Abstract

This paper studies social security reforms in a model with declining population growth and increasing life expectancy. Based on simulations using data on China, it is found that a switch from a pay-as-you-go (PAYG) system to a notional defined contribution system favors the rich, causes the poor to work more, and may change the capital-effective labor ratio depending on the rate of return to personal accounts. A switch from the PAYG system to a modified PAYG system that saves part of the receipts, with the interest rate greater than the growth rate, increases labor supply and decreases the capital-effective labor ratio in period one; decreases labor supply and increases the capital-effective labor ratio after period one; and hurts the poor old more than the rich old while benefitting the poor in future generations more than the rich. If the interest rate is less than the growth rate, the accumulated funds are insufficient to balance the social security budget.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

As the population ages, social security reforms have become inevitable. Current social security reforms face two options to cope with insufficient social security revenues. One is to establish the notional defined contribution pay-as-you-go (PAYG) system, also called a notional defined contribution (NDC) system, to replace the current PAYG system. Another is to save part of the current receipts in the PAYG system for future social security expenditures, called a modified PAYG system. This paper examines effects of these two types of social security reform on labor supply, capital accumulation, income redistribution, and welfare of different groups within and across generations.

An enormous amount of research has emerged concerning the efficiency, equity, and sustainability of social security systems. Studies have shown that the traditional PAYG social security system negatively affects private savings and capital accumulation (see Feldstein 1974, 1996; Kotlikoff 1979). As the population ages, many countries face social security unsustainability (see Kotlikoff 1996a; Gruber and Wise 1997; Börsch-Supan et al. 2023). Kotlikoff (1996a) and Feldstein and Samwick (1996) called for privatization of the PAYG system. With huge implicit debt (i.e., the amount of social security payment the government owes retirees and workers who have already made contributions to the program), it is very difficult to privatize the social security system.Footnote 1

In recent decades, many countries in Europe, such as Sweden and Italy, have introduced the NDC system. Under the NDC system, an individual contributes to the PAYG account, and the government records everyone’s contribution and promises to pay back along with interest at retirement. However, the government uses social security receipts immediately to pay social security benefits for current retirees, and there is no accumulation of funds in personal accounts. The personal account is notional. The rate of return could be the growth rate of GDP, the growth rate of average earnings, the growth rate of total wage, the growth rate of total social security income, etc.

Another type of social security reform has been going on for forty years in the United States. To deal with the problem of the population aging, President Reagan appointed Alan Greenspan to the National Commission on Social Security Reform, and the Greenspan Commission (1983) soon provided a report that suggested raising contributions and reducing the growth of benefits, and gradually increasing the retirement age. The United States government soon passed the Social Security Amendments of 1983. Since then, the United States has run surpluses in the social security PAYG account every year except 2021 and has accumulated a large amount in the Social Security Trust Fund.Footnote 2 The ratio of asset reserves to GDP was 0.68% in 1983, 13.92% in 2020, and 12.4% in 2021.Footnote 3 The more assets reserved, the less burden that future generations will have. This new social security system can be called a modified PAYG system. Studies on the modified PAYG system have mainly focused on the sustainability of the system, instead of the effect of the system on capital accumulation and welfare of different generations. For example, the Social Security and Medicare Boards of Trustees (2022) predicted that the Old-Age and Survivors Insurance Trust Fund would be able to pay scheduled benefits on a timely basis until 2034 and suggested that lawmakers take actions to reduce or eliminate the long-term financing shortfalls in social security.

This paper intends to fill the gap in the literature by examining the effect of the above two types of social security reform, i.e., a switch from the PAYG system to a NDC system and a switch from the PAYG system to a modified PAYG system, on labor supply, capital accumulation, income redistribution, and welfare of different groups within and across generations. An overlapping generations model is developed with the following features: There are two different groups of agents in a generation, skilled and unskilled individuals. The fertility rate declines, but life expectancy increases due to the decline of the probability of death in the second period of life, and the population growth rate declines. Labor supply is endogenous, and individuals face a labor-leisure choice. In the baseline the government runs a PAYG social security program, collecting payroll tax at a fixed rate to finance social security benefits; with declining fertility and rising life expectancy, the pension benefit (pension replacement rate) must decrease to keep the social security budget balanced. To analyze social security reforms, we allow the government to have notional social security accounts for individuals, or to save part of social security revenue for future use. Many prior studies assumed that the interest rate is greater than the growth rate of output (Feldstein 1995, 1999). In view of low real interest rates in recent decades, we consider both cases where the interest rate is greater than and less than the growth rate of output. Simulation results are provided based on data for the Chinese economy.

The major findings of the paper are as follows. With population aging, a switch from the PAYG system to a NDC system, with the rate of return being the growth rate of total wages, increases labor supply of unskilled individuals but decreases labor supply of skilled individuals; decreases the capital-effective labor ratio in the beginning, and then, does not affect that ratio; and increases the utility of the skilled and decreases the utility of the unskilled.

A switch from the PAYG system to a NDC system, with the rate of return being the interest rate, increases labor supply of both skilled and unskilled individuals; decreases the capital-effective labor ratio in the short run, while decreasing (increasing) the capital-effective labor ratio in the long run if the interest rate is greater (less) than the growth rate of output; increases the initial old generation’s utility, and reduces the current young generation’s utility; and decreases the utility of future unskilled individuals, and decreases (increases) the utility of future skilled individuals if the interest rate is greater (less) than the growth rate of output.

A switch from the PAYG system to a modified PAYG system, with the interest rate being greater than the growth rate of output, increases labor supply and decreases the capital-effective labor ratio slightly in period 1, and decreases labor supply and increases the capital-effective labor ratio after period 1; decreases the initial old and current young generations’ utility but increases future generations’ utility, and hurts the poor old more than the rich old while benefitting the poor in the future generations more than the rich. With the interest rate below the growth rate of output, the accumulated social security funds will not be enough to balance the social security budget.

This paper is related to studies on the sustainability of the PAYG system and various social security reforms induced by population aging. Cerda (2005) showed that the PAYG system is not sustainable and pension payments must decrease without continuous increase in the social security tax rate. Fanti and Gori (2012) found that a falling birth rate need not necessarily cause the fall of pensions in the long run in a simple OLG model. However, Cipriani (2014) showed that, population aging due to decreased birth rate and increased longevity implies a fall of pensions. Schon (2023) showed that the longevity effect has a positive impact on the rates of return which households generate within a PAYG pension system due to the expansion of the budget of the pension system. Many studies also analyzed the welfare implications of various social security reforms induced by population aging. Ono (2003) considered an economy in which population aging forces the government to issue debt to finance the payment and showed that the economy may achieve two dynamically inefficient equilibria with capital over accumulated. In an OLG model, Fehr et al. (2003) investigated five reform proposals for the Norwegian economy in a numerical OLG model with an endogenous retirement age and found that various reforms, which scale down the public non-actuarial pension system, lead to increases in the retirement age and steady-state welfare gains for all income classes. In a three-period OLG model with fertility and human capital accumulation being endogenous, Cigno (2010) outlined a second-best policy which includes a public pension system made up of two parallel schemes: a Bismarckian one allowing individuals to qualify for a pension by working and paying contributions, and an unconventional one allowing them to qualify for a pension by having children and investing time and money in their upbringing. Bonenkamp et al. (2017) showed formally that pension reform can be seen as a welfare-best response to population aging. The above studies demonstrated the unsustainability of the current PAYG social security system and discussed possible solutions, such as issuing government debt, scaling down the public non-actuarial pension system, qualifying a pension by having children, moving to a defined contributions scheme, etc. The current study addresses the issue of social security unsustainability by examining two social security reforms: a switch from the PAYG to a NDC system, and a switch to a modified PAYG system.

This paper is also related to a strand of literature on the NDC system. It is believed that the NDC system can provide incentives for individuals to contribute to the social security system and can maintain the system fiscally sustainable (see Diamond (1996) and Auerbach and Lee (2009)).Footnote 4 Questions have been raised concerning the NDC system. Valdés-Prieto (2000) showed that notional account benefit formulas cannot provide automatic financial equilibrium in the short run which is a serious problem. Börsch-Supan (2005) examined traditional PAYG defined benefit (DB) and the NDC systems based on the pension reform process in Sweden, Italy, and Germany and showed that properly designed NDC pension systems contain powerful economic and political mechanisms that may facilitate pension reform, but that the distinction between the NDC and DB systems is more ambiguous than usually claimed. Williamson and Williams (2005) raised the equity issues of the NDC system by arguing that the low-waged and women will be punished by the new system. In an OLG model in which endogenous growth relies on the accumulation of knowledge driven by skilled workers, Le Garrec (2015) showed that conventional pension systems, contrary to NDC systems, can enhance economic growth by linking benefits only to the partial earnings history, and thus, the optimal adjustment could consist of increasing the size of existing retirement systems rather than switching to a NDC system. While the above studies focused on issues concerning fiscal sustainability, risks spreading across generations, equity for the different groups, economic growth, etc., this study examines the effects of NDC system on labor supply of different individuals, capital accumulation, and inter- and intra-generational welfare.

