null final gain) or on the contrary to give him a positive portion mR of w. If the dictator seeks to maximize his/her payoff, he will not share with the recipient (mR will be equal to 0) and takes the entire amount w. The final payments are mD= w − mR for the dictator and mR for the recipient.

4.1.2 Treatment 2: The loss-framed DG

Both players receive each an equal endowment of w. Nevertheless, they incur a general loss of w that has to be shared by the dictator between himself/herself and the recipient. The recipient has a passive role and can only accept the decision of the dictator. The dictator decides of the part of the loss lR he/she wants the recipient to incur, and the recipient finishes the game with mR = w − lR; the dictator incurs the remaining loss which equals mR, i.e. he finishes the game with mD= w − mR. If the dictator seeks to maximize his/her payoff, he/she will make the other player incurring the whole loss and this will lead to a final payoff of w (0) for the dictator (recipient).

To summarize, we vary the reference point between the two treatments while keeping fixed the final payoff. Mathematically speaking, the treatments are equivalent (final earnings are mD and mR respectively for the dictator and the recipient). In the gain-framed DG, the allocation that leaves the recipient with nothing has a label of zero, while the same allocation in the loss-framed DG is labeled − w. Interestingly, Gächter and Riedl (2005) also introduced a method to induce different reference points in bargaining and showed that reference points in entitlements influence bargaining.

4.2 Second experiment

To avoid reluctant involvement in tasks and role-playing, we extended the main experiment with a second experiment in which players A could decide to which treatment (the gain DG or the loss DG) they were willing to participate. 896 different participants have been recruited in the same fashion (52% females). After their arrival at the lab, they were randomly assigned either to the role of dictators (players A) or recipients (players B). The novelty was that players A could decide to play either the gain or loss-framed DG. They are presented both games in the instructions, and they choose which one of the games will be played with their recipient. Hence, in this second design, each dictator had the possibility to choose among treatments and opt-in [as done by Lazear et al. (2012) in a different context]. This gives individuals the possibility to sort and self-select in the frame they prefer. We performed this extension to avoid reluctant participation in a given task and ensure a purer voluntary participation, given that in real-life, individuals can sometimes avoid situations in which they do not want to be involved.

There are two reasons for which one could self-select into a specific situation: either because the default choice in that situation is comfortable to them, or because the active option in that situation corresponds to the behavior they are willing to implement. In our experiment, more than 95% of our participants, after selecting into their preferred frame, do take an active decision. We therefore conclude that in our case, self-selection occurred because of the active choice. The active choice in the gain situation is to give. If individuals self-select into this frame, it is because they intend to give to the other participant. The active choice in the loss frame is to take from the other participants. If individuals self-select into this frame, it is because they intend to take from the other participant. We therefore expect in this extension to obtain the reverse result as compared to our main experiment, i.e. less generosity from dictators in the loss-treatment than in the gain-treatment. Indeed, this loss context is less likely to induce a compassion effect (Baquero et al. 2013). Intuitively, what the theory tells us on social concerns towards a powerless recipient in loss-domain does not work when individuals choose knowingly a context in which they may take money rather than a context in which they could give it. Thus this study allows to a certain extent to test the effect of a loss while mitigating the compassion effect towards a powerless recipient.

4.3 Results

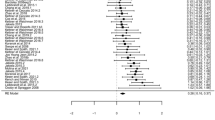

The aggregate results from the main experiment are presented in Table 1 and Fig. 1. As explained before, to make decisions comparable between the gain and loss framed treatments, we present the recipient’s payoff \(m_{R} ,\)which can be interpreted as the dictator’s offer in both situations (for instance, a transferred loss of 6 euros in the loss-framed treatment corresponds to an offer of 4 euros in the gain framed treatment). In the following, we test the three hypotheses presented above and provide other results whenever relevant.

The average payoff of recipients in the gain-framed DG, i.e. 2.39 euros (SD 2.20) is not really surprising and is consistent with the standard literature result of an average donation equal to about 20–30% of the endowment (Engel 2011). In our experiment, this treatment serves as a control to make an insightful comparison with the loss-framed DG. The average payoff of recipients in the loss-framed DG corresponds to a loss transfer of 7.11 euros, which is equivalent to a donation of 2.89 euros (SD 2.09). Interestingly, dictators are significantly more generous in the loss-framed DG than in the gain-framed DG (Wilcoxon Mann–Whitney, p value: 0.013Footnote 14). Figure A.1 in Online Appendix 4 allows us to easily see a more extreme selfish behavior of individuals in the context of gains than in the context of losses: the percentage of dictators leaving only 20% or less of the endowment to the recipient is 55% in the gain-framed DG, whereas it is only 40% in the context of losses.

