Abstract

Growth theory argues that thresholds can lead to multiple growth regimes, which are reflected in heterogeneous patterns of cross-country convergence and divergence. We study sectoral convergence patterns by using a new longitudinal sectoral database for 65 developed and developing countries. We employ an econometric method, quantile smoothing splines, which explicitly allows for identification of parameter heterogeneity both with regard to initial conditions (X-heterogeneity) and growth performances (Y-heterogeneity). Findings suggest that convergence is rather the exception than the rule.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In their pioneering study, Bernard and Jones (1996) brought the analysis of cross-country convergence and divergence to the level of sectors, instead of following a large previous literature that had focused on the aggregate performance of national economies. BJ found unconditional convergence of labor productivity levels in the services sectors, and argued that it is the service industries that drive the aggregate convergence patterns observed by Baumol (1986) for national economies within the OECD area.

However, the limited availability of high quality sector-level data led BJ to study sectors in a very small set of countries (14 of the richest OECD countries), which could hardly be seen as “representative” of the world. Subsequent studies vindicated their results using detailed input and output price data for the same set of countries (Inklaar and Timmer, 2009). Other studies, however, showed that BJ’s results were quite sensitive to, among other things, the inclusion of other (non-OECD) countries in the sample, and more recent analyses based on larger country samples point instead to manufacturing as the sector that is characterized by productivity convergence (Sørensen, 2001; Duarte and Restuccia, 2010; Rodrik, 2013).

Applied growth research on sectoral convergence appears on the whole inconclusive as to whether convergence is a trend that characterizes the majority of sectors. Do we find lakes of non-convergence or even divergence in a Pangea of convergence, as previous studies seem to suggest, or rather convergence islands in oceans of non-convergence?

Two main issues hamper further progress of research in this literature. One is the lack of good quality sector-level data for a relatively large sample of countries.Footnote 1 The other is the heterogeneity issue, i.e. the inability of the standard convergence equation to take into due account that observations (for a given sector, in several countries) with very different initial income levels and other conditions might well be characterized by different growth dynamics (Bernard and Durlauf, 1996; Temple, 1999; Durlauf et al., 2005).

This paper intends to address both problems. On the sectoral data issue, we investigate sectoral productivity dynamics for a relatively large sample of economies. Our novel dataset contains labor productivity figures for the same six broad sectors as studied by BJ, but for as many as 65 countries over the period 1970–2009. Our data contains observations for many developed countries as well as developing countries in Latin America, Africa and Asia.

On the methodological aspect (the heterogeneity issue), the paper proposes the use of a new empirical method focusing on the discovery of parameter heterogeneity in processes of sectoral convergence. Recent growth models argue that thresholds of various kinds could demarcate and explain coexistent regimes of convergence and non-convergence.Footnote 2 We aim to provide more insights into the relative importance of both regimes at the level of sectors. To do so, we make use of an estimation method that is able to reconcile the standard beta-convergence specification with the heterogeneity aspect. We apply quantile smoothing splines (Koenker et al., 1994) and argue that this provides us with a richer view of the distributional dynamics of productivity across a large sample of country-sectors. We thus obtain a characterization of relative productivity changes that allows for varying convergence parameters along two dimensions.

First, country-sectors differ substantially in terms of their initial conditions (e.g. in terms of productivity levels). The previous literature on cross-country convergence has shown that it is possible to identify different regimes related to thresholds in initial conditions (Durlauf and Johnson, 1995; Castellacci and Archibugi, 2008; Saviotti and Pyka, 2011). Since initial conditions typically represent the key explanatory variable in the standard convergence equation, we label this first source of heterogeneity as X-heterogeneity.

Second, our convergence estimation method also allows for the investigation of heterogeneity in growth performance, i.e. parameters are allowed to vary across the broad spectrum bounded by ‘growth miracles’ and ‘growth disasters’. Such country-sectors attained productivity growth rates well above and well below what could be expected given their initial conditions, respectively. We label this Y-heterogeneity, since the dynamic performance of country-sectors (e.g. productivity growth) is the standard dependent variable in the convergence equation. A few studies have recently made use of quantile regressions to take this source of heterogeneity into account (Barreto and Hughes, 2004; Krüger, 2009; Castellacci, 2011).

The novelty of the quantile smoothing spline method for convergence analyses is that it makes it possible to consider both sources of heterogeneity simultaneously. For each sector, we determine different regions in the space spanned by the values of X (initial labor productivity level) and Y (labor productivity growth) characterized by convergence and divergence, respectively.

The results show that convergence is rather the exception than the rule. The observed patterns are most aptly described as “convergence islands in oceans of non-convergence”. The convergence islands can be found in the Northeastern ranges of the convergence map, i.e. country-sectors that were initially rather close to the world productivity leader and that performed considerably better than what could be expected given this initial gap. Most other country-sectors did not experience convergence (oceans of non-convergence) over the considered time span. Among these, divergence surfaced for a number of under-achieving manufacturing and services country-sectors.

The remainder of this paper is structured as follows. Section 2 presents a brief review of the recent growth literature that focuses on the emergence of thresholds and the interactions among determinants of growth. Section 3 describes the dataset, while section 4 introduces the estimation methods. Section 5 re-examines the productivity convergence hypothesis by using the standard OLS regression approach, and reassesses the results that were previously obtained by BJ in the context of advanced economies only. Section 6 then tackles the heterogeneity issue by making use of quantile smoothing splines in the enlarged dataset. Section 7 concludes and summarizes the main results.

2 Heterogeneity and convergence

The convergence hypothesis has attracted a great deal of attention in growth theory. The standard formulation of the convergence mechanism implies that countries that start from a lower initial level of economic development will experience higher long-run growth rates than already rich economies. This may be due either to decreasing returns to capital accumulation (the neoclassical interpretation, e.g. Mankiw et al., 1992), or to the international diffusion of advanced technologies (the Schumpeterian-evolutionary interpretation, e.g. Fagerberg and Verspagen, 2002; Fagerberg and Srholec, 2008; Castellacci, 2008; Filippetti and Peyrache, 2011).

Recently, numerous applied growth studies have reconsidered the convergence hypothesis and criticized its standard formulation by focusing on the heterogeneity issue. (See overviews in Temple, 1999, and Durlauf et al., 2005.) Countries differ greatly in terms of their growth performance as well as the underlying set of economic and institutional factors that may explain it. Hence, it is questionable whether a single convergence regression may provide a reasonable representation of the dynamics of a large set of remarkably different economies (Harberger, 1987; Bernard and Durlauf, 1996).