The paper contributes to the literature in the following ways. First, it extends the literature on social security unsustainability by considering a modified PAYG system in which both the contribution rate and the rate of return to contribution are fixed for all generations. A switch from the traditional PAYG system to the modified PAYG system represents a reduction of the generosity of the PAYG system for the current generations but an increase in the generosity for future generations. In the existing literature (see, for example, Li and Lin 2016), to balance the social security budget due to the population aging, the generosity of a PAYG pension system must be reduced for current young and future generations through either a reduction of pension payment or a delay of retirement, with contribution rate being given.

Second, it extends the literature on the NDC system by examining the effect of a transfer to a NDC system on labor supply, capital accumulation, and welfare of different skill groups within and across generations under alternative rates of return to personal accounts. Specifically, we considered the rate of return to a personal account being equal, less than, and greater than that in the PAYG system. Alternative results are obtained under different circumstances.

Third, this paper examines the effects of social security reforms by using Chinese data. China has already accumulated debt in the PAYG social security account (see Li and Lin (2019)). The government is eager to find ways to reform the current PAYG system. Economists including Feldstein (1999) suggested China privatize the system. However, with a large implicit social security debt (the social security benefit owed to current retirees and those who have contributed to the system), social security privatization is very difficult. Some advised China to switch to the NDC system (e.g., Barr and Diamond (2010)), while others suggested China reduce the debt and accumulate assets in the PAYG account (e.g., Li and Lin (2019)). To make an appropriate choice, it is necessary to understand the effect of the two types of social security reform.

The paper proceeds as follows. Section 2 presents the model. Section 3 describes a NDC system and a modified PAYG system. Section 4 discusses the data and model calibration. Section 5 provides simulation analyses of switching from the PAYG system towards a NDC system and towards a modified PAYG system, i.e., the scheme of saving part of the receipts for the future. Section 6 concludes.

2 The model

There are many individuals and firms in a two-period economy. Period 1 is young adulthood, during which individuals supply labor, contribute to the pension system, consume, and save for their old days. Period 2 is old adulthood, which is reached with a probability \({p}_{t}\), where \(0<{p}_{t}<1\). During the old age, individuals do not work, and consume their savings and pension benefits. As in Leroux et al. (2021), the probability of survival to the second period is exogenous.Footnote 5 The population of young generation in period t +1 (also called generation t +1), \({N}_{t+1}\), is:\({N}_{t+1}=\left(1+{n}_{t+1}\right){N}_{t}\), where \({n}_{t+1}\) is the population growth rate of the young generation. Like Yuan et al. (2018), fertility is exogenous.Footnote 6 We focus on the impact of social security reforms on capital accumulation, income redistribution, and welfare with the population aging.Footnote 7

2.1 Heterogeneity

Individuals differ in labor ability. Specifically, there are two types of individuals within a generation, type-H and type-L. Following Fuster et al. (2003), labor ability affects individual’s lifetime opportunities in two ways. First, labor ability determines the quality of individual’s labor. Type-H denotes the skilled individual who has higher quality labor (the rich); while type-L denotes the unskilled individual who has lower quality labor (the poor). Second, labor ability determines an individual’s life expectancy.Footnote 8 Following Leroux et al. (2021), we assume that type-H individuals have a high life expectancy, i.e., a high probability to reach the old age, whereas type-L have a low life expectancy.

Let \(\phi\) stand for the proportion of skilled individuals within a generation, and \(1-\phi\) stand for the proportion of unskilled individuals within a generation.Footnote 9 The number of the H-type young generation in period t is \({N}_{t}^{H}=\phi {N}_{t}\), and the number of the L-type young individuals in period t is \({N}_{t}^{L}=\left(1-\phi \right){N}_{t}\). The total number of young individuals in period t is \({N}_{t}={N}_{t}^{H}+{N}_{t}^{L}\). Let \({p}_{t+1}^{i}\) denote the probability to reach the old age for type-i individual born in period t, \(i=H,L\), and we have \({p}_{t+1}=\phi {p}_{t+1}^{H}+\left(1-\phi \right){p}_{t+1}^{L}\). Adding up young and old generations living in period t gives the total population,\({P}_{t}\), living in that period: \({P}_{t}=\left({N}_{t}^{H}+{N}_{t}^{L}\right)+\left({p}_{t}^{H}{N}_{t-1}^{H}+{p}_{t}^{L}{N}_{t-1}^{L}\right)={N}_{t}+{p}_{t}{N}_{t-1}\).

Population aging due to declining fertility and rising life expectancy leads to increase in the old-age dependency ratio.Footnote 10 To describe the aging of the population, we assume that (1) the population growth rate of the young generation (\({n}_{t}\)) keeps decreasing until \({n}_{T}\) in period T; and remains unchanged afterwards; (2) the probability to live until the second period keeps increasing until it reaches to \({p}_{T}^{i}\) in period T, and it remains unchanged afterwards. Specifically,

That is, \({n}_{t+1}\le {n}_{t}<\dots <{n}_{1}\), and \({p}_{t+1}^{i}\ge {p}_{t}^{i}>\dots >{p}_{1}^{i}\) (for t > 1, and \(i=H,L\)).

2.2 The firm

The economy produces one good, which can be either consumed or invested. Each individual is endowed with one unit of time in the first period, which can be either allocated for leisure or for work. Let \({l}_{t}^{i}\) be the time used for leisure by a type i agent in period t, and \({e}_{t}^{i}=1-{l}_{t}^{i}\) be the labor supplied by a type i agent in period t. Thus, total amount of labor supplied by generation t in period t, is:

where \(1-{l}_{t}=\left(1-{l}_{t}^{H}\right)\phi +\left(1-{l}_{t}^{L}\right)\left(1-\phi \right)\) is the average labor supply per worker in period t. Let \({e}_{t}=1-{l}_{t}\).

Output is produced by identical competitive firms using a constant-returns-to-scale production technology. There are two inputs in the production: capital and labor. Specifically, the production function is as follows:

where \({K}_{t}\) is the stock of capital in period t; \({A}_{t}\) is the productivity parameter, \({A}_{t+1}=\left(1+\gamma \right){A}_{t}\) where \(\gamma ={A}_{t+1}/{A}_{t}-1\) is the growth rate of productivity, \({A}_{t}{L}_{t}\) is effective labor. Let \({y}_{t}={Y}_{t}/\left({A}_{t}{L}_{t}\right)\), the output-effective labor ratio, and \({k}_{t}\)=\({K}_{t}/\left({A}_{t}{L}_{t}\right)\), the capital-effective labor ratio. Assume that capital is fully depreciated after one period’s production, as in Lin (1998) and Lin and Tian (2003).Footnote 11

Factor markets are perfectly competitive. The rate of return to each factor is its marginal product.

where \(1+{r}_{t}\) is the rate of return to capital, \({w}_{t}\) is the rate of return to effective labor, and \({A}_{t}{w}_{t}\)= \(\partial {Y}_{t}/\partial {L}_{t}\) is the rate of return to labor. Hence, \({A}_{t}{w}_{t}^{H}\left(1-{l}_{t}^{H}\right)\) and \({A}_{t}{w}_{t}^{L}\left(1-{l}_{t}^{L}\right)\) is the labor income for each skilled individual and unskilled individual, respectively. Since the skilled individual has higher quality labor than the unskilled individual, we assume that \({w}_{t}^{H}=\beta {w}_{t}^{L}\), and \(\beta\)>1. Thus, we obtain the following total wage income of the young generation:

2.3 The consumer

Each individual lives for two periods, deciding how much to consume and how much time to allocate for work in the first period; and consuming savings, interest income, and pension benefits in the second period. Following Blanchard (1985), Leroux and Ponthiere (2018), we assume that there exists a perfect annuity market with actuarially fair returns. The return on savings for an individual of type i in case of survival to old age is \(\left(1+{r}_{t+1}\right)/{p}_{t+1}^{i}\).Footnote 12 Thus, the type-i individual faces the following utility maximizing problem (i = H, L):

where i = H, L, denoting the type-H individual (the skilled individual) and the type-L individual (the unskilled individual), respectively; \({c}_{t,t+j}^{i}\) is consumption in period t+j of an agent of type i born in period t (called generation t), j = 0, 1; \(\pi\) is the payroll tax rate; \({A}_{t}{w}_{t}^{i}\left(1-{l}_{t}^{i}\right)\) is the labor income of an agent of type i born in period t; \(\pi {A}_{t}{w}_{t}^{i}\left(1-{l}_{t}^{i}\right)\) is the social security tax or contribution to the social security system ; \({v}_{t+1}^{i}\) is the social security benefits of an agent of type i born in period t received in the period of t+1; \({\tau }_{t}^{i}\) is the lump-sum tax collected in period t from an agent of type i born in period t; and \({s}_{t}^{i}\) represents private savings in period t of an agent of type i born in period t, which is the difference between the first-period disposable income and the first-period consumption. Combining the above two budget constraints, we have:

where \({E}_{t}^{i}\) is the present value of lifetime disposable income of the type- i individual in period t.

