Abstract

We use matched employer–employee data from Finland to model transitions out of work into sick leave and disability retirement. To identify the role of institutional factors, we exploit reforms that changed medical requirements for disability pension eligibility and experience-rated employer contributions. We find that transitions to sick leave and disability pension benefits are relatively rare in growing establishments, but rather common in establishments with a high degree of excess worker turnover. We also show that transitions to disability retirement depend on the stringency of medical screening and the degree of experience rating applied to the employer.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The disability benefit scheme is one of the largest social security programmes in many countries and therefore of particular interest. In Finland, disability is the most common reason for early retirement, and disability expenditure accounted for some 3.5% of GDP in 2003, which was the third highest share in the EU after Sweden and Denmark (Börsch-Supan 2007). Disability enrolment rates of older employees vary strikingly across the European countries and the USA. These cross-country differences cannot be explained by demographic or health-related factors, but are attributable to institutional differences in the disability schemes (Börsch-Supan 2007). During the past two or three decades, many countries have also experienced an expansion of disability benefit enrolment. This is a serious concern given the common goal to induce people to retire later. The widespread use of disability benefits as an early retirement instrument has been argued to be a particularly serious problem in Finland (e.g. OECD 2008).

Disability benefits are designed to provide insurance for employees’ labour income against the risk of becoming disabled and incapable of regular work. In practice, it may be difficult to identify employees who are truly disabled, which suggests the possibility that disability benefits can distort labour supply and demand in some cases. Autor and Duggan (2003, 2006), for example, argue that rapid growth in disability benefit rolls in the USA cannot be explained by changes in health, but is driven by a combination of labour demand conditions and changes in the disability scheme itself (in terms of generosity, coverage and screening intensity). Other authors have also found evidence of the importance of the generosity of disability benefits, the stringency of medical screening and the economic environment when explaining participation in disability programmes (e.g. Gruber 2000; Black et al. 2002; Campolieti 2004). A majority of this literature has been motivated by a simple labour supply framework, in which an employee chooses whether to apply for disability benefits, while the employer has no role at all. Surprisingly little effort has been made to study the labour demand side (some exceptions are Hassink et al. 1997; Koning 2009).

When employment reductions are necessary, firms often get rid of their oldest employees first. If health requirements for disability benefit eligibility are weak, early retirement via the disability scheme can be a useful strategy in effective downsizing, providing a way to reduce the workforce in a ‘soft’ way. On the other hand, some firms can also target dismissals at those employees with a high risk of disability. In doing so, the employer may avoid disability costs arising from the experienced-rated contributions of disability pension benefits. Encouraging disability retirement can be an attractive strategy also for an employer that wants to change the composition of the workforce at the time of stable or growing employment when dismissals are difficult to justify.

This study aims to shed some light on the relationships between labour demand, institutional factors and early retirement through disability programmes. We consider the importance of the labour demand side by examining the relationship between the establishment’s growth and restructuring rates and its employees’ disability entries. In addition, we assess the effectiveness of two policy instruments: the strictness of medical requirements for disability pension eligibility and the experience rating of disability expenditures. The first one determines the ease of access to disability pension benefits, whereas the latter one directs part of the costs of early retirement to the employer.

Using matched employer–employee data from Finland, we model transitions out of work to sick leave and disability retirement. To identify the role of institutional factors, we exploit a law change that made the medical requirements for disability pension eligibility tougher for a certain group, as well as changes in partially experience-rated employer contributions. We show that transitions to sick leave and disability pension benefits are relatively rare in growing establishments, but rather common in establishments with a high degree of excess worker turnover. We find no evidence that employers would actively encourage disability retirement as a way of adjusting their workforce when downsizing. Finally, we show that the transition rate to disability retirement depends on the stringency of medical screening and the degree of experience rating applied to the employer.

The paper proceeds as follows: In the next section, we give a short overview of the existing literature. Section 3 describes the Finnish social security system for sickness benefits and disability pensions. We discuss our data and report descriptive statistics in Section 4. The results of our econometric analyses are reported and discussed in Section 5, which is followed by a concluding section.

2 Related literature

Disability benefits are typically determined as a function of past earnings, which are likely to be correlated with the employee’s preferences for work. The resulting endogeneity problem has hampered attempts to quantify the impact of disability benefits on labour supply. Gruber (2000) and Campolieti (2004) overcome the endogeneity problem by exploiting policy changes in the Canadian disability benefit scheme that had differential effects on people living in different parts of the country. While Gruber estimates that the elasticity of non-participation with respect to disability insurance benefits is between 0.28 and 0.36, Campolieti finds no statistically significant relationship. In the late 1980s, which is the period analysed by Gruber, non-medical factors related to the availability of suitable jobs in the region and personal skills were taken into consideration when determining benefit eligibility. Campolieti considers an earlier reform that took place in the early 1970s when the eligibility requirements and the stringency of medical screening were tougher. This led Campolieti to argue that the generosity of the disability benefits may not distort working decisions when it is difficult to qualify for such benefits because of a strict screening process.

Using aggregate data for the USA, Black et al. (2002) and Autor and Duggan (2003, 2006) find evidence of the relationship between disability participation and business cycle conditions. Black et al. use data from the coal boom and bust in the 1970s and 1980s, which affected only a few coal-producing counties, to construct instrumental variables for local labour market shocks. According to their county-level analysis, participation in disability programmes falls during economic upturns, and this relationship is much stronger for permanent than for transitory economic shocks. Autor and Duggan discuss a dramatic expansion of disability insurance enrolment during the past two decades in the USA.Footnote 1 They argue that this growth cannot be explained by a true increase in the incidence of disabling illness. Instead, they claim that the reduced stringency of the screening for disability benefits after 1984, an increase in the earnings replacement rate and an increase in female labour force participation have played important roles. As a result of the liberalization of disability benefits in 1984, the disability application rates were found to become more responsive to adverse labour demand shocks. This result supports Campolieti’s (2004) interpretation of Canadian evidence. Autor and Duggan (2003) estimate that the unemployment rate of workers aged 25–64 in 1998 was a half percentage point lower than it would have been otherwise. They argue that the US disability system has begun to ‘function much like a long-term unemployment insurance program for the unemployable’ (Autor and Duggan 2006, p. 74).

Unlike the US studies based on aggregate data, Vahtera et al. (2007) and Rege et al. (2009) analyse individual-specific disability risks. Using matched employer–employee data for Norway, Rege et al. explain the likelihood of being on a disability pension with dummy variables indicating various degrees of plant downsizing during the past 6 years. They find a substantial increase in the transition rate to disability retirement following plant downsizing or plant closure.Footnote 2 Whereas Rege et al. do not make a distinction between those who kept their jobs and those who lost their jobs in plant downsizing, Vahtera et al. consider a risk of disability retirement among Finnish municipal employees who kept their jobs after the reduction of personnel in their organisation. These employment reductions were carried out between 1991 and 1993, during a period of severe recession in Finland. They find an almost twofold risk of being granted a permanent disability pension in the next 5 years after a major downsizing (more than 18% reduction in the personnel) than after no downsizing (less than 8% reduction). Thus, not only employees who lose their jobs but also those who keep their jobs after the employment reduction are subject to an increased disability risk.

