Abstract

In this paper, we empirically study the relationship between entrepreneurial culture and economic growth. Based on a micro based comparison of entrepreneurs and non-entrepreneurs, we develop a measure reflecting entrepreneurial attitude at the regional level. We subsequently relate this newly developed variable, ‘entrepreneurial culture,’ to innovativeness and economic growth in 54 European regions. Extensive robustness analysis suggests that differences in economic growth in Europe can be explained by differences in entrepreneurial culture, albeit mostly in an indirect way.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The claim that differences in national and regional economic success are related to the presence or lack of an entrepreneurial culture is not new (Hoselitz 1957; Baumol 1968; Leff 1979; Soltow 1968). Theoretically, several attempts have been made to either formally model the role of the entrepreneur (Lucas 1978; Kihlstrom and Laffont 1979; Schmitz 1989; Jovanovic 1994) or to provide conceptual frameworks (Leibenstein 1968; Kirzner 1997). Empirically, however, there are two problems. First, empirical studies are either case based (Saxenian 1994), limiting the scope for generalization, or—in the occasional case of large samples-entrepreneurial culture is ‘measured’ by the residual or a fixed effect (Davidsson 1995; Georgellis and Wall 2000; Guerrero and Serro 1997; Wagner and Sternberg 2002). Except for the Achievement Motivation Index as developed by McClelland (1961) and Lynn’s (1991) analysis of the entrepreneurial orientation of students, to our knowledge there have been no empirical attempts actually to measure entrepreneurial culture and to relate it to economic development. Although most recently several scholars have provided valuable insights regarding the relationships between entry and exit rates, new business formation, and regional economic growth (Audretsch and Keilbach 2004a; Fritsch 2004), we are not aware of empirical studies on the role of entrepreneurial culture specifically. Secondly and related, in order to measure a concept such as entrepreneurial culture, one has to combine different strands of literature in the field of entrepreneurship, thereby crossing disciplinary boundaries (Acs and Audretsch 2003).

The field of entrepreneurship is scattered across different paradigms (Stevenson and Jarillo 1990; Suarez-Villa 1989). Economists are mainly concerned with the effects of entrepreneurship, and social psychologists are more interested in the origins of entrepreneurship. Measuring entrepreneurial culture automatically implies one has to incorporate insights from the social psychological literature, more specifically entrepreneurial trait research (McClelland 1961; Rotter 1966; Brockhaus 1982; Cromie 2000; McGrath et al. 1992). In order to assess its economic significance, one has to relate to the empirical economic growth literature (Barro 1991; Mankiw et al. 1992; Barro and Sala-I-Martin 1995). Hence, the added value of this paper lies not so much in making a contribution to the before mentioned disciplines individually. It is the recombination of existing inputs that forms the core of this entrepreneurial venture to relate empirically entrepreneurial culture to economic development by means of large scale statistical tests. Formally, we test the hypothesis that entrepreneurial culture positively affects regional economic development.

The contribution we aim to make in this paper is confined to an empirical attempt to complement existing, mainly conceptual, literature on the role of entrepreneurial spirit in explaining economic success, and the relation between culture and economic development in general. Despite the lack of well-developed theory, a number of scholars have provided useful starting points to the analysis of the way in which entrepreneurial culture may affect the process of economic development. We theorize on the direct and indirect links between entrepreneurial culture and economic growth. In doing so, we explicitly include the literature on entrepreneurial traits. Our empirical approach consists of several steps. First, we construct a micro-based measure of entrepreneurial culture by comparing the value pattern of entrepreneurs and non-entrepreneurs. Based on the distinctive pattern of entrepreneurs at this individual level, we calculate the average score of a population on these entrepreneurial characteristics. As this unique European Value Studies (EVS) dataset is only available for Europe, we calculate the score on this new variable ‘entrepreneurial culture’ for our final sample of 54 European regions. In our final step, we correlate this micro-embedded measure of entrepreneurial culture with regional innovation patterns and economic growth. Hence, we test for direct and indirect effects of entrepreneurial culture.

2 Literature review

2.1 Entrepreneurial traits and entrepreneurial culture

The field of (economic) psychology has a long history of measuring traits of entrepreneurs (Brockhaus and Horovitz 1986; McClelland 1961; Rotter 1966; Timmons 1978; Davidsson 2004; Shane 2003). Reviewing the literature on entrepreneurial trait research, a number of authors have related specific personality characteristics to entrepreneurs. Central to the trait research is the notion that entrepreneurs are different (Brenner 1987). Brockhaus (1982) identifies three attributes consistently associated with entrepreneurial behavior: need for achievement, internal locus of control, and a risk-taking propensity. Sexton and Bowman (1985) conclude that entrepreneurs need autonomy, independence, and dominance. Chell et al. (1991) associate entrepreneurs with traits such as being opportunistic, innovative, creative, imaginative, restless, and proactive, and perceive them as agents of change. Thomas and Mueller (2000) find similar personality characteristics as Brockhaus. In an attempt to summarize the personality trait literature, Cromie (2000) concludes there are (at least) seven characteristics distinguishing entrepreneurs or business owners from non-entrepreneurs. Although the differences are not equally strong for all groups of non-entrepreneurs (e.g. he found that managers or university professors score equally high on some of the seven dimensions), he lists the following seven. First is the ‘Need for achievement’ (c.f. McClelland 1961). This reflects a person’s need to strive hard to attain success. According to Cromie, ‘high achievers set demanding targets for themselves and are proactive and bold in setting about accomplishing objectives’ (Cromie 2000, p. 16). Second is locus of control (c.f. Rotter 1966; Brockhaus 1982). This depicts the extent to which an individual feels in charge. It reflects the extent to which people feel that luck and fate do not determine what happens to them; in other words, they feel they control the environment by the actions they take, and do not respond to some third party. The third aspect Cromie (2000) mentions is risk taking. Despite the complexity of the concept of risk, entrepreneurs are generally considered to have a greater propensity to take risks. The fourth characteristic is creativity. Enterprising individuals develop new ideas, spot market opportunities and recombine existing inputs in order to create added value (Leibenstein 1968). Finally, there is the need for autonomy, tolerance for ambiguity, and self confidence. Need for autonomy refers to the ability and will to be self-directed in the pursuit of opportunities (Lumpkin and Dess 1996). Tolerance for ambiguity is related to the uncertainty inherent in entrepreneurial action (see also Wennekers et al. 2007). Entrepreneurs are associated with the ability to deal effectively with situations or information that are vague, incomplete, unstructured, uncertain or unclear, without experiencing psychological discomfort (Scheré 1982). Self confidence, finally, is related to self-efficacy (Chen et al. 1998), which can be defined as an individual’s cognitive estimate of his ‘capabilities’ to mobilize the motivation, cognitive resources, and courses of action needed to exercise control over events in their lives (Wood and Bandura 1989).

Obviously, personal attributes are important but not all-pervading determinants of behavior (Cromie 2000, p. 25). The economic environment, family background, employment history, organizational experiences, social networks, national culture and personality traits all affect the probability that some one will act entrepreneurially (Rauch and Frese 2000). In the context of this paper, it is interesting to point to the role of national cultures. McGrath et al. (1992) have pushed trait research even further by investigating whether this supposed set of entrepreneurial characteristics transcends cultures. In other words, do entrepreneurs have a predictable set of values other than non-entrepreneurs without regard of the home culture? To answer this question, McGrath et al. (1992) and McGrath and MacMillan (1992) use Hofstede’s four dimensional cultural framework to compare the value orientation of non-entrepreneurs and business owners in a sample of eight, respectively, nine, countries. They find that entrepreneurs have a persistent and characteristic value orientation, irrespective of the values of their national culture.

