Abstract

The paper presents a model that links the diffusion process of a technological innovation and the dissemination of a social norm. Our approach introduces a new dimension to the interaction between markets and social norms beyond the interplay of monetary and non-monetary incentives: the innovation of material goods as a catalyst of norm evolution. We analyze how the dissemination of a social norm may be affected by product innovation, which adds to the variation of products with respect to their level of norm compliance. The market is linked to the process of norm adoption via psychological forces, endogenizing the rates of adoption and abandonment. We derive necessary and sufficient conditions for a) a positive impact of the innovation on the level of norm adoption and b) for multiplicity of norm equilibria. In concluding, we discuss several policy implications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many of today’s environmental problems stem from private consumption patterns. Individuals consume transportation, heating and food, leaving a significant carbon footprint. Preferences for choosing more or less polluting variants of these products and services are shaped by their availability as well as social norms and other institutions. Thus, solutions to mitigate environmental problems depend not only on product innovation, but also on the presence of social norms, with the former enriching markets with sustainable products, and the latter supporting sustainable consumption. When recognizing that social norms influence preferences, it becomes apparent that markets and social norms cannot be treated separately.

The existing literature has widely studied the interrelation between markets and social norms in both directions – how social norms affect markets and how markets affect social norms. The influence of social norms on markets has been studied from theoretical, empirical and experimental perspectives. With respect to theory, there have been various attempts to incorporate norm-motivated behavior into neoclassical theory (see e.g. Vendrik 2003; Brekke et al. 2003; Nyborg et al. 2006), or treat social norms as a prerequisites for working market systems (e.g. Platteau 1994).Footnote 1 However, there is no general or partial equilibrium theory based on norm-motivated behavior.Footnote 2 In the field of evolutionary and institutional economics, the coevolution of technology and institutions in particular informal institutions including social norms has been studied (e.g. Noailly 2008; Los and Verspagen 2009; Cecere et al. 2014; Cordes and Schwesinger 2014). The part of that research that incorporates a formal analysis applies (agent-based) simulations techniques (e.g. Janssen and Jager 2002; Dijk et al. 2013) to derive their results or is restricted to the analysis of certain scenarios. Regarding empirical research, Hong and Kacperczyk (2009) and Johnson (2004) study the impact of norms on financial markets. Kim (2007) finds support for the relevance of norms for the market pricing of private property rights. A series of competitive-market and bilateral-bargaining experiments carried out by Fehr et al. (1998) indicate that competition has a rather limited effect on market outcomes if the norm of reciprocity is operative. The impact of wanting to maintain a positive self-image as a socially responsible person on the demand for “green” electricity is studied by Ek and Söderholm (2008). Johnson (2004) develops a framework using evidence from central Kenya for the relationship between gender norms and financial markets, i.e. the demand for and access to financial services.

The research on the impact of markets on the evolution of norms primarily deals with the analysis of the relationship of norm-driven intrinsic motives and market- or price-driven extrinsic motives. Fehr and Gächter (2001) provide empirical support for incentive contracts crowding out reciprocity-driven voluntary cooperation. In a similar vein, Gneezy and Rustichini (2000) present results from a field study that contradict any deterrence hypothesis. A first survey of this stream of empirical literature on crowding-out effects was carried out by Frey and Jegen (2001). With respect to theory, Benabou and Tirole (2006) provide a theory of pro-social behavior where rewards or punishments create doubt about the true motives for which good deeds are performed, and hence, may lead to partial or even total crowding-out of pro-social behavior. Huck et al. (2012) provide a model of the interplay of social norms and economic incentives in a firm in which crowding-out of social incentives may occur. Bohnet et al. (2001) study the connection between contract enforceability and individual performance, both theoretically and in the laboratory. They find that trustworthiness is “crowded in” with weak enforcement and “crowded out” with medium enforcement. All of these approaches are limited to monetary incentives provided by markets and their regulation. This, however, reduces markets to their price-quantity aspect and completely neglects their innovation capacity. The variation due to such innovations is an important missing element of the market-norm interaction.

In this paper, we try to close that gap by focusing on the interdependence between innovative variation of products and the process of norm-adoption. To understand the explanatory potential of the interdependence, consider a market where, at the pre-innovation stage, the individual characteristic of having adopted a specific norm is not observable, either by observation of the individual itself or its general behavior, or by observation of its consumption behavior. Obviously, the latter presupposes that products or services fail to differ with respect to their norm compliance. After a new product or service characterized by a relatively high degree of norm compliance has entered the market, the process of norm adoption changes in two ways. First, an individual is now able to consume in accordance with his or her norm, which could not have happened before the innovation. The innovation thereby directly facilitates the adoption of the norm by reducing potential cognitive dissonances that would occur if a norm adopter consumes in contradiction to his or her norm. We call this event cognitive bias. Second, the new variety allows the conformity bias (Boyd and Richerson 1985) and other social influences (Cialdini and Goldstein 2004) to enter the scene. The consumption of the (old) norm-violating product and of the (new) norm-complying product will, hence, become more attractive, the more other individuals still, or already, consume the respective product.

In our model, we address both of these elements of the link between product innovation and the evolution of social norms. To achieve this goal, we consider a market in which consumers are heterogeneous with respect to their norm-dependent and product-specific demand and the producers’ product-portfolios heterogeneity evolves endogenously. The equilibrium of this market depends on the share of consumers who have adopted the norm to which the new product complies. Conversely, the innovation and the equilibrium ratio of norm-complaint to norm-violating consumption affects the norm-adoption process via the two biases we introduced in the preceding paragraph. Since the equilibria of markets strongly depend on market structure, and markets for innovative products are highly susceptible to monopoly or oligopoly power, we control for market structure. We do so by opposing the two cases of a discrete number of firms and a continuum of producers of the innovative product.

The link between the process of norm adoption and the market may only be relevant if the product or service is sufficiently important for individuals in terms of the time spent with it, money spent on it, utility drawn from it, social status connected to it, etc., since otherwise, cognitive dissonances would be too weak to have a major impact. For our analysis, we therefore employ e-mobility as the innovation and sustainable transportation as the norm. In 2010, German households spent around two-thirds of their income on the following four categories: housing, water, electricity, gas and other fuels (30.8%); transportation (13.2%Footnote 3); leisure, entertainment and culture (11.6%); and food, including non-alcoholic beverages (10.4%). Of these four categories, only the expenditure for transportation and food reflect the attitude towards sustainable consumption in an observable way.Footnote 4 According to an extensive study on mobility in Germany conducted by the infas Institute for Applied Social Sciences and the DLR German Aerospace Centre in 2008 (MiD 2008, p.21), a mobile person spent on average 1.5 h a day on traveling excluding regular travel time associated with a job, e.g. as a bus driver. Almost 60% of that time (about 54 min) is assigned to private transportation. In summary, the car is expensive, important, omnipresent and relevant for sustainable consumption and therefore a product with a high potential for a conformity bias and cognitive dissonances for norm-adopters.

Our analysis, however, is not limited to this case. We include two other examples that illustrate the wider relevance of our approach. Consider first the technological innovation of social networks such as Facebook or Twitter and the norm share yourself (opinions, activities, etc.) in opposition to the norm protect your privacy. Prior to social networking, individuals willing to share their lives with a wider public audience could not live in accordance with their norm. In contrast, privacy-loving individuals were able to conceal most of their information. Protect your privacy was the prevalent norm in many countries. When internet services such as Facebook or Twitter entered the market, some individuals could start living according to their norm, share yourself. The innovation has caused a complete reversal of the social norm. The second example is the innovation of ecological food and the norm of sustainable and healthy consumption. Today, almost all large supermarket chains include ecological food on their shelves, many being branded directly by the supermarkets themselves. With this innovation, people concerned with sustainability, health and also with the conditions of livestock breeding can live in accordance with this norm, and have become a large minority.

