Abstract

This study reinvestigates the relationship between unemployment and crime, but is the first to focus explicitly on the effects of long-term unemployment on crime. A unique finding is that long-term unemployment shows a strong association with violent crime, an effect which is greater than that of total unemployment on property crime in this and most previous studies. Long-term unemployment thus identifies a marginal group for committing crime (particularly violent crime) better than total unemployment, with the duration of unemployment plausibly increasing the strain that fosters violent behaviour.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent research has repeatedly demonstrated a positive association between unemployment and property crime (Mustard 2010). The consensus is that a one percentage-point increase in the unemployment rate increases property crime by 1–2 % (Lin 2008; Mustard 2010). However, empirical research has been unable to establish a similar relationship between unemployment and violent crime. This confirms economic theory, which assumes that labour market opportunities affect the choice between legal and illegal activities (Ehrlich 1973). Because violent crime (as opposed to property crime) is rarely economically motivated (Levitt 2004), a weak relationship between unemployment and violent crime can be expected.

Another cause is specified in strain theory, which states that the strain of unemployment affects (primarily) violent crime (Agnew 1992). A similar effect is assumed in criminology literature, i.e., the distress of unemployment causes a delayed motivation effect (Cantor and Land 1985).Footnote 1 Idleness, which increases with duration of unemployment, is also reported to increase violent crime (Rege et al. 2009; Grönqvist 2011) and violence-related criminal activities such as alcohol and narcotics crime (Felson 1998). Since these mechanisms are plausible and intuitive, it is surprising that previous research using aggregated data has not found any links between unemployment and violent crime. One reason for this may be that the frustration and alienation of unemployment are poorly measured by total unemployment. Total unemployment mainly captures changes in the stock of short-term unemployed, whereas to capture duration-dependent externalities the duration of unemployment spells has to be considered.

The aim of this study is therefore to reinvestigate the effect of unemployment on crime rates in Sweden using a long-term unemployment measure. This is the first study to explicitly analyse long-term unemployment with aggregated data,Footnote 2 and is intended to contribute unique results regarding the relationship between unemployment and crime. The large body of the literature available on unemployment and crime use mostly aggregated data, so it is important to confirm a long-term unemployment effect on crime in such data.

To capture effects of unemployment on crime, it is necessary to identify those individuals likely to commit crime. For property crime, the group at the margin of substitution between the legal and illegal sectors must be identified (Mustard 2010). As economic theory states that a higher risk of unemployment decreases the opportunity cost of crime, most previous studies use total unemployment rate as the labour market variable. Although this measure seems to identify the marginal group, the youth unemployment rate might be a better identifier (Fougère et al. 2009). Using the wage level of unskilled workers identifies another important group (Gould et al. 2002; Machin and Meghir 2004).

Since the total unemployment rate fails to explain violent crime, unemployed individuals at the margin of committing violent crime may not have been identified in previous approaches. In this study, we examine whether long-term unemployment identifies a more selective group than total unemployment rate, which identifies a group with a relatively strong attachment to the labour market. However, for the long-term unemployed, who are less likely to return to the labour market in the near future, discount rates may be particularly high. Mustard (2010) points out that crime may be more responsive to “long-term effects” than “short-term fluctuations”. Moreover, a Swedish study using longitudinal register data shows that the probability of young people committing crime (both violent and property) increases with unemployment duration (Grönqvist 2011).

This study uses a panel dataset of 288 municipalities and annual data for the period 1998–2010. Data for the crisis in the beginning of the present decade and the Great Recession, which have not been used previously in studies examining the effect of unemployment on crime,Footnote 3 are thus included. A rich set of independent variables and regional time trends is used to avoid omitted variable bias.

Reversed causation that criminal activity reduces the employability of offenders or that economic growth is harmed by a high crime rate in the region may also bias the effect of unemployment on crime. Recent research using instrumental variable (IV) techniques shows that the relationship between market position and crime is underestimated due to endogeneity between unemployment and crime (Raphael and Winter-Ebmer 2001; Gould et al. 2002; Agell and Öster 2007; Lin 2008; Fougère et al. 2009). As a sensitivity test, we address endogeneity here by using exogenous changes in employment, i.e., national changes in the sectoral composition of employment, as an instrument. Because long spells of unemployment caused by exogenous and structural shocks to employment are particularly likely to cause idleness and strain, the instrument can be expected to be an excellent identifier of the effect of long-term unemployment on violent crime. It is reported that unexpected events are much more likely to cause strain and violent behaviour than expected events (Card and Dahl 2011).

The paper is organised as follows: The next section provides an overview of the literature, followed by sections presenting our data and descriptive statistics and the econometric specification approach used. The results are then presented, followed by some conclusions.

2 Previous research

The literature on unemployment and crime until the 1990s showed a discrepancy between empirics and theory (Mustard 2010). In a comprehensive survey of early literature, Chiricos (1987) reviewed 63 studies and found that only one-third showed a positive relationship between unemployment and crime.

