Abstract

Using cross-sectional data from the Labour Force Survey, we investigate whether a wage curve, i.e. a negative relationship between real wages and regional unemployment, could be estimated in the Greek labour market and in the period 1999–2014. Adopting individual static and regional dynamic specifications, our results do not support the existence of such a relationship despite the extensive macroeconomic adjustment of real wages after 2009. However, allowing for period-specific heterogeneous slopes, we find that a negative relationship between wages and regional unemployment emerged in the period 2010Q2–2011Q4 which however was short-lived. This relationship appears to be exclusively due to the restructuring of the collective bargaining regime and the reduction in the national minimum wages, both of which were implemented in the private sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The relationship between real wages and unemployment has traditionally been under extensive scrutiny by both theoretical and empirical economists (Blanchard and Katz 1999). In particular, when the underlying labour market is highly institutionalized, such as the Greek one, questions are raised about its allocative efficiency and its ability to absorb adverse shocks or to adjust to structural changes. Wage reactions can occur at different levels of the economy. For instance, wage adjustments can be identified at the (a) national level, which are described by the so called wage-setting curve (Layard et al. 2005; Carlin and Soskice 2015) and (b) local/regional level, which are analysed within the “wage curve” framework (Blanchflower and Oswald 1994, 1995). In the latter case, the impact of the prevailing local labour market conditions on individual wages can be effectively identified by regional unemployment. In addition, both models recognize that the degree of wage flexibility also depends on institutional factors (e.g. wage bargaining, minimum wage legislation) linked to the labour market (de Menil 1971; Carruth and Oswald 1989; Booth 2014).

The purpose of the present study is to estimate wage curves for the Greek labour market and to analyse the adjustment of real wages during a 16-year period (1999–2014) of both normal and exceptional circumstances such as the global financial crisis of 2007–2009Footnote 1 and the subsequent sovereign Greek debt crisis (2009Q4 and afterwards). The post-2009 developments regarding the functioning of the Greek labour market and the relevant public policy initiatives justify the investigation of the wage adjustment process. In this period, a significant decline in real wages is observed while the labour market conditions have substantially deteriorated (Christopoulou and Monastiriotis 2014). For example, while the unemployment rate was oscillating in the neighbourhood of 10 % for nearly three decades, it climbed to more than 25 % at the end of 2012. This “break” was observed at the third quarter of 2008 as both regional (Bakas and Papapetrou 2014) and national unemployment series (Venetis and Salamaliki 2014) indicate. The evolution of real hourly wages and unemployment is portrayed in Fig. 1 for both national and regional levels. We observe that wages and unemployment (a) follow parallel paths during the periods 1999–2008 and 2013–2014 and (b) are negatively related during the period 2009–2012.

It is well established that the labour relations system in Greece is centralized and wages are rigid since they are determined independently of the prevailing local/regional labour market conditions (Fabiani et al. 2010; OECD 2011). Since 2010, a series of legislative structural reforms were recommended by the “Troika”Footnote 2 and implemented by the Greek government. These reforms included horizontal cuts in public sector wages, adoption of measures that promote labour market flexibility, changes in the minimum wage legislation and decentralization of the wage bargaining process.Footnote 3 We note that in an analogous setting Devicienti et al. (2008) found that an Italian wage curve could only be identified after 1993, when a series of reforms were implemented in order to make wages more sensitive to the contemporaneous labour market conditions. More specifically, in the post-2009 period the Greek government reduced public sector wages across the board at the beginning of 2010 by adopting the Act No. 3833/2010 (15 March 2010) and later the Act No. 3845/2010 (5 May 2010) which is widely known as the first Memorandum of Understanding (MoU). While wages in the private sector were not affected directly by those measures until the end of 2011, they were indirectly affected by legislation that promoted higher labour market flexibility (e.g. temporary jobs). This legislation includes the Act No. 3846/2010 (11 May 2010) and Act No. 3899/2010 (17 December 2010). Furthermore, the Greek government introduced in 27 October 2011 the Act No. 4024/2011 which constitutes a major reform of the collective bargaining system in Greece and a new unitary pay system for public sector employees. Regarding this new version of the collective bargaining system, contractual base wages are allowed to be lower than those reached after negotiations at higher levels, i.e. sectoral/ occupational/ regional, but not lower than the national minimum wage. As a result, the number of sectoral/occupational/regional agreements was not renewed after their expiration (spring semester of 2011) and a dramatic increase in the number of firm-level contracts was observed immediately thereafter (Daouli et al. 2013). On 14 February 2012, wages in the private sector were reduced due to a sharp decline in the statutory minimum wage when the Greek government adopted the Act No. 4046/2012. This reduction was 22 (32) % for workers above (under) the age of 25, and it was imposed in an attempt to reduce labour costs and decelerate the growth of unemployment (Yannelis 2014). These developments may have had an important impact on the underlying mechanism of the wage curve relationship, and they should be taken into consideration.