To make our argument precise, in the remainder of the paper, we proceed as follows. In Section 2, we introduce the model. Assumptions and notation are presented in 2.1. In 2.2, we derive the market equilibrium for a given share of norm-adopters and a given number of firms operating on innovative and traditional markets and then deduce the equilibrium number of firms supplying the innovative market. We then turn to studying the dynamics of norm adoption in 2.3. Results are summarized in Section 3. Policy implications are discussed in Section 4, and Section 5 concludes.

2 The model

We consider a market where demand is characterized by a large number of consumers, who differ only with respect to their having adopted a particular consumption-related norm. The commodity traded on the market may occur in two specifications, one in compliance with the norm and one in violation thereof. We base our argument on a specific example, the market for automobiles and the norm of sustainable transportation, with electric cars as the norm-compliant variant and gasoline cars as the norm-violating variant. However, as we have already argued in the introduction, the argument extends to other examples as well.

To make identification of the two consumer groups easy, we call those consumers who have adopted the norm-adopters and those who did not, hedonists. t∈{a,h} identifies the type of consumers in the natural way, while v∈{e,g} identifies the variant of the norm-compliant (electric-powered) and, respectively, the norm-violating (gasoline-powered) variant of the commodity automobiles. For simplicity, both variants of the commodity are imperfect substitutes for each other and the slopes of demand curves as well as substitutability are assumed to be independent of the type of the consumer. With the simplification of linearity, and p e and p g denoting the prices of electric and gasoline cars, respectively, demand per consumer can be written as

for those price combinations that induce strictly positive quantities. For simplicity, we concentrate on these combinations and leave other cases to further research:

-

Assumption 1:

\( \min \left({x}_a^e\left({p}^e,{p}^g\right),{x}_a^g\left({p}^e,{p}^g\right),{x}_h^e\left({p}^e,{p}^g\right),{x}_h^g\left({p}^e,{p}^g\right)\right)>0 \).

We refer to \( {\chi}_t^v \) as the zero-price consumption of variant v by type t. To reflect that electric cars comply with the norm of sustainable transportation to a larger degree than gasoline cars, we state the following,

-

Assumption 2:

If prices of the two variants of the commodity are identical (p e=p g), then the difference between consumption of the norm-compliant variant and of the norm-violating variant will be larger for the norm-adopters than for the hedonists: \( {x}_a^e\left(\tilde{p},\tilde{p}\right)-{x}_a^g\left(\tilde{p},\tilde{p}\right)> \) \( {x}_h^e\left(\tilde{p},\tilde{p}\right)-{x}_h^g\left(\tilde{p},\tilde{p}\right) \).

Corollary 1

\( {\chi}_a^e-{\chi}_a^g>{\chi}_h^e-{\chi}_h^g \).

We will later make use of the effect of norm adoption on individual demand for electric cars and for gasoline cars, \( {\Delta}^e\equiv {\chi}_a^e-{\chi}_h^e \) and \( {\Delta}^g\equiv {\chi}_a^g-{\chi}_h^g \), respectively, where the former is obviously larger than the latter due to Corollary 1.

If we normalize the number of consumers to unity and write q as the proportion of consumers who have adopted the norm, market demands for the two product variants isFootnote 5:

or equivalently, the system of inverse demand functions:

The supply side will be modeled as an oligopoly with product differentiation as commonly adopted in the literature (e.g., Goldberg 1995; Berry et al. 1995). In the medium and long run, firms compete in capacities (Davidson and Deneckere 1986), and we therefore assume myopic profit maximizationFootnote 6 on a simple Cournot oligopoly market for both variants of the commodity with constant marginal production costs of c g and c e for gasoline-powered and electric cars, respectively. We assume that the number of suppliers on the market for gasoline cars is given exogenously by n. The number m of suppliers on the market for electric cars is given by the maximum number of producers who can profitably produce for both markets when adding the second production line, entailing a fixed cost of k. Note that the oligopoly market may turn into a monopoly market. For consistency with the simplifications on the demand side, we exclude by assumption the absence of electric car producers.

We assume that markets find their equilibrium fast enough to neglect the specific dynamics when investigating the norm dynamics. In other words, we make use of the method of adiabatic elimination,Footnote 7 which allows us to include markets into the norm dynamics only by their equilibria, which may, of course, depend on the current level of norm adoption.

Social psychologists assume that the core of our values system develops in the early childhood and is rather stable over time. Parts of the Universal Declaration of Human Right could serve as an example of such slow-changing values which, in particular, are unlikely to change for a single individual. However, if we take a look at the larger domain of derived values, the further we move away from the core the more likely they are to change over time, often triggered by new information and experience. Norms on war as an instrument to protect democracy, on abortion or on vaccination may serve as examples for such adoption or abandonment of derived values. There is, indeed, evidence that individuals change their attitudes and social values in the course of their life. For instance, intergenerational effects alone cannot account for the significant fluctuations in a time interval of 10 years reported in the world value survey and the European value survey. Another example is the study of Rokeach (1974) that shows an increased importance of equality from seventh- to third-ranked value among US citizens within only three years, from 1968 to 1971. That Americans underwent dramatic value changes during a period of 12 years is reported in Rokeach and Ball-Rokeach (1989). As a last example for intra-generational changes of values, we refer to Tompsett et al. (2006) who report significant changes in the public opinion on homelessness in the US between 1993 and 2001.

We therefore assume that the dynamics of norm adoption and norm abandonment is a Markov process driven by randomly assigned moments in which each individual may adopt or abandon the norm. Whether they do may depend on the current state of the society with respect to norm adoption and norm-related market behavior. At the pre-innovation stage the dynamics of the proportion of individuals having adopted the norm, q, is thus given by

where the transition rates π h → a and π a → h are the expected number of adoptions and abandonments of the norm per individual and per time unit.Footnote 8 This approximate equation of motion is standard in population dynamicsFootnote 9 and is highly intuitive. The change in the share is simply the difference in the inflow and outflow. The inflow (outflow) is the product of the share of hedonists (norm-adopters) and the rate of transition from hedonists to adopters (adopters to hedonists).

In order to clearly identify the effect of the market innovation on the norm dynamics, we assume that norms may not be inferred from consumption behavior and are not observable when no product variant compliant with the norm exists. The transition rates are then independent of the current proportion of norm adoption in society and any parameters relating to the (non-existent) market for the norm compliant variant of the commodity:

If the norm-compliant variant of the product enters the market, it will have two effects on the transition rates, a cognitive dissonance effect and a conformity bias effect. The former is caused by the possibility to behave according to the norm. It makes adopting the norm easier and being a norm-adopter less repelling. We capture this idea in the formal presentation of the dynamics by increasing the norm adoption rate by a factor (1+CD) and lowering the rate by which norm holders abandon it by a factor (1-CD), where CD is the reduction in cognitive dissonances from having the norm but not complying with it. We assume CD <1 to ensure that the transition rates remain positive.

The conformity bias has a similar effect on norm adoption and norm abandonment. Once the norm-compliant variant of the product enters the market, individual consumers may observe whether their consumption conforms to the majority of consumers. Acting against the majority implies dissonances, which will be larger when the majority is larger. An individual is more likely to adopt the norm if norm-compliant behavior reflects the consumption pattern of the majority, i.e. if the ratio of electric cars to gasoline cars exceeds unity, then the transition rate towards norm adoption should increase relative to the pre-innovation level. If the opposite is true with respect to \( \frac{X^e}{X^g} \), then the abandonment should be facilitated.Footnote 10 This approach is essentially equivalent to the standard non-linear frequency-dependent function first proposed by Boyd and Richerson (1985). If α∈(0,1) measures the relative weight on the conformity bias, the post-innovation rates of transition are now endogenous and can be written as follows:

Thus, the dynamics of the proportion of norm-adopters becomes:

The market-norm dynamics described in eq. (7) completes the model. The equilibria for the model will be discussed in the following sections.

