Abstract

European insurers are allowed to make discretionary decisions in the calculation of Solvency II capital requirements. These choices include the design of risk models (ranging from a standard formula to a full internal model) and the use of long-term guarantees measures. This article examines the situation of insurers that utilize the discretionary scope regarding capital requirements for market risks. In a first step of our analysis, we assess the risk profiles of 49 stock insurers using daily market data. In a second step, we exploit hand-collected Solvency II data for the years 2016 to 2020. We find that long-term guarantees measures substantially influence the reported solvency ratios. The measures are chosen particularly by less solvent insurers and those with high interest rate and sovereign credit risk sensitivities. Internal models are used more frequently by large insurers and especially for market risks for which they have already found adequate immunization strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Modern regulatory frameworks for financial institutions aim to provide a fair view of the risk and solvency situation of regulated entities. Solvency II, introduced in 2016 for insurance companies in the European Economic Area (EEA), was one of the first frameworks that aimed to accurately measure the solvency of insurers, taking into account multiple risk categories and diversification effects. Similar to banking regulation under the Basel Capital Accord, Solvency II does not define a unique method for quantifying risk, but instead allows insurers to choose among options. One important option is to choose between a standardized and an internal approach to calculating capital requirements. For banks, this set-up with two alternatives has been the subject of considerable criticism. Since the initial implementation of the internal approach is costly for banks, only large financial institutions are effectively in a position to choose such an approach and thereby gain a competitive advantage. The option may thus create moral hazard problems and increase the aggregate risk in the economy (Hakenes and Schnabel 2011). Moreover, empirical evidence suggests that banks deliberately choose and calibrate their risk models in such a way that their reported risk situation brightens up (Colliard 2019; Plosser and Santos 2014).

Compared to the Basel Capital Accord, Solvency II offers insurers a much wider range of implementation options. The first pillar defines a market-oriented balance sheet approach to measure insurers’ own funds and a risk-based approach to determine their Solvency Capital Requirement (SCR). The SCR is intended to reflect the loss of an insurer’s own funds over a 1-year time horizon in a 1-in-200 year event due to various risks, including market and underwriting risks. When the solvency ratio, defined as an insurer’s own funds divided by its SCR, is above 100%, an insurer is said to comply with the Solvency II capital standards. To calculate SCR, insurers can use a proprietary full internal model that covers the entire risk landscape, or a standard formula defined by the regulator. As a further option, insurers can use a partial internal model, which means they select the risk categories they model internally and use the standard formula for the others. In addition, there are four non-mandatory long-term guarantees (LTG) measures that insurers can use (Omnibus II Directive 2014, Art. 77, 308): matching adjustment, volatility adjustment, transitional on technical provisions, and transitional on risk-free interest rates. These measures affect the discount rate that insurers use to calculate their technical provisions and have a direct impact on the own funds and the SCR. Both, LTG measures and internal models are positively associated with insurer size.Footnote 1

The aim of this paper is to investigate discretionary decisions of publicly traded insurers in the implementation of Solvency II. To this end, we consider a panel of 49 listed insurance companies from 15 European countries over the time period from 2016 (when Solvency II came into force) to 2020. As a first step, we empirically assess insurers’ risk profiles with respect to interest rate risk, sovereign credit risk, and market sentiment. For this purpose, we analyze how the insurers’ stock returns respond to movements in long-term interest rates, spreads on credit default swaps (CDS), and the stock market.Footnote 2 For all years of the considered time period, we find that most insurers suffer from declines in interest rates and increases in CDS spreads. This result is broadly consistent with the empirical literature (e.g., Hartley et al. 2017; Düll et al. 2017).

In a second step, we systematically gather information on the listed insurers’ discretionary decisions and risk management approaches from the Solvency and Financial Condition Reports (SFCRs) that European insurers are required to publish annually.Footnote 3 We obtain data on the insurers’ solvency ratios before and after the application of LTG measures and are therefore able to quantify the impact of LTG measures on the solvency ratio.

We document that the LTGs overall have a substantial impact, increasing the reported solvency ratio of an average insurer by a total of 29 percentage points (ppt). For example, the volatility adjustment is applied by 69% of listed insurers in 2020 and has a significantly larger impact on the solvency ratio for otherwise less solvent insurers and for firms with high interest rate sensitivity, even after controlling for the share of life business. The matching adjustment has the largest impact, increasing the solvency ratio by an average of 59 ppt when applied. The impact is significantly more pronounced for large insurers and those with high sovereign credit risk. The use of the transitional for technical provisions is related to insurers’ true solvency ratios and their exposure to interest rate risk.

Our findings suggest that insurers use LTGs strategically to exploit the flexibility offered by Solvency II in order to maximize the reported solvency ratio and to mask their market risk profiles. Discretionary decisions can thus cause Solvency II figures to deviate from a market-oriented, risk-based view of insurers’ risk positions.

From the SFCRs, we also obtain qualitative information on whether insurers use a (partial) internal model and, if so, which market risks it covers. To the best of our knowledge, this is the first research article to provide data on the composition of internal models. We find heterogeneity in their composition across European insurers. While only five listed insurers in our sample use full internal models in 2020, 19 model the SCR market risk module internally. Moreover, we document that as many as 32% of internal model users include the spread risk of EU government bonds, even though this is not required by law.

By shedding light on the relationship between insurers’ market risk profiles and their SCR implementation strategy, we highlight that listed insurers strategically make use of the leeway in determining the solvency ratio. When deciding on LTG measures and internal models, they weigh the advantages and disadvantages. While LTGs can improve an insurer’s reported solvency ratio, they involve increased disclosure requirements and regulatory attention, as local regulators closely monitor their use. The trade-off may depend on an insurer’s risk profile. For instance, the volatility adjustment enhances an insurer’s solvency ratio more effectively the higher its interest rate risk is. Internal models tend to measure risks more accurately than the standard formula, for which systematic biases in the measurement of market risk and default risk have been identified (Fischer and Schlütter 2015; Braun et al. 2017; Asadi and Janabi 2020). On the one hand, internal models can be advantageous as a basis for decision-making, because they more accurately assess the impact of strategic options on the risk profile. On the other hand, the development and operation of the models is complex and costly, especially as the models have to comply with regulatory requirements. The impact of an internal model on the solvency ratio is ambiguous, as the standard formula is partly built with safety buffers, but some risks cannot be covered by capital.

Previous studies examining the risk profiles of insurers find that market risks are typically the biggest threat to the solvency of life insurance companies, mainly due to the long duration of their liabilities and a high proportion of investments in government bonds (Duverne and Hele 2017; Frey 2012; EIOPA 2017a). Several empirical papers have measured the exposure of insurers to changes in long-term interest rates (e.g., Brewer et al. 2007; Carson et al. 2008; Möhlmann 2021). For instance, Hartley et al. (2017) show that insurers benefitted significantly from rising long-term interest rates in the low interest rate environment following the financial crisis. Moreover, Düll et al. (2017) reveal that insurers are significantly affected by changes in CDS spreads on government bonds. Grochola et al. (2023) compare the influence of interest rate risk and sovereign credit risk for stock insurers in Europe and the US. The authors find that for European insurers, the sensitivity of stock returns to interest rate changes is only 44% greater than the sensitivity to sovereign CDS spreads, possibly because spread risk and default risk are not entirely hedged.

Apart from the well-documented relevance of market risks to insurers, there are two other reasons for the focus on market risk in this paper. First, the LTG measures are designed to address insurers’ market risk exposures rather than their underwriting risks. For instance, the volatility adjustment immunizes insurers against interest rate fluctuations, and the matching adjustment lowers the SCR for spread risk. Thus, insurers’ discretionary decisions regarding LTGs may be related to their market risk profiles. Second, while the frequency of interest rate and CDS data allows for comparable and dynamic estimates of listed insurers’ market risk sensitivities, the construction of risk driver variables for underwriting risk would be more complex. In this context, it is also worth noting that effective immunization strategies against underwriting risk vary widely across an insurer’s lines of business.Footnote 4

The idea behind the SFCRs is that insurers’ stakeholders gain transparency on their risk profiles and that their potential reaction provides insurers with an incentive to seek a sound risk and solvency position. From a stakeholder perspective, it is important to have empirical evidence on whether the reported solvency ratio is meaningful and whether this regulatory tool works. Gatzert and Heidinger (2020) and Mukhtarov et al. (2022) show that the published quantitative data on risk characteristics lead to a significant abnormal stock return, suggesting that shareholders react to the news provided by SFCRs. However, it remains an open question concerning the extent to which the reported solvency ratios reflect the insurers’ true risk profiles.