Börsch-Supan (2007) points out that disability expenditures and enrolment rates vary notably across different countries. In Europe, disability expenditures are the highest in Finland, Sweden and Denmark.Footnote 3 Börsch-Supan analyses the cross-country differences in the disability enrolment rates of people aged 50 to 65 years, using harmonized survey data for 12 European countries and similar survey data for the UK and USA. He finds very little explanatory power for demographic and health-related differences across the countries. By contrast, three quarters of the cross-country variation was explained by the institutional variables that describe the generosity and the ease of access of the disability insurance. The most influential institutional factor turned out to be the strictness by which vocational considerations are applied when determining eligibility.

The studies discussed above do not pay much attention to the employer’s role. Hutchens (1999) develops a theoretical framework that helps to understand why employers may be actively involved in early retirement decisions. He introduces an implicit contract model of a firm that uses early retirement benefits, provided by the government, as a form of unemployment insurance. Within this framework, the public early retirement benefits effectively subsidize workforce reductions. Therefore, the firm responds to slack demand by encouraging early retirement, which leads to an inefficiently high level of early retirement. Hutchens also discusses two alternative policies: actuarial adjustments and experience rating. An actuarial adjustment places costs on early retirees by reducing their future benefits compared to the case where retirement occurs at a later day, whereas experience rating places costs on firms by directing part of the early retirement expenditure to the former employer. While both of these policies can be used to reduce the implicit subsidy and thereby restore early retirement to the efficient level, their implementation is subject to some practical drawbacks. Namely, an effective early retirement scheme should vary with individual characteristics, like wages and survival probabilities. Since the real-world scheme cannot account for all individual heterogeneity, the implicit subsidy will exist at least for some groups even if the scheme eliminates the subsidy ‘on average’.

Theoretical insights of Hutchens (1999) are supported by empirical findings of two studies from The Netherlands. Using data on the dismissal and disability rates of Dutch firms, Hassink et al. (1997) examine to what extent separations into disability are used as an alternative to dismissals. They estimate that about one tenth of the observed inflow into disability was effectively dismissals. The data used by Hassink et al. covered the years 1988 and 1990 when the experience rating of disability benefits was not yet introduced in The Netherlands. In 1998, the employer’s annual disability insurance contribution rate was tied to the amount of disability benefits received by its former employees during a past 5-year period (beginning 7 and ending 2 years prior to the year in question). As a result, the employers became partly liable for the costs of the first 5 years of disability benefits. Koning (2009) compares inflow rates to disability benefits between employers that experienced a change in the contribution rate in 2001 (triggered by a decline or increase in the disability inflow in 1999 compared with an earlier period) and those with no change in the contribution rate. He finds that in the firms that experienced a (positive or negative) change in the contribution rate, the disability inflow rate decreased during the next 2 years compared with the firms with no change in the contribution rate. Koning interprets this as evidence that employers were not completely aware of the experience rating scheme, and hence, the change in the contribution rate acted as a ‘wake-up call’ to pay attention to experience rating. This in turn induced the employers to increase preventive actions, reducing disability events in the subsequent years.

It should be stressed that Koning’s data only covered three post-reform years, and thereby there were no exogenous changes in the experience rating scheme during the observation period. Instead, all the observed changes in the contribution rates were driven by changes in firms’ own disability history. While Koning’s findings indicate some information imperfections (at least a few years after the introduction of the experience rating system) and imply that experience rating does matter, his results do not describe the causal effects of having a given degree, or a particular type, of an experience rating system compared with the counterfactual case of having some another scheme.

In sum, we can draw the following lessons from the existing literature: (1) the generosity of disability compensation and negative demand shocks increase the entry rates to disability benefit schemes, (2) the strength of this relationship depends on the stringency of medical screening and (3) the experience rating of disability benefit costs can be used to reduce the moral hazard problem. Our study complements this literature in a number of ways. First, in addition to studying transitions from work to disability retirement, we also consider transitions from work to sick leave and from sick leave to disability retirement. In this way, we can differentiate between factors affecting the incidence of sickness or injury (ex ante effects) and those affecting the intensity or success of medical and occupational rehabilitation (ex post effects). This distinction helps us to detect the point in the disability pension track when certain policy instruments are effective. Second, when analysing the role of labour demand, we pay particular attention to excess worker turnover, which describes a degree of restructuring for a given employment change. This helps us to show that disability benefits may be used to adjust the structure of the workforce at the times when the employment level is stable. Third, we take advantage of two policy reforms to identify the causal effects of the experience rating of disability benefits. Our results indicate that experience rating reduces the incidence of disability and sickness. Finally, by accounting for a firm’s financial position, we also show that experience rating has a heterogeneous effect, being less effective for those employers that can easily incur their share of the disability pension costs.

Given that there is hardly any evidence on the experience rating of disability benefits, our analysis of the effects of experience-rated contributions on the disability entry rate is the main contribution of the paper. Koning (2009) is an exception, but we extend his work in several ways. Most importantly, our estimates for the impact of experience rating can be given a causal interpretation. The lack of prior evidence is partly due to the fact that disability benefit expenditures are subject to experience rating only in a few countries. Still, the topic should be of considerable interest as many countries suffer from high and still growing rates of disability programme participation, and experience rating is one potentially effective policy instrument.

3 Institutional framework for Finland

The Finnish social security system has been subject to continuous changes over time. Below we describe the features of the system that were in force from the early 1990s until 2004, which is the time period covered by our empirical analysis.

3.1 Sickness and disability benefits

An employee who is unable to perform his job due to illness or injury is entitled to compensation for income losses. The applicant needs a statement by a doctor or hospital certifying that he is not capable of work. For the first 10 working days, the applicant is fully compensated by the employer, after which he can claim a sickness benefit from the Social Insurance Institution (KELA). Depending on the collective labour agreement, many employers continue to pay wages or salary after the mandatory waiting period of 10 working days, in which case the allowance is paid to the employer. As a result, the time out of work until receipt of a sickness benefit directly from the Social Insurance Institution is typically 1 to 3 months. The sickness benefit is determined by the past taxable earnings, and it can be received for a maximum of about one year (300 working days, Saturdays included). Depending on illness or disability, the applicant’s rehabilitation needs and possibilities are assessed in a more extensive medical examination during the sickness benefit period. In case of a prolonged illness or permanent disability, the employee can apply for a disability pension.

An ordinary disability (OD) pension is payable to individuals aged 16 to 64 whose working capacity has significantly decreased. A full benefit is conditional on the working capacity loss of at least 60% and a partial benefit for a loss of 40% to 59%. When determining eligibility, an individual’s capability to support herself by regular work, age, education, occupation and place of residence are taken into account along with the medical assessment. The OD pension can be granted either indefinitely (if return to work is not likely) or for a specific period. In the latter case, the OD pension is also referred to as a rehabilitation subsidy or a cash rehabilitation benefit, and its receipt is conditional on a rehabilitation plan. An OD pension may be discontinued if the working capacity of the recipient improves, but this rarely happens among older recipients (e.g. OECD 2008, p. 116). There is no automatic retesting of the disability status except for new periods of the rehabilitation subsidy.