3 Equilibria

3.1 Market equilibrium

To find the equilibria of the norm-cum-market system described in the previous section, we first determine the market equilibrium and then turn to the dynamic part (Section 3.2).

As oligopolists, each producer i∈{1,2,...,n} maximizes \( \left\{{\widehat{\Pi}}_i,{\tilde{\Pi}}_i\right\} \), with \( {\widehat{\Pi}}_i={p}^g{\widehat{x}}_i^g-{c}^g{\widehat{x}}_i^g \) and \( {\tilde{\Pi}}_i={p}^g{\tilde{x}}_i^g+{p}^e{\tilde{x}}_i^e-{c}^g{\tilde{x}}_i^g-{c}^e{\tilde{x}}_i^e- k \) over his production quantities \( {\widehat{x}}_i^g \), \( {\tilde{x}}_i^g \) and \( {\tilde{x}}_i^e \).

Proposition 1

For each share of norm-adopters q∈[0,1] and each number m∈{0,...,n} of firms producing the innovative product, there is a unique equilibrium in the Cournot oligopoly game.

The proof follows Okuguchi and Szidarovszky (1990) and is given in the appendix, as are all other proofs for this paper.

Taking the derivatives of \( {\tilde{\Pi}}_i \) for m producers of both variants with respect to \( {\tilde{x}}_i^g \) and \( {\tilde{x}}_i^e \) yields two first order conditions, which entail

Similarly, the derivative of \( {\widehat{\Pi}}_i \) for the n-m producers of gasoline cars only with respect to \( {\widehat{x}}_i^g \) yields a first order condition that simplifies to

Summing up all \( {x}_i^g \) and all \( {x}_i^e \) yields

Inserting p e and p g from eq. (3) and solving for X e and X g gives the market equilibrium quantities

As is obvious from Eqs. (8) and (9), the equilibrium is symmetric in the sense that each firm of the same type (only conventional cars or both variants of cars) produces the same quantities. Indeed from Proposition 1 we know that this equilibrium is unique.

The market entry equilibrium in terms of the equilibrium number of firms operating in both markets is given by the condition of equal payoffs. Due to indivisibility, the equilibrium number of firms active on the market for e-mobility, m eq, corresponds to the integer part of m* solving \( {\tilde{\Pi}}_i={\Pi}_i \) with \( {\tilde{x}}_i^g,{\tilde{x}}_i^e,{\widehat{x}}_i^g \) given by (8) and (9) and p e and p g by inserting X e*, X g* from (11) into (3). m eq is thus given by:

Note that the condition on m eq to be of integer value will cause discontinuity in equilibrium prices and quantities at levels of q that induce a change in the value of m eq. The number of firms serving both markets in equilibrium is increasing in the weighted willingness to pay for e-mobility and in the weighted cost differential between conventional cars and electric cars. The number of firms is decreasing in fixed costs k. Notably, the equilibrium number of firms producing both products is independent of the total number of firms n. We further note the following:

Proposition 2

The number of firms m * is monotonically increasing in the share of norm-adopters if and only if \( {\chi}_a^e>{\chi}_h^e \), i.e., if and only if the effect of the norm adoption on individual demand for electric cars is positive (Δe >0).

Hence, if the sustainable-transportation norm accompanied with a reduced overall demand for individual mobility, then an increasing share of norm-adopters may induce a larger number of producers of electric cars. This is true only if the reduction in the demand for transportation exclusively affects the demand for gasoline cars, which has to be partially substituted by an increased demand for electric cars. Proposition 2 will be helpful in Section 3.2.4 when we study the impact of the discontinuity of m eq on the number of stable equilibria.

Having derived the number of firms serving both markets, we can now determine the quantities emerging if the expansion of firms on the e-mobility market is endogenous as \( {\widehat{X}}^e={\left.{X}^{e\ast}\right|}_{m={m}^{e q}} \) and \( {\widehat{X}}^g={\left.{X}^{g\ast}\right|}_{m={m}^{eq}} \). For expositional simplicity, we will heavily make use of the continuous version of m for the moment:

where the tilde denotes the simplification based on the continuous version of m and the two terms

facilitate notation in the remainder of the paper.

In words, continuous equilibrium quantities for both types of cars decrease in marginal cost and increase in the marginal cost of the substitute. Moreover, equilibrium demand is linear in the share of norm adoptors. Whether the demand increases or decreases in the share of norm adoptors depends on the sign and the size of the effect the norm has on individual demand, measured by Δe and Δg.

3.2 Norm equilibrium

We now turn to the evolution of the share q in the population carrying a norm to consume in a sustainable way. As our model is fully specified, we can refine our research question concerning the impact of an innovation of a relative norm-compliant product variant on the evolution of a social norm shaping the preference for the good considered. We will address two questions in detail. First, what is the effect of the market dynamics on the evolution of the norm with respect to the existence and stability of equilibria? Second, what is the impact of an innovation that differs with respect to the level of norm compliance on the dissemination of a norm?

3.2.1 Effect of market dynamics

The equilibrium demand for electric and gasoline cars is affected by the share of norm adoptors in the population. In turn, the market feeds back into the norm-dynamics via the conformity bias. Therefore, we will study the consequences of a conformity bias on the existence and stability of norm equilibria. For now, we neglect the requirement that the number of firms supplying the norm-compliant variant of the product is an integer, and base our argument on the continuous version of the equilibrium number of such firms as defined by m * in Eq. (12). Obviously, this requires assuming that the demand for electric vehicles by hedonists is large enough to keep X e as defined by Eq. (13) strictly positive. In order to differentiate clearly between the continuous-m* version of the model from the version with the discrete m eq, we write \( \dot{\tilde{q}} \) instead of \( \dot{q} \) whenever we use \( {\tilde{X}}^e \) and \( {\tilde{X}}^g \) instead of \( {\widehat{X}}^e \) and \( {\widehat{X}}^g \) in Eq. (7). To guarantee differentiability of \( \dot{\tilde{q}} \), we will further assume that m *∈[1,n]. This is, for instance, satisfied if the number of firms n is sufficiently high and fixed set up cost k are sufficiently small. We will return to this issue in Section 5.

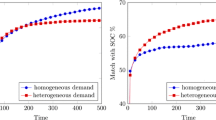

The presence of a conformity bias changes the motion of the norm adoption proportion described in Eq. (7) from a linear function to an s-shaped function with at most one increasing branch in the middle (see Fig. 1). Hence, the presence of a conformity bias in the product market impacts the social norm dynamics in a way that multiple equilibria might exist.

In the following, we will focus on conditions such that this important phenomenon emerges. The importance stems from the fact that in the presence of multiple equilibria short-term shocks can have long-lasting consequences, i.e., the transition from one equilibrium to another. As a first insight, note that the roots of Eq. (7), i.e., stationary points of the norm dynamics, solve a polynomial of degree three. Thus, there can be at most three equilibria.

It turns out that, if there are very few norm adoptors, then their share in the population increases (\( \dot{\tilde{q}} \)>0), whereas if almost everybody adopted the norm, their share decreases (\( \dot{\tilde{q}} \)<0). Since stable equilibria are characterized by a positive growth rate to the left of the stationary point and by a negative growth rate to the right of the equilibrium, we can have at most two stable equilibria (see Fig. 1). Taken these two facts together implies that multiple equilibria may only exist if the global decline in the growth rate of the share of norm adoptors is interrupted for a subinterval of [0,1] (see Fig. 1).