The utility function is twice differentiable and strictly quasi-concave. The marginal utility is positive but diminishing. To obtain explicit solutions for savings and other endogenous variables and to keep the model tractable, assume that the utility function is log-linear:

where \(\delta\) is the leisure preference, ρ is pure rate of time preference or discount factor, and \({p}_{t+1}^{i}\) is the probability of survival to the second period for the type-i individual. The individual of type- i who is young in period t chooses savings \({s}_{t}^{i}\) and leisure \({l}_{t}^{i}\), and forms anticipations about future interest rate \({r}_{t+1}^{E}\), so as to maximize his/her lifetime welfare, taking market prices as given. Following Ponthiere (2020), assume that individuals have perfect foresight, so that \({r}_{t+1}^{E}={r}_{t+1}\).Footnote 13 Solving the agent's maximization problem in the PAYG system yields:Footnote 14

Equations (8), (9), (10), and (11) show the optimal first- and second-period consumption, leisure, and optimal savings.

2.4 The government

The government runs a social security system and faces the following constraint:

where \({B}_{t}\) is the social security expenditure, i.e., the total amount that the government must pay to all retirees living in period t (or born in period t-1); Zt denotes the government’s social security savings in period t, which equals social security revenue minus social security expenditure in period t. Social security revenue includes social security contribution,\(\pi {A}_{t}{w}_{t}{L}_{t}\), lump-sum tax, \({\tau }_{t}{N}_{t}=\left[{\tau }_{t}^{H}\phi +{\tau }_{t}^{L}\left(1-\phi \right)\right]{N}_{t}\), and principal and interest of last period’s social security savings, \(\left(1+{r}_{t}\right)\) Zt-1. In the PAYG system, the government uses payroll tax to finance social security benefits, with \({\tau }_{t}^{i}\)= 0 and Zt = 0. In the modified PAYG system, the government saves part of the receipts and uses payroll tax to finance social security benefits, with \({\tau }_{t}^{i}\)= 0 and Zt > 0. In the NDC system, the government uses payroll tax and lump-sum tax to finance social security benefits, with Zt = 0. When the predetermined rate of return in the NDC system is not the same as the rate of return in the PAYG system, lump-sum tax must be used to balance the social security budget. For simplicity, we assume that other government expenditures and taxes are absent.

Dividing both sides of Eq. (12) by \({A}_{t}{L}_{t}\) yields:

where \({z}_{t}={Z}_{t}/\left({A}_{t}{L}_{t}\right)\).

2.5 The equilibrium

A competitive equilibrium for the economy is a set of sequences \(\left\{{l}_{t},{r}_{t},{w}_{t},{w}_{t}^{i},{c}_{t,t}^{i},{c}_{t,t+1}^{i},{l}_{t}^{i},{s}_{t}^{i},{z}_{t},{k}_{t}\right\}\) satisfying Eqs (1), (2), (3), (4), (8), (9), (10), (11), (13), and

where \({K}_{t+1}\) is the private capital to be used in period t+1, \({S}_{t}\) is the total savings at the end of period t, \({N}_{t}{s}_{t}\) is the private savings at the end of period t, and Zt is the government’s social security savings in period t.

Dividing both sides of Eq. (14) by effective labor in period t,\({A}_{t}{L}_{t}\) yields:

Recall that \({N}_{t+1}/{N}_{t}=1+{n}_{t+1}\) and \({A}_{t+1}/{A}_{t}=1+\gamma\).

In the PAYG system, social security is financed by a payroll tax. An individual only needs to pay the payroll tax, \(\pi {A}_{t}{w}_{t}^{i}\left(1-{l}_{t}^{i}\right)\), and does not pay any additional tax (i.e., \({\tau }_{t}^{i}\)= 0). The contribution made by all young individuals in period t,\(\pi {A}_{t}{w}_{t}\left(1-{l}_{t}\right){N}_{t}\), is used directly to pay social security benefit,\({B}_{t}\), to the old generation living in period t, where \({B}_{t}={v}_{t}{p}_{t}{N}_{t-1}={v}_{t}^{H}{p}_{t}^{H}\phi {N}_{t-1}+{v}_{t}^{L}{p}_{t}^{L}\left(1-\phi \right){N}_{t-1}\). Thus, there is no social security savings (i.e., Zt = 0). The social security budget constraint is as follows:

where \({v}_{t}\) is the average social security benefits of an agent, born in period t-1 and survived to period t, received in the period of t. Let \({v}_{t}^{H}=\chi {v}_{t}^{L}\), and 1<\(\chi <\beta\). Recall that \({v}_{t}^{H}\) and \({v}_{t}^{L}\) is the pension benefit for the skilled individual and the unskilled, and we have \({v}_{t}^{H}={\varepsilon }_{v,t}^{H}{v}_{t}\) and \({v}_{t}^{L}={\varepsilon }_{v,t}^{L}{v}_{t}\), where \({\varepsilon }_{v,t}^{H}={p}_{t}\chi /\left[{p}_{t}^{H}\phi \chi +{p}_{t}^{L}\left(1-\phi \right)\right]\), and \({\varepsilon }_{v,t}^{L}={p}_{t}/\left[{p}_{t}^{H}\phi \chi +{p}_{t}^{L}\left(1-\phi \right)\right]\). Thus, \(\left[\left(p_t^Hv_t^H\right)/\left(p_t^Lv_t^L\right)\right]/\left(w_t^H/w_t^L\right)=\left(p_t^H/p_t^L\right)\left(\chi/\beta\right)\) can proxy the intragenerational redistribution of the PAYG system.Footnote 15

As mentioned earlier, in the present model, to capture the increase in the life expectancy, it is assumed that the probability of surviving to the second period is less than 1, but the probability is increasing over time. With these assumptions, the number of individuals alive in the second period is less than that in the first period. Therefore, the social security benefit of an individual, born in period t-1 and survived to period t, should be the contribution of \(1+{n}_{t}\) young individuals divided by the survival probability, \({p}_{t}\) (see Eq. (16)). At any given growth rate of productivity, pension benefit in the PAYG system depends on both population growth rate of the young generation and the probability of survival to the second period. Either declining fertility or rising life expectancy could cause the pension benefits of the current working generation and the future generations decrease if the payroll tax rate,\(\pi\), remains unchanged. Thus, the PAYG system hurts current working generations and future generations. How to alleviate the burden of future retirees has been a challenge in social security reform.

Facing the declining fertility, the rising life expectancy, and the unsustainability of the PAYG system, scholars put forward several solutions, for example, social security privatization (e.g., Feldstein (1995), Feldstein and Samwick (1996), Kotlikoff (1996a), Kotlikoff et al. (1998)), switching to a NDC system (e.g., Barr and Diamond (2010)), and saving part of the current receipts in the current PAYG system for future social security expenditure, called the modified PAYG system (e.g., Greenspan Commission (1983), and Congress of the United States (1983)). Due to large implicit social security debt (the amount the government owed to current retirees and those who have already contributed to the PAYG system), many countries are now reluctant to privatize the current PAYG system, and some turn to the second and third options. We will focus on the analysis of the NDC system and the modified PAYG system.

3 A NDC system vs a modified PAYG system

3.1 Switching to a NDC system

This subsection examines a social security reform that switches from the current PAYG system to a NDC system. In reality, countries that adopted the NDC system selected different rates to achieve financial sustainability.Footnote 16 In our paper, two cases are considered, a case where the rate of return to personal accounts is equal to the growth rate of total wage (which is the same as the rate of return under the PAYG system and can guarantee financial sustainability), and a case where the rate of return to personal accounts is equal to the interest rate.