To further substantiate this analysis, we use an econometric regression. We note first that over the 398 observations that lie in the interval [0, 10], 106 are equal to 0, and 2 are equal to 10. Hence, given the nature of our explained variable, we use a Tobit model left-censored to 0 and right-censored to 10. The framework for this analysis is the following model:

where the dependent variable \(m_{Ri}\), is the amount offered to the recipient or equivalently the recipient’s payoff; \(loss_{i}\) is a dummy treatment indicator equal to 0 in the gain-framed DG and to 1 in the loss-framed DG; \({{\varepsilon }}_{\text{it}} \to {{\rm{N(0,}}{\sigma }}_{{{\varepsilon }}}^{ 2} )\) is a residual error term. The model is estimated by using the maximum likelihood method. Estimation results are reported in the column (1) of Table 2. This analysis confirms that offers are significantly higher in the loss-framed treatment. We therefore reject Hypothesis 1:

Result 1: Dictators’ average offers are larger in the loss than in the gain-framed treatment, i.e. \(\varvec{m}_{\varvec{R}}^{{\varvec{Loss}}} > \varvec{m}_{\varvec{R}}^{{\varvec{Gain}}}\).

This result is consistent with a larger compassion effect than loss aversion effect when making decision in loss context, i.e. \(\theta < \rho\). In short, it seems that at the whole sample level, loss aversion does not offset other-regarding preferences.

To investigate possible gender differences, we separated male and female dictators and examined the decisions of each subgroup (Figs. 2 and 3). According to Fig. 2, most men either offer nothing, or 50% of their endowment. Figure 4 provides a visual comparison of average offers per treatment and gender. The mean value of the donation provided by men represents 2.19 euros (SD 2.30) in the gain-framed DG and 2.56 euros (SD 2.16) in the loss-framed DG. Despite the fact that men seem to adopt a more selfish behavior in the gain contextFootnote 15 the effect of the loss-frame is not statistically significant for men (Mann–Whitney, p-value = 0.19). Interestingly, a significant proportion of female dictators chooses a 50–50 split, which may reflect a real aversion to inequality (Fig. 3). Figure 4 shows that the mean value of donations provided by women is 2.59 euros (SD 2.07) of the endowment in the gain-framed DG and 3.31 euros (SD 1.94) in the loss-framed DG. These results are consistent with the postulate of Andreoni and Vesterlund (2001) that “men are more likely to be either perfectly selfish or perfectly selfless, whereas women tend to be ‘equalitarians’ who prefer to share evenly”. Few women adopt the selfish behavior of men. Moreover, from the Wilcoxon Mann–Whitney test, we find a positive and significant effect of loss on women (p-value= 0.012).

Hypotheses 2 and 3 focus on gender differences respectively in the gain-framed and the loss-framed treatments. From Wilcoxon Mann–Whitney tests, we conclude that women offer significantly more than men (p-value = 0.092 in the gain-framed treatment, p-value = 0.013 in the loss-framed treatment).

To further investigate the gender effect, we extend the previous econometric model as:

where femalei is a dummy gender indicator equal to 0 for men and to 1 for women. Estimation results are reported in the column (2) of Table 2. The coefficient female is highly significantly positive, confirming that overall, females offer more than males.

To investigate whether the gender effect varies with the framing, we finally extend the previous econometric model as:

where \(loss_{i} \times female_{i}\) is an interaction term. Estimation results are reported in column (3) of Table 2. Because of the presence of the interaction term, the coefficient female now captures the gender effect in the gain-framed treatment, i.e. \(E\left( {m_{Ri} |loss_{i} = 0,female = 1} \right) - E\left( {m_{Ri} |loss_{i} = 0,female = 0} \right) = \left( {\alpha_{0} + \alpha_{2} } \right) - \left( {\alpha_{0} } \right) = \alpha_{2}\). We find the standard result according to which women tend to be more generous than men in the gain-framed DG (p = 0.081). This is consistent with Hypothesis 2, which is in line with the assumption that women are more inequality averse than men in the gain domain (\(\beta_{F}^{Gain} > \beta_{M}^{Gain}\)):

Result 2: In the gain domain, females offer on average more than males, i.e. \(\varvec{m}_{{\varvec{R}_{\varvec{F}} }}^{{\varvec{Gain}}} > \varvec{m}_{{\varvec{R}_{\varvec{M}} }}^{{\varvec{Gain}}}\).