A positive growth rate of \( \dot{\tilde{q}} \), i.e., \( \frac{d\dot{\tilde{q}}}{ d q}>0 \), requires that the ratio of electric cars and gasoline cars increases in order to generate a sufficient momentum through the conformity bias. This, in turn, requires that the effect of the norm adoption on the demand for electric cars (Δe) is relatively strong compared to the effect on gasoline cars (Δg). The following lemma summarizes these insights.

Lemma 1

Assume that \( {\chi}_h^e \) and \( {\chi}_a^g \) are large enough to guarantee that \( {\tilde{X}}^e \) and \( {\tilde{X}}^g \) as defined by eq. (13) are strictly positive for all q∈[0,1]. Then:

-

1.

\( {\left.\dot{\tilde{q}}\right|}_{q=0}>0 \) and \( {\left.\dot{\tilde{q}}\right|}_{q=1}<0 \);

-

2.

Any value of \( \dot{\tilde{q}} \) is reached for at most three different q∈[0,1]; and

-

3.

\( {\Delta}^e\le \frac{\theta^e}{\theta^g}{\Delta}^g \) implies \( \frac{d\left({\tilde{X}}^e/{\tilde{X}}^g\right)}{ d q}\le 0 \), which in turn implies \( \frac{d\dot{q}}{ d q}<0 \).

As a consequence of Claim 1 of Lemma 1, \( \dot{\tilde{q}} \) must have at least one branch declining in q. Claim 2 of the Lemma then implies that there is at most one increasing branch. Such an increasing branch is a necessary condition for multiple inner equilibria of the market-norm dynamics. Hence, a direct consequence of Claim 3 is the following:

Proposition 3 (necessary conditions)

If the market-norm dynamics has multiple (two) stable inner equilibria, then \( {\tilde{X}}^e/{\tilde{X}}^g \) increases strongly in q for all q∈[0,1], i.e. Δe>Δg θ e/θ g.

We will now turn to sufficient conditions and thereby to the parameter set that gives rise to the phenomenon of multiple equilibria. With the assumption of strictly positive demand, the roots of (7) are equivalent to the roots of (15).

The dynamics given by (15) is a polynomial of degree 3 and has two stable inner equilibria in the unit interval if and only if it has two extreme points q Low and q High with a negative functional value at the minimum and a positive functional value at the maximum (see Fig. 1)Footnote 11:

Since demand is linear in the share of norm-adopters, the conditions of positive demand amount to:

Proposition 3 reveales the importance of the relation of Δe and Δg for multiple equilibria to exist. Since our primary focus is on the dynamics of the social norm that impacts market equilibrium via the measures Δe and Δg, we concentrate in the following on the conditions for multiple equilibria with respect to these two parameters.

Note that only the conditions of Eq. (16) and of Eq. (17b) depend on Δe and Δg. Therefore, if we study the parameter region of Δe and Δg such that multiple equilibria exist, only these three conditions are relevant, given that the values for the other parameters satisfy the remaining inequality (17a). Figure 2 gives an illustrative example. We will refer to the triangular area spanned by the points A, B, and C depicted in Fig. 2 as multiple equilibrium set (MES). A formal definition is given in the Appendix.

Range of multiple equilibria: line AB: \( {\tilde{X}}^g \)(1)=0, \( {\tilde{X}}^g \)(1)>0 to the right of the line AB; line BC: Δe,Min(Δg) upper bound of Δe allowing for multiple equilibria; line AC: Δe,Max(Δg) lower bound of Δe allowing for multiple equilibria. θ e = 0.1 , θ g = 1 , σ h /σ a = 1 , n = 4 , α = 0 , λ/κ = 4/5

The intuition behind having an upper and lower limit for Δe is simple. If Δe were too large, X e (q) increases too quickly relative to X g (q) that \( \dot{\tilde{q}} \)(q) increases at q=0 or the minimum of \( \dot{\tilde{q}} \)(q) is above the \( \dot{\tilde{q}} \)=0-axis. If Δe were too small, X g (q) declines rapidly relative to X e (q) so that \( \dot{\tilde{q}} \)(q) never increases or only has a minimum but no maximum, or has a maximum which remains below the \( \dot{\tilde{q}} \)=0-axis. In our application, a relatively large Δe implies that norm adoption has such a strong effect on the market equilibrium amount of norm compliant consumption that the growth in this consumption (possibly at the cost of norm violating consumption) reinforces the norm very quickly. This happens at such a pace that norm adoption is always self-reinforcing until the number of individuals not having adopted the norm becomes very small. If, on the other hand, Δe is very small, then norm adoption has too little of an effect on norm compliant consumption to become self-reinforcing.

Note that the differential equation that gives rise to Δe,Min(Δg) and Δe,Max(Δg) has no analytical solution equilibria (see Appendix, for details). We will make use of approximation techniques in order to derive sufficient conditions for the existence of multiple. Figure 3 illustrates our approximation approach, details of which are deferred to the Appendix. Our approximation of MES is defined by three linear conditions and has the property that the approximated parameter space is empty if and only if MES is empty. Since the intuition behind these constraints is identical to the above reasoning regarding the upper bound Δe,Min(Δg) and lower bound Δe,Max(Δg), we refer the interested reader to the appendix for the technical details.

Beyond necessary conditions and conditions on demand parameters for the existence of multiple equilibria, Fig. 1 illustrates, that the presence of the conformity bias deforms the linear pre-innovation dynamics into a s-shaped function. As mentioned above, the dynamics given by (7) consist of a linear and nonlinear term, the latter weighted with 1‑α. Intuitively, one would expect that α, the weight of the linear term, must be sufficiently small so that the nonlinear term dominates the dynamics and for some parameter constellations multiple equilibria might arise. It indeed turns out that there exists a unique threshold value for α, such that multiple equilibria are possible. Its derivation is deferred to the appendix.

Proposition 4

There exists a unique α crit such that MES is non-empty if and only if \( \alpha <{\alpha}^{crit.}=\frac{\left(1- CD\right)\left( n+1\right){\theta}^e+2\left( n{\theta}^g-{\lambda \theta}^e\right)-\sqrt{{\left(\left(1- CD\right)\left( n+1\right){\theta}^e\right)}^2+4{\left( n{\theta}^g-{\lambda \theta}^e\right)}^2\left(1-{CD}^2\right)}}{2\left({CD}^2\left( n{\theta}^g-{\lambda \theta}^e\right)+\left( n+1\right)\left(1- CD\right){\theta}^e\right)} \).

In other words, as long as the weight for the non-linear term reflecting the conformity bias is sufficiently large, there will always be (Δe,Δg) pairs such that multiple equilibria exist. It turns out that the critical value α crit increases in parameters such as c e , k , \( {\chi}_h^g \), which ceteris paribus disfavor electric cars relative to gasoline cars as their values increase. An increase in the number of firms or a stronger demand for gasoline cars also increases this critical value. Consequently, the more favorable the environment for electric cars in terms of demand and supply conditions, the more likely the existence of multiple equilibria.Footnote 12

3.2.2 Impact of the innovation on the norm equilibrium

So far we explored the consequences of the market dynamics on the number and stability of norm equilibria. We now turn to the second question and study whether the innovation induces an increase or decrease in the level of norm adoption. In the pre-innovation stage where transition rates are given by the constants defined in Eq. (5), the dynamics of Eq. (4) has an easy-to-calculate stable and unique equilibrium at q o = σ a /(σ h + σ a ). Thus, our second research question amounts to the question of the sign of the growth rate of q at qº.

As a first insight on the effect of market dynamics, note that neglecting the conformity bias (α=1), inspection of Eq. (7) shows that cognitive bias shifts the norm dynamics upwards and turns it counterclockwise. As a consequence, the equilibrium level of norm adoption increases. However, the presence of a conformity bias changes the motion of the norm adoption proportion from a linear function to an s-shaped. The following Proposition states the necessary and sufficient condition for a positive growth rate in norm adoption at the pre-innovation level.

