Abstract

We propose a unified framework bridging the gap between team and competition issues in price and quantity games, played by producers of either substitutes or complements, when information is imperfect and dispersed. We reconsider the social value of private and public information in this context and compare the outcomes of the two types of games in terms of equilibrium and social welfare. By parting with full cooperation, the competition motive fitted into the payoffs introduces a strategy distortion and, when information is dispersed, an informational distortion, both increasing with the intensity of competition. The former affects the response to the expected value of the fundamental, and the latter translates into an inefficiently low (high) weight on public information under strategic complementarity (substitutability). Contrary to the latter, which vanishes in the absence of the competition motive, the former is eliminated, under strategic complementarity and dispersed information, at some positive strength of the competition motive, decreasing with the information quality. This disparity creates a trade-off between the minimization of each distortion. As to the social value of public information, it is always positive, while that of private information may be negative, again under strategic complementarity, if competition is intense and the quality of private information relatively poor. Finally, it is more profitable to play under strategic substitutability, except possibly for an intermediate range of the intensity of competition if the quality of private information is again relatively poor.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The payoffs of Keynes’ beauty contest, as modeled by Morris and Shin (2002), involve three motives (Cornand and Heinemann 2008): a fundamental motive, making agents strive to predict and fit some exogenous fundamental value, a coordination motive, giving them an incentive to match the conventional value to be set by the market, and a competition motive, making them better off when beating the market.

Should information be perfect, the fundamental and the coordination motives would be compatible: all agents would simply coordinate on the fundamental value. As information becomes imperfect, blurring the fundamental, and dispersed, obstructing coordination, a conflict emerges between the fundamental and coordination motives. The competition motive introduces a further conflict, even in the absence of informational frictions, since pursuing the coordination and the competition motives means meeting and beating the market at the same time. While the conflict between the fundamental and the coordination motives has been largely explored in the beauty contest literature, less attention has been paid to the influence of the competition motive, which we want to emphasize now as a source of inefficiency under perfect as well as under imperfect and dispersed information.

Our contribution consists in building a unified framework bridging the gap between team and competition issues. On the one hand, this unified framework allows us to reconsider the social value of private and public information in a large category of contexts going beyond the Keynesian beauty contest, since they extend from situations of strategic complementarity generated by the coordination motive to situations of strategic substitutability resulting from an anti-coordination motive, when agents want to move away from each other. On the other hand, it enables us to formulate direct comparisons between the performances of price and quantity games when information is imperfect and dispersed.

To obtain the unified framework and capture the specific impact of the competition motive, we model an economy with a simple multidivisional company,Footnote 1 where each division supplies a diversified good and is assigned to maximize a convex combination of its own profit and of the company joint profit. We thus obtain as polar cases full competition (leading to a standard oligopolistic equilibrium) and full cooperation (entailing the collusive solution).Footnote 2

The model is studied in the context of both price and quantity games, with goods that are either substitutes or complements. Introducing the competition motive has two effects. First, independently from informational issues, this motive distorts the equilibrium strategies away from their efficient value, thus generating a (price or quantity) strategy distortion. Second, under coexisting public and private information on the stochastic fundamental (the market size), the competition motive distorts the relative weights put on the two kinds of information, generating an informational distortion, which countervails the effect of the coordination (or anti-coordination) motive. In both price and quantity games, the informational distortion generated by the competition motive thus translates into an inefficiently low weight on the public signal in the presence of the coordination motive (hence under strategic complementarity) and into an inefficiently high weight on the public signal in the presence of the anti-coordination motive (hence under strategic substitutability). Both distortions increase with the intensity of competition.

When information is perfect, or even imperfect but homogeneous, the competition motive is sole responsible, by the strategy distortion it generates, for equilibrium inefficiency. In this context, efficiency is simply attained by suppressing the competition motive and enforcing the collusive solution. However, under heterogeneous information, inefficiency arises also from the conflict between the fundamental and the coordination motives. Because it countervails the effect of the latter in favor of the former, the competition motive can then be called upon to restore equilibrium efficiency: the collusive solution is not optimal under the coordination motive when information is dispersed. We thus end up with a trade-off between minimizing the informational distortion by inactivating the competition motive and minimizing the strategy distortion by keeping it active with some positive strength.

After examining the well-known case of perfect information where the competition motive is responsible for the sole strategy distortion, we establish, for the case of imperfect and dispersed information where the strategy and informational distortions interact, some results regarding equilibrium efficiency and the social value of information.Footnote 3 When the competition motive combines with the anti-coordination motive (hence under strategic substitutability), the collusive solution is optimal from the producers’ standpoint and the social value of both public and private information is always positive, whatever the intensity of competition. By contrast, when it combines with the coordination motive (hence under strategic complementarity), equilibrium efficiency requires a positive strength of the competition motive, increasing with the cost of information imperfection and dispersion. Also, while the social value of public information is still positive, that of private information becomes negative for a high enough intensity of competition. Indeed, increasing the precision of either public or private information directly helps divisions better predict the fundamentals, but may also augment the informational distortion. This additional effect of an increase in the precision of private information results under strategic complementarity in an excessive weight put on the private signal. The negative indirect effect eventually dominates the positive direct effect as the intensity of competition becomes larger and larger, reducing the importance of the fundamental motive.

We further compare from a welfare point of view the outcomes of price and quantity games. Under perfect information, producers prefer to play under the influence of anti-coordination rather than coordination (hence under strategic substitutability rather than strategic complementarity), whereas the consumers prefer the price game. Under imperfect and dispersed information, the same result applies when competition is sufficiently intense, undermining the influence of informational costs. At the other extreme, when competition is very soft and informational costs all important, the producers have still a preference for anti-coordination, while the consumers prefer coordination (which changes their position in the case of complementary goods, where they prefer the quantity game). However, there is an intermediate range of competition intensity for which producers prefer coordination and consumers anti-coordination when the relative precision of private information is sufficiently low.

The paper contributes to two main strands of the literature. First, it belongs to the growing literature on the social value of information initiated by Morris and Shin (2002), who highlight the conflict between the fundamental and the coordination motives, and show that an increase in the precision of public information is harmful in a context of strategic complementarity if private information is already precise enough. This result is largely due to the presence of the sole fundamental motive in the social welfare function, the coordination motive being exactly counterbalanced by the competition motive in Morris and Shin’s framework. Angeletos and Pavan (2007) show that Morris and Shin’s result must indeed be qualified, in particular by referring to the relation between the equilibrium and the efficient uses of information. Also, Ui and Yoshizawa (2015) characterize the social value of information in symmetric quadratic-payoff games for a larger class of environments than Angeletos and Pavan.Footnote 4 Both propose IO (Bertrand and Cournot) applications,Footnote 5 without pointing to the source of the discrepancy between the equilibrium and efficient uses of information, namely the competition motive.Footnote 6 The same IO illustrations of beauty contest games, used to emphasize the conflict between the fundamental and the coordination motives, appear in Myatt and Wallace (2012, 2015, 2018), a series of papers extending the analysis to endogenous information acquisition. By taking as the fundamental targets pursued by the oligopolistic firms the Bertrand and the Cournot equilibrium strategies, Myatt and Wallace merge the fundamental and competition motives. Such a procedure does not allow to consider the effect of the competition motive separately, which is our aim in the present paper. We take instead the collusive strategies as the fundamental targets, which allows us to disentangle the fundamental and the competition motives. Bayona (2018) reconsiders the results of Angeletos and Pavan (2007) and notably that of their IO applications to Bertrand and Cournot competition when an endogenous public signal is considered. In particular, she shows that such an informational assumption may reverse the social value of private information.