The remainder of the paper is structured as follows. “Overview of discretionary decisions and hypotheses” section motivates and states the hypotheses. The methodology for estimating market risk sensitivities is outlined in “Estimation of market risk sensitivities” section. Our approach and the empirical results addressing the research question on the relationship between discretionary decisions under Solvency II and insurers’ market risk profiles are presented in “Analysis of discretionary decisions” section. “Conclusion” section concludes the paper.

Overview of discretionary decisions and hypotheses

The four LTG measures were introduced in the Omnibus II Directive (2014).Footnote 5 They differ in their background, functions and impact on the solvency ratio. Despite these differences, all LTGs have in common that they tend to improve the solvency ratio and are therefore likely to be used by insurers that would otherwise have a rather low solvency ratio (hereafter referred to as solvency ratio pre LTG).

The volatility adjustment (Omnibus II Directive 2014 Art. 77d) is a constant add-on to the discount rates of liabilities. It is defined by EIOPA and is based on the risk-corrected spread between the interest rate earned on a reference portfolio of assets and the risk-free interest rates. By reducing the value of liabilities, the volatility adjustment mitigates the effect of short-term fluctuations in financial markets and in particular short-term changes in interest rates. It may therefore be particularly relevant for insurers with wide duration gaps and thus higher interest rate risk sensitivities. We hypothesize:

H1

The impact of the volatility adjustment on the solvency ratio is, ceteris paribus, positively related to insurers’ sensitivity to interest rate risk, and negatively related to their solvency ratio pre LTG.

The matching adjustment (Omnibus II Directive 2014 Art. 77b and c) is also an add-on to the liability discount rate. Its application and that of the volatility adjustment are mutually exclusive per liability portfolio. The matching adjustment is computed by insurers based on their individual asset portfolios. It is derived from the spreads between the interest rates achievable on the insurer’s assets and the basic risk-free rates, with a reduction for a fundamental spread to accommodate anticipated loss from asset default or downgrade. We expect the matching adjustment to be used primarily by insurers with a high sensitivity to credit risk, for example due to riskier assets. To obtain supervisory approval to use the matching adjustment, insurers must meet extensive requirements, including appropriate duration matching and a declaration to hold assets until maturity (EIOPA 2018). Both of these requirements involve extensive documentation and reporting that may be difficult for small insurers to meet. Consequently, only 11.1% of the listed insurers in our sample applied the matching adjustment in 2020. In contrast to the volatility adjustment, the application process is more demanding for insurers. As a result, we expect the matching adjustment to be used mainly by larger insurers. We therefore hypothesize:

H2

The impact of the matching adjustment on the solvency ratio is, ceteris paribus, positively related to insurers’ sensitivity to sovereign credit risk and to their size, and negatively related to their solvency ratio pre LTG.

The transitional for technical provisions and the transitional for interest rates are defined in Omnibus II Directive (2014), Art. 308c and d. The transitionals are designed to help insurance companies gradually adapt to the changes in the regulatory framework from Solvency I to Solvency II. They can only be used temporarily for contracts concluded before 2016 until the year 2032 (EIOPA 2016). Specifically, the transitional for technical provisions enables insurers to smooth the capital reserve calculation over this 16-year period, during which the effect of the transitional declines linearly (EIOPA 2018). The effectiveness of the transitional may be higher the larger the duration gap between liabilities and assets, and hence the more sensitive insurers are to interest rate changes. We hypothesize:

H3

The impact of the transitional for technical provisions on the solvency ratio is, ceteris paribus, positively related to insurers’ sensitivity to interest rate risk, and negatively related to their solvency ratio pre LTG.

The transitional for interest rates allows insurers to gradually adjust to the regulatory changes in risk-free interest rate assumptions. The transitional is not widely used and only one or two insurers in our sample apply it each year. Therefore, we do not include this transitional in our empirical analyses.

In terms of the SCR calculation, insurers have wide discretion in the choice of a model. Most insurers with an internal model do not use a full internal model covering all subsidiaries and all risk categories. Instead, they use a partial internal model, which means that some risks are modeled using the standard formula. In terms of the focus of our analysis, we record whether insurers use an internal model for at least one risk category, whether they model interest rate risk internally, and whether they model sovereign credit risk internally.

We expect that (partial) internal models help insurers to maintain a diversified asset-liability portfolio and to find appropriate immunization strategies. Because of better risk management and because the standard formula may include safety charges that can be avoided with an internal model, we expect internal model users to have lower market risk sensitivities and to be able to achieve a higher solvency ratio than standard formula users. Given that internal models may support insurers to better economize on equity capital, we expect that insurers with a higher cost of capital will be more likely to use an internal model. To this end, we use a market sentiment variable that reflects how insurers’ stock returns react to stock market changes (controlling for interest rate and sovereign CDS spreads). Market sentiment is indicative of the CAPM beta, so higher values suggest a greater incentive to reduce the SCR using an internal model. Implementing an internal model is a long and costly process, and we expect larger insurers to benefit from sufficient economies of scale to make it worthwhile. In addition, larger insurers may be characterized by more complex risk profiles that necessitate the use of an internal model to comply with Solvency II requirements.

According to Art. 180(2) of the European Commission (2015), insurers are not required to take into account the credit risk stemming from investments in government bonds issued by EU countries. While this provision provides an incentive to invest in these bonds, it has been criticized for neglecting a true market risk, even though Solvency II aims at a market-consistent valuation of assets and liabilities (Wilson 2013; Thibeault and Wambeke 2014). Due to higher public attention, it may be more relevant for large insurers to model the spread and default risk of EU government bonds. Overall, we hypothesize:

H4

The likelihood that insurers use an internal model for market risks is, ceteris paribus, negatively related to their market risk sensitivities, and positively related to market sentiment, their reported solvency ratio, and to their size.

Estimation of market risk sensitivities

Dependent variable

Our sample consists of European insurers that are publicly traded and for which daily share price data can be obtained from Refinitiv. Thus, the scope of the paper is limited to listed insurers. Additionally, we restrict our analysis to insurers that have published at least one Solvency and Financial Condition Report (SFCR) at the group level. We exclude from the sample five micro-cap insurers with less than $250 million in total assets at year-end 2020,Footnote 6 and three insurers due to low data frequency (less than 100 stock price observations per year), as the estimated insurer-level coefficients may be biased due to more volatile, missing, or inaccurately timed observations. Therefore, a total of eight insurers are excluded, none of which used an LTG measure or internal model between 2016 and 2020.Footnote 7

To conduct the empirical analysis of market risk sensitivities, we collect daily stock prices for 49 insurers across 15 European countries from 20 March 2006 to 30 December 2019, using Refinitiv as our data source. We choose this time frame to adequately reflect the performance of the insurers and then estimate their long-term risk profiles through sensitivities to market risk drivers. Our analysis covers a period of 3,775 trading days, during which we observe daily returns. The dependent variable in our regression model, \(r_{i,t}\), is the relative daily change in the total return index (TRI), which captures stock prices after accounting for dividend payments and fluctuations in the number of shares outstanding. We use \(r_{i,t}\) as a measure of the stock return of insurer i on day t.

If the TRI remains unchanged for at least three consecutive days, we assume missing data and exclude the TRI observation starting from the second day. Outliers with absolute daily returns greater than 50% are removed from the regressions. Table 1 presents the descriptive statistics for the sum of all remaining stock price and stock return observations. On an insurer level, the mean of the daily stock returns ranges from \(-\) 0.01 to 0.22% and the standard deviation from 1.21 to 4.05%.