However, it is also found that societies differ in their orientation towards entrepreneurial activity (Wennekers et al. 2005) and that some societies have higher rates of entrepreneurial activity than others. A number of authors have suggested that, irrespective of the economic and environmental conditions, a society’s cultural orientation towards entrepreneurship may play an important role in this respect. The high levels of entrepreneurship in the United States have been related to cultural values such as freedom, independence, achievement, individualism and materialism (Morris et al. 1994; Spence 1985). To our knowledge, the first author who systematically described this idea was McClelland. The concept of achievement motivation, originally developed by Murray (1938) and popularized by McClelland in 1961 in his seminal work The Achieving Society has been argued to be crucial for economic development (McClelland 1961). Though his analysis of 22 countries has been criticized for lack of robust results and questionable proxy measures, such as the use of changes in electricity generation to measure economic development (O’Farrell 1986; Schatz 1965; Frey 1984; Gilleard 1989), McClelland made the first attempt actually to measure entrepreneurial culture and to relate it to economic development.

Hofstede’s (2001[1980]) seminal work on culture’s consequences (including entrepreneurship) triggered a number of studies relating his four cultural dimensions to entrepreneurship and entrepreneurial activity. In addition to the studies mentioned earlier by McGrath et al., Shane (1992) developed a theoretical framework and tested the relationship between national cultures and rates of innovation (Shane 1993). Morris et al. (1994) relate one of Hofstede’s dimensions—individualism/collectivism—to corporate entrepreneurship. They focus on individualism as it has been linked to the willingness of people to violate norms and their level of achievement motivation (Hofstede’s 2001[1980]), both of which are associated with entrepreneurship, and showed that entrepreneurship declines the more collectivism is emphasized (Morris et al. 1994). Though it was also found that dysfunctional (high) levels of individualism exist, this result suggests that in cultures in which group-thinking may outweigh individual initiative, few individuals would put their (perhaps latent) entrepreneurial ambitions into action.

In this paper, we build on insights from trait research by applying an aggregate psychological trait explanation. This is based on the view that if there are more people with entrepreneurial values in a country, there will be more people displaying entrepreneurial behavior (Uhlaner and Thurik 2007). We perceive an entrepreneurial culture as a collective programming of the mind (Hofstede 2001[1980]) in which the underlying value system is oriented towards such behavior and the above described associated traits. Before doing so, we explore the role of the entrepreneur in economic theory and theorize on the relationship between entrepreneurial culture and economic performance.

2.2 Entrepreneurs in economic theory

There is no well-developed theory as to the way in which entrepreneurial culture may affect national or regional economic development processes. This lack of a sophisticated framework may at least partly be caused by the fact that mainstream (neoclassical) economic theory does not leave much room for the role of the entrepreneur (Leibenstein 1968; Baumol 1968, 1993; Kirzner 1997). According to Leibenstein (1968), the main difficulty of the misfit of the entrepreneur in mainstream (neoclassical) thinking is caused by the conventional theory of the production function, in which the complete set of inputs is specified and known and has a fixed relation with output. He argues that this is not realistic. In his view, the entrepreneur is someone who extends the production function by broadening the existing set of inputs. Leibenstein calls this the ‘input-completing capacity’ of entrepreneurs. This input-completing capacity of the entrepreneur implies that the entrepreneur has to employ ill-defined inputs which are vague in their nature and the output of which is indeterminate. The capacity to do so is not uniformly distributed and the ability and willingness for such a risky process of gap-filling and input-completing can be considered a scarce talent, which is exactly what trait research suggests. In his view, the entrepreneur as a gap-filler and input-completer is the prime mover of the capacity creation part of the economic growth process (Leibenstein 1968).

This view of the role of the entrepreneurial process corresponds with that of the Austrian school (Kirzner 1997; Rosen 1997; Yeager 1997). Building on the works of von Mises (1949) and von Hayek (1948), scholars in this tradition theorize that the market is an entrepreneurially-driven process in which market participants acquire better knowledge concerning the plans made by fellow market participants. Entrepreneurs are crucial in this process for their willingness to take risk in pursuing market opportunities. Entrepreneurial activities are only possible when knowledge and information are incomplete and dispersed. In contrast to the neoclassical world, an entrepreneur in the Austrian approach operates to change price/output data (Kirzner 1997). For von Mises (1949, p. 255 on cit. Kirzner 1997), an entrepreneur is ‘an acting man in regard to the changes occurring in the data of the market,’ and entrepreneurship is human action ‘seen from the aspect of uncertainty inherent in every action.’

Entrepreneurship is not only associated with the formation of new firms, but with action in the sense of starting something new. It is a process that often leads to new business formations, but it may very well include innovative and enterprising behavior inside existing organizations (Cromie 2000). Intra-preneurship or corporate entrepreneurship plays an important role in the process of strategic renewal of existing firms. It may be associated with alertness, finding new product-market combinations and innovation (Wennekers and Thurik 1999). Entrepreneurs are important for the growth of firms since they provide the vision and imagination necessary to carry out opportunistic expansion (Penrose 1959). Entrepreneurial activity shakes up existing business routines (Schumpeter 1934, 1951). In the long run, it is expected to affect positively firms’ competitiveness (Leibenstein 1968).

2.3 Entrepreneurial culture and economic success

The logic developed above is interesting and relevant for the thesis on the relationship between entrepreneurial culture and (regional) economic growth we aim to put forward in this paper. In Leibenstein’s view, the set of individuals with gap-filling and input-completing capacities is exogenous and the personality characteristics of these entrepreneurs are important. The Austrians argue that it is this relatively scarce willingness to take risk that allows an economy to develop and to grow. Hence, if more people possess these entrepreneurial traits, it can logically be argued that this results in increased economic dynamism and economic growth in the end (Davidsson 1995; Uhlaner and Thurik 2007). In other words, entrepreneurship, innovation and economic growth are logically linked through the recognition and exploitation of opportunities in economic and social arenas (Drucker 1985; Schumpeter 1951). Despite the intuitive attractiveness of Leibenstein’s concept of the entrepreneur and the Austrian school, their abstract concepts of the entrepreneurial process only indirectly allow for theorizing on the relationship between entrepreneurial culture and economic growth.

However, the lack of a well-developed framework has not stopped scholars from developing and/or testing hypotheses on the relationship between entrepreneurial culture and economic success. As sketched earlier, a number of authors have argued that entrepreneurial culture may affect aspects of economic performance (Shane 1993) or economic growth in general (McClelland 1961; Freeman 1976; Suarez-Villa 1989; Lynn 1991). Without specifying the causality—for example, via the production function (Leibenstein 1968)—the core idea is that entrepreneurial culture is beneficial for economic performance. Entrepreneurial culture may affect economic growth in an indirect way as well. A society characterized by an entrepreneurial culture may lead to higher levels of entrepreneurship (Suddle et al. 2006), subsequently triggering a process of economic dynamism, resulting in economic growth (Carree and Thurik 2003).