Proposition 5

Equation (18) reveals that for sufficiently low levels of conformity, α, and sufficiently high levels of cognitive dissonance, the innovation will cause an increase in the share of adoptors. Moreover, the equilibrium quantities of electric cars at the pre-innovation share of adoptors must be sufficiently high compared to conventional cars in order to induce an increase in norm adoption. This translates via Eqs. (13) and (14) to conditions on production costs and demand parameter. It turns out that the more favorable the environment for electric cars in terms of demand and supply conditions, the more likely the innovation induces a growth in the share of norm adoptors.

If \( \dot{\tilde{q}} \)(qº)<0, then it implies that the positive cognitive bias is offset by a negative conformity bias with a sufficiently large weight α. Obviously, the conformity bias is negative only if at qº the market-equilibrium quantity of the norm-compliant variant of the good is less than the corresponding quantity of the norm-violating variant.

3.2.3 Comparative statics

The effects of market parameter variations on the location of \( \dot{\tilde{q}} \)(q) and on the number of equilibria are best understood by observing that they only enter via \( {\tilde{X}}^e \) and \( {\tilde{X}}^g \) into eq. (7). Since \( \frac{d\dot{\tilde{q}}(q)}{{d\tilde{X}}^e}>0>\frac{d\dot{\tilde{q}}(q)}{{d\tilde{X}}^e} \), the derivatives are all straight forward. In particular, \( \frac{d\dot{\tilde{q}}(q)}{d{\varDelta}^e}>0>\frac{d\dot{\tilde{q}}(q)}{d{\varDelta}^e} \), i.e. the effect of norm adoption on the demand for electric (gasoline) cars has a positive (negative) effect on the growth rate of the share of adopters. As a consequence, independently of the number of equilibria, all stable equilibria are shifted to the right (left) if Δe (Δg) increases. The more individual demand for electric cars increases when the norm is adopted, the larger the stable-equilibrium number of norm holders will be. In general, any change in parameters of the demand or supply side that favors electric cars over gasoline cars, such as decrease in c e or k or an increase in c g, shifts all stable equilibria to the right.

3.2.4 Discontinuity of firm number

We now drop the simplifying assumption of continuity of the equilibrium number of firms producing the norm-compliant variant of the product. We first study the effect of the discreteness of this number of firms on the pace at which norm adoption changes and then infer consequences for the number and location of equilibria with reference to the structure of the market of the innovative good. A helpful first insight is the following:

Proposition 6

Except for the discontinuities, where \( \dot{q} \)(q)=\( \dot{\tilde{q}} \)(q) holds true, we have:

Figure 4 visualizes the relationship between Δe >0 and \( \dot{\tilde{q}} \)(q) reported in Proposition 6.

The discontinuities described in Proposition 6 may increase the number of instances at which the sign of \( \dot{q} \)(q) changes from positive to negative as q increases, i.e. the number of stable equilibria. It does not reduce this number. The additional stable equilibria may not occur over the entire range of q, but only in those intervals in which the “jumps” and the slope in the neighborhood of the discontinuities are in opposite directions. Only then may the discontinuities result in additional sign changes. We state the argument more precisely in the following:

Corollary 7

Additional stable equilibria due to the discontinuities of \( \dot{q}(q) \) occur if and only if the discontinuities entail additional sign changes of \( \dot{q} \)(q). If Δe >0, every additional stable equilibrium is in one of the intervals in which \( \dot{q} \)(q) is continuous and has its lower bound in one of the decreasing branches of \( \dot{\tilde{q}} \)(q). If Δe <0, almost allFootnote 13 additional stable equilibria occur at discontinuities that form the lower bound of a continuity interval of \( \dot{q} \)(q) that is at least partly in the increasing branch of \( \dot{\tilde{q}} \)(q).

We note that this corollary implies that, with negative Δe and a monotonously decreasing function \( \dot{\tilde{q}} \)(q), the discontinuity will never induce additional equilibria. The relevance of this insight becomes obvious if one remembers that, with negative Δe, the existence of an increasing branch of \( \dot{\tilde{q}} \)(q) is only possible if Δg is sufficiently smaller than Δe.

Importantly, with more stable equilibria, temporary policies are more likely to induce a permanent shift in market structures or market outcomes, but as the larger number of stable equilibria become less distant, such permanent effects of temporary policies tend to be smaller. Much of the discussion in the following section on policy implications is based on this insight.

4 Policy implications

The policy implications of our model depend to some degree on the definition of policy goals. Within the realm of environmental policy in general and traffic-emissions policy, in particular, policy goals may run the gamut from the dissemination of environment-friendly products over a reduction of particularly polluting products to straight emission reductions. Very often, environmental sustainability and emission reductions may be the final goal, but political activism often involves preliminary targets such as electric cars replacing gasoline cars. General adoption of environmental norms, such as the sustainable-transportation norm we have been using as a running example in our model, may also serve as one of the more immediate goals.

All these goals may be affected by innovation such as electric cars with similar consumption properties as gasoline cars. If the innovation is unrelated to a norm, or if the adoption and abandonment of the norm do not depend on the relative frequency of the consumption of the new, norm-compliant product variant, then there would be few arguments for government support of the new technology, except for the internalization of external effects. However, if the dissemination of the innovation is linked to a norm in the two ways we have described in our model, namely, both higher valuation of the new product by norm bearers and the feedback of norm-compliant consumption on the dissemination of the norm, then the introduction of a norm-compliant innovation ceases to have unambiguous effects.

We have discussed the case that the conformity bias may be so strong that it can hinder the dissemination of innovation. In fact, as innovation allows for the observable choice between norm-compliant and norm-violating behavior, the innovation may reduce the number of norm-adopters if it enters the market in small numbers at the beginning, and thereby hinders its own further dissemination into the market. In these cases, it is particularly appropriate for political interference with market forces (and norm formation!). However, policy measures should be carefully chosen. It would be detrimental if policy aimed at (and succeeded in) increasing the influence of the normative sphere on the market by strengthening the conformity bias in society. Such policy measures would only reinforce the innovation-curbing effects of the conformity bias. However, policy should be willing to strongly support innovation in an early stage by improving market parameters in order to shift the market-norm system into the region of attraction of the high level of norm adoption. Only in the long run should such policies be replaced by supporting the conformity bias in order to further shift the “good” equilibrium towards greater norm adoption. The reverse order of these measures may have detrimental effects: the system may be driven to the “bad” equilibrium if it exists, and this may make later successful market interference extremely expensive.

Among the market parameters to be influenced politically, choices should be made according to the dissemination of the norms in the given society. Political measures that alter the effect that the norms impose on demand should only be implemented when norm adoption is wide already. If it is not, the effect is not only diminished by the small number of individuals who may react to the policy measure, but also by a possible reintroduction of at least some cognitive dissonances from having the norm but not complying with it, which in our model would be tantamount to reducing CD. The effect would be less norm adoption and thus even less effectiveness of the political instruments. Policies that affect the valuation for the innovative product of both norm-adopters and hedonists in the same way (such as a subsidy for consumption of norm-compliant behavior) or operate on the supply side (such as cost reductions) will, of course, also have the desired effects, but cannot be tailored to the level of norm adoption.

