Abstract

We compare the concepts underlying modern actuarial solutions to pension insurance and present two recently developed pension products—pooled annuity overlay funds (based on actuarial fairness) and equitable income tontines (based on equitability). These two products adopt specific approaches to the management of longevity risk by mutualising it among participants rather than transferring it completely to the insurer. As the market would appear to be ready for such innovations, our study seeks to establish a general framework for their introduction. We stress that the notion of actuarial fairness, which characterises pooled annuity overlay funds, enables participants to join and exit the fund at any time. Such freedom of action is a quite remarkable feature and one that cannot be matched by lifelong contracts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction and motivation

Annuity providers face systematic longevity risk and, in order to account for this uncertainty, they are obliged to charge premiums higher than they would without longevity risk. In addition, providers need to set aside solvency capital and so annuities become more expensive than they would otherwise.

Despite the demand from pension providers, the market for longevity risk is limitedFootnote 1 and there is evidence that new forms of pension products are likely to enter the market.

Given this state of affairs, an interesting new stream has emerged in the academic literature that adopts a different focus to annuities by pooling longevity risk among participating pensioners. There is evidence in the media that these ideas are entering the scene.Footnote 2

Some of these new products take their inspiration from ideas similar to those employed by Lorenzo di Tonti in the seventeenth century.Footnote 3 In that case, a lump-sum payment gave the right to an annuity, and this lifelong pension increased over time, as the yields were increasingly distributed among a smaller number of surviving beneficiaries. Likewise, modern tontine-type annuity products reduce longevity risk for the companies, and they can therefore offer customers a lower-cost instrument for retirement income.Footnote 4

This new class of pension scheme is likely to attract much more attention in the academic literature as well as in the market, with many insurers keen to explore innovations in retirement products as reported by Milevsky and Salisbury.Footnote 5 Weinert and GründlFootnote 6 are in favour of tontinising some fraction of the individual retirement wealth on the individual lifetime utility, considering an increasing liquidity need at old ages.

In this paper, we consider examples of this new class of pension product and outline some of their respective similarities and differences. In so doing, we show that there are fundamental concepts in the definition of these products that deserve closer attention. A survey of the methods employed and a new general framework for these pension products are needed for future developments in this rapidly growing area of pension insurance.

We select to analyse two products that capture the essential features of the more prominent literature. While Donnelly et al. Footnote 7 is linked to the contribution by StamosFootnote 8 on pooled funds, Milevksy and Salisbury5 extends pension tontines principles of Forman and SabinFootnote 9 and classical tontines. So these two products capture the essential features of the more prominent literature.

When looking at the legal aspects, Forman and Sabin10 study the main features of what they called the tontine pensions. They define a tontine as a “financial product that combines the features of an annuity and a lottery”. In a simple tontine, a group of investors pool their money together to buy a portfolio of investments and, as investors die, their shares are forfeited, with the entire fund going to the last surviving investor. They briefly describe the technical issues of tontine pensions, namely taxation benefits, legal matters, gender and how to deal with market volatility. After showing that chronic underfunding of some state and local pension plans like the California State Teachers’ Retirement System could benefit from considering a tontine-like method, they insist that the suppression of longevity risk could reduce the fees and, therefore, this means that tontine pensions would provide significantly higher benefits to retirees than classical commercial annuities.

Lusardi and MitchellFootnote 10 report that, in an environment of low interest rates, annuitants receive lower annuities than they did in the past, which in turn impacts financial decisions for retirement and lowers the overall appetite for annuity projects.

Description

We analyse pooled annuity overlay funds and equitable retirement income tontines by comparing these two recent actuarial approaches to eliminating the longevity risk management constraints of the annuity business. We do so by comparing the respective contributions of Donnelly et al. 7 and Milevsky and Salisbury.5 These two products are chosen because they have similar forms of dealing with longevity risk within the pool of participants, rather than transferring this risk to the insurer.

The additional reason why we have decided to compare these two schemes is because, even if they are closely related, there are some differences between them that may be difficult to grasp from the analysis of their technical definition.

The basic concept underpinning both approaches is the pooling of the wealth of individuals (and, hence, their mortality risk) as opposed to individuals investing separately in the pension products provided by an insurer. Both approaches have a similar starting point insofar as they modify an existing product in order to treat all participants equally.

To formalise the concept of equality, Donnelly et al. 7 use the notion of actuarial fairness, that is, if the instantaneous expected actuarial gains (i.e. the benefits expected from participating minus the initial investment) are zero and this holds for all participants at any time, then the product is deemed “actuarially fair”. In other words, no single participant subsidises or benefits from the other participants at any instant.

Milevsky and Salisbury5 introduce their slightly weaker condition of equitability, that is, if the expected benefits, measured per initial dollar invested, are equal for all participants, then the product is deemed “equitable”.