3.1.1 Case 1: With the rate of return being the growth rate of total wage

Assume that starting from period 1 the government decides to reform the PAYG social security system and establishes a NDC system. The rate of return in the NDC system is predetermined and social security savings is zero (i.e., Zt = 0). Assume that the rate of return to personal accounts of type-i agent is the growth rate of their total wage, i.e.,

Recall that \({w}_{t}^{i}\), \(1-{l}_{t}^{i}\), and \({N}_{t}^{i}\) are the wage rate, labor supply, and the number of young generation for the type-i agent in period t, respectively. Lump-sum tax (\({\tau }_{t}^{i}\)) is endogenous to maintain the balance of government budget, and equals zero (i.e., \({\tau }_{t}^{i}\)= 0) with this rate of return. The pension benefit equation can be written as follows:

where \(\left[\pi {A}_{t-1}{w}_{t-1}^{i}\left(1-{l}_{t-1}^{i}\right){N}_{t-1}^{i}\right]\) is the payroll tax paid by all young agents of type-i in period t-1. Dividing both sides of the above equation by \({p}_{t}^{i}{N}_{t-1}^{i}\) gives;

Maximizing the type-i individual’s utility (see Eq. (5)), subjected to the budget constraints (Eqs (6) and (17)) yields:Footnote 17

Equations (18), (19), (20), and (21) show the optimal first- and second-period consumption, leisure, and optimal savings in the NDC system with the rate of return being the growth rate of total wage. Using Eq. (17), we obtain the ratio of pension benefit between the rich and the poor for generation t-1, \({v}_{t}^{H}/{v}_{t}^{L}\):

where \(\left[{w}_{t}^{H}\left(1-{l}_{t}^{H}\right)\right]/\left[{w}_{t}^{L}\left(1-{l}_{t}^{L}\right)\right]\) is the ratio of labor income between the rich and the poor for generation t;\({p}_{t}^{i}\) is the probability to reach the old age for type-i individuals born in period t-1 (generation t-1); and \(\beta ={w}_{t}^{H}/{w}_{t}^{L}\) is the ratio of wage rate between the rich and the poor, as defined earlier. According to Eq. (22), \({v}_{t}^{H}/{v}_{t}^{L}\), is related to \(\beta\), implying no redistribution from the skilled to the unskilled.

3.1.2 Case 2: With the rate of return being the interest rate

Assume that starting from period 1 the government decides to reform the PAYG social security system and establishes a NDC system. The rate of return in the NDC system is predetermined and social security savings is zero (i.e., Zt = 0). We assume that the rate of return to personal accounts is the interest rate. With this predetermined rate of return, additional taxes may be needed to balance government budget. For simplicity, a lump-sum tax, \({\tau }_{t}^{i}\), is used to balance the government budget.\({\tau }_{t}^{i}\) can be either positive or negative.

The pension benefit per old person in period t and lump-sum tax per young person in period t are as follows:Footnote 18

where \(\left[\pi {A}_{t-1}{w}_{t-1}^{i}\left(1-{l}_{t-1}^{i}\right){N}_{t-1}^{i}\right]\) is the payroll tax paid by all young agents of type-i in period t-1. Maximizing the type-i individual’s utility (see Eq. (5)), subjected to the budget constraints (Eqs (6), (23), and (24)) yields:Footnote 19

Equations (25)-(28) show the optimal first- and second-period consumption, leisure, and optimal savings in the NDC system with the rate of return being the interest rate. Using Eq. (23), we obtain the ratio of pension benefit between the rich and the poor for generation t-1,\({v}_{t}^{H}/{v}_{t}^{L}\):

where \(\left[{w}_{t-1}^{H}\left(1-{l}_{t-1}^{H}\right)\right]/\left[{w}_{t-1}^{L}\left(1-{l}_{t-1}^{L}\right)\right]\) is the ratio of labor income between the rich and the poor for generation t-1. Recall that \({p}_{t}^{i}\) is the probability to reach old age for type-i individuals born in period t-1 (generation t-1); and \(\beta\) is the ratio of wage rate between the rich and the poor. With the rate of return being the interest rate, a NDC system connects contributions paid at young to the pension benefits received at old. This link increases the incentive of labor supply compared to the PAYG system. As we can see from Eq. (29), the more labor supplied, the more pension benefit one can receive at old age. Consequently, a move from the PAYG system to a NDC system decreases pension progressivity, and increases the incentive for labor supply (Fehr 2000).

3.2 Switching to a modified PAYG system

Assume that starting from period 1 the government decides to reform the current PAYG system, i.e., saves part of the receipts for the future in a modified PAYG system. Specifically, social security contribution collected in period 1 is divided into two parts: one part is used for pension benefit in period 1; the other part is saved to support future retirees. Let \(\theta\) be the proportion used for pension benefits in period 1 and 1-\(\theta\) be the proportion saved for the future. An individual only needs to pay the payroll tax, \(\pi {A}_{t}{w}_{t}^{i}\left(1-{l}_{t}^{i}\right)\), and does not pay any additional tax (i.e., \({\tau }_{t}^{i}\)= 0). Recall that in the PAYG system, the average pension benefit is \({v}_{t}=\pi {A}_{t}{w}_{t}\left(1-{l}_{t}\right)\left(1+{n}_{t}\right)/{p}_{t}\)(see Eq. (16)) with the rate of return being \(\left(1+{n}_{t}\right)\left(1+\gamma \right)\). Assume that with the rate of return to contribution being \(\theta \left(1+{n}_{1}\right)\left(1+\gamma \right)\) and 0 <\(\theta\)<1 under the modified PAYG system, the average pension benefit, \({v}_{t}\), becomes:

Similar to the PAYG system, a skilled individual’s pension benefit is higher than an unskilled individual’s pension benefit, i.e.,\({v}_{t}^{H}=\chi {v}_{t}^{L}\), and 1<\(\chi <\beta\). Recall that \(\beta\) is the ratio of a skilled individual’ wage to an unskilled individual’s wage. Thus,

where \({\varepsilon }_{v,t}^{H}={p}_{t}\chi /\left[{p}_{t}^{H}\phi \chi +{p}_{t}^{L}\left(1-\phi \right)\right]\), and \({\varepsilon }_{v,t}^{L}={p}_{t}/\left[{p}_{t}^{H}\phi \chi +{p}_{t}^{L}\left(1-\phi \right)\right]\). In period 1, the social security contribution is \(\pi {A}_{1}{w}_{1}\left(1-{l}_{1}\right){N}_{1}\), and the social security expenditure is \({B}_{1}={v}_{1}{p}_{1}{N}_{0}\). Thus, the social security savings in period 1 is \({Z}_{1}=\left(1-\theta \right)\pi {A}_{1}{w}_{1}\left(1-{l}_{1}\right){N}_{1}\). We also obtain the social security savings in period t as follows:

where the first term is the gap between the social security contribution and social security expenditure in period t; and the second term is the principal and interest of last period’s social security savings. Maximizing the type-i individual’s utility (see Eq. (5)), subjected to the budget constraints (Eqs. (6), and (30)) yields the optimal first- and second-period consumption, leisure, and optimal savings, which are the same as Eqs. (8)-(11).Footnote 20

4 Calibration

In this section, we calibrate the model to China’s data. To solve the model, we specify the demographic transition process, the preference and technology parameters, and the social security tax rate. We now introduce our parameter choices based on data for the Chinese economy, summarized in Table 1.

For demographic parameters we use population data and projections from the United Nations (2020) and life expectancy for each province from the China National Bureau of Statistics (2021). Specifically, we need to calibrate the population growth rate of the young generation and the survival probabilities. We assume that, in our two-period model, each period lasts 35 years. Based on the data from the United Nations (2020), the population growth rate is set at 0.1 in period 1, keeps decreasing to -0.15 in period 4, and remains unchanged afterwards;Footnote 21 the average survival probability,\({p}_{t}\), is set at 0.59 in period 1, keeps increasing to 0.82 in period 4, and remains unchanged afterwards.Footnote 22 Note that the United Nations (2020) only provides average values for \({p}_{t}=\phi {p}_{t}^{H}+\left(1-\phi \right){p}_{t}^{L}\). In order to calibrate the type-i individual’s survival probabilities,\({p}_{t}^{H}\) and \({p}_{t}^{L}\), we need to know the proportion of skilled individuals in a generation,\(\phi\). Following Takahashi and Yamada (2022), we classify the skilled and the unskilled individuals according to their educational attainment, with college education or above being the skilled, and the rest being the unskilled.Footnote 23 In 2020, among the employed persons, 22% have college education or above (see China National Bureau of Statistics 2021). Therefore, the proportion of skilled individuals in a generation is set at 0.22 (\(\phi\)= 0.22).Footnote 24