Later research using panel data at local level (city or county) proved more successful in demonstrating a relationship between unemployment and crime than research using larger areas of aggregation. Because crime varies in important ways across even relatively small geographical areas, national or state-level data may disguise much of the important variation needed to identify an effect of unemployment (Levitt 2001; Mustard 2010). Recent studies also commonly use a time and area fixed effect specification and a much wider array of control variables than earlier studies. Using these techniques, recent research consistently shows that labour market conditions affect crime rates (Mustard 2010). A typical estimate is that a one percentage-point increase in the unemployment rate increases property crime by 1–2 % (Lin 2008; Mustard 2010).

Because the theory of economics of crime is most applicable to property crime, the literature focuses on this type of crime and violent crime is sometimes not even analysed. Raphael and Winter-Ebmer (2001) use US state-level panel data for the period 1971–1997 and report evidence of an effect of unemployment on property crime. Evidence of a positive effect on violent crime is much weaker, and for some violent crime categories the estimated relationships are even negative. Lin (2008) also uses US state-level data for the period 1974–2000 and shows that unemployment has a significant effect on crime, especially property crime, but not on violent crime. Papps and Winkelmann (2000) analyse panel data on 16 New Zealand regions for the period 1984–1996 and conclude that unemployment has a positive effect on total crime (and several subcategories), but not on violent crime. For Sweden, Edmark (2005) uses panel data on 21 counties in Sweden for the period 1988–1999 and Agell and Öster (2007) use Swedish municipality level data for the period 1996–2000 and both studies show evidence of an effect of unemployment on property crime, but not on violent crime.

Mustard (2010) argues that it is important to identify groups at the margin between a legal and illegal career, so labour market outcomes other than unemployment rate are usually used. Gould et al. (2002) use US county-level data on unskilled men for the period 1979–1997 and analyse the effect of wages and unemployment on crime rates. They conclude that the wage level is a more important determinant than the unemployment rate and that the wage effect is stronger on property crime than on violent crime. Machin and Meghir (2004) use panel data on 42 areas in England and Wales for the period 1975–1996 to investigate the relationship between bottom-end wages and property crime and show that the effect of bottom-end wages is larger than the effect of unemployment on property crime.

Fougère et al. (2009) explore different labour market variables using panel data on 95 regions in France during the period 1990–2000 and show similar results to the studies cited above, but also identify an effect of unemployment on crime for young people. However, a Swedish study (Agell and Öster 2007) and a US study (Lin 2008) on youth employment rate and crime report no relationship.

Fougère et al. (2009) is the only study to address the effects of long-term unemployment on crime rates using aggregated panel data,Footnote 4 but reports no effect. However, the main focus in that study is on other measures. Using Swedish individual data for the period 1992–2005, Grönqvist (2011) documents a relationship between unemployment duration and the probability of committing crimes.

Overall, there seems to be consensus in recent studies that the relationship between violent crime and the labour market is weak, but both Raphael and Winter-Ebmer (2001) and Lin (2008) question this finding. For example, if procyclical crime-related measures, such as alcohol, , and drugs, are not considered, there is a risk of underestimating the effect of unemployment on crime (Levitt 2001; 2004). Lin (2008) therefore includes a “state crack cocaine index” (calculated by Fryer et al. 2005) and shows that the effect of unemployment on violent crime becomes positive, but nonsignificant. Furthermore, Raphael and Winter-Ebmer (2001) suggest that the exposure of offenders might be greater in good times, thus masking the effect of unemployment on violent crime.

Most studies use aggregated data, but because the relevant theories are built upon individual behaviour there are good reasons for conducting studies with micro-data (Eide et al. 2006). Grogger (1998) uses the dataset NLSY, which comprises US panel data containing a representative sample of youth. He presents evidence of a relationship between the wage level of young people and property crime, but violent crime is not analysed. Gould et al. (2002) use individual data and report positive effects of wage level and unemployment on property crime.

Two recent papers using individual data are of particular interest to the present study. Rege et al. (2009) use Norwegian longitudinal data for the period 1992–2005 to investigate the effect of plant closure on criminal activity. Surprisingly, they report no effect on property crime, but an effect on traffic violations and violent crime. As previously mentioned, Grönqvist (2011) also uses individual data (on youths) and demonstrates an association between unemployment and violent crime in addition to property crime (theft). Moreover, he concludes that the association with both violent and property crime increases with unemployment duration, but with a stronger effect for property crime. These studies also show idleness to be an important mechanism, since the effect of unemployment and the plant closure effect on crime are measurably larger during weekdays than at weekends.