Empirical findings on polarization and non-linearities in the growth process have inspired a class of theoretical models, rooted in the Schumpeterian economics tradition, that seek to understand the mechanisms causing the existence of groups of countries with different growth patterns. Which factors could cause thresholds between growth regimes and how could interactions between characteristics of economies play a role? Most Schumpeterian models of multiple equilibria focus on the interactions between two factors: technological progress and human capital formation. Below, we will briefly discuss some of these theories, which provide justifications for our empirical analysis in the next sections.

A seminal study is the multiple equilibria model proposed by Azariadis and Drazen (1990). This model augments the neoclassical growth model with a new feature that produces multiple growth paths: threshold externalities in the accumulation of human capital. The threshold property and non-linearity of the model are explained by the mechanism through which individual agents accumulate human capital. Individual investments in education are assumed to depend on two factors: the time invested in human capital formation by each individual, and the private yield on education. The latter factor, in turn, is assumed to be a positive function of the average (aggregate) level of human capital in the economy. This formalization generates threshold externalities because the private incentives to invest in education increase rapidly above a certain threshold level of aggregate human capital, whereas below this given threshold, low private yields cause stagnant growth of aggregate human capital and, hence, economic growth. In this model, different initial conditions in terms of human capital levels may therefore explain long-run dynamics of national economies that cannot be defined by a single set of parameters.

Nelson and Phelps’ (1966) and Verspagen (1991) models introduced the important idea that threshold and non-linearities in the growth process may be explained by the interaction between human capital and technological dynamics, i.e. they pointed out an exponential diffusion mechanism according to which a country’s absorptive capacity is affected by its level of human capital. Galor and Moav (2000) also presented a model in which non-linearities in the growth process are determined by the interaction of human capital and technological change. The basic idea is that an increase in the rate of technical progress tends to raise the relative demand for skilled labor and, hence, to increase the rate of return to private investments in education. The subsequent increase in the supply of educated individuals, in turn, acts to push technological change further. It is such a dynamic interaction between the processes of skill formation and technological upgrading that is at the heart of the cumulativeness of aggregate growth trajectories.

Howitt (2000) and Howitt and Mayer-Foulkes (2005) refined the Schumpeterian growth model by arguing that cross-country differences in the rates of return to investments in human capital may shape the dynamics of absorptive capacity (see Abramovitz, 1986, and Basu and Weil, 1998, for related expositions) and thus generate three distinct convergence clubs: an innovation, an implementation and a stagnation group. The first is rich in terms of both innovative ability and absorptive capacity. The second is characterized by a much lower innovative capability, but its absorptive capacity is developed enough to enable an imitation-based catching up process. The stagnation group is instead poor in both aspects, and its distance vis-à-vis the other two groups tend to increase over time. (See Acemoglu et al., 2006, for further refinements.)

A different explanation for the existence of multiple growth paths is provided by Durlauf (1993) and Kelly (2001). Their formalizations focus on the dynamics of industrial sectors and the importance of intersectoral linkages to sustain the aggregate dynamics of the economic system. The main idea of these models is that, when intersectoral linkages among domestic industries are sufficiently strong, the growth of leading sectors propagates rapidly to the whole economy, whereas if such technological complementarities are not intense enough, the aggregate economy follows a less dynamic growth path.

This brief survey indicates the relevance of the heterogeneity issue and its implications for the convergence process. The literature clearly suggests that X- and Y-heterogeneity may be seen as complementary aspects of the convergence process. It indicates that different initial development levels may lead to situations in which multiple parameter sets are needed to correctly describe the relationship between productivity growth and initial productivity levels (X-heterogeneity). Furthermore, the interactions between initial productivity and a host of variables that often cannot be included in sector-level convergence regressions will lead to Y-heterogeneity. A country-sector employing much more human capital than most of its foreign counterparts with a similar initial labor productivity level is likely to end up as a growth miracle if lack of data prevents researchers from including human capital as an explanatory variable. For country-sectors with large stocks of unobserved human capital, convergence to the productivity leader might exist, while country-sectors with a similar initial labor productivity level but smaller stocks of unobserved human capital might fail to do so. The overview of the literature thus shows that the growth performance of growth miracles is obviously very different from the growth performance of modal growers or growth disasters.

Therefore, our paper provides an attempt simultaneously to consider various sources of heterogeneity in the convergence process. First, we consider sectoral heterogeneity by explicitly focusing on the sector-level and by comparing the convergence patterns that we observe in different branches of the economy (Bernard and Jones, 1996; Duarte and Restuccia, 2010; Rodrik, 2013). Second, we employ an econometric methodology (quantile smoothing splines) that is able simultaneously to model X- and Y-heterogeneity by searching for threshold levels and non-linearities in the convergence process for different quantiles of the conditional growth distribution.

3 Reconsidering Bernard and Jones (1996): A New Dataset

We start by reconsidering the findings on unconditional productivity convergence documented by Bernard and Jones (1996; BJ), who focused on convergence in a sample of 14 OECD countries for the period 1970–1987.Footnote 3 They found significant unconditional productivity convergence for the services sector, public utilities, and construction, but not for agriculture and manufacturing. This suggested that convergence as observed for total economies was driven by convergence in services and what they called “other industries”. In this section, we briefly introduce a conceptually comparable dataset that broadens BJ’s country coverage and replicate BJ’s analysis to assess the robustness of their results.

Our data set comprises 65 countries for the period 1970–2009.Footnote 4 These countries are spread over various continents and feature very different initial labor productivity levels. To arrive at this dataset, we merged various existing datasets. Annual sectoral data on value added and employment for developing countries is obtained from the updated GGDC 10-sector database (Timmer and de Vries, 2009) and the new Africa Sector Database (de Vries et al., 2013). The sources for developed countries are the EU KLEMS database (see O’Mahony and Timmer, 2009) and the socio-economic accounts of the World Input–output Database (Timmer et al., 2014). The database covers the ten main sectors of the economy as defined in the International Standard Industrial Classification, Revision 3 (ISIC rev. 3).Footnote 5 Together, these ten sectors make up the national economies of the countries included. Below, we will use a slightly more aggregate sector grouping, closely following the sectors distinguished in BJ.