Independent variables

To assess interest rate risk, we use 10-year interest rates from the European Central Bank (ECB). The data is sourced from daily estimates of the euro yield curve, with a term structure that is derived using the Svensson model applied to AAA-rated euro-area government bonds. The resulting annual interest rates represent those of a 10-year zero-coupon bond.

Following the methodology of Brewer et al. (2007) and Grochola et al. (2023), we use the holding period return (hpr) of long-term interest rates as the independent variable to measure interest rate risk. The 1-day hpr is equal to the return on a zero-coupon bond purchased at the prevailing interest rate and sold the next day. If the 10-year interest rate (denoted as y10) were to rise in the meantime, the market value of the bond would fall, resulting in a negative hpr within one trading day. Thus, a positive hpr would only be observed after a decline in the interest rate. The calculation of the hpr on day t is as follows:

Given that European insurers allocate a significant portion of their assets to sovereign debt, as evidenced by EIOPA (2023), we implement CDS spreads on government bonds as a proxy for sovereign credit risk.Footnote 8 The data for CDS spreads are obtained from IHS Markit. Following the approach of Düll et al. (2017), we specifically select CDS spreads denominated in USD with a maturity of five years. These spreads reflect the estimated probability of a country defaulting on its payment obligations within five years of the issue date, and thus serve as an indicator of sovereign credit risk.

We collect sovereign CDS data for all countries in which the insurers in our sample are headquartered. A first-best approach to measuring sovereign credit risk in insurers’ bond portfolios would be to weight CDS spreads by country of issuance according to each insurer’s asset allocation. However, this level of granularity of bond holdings is not included in the Solvency II disclosures, and we are not aware of a possible source for it.

As a proxy, we assign to each insurer the domestic CDS spreads based on its country of origin (denoted as c). This proxy is consistent with empirical evidence of a home bias in the sensitivity of insurers to CDS spreads (Düll et al. 2017). The home bias of insurers’ bond investments is also documented by Grochola et al. (2023), Table 2. On average, 58% of European insurers’ government bond investments are in the country of origin of the insurer. The home bias may be exacerbated by Solvency II rules, as insurers’ investments in government bonds have to meet certain criteria to qualify as own funds (Art. 69–78, European Commission 2015).Footnote 9 For each day t, we calculate the relative daily change in the CDS spread on government bonds of each country c.Footnote 10 Thus, the following formula applies:

To assess sensitivities to market sentiment, we collect daily data on the index prices of the Euro Stoxx 50 from Refinitiv. The index comprises the stock prices of 50 large corporations with liquid shares from euro-area countries and is widely recognized as a reliable indicator of the overall growth of the European economy, as documented by Brechmann and Czado (2013). In an empirical model, the market index returns \(r_{m,t}\) account for macroeconomic shocks that affect all insurers simultaneously (Hartley et al. 2017). They are defined as:

The summary statistics of the variables used to measure interest rate risk, sovereign credit risk, and market sentiment sensitivities over the time period from 2006 to 2019 are presented in Table 1. Sovereign CDS spreads are reported for each country. In absolute terms, the 5-year CDS spreads range from 0.0108% (Finnish government bonds in June 2007) to 232% (Greek government bonds in January 2013). In a robustness test, we use national stock indices instead of the Euro Stoxx 50 to measure insurers’ sensitivities to market sentiment. The summary statistics for the national stock indices are shown in Table 9 in Appendix.

The Pearson correlation matrix for the independent variables is shown in Table 2. Notably, the correlation between the interest rate hpr and the CDS spread returns is relatively low (0.18). The augmented Dickey-Fuller test and the variance inflation factor (VIF) suggest that the independent variables are stationary and that there is no multicollinearity.

Regression model

In the first stage of our regression analyses, we consider the effects of changes in interest rates, CDS spreads, and stock market indices on insurers’ performance over the period from 2006 to 2019.Footnote 11 In line with previous studies that have performed firm-level regressions with stock returns to obtain individual betas (Berends et al. 2013; Brewer et al. 2007; Campbell et al. 2001; Da et al. 2012), we analyze market risk sensitivities at the insurer level using time-series data. This approach allows us to investigate the heterogeneity in market risk exposures across insurers, as highlighted by Berends et al. (2013) and Möhlmann (2021). Following the approach of Düll et al. (2017), we apply logarithmic transformations to all variables, which allows us to interpret the beta coefficients as elasticities.

To determine insurers’ market risk sensitivities, we use rolling time windows, building on the approach of Hartley et al. (2017). This allows us to account for changes in insurers’ risk profiles, as Brewer et al. (2007) show that sensitivities vary over time. The time windows cover a time frame of 10 years each, resulting in five periods p: 2006 to 2015, 2007 to 2016, 2008 to 2017, 2009 to 2018, and 2010 to 2019.Footnote 12

The motivation for choosing revolving 10-year time windows is that while insurers can dynamically change their investment portfolio and the insurance policies they offer, past investments and legacy contracts have a substantial impact on their underlying market risk exposures.Footnote 13 The decision of whether to use an LTG measure or an internal model under Solvency II should be based on an insurer’s long-term risk profile, which we measure through sensitivities to stock performance over several years. These include periods of crises such as the global financial crisis (2007–2009) and the European sovereign debt crisis (2010–2013), when the market risk sensitivities of individual companies become more visible.Footnote 14

For each period p, we run an OLS regression for each of the 49 insurers i in the sample, given that stock price data are available. We obtain insurer-specific and period-specific measures of interest rate risk, sovereign credit risk and market sentiment sensitivities. In this way, the approach provides individual risk profiles of insurance companies based on stock price reactions. The linear regressions for each insurer i in the sample and for each period p are based on the following model:

In Eq. 5, c(i) reflects the country in which insurer i is domiciled. An insurer’s daily stock return, denoted by \(r_{i,t}\) for each insurer i and day t, serves as the dependent variable in the regression analyses. The first independent variable is \(r_{y10,t}\), which is the 1-day hpr of a 10-year AAA-rated zero-coupon bond. The second independent variable, \(r_{\text{CDS},c(i),t}\), measures changes in CDS spreads on domestic sovereign debt, based on an insurer’s country of origin. The last independent variable, \(r_{m,t}\), reflects daily changes in the Euro Stoxx 50 index. The residual term is denoted by \(\varepsilon_{i,p,t}\). We store the estimated beta coefficients \(\beta_{y10,i,p}\), \(\beta_{\text{CDS},i,p}\) and \(\beta_{m,i,p}\) for each insurer i and period p from all 232 regressions as inputs for the second stage of our empirical analysis in “Analysis of discretionary decisions” section. The betas indicate the direction of the relationship between each market risk driver and each insurer’s stock price, as well as the magnitude of their influences during a given time window.

Resulting sensitivities

Our findings on insurers’ sensitivities to market risk drivers are broadly consistent with previous empirical studies. With respect to interest rate risk, our results show that most insurers benefit from higher 10-year interest rates (Hartley et al. 2017; Grochola et al. 2023). This can be seen in the fact that 78% of the coefficients \(\beta_{y10,i,p}\) are negative, meaning that the insurers suffer from a higher hpr, as measured by \(r_{y10,t}\). For a median insurer, a 1% decrease in the 1-day hpr of 10-year rates causes a 0.128% decrease in its stock return, holding the other regressors constant. Of the 232 estimated interest rate sensitivities, 41% are statistically significant at the 10% level.

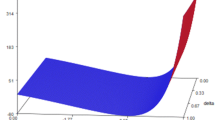

The evolution of the distribution of the estimated interest rate betas over time is shown in Fig. 1a, where the median and the 25th and 75th percentiles (upper and lower bounds of the gray area) are plotted. For each year y (2016 to 2020), we show the betas estimated on the basis of the ten years preceding that year. For instance, the insurer-level beta coefficients for the year 2020 depend on the sensitivities in the period from 2010 to 2019. While the median interest rate beta is relatively constant over time, the empirical corridor covering 50% of all estimates becomes narrower, as the time period of the global financial crisis is not (or not fully) covered when estimating the regression coefficients for later years.