However, the effect of unemployment may be biased if there is reverse causation. Cullen and Levitt (1999) suggest that high-income individuals or employers leave areas with high crime rates, Gould et al. (2002) claim that crime makes businesses relocate to areas with lower crime rates, and Willis (1997) reports that low-wage employers in the service sector may relocate due to increased crime rates. Mustard (2010) concludes that “Some, but not all, studies report substantially larger estimated effects with 2SLS than with OLS”. For example, Lin (2008) reports an effect of unemployment on property crime that is approximately threefold higher with 2SLS methods than when using OLS. Hence, OLS might underestimate the causal effect of unemployment on crime.

3 Data and descriptive statistics

Our panel data set consists of annual data for Swedish 288Footnote 5 municipalities in the period 1998–2010. The relatively long time period and the number of municipalities give a large number of observations (3696).Footnote 6 Studies with US data typically use state-level data and thus have much fewer observations. However, Gould et al. (2002) use county-level US data and include more observations than the present study.

Unemployment data at municipal level in Sweden are taken from the National Labour Market Board (AMS). The number of unemployed individuals is the average number of individuals, aged 16–64, registered as job-seekers (at AMS) on a certain date each month during the year. Thus, the unemployment variable includes both idle unemployed and unemployed participating in labour market programmes.Footnote 7 The vast majority are idle unemployed. This sum, often referred to as total unemployment, is the unemployment measure used in most studies. Data on the long-term unemployment variable, which is included in the database STATIV, are taken from Statistics Sweden (SCB).Footnote 8 Individual in the age group 20–24 are considered long-term unemployed if registered at AMS as unemployed for more than 100 days. For the age group 25–64, the period is 6 months or longer. The long-term unemployment measure is based on the total number of people who meet these criteria at any time during the year. Moreover, long-term unemployment is a proper subset of idle unemployment, i.e., individuals cannot be long-term unemployed and participating in a labour market programme. Like earlier Swedish studies, all our unemployment variables have the working age population, and hence not the labour force, in the relevant age group in the denominator. As argued by Fougère et al. (2009), this is a more effective measure since variations in the labour force might otherwise create noise in the unemployment rate.

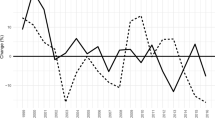

As shown in Fig. 1, unemployment rates in Sweden 1998–2010 fluctuate widely. Because long-term unemployment seems to vary less than total unemployment, there may be insufficient variation to identify a link to the dependent variable. However, by comparing the standardised national unemployment measures (subtracting the mean and dividing by the standard deviation)Footnote 9 in Fig. 2, we find that the relative variation is similar at the national level. Furthermore, on municipal level the variation in the long-term unemployment measure is even larger than for total unemployment. Thus, computing the relative change (where i is municipality and t is time):

in the municipal unemployment levels and taking the standard deviation of these measures provides an estimate that can be used for comparing the variation in the unemployment measures.Footnote 10 This exercise gives 0.22 for the total unemployment variable and 0.37 for the long-term unemployment variable. Thus, in relative terms, long-term unemployment exhibits an approximately 1.65-fold larger variation than total unemployment.Footnote 11

We also investigate the fluctuations in long-term unemployment and total unemployment, i.e., whether the measures capture the same fluctuations, by comparing the number of times the unemployment measures move in the same direction (simultaneously up or down), in opposite directions or at all relative to the other. The two unemployment measures do not always follow the same pattern and thus cannot have the same effect on crime rates. In 32 % of cases the rates go in opposite directions (or one is unchanged). More precisely, in about half of these cases, the long-term unemployment rate increases (or is unchanged) and the total unemployment rate decreases, and in the other half the long-term unemployment rate decreases (or is unchanged) and the total unemployment rate increases. Thus, the unemployment measures partly capture different fluctuations in the business cycle.

Data on crime rates, reported as crimes per 100,000 inhabitants, are taken from the National Council for Crime Prevention (NCCP). Property crime includes burglary; thefts and pilfering; thefts from vehicles; and handling stolen property. Here we exclude vehicle thefts, since due to technological advances that make vehicles difficult to steal, there is a very large drop in vehicle thefts in the study period of almost 60 % since the early 1990s (NCCP 2008). The significant negative relationship between vehicle theft and unemployment may be due to this fact.Footnote 12 For violent crime the categorisation follows that of NCCP, with the exception that robbery is excluded from violent crime. The reason is that the motive for robbery is mostly monetary and we are interested in ‘pure’ violent and property crime categories.Footnote 13 The proportions of crime in the property crime and violent crime are illustrated in Fig. 3.

The overall crime rate has increased by 10–20 % since 1985, as shown in Fig. 4. That diagram also illustrates separately the change in the property crime rate and the violent crime rate. There is a steady decrease in property crime rates during the study period, by about 30 % since 2000. An entirely different trend is apparent for violent crime rate, which has gradually increased for a long time, by more than 40 % from 1998 to 2010.

However, the data are based on reported crimes, and there may be a discrepancy between crimes committed and crimes reported. The rate of reporting for violent crime is relatively low, and recent surveys attempting to measure the actual number of crimes committed show that a higher reporting rate explains the increase in violent crime figures (NCCP 2008). However, property crime has a high reporting rate, and the decrease in property crime is not caused by changes in reporting (NCCP 2008).