In an empirical analysis of the effects of regional characteristics on new firm formation in Finland, Kangasharju (2000) argues there are a number of significant local characteristics. Besides local market growth, agglomeration and urbanization effects, and government policies, he argues that ‘entrepreneurial ability’ is an important factor in explaining the probability of firm formation. A regional analysis of entrepreneurship in Sweden showed that regional rates of new firm formation partly depend on entrepreneurial values (Davidsson 1995). Georgellis and Wall’s (2000) study of rates of self-employment across British regions suggests that the ‘entrepreneurial human capital’ of a region is an important explanatory factor. Recent research on Florida’s idea of creative classes suggests a positive link exists between the regional existence of creative classes and firm formation rates (Florida 2002; Lee et al. 2004).

Recent contributions on the relationship between entrepreneurship and economic growth suggest that this relationship is not as straightforward as initially thought (van Stel 2005; Carree and Thurik 2003). First of all, it is found that the effect of entrepreneurial activity on economic growth depends on the level of development. There is a positive relationship (as for example found by Braunerhjelm and Borgman 2004), but the effect is stronger in well-developed countries than in poorer countries (see also van Stel et al. 2005 and Wennekers et al. 2005). Secondly, van Stel (2005) finds that high start-up rates do not necessarily translate into employment growth at the aggregate level (see also van Stel and Storey 2004). Audretsch and Fritsch (2002) suggest the lack of robust empirical evidence may be due to the relatively long time lags for the effects of new entries to take shape. Fritsch and Mueller (2004) explain the insignificant or sometimes even negative effect of entrepreneurship on growth through the crowding out of competitors, improvement of supply conditions and improved competitiveness. On the other hand, Acs and Armington (2004) have found that this is exactly the reason new firms may be crucial in taking advantage of knowledge externalities, because entrepreneurship is the vehicle by which spillovers contribute to economic growth. In this case, entrepreneurial culture increases start-up rates yielding innovation and subsequently contribute to economic growth.

In sum, despite the lack of well developed theoretical framework, there is the general idea that entrepreneurial culture may translate into economic outcomes including growth, even though the empirical evidence on the indirect effect on growth through higher start-up rates is mixed.

3 Measuring entrepreneurial culture

The majority of the studies that aim to link entrepreneurial values to aggregate economic outcomes only do so indirectly. For example, in explaining the regional variance in innovation rates among European regions by so-called ‘innovation-prone’ and ‘innovation-averse’ societies, Pose (1999) does not actually measure culture. In most cases, entrepreneurial culture is included in some kind of region-specific fixed effect (Guerrero and Serro 1997; Wagner and Sternberg 2002). A notable exception to this is Lynn’s (1991) attempt to score the value system of students and to combine these into one national indicator of entrepreneurial attitude. Though again, as did McClelland (1961), Lynn does not use economic models to test for alternative explanations, his analysis does suggest that especially a society’s orientation towards competitiveness is related to economic growth rates.

In our study, we proceed in the following way in developing a measure for entrepreneurial culture. In order to construct an empirically founded measure, we compare the value pattern of entrepreneurs with non-entrepreneurs. Based on the insights from personality trait research, we may expect to find distinguishing characteristics related to a preference for innovation and own responsibility for success (and failure). Having done so, we calculate the score of the average population (excluding the entrepreneurs) on these distinguishing characteristics.

3.1 Value patterns of entrepreneurs versus non-entrepreneurs

The data-set we use to trace the distinguishing characteristics of entrepreneurs and subsequently to construct our regional measure of entrepreneurial culture is the European Values Survey (EVS). EVS is a large-scale, cross-national, and longitudinal survey research program on basic human values, initiated by the European Value Systems Study Group (EVSSG) in the late 1970s. The EVS aimed at designing and conducting a major empirical study of the moral and social values underlying European social and political institutions and governing conduct. Our goal to develop a micro based measure of entrepreneurial culture provides a methodological limitation in the sense of available data. This European sample allows us to embed our aggregate measure of culture at the individual level of the entrepreneur.

Using the EVS, we relate the value pattern of individuals to their occupation. Given the cross sectional nature of our study, entrepreneurship is measured in terms of self-employment. Our dependent variable is self-employment as indicated by the respondent himself. We estimate two different regression equations. In the first analysis, we compare self-employed with the rest of the population, including e.g. unemployed, retired people, students, and housewives. The number of observations equals 14,846, of which 888 are self-employed (6%). In our second analysis, the reference category in the self-employment equation is the wage- and salary earners. Here, the number of observations is 8332, of which again 888 are self-employed (10.6%). All data refer to 1990. Countries included in this analysis are France, Germany, Great Britain, Spain, Italy, Belgium and The Netherlands.

Following the literature on trait research referred to earlier, we selected a number of questions from the EVS. These questions pertained to ascribed reasons for personal success or failure, values instilled in children, attitudes towards future developments, preference for equality versus freedom, preference for state versus private ownership of business, state versus individual responsibility for welfare, and the relative importance of freedom versus equality. The exact wording of the questions used in our test can be found in Table 1. As both self-employment and personality characteristics are related to other factors, we also control for sex, age, income and socio-economic status. For reasons of privacy, income is measured on a 10-point scale. With respect to age, we expect a curvilinear relationship, as very young and very old people are not expected to be self-employed (Evans and Leighton 1989; Storey 1994; Cowling and Taylor 2001). We control for level of education or human capital by including information on socio-economic status (non-manual workers, skilled or semi skilled manual workers, unskilled manual workers). As countries with higher levels of GDP and corresponding lower shares of the agricultural sector (Chenery 1960) are characterized by lower levels of self-employment, we also include the GDP per capita (in 1990) (taken from Penn World Tables). Finally, we include country dummies to control for country-specific effects other than GDP.

Our empirical test consists of two logit regressions. In the first model, we relate self-employment to the general population. The second model uses wage- and salary-earners as a reference group. When a variable is statistically significant, it implies that entrepreneurs are different from non-entrepreneurs. A positive coefficient means that the independent variable tends to increase the probability that one is self-employed; a negative coefficient signifies the opposite.Footnote 1

The results of the binomial regressions are presented in model 1 and model 2 in Table 1. Both models converge after five iterations, and have a high explanatory power. Chi-square is 658.02 (p < 0.0001) in model 1 and 512.28 (p < 0.0001) in model 2. In order to assess how well our maximum likelihood model fits the data, we compare the classification rate to the rate that would have been obtained by chance (Amemiya 1981). Results indicate that the model’s ability to correctly classify people who are self-employed and those who are not is higher than the success rate obtained by chance (results are not shown but are available upon request).

Our logit comparison of self-employed and those who are not yields five distinguishing characteristics. The self-employed distinguish themselves both from the general population as well as from wage- and salary earners in their stronger preference for greater incentives for individual effort and their opinion that the state should not take more responsibility. This corresponds with the findings by McGrath et al. (1992). They also find that entrepreneurs score lower on the preference for equality and feel more personal responsibility (McGrath et al. 1992, p. 128). The latter is in line with what locus of control theorists tell us. Moreover, our analysis suggests that entrepreneurs feel that private ownership should be increased, that the unemployed should not have the right to refuse a job, and that success is not a matter of luck and having connections, but of hard work. Again, this is in line with the findings of McGrath et al. (1992), and reflects the personal responsibility entrepreneurs are expected to feel for their actions (more than non-entrepreneurs). Our result regarding the possibility to refuse a job fits the finding by McGrath and MacMillan (1992). McGrath et al. (1992) also found that entrepreneurs link positive results to merit, which fits our finding regarding the notion of hard work versus luck. Finally, our results suggest that the self-employed differ from the general population with respect to values that they think are important in raising children. The self-employed attach significantly more importance to hard work than the rest of the population. The non-significant finding in model 2 suggests that this characteristic is not a distinguishing factor between wage and salary earners and those who are self-employed. In other words, our results suggest that hard work as a quality to teach children does not have to do with being self-employed, but with having a job, either as a wage or salary earner, or as an entrepreneur. All in all, we find in our data significant characteristics of the self-employed associated with the issues suggested by trait research, specifically the need for achievement, risk-taking attitude, and internal locus of control.

