Abstract

This paper uses data from the Survey of Health, Ageing, and Retirement in Europe to analyze the effect of spousal health shocks on own labor supply decisions. The results suggest minimal changes to the probability of work and the intensity of work for both husbands and wives of disabled spouses. Wives do, however, experience an increase in the probability of retirement after their husbands experience a work-limiting health shock. The results suggest that this increased probability is due to the desire to consume joint leisure. Finally, the analysis finds substantial cross-regional heterogeneity in the effects that spousal health shocks have on the various labor market outcomes examined here, which suggests an important role for country-specific factors in the estimates provided in the earlier literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Researchers and policymakers have long been interested in the economic well-being of individuals suffering from work-limiting health shocks. With advances in the application of panel data techniques, researchers have been able to document the dynamic, long-term impact health shocks have on workers, specifically focusing on earnings, income, and hours worked. The onset of a work-limiting disability is associated with a large reduction in labor earnings (Stephens 2001; Charles 2003; Mok et al. 2008; Meyer and Mok 2019), which leads to downward movement in the earnings and income distributions (Nagi and Hadley 1972; Jolly 2013). An area that has received less attention is how the onset of a work-limiting disability influences the labor market outcomes of the affected individual’s spouse. This paper uses longitudinal data from the Survey of Health, Ageing and Retirement in Europe (SHARE) from 2006 to 2019 to study the relationship between labor supply and spousal health shocks.

While understanding the individual experiences of disabled workers is important, it is necessary to explore the impact that work-limiting health shocks have on affected workers’ spouses, particularly if programs designed to assist the disabled are to be structured efficiently (Riphahn 1999). Given the financial distress caused by disability, it is reasonable for spouses to adjust their labor supply. Knowing the extent of this adjustment is necessary for understanding whether the loss of the disabled worker’s earnings is a permanent loss to family income or is offset by increased spousal earnings. Theory does not provide a clear prediction as to the directional relationship between work-limiting health shocks and spousal labor supply.

On the one hand, the onset of a disability should increase spousal labor supply through the added worker effect. A permanent decline in a disabled worker’s earnings decreases spousal non-labor income, which should increase labor supply, assuming leisure is a normal good. The added worker effect may be amplified along four dimensions (Coile 2004; Wu 2003). First, a liquidity-constrained household that cannot borrow to insure against a permanent income shock may experience a larger added worker effect. Second, if the affected worker needs to leave the labor force and loses employer-sponsored health insurance, then the spouse may face added pressure to increase labor supply to qualify for insurance. Third, household expenses may increase due to out of pocket medical expenses, thus increasing the need to work. Finally, one spouse’s home production may substitute for the other’s. If the disabled individual increases time spent on home production, then this will free up market-based time for the spouse.Footnote 1

On the other hand, health shocks may reduce spousal labor supply. This occurs if the healthy spouse needs to provide in-home care to the disabled individual. Additionally, work-limiting health shocks reduce workers’ labor supply (e.g., Charles 2003), which leads to an increase in time spent at home. If non-market-based time of one spouse complements the other’s, then the disability should reduce spousal labor supply because of an increase in the consumption of joint leisure. Finally, public assistance programs that provide financial aid to those who suffer from work-limiting health shocks may crowd out spousal labor supply. Berger and Fleisher (1984) provide evidence of public program crowd out. The authors do not differentiate between the types of public assistance received; however, Chen (2012) provides evidence showing spousal labor supply crowd out from Social Security Disability Insurance.

In this paper, we use 2006 to 2019 SHARE data to analyze the relationship between work-limiting health shocks and spousal labor supply. The SHARE data contain survey responses from individuals aged 50 or older and their spouses irrespective of age across 28 European countries and Israel. On average, our results show that men do not alter their labor supply decisions upon the onset of their wives’ health shock. Women married to men who suffer a health shock experience an increase in the probability of retirement and an increase in the desire to retire early. Additional analysis suggests that the need to provide care and the desire to consume joint leisure dominate any added worker effect that may exist.

The results presented here add to a growing literature that has, to date, provided inconsistent results regarding the effect of spousal health shocks on labor supply. Each of the earlier studies on this topic uses data from a single country. Countries studied include the USA, Germany, the Netherlands, Denmark, South Korea, and China. Differences in public assistance programs and social norms may lead to discrepancies in the estimated effects of health shocks on spousal labor supply decisions. Furthermore, there is variability in the type of health shock studied across the earlier literature (e.g., heart attacks versus self-reported work limitations). There is no reason to expect that different health shocks lead to the same spousal labor supply response. Our study contributes to this earlier literature by using SHARE data. The SHARE data contain survey responses from individuals across 28 European countries and Israel. Here, we focus on a single health shock and apply common sample selection criteria across all countries. This harmonization across countries, in addition to including individual-level fixed-effects in the estimated equations, allows us to control for any country-specific characteristics that may serve as potential confounding factors. In fact, we present evidence of substantial cross-regional heterogeneity in the estimated effect of health shocks on labor supply, thereby replicating the differences in the estimated effects found in the earlier literature.

The paper proceeds by discussing the relevant literature in Section 2. Section 3 details the data and empirical methodology. Section 4 describes the results, while Section 5 offers concluding remarks.

2 Literature review

The earlier literature on health shocks and spousal labor supply finds conflicting evidence. When focusing on the female labor supply response to a husband’s health shock, Coile (2004), Garcia-Gomez et al. (2013), Braakmann (2014), and Meyer and Mok (2019) find no effect, whereas Charles (1999) and Kim et al. (2018) find a positive effect. Fadlon and Nielsen (2021) find no effect on female labor supply after a severe, non-fatal health shock, and a positive effect after a fatal one. Berger and Fleisher (1984) find a positive female labor supply response to a husband’s health shock that is mitigated by the availability and generosity of public assistance programs. Only Jeon and Pohl (2017) and Shen et al. (2019) find a negative relationship between a husband’s health shock and his wife’s labor supply. Finally, Siegel (2006) finds that wives’ labor supply responses differ depending on the measure of the husband’s health used in the analysis.

The evidence is also inconsistent when focusing on the husband’s labor supply response to his wife’s health shock. Some find that men reduce their labor supply (Charles 1999; Garcia-Gomez et al. 2013; Jeon and Pohl 2017; Shen et al. 2019; Fadlon and Nielsen 2021), whereas others find an increase (Coile 2004) or no change (Braakmann 2014; Kim et al. 2018). Most studies find that husbands’ and wives’ respond differently to a spousal health shock. However, there are three exceptions. Jeon and Pohl (2017) and Shen et al. (2019) find that men and women reduce their labor supply by relatively similar magnitudes in response to a spousal health shock; Braakmann (2014) finds insignificant labor supply responses across genders.

Given the theoretically ambiguous effect of health shocks on spousal labor supply described above, it is unsurprising that the literature finds differing effects. However, differences across studies exist in terms of data used, and these differences help to explain the inconsistent findings. For example, Berger and Fleisher (1984), Charles (1999), Coile (2004), Siegel (2006), and Meyer and Mok (2019) study the USA, whereas Garcia-Gomez et al. (2013) use data from the Netherlands, Fadlon and Nielsen (2021) use Danish data, Jeon and Pohl (2017) use Canadian data, Kim et al. (2018) study South Korea, Shen et al. (2019) use Chinese data, and Braakmann (2014) studies Germany. These countries have different social safety nets and social norms, which could lead to dissimilar findings across studies.