By definition, we assume that “fairness” implies “equitability”, since the expected benefits per dollar of initial investment would be equal to exactly one dollar for all participants. However, the reverse implication does not hold. Thus, while equitability means that the expected benefits are equal for all participants, they might still be lower than the initial investment made. Hence, the expected actuarial gain would be less than zero, whereas, for fairness to hold, the actuarial gain needs to be zero. Below we compare the two products.

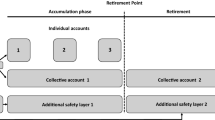

The pooled annuity overlay fund

Although Donnelly et al.’s7 pooled annuity overlay fund includes the word annuity, the concept is quite distinct from that of a standard life annuity. It does not, for example, transfer the risk of mortality to a third party (insurer), nor does it guarantee the pensioner a fixed payout stream (until death). Yet, it does seek to overcome the problems inherent to a life annuity, including its lack of transparency as regards costs (and, hence, the fairness of the proposed price) and the irreversibility of a lifelong contract, which is its most notable characteristic.

The goal of Donnelly et al. 7 is to propose a new kind of pooled annuity fund that is transparent in its costs, actuarially fair and guarantees the investment freedom of each individual in addition to the heterogeneity of the group.

Let us begin by examining the pooled annuity fund proposed by Stamos.8 This product pools the wealth and mortality risk of a homogeneous group of individuals (i.e. same age, same mortality rate and same initial investment). Whenever one of the individuals in the fund dies, their wealth is redistributed among the surviving participants. The portion of the redistributed wealth that corresponds to each surviving participant is in proportion to each survivor’s current wealth. Stamos’8 contribution is to derive the optimal continuous-time payout structure (or consumption) and the optimal portfolio choice.

Donnelly et al. 7 introduce a generalisation of Stamos’ pooled annuity fund, which they refer to as the pooled annuity overlay fund. The idea in Donnelly et al. 7 can be simply explained as follows: for a specified amount of time, individuals pool their wealth, but if one participant should die during this period, his/her wealth is redistributed among the survivors and also himself/herself. Essentially, since the participant who has died is also considered in the redistribution, then part of his/her wealth is left as a bequest to his/her descendants.

The amount redistributed to each individual is proportional to the initial wealth invested and their rate of mortality. At the end of the specified period, the pool is dissolved. Note that, in theory, the pooled annuity overlay fund operates on an instantaneous basis rather than over a long time period. The key feature of the product is that it is actuarially fair at every instant in timeFootnote 11.

The advantages of actuarial fairness are manifold: first, it is possible to exit the fund at any given time (given that the expected actuarial gains are zero, an individual can exit the fund simply by withdrawing his/her money), and, second, no group of individuals profits financially at the expense of another group and so individuals with different demographics can join the pool without any restriction. This actuarial equilibrium copes with adverse selection because no one can benefit from leaving the group or entering it.

Regarding the possible implications of adverse selection, Valdez et al. Footnote 12 constructed a model for examining the demand for annuities when an individual consumer has access to both a private annuity market and a market with a pooled annuity fund. Their form of pooled annuity is exactly a group self-annuity (GSA) plan which allows retirees to pool together and form a fund to provide for protection against longevity. However, there is no redistribution of wealth in this product. In a GSA plan, benefits are not fixed from the beginning as classical annuities, instead, benefits are updated regularly in order to account for deviation in the rate of return on the investments from that expected and, additionally, by a factor to account for mortality or survivorship deviations. These authors recognise that the presence of the pooled annuity fund does not completely eliminate adverse selection, but they find that for certain classes of utility functions, the presence of the pooled annuity fund reduces adverse selection. Individuals adversely select against the pooled annuity fund to a lesser extent than against a conventional, classical annuity. Valdez et al. 12 say that this can be intuitively explained by the fact that there is additional randomness in the rate of return expected from the pooled annuity fund, which is derived from the real outcome of the mortality or survivorship probabilities of the pooled individuals.

As the pooled annuity overlay fund allows individuals to decide how they want to invest their wealth on the financial market, overall financial gains depend on their risk preferences. Donnelly et al. 7 report extensive numerical simulations to illustrate the performance of a pooled annuity overlay fund.Footnote 13

The income tontine

The second main actuarial product we examine is the optimal retirement income tontine developed by Milevsky and Salisbury.5 The income tontine differs from the pooled annuity overlay fund in some specific features. First, the value of the lifelong payments made to the group of tontine participants (which is called the payout) is deterministic and, second, the whole lifecycle has to be considered as the time frame.

However, the product proposed by Milevsky and Salisbury5 employs a redistribution concept similar to the one developed by Donnelly et al., 7 insofar as it distributes the payout in relation to the individual’s wealth and a share price, which usually depends on the mortality rate.

To understand the idea presented by Milevsky and Salisbury,5 we need to go back and examine the original concept of the tontine annuity, whereby a group of individuals invested the same amount of money. In exchange, a regular dividend payout was made to survivors until the last participant died.