If the norm compels individuals to use electric mobility rather than to avoid gasoline cars, i.e. if the effect of norm adoption on individual demand for electric cars (Δe in our model) is positive, then discontinuity of the number of firms may have to be considered when determining political action to support the innovation of electric cars. In particular, if the number of suppliers is small due to an initially low demand for such cars, discontinuity effects tend to be large. As a consequence, temporary policy measures supporting the innovation are more likely to have permanent effects. In addition, the permanence of the effects is triggered faster than if multiplicity of the equilibria only stems from positive feedback loops in norm formation (in our model, working via the market). However, this permanence cuts both ways. Not only is the return to an initial equilibrium with lower consumption of the innovation avoided, but also further increases in consumption may be hindered. If additional stable equilibria occur on the way from an equilibrium of little consumption to an equilibrium of much consumption, then their regions of attraction may trap the system before it can evolve to the region of attraction of the “best” equilibrium. Hence, if policy suspects the existence of multiple equilibria due to positive feedback loops in the norm formation process and the market structure on the new market is a small oligopoly or even a monopoly, then policies aiming at overcoming equilibria of little norm adoption have to be particularly strong and patient.

5 Conclusions

Our paper introduces a new dimension to the interaction between markets and norms beyond the interplay of monetary and non-monetary incentives to act in a certain way: innovation of material goods as a catalyst of norm evolution. This new dimension allows us to incorporate two neglected channels through which markets affect norm evolution. On the one hand, consumption may express the normative attitude of an individual, but only if products vary sufficiently with respect to compliance of the considered norm. On the other hand, observed consumption also exposes an individual to social influence that may reinforce norm adoption or norm abandonment. We have condensed these arguments in a model that extends the existing literature on the evolution of social norms in three ways. First, our model incorporates the influence of a product innovation on the process of norm adoption. Second, we consider how conformity bias in the consumption of material goods affects the adoption of idealistic norms. Third, we demonstrate how market structure, through its impact on market outcomes, may influence norm dynamics. We thereby add to the understanding of how the evolution of norms depends on market activities.

Within our model, we have pursued two questions. First, we studied how an innovation that differs with respect to the level of norm compliance modifies the dissemination of a norm. Second, we investigated the effect of market dynamics on the evolution of the norm with respect to the existence and stability of the equilibria. Concerning the first question, we have derived the necessary and sufficient conditions for an innovation to induce an increasing dissemination of the social norm. The innovation increases the norm diffusion if (1) the conformity bias is weak or enough individuals already bear the norm prior to the innovation and (2) the increase of individual demand for the norm-compliant product variant resulting from norm adoption exceeds the corresponding demand for the norm-violating variant by a sufficient degree. These conditions become more restrictive when fewer firms are in the market, since then the required increase in profits to induce an additional incumbent to produce the innovative product increases.

With respect to the second question, we have shown that multiple norm equilibria may not only result if norm adoption is a frequency-dependent opinion formation process with direct positive feedback loops. Multiplicity may also arise if norm adoption depends on observed market behavior, in particular, on the proportion of norm compliant consumption. The direct positive feedback loop may be weaker when multiple equilibria are also supported by a conformity bias in consumption of material goods. We have further derived sufficient conditions under which the positive effect of norm adoption on individual demand induces multiplicity of equilibria. It turns out that the effect of the norm on the demand for the norm-compliant variant may be neither too high nor too low as compared to the effect on demand for the norm-violating product for multiplicity to arise. We have also discussed a second possible source of multiplicity of norm equilibria, the market structure. In principle, if more suppliers offer a norm-compliant good, they would offer the good at lower prices, thereby facilitating norm compliance and norm adoption. This could, in turn, increase the demand for the norm-compliant good and thereby allow more suppliers to enter the market. It turns out, though, that this feedback loop may reinforce already existing positive frequency dependency as source of multiplicity of equilibria, and will rarely induce multiple equilibria on its own.

Based on these results, we have drawn conclusions for policy makers aiming at a higher dissemination of the social norm as an intermediate goal to achieving ultimately the goal of reducing environmental pollution. We have discussed the case that the conformity bias may be so strong that it hinders the dissemination of the innovation. It is mainly in these cases where political interference with market forces (and norm formation) is appropriate. If policy suspects the existence of multiple equilibria due to positive feedback loops in the norm formation process and the market structure on the new market is a small oligopoly or even a monopoly, then policies aiming at overcoming equilibria of little norm adoption have to be strong and patient. Political measures that alter the effect that the norm imposes on demand should only be implemented when norm adoption is already wide spread. If it is not, the effect is not only diminished by the small number of individuals who may react to the policy measure, but also by a possible reintroduction of at least some cognitive dissonance from having the norm but not complying with it.

Notes

For a normative theory of social norms in market economies, see Bergsten (1985).

More than 85% of these expenditures are spent on private transportation.

Exceptions are things such as solar panels for the accommodation category or the attendance of a pro-environment concert.

For discussions of the conditions for discrete choice models generating linear aggregate demand functions, see, Jaffe and Weyl 2010, Armstrong and Vickers 2015, and the literature cited therein. We refrain from adopting a discrete choice approach as our focus is on the interaction between aggregate market demand and social norm dynamics.

We believe that profits, especially in large incorporations, are the main concerns of decision makers.

The method was introduced under this label by Haken (1977) for the synergetic approach of aggregation of dynamics of micro-data to the dynamics of macro-data. It has been introduced to economics e.g. by Weidlich and Haag (1983). The basic idea of the method may, however, already be found in Samuelson (1947).

Strictly speaking, the transition rates are the limits of the expected number of transitions per second, when we consider ever shorter time intervals (similar to the speed of a car being measured in miles per hour, but measured for a specific point in time, not for an entire hour).

For example, see Weidlich and Haag (1983).

We neglect the possibility of having a conformity bias that affects consumption directly. This allows us to concentrate on the effects of the conformity bias on norm adoption and abandonment. We conjecture that this has no qualitative effects because the conformity bias affecting consumption directly should only reinforce the effects of the norm-related conformity bias.

Note that if there are two extreme points q Low <q High, then \( \dot{q} \)(q High)>0 implies q High <1 and \( \dot{q} \)(q Low)<0 implies q Low >0 by inspection of (7), given strictly positive demand. Given \( \dot{q} \)(q High)>0 and \( \dot{q} \)(q Low)<0, the fact that \( \dot{q} \)(0)>0, \( \dot{q} \)(1)<0 implies that q Low is the minimum and q Hgih is the maximum. Hence, only the two conditions with respect to the existence of two extrema and the sign condition at the extrema points remain.

See the proof of Proposition 4 for the derivation of partial derivatives.

The only case in which an additional equilibrium may be in a continuity interval of \( \dot{q} \)(q) occurs if \( \dot{\tilde{q}} \)(q) has a minimum, this minimum is positive, a continuity interval of \( \dot{q} \)(q) embraces this minimum, has an interior minimum that is negative and has positive limits at both bounds.

References

Armstrong M, Vickers J (2015) Which demand systems can be generated by discrete choice? J Econ Theory 158:293–307

Benabou R, Tirole J (2006) Belief in a just world and redistributive politics. Q J Econ 121(2):699–746

Bergsten GS (1985) On the role of social norms in a market economy. Public Choice 45(2):113–137

Berry S, Levinsohn J, Pakes A (1995) Automobile prices in market equilibrium. Econometrica 63(4):841–890

Bohnet I, Frey BS, Huck S (2001) More order with less law: on contract enforcement, trust, and crowding. Am Polit Sci Rev 95(1):131–144

Bowles S, Gintis H (2000) Walrasian economics in retrospect. Q J Econ 115(4):1411–1439

Boyd R, Richerson PJ (1985) Culture and the evolutionary process. University of Chicago Press, Chicago

Brekke KA, Kverndokk S, Nyborg K (2003) An economic model of moral motivation. J Public Econ 87(9):1967–1983

Cecere G, Corrocher N, Gossart C, Ozman M (2014) Lock-in and path dependence: an evolutionary approach to eco-innovations. J Evol Econ 24(5):1037–1065