Estimated market risk sensitivities (betas). The regression coefficients (y axis) are estimated based on the insurer-level regression analyses formulated in Eq. 5. The sensitivities of each year depend on the influence of the market risk drivers on the stock performance of insurers over the 10 years preceding year y (x axis). The top (bottom) line reflects the 75th (25th) percentile of the distribution in a given year. The middle line represents the median. The gray area corresponds to the empirical corridor covering 50% of the beta estimates. For instance, a shows the sensitivities to interest rate risk that we estimate for each insurer in the sample for five different 10-year time windows (2006–2015, 2007–2016,…,2010–2019). In 2016 (2006–2015 window), the median of \(\beta_{y10,i,p}\) is − 0.118, while the 25th percentile is − 0.225, and the 75th percentile is 0.028. These sensitivities are not symmetric, but rather right-skewed across insurers (especially for interest rate risk and market sentiment)

Regarding sovereign credit risk sensitivities, European insurers benefit from a lower probability of default on domestic sovereign debt in line with Düll et al. (2017) and Grochola et al. (2023). More clearly than for interest rates, the estimated coefficients \(\beta_{\text{CDS},i,p}\) are mostly negative (91% of all betas) and significant at the 10% level (67% of all betas). The median implies that, ceteris paribus, a 1% increase in domestic CDS spreads reduces an insurer’s stock return by 0.028%. The effect of a 1% change is, thus, relatively smaller compared to 10-year interest rates. As shown in Fig. 1b, the empirical corridor covering 50% of all betas (gray area) is fairly constant over time.

Insurers’ sensitivities to market sentiment are the most important driver of insurers’ stock returns. The relationship is positive for all insurers in the sample and the coefficients \(\beta_{m,i,p}\) are significant at the 10% level for 97.8% of the estimates. Insurers’ stock returns are thus positively related to the Euro Stoxx 50 index, even after controlling for changes in interest rates and sovereign CDS spreads. Figure 1c illustrates that both the 75th percentile and the median of the beta coefficients fall slightly in later years (after 2017), indicating a decreasing dependence of listed insurers’ performance on overall economic growth in Europe.

\(-\) \(-\)

The estimated insurer-level sensitivities to interest rate risk and sovereign credit risk are shown in Fig. 2 for the period from 2010 to 2019. A dot in the lower left-hand corner of the figure would represent an insurer that suffers greatly from both falling interest rates and rising CDS spreads. The distribution illustrates the heterogeneity of European insurers’ market risk profiles, which can be related to several factors such as the share of life business, the riskiness of investments, the width of duration gaps or the use of guarantees for life insurance policies. Notably, of the ten insurers for which we estimate the highest interest rate risk (sovereign credit risk), nine insurers (eight insurers) use at least one LTG measure. In particular, we observe that many insurers with higher interest rate risk use the volatility adjustment and that it has a relatively larger impact on their reported solvency ratio. Similarly, insurers with higher sovereign credit risk tend to use the matching adjustment, which can substantially increase the solvency ratio. Anecdotal evidence for five insurers with large market risk sensitivities is shown in Fig. 7 in the Appendix.

Insurer-specific estimates for sensitivities to interest rate and CDS changes. Each dot reflects an insurer’s estimated regression coefficients βy10,i,p and βCDS,i,p from Eq. 5 over the period from 2010 to 2019. An insurer on the lower left would substantially suffer from falling 10-year interest rates and rising CDS spreads of domestic sovereign debt. (Color figure online)

The estimated beta coefficients measuring the sensitivities to interest rate risk \(\beta_{y10,i,p}\) and sovereign credit risk \(\beta_{\text{CDS},i,p}\) are almost perfectly uncorrelated, as shown in Table 3. The correlation coefficients are negative and larger between market sentiment \(\beta_{m,i,p}\) and the other two sensitivity measures. This suggests that insurers that suffer more from falling interest rates or rising CDS spreads also tend to suffer more from a falling stock market index.

The insurer-level betas estimated with Eq. 5 are used in the second stage of the regression analyses described in Sect. 4. Summary statistics of the betas are provided in Table 4. In the remainder of this paper, we will refer to the beta variables as sensitivities to each market risk (interest rate risk, sovereign credit risk, and market sentiment).

Analysis of discretionary decisions

Data

In the second stage of the empirical analysis, we investigate insurers’ discretionary decisions under Solvency II. For this purpose, we use data published in the SFCRs of the years 2016 to 2020 for all 49 stock insurers in the sample for which we estimated market risk sensitivities in the first stage in Sect. 3. Non-listed insurers are thus excluded from the sample. We only use Solvency II publications on the group level. Quantitative regulatory data for 164 out of 233 insurer-year observations was gathered from the data provider SNL and is based on Quantitative Reporting Templates (QRTs). We have substantially double-checked the SNL data with hand-collected data from original SFCR publications and have corrected seven insurer-year observations. For the remaining 69 insurer-year observations, the quantitative data was hand-collected from QRTs.

To the best of our knowledge no provider yet offers data about the composition of internal models as reported in the SFCRs. Therefore, we have hand-collected information from the SFCRs about important aspects of the design of internal models. This includes information such as whether certain risk modules are modeled internally and whether the risks related to investments in EU government bonds are taken into consideration. Even though the data is partly provided as textual information and in languages other than English, we were able to collect it for all 233 insurer-year combinations.Footnote 15

Solvency ratio and LTG measures

In terms of the QRT data, our focus is on information which is based on the firm managements’ discretionary decisions. This is mainly reflected by the use of LTG measures, i.e., the matching and volatility adjustment as well as the transitionals on technical provisions and interest rates (see Sect. 2).

The solvency ratio is an important measure to present an insurer’s solvency position in a single figure (Crean and Foroughi 2017; Mukhtarov et al. 2022). It combines the main results of Pillar I of the Solvency II regulation (European Commission 2015), namely the insurer’s eligible own funds and the Solvency Capital Requirement (SCR). The SCR is intended to ensure that the probability of the company going bankrupt over a one-year horizon does not exceed 0.5%. The solvency ratio is defined as the ratio of the two:

The aggregate SCR of the insurers in our sample is EUR 253 billion, which is 59% of the aggregate SCR of all insurers as reported by EIOPA (2020).Footnote 16 Eligible own funds amount to EUR 531 billion in 2020, resulting in an average reported solvency ratio of 210% in our sample. In terms of total assets, the insurers in our sample have EUR 7.606 trillion in 2020, which corresponds to a market share of 57% compared to EIOPA (2023) data. The remaining 43% is associated with non-listed European insurers.

LTG measures can affect both the numerator and the denominator of the solvency ratio. The dependent variable in our empirical analysis to examine \(H_1\) to \(H_3\) is the impact of a given LTG k (VA, MA or TP) on the solvency ratio of insurer i in year y, denoted by \(\textit{LTG k Impact}_{i,y}\), where VA stands for volatility adjustment, MA for matching adjustment, and TP for transitional for technical provisions. If an insurer does not apply an LTG in a given year, the impact on the solvency ratio is zero. Notably, insurers can choose to use more than one LTG measure in a year. We obtain the impact of each LTG measure on the solvency ratio of each insurer in each year from the QRT form S.22.01.22.Footnote 17 All SFCRs and corresponding QRTs are publicly available and typically accessible through an insurer’s investor relations department.

In our sample, the number of insurer-year observations with an applied LTG varies between 6 for the transitional for interest rates, 30 for the matching adjustment, 77 for the transitional for technical provisions, and 149 for the volatility adjustment. In total, we find 262 applications for the 233 insurer-year observations. An average insurer thus uses 1.12 LTGs per year. In 259 of the 262 applications, the LTG measure increases the reported solvency ratio,Footnote 18 and for all 233 insurer-year observations, the sum of all LTG measures has a positive overall effect. Therefore, the use of LTGs reflects latitude in the implementation of Solvency II and contains potentially relevant information for policyholders and investors.

