Abstract

The demand for port services is intricately tied to international trade between production centers and the global market. This paper introduces a unique econometric forecasting model tailored to predict container port throughput at a transshipment hub, leveraging the dynamic and uncertain nature of international trade flows, originating from three global production centers: China, the USA, and Germany. The paper examines how the trade flow dynamics of these centers impact a transshipment hub, especially in scenarios where the hub is strategically positioned along major shipping routes, serving as the sole container transshipment facility in a region. The validation of the model is conducted through empirical testing using time series analysis of trade flows from the above three major production centers to the South Asian port region. The Port of Colombo (PoC) is used as the regional hub port. The model incorporates external shocks to assess their influence on the demand for the services of the hub and its resilience to global disruptions. Findings indicate the substantial influence of China, with a notable impact on exports to the USA from South Asia and imports from Europe and Central Asia to China, establishing positive and long-term relationships with PoC. Furthermore, the paper offers insights into PoC’s resilience during crises such as the Red Sea incident, leveraging its strategic location. The findings not only contribute in developing PoC’s strategic position, but they also lay the groundwork for future studies on global trade patterns and the adaptability of transshipment hubs in the face of dynamic demand.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

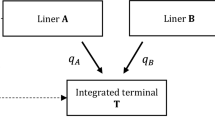

Demand for seaport services depends on the structure of trade between a country and the rest of the world (Notteboom et al. 2022). Demand for transshipment services, however, depends not only on national demand but also on trade between third countries and major production centers. In maritime supply chains (MSC), shipping (links) and seaports (nodes) play a vital role in merchandise trade (Jiang et al. 2021). General cargo goods are typically transported in containers, and transshipment hubs facilitate their efficient handling in a relay network connecting production centers with demand points. Haralambides (2017) further mentions that containerships in deep-sea liner trades select only a few transshipment ports, which have become the foci of international trade in a hub-and-spoke network. The expansion of container terminal capacity, including its potential for transshipment, persists without interruption. This is a customary occurrence and, over time, port capacity aligns with the growth of international trade. Consequently, the capacities of transshipment ports must align with anticipated shifts in demand, accounting for the dynamic nature and volatility of international trade flows originating from major production centers. Of particular significance are the trade flows from such production centers to feeder market regions associated with transshipment ports within a hub-and-spoke network. Thus, the adaptability and scalability of transshipment hubs become paramount considerations to efficiently accommodate evolving trade patterns and meet the demands of global commerce. Figure 1 presents the link between production centers and demand points via transshipment hubs.

Figure 1 illustrates a transshipment hub port (THi) connected with shipping routes and international trade flows to and from the major production centers (PC1, PC2, PC3..Pi), regional markets (FN1, FN2, FN3,…Fi) in the proximity of TH, and its hinterland (LH). Demand for THi and its capacity requirements are determined by variations in trade flows originating from, and destined for, each production center and hinterland markets. Therefore, it is crucial to align the expansion of capacities and the number of transshipment hubs in the region with anticipated increases in trade volumes to ensure they can accommodate future international demand, which typically fluctuates with business cycles of economic growth, recessions, crises, and recoveries (UNCTAD 2022). Uncertainty in trade flows arises from both local circumstances and global developments such as the financial meltdown of 2008–2009 (Feng et al. 2019), the 2015 financial crisis in the USA (Strandenes & Thanopoulou 2020), and COVID-19 (Clarksons, 2023). According to World Trade Organization (2023) statistics, China is the leading exporter and importer, followed by the USA and Germany, as major world production centers. UNCTAD (2022) further mentions that intra-Asia routes, serving intra-regional supply chains, experienced the fastest growth from 2015 to 2022, mirroring global manufacturing trends. This growth was particularly notable between 2021 and 2022, with China acting as the global manufacturing center, supported by adjacent East Asian countries supplying various intermediate goods.

Transshipment ports play a critical role as strategic nodes in global supply chains. The management and operations of transshipment hubs have become increasingly complex due to growing trade volumes and carrier demands for port capacity and higher efficiency. Ports need to carefully plan their development and operations according to throughput forecasts. These become more challenging due to hinterland development and the consequent stochastic nature of the demand for port services (Cong et al. 2020; Munim et al. 2023; Dragan et al. 2021; Notteboom & Haralambides 2020; Du et al. 2019). Furthermore, Haralambides (2019) provides an extensive analysis of the impacts of increasing vessel sizes on port infrastructure and global logistics. This work is critical for understanding the challenges and opportunities that hub ports face in the context of international trade.

In view of the above, the main objective of this paper is to develop an econometric forecasting model for the container throughput of a transshipment hub port connected with shipping routes and international trade flows to and from major production centers and regional markets in the hub’s vicinity. The model incorporates the trade dynamics of major production centers and global uncertainty. The paper is structured as follows: Sect. 2 presents a review of previous studies. The data and methodology are detailed in Sect. 3. Data analysis and their discussion are presented in Sect. 4, and the study concludes with policy implications along with future research directions in Sect. 5.