Cialdini RB, Goldstein NJ (2004) Social influence: compliance and conformity. Annu Rev Psychol 55:591–621

Cordes C, Schwesinger G (2014) Technological diffusion and preference learning in the world of homo sustinens: the challenges for politics. Ecol Econ 97:191–200

Davidson C, Deneckere R (1986) Long-run competition in capacity, short-run competition in price, and the Cournot model. RAND J Econ 17(3):404–415

Dijk M, Kemp R, Valkering P (2013) Incorporating social context and co-evolution in an innovation diffusion model—with an application to cleaner vehicles. J Evol Econ 23(2):295–329

Ek K, Söderholm P (2008) Norms and economic motivation in the Swedish green electricity market. Ecol Econ 68(1):169–182

Fehr E, Gächter S (2001) Do Incentive Contracts Crowd Out Voluntary Cooperation? Institute for Empirical Research in Economics, University of Zürich, Working Paper No. 34

Fehr E, Kirchler E, Weichbold A, Gächter S (1998) When social norms overpower competition: gift exchange in experimental labor markets. J Labor Econ 16(2):324–351

Frey BS, Jegen R (2001) Motivation crowding theory. J Econ Surv 15(5):589–611

Gneezy U, Rustichini A (2000) A fine is a price. J Leg Stud 29(1):1–18

Goldberg PK (1995) Product differentiation and oligopoly in international markets: the case of the US automobile industry. Econometrica 63(4):891–951

Haken H (1977) Synergetics—an introduction: Nonequilibrium phase transitions and self-Organization in Physics, chemistry and biology. Springer, Berlin

Hong H, Kacperczyk M (2009) The price of sin: the effects of social norms on markets. J Financ Econ 93(1):15–36

Huck S, Kübler D, Weibull J (2012) Social norms and economic incentives in firms. J Econ Behav Organ 83(2):173–185

Jaffe S, Weyl EG (2010) Linear demand systems are inconsistent with discrete choice. The BE J Theor Econ 10(1):52

Janssen MA, Jager W (2001) Fashions, habits and changing preferences: simulation of psychological factors affecting market dynamics. J Econ Psychol 22(6):745–772

Janssen MA, Jager W (2002) Stimulating diffusion of green products. J Evol Econ 12(3):283–306

Johnson S (2004) Gender norms in financial markets: evidence from Kenya. World Dev 32(8):1355–1374

Kim AM (2007) North versus south: the impact of social norms in the market pricing of private property rights in Vietnam. World Dev 35(12):2079–2095

Los B, Verspagen B (2009) Localized innovation, localized diffusion and the environment: an analysis of reductions of CO2 emissions by passenger cars. J Evol Econ 19(4):507–526

MiD 2008 – Mobilität in Deutschland (2008) Ergebnisbericht; Struktur – Aufkommen – Emission – Trends. infas; DLR. Bundesministerium für Verkehr, Bau und Stadtentwicklung (Hg.)

Noailly J (2008) Coevolution of economic and ecological systems. J Evol Econ 18(1):1–29

Nyborg K, Howarth RB, Brekke KA (2006) Green consumers and public policy: on socially contingent moral motivation. Resour Energy Econ 28(4):351–366

Okuguchi K, Szidarovszky F (1990) The theory of oligopoly with multi-product firms. Springer, Berlin

Platteau J (1994) Behind the market stage where real societies exist. Part II: the role of moral norms. J Dev Stud 30:753–817

Rokeach M (1974) Change and stability in American value systems, 1968-1971. Public Opin Q 38(2):222–238

Rokeach M, Ball-Rokeach SJ (1989) Stability and change in American value priorities, 1968–1981. Am Psychol 44(5):775–784

Samuelson PA (1947) Foundations of economic analysis. Harvard Univ. Press, Cambridge, Mass

Tompsett CJ, Toro PA, Guzicki M, Manrique M, Zatakia J (2006) Homelessness in the United States: assessing changes in prevalence and public opinion, 1993–2001. Am J Community Psychol 37(1–2):29–46

Vendrik M (2003) Dynamics of a household norm in female labour supply. J Econ Dyn Control 27(5):823–841

Weidlich W, Haag G (1983) Concepts and models of a quantitative sociology: the dynamics of interacting populations. Springer, Heidelberg and New York

Acknowledgements

This research was financially supported by the Federal Ministry of Education and Research (01UN1018C).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

This research was financially supported by the Federal Ministry of Education and Research (01UN1018C).

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix

Appendix

Proof of Proposition 1: The demand system (19) in vector notion is given by \( \left(\begin{array}{c}\hfill {p}^e\hfill \\ {}\hfill {p}^g\hfill \end{array}\right)= A\left(\begin{array}{c}\hfill {X}^e\hfill \\ {}\hfill {X}^g\hfill \end{array}\right)+ b \). According to Okuguchi and Szidarovszky (1990, p.34), given the linear structure of the model, negative definiteness of A + A T is sufficient for uniqueness of the Cournot equilibrium. Eigenvalues of A + A T are given by \( -\frac{1}{\kappa -\lambda}\left(1\pm \sqrt{1-\frac{1}{\kappa -\lambda}}\right) \) and negative by inspection. QED

Proof of Proposition 2: \( \frac{\partial {m}^{\ast }}{\partial q}\underset{<}{\overset{>}{=}}0\iff \frac{\partial {m}^{\ast }}{\partial q}\underset{<}{\overset{>}{=}}0.\mathrm{QED} \)

Proof of Lemma 1: Claim 1 is obvious when X e and X g are strictly positive. Claim 2 follows from the fact that X e and X g are linear in q and thus solving Eq. (7) for q for any given value of \( \dot{\tilde{q}} \) is tantamount to solving a polynomial of degree three. The first implication of Claim 3 follows from the fact that the denominator of the derivative \( \frac{d\left({\tilde{X}}^e/{\tilde{X}}^g\right)}{ d q} \) is strictly positive and the numerator is given by:

The second implication of Claim 3 follows from the observation that all three terms summed up in

are negative if \( \frac{d\left({\tilde{X}}^e/{\tilde{X}}^g\right)}{ d q}\le 0.\mathrm{QED} \)

1.1 Definition of MES and Approximation

In what follows, we will derive the vertices of the MES and reformulate the two differential equations \( \dot{q}\left({q}^{Low}\right)<0 \), \( \dot{q}\left({q}^{High}\right)>0 \) as differential equation for Δe(Δg).

At q=q ex such that \( {\dot{q}}^{\prime } \)(q ex.)=0, solving for the stationary points of (7) is equivalent to solving an equation in Δe,Δg: \( \dot{q} \)(q ex.(Δe,Δg))=0. Given strictly positive demand and a strictly positive conformity bias, \( \dot{q} \)(q)=0 is equivalent to:

where \( \gamma =\frac{\alpha}{1-\alpha}{\sigma}_a\left(1+ CD\right),\beta =-\frac{\alpha}{1-\alpha}\left({\sigma}_a\left(1+ CD\right)+{\sigma}_h\left(1- CD\right)\right) \).

Let \( z(q)\equiv \frac{X^e}{X^g},\sigma \equiv {\sigma}_h/{\sigma}_a \), then (21) can be written as:

Taking the total derivative of (22) with respect to Δe, Δg and applying the envelope theorem gives us:

Equation (23) amounts to \( \frac{n+1}{n}\frac{n+1}{n}+\frac{n+1}{n}=\frac{n+1}{n} \), which is equivalent to:

Together with initial conditions: (Δe,Δg)|\( \dot{q} \)(q Max(Δe,Δg))=0 and (Δe,Δg)|\( \dot{q} \)(q Min(Δe,Δg))=0 the differential eq. (24) gives rise to two boundary functions: Δe,Min(Δg), Δe,Max(Δg).