Second, the paper extends to a context of imperfect and dispersed information the systematic comparison of price and quantity competition initiated by Singh and Vives (1984) for a differentiated duopoly with linear demand. (Recent contributions, also under perfect information, are provided by Amir and Jin 2001 and Amir et al. 2017.) In the same vein, we observe the development of a literature on the aggregation of private information in oligopolies with either demand or cost uncertaintyFootnote 7 (Raith 1996; Vives 1988, 2011). This literature goes beyond the scope of the present paper in dealing with firms’ strategic decisions concerning information sharing and acquisition, or else with private information revelation at equilibrium. Nonetheless, our work could have some implications of interest in terms of information sharing about uncertain demand. We show indeed that information sharing—viewed, like in Angeletos and Pavan (2007), as an increase in the precision of public information—is profit enhancing under both Bertrand and Cournot regimes of competition. While this result is in line with Amir et al. (2010, Corollary 2) and finds some empirical support in the recent though scarce empirical literature (see notably Gardete 2016), it stands in contrast to that of most of the theoretical literature (as developed by Gal-Or 1985; Novshek and Sonnenschein 1982; Li 1985; Sakai 1985). As emphasized by Raith (1996, p. 263) in his synthetic model, a general result in this literature is that “with a common value and strategic complements, complete information pooling is an equilibrium of the two-stage game (which is efficient from the viewpoint of the firms), regardless of all other parameters. With a common value and strategic substitutes, no pooling is the equilibrium solution. This solution is efficient in Cournot markets with homogeneous goods and inefficient for a large degree of product differentiation.” The present article differs from this literature in several respects. First, it proposes a more general profit function by possibly including the total profit in the objective function of each division. Second, while this literature generally considers only private signals (and their potential revelation as multiple public signals), the information structure of the present paper considers the simultaneous provision of public and private information, which allows analyzing how firms use public relatively to private information. Moreover, this literature usually considers prior information on demand conditions, while we do not allow for prior information.

The remaining of the paper is structured as follows: Section 2 presents the setup of the economy. Section 3 focuses on the perfect information benchmark, emphasizing the strategy distortion generated by the competition motive, while Sect. 4 examines equilibrium and welfare under dispersed information, introducing the informational distortion and reconsidering the strategy distortion in this context. Section 5 concludes.

2 The economy

We consider a simple economic sector composed of a representative consumer and a multidivisional company.

2.1 The representative consumer

We assume that the representative consumer’s utility is symmetricFootnote 8 quadratic with respect to the differentiated goods supplied by the company divisions and quasilinear with respect to a composite good representing the rest of the economy.

The representative consumer, endowed with positive wealth w, buys at prices \(\mathbf {p}\in \mathbb {R}_{++}^{n}\) a basket \(\mathbf {q}\in \mathbb {R} _{+}^{n}\) of n differentiated goods to the n divisions of the company, plus a quantity \(z\in \mathbb {R}_{+}\) of a composite numeraire good to a competitive industry, so as to maximize, under the budget constraint \( \mathbf {pq}+z\le w\) utility

with

The positive parameter \(\theta \) is an index of market size and \(\left| \gamma \right| \) is the degree of interdependence between goods, goods being substitutes if \(\gamma >0\), complements if \(-1/n<\gamma <0\), independent if \(\gamma =0\).Footnote 9

The first-order condition for utility maximization leads directly to the inverse demand function for each good \(i=1, \ldots ,n\):

From this equation system, we easily obtain the demand function for each good \(i=1, \ldots ,n\):

2.2 The multidivisional company

The company assigns as objective to each division \(i=1,\ldots ,n\) a convex combination of the division’s own profit and of the joint profit of all divisions. The relative weight \(\lambda \) put on the former is a measure of the strength of the competition motive within the organization. We thus obtain as polar cases: the fully noncooperative conduct (oligopolistic competition between the divisions) for \(\lambda =1\) and the fully cooperative conduct (collusion between the divisions) for \(\lambda =0\). More explicitly, the program of each division i is, assuming zero production costs,

where \(\varvec{Q}\left( \mathbf {p}\right) \equiv \left( Q_{1}\left( \mathbf {p}\right) ,\ldots ,Q_{n}\left( \mathbf {p}\right) \right) \), when divisions play in prices, and

where \(\mathbf {P}\left( \mathbf {q}\right) \equiv \left( P_{1}\left( \mathbf {q }\right) ,\ldots ,P_{n}\left( \mathbf {q}\right) \right) \), when they play in quantities.

3 The perfect information benchmark: the competition motive and the strategy distortion

We first refer to the benchmark of perfect information, considering successively equilibrium and welfare in the price and quantity games, before directly comparing the two kinds of games.

3.1 Equilibrium

3.1.1 The price game

Instead of referring to program (1), we can alternatively refer to an equivalent program consisting in minimizing the loss of the objective assigned to division i relative to the collusive profit (obtained for \( \lambda =0\) with all prices equal to the fundamental \(\theta \)):

with \(p_{-i}=\left( \sum _{j\ne i}p_{j}\right) /\left( n-1\right) \) and the loss function \(L^{P}\) (to be minimized in \(p_{i}\))

This loss function is obviously reminiscent of the loss function introduced by Morris and Shin (2002) in their seminal modeling of the beauty contest, with its three motives:Footnote 10 the fundamental, the coordination and the competition motives.Footnote 11 We formulate three remarks concerning the present loss function.

First, the fundamental motive stands naturally alone when there is a single division (\(n=1\)) or when the goods are independent (\(\gamma =0\)). Correspondingly, its relative weight diminishes as the level \(\left( n-1\right) \left| \gamma \right| \) of interdependence between divisions increases (either through the number \(n-1\) of competitors of each division or through the degree \(\left| \gamma \right| \) of interdependence between goods).

Second, the coordination motive becomes in fact an anti-coordination motive when we switch from the case of substitutable goods (\(\gamma >0\)) to the case of complementary goods (\(\gamma <0\)). There is, however, more than a simple change of signs. An important difference between the two cases is that, as the level of interdependence between divisions tends to its maximum, the fundamental motive eventually vanishes relative to the coordination motive (since \(\left( n-1\right) \left| \gamma \right| \rightarrow \infty \) as \(\gamma \rightarrow \infty \)), whereas it always dominates the anti-coordination motive (since \(\left( n-1\right) \left| \gamma \right| \rightarrow 1-1/n<1\) as \(\gamma \rightarrow -1/n\)).

Third, symmetry in strategy deviations from the targets is broken by the competition motive, which introduces a downward (upward) bias when the coordination (anti-coordination) motive prevails. The weight on the competition motive is the intensity of competition, obtained by multiplying the level \(\left( n-1\right) \left| \gamma \right| \) of interdependence between divisions and the strength \(\lambda \) of the competition motive, thus combining two structural characteristics and a conduct characteristic of competition.

The first-order condition for minimization of \(L^{P}\left( \cdot ,p_{-i},\theta \right) \) gives the best reply function

Naturally, the coordination motive (for \(\gamma >0\)) implies strategic complementarity, and the anti-coordination motive (for \(\gamma <0\)) strategic substitutability.

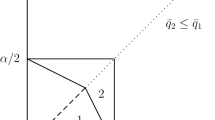

By symmetry (\(p_{i}=p_{-i}\)), we deduce from the best reply function the equilibrium price \(p^{P}\) (and the corresponding quantity \(q^{P}\)), equal for all i and depending upon the strength \(\lambda \) of the competition motive:

The equilibrium price \(p^{P}\), equal to the fundamental in the absence of the competition motive, is otherwise distorted, taking lower (higher) values in the presence of the coordination (anti-coordination) motive, in other words under strategic complementarity (substitutability). Of course, we obtain an opposite effect on the equilibrium quantity \(q^{P}\). The distortion—a consequence of the bias introduced by the competition motive—is the larger the higher the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \).

3.1.2 The quantity game

Proceeding in the same way, we consider the loss of the objective assigned to division i relative to the collusive profit (obtained for \(\lambda =0\) with all quantities equal to \(\theta /\left( 1+n\gamma \right) \)) as

with \(q_{-i}=\left( \sum _{j\ne i}q_{j}\right) /\left( n-1\right) \) and the loss function \(L^{Q}\) (to be minimized in \(q_{i}\))

Again, this loss function is reminiscent of the one in the beauty contest model of Morris and Shin (2002). The observations formulated for \(L^{P}\) stand for \(L^{Q}\), but the sign of the weight put on the coordination and competition motives is naturally reversed, an anti-coordination motive prevailing now when goods are substitutes. As in the price game, when the intensity of competition tends to its maximum, this weight tends to infinity if applied to the coordination motive but it remains dominated if applied to the anti-coordination motive.