If the propensity to report a crime changes over time in the same way across all municipalities, or varies across municipalities but remains constant over time, and then, the fixed effect estimate is unbiased. As Eide et al. (2006) point out, this seems to be an implicit assumption in most studies. Nevertheless, the propensity to report a crime does vary across Sweden and there is some evidence that the difference in reporting rates between different Swedish regions has varied over time (NCCP 2008), but the evidence is far from clear-cut. Moreover, a relationship between unemployment and the propensity to report crimes is probably linked to social capital and civic norms, i.e., when the social capital in society decreases, fewer crimes are reported (Buonanno et al. 2009). Thus, if this holds true (and unemployment and social capital are negatively related), the effects of unemployment risk being underestimated rather than overestimated. However, by including municipality-specific time trends a linear trend in the reporting rate is eliminated.

4 Econometric specification

The empirical approach used here is that commonly employed in recent papers on the topic. We use a time and area fixed effect model that uses the within-municipality variation in crime and unemployment to identify the effect of unemployment on crime:

where i and t are indices for municipality and year, respectively, Crime\(_{it}\) is the number of crimes per 100,000 inhabitants, Unempl\(_{it }\)represents the particular type of unemployment rate, \(\alpha _{i}\) is the municipality fixed effects and \(\delta _{t}\) is the time fixed effects, \(X_{it}\) is a vector of control variables, and \(Y_{it}\) is municipality-specific time trends.

One of the advantages in this study is that we use a broad set of control variables, which are shown with descriptive statistics in Table 7. By including a rich variety of crime explanatories, the risk of spurious correlations is small.

According to economic theory, a high-income level in a region could increase or decrease crime rates. However, when a high income or wage level in a region makes crime less attractive, the returns to crime become higher (i.e., there are more valuable goods to steal). Due to this, we add both the Logarithm of income and the First difference of the logarithm of income Footnote 14 to the model. Using these variables, we try to capture the diverse effects of income on crime. Data on mean per capita income (gross income for individuals aged 20 or older) in each municipality are taken from SCB and deflated with the Consumer Price Index (also taken from SCB).

Men and youth are highly overrepresented among criminalsFootnote 15, and therefore, the Share of males and the demographic age structure in the municipality are included. The Share with foreign background (including both first- and second-generation immigrants) is added for the same reason (NCCP 2005, 2008). Some previous empirical papers separate foreigners into specific groups of origin (see, e.g., Fougère et al. 2009), but our data do not allow such a precise classification.

It is a well-known fact that crime rates per capita are higher in larger cities (NCCP 2008). To capture this phenomenon, we add the Logarithmic population density (inhabitants per km\(^{2})\) and Logarithmic population size to the model.

For reasons discussed in Sect. 2, Alcohol consumption (litres of 100 % alcohol purchased at the state monopoly alcohol retailer (Systembolaget) per capita aged 15 or older) is also added. In Sweden, few violent crimes are committed under the influence of narcotics (NCCP 2008) and it is therefore not necessary to control for narcotic use.

The level of education is also an important determinant of criminal behaviour. With the Share of pupils qualified for high school and Share of pupils qualified for university (defined as the number of pupils qualified in year t divided by the total number of pupils graduating in year t), we measure the academic achievements of those just about to enter the labour market or continue to higher education, i.e., a group at the risk of criminal behaviour. In addition, we add the Logarithm of expenditure on education and Logarithm of expenditure on culture and leisure activities. These expenditure data are per capita and deflated with the Consumer Price Index.

Data for the variables Conviction rate\(_{t-1}\) and Logarithm of police force\(_{t-1}\) (included in a sensitivity analysis) are taken from county level. The police force is the number of policemen (and the number of civilians employed by the police) per thousand population. Conviction rate is the number of convictions divided by the total number of crimes (multiplied by 100). These deterrence variables are lagged one year, as done in previous studies (e.g., Lin 2008).

5 Results

The main results are shown in Table 1, and the results with added linear municipality-specific time trends are shown in Table 2. In columns 1–4 in Table 1, the effect of total unemployment and the effect of long-term unemployment are estimated separately, while columns 5 and 6 contain two mutually exclusive unemployment measures, i.e., by subtracting long-term unemployment from total unemployment a measure of short-term unemployment is obtained.Footnote 16 Columns 1 and 2 in Table 1 show that total unemployment has a significant effect on property crime, but not on violent crime, confirming economic theory and previous research. The point estimate, where a one percentage-point increase in total unemployment increases property crime by 1.11, is of the same magnitude as in previous Swedish and international studies. Importantly, in column 4 long-term unemployment shows a significant effect on violent crime, with a point estimate of 2.13. In addition, long-term unemployment affects property crime, but the point estimate is smaller, 1.81, and only significant at \(p<0.10\). Notably, long-term unemployment has a larger impact on property crime than total unemployment.