Moreover, we can estimate the marginal effect of female for the loss-framed treatment as \(E\left( {m_{Ri} |loss_{i} = 1,female = 1} \right) - E\left( {m_{Ri} |loss_{i} = 1,female = 0} \right) = \alpha_{2} + \alpha_{3}\).The estimated effect is 1.056*** (p = 0.009), showing that women offer highly significantly more than men in the loss-framed DG. Thus, we derive the third result, consistent with Hypothesis 3:

Result 3: In the loss domain, females offer on average more than males, i.e. \(\varvec{m}_{{\varvec{R}_{\varvec{F}} }}^{{\varvec{Loss}}} > \varvec{m}_{{\varvec{R}_{\varvec{M}} }}^{{\varvec{Loss}}}\).

This is consistent with the condition \(\beta_{F}^{Gain} - \frac{1}{2}\frac{{\theta_{F} }}{{\rho_{F} }} > \beta_{M}^{Gain} - \frac{1}{2}\frac{{\theta_{M} }}{{\rho_{M} }}\). If our assumption \(\theta_{F} = \theta_{M} = \theta\) is correct, this result has two possible explanations. First, women’s compassion effect in the loss domain is larger than men’s, i.e. \(\rho_{F} > \rho_{M}\). Second, \(\beta_{F}^{Gain}\) is sufficiently larger than \(\beta_{M}^{Gain}\). The fact that Result 2 was only weakly significant and the next two results provide more support for the former interpretation.

Two further results can be derived from the regression analysis. First, the coefficient loss, which pertains to the effect of the framing for males \((E\left( {m_{Ri} |loss_{i} = 1,female = 0} \right) - E\left( {m_{Ri} |loss_{i} = 0,female = 0} \right) = \alpha_{1} ),\) is not significant. This confirms the previous non parametric test showing that men do not offer more in the loss-framed DG.

Result 4: Males do not offer on average more in the loss than in the gain domains.

This result is consistent with \(\theta_{M} \approx \rho_{M}\), suggesting that for men, the loss aversion effect would tend to cancel out with the compassion effect.

The interesting result is the marginal effect of the loss framing for women: \(E\left( {m_{Ri} |loss_{i} = 1,female = 1} \right) - E\left( {m_{Ri} |loss_{i} = 0,female = 1} \right) = \alpha_{1} + \alpha_{3}\).The estimated effect is 0.830** (p = 0.046), showing that women offer significantly more in the loss-framed than in the gain-framed DG:

Result 5: Females offer on average more in the loss than in the gain domains, i.e. \(\varvec{m}_{{\varvec{R}_{\varvec{F}} }}^{{\varvec{Loss}}} > \varvec{m}_{{\varvec{R}_{\varvec{F}} }}^{{\varvec{Gain}}}\).

This result is consistent with \(\theta_{F} < \rho_{F}\), meaning that for women, the loss aversion effect is lower than the compassion effect.

Taken together and assuming that \(\theta_{F} = \theta_{M} = \theta\), these last two results are in line with \(\rho_{F} > \rho_{M}\), which is also consistent with past literature. However, the assumption that men and women have similar levels of loss aversion need to be further tested in future studies, as our results are also consistent with the fact that men are more averse to losses than women (i.e., \(\theta_{F} < \theta_{M}\)).

Finally, what happens when participants self-select into frames? For the second experiment, interestingly, most participants, namely 65%, self-selected into the loss-framed DG (62% of women, 67% of men). Dictators choose significantly more to play the game in a “loss context” than the game in a “gain-context” (binomial test, p = 0.000). It could be due to the fact that intuitively, for the same final earnings, a dictator will feel more powerful when he can withdraw money from the recipient (loss context) than when he can only give some.

Table 3 displays the main descriptive statistics in case of self-selection. We observe that the respective mean offers in the self-selected gain-framed and the loss-framed treatments are 3.49 euros (SD 2.00) and 3.11 euros (SD 2.16) and the difference is significant (Mann–Whitney, p = 0.068). Thus, contrary to what was found in the main experiment, offers are lower in the loss-framed treatment. This treatment effect is significant for men (Mann–Whitney, p = 0.084) but not for women (Mann–Whitney, p = 0.470). We do not find any significant gender difference in the gain frame and in the loss frame on the basis of Mann–Whitney tests.