The sector data has been constructed paying attention to three checks on consistency, i.e. intertemporal, international and internal consistency. For sectoral GDP, our general approach was to start with GDP levels for the most recent available benchmark year, expressed in that year’s prices, from the National Accounts provided by the National Statistical Institute or Central Bank. Historical national accounts series were subsequently linked to this benchmark year. This linking procedure ensures that growth rates of individual series are retained although absolute levels are adjusted according to the most recent information and methods. Our time series of gross value added and employment are thus consistent over time. Through our linking procedure as described above, major breaks in the series have been repaired. Internal and international consistency of the cross-country sectoral data is ensured by using the system of national accounts for value added, the employment concept of persons engaged and the use of a harmonized sectoral classification. For the derivation of meaningful productivity measures, the labor input and output measures should cover the same activities (that is, being internally consistent). As we use persons employed as our employment concept rather than employees, overlap in coverage of the employment statistics and value added from the national accounts is maximized. However, a notable exception is the own-account production of housing services by owner-occupiers. For this, an imputation of rents is made and added to GDP in many countries, in line with the System of National Accounts. This imputed production does not have an employment equivalent and should preferably not be included in output for the purposes of labor productivity comparisons. Therefore, separate series for imputed rents are presented. In our analysis, we excluded imputed rents.

We measure labor productivity as gross value added per worker. Employment in the data set is defined as ‘all persons employed’, including all paid employees, but also informal workers such as own-account workers and employers of informal firms. To arrive at initial productivity levels (the explanatory variable in our convergence regressions) that are comparable across countries, we converted value added in national currencies to US dollars using sector-specific PPPs for 2005. We use these because it is well known that relative prices vary substantially across tradable and non-tradable sectors, such that the use of aggregate PPPs is not appropriate. Relative prices across sectors are based on price data collected by the World Bank in the 2005 ICP round, except for agriculture (Inklaar and Timmer, 2013). For this sector, data on relative prices are based on unit value information from FAO.Footnote 6 For each country-sector, we extrapolated sectoral value added in US dollars by its value added volume series. Appendix Table 5 reports average annual labor productivity growth rates by country and sector for the period 1970–2009.

To provide some evidence on the plausibility of our data, we start by analyzing the subsample of country-sectors studied in BJ, also considering the same time period (1970 to 1987). The model we estimate is

in which Y i is the labor productivity growth rate in country-sector i, X i is the log of its initial labor productivity level and n is the number of country-sectors. Of particular interest are the values and signs of β 1 in the equation. According to the simplest formulation of the β-convergence hypothesis, unconditional productivity convergence prevails if ordinary least squares regression yields a significantly negative value for β 1.

Table 1 shows the first set of estimation results, which compares the results obtained by BJ and us, and presents the consequences of extending BJ’s sample of advanced countries with emerging and developing countries. The first columns are based on identical OECD-samples. Unlike BJ, we do not report estimates for the total private sector, since our data do not allow us to remove government activities. Nevertheless, their basic convergence result for the total private sector is resembled in our almost identical result for Total Economies.

In contrast to BJ, we find unconditional productivity convergence in all sectors over 1970–1987, except for public utilities. Two differences may underlie these results. First, BJ used the OECD intersectoral database, whereas we use the recently constructed EU KLEMS database and the World Input–output Database. The latter are balanced panels, whereas the OECD intersectoral database is unbalanced for some countries (data for Australia, Belgium, Italy and the Netherlands are missing for some years), as a consequence of which BJ’s growth rates for some countries were computed over slightly different periods. Second, and probably more important, BJ used different PPP indicators to convert value added expressed in national currencies into value added in US dollars. Their conversion is based on 1980 GDP PPPs, as opposed to the sector-specific 2005 PPPs that we use. Sørensen (2001) argued that the use of different base years is very likely to affect the estimates for β 1, if aggregate PPPs are used. Choosing a later base year tends to increase the significance of convergence in manufacturing productivity.Footnote 7 Our use of sectoral PPPs avoids the sensitivity of the estimated convergence parameter to the choice of a rather arbitrary base year.

After including developing countries, we find that convergence still holds for some sectors, but not for others. For Mining and Construction, we obtain significant negative estimates of β 1, implying that there has been unconditional catch-up in labor productivity during this period. However, we do not find evidence for convergence in Agriculture, Manufacturing, and Services anymore.Footnote 8 Thus, adding more countries to the regression affects the results in a qualitative sense. Our findings thus suggest that BJ’s convergence results for services are not robust against broadening the sample of countries. In a sense, this key result of Bernard and Jones (1996) appears to be as sensitive to heterogeneity and selection bias as Baumol’s (1986) result for aggregate economies.

The finding that the service sector is characterized by an absence of global cross-country convergence, however, would not pay justice to the strong convergence found for this sector in the sizable subsample of OECD countries. Apparently, part of the sample is characterized by productivity convergence, while it does not prevail in other parts of the sample. Quantile regressions and quantile smoothing splines as introduced in the next section will allow for a considerably richer analysis of sectoral convergence patterns, paying more justice to parameter heterogeneity.

4 Methods

Our empirical strategy will be as follows. First, we use quantile regression analysis, which explicitly accounts for heterogeneity in productivity growth rates conditional upon initial labor productivity (Y-heterogeneity). This approach does not collapse conditional distributions of productivity growth rates into their means, as does ordinary least squares regression. Therefore, it is able to address the main criticism against the β-convergence concept raised by Quah (1993). If the estimated convergence parameter were more or less uniform over the entire conditional distribution, the type of mobility between productivity classes emphasized by Quah would be limited. By contrast, indications of the probabilities of country-sectors moving from one productivity class to another (the transition probabilities in Quah’s Markov chain setting) could be derived from estimates relating to several parts of the conditional productivity growth distributions. Quantile regression analysis allows for parameter heterogeneity across the conditional distribution of growth rates, but assumes that the parameters are identical for all values of the independent variable(s). (See Barreto and Hughes, 2004; Krüger, 2009; Castellacci, 2011.) Second, we argue that quantile smoothing splines enable us to consider Y-heterogeneity and X-heterogeneity simultaneously. This methodology enables us to detect parameter heterogeneity between country-sectors with high or low initial levels of labor productivity (the explanatory variable) as well. This type of heterogeneity is crucial to the theories reviewed in Section 2.