The first-order condition for minimizing \(L^{Q}\left( \cdot ,q_{-i},\theta \right) \) gives the best reply function

As in the case of the price game, coordination generates strategic complementarity and anti-coordination strategic substitutability. By symmetry (\( q_{i}=q_{-i}\)), we deduce from the best reply function the equilibrium quantity \(q^{Q}\) (and the corresponding price \(p^{Q}\)), the same for each i and depending upon the strength of the competition motive \(\lambda \):

Observe that under full cooperation of the company divisions, \(p^{Q}\left( 0\right) =p^{P}\left( 0\right) =\theta \) and \(q^{Q}\left( 0\right) =q^{P}\left( 0\right) =\theta /\left( 1+n\gamma \right) \). Under perfect information and a vanishing competition motive, it is indifferent to play in prices or in quantities. However, if \(\lambda >0\), the equilibrium price is distorted in the same way as in the price game. Notice further that, for \( \gamma \ne 0\), \(p^{Q}\left( \lambda \right) >p^{P}\left( \lambda \right) \) independently of the nature of the interdependence between goods: the strategy distortion is just larger under strategic complementarity, pushing the price \(p^{P}\) downwards when \(\gamma >0\), and the price \(p^{Q}\) upwards when \(\gamma <0\).

The following proposition summarizes the consequences of introducing the competition motive in the two games.

Proposition 1

The competition motive generates a strategy distortion in both price and quantity games: as it becomes stronger (through a larger \(\lambda \)), equilibrium prices become lower (higher) and equilibrium quantities higher (lower) when goods are substitutes (complements). This distortion increases with the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \) and is larger when the coordination motive prevails, hence under strategic complementarity (in the price game when goods are substitutes, and in the quantity game when they are complements).

3.2 Welfare

Because of the representative consumer assumption, it is straightforward to proceed to welfare analysis. Consumer’s utility at equilibrium quantities (be it \(\mathbf {q}^{*}=\mathbf {q}^{P}\left( \lambda \right) \) or \( \mathbf {q}^{*}=\mathbf {q}^{Q}\left( \lambda \right) \)) can be decomposed as follows:

3.2.1 The price game

We compute profit, social welfare and the consumer surplus successively. By symmetry and using (5), the company profit

is seen to be equal to the collusive profit \(n\theta ^{2}/\left( 1+n\gamma \right) \) multiplied by the factor \(1-\left( 1-K^{P}\left( \lambda \right) \right) ^{2}\), which is always smaller than one if \(\lambda >0\), and decreasing in the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \). As expected, the company profit is maximized at \(\lambda =0\). Social welfare

and the consumer surplus

are by contrast increasing (decreasing) in the intensity of competition if goods are substitutes (complements). Hence, they are both maximized at \( \lambda =1\) when goods are substitutes and at \(\lambda =0\) when they are complements. As already shown by Cournot (1838, ch. IX), producers’ and consumers’ interests converge when goods are complements, whereas they diverge when goods are substitutes.

3.2.2 The quantity game

By symmetry and using (8), the company profit

is again seen to be equal to the collusive profit multiplied by a factor (between brackets) which is always smaller than one if \(\lambda >0\), and which is decreasing in the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \), so that profit is maximized at \( \lambda =0\). Social welfare

and the consumer surplus

are, as in the price game, both increasing (decreasing) in the intensity of competition if goods are substitutes (complements). Hence, social welfare and consumer surplus are again maximized at \(\lambda =1\) when goods are substitutes and at \(\lambda =0\) when they are complements.

We recall in the following proposition the preceding observations.

Proposition 2

Under perfect information, profit is decreasing in the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \) (as the strategy distortion becomes more severe) in both price and quantity games. Social welfare and the consumer surplus are increasing (decreasing) in the intensity of competition if goods are substitutes (complements): the interests of the company and of the consumer diverge when goods are substitutes, but converge when they are complements.

3.3 Price versus quantity games

In this subsection, we compare price and quantity games from a welfare perspective. Take first, using Eqs. (10) and (13), the difference in profits obtained when playing each kind of strategies.

There are two cases in which this expression vanishes. The first case is when \(\gamma =0\), entailing \(K^{P}\left( \lambda \right) =\left( 1+n\gamma \right) K^{Q}\left( \lambda \right) =1\) for any \(\lambda \): it is indifferent to play in quantities or in prices when goods are independent. The second is when \(\lambda =0\) since, again, \(K^{P}\left( 0\right) =\left( 1+n\gamma \right) K^{Q}\left( 0\right) =1\): it is indifferent for the company to play in quantities or in prices when the competition motive is suppressed. In these two cases, equilibrium prices are equal to \(\theta \) in both games, as we have already pointed out.

Otherwise, if \(\lambda >0\), it is easy to check from (5) and (8 ), that \(K^{P}\left( \lambda \right)<1<\left( 1+n\gamma \right) K^{Q}\left( \lambda \right) \) for \(\gamma >0\), \(\left( 1+n\gamma \right) K^{Q}\left( \lambda \right)<1<K^{P}\left( \lambda \right) \) for \(\gamma <0\), and \( K^{P}\left( \lambda \right) +\left( 1+n\gamma \right) K^{Q}\left( \lambda \right) <2\) in both cases. Hence, \(\Pi ^{Q}\left( \lambda \right) -\Pi ^{P}\left( \lambda \right) \) has the sign of \(\gamma \): profits will always be larger when decision variables are strategic substitutes, that is, under the anti-coordination motive.

As to social welfare and the consumer surplus, using Eqs. (11), ( 12), (14) and (15), we have ’

and

both strictly negative if \(\gamma \ne 0\) and \(\lambda \ne 0\). Under this condition, the price game is always preferable in terms both of the consumer surplus and of social welfare. Convergence of interests between the company and the consumer when goods are complements and divergence when they are substitutes is again apparent.

To recall,

Proposition 3

Whenever \(\gamma \ne 0\) and \(\lambda \ne 0\), the consumer always prefers the price game, which is also preferable in terms of social welfare. For the company, however, playing under the anti-coordination motive (and thus minimizing the strategy distortion) is preferable, so that the price game leads to a higher profit if and only if goods are complements.

4 Dispersed information: the competition motive and the informational distortion

We shall now assume that the fundamental \(\theta \) is stochastic and that the company divisions do not know its realization, about which they only observe two noisy signals, one public and the other private.

4.1 Information

The fundamental is a random variable perturbing the utility of the representative consumer.Footnote 12 Once realized, with positive value \(\theta \), each division i receives a public signal \(y=\theta +\eta \) and a private signal \( x_{i}=\theta +\varepsilon _{i}\) with independent Gaussian noises \(\eta \sim \mathcal {N}\left( 0,\sigma _{y}^{2}\right) \) and \(\varepsilon _{i}\sim \mathcal {N}\left( 0,\sigma _{x}^{2}\right) \). We may, for instance, think of the company observing perfectly the realized value \(\theta \) of the fundamental and then sending noisy signals y and \(x_{1},\ldots ,x_{n}\) to its n divisions, otherwise uninformed of that realization.Footnote 13 We assume that players’ information is imperfect (the precisions \(\alpha =\sigma _{y}^{-2}\) and \(\beta =\sigma _{x}^{-2}\) are finite) and also that it is dispersed (the precision \(\beta \) is strictly positive). As our analysis of the divisions’ strategies will involve linear responses to the signals, positivity of prices and quantities requires positive signals. We assume accordingly high enough precisions \(\alpha \) and \(\beta \) for the probability of observing negative signals to be kept negligible.Footnote 14

Like Morris and Shin (2002), we assume for simplicity that players share an improper (uninformative) prior over the fundamental, so that agent i’s expected value of \(\theta \), conditional on both public and private information, is simply \(\mathbb {E}\left( \left. \theta \right| y,x_{i}\right) =\left( \alpha y+\beta x_{i}\right) /\left( \alpha +\beta \right) \). In this respect, our approach is different from Angeletos and Pavan (2007), who consider a proper distribution \(\mathcal {N}\left( \mu ,\sigma _{\theta }^{2}\right) \) of the fundamental which is known by all the players. Player i’s posterior public information is then described by the synthetic public signal \(z\equiv E\left( \left. \theta \right| y\right) =\phi y+\left( 1-\phi \right) \mu \), with \(\phi \equiv \sigma _{y}^{-2}/\left( \sigma _{y}^{-2}+\sigma _{\theta }^{-2}\right) \). Our uninformative prior assumption would correspond under this approach to the limit case of an infinite variance \(\sigma _{\theta }^{2}\) (leading to \(\phi =1\)). Another difference to be emphasized is that, like Morris and Shin, we will refer to expected welfare conditional on the realization \(\theta \) of the fundamental, whereas Angeletos and Pavan refer to the unconditional expected welfare, evaluated before the realization of theta. We will come back to the consequences of this difference of approaches in Sects. 4.3 and 4.5, on the efficient use of information and the social value of information, respectively, and analyze them in Appendix through a detailed comparison of our results with those of Angeletos and Pavan.