According to Milevsky and Salisbury,5 the mechanism can be seen as “a perpetual (i.e. infinite maturity) bond that is purchased from an issuer by a group of investors who agree to share periodic coupons only amongst survivors”. Clearly, this classical concept implied a transfer of wealth from the old to the young, but Milevsky and SalisburyFootnote 14 assume that all participants have the same age. The paper of Milevsky and Salisbury5 mixes people of different ages, but there is no “transfer of wealth” from old to young, either, because the price at which they enter the pool is different. An equitable scheme is by definition not going to transfer wealth across generations ex post.

Milevsky and Salisbury5 adapt the classical tontine in a very convenient way and introduce equitable tontines, i.e. tontines where all the participants have the same expected benefits.

It should be stressed that Milevsky and Salisbury’s5 setup differs from that of the pooled annuity overlay fund in a variety of ways. First, as stated, they focus solely on lifetime income, which means that the time frame is fixed to the whole lifecycle. This also means that individuals can neither enter nor exit the equitable tontine once it has been set in motion.

However, in contrast, modern tontines as presented by Milevsky and Salisbury5 guarantee a deterministic—in special cases nearly constant—income rule, which is the predetermined payout.

In contrast to Donnelly et al.’s7 product, all the wealth is distributed solely among the surviving participants (i.e. no part of the fund is set aside for recently deceased participants) and so Milevsky and Salisbury’s5 product does not provide the possibility of making a bequest.

The comparison

To conclude this section, we provide a summary overview of the differences and similarities of the two products (see Table 1).

Finally, because of the immediate and simple conditions of entering and exiting the pooled annuity fund, we expect the principle of a pooled annuity overlay fund to lend itself better to modern product innovations than the closedness property of income tontines.

Notation and models

Having briefly introduced the main features of the models, we now describe them more formally. Let us assume that we have a group with n participants. We can then split this group into M homogeneous subgroups each with n i participants so that \(\sum {n_{i} } = n.\) The homogeneity of these subgroups is reflected in the fact that their members have the same age, wealth, risk preference and mortality characteristics. This means that each participant in a subgroup k has the same rate of mortality \(\lambda_{t}^{k}\) and wealth \(W_{t}^{k}\). Note that this mortality rate and wealth refer to an instant in time t.

In the pooled annuity overlay fund, all members of the same subgroup have the same risk preferences with regard to investment, which means that their wealth allocation strategy in response to a riskless and a risky asset is invariable throughout the subgroup. The main question that remains unanswered is how actuarial gains can be accumulated. As this occurs on a continuous basis, let us specify an instant in time \((t, \,t + dt)\) for this. The wealth of each individual that dies in this short period of time is placed in the so-called notional mortality account. This amount is then shared among those who remained alive at time t, as well as those who died within the period \((t, \,t + dt)\). The crucial point is that, in the pooled annuity overlay fund, the allocation is proportional to the wealth invested \(W_{t}^{k}\) by the individual and his mortality rate \(\lambda_{t}^{k}\) at \((t, t + dt)\), i.e. each individual receives the following proportion of the overall amount in the notional mortality account:

where \(L_{t}^{m}\) is the number of people alive at time t in subgroup m, i.e. including those that died in \((t, \,t + dt),\)

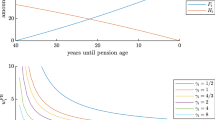

Likewise, when we consider a tontine-type product, we assume a group with n participants and M homogeneous subgroups (or, as Milevsky and Salisbury5 call them, cohorts), each with n i participants so that \(\sum {n_{i} } = n\). The subgroups are homogenous in that their members are of the same age and have the same initial wealth to invest (i.e. at time t = 0 denoted by \(W_{0}^{k}\)). To minimise the actuarial unfairness of the classical tontines, Milevsky and Salisbury5 introduce the price per share \(\frac{1}{{\pi_{i} }}\) for a subgroup i. Thus, based on their wealth and other factors such as age (i.e. force of mortality), the individuals in the different subgroups are required to pay a different price per share and, hence, they acquire a different number of shares, respectively. The overall payout is determined by the total amount initially invested by the group multiplied by the deterministic payout function d(t) that governs the payout per initial dollar invested. Recall that the payout function d(t) is continuous and so is the payout, i.e. payouts are not only made when an individual dies. As such, the proportion of the overall payout for each living individual is given by the amount of shares held with respect to the sum of the shares of the survivors. This means that a known overall amount is paid out to a decreasing number of surviving individuals.

The explicit structure of this tontine depends on the specification of the payout rate d(t) and the price per share for each subgroup \(\frac{1}{{\pi_{i} }}\). Milevsky and Salisbury5 provide necessary and sufficient conditions for the existence of an equitable tontine for a given payout function d(t).Footnote 15 This means that they provide conditions for share prices to exist so that the tontine is equitable. As they explain, intuitively, their theorem states an equivalent condition to the non-existence of equitable share prices: if share prices exist such that a subgroup finds this tontine favourable even though they only get paid after all individuals from another subgroup have died, then share prices which make this tontine equitable do not exist.