4.1 Quantile regressions

Quantile regression was pioneered by Koenker and Bassett (1978).Footnote 9 Quantile regression does not consider distributions of growth rates as such, but distributions of growth rates conditional on the values of covariates. In the context of the present paper, the relationship between productivity growth rates and initial labor productivity is assessed for quantiles τ. Such a quantile refers to the conditional growth rates that are equal or higher than the proportion τ of the full set of conditional growth rates, and lower than the proportion (1 - τ).

Median regression estimates (τ = 0.5) are obtained as the solution to the problem of minimizing the sum of absolute residuals. For other quantiles, a sum of asymmetrically weighted absolute residuals is minimized. Different weights are attached to positive and negative residuals. The minimization problem is:

In this equation, the loss function, ρ τ , associated with differences between actual and predicted values is defined as

in which I represents the indicator function, which is equal to one if ε <0 and zero otherwise (ε i = Y i − β τ0 − β τ1 X i ). By varying the parameter τ on the (0,1) interval, we can generate several quantile regressions and thus obtain a representation of the conditional growth distribution Y i given initial productivity levels X i .

If initial productivity only affects the location of the conditional growth distribution (that is, the estimated intercept is higher for high values of τ than for lower values, but the slope estimates are not significantly different), OLS is an appropriate method. In the context of this paper, however, quantile regressions allow us to show that patterns of convergence and divergence for growth miracle country-sectors often deviate strongly from those for growth disasters. Quantile regressions thus allow us to include the over-performing agricultural sector of Denmark into the same regression sample as the under-achieving agricultural sector of Venezuela. These country-sectors had similar labor productivity levels in 1970, but showed completely different productivity growth performances and may well have been driven by different ‘laws of motion’.Footnote 10 Such laws are uncovered by quantile regressions applied to our large samples of heterogeneous country-sectors.

The quantile regression approach has two additional advantages over a standard OLS convergence estimator. First, quantile regressions identify differences between the behavior of successful versus unsuccessful country-sectors, but they do not address the question of why some country-sectors have been more successful than others. Differences in estimated regression equations for high and low quantiles point to omitted variables problems present in OLS estimations. Differences between the growth performances of miracles and disasters could be due to differences in human capital endowments, for example (see Section 2). Omitting human capital variables from OLS regressions can have severe consequences for the parameter estimates. The advantage of quantile regressions is that omitted variables are just reflected in the distribution of country-sectors over high quantiles and low quantiles. These can be governed by different convergence patterns.

Secondl, quantile regressions also offer advantages over OLS if heteroscedasticity is present (see Koenker and Bassett, 1982). In OLS regressions, the well-known funnel-like scatterplots (see, e.g. Baumol, 1986; Pritchett, 1997), which show much more variability of productivity growth rates for countries with low initial productivity levels than for countries with high initial productivity levels, is only reflected in the structure of the residuals but not in the estimated parameters. As will be shown in the next section, quantile regressions show that convergence prevails for the miracles, while divergence dominates the growth performance of disasters. Consequently, they can offer a richer description of Y-heterogeneity.

4.2 Quantile smoothing splines

Quantile regressions cannot cope with what we call X-heterogeneity, i.e. heterogeneity of convergence patterns with respect to the set of explanatory variables. Hence, critics of cross-country regressions still have a valid point in questioning the usefulness of including, for instance, the agricultural sectors of the Netherlands and Nigeria in a single quantile regression equation. Even though these country-sectors can be shown to belong to similar quantiles of the conditional growth distribution, threshold effects related to their different initial productivity levels (see the theories discussed in Section 2) might well have prevented them from being governed by the same productivity growth regime.

In this paper, initial labor productivity is a natural candidate to use for identifying threshold levels and non-linearities in the growth process (Durlauf and Johnson, 1995). In line with the empirical and modeling literature in the convergence clubs tradition, the initial level of productivity is a commonly used proxy for its overall level of economic, technological and institutional development. Thus, in the context of this paper, X-heterogeneity refers to cross-country differences in sectoral productivity levels at the beginning of the estimation periods.

In order simultaneously to take Y- and X-heterogeneity into account, we rely again on work by Roger Koenker. Koenker et al. (1994) introduced quantile smoothing splines. For each quantile of the conditional growth distribution (Y-heterogeneity), the smoothing splines estimation method identifies threshold levels for the initial productivity (X-heterogeneity) and provides estimates of the convergence parameter for subsamples of observations above and below these thresholds.

A brief formal presentation of the method is as follows. He and Ng (1999) define “fidelity” to the data as

in which g is a smooth function, and measure “roughness” as

The τth quantile linear smoothing spline is the solution to:

The smoothing parameter λ in Eq. 6 is determined as the outcome of a trade-off between the fidelity of the fitted function to the data and its roughness. For λ = 0, the smoothing spline interpolates all observations. In that case, the fit is perfect but it is unlikely that any patterns common to a number of country-sectors can be discovered. For large values of λ, the smoothing spline produces a single linear fit for the entire sample.Footnote 11 Koenker et al. (1994) proposed to base the value of λ on minimization of Eq. 7, which can be interpreted as a Schwarz Information Criterion for quantile smoothing splines:

in which ĝ(x i ) indicates the estimated function. Equation 7 represents a trade-off between fit as measured by the log-likelihood value (captured by the first term), and parsimony as measured by the number of linearly interpolated y i s (captured by the second term). In our empirical applications, we follow Koenker et al. (1994) in choosing the smoothing parameter λ such that the SIC criterion in (7) reaches its global minimum. Conditional on this λ, the number of productivity growth regimes is determined by the data, according to Eq. 6.

5 X- and Y-heterogeneity: Empirical Results

In line with a distance-to-frontier interpretation of the convergence equation (see, e.g. Fagerberg, 1994, and Aghion and Howitt, 2006), we now specify the regression equation in relative terms. X i refers to the logarithm of the ratio of relative initial labor productivity levels (of follower and leader), whereas Y i refers to relative labor productivity growth rates (follower minus leader). Further, we consider growth rates for four sub-periods, 1970–1980, 1980–1990, 1990–2000 and 2000–2009. We consider these periods of 10 years as sufficiently long to reveal sources of long-run labor productivity change. Short-run business cycle effects would dominate such growth rates if shorter periods were chosen. We pool all observations and do not include fixed effects in the equations, since inclusion of these would shift the focus from studying the presence of unconditional convergence (following BJ) to studying conditional convergence (see Rodrik, 2013).Footnote 12 This procedure yields a sample of 213 observations. The sample is unbalanced due to the absence of Eastern European countries in the early subperiods.