4.2 Equilibrium

Division i forms expectations on the realization \(\theta \) of the fundamental, but also on the mean strategy \(p_{-i}\) or \(q_{-i}\) of the other divisions, according to the game type, by referring to the two signals y and \(x_{i}\). We assume that it responds linearly to those two signals, targeting the expected best price or quantity reply to others’ expected strategies (conditional on the two signals): \(p_{i}=\zeta _{i}^{P}y+\xi _{i}^{P}x_{i}\) or \(q_{i}=\zeta _{i}^{Q}y+\xi _{i}^{Q}x_{i}\). This amounts for division i to choose in fact a nonnegative strategy pair \(\left( \zeta _{i}^{P},\xi _{i}^{P}\right) \) or \(\left( \zeta _{i}^{Q},\xi _{i}^{Q}\right) \).

4.2.1 The price game

The choice of \(\left( \zeta _{i}^{P},\xi _{i}^{P}\right) \) targets the expected best price reply, which we can infer from Eq. (4):

As \(\mathbb {E}\left( \left. \theta \right| y,x_{i}\right) =\left( \alpha y+\beta x_{i}\right) /\left( \alpha +\beta \right) \), we have

implying at equilibrium

The next step allows us to determine

At equilibrium, the sum of the two strategies

does not depend upon the quality of information, as given by the precisions \( \alpha \) and \(\beta \). It is equal to the coefficient multiplying the fundamental to obtain the equilibrium price under perfect information. Notice indeed that ex ante, before the fundamental is realized, the expected price is still \(\left( \zeta ^{P}+\xi ^{P}\right) \theta =K^{P}\left( \lambda \right) \theta \). The strategy distortion with its effects derived in the benchmark case is thus still at work, implying in particular that “the Bertrand price reacts too little to \(\theta \) as compared to the monopoly price” (Angeletos and Pavan 2007, p. 1129), meaning in our framework that \(K^{P}\left( 1\right) <K^{P}\left( 0\right) \), a fact which depends upon the strategy distortion and which is not modified by the imperfection and dispersion of the information, as \(K^{P}\left( \lambda \right) \) is independent from the quality of information.

The novelty introduced by assuming imperfect and dispersed information comes from the relative weights \(\zeta /\left( \zeta +\xi \right) \) and \(\xi /\left( \zeta +\xi \right) \) put, respectively, on the public and private signals, with

and \(\xi ^{P}/\left( \zeta ^{P}+\xi ^{P}\right) =1-\kappa ^{P}\left( \lambda \right) \). The efficient (relative) weight on the public signal is obviously \(\kappa ^{P}\left( 0\right) \), which takes into account the fundamental and the coordination (or anti-coordination) motives, without the competition motive. The fundamental motive alone would lead to a relative weight on the public signal given by its relative precision \(\alpha /\left( \alpha +\beta \right) \). However, for the sake of coordination, and as long as the goods are substitutes (\(\gamma >0\)), hence prices strategic complements, the efficient (relative) weight on the public signal

is increasing in the level of interdependence between divisions, as measured by \(\left( n-1\right) \left| \gamma \right| \). Obviously, it is decreasing in the level of interdependence between divisions under the anti-coordination motive (\(\gamma <0\)), hence under strategic substitutability.

Introducing the competition motive leads to an informational distortion , by decreasing (increasing) \(\kappa ^{P}\left( \lambda \right) \) under the coordination (anti-coordination) motive, thus by countervailing the effect of this motive. In relative terms, this informational distortion is

increasing in the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \) and decreasing in the ratio of precisions \( \alpha /\beta \).

4.2.2 The quantity game

The choice of the strategy pair \(\left( \zeta _{i}^{Q},\xi _{i}^{Q}\right) \) now targets the expected best quantity reply, which we can infer from Eq. (7):

so that

with a sum

Again, the sum of the two strategies does not depend at equilibrium upon the quality of information and is equal to the coefficient multiplying the fundamental in the expression for the benchmark equilibrium quantity, so that the strategy distortion is at work, with its effects derived when information is perfect.

As to the relative weight on the public signal, we have

Its efficient value \(\kappa ^{Q}\left( 0\right) \) is again increasing in the level of interdependence \(\left( n-1\right) \left| \gamma \right| \) under the coordination motive (now when \(\gamma <0\)), hence under strategic complementarity. It is decreasing under the anti-coordination motive (when \( \gamma >0\)), hence under strategic substitutability. The competition motive induces an informational distortion, by decreasing (increasing) \( \kappa ^{Q}\left( \lambda \right) \) under the coordination (anti-coordination) motive, hence by countervailing the effect of this motive. In relative terms,

increasing in \(\left( n-1\right) \left| \gamma \right| \lambda \) and decreasing in \(\alpha /\beta \).

To recall,

Proposition 4

Under imperfect and dispersed information, the competition motive generates, in both price and quantity games, an informational distortion which countervails the effect of the coordination (anti-coordination) motive, making the relative weight put on the public signal inefficiently low (high) under strategic complementarity (substitutability). This distortion is the stronger the higher the intensity of competition \(\left( n-1\right) \left| \gamma \right| \lambda \) and the lower the relative precision \(\alpha /\beta \) of the public signal.

4.3 Welfare: efficiency in the use of information

We examine the efficiency of the relative weight on public information, \( \kappa ^{P}\left( \lambda \right) \) or \(\kappa ^{Q}\left( \lambda \right) \), put at equilibrium by the divisions. This will be done in terms of the company profit, of social welfare and of consumer surplus, successively, defined as in the benchmark case, although referring now to their mathematical expectations conditional on the realized \(\theta \).

4.3.1 The price game

The expected profit is

with \(p_{i}^{*}=K^{P}\left( \lambda \right) \left( \theta +\kappa ^{P}\left( \lambda \right) \eta +\left( 1-\kappa ^{P}\left( \lambda \right) \right) \varepsilon _{i}\right) \), hence equal to

is an informational cost, the only element in the expression of \( \mathbb {E}\left( \left. \Pi ^{P}\right| \theta \right) \) which depends upon the information use and quality. Obviously, taking \(C^{P}=0\), the expected profit is the one obtained under perfect information. When positive, the informational cost should be kept small enough for the expected company profit to remain positive—a consequence of the assumption that the precisions of the public and private signals are sufficiently high to make negligible the probability of getting negative signals. The informational cost is minimized in \(\kappa \) under the first-order condition

which corresponds to \(\lambda =0\): the efficient use of information by the company is obtained by suppressing the competition motive and the consequent informational distortion.

The expected social welfare is

hence

Again, taking \(C^{P}=0\), the expected social welfare is the one obtained under perfect information. By comparing (19) and (20), we see that efficiency in the use of information by the company, resulting from a minimum informational cost \(C^{P}\) associated with the suppression of the competition motive, extends to the social welfare viewpoint.

Finally, the expected consumer surplus is

Maximization in \(\kappa \) of the consumer surplus would now require maximization of the informational cost under the constraint of equilibrium implementation, which can only result from the corner solution \(\lambda =1\), as \(C^{P}\) is a strictly convex function of \(\kappa ^{P}\). Since \(\kappa ^{P}\left( 1\right) <\kappa ^{P}\left( 0\right) \) (\(\kappa ^{P}\left( 1\right) >\kappa ^{P}\left( 0\right) \)) when goods are substitutes (complements), the representative consumer’s preferences reverse the company bias in favor of public (private) information associated with the coordination (anti-coordination) motive.

4.3.2 The quantity game

The expected profit is

with \(q_{i}^{*}=K^{Q}\left( \lambda \right) \left( \theta +\kappa ^{Q}\left( \lambda \right) \eta +\left( 1-\kappa ^{Q}\left( \lambda \right) \right) \varepsilon _{i}\right) \), hence equal to

is the informational cost \(C^{Q}\), which is the only component depending upon information use and quality and which is minimized in \( \kappa \) under the first-order condition:

with no competition motive and no resulting informational distortion, a situation corresponding to the efficient use of information by the company.