An individual early retirement (IER) pension is another disability pension which is available for employees who have a long working career and who are unable to continue in their current job because of deteriorated health. Compared with the OD pension, eligibility for the IER pension is subject to less strict medical criteria. The minimum degree of working incapacity is not defined, and occupational factors like the length of service and working conditions carry greater weight. It suffices that working capacity has reduced to such an extent that the person cannot continue in her present job or occupation, so that other working possibilities are not considered. Unlike the OD pension, however, the IER pension is payable only to employees above a certain age threshold. In the private sector, there was a uniform age threshold of 55 until 1994 when it was raised by 3 years to 58 for people born in 1940 or later. In 2000, the age threshold was raised further by 2 years to 60 for those born in 1944 or later. In 2004, the IER scheme was abolished entirely from these same cohorts. At the same time, the medical criteria for OD pension eligibility were somewhat relaxed for people aged 60 and over.

Saurama (2004) provides some survey evidence that bad health is not the only reason for entering into a disability pension in Finland.Footnote 4 As expected, disability pensioners reported bad health as one of the main reasons for retirement, but many of them said that straining work played an important role as well. In particular, 62% of OD pensioners and 74% of IER pensioners had felt that their job had become too exhausting or they could not handle their job any more. A notable fraction of the respondents had also felt pressure to retire from the management or colleagues: 14% of OD pensioners and 24% of IER pensioners were partly forced out of their job. Hence, difficulties in performing job tasks and the pressure from the workplace are important factors affecting disability pension entry.

The purpose of the gradual abolition of the IER pension was to reduce the disability enrolment rates at higher ages. This reform made the medical requirements for disability pension eligibility tougher for the later cohorts who have been able to apply only for the OD pension and thereby should reduce the flow into disability pension benefits among those who are not truly disabled. Because only those employees born after 1939 (1994 reform) or after 1943 (2000 reform) were affected, these reforms provide us with a quasi-experimental setting for studying the importance of the stringency of medical screening.

3.2 Experience rating of disability pension benefits

A particular feature of the Finnish disability scheme is that employers are partially liable for the disability pension costs of their former employees via experience-rated employer contributions. Experience rating is not applied to firms with fewer than 50 (300 until 1995) employees, which pay a fixed tariff rate for each employee. The larger firms are partially covered by experience-rated contributions and partially by fixed (age-dependent) tariff rates. The employer subject to experience rating must pay its share of the present value of disability pension costs at the time when a disability pension is awarded to its former employee. Given that disability pension costs can accumulate over several years until the person reaches age 65 and transfers to an old-age pension, the disability event can become very costly for the former employer in the case of a large firm.

To be more specific, consider an employee i of firm j who is awarded a disability pension in year t. As a consequence, his employer has to make a lump-sum contribution equal to

where b i is an annual disability pension benefit, γ is the present-value multiplier and α is the degree of experience rating applied to firm j. The product of pension benefit b i and multiplier γ serves as an estimate of the present value of expected disability pension benefits up to the age when the entitlement to an old-age pension begins.Footnote 5 The multiplier γ is a decreasing function of worker’s age at the time of disability retirement, ranging from 9.66 at age 50 to 2.31 at age 62 for the groups analysed in this study.

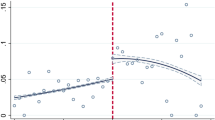

The realized marginal cost of a disability retirement entry depends crucially on the degree of experience rating, α, which is determined by the size of the firm’s workforce in year t − 1. Until 1995, α was 0 for all firms with fewer than 300 employees. In these firms, the pension contributions were independent of the retirement events of their employees, and consequently, the marginal cost of disability retirement was 0. For the larger firms, α increased as a linear function of firm size from 0 (300 employees) to 1 (1,000 employees); see Fig. 1. That is, the largest firms with at least 1,000 employees were fully liable for the expected disability pension costs of their former employees.

During the time period under investigation, the experience rating scheme changed twice. In 1996, the experience rating scheme was first extended to cover also firms with 50 to 299 employees. A smaller reform took place in 2000 when the maximum liability share was limited to 0.8. As a result of the two reforms, the degree of experience rating varies across firms of a given size over time, which can be seen in Fig. 1. By exploiting this variation for identification, we can distinguish the effect of experience rating from the firm size effect.

To highlight the size of disability costs for the employer, consider a worker who is awarded a disability pension at age 55 (γ ≈ 7.22). Assuming the pension benefit equals 55% of the past annual salary, which is true on average, the maximum disability cost for the former employer would be as much as four times the annual salary (i.e. α = 1 for a firm with over 1,000 employees before 2000). In the case of a firm with 400 employees, the disability cost would correspond either to 7 months’ salary (pre-1996 rules) or 18 months’ salary (rules from 1996 onwards). Hence, it is evident that the disability costs for the former employers can be quite large and that these costs changed substantially due to the two reforms.Footnote 6

The aim of experience rating is to minimize the employer’s moral hazard problem by placing costs on those firms whose employees enter the disability pension schemes. When an employee applies for a disability pension, the employer has no direct control over the decision made by the pension institution. Nevertheless, the employer has the means to indirectly affect the flow into sick leave and the likelihood that recipients of sickness benefits will return to work rather than retire via a disability pension scheme. If effective, experience rating should induce the employer to take preventive measures to minimize the flow into sick leave (the ex ante effect), as well as to put effort into getting its employees back to work from sick leave (the ex post effect). The preventive action may involve reallocation of the workload to minimize stress-related illness and arrangements that reduce accidents at the workplace. When helping people come back to work from sick leave, occupational rehabilitation and job modifications that allow the switching of jobs within the firm are crucial for those who cannot perform their old tasks despite medical rehabilitation.

4 Data and descriptive evidence

4.1 Data

Our data set was drawn from the records of the Finnish Longitudinal Employer–Employee Database (FLEED). Employee information in the database is obtained by merging information from over 20 administrative registers with unique personal identity numbers. The database covers effectively everyone with a permanent residence in Finland. Along with standard sociodemographic background variables, the database includes detailed information on annual income (from the tax authorities), job spells (from the pension institutes), unemployment spells and participation in labour market programmes (from the employment offices). For people who are employed in the last week of a given year, the ES database also includes the unique identification code of the firm and establishment. This allows us to identify individuals who are working for the same employer and provides a link to firm records. Thus, we are able to measure labour turnover and employment changes at establishment and firm levels.

The principal source of firm records in the FLEED is the Financial Statements Statistics, which is an annual survey conducted by Statistics Finland. The survey contains corporate income statement and balance sheet data on firms in manufacturing, construction, retail and wholesale trade, business services, hotel and restaurant services, and transportation. These data are available with time consistent variable definitions for the period 1986–2005. All firms above a certain size threshold, which varies between the sectors and over time, have been included in the survey. Until 1996, also a sample of smaller firms was included in the survey, but since then Statistics Finland have collected information on the small firms only from the administrative registers. So, the survey data for the later years have been complemented by adding firm records from the Business Tax Register with more limited information content but covering all firms in the private sector. The combined survey–register data should be dynamically representative over all firms in each year, although some small firms are missing from the first 6 years of our observation period.

Some key variables in the employee data contain information on sickness benefits, paid by KELA during the year, and on the types of pension benefits received at the last week of the year. These are used to detect transitions into sick leave and disability retirement. As discussed above, employees on sick leave are fully compensated by their employers for the first 10 days to 3 months, depending on the collective labour agreement under which they are employed. Hence, receipt of sickness benefits directly from KELA indicates a prolonged illness.

We can distinguish between OD and IER pension benefits, but we do not know the compensation level (partial or full benefit), nor whether a disability pension was granted indefinitely or for a specific period. We classify an employee as being on a disability pension if he or she received either OD or IER pension benefits at the last week of the year.