As we systematically analyze SFCRs and the corresponding QRTs, we calculate the impact of the use of the LTG measures on the solvency ratio from Eq. 6. In our sample, the reported solvency ratio would have been on average up to 29 ppt lower without the use of these measures. EIOPA (2016, 2020) initially presents even larger impacts of LTGs of 60 ppt in 2016, followed by only 28 ppt in 2020 due to a decreasing influence of transitionals on the solvency ratio and due to insurers adapting to the new regulation standards. For up to 7.3% of our observations, insurers would have to report solvency ratios below 100%,Footnote 19 which implies that their own funds are insufficient to meet regulatory requirements under the first pillar of Solvency II (Art. 100, Solvency II Directive 2009). In this case, insurers are obligated to take corrective actions in line with the regulations of the national supervisory authority to restore compliance within six months (EIOPA 2016). Potential actions include capital injections, recovery and restructuring plans, and sanctions.Footnote 20

As a regressor in our empirical analysis, we determine for each insurer, each year, and each LTG the solvency ratio pre LTG as the difference between the reported solvency ratio and the impact of the respective LTG measure. This procedure is in line with hypotheses \(H_1\) to \(H_3\), which make statements about the relation between the LTG impact and the solvency ratio before using the respective LTG. Specifically, to derive a benchmark for the marginal effect of an LTG, subtracting the impact of each respective LTG may be more meaningful than subtracting the sum of the impacts of all LTGs that the insurer uses. Thereby, any mutual interference between individual LTGs is circumvented. Hence, we calculate the solvency ratio in the absence of each LTG measure k for each insurer i and each year y:

The overall descriptive statistics of the variables used in the second stage of our empirical analysis are presented in Table 4. This includes the Solvency II quantitative data mentioned in Eq. 7 and binary variables reflecting the composition of internal models. To investigate the relationship between insurers’ risk profiles and their discretionary choices regarding LTG measures, we also use the insurer-level sensitivity coefficients (betas) estimated in the first stage (see Eq. 5) and two distinguishing firm characteristics: the share of insurance reserves stemming from life and health insurance business and the natural logarithm of the size (measured by total tangible assets). Without the firm characteristics, we have 232 total observations and our models including the firm characteristics rely on 225 observations.

We find that the four LTGs differ in terms of frequency of application and impact on the solvency ratio. Figure 3 illustrates the use of LTG measures in the year 2020. The blue columns in Fig. 3a show the share of listed insurers in our sample that use a particular LTG measure. No LTG represents the share of insurers (26.7%) that do not use any LTG in 2020. The gray columns in Fig. 3b show the mean impact of an LTG on the solvency ratio under the condition that the LTG is used. The two bar charts highlight that LTGs are widely used by listed insurers and that they have a large impact on the solvency ratio.

Use of LTG measures in 2020. VA stands for volatility adjustment, MA for matching adjustment, TP for transitional for technical provisions, and IR for the interest rate transitional. No LTG means that an insurer does not use any LTG measure. Note that the blue and gray bars do not add up to 100% because the use of individual LTGs is independent of each other. Thus, insurers may choose to use multiple LTGs in a given year. (Color figure online)

The volatility adjustment was used by as many as 68.9% of the listed insurers in our sample in 2020 (see Fig. 3a) and is thus becoming more popular over time (50.9% in 2016). Its average impact on the solvency ratio is 17.9 ppt. For the matching adjustment, we find that it was applied by only 11.1% of insurers, presumably due to the extensive regulatory requirements associated with its use (see Sect. 2). Comparing the four LTGs, the matching adjustment has the largest average impact on the solvency ratio at 59.1 ppt. This effect is notable given that the matching adjustment primarily reduces credit spread risk, whereas Grochola et al. (2023) show that interest rate risk is more relevant than sovereign credit (or spread) risk for European insurers. Notably, there is heterogeneity in the impact of LTGs, as we observe extreme cases in which the volatility adjustment improves a solvency ratio from 102% to 230% and the matching adjustment from only 25% to 189%.

The transitional for technical provisions was applied by 35.6% of the stock insurers in the sample in 2020, considerably increasing their solvency ratios by 27.4 ppt on average (see Fig. 3). However, in line with the regulation, the effect diminishes over time (35.3 ppt in 2016). The transitional for interest rates is not widely used, as only one or two insurers in our sample apply it each year. We therefore exclude it from our empirical analysis.

Internal models for SCR calculation

In addition to the LTG measures, there are several other discretionary decisions in the calculation of the SCR that we collect from the SFCRs. In particular, we examine whether insurers use an internal model or the standard formula. The standard formula determines the SCR in a multilevel approach, the structure of which is shown in a simplified form in Fig. 4 that illustrates the bottom-up approach of Solvency II. At the lowest level, known as the submodules, the SCR is determined, for example, for interest rate risk and spread risk. These submodules are aggregated to the module level. Interest rate risk and (credit) spread risk are part of the market risk module, which is typically the largest risk component for calculating the SCR, accounting for 49% of the undiversified SCR in our sample.Footnote 21 This corresponds to EUR 189 billion. Another module reflects the SCR for counterparty default risk, which accounts for 6.4% of undiversified SCR (or 9.1% of total SCR). The SCR covers several other types of risks, including underwriting risks (health, life, non-life) and operational risks.

Structure for SCR calculation under the standard formula. Note that Fig. 4 shows all existing SCR risk modules, but only 2 out of 27 submodules. For an overview of the entire structure, see EIOPA (2014b). In our analysis, we focus on selected SCR modules and submodules. BSCR stands for Basic SCR and includes diversification effects between the risk modules in the row below

Insurers can replace the complete SCR calculation for all group entities with their own full internal models. These are meant to better fit the insurers’ risk profiles and are subject to regulatory approval. Full internal models can have a different structure for calculating SCR than the standard formula shown in Fig. 4. Alternatively, insurers can model only selected (sub)modules internally. If at least one subsidiary of an insurance group retains a (sub)module of the standard formula, it is referred to as a partial internal model.

We have hand-collected the information on the SCR calculation from Section E.4 of the SFCRs, entitled “Differences between the standard formula and any internal model used”. Overall, we find that the listed insurers use a full or partial internal model for 51% of the insurer-year observations (see Table 4). Only a few insurers (9.4% of observations) in our sample use full internal models. A much larger proportion (41.6%) use partial internal models, implying that insurers choose to use the standard formula approach for at least one SCR (sub)module. For these firms, it is particularly interesting to observe which modules they calculate internally and to examine the relationship between these decisions and their market risk profiles. For this purpose, we construct several binary variables for the SCR (sub)modules (see Table 4). For example, \(\textit{Internal Market Risk}_{i,y}=1\) if an insurer i in a given year y uses an internal model for the SCR market risk module (meaning that at least one submodule is modeled internally), and zero otherwise. Figure 5 shows the proportion of (sub)modules modeled internally for all listed insurers using internal models (either partially or fully) in 2020. Accordingly, 76% of insurers with internal models have modeled the market risk module internally, while the share for the counterparty default risk module is only 56%.

Moreover, we examine whether listed insurers using internal models consider the spread (default) risk of investments in government bonds issued by EU countries when calculating their SCR, which they are not required to do. We find that insurers voluntarily include this risk in their SCR calculation for 19% (9%) of insurer-year observations (see Table 4). Among all listed insurers using internal models in 2020, 32% (16%) explicitly state in their SFCRs that they take these risk types into account (see Fig. 5). Typically, these are large insurers that model most SCR risk modules internally.

\(-\)

Notably, insurers using internal models tend to have higher reported solvency ratios than standard formula users (see blue / left columns in Fig. 6). Overall, insurers that calculate their SCR using a partial or full internal model (i.e., at least some risk category is modeled internally) report a solvency ratio that is 6 ppt higher in 2020. For each (sub)module for which we collect data, we find that insurers that model them internally have higher average reported solvency ratios than insurers that use the standard formula to calculate SCR.Footnote 22

Solvency ratios based on internal model composition. The reported solvency ratio (blue / left) and the solvency ratio excluding the impact of all LTGs (gray / right) are shown for different groups of insurers: standard formula users, insurers using a (partial) internal model for at least some risk category, and insurers using a (partial) internal model for a specific risk category. The numbers at the top of the figure (e.g., n=24) show how many insurers in our sample use a specific SCR calculation method in 2020. Only five insurers use a full internal model. (Color figure online)

However, if we remove the impact of LTG measures, we find that the solvency level of internal model users is substantially lower (see gray / right columns in Fig. 6). Overall, the difference is 25 ppt, and for insurers modeling the interest rate risk submodule internally, the solvency ratio excluding the LTGs is as much as 39 ppt lower than for standard formula users. Similarly, the few insurers that include EU government bond default risk in their internal models have higher reported solvency ratios (27 ppt) but are actually substantially (− 50 ppt) less solvent than standard formula users when the LTGs are excluded.