The expected social welfare is

with the sole term \(C^{Q}\) depending on information use and quality. The efficient use of information by the company is consequently efficient from the point of view of social welfare too.

As to the expected consumer surplus, it is equal to

Since the informational cost, the sole term depending upon information use and quality, appears now with an opposite sign, the expected consumer surplus would be maximized under the constraint of equilibrium implementation when the strength of the competition motive is at its maximum (\(\lambda =1\)). When goods are substitutes, consumers would prefer to put more weight on public information (\(\kappa ^{Q}\left( 1\right) >\kappa ^{Q}\left( 0\right) \)), reversing the producers’ bias in favor of private information imposed by the anti-coordination motive, as already stressed by Myatt and Wallace (2015, p. 478). Obviously, the reverse is true when goods are complements.

We summarize the preceding results in the following proposition.

Proposition 5

Under imperfect and dispersed information, the informational cost components of expected profit and social welfare are minimized in \(\kappa \) at \(\kappa ^{P}\left( 0\right) \) and \(\kappa ^{Q}\left( 0\right) \) for the price and quantity games, respectively: the equilibrium use of information is efficient when the competition motive is suppressed (together with the consequent informational distortion). By contrast, the consumer surplus is maximized in \(\kappa \), under the constraint of equilibrium implementation, when the competition motive reaches its maximum strength \((\lambda =1)\).

As already emphasized, we have been referring to expected profit, social welfare and consumer surplus, conditional on the realization \(\theta \) of the fundamental. What difference would it make if we referred instead to unconditional expectations? As the consumer’s utility is quadratic and the information signals are normally distributed, we end up with relevant expected values which are all linear in the informational cost, their sole component depending upon information quality. Besides, the informational cost and the coefficient affecting it are independent from the fundamental. Hence, when switching to unconditional expectations, one obtains the same results concerning efficiency in the use of information or, more generally, depending on the quality of information. The difference between our results and those in the literature well represented by Angeletos and Pavan (2007) must consequently be imputed, as explained in Appendix, to the difference in the assumptions about prior information and in the consequent impact of changes in the quality of public and private information.

4.4 Welfare: efficiency in the response to the fundamental

We reconsider the efficiency of the divisions equilibrium response to the fundamental, \(K^{P}\left( \lambda \right) \) or \(K^{Q}\left( \lambda \right) \) , in the context of imperfect information. This will be done, as in the previous subsection, in terms of the expectations, conditional on the realized \(\theta \), of the company profit, social welfare and consumer surplus.

4.4.1 The price game

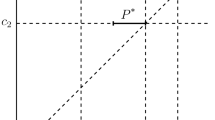

The existence of an informational cost qualifies the efficiency of the equilibrium response \(K^{P}\left( \lambda \right) \) to the fundamental, which may not result anymore from the suppression of the competition motive and of the consequent strategy distortion, as in the benchmark case. Indeed, when maximizing in K the expected profit [given by Eq. (19)], we obtain as the first-order condition

so that the efficient response to the fundamental deviates downwards from one, and the more so the higher the relative informational cost \( C^{P}/\theta ^{2}\). When goods are complements and the prices strategic substitutes, \(K^{P}\left( \lambda \right) >1\) for \(\lambda >0\), so that \( K^{P}\left( 0\right) \) remains constrained efficient. By contrast, when goods are substitutes and the prices strategic complements, the efficient value of \(K^{P}\left( \lambda \right) \) is obtained for some \(\lambda ^{P}\in \left( 0,1\right] \) as soon as \(C^{P}>0\). The competition motive appears now, when information is dispersed, as a way of counteracting the coordination motive in favor of the fundamental motive. However, since the company is not assumed in our model to impose directly its choice of \(\kappa ^{P}\) and \(K^{P}\) (or, equivalently, of \(\zeta ^{P}\) and \(\xi ^{P}\)) to its divisions, but only its choice of a unique strength \(\lambda \) of the competition motive, it is confronted under strategic complementarity with a trade-off between the minimization of the informational distortion (through \( \lambda =0\)) and that of the strategy distortion (through \(\lambda ^{P}>0\)).

The expected social welfare [given by Eq. (20)] is decreasing in \(K^{P}\left( \lambda \right) \). So is the expected consumer surplus, as can be easily checked by using Eq. (21) and by taking the expected profit positivity condition into account. Hence, \(\lambda =0\) (\(\lambda =1\)) is socially optimal when goods are complements (substitutes). Again, the two points of view, of the company and of the consumer, coincide in the complementarity case and diverge in the substitutability case, although less so than in the benchmark case of perfect information.

4.4.2 The quantity game

Maximization in K of the expected profit leads to the first-order condition:

When goods are substitutes and the quantities strategic substitutes, \( K^{Q}\left( \lambda \right) >1/\left( 1+n\gamma \right) \) for \(\lambda >0\), so that \(K^{Q}\left( 0\right) \) remains constrained efficient. However, when goods are complements and the quantities strategic complements, the efficient value of \(K^{Q}\left( \lambda \right) \) is obtained for some \( \lambda ^{Q}\in \left( 0,1\right] \) if \(C^{Q}>0\), the competition motive appearing as a way of counteracting the coordination motive in the sense of the fundamental motive. Again, under strategic complementarity, the company is confronted with a trade-off between the minimization of the strategy and informational distortions.

Using Eq. (23), it is easy to check that the expected social welfare is maximized in K at a value

the inequality \(\widehat{K}>K^{Q}\left( \lambda \right) \) resulting from the expected profit positivity condition [see Eq. (22)]. Hence, when goods are substitutes (so that \(K^{Q}\left( \lambda \right) \) is an increasing function), the interest of the company and the interest of society diverge as in the benchmark case, and a positive strength of competition (not necessarily \(\lambda =1\) anymore) will be socially optimal. When goods are complements (so that \(K^{Q}\left( \lambda \right) \) is a decreasing function), it would be socially optimal to decrease the strength \(\lambda \) of the competition motive from the value \(\lambda ^{Q}\) that is efficient from the point of view of the company.

The expected consumer surplus [given by Eq. (24)] is increasing in \(K^{Q}\left( \lambda \right) \), so that the consumer would prefer \(\lambda =1\) when goods are substitutes and \(\lambda =0\) when they are complements. The company and the consumer’s interests diverge in both cases, although less when goods are complements.

To recall,

Proposition 6

Under imperfect and dispersed information, the expected company profit is still maximized when the competition motive is suppressed but only under the anti-coordination motive. Under the coordination motive, maximization of the expected profit is obtained only when it is countervailed by the competition motive, with a strength increasing with the relative informational cost \( C^{P}/\theta ^{2}\) or \(C^{Q}/\theta ^{2}\).

As in the benchmark case, the consumer prefers \(\lambda =1\) when goods are substitutes and \(\lambda =0\) when they are complements, so that the situation is unchanged when the producers’ payoffs exhibit an anti-coordination motive. Otherwise, in the price game with substitutable goods, a (positive) strength \(\lambda <1\) may now be socially optimal and, in the quantity game with complementary goods, it is socially optimal to soften competition.

4.5 The social value of information

As we have just seen, information quality can influence the mathematical expectations of profit, social welfare and consumer surplus only through the informational cost, \(C^{P}\) or \(C^{Q}\,\)according to the type of the game. Now, an increase in the information quality (a higher precision \(\alpha \) or \(\beta \)) does not necessarily diminish the informational cost because of the possible countervailing effect of a less efficient use of information due to the informational distortion. Let us consider the two types of game, successively.