We conducted the same econometric regressions as for the main experiment and reported the results in Table 4. Column (1) shows that there is a global negative treatment effect, which is the opposite to what we previously found:

Result 6: When participants self-select, in the loss-framed DG, dictators give on average less than in the gain-framed DG.

The output of the full regression in column (3) shows that the coefficient loss is significantly negative, providing support that males offer less in the loss-framed game. No other significant effect can be found in case of self-selection.

Result 7: When participants self-select, males offer less in the loss-framed than in the gain-framed game but females do not offer different amounts between the two framings.

Given the absence of random assignment to the gain or loss-framed DG, the results could have been expected. As explained before, it is possible that individuals who self-select into the loss treatment are different (i.e., less generous) from those who self-select into the gain treatment. In the same vein, individuals who self-select in the gain frame are likely to be more altruistic. More importantly, we can expect that they are more generous than those enrolled in gain situations in absence of self-selection (indeed, they give 3.5 on average, more than 2.39). We can therefore conclude that in naturally occurring situations (as in our first experiment), more generosity is predictable in loss situations; however, if individuals decide themselves of the situations in which they want to evolve, their generosity could be affected.

5 Conclusion

Thanks to an original experimental design, we provided answers to two main research questions related to the generosity of dictators in a loss context (as compared to a gain one) and possible gender differences. We have shown that sharing decisions are dependent on framing. Indeed, the loss frame can provide all individuals in the dictator games (i.e. both dictators and recipients) with a perception that makes them feel entitled to the endowment received. Dictators could simply try to protect their entitlement, but they will also understand that recipients can be also attached to this entitlement. Unlike the predictions of the prospect theory, dictators seem, on average, significantly more generous in a loss-framed DG than in a gain-framed DG. This could be due to the specific context of the dictator’s game. Indeed, in this context, the dictator has all the power, and is therefore responsible for the well-being (or unhappiness) of the recipient. Admittedly, losing a certain amount of money has more impact on utility than earning the same amount. Therefore, at first glance, we could think that the dictator is going to be less generous in the loss-framed DG than in the gain-framed DG. However, “unfairness in losses looms larger than unfairness in gains”, thus participants tend to associate loss with “unfair” and gain with “fair”. Consequently, having someone who loses a certain amount of money has more impact on our utility than having someone who earns the same amount. Thus, the situation of the recipient is even less enviable in a loss context, which is quite intuitive. Our results are therefore in line with the conclusions of Buchan et al. (2005), Leliveld et al. (2009) and Zhou and Wu (2011) for the ultimatum game. Nevertheless, investigating the effect of losses in a dictator game where strategic issues are absent allowed us to extend this previous literature: the proposer offers more in the loss domain because he is intrinsically motivated to do it, not only because he anticipates that the receiver will be more demanding.

There are two divergent specific effects in action, but, according to our results, the net effect of compassion with respect to loss aversion is on average higher for women than for men. We observe that women’s offers are significantly larger in the loss context than in the gain context. For men, this difference exists but is not significant. It seems that the gender effect that has been found in the standard dictator game (see Eckel and Grossman 1998; Engel 2011) is even larger in the loss context. Thus, we observe that sharing a loss has more impact on women than on men. Therefore, our results extend the literature on gender effects to the context of losses. Our findings are consistent with the postulate of Andreoni and Vesterlund (2001), Carlsson et al. (2005) and many others, showing that women tend to be more socially-oriented than men. Indeed, much fewer women adopt the selfish behavior of men, and this is even truer in the loss domain. The most interesting result of this study (i.e. dictators’ offers increase in the domain of losses, especially for women) would mainly come from compassion-like motivations, which are rarely studied social preferences in experimental economics. As argued by Adam Smith (1759), we cannot share “the misery of others” if not aware of it. The context of losses, by making us more aware of the pain of others, makes us more prone to reduce it.

Our main finding seems relevant in several ways. First, it helps to identify circumstances under which people are more willing to share equally with the others. Indeed, when individuals are in a situation framed as a possible loss from a reference point, they seem to be more likely to share losses equally as compared with a situation framed as a gain. Second, a natural implication of our result for decision makers is to devote enough attention to gain–loss perception and to potentially unintended effects from framing. Loss frames are clearly more efficient to enhance sharing, at the condition they are not provoked by the participants and occur naturally. This is clearly good news: when natural disasters occur, we can expect humankind, especially driven by women, to show more altruism.