3.2 A micro based (aggregate) measure of entrepreneurial culture

The next step in our analysis consists of constructing a regional aggregate that captures the characteristics we distinguish in our individual level comparison of entrepreneurs and non-entrepreneurs. First, we apply principal components analysis on the five items that were significant in both model 1 and model 2 of the logit regression. We estimate the principal components by making use of the interval-scaled items ‘individual effort,’ ‘government ownership,’ ‘state responsibility,’ ‘unemployed’ and ‘success’ (0–10). Results suggest that the five items can be grouped in one component (groups of items), yielding a Cronbach’s alpha of 0.56. Given a threshold of 0.60 for exploratory studies such as ours, we base the construction of our new variable on these five items (Nunnally 1978, p. 245). For the analyses in the following sections, we calculate regional scores on entrepreneurial attitude for all (interviewed) inhabitants of a specific region on the basis of this five-item-based factor score (excluding the entrepreneurs). Following Porter (2003), our regional aggregate reflects the entrepreneurial ‘spirit’ at the regional level. Table 2 summarizes the items included in our measure for entrepreneurial culture.

Before actually calculating and analyzing the new variable at the European regional level, we analyze the stability of the culture variable over time. There are two reasons to do so. First, we need to assess whether our measurement in 1990 is not biased in any way, as it only provides a snapshot in time. Second, the distinguishing characteristics that we obtained after the comparison of entrepreneurs with the two reference groups can be argued to reflect attitudes instead of values. Unfortunately, it is not possible to calculate the scores on the distinguishing features in other years and correlate these scores over time. We can, however, calculate the scores for the different age groups and perform a cohort analysis.

As the number of observations is reduced in this cohort analysis, we can only do this analysis at country level. If the scores of the entrepreneurial culture variable yield consistent rankings for each country in each age cohort, this suggests that differences between countries are relatively stable. Alternatively, if countries do not have overlapping culture scores, especially in the lower age cohorts, we may assume that the values of our culture variable are relatively stable. We calculate the score on entrepreneurial culture for the following age cohorts: 18–29, 30–39, 40–49, 50–59 and 60+.

Of the seven countries in our sample for which we are able to do a cohort analysis, only three of the 28 possibilities (7 + 6 .... + 2 + 1 = 28) yield inconsistent rankings of countries on our score of entrepreneurial culture. This is the case for Italy with The Netherlands, Italy and Belgium, and France and Belgium. These country pairs have one age cohort that is not consistently lower (or higher) than the other country in this pair. Whereas Spain always scores lowest for each age group, Germany scores highest for each cohort. Acknowledging that we cannot assess the scores on our measure of entrepreneurial culture over time, our cohort analysis of the 1990 data suggests that the relative rankings of the countries in our sample hardly changes. Hence, we have no reason to assume that our culture variable is unstable or severely biased due to the single moment of observation.

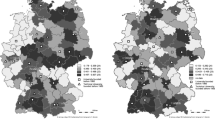

After these validity checks, we calculate the scores for each region. We are able to calculate scores on this new variable for 54 European regions of the seven countries mentioned earlier. In order to correlate this culture variable with regional economic data, we follow the standard regional classification of the European Statistical Office (the so-called NUTS 1 level). This implies that France is divided in eight regions, Belgium 3, Italy 11, Germany 11 (former German Democratic Republic excluded), Spain 7, The Netherlands 4, and Great-Britain 10.

4 Analysis

Our final step consists of a comparison of our entrepreneurial culture variable with measures of (regional) economic success. We relate culture to two economic variables, innovation and economic growth. Acknowledging that innovation is only one of the channels through which an entrepreneurial culture may translate into economic growth (Acs and Armington 2004), data limitations at the European regional level do not allow us to use other variables, for example, regional entry-and exit rates of (new) firms or the actual number of entrepreneurial ventures at the regional level. In the growth analysis, we also perform regressions in which we use entrepreneurial culture as a potential explanatory variable for innovation subsequently affecting economic growth. Hence, we both test for a direct and indirect effect.

4.1 The model

We use a standard regional growth framework, in which economic growth is explained by a number of key economic variables (Barro 1991; Baumol 1986; Mankiw et al. 1992). We closely follow Barro and Sala-I-Martin (1995), who explain regional growth differentials in Europe between 1950 and 1990.Footnote 2 Complementing the data used by Barro and Sala-I-Martin with more recent economic data, we initially analyze the period 1950–1998. In the robustness analysis, we also test for alternative periods. The 1998 data on GRP are based on information from the European Statistical Office (Eurostat). The basis for the regression analyses is the standard “Barro-type” of growth regression, including investment in physical capital, human capital and the initial level of economic development. To control for country specific effects, we use weighted least squares, where regional standard errors are adjusted on the basis of belonging to the same country. This cluster adjusted standard error method is an extension of White’s heteroskedasticity consistent standard errors, where standard errors are corrected for dependence within (in this case) countries. Cluster (hence country) based adjusted standard errors basically correspond to random effects, and using dummies would be a fixed effect estimator. In the robustness analysis in the next section, we check for this alternative method of directly including country dummies.

4.2 The Data

Due to the unavailability of reliable regional investment data,Footnote 3 the investment ratio is measured at country level as the average investment over the period observed. Our measure of the investment ratio is taken from the Penn World Tables (Summers and Heston 1991). Data limitations at the regional level do not enable us to measure the school enrolment ratio as some average over time, but there are data on the total number of pupils at first and second level in 1977, divided by total number of people in the corresponding age group.Footnote 4 Our measure for school enrolment (human capital) is obtained from the European Statistical Office. We have taken uncorrected regional figures because it has been shown that migration plays only a minor role in European regions and the relation with per capita GDP is weak (Barro and Sala-i-Martin 1995; Begg 1995).

In order to control for concentration of human capital in agglomerations, we include an interaction variable, which consists of a dummy variable for an agglomeration multiplied by the score of the school enrolment rate.Footnote 5 This proxies the concentration of human capital in agglomerations. Furthermore we control for spatial correlation. Acknowledging that testing for spatial dynamics is important (Le Gallo and Ertur 2003), it is beyond the scope of this paper to do so extensively. Ideally, one should use interregional input–output tables to calculate regional multipliers and to construct a variable that controls for spatial correlation.Footnote 6 However, this information was not available. Instead, we chose to control for spatial autocorrelation in a limited way, i.e. by applying Quah’s (1996) approach of the neighbor relative income. This method implies that we use average per capita income of the surrounding, physically contiguous regions to control for spatial auto-correlation.