The wage curve methodology was introduced by Blanchflower and Oswald (1994, 1995), and since then it has become the standard methodological approach for evaluating wage flexibility with respect to the contemporaneous local/regional unemployment rates. In this context, real wages and local unemployment are negatively related, with the estimated coefficient of unemployment being in the neighbourhood of \(-0.10\).Footnote 4 Over the years, the accumulated empirical literature has failed to confirm the existence of wage curves in only a handful of cases (Nijkamp and Poot 2005). For example, the unemployment elasticity of pay was not found to be statistically different from zero in the case of Romania (Iara and Traistaru 2004) and in the Nordic labour markets (Albæk et al. 2000). Regarding Greece, Livanos (2010) using micro-data for the period 2000–2004 also failed to identify a wage curve once controls for time and regional fixed effects were included in the estimated models.

For analytical purposes we utilize micro-data drawn from the Greek Labour Force Survey (LFS, hereafter). Our empirical strategy pertains to the estimation of typical empirical specifications of the wage curve (Blanchflower and Oswald 1994, 1995) as well as models that take into account the dynamic nature of regional wages (Bell et al. 2002). More specifically, we estimate a wage curve specification for the entire period using typical least squares estimators 2SLS-IV techniques that control for the endogenous character of regional unemployment rates (using past realizations of one and two period lags) and fixed-effects panel estimation techniques. The obtained herein least squares estimates suggest that the impact of regional unemployment on real wages is \(-0.016\); the 2SLS-IV estimates are higher (almost double) but less consistent while the regional panel estimates are found to be practically zero. In the process, we present evidence on the macroeconomic adjustment of real wages to the national unemployment rate. For the examined period (1999–2014), our findings suggest that while real wages do not seem to respond to the changing local labour market conditions, they do respond to the deteriorating macroeconomic environment. Thus, for identification purposes, we continued the analysis by allowing the wage curve to differentiate with respect to time as well as to several sources of observed heterogeneity (i.e. different intercepts and heterogeneous slopes).

In order to test for different intercepts and slopes in the uncovered wage curve, we estimated least squares models (with centring) augmented by a full set of interaction terms between the demeaned regional unemployment and (a) individual characteristics and (b) period-specific effects. As expected, real wages are characterized by different intercepts across different groups of workers. We also found that real wages do not seem to react homogeneously to the changing local labour market conditions. In particular, real wages are decreasing due to higher regional unemployment mostly for private sector employees, permanent and prime-age workers, males, with low education and those residing in non-urban areas. In order to account for different intercepts in the wage curve due to the aforementioned policy initiatives introduced in the post-2009 period, we constructed period-specific indicators for (a) the 1st round of public sector pay cuts (2010Q1), (b) the 2nd round of public sector pay cuts, the labour market reforms associated with the MoU and the period during which a large number of collective sectoral agreements became ineffective (2010Q2–2011Q3) and (c) the decentralization of the collective bargaining system, the minimum wage legislation and the second adjustment program of the Greek economy (2011Q4–2014Q4). We identified that real wages also have different intercepts across time periods. In particular, the horizontal reduction in real wages was found to be 10.4 % in the period 2010Q2–2011Q3 and 9.1 % in the period 2011Q4–2014Q4. In this context, we found a wage curve with an elasticity of \(-0.088\) only for the period 2010Q2–2011Q3. Given the stronger link between private sector wages and local labour market conditions, we next examined how the effect of the increasing regional unemployment on real wages evolved in both sectors (public and private) as the Greek debt crisis unfolded. We found that workers in regions with increasing unemployment earn systematically less if they work in the private sector while the effect became greater as the crisis deepened. The findings were consistent with those obtained in the preceding analysis and highlight the importance of the deteriorating local labour market conditions and the sector of employment in the identification of the wage curve.

The remainder of the paper is organized as follows. Section 2 presents the utilized dataset, and Sect. 3 outlines the adopted econometric methodology. Section 4 discusses the estimation results, and conclusions are given in Sect. 5.

2 Data

We draw individual data from the Greek Quarterly LFS, provided by the Hellenic Statistical Authority (EL.STAT), covering the period 1999Q1–2014Q4. The LFS data contain detailed information on individual characteristics such as, four age groups (15–29, 30–44, 45–54 and 55–64), three groups of completed education (primary school, secondary school and tertiary education), gender (males vs. females), country of birth (natives vs. foreign-born), marital status (married vs. unmarried/divorced/widowed), ownership type of the workplace (central government vs. enterprises in the private/public sectors),Footnote 5 type of labour contract (temporary vs. permanent), 92 sectors at the two-digit level of industrial classification (STAKOD-91 and NACE Rev.2 for the periods before and after 2008, respectively), 54 occupational dummies at the two-digit level of occupational classification (STEP-98 and STEP-08 for the periods before and after 2011, respectively), three groups of the degree of urbanization of the current residence (urban, semi-urban, rural) and net monthly earnings reported in income bands. Hourly wages are calculated by dividing the midpoint of each income band by the usual monthly hours of work (usual weekly hours/usual days per week \(\times \) 22 days per month), deflated by the consumer price index (\(2009=100\)). The range of the income bands is 250 euros corresponding to eight distinct categories. These approximations are expected to decrease variability and increase measurement errors; however, they constitute the only alternative viable measure of individual wages and they have been shown to provide robust estimates of Mincer equations (Christopoulou and Monastiriotis 2014, 2015).Footnote 6 After removing observations with missing values on key variables, we are left with a sample of around 800,000 individuals clustered in 15 regions over a 16-year period (64 quarters). Survey weights are provided by the EL.STAT. The quarterly unemployment rate is calculated for each region using LFS data and according to the ILO definition. The most disaggregated level at which regional information is provided is the NUTS-II level, where fifteen distinct administrative regions are identified. Descriptive statistics on key variables are available from the authors upon request.