Definition: All (Δe,Δg) pairs that satisfy the following three conditions define a parameter region such that multiple equilibria exist: (1) \( {\varDelta}^e<-{\theta}^e+\frac{n}{\lambda}\left({\varDelta}^g+{\theta}^g\right) \), (2) Δe >Δe,Min(Δg), (3) Δe <Δe,Max(Δg). We will refer to this set as the multiple equilibria set (MES).

Before we continue, we will state some observations based on \( \frac{d{\varDelta}^e}{d{\varDelta}^g}=\frac{1}{\frac{n+1{X}^g}{n{ X}^e}+\frac{\lambda}{n}} \) that will be helpful in the course of our argument:

-

(1)

The slopes of Δe,Min(Δg),Δe,Max(Δg) are positive and smaller than the slope of the third constraint\( {\varDelta}^e<-{\theta}^e+\frac{n}{\lambda}\left({\varDelta}^g+{\theta}^g\right) \).

-

(2)

By corollary 4, \( \frac{d{\Delta}^g}{d{\Delta}^e}=\frac{\Delta^g q+{\theta}^g}{\Delta^e q+{\theta}^e} \) is ceteris paribus decreasing in q

-

(3)

At point A, the relevant constraints have the same slope.

We are able to determine the coordinates for points A and B (see Fig. 2) analytically. For better readability, Table 1 presents the results for α=0. Note that there exist multiple equilibria if and only if (Δe)B >(Δe)A.

Approximation for α=0:

The differential equations given by (25) cannot be solved analytically. In the following, we present our approximation strategy for α=0, such that we can state explicit sufficient conditions for multiple equilibria to exist.

Note that the values for q that corresponds to (Δe,Δg) pairs that are elements of the graph of Δe,Max(Δg) range from \( {q}^C=\frac{\left( n{\theta}^g-{\lambda \theta}^e\right)}{3\left( n{\varDelta}^g-\lambda {\varDelta}^e\right)+4\left( n{\theta}^g-{\lambda \theta}^e\right)} \) to q A=1. We can use the (Δg)B as a lower bound for Δg and by that, can give a lower bound for q independent of Δe and Δg, i.e. \( \underset{\bar{\mkern6mu}}{q}=\frac{4{\left( n+1\right)}^2{\theta}^e}{4{\left( n+1\right)}^2{\theta}^e+3\lambda \left( n{\theta}^g-{\lambda \theta}^e\right)} \). The system \( \dot{q}\left({q}^C\right)=0 \), \( {\dot{q}}^{\prime}\left({q}^C\right)=0 \) can be solved for Δe and Δg as a function of q. If we plug in \( \underset{\bar{\mkern6mu}}{q} \), we get as point D a (Δe,Δg) pair on the graph of Δe,Max(Δg) that corresponds to a maximum for the dynamics in (7) that equals \( \underset{\bar{\mkern6mu}}{q} \).

We approximate the upper and lower boundaries by linear functions intersecting point B and D, respectively. Our observation above, that the slope Δe,Min(Δg) is decreasing in q, gives us a lower bound for the slope by \( \frac{\theta^e}{\theta^g} \). Figure 3 illustrates our approximation procedure. Note that, under our approach, MES is not empty if and only if the area spanned by X g(1)>0 and the two approximating linear function is non-empty.

Proposition (sufficient conditions): If α=0 and \( 0<{\theta}^e<\frac{n}{\lambda}{\theta}^g \), \( \dot{\tilde{q}}=0 \) has three solutions if:

where \( \underset{\bar{\mkern6mu}}{q}=\frac{4{\left( n+1\right)}^2{\theta}^e}{4{\left( n+1\right)}^2{\theta}^e+3\lambda \left( n{\theta}^g-{\lambda \theta}^e\right)} \).

Approximation for α ≠ 0

Since we have an analytical solution for point A, we now focus the general solution for the tangent point D:

where

To find such a point, we apply the following approach: First, we express two of the conditions for the inflection point C, \( \dot{q} \)(q)=0, \( {\dot{q}}^{\hbox{'}} \)(q)=0 in terms of Δg(q). With these two conditions, we can solve for Δe. However, we still have to find a q that will be greater than q IP and independent of Δe and Δg.

For the general case α ≠ 0, we again choose q such that we can be sure that it will correspond to a point on the graph of Δe,Max(Δg). This can be achieved by choosing (Δg)B as a lower bound for Δg and ‑θ e as a lower bound for Δe.

This gives us a lower bound for the maxima that correspond to Δe,Max(Δg) independent of Δe and Δg. We can then calculate the slope at point D: \( \frac{d{\varDelta}^e}{d{\varDelta}^e}=\frac{d{\varDelta}^e}{d{\varDelta}^e} \).

Proof of Proposition 4: The situation where MES is empty corresponds to the case point A, B and C are equal, i.e. where q Max=q Min≡q IP=1, \( \dot{q} \)(1)=0 and X g (1)=0. The latter two conditions provide a solution for Δg as a function of α: \( {\varDelta}^g\left(\alpha \right)=\frac{{\alpha \lambda \delta}_h\left(1- CD\right)\left( n{\theta}^g-{\lambda \theta}^e\right)}{n\left( n+1\right)\left(1-\alpha \right){\delta}_a}-{\theta}^g \). The first condition amounts to a condition for α as a function of Δg:

where τ=(nθ g ‑ λθ e). Solving these two equations for α yields the critical value:

Derivation of the partial effects on the critical value α crit:

In the next step, we first rearrange the term on the left-hand side of the last inequality and, second, we distinguish two cases to establish the strict positivity of the term.

Proof of Proposition 5: Inserting equilibrium quantities given in (13) into (7) and evaluation at qº yields eq. (18). QED

Proof of Proposition 6: At the discontinuities we have m * =m eq and thus \( \dot{q}(q)=\dot{\tilde{q}}(q) \). Otherwise, m * >m eq implies \( {\tilde{X}}^e>{\widehat{X}}^e \) and \( {\tilde{X}}^g<{\widehat{X}}^g \) due to \( \frac{dX^{e\ast }}{dm}>0 \) and \( \frac{dX^{g\ast }}{dm}<0 \). Hence, \( \dot{q}(q)<\dot{\tilde{q}}(q) \) for all q in the intervals of continuity. For the second part of the claim, note that we can write \( \dot{q}=\dot{q}\left(\frac{X^e}{X^g}\left( m(q), q\right), q\right) \) and thus, \( \frac{d\dot{q}}{ d q}=\frac{\partial \dot{q}}{\partial \frac{X^e}{X^g}}\left(\frac{\partial \frac{X^e}{X^g}}{\partial m}\frac{d m}{ d q}+\frac{\partial \frac{X^e}{X^g}}{\partial q}\right)+\frac{\partial \dot{q}}{\partial q} \). Since \( \frac{dm^{\ast }}{dq}=\frac{\Delta^e}{\sqrt{k\kappa}} \) and \( \frac{dm^{eq}}{dq}=0 \) for all q in the intervals of continuity, and the other terms in \( \frac{d\dot{q}}{ d q} \) are the same for the discontinuous version of \( \dot{q} \) and its continuous approximation \( \dot{\tilde{q}} \), the observation \( \frac{\partial \dot{q}}{\partial \frac{X^e}{X^g}}=\left(1-\alpha \right)\left(\left(1- q\right){\sigma}_a+\frac{q{\sigma}_h}{{\left(\frac{X^e}{X^g}\right)}^2}\right)>0 \) implies the second claim of the Proposition. QED.

Rights and permissions

About this article

Cite this article

Müller, S., von Wangenheim, G. The impact of market innovations on the dissemination of social norms: the sustainability case. J Evol Econ 27, 663–690 (2017). https://doi.org/10.1007/s00191-017-0509-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-017-0509-5