Overall, internal model users have an average solvency ratio excluding LTGs that is 43 ppt lower than the reported solvency ratio including LTGs. In contrast, for standard formula users the average difference between the reported solvency ratio and the solvency ratio without LTGs is only 13 ppt. Thus, we observe a connection between the effectiveness of LTG measures and the granularity of risk models: insurers that model market risks with an internal model tend to experience a greater impact of LTG measures on their solvency ratio than insurers using the standard formula. These findings suggest that it is particularly important to pay attention to the impact of LTG measures when insurers use internal models.

Empirical approach

In a first set of analyses to examine discretionary decisions in the implementation of Solvency II, we investigate the use of LTG measures. To this end, we consider regression models with the impact of the LTG measure on the solvency ratio as the dependent variable (\(\textit{VA Impact}_{i,y}\), \(\textit{MA Impact}_{i,y}\) and \(\textit{TP Impact}_{i,y}\)). The independent variables are the market risk sensitivities from the first stage of the regression analyses and the solvency ratio calculated without each particular LTG from Eq. 7. For instance, the coefficients on \(\textit{Solvency Ratio pre VA}_{i,y}\) may indicate whether the volatility adjustment is applied by insurers with otherwise lower solvency ratios. We also control for the logarithm of firm size and the proportion of life business. Since our sample consists of 49 insurance companies and we observe their solvency situation at three different points in time, we run panel regressions.

For each model, we use the Hausman test to determine whether fixed effects are present. In our models for the volatility and matching adjustment impact, the Hausman test suggests that fixed effects are not significant (p-values > 0.2). Therefore, we use random effects models, which are more efficient and control for autocorrelation. When examining the impact of the transitional for technical provisions, we use insurer fixed effects, as suggested by the Hausman test (p-value = 0.0001). We estimate the following three models:

All variables in Eqs. 8–10 refer to an insurer i in year y. \(\textit{Solvency Ratio pre LTG }k_{i,y}\) is model-specific and subtracts the value of the dependent variable from the solvency ratio (see Eq. 7). In each model, \(\beta_1\) indicates whether the impact of using an LTG measure is higher for an insurer with an otherwise low solvency ratio. \(\textit{Sensitivity }j_{i,y}\) represents the estimated coefficients for the three market risks \(j=\{y10\text{, }CDS\text{, }Market\}\) from the first stage of the empirical analysis. These are \(\beta_{y10,i,p}\), \(\beta_{\text{CDS},i,p}\) and \(\beta_{m,i,p}\) from Eq. 5, which measures insurers’ sensitivities to long-term interest rates, sovereign CDS spreads, and the Euro Stoxx 50 market index.Footnote 23 We control for \(ln(\textit{Size}_{i,y})\) and the share of life insurance reserves \(\textit{Life}_{i,y}\). \(\alpha_i\) represents random effects, \(\mu_i\) signifies insurer fixed effects, and \(\varepsilon_{i,y}\) is the error term. Based on the VIFs, which never exceed a value of 10 for the variables of interest, there is no evidence of multicollinearity.

In a second set of analyses, we examine the discretionary decisions regarding internal models for calculating SCR. For this purpose, we run logistic regressions with the binary variables for Solvency II modeling (see Table 4) as dependent variables. We assume random effects and, for the most part, we use the same independent variables as in previous models.Footnote 24 The general formula for the logistic panel regressions is shown below. The dependent binary variable differs in the individual models. Thus, \(\textit{Binary}_{i,y}\) from Eq. 11 should be replaced by the variables reflecting the individual components of the internal models (\(\textit{Internal Model}_{i,y}\), \(\textit{Internal Interest Rate Risk}_{i,y}\), \(\textit{EU Gov Bond Spread Risk}_{i,y}\), etc.).

Results

Solvency ratio and LTG measures

Tables 5, 6 and 7 present the regression results for the volatility adjustment, the matching adjustment, and the transitional on technical provisions. Columns (1)-(2) show the coefficients and p-values (in parentheses) of simplified models. Column (1) is based on univariate OLS regressions with the solvency ratio excluding the respective LTG impact, \(\textit{Solvency Ratio pre LTG k}_{i,y}\), as the only independent variable. Column (2) extends the model in column (1) by introducing the three sensitivity estimates \(\textit{Sensitivity }j_{i,y}\) (betas from the first stage of the empirical analysis in Sect. 3) as additional regressors. Column (3) additionally controls for firm characteristics and thus corresponds to our empirical models from Eqs. 8–10.

For the volatility adjustment, the empirical results are presented in Table 5. In all three columns, the coefficient of \(\textit{Solvency Ratio pre VA}_{i,y}\) is significantly negative. This result is consistent with hypothesis \(H_1\) (see Sect. 2), suggesting that the volatility adjustment tends to be used by insurance companies with a lower solvency ratio pre VA. The coefficient of − 0.083 in column (3) means that for two otherwise identical insurance companies with solvency ratios that differ by 100 ppt, the insurer with the lower value will, on average, adjust its reported solvency ratio upwards by 8.3 ppt just by using the volatility adjustment.

Furthermore, in line with \(H_1\), the results show that the interest rate risk, as perceived by financial investors, is significantly related to the impact of the LTG measure on the solvency ratio.Footnote 25 A 1 ppt decrease in the sensitivity measure \(\textit{Sensitivity}_{y10,i,y}\) (\(=\beta_{y10,i,p}\) from the first stage of the regression analysis) relates to a ceteris paribus increase in the impact of the volatility adjustment of 0.21 ppt (column (3)).Footnote 26 Hence, the more insurers suffer from falling interest rates, the greater is the impact of the volatility adjustment on the solvency ratio. Notably, the regression coefficients of \(\textit{Sensitivity}_{y10,i,y}\) and \(\textit{Solvency Ratio pre VA}_{i,y}\) are still significant at the 0.5% level when controlling for the share of life insurance technical provisions, and are robust to all tests performed in Sect. 4.4, such as using country fixed effects instead of random effects.

We also find that the impact of the volatility adjustment on the solvency ratio is significantly higher for life insurers. A pure life insurer adjusts its solvency ratio upwards by about 15 ppt on average using the volatility adjustment compared to an otherwise identical pure non-life insurer (column (3)). According to the empirical analysis, sovereign credit risk and market sentiment sensitivities cannot be identified as significant determinants of the impact of the volatility adjustment. The effect of \(ln (\textit{Size}_{i,y})\) is borderline insignificant, but the coefficient indicates that the volatility adjustment has a greater effect on the reported solvency ratio of large insurers.

The regression results for the matching adjustment are shown in Table 6. The coefficient of \(\textit{Solvency Ratio pre MA}_{i,y}\) is significantly negative in columns (1) and (2), which is consistent with \(H_2\). However, it is borderline insignificant in column (3), i.e., after controlling for insurer size and life business. Thus, although the matching adjustment has the largest average impact on the solvency ratio of all LTGs (see Fig. 3b), we find no evidence at the 10% significance level that its impact is higher for insurers with otherwise low solvency ratios. Also, the coefficients of \(\textit{Solvency Ratio pre MA}_{i,y}\) are almost five times smaller than the corresponding variable \(\textit{Solvency Ratio pre VA}_{i,y}\) in Table 5 (− 0.017 vs. − 0.083).