3 Econometric methodology

3.1 Static model

In order to estimate the regional unemployment elasticity of wages, we begin by using the empirical wage curve specification as it was originally proposed by Blanchflower and Oswald (1995). The natural logarithm of the current regional unemployment rate enters as an additional explanatory variable in standard à-la- Mincer wage generating functions, alongside controls for observed individual characteristics, regional, period and time fixed effects. The estimated model is of the following form:

where \(\beta \) is the coefficient of interest measuring the elasticity of individual hourly wages with respect to the regional unemployment rate (\(U_{\textit{rt}}\)), \(X^k_{\textit{irt}}\) is the controls for k individual characteristics (gender, country of origin, marital status, age, education, urbanization, sector of employment, temporary job, industry and occupation), \(\Phi ^\tau _{t}\) is a set of \(\tau \) period-specific dummy indicators (1999Q1–2009Q4, 2010Q1, 2010Q2–2011Q3 and 2011Q4–2014Q4), \(\delta _{t}\) and \(\pi _{r}\) are indicators removing bias stemming from group effects which are common across time and regions, respectively, and \(u_{\textit{irt}}\) is the remaining disturbance term. We note that the inclusion of regional dummies ensures that the effect of regional unemployment on wages is net of permanent interregional wage differentials; hence, the estimated value of \(\beta \) shows how wages respond to the transitory component of regional unemployment (Card 1995). This benchmark model is estimated by least squares methods (OLS) using survey weights. The standard errors have been corrected for clustering at the regional level in order to control for variance components that are common for individuals observed in the same region, and they cannot be attributed to the explanatory variables (Moulton 1986). Given that several authors (e.g. Blanchflower and Oswald 1995; Baltagi et al. 2009; Baltagi and Blien 1998) have raised concerns regarding the endogeneity of the unemployment variable in the wage equation, we also estimate Eq. (5) by using a two-stage least squares estimator (2SLS) where regional unemployment rate is instrumented by its own past realizations (one-year and two-year lagged values).

In order to examine whether the wage curve is homogeneous across different groups of workers (e.g. Blanchflower and Oswald 1995; Baltagi and Blien 1998; Baltagi et al. 2009, 2013; Livanos 2010), we present estimates of a model with interaction terms between the \(\ln {}U_{\textit{rt}}\) and (i) the kth variable of the X set of independent variables, (ii) the period-specific dummy indicators \(\Phi ^\tau _{t}\). This approach may facilitate the choice among competing theories of the wage curve, since according to the literature, the fact that the wage curve is steeper for women and younger workers can be attributed to the operation of internal labour markets and the lower human capital levels of younger and less senior workers (Card 1995). In addition, we examine whether the slope of the wage curve is different across time periods and especially during those where significant reforms affecting the wage formation in the post-2009 period in Greece were introduced. Empirical evidence suggests that in the case of Italy Devicienti et al. (2008) the wage curve could only be identified after 1993, when a series of reforms were implemented in order to make wages more sensitive to contemporaneous labour market conditions. In our case, the period-specific dummy indicators \(\Phi ^\tau _{t}\) concern (a) a short period in which public sector pay cuts were implemented (2010Q1), (b) a longer period of additional public sector pay cuts, labour market reforms and expired collective sectoral agreements (2010Q2–2011Q3) and (c) a period in which the collective bargaining system was decentralized, the reduced minimum wage was applied and the second adjustment program of the Greek economy was implemented (2011Q4–2014Q4). The partial effect of regional unemployment on real wages is \(\beta +\gamma ^{k}\), and it pertains to the interaction term of the regional unemployment with the kth variable. We note that the interpretation of the partial effects of the kth variable in X and the \(\tau \)th indicator in \(\Phi \) requires the re-parameterization of Eq. (1) by using the demeaned variable \(\text {ln}\,{}U_{{\textit{r}t}}-\mu _{\mathrm{ln}{}U}\) where \(\mu _{\mathrm{ln}{}U}\) is the population mean of \(\text {ln}\,{}U_{{\textit{r}t}}\) (Wooldridge 2010). For example, the estimated effect of the \(\tau \)th period indicator on \(\Phi \) refers to the population average partial effect, i.e. \(\zeta ^\tau +\beta \mu _{\mathrm{ln}{}U}\).