In the joint model, the effect of short-term unemployment on property crime (column 5) is of roughly the same magnitude as the effect of total unemployment on property crime, but is nonsignificant. The effect of long-term unemployment on violent crime (column 6) is somewhat greater than the effect in column 4, showing that the effects of unemployment are distinct from each other, i.e., the unemployment measures capture different unemployment–crime relationships.

Furthermore, we estimated the model on removing covariates that may be endogenous, i.e., the income variables and alcohol consumption (results not reported but available on request).Footnote 17 Without these covariates included, the effect of unemployment decreases somewhat, with most of the decrease from removing the income variables. Adding endogenous covariates is therefore not a major problem, and the unemployment effects are more likely to be biased when omitting income since including income is standard). Moreover, with only the fixed effects included (not reported), the effect of long-term unemployment on violent crime is larger than in Table 1.

When municipality-specific linear time trends are added, the effect of long-term unemployment on violent crime increases somewhat (columns 4 and 6 in Table 2).Footnote 18 The effect of total unemployment on property crime decreases and turns nonsignificant.

The control variables show both expected and unexpected signs depending on the specification and type of crime. For example, Share aged 15–19 years is strongly correlated with crime, positively with violent crime and negatively with property crime. These findings indicate that adolescents are prone to violent but not property crimes, which is a surprise. However, when including linear time trends, the negative effect of Share aged 15-19 on property crime turns positive and insignificant (not reported), indicating a spurious finding.

Thus, since one could always come up with plausible explanations (particularly in a fixed effect framework) for the results, we prefer not to speculate on the covariate estimates.

Tables 9 and 10 in the Appendix show the results obtained on estimating the effects of unemployment for specific crime categories available to us.Footnote 19 Due to large standard errors, it is difficult to show significant effects of unemployment for many crime categories, but the effects are often economically significant. For long-term unemployment, the effects are large for Theft from vehicles, Burglary, Handling stolen property, Assault, Rape, and Violation of women’s integrity, but significant effects are found only for Theft from vehicles (when time trends are added) andAssault (both with and without time trends added). For total unemployment, there are large and significant effects on Theft and Violation of women’s integrity (but only without time trends).

5.1 Adding the share of social benefits recipients

Social benefits recipients, such as the long-term unemployed, may be a group at the margin of committing crimes. As many of the long-term unemployed are also social benefits recipients, the effect of long-term unemployment could partly be an effect of being a social benefits recipient.Footnote 20 For this reason, in a sensitivity test we add a variable measuring the share of social benefits recipients to the model. The results (without time trends) are reported in columns 1–4 in Table 3. Social benefits recipients affect both crime types, but the effect is larger on violent crime, where a one percentage-point increase in the share of social benefits recipients increases violent crimes by about 2.8 %. The effects of unemployment decrease slightly, but remain significant at 10 % level.

In the model with linear time trends (columns 5–8 in Table 3), long-term unemployment shows robust results for violent crime, while the other unemployment effects turn nonsignificant. Thus, the effect of long-term unemployment on violent crime remains when adding social benefits recipients to the model, thus indicating that long-term unemployment and social benefits are both stigmatised states, each with a distinct effect on crime rates.

5.2 Adding conviction rate and police force

The importance of including deterrence variables in the crime equation is shown in studies by Levitt (1996) demonstrating that prison population size affects crime rates negatively through deterrence in capacitation and Levitt (1997) demonstrating that a larger police force decreases crime rates. The effects on violent crime are shown to be larger than those on property crime.

However, it is uncertain whether deterrence variables should be included in the crime equation. Economic conditions may affect both the unemployment rate and investments in the legal system, and if these investments decrease crime rates, the effect of unemployment might be overestimated. On the other hand, investments in the legal system may be a response to high crime rates, and deterrence variables may therefore mask the relationship between unemployment and crime. The conservative approach is to include deterrence variables and see whether this affects the unemployment-crime relationship. In Table 4, we therefore add Logarithm of police force \(_{t-1}\) and Conviction rate \(_{ t-1}\) to the model. A larger police force and a higher conviction rate seem to decrease crime rates generally, but Logarithm of police force \(_{t-1}\) increases violent crime, which may be due to responses to higher violent crime rates.

Comparing the results in Table 4 with our earlier results, we find that the effects of unemployment (both with and without linear time trends) are more or less unaffected by the inclusion of deterrence variables. Thus, crime deterrence does not seem to be a problem for the analysis.

5.3 Nonlinear effect of unemployment

Moreover, when unemployment increases, the marginal individual is assumed to be less selective, and therefore, the effect on crime rates may decrease with unemployment. Thus, we include squared unemployment rates in the model to ascertain whether the effects of unemployment are linear or not.