4.5.1 The price game

Recall that, according to Eq. (19), the informational cost is

As \(\left( \partial \kappa ^{P}\left( \lambda \right) /\partial \left( \alpha /\beta \right) \right) \alpha /\beta =\left( 1-\kappa ^{P}\left( \lambda \right) \right) \kappa ^{P}\left( \lambda \right) \), we have

so that the informational cost unequivocally decreases in response to a higher precision \(\alpha \) or \(\beta \), as long as the competition motive is inactive (\(\lambda =0\)), entailing \(\partial C^{P}/\partial \kappa =0\) by optimality of \(\kappa ^{P}\left( 0\right) \). Under the coordination motive (when \(\gamma >0\)), \(\kappa ^{P}\left( \lambda \right) <\kappa ^{P}\left( 0\right) \) for \(\lambda >0\), so that \(\partial C^{P}/\partial \kappa <0\) by strict convexity of \(C^{P}\) relative to \(\kappa \). By a symmetric argument,\(\partial C^{P}/\partial \kappa >0\) under the anti-coordination motive (when \( \gamma <0\)). As a consequence, the informational cost is decreasing in the precision \(\alpha \) (resp. \(\beta \)) of the public (resp. private) signal under the coordination (resp. anti-coordination) motive. By Eq. (25), since

the informational cost is also decreasing in the precision \(\alpha \) of the public signal under the anti-coordination motive (when \(\gamma <0\)). It remains to check the sign of \(\partial C^{P}/\partial \beta \) under the coordination motive (when \(\gamma >0\)). By Eq. (26), and computing \(\partial C^{P}/\partial \kappa \) from the expression of \( C^{P} \) in Eq. (19), the informational cost increases with more precise private information if

Now, consider an indefinite increase in the level \(\left( n-1\right) \gamma \) of interdependence between divisions. If \(\kappa ^{P}\left( \lambda \right) \) remains smaller than one, the second term in the preceding expression will remain finite, and if \(\kappa ^{P}\left( \lambda \right) \ \) tends to a value larger than 1 / 2, the first term will tend to minus infinity. By referring to the definition of \(\kappa ^{P}\left( \lambda \right) \), we obtain:

iff \(0<\lambda <2\alpha /\beta \), a condition which is easier to satisfy if the relative precision of the public signal \(\alpha /\beta \) is large, but which can always be verified for a low enough (but still positive) \(\lambda \) . Under this condition, \(\lim _{\left( n-1\right) \gamma \rightarrow \infty }\partial C^{P}/\partial \beta =\infty \).

We have seen that the informational cost is decreasing in the precision of the public signal, but not necessarily in the precision of the private signal. This result reverses the main conclusion of Morris and Shin (2002), which is, however, obtained in a situation where social welfare depends upon the sole fundamental motive, given the existence of an exact balance between the coordination and competition motives.Footnote 15 This result is also contrary to Corollary 11 in Angeletos and Pavan (2007), excluding in a similar context the case of a profit depressing effect of a higher precision of the private signal. Appendix A.2 offers a direct comparison between our result and theirs. It emphasizes in particular the fact that under their very specification and information assumptions, one can obtain, contrary to what is stated in their Corollary 11, a decrease in expected profits as a consequence of a higher precision of the private signal. This possibility is open for a high enough intensity of competition and a high enough precision of the public signal relative to that of the private signal, provided the slope of the marginal cost curve is itself large enough (entailing a high price response to demand shocks). Under our own specification, without production costs, such possibility is consequently excluded with the information structure postulated by Angeletos and Pavan, that is, assuming prior public information on the stochastic fundamental \(\theta \). However, in the absence of prior information, the role of the posterior public signal is reinforced, opening again the possibility that more precision of the private signal decreases expected profits as competition becomes, for structural reasons, sufficiently intense.

4.5.2 The quantity game

By Eq. (22), the informational cost is

As \(\left( \partial \kappa ^{Q}\left( \lambda \right) /\partial \left( \alpha /\beta \right) \right) \alpha /\beta =\left( 1-\kappa ^{Q}\left( \lambda \right) \right) \kappa ^{Q}\left( \lambda \right) \), we have

As in the price game, the informational cost unequivocally decreases in response to a higher precision \(\alpha \) or \(\beta \), as long as the competition motive is inactive (\(\lambda =0\)), entailing \(\partial C^{Q}/\partial \kappa =0\) by optimality of \(\kappa ^{Q}\left( 0\right) \). Under the anti-coordination motive (when \(\gamma >0\)), \(\kappa ^{Q}\left( \lambda \right) >\kappa ^{Q}\left( 0\right) \) for \(\lambda >0\), so that \( \partial C^{Q}/\partial \kappa >0\) by strict convexity of \(C^{Q}\) relative to \(\kappa \). By a symmetric argument, \(\partial C^{Q}/\partial \kappa <0\) under the coordination motive (when \(\gamma <0\)). Again, the anti-coordination motive entails the unequivocally positive social value of information of the private signal, and the coordination motive that of the public signal. Also, by Eq. (27), the informational cost is always decreasing in the precision \(\alpha \) of the public signal, even under the anti-coordination motive, since

This result differs from that stated in Corollary 10 of Angeletos and Pavan (2007), admitting that the expected profit can decrease with the precision of the public signal. The reason for this difference is formally explained in Appendix A.1. As already emphasized, our information structure differs from theirs, as we consider no prior public information. The presence of prior information limits the role of the public signal received a posteriori by the players. By contrast, when the prior is taken as uninformative, by making its variance tend to infinity in the specification of Angeletos and Pavan, the role of the public signal is reinforced, and more precision of this signal always translates into higher expected profits, even when competition is intense.

Under the coordination motive (when \(\gamma <0\)), \(\partial C^{Q}/\partial \beta \) may be positive since

as \(n\gamma \rightarrow -1\), if \(\lim _{n\gamma \rightarrow -1}\kappa ^{Q}\left( \lambda \right) \in \left( 1/2,1\right) \), which results from \( 0<\lambda <2\alpha /\beta \), the same result as in the price game.

4.5.3 Summary of the results

We may now summarize the results of this subsection in the following proposition.

Proposition 7

Variations of information quality have, in both games, the same qualitative effects on expected profit and social welfare, and opposite effects on expected consumer surplus. In the absence of the competition motive or else under the anti-coordination motive, both precisions are always profit and welfare enhancing: information has necessarily a positive social value. However, under the coordination motive, if profit and social welfare always increase with a higher precision \(\alpha \) of the public signal, they decrease, for a high enough degree \(\left| \gamma \right| \) of interdependence and if \(0<\lambda <2\alpha /\beta \), when the precision \( \beta \) of the private signal increases.

A few comments on the reasons for the results stated in this proposition are in order. An increase in the precision of any of the two signals has a favorable direct effect on the informational cost, hence on profit and welfare, plus an indirect effect (if \(\lambda >0\)) through the relative weight \(\kappa \left( \lambda \right) \) [see Eqs. (25 ), (26) for the price game and (27), (28) for the quantity game]. Under the coordination motive, hence under strategic complementarity, \(\kappa \left( \lambda \right) <\kappa \left( 0\right) \): the informational distortion leads to an excessive weight put on the private signal. As this distortion is decreasing in the ratio of precisions \(\alpha /\beta \), an increase in the quality of public—not private—information has a favorable indirect effect on the informational cost. So, we are left with two opposite effects of an increase in the precision of the private signal. As the interdependence level hence the informational distortion increases, the unfavorable indirect effect will eventually dominate. The analysis is not completely symmetric when we switch to the case of the anti-coordination motive, a situation in which the informational distortion leads to an excessive weight put on the public signal. This is because indefinitely increasing the intensity of competition keeps the anti-coordination and competition motives dominated by the fundamental motive. As a consequence, the favorable direct effects always dominate.

4.6 Price versus quantity games

In this subsection, we compare price and quantity games from a welfare perspective. Using Eqs. (19) and (22), we first compute the difference in expected profits obtained when playing each kind of strategies:

As to the expected social welfare, we use Eqs. (20) and (23) and compute:

Finally, for the difference between consumer surpluses, we obtain from Eqs. (21) and (24):

The first terms of \(\Delta ^{\Pi }\), \(\Delta ^{u}\) and \(\Delta ^{CS}\) are the corresponding differences found in the benchmark perfect information case, resulting here from \(C^{P}=C^{Q}=0\), due either to \(\alpha =\infty \) or to \(\beta =\infty \). We know that, when goods are independent (\(\gamma =0\) ) or when the competition motive is absent (\(\lambda =0\)), \(K^{P}=\left( 1+n\gamma \right) K^{Q}=1\), so that we are left with the difference \( C^{P}-C^{Q}\) to determine the sign of these expressions. If \(\gamma =0\), \( C^{P}=C^{Q}=1/\left( \alpha +\beta \right) \), so that it remains indifferent to play in prices or in quantities when goods are independent. If \(\lambda =0 \), the same is true, provided information, if not perfect, is at least homogeneous (\(\beta =0\)), since we have then \(C^{P}=C^{Q}=1/\alpha \).