3.2 Dynamic model

The previous model ignores the dynamic aspects of the wage formation process. Moreover, while it controls adequately for cross-sectional variation in real wages, it does not control for the time-varying regional heterogeneity which can also be an important factor of downward wage pressure. As pointed out by Bell et al. (2002), these time-varying regional indicators are not easily observed and their number can be quite large. They propose the construction of a regional-level panel so that the relationship between wages and unemployment can be identified through time series variation. At the first stage of their method, they generate a measure of regional wages that has been adjusted for individual composition effects. This can be done in two ways (Baltagi et al. 2009; Longhi 2012; Brown and Taylor 2014). The first one is to include controls for region-specific fixed effects and pertains to the estimation of a wage regression for each year t:

where the estimated coefficients of \(\pi _{r}\) are the “composition corrected” wages for each region r. These values are used as the dependent variable in the second stage (namely \(\hat{\delta }_{\textit{rt}}\)).

The second way is to include controls for time-specific fixed effects and pertains to the estimation of a wage regression for each region r:

where the estimated coefficients of \(\delta _{t}\) for each region r are used as the wage measure (namely, \(\hat{\delta }_{\textit{rt}}\)) in the second stage. We note that Eqs. (2) and (3) are estimated by least squares due to the cross-sectional design of the LFS although optimally, one should eliminate any individual fixed effects using longitudinal data. Given the estimates obtained from either Eq. (2) or (3), we can now estimate whether regional unemployment rates are correlated with these composition-corrected effects. For each one of these two alternative measures, we estimate the following model:

which is a dynamic regional panel data model where \(U_{\textit{rt}}\) controls for the contemporaneous regional unemployment rate, \(\Phi ^\tau _{t}\) is a set of \(\tau \) period-specific dummy indicators (1999–2009, 2010–2011 and 2012–2014), \(T_{\textit{rt}}\) corresponds to region-specific linear time trend (in quadratic form) proxying systematic region-specific wage pressures (e.g. due to unobserved labour quality, unionization, rent sharing, product market competition etc.) and \(\omega _{\textit{rt}}\) is the error term. Furthermore, a lagged dependent variable \(\hat{\delta }_{\textit{rt}-1}\) is also included to control for inertia in the wage adjustment process. Equation (4) is estimated for the entire period (1999–2014) since estimating it for shorter sub-periods can result in biased estimates of the coefficient of the lagged dependent variable of order 1 / T (Nickell 1981). Nevertheless, this model provides evidence regarding the wage curve elasticity for the entire period and it is fairly comparable to the model that employs individual-level data. For the estimation of these models, we use the fixed-effects (FE) estimator where the prevailing regional unemployment rate is treated as exogenous. For comparison purposes, we also use a fixed-effects instrumental variable (FE-IV) estimator where regional unemployment is treated as endogenous and it is instrumented with its one-year lagged values.

3.3 Differentiated wage curve across periods and sectors

Real wages and regional unemployment may not vary only across regions and time but also across sectors of employment. In addition, certain reforms affect only private sector workers (e.g. collective bargaining and national minimum wage reductions). In this context, we investigate whether private sector workers \((P_{\textit{irt}})\) in regions with higher unemployment earn relatively lower wages and whether the intensity of this effect varies during the crisis. Using interaction terms between regional unemployment, sector of employment and time period indicators will enable us to isolate the effect of the prevailing local labour market conditions from that of other potential confounding factors. Focusing on the demeaned regional unemployment rate (i.e. \({\text{ ln }}{}U^\mu _{\textit{rt}}={\text{ ln }}{}U_{\textit{rt}}-\mu _{{\text{ ln }}{}U}\)), we estimate the following specification:

The main coefficient estimate of interest is that of the triple interaction term (\(\ln {}U^\mu _{\textit{rt}}\times P_{\textit{irt}}\times \Phi ^\tau _{t}\)). This term indicates whether the sensitivity of private sector wages with respect to the deteriorating local labour market conditions, as the latter are captured by the regional unemployment, has intensified during the crisis period. The estimated coefficients of the triple interaction terms indicate whether any negative effects on real wages (caused by the adopted labour market reforms in the post-2009 period) were not only stronger in regions with tighter labour markets but they exclusively concerned the private sector.

4 Estimation results

4.1 Cross-sectional wage curve

Table 1 presents the estimated results (of Eq. 1) regarding the determinants of real wages in Greece for the entire period (1999Q1–2014Q4). The OLS estimates indicate the presence of a rather weak wage curve elasticity in the Greek labour market over the examined period and after controlling for observed individual heterogeneity as well as for time and region fixed effects (Column 1, Panel A). Its size suggests that a hypothetical doubling of the unemployment rate in a given region will result, ceteris paribus, in a mean reduction of approximately 1.6 %. This estimate is well below the empirical law of 10.0 %, suggested by Blanchflower and Oswald (1995) and outside the range of wage elasticities in continental European economies (Nijkamp and Poot 2005). In the process, we found that workers in the private sector earn, on average, almost 12 % lower real wages than their counterparts in the public sector and that workers with temporary contracts earn lower wages, by around 11 %, in comparison with those with permanent jobs. In addition, male wages are 8.1 % higher than female ones, the wages of foreign-born individuals are lower than those earned by native-born by 8.5 %, the wages of married workers are 7.6 % higher than those earned by unmarried/divorced/widowed, older workers earn higher wages than younger ones, more educated workers earn higher wages and lastly, workers residing in rural areas earn slightly lower (1.2 %) wages than those living in urban areas.