The squared unemployment estimates obtained (Table 5) are always negative, but it is only when including linear time trends that the effect of squared unemployment on violent crime becomes significantly negative. This suggests that the marginal individual is decreasingly prone to commit crime. However, because there is a significantly squared estimate only for violent crime, theories focusing on the mental distress of the unemployed propose another explanation. Assuming that the stigma of long-term unemployment is larger when the long-term unemployment rate is low, a rise in long-term unemployment rates might decrease the strain of unemployment and therefore also the negative externality on violent crime rates.

6 An instrumental variable approach

With reverse causation, the effect of unemployment on crime may be biased, i.e., if criminal activity reduces the employability of offenders or if economic growth is harmed by a high crime rate, the effect of unemployment on crime can be assumed to be overstated. However, as is often the case when using instruments, the IV estimates are larger than the OLS estimates (Raphael and Winter-Ebmer 2001; Gould et al. 2002; Agell and Öster 2007; Lin 2008; Fougère et al. 2009). A high IV estimate indicates that the instrument identifies a change in the unemployment rate that affects crime more than the average change, i.e., a local average partial effect is identified.Footnote 21

In this section, we use an instrument developed in earlier studies to confirm the effect of long-term unemployment on violent crime. This instrument,Predicted employment, which captures exogenous shocks to employment level in the municipality, is based on a design used by Gould et al. (2002) and adopted in different setups by others (e.g., Fougère et al. 2009).Footnote 22 Here, we use the national changes in the sectoral composition of employment to predict the current regional employment level in the sectors. The predictions are identical to the true employment levels if the sectoral composition of employment in each municipality evolves exactly like the national trend.Footnote 23 Because the instrument captures structural changes on the labour market, it can be assumed to be exogenous to the crime level in the municipality. Here we use data on employment in 16 different industry and business sectors. These data are unfortunately only available for the period 2000–2010 and using lags to construct the instrument leaves data for the period 2001–2010.Footnote 24

The results of the 2SLS regressions are shown in Table 6. A decreasing effect of Predicted employment on unemployment is apparent, and therefore, it is important to add a squared variable. Below we present the IV results of this model, before discussing the pitfalls of instruments, for example whether the instrument is weak.

The IV results show an effect of total unemployment of 2.67 for property crime and 15.30 for violent crime and an effect of long-term unemployment of 4.34 for property crime and 26.40 for violent crime. In particular, the large IV estimates for violent crime might be an indication of weak instruments, giving biased estimates and underestimated standard errors (Stock et al. 2002; Murray 2006). However, since both instruments in the first-stage regression are significant at \(p<0.10\) (and show the expected signs), the instruments seem strong. In fact, according to the F-statistics for the weak-IV test, the instruments are strong, i.e., as a rule of thumb the test statistic should be above 10 and here it is 14.22 for total unemployment and 27.35 for long-term unemployment.Footnote 25

To sum up, the IV results confirm the effects of long-term unemployment on crime and possibly a downward bias in the OLS effects of unemployment, but with the reservation that the IV estimates are probably also biased (perhaps because of misspecification at the first stage). Therefore, the IV approach can be viewed as a sensitivity test confirming the relationship between long-term unemployment and violent crime, and not as a way of identifying unbiased parameters.

7 Conclusions

This study shows a strong association between long-term unemployment and violent crime, with a point estimate for long-term unemployment of 2.1 for violent crime in the standard approach. The effect of total unemployment on property crime is significant but relatively small (point estimate 1.1), and no effects on violent crime are evident, confirming previous results. This indicates that long-term unemployment; (i) captures a specific mechanism compared with that captured with the total unemployment measure, and/or (ii) identifies the marginal group for committing violent crime better than total unemployment.

Long-term unemployment, but not total unemployment, increasing violent crime cannot be explained by conventional economic theory of crime. As crime rates (especially violent crime rates) increase with the share of the population receiving social benefits, being far from the labour market seems to matter. Long-term unemployment (and receiving social benefits) possibly creates strain that fosters violent behaviour.

The effects of unemployment on violent crime seem to decrease with unemployment level, suggesting that a more selective or different group faces the risk of committing violent crime and that long-term unemployment is superior in identifying this marginal group. Moreover, assuming that the stigma of long-term unemployment is larger when the long-term unemployment rate is low, a rise in the long-term unemployment rates might decrease the strain of unemployment and thus the negative externality on violent crime.

The IV results confirm these findings and, as in previous studies, are larger than the corresponding OLS estimates. Employment shocks caused by exogenous factors outside the municipality are shown to have an large impact on violent crime, i.e., the group that becomes long-term unemployed because of exogenous shocks to the employment level seems particularly prone to commit violent crime. This is plausible, as unforeseen and long-lasting changes in the labour market status of individuals are likely to cause much anger and strain.

Thus, unemployment imposes costs to society not only directly in the form of unemployment benefits, etc., but also indirectly in the form of costs of crime. Previous research on the social costs of crime generally shows that property crime incurs great costs for societyFootnote 26, but that violent crime is usually many times more costly. Our finding of a link between long-term unemployment and violent crime shows that the total costs of unemployment are underestimated to date.