Still with \(\lambda =0\), but with \(\alpha <\infty \) and \(0<\beta <\infty \), it is straightforward to check that the difference

has the sign of \(\gamma \): playing under the anti-coordination motive (hence under strategic substitutability) is better for the company and worse for the consumer, social welfare validating the producer’s stand point.

Thus, informational costs per se (that is, when \(\lambda =0\)) lead, for the company, to the same result as the one induced by the strategy distortion in the benchmark situation of perfect information. However, as the competition motive comes in, the two combined distortions start to affect the difference between the weighted informational costs by modifying the weights and possibly by changing the sign of \(C^{P}-C^{Q}\). As long as competition remains soft, with \(K^{P}\left( \lambda \right) \) and \(\left( 1+n\gamma \right) K^{Q}\left( \lambda \right) \) both close to 1, the signs of \( \Delta ^{\Pi }\), \(\Delta ^{u}\) and \(\Delta ^{CS}\) are essentially determined by this difference (common, up to its sign, to the three expressions). By continuity, the company and the consumer keep first their preferences for anti-coordination and coordination, respectively, but as competition becomes more intense there is less (more) weight on \(C^{P}\) and more (less) on \( C^{Q} \) when goods are substitutes (complements), which works against the sign of \(C^{P}-C^{Q}\) at \(\lambda =0\). The weighted difference of informational costs will the more easily change signs the higher the ratio \( \alpha /\beta \): a higher relative precision of public information favors the game that displays strategic complementarity. Take indeed the limit case of homogeneous information (\(\beta =0\)), where \(C^{P}=C^{Q}=1/\alpha \). The sign of the difference between the informational costs is then the sign of \( K^{P}\left( \lambda \right) -\left( 1+n\gamma \right) K^{Q}\left( \lambda \right) \), which is the sign of \(-\gamma \). By continuity, when competition is sufficiently soft and the precision of private information sufficiently low, the company will prefer to play under the coordination motive and the consumer under the anti-coordination motive.

As competition becomes more and more intense, the signs of \(\Delta ^{\Pi }\), \(\Delta ^{u}\) and \(\Delta ^{CS}\) will depend less and less on informational costs. This can be seen by taking from these expressions the ratio, for each type of games, of the perfect information component of the expected profit to the informational cost, bounded above by the expected positivity condition given by Eqs. (19) and (22). We obtain for \( \Delta ^{\Pi }\):

the right-hand sides of these inequalities increasing from zero to infinity as the intensity of competition increases indefinitely (\(\gamma \rightarrow \infty \) or \(\gamma \rightarrow -1/n\), \(n\rightarrow \infty \), \(\lambda \rightarrow 1\)). Hence, when competition is sufficiently intense, the possible contrary effect of informational costs is dominated and we retrieve the result obtained under perfect information.

As to the difference between consumer surpluses, \(\Delta ^{CS}\) has a first term which is always negative. When goods are complements, increasing the intensity of competition diminishes the weight on the positive term, in \( C^{Q}\), which vanishes as the intensity of competition tends to its upper bound (through \(\gamma \rightarrow -1/n\)). Only negative terms eventually subsist, so that the consumer ends up preferring the game in prices, as in the benchmark case. When goods are substitutes, we obtain by an argument similar to the one used for \(\Delta ^{\Pi }\):

where the right-hand sides of the two inequalities increase from 1 to \( \infty \) as the intensity of competition increases indefinitely. Again, when competition is sufficiently intense, the effect of informational costs is dominated and the result obtained in the benchmark case applies.

As to social welfare, \(\Delta ^{u}\) has again a negative first term. The argument is the same as for \(\Delta ^{CS}\), but we have to interchange complements and substitutes, as well as prices and quantities. In other words, the sole positive term, in \(C^{P}\), vanishes as the intensity of competition tends to infinity when goods are substitutes, and the ratios of perfect information components of the expected profit to the informational costs give:

with right-hand sides of the two inequalities increasing from 1 to \(\infty \) as the intensity of competition increases from zero to its upper limit, when goods are complements.

We summarize the preceding results in the following proposition.

Proposition 8

When competition is sufficiently soft, the company prefers the game under the anti-coordination motive (also preferable according to social welfare), whereas the consumer prefers the game under the coordination motive. These preferences are reversed for an intermediate range of the intensity of competition, if the relative precision of the private signal is low enough. Finally, when competition is sufficiently intense, the influence of informational costs is dominated and the results obtained in the benchmark case apply: the company prefers to play under the anti-coordination motive, whereas the consumer prefers the price game (also preferable according to social welfare).

5 Conclusion

We proposed a simple unified framework for the analysis of price and quantity games played by producers of either substitutes or complements, under imperfect and dispersed information, which bridges the gap between team and competition issues. This framework allows to compare the outcomes of the two kinds of games in terms of equilibrium and social welfare, and in particular to reconsider in this context the social value of information.

We focused our analysis on the competition motive fitted into the payoffs outside the limit case of full cooperation. This motive creates, when information is perfect, a strategy distortion, and creates in addition, when information is imperfect and dispersed, an informational distortion. Both distortions are detrimental to profitability, and the more so the higher the intensity of competition, through either structure (by the degree of interdependence between goods or by the number of competitors) or conduct (by the strength of the competition motive). The informational distortion generated by the competition motive in both price and quantity games is detrimental as it makes the relative weight put on the public signal inefficiently high (low) under the anti-coordination (coordination) motive, hence under strategic substitutability (complementarity). However, information heterogeneity affects the strategy distortion by creating a conflict between the coordination and the fundamental motives: because it countervails the effect of the former in favor of the latter, the optimal (price or quantity) strategy would correspond to a positive strength of the competition motive, increasing with the informational cost. As a consequence, there is in fact a trade-off between minimizing the informational distortion by suppressing the competition motive and minimizing the informational distortion by allowing the competition motive to remain active.

Regarding the social value of information, we have shown that increasing the precision of public information always improves welfare. By contrast, the social value of private information may be negative under the coordination motive (in the presence of strategic complementarity) for a high enough intensity of competition.

While the competition motive yields higher profit when operating under anti-coordination (in the presence of strategic substitutability) if information is perfect, imperfect and dispersed information mitigates such a result, which remains valid only when competition is sufficiently soft, or on the contrary sufficiently intense. Indeed, for an intermediate range of the intensity of competition, if the relative quality of private information is low enough, profit is higher when operating under coordination (in the presence of strategic complementarity).

Finally, we may derive some policy implications from our findings. First, while the results obtained earlier in the literature indicate that “an industry will have incentives to create an ‘association’ that collects and publicizes information dependent upon the type of competition in the industry and the nature of the information structure” (Gal-Or 1986, p. 91), we argue that such an association is relevant independently from the type of competition. Though beneficial from the firms’ point of view and with regard to the overall welfare, such an association is, however, detrimental to the consumers’ perspective.

Second, our results may have some implications on the performance of the competition regimes (price vs. quantity competition). In a context where the producers compete softly and have poorly accurate information on the fundamental (the market size), they may prefer to compete in prices (quantities) if goods are substitutes (complements). A regulator that would increase the precision of public information or the intensity of competition might reverse such preference.

The restriction of the analysis performed in this paper to symmetric games and symmetric solutions is of course a limitation that further research might overcome. As structural asymmetries have already been dealt with in the related context of firm-specific information sharing in oligopolies (Amir et al. 2010), it may be particularly important to consider the conduct asymmetry regarding the strength of the competition motive assigned to each division (or adopted by each firm). How does this asymmetry influence the social value of public information? Also, allowing for asymmetry in the precision of the private signals, how does an improvement in the quality of private information benefitting to some particular firm impact on its own profit and on the profit of its competitors? Are these effects modulated by the corresponding strengths of the competition motive? These are typical questions we want to address in the future.

Notes

On the multidivisional form of organization, see Mahoney (1992).

As suggested by the very terminology, we are using, an alternative interpretation of our model is that of an oligopolistic market for diversified goods, in which firms engage in a more or less cooperative conduct. Related literature has generally considered only the two extreme conducts, resulting in standard Cournot and Bertrand oligopoly equilibria or in the monopoly solution (Amir et al. 2010, 2016, respectively, are good representatives of this methodological choice). We consider instead any possible semi-cooperative conduct, but the conditions underlying the choice and the enforcement of such conduct by independent firms are not contemplated in the present analysis. Using a model of differentiated duopoly, Cornand and Dos Santos Ferreira (2017) focus upon the strategic choice by firm owners of the degree of cooperation ruling the conduct of firm managers, hence upon the endogeneity of the relative weight to be attributed to the competition (and coordination) motive(s).