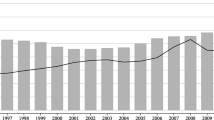

4.2 Incidence of disability retirement

We begin by considering the extent of the disability problem in Finland. While the official retirement age was 65 until 2005,Footnote 7 the effective retirement age—the average age of new pensioners—has been around 60 due to early retirement schemes, of which the disability schemes are the most important ones. In 2007, a roughly equal number of new pensioners were granted a disability pension and an old-age pension, but a few years earlier, the disability pension was the most common pathway to retirement. This explains why disability expenditures are so high in Finland compared with other industrialized countries.

A high incidence of disability is illustrated in Fig. 2 where the disability enrolment rates (including both OD and IER pension recipients) are shown as a function of age for four birth cohorts by sex.Footnote 8 Within all birth cohorts, women have lower enrolment rates at each age. Compared with the later cohorts, employees born in 1940 are more likely to be disabled at all ages. Close to 30% of this cohort were on a disability pension at age 60, which is a strikingly large figure. There are no notable differences in disability rates at a given age between the 1945, 1950 and 1955 cohorts. The lower disability rates for these cohorts may to some extent be related to their ineligibility for the IER pension scheme.

4.3 Outcome variables for analysis of transitions

We distinguish the likelihood of entering sick leave, which often means only temporary absence from work, from the likelihood of being granted a disability pension, which almost surely means a permanent withdrawal from the labour market. The determinants of these events can differ and be affected by experience rating in different ways. Hence, we shall model transitions from work to a disability pension, from work to sick leave and from sick leave to a disability pension. This approach ignores possible spillover effects towards other exit destinations, most notably into unemployment, which should be kept in mind when interpreting our results.

In all of our models, the risk set in year t includes employees who (a) were 50 to 62 years old at the end of year t − 1, (b) held a job at the end of year t − 1 in a private sector firm with at least ten employees, (c) had been working, without receiving any pension benefits, at least for three consecutive years (i.e. from the beginning of year t − 3 until the end of year t − 1),Footnote 9 and (d) did not receive sickness benefits during year t − 1.Footnote 10 We exclude the younger and older employees because their transitions into disability retirement are very rare. Moreover, for younger employees, it is probably very difficult to be granted a disability pension without serious injury or illness, whereas the older employees can retire via other early retirement schemes, suggesting that the misuse of the disability pension schemes is not a serious issue for these groups. We also exclude employees from firms with less than ten employees, as the data on very small firms are noisy.

Transitions to disability pension

Because receipt of a disability pension typically follows a sick leave and/or rehabilitation measures, there is a gap between the job withdrawal, which is of our primary interest, and actual entry into disability pension benefits. To detect the year when the process towards disability retirement started, we follow each person at risk in year t for the next 3 years (2 years from 2002). The employee is classified as becoming disabled in year t if her working career was interrupted during that year, and she was granted a disability pension by the end of year t + 2, without being unemployed or employed in the another firm in meantime.Footnote 11 That is, we are interested in transitions from a given workplace to disability retirement, but allow for periods of sick leave and rehabilitation between these two events. The majority of disability pensions following job withdrawal in year t are granted during year t (46%) or t + 1 (48%), while the number of entries into disability retirement drops sharply in year t + 2. A few pensions are also granted at the later periods, but we think that assigning them to the employer at the end of year t − 1 is too unreliable and hence we discard those cases.

Transitions to sick leave

Receipt of an OD pension typically follows a 1-year period on sickness benefits, and therefore, almost all OD pensioners have been on sick leave before retiring. However, some employees have retired directly via the IER scheme without being on sickness benefits first. Since deteriorated health is a prerequisite for receipt of an IER pension as well (and since short spells of sickness benefits are not observed in the data), also these employees are classified as entering sick leave in the year when the pension was granted. Thus, an employee at risk in year t moves into sick leave during that year if he started to collect sickness benefits or was granted a disability pension during year t even without actually receiving sickness benefits. About a quarter of workers who were awarded a disability pension did not receive sickness benefits. However, apart from the effect of IER pension eligibility, our estimates appear to be fairly robust with respect to the treatment of this group.

Transitions from sick leave to disability pension

When modelling the likelihood of being granted a disability pension conditional on being on sickness benefits, the risk set in year t includes only those employees who started to collect sickness benefits during year t, including also those who were granted a disability pension without a period of sick leave.

Illustration

Four possible labour histories are shown in Fig. 3. Each of these persons is at risk of making a transition to disability retirement and to sick leave in year t. Employees A, B and C withdrew from work in year t and were granted a disability pension by the end of year t + 2. According to our definition, they made a transition from work to disability retirement in year t (D t = 1). Since employees A and D received sickness benefits and employee C started to collect disability pension benefits in year t, they are also classified as entering sick leave in that year (S t = 1). When modelling transitions from sick leave to disability retirement, employees A, C and D would be included in the risk set in year t, but not employee B who was out of work for an unknown reason.

4.4 Sample design for modelling transition rates

The transition probabilities (or rates) defined above are closely interrelated but not perfectly. Namely, it holds that

where \(\Pr (D_{t}=1)\) denotes the likelihood of starting disability retirement (by the end of year t + 2) due to job withdrawal in year t, \( \Pr (S_{t}=1)\) is the likelihood of entering sick leave in year t and \( \Pr (D_{t}=1\left\vert S_{t}=1\right) \) is the likelihood that a sick leave starting in year t eventually leads to disability retirement. It should be stressed that employees whose working career was interrupted without receipt of sickness benefits in year t and who were granted a disability pension in year t + 1 or t + 2 contribute to the event on the left-hand side of the equation but not to the events on the right-hand side (e.g. person B in Fig. 3). As a result, the product of the two probabilities on the right-hand side is typically less than the overall disability probability on the left-hand side. Nevertheless, the product of \(\Pr (S_{t}=1)\) and \(\Pr (D_{t}=1\left\vert S_{t}=1\right)\) gives a useful decomposition for \(\Pr (D_{t}=1),\) although its approximate nature should be kept in mind when interpreting the results. By comparing the determinants of \(\Pr (S_{t}=1)\) and \(\Pr (D_{t}=1\left\vert S_{t}=1\right) \), we aim at making a distinction between the ex ante and ex post effects of the covariates of interest.

Our estimation samples include all employees who are at risk of making a transition of interest between the years 1991 and 2002. The sample period ends in 2002 because when detecting the timing of job withdrawals, we have to be able to follow employees at risk at least for the next 2 or 3 years. The first period is 1991 because the FLEED employee data are available from 1988 onwards and we need employee records from the past 3 years to construct the worker flow variables. Our samples are rotating panels, where in each year new employees enter the risk set while some old ones leave it.

4.5 Raw transition rates

Table 1 reports the sizes of the risk groups and the raw transition rates by age. All transition rates increase almost uniformly with age. The likelihood of a transition to sick leave becomes five times larger while the likelihood of being granted a disability pension grows eightfold from age 50 to 62. This is explained by the fact that employees are less likely to return to work from sick leave at older ages, as seen in the last column. The transition rate from sick leave to disability retirement is strikingly high at all ages; one half of sickness benefit recipients aged 50 and four in five above age 58 do not return to work but end up in disability retirement.