Note, however, that while the effect of long-term unemployment on violent crime is plausible and potentially causal, the choice of study period might alter the effect, i.e., the effect may be different in previous time periods. Therefore, studies that compare pre- and post-2000 data are needed to confirm that there has not been an overall change in the unemployment-violent crime patterns.

Notes

In the short term, Cantor and Land (1985) assumes that improved economic conditions cause a negative opportunity effect; when economic conditions improve, it increases the criminal opportunities. However, in economics this mechanism is explained as higher returns to crime and the effect is assumed to be captured by the income level and not the unemployment level.

Fougère et al. (2009) estimate effects of long-term unemployment simultaneously with effects of youth and adult unemployment and report no effect of long-term unemployment.

At the moment there are 290 municipalities in Sweden. The municipalities of Nykvarn and Knivsta were created in 1999 and 2003, respectively, and are therefore excluded. They are also very small.

Most missing values are in the covariates, but there are also 17 missing values in the long-term unemployment variable.

Excluding the share participating in labour market programmes does not affect the results in this study.

The unemployment measures are therefore taken from different sources, but a measure from SCB could have been used for regular unemployment too. The main reason for not using this measure is that we want a measure for total employment that is similar to that used in previous studies, and the SCB measure differs slightly in its construction. Moreover, the effect of total unemployment on property crime estimated with this measure is smaller than with the measure from AMS.

Because the standardised measures are computed from unemployment at municipal levels, we also weight with municipality population size.

We have unemployment data for 1997 and can therefore construct a first difference variable for 1998.

When calculating the within variation for the standardised measures with xtsum in STATA, the variation is 1.26-fold larger for long-term unemployment than total unemployment. With our method of calculating variation, a larger difference shows that the variation is mainly larger between years than to the mean.

Weapon theft is also excluded, because weapons may be used when committing a violent crime. However, such thefts are very few, so excluding them does not change the results.

Robbery is categorised by NCCP as both a violent and a property crime. However, robbery is included in the Appendix when specific crime categories are analysed separately.

Another reason to add the first difference is that municipality income levels are nonstationary.

Different age groups are also targets and victims of different crimes (NCCP 2008).

Thus, the short-term measure is the average yearly total unemployment rate minus the share long-term unemployed during some part of the year. The measures are therefore not totally mutually exclusive because they are measured differently, but we are confident that this does not pose problems for the analysis. That is, the constructed short-term variable should capture short-term unemployment fluctuations that do not turn into long-term unemployment fluctuations during the year.

In regressions also including indicators of migration patterns (inflow and outflow of individuals) and the divorce rate, the results are not changed.

When adding both linear and quadratic municipality-specific time trends, long-term unemployment loses its significance for violent crimes. However, the effect stays large, 1.54. This specification (adding 2 times 288 variables) probably removes too much of the variation in violent crimes to identify a significant effect.

We lack data at the municipal level for murder and violence against officials. Nevertheless, since the number of such crimes is very low, the variable has too many zeros and too little variation. Murder and manslaughter cases are also too few as the number of reported murders and manslaughter cases during most of our period has typically varied between 2 and 3 per 100,000 inhabitants (NCCP 2008).

In 2008, almost 50 % of the social benefits recipients in Sweden were registered job-seekers at the National Labour Market Board (Mörk 2011).

Further information on data sources and the description of the construction of the instruments are provided in the Appendix.

See Gould et al. (2002) for a more profound discussion of the instrument.

By including a squared variable, we have more instrumental variables than endogenous variables. Yet, performing an overidentification test is pointless, since it is not two instruments, but rather one instrument modelled with two variables.

References

Agell J, Öster A (2007) Crime and unemployment in turbulent times. J Eur Econ Assoc 5(4):752–775

Agnew R (1992) Foundation for a general strain theory of crime and delinquency. Criminology 30:47–87

Boardman AE, Greenberg DH, Vining AR, Weimer DL (2011) Cost-benefit analysis; concepts and practice, 4th edn. Pearson Education Inc, New York

Buonanno P, Montolio D, Vanin P (2009) Does social capital reduce crime? J Law Econ 52:145–170

Cantor D, Land KC (1985) Unemployment and crime rates in the post World War II United States: a theoretical and empirical analysis. Am Soc Rev 50:317–332

Card D, Dahl GB (2011) Family violence and football: the effect of unexpected emotional cues on violent behavior. Quart J Econ 126:103–143

Chiricos TG (1987) Rates of crime and unemployment: an analysis of aggregate research evidence. Soc Probl 34:187–212

Cohen MA (1998) The monetary value of saving a high risk youth. J Quant Criminol 14:5–33

Cohen MA, Rust RT, Steen S, Tidd ST (2004) Willingness-to-pay for crime control programs. Criminology 42:89–108

Cullen JB, Levitt SD (1999) Crime, urban flight, and the consequences for cities. Rev Econ Stat 81:159–169