Next, we need to estimate the ratio of the survival probability of the skilled to that of the unskilled,\({p}_{t}^{H}/{p}_{t}^{L}\). The household or individual level data are not available for estimating the skill-dependent survival rates in China. The China National Bureau of Statistics (2021) published population life expectancy by regions. In general, regions with high per capita disposable income have a longer life expectancy. Thus, we estimate the skill dependent survival rates by regional data. We obtain life expectancy at birth, per capita disposable income, and population in each province in the years of 2000, 2010, and 2020, and use these data to proxy \({p}_{t}^{H}/{p}_{t}^{L}\).Footnote 25 Based on our calculation, the ratio of the survival probability of the skilled to that of the unskilled,\({p}_{t}^{H}/{p}_{t}^{L}\), is 1.13 for 2020, close to 1.122 that was estimated by Leroux et al. (2021) for France. In addition, the gap between the life expectancies of the rich and the poor decreased from 2000 to 2020 in China. Thus, we assume that \({p}_{t}^{H}/{p}_{t}^{L}\) declines gradually.Footnote 26 Specifically, we set \({p}_{t}^{H}/{p}_{t}^{L}\)=1.13 in period 1, which gradually declines to 1.05 in period 4, and remains unchanged afterwards. Based on the average value \({p}_{t}\), the proportion parameter \(\phi\), and the ratio \({p}_{t}^{H}/{p}_{t}^{L}\), we obtain \({p}_{t}^{H}\), and \({p}_{t}^{L}\) in the base year and afterwards (see Table 1).

In the calibration for the household sector, following Zhang et al. (2022), we use the annual discount factor of 0.98 and the weighted average survival probability in period 1 (\({p}_{1}\)), to obtain the pure rate of time preference ρ = 0.85.Footnote 27 Following Auerbach and Kotlikoff (1987), Fehr and Habermann (2008), and Mateos-Planas (2010), the leisure preference parameter, \(\delta\), is calibrated to match the fact that young individuals work approximately 40 percent of the time. The parameter determining the pension benefit and the wage rate of the type-i individual, \(\chi\) and \(\beta\), is calibrated to match the data from Peking University, China Family Panel Studies (CFPS 2018).Footnote 28 Based on the data, we set \(\chi =2\), and \(\beta =3\).Footnote 29

In the calibration for the production sector, we use the historical labor’s share in production in China to calibrate the value of \(\alpha\). Following Auerbach et al. (1991), we adjust labor earnings data by making them equal to the sum of (1) the compensation of employees, and (2) a portion of net production tax. Based on our calculation, the average labor share is 0.59 in 1980-2017 and we set \(\alpha\)=0.4.Footnote 30 According to the China National Bureau of Statistics (2022), China’s annual per capita GDP growth rate is 2.05% in 2020, which yields the productivity growth rate \(\gamma\)= (1+0.0205) 34 -1=0.9936.

For the social security system, the contribution to the pension system is approximately 2.9% of GDP in 2020.Footnote 31 The payroll tax rate is calibrated to match this ratio. The proportion of social security receipts used for pension benefits in period 1, \(\theta\), is assumed to be 0.9, and we also conduct a sensitivity analysis for different values of 0.8, 0.7, and 0.6.

5 Quantitative analysis

The baseline simulation shows the variables under the PAYG system, and the simulation of the reforms shows the results under a NDC system or a modified PAYG system. We compare these results to examine the effects of the social security reform (i.e., switching from the current PAYG system to a NDC system or a modified PAYG System) on labor supply, pension benefit, capital-effective labor ratio, aggregate output, and welfare.

5.1 Switching to a NDC system

5.1.1 Case 1: With the rate of return being the growth rate of total wage

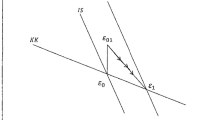

Figure 1 illustrates effects of a switch from the PAYG system to a NDC system with the rate of return being the growth rate of total wage on labor supply, pension benefit, capital-effective labor ratio, and aggregate output. For convenience, we define the ratio of aggregate output under the NDC system to the aggregate output under the PAYG system as \({\widehat{Y}}_{t}\), and we define \({\widehat{e}}_{t}^{H}\),\({\widehat{e}}_{t}^{L}\),\({\widehat{v}}_{t}^{H}\),\({\widehat{v}}_{t}^{L}\), and \({\widehat{k}}_{t}\), in a similar way. Note that the ratio being greater (less) than 1 means that the reform increases (decreases) the represented variable, and the ratio equal to 1 means that the reform does not affect the represented variable.

Recall that from Eq. (22), the NDC system does not have an intragenerational redistributive function unlike the PAYG system. The ratio of the pension benefit of the rich to that of the poor is related to the ratio of their wages, \(\beta\). As a result, pension benefits for the skilled and the unskilled change in the opposite direction after the switch from the PAYG system to a NDC system. As shown in Figures 1C and D, pension benefit increases for the skilled while decreasing for the unskilled. After the pension reform, the skilled obtains higher pension benefit, higher life-time disposal income, more leisure, and thus, supplies less labor; while the unskilled does the opposite (see Fig. 1A and B). The total labor supply increases after the reform.

Figure 1E shows the change in capital-effective labor ratio. The capital-effective labor ratio decreases slightly in the first few periods, and then, increases to the same level as that in the PAYG system. On the one hand, at the beginning of period 1, aggregate capital (\({K}_{1}\)) is the same under both systems, but total labor supply is higher in the NDC system than in the PAYG system, which causes capital-effective labor ratio to decrease in the first period (lower than 0.1%). On the other hand, with the rate of return being the growth rate of total wage, the payroll tax collected from the young is exactly equal the pension benefit paid to the old, which implies that lump-sum tax is zero in the NDC system. As the rates of return in both pension systems are the same, the capital-effective labor ratio increases to the same level as that in the PAYG system in the steady state. The evolvement of aggregate output is displayed in Fig. 1F. In the NDC system, aggregate output is higher than that in the PAYG system, which mainly comes from the increase in the total labor supply.

In summary, with the rate of return being the growth rate of total wage, a switch from the PAYG system to a NDC system, (1) increases labor supply of the unskilled individual but decreases labor supply of the skilled individual; and (2) in the beginning periods reduces, and then, does not affect the capital-effective labor ratio.

What about utility? Let \(u_t^i\left(c_{t,t}^i,\;c_{t,t+1}^i,l_t^i\right)=\log\;c_{t,t}^i+\delta\;\log\;l_t^i+p_{t+1}^i\rho\;\log\;c_{t,t+1}^i\), denote utility level in the PAYG system and \(\widetilde u_t^i\left(\widetilde c_{t,t}^i,\widetilde c_{t,t+1}^i,\widetilde l_t^i\right)=\log\;\widetilde c_{t,t}^i+\delta\;\log\;\widetilde l_t^i+p_{t+1}^i\rho\;\log\;\widetilde c_{t,t+1}^i\) denote utility level in the NDC system, where i = H, L denoting the skilled individual (the rich) and the unskilled individual (the poor). Adjust consumption and leisure to make an individual in the PAYG system achieve the same level of utility as the individual in the NDC system. Define \({\lambda }_{t}^{i}\) satisfying the following equation:

Solving the above equation, we obtain the value of \({\lambda }_{t}^{i}\). If \({\lambda }_{t}^{i}\)>1 (or \({\lambda }_{t}^{i}\)<1), which means that consumption and leisure should be increased (or decreased) by \({\lambda }_{t}^{i}-1\) (or \(1-{\lambda }_{t}^{i}\)) in order to make people in the PAYG system achieve the same utility level as in the NDC system.

Figure 2 shows the impact of a switch from the PAYG system to a NDC system with the rate of return being the growth rate of total wage on utility of current and future generations, i.e., the value of \({\lambda }_{t}^{i}\).Footnote 32 The reform increases the utility of the skilled (the rich) while decreasing the utility of the unskilled (the poor). The intuition is clear. The PAYG system has an intragenerational redistributive function: the rich contribute more into the pension system but receive relatively less pension benefit, while the poor contribute less into the pension system but receive relatively more pension benefit.Footnote 33 When switching to the NDC system, the intragenerational redistributive function disappears as shown in Figures 1C and D, and thus, the skilled is better off while the unskilled is worse off.

Briefly, with the rate of return being the growth rate of total wage, a switch from a PAYG system to a NDC system favors the skilled, which makes the skilled gains and the unskilled loses.

5.1.2 Case 2: With the rate of return being the interest rate

Figure 3 illustrates the effects of a switch from the PAYG system to a NDC system with the rate of return being the interest rate on labor supply, pension benefit, capital-effective labor ratio, and aggregate output. Figures 3A and B show the change in labor supply. Labor supply of both the skilled and the unskilled increases, with labor supply of the unskilled increasing more than that of the skilled. The intuition is clear. As Eq. (29) shows, the NDC system connects contributions made at young to the pension benefits received at old, and hence increases the incentive of labor supply compared to the PAYG system.