Recall that equitability, unlike actuarial fairness, means that a participant can expect a small actuarial loss, but at least this does not discriminate any subgroup. Milevsky and Salisbury5 claim that this is an acceptable property in return for having a simple, transparent product with a deterministic payout function. However, note that, as participation in a pooled annuity overlay fund can be reconsidered at any moment in time, pensioners therefore also have the freedom to design their own investment decisions, that is, they can reduce the investment amount in order to obtain the other part as a payout. In other words, members can join or exit the pool as they wish, and they can also reconsider their reinvestment decisions and, so, reduce a proportion of their wealth according to a certain payout structure.

Let us consider a number of different examples of tontines as presented in Milevsky and Salisbury5. First, consider the so-called proportional tontine. Here, the price per share (for each subgroup) equals the price that an individual in this subgroup has to pay for a standard annuity which pays US$1 for the rest of his life. Further, the payout function d(t) is proportional to the mean number of surviving tontine shares. This tontine is only equitable in the limit, i.e. for an infinitely sized group. Also, it is optimal in the limit as shown in Milevsky and Salisbury (Theorem 6)Footnote 16. This means that (for a strictly concave utility function) the utility of each subgroup is optimised simultaneously.

A generalisation of the proportional tontine is the so-called natural tontine where the payout function has to be proportional to the mean number of surviving tontine shares, but no specification about the share prices is made. They are referred to as “natural” by Milevsky and Salisbury5 because it seems a natural requirement to the payout function to have this proportionality. The natural tontine equals the proportional tontine in the limit (and thus is asymptotically optimal). To have not only natural but also, as desired, equitable tontines, we have to compute simultaneously share prices \(\frac{1}{{\pi_{i} }}\) for each subgroup i and the payout function d(t). This problem can be a computational challenge in practice. As mentioned, there exist necessary and sufficient conditions with regard to a tontine for the existence of equitable prices (which are then unique up to a multiplicative constant). But in the case of natural tontines, to date, this remains a mere conjecture of Milevsky and Salisbury5. This makes proportional tontines, although not equitable, easier to use, at least from a practical point of view. Milevsky and SalisburyFootnote 17 argue: “Though the theoretical basis of proportional tontines is not as appealing as that of natural ones, they are simpler to compute, and they do appear to perform reasonably well in practice”. Thus, they see proportional tontines as “acceptable alternatives” in cases when the computation of a natural equitable tontine is too difficult.

A general framework

A comparison of the characteristics of the two products presented in the “Notation and models” section, is of obvious interest to the sector and should provide us with a more complete understanding of them. To be able to compare a pooled annuity overlay fund and an equitable tontine, we first have to modify the redistribution of wealth in the former so that it is only redistributed among surviving members. A general common framework like the one presented below has not been developed before.

The way to achieve this general model can be outlined as follows. For a given instant of time \((t,\, t + dt)\), we assume that the kth person died within this time interval and that his/her wealth \(W_{t}^{k}\) is to be redistributed (recall that, in the standard setting, a certain fraction is withheld for the bequest of the deceased). We wish to find the factor \((1 + A_{t}^{k} )\) by which we have to increase the wealth \(W_{t}^{k}\) of this person so that the amount redistributed among all surviving members is exactly equal to the initial wealth \(W_{t}^{k}\) of the kth person. In other words, the new total amount \(\left( {1 + A_{t}^{k} } \right) W_{t}^{k}\) minus the proportion corresponding to the deceased member must equal the initial amount \(W_{t}^{k}\). As we are unable to determine in advance the subgroup in which a member will die, we need to impose this condition for all subgroups \(k = 1, \ldots ,M\). As such, the following formula should hold:

This can be rewritten as

In Eq. (2), the denominator consists of the sum of the wealth (weighted according to the mortality rate) of the members alive at time t + dt, i.e. all except the kth person. To compute the \(A_{t}^{k}\), we fix a starting value \(A_{t}^{k,0}\) and propose an iterative procedure to determine the final value:

for a positive natural number h, indicating the iterations.

Using this procedure, we can ensure that the entire wealth of the deceased W k t is redistributed among the surviving members. Thus, instead of considering the pooled annuity overlay fund with initial wealth \(W_{t}^{k}\) for \(k = 1, \ldots ,M\), we consider the pooled annuity overlay fund with initial wealth \(W_{t}^{k}\) \((1 + A_{t}^{k} )\) for each \(k = 1, \ldots ,M\). Then, Equation (1) ensures that the wealth of the deceased \(W_{t}^{k}\) is redistributed among the surviving members.

From a technical point of view, this solution is viable only if one member dies at the given instant in time. In practice, if more than one member dies during the time interval considered (e.g. a day), the algorithm would have to be applied separately and consecutively, ordering the deaths by descending age of the deceased.

Illustration

We are now in a position to compare the actuarial mechanisms of the pooled annuity overlay fund7 and the equitable scheme5 by considering a simple example. While the setup for the pooled annuity overlay fund is fully specified, we need more precise details regarding the tontine being used. By selecting the payout function d(t) and the price per share \(\frac{1}{{\pi_{i} }}\) for each subgroup, we can fully specify the Milevsky and Salisbury5 tontine and determine if it is equitable or not. As discussed above, Milevsky and Salisbury5 recognised that a proportional tontine can be considered instead of a natural and equitable one, and it will “perform reasonably well in practice”. So, for the sake of simplicity, we consider a proportional tontine.