Even within US-based papers, the data used contain different sub-groups. Charles (1999), Coile (2004), and Siegel (2006) use data from the Health and Retirement Study (HRS), while Meyer and Mok (2019) use the Panel Study of Income Dynamics and Berger and Fleisher (1984) use the National Longitudinal Surveys. The HRS is a sample of older individuals, whereas Meyer and Mok (2019) limit their sample to male household heads younger than 62.Footnote 2 Results may differ for older versus younger spouses. Young individuals facing a health shock have a greater incentive to reinvest in human capital to help adjust due to the longer working life expected when compared to older individuals experiencing a similar health shock (Charles 2003). Therefore, younger spouses may adjust differently relative to their older counterparts.

Differences across data sets exist not only in terms of country studied, but also in terms of the type of health shock examined. Berger and Fleisher (1984), Charles (1999), and Meyer and Mok (2019) focus on self-reported work-limitations, whereas Coile (2004) and Kim et al. (2018) examine acute health events, such as heart attacks, chronic illnesses, such as lung disease, and accidental injuries. Shen et al. (2019) investigate chronic diseases such as cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes. Other papers look at acute hospitalizations (Garcia-Gomez et al. 2013), cancer diagnoses (Jeon and Pohl 2017), heart attacks, strokes, and deaths (Fadlon and Nielsen 2021). There is no reason that these very different health events should lead to the same type of familial response.

This paper contributes to the literature by using SHARE data in the analysis. The Survey of Health, Ageing and Retirement in Europe is a longitudinal dataset currently surveying individuals residing in 28 European countries and Israel. This multinational characteristic of the dataset offers harmonization of survey questions and sample selection criteria across multiple countries, thereby allowing researchers the ability to pool countries into one dataset. By pooling countries and including individual-level fixed-effects in the estimated equations (discussed below), the estimates provided here control for any country-specific features (e.g., social safety nets and social norms) that would influence estimates of the labor supply response to spousal health shocks. In our analysis, we estimate the average relationship between spousal health and a wide array of own-labor market outcomes, including the probability of employment, the probability of working full-time, weekly hours worked, the probability of retirement, and the desire to retire early while controlling for these country-specific institutional features.

Furthermore, because of the multinational feature of the data, we perform an analysis comparing these relationships across four distinct regions. We group countries into regions based upon similarities in social norms/cultures and similarities in public assistance programs designed to aid the work-disabled. According to Börsch-Supan (1992), the importance of international comparisons is crucial as different countries have different institutions and different social safety nets. When studying a single country, it is infeasible to separate preferences from the impact of institutions and policies since there are possibly very few changes in institutions and policies in one country in order to properly identify their impacts (Börsch-Supan 1992). In fact, Angelini et al. (2012) use the first wave of the SHARE data to uncover significant cross-country heterogeneity in self-reported disability status of elderly people in Europe. This heterogeneity in self-reported disability rates is driven by macroeconomic differences across countries and different institutional features associated with the generosity of disability schemes.

To our knowledge, this is the first study to provide an international comparison of the relationship between labor supply and spousal health. In fact, Riekhoff and Vaalavuo (2021) is the only other study using SHARE data to investigate couples’ labor supply decisions after the onset of a husband’s work-limiting health shock. The authors find that the probability of both partners working full-time falls after the husband experiences a health shock. However, the propensity for joint retirement increases as does the odds of the husband retiring and the wife continuing to work either part- or full-time. These changes in probability depend upon whether the spouses have similar levels of schooling.

Our paper differs from Riekhoff and Vaalavuo (2021) along several important dimensions. First, Riekhoff and Vaalavuo (2021) limit their analysis to health shocks experienced by the husband. The authors do not examine female health shocks, which precludes a comparison across genders. Here, we explicitly compare responses to spousal health shocks across genders. Additionally, Riekhoff and Vaalavuo (2021) limit their sample to two waves of SHARE data, which limits the sample to 1,022 couples. The authors note how this small sample restricts their ability to perform a cross-regional comparison, and instead only include regional dummy variables in the estimated equations. As discussed below, we use more waves of SHARE, which brings our sample to 18,812 couples. Finally, Riekhoff and Vaalavuo (2021) only use post-treatment observations and do not account for individual fixed-effects in their analysis to control for unobservable differences across survey respondents. Doing so precludes the ability to estimate the causal relationship between spousal health and labor supply decisions. In contrast, our methodology relies on a methodology developed by Callaway and Sant’Anna (2021), which is designed specifically to estimate causal effects flexibly.

3 Data and methodology

The data for this analysis come from the Survey of Health, Aging and Retirement in Europe (SHARE), which is a longitudinal dataset designed to understand how health, economic, social, and environmental policies affect individuals who are at least 50 years old and reside in Europe and Israel. The SHARE project began in 2004 by surveying individuals from 11 European countries and Israel. Since 2004, eight additional surveys occurred in 2006, 2008, 2011, 2013, 2015, 2017, 2019, and 2021. We use data from five SHARE waves. We do not use data from wave 1 (2004) as the question used to identify a health shock (described below) was not asked. We do not use data from wave 3 (2008) as wave 3 gathered retrospective information detailing life events, not information on year-specific characteristics such as current labor market status. Finally, to avoid any confounding factors associated with the COVID-19 pandemic, we exclude waves 8 (2019) and 9 (2021). In each new wave, new countries are included. SHARE offers data from 28 European countries and Israel. The list of countries we use in our analysis and their year of inclusion appear in Table 1.

The unit of analysis here is an individual in a married, opposite-sex couple with spouse present who does not live in a country that first joined the SHARE project in 2017. Just as in 2008, individuals residing in countries that first joined SHARE in 2017 were asked about retrospective information on life events, not information on year-specific labor market characteristics. We also exclude couples living in Ireland from the analysis because respondents in that country only participated in the second wave of SHARE. We further remove observations from the sample if both spouses report working more than 168 h per week. We exclude individuals with missing information on education, year of marriage, area of residence, and length of marriage. For marital status, geographic distance to children, year of marriage, region of residence, and being born in the country of the interview, we replace missing values in a given wave with the value reported in the previous wave. We remove individuals if either partner in the couple reports that the marriage occurred when either spouse was younger than 15. Finally, we require all individuals to respond to at least two surveys to be used in the analysis.

The focus of this paper is on health shocks that hinder an individual’s ability to work in the same capacity as before the shock, i.e., work-limiting disabilities. We define a disabled individual as one who responds yes to a survey question asking if the respondent has a health problem or disability that limits the kind or amount of paid work he or she can do. A disabled couple is one where either the husband or the wife (or both) reports a work-limiting disability. This definition of disability is similar to that used by Berger and Fleisher (1984), Charles (1999), and Meyer and Mok (2019). This survey question does not exist in the first wave of the survey. Therefore, we drop observations from this wave in the analysis. In wave 2 of the SHARE data, respondents of any age were eligible to answer this question. However, starting in wave 4, only those aged 75 or younger are eligible to respond. Therefore, we limit the analysis to couples where both partners are 75 or younger. To ensure that we are observing a true shock, we require that all disabled couples have at least one wave of data before the initial report. Therefore, all disabled couples experience the shock while they are observed in the sample window, and no one can enter the sample having previously experienced a disability.