4.2.1 Regional innovation

We measure regional innovativeness by developing a new variable based on two underlying indicators reflecting the innovativeness of a region. Both indicators are based on patent information. The first indicator was developed by Paci and Usai (2000) and measures the patent density at the regional level between 1980–1990. Their ‘Crenos’ data set is based on information from the European Patent Office. The second indicator is taken from the European Statistical Office (Eurostat) and measures the average number of patents per capita between 1990 and 2003. Although both indicators relate to patent information, it is unfortunately impossible to simply add them and calculate the ‘new’ average patent density for the overall period 1980–2003. The indicators correlate strongly, however (correlation is 0.83), suggesting that they reflect a similar underlying phenomenon. To use one single measure of regional innovativeness in our analysis covering the entire period, we factor analyze the two indicators and use the factor scores to calculate our measure for regional innovativeness. Whereas the regression is based upon the overall measure of regional innovativeness 1980–2003, additional analyses (not shown) indicate that all empirical results are similar when using the two indicators for the different time periods separately.

Acknowledging the potential weaknesses of patents as an indicator of innovativeness, it has been shown that it is correlated with aggregate measures of economic performance such as labor productivity (see Paci and Usai (2000) for EU regions). In an analysis of US regions, Porter (2003) showed that regions differ considerably in their innovation rate, which subsequently affects differences in overall regional economic performance.

Figure 1 shows the relation between regional innovativeness 1980–2003 and our measure of entrepreneurial culture. For reasons of convenience, the latter is re-scaled between 0 (low entrepreneurial culture) and 100 (high entrepreneurial culture). The upward slope of the line plotted in Fig. 1 suggests a positive relationship; the correlation between entrepreneurial culture and regional innovativeness 1980–2003 is 0.61, while the correlation between entrepreneurial culture and the ‘Paci and Usai’ (2000) measure for regional innovativeness for the sub period 1980–1990 equals 0.54. The correlation for the period 1990–2003 equals 0.63.

4.3 Estimation results

Our basic regression analysis includes initial level of GRP per capita, investment ratio, school enrolment rate, spatial correlation and a variable that captures the concentration of human capital in major agglomerations. In addition, we include the culture and innovation variables.

Table 3 provides the descriptive statistics of all variables. Correlations between the independent variables are typically moderate to low, implying few multi-collinearity problems. Model 1 in Table 4 presents the OLS regression results for the default growth model, only including basic economic variables. As the results in Table 4 show, all variables except for Investment are significant. This result is not surprising given our control for country specific effects and the fact that the investment ratio is measured at the country level. Schooling is significant at the 10% level. Economic growth is negatively related to the initial level of GRP per capita, which corresponds with other findings on regional convergence in Europe (Martin and Sunley 1998).Footnote 7

In model 2, we test whether differences in economic growth can be explained by differences in entrepreneurial culture. The results of the OLS regression indicate that entrepreneurial culture is positively and significantly related to regional economic growth (p < 0.05). Model 3 extends our basic model with our measure of regional innovativeness. As expected, fast growing regions are also characterized by high innovation rates. Although we cannot judge the causality between innovation and growth, closer analysis (not shown) indicates that average innovation rates measured for 1980–1990 (Paci and Usai’s measure) are significantly and positively related to growth in the period 1990–1998. Moreover, the effect size of regional innovation 1980–1990 is 0.62 over the period 1990–1998, 0.42 over the period 1984–1998, and only 0.09 over the period 1950–1998 (ceteris paribus). Although this is merely circumstantial evidence, the apparent increase in effect size when estimating innovation on subsequent growth suggests that innovation triggers growth. To formally test the potential endogeneity of innovation, we performed a Hausman test. Results of this test suggest that endogeneity does not bias our results significantly, which is in line with the remark on the effect size of the estimated innovation coefficient.

Interestingly, when we include both the culture and the innovation variable, the results in model 4 clearly show that innovativeness is positively and significantly related with growth (p < 0.01), but entrepreneurial culture is insignificant. This is an indication of the relatively strong explanatory power of innovation vis-à-vis entrepreneurial culture, and it holds for all model specifications as performed in our robustness analysis. Once we control for innovation, the culture variable is insignificant. The results of model 2, 3 and 4 together suggest that entrepreneurial culture is related to growth, but once we control for one of the potential mechanisms (innovation) through which culture may translate into growth, culture becomes insignificant. Hence, part of the unexplained variance in growth that can be related to culture is fully absorbed by the innovation variable. Theoretically, this is not very surprising, as it can be argued that culture only affects growth through intermediating mechanisms, and once we control for these, they pick up the otherwise unexplained variance.

Acknowledging that it is not statistically required (given the earlier mentioned Hausman test), we have also performed a 2SLS regression (model 5) in which we relate economic growth to regional innovativeness, which is subsequently related to entrepreneurial culture. This 2SLS approach implies that we estimate two regressions: in the first, we regress entrepreneurial culture on regional innovativeness. In the second regression, we use the estimated value of regional innovativeness as an independent variable explaining regional economic growth. More formally, we use entrepreneurial culture as an instrument for regional innovativeness in explaining growth differentials between European regions. As the results show, explaining regional innovativeness by entrepreneurial culture does not affect the significant relationship of innovation with growth. More important is the fact that entrepreneurial culture is significantly and positively related to regional innovativeness (p < 0.01) Hence, we find that differences in growth are partly due to differences in regional innovativeness, which can be explained by differences in entrepreneurial culture. The question is whether these finding are robust.

4.4 Tests of robustness

We explore the robustness of our results along several dimensions. First, we test for an alternative method to control for country specific effects. In Table 4, we show the estimates with cluster adjusted standard errors. The use of country-based adjusted standard errors may yield inconsistent estimates, if the unobserved variables effecting growth are correlated with observed characteristics (Greene 2003). Therefore, as an additional test, we also use a (more conventional) fixed effects method by directly including country dummies. As shown in Table 5, the result on entrepreneurial culture as shown in Table 4 is robust for the inclusion of country dummies (p < 0.10) both in the OLS and the 2SLS regression. The country dummies are insignificant (United Kingdom is the country of reference). Logically, the investment variable (measured at the national level) is dropped when including these country dummies.

Second, we test for alternative growth periods. Given that entrepreneurial culture is measured in 1990, we tested two alternative growth periods; 1984–1998 and 1990–1998. Apart from data driven logic, it may also be theorized that entrepreneurial culture can be both the cause and the result of economic growth. High growth regions may attract entrepreneurs, and in the long run one may expect this to influence positively the general attitude towards entrepreneurial activity. Hence, the causality may run the other way around. Although a more careful analysis is required, the positive and significant finding when estimating growth between 1990–1998 supports the theoretical (causal) argument that entrepreneurial culture affects economic growth. As Table 5 shows, the findings of Table 4 are robust to changes in the growth period.

Finally, we tested for potential outliers by applying the recursive method. As Fig. 1 shows, there are a number of observations scoring high on regional innovativeness. In the robustness analysis, we tested for the influence of these outliers by excluding these observations. The recursive method implies that, based on the order in which the observations are represented, observations are deleted and the estimated coefficients are based on this smaller sample. We chose to order the 54 regions according to growth and the variables proxying regional innovativeness and entrepreneurial culture. When applying the recursive method with respect to growth, we estimate the effect of the latter two variables when the four slowest and four fastest growing regions are excluded. In a similar way, we perform the regression analysis and exclude the four regions with the highest, respectively, lowest, scores on the variables for regional innovativeness and entrepreneurial culture.Footnote 8 As Table 5 shows, the main results presented in Table 4 are robust to the exclusion of observations.