Column 2 of Table 1 (Panel A) presents coefficient estimates when controls for period-specific effects are included as additional arguments. We observe that the estimated slope of the wage curve is now not statistically different from zero (\(-.010\)). Furthermore, the estimated coefficients of the period-specific variables indicate that the formation of wages in the period 1999–2014 follows different paths (i.e. different intercepts). In particular, real wages in the post-2009 periods appear to follow a decreasing path. For example, in the period 2011Q4–2014Q4 real wages are, on average, 8.4 % lower than those in the pre-2010 period.

Panels B and C of Table 1 present 2SLS-IV estimates of Eq. (1) when the regional unemployment rate is treated as an endogenous variable. Instrumenting the contemporaneous regional unemployment rate by its past realizations (1-year and 2-year lagged regional unemployment), we observe that the slope of the wage curve is between \(-.03\) and \(-.04\) (Column 1) and it drops below \(-.03\) when the additional period-specific fixed effects are taken into consideration (Column 2). Nevertheless, these estimates should be interpreted with caution since the identified wage elasticities and their estimated standard errors are twice as large as the OLS estimates.

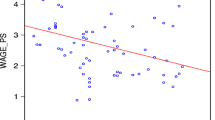

We also caution that the absence of a systematic strong relationship between wages and regional unemployment in the Greek labour market should not be interpreted as evidence of wage inflexibility during a period of skyrocketing unemployment. What the obtained results imply so far is that regional variation in wages is practically absent. However, as Fig. 1 clearly shows, real wages are falling during the Greek debt crisis indicating that the wage adjustment is a relatively uniform outcome with lack of regional wage variation. In an attempt to clarify the observed wage reaction, we present at Fig. 2 the relationship between the estimated coefficients of the year dummies (corresponding to Column 1 of Table 1) and the national unemployment rate. Indeed, the macroeconomic adjustment of real wages is profound (net of individual and regional characteristics), a finding that can be explained in a wage-setting curve framework. Thus, during the period 1999–2014, real wages do not seem to respond to the varying local labour market conditions, but they do follow horizontally a negative path as the economic conditions deteriorate over time.

Macroeconomic adjustment of real wages in Greece. Source Labour Force Survey (LFS), Hellenic Statistical Authority (ELSTAT) and authors’ calculations. Notes In the vertical axis, we measure the estimated yearly effect (Eq. 1, column 1, Table 1). The horizontal axis measures the national unemployment rate.

4.2 Dynamic regional wage curve

Regarding the wage curve elasticity in the entire period under examination, we also provide in this subsection evidence based on a two-stage procedure proposed by Bell et al. (2002). Table 2 presents the results from a fixed-effects (FE) estimation of Eq. (4) using two alternative measures of composition-corrected wages. Columns [1] and [2] present the estimated results of the region adjusted wages, derived from estimating at the first-stage wage regressions for each year. The correlation between regional unemployment and wages appears to be practically zero, using either a fixed-effects (FE) estimator or an instrumental variables fixed effects (FE-IV) estimator (i.e. treating regional unemployment as an endogenous variable). In both cases, wages exhibit a weak autoregressive nature (around .13) which does not support the existence of a Phillips curve relationship in the Greek economy, since the estimated coefficient of the lagged dependent variable is far from unity. This result is due to the inclusion of a region-specific time trend which denotes the presence of strong inertia in the composition of wages within regions. Furthermore, the estimated coefficients of the period-specific dummies indicate that the regional differences in the composition-corrected wages exhibit a horizontal downgrading (around 3 %) in the period 2010–2011 (compared to 1999–2009).

These results are almost identical with those presented at Columns [3] and [4] where the dependent variable corresponds to the wage measure obtained after estimating wage regressions for each region. Again, we found no significant evidence for a wage curve relationship while the estimated coefficient of the lagged dependent variable is now larger (around .19). The results remain unaffected after instrumenting regional unemployment by its one-year lagged value (FE-IV models). With regard to the effects of the period-specific dummies, we observe that composition-corrected wages do not exhibit any differentiated profile between time periods. Overall, the results of Table 2 provide further support for the argument that the Greek labour market is rather non-responsive to the contemporaneous regional labour market conditions while the wage formation process at the regional level is rather stable across time, as indicated by the strong region-specific trend. Similar conclusions have been reached by numerous studies which suggest that Greece belongs to the group of EU countries exhibiting a high degree of downward wage rigidity (e.g. Knoppik and Beissinger 2009; Fabiani et al. 2010).