There is a potential issue regarding the timing of disability onset. A question asking when the disability occurred does not exist in SHARE. Furthermore, households are surveyed in SHARE approximately every two years. Therefore, the disability could have occurred at some point between survey waves. To this end, we treat the period of onset as the wave of the first reported work limitation. This timing issue may attenuate the magnitude of the estimated effect of spousal health shocks on labor supply.

The general form of the estimated equation used throughout much of the analysis is

In Eq. (1), \({y}_{it}\) is one of several labor market outcomes reported by respondent i in wave t. The outcomes investigated here include: current employment status (\({y}_{it}\) equals one if employed or self-employed, zero otherwise), average weekly hours of work on one’s current main job, and whether the respondent currently works full-time (\({y}_{it}\) equals one if working full-time, zero if working part-time). Full-time work consists of working at least 30 h per week on the respondent’s main job. The 30-h cut-off is arbitrary. However, there is support for its use (van Bastelaer et al. 1997). When the dependent variable is hours worked or the full-time binary variable, we restrict the sample to those who report positive hours of work.

Given that SHARE interviews those who are at least 50 years old, we also investigate the relationship between spousal health shocks and retirement decisions. To this end, we define two retirement outcomes. The first is a dummy variable indicating whether the respondent is currently retired (\({y}_{it}\) equals one if retired, zero otherwise). The second is a dummy variable indicating if the respondent wishes to retire from his/her main job as soon as possible (\({y}_{it}\) equals one if wants to retire as soon as possible, zero otherwise). When investigating these outcomes, we limit the sample to those who were not already retired during the first wave observed.

The vector \({x}_{it}\) contains binary variables for the level of education (omitted category is pre-primary education) and a quartic in age.Footnote 3 The vector \({\theta }_{t}\) includes survey wave fixed effects. The \({\alpha }_{i}\) accounts for any individual-specific, unobserved heterogeneity that is related potentially to the observed regressors, particularly the health shock variable described below. Importantly, no couple in our data moves between countries. Therefore, the \({\alpha }_{i}\) also captures country-specific effects, such as social norms and government transfer programs to aid the disabled.

The variable of interest is \({D}_{it}^{k\ge 0}\). The superscript k indexes time relative to the wave of onset of a work-limiting disability, with wave zero being the wave of the first report. Here, \({D}_{it}^{k\ge 0}\) is a binary variable equaling one in every wave after respondent i’s spouse reports a work-limiting health shock (regardless of how long the spouse has been disabled), including the wave of onset, and zero otherwise. Recall that all individuals in the treatment group (i.e., those married to someone who experiences a disability) must have at least one pre-treatment observation. Therefore, treatment must occur during the sample window. Importantly, we limit the control group to households where neither spouse ever experiences a work-limiting health shock. Estimates of \({\beta }_{1}\) show the average annual effect that a spouse’s health shock has on various measures of labor supply. As an example, when focusing on the probability of retirement as the outcome, the estimate of \({\beta }_{1}\) measures the difference in average annual retirement probabilities after disability onset between treated and control units regardless of the length of the disability.

Generally, there are some concerns with using self-reported health conditions when trying to identify a causal relationship between health and labor market outcomes (Kalwij and Vermeulen 2008). The first is justification bias. Respondents may use their spouse’s ill health as a justification for their own poor labor market outcomes. This bias would magnify the size of the estimated effect. To help mitigate this concern, Eq. (1) includes individual-level fixed effects. Importantly, including fixed effects will not completely alleviate justification bias. Individual-level fixed effects only account for time-invariant unobservable characteristics. Justification bias may evolve over time. Lindeboom and Kerkhofs (2009) note how justification bias depends upon an individual’s labor market status (i.e., employed, unemployed, retired, etc.). Therefore, when a person transitions from (for example) working to not working after a spouse’s disability onset, there could be a higher likelihood of justification bias. This may mean that individual-level fixed effects will not fully capture the endogeneity caused by justification bias because this bias changes as the labor market status of the person evolves over time.

The second concern is measurement error. Stephens (2001) notes how self-reports of work-limiting disabilities like the one used here are noisy measures of true health status. This noise would attenuate our estimates to zero.

The third concern is omitted variables bias. Kalwij and Vermeulen (2008) note that coefficients associated with self-reported health measures suffer from an omitted variables bias, where the omitted variable is a measure of objective health. The authors argue that self-reported health measures are correlated with objective measures of health, and these other objective measures of health have effects on labor market variables over and above the self-reported measures typically used. To help mitigate this concern we perform a sensitivity analysis by following Kalwij and Vermeulen (2008) and Siegel (2006) and construct an index based on the number of restrictions of physical functioning and activities of daily living that the individual faces. We then add this index as an extra control variable alongside our main health measure. Importantly, all health measures reported in surveys contain some degree of subjectivity. Therefore, this sensitivity analysis does not fully eliminate this particular concern.

A final concern in identifying a causal relationship between labor market outcomes and spousal health is assortative mating along the dimension of health. If health is one dimension along which individuals sort into marriage, then the coefficient associated with \({D}_{it}^{k\ge 0}\) may capture not only the effect of the spouse’s health shock on the respondent’s labor supply, but also the effect of own health on labor supply. In our sample, the correlation between the spouses’ health shocks is 0.27. To reduce the severity of this potential issue, we include a binary variable for own-work-limiting disabilities in a sensitivity analysis.

These four concerns (justification bias, measurement error, omitted variables, and assortative mating) will bias the estimated causal effect of spousal health on labor supply. We take steps to minimize the amount of bias that exists. However, none of these steps perfectly alleviates these four concerns. Therefore, the estimated effects presented below may still be biased estimates of the causal effect of spousal health on labor supply.

Equation (1) provides an estimate of the average annual effect of spousal health shocks on labor supply/retirement decisions. It is possible that spousal health shocks have dynamic impacts on the various labor supply decisions investigated here. To this end, we alter Eq. (1) as follows:

As with Eq. (1), k references time relative to the wave of initial disability onset. However, \({D}_{it}^{k}\) now equals one in specific waves relative to the wave of onset. For example, \({D}_{it}^{-2}\) equals one during the period two waves prior to reported onset and zero otherwise. Estimates of \({\omega }_{k}\) and \({\beta }_{k}\) trace out the dynamic relationship between labor supply and spousal health shocks.

The two-way fixed-effects specification shown in Eq. (1) and the event history setup proposed in Eq. (2) may still not provide causal estimates of spousal health shocks on labor supply decisions. Callaway and Sant’Anna (2021) and Sun and Abraham (2021) provide detailed discussions regarding how the coefficients from Eqs. (1) and (2) can provide biased estimates of causal effects when entry into treatment varies over time and when treatment effects are potentially heterogenous across groups at the time of entry into treatment. As described in Sun and Abraham (2021), treatment effect heterogeneity may arise in this context. Those who experience health shocks later in the panel are, by definition, older than those who experience similar shocks earlier. Furthermore, different macroeconomic conditions that occur at the time of disability onset will affect the impact of spousal health shocks on labor supply decisions.