It is noteworthy that the size of the group at risk of entering sick leave or becoming disabled declines rapidly with age. While the total number of employees at risk is about 127,000 at age 50, the group at risk halves by age 56 and includes only 11,000 employees at age 62. This declining age pattern reflects the fact that people tend to withdraw from employment quite early. In particular, it is rather common for private sector employees to end up in long-term unemployment at older ages because employees above a certain age threshold at the time of unemployment entry can collect earnings-related unemployment insurance benefits until retirement at age 60 via the unemployment pension scheme (see, e.g. Kyyrä and Wilke 2007).

Because of the experience rating system, variation in the transition rates across firms of different sizes is of particular interest. In Table 2, employees are classified into four groups according to the size of their employer at the end of year t − 1. As seen in the last column, there are no systematic differences in the transition rates to sick leave or disability retirement in firms with 1,000 or fewer employees. However, in the largest firms, the transition rate to both sick leave and disability retirement is notably higher than in the smaller firms. The experience rating of disability pension expenditures, which devotes higher cost shares for larger firms, would have implied the opposite. Moreover, the transition rate from sick leave to disability retirement does not vary with firm size, giving no support for the ex post effect of experience rating.

There are reasons why disability and sick leave entries may be associated with current or past employment changes at the workplace. The past employment reductions can lead to added stress at the workplace, such as reduced control over one’s chores and increased workload and job insecurity. This could cause health problems for those who kept their jobs (e.g. Vahtera et al. 2007). Encouraging disability retirement of older employees can be a helpful strategy in downsizing and restructuring endeavours of a firm, suggesting that there might be a relationship between the current growth rate and disability incidence.Footnote 12 Since the difficulties of laying off older employees probably vary with business conditions, the disability entry rates can also vary between downsizing and expansion periods.

To address these questions, we examine the relationship between the transition probabilities and the past and current growth rates of employment. The growth rates are measured over 3-year periods to smooth out annual noise in employment variation and because retirement decisions are hardly based on yearly variation. Following the job and worker flow literature, we define the growth rate as \(\Delta e_{t,s}/\overline{e}_{t,s},\) where Δe t,s is the employment change from year t to year s in a given establishment and \(\overline{e}_{t,s}\) is the average employment level in years t and s. The growth rates defined in this way can take values on the interval \(\left[ -2,2\right]\). Employment is measured by the number of employees in the establishment at the end of the year. Since employees at risk in year t were by construction all still employed at the end of year t − 1, the past growth rate is computed over the period from year t − 4 to year t − 1. With the current growth rate, we refer to the employment change from year t − 1 to year t + 2, as the possible transition to disability retirement must take place by the end of year t + 2.

We believe that labour demand conditions are best described by employment changes in the establishment for those who are employed in large firms with multiple establishments. So we consider employment variation at establishment level, even though we control the size of the personnel at firm level. In Table 2, employees are further divided into groups according to the past and current growth rate of the establishment at which they worked at the end of year t − 1. Establishments whose growth rate lies on the interval [ − 0.10,0.15) are labelled to be ‘stable’ as opposed to contracting and expanding ones. The average growth during the period under investigation was slightly below 0.05, so that the contracting and expanding establishments are defined in comparison to the growth trend.

First of all, note that our finding that the transition rates to sick leave and disability retirement are the highest for the employees of firms with over 1,000 employees holds also when we are conditioning on the past or current employment growth category. Somewhat surprisingly, none of the transition rates does seem to be sensitive with respect to the past or current growth rates. Differences in the transition rates between employees at contracting, expanding and stable establishments are generally very small and do not exhibit consistent patterns. These results should not be taken as conclusive, however, since it is possible that compositional differences in the older workforce across firms of different size and establishments in different growth categories mask the underlying true relationships.

5 Determinants of transition rates

We apply pooled-data logit models to study the determinants of the transition rates. The results from our baseline specification for individual-specific and employer-specific covariates are shown in Tables 3 and 4, respectively. We report the odds ratios for dummy variables and the marginal effects for all covariates along with standard errors that are robust to clustering to account for correlation across individuals working in the same establishment. The marginal effects are computed for an average person of the risk group.Footnote 13 We begin our discussion with the impact of individual background characteristics. Then we proceed to the parameters of primary interest, describing the effects of the strictness of medical criteria, experience rating and growth rates.

5.1 Individual characteristics

As seen in Table 3, the transition rate to sick leave and disability retirement increases strongly with age. For example, the likelihood of entering sick leave is 3.6 percentage points higher at age 62 than at age 50. The difference in the likelihood of becoming disabled grows faster with age and is almost 6 percentage points higher at 62. These are relatively large increases as the general level of the transition rates is rather low. The average probabilities of entries into sick leave and disability retirement are around 2.2% and 1.9% per year, respectively, as shown in Table 1. In terms of the odds ratios, the effect of age on the transition rate from sick leave to disability retirement is largely similar to the effect on the transition rate from work to sick leave.

Women are less likely to move into sick leave and more likely to return to work from sick leave, leading to a lower transition rate to disability retirement. This finding is in line with women’s lower incidence of disability in Fig. 2. The likelihood of being granted a disability pension decreases uniformly with education. The odds of becoming a disability pension recipient is 0.45 for an employee with a Master’s degree or higher compared with an otherwise similar employee with a basic education, which corresponds to a 1.2 percentage point lower annual risk of becoming disabled. Education has no effect on the likelihood of returning to work from sick leave. Hence, the lower risk of disability for the educated people is explained by their lower transition rates to sick leave.

Employees holding better jobs at the workplace, as measured by their position in the wage distribution, have a lower risk of disability retirement because they are less likely to end up on sick leave and more likely to return to work from sick leave. Family background also matters. Compared with singles, employees whose spouse is still working have a slightly lower probability of sick leave but a higher probability of moving from sick leave to a disability pension. It appears that employees with a retired spouse are the most likely to enter sick leave and the least likely to return to work from sick leave. This may indicate that employees with a retired spouse value their leisure time more than the other groups. Alternatively, their spouses may require special attention at home if they suffer from health problems.

Unfortunately, our data do not contain direct measures of health. To approximate health history, we exploit information on the amount of sickness benefits collected in the past years. By construction, the employee at risk in year t did not receive sickness benefits in year t − 1. For year t − 2, we add a dummy variable indicating whether the employee received sickness benefits, as well as the share of sickness benefits of taxable labour income as a proxy for the fraction of the time spent on sick leave during that year.Footnote 14 For the next 2 years, we also add dummy variables indicating receipt of sickness benefits. Not surprisingly, receipt of sickness benefits in the past increases the transition rates to sick leave and to disability retirement. Having been on sick leave in year t − 2 raises the likelihood of becoming disabled at least by 2.1 percentage points, the overall effect depending on the time spent on sickness benefits. Conditional on being on sick leave, past sickness history has no effect on the likelihood of being granted a disability pension.

5.2 Strictness of medical criteria

In 1994, the age threshold for the IER retirement scheme was increased from 55 to 58 for workers born in 1940 or later. In 2000, the entire scheme was effectively abolished from all private sector employees born in 1944 or later. Given a relatively low emphasis on medical factors when determining eligibility for IER pensions, these reforms can be viewed as increases in the stringency of medical screening for the disability status. It is worth emphasizing that the oldest affected employees were below the pre-reform age thresholds at the time of the reforms. This rules out anticipation behaviour towards IER pensions, providing us with a quasi-experimental setting for evaluating the impact of the medical criteria. More specifically, we exploit the changes in the criteria by including a time-varying dummy variable that equals one for employees born before 1940 who were at least 54 years old at the end of year t − 1 and for those born between 1940 and 1943 who were at least 57 years old at the end of year t − 1 (relaxed medical criteria in Table 3). These groups of employees can potentially qualify for IER pension benefits by the end of year t, so that their disability pension applications are subject to the less strict medical assessment compared with all other employees.