Imagine a single man with an initial wealth of US$100, aged 65 and a mortality rate of 0.99. He wishes to join a homogeneous pool of 99 people (i.e. n = 100) also aged 65, with the same mortality rate (i.e. 0.99) and who each have an initial wealth of US$10. For the sake of simplicity, we assume the risk-free interest rate to be r = 0 per cent (we thereby avoid the effect of returns resulting from investing wealth with fixed returns).

To illustrate a cumulative payout, we consider different instants in time (1, 5, 10, 20 and 30 years). For these instants, we examine different cases: first, we consider the payout in the case that none of the members dies. Second, we consider likely outcomes in a cohort of 65-year-olds (although, of course, these can be accommodated to other situations). Here, we consider one death after one year, two deaths after five years, five deaths after ten years, eleven deaths after twenty years and thirty deaths after thirty years. We also consider highly unlikely outcomes for a cohort purchasing an annuity tontine at the age of 65. Hence, we consider five deaths after one year, ten deaths after five years, twenty-five deaths after ten years, fifty deaths after twenty years and ninety deaths after thirty years, which would be considerably more deaths than any reasonable mortality table would indicate for a modern society.

Calculating the cumulative payouts

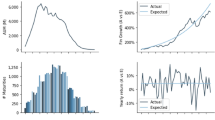

Table 2 records the cumulative payout for the single person (with US$100 initial wealth), and Table 3 shows the cumulative payout for the other investors (with US$10 initial wealth) in the case that they survive. Figure 1 presents a possible sample trajectory of individual cumulative payouts.

As discussed, two choices have to be made concerning the tontine: namely, the payout function d(t) and the price per share \(\frac{1}{{\pi_{i} }}\) for each subgroup. In a proportional tontine, the price per share equals the price that has to be paid to obtain a standard annuity of US$1 for life. As we know, this price depends on the age of the members in the corresponding subgroup. Given that in our example all the participants are of the same age (in both subgroups), the price per share \(\frac{1}{{\pi_{i} }}\) is the same for all participants (US$15.02). Note that we have used the Society of Actuaries’ (2008) mortality table available in the lifecontingencies R packageFootnote 18.

In a proportional tontine, the payout function d(t) (per initial dollar of investment) is a weighted sum of the annuity factors (the inverse of the price for the standard annuity of US$1 per life) for each subgroup. Given that, in our example, the prices were the same across all subgroups, the payout function d(t) at time t simplifies to the product of the survival function for a 65-year-old individual surviving t years, t p 65, and the annuity factor for a 65-year-old, \(\frac{1}{{a_{65} }}\), where a 65 is the price for a standard annuity of US$1 for life for a 65-year-old:

For example, the payout rate after one year is \(d\left( 1 \right) = 0.978\; \times \;\frac{1}{15.02}\) = 0.065 per initial dollar invested. Then, the overall payout at one year is the initial total wealth multiplied by the payout rate: \(d\left( 1 \right)\,\; \times \;\left( {1 \times 100 + 99 \times 10 } \right) = 71.01\).

This amount is redistributed among the surviving participants according to the shares held. As the share prices are equal in both subgroups, this is equivalent to a distribution made according to the proportion of the initial investment made.

If no one dies, the single man with the greatest initial wealth would receive \(\frac{100}{100 + 99 \times 10} = 9.17\;{\text{per}}\,{\text{cent}}\) of the total payout and each of the other participants would receive \(\frac{10}{100 + 99 \times 10} = 0.92\,{\text{per}}\;{\text{cent}}\), i.e. as the former invested 10 times more than the latter, he would likewise receive 10 times more. Multiplying these percentages with the overall payout after one year, US$71.01, we obtain the first number (as a percentage of capital invested) in the first row of Tables 2 and 3, respectively.

If a member dies, the same overall amount is distributed among all surviving members according to the remaining shares. Note that which person dies makes a difference.

If the single man with the greatest initial wealth (i.e. US$100) dies, then the overall amount paid out after 1 year, US$71.01, is redistributed equally among the remaining 99 members (given that they all made the same initial investment), i.e. US$71.01 : 99 = US$0.717, which equals 7.17 per cent of their initial investment of US$10 (see the first value in the third row of Table 3).

If, on the other hand, one of the members with a US$10 initial investment dies, the percentages change only slightly (in comparison to the scenario in which all the members survive). Thus, the single man with the greatest initial wealth would receive \(\frac{100}{100 + 98\; \times \;10} = 9.26\,{\text{per}}\;{\text{cent}}\) and each of the other survivors would receive \(\frac{10}{100 + 98\; \times 10} = 0.93\,{\text{per}}\;{\text{cent}}\). Accordingly, the difference between the first and second values in the first column of each table is not very great.