In terms of insurers’ sensitivity to sovereign credit risk, the empirical results support \(H_2\). A 1 ppt decrease in \(\textit{Sensitivity CDS}_{i,y}\) (\(=\beta_{\text{CDS},i,p}\) from the first stage of the regression analysis in Sect. 3), ceteris paribus, goes along with a 0.527 ppt increase in the impact on the solvency ratio (column (3)). The standardized beta coefficients are about twice as high as for the volatility adjustment and \(\textit{Sensitivity y10}_{i,y}\), underlining the strong relationship between sovereign credit risk sensitivity and the use of the matching adjustment. All else equal, an insurer with a one standard deviation lower \(\textit{Sensitivity CDS}_{i,y}\) (0.03 ppt, see Table 4) experiences a 0.37 standard deviation higher impact of the matching adjustment (0.0962 ppt). Thus, insurers with greater sovereign credit risk sensitivities may have a higher incentive to use this LTG measure. The coefficients suggest that the impact of the matching adjustment on the solvency ratio is disproportionate to the magnitude of the market risk sensitivities estimated from market data. This discrepancy indicates that the weighting of the modules for the SCR calibration does not optimally reflect the true market risk profiles of insurers and that the ability to use LTG measures may introduce a systematic bias.

Finally, in line with \(H_2\), the empirical results in column (3) of Table 6 indicate that the impact of the matching adjustment on the solvency ratio is significantly more pronounced for larger insurers. The positive relationship between \(\textit{MA Impact}_{i,y}\) on the one hand and both \(\textit{Sensitivity CDS}_{i,y}\) and \(ln (\textit{Size}_{i,y})\) on the other hand is robust to all the adjustments in Sect. 4.4. Notably, in our sample, the matching adjustment is used only by insurers from the Netherlands, Spain, and the UK. The average duration gap of insurers in Spain and the UK is only 0.75 and − 1.05 years, respectively, which is far below the EU average of 4.21 years (EIOPA 2014a). Nevertheless, we can rule out that our results are biased by similar market characteristics in these countries, as the effects of \(\textit{Sensitivity CDS}_{i,y}\) and \(ln (\textit{Size})_{i,y}\) are still significant in a model with country fixed effects.

In Table 7, we examine the impact of the transitional for technical provisions. In line with \(H_3\), the coefficient of the solvency ratio calculated without the LTG measure, \(\textit{Solvency Ratio pre TP}_{i,y}\), is negative and highly significant in all models. According to column (3), which corresponds to the model presented in Eq. 10, for two otherwise equal insurers with a solvency ratio that differs by 100 ppt, the less solvent insurer will use the transitional to adjust its solvency ratio upward by 10 ppt on average.

Again consistent with \(H_3\), the coefficient of \(\textit{Sensitivity y10}_{i,y}\) is negative and significant for the transitional on technical provisions (columns (2) and (3)). This result indicates that insurers facing higher interest rate risk tend to experience a larger effect than insurers less exposed to falling interest rates. In comparison with the volatility adjustment, the standardized beta coefficients in column (3) of Table 7 are smaller (− 0.14 vs. − 0.19) and the p-values are larger (0.059 vs. 0.003) compared to Table 5. Also, the effect is less robust (Table 10). This suggests that insurers’ sensitivity to interest rates is more closely related to the impact of the volatility adjustment than to the impact of the transitional for technical provisions. For the other market risk sensitivities and firm characteristics, we do not observe a significant effect on the impact of the transitional on the solvency ratio.

Overall, our empirical analysis fully supports the statements of \(H_1\) and \(H_3\) regarding the volatility adjustment and the transitional on technical provisions. With respect to \(H_2\) and the impact of the matching adjustment, our results support the expected relationships in terms of sensitivity to sovereign credit risk and insurer size. Only the relationship with the solvency ratio pre LTG is not supported when controlling for size and life insurance share.

Our findings indicate that listed insurers use LTG measures strategically in a way that exploits the discretion to optimize the reported solvency ratio and to mask their own risk profiles. This is reflected in the findings that the average impact of each LTG is higher for insurers with otherwise lower solvency ratios and for insurers with relatively greater sensitivities to either long-term interest rates or sovereign CDS spreads. In particular, insurers with large market risk exposures may use the LTG measures to make their SCR less sensitive to these risks and to better present themselves to the public through higher solvency ratios.

Internal models for SCR calculation

In addition to the LTG measures, we examine discretionary choices in the composition of internal models for calculating the SCR under Solvency II. Table 8 presents the results of the logistic regressions defined in Eq. 11. Unlike previous regression tables, we now use binary dependent variables that differ in each column. For instance, the dependent variable in column (1) is \(\textit{Internal Model}_{i,y}\) which equals one if an insurer uses a partial or full internal model to calculate its SCR. Additional results from the logistic regressions for other dependent variables, including \(\textit{Internal Market Risk}_{i,y}\) and \(\textit{Internal Default Risk}_{i,y}\) are presented in Table 11 in Appendix.

Overall, the results are in line with hypothesis \(H_4\). The regression coefficients in column (1) of Table 8 show that the probability of choosing an internal model is significantly higher (on a 1% level) for more solvent insurers, those with lower sovereign credit risk sensitivities, those with higher market sentiment sensitivities and for larger insurers.

In column (2), we investigate insurers’ decision to replace the standard formula’s interest rate risk submodule, which is part of the market risk module, with a (partial) internal model. The detected relationships fully support \(H_4\). Notably, the use of an internal model for interest rate risk is more likely for insurers with lower sensitivities to interest rates and sovereign CDS spreads. The regression results suggest that internal models are more likely to be used for market risks to which insurers are relatively less sensitive compared to other insurers, possibly because they have found adequate immunization strategies through their efforts to adopt an internal model. This argumentation is also supported by the results shown in Table 11, which emphasize that insurers with low sensitivity to sovereign credit risk are significantly more likely to model spread risk and counterparty default risk internally (columns (2) and (3)). Similarly the probability of modeling the market risk module internally is also higher for insurers with lower interest rate risk and sovereign credit risk (column (1) of Table 11).

Finally, column (3) of Table 8 presents results for the likelihood of including the spread risk stemming from EU government bonds in an internal model, even though these investments are exempt from spread and default risk under Solvency II. Here we find support for \(H_4\) for insurer size and, at the 10% significance level, for market sentiment. For insurers’ sensitivity to interest rate risk and sovereign credit risk, we find no significant relationship with the consideration of spread risk associated with EU government bonds.

We also find that, ceteris paribus, non-life insurers are more likely than life insurers to use an internal model, and in particular an interest rate risk model (columns (1) and (2)). At first glance, this result may seem surprising, as life insurers tend to be much more exposed to market risk movements, while non-life insurers typically do not have large duration gaps and have implemented rather prudent investment strategies. To explain the result, it should be noted that the three regressors of market risk sensitivities may work well in capturing the structural sensitivities between the market risk exposures of life and non-life insurers. In other words, we find that a non-life insurer is more likely to use an internal model than a life insurer when both are equally exposed to market risk. The ceteris paribus difference may be due to the fact that non-life insurers have potentially large benefits from internal models by optimizing their underwriting risk profile and reinsurance portfolio. The market risk models for non-life insurers may be a by-product with relatively low marginal costs.

Robustness

The empirical results are robust to several adjustments. In particular, we perform the following set of robustness tests against the original specifications in Eqs. 8, 9 and 10. An overview of the corresponding regression results is presented in Table 10 in the Appendix.

-

1.

We use t-values instead of betas to estimate insurers’ sensitivities to interest rates, CDS spreads, and market sentiment. High absolute t-values demonstrate the statistical significance of a relationship with an insurer’s stock performance.

-

2.

We use 5-year time windows with at least 500 insurer stock observations instead of 10-year time windows to estimate insurers’ market risk sensitivities in the first stage of the empirical analysis.Footnote 27

-

3.

We use 3-year time windows with at least 500 insurer stock observations instead of 10-year time windows to estimate insurers’ market risk sensitivities in the first stage of the empirical analysis.

-

4.

We control for corporate credit risk by extending the panel regression models in Eqs. 8, 9 and 10 to include insurers’ sensitivities to CDS spreads on corporate bond indices in addition to CDS spreads on domestic government bonds.Footnote 28

-

5.

We use weighted CDS returns based on insurers’ country-specific investments instead of measuring sensitivities to domestic sovereign CDS spreads.Footnote 29

-

6.

We use national stock indices to estimate insurers’ market sentiment sensitivities instead of using the Euro Stoxx 50 index for all insurers.