Being eligible to apply for an IER pension clearly raises all three transition rates. The odds of entering sick leave is 1.6, implying a 1.2 percentage point higher transition rate to sick leave for an employee who can apply for an IER pension benefit than for an otherwise similar non-eligible employee. Conditional on being on sickness benefits, the IER pension scheme increases the likelihood of being granted a disability pension by 9.8 percentage points. The overall probability of moving to the disability pension track is 1 percentage point higher for employees with an option to apply for an IER pension. Not surprisingly, these estimates are somewhat sensitive with respect to the treatment of workers who moved directly from work to disability retirement without receiving sickness benefits first. If these workers are removed from the pool of sickness benefit recipients, the impact of IER scheme eligibility becomes weaker: Its effect on the odds of entering sick leave drops to 1.3 (and the associated marginal effect to 0.0046) and that on the odds of moving from a sick leave to disability retirement reduces to 1.2 (and the marginal effect to 0.0327). Nevertheless, all the effects remain statistically significant at the conventional confidence levels, implying that our qualitative results are robust. Overall, our findings are in accordance with Börsch-Supan’s (2007) conclusion that the strictness by which vocational considerations (at the expense of medical criteria) are applied when determining eligibility for disability pension benefits is strongly related to disability pension incidence.

5.3 Experience rating

Next we turn to the effects of the covariates that are closely related to the experience-rated contributions: firm size, disability cost and equity ratio. The first determines the degree of experience rating but could have an effect on its own. The second measures the expected lump-sump payment the employer has to pay in the case the employee is granted a disability pension in year t. This marginal cost of the disability event is a function of the worker’s age, disability pension benefit (determined by earnings history) and the degree of experience rating applied to the employer (determined by firm size in a given year).Footnote 15 As we control for age, earnings, firm size and year fixed effects in the model, the effect of disability cost is identified by the two reforms in the experience rating scheme that were described in Section 3.2. The third variable, the equity ratio, measures the firm’s ability to incur disability pension costs.

The model includes three dummy variables for the size of the employing firm at the end of year t − 1. The smallest firms with 10 to 50 employees, which were not subject to the experience-rated contributions in any year, serve as the reference category. This size categorization is relatively coarse, but our results are not sensitive with respect to different specifications of the firm size effects. As seen in Table 4, the likelihood of a transition from work to sick leave increases with firm size, being significantly higher for the largest firms. Namely, an employee of a firm with over 1,000 employees has a 0.9 percentage point higher risk of entering sick leave per year than an otherwise similar person in a firm with 50 or fewer employees. In the large firms, many people are doing similar work, making it easier to share job tasks of a sick person between the remaining employees. This may induce the employees of large firms to apply for sickness benefits more frequently, which could explain our finding. On the other hand, the likelihood of disability retirement conditional on being a recipient of sickness benefits is almost independent of the firm size. As a consequence, there is a positive relationship between the firm size and the overall risk of ending up with a disability pension. Note that these estimates should describe the true firm size effects, as the disability cost variable accounts for the effect of the degree of experience rating.Footnote 16

The expected cost of disability retirement has a negative effect on all the transition rates (see Table 4). These effects are accurately estimated, but the magnitude of the marginal effects is very small. For a recipient of sickness benefits, a 10 percentage point increase in the disability cost decreases the likelihood of being awarded a disability pension by 0.1 percentage points. The other two marginal effects are even smaller. However, one should note that the disability cost variable exhibits a large degree of variation, ranging from zero to several times the annual earnings. To get a better picture of the effects of experience rating, we computed the transition probabilities at different ages and different values of the disability cost variable, holding all the other covariates fixed at their sample means. In the absence of the disability cost due to experience rating, the likelihood of being granted a disability pension at age 55 would be 0.024. When the disability cost is introduced and set to the median value of disability costs in the sample, this probability declines to 0.017, i.e. a decrease of about 30%. Furthermore, by introducing the maximum degree of experience rating, it is possible to obtain some 50% decline in the disability risk at age 50 compared with the case of no experience rating. A somewhat larger part of these experience rating effects can be attributed to the decline in the transition rate to sick leave, but the increase in the likelihood of returning to employment from sick leave plays a notable role as well. In other words, both the ex ante and ex post effects of experience rating are not only statistically significant but also economically important.Footnote 17

Since experience rating aims to affect employer behaviour through financial incentives, the effectiveness of such incentives should depend on the firm’s financial position. When the experience-rated firm is short of liquid assets, it might try harder to deter exits to disability retirement to avoid the costs that in a dire financial situation might bankrupt the firm. This is a relevant concern especially in the Finnish system where the employer has to pay its share of the present value of disability costs as a lump-sum payment at the time when a disability pension is granted to its employee. To address this question, we use the equity ratio as a proxy for the firm’s financial position.Footnote 18 In Table 4, the equity ratio has a positive effect on the likelihood of being granted a disability pension. It also has a strong effect on the likelihood that a sick leave will be followed by a disability pension. This implies that a recipient of sickness benefits in a firm in a weak financial position returns to work with a relatively high probability.

Given that the experience-rated contributions depend on firm size and that larger firms may have better possibilities to organise retraining and arrange alternative job tasks for their employees with reduced working capacity, we should expect the effect of the equity ratio to vary across firms of different size. We therefore extend our baseline specification by adding interaction terms of firm size categories and equity ratio. The results of this exercise are shown in Table 5. There is no evidence of statistically significant effects in the smallest firms that are not subject to experience rating, which is consistent with the claim that the effect of the equity ratio is attributable to the experience rating system. In firms that employ more than 300 employees, the likelihood of being granted a disability pension increases with the equity ratio. In the case of the largest firms, the likelihood of being granted a disability pension for a recipient of sickness benefits increases with the equity ratio: an increase of 10 percentage points in the equity ratio is related to a 1.9 percentage point increase in the disability pension incidence. Put differently, large firms that can afford the cost of disability pension expenditures seem to put less effort into occupational rehabilitation compared with large firms in a weaker economic position.

In sum, our findings give strong support for the hypothesis that experience rating affects employer behaviour. The higher expected cost of the disability event for the employer lowers transition rates from work to sick leave and from sick leave to disability retirement. This suggests that the firms subject to experience rating apply preventive measures to minimize entries to sick leave, as well as put more effort in occupational rehabilitation to get their employees on sickness benefits back to work. Our results for the effect of the equity ratio give further support for the importance of experience rating effects. Namely, the financial position of a firm has an effect on the employees of the larger firms that are liable for a significant fraction of disability pension expenditure of their former employees, whereas we find no relationship between the equity ratio and transition rates in the firms that are not subject to experience rating.

5.4 Employment growth and excess turnover

In addition to the growth rates, our models include a control variable for excess worker turnover, which measures the degree of restructuring at the workplace for a given net change in employment.Footnote 19 In general, the growth and excess turnover rates are affected by the outcome of interest, that is, the worker’s transition out of work. To eliminate the resulting endogeneity problem, we have adjusted these covariates for each worker by removing the effect of the worker’s own mobility in and out of the establishment.