Notes

Experimental investigations of bankruptcy problems have addressed a part of this point. In this type of experiment, authors sought to determine how the liquidation value should be divided among creditors when a firm goes bankrupt (Herrero et al. 2010; Cappelen et al. 2019). However, in this type of experiment, the sharing of the liquidation value is decided by a participant who is not affected by the bankruptcy. Antinyan (2014) investigates this issue in the dictator game by looking at how participants split a reduced endowment (a gain) after incurring a loss (a reduction of the pie).

We also extend our investigation to non-conventional samples (see Online Appendix 3).

We recently found a PhD thesis (Hillenbrand 2016) including a game where an individual must decide how to share a loss between him and another person. He finds that offers are lower in the loss than in the gain context. However, in addition to all the other differences with our design (e.g. binary choice, repeated game, etc.), the game presented is not strictly speaking a standard dictator game because the receiver does not have a passive role. Indeed, he is the dictator of another person. Thus, in this experiment, the participant has to decide how to share a loss with another dictator, which will then do the same with another dictator, etc. Thus, “moral responsibility” towards a powerless individual cannot be the motivation for giving. All individuals in this experiment have the same power, which could explain in large part the differences with our results. For more details, see Hillenbrand (2016), pp. 41–62.

Indeed, splitting a reduced endowment after incurring a loss and directly splitting a loss which is deducted from an initial endowment are different framings that are not likely to be equivalent from the behavioral perspective: the first situation, presented in Antinyan (2014)’s design, is simply a traditional dictator sharing situation in which the dictator has to share a reduced pie (i.e., a lower gain), while having as a reference point a bigger pie; the second situation (our design) is a situation in which both participants have an identical initial reference point corresponding to a received endowment that will be affected by the loss and the decision of the dictator. The first situation is therefore still a gain framed situation, while the second, a loss framed situation.

According to List (2007, pp. 484–485), “in the dictator game, the traditional action set invokes expectations of the givers and receivers that seemingly “demand” a positive gift, since a zero transfer is equivalent to being entirely selfish with money that an authoritative figure has just kindly endowed. In lieu of the fact that this same authoritative figure asks the subject if she would like to share the endowment, the wheels of motion for giving are set in place. (…) By allowing choices that are not entirely selfish in the nonpositive domain, the social norms of the game change, providing the dictator with the “moral authority” to give nothing. In this spirit, subjects are using the contextual cues of the game to figure out which set of norms given in dictator games applies to the particular problem at hand”.

Empathy-like motivations have long been studied in social psychology. See for example Willer et al. (2015).

The binary prediction is due to the linearity of the model. This is a satisfactory approximation of decisions in the dictator game (see e.g. Engel 2011).

Our results show that only 2.8% of dictators gave more than half of their endowment in our main experiment.

We chose to keep the model in its linear version as the Fehr and Schmidt (1999) model. Using the nonlinear models would allow us to refine the predictions but would not affect them in essence.

The utility function is therefore assumed to be additively separable in the value function and the inequality aversion term. Such a form of the utility function has been provided axiomatic characterization by Neilson (2006).

These results should nevertheless be taken with precaution as Croson and Gneezy (2009) highlight the fact that women’s behavior is more sensitive to subtle variations in the context of the experiment than the behavior of men.

A robustness test of the lab experiment was conducted by running the same experiment with a sample of 232 more diverse participants, see Online Appendix 3.

As students reported no variability in age, we did not use this variable in the regressions.

All tests are two-sided.

See Figure A.3 in Online Appendix 4, the share of male dictators leaving only 20% or less of the allocation to the recipient is 60% in the gain-framed DG, whereas it is 46% in the loss context.