Callaway and Sant’Anna (2021) (CS) describe that when treatment effects vary over time, estimates of \({\beta }_{1}\) from Eq. (1) will be a weighted average of treatment effect parameters. However, these weights may be negative, which can lead to instances when the true treatment effect is of one sign (e.g., positive) but the estimated effect is of the opposite sign (e.g., negative). This issue is particularly important here. If Eq. (1) suggests that the treatment effect is negative, then that implies spouses are reducing labor supply to provide care or consume joint leisure with their unhealthy spouse. However, if the true treatment effect is positive, then the added worker effect is dominant. This has different implications for policies designed to aid the work-disabled and their families. Sun and Abraham (2021) show that weighting problems still exist in event history specifications like in Eq. (2). To account for these potential issues, we estimate Eqs. (1) and (2) using methods proposed by CS. We choose the CS estimator over the Sun and Abraham (2021) estimator as the one proposed by Sun and Abraham (2021) is nested within the CS estimator. Callaway and Sant’Anna (2021) note how the average treatment effect on the treated is identified whether using outcome regression, inverse probability weighting, or the doubly-robust technique. Here, we use the outcome regression approach. Finally, we estimate Eqs. (1) and (2) separately for husbands and wives.

4 Results

4.1 Descriptive statistics

Table 2 presents descriptive statistics of the variables analyzed here by gender and disability status. To ensure that the treatment and control groups are as comparable as possible, calculations only include the first observation for each individual. Recall that the sample is restricted to those in marriages where neither partner is over the age of 75, and the disabled subgroups are required to have at least one observation prior to the onset of the first disability.

The treatment and control groups are similar along a few dimensions. For wives who choose to work, they tend to work approximately 33 h per week, and between 70 and 74% work full-time regardless of disability status. Wives have an average age of roughly 58 regardless of whether they are in the treated samples or the control group. Husbands across treatment status share the same types of similarities as wives do. Employed husbands work approximately 40 h per week, and between 87 and 90% of employed husbands work full-time. The average age of husbands is approximately 60 regardless of treatment status.

Despite these similarities, some differences across disability status exist. Those in the treatment groups tend to have lower probabilities of being employed during their first observation and have higher odds of being retired relative to the non-disabled control group. Husbands and wives in eventually-disabled households also have lower levels of schooling and labor earnings relative to their non-disabled counterparts.

Table 3 provides data on the 2016 early and normal retirement ages for each country that appears in the data. When retirement ages differ by gender, we report the ages separately for men and women. The average ages shown in Table 2 are near the early retirement age for many of the countries in the sample. Recall that all disabled couples must have at least one observation before disability onset. Therefore, in Table 2, we restrict the calculations to only the first observation to ensure that the treated and control units are as comparable as possible. This makes the average ages slightly younger than the averages calculated across the entire panel. For women in the control group, the average age is 60 when using all observations across the entire panel. For women married to disabled men, the average is 61; for women who become disabled, the average is 61. The same numbers for men are 63, 64, and 64, respectively. Therefore, work-limiting disabilities are occurring when individuals are of early and normal retirement age. This may have implications for the effect of spousal health shocks on labor supply decisions. We perform a heterogeneity analysis later in this section to investigate this issue further.

4.2 Labor market outcomes after own disability

Before documenting labor market responses to spousal disability onset, we estimate individual-level outcomes after own-disability. Doing so helps to motivate and explain some of the responses a partner has to the onset of a spouse’s work-limiting health shock. To this end, we estimated Eq. (1) using the CS methodology. However, instead of treatment being the disability onset of the spouse, treatment is the onset of own disability. The outcomes examined in this sub-section include the probability of employment, the probability of working full-time, average weekly hours worked, the probability of being retired, the natural log of earnings, and the natural log of total monthly household income.Footnote 4 Results appear in Table 4.

Focusing on wives, the results in Table 4 suggest that the onset of a work-limiting health shock is associated with a decrease in employment of 3.1 percentage points. Those wives who remain employed reduce their intensity of work. The probability of working full-time falls by 6.8 percentage points, and there is a corresponding reduction of 1.12 h of work per week. With some wives leaving employment, there is a corresponding increase in the probability of retirement post-disability. There appears to be no statistically significant relationship between earnings or income and the onset of a work-limiting health shock for wives.

When moving to husbands, results show many of the same patterns as for wives: there is a significant reduction in the probability of being employed and a corresponding increase in the probability of retirement of nearly equal magnitude. Interestingly, results in Table 4 suggest that the structure of work does not change significantly for husbands who remain employed post-disability onset. The probability of working full-time does fall by 2.7 percentage points; however, the estimate is only marginally significant at the 10% level. There is no meaningful change in weekly hours of work after onset relative to the comparison group. Husbands experience earnings declines of approximately 13% after suffering from a work-limiting health shock. However, there is no significant relationship between male disability onset and total monthly household income, suggesting that other sources of income exist to mitigate the decline in earnings experienced after the work-limiting health shock.

To investigate any dynamic treatment effects, we estimated Eq. (2) using the CS methodology and plotted the event history coefficients, along with the associated 95% confidence intervals, for wives and husbands in Figs. 1 and 2, respectively. In each figure, the horizontal axis represents time relative to the wave of own-disability onset. Focusing on wives, Fig. 1 shows that the onset of a disability is associated with a relatively permanent reduction in the probability of employment. Aside from period t + 3, the reduced probability of employment seems to be rather stable post-disability onset. For those wives who remain employed after this health shock, the reduction in work intensity (i.e., full-time employment and hours worked per week) seems to dissipate by the second survey after onset. Disability’s effect on the probability of retirement tends to grow as time passes. Interestingly, the effect is not immediate, and wives tend to experience this increased probability starting in the first survey after the work-limiting health shock. Finally, Fig. 1 shows no temporal pattern regarding earnings or family income.

Event history analysis—wives’ labor market outcomes around wives’ disability onset. Notes: The dashed lines represent the 95% confidence intervals. The event history analysis is estimated using the methodology developed by Callaway and Sant’Anna (2021) (CS). The CS methodology does not have an omitted relative time period like the traditional event history analysis does. Pre-treatment estimates are calculated relative to the preceding wave. For example, for someone reporting a disability in wave 5, the t – 1 estimate uses wave 2 as the base wave. For someone reporting a disability in wave 6, the t – 1 estimate uses wave 4 as the base. See Callaway and Sant’Anna (2021) for more detail

Event history analysis – husbands’ labor market outcomes around husbands’ disability onset. Notes: The dashed lines represent the 95% confidence intervals. The event history analysis is estimated using the methodology developed by Callaway and Sant’Anna (2021) (CS). The CS methodology does not have an omitted relative time period like the traditional event history analysis does. Pre-treatment estimates are calculated relative to the preceding wave. For example, for someone reporting a disability in wave 5, the t – 1 estimate uses wave 2 as the base wave. For someone reporting a disability in wave 6, the t – 1 estimate uses wave 4 as the base. See Callaway and Sant’Anna (2021) for more detail

When moving to Fig. 2 for husbands, results show that the negative impact of disability on employment dissipates over time. By the second survey after onset, the probability of employment for the disabled is not different from the comparison group. As suggested by Table 4, there is no temporal relationship between work intensity and disability. Unlike wives, the effect of the husband’s disability on retirement is immediate, starting with the wave of onset, and grows over time. Finally, while there is no temporal pattern around the wave of onset for monthly household income, the earnings losses experienced by disabled husbands tend to be short-lived and only occur during the survey wave of the first report.

4.3 Labor supply responses to spousal disability

Given the significant employment changes and, in the case of husbands, earnings losses, associated with disability onset documented above, it is reasonable to expect that the non-disabled spouse will adjust their labor supply in some way. The direction of the response, however, is ambiguous and depends on whether the caring/consumption of joint leisure effect dominates the added worker effect. We estimate Eq. (1) for husbands and wives separately five times, once for each of the four measures of labor supply investigated here (the probability of employment, the probability of working full-time, average weekly hours of work, and the probability of retirement) and again for the desire to retire early. Results are in Table 5.