Excess worker turnover can be either voluntary or involuntary from the employees’ standpoint. It may result from the restructuring measures through which the employer adjusts the structure of the workforce. Or it may be driven by a high level of voluntary quits, perhaps induced by poor working conditions, management or wage rates, which are compensated by new hires. As seen in Table 4, excess worker turnover over the past 3 years has no effect on the transition rates. But employees in the establishments with high current levels of excess worker turnover are more likely to enter sick leave and less likely to return to work from sick leave. Consequently, exits via disability retirement are more common in workplaces with a high rate of excess worker turnover. It should be noted that the effect of excess worker turnover is conditional on a given change in the employment level, as we control for the employment growth rates. High turnover can result in extra training work for the tenured employees and cause other problems at the workplace and thereby lead to an increase in stress factors. When high turnover reflects an ongoing restructuring process, our estimates suggest the possibility that the employer encourages some older employees to apply for a disability pension. For an employer that is adjusting the structure of the workforce but is not downsizing, such a policy can be an effective alternative for dismissals that would be difficult to justify. If so, we should expect to find a positive effect for the employment growth rate as well, but none of the effects of the employment changes during the 3-year periods differs statistically significantly from zero in Table 4.

The underlying assumption of symmetric effects for the expansion and contraction of the workforce is quite restrictive. In Table 6, we therefore report results from model specifications that do not impose such a restriction but allow for different coefficients for positive and negative growth rates. It seems that the risk of being granted a disability pension is lower for employees holding jobs in establishments that are currently either downsizing or expanding. The effects of the current growth rates can be attributed to the increased risk of sick leave, whereas the transition rate from sick leave to disability retirement is not affected by the current growth rates.

The marginal effect of the current decline in employment on the probability of disability pension receipt is 0.003. For example, a 50% decrease in the workforce over the next 3 years (i.e. the growth rate of − 0.67) is estimated to reduce the disability pension entry rate by 0.2 percentage points (= − 0.67×0.003×100) compared with the case of no change in the size of the workforce. One possible explanation is that employees with health problems are less willing to apply for sick leave at the times when they are worried about their jobs. During slack demand, employers may also use dismissals to get rid of employees with reduced working capacity before they apply for a sickness benefit or disability pension. In any case, the effect of downsizing is very small. It also implies that the employers do not encourage early retirement through the disability schemes as a soft way of downsizing.

The marginal effect of the current employment expansion on the likelihood of disability pension receipt is quite large, being − 0.0187. Thus, being employed in an establishment whose workforce increases by one half by the end of year t + 2 (i.e. the growth rate of 0.4) decreases the probability of being granted a disability pension by 0.75 percentage points (= 0.4× − 0.0187×100) compared with the case of working in a stable establishment. When a firm is expanding its business rapidly, it may experience difficulties in hiring the sufficient amount of skilled labour. In such a case, the employer may put some extra effort to keep its old employees at work, which may explain our finding. Furthermore, for the employee, an expansion period may indicate better economic opportunities, in terms of promotion possibilities or extra pay, which increase the value of staying employed despite some health problems.

Black et al. (2002) found that negative (positive) demand shocks increase (decrease) the entry rate to disability benefit schemes in aggregate US data. We have just shown that the reverse relationship holds for the negative shocks at the establishment level in the Finnish labour market. Of course, one should bear in mind that we are considering only transitions out of work. During economic downturns, transitions from non-participation and unemployment to disability schemes are likely to increase, and such transitions may dominate the US data.

Compared with the impact of the current growth rates, the past growth rates have the opposite effects on the likelihood of being granted a disability pension. Namely, both the reduction and expansion in the workforce during the past 3 years increase the transition rate to disability retirement. Hence, our findings are in accordance with the results of Vahtera et al. (2007) and Rege et al. (2009), who found that a large reduction of the workforce in the past leads to a notable increase in the entry rate to disability retirement. This is quite remarkable given the differences in the research design. Recall that the risk set of Rege et al. included also those who lost their job as a result of plant downsizing, whereas Vahtera et al. considered only employed workers but their data came from the municipal sector and cover an exceptional period of deep recession.

6 Concluding remarks

In this study, we analysed how labour demand and institutional factors affect transitions to sick leave and disability retirement. Using matched employer–employee data for the Finnish private sector, we were able to measure the employment growth rates and excess worker turnover at the establishment level. To study the role of the institutional setting, we exploited the law changes that affected the medical requirements for disability pension eligibility and the partially experience-rated employer contributions. Our main findings can be summarized as follows:

-

For older employees, a transition to sick leave is often a one-way street out of employment, leading eventually to disability retirement. Some one half of the 50–55-year-olds and over two thirds of older workers on sickness benefits end up in disability retirement within the next 3 years. This highlights the importance of preventive measures aimed at minimizing the flow into sick leave.

-

Those employees who can apply for a disability pension under more lenient medical requirements are much more likely to enter sick leave and to retire via disability pension benefits. Therefore, the abolition of the individual early retirement scheme in 2000 reduced notably the flow into disability retirement in the affected groups.

-

There is ample evidence that experience rating lowers the flow into sick leave (i.e. the ex ante effect) and reduces transitions from sick leave to disability retirement (i.e. the ex post effect). Moreover, the large firms that can easily incur their share of early retirement costs due to a strong financial position let their employees on sickness benefits exit more easily via disability pension schemes than firms in a weaker position do. Financial situation does not matter for the smaller firms that are not subject to experience rating.

-

The transition rates to sick leave and disability retirement are relatively large in establishments experiencing a high degree of excess worker turnover. When the establishment is growing, transitions to sick leave and disability retirement become less frequent. There is no evidence that the employers would exploit the disability pension scheme as a way of adjusting their workforce when downsizing.

These findings imply two policy recommendations to reduce the disability benefit enrolment rate of older workers. First of all, the stringency of medical criteria and medical screening for disability benefit eligibility should be tough enough. When non-medical factors are weighted at the expense of medical criteria, disability benefits may distort labour supply decisions, inducing also workers who are not truly disabled to retire via disability programmes. This appears to be mainly the labour supply issue, as we did not find evidence that employers would have encouraged disability retirement when downsizing. Secondly, the experience rating of disability benefit costs seems to be an effective policy instrument. It seems to induce employers to take preventive actions to reduce the inflow into sick leave, as well as to put more effort to get their employees on sickness benefits back to work. This finding should be of considerable interest, not only for Finland but also for the other countries that do not have an experience rating system for disability benefits (yet). Obviously, there are still a number of open questions, regarding, for example, the optimal design of experience rating and possible spillover effects on hirings and transitions out of work to other destinations than disability retirement. These questions need to be addressed in order to get a more complete picture of the consequences of the experience rating of disability benefits.

Notes

See McVicar (2008) for discussion about the growth in disability benefit rolls in the UK.

They also find an increase in mortality rates among workers whose plants downsized.

Disability schemes represent only a part of the social security system. How people who are unable, or unwilling, to work are allocated between sickness, unemployment, disability and early retirement schemes depends on relative compensation levels and eligibility criteria, which vary from country to country. Hence, a low disability enrolment rate may be associated with a high rate of sickness absence, long-term unemployment or voluntary early retirement. This kind of spillovers should be kept in mind when interpreting the results from cross-country comparisons.