Both tables show that, even after 30 years, the initial investment of US$100 or US$10, respectively, has not been paid back (except in the case of the highly unlikely events after 30 years). It should be recalled that in the income tontine plan, all members have to remain in the scheme, whereas, in the case of the pooled annuity overlay fund, participants are free to leave as and when they wish. This means that, after an initial investment (let us say US$100) in the pooled fund, a member can withdraw the exact same amount of wealth from it as he/she would receive as a payout from the proportional tontine (which is then accumulated in Tables 2 and 3). Hence, one could replicate exactly the tontine payout structure and still have an amount left to further invest in the pooled annuity overlay fund.

Calculating the benefits of pooling mortality

Pooled annuity funds reduce the cost and are welfare improving after taking into account the aggregate mortality risk. As noted by Donnelly et al., 4 for participants of the same age and gender, the stability of income streams from a pooled annuity fund depends on the size of the pool, but the inherent advantage is that participants are not charged for uncertain mortality.

Cost reduction in the pooled annuity fund can be expressed as the cost of having the same expected returns on wealth for the pooled annuity and a mortality-linked fund, given equal volatilities of return. Some illustrative results follow from the calculation in Donnelly et al. 7 and are presented in Table 4. By definition, the instantaneous break-even costs applying at time t are the costs such that, for equal instantaneous volatilities of return on the wealth, a surviving individual has the same instantaneous expected return on wealth from the pooled annuity fund as from the mortality-linked fund at time t. If the actual costs charged by the mortality-linked fund are higher than the instantaneous break-even costs, then the individual can obtain a higher expected return from the pooled annuity fund for the same amount of volatility of return on wealth. The instantaneous break-even costs depend on the number of participants in the pooled annuity fund, the proportion invested in the risky asset and the force of mortality, the expected return and the volatility of the return on wealth. The calculation procedure is specified at the bottom of Table 4. In this table, we consider pool sizes ranging from 100 to 10,000. The proportion invested in the risky asset varies from 25 per cent to 75 per cent. As in Donnelly et al., 7 the force of mortality is assumed to be equal to 0.04, the average risk-free return equals 2 per cent, the average risky asset return is equal to 6 per cent and the risky asset volatility is equal to 18 per cent.

For a pooled annuity fund of 100 participants who have a force of mortality equal to 0.04 and who invest 10 per cent of their wealth in the stock market, the costs charged by the seller of the mortality-linked fund would need to be less than 0.199 per cent of the participant wealth before a higher expected return from joining the mortality-linked fund would be preferable to the pooled annuity fund.

Milevsky and PosnerFootnote 19 report that market prices for insurance risk charges are substantially above their theoretical values. A simple return-of-premium death benefit is worth between 0.01 and 0.10 per cent, depending on gender, purchase age and asset volatility. In contrast, the median mortality and expense risk charge for return-of-premium variable annuities is 1.15 per cent basis points. However, we should acknowledge the limited applicability of the Milevsky and Posner19 study, which focuses on variable annuities (which often have high and opaque fees), to the immediate annuity market.

Donnelly et al. 7 also considered heterogeneous pools with different ages. They concluded that, if the cost of longevity premium were 1 per cent per annum of wealth and, assuming individuals are indifferent to the source of volatility, then participants would obtain a higher expected return on wealth from joining a pooled annuity fund even for very small group sizes of 300. For higher group sizes like 1000 or 10,000, then the so-called break-even costs are much smaller. And for the sample sizes of several hundred thousand that we find in many big pension companies there is no reason for the pensioners not to pool. Therefore, any mortality risk-related cost inferred via a major pension company would be eliminated via these pooled annuity funds. On the other hand, it might leave pension companies with less profit if they introduce pooled annuity funds. Our suggestion is that these companies do introduce pooled annuity funds anyway and let the customer benefit from the simpler administration and the savings thus realised. To remain profit levels intact, companies could introduce an administration cost instead. That would be fair and more transparent to the pension customers as well. So the conclusion is that pooled funds eliminate expensive and unnecessary risk cover for a group of pensioners and facilitate a more transparent and hopefully also increasingly fair profit income of the pension company when risk profits are replaced by administration cost charges.

Conclusions

We have analysed two new products—pooled funds as proposed by Donnelly et al., 7 and income tontines as outlined by Milevsky and Salisbury5—that pool longevity risk among participants. In line with Weinert and Gründl6, we feel that there exist appropriate incentives for individuals to hold some fraction of their retirement wealth in these contemporary tontine products as opposed to the complete annuitisation of their wealth.

Relative to the products studied, traditional annuities insure the annuitant against both the risk of being part of a “bad” pool in the sense that participants live longer than expected and also the risk that the mortality tables turn out to be incorrect.

Yet, having said that, Weinert and Gründl’s 6 analysis of consumer spending (drawing on data from the German Socio-Economic Panel Study, 1984–2013) shows that an old-age liquidity-need function is concave and increasing with age. However, the requirements and circumstances of each pensioner make these budget needs highly specific and extremely difficult to specify in advance. As such, the possibilities of investment and participation provided by the pooled annuity overlay fund appear to be especially valuable, since they allow participants to adopt personalised strategies and to modify them in the decumulation phase, something that a predefined annuity fails to do.