Starting with husbands, the results in Table 5 suggest that husbands do not alter their labor supply/retirement decisions after their wives experience a work-limiting health shock. None of the estimates is large or statistically significant at conventional levels. Focusing on wives responding to their husbands’ disability, we can see that the probability of employment and measures of work intensity (working full-time and weekly hours worked) do not change significantly after the husbands’ disability occurs. There is a significant increase in the probability that the wife retires after her husband experiences a work-limiting health shock, and this estimate is significant at the 5% level. After onset, wives are 2.8 percentage points more likely to retire relative to wives of the non-disabled. Moreover, when husbands suffer a work-limiting health shock, wives experience a statistically significant increase in the probability of wanting to retire as early as possible equaling 2.8 percentage points. Therefore, not only are wives retiring when their spouses become disabled, but also, they change their desire to retire.

To investigate any dynamic effects associated with wives’ retirement decisions, we estimated Eq. (2) using these two outcomes as dependent variables. We focus on the dynamic relationship with wives’ retirement decisions as these were the only two statistically significant estimates presented in Table 5. The coefficients and associated 95% confidence intervals appear in Fig. 3. Focusing on the wives’ probability of retirement, it appears that the effect of spousal disability increases over time. Furthermore, despite some imprecision in the estimates in the post-treatment periods, the same can be said for the wife’s probability of the desire to retire early (periods t + 1 and t + 2 are significant at the 10% level).

Event history – wives’ response to husbands’ disability. Notes: The dashed lines represent the 95% confidence intervals. The event history analysis is estimated using the methodology developed by Callaway and Sant’Anna (2021) (CS). The CS methodology does not have an omitted relative time period like the traditional event history analysis does. Pre-treatment estimates are calculated relative to the preceding wave. For example, for someone reporting a disability in wave 5, the t – 1 estimate uses wave 2 as the base wave. For someone reporting a disability in wave 6, the t – 1 estimate uses wave 4 as the base. See Callaway and Sant’Anna (2021) for more detail

The results in Table 5 suggest that women are more likely to retire after their husband becomes disabled. Given that husbands are more likely to retire after they become disabled, then the wives’ response could be due to the desire to consume joint leisure or to provide care to their husband. To investigate the provision of care further, we create a new variable that equals one if the respondent needed to provide personal care on a regular basis to his/her spouse within the last 12 months and zero otherwise. Here, personal care includes such actions as helping with washing, getting out of bed, or dressing; helping regularly means providing care on a nearly daily basis for at least three of the previous 12 months. We would expect that the onset of a spouse’s disability would result in an increased probability that the other partner provides personal care help. Results from re-estimating Eq. (1) with this new dependent variable support this notion and appear in Table 6. For instance, husband’s disability increases the probability that the wife will offer help with personal care by 6.2 percentage points, whereas the wife’s disability increases the probability that the husband will offer help with personal care by 4 percentage points. Furthermore, the estimates from Eq. (2), which are graphed in Fig. 4, suggest that this increased probability is immediate and permanent. In combination with the results in Table 5, it appears that while both genders are more likely to provide care to their disabled partner, women are more likely to retire in order to do so.

Event history – providing care after spousal disability. Notes: The dashed lines represent the 95% confidence intervals. The event history analysis is estimated using the methodology developed by Callaway and Sant’Anna (2021) (CS). The CS methodology does not have an omitted relative time period like the traditional event history analysis does. Pre-treatment estimates are calculated relative to the preceding wave. For example, for someone reporting a disability in wave 5, the t – 1 estimate uses wave 2 as the base wave. For someone reporting a disability in wave 6, the t – 1 estimate uses wave 4 as the base. See Callaway and Sant’Anna (2021) for more detail

We did investigate how the natural log of earnings adjusts after spousal disability onset for both husbands and wives. We present these results in On-Line Appendix A and provide a brief discussion here. Regardless of gender, the natural log of earnings is statistically unaffected by spousal disability onset at conventional levels. This is unsurprising given the lack of labor supply responses found here. As shown in Table 4, husbands experience significant earnings losses after they suffer from a work-limiting health shock; however, there is no significant effect on family income. The results in Table 4, coupled with the earnings results discussed here, suggest that other sources of income serve to mitigate the earnings losses experienced by husbands. Investigating which sources of income help disabled husbands the most is beyond the scope of this paper and is an interesting area for future research.Footnote 5

4.4 Sensitivity analysis

Thus far, our main results suggest that while husbands and wives provide care upon the onset of spousal disability, there is an increase in the probability of retirement/desire to retire early for wives of disabled husbands. This sub-section explores the sensitivity of our results. In Table 7, we examine how sensitive our results are to changes in the econometric specification. All estimates come from Eq. (1) and are comparable to results presented in Table 5.

Assortative mating along the dimension of health could exist. In other words, spouses may experience health shocks together. If so, then the estimate associated with the spouse’s health shock may capture the effect of own health on labor supply if we exclude own health shocks from the model. Panel A in Table 7 investigates this by including an own work-limiting disability variable as an extra control. This variable equals one during any wave the respondent reports a work-limiting health shock and zero otherwise.Footnote 6 Results in panel A show that the main results from Table 5 are maintained even after including controls for own-health shocks.

Individuals may alter labor supply upon the onset of a spousal disability to offset lost income, provide care, or to consume joint leisure. Given the findings from Table 5 (i.e., an increased probability of retirement for the wife following her husband’s health shock), caring and the consumption of joint leisure dominate the added worker effect. The results in Table 6 support the notion that providing care increases upon the onset of spousal disability. To investigate the relative importance of providing care versus joint leisure more directly, we construct a measure of limitation in the spouse’s ability to perform activities of daily living (ADL) following Siegel (2006) and include this index as an additional control variable in Eq. (1).Footnote 7 The results from doing so are in panel B of Table 7. The magnitude and significance of the estimates remain similar to the results in Table 5. These results suggest that, while caring increases upon a husband’s disability, the increased probability of retirement for wives is mainly due to the desire to consume joint leisure.

Observable characteristics of the spouse may be correlated with the onset of a spousal work-limiting health condition and labor supply decisions. In other words, characteristics of the husband may be correlated with the probability of him experiencing a health shock and the labor supply decisions of the wife and vice versa. To account for this, we re-estimate Eq. (1) after including all of the spouse’s characteristics as additional control variables. Specifically, we include a quartic in the husband’s age and husband educational attainment dummy variables in the wife’s labor supply regressions and include the wife’s characteristics in the husband’s labor supply functions. Results from this re-estimation appear in panel C of Table 7. As these estimates show, including observable spousal characteristics in the estimated equations does not alter the qualitative/quantitative results in any meaningful manner.

4.5 Heterogeneity

Since labor supply responses to spousal disability depend on the caring, joint leisure, and added worker effects, and since these effects differ for different subgroups, it is possible that labor supply responses vary depending on different observable characteristics. To this end, this subsection investigates heterogeneity along three dimensions: geographic proximity to children, the age at which the spouse becomes disabled, and whether the couple is age-eligible for early retirement at the time of disability onset. We discuss each of these analyses in turn.