The target population of the survey was all people who received early retirement benefits at the end of 1998. The early retirees were asked for their reasons of retiring. The response rate was quite low—only 51.3%—and young disability pensioners were under-represented. The numbers referred to in the text were taken from Table 12 in Saurama (2004, p. 132).

We obtained the values of γ from a pension institution. The same values are used by all the pension institutions. The multiplier is basically determined by the average duration of disability pension receipt of persons who are granted a disability pension at a given age. It also accounts for the (average) probability that the person returns to work and the (average) survival probability until age 65.

It is worth noting that the Finnish experience rating system differs from the Dutch one studied by Koning (2009) at least in the following ways: (1) the employer’s liability is not limited to the first 5 years of disability benefit costs, (2) the disability event causes a lump-sum payment, having no effect on the pension contributions thereafter, and (3) the degree of experience rating varies much more across firms of different size.

The ordinary old-age pension was available for people older than 61 but only those entering at age 65 received the full benefits. Since 2005, employees have been able to choose freely at which age between 63 and 68 they begin to collect the old-age pension benefits.

Statistics Finland changed its procedure of merging register data on pension benefits in 1995. This led to an unexplained (small) drop in the number of disability pension recipients in the FLEED for that year, reflecting some technical problems. For that reason, we chose to break the time series in 1995.

The cost of a disability pension is borne by the former employer (according to the experience-rating rules concerning firm size) only when the employment relationship has lasted for a minimum of 3 years. We also include workers who changed their jobs within the 3-year period but control for job tenure in the probability models. Excluding these workers from the analysis does not notably affect our results.

Our results for transitions from work to disability retirement are not sensitive with respect to this restriction. We exclude those on sickness benefit in year t − 1 to be able to analyse also the entry rate into sick leave.

Receipt of a disability pension is not observed for some people in 1995 due to the change in the procedure of merging the underlying register data. Using the 3-year moving window for transitions to disability pension also minimizes this problem.

A recent study by Gielen and Van Ours (2006) analyses age differences in job reallocation and labour mobility using matched worker–firm data for The Netherlands. They find that firms adjust their workforce mainly via entry for young and prime-age workers but via separations for older workers. Furthermore, employment of old workers is found to be more responsive to firm-specific employment changes.

The risk group for transitions from sick leave to disability retirement is different from that for other transitions, and thereby the marginal effects are evaluated at the different values of the covariates. This does not, however, alter our interpretation of covariate effects.

This is not an accurate measure because the waiting time until the receipt of sickness benefits from KELA can vary between employees and because the amount of a sickness benefit is determined as a decreasing fraction of the past earnings.

The disability costs are estimated using the formula in Eq. 1. Since the true level of the disability pension benefit is not known, we assume the pension benefit would be a fixed percent (55%) of the annual earnings.

Should we exclude the disability cost from the model, there would be a large effect of firm size on the transition rate from sick leave to disability retirement. For the employees of the two largest employer groups, the odds of moving from sick leave to disability retirement would be about 0.66, corresponding to a decrease of 9 percentage points in the disability probability for the average recipient of sickness benefits.

It is not clear at which point the employers became aware of the new experience rating scheme before the law changes. The reforms may also have induced some sort of anticipationary behaviour just before the new rules came into effect. However, if we drop 1 or 2 years preceding the reforms from the analysis, our results do not change notably.

There are a few extreme values for the equity ratio. To deal with such outliers, we bottom coded and top coded the equity ratio at the 5th and 95th percentiles, respectively. That is, we use the threshold values for observations below the 5th percentile or above the 95th percentile.

Excess worker turnover in year t is defined as \(h_{t}+s_{t}-\left\vert \Delta e_{t}\right\vert ,\) where h t and s t denote the number of hires and separations during year t, respectively, and Δe t is the employment change from the end of year t − 1 to the end of year t in a given establishment. This quantity is the worker flow in excess of what is needed to explain the net change in the size of establishment’s workforce. Dividing it by the average employment level at the end of years t − 1 and t, say \(\overline{e}_{t},\) gives the excess turnover rate: \( (h_{t}+s_{t}-\left\vert \Delta e_{t}\right\vert )/\overline{e}_{t}\), which takes a value on the interval \(\left[ 0,2\right]\). To smooth annual variation, we take the average of the excess turnover rates between years t − 4 and t − 1 (for the past period) and between years t − 1 and t + 2 (for the current period).

References

Autor HD, Duggan MG (2003) The rise in the disability rolls and the decline in unemployment. Q J Econ 118(1):157–205

Autor HD, Duggan MG (2006) The growth in the social security disability rolls: a fiscal crisis unfolding. J Econ Perspect 20(3):71–96

Black D, Daniel K, Sanders S (2002) The impact of economic conditions on participation in disability programs: evidence from the coal boom and bust. Am Econ Rev 92(1):27–50

Börsch-Supan A (2007) Work disability, health, and incentive effects. MEA discussion paper 135-2007, Mannheim

Campolieti M (2004) Disability insurance benefits and labor supply: some additional evidence. J Labor Econ 22(4):863–888

Gielen AC, Van Ours JC (2006) Age-specific cyclical effects in job reallocation and labor mobility. Labour Econ 13(4):493–504

Gruber J (2000) Disability insurance benefits and labor supply. J Polit Econ 108(6):1162–1183

Hassink WHJ, Van Ours JC, Ridder G (1997) Dismissal through disability. De Economist 145(1):29–46

Hutchens R (1999) Social security benefits and employer behaviour: evaluating social security early retirement benefits as a form of unemployment insurance. Int Econ Rev 40(3):659–678

Koning P (2009) Experience rating and the inflow into disability insurance. De Economist 157(3):315–335

Kyyrä T, Wilke R (2007) Reduction in the long-term unemployment of the elderly: a success story from Finland. J Eur Econ Assoc 5(1):154–182

McVicar D (2008) Why have UK disability benefit rolls grown so much? J Econ Surv 22(1):114–139

OECD (2008) Sickness, disability and work: breaking the barriers. Denmark, Finland, Ireland and The Netherlands, vol 3. OECD, Paris

Rege M, Telle K, Votruba M (2009) The effect of plant downsizing on disability pension utilization. J Eur Econ Assoc 7(4):754–785

Saurama L (2004) Experience of early exit: a comparative study of the reasons for and consequences of early retirement in Finland and Denmark in 1999–2000. Finnish Centre for Pensions Studies 2004:2

Vahtera J, Kivimäki M, Forma P, Vikström J, Halmeenmäki T, Linna A, Pentti J (2007) Organisational downsizing as a predictor of disability pension: the 10-town prospective cohort study. J Epidemiol Community Health 59(3):238–242

Acknowledgements

Financial support from the Finnish Centre for Pensions is gratefully acknowledged. We are grateful to Mikko Kautto, Raija Gould and Juha Rantala for helpful comments and to Tuuli Ylinen and Eija Mustonen for research assistance. Comments of two anonymous referees and a co-editor substantially improved the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: James Albrecht

Rights and permissions

About this article

Cite this article

Korkeamäki, O., Kyyrä, T. Institutional rules, labour demand and retirement through disability programme participation. J Popul Econ 25, 439–468 (2012). https://doi.org/10.1007/s00148-010-0330-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-010-0330-z