5.1 Quantile regression analysis: accounting for Y-heterogeneity

We first contrast quantile regression results with those obtained from OLS regressions. In Table 2, OLS results are displayed first. Subsequently, three quantile estimates are presented, for τ = 0.25, 0.5, and 0.75.Footnote 13

Comparison of the results with (column β 1,FE ) and without (column β 1,NFE ) country-fixed effects shows that inclusion of these fixed effects has very limited effects at the level of sectors. For the Total Economy estimates, the differences are larger, with a stronger tendency towards convergence for the specification with fixed effects if higher quantiles are considered. These two results suggest that above-average performing countries experienced rapid employment shifts from low-productive to high-productive sectors. In view of our focus on unconditional labor productivity convergence (as opposed to conditional convergence) and on productivity dynamics at the sector level, the remainder of the empirical analysis will abstract from fixed effects.

For Total Economies, Table 2 indicates that the lack of convergence observed in the OLS regression is driven by the observations below or around the median of the conditional productivity growth distribution. For the upper tail (τ = 0.75), we find statistically significant indications of convergence. For the sectoral subsamples, we find a heterogeneous set of results. In Agriculture, productivity convergence appears to be absent, while in Mining, Services and Construction, unconditional convergence is found for the two highest quantiles. The results for Manufacturing and Utilities more or less resemble those for Total Economy, that is, convergence is absent for the median and lower quantiles, but the results for the highest quantile show that the country-sectors that performed well above expectations actually converged in productivity growth to the initial leader. In Manufacturing and Services, we even find productivity divergence for τ = 0.25, indicating that productivity growth of badly performing low-productive countries was slower than US labor productivity growth. These results show that going deeper into the conditional distributions of productivity growth allows for the discovery of much richer convergence dynamics than revealed by Ordinary Least Squares estimation.

To assess whether the differences between point estimates across quantiles are statistically significant, we perform a non-parametric test for the individual coefficients (Koenker and Xiao, 2002). This procedure tests the null hypothesis under which the β 1,NFE coefficient is constant across the conditional growth distribution, against the alternative hypothesis that the β 1,NFE coefficient varies across the conditional growth distribution. Results from the Koenker-Xiao test are reported in Table 3. The differences between the estimates for the lower and higher tails for Manufacturing and Services as reported in Table 2 are significant, which implies that the dynamic patterns for “miracle” country-sectors are different from those for “disasters” indeed. We find a similar result for the Total Economy sample. Agriculture is the only sector for which we do not find statistically significant differences. Convergence appears absent in this sector. In Mining, Services and Construction (and for Total Economy as well), the differences between the results for the median and the 0.75 quantile are not significant at 5 %, which implies that the main variation in convergence patterns is due to falling behind of country-sectors, of which productivity grew slower than could be expected on the basis of their initial productivity only.

5.2 Quantile smoothing splines: accounting for X- and Y-heterogeneity

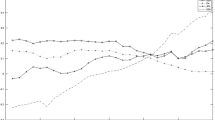

We now combine the analysis of Y-heterogeneity in growth rates with X-heterogeneity in initial labor productivity levels. Figure 1 shows quantile smoothing splines estimations (as introduced in Section 4.2) of convergence equations for each sector and for the Total Economy.Footnote 14 The X-axis displays (the log of) the ratio of initial labor productivity levels and the initial productivity level of the leader, whereas growth rates relative to the leader are shown along the Y-axis. The smoothing parameter λ is chosen on the basis of the Schwarz criterion (Eq. 7). For each sector and the Total Economy, we estimate three quantile smoothing splines. These refer to the 75th quantile (the upper dash-dotted line), the median quantile (the dotted line in the middle), and the 25th quantile (the dashed line at the bottom).

Our results provide evidence for the existence of threshold effects and non-linearities in the convergence process (X-heterogeneity) for some of the sectors and for Total Economy. We will turn to this below, but would like to address the estimates for the slopes first.

A brief glance at the panels of Fig. 1 might well lead to the conclusion that convergence prevailed for large ranges of initial productivity gaps, for the medians and the 75th quantiles. Many line segments are downward sloping. If these were not significantly different from zero, however, they would not indicate convergence. Formal tests on model parameters obtained in a quantile smoothing spline estimation framework do not yet exist.Footnote 15 To get reasonable insights into parameter significance, we ran quantile regressions on subsamples indicated by the splines. For Services, for example, the 75th percentile smoothing spline depicted in Fig. 1 shows a clear kink for an initial log labor productivity gap of −0.701. Hence, a regression estimate for τ = 0.75 was obtained for the subsample of observations with X i smaller than or equal to −0.701. In Table 4, both types of estimates are documented. To assess whether the slopes are significantly different from zero, we use bootstrapped standard errors as suggested by Holst Milton Bache et al. (2013), based on 50 pseudo-samples. In general, the differences between the quantile smoothing splines estimates (β 1 QS) and the approximate quantile regression estimates for part of the sample (β 1 PQR) are small. This is particularly true for those subsamples for which the quantile regression estimates are found to be significantly different from zero. In Fig. 1, these parts of the lines are indicated by solid lines.

We will restrict our discussion of the results in Fig. 1 and Table 4 to the sectors that had large shares in total employment in a substantial number of countries (i.e., Agriculture, Manufacturing and Services), and Total Economy. For Total Economy, convergence is only found for countries with small initial gaps, provided that these countries are close to or above the median of the conditional productivity growth distribution. For the median and 0.75 quantiles, only countries with initial productivity gaps to the U.S. smaller than those of Mexico in 1970 or Portugal in 1990 proved able to catch-up (the productivity gaps of these countries (not shown) correspond to the log labor productivity gap of −0.913 in Table 4) . For most countries that were further behind in initial periods, convergence to the U.S. productivity ‘frontier’ appeared not to occur, irrespective of their position in the conditional growth distribution.