4.3 Wage curve with different slopes

In this subsection, we proceed in three steps. First, we present least squares estimates for versions of Eq. (1) with interaction terms in order to detect whether the slopes of the wage curve vary among different groups of workers. In this case, we estimate separate regressions augmented with interaction terms involving the demeaned regional unemployment rate and a specific independent variable each time, using the sample of workers for the entire period (19991Q1–2014Q4). Secondly, we present least squares estimates of Eq. (5) focusing on the estimated coefficient of the double and triple interaction effects between regional unemployment, private sector employment and period-specific indicators. Lastly, using a more flexible specification (along the lines of Eq. 5) we illustrate how the effect of regional unemployment on real wages evolved, as the Greek debt crisis unfolded, by allowing the effect of regional unemployment on the composition of real wages to vary non-linearly over time.

Table 3 presents the estimation results which correspond to the first step. Column [1] presents the average partial effect of the variable of interest when regional unemployment takes its mean value. This effect actually constitutes a test of whether real wages have different intercepts between different groups of workers. In Column [2], we present the partial effect of regional unemployment on real wages for various groups of workers. This can be viewed as a test for the existence of different slopes in the wage formation process. Column [3] presents the value of the F-test for the joint statistical significance of the interacted terms in question. Regarding the interaction between regional unemployment and period dummies, we observe that real wages are falling by 10.4 and by 9.1 % in the periods 2010Q2–2011Q3 and 2011Q4–2014Q4, respectively (compared with the pre-2010 period). With regard to the heterogeneous slopes of the wage curve, we observe that only statistically significant result is obtained when the interaction concerns the overall regional unemployment rate and the period dummy of 2010Q2–2011Q3. We note the proximity of this elasticity (\(-.088\)) to the empirical law (\(-.100\)). Thus, real wages in Greece are falling horizontally in the post-2010 period and they react to the deteriorating local labour market conditions only in the period 2010Q2–2011Q3.

With regard to the interaction term between regional unemployment and private sector employment, we observe that real wages in the private sector are 13 % lower than those in the public sector while the estimated slope of the wage curve is statistically significant only in the private sector. In this case, the slope of the wage curve is \(-.020\) implying that the doubling of regional unemployment is associated with a 2 % reduction in real wages of private sector employees. Regarding the estimated interaction effect of regional unemployment with the indicator of temporary contracts, we observe that workers with temporary jobs earn lower wages than those with permanent contracts (\(-.086\)) and the wage curve elasticity for workers with permanent contracts is \(-.019\). With regard to the interaction between regional unemployment and the gender indicator, we found that a male wage premium of 4.9 % does exist, but the worsening of the local labour market conditions affects exclusively the wages of male workers (\(-.030\)). Foreign-born workers are paid less than their native-born counterparts, but the increasing regional unemployment rate induces wage reductions in the same magnitude for both groups. The same finding applies for the interaction term between regional unemployment and the indicator for marital status. Furthermore, the wages of older workers are higher than younger ones, but the slope of the curve could only be identified in the case of prime-age workers (age group of 30–44). Thus, younger workers are not only paid less, but they bear additional burden due to the wage adjustments associated with the deteriorating local labour market conditions. With regard to the interaction term between schooling and regional unemployment, we found that more educated workers are paid more than low educated ones while the wage curve elasticity is \(-.027\) for workers of primary education and \(-.018\) for workers with secondary education. Lastly, workers living in rural areas are paid less and their wage curve elasticity is \(-.026\).

Overall, allowing for a more flexible regression specification of the wage curve we are able to provide strong evidence for the existence of a highly diversified profile between regional unemployment and real wages. Furthermore, the use of period-specific effects provides evidence in support of the differentiated impact of regional unemployment on real wages before and after the outburst of the Greek debt crisis. This exercise also enabled us to identify the macroeconomic adjustment of real wages in the examined period, 1999–2014, in terms of different intercepts between time periods. At the same time, the obtained results indicate the presence of real wage responsiveness to the deteriorating local labour market conditions in the period 2010Q2–2011Q3.

The estimated results of Eq. (5) are presented in Table 4. Column [1] reports the estimated coefficients of the triple interaction term (\(\ln {}U^\mu _{\textit{rt}}\times P_{\textit{irt}}\times \Phi ^\tau _{t}\)). The results indicate that private sector wage reductions, due to the increasing regional unemployment rates, intensified in the period 2010Q2–2011Q3. This finding remain valid when we added a wide set of observed individual characteristics (Column 2). Thus, our findings suggest that the differential response of real wages across regions and sectors of employment as well as the adoption of specific labour market reforms are important factors for identifying the wage curve.