-

7.

We winsorize stock returns in the first stage of the regression analysis (see Eq. 5) at the 0.5% and 99.5% levels.Footnote 30

-

8.

We winsorize the estimated sensitivity coefficients (betas) for the second stage of the empirical analysis (see Eqs. 8, 9 and 10) at the 0.5% and 99.5% levels to ensure that the results are not driven by extreme outliers.

-

9.

We include in the sample five micro-cap insurers with less than $250 million in total assets as of year-end 2020. While our empirical results are less significant for this subset, they still hold for this expanded sample.

-

10.

We use country fixed effects in the regression models for each of the LTG measures.

-

11.

We use the solvency ratio without all LTGs instead of \(\textit{Solvency Ratio pre LTG }k_{i,y}\) as independent variable.

Conclusion

One of the main objectives of Solvency II is to provide a fair view of the risk and solvency position of European insurers. For this aim, the regulatory framework takes an economic and risk-based approach with the solvency ratio as the central outcome of Pillar I. Nevertheless, insurers have some leeway in the implementation of Solvency II, allowing them to use internal models and to adjust their reported solvency ratio upwards by using LTG measures. This paper examines listed insurers’ discretionary choices and their impact on the solvency ratio, and explores the relationship with insurers’ market risk profiles.

To address the research question, we measure the market risk sensitivities of stock insurers and compare the estimated risk profiles with relevant information in SFCRs. By performing multivariate regression analyses at the insurer-level, we are able to reproduce the results of previous papers with respect to interest rate risk and sovereign credit risk (Berends et al. 2013; Düll et al. 2017; Hartley et al. 2017). This implies that we find a negative effect of falling interest rates and of rising sovereign CDS spreads on insurers’ stock prices. The beta coefficients obtained from the market data analysis serve as sensitivity estimates for interest rate risk, sovereign credit risk, and market sentiment.

After systematically analyzing the SFCRs from 2016 to 2020, we find that insurers optimize their reported solvency situation by making discretionary decisions that reduce capital requirements for material risk drivers. For instance, the use of the volatility adjustment, applied by 69% of the listed insurers in our sample, is positively related to the interest rate risk as perceived by financial markets, even when controlling for the share of life insurance in technical provisions. Similarly, the matching adjustment, which lowers the SCR for spread risk, is associated with significantly higher sovereign credit risk sensitivities. The matching adjustment has the largest average impact on the solvency ratio when applied (59 ppt), even though market data indicate that interest rate risk is more relevant for European insurers.

In addition, both the volatility adjustment and the transitional for technical interest rates are used mainly by insurers with otherwise low reported solvency ratios. The LTG measures thus appear to provide a regulatory loophole to avoid higher SCR that would be appropriate under a market-oriented risk management approach. While Solvency II aims to provide a risk-based economic approach, the LTG measures prevent the SFCRs from providing a stand-alone figure that transparently informs about insurers’ risk exposures and solvency position. Instead, our empirical results suggest that the implementation of LTGs may lead to adverse selection in a manner similar to the banking sector.

Our hand-collected data on the composition of internal models shows that listed insurers tend to model internally those market risks for which they have already established effective immunization strategies. Moreover, internal models are primarily used by large insurance companies, which are subject to more regulatory and public scrutiny.

It should be noted that the findings of this paper are limited to publicly traded insurers and are not generally applicable to other types of companies. Non-listed insurers use LTG measures and internal models much less frequently: Overall, only 42.2% of EEA insurance groups use at least one LTG measure in 2020 according to EIOPA (2020), while this is the case for even 73.3% of listed insurers in our sample. Similarly, internal models are used by only 10.3% of all EEA insurance groups, compared to 55.6% in our sample. Possible reasons for this are stricter regulatory requirements and a greater complexity of calculations associated with these discretionary options. There are many small mutual insurers that are structurally different from the listed ones, where the latter have a market share of around 60%. In addition, our focused study relates in particular to market risks, which are the largest risk factor under Solvency II, followed by underwriting risk. Analyzing the discretionary decisions of non-listed insurers and investigating the role of other risk factors would be an interesting topic for further research.

Data availability

The empirical data that support the findings of this study are available from third parties. Restrictions apply to the availability of these data, which were used under license for this study.

Notes

Insurers using at least one LTG measure hold 80% of the technical provisions of all insurers subject to Solvency II (EIOPA 2020). Internal model users in our sample have total assets of at least $4 billion.

The SFCRs provide detailed information on insurers’ business, performance, governance, risk profile, valuation for solvency purposes, and capital management (Art. 292–298, European Commission 2015).

Insuring against cyber risk, for example, results in a different underwriting risk profile than insuring against natural catastrophes, mortality, or automobile accidents. Reinsurance strategies also play a role.

The composition of choices described as LTG measures is in line with EIOPA (2020). Other measures do not reflect discretionary decisions (e.g., the symmetric adjustment to the equity risk change) or are hardly used (e.g., the duration-based equity risk submodule is used by only one insurer in France (EIOPA 2020)).

Micro-cap firms have lower liquidity and potentially anomalous risk-return profiles compared to larger companies due to factors such as higher volatility and growth prospects (Lins et al. 2017). Our empirical results are robust to the inclusion of micro-cap insurers in the sample (see Table 10 in Appendix).

The excluded firms are mostly from smaller European insurance markets: Cyprus (two insurers), Croatia (one), Hungary (one), Iceland (one), Malta (one). There is one insurer each from Norway and the UK.

Accordingly, 53% of the bond investments of EEA insurers are allocated to government bonds in 2020, while 43% are allocated to corporate bonds. Notably, the share of corporate bond investments is much higher for US insurers (about 80%, cf. NAIC 2021). In an alternative model specification in robustness test 4 in “Robustness” section, we measure credit risk sensitivities using CDS spreads on corporate bond indices and find no significant effect on discretionary decisions regarding capital requirements under Solvency II.

For instance, insurers should hold assets in a currency that matches their liabilities (EIOPA 2022).

In robustness test 5 in “Robustness” section, we use an alternative specification that takes into account the distribution of insurers’ government bond investments across different bond issuers at the country level. For this purpose, we use weighted CDS returns based on country-specific investment portfolios instead of domestic sovereign CDS spreads.

Considering these three market risk factors in a joint model mitigates the risk of omitted variable bias that could arise if the market risk factors were analyzed separately. Similarly, European insurers are obliged to consider all market risks and their interdependencies under Solvency II (Art. 164 of the European Commission 2015).

Our empirical results are robust to shorter time windows, as shown in Table 10 in the Appendix.

In its stress test, EIOPA (2014a) finds an average duration of insurers’ government bond investments of 8 years and an average duration gap between liabilities and assets of 4.21 years.

For example, there is much more variation in sovereign CDS spreads in 2012 (average of 3.6% and standard deviation of 2.44%) than in 2018 (average of 0.5% and standard deviation of 0.05%).

While the majority of SFCRs and QRTs are in English, we collect data from 15 insurer-year combinations in German, 7 in Spanish, 7 in Danish, 2 in French and 2 in Norwegian.

Note that EIOPA’s LTG report from 2020 excludes UK insurers for the first time, even though Solvency II regulation was still binding under UK national law and reforms were not announced until 2022 (Chaplin et al. 2022). We subtract the SCR for UK insurers in our sample before calculating the market share.

Few insurers use the more extensive QRT form S.22.01.21, which is binding for insurers on the solo entity level, to also report the impact of LTG measures on the group level. Insurance groups that do not use any LTG measure do not need to report the QRT form S.22.01.22. For these insurers, we collect data on eligible own funds and the SCR from the QRT form S.23.01.22.

The three exceptional cases in which an LTG measure reduces the solvency ratio occur when insurers apply three LTG measures simultaneously over several years and one of the three measures has a temporary negative effect on the solvency ratio. In only one case is the effect greater than 1 ppt.

The consequences are more severe if an insurer does not comply with the Minimum Capital Requirements (MCR) which usually accounts for 25% to 45% of SCR. The supervisor intervenes directly and withdraws the firm’s business license if the MCR are not met again within a period of three months (EIOPA 2016).