Those who live closer to their children most likely have an enhanced joint leisure effect and dampened caring and added worker effects. Results thus far show that, on average, disability onset increases the probability of retirement for both husbands and wives. Results further show that spousal disability onset increases the probability of retirement for wives, and this may be due to the consumption of joint leisure. The ability to spend time with children and (potentially) grandchildren may enhance the desire to retire. The probability of being able to spend time with children increases as the distance from children and grandchildren declines. Additionally, close proximity to children may allow for caring responsibilities to be shared, which would reduce the necessity to alter work schedules for the disabled person’s spouse. Finally, if older couples live with their children, then it is possible that the financial stress associated with the onset of a work-limiting health-shock may reduce the need to increase spousal labor supply.

To investigate this, we estimate Eq. (1) separately by whether the disabled worker lives close to (within 5 km) or far from (more than five kilometers) the closest child at the time of the first reported disability. We chose 5 km as the cut-off as approximately 64% of the sample lives within 5 km of their children. We treat those without children as living more than 5 km away from the closest adult child. For those in the control group, we delineate the sample based upon living close to children during the first observation in the sample so as to make the control group as similar to the treated groups as possible. Results from this analysis are in Table 8. Focusing on husbands, results show that regardless of the geographic proximity of the couple to children, men do not significantly alter their work or retirement decisions upon spousal disability onset.

The results suggest a different story for the wives of disabled husbands. As Table 8 shows, wives of disabled husbands respond similar to the description provided above. Women who live close to children at the time of the husband’s disability have no significant change in work schedules; however, they are more likely to retire, and they are more likely to want to retire early. Women who live far from children, however, are more likely to work relative to wives of non-disabled husbands, and the probabilities of retirement and wanting to retire early are no different from the comparison group’s respective probabilities. Interestingly, for those wives who do work, they work approximately 1.6 h per week less than the wives of the non-disabled. Therefore, while the wives of disabled husbands who live far from their children are more likely to work than those wives in the comparison group, they work slightly less at the intensive margin.

It is possible that the effect of spousal health shocks on labor supply/retirement decisions differs based on an individual’s age at the time of onset. This may be due to differences in the length of time remaining in the life cycle after a person becomes disabled. To this end, we separate the treatment groups based upon the median age at the wave of the first disability report. We separate the treatment groups once based upon the husband’s age and again based upon the wife’s age. Results from this analysis are in Table 9. Panel A shows results from Eq. (1) when focusing on the wife’s response to her husband’s disability. There are four sets of estimates in panel A. The first two separate the treatment group based upon the median age of husband at the time the husband experiences the health shock. The other two separate the treatment group based on the median age of the wife at the time of the husband’s disability. Panel B is similar and examines the husband’s response to his wife’s health shock.

We begin by focusing on the first set of estimates in panel A. When husbands are below age 65 at the time they become disabled, wives respond similarly to the main results presented above. In other words, there is no change in the probability of employment, the probability of working full time, or weekly hours of work; however, there are significant increases in the probabilities of retiring and the desire to retire early. When husbands are relatively older at the time of disability, however, we see that the only significant effect is on the wife’s probability of retiring. Therefore, instead of wanting to retire early, women who are married to men who are relatively older at the time of the health shock simply choose to retire. We see similar results when separating the treatment group by the wife’s age at the time of the husband’s disability. The only result that differs from the main findings is that wives increase the probability of employment when they are relatively older when their husbands become disabled.

Focusing on the husband responding to his wife’s disability, panel B shows that whether we separate the treatment group by the wife’s median age at the time she becomes disabled or the husband’s median age at the time of the wife’s health shock, the same two findings arise: first, for the younger groups, men experience an increase in the probability of retiring after his wife’s health shock. This increased probability may be indicative of the desire to consume joint leisure. Second, for the older groups, husband’s experience an increase in the probability of employment after the onset of a spousal health shock.

As discussed previously, the average ages of the analytical sample used here are near the age at which individuals can retire and receive a pension. Furthermore, results suggest that wives’ desire to retire early and the probability of retirement increase significantly after spousal disability onset. Retirement decisions after a spouse’s health shock may be different depending upon whether individuals are age-eligible to receive a pension. To this end, we replicate the main analysis after separating the treatment groups based on whether individuals are age-eligible to receive pension payments. We define age eligibility using the ages presented in Table 3. When a country differentiates between early and normal retirement, we use the younger of the two ages. Results from this analysis appear in Table 10. As with the heterogeneity analysis by age, we separate the treatment groups in two ways. First, we separate the groups based on whether the disabled spouse is age-eligible for receiving pension payments; we then delineate by whether the healthy spouse is age-eligible. Panel A presents results focusing on wives responding to their husband’s disability. Panel B shows results for the husband’s response.

When focusing on the wife’s response to her husband’s health shock, results show that the probability of wanting to retire early increases significantly when individuals are not age-eligible for pension receipt. However, when they are eligible, the probability of actual retirement increases. These findings are intuitive. It is less costly to retire when one individual in a couple is capable of receiving pension payments. Therefore, we would expect that retirement probabilities increase when this is the case. However, the probability of wanting to retire early should increase when individuals in a couple are age-ineligible to actually retire.

We see similar results for the husband’s response to spousal disability when separating the treatment group based on whether the husband is age-eligible at the time of the wife’s health shock. In other words, when husbands are ineligible to receive a pension, they experience an increase in the desire to retire early; when husbands can receive a pension at the time of the wife’s health shock, however, they actually increase the probability of retiring. The precision of these estimates is somewhat low, as they are only significant at the 10% level. Interestingly, when separating the treatment group based on the wife’s eligibility status, we find no statistical effects on the husband’s retirement decisions/intentions. However, there is an increase in the probability of the husband being employed when the wife is eligible to receive pension payments, and there is a marginally significant increase in the probability of working full time when the wife is age-ineligible at the time of the health shock.

4.6 Regional differences

The previous literature on spousal health shocks and labor supply has come to differing conclusions regarding the size and direction of the effect. One reason for these differences across studies could be differences in research designs. Researchers have used different health shocks, different sample selection criteria, and, importantly, different countries. Countries have different social safety nets, which may enhance or dampen the added worker, caring, or joint leisure effects. Even if public programs designed to assist the disabled and their families are structured the same across countries, individuals in different locales may have different preferences based on varying social norms. Therefore, even observationally identical countries may have different net effects of spousal health shocks on labor supply decisions. The purpose of this sub-section is to replicate the variation in results found in the earlier literature to highlight the importance of geography in the estimated effects found in earlier studies. One benefit to using SHARE is that it allows for the pooling of countries. The analysis here contains 19 countries from Europe and Israel. This multinational characteristic of the dataset offers harmonization of survey questions and sample selection criteria across countries. This harmonization allows researchers the ability to isolate the effect of country differences in effects from differences in health outcomes and sample characteristics.

To replicate the variability in results found in the earlier literature, we follow Trevisan and Zantomio (2016) and group countries into four regions: Nordic (Sweden, Denmark, Netherlands), Continental (Austria, Germany, France, Switzerland, Belgium, Luxemburg), Mediterranean (Spain, Italy, Greece, Portugal, Israel), and Eastern (Czech Republic, Poland, Slovenia, Estonia, Hungary, Croatia). Trevisan and Zantomio (2016) note that these groupings represent countries that are relatively homogenous in terms of culture and welfare institutions. Table 11 shows each country’s average annual spending on disability benefits and unemployment benefits as a percentage of GDP from 2004 to 2017. With the exception of the Eastern region, spending on unemployment benefits is relatively similar; however, and importantly for this study, differences in spending on disability benefits exist, with Nordic countries spending the most at 3.9% and Eastern countries spending the least, 1.57%.