If the rate of return in the NDC system is the interest rate, the interest rate determines whether the pension benefit in the NDC system is higher or lower than that in the PAYG system. Specifically, when the interest rate is greater (less) than the growth rate of output, the average pension benefit in the NDC system is greater (less) than that in the PAYG system. Therefore, we need to consider both the interest rate being greater than and less than the growth rate of output. Based on the plausible parameters described in Section 4, the baseline (the PAYG system) simulations indicate that \(\left(1+{r}_{t}\right)>\left(1+{n}_{t}\right)\left(1+\gamma \right)\). Therefore, a switch from a PAYG system to a NDC system with the rate of return equal to the interest rate, increases the average pension benefit. Since the pension benefit depends on the individual’s own contribution, the NDC system does not have intragenerational redistributive function as does the PAYG system. As a result, changes in pension benefit for the skilled and the unskilled are different: pension benefit increases more for the skilled than for the unskilled, as Figures 3C and D show. Since pension benefit of the unskilled increases less than that of the skilled, life-time disposal income and leisure increases less, and hence, labor supply increases more. In our simulations, labor supply for the unskilled increases 7.34% and for the skilled individual increases 6.65% in the steady state.

To maintain the guaranteed pension benefit as well as maintain fiscal balance, more tax revenue must be collected, i.e.,\({\tau }_{t}^{i}\)> 0. The increase in tax reduces the disposable income and private savings, resulting in a decrease in capital accumulation. In the steady state, the capital-effective labor ratio in the NDC system is 87% of that in the PAYG system (see Fig. 3E). If the predetermined rate of return in the NDC system is greater than that in the PAYG system, the NDC system has a lower capital-effective labor ratio than the PAYG system. The evolvement of aggregate output is displayed in Fig. 3F. The positive effect from a higher labor supply dominates the negative effect from a lower capital-effective labor ratio, leading to an increase in the aggregate output.

In summary, if the interest rate is greater than the growth rate of output in the PAYG system, a switch from the PAYG system to a NDC system with the rate of return being the interest rate, (1) increases labor supply but increases labor supply of the unskilled more than that of the skilled; and (2) decreases the capital-effective labor ratio.

Figure 4 shows the impact of a switch from the PAYG system to the NDC system with the rate of return being the interest rate on utility of current and future generations. As in case 1, we focus on the value of \({\lambda }_{t}^{i}\). On average, the initial old has a utility gain while the following generations have a utility loss. Thus, the reform has a strong intergenerational redistribution effect. The intuition is clear. As we mentioned earlier, individuals obtain higher pension benefits and pay lump-sum tax in the first period of life in the NDC system (case 2). The initial old gains because they do not need to pay lump-sum tax but obtain higher pension benefit. As time goes by, capital stock and hence wage keep decreasing (as we can see from Fig. 3E), the loss from receiving lower wage and paying lump-sum tax dominate the gain from a higher pension benefit, and the following generations have a utility loss. Moreover, the reform favors the rich, which makes the skilled gain more or lose less than the unskilled, because of the elimination of the intragenerational redistributive function.

In short, if the interest rate is greater than the growth rate of output in the PAYG system, a switch from the PAYG system to a NDC system with the rate of return being the interest rate, increases the initial old generation’s utility, decreases current young and future generations’ utility, and makes the skilled gain more or lose less than the unskilled.

Figures 3 and 4 show the effects of transferring from a PAYG system to a NDC system with the rate of return being the interest rate when \(\left(1+{r}_{t}\right)\)>\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\). However, what happens if \(\left(1+{r}_{t}\right)\)<\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\)? Following Auerbach and Kotlikoff (1987) and Altig et al. (2001), we set capital’s share in production, \(\alpha\)=0.25; change the annual discount factor to 0.985,and redo the simulation.Footnote 34Now the baseline simulation under the PAYG system shows the case where \(\left(1+{r}_{t}\right)\)<\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\). When switching to a NDC system, the evolution for labor supply is similar to that in Figure 3 (see Fig. 5A and B). Because of the elimination of intragenerational transfers through social security, pension benefit increases for the skilled but decreases for the unskilled (see Fig. 5C and D). Capital-effective labor ratio decreases in the beginning periods, and then increases to the level higher than that in the PAYG system. At the beginning of period 1, aggregate capital (\({K}_{1}\)) is the same under both systems, but labor supply is higher in the NDC system than in the PAYG system, which causes capital-effective labor ratio to decrease in the first period. Recall from Eq. (24), when \({\tau }_{t}^{i}\)<0, young agents obtain lump-sum transfer. Lump-sum transfer increases the disposable income and private savings, resulting in a higher capital-effective labor ratio in the NDC system than in the PAYG system. In the steady state, the capital-effective labor ratio in the NDC system is 2.8% higher than in the PAYG system (see Fig. 5E). If the predetermined rate of return in the NDC system is less than in the PAYG system, the NDC system has a higher capital-effective labor ratio. Aggregate output is higher in the NDC system than in the PAYG system, which mainly comes from the increase in the labor supply and the capital-effective labor ratio (see Fig. 5F).

In summary, if the interest rate is less than the growth rate of output, a switch from the PAYG system to a NDC system with the rate of return being the interest rate, (1) increases labor supply and labor supply of the unskilled increases more than that of the skilled; and (2) in the beginning two periods decreases, and then increases the capital-effective labor ratio.

If the interest rate is less than the growth rate of output, i.e., \(\left(1+{r}_{t}\right)\)<\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\) in the PAYG system, a switch from a PAYG system to a NDC system, with the rate of return being the interest rate, increases the utility of the initial old generation and decreases the utility of the current young generation. Recall from Figure 5E, capital-effective labor ratio decreases in the beginning periods, which causes the interest rate to increase and the wage rate to decrease. Therefore, the initial old generation gains from the higher interest income obtained at the second period of life, while the current young generation loses from the lower wage received in period 1. Moreover, the reform increases the utility of the skilled (the rich) in future generations but decreases the utility of the unskilled (the poor) in future generations. The intuition is clear. With the rate of return being the interest rate, a switch from the PAYG system to the NDC system increases the capital-labor ratio and the wage rate in the long run (see Fig. 5E); pension benefit increases for the skilled but decreases for the unskilled (see Fig. 5C and D). Thus, the skilled is better off because of the increased wage and pension benefit, while the unskilled is worse off because the decrease in pension benefit is greater than the increase in wage (see Fig. 6).

In brief, if the interest rate is less than the growth rate of output in the PAYG system, i.e., \(\left(1+{r}_{t}\right)\)<\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\), a switch from the PAYG system to a NDC system, with the rate of return being the interest rate, (1) increases the utility of the initial old generation while decreasing the utility of the current young generation; and (2) increases the utility of future skilled individuals but decreases the utility of future unskilled individuals.

5.2 Switching to a modified PAYG system

Figure 7 illustrates the effects of a switch from the PAYG system to a modified PAYG system on labor supply, pension benefit, capital-effective labor ratio, and aggregate output. All generations, except the initial old and current young, obtain higher pension benefit (see Fig. 7C and D). The reason is clear. The rate of return in the modified PAYG system, i.e., \(\theta \left(1+{n}_{1}\right)\left(1+\gamma \right)\), is less than the rate of return in the PAYG system, i.e., \(\left(1+{n}_{t}\right)\left(1+\gamma \right)\), in the first few years.Footnote 35 However, with the decline of the population growth rate, we have \({n}_{t+1}\le {n}_{t}<{n}_{1}\)(for t > 1). Thus, over time, the rate of return to contribution in the modified PAYG system may become greater than that in the PAYG system.

Figures 7A and B show the change in labor supply. Labor supply decreases after transferring from the PAYG system to the modified PAYG system for all generations except the current young. The intuition is as follows. For the current young generation, they obtain a lower pension benefit, which decreases their disposable lifetime income, and hence decreases leisure and increases labor supply, by 0.02% on average. The following generations obtain higher wage, as well as higher pension benefit, and hence increase leisure time.

Figure 7E shows that the capital-effective labor ratio decreases in period 1, i.e., 0.02%, and increases after period 1. The intuition is clear. At the beginning of period 1, aggregate capital (\({K}_{1}\)) is the same under both systems, but labor supply is slightly higher in the modified PAYG system than in the PAYG system, leading to a decrease in the capital-effective labor ratio in period 1. Afterwards, as part of the social security contribution is saved to support future retirees, the accumulated social security funds clearly increase capital stock (see Eq. (15)). Aggregate output increases mainly because of the increase in the capital-effective labor ratio, as shown in Fig. 7F.