References

Anbarci N, Arin KP, Okten C, Zenker C (2017) Is Roger Federer more loss averse than Serena williams? Appl Econ 49(35):3546–3559

Andreoni J, Vesterlund L (2001) Which is the fair sex? Gender differences in altruism. Q J Econ 116(1):293–312

Antinyan A (2014) Loss and other-regarding preferences: evidence from dictator game. No 03, Working Papers, Department of Management, Università Ca’Foscari Venezia. https://EconPapers.repec.org/RePEc:vnm:wpdman:74. Accessed 15 June 2020

Ariely D, Loewenstein G, Prelec D (2003) Coherent arbitrariness: stable demand curves without stable preferences. Q J Econ 118(1):73–105

Baquero G, Smit W, Wathieu L (2013) The generosity effect: fairness in sharing gains and losses. ESMT Working paper, No. 13-08

Bardsley N (2008) Dictator game giving: altruism or artefact? Exp Econ 11(2):122–133

Baron J, Ritov I (1994) Reference points and omission bias. Organ Behav Hum Decis Process 59:475–498

Blau PM (1964) Exchange and power in social life. Transaction Publishers, Piscataway

Bolton GE, Katok E (1995) An experimental test for gender differences in beneficent behavior. Econ Lett 48(3):287–292

Bouchouicha R, Deer L, Eid AG et al (2019) Gender effects for loss aversion: yes, no, maybe? J Risk Uncertai 59(2):171–184

Brañas-Garza P, Rodríguez-Lara I, Sánchez A (2017) Humans expect generosity. Sci Rep. https://doi.org/10.1038/srep42446Published online 2017 Feb 14

Buchan N, Croson R, Johnson E, Wu G (2005) Gain and loss ultimatums. In: Morgan John (ed) Advances in applied microeconomics, volume 13: experimental and behavioral economics. Elsevier, Amsterdam, pp 1–24

Cappelen AW, Luttens RI, Sorensen E, Tungodden B (2019) Fairness in bankruptcies: an experimental study. Manag Sci 65(6):2832–2841

Carlsson F, Daruvala D, Johansson-Stenman O (2005) Are people inequality-averse, or just risk-averse? Economica 72(287):375–396

Chen W, Lu J, Liu L, Lin W (2014) Gender differences of empathy. Adv Psychol Sci 22(9):1423–1434

Croson R, Gneezy U (2009) Gender differences in preferences. J Econ Lit 47(2):448–474

Davis M (1980) A multidimensional approach to individual differences in empathy. JSAS Cat Sel Doc Psychol 10:85

De Dreu CK (1996) Gain–loss-frame in outcome-interdependence: does it influence equality or equity considerations? Eur J Soc Psychol 26(2):315–324

De Dreu CK, Lualhati JC, McCusker C (1994) Effects of gain—loss frames on satisfaction with self–other outcome-differences. Eur J Soc Psychol 24(4):497–510

Eckel CC, Grossman PJ (1998) Are women less selfish than men? Evidence from dictator experiments. Econ J 108(448):726–735

Eckel CC, Grossman PJ (2008) Differences in the economic decisions of men and women: experimental evidence. Handb Exp Econ Results 1:509–519

Ellingsen T, Johannesson M, Mollerstrom J, Munkhammar S (2012) Social framing effects: preferences or beliefs? Games Econ Behav 76(1):117–130

Emerson RM (1962) Power-dependence relations. Am Sociol Rev 27(1):31–41

Engel C (2011) Dictator games: a meta study. Exp Econ 14(4):583–610

Fehr E, Schmidt KM (1999) A theory of fairness, competition, and cooperation. Q J Econ 114(3):817–868

Fehr E, Schmidt KM (2006) The economics of fairness, reciprocity and altruism–experimental evidence and new theories. Handb Econ Giv Altruism Reciprocity 1:615–691

Forsythe R, Horowitz JL, Savin NE, Sefton M (1994) Fairness in simple bargaining experiments. Games Econ Behav 6(3):347–369

Gächter S, Riedl A (2005) Moral property rights in bargaining with infeasible claims. Manag Sci 51(2):249–263

Gächter S, Johnson EJ, Herrmann A (2007) Individual-level loss aversion in riskless and risky choices. CeDEx Discussion Paper Series, No. 2010-20, The University of Nottingham

Gault BA, Sabini J (2000) The roles of empathy, anger, and gender in predicting attitudes toward punitive, reparative, and preventative public policies. Cogn Emot 14(4):495–520

Greenberg J (1978) Effects of reward value and retaliative power on allocation decisions: justice, generosity, or greed? J Pers Soc Psychol 36(4):367–379

Grolleau G, Kocher MG, Sutan A (2016) Cheating and loss aversion: do people cheat more to avoid a loss? Manag Sci 62(12):3428–3438