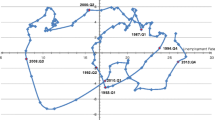

Estimated impact of regional unemployment on real wages across sectors and time (quarters) in Greece, 1999–2014. Source Labour Force Survey (LFS), Hellenic Statistical Authority (ELSTAT) and authors’ calculations. Notes The vertical axis depicts estimated coefficients of the triple interaction term (Eq. 5). Two linear trend lines for these coefficients are plotted, one for the period 1999Q1–2010Q1 and another for the period 2010Q2–2014Q4

Lastly, in an attempt to illustrate the short-run effects of the deteriorating local labour market conditions on the structure of real wages, we proceed further by relaxing the assumption that the crisis resulted in a one-shot change in real wages. More specifically, we examine how the effect of local unemployment rates on real wages evolved as the Greek debt crisis unfolded. To do this, we employ a more flexible regression specification (Eq. 5) where a full set of quarter dummies is utilized—instead of the period-specific indicator—and we interact each quarter dummy with the product of the regional unemployment and the private sector employment. We plot the obtained coefficient estimates against time (quarters) in Fig. 3. Two linear regression trend lines emerge for the pre- and post-2010Q2 periods. We observe that despite the quarterly volatility, the coefficients of the interactions between regional unemployment and private sector are everywhere negative. This reinforces our earlier finding that private sector workers in regions with increasing unemployment rate systematically earn less. In addition, our findings provide clear evidence that the importance of the local labour market conditions in the composition of real wages increased dramatically as the crisis deepened. Furthermore, we observe a pronounced break around 2010Q2, the quarter in which significant reforms introduced in the functioning of the Greek labour market. We note that this is consistent with the core results obtained from the estimation of Eq. (5).

5 Conclusions

Using micro-data drawn from the Greek LFS for the period 1999–2014, we performed a detailed investigation of the wage curve relationship in the Greek labour market. Adopting either static individual or regional dynamic model specifications, a wage curve relationship does not seem to be in operation in the Greek labour market in the examined period. This basic finding appears to be robust to alternative modelling strategies which treat regional unemployment as an endogenous variable (2SLS-IV). However, using more flexible specifications of the wage curve by interacting regional unemployment with individual characteristics and time periods, we uncovered a heterogeneous profile in the wage responsiveness to local labour market conditions. In particular, the slope of the wage curve is steeper for private sector employees, permanent job holders, males, younger, low educated and for workers residing in non-urban areas. Moreover, we provide clear evidence for a substantial, albeit horizontal, real wage adjustment to the deteriorating macroeconomic conditions. Given that in the examined period numerous public policy initiatives have been implemented, in an effort to stabilize the Greek economy and improve its competitiveness, we found that real wages seem to respond to the changing regional unemployment rates (\(-.088\)) only in the period 2010–2011.

Given that real wages and regional unemployment vary across regions and time and given that certain reforms affect only private sector workers (e.g. collective bargaining and national minimum wage reductions), we examined whether workers in the private sector employed in regions with higher unemployment earn relatively lower wages and how the intensity of this effect varies in the crisis period. Using interaction terms between regional unemployment, sector of employment and time period indicators enabled us to isolate the effect of the prevailing local labour market conditions from that of other potential confounding factors. Our findings suggest that the differential response of real wages across regions and sectors of employment as well as the adoption of specific labour market reforms are important factors for identifying the wage curve. In particular, private sector workers in regions with increasing unemployment rate systematically earn lower wages and this is more pronounced in the post-2009 periods when the aforementioned labour market reforms were implemented.

Nevertheless, our findings should be viewed with some caution given that the cross-sectional character of the LFS database does not allow us to explicitly deal with potential biases related to the various sources of time-invariant unobserved heterogeneity. It is clear that longitudinal data at the individual level could be more appropriate for establishing causality.

From a policy perspective, our results are in agreement with the widely held view that more elastic wage curves are associated with more flexible labour markets (Gregg et al. 2014). As far as the public sector is concerned, our results indicate that the wage-setting mechanism could be a more appropriate analytical framework for studying the macroeconomic adjustment of public sector wages. On the other hand, given that the labour market of the private sector is more flexible and still in a transitory phase, public policy should focus on the implementation of measures that promote decentralized collective bargaining and reinforce the links between wages and local labour market conditions. Lastly, future research should focus on the investigation of the determinants regarding the longevity of the wage curve in the Greek labour market as more recent data become available.

Notes

European Commission, European Central Bank and International Monetary Fund.

A compact review regarding the specifics of the Greek labour relations system before and after the structural reforms is provided by Voskeritsian and Kornelakis (2014).

Nijkamp and Poot (2005) reported that this elasticity is around \(-.070\) after performing a meta-analysis using numerous wage curve studies.

We define two groups for the sector of employment (public and private). The first includes employees in central government, public utilities, public organizations and the local administration while the second includes employees in partially owned public enterprises, the banking sector and the private sector.

A number of robustness checks using interval regression techniques have led to the same results.