2 Literature review

Past research focusing on country level context has presented various port throughput forecasting models. Chou et al. (2008) developed an adjusted regression model for forecasting the volumes of import and export containers at ports in Taiwan using stepwise regression. Their model included containerized imports and exports as dependent variables and explanatory variables such as population, industrial production, gross national product (GNP), GNP per capita, wholesale price index, gross domestic product (GDP), agriculture GDP, industry GDP, and service GDP of Taiwan. The findings indicate that the modified regression model has superior predictive accuracy compared to other forecasting methods.

Tsai and Huang (2017) used GDP, exchange rates, economic growth, industry production index, per capita gross domestic production, and import and export trade value of Japan, Hong Kong, China, Taiwan, South Korea, and Singapore to develop artificial neural networks (ANNs) for predicting port throughput. The results indicated that prediction errors were relatively small, thus encouraging shipping companies to use their model in predictions of container flows.

The Vector Error Correction Model (VECM) developed by Gosasang et al. (2018) forecasted the port throughput of Laem Chabang Port using imported (inbound) and exported (outbound) containers, alongside variables such as economic growth rate, interest rates, inflation rate, fuel price, exchange rate, population, trade value of imports and exports, manufacturing production index (MPI), and industrial production index (IPI). The results entailed implications for port planning strategies related to capacity improvements in port terminals.

Rashed et al. (2018) developed an Autoregressive Distributed Lag (ARDL) model for ports in the Hamburg–Le Havre range using the volume of exports and imports, final household consumption, and total manufacturing output of the port’s host country. Their results highlighted a long-term relationship between the trade indices of the EU19 and the overall container throughput, indicating a relatively high demand elasticity for port services.

Tang et al. (2019) presented multiple predictive models, including a gravity model, a triple exponential smoothing one, multiple linear regression, and a backpropagation neural network model, using data on total retail sales of consumer goods, GDP of the local city, import and export trade volumes, total output value of the manufacturing industry, and total fixed asset investment, to predict demand for Lianyungang Port and Shanghai Port. The comparison of model results showed that the backpropagation neural network model is more suitable in forecasting container throughput.

Cong et al. (2020) examined the impact of port throughput on port city economy using panel data from 16 ports with a Granger Causality test. Findings indicated that port throughput influences significantly Gross Domestic Product (GDP), although it has a negative effect on total retail sales of consumer goods (TRSCG). Port throughput showed synchronous growth with the added value of the secondary sector but exhibited a negative correlation with the primary and tertiary sectors. The causality test confirmed an interactive relationship between the economy of port cities and port throughput across the sampled city-port pairs.

Dragan et al. (2021) presented a dynamic factor analysis model—the Autoregressive Integrated Moving Average (ARIMAX) model—principal component regression, and Monte Carlo simulation, to forecast cargo throughput in the Adriatic seaport of Koper. The authors used data on liquid bulk, solid bulk cargo, general cargo, total cargo, containers, import, export, purchasing power parity, and GDP per capita. Their results indicated that a predictive system, due to its enhanced ability to forecast observed throughputs, can be regarded as a functional decision support system, and the proposed models surpass competing predictive models on port performance. Apart from using macroeconomic factors in forecasting models found in literature, several models exist to predict demand under uncertainty (Table 1).

Table 1 illustrates the array of uncertainties inherent in various predictive methodologies for demand forecasting in maritime contexts. Past research has predominantly concentrated on constructing predictive frameworks utilizing macroeconomic indicators and external perturbations for individual ports or clusters of ports within a region. However, previous studies have failed to model container throughput fluctuations, especially those related to connections between major production centers and hub ports, as well as inter-port trade dynamics within a port region. This represents a notable void in scholarly discourse, as there has been limited attention devoted to developing forecasting models tailored specifically for transshipment ports, particularly concerning the intricate trade dynamics associated with global production centers. This paper addresses this gap by introducing an econometric approach specifically tailored for transshipment hubs, incorporating trade dynamics stemming from the world’s primary production centers.

3 Methods and model development

This section outlines the methodological approach employed in our study to investigate the shipping and trade dynamics between the major production centers and the regional markets. The methodology is structured to identify causality, test for stationarity, assess long-term equilibrium, and estimate the vector error correction model (VECM). Each stage leverages robust statistical techniques to ensure the reliability and validity of the results.