X-heterogeneity appears not to play an important role in the convergence patterns in Agriculture and Manufacturing. The apparent absence of thresholds associated with significant estimates of convergence or divergence implies that the results documented in Table 4 are largely identical to those in Table 2. For country-sectors in the highest parts of the conditional productivity growth distributions, convergence to the world leader was a global phenomenon. Irrespective of the initial productivity gap, these country-sectors managed to catch up. For the country-sectors in the lower quantiles, however, divergence prevailed, even if the initial productivity gaps were very small. The divergence for growth disasters with a high initial productivity level might indicate that staying close to the technology frontier requires continuous investment in innovative capabilities and human capital to benefit from spillovers from leading countries in Manufacturing, if the technology-gap perspective discussed in Section 2 is adopted (Verspagen, 1991; Fagerberg and Verspagen, 2002).

For Services, X-heterogeneity also plays a minor role. Productivity growth disasters experience divergence over the entire range of initial productivity gaps, while country-sectors around the median of the conditional productivity growth distribution do not converge to the leader. In order to benefit from much stronger catch-up, initial labor productivity of country-sectors in the upper tail should have been rather close to the initial level of the leader. The gap of −0.701 roughly corresponds to the gap in services labor productivity between Australia and the US in 1980 (not shown; a table with gaps is available from authors upon request).

The virtual absence of thresholds in Manufacturing and Services is rather remarkable, since the interaction effects of schooling, technology and institutional quality as stressed in the growth theories in Section 2 might have been expected to play an important role in these sectors.Footnote 16

What can be gained by moving from quantile regressions to quantile smoothing splines? Comparing results for Total Economy shows how insights obtained from quantile regressions should be nuanced (see Tables 2 and 4). Not accounting for X-heterogeneity leads to the conclusion that growth miracles usually catch up to the productivity leader, irrespective of how far they were behind initially. In a similar vein, the quantile regression results suggest that countries around the median of the conditional productivity growth distribution do not tend to converge unconditionally. Accounting for X-heterogeneity by means of quantile smoothing splines, we find that productivity growth miracles that were farther behind the US than Mexico in 1970 generally lost ground, while countries with an approximately median performance managed to catch up as long as they were closer to US productivity levels than Mexico in 1970.

The sector-specific results show that convergence is rather the exception than the rule. We do not find a single sector with unconditional convergence for the full set of quantiles and initial productivity levels. In a few sectors, the productivity levels of “growth miracles” and/or country-sectors close to the median tend to converge to the world leader. Such patterns are found for Mining and Utilities. In none of the samples did country-sectors in the bottom part of the conditional productivity growth distribution converge to their US counterpart, irrespective of the initial productivity gap. The simultaneous consideration of X- and Y-heterogeneity clearly provides a more detailed characterization of the convergence pattern for different groups of country-sectors than OLS-regressions such as those presented by BJ. We feel that the observed patterns are most aptly described by “convergence islands in oceans of non-convergence”. Most of these islands can be found in the Northeastern ranges of the map, i.e. country-sectors that were initially rather close to the world productivity leader and performed considerably better than what could be expected given this initial gap.

6 Conclusions

This paper studied sectoral labor productivity convergence. We used a recently constructed sectoral dataset that covers 65 countries, including many countries in Eastern Europe, Latin America, Asia and Africa. Paying tribute to Harberger’s (1987) famous words about inclusion of very different countries in a single regression equation, the empirical methods we chose emphasized the importance of several sources of heterogeneity. We first showed that BJ’s results are not robust against inclusion of developing countries. First, Total Economies (including government services) did not converge to the world leader. Second, at the sectoral level, we found that productivity growth rates in services did not converge anymore when our non-OECD countries were added to BJ’s sample. These results warrant investigations allowing for parameter heterogeneity with regard to initial conditions and unobservable variables.

We first focused on Y-heterogeneity (the relation between sectoral productivity growth and initial productivity might be different for “growth miracles” and “growth disasters”, for example due to unobservable variables), by means of quantile regressions. For most sectors, we found that convergence is only apparent in country-sectors that did well in comparison to country-sectors with a comparable initial labor productivity level. Country-sectors that did not fare very well in comparison to foreign counterparts with similar initial productivity levels generally did not only lose ground to these counterparts, but also failed to catch-up to the US.

Next, we enriched this analysis of heterogeneity and convergence by making use of quantile smoothing splines. This estimation method identifies threshold effects (X-heterogeneity), while the distinction between productivity growth miracles and disasters is maintained. The results show that the convergence hypothesis represents a useful model to describe the behavior of only a limited group of country-sectors. By contrast, most other observations in our sample, representing under-performing country-sectors and those below a minimum threshold level of initial development (in Services, for example), lacked convergence or even experienced divergence over the most recent four decades. This result leads us to view the worldwide pattern of sectoral labor productivity dynamics as “convergence islands in oceans of non-convergence”.

The results reported in this paper ask for further research efforts, first of all addressing data issues. Measurement error is larger for the more disaggregated data used in this paper and is typically larger for less developed countries. Also, the measurement of output in non-market services is difficult due to the absence of prices. A further disaggregation of our broad Manufacturing and Services sectors into low-tech and high-tech sectors might shed light on the somewhat surprising result that we do not find the types of kinked convergence equations for these sectors, although modern growth theories suggest that threshold effects should be apparent in these branches of the economy.

Data at the sector level regarding other variables than just productivity are also needed. Our analyses show that convergence patterns of “growth miracles” are often different from those of “growth disasters”. If data on skill levels and institutional differences (to mention two important candidates suggested by growth theory) were available at the sector level and could be included in analyses like ours, it would be possible to provide a better account of the performance of growth miracles and growth disasters. In this respect, too, some major efforts have produced results that justify some optimism. The EU KLEMS and WIOD datasets (see O’Mahony and Timmer, 2009; Timmer et al., 2014) contain information on inputs of low-skilled, medium-skilled and high-skilled labor at a detailed industry-level, while internationally comparable data on issues such as trade liberalization have become available for important subsets of industries (see, e.g., Kalirajan, 2000, and Mattoo et al., 2006). Inclusion of variables like these might provide a more precise explanation of Y-heterogeneity and could allow for a testing framework that can address the threshold effects predicted by modern growth theories much more directly. This paper should be seen as providing evidence that such efforts could pay off, because estimating a worldwide valid, single convergence equation hides substantial amounts of heterogeneity. More efforts are needed to find empirical evidence for the causes that make convergence islands co-exist with oceans of non-convergence.