In summary, if the interest rate is greater than the growth rate of output in the PAYG system, i.e., \(\left(1+{r}_{t}\right)\)>\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\), a switch from the PAYG system to a modified PAYG system, i.e., saving part of the receipts in the PAYG system for the future, increases labor supply and decreases the capital-effective labor ratio slightly in period 1, but decreases labor supply and increases the capital-effective labor ratio after period 1.

Figure 8 provides the change of utility under the modified PAYG system, i.e., the value of \({\lambda }_{t}^{i}\). The initial old and current young generations have a utility loss. However, the following generations have a utility gain. The intuition is clear. As shown in Fig. 7C and D, with population aging this scheme smooths the pension benefit among generations, resulting in an intergenerational redistribution. Specifically, it protects the interest of the future generations at the expense of the current generations.

Moreover, unlike the NDC system which disfavors the poor, the modified PAYG system benefits the poor more than the rich in future generations. A switch from the PAYG system to a modified PAYG system symbolizes an increase in the generosity of the PAYG system for future generations, implying that both the skilled and the unskilled in future generations obtain more pension under the modified PAYG system than under the traditional PAYG system. However, the labor supply of the unskilled decreases more than the skilled (see Fig. 7A and B), i.e., the leisure of the unskilled increases more than the skilled, resulting in a greater increase in utility of the unskilled. Similarly, a switch from the PAYG system to a modified PAYG system stands for a decrease in the generosity of the PAYG system for current generations, implying that both the skilled and the unskilled in these generations obtain less pension under the modified PAYG system. As the capital-effective labor ratio decreases in period 1, the interest rate increases and the initial old obtain higher interest income. However, the interest income increases less for the unskilled than for the skilled since the unskilled have less savings than the skilled. Therefore, the reform hurts the poor old more than the rich old.

In short, if the interest rate is greater than the growth rate of output in the PAYG system, a switch from the PAYG system to a modified PAYG system decreases the initial old and current young generations’ utility but increases future generations’ utility; and it hurts the poor old more than the rich old, while benefiting the poor in future generations more than the rich.

What happens if \(\left(1+{r}_{t}\right)\)<\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\)? Following Auerbach and Kotlikoff (1987) and Altig et al. (2001), we set capital’s share in production, \(\alpha\)=0.25; change the annual discount factor to 0.985,and redo the simulation.Footnote 36The baseline simulation (i.e., variables in the PAYG system) shows that \(\left(1+{r}_{t}\right)\)<\(\left(1+{n}_{t}\right)\left(1+\gamma \right)\). When switching towards the modified PAYG system, the social security savings become negative since period 4. The reason is clear. Recall from the social security savings Eq. (32),

The first term in the social security savings equation is the gap between the social security contribution and social security expenditure in period t. The gap is positive in the first few periods, but may turn negative in the following periods as the population growth rate of the young generation keeps decreasing, i.e., \({n}_{t+1}\le {n}_{t}<\dots <{n}_{1}\). The second term in the social security savings equation is the principal and interest of last period’s social security savings. If the interest rate is high, the principal and interest of last period’s social security savings will be enough to make up the gap, and we have a positive social security savings; otherwise, we have a negative social security savings, which implies that the guaranteed rate of return to contribution in the modified PAYG system, i.e., \(\theta \left(1+{n}_{1}\right)\left(1+\gamma \right)\) is not sustainable.

In the above analyses, we assume that the proportion of social security receipts used for pension benefits in period 1,\(\theta\), be 0.9. We conduct some sensitivity analyses for \(\theta\) by letting \(\theta\) be 0.8, 0.7, and 0.6, respectively. On the one hand, as \(\theta\) decreases, the rate of return to contribution in the modified PAYG system decreases and the less pension benefit received by the first few generations decreases, and hence the loss suffered by the first few generations increases. For example, with \(\theta\) being 0.8, the first three generations (generation 0, 1, and 2) have a utility loss, while with \(\theta\) being 0.7 and 0.6, the first four generations have a utility loss. On the other hand, as \(\theta\) decreases, social security savings will accumulate, and hence the capital-effective labor ratio and wage rate will increase. For example, with the values of \(\theta\) being 0.9, 0.8, 0.7, and 0.6, the ratio of social security savings to aggregate output is 15.7%, 17.7%, 18.5%, and 19.1% in period 15. The changes in \(\theta\) do not affect the analytical results qualitatively.

6 Concluding remarks

Using an overlapping generations model with skilled and unskilled individuals, declining fertility, and rising life expectancy, this paper studies the effects of social security reforms, namely switching from the PAYG system to a NDC system and to a modified PAYG system that saves part of the current social security receipts for the future, on labor supply, capital accumulation, income redistribution, and welfare of different groups within and across generations. All the crucial parameters are calibrated based on data from the Chinese economy. Different reforms have different effects on the economy.

A switch from the PAYG system to a NDC system, with the rate of return being the growth rate of total wage, increases labor supply of the unskilled individual but decreases labor supply of the skilled individual; decreases the capital-effective labor ratio in the beginning, and then, does not affect that ratio; and makes the skilled better off and the unskilled worse off.

If the interest rate is greater than the growth rate of output in the PAYG system, a switch from the PAYG system to a NDC system with the rate of return being the interest rate, increases labor supply but increases labor supply of the unskilled individual more than that of the skilled individual; decreases the capital-effective labor ratio; increases the initial old generation’s utility, decreases current young and future generations’ utility; and makes skilled individuals gain more or lose less than unskilled individuals.

If the interest rate is less than the growth rate of output in the PAYG system, a switch from the PAYG system to a NDC system with the rate of return being the interest rate, increases labor supply and labor supply of the unskilled individual increases more than that of the skilled individual; in the beginning periods decreases, and then increases the capital-effective labor ratio; increases the initial old generation’s utility, decreases the current young generation’s utility; and increases utility of skilled individuals but decreases the utility of unskilled individuals in the future.

If the interest rate is greater than the growth rate of output in the PAYG system, a switch from the PAYG system to the modified PAYG, i.e., saving part of the receipts in the PAYG system for the future, increases labor supply and decreases the capital-effective labor ratio in period 1, but decreases labor supply and increases the capital-effective labor ratio after period 1; decreases the initial old and current young generation’s utility but increases future generations’ utility, and hurts the poor old more than the rich old, while benefitting the poor in future generations more than the rich. With the interest rate being less than the growth rate of output, the accumulated social security funds will not be enough to balance the social security budget. Thus, the rate of return to the social security fund or the interest rate is crucial for the sustainability of the modified PAYG system.

The above analyses show the effect of two types of social security reform on labor supply, capital accumulation, and welfare of different types of individuals under various conditions. Clearly, the interest rate and growth rate of output are crucial in determining the effects of the reforms. Government can also choose the rate of returns to personal accounts in the NDC system and the savings rate of social security receipts in the modified PAYG system. The goals of social security reforms are to improve efficiency, achieve equity, and maintain sustainability. Policies must be carefully designed to achieve these goals.

The current research can be extended in several interesting directions. First, by extending the current model to a three-period model, one can introduce children into the model. In the first period individuals accumulate skills; in the second period, they supply labor; and in the third period they are retired. With children in the model, one can also consider the case that children provide financial support to their parents at old age as in Barnett, et al. (2018). The current model could also be extended to a multi-period model, such as a 55-period OLG model (e.g., Li and Lin (2016, 2023)), to calibrate the effects of the social security reforms when the detailed data on skill-dependent survival rates by every age group become available. Second, the model can be used to examine the optimal savings rate of social security receipts under the modified PAYG system. One may maximize a social welfare function which is the sum of utilities of the rich and the poor in all generations to derive the optimal savings rate of social security receipts for both skilled and unskilled of every generation. Third, the model may be extended to study social security reforms that can make all agents in all generations better off through inter- and intra-generational transfers, following the approach adopted by Kotlikoff (1996a) and Fehr (2016). Fourth, the analysis can be extended to a small open economy, which takes the world interest rate as given, to study its social security reforms.

Data availability

China Family Panel Studies (CFPS) data used for this study is available at https://www.isss.pku.edu.cn/cfps/en/index.htm, and researchers may apply to the Institute of Social Science Survey of Peking University for access to the data. The other data used for this study is all publicly available. Specifically, we obtain data on population projections from the United Nations, and data on population life expectancy by regions from the China National Bureau of Statistics, as discussed in the paper.

Notes

Li and Lin (2011) shows that privatization of the current PAYG system will not stimulate capital accumulation if the implicit social security debt is taken into consideration.

See Svahn and Ross (1983) for a detailed discussion of the amendments.

See the United States Social Security Administration (2022).