The recent increase in published studies addressing this subject is indicative of the interest in pension insurance in a very broad sense in all countries. To mention just a few, Huang and MilevskyFootnote 20 analyse the retirement consumption problem with differentially taxed accounts of retirees, showing how Canadians decumulate financial wealth during retirement. Huang et al. Footnote 21 turn their focus on optimal purchasing of deferred income annuities. The authors assume a mean-reverting model for payout yields and show that a risk-neutral consumer who wishes to maximise his expected retirement income should wait until yields reach a threshold (above historical averages) and then purchase the deferred income annuity in one lump sum. Denuit et al. Footnote 22 propose that the length of the deferment period could be subject to revision, providing longevity-contingent deferred life annuities and allowing for a dynamic decision process over time rather than having to make a choice immediately on retirement. Mikevsky and Salisbury,14 in presenting optimal retirement income tontines, rekindle a debate about retirement income products that has long been neglected and provide the mathematical finance tools to design the next generation of tontine annuities. Yet, DonnellyFootnote 23 insists that actuarial unfairness cannot be referred to as solidarity, given that there is no uncertainty as to who bears the expected losses resulting from the actuarial unfairness. She also examines other schemes, including the group self-annuitisation scheme proposed by Piggott et al., Footnote 24 for any heterogeneous group of members which is not actuarially fair.Footnote 25 More recently, Huang et al. Footnote 26 have solved a retirement lifecycle model in which the consumer’s age does not move in lockstep with calendar time, but is a function of biological biomarkers.

In short, all these studies appear to be inspiring private pension providers to innovate and, we believe, they will be highly influential in the way longevity risk management will be addressed in the near future.

It is self-evident that modern tontines and pooled funds can reduce both the insurer’s capital requirements and the safety loadings included in annuity prices, but just how substantial these reductions might be needs to be clarified by further research, since they will depend greatly on the marketing and uptake of these new products. In their study of enhanced annuities, Gatzert and KlotzkiFootnote 27 indicate that modern tontines and pooled funds are likely to come up against notable obstacles in the future, given consumers’ insufficient familiarity with the product, continuing hesitation on the part of distributors and the general absence of interest among consumers for a lifelong annuity, which is in line with their underestimation of their own life expectancy.

Notes

In an article published in The New York Times by Verde (2017, 24 March), there is a reference to a venture called Survival Sharing that would offer a tontine-inspired investment that pooled people of similar age, gender and health status. This firm was established by Bruno Caron, currently an actuary at A.M. Best. While the financial services industry has not embraced tontines, the Society of Actuaries is reported to have begun warming to them. Earlier references can be found in The Washington Post (Guo 2015) and The Huffington Post (Vertes 2016). There is evidence that Allianz insurance company also refers to these new schemes and compares them to similar forms of savings structures that are called “Susu” in Africa and that are in the spotlight of microinsurance developments.

Milevsky (2015).

Donnelly et al. (2013).

Milevsky and Salisbury (2016).

Weinert and Gründl (2016).

Donnelly et al. (2014).

Stamos (2008).

Forman and Sabin (2014).

Lusardi and Mitchell (2007).

Proposition 3.1 in Donnelly et al. (2014).

Valdez et al. (2006).

In addition, the performance of pooled annuity overlay mortality funds is compared to that of a mortality-linked fund (as introduced by Donnelly et al., 2013). The latter is similar in many respects to a pooled annuity fund insofar as the participants also pool their wealth but, in this instance, the insurer (or the seller of the product), as opposed to the participants, bears the volatility of mortality. As a result, the participants obtain a deterministic, mortality-linked interest rate (that is proportional to their mortality rate) instead of redistributing the wealth of the deceased participants among the survivors. However, upon their death the participants lose their money (to the fund). While the pooled annuity overlay fund has two sources of volatility (that of the financial market and that of mortality), the mortality-linked fund is volatile only as regards the members’ investments in the financial market. A comparison of the two products shows that the use of a pooled annuity overlay fund can be advantageous, since for the same volatility as in the mortality-linked fund, a higher expected return can be achieved with a moderately heterogeneous pooled annuity overlay fund of just a few hundred members (Donnelly et al., 2014).

Milevsky and Salisbury (2015).

Milevsky and Salisbury (2016), Theorem 4.

Milevsky and Salisbury (2016), Theorem 6.

Milevsky and Salisbury (2016, p. 18).

Spedicato (2013).

Milevsky and Posner (2001).

Huang and Milevsky (2016).

Huang et al. (2016).

Denuit et al. (2015).

Donnelly (2015).

Piggott et al. (2005).

Qiao and Sherris (2013).

Huang et al. (2017).

Gatzert and Klotzki (2016).