We re-estimated Eq. (1) after interacting the disability dummy variable with dummies for region of residence. Unlike the previous analyses presented above, we estimate Eq. (1) as a traditional two-way fixed-effects model instead of using the CS methodology.Footnote 8 This is because the point of this section is to replicate the heterogeneity in results found in the earlier literature. The earlier studies all used the traditional two-way fixed-effects/event history models presented in Eqs. (1) and (2). The results appear in Table 12.

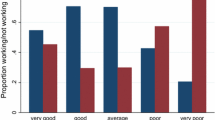

As expected, estimates vary across regions in terms of size, significance, and magnitude. Focusing on wives, those in the Mediterranean group experience a significant increase in the probability of employment after spousal disability onset of 6.2 percentage points, whereas wives in the Nordic countries experience a significant decrease in the probability of employment by 4 percentage points. Wives in the Nordic, Continental, and Eastern regions experience an increase in the probability of retirement, with the Eastern region having the largest increase; wives in the Mediterranean nations experience a significant reduction in the probability of retirement after spousal disability onset. Even though the results for hours worked per week and the probability of working full-time are insignificant, the point estimates differ in sign and magnitude. Differences in estimates occur for husbands as well. We performed an analysis similar to that presented in Table 12. However, instead of interacting the spousal health shock variable with regional dummies, we interacted the treatment variable with country dummies. These results are available in On-Line Appendix B and show substantial heterogeneity across countries.

The results in Table 12 are new to the literature. To our knowledge, no study exists that compares labor supply responses to spousal health shocks across regions. These findings are important for two reasons. First, they help explain why differences across studies exist when studies focus on just one country. Second, the cross-regional heterogeneity found here highlights the importance of country-specific characteristics that affect how individuals adjust to familial health shocks. However, the results in Table 12 do not separate country-specific institutions, such as generosity of public programs designed to assist the disabled, from social norms. To investigate this, we re-estimated Eq. (1) after interacting the treatment dummy variable with the country-specific disability spending figures presented in Table 11. This is similar to Trevisan and Zantomio (2016). Here, we would expect that more spending on disability benefits would reduce labor supply and increase retirement decisions/intentions. In other words, the estimated coefficients associated with the interaction term would be negative for the labor supply outcomes (probability of employment, probability of full-time work, and hours worked per week) and positive for the retirement outcomes. The coefficients associated with the interaction terms are presented in Table 13. The remaining coefficients are available in On-Line Appendix D.

Regardless of gender, the coefficient associated with the interaction terms are of the expected sign when focusing on the labor supply outcomes. While the estimates are insignificant for the probability of working full-time and hours worked per week, increased disability spending significantly reduces the probability of employment after spousal disability onset for both wives and husbands. The evidence regarding retirement decisions is mixed. For wives, the interaction terms are insignificant for both retirement outcomes. The coefficient is positive for the probability of retiring; however, it is negative for the desire to retire early. The signs switch when focusing on husbands. Here, the interaction term is significantly negative for the probability of retirement and insignificant and positive for the desire to retire early.

5 Conclusions

The purpose of this paper is to analyze the effect that spousal health shocks have on labor market outcomes. Specifically, we use data from five waves of the Survey of Health, Ageing and Retirement in Europe, and examine how the onset of a spouse’s work-limiting disability influences employment, hours worked, the propensity to work full-time, retirement, and the desire to retire early. Results from the analysis suggest that the onset of spousal disability has no effect on labor supply or retirement decisions for husbands. Wives of disabled husbands, however, experience an increase in the probability of retirement and an increase in the desire to retire early. Results suggest that this may be due to the desire to consume joint leisure. These estimates are robust to a series of specification changes.

The analysis presented here relies upon self-reported work limitations due to health. When estimating the effect of spousal health on labor supply, these self-reported measures typically suffer from four sources of bias: justification bias, measurement error, omitted variables, and assortative mating. We attempt to alleviate this bias through a series of sensitivity analyses. However, none of the sensitivity analyses performed here completely eliminates the bias from these four sources. Therefore, the estimated effects presented above may still be biased estimates of the causal effect of spousal health on labor supply.

The main contribution of our study is the use of a broad, international dataset. The SHARE dataset used here contains responses from households within 19 European countries and Israel. This is the first paper to provide separate estimates of the relationship between spousal health and labor supply for a multitude of countries using harmonized sample selection criteria and measures of health. We show substantial cross-regional heterogeneity in household responses to spousal disability. These results highlight the importance of considering country-specific factors and help to reconcile and replicate the inconsistent results found in the earlier literature.

Data availability

The data used in this study come from the Study of Health, Ageing, and Retirement in Europe and are available here: http://www.share-project.org/home0.html. Code used to create the analytical sample and derive the estimates presented in the manuscript is available from the corresponding author upon reasonable request.

Notes

Hardoy and Schøne (2014) examine the effect of husbands’ job displacements on their wives’ labor supply using Norwegian data. The authors find no evidence of an added worker effect, which suggests some crowding-out effect of social welfare programs. However, Kohara (2010), using Japanese data, finds an increase in wives’ labor supply at the intensive and extensive margins following husbands’ job displacements.

Berger and Fleisher (1984) did not report an age range. However, the average age of the women in their sample is 46 years old.

In the USA, pre-primary education is equivalent to nursery school/preschool.

Earnings and income data in SHARE refer to earnings in the calendar year preceding the survey wave. As described above, it is not possible to correctly time the onset of the work-limiting disability. Given that households are surveyed approximately every two years in SHARE, the earnings and income data could come from the same calendar year as the onset of the health shock, the year before onset, or the year afterwards.

We also estimated the effect of spousal disability on the log of own pension income. As with log earnings, we find no significant effect of spousal health shocks on own pension income.

Results are unchanged if we define the own health shock variable to equal one in every wave after the first report.

The ADLs investigated here include: ability to walk 100 m, get up from a chair after sitting for long periods, climb several flights of stairs without resting, climb one flight of stairs without resting, stoop or kneel or crouch, reach or extend the arms above shoulder level, pull or push large objects like a living room chair, lift or carry weights over 10 pounds/5 kilos, pick up a small coin from a table, dress, walk across a room, bath or shower, eat, and get in or out of bed.

We replicated the entire analysis using the traditional two-way fixed-effects methodology. The results are very similar to the ones derived from the CS method and are available in On-Line Appendix C. Therefore, any bias in the two-way fixed-effects setup is minimal.