Bonenkamp et al. (2017), Pestieau and Ponthiere (2017), Baldanzi et al. (2019), Futagami and Konishi (2019), and Ponthiere (2020) also assumed that the survival probability is exogenous. Some studies assumed that the survival probability depends on age, private healthcare spending, or education (see Pestieau, Ponthiere, and Sato 2008; Pestieau and Ponthiere 2016; Laun, et al. 2019).

For this purpose, we develop a two-period OLG model with declining population growth and increasing life expectancy. Using a more general model, such as an N-period OLG model, would complicate the presentation, without bringing additional insights for the current purpose. With appropriate calibration and robustness checks, the simulation results appear quantitatively robust.

In many countries, individuals with higher socioeconomic status (SES) have been found to live longer than those with lower SES, whether SES is measured by income, education, or occupation (Lee and Sánchez-Romero 2019). In addition, Tarkiainen et al. (2013) showed that in Finland socioeconomic mortality differences have increased in recent decades mainly because of slower mortality decline among the lower social groups. National Academies of Sciences, Engineering, and Medicine (2015) and Sanchez-Romero et al. (2020) showed that in the United States, life expectancy has been rising fastest for people with higher income, and the gap in longevity by socioeconomic status has been increasing as well.

Following Lefèbvre et al. (2019), we assume that \(\phi\) is constant.

In period t, the population of young generation is \({N}_{t}\), and the population of old generation is \({p}_{t}{N}_{t-1}\). Thus, old-age dependence ratio in period t is equal to \({p}_{t}/\left(1+{n}_{t}\right)\). Either a decrease in the population growth rate (\({n}_{t}\)) or an increase in the survival probability \({p}_{t}\) increases the old-age dependence ratio.

Under perfect foresight (rational expectations), savings are the function of current and future factor prices; while under myopic anticipations, agents take the current wages and interest rates as a proxy for future wages and interest rates when choosing their savings. See Pestieau and Ponthiere (2014).

See Appendix 1 for detailed derivation.

Recall that skilled individuals have a higher life expectancy, i.e., a higher probability to reach the old age than unskilled individuals. Hence, the intragenerational redistributive power of PAYG system could be partly eroded by the longer life expectancy of rich individuals. For example, although the United States retirement-benefit program is designed to be progressive, and intended to redistribute income from the rich to the poor, the difference in life expectancy causes the program to favor upper-income over lower-income households (see Aaron 1977; Fuster et al. 2003; Sanchez-Romero et al. 2020).

For example, Italy chose the GDP growth rate, Sweden selected the per capita wage growth, and Latvia, Norway, and Poland selected the growth rate of the contribution wage. See Holzmann (2017).

See Appendix 2 for detailed derivations.

When \(\left(1+n_t\right)\left(1+\gamma\right)<1+r_t\), as argued by Feldstein (1999), \(\tau_t^i>0\) , and young generation pays lump-sum tax; while \((1+n_t)(1+\gamma)>1+t_t\), \(\tau_t^i<0\) , and young generation obtains lump-sum transfer.

See Appendix 3 for detailed derivation.

See Appendix 1 for detailed derivation.

(1) According to the United Nations (2020), the annual population growth rate in China is 2.822‰ for 2020-2025, and gradually decreases to -4.74‰ for 2095-2100. This yields that \({n}_{t}\) is equal to (1+2.822‰)34 -1=0.1 in the base year and -0.15 for 2095-2100. (2) Period 1 is the base period. With one period being 35 years, it takes (2100-2020)/35≈2.3 periods to reach the year 2100. Thus, we assume that it takes 3 periods to reach the level of 2100, i.e., period 4.

(1) The retirement age is 60 for men, 55 for female civil servants (ganbu), and 50 for female workers (gongren). Many retired workers still take temporary jobs for extra money. Professionals, such as professors or medical doctors, can retire at 65. There is no official data for the number of the above groups. For simplification, we assume that people retire at age 60. (2) According to the United Nations (2020), life expectancy at 60 in China is 20.78 for 2020-2025, and gradually increases to 28.83 for 2095-2100. This yields that \({p}_{t}\) is equal to 20.78/35=0.59 in the base year and 0.82 for 2095-2100.

Takahashi and Yamada (2022) classified the skilled and the unskilled individual according to their educational attainment for the United States and Japan, with four-year college graduates classified as skilled, and the rest classified as unskilled.

We also conducted a sensitivity analysis by considering an alternative value for the proportion of skilled individuals in a generation, \(\phi\)= 0.4. Similar simulation results are obtained. See Appendix 5.2.

Life expectancy at birth is from the China National Bureau of Statistics (2021), and the other data are from the China National Bureau of Statistics (2022). The China National Bureau of Statistics did not provide life expectancy at 60 for each province in the years of 2000, 2010, and 2020. See Appendix 4 for detailed calibration.

Note that the survival probability plays a similar role to the pure rate of time preference (or pure discount factor) ρ, and is often regarded as a natural discount factor (Pestieau and Ponthiere 2016). Thus, \(\rho ={\left(0.98\right)}^{34}/{p}_{1}\).

The China Family Panel Studies (CFPS) is a nationally representative, biennial longitudinal survey of Chinese communities, families, and individuals by the Institute of Social Science Survey (ISSS) of Peking University, China. See Wu et al. (2021) for the details about CFPS (2018).

China’s current PAYG pension system has a strong Beveridgean component and is redistributive. The pension benefit is related to the average wage of the city or region as well as the individual’s own contribution (The State Council 2005). As a result, the skilled, with a higher wage, contribute more into the pension system and receive relatively less pension benefit. From the data, the ratio of wage rate between the rich and the poor \(\left(\beta\right)\) is greater than the ratio of pension benefit between the rich and the poor \(\left(\chi\right)\).

GDP by income approach includes compensation of employees, fixed asset depreciation, net production tax, and operating surplus. We add up the regional data to obtain data in the aggregate economy level. Data for 1980-1995 is from the China National Bureau of Statistics (1997), and data for 1996-2017 is from the China National Bureau of Statistics (2022).

China Ministry of Finance (2021).

The horizontal axis indicates generation t. For example, a value of zero means generation zero, who is born and young in period zero, and is old in period 1. The vertical axis shows the change of utility level. For example, a value of 1.05 means that the generation’s remaining lifetime utility under the NDC system is 5% higher than it would have been in the PAYG system. (See Kotlikoff 1996b; Kotlikoff et al. 2007).

Based on the calibration, we have \(\beta=w_t^H/w_t^L>(p_t^Hv_t^H)/(p_t^Lv_t^L)=p_t^H\chi/p_t^L\) .

Note that the survival probability plays a similar role to the pure rate of time preference (or pure discount factor) ρ, and is often regarded as a natural discount factor (Pestieau and Ponthiere 2016). Thus, \(\rho ={\left(0.985\right)}^{34}/{p}_{1}\)

Recall that \(\theta\) is the proportion of social security receipts used for social benefits in period 1 and (\(1-\theta\)) is the proportion of social security receipts saved.

Note that the survival probability plays a similar role to the one of the pure discount factor ρ, and often regarded as a natural or biological discount factor (Pestieau and Ponthiere 2016). Thus, \(\rho ={\left(0.985\right)}^{34}/{p}_{1}\).

References

Aaron HJ (1977) Demographic effects on the equity of social security benefits. In: Feldstein MS, Inman RP (eds) The economics of public services International economic association conference volumes. Palgrave Macmillan, London, pp 151–173

Altig D, Auerbach AJ, Kotlikoff LJ, Smetters KA, Walliser J (2001) Simulating fundamental tax reform in the United States. Am Econ Rev 91(3):574–595

Auerbach AJ, Kotlikoff LJ (1987) Dynamic fiscal Policy. Cambridge University Press, Cambridge

Auerbach AJ, Lee R (2009) Notional defined contribution pension systems in a stochastic context: design and stability. In: Brown J, Liebman J, Wise DA (eds) Social security policy in a changing environment. University of Chicago Press, Chicago, pp 43–68

Auerbach AJ, Lee R (2011) Welfare and generational equity in sustainable unfunded pension systems. J Public Econ 95(1–2):16–27

Auerbach AJ, Kueng L, Lee R, Yatsynovich Y (2018) Propagation and smoothing of shocks in alternative social security systems. J Public Econ 164:91–105

Auerbach AJ, Cai J, Kotlikoff LJ (1991) US demographics and saving: predictions of three saving models. Carnegie Rochester Conference Series on Public Policy 34(135):156

Baldanzi A, Prettner K, Tscheuschner P (2019) Longevity-induced vertical innovation and the tradeoff between life and growth. J Popul Econ 32(4):1293–1313