5 Conclusions and discussion

The literature has stressed the role of an entrepreneurial culture in explaining the economic success of countries and regions. Empirical evidence for this thesis is, however, scarce. In this paper, we developed a measure of entrepreneurial culture and empirically tested the above hypothesis. Instead of using proxies for general societal characteristics, we developed a measure of entrepreneurial culture based on the individual comparison of entrepreneurs and non-entrepreneurs. Following insights from social psychology on personality trait research, we find five distinguishing characteristics of entrepreneurs. Results show that entrepreneurs distinguish themselves by an internal locus of control reflected in a preference for own responsibility and private (versus state) initiative. By using principal components analysis, we developed a single index and subsequently calculated the average score of a regional population on this new variable. The literature suggests that entrepreneurial culture may both directly and indirectly affect economic success. To test the hypothesis on the economic effects of an entrepreneurial culture, we regressed our regional measure of entrepreneurial culture on regional innovation intensity, measured by average patents per capita, and regional economic growth. Acknowledging a sample of only 54 European regions, the extensive robustness analysis largely supports the claim that regions that have experienced higher economic growth rates have a culture that can be characterized as entrepreneurial. However, more research is needed regarding the channel through which an entrepreneurial culture translates into economic development.

The result of this paper should by no means be interpreted in a way to suggest that economic growth depends on an entrepreneurial spirit, which waxes and wanes for unexplained reasons (c.f. Baumol 1993), and that ‘underdevelopment is just a state of mind’ (Harrison 2000). Cultural features together with the institutional setting jointly determine the allocation of entrepreneurial activity (Desai et al. 2003). For reasons of comprehensiveness and for the sake of our argument (and also data availability), we refrained from the formal rules of the game in this paper, but future research might consider a more explicit role of institutions. It is the interplay of the formal and informal rules of the game that determines the degree of entrepreneurial activity in an economy. The fact that the United States and the United Kingdom have higher turbulence rates (= total of entry and exit) than, for example, The Netherlands and Germany, cannot only be accounted for by a stronger entrepreneurial spirit in these Anglo-Saxon countries, but is also caused by the type and degree of regulation in the European countries (Parker and Robson 2004).

Based on the results presented in this paper, we think that entrepreneurial climate is beneficial for economic growth, but as Baumol wrote in 1968, ‘the view that this [economic growth] must await the slow and undependable process of change in social and psychological climate is a counsel of despair for which there is little justification. Such a conclusion is analogous to an argument that all we can do to reduce spending in an inflationary period is to hope for a revival of the Protestant ethic and the attendant acceptance by the general public of the virtues of thrift’ (Baumol 1968, p. 71). In other words, whereas the results of this paper suggest that policy makers should try to change the general atmosphere towards entrepreneurship, this should be complemented by changing the formal rules and regulations regarding entrepreneurial behavior (c.f. Venkataraman 2004). Sectoral structure, industry life cycle, firm level factors and national institutions are all related to the extent to which a region can be called entrepreneurial. In this paper, we focused only on one element, i.e. the role of entrepreneurial culture.

Clearly, the key ingredients of a theory of entrepreneurial culture and regional economic success need to be integrated in a more thorough manner than has been achieved in this paper. Obviously, it is not only a society’s culture that matters, but more general factors conducive to entrepreneurial activity. Audretsch and Keilbach (2004b) use the term entrepreneurship capital to denote this complex constellation of factors (they mention innovative milieu, venture capital availability, social acceptance of entrepreneurs, and existence of formal and informal networks). Moreover, there are a number of empirical issues as well. First of all, the measurement of (regional) innovativeness by patents per capita entails a number of weaknesses (Griliches 1990; Jaffe et al. 1993). Though lack of data has forced us and many other scholars studying the empirics of innovation at the (European) regional level (Paci and Usai 2000; Piergiovanni and Santarelli 2001; Bottazzi and Peri 2002; Porter 2003) to use an incomplete measure based on patents, it is widely acknowledged that there are a number of problems with patents (Porter 2003).

Second, though empirically validated at the individual level of the entrepreneur, we only used one single measure of entrepreneurial culture. It should be noted, however, that the characteristics and items used in this measure may not be universal drivers of entrepreneurship and innovativeness (Begley and Tan 2001).

Finally, the data on entrepreneurial values constrained the analysis to a European regional setting. Despite the added value of this approach, the problematic character of regional data availability has limited the inclusion of control variables. We would prefer to have included a range of alternative variables relating to structural characteristics of regions, such as, e.g., small firm density, regional start-up (and exit) rates, detailed information on regional industry structure and also regional differences in institutional support of entrepreneurship (Davidsson 2004). As these data are more easily available at the country level, it would be interesting to explore the opportunities for a similar analysis at country level.

Notes

Acknowledging that these type of binomial regressions are normally used to predict the probability of a certain outcome (in this case someone becoming self-employed), this would require more information, such as panel data on the moment (and the period before) people decide to become an entrepreneur. Our data set does not allow us to do so, but, more importantly, this is not the goal of our analysis.

Similar to Barro and Sala-I-Martin (1995), we compute the regional growth figures by relating the regional GDP per capita information to the country mean. There are two reasons to use the country mean as a correction factor. First of all, we do not have regional price data. Second, the figures on regional GDP are provided in an index form that is not comparable across countries. Hence, we use Gross Regional Product (GRP) figures that are expressed as deviations from the means from the respective countries. An additional advantage of using relative data versus non-relative data is the direct control for national growth rates that might bias regional growth rates. The 1950 data are based on Molle et al. (1980), except for the data for Spain which refer to 1955, and are based on Barro and Sala-I-Martin (1995) calculations. By using the log value of this ratio, our analysis corresponds with including country averages as independent variables, also referred to as a quasi fixed effects approach (Hsiao 1986).

Eurostat and Cambridge Econometrics provide data on Gross Fixed Capital Formation. However, data are incomplete for some countries or in time.

The basic growth period we analyze is 1950–1998. The school enrolment rate in 1977 falls in between these dates and, given the fact that school enrolment rates have increased since 1950, the 1977 information may be a reasonable proxy for the average over the entire period. Data on school enrolment rates in Spanish regions refer to 1985.

Major agglomerations are the Western parts of The Netherlands, Greater Paris, Berlin, London, the Barcelona area, Brussels, and the Italian region Lazio (Rome).

There exist other ways to have a more refined control variable that can be taken into consideration, for example the physical length of abutting boundaries or the physical characteristics of the border terrain. However, these kinds of extensions go beyond the scope of the current paper.

However, if we take shorter periods of time (e.g. 1984–1998), we cannot find proof for the convergence hypothesis. This is in line with previous studies on country (Levine and Renelt 1992) and regional level (Fagerberg and Verspagen 1995). The period in the 1980s can be roughly characterized by divergence instead of the observed convergence in the period before (Maurseth 2001).

In principle, the recursive method allows a graphical representation of the estimated coefficients when all 54 observations are subsequently deleted. For reasons of clarity and comprehensiveness, we have chosen to show only the results when the four highest/lowest observations are deleted.