References

Chan, W.S., Li, J.S., Zhou, K.Q. and Zhou, R. (2016) ‘Towards a large and liquid longevity market: A graphical population basis risk metric’, The Geneva Papers on Risk and Insurance—Issues and Practice 41(1): 118–127.

Denuit, M., Haberman, S. and Renshaw, A.E. (2015) ‘Longevity-contingent deferred life annuities’, Journal of Pension Economics & Finance 14(03): 315–327.

Donnelly, C. (2015) ‘Actuarial fairness and solidarity in pooled annuity funds’, ASTIN Bulletin 45(1): 49–74.

Donnelly, C., Guillén, M. and Nielsen, J.P. (2013) ‘Exchanging uncertain mortality for a cost’, Insurance: Mathematics and Economics 52(1): 65–76.

Donnelly, C., Guillén, M. and Nielsen, J.P. (2014) ‘Bringing cost transparency to the life annuity market’, Insurance: Mathematics and Economics 56: 14–27.

Forman, B.J. and Sabin, M.J. (2014) ‘Pension tontines’, University of Pennsylvania Law Review 163: 755–831.

Gatzert, N. and Klotzki, U. (2016) ‘Enhanced annuities: Drivers of and barriers to supply and demand’, The Geneva Papers on Risk and Insurance—Issues and Practice 41(1): 53–77.

Guo, J. (2015) ‘It’s sleazy, it’s totally illegal and yet it could become the future of retirement’, The Washington Post, 28 September.

Huang, H. and Milevsky, M.A. (2016) Longevity risk and retirement income tax efficiency: A location spending rate puzzle. Insurance: Mathematics and Economics 71: 50–62.

Huang, H., Milevsky, M.A. and Salisbury, T.S. (2017) Retirement spending and biological age (15 February 2017). Available at SSRN: https://ssrn.com/abstract=2918055 or http://dx.doi.org/10.2139/ssrn.2918055

Huang, H., Milevsky, M.A. and Young, V.R. (2016) ‘Optimal purchasing of deferred income annuities when payout yields are mean-reverting’, Review of Finance 21(1): 1–35.

Lin, Y. and Cox, S.H. (2005) ‘Securitization of mortality risks in life annuities’, The Journal of Risk and Insurance 72(2): 227–252.

Lusardi, A. and Mitchell, O.S. (2007) ‘Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth’, Journal of Monetary Economics 54(1): 205–224.

Milevsky, M. (2015) King William’s Tontine: Why The Retirement Annuity of the Future Should Resemble its Past, New York, NY: Cambridge University Press.

Milevsky, M.A. and Posner, S.E. (2001) ‘The Titanic option: valuation of the guaranteed minimum death benefit in variable annuities and mutual funds’, The Journal of Risk and Insurance 68(1): 93–128.

Milevsky, M.A. and Salisbury, T.S. (2015) ‘Optimal retirement income tontines’, Insurance: Mathematics and Economics 64: 91–105.

Milevsky, M.A. and Salisbury, T.S. (2016) ‘Equitable retirement income tontines: Mixing cohorts without discriminating’, ASTIN Bulletin 46(3): 571–604.

Piggott, J., Valdez, E.A. and Detzel, B. (2005) ‘The simple analytics of a pooled annuity fund’, The Journal of Risk and Insurance 72(3): 497–520.

Qiao, C. and Sherris, M. (2013) ‘Managing systematic mortality risk with group self-pooling and annuitization schemes’. The Journal of Risk and Insurance 80 (4): 949–974.

Spedicato, G.A. (2013) ‘The lifecontingencies package: Performing financial and actuarial mathematics calculations in R’. Journal of Statistical Software 55(10): 1–36. URL http://www.jstatsoft.org/v55/i10/.

Stamos, M.Z. (2008) Optimal consumption and portfolio choice for pooled annuity funds. Insurance: Mathematics and Economics 43(1): 56–68.

Valdez, E.A., Piggot, J. and Wang, L. (2006) Demand and adverse selection in a pooled annuity fund. Insurance: Mathematics and Economics 39(2): 251–266.

Verde, T. (2017) ‘When others die, tontine investors win’, The New York Times, 24 March.

Vertes, D. (2016) ‘Tontines: strange name, great idea for retirement (so good they’re illegal)’, The Huffington Post, 1 October.

Weinert, J.H. and Gründl, H. (2016) The modern tontine: An innovative instrument for longevity risk management in an aging society, ICIR Working Paper Series No. 22/16.

Acknowledgements

We thank the Spanish Ministry of Economy FEDEF grant ECO2016-76203-C2-2-P and ICREA Academia. Jens Perch Nielsen was funded by the research grant “Minimizing longevity and investment risk while optimizing future pension plans”, sponsored by the Institute and Faculty of Actuaries, UK.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bräutigam, M., Guillén, M. & Nielsen, J.P. Facing Up to Longevity with Old Actuarial Methods: A Comparison of Pooled Funds and Income Tontines. Geneva Pap Risk Insur Issues Pract 42, 406–422 (2017). https://doi.org/10.1057/s41288-017-0056-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-017-0056-1