Finally, regarding the methodological contribution of this paper, it is important to point out that the econometric method that we have used is not only a useful tool to study cross-country convergence patterns, but it may potentially have wider applicability and great relevance for other branches of research within Schumpeterian and evolutionary economics. Heterogeneity is in fact a crucial dimension of economic systems not only at the sectoral level but, first and foremost, at the micro-level. Specifically, the joint consideration of X- and Y-heterogeneity, which we have proposed in this paper, may in principle be highly relevant for micro-econometric studies of firm-level dynamics. Firms’ resources and capabilities are in fact characterized by cumulativeness and persistent differences (X-heterogeneity), and so do their dynamics and growth performance (Y-heterogeneity). The joint consideration of these two sources of heterogeneity by means of quantile smoothing splines may therefore open up new perspectives for micro-econometric research in the Schumpeterian tradition.

Notes

In what follows, we will use the term country-sectors to denote the observations in our samples (i.e. the Dutch agricultural sector, or the Indonesian manufacturing sector).

See the theoretical models reviewed in section 2 of this paper.

The 14 countries in BJ’s sample are Australia, Belgium, Canada, Denmark, Finland, France, Italy, Japan, the Netherlands, Norway, Sweden, the United Kingdom, the United States, and West Germany.

For 49 countries, the series start in 1970; for many Eastern European countries, reliable data is only available from 1995 onwards.

The main sectors are: Agriculture, Mining, Manufacturing, Utilities, Construction, Wholesale and retail trade, Transport, storage and communication, Financial services, and Non-market services (community social and personal services, and government services). The data are publicly available for free at www.ggdc.net and www.wiod.org.

Details about the estimation of the sectoral PPPs for 2005 can be found in Inklaar and Timmer (2013).

In a reply to Sørensen (2001), Bernard and Jones (2001) argued that this systematic finding is a consequence of the Balassa-Samuelson effect. In countries with high labor productivity growth in manufacturing, relative manufacturing prices tend to decline rapidly; hence, initial value added in manufacturing is underestimated in high productivity growth countries if GDP PPPs associated with a later base year are used to deflate its value added, leading to a tendency to find β-convergence.

In a recent paper, Rodrik (2013) focused on the manufacturing sector, finding strong evidence for unconditional labor productivity convergence in a sample that contains even more non-OECD countries than ours. His analysis, however, is based on UNIDO industrial survey data, which typically only considers the formal economy, while our data also take informal economic activity into account.

See Koenker (2005) for an extended exposition.

In the period 1970–2009, labor productivity growth in Denmark’s agricultural sector grew on average by 7.3 % per year, while Venezuela’s corresponding figure amounted to a tiny 0.7 %. We borrowed the term ‘law of motion’ from Bernard and Durlauf (1996).

The number of linearly interpolated y i s (p λ ) is at least 2 and at most the number of observations n. The number of linear segments in the fitted function associated with the smoothing parameter λ equals (n - p λ +1).

In view of the limited number of observations, we do not produce regressions for “extreme” quantiles (such as τ = 0.1 and 0.9). Programs for quantile regressions are available in R and Stata. Code to run quantile smoothing splines is currently only available in R (Ng and Maechler, 2011).

Unconstrained linear quantile smoothing splines were estimated using the COBS package, version 1.1–3.5 (He and Ng, 1999).

An all-encompassing approach to assessing the statistical significance of results of analyses based on quantile smoothing splines would also consider the stochastic nature of the existence and location of the kinks. Are the kinks statistically significant, and what are the confidence intervals for the initial productivity level where a kink is located? In principle, simultaneously testing for the existence of kinks and the significance of slopes should also be possible using a bootstrapping approach. However, we consider that developing such a testing framework and carefully assessing its statistical properties would be beyond the scope of this paper.

Appendix B shows that the absence of kinks for manufacturing and services is not due to the value of the parameter λ that follows from the Schwarz Information Criterion (Eq. 7)

References

Abramovitz M (1986) “Catching Up, forging ahead, and falling behind”. J Econ Hist 46:385–406

Acemoglu D, Aghion P, Zilibotti F (2006) “Distance to frontier, selection and economic growth”. J Eur Econ Assoc 4:37–74

Aghion P, Howitt PW (2006) Joseph Schumpeter lecture - appropriate growth policy: a unifying framework”. J Eur Econ Assoc 4:269–314

Azariadis C, Drazen A (1990) Threshold externalities in economic development”. Q J Econ 105:501–526

Barreto R, Hughes A (2004) Underperformers and overachievers: a quantile regression analysis of growth”. Econ Rec 80:17–35

Basu S, Weil DN (1998) Appropriate technology and growth”. Q J Econ 113:1025–1054

Baumol WJ (1986) “Productivity growth, convergence, and welfare: what the long-Run data show”. Am Econ Rev 76:1072–1085

Bernard AB, Durlauf SD (1996) Interpreting tests of the convergence hypothesis”. J Econ 71:161–173

Bernard AB, Jones CI (1996) Comparing apples to oranges: productivity convergence and measurement across industries and countries”. Am Econ Rev 86:1216–1238

Bernard AB, Jones CI (2001) Comparing apples to oranges: productivity convergence and measurement across industries and countries: reply”. Am Econ Rev 91:1168–1169

Castellacci F (2008) “Technology clubs, technology gaps and growth trajectories”. Struct Chang Econ Dyn 19:301–314

Castellacci F (2011) Closing the technology Gap?”. Rev Dev Econ 15:180–197

Castellacci F, Archibugi D (2008) The technology clubs: the distribution of knowledge across nations”. Res Policy 37:1659–1673

de Vries GJ, Timmer MP, de Vries K (2013) “Structural transformation in africa: static gains, dynamic losses”, GGDC research memorandum 136. University of, Groningen

Duarte M, Restuccia D (2010) The role of the structural transformation in aggregate productivity”. Q J Econ 125:129–173

Durlauf SN (1993) Nonergodic economic growth”. Rev Econ Stud 60:349–366

Durlauf SN, Johnson PA (1995) Multiple regimes and cross-country growth behaviour”. J Appl Econ 10:365–384

Durlauf, S.N., P.A. Johnson and J. Temple (2005), “Growth Econometrics”, in: Aghion, Ph. and S. Durlauf (eds.), Handbook of Economic Growth (Elsevier- North Holland), pp. 555–667.