Edmark K (2005) Unemployment and crime: is there a connection? Scand J Econ 107:353–373

Ehrlich I (1973) Participation in illegitimate activities: a theoretical and empirical investigation. J Pol Econ 81:521–565

Eide E, Rubin PH, Shepherd JM (2006) Economics of crime. Found Trends Microecon 2:205–279

Felson M (1998) Crime and everyday life. Pine Forge Press, Thousand Oaks

Fougère D, Kramarz F, Pouget J (2009) Youth unemployment and crime in France. J Eur Econ Ass 7:909–938

Fryer R, Heaton P, Levitt S, Murphy K (2005) Measuring crack cocaine and its impact. Econ Inq 51:1651–1658

Gould E, Weinberg B, Mustard D (2002) Crime rates and local labor market opportunities in the United States: 1979–1997. Rev Econ Stat 84:45–61

Greenberg D (2001) Time series analysis of crime rates. J Quant Criminol 17:291–327

Grogger F (1998) Market wage and youth crime. J Lab Econ 16:756–791

Grönqvist H (2011) Youth unemployment and crime: new lessons exploring longitudinal register data. Working Paper 7/2011, (SOFI) Stockholm University

Levitt SD (1996) The effect of prison population size on crime rates: evidence from prison overcrowding litigation. Quart J Econ 111:319–351

Levitt SD (1997) Using electoral cycles in police hiring to estimate the effect of police on crime. Am Econ Rev 87:270–290

Levitt SD (2001) Alternative strategies for identifying the link between unemployment and crime. J Quant Criminol 17:377–390

Levitt SD (2004) Understanding why crime fell in the 1990s: four factors that explain the decline and six that do not. J Econ Perspect 18:163–190

Lin M-J (2008) Does unemployment increase crime? evidence from U.S. data 1974–2000. J Hum Resour 43:413–436

Machin S, Meghir C (2004) Crime and economic incentives. J Hum Resour 39:958–979

Miller TR, Cohen MA, Wiersema B (1996) Victim costs and consequences: a new look. NCJ 155282, National Institute of Justice, Washington DC

Murray M (2006) Avoiding invalid instruments and coping with weak instruments. J Econ Perspect 20(4):111–132

Mustard D (2010) How do labor markets affect crime? new evidence on an old puzzle. In: Benson B, Zimmerman P (eds) Handbook on the economics of crime. Edward Elgar Publishing, Cheltenham, pp 342–358

Mörk E (2011) Från försörjningsstöd till arbete—Hur kan vägen underlättas? Report 2011:6, Institute for Evaluation of Labour Market and Education Policies (IFAU), Uppsala

NCCP (2005) Brottsligheten bland personer födda i Sverige och i utlandet. Report 2005:17, The National Council for Crime Prevention, Stockholm

NCCP (2008) Brottsutvecklingen i Sverige fram till år, 2007 Brottsutvecklingen i Sverige fram till år, (2007) Report 2008:23. The National Council for Crime Prevention, Stockholm

Papps K, Winkelmann R (2000) Unemployment and crime: new evidence for an old question. New Zealand Econ Pap 34:53–72

Rege M, Skardhamar T, Telle K, Votruba M (2009) The effect of plant closure on crime. Statistics Norway, Research Department, Discussion Papers No 593

Raphael S, Winter-Ebmer R (2001) Identifying the effect of unemployment on crime. J Law Econ 41:259–283

Saridakis G (2004) Violent crime in the United States of America: a time-series analysis between 1960–2000. Eur J Law Econ 18:203–221

Stock J, Wright J, Yogo M (2002) A survey of weak instruments and weak identification in generalized method of moments. J Bus Econ Stat 20:518–529

Willis M (1997) The relationship between crime and jobs. Working paper, University of California-Santa Barbara

Acknowledgments

We would like to thank Roberto Galbiati, Hans Grönqvist and participants in the seminar at ESPE (2012) for helpful comments and suggestions. Research grants from the Swedish Council for Working Life and Social Research and the Health Economics Program (HEP), Lund University are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This section describes the instrument used, which was constructed by connecting the industry (or business) sectoral composition of employment at municipal level with the national growth trends in these sectors. It thus measures the expected variation (predicted by the national trend) in labour demand in the municipalities. We begin by constructing the national growth rate in employment in industry j between time \(t -1\) and time t :

where \(E_{jt }\)is the number of employed workers in industry j at time t at the national level. Then, we multiply the national growth rate, \(g_{j}\), by the municipality-specific sector composition of employment, lagged one period, \(E_{ijt-1}\):

The employment data at municipal level collected by SCB are only available for the period 2000–2010. Here, we use employment data differentiated into 16 different industry sectors (Tables 7, 8, 9, 10).

Rights and permissions

About this article

Cite this article

Nordin, M., Almén, D. Long-term unemployment and violent crime. Empir Econ 52, 1–29 (2017). https://doi.org/10.1007/s00181-016-1068-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1068-6