References

Acs Z, Armington C (2004) Employment growth and entrepreneurial activity in cities. J Evol Econ 38(8):911–927

Acs Z, Audretsch D (2003) Handbook of entrepreneurship research; an interdisciplinary survey and introduction. Kluwer, Boston

Amemiya T (1981) Qualitative response models; a survey. J Econ Lit 19:1483–1536

Audretsch D, Keilbach M (2004a) Entrepreneurship and regional growth: an evolutionary interpretation. J Evol Econ 14:605–616

Audretsch D, Keilbach M (2004b) Entrepreneurship capital and economic performance. Reg Stud 38(8):949–959

Audretsch D, Fritsch M (2002) Growth regimes over time and space. Reg Stud 36:113–124

Barro RJ, Sala-I-Martin X (1995) Economic growth. McGraw-Hill, New York

Barro RJ (1991) Economic growth in a cross section of countries. Q J Econ 106:407–443

Baumol W (1968) Entrepreneurship in economic theory. Am Econ Rev 58:64–71

Baumol W (1986) Productivity growth, convergence, and welfare: what the long run data show. Am Econ Rev 76:1072–1085

Baumol W (1993) Entrepreneurship, management, and the structure of payoffs. MIT, Cambridge

Begg I (1995) Factor mobility and regional disparities in the European Union. Oxf Rev Econ Policy 11:96–112

Begley TM, Tan WL (2001) The socio-cultural environment for entrepreneurship: a comparison between East Asian countries and Anglo-Saxon countries. J Int Bus Stud 32:537–553

Bottazzi L, Peri G (2002) Innovation and spillovers in regions: evidence from European patent data. IGIER working paper 215, Bologna, Italy

Braunerhjelm P, Borgman B (2004) Geographical concentration, entrepreneurship and regional growth: evidence from regional data in Sweden, 1975–1999. Reg Stud 38(8):929–947

Brenner R (1987) National policy and entrepreneurship: the statesman’s dilemma. J Bus Venturing 2(2):95–101

Brockhaus RH (1982) The psychology of an entrepreneur. In: Kent C, Sexton DL, Vesper KH (eds) Encyclopedia of entrepreneurship. Prentice Hall, Englewood Cliffs, NJ, pp 39–56

Brockhaus RH, Horovitz PS (1986) The psychology of the entrepreneur. In: Sexton DL (ed) The art and science of entrepreneurship. Ballinger, Cambridge, MA

Carree M, Thurik R (2003) The impact of entrepreneurship on economic growth. In: Acs Z, Audretsch D (eds) Handbook of entrepreneurship research. Kluwer, Boston, pp 437–471

Chell E, Haworth J, Brearley S (1991) The entrepreneurial personality: concepts, cases and categories. Routledge, London

Chen CC, Greene PG, Crick A (1998) Does entrepreneurial self-efficacy distinguish entrepreneurs from managers? J Bus Venturing 13:295–316

Chenery HB (1960) Patterns of industrial growth. Am Econ Rev 50:624–654

Cowling M, Taylor M (2001) Entrepreneurial women and men: two different species? Small Bus Econ 16:167–175

Cromie S (2000) Assessing entrepreneurial inclinations: some approaches and empirical evidence. Eur J Work Organ Psychol 9(1):7–30

Davidsson P (1995) Culture, structure and regional levels of entrepreneurship. Entrep Reg Dev 7:41–62

Davidsson P (2004) Researching entrepreneurship. Springer, Berlin Heidelberg New York

Desai M, Gompers P, Lerner J (2003) Institutions, capital constraints and entrepreneurial firm dynamics: evidence from Europe. NBER working paper 10165, Cambridge, MA

Drucker P (1985) Innovation and entrepreneurship. Harper & Row, New York

Evans DS, Leighton LS (1989) Some empirical aspects of entrepreneurship. Am Econ Rev 79:519–535

Fagerberg J, Verspagen B (1995) Heading for divergence? Regional growth in Europe reconsidered. MERIT working paper 2/95–014

Florida R (2002) The rise of the creative class: and how it’s transforming work leisure, community and everyday life. Basic Books, New York

Freeman KB (1976) The significance of McCelland’s achievement variable in the aggregate production function. Econ Dev Cult Change 24:815–824

Frey R (1984) Need for achievement, entrepreneurship, and economic growth: a critique of the McClelland thesis. Soc Sci J 21:125–134

Fritsch M (2004) Entrepreneurship, entry and performance of new business compared in two growth regimes: East and West Germany. J Evol Econ 14:525–542

Fritsch M, Mueller P (2004) Effects of new business formation on regional development over time. Reg Stud 38(8):961–975

Georgellis Y, Wall H (2000) What makes a region entrepreneurial? Evidence from Britain. Ann Reg Sci 34:385–403

Gilleard CJ (1989) The achieving society revisited: a further analysis of the relation between national economic growth and need achievement. J Econ Psychol 10:21–34

Greene WH (2003) Econometric analysis. Prentice Hall, Upper Saddle river, NJ

Griliches Z (1990) Patent statistics as economic indicators; a survey. J Econ Lit 92:630–653

Guerrero DC, Serro MA (1997) Spatial distribution of patents in Spain: determining factors and consequences on regional development. Reg Stud 31:381–390

Harrison L (2000) Underdevelopment is a state of mind. The Latin American case. Madison, Lanham, MD (rev. ed. 1985)

Hofstede G (2001[1980]) Culture’s consequences; comparing values, behaviors, institutions and organizations across nation, 2nd edn. Sage, Beverly Hills

Hoselitz B (1957) Non-economic factors in economic development. Am Econ Rev Pap Proc 47:28–41

Hsiao C (1986) Analysis of panel data. Cambridge University Press, Cambridge

Jaffe A, Trajtenberg M, Henderson R (1993) Geographic localization of knowledge spillovers as evidenced by patent citations. Q J Econ 108:577–598

Jovanovic B (1994) Firm formation with heterogeneous management and labor skills. Small Bus Econ 6:185–191

Kangasharju A (2000) Regional variation in firm formation: panel and cross-section data evidence from Finland. Pap Reg Sci 79:355–373

Kihlstrom R, Laffont JJ (1979) A general equilibrium entrepreneurial theory of firm formation based on risk aversion. J Polit Econ 87:719–748

Kirzner I (1997) Entrepreneurial discovery and the competitive market process: an Austrian approach. J Econ Lit 35:60–85

Lee SY, Florida R, Acs ZJ (2004) Creativity and entrepreneurship: a regional analysis of new firm formation. Reg Stud 38(8):879–891

Leff NH (1979) Entrepreneurship and economic development: the problem revisited. J Econ Lit 17:46–64

Le Gallo J, Ertur C (2003) Exploratory spatial data analysis of the distribution of regional per capita GDP in Europe, 1980–1995. Pap Reg Sci 82:175–201

Leibenstein H (1968) Entrepreneurship and development. Am Econ Rev 58:72–83 (papers and proceedings)

Levine R, Renelt D (1992) A sensitivity analysis of cross-country regressions. Am Econ Rev 82:942–963

Lucas RE (1978) On the size distribution of business firms. Bell J Econ 9:508–523

Lumpkin GT, Dess GG (1996) Clarifying the entrepreneurial orientation construct and linking it to performance. Acad Manage Rev 21(1):135–172

Lynn R (1991) The secret of the Miracle economy. Different national attitudes to competitiveness and money. The Social Affairs Unit, London