Fagerberg J (1994) Technology and international differences in growth rates”. J Econ Lit 32:1147–1175

Fagerberg J, Verspagen B (2002) “Technology-gaps, innovation-diffusion and transformation: an evolutionary interpretation”. Res Policy 31:1291–1304

Fagerberg J, Srholec M (2008) “National innovation systems, capabilities and economic development”. Res Policy 37:1417–1435

Filippetti A, Peyrache A (2011) The patterns of technological capabilities of countries: a dual approach using composite indicators and data envelopment analysis”. World Dev 39:1108–1121

Galor O, Moav O (2000) “Ability-based technological transition, wage inequality, and economic growth”. Q J Econ 115:469–497

Harberger AC (1987) Comment”. In: Fischer S (ed) NBER macroeconomics annual 1987. NBER, Cambridge, pp 255–258

He X, Ng P (1999) COBS: qualitatively constrained smoothing Via linear programming”. Comput Stat 14:315–337

Holst Milton Bache S, Moller Dahl C, Tang Kristensen J (2013) Headlights on tobacco road to Low birthweight outcomes”. Empir Econ 44:1593–1633

Howitt P (2000) Endogenous growth and cross-country income differences”. Am Econ Rev 90:829–846

Howitt P, Mayer-Foulkes D (2005) R&D, implementation and stagnation: a Schumpeterian theory of convergence clubs”. J Money Credit Bank 37:147–177

Inklaar R, Timmer MP (2009) Productivity convergence across industries and countries: the importance of theory-based measurement”. Macroecon Dyn 13:218–240

Inklaar, R., and M.P. Timmer (2013) “The Relative Price of Services." Review of Income and Wealth, forthcoming.

Kalirajan K (2000) “Restrictions on trade in distribution services”. Productivity Commission Staff Research Paper, AusInfo, Canberra

Kelly M (2001) Linkages, thresholds, and development”. J Econ Growth 6:39–53

Koenker R (2004) Quantile regression for longitudinal data”. J Multivar Anal 91:74–89

Koenker R (2005) Quantile regression, econometric society monograph no. 38. Cambridge University Press, New York

Koenker R, Bassett G Jr (1978) Regression quantiles”. Econometrica 46:33–50

Koenker R, Bassett G Jr (1982) Robust tests for heteroscedasticity based on regression quantiles”. Econometrica 50:43–61

Koenker R, Ng P, Portnoy S (1994) Quantile smoothing splines”. Biometrika 81:673–680

Koenker R, Xiao Z (2002) Inference on the quantile regression process”. Econometrica 70:1583–1612

Krüger, J. (2009), “Inspecting the Poverty-Trap Mechanism: A Quantile Regression Approach”, Studies in Nonlinear Dynamics & Econometrics, vol. 13 (3), Article 2.

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth”. Q J Econ 107:407–436

Mattoo A, Rathindran R, Subramanian A (2006) Measuring services trade liberalization and its impact on economic growth”. J Econ Integr 21:64–98

Mulder P, de Groot HLF (2007) Sectoral energy- and labor-productivity convergence”. Environ Resour Econ 36:85–112

Nelson R, Phelps E (1966) “Investments in humans, technological diffusion, and economic growth”. Am Econ Rev 56:69–75

Ng, P.T. and M. Maechler (2011), “COBS – Constrained B-splines (Sparse matrix based)”, code available at http://stat.ethz.ch/CRAN/web/packages/cobs/).

O’Mahony M, Timmer MP (2009) “Output, input and productivity measures at the industry level: the EU KLEMS database”. Econ J 119:F374–F403

Pritchett L (1997) “Divergence, Big time”. J Econ Perspect 11:3–17

Quah DT (1993) Galton’s fallacy and tests of hte convergence hypothesis”. Scand J Econ 95:427–443

Rodrik D (2013) Unconditional convergence in manufacturing”. Q J Econ 128(1):165–204

Saviotti P, Pyka A (2011) Generalized barriers to entry and economic development”. J Evol Econ 21:29–52

Sørensen A (2001) Comparing apples to oranges: productivity convergence and measurement across industries and countries: comment”. Am Econ Rev 91:1160–1167

Temple J (1999) The New growth evidence”. J Econ Lit 37:112–156

Timmer MP, Dietzenbacher E, Los B, Stehrer R, de Vries GJ (2014) “The world input–output database: content, concepts, and applications”, GGDC research memorandum 144. University of, Groningen

Timmer MP, de Vries GJ (2009) Structural change and growth accelerations in Asia and Latin america: a New sectoral data Set”. Cliometrica 3:165–190

Verspagen B (1991) A New empirical approach to catching Up or falling behind”. Struct Chang Econ Dyn 2:488–509

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper benefitted comments from and discussions with participants at the DIME conference in Maastricht, the Globelics Conference in Mexico City, the North-American Productivity Workshop at New York University, a seminar at the University of Groningen, communication with Roger Koenker and Pin Ng, and detailed comments by two anonymous referees and the Editor of this journal.

Appendices

Appendix A

Appendix B

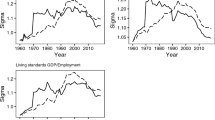

Section 4.2 explains the role of λ, which is a smoothing parameter for the estimated splines. In our empirical application of quantile smoothing splines, we choose the smoothing parameter λ such that the SIC criterion in Eq. 7 reaches its global minimum. The results indicate that X-heterogeneity appears to play a limited role in the convergence patterns in Agriculture, Manufacturing and Services. Here, we analyze the sensitivity of these results to the selection of lambda.

For Agriculture, we find that the SIC criterion leads us to choose λ = 1403, for all three quantiles. However, a plot of the SIC criterion against λ suggests that the value of SIC hardly increases if λ is stepwise reduced, until λ = 10. For values lower than 10, SIC is considerably higher. Hence, λ = 10 might serve as a lower bound to examine the absence of X-heterogeneity (note that if λ = 0, all observations for a quantile are linearly interpolated). The results for Agriculture obtained for λ = 10 are depicted in Fig. 2. A similar strategy was followed for Manufacturing and Services. All results clearly suggest that the absence or minor role of thresholds in the sectoral productivity dynamics is a result that is not sensitive to the choice of other reasonable values for the smoothing parameter λ.

Rights and permissions

About this article

Cite this article

Castellacci, F., Los, B. & de Vries, G.J. Sectoral productivity trends: convergence islands in oceans of non-convergence. J Evol Econ 24, 983–1007 (2014). https://doi.org/10.1007/s00191-014-0386-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-014-0386-0