References

Albæk K, Asplund R, Blomskog S, Barth E, Gumundsson BR, Karlsson V, Madsen ES (2000) Dimensions of the wage-unemployment relationship in the Nordic countries: wage flexibility without wage curves. Res Labour Econ 19:345–381

Baltagi BH, Blien U (1998) The German wage curve: evidence from the IAB employment sample. Econ Lett 61(2):135–142

Baltagi BH, Blien U, Wolf K (2009) New evidence on the dynamic wage curve for Western Germany: 1980–2004. Labour Econ 16:47–51

Bakas D, Papapetrou E (2014) Unemployment in Greece: evidence from Greek regions using panel unit root tests. Q Rev Econ Financ 54(4):551–562

Baltagi BH, Baskaya YS, Hulagu T (2013) How different are the wage curves for formal and informal workers? evidence from Turkey. Pap Reg Sci 92(2):271–283

Bell B, Nickell S, Quintini G (2002) Wage equations, wage curves and all that. Labour Econ 9:341–360

Blanchard O, Katz L (1999) Wage dynamics: reconciling theory and evidence. Am Econ Rev 89(2):69–74

Blanchflower DG, Oswald AJ (1994) The wage curve. MIT Press, Cambridge

Blanchflower DG, Oswald AJ (1995) An introduction to the wage curve. Journal of Economic Perspectives 9(3):153–167

Booth A (2014) Wage determination and imperfect competition. Labour Econ 30:53–58

Brown S, Taylor K (2014) The reservation wage curve: evidence from the UK. IZA Discussion paper series DP no. 8519

Card D (1995) The wage curve: a review. J Econ Lit 33(2):785–799

Carlin W, Soskice D (2015) Macroeconomics: institutions, instability and the financial system. Oxford University Press, Oxford

Carruth AA, Oswald AJ (1989) Pay determination and industrial prosperity. Oxford University Press, Oxford

Christopoulou R, Monastiriotis V (2014) The Greek public sector wage premium before the crisis: size, selection and relative valuation of characteristics. Br J Ind Relat 52(3):579–602

Christopoulou R, Monastiriotis V (2015) Public–private wage duality during the Greek crisis. Oxford Economic Papers (in press)

Daouli JJ, Demoussis M, Giannakopoulos N, Laliotis I (2013) The impact of the 2011 collective bargaining reform on wage adjustments in Greece, Working paper. Department of Economics, University of Patras, Greece

de Menil G (1971) Bargaining: monopoly power versus union power. MIT Press, Cambridge

Devicienti F, Maida A, Pacelli L (2008) The resurrection of the Italian wage curve. Econ Lett 98(3):335–341

Fabiani S, Kwapil C, Room T, Galuscak K, Lamo A (2010) Wage rigidities and labour market adjustment in Europe. J Eur Econ Assoc 8(2–3):497–505

Gregg P, Machin S, Fernández-Salgado M (2014) Real wages and unemployment in the big squeeze. Econ J 124:408–432

Iara A, Traistaru I (2004) How flexible are wages in EU accession countries? Labour Econ 11(4):431–450

Knoppik C, Beissinger T (2009) Downward nominal wage rigidity in Europe: an analysis of European micro data from the ECHP 1994–2001. Empir Econ 36:321–338

Layard PRG, Nickell SJ, Jackman R (2005) Unemployment: macroeconomic performance and the labour market. Oxford University Press, Oxford

Livanos I (2010) The wage-local unemployment relationship in a highly regulated labour market: Greece. Reg Stud 44(4):389–400

Longhi S (2012) Job competition and the wage curve. Reg Stud 46(5):611–620

Moulton BR (1986) Random group effects and the precision of regression estimates. J Econ 32(3):385–397

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426

Nijkamp P, Poot J (2005) The last word on the wage curve? J Econ Surv 19(3):421–450

OECD (2011) OECD economic surveys: Greece 2011. OECD Publishing. doi:10.1787/eco_surveys-grc-2011-en

Venetis I, Salamaliki PK (2014) Unit roots and trend breaks in the Greek labor market. J Econ Stud 42(4):641–658

Voskeritsian H, Kornelakis A (2014) The transformation of employment regulation in Greece: towards a dysfunctional liberal market economy? Relat Ind/Ind Relat 69(2):344–365

Wooldridge JM (2010) Econometric analysis of cross section and panel data, 2nd edn. MIT Press, Cambridge

Yannelis C (2014) The minimum wage and employment dynamics: evidence from an age based reform in Greece. Royal Economic Society Annual Conference, April 2014

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors greatly acknowledge two anonymous referees for their constructive comments and suggestions in earlier versions of the manuscript. Also, the authors thank for the comments made from participants at the Scottish Economic Society 2012 Annual Conference, the 2012 workshop on “The Greek labour market during the Crisis” organized by the Bank of Greece, the European Regional Science Association 2013 Annual Conference, the 8th IZA/World Bank Conference on Employment and Development, the 28th Annual Congress of the European Economic Association and the LSE 2015 Workshop on “The State of the Greek Labour Market”. The usual disclaimer applies.

Rights and permissions

About this article

Cite this article

Daouli, J., Demoussis, M., Giannakopoulos, N. et al. The wage curve before and during the Greek economic crisis. Empir Econ 52, 59–77 (2017). https://doi.org/10.1007/s00181-016-1073-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1073-9