Mankiw NG, Romer D, Weil D (1992) A contribution to the empirics of economic growth. Q J Econ 107:407–431

Martin R, Sunley P (1998) Slow convergence? The new endogenous growth theory and regional development. Econ Geogr 74:201–227

Maurseth PB (2001) Convergence, geography and technology. Struct Chang Econ Dyn 12:247–276

McClelland D (1961) The achieving society. Van Nostrand Reinhold, Princeton, NJ

McGrath RG, MacMillan I (1992) More like each other than anyone else? A cross cultural study of entrepreneurial perceptions. J Bus Venturing 7:419–429

McGrath RG, MacMillan I, Scheinberg S (1992) Elitists, risk-takers, and rugged individualists? An exploratory analysis of cultural differences between entrepreneurs and non-entrepreneurs. J Bus Venturing 7:115–135

Molle W, Van Holst B, Smit H (1980) Regional disparity and economic development in the European Community. Saxon House, Westmead, England

Morris MH, Davis DL, Allen JW (1994) Fostering corporate entrepreneurship: cross cultural comparisons of the importance of individualism versus collectivism. J Int Bus Stud 25(1):65–89

Murray, HA (1938) Explorations in personality. Oxford University Press, New York

Nunnally J (1978) Psychometric theory. McGraw-Hill, New York

O’Farrell PN (1986) Entrepreneurs and industrial change. IMI, Dublin

Paci R, Usai S (2000) Technological enclaves and industrial districts: an analysis of the regional distribution of innovative activity in Europe. Reg Stud 34:97–114

Parker, SC, Robson, MT (2004) Explaining international variations in self-employment: evidence from a panel of OECD countries. South Econ J 71(2):287–301

Penrose E (1959) The theory of the growth of the firm. Blackwell, Oxford

Piergiovanni R, Santarelli E (2001) Patents and the geographic localization of R&D spillovers in French manufacturing. Reg Stud 35:697–702

Porter M (2003) The economic performance of regions. Reg Stud 37:549–578

Pose A (1999) Innovation prone and innovation averse societies: economic performance in Europe. Growth Change 30:75–105

Quah D (1996) Regional convergence clusters across Europe. Eur Econ Rev 40:951–958

Rauch A, Frese M (2000) Psychological approaches to entrepreneurial success. A general model and an overview of findings. In: CL Cooper, Robertson IT (eds) International review of industrial and organizational psychology. Wiley, Chichester, pp. 101–142

Rosen S (1997) Austrian and neoclassical economics: any gains from trade? J Econ Perspect 11:139–152

Rotter JB (1966) ‘Generalised expectancies for internal versus external control of reinforcement.’ Psychological monographs: general and applied 80, No 609

Saxenian AL (1994) Regional advantage: culture and competition in Silicon Valley and Route 128. Harvard University Press, Cambridge, Massachusetts

Schatz SP (1965) Achievement and economic growth: a critique. Q J Econ 79:234–245

Scheré J (1982) Tolerance for ambiguity as a discriminating variable between entrepreneurs and managers. Academy of management best paper proceedings, pp 404–408

Schmitz JA (1989) Imitation, entrepreneurship, and long-run growth. J Polit Econ 97:721–739

Schumpeter J (1934) The theory of economic development. Harvard University Press, Cambridge, MA

Schumpeter JA (1951) Change and the entrepreneur. In: Clemence RV (ed) Essays of JA Schumpeter, Addison-Wesley, Reading, MA

Sexton DL, Bowman N (1985) The entrepreneur: a capable executive and more. J Bus Venturing 1(1):129–140

Shane S (1992) Why do some societies invent more than others? J Bus Venturing 7:29–46

Shane S (1993) Cultural influences on national rates of innovation. J Bus Venturing 8:59–73

Shane S (2003) A general theory of entrepreneurship. Edward Elgar, Aldershot, UK

Soltow JH (1968) The entrepreneur in economic history. Am Econ Rev 58:84–92 (papers and proceedings)

Spence JT (1985) Achievement American Style: the rewards and costs of individualism. Am Psychol 40:1285–1295

Stevenson HH, Jarillo JC (1990) A paradigm of entrepreneurship: entrepreneurial management. Strateg Manage J 11:17–27

Storey DJ (1994) Understanding the small business sector. Routledge, London

Suarez-Villa L (1989) The evolution of regional economies: entrepreneurship and regional change. Praeger, London

Suddle K, Beugelsdijk S, Wennekers A (2006) Entrepreneurial culture as a determinant of nascent entrepreneurship. EIM working paper, Zoetermeer

Summers R, Heston A (1991) The Penn World Table (Mark 5): an expanded set of international comparisons 1950–1988. Q J Econ 106:327–368

Thomas A, Mueller S (2000) A case for comparative entrepreneurship: assessing the relevance of culture. J Int Bus Stud 31:287–301

Timmons JA (1978) Characteristics and role demands of entrepreneurship. Am J Small Bus 3:5–17

Uhlaner L, Thurik R (2007) Post materialism affecting total entrepreneurial activity across nations. J Evol Econ (This issue)

van Stel A (2005) Entrepreneurship and economic growth; some empirical studies, dissertation #350. Erasmus University Rotterdam

van Stel A, Storey D (2004) The link between firm births and job creation: is there a Upass Tree Effect? Reg Stud 38(8):893–909

van Stel A, Carree M, Thurik R (2005) The effect of entrepreneurial activity on economic growth. Small Bus Econ 24:311–321

Venkataraman S (2004) Regional transformation through technological entrepreneurship. J Bus Venturing 19:153–167

von Hayek F (1948) Individualism and economic order. Routledge and Kegan Paul, London

von Mises L (1949) Human action. Yale University Press, New Haven

Wagner J, Sternberg R (2002) Personal and regional determinants of entrepreneurial activities: empirical evidence from the REM Germany. IZA Discussion paper 624. Bonn, Germany

Wennekers S, Thurik R (1999) Linking entrepreneurship and economic growth. Small Bus Econ 13:27–55

Wennekers A, van Stel A, Thurik R, Reynolds P (2005) Nascent entrepreneurship and the level of economic development. Small Bus Econ 24:293–309

Wennekers A, Thurik R, Stel van A, Noorderhaven N (2007) Uncertainty avoidance and the rate of business ownership across 21 OECD countries, 1976–2004. J Evol Econ (This issue)

Wood R, Bandura A (1989) Social cognitive theory of organizational management. Acad Manage Rev 14:361–384

Yeager LB (1997) Austrian economics, neoclassicism and the market test. J Econ Perspect 11:153–165

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was written while the author was visiting the European University Institute, Florence. The author is grateful to the Dutch Organisation for Scientific Research. A previous version of this paper was finalist for the Carolyn Dexter Best International Paper Award at the Academy of Management (Denver 2002) and second best paper prizewinner at the European Regional Science Association Conference (Porto 2004). I thank the seminar participants at Tilburg University, Case Western Reserve University, Temple University, Copenhagen Business School, University of Girona (Spain), Nijmegen School of Management (The Netherlands) and the Max Planck Institute in Jena (Germany). The author thanks the reviewers for their useful suggestions.

Rights and permissions

About this article

Cite this article

Beugelsdijk, S. Entrepreneurial culture, regional innovativeness and economic growth. J Evol Econ 17, 187–210 (2007). https://doi.org/10.1007/s00191-006-0048-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-006-0048-y