Handgraaf MJ, Van Dijk E, Vermunt RC, Wilke HA, De Dreu CK (2008) Less power or powerless? Egocentric empathy gaps and the irony of having little versus no power in social decision making. J Pers Soc Psychol 95(5):1136–1149

Herrero C, Moreno-Ternero JD, Ponti G (2010) On the adjudication of conflicting claims: an experimental study. Soc Choice Welf 34(1):145–179

Herweg F, Schmidt KM (2014) Loss aversion and inefficient renegotiation. Rev Econ Stud 82(1):297–332

Herweg F, Müller D, Weinschenk P (2010) Binary payment schemes: moral hazard and loss aversion. Am Econ Rev 100(5):2451–2477

Hillenbrand A (2016) Essays in behavioral and experimental economics. Doctoral dissertation, Bonn, Rheinische Friedrich-Wilhelms-Universität Bonn

Hoffman E, McCabe K, Shachat K, Smith V (1994) Preferences, property rights, and anonymity in bargaining games. Games Econ Behav 7(3):346–380

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econom J Econom Soc 47(2):263–291

Kahneman D, Tversky A (1982) The psychology of preferences. Sci Am 246:60–73

Kahneman D, Knetsch JL, Thaler RH (1986) Fairness and the assumptions of economics. J Bus 59(4):S285–S300

Kern MC, Chugh D (2009) Bounded ethicality: the perils of loss framing. Psychol Sci 20(3):378–384

Kvaløy O, Luzuriaga M, Olsen TE (2017) A trust game in loss domain. Exp Econ 20(4):860–877

Lazear EP, Malmendier U, Weber RA (2012) Sorting in experiments with application to social preferences. Am Econ J Appl Econ 4(1):136–163

Leliveld MC, Van Beest I, Van Dijk E, Tenbrunsel AE (2009) Understanding the influence of outcome valence in bargaining: a study on fairness accessibility, norms, and behavior. J Exp Soc Psychol 45(3):505–514

Lennon R, Eisenberg N (1987) Gender and age differences in empathy and sympathy. In: Eisenberg N, Strayer J (eds) Empathy and its development. Cambridge University Press, Cambridge, pp 195–217

List JA (2007) On the interpretation of giving in dictator games. J Polit Econ 115(3):482–493

Lusk JL, Hudson MD (2010) Bargaining over losses. Int Game Theory Rev 12(01):83–91

Macaskill A, Maltby J, Day L (2002) Forgiveness of self and others and emotional empathy. J Soc Psychol 142(5):663–665

Mestre MV, Samper P, Frías MD, Tur AM (2009) Are women more empathetic than men? A longitudinal study in adolescence. Span J Psychol 12(1):76–83

Neilson WS (2006) Axiomatic reference-dependence in behavior toward others and toward risk. Econ Theor 28(3):681–692

Neumann T, Kierspel S, Windrich I, Berger R, Vogt B (2018) How to split gains and losses? Experimental evidence of dictator and ultimatum games. Games 9(4):78

Poppe M, Valkenberg H (2003) Effects of gain versus loss and certain versus probable outcomes on social value orientations. Eur J Soc Psychol 33(3):331–337

Rau HA (2014) The disposition effect and loss aversion: do gender differences matter? Econ Lett 123(1):33–36

Smith A (1759) The theory of moral sentiments (Henry G. Bohn, London, 1853). HG Bohn, 1853. Original work published 1759.

Toussaint L, Webb JR (2005) Gender differences in the relationship between empathy and forgiveness. J Soc Psychol 145(6):673–685

Tversky A, Kahneman D (1981) The framing of decisions and the psychology of choice. Science 211(4481):453–458

Willer R, Wimer C, Owens LA (2015) What drives the gender gap in charitable giving? Lower empathy leads men to give less to poverty relief. Soc Sci Res 52:83–98

Zhou X, Wu Y (2011) Sharing losses and sharing gains: increased demand for fairness under adversity. J Exp Soc Psychol 47(3):582–588

Acknowledgements

This work was supported by the Burgundy School of Business. We are very grateful for insightful comments and helpful suggestions from the editors, as well as the two anonymous reviewers, throughout the revision process. We would also like to thank several colleagues for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Cochard, F., Flage, A., Grolleau, G. et al. Are individuals more generous in loss contexts?. Soc Choice Welf 55, 845–866 (2020). https://doi.org/10.1007/s00355-020-01266-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-020-01266-y