3.1 Stage 1: identification of causality

The Granger causality test was used to establish the usefulness of a variable in forecasting another, applied to identify pairwise causality between variables of time series data, of a high possibility for multicollinearity (Granger 1969). We use the Toda–Yamamoto (T–Y) approach of the Granger causality test which is superior to the traditional Granger causality test (Toda & Yamamoto 1995). T–Y eliminates the need for pre-testing for cointegration and it is suitable for any level of integration of the employed series and procedure of Granger causality test; it is moreover valid irrespective of whether the series is I (0), I (1), or I (2). If a time series, \({Y}_{t}\), can anticipate the future of another, Xt, then Yt “Granger-causes” Xt. These two variables were considered with time period T, (t = 1, 2, … T) indicating their results at time t. A bivariate AR model can be written as shown in (1) and (2) to model Xt and Yt (Granger 1969).

where β0, β1, \({\alpha }_{\text{i}}\) \(\theta\)i, \({\beta }_{\text{i}}\) , and \(\delta\)i are parameters and et is the error term. Coefficients were estimated by Ordinary Least Squares. The F-statistic was used for the significance test. We tested for stationarity (below) and autocorrelation of the residuals (elt and e2t).

3.2 Stage 2: testing for stationarity

As data on port demand are time series, stationarity is an important condition in regression analysis. We thus employed the Augmented Dickey–Fuller (ADF) test (Dickey & Fuller 1979) and the Phillips–Perron (P–P) test (Phillips & Perron 1988) to test for stationarity and the results are shown in Tables 2 and 3.

Table 2 confirmed that series are not stationary at levels but they are at first differences (Table 3). Therefore, the series are I(1) integrated.

3.3 Stage 3: testing variables for long-term equilibrium

The Engle–Granger two-step procedure and the Vector Error Correction Model (VECM) were used (Engle & Granger 1987; Johansen & Juselius 1990). The estimation of the long-run relationships using Ordinary Least Squares (OLS) and the subsequent Error Correction Model (ECM) specification are commonly employed in cointegration analysis in maritime economics (Enders 2014). Diagnostic tests such as the Breusch–Godfrey test for autocorrelation and the Breusch–Pagan test for heteroskedasticity are standard procedures for validating ECMs in maritime-related research (Brooks 2014).

The long-run equilibrium relationship among the variables is estimated by Ordinary Least Squares (OLS). The regression equation is specified as

where Yt is the dependent variable; Xt represents the set of explanatory variables, and εt denotes the error term. The residuals (εt) from the OLS regression were extracted and tested for stationarity using the ADF test. If the residuals are found to be stationary, then the variables are cointegrated.

Given the presence of cointegration, the second step involved specifying and estimating the Error Correction Model. The ECM captures both short-term dynamics and the long-term equilibrium relationship. The error correction term (ECT) is incorporated into the short-term dynamics model. The general form of the ECM is

where Δ denotes first differences; γi are short-term coefficients; δ is the speed of adjustment coefficient; ECTt − 1 is the lagged error correction term; and νt is the white noise error term. The ECM parameters are estimated using OLS. Diagnostic tests, including tests for autocorrelation (Breusch–Godfrey test) and heteroskedasticity (Breusch–Pagan test) are carried out to validate the model. Model Specification is therefore given by

With two dummy variables:

Φ, α, β, δ, γ, Ω are parameters and ζ is error term. X is represented by the respective variable (Table 7), which has a granger caused with TEU.

3.4 Stage 4: Collection of data

The model was estimated using annual container throughput data (1991–2023) of the Port of Colombo obtained from the Clarksons research network (Clarksons 2023) and the total merchandise exports of China, Germany, USA, and India and the trade flows between production centers and South Asia were obtained from the data published by the World Trade Organization and its World Integrated Trade Solution (WITS) database (WITS 2023; WTO 2023). The model included two dummy variables to capture the uncertainty of trade flows. The dummies represented the financial crisis in 2008/2009 (IMF 2023) and COVID-19 in 2019 (Xu et al. 2021). Table 4 presents the data used.

3.5 Stage 5: model testing

The model was tested using in five scenarios using the container throughput of the Port of Colombo as the dependent variable: D(TEU). They are as follows:

-

Scenario 1: VECM model with China production center merchandise trade flows;

-

Scenario 2: VECM model with Germany production center merchandise trade flows;

-

Scenario 3: VECM model with USA production center merchandise trade flows;

-

Scenario 4: VECM model with China, Germany, and USA trade as production centers to South Asia; and

-

Scenario 5: VECM model with China production center trade to main regions associated with the PoC.

4 Analysis of results

4.1 Descriptive statistics

The Port of Colombo, as a transshipment port, benefits from cargo coming from and going to Europe, East and South Asia, the Persian Gulf, and East Africa. Much of this traffic transits (transships at) the port (SLPA 2023), due to its strategic location along the east–west main trunk routes (Kavirathna et al. 2021).

Figure 2 illustrates the strategic position of the Port of Colombo along key shipping routes linking major production centers. In addition to catering to its own region, the port serves as a crucial link between the Persian Gulf and East Africa, facilitating seamless maritime connectivity. Notteboom et al. (2024), citing the recent Red Sea crisis, highlight the significance of the Port of Colombo as a transshipment hub located in close proximity to the crisis area. During the crisis, the port had to handle a surge in traffic and redirect some small capacity vessels to the Hambantota International Port, situated in the