The social value of information is assessed in terms of social welfare. Our economy is reduced to a representative consumer with quasilinear utility and to a multidivisional company. This modeling approach rationalizes the standard view of “social” welfare (here identified with consumer’s added utility) as the sum of the consumer surplus and distributed profits. Clearly, in a more diversified economy with profits distributed to only part of the consumers, the evaluation of social welfare would be more problematic.

In particular, they also establish results for certain games with a finite number of players, which are useful for applications such as oligopoly games. Their main contribution is to provide a necessary and sufficient condition for welfare to increase with either the precision of public or the precision of private information, starting from an arbitrary precision of these sources. Welfare is represented as a linear combination of the volatility of the average action and the dispersion of the individual actions.

A former IO application of the welfare effects of public and private information in a coordination game was proposed by Clark and Polborn (2006) in a binary choice context.

Ui (2009) has already built a bridge between the beauty contest literature and the team literature (which goes back to Radner 1962), focusing on a team problem similar to our collusion benchmark. His result generalizes Cremer (1990), emphasizing that ”shared knowledge is better than diversified knowledge if and only if a team exhibits strategic complementarity” (Ui 2009, p. 273).

Our framework addresses only the first type of uncertainty.

Symmetry is a convenient but restrictive assumption. Amir and Jin (2001) and Amir et al. (2010) compare Cournot and Bertrand equilibria, also with linear demand, but without imposing symmetry. Asymmetry allows in particular taking firm-specific demand shocks into account. See also Myatt and Wallace (2017), who consider asymmetries (in particular in Cournot competition) relevant in the use and acquisition of information.

The restriction on the admissible values of \(\gamma \) (\(-1/n<\gamma <\infty \) ) ensures strict concavity of the sub-utility function u (cf. Lemma 11 of Amir et al. 2017, where the interdependence between goods is represented by a parameter \(\gamma ^{\prime }\in \left( -1/\left( n-1\right) ,1\right) \) such that our \(\gamma =\gamma ^{\prime }/( 1-\gamma ^{\prime }) \) ).

Morris and Shin (2002) loss function is indeed the sum of a fundamental, a coordination and a competition motives:

$$\begin{aligned} (1-r)\left( a_{i}-\theta \right) ^{2}+r\left( a_{i}-\overline{a}\right) ^{2}-r\frac{1}{n}\sum _{j}\left( a_{j}-\overline{a}\right) ^{2}\text {,} \end{aligned}$$with given weights \(1-r\), r and \(-r\), respectively, and involving individual and mean strategies \(a_{i}\) and \(\overline{a}\). An important difference with respect to our own loss function is that, by assuming a continuum of agents, Morris and Shin make the competition motive inoperative regarding individual decisions. Another important difference concerns aggregate losses: the competition motive exactly balances the coordination motive in the Morris and Shin specification, so that the fundamental motive stands alone as a component of social welfare. By contrast, the competition motive vanishes under symmetry by aggregation of our loss functions, so that coordination contributes in our case to agents’ welfare.

Myatt and Wallace (2012) assume a continuum of competitors supplying differentiated substitutes and rewrite directly the profit function as a loss function (up to its sign):

$$\begin{aligned} p_{i}\left( \left( 2-\beta \right) \theta -p_{i}+\beta p\right) =-\left( 1-\beta /2\right) \left( p_{i}-\theta \right) ^{2}-\left( \beta /2\right) \left( p_{i}-p\right) ^{2}+\left( 1-\beta /2\right) \theta ^{2}+\left( \beta /2\right) p^{2}\text {,} \end{aligned}$$with \(\beta \in \left( 0,1\right) \). This loss function exhibits the sole fundamental and coordination motives, but the competition motive is actually merged with the fundamental motive, since the fundamental \(\theta \) is the (monopolistically) competitive price, not the collusive price \(\theta \left( 1-\beta /2\right) /\left( 1-\beta \right) \) as in our framework.

By assuming perturbations of the consumer’s utility function independently of the competition regime, we take the same approach as Amir et al. (2016), in contrast to most of the literature (including Angeletos and Pavan 2007), where demand shocks are approached under Bertrand competition through a random intercept of the direct demand function—a derived variable.

This interpretation has been suggested to us by Claude d’Aspremont.

This assumption is combined with that of positive realizations of the fundamental. Should we have in mind an objective prior distribution of the fundamental (not known by the players), this distribution would have to be taken with a nonnegative support, or else with a small enough variance so as to make negligible the probability of observing negative values of the fundamental (see Vives 1984, p. 77, n. 2). Myatt and Wallace (2015, p. 6) discuss the limits of this approach, but also of alternative ways of tackling the problem. Abandoning the normal specification destroys the justification for conditional expectations linearity if the players are assumed to know and take as their common prior the objective distribution of the fundamental. An alternative way is to adopt the approach of Amir et al. (2010), who make superfluous any specific distributional assumption. Restraining instead the space of players’ strategies to nonnegative values may considerably modify the uniqueness and welfare results obtained in the context of incomplete information (Lagerlöf 2007). In order to preserve comparability with the core of the literature related to the purpose of this paper, we leave these avenues to further research.

See footnote 10. As the distorted relative weight \(\kappa \left( \lambda \right) \) on the public signal belongs to the interval \(\left[ \alpha /\left( \alpha +\beta \right) ,\kappa \left( 0\right) \right] \), the reversal of results is the natural consequence of referring to an optimal \( \alpha /\left( \alpha +\beta \right) \), as in Morris and Shin (2002), instead of an optimal \(\kappa \left( 0\right) \), as in the present context. See also Angeletos and Pavan (2007, p. 1126) commenting on such reversal obtained in other contexts.

The first condition is stated in the proof of Corollary 10 of AP as the stronger requirement

$$\begin{aligned} \frac{\partial ^{2}u_{i}/\partial q_{i}\partial Q}{\left| \partial ^{2}u_{i}/\partial q_{i}^{2}\right| }=\frac{-a_{3}}{2\left( a_{2}+c_{2}\right) }<-1\text {,} \end{aligned}$$involving the sole direct effect of a variation in the precision \(\alpha \) on \(\mathbb {E}\left( u_{i}\right) \), without taking into account the indirect effect through the adjustment of \(\kappa \). The second condition is also stated in the same passage. It implies that the variance \(\sigma _{\theta }^{2}\) of the fundamental must be large enough relative to the variance \(\sigma _{x}^{2}\) of the private signal.

References

Amir, R., Jin, J.: Cournot and Bertrand equilibria compared: substitutability, complementarity and concavity. Int. J. Ind. Organ. 19, 303–317 (2001)

Amir, R., Jin, J., Troege, M.: Robust results on the sharing of firm-specific information: incentive and welfare effects. J. Math. Econ. 46, 855–866 (2010)

Amir, R., Jin, J., Pech, G., Troege, M.: Prices and deadweight loss in multi-product monopoly. J. Public Econ. Theory 18, 346–362 (2016)

Amir, R., Erickson, P., Jin, J.: On the microeconomic foundations of linear demand for differentiated products. J. Econ. Theory 169, 641–665 (2017)

Angeletos, G.-M., Pavan, A.: Efficient use of information and social value of information. Econometrica 75, 1103–1142 (2007)

Bayona, A.: The social value of information with an endogenous public signal. Econ. Theory 66, 1059–1087 (2018). https://doi.org/10.1007/s00199-017-1081-9

Clark, C., Polborn, M.K.: Information and crowding externalities. Econ. Theory 27(3), 565–581 (2006)

Cornand, C., Dos Santos Ferreira, R.: Cooperation in a differentiated duopoly when information is dispersed: a beauty contest game with endogenous concern for coordination. Working Paper BETA 2017-05 (2017)

Cornand, C., Heinemann, F.: Optimal degree of public information dissemination. Econ. J. 118, 718–742 (2008)

Cournot, A.: Recherches sur les principes mathématiques de la théorie des richesses. Hachette, Paris (1838). English translation by Bacon, N.T.: Researches into the Mathematical Principles of the Theory of Wealth. Macmillan, New York (1897)