References

Angelini V, Cavapozzi D, Paccagnella O (2012) Cross-country differentials in work disability reporting among older Europeans. Soc Indic Res 105:211–226

Berger MC, Fleisher BM (1984) Husband’s health and wife’s labor supply. J Health Econ 3:63–75

Börsch-Supan A (1992) Population aging, social security design, and early retirement. J Inst Theor Econ 148(4):533–557

Börsch-Supan A (2017) Survey of health, ageing and retirement in Europe (share) In: Encyclopedia of Geropsychology, pp. 2343–2350, (edited by Nancy A Pachana). Springer, Singapore

Börsch-Supan A (2020) Survey of health, ageing and retirement in Europe (share) Wave 2. Release version: 7.1.0. SHARE-ERIC. Data set. https://doi.org/10.6103/SHARE.w2.710

Börsch-Supan A (2020) Survey of health, ageing and retirement in Europe (share) Wave 4. Release version: 7.1.0. SHARE-ERIC. Data set. https://doi.org/10.6103/SHARE.w4.710

Börsch-Supan A (2020) Survey of health, ageing and retirement in Europe (share) Wave 5. Release version: 7.1.0. SHARE-ERIC. Data set. https://doi.org/10.6103/SHARE.w5.710

Börsch-Supan A (2020) Survey of health, ageing and retirement in Europe (share) Wave 6. Release version: 7.1.0. SHARE-ERIC. Data set. https://doi.org/10.6103/SHARE.w6.710

Börsch-Supan A (2020) Survey of health, ageing and retirement in Europe (share) Wave 7. Release version: 7.1.1. SHARE-ERIC. Data set. https://doi.org/10.6103/SHARE.w7.711

Börsch-Supan A, Brandt M, Hunkler C, Kneip T, Korbmacher J, Malter F, Schaan B, Stuck S, Zuber S (2013) Data resource profile: The survey of health, ageing and retirement in Europe (share). Int J Epidemiol 42(4):992–1001

Braakmann N (2014) The consequences of own and spousal disability on labor market outcomes and subjective well-being: Evidence from Germany. Review of the Economics of the Household 12:717–736

Callaway B, Sant’Anna PHC (2021) Difference-in-differences with multiple time periods. J Econ 225(2):200–230

Charles KK (1999) Sickness in the family: Health shocks and spousal labor supply. Ford School of Public Policy University of Michigan

Charles KK (2003) The longitudinal structure of earnings losses among work-limited disabled workers. Journal of Human Resources 38(3):618–646

Chen ES (2012) Spousal labor supply responses to government programs: Evidence from the disability insurance program. University of Michigan Retirement Research Center, Working Paper WP 2012–261

Coile CC (2004) Health shocks and couples’ labor supply decisions. NBER Working Paper # 10810

Fadlon I, Nielsen TH (2021) Family labor supply responses to severe health: Evidence from Danish administrative records. Am Econ J Appl Econ 13(3):1–30

Garcia-Gomez P, van Kippersluis H, O’Donnell O, van Doorslaer E (2013) Long-term and spillover effects of health shocks on employment and income. Journal of Human Resources 48(4):873–909

Hardoy I, Schøne P (2014) Displacement and household adaptation: Insured by the spouse or the state? J Popul Econ 27:683–703

Jeon SH, Pohl RV (2017) Health and work in the family: Evidence from spouses’ cancer diagnoses. J Health Econ 52:1–18

Jolly NA (2013) The impact of work-limiting disabilities on earnings and income mobility. Appl Econ 45(36):5104–5118

Kalwij A, Vermeulen F (2008) Health and labour force participation of older people in Europe: What do objective health Indicators add to the analysis? Health Econ 17:619–638

Kim K, Sang-Hyop L, Halliday TJ (2018) Health shocks, the added worker effect, and labor supply in married couples: Evidence from South Korea. University of Hawaii at Manoa. Working Paper Number 18–12

Kohara M (2010) The response of Japanese wives’ labor supply to husbands’ job loss. J Population Econ 23:1133–1149

Lindeboom M, Kerkhofs M (2009) Health and work of the elderly: Subjective health measures, reporting errors, and endogeneity in the relationship between health and work. J Appl Economet 24:1024–1046

Meyer BD, Mok WKC (2019) Disability, earnings, income, and consumption. J Public Econ 171:51–69

Mok WKC, Meyer BD, Charles KK, Achen AC (2008) A note on “the longitudinal structure of earnings losses among work-limited disabled workers.” Journal of Human Resources 43(3):721–728

Nagi SZ, Hadley LW (1972) Disability behavior: Income change and motivation to work. Ind Labor Relat Rev 25(2):223–233

Riekhoff AJ, Vaalavuo M (2021) Health shocks and couples’ labor market participation: A turning point or stuck in the trajectory. Soc Sci Med 276:113843

Riphahn RT (1999) Income and employment effects of health shocks. A test case for the German welfare state. J Popul Econ 12:363–389

Shen Z, Zheng X, Tan Y (2019) The spillover effects of spousal chronic diseases on married couple’s labour supply: Evidence from China. Int J Environ Res Public Health 16:4214. https://doi.org/10.3390/ijeprh16214214

Siegel MJ (2006) Measuring the effect of husband’s health on wife’s labor supply. Health Econ 15:579–601

Stephens M (2001) The long-run consumption effects of earnings shocks. Rev Econ Stat 3(1):28–36

Sun L, Abraham S (2021) Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. Journal of Econometrics 225(2):175–199

Trevisan E, Zantomio F (2016) The impact of acute health shocks on the labour supply of older workers. Evidence from sixteen European countries. Labour Econ 43:171–185

van Bastelaer A, Lemaître G, Marianna G (1997) The definition of part-time work for the purpose of international comparisons. OECD Labour Market and Social Policy Occasional Papers, No. 22, OECD Publishing, Paris, https://doi.org/10.1787/132721856632.

Wu S (2003) The effects of health events on the economic status of married couples. Journal of Human Resources 38(1):219–230

Acknowledgements

This paper uses data from SHARE Waves 2, 4, 5, 6 and 7 (https://doi.org/10.6103/SHARE.w2.800, https://doi.org/10.6103/SHARE.w4.800, https://doi.org/10.6103/SHARE.w5.800, https://doi.org/10.6103/SHARE.w6.800, https://doi.org/10.6103/SHARE.w7.800), see Börsch-Supan et al. (2013) for methodological details. The SHARE data collection has been funded by the European Commission, DG RTD through FP5 (QLK6-CT-2001-00360), FP6 (SHARE-I3: RII-CT-2006-062193, COMPARE: CIT5-CT-2005-028857, SHARELIFE: CIT4-CT-2006-028812), FP7 (SHARE-PREP: GA N°211909, SHARE-LEAP: GA N°227822, SHARE M4: GA N°261982, DASISH: GA N°283646) and Horizon 2020 (SHARE-DEV3: GA N°676536, SHARE-COHESION: GA N°870628, SERISS: GA N°654221, SSHOC: GA N°823782, SHARE-COVID19: GA N°101015924) and by DG Employment, Social Affairs & Inclusion through VS 2015/0195, VS 2016/0135, VS 2018/0285, VS 2019/0332, and VS 2020/0313. Additional funding from the German Ministry of Education and Research, the Max Planck Society for the Advancement of Science, the U.S. National Institute on Aging (U01_AG09740-13S2, P01_AG005842, P01_AG08291, P30_AG12815, R21_AG025169, Y1-AG-4553-01, IAG_BSR06-11, OGHA_04-064, HHSN271201300071C, RAG052527A) and from various national funding sources is gratefully acknowledged (see www.share-project.org). We are grateful to editor Alfonso Flores-Lagunes and two anonymous referees whose guidance, comments and suggestions significantly improved the paper. We also thank Alexandros Polycarpou and George Voucharas for data support. Participants at the Midwest Economic Association Annual Meetings (2022), the SHARE Netherlands User Conference (2021), and the SHARE, EM-AGE/AL-SEHA Conference (2021) in the American University of Cairo provided useful comments. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible editor: Alfonso Flores-Lagunes

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jolly, N.A., Theodoropoulos, N. Health shocks and spousal labor supply: an international perspective. J Popul Econ 36, 973–1004 (2023). https://doi.org/10.1007/s00148-022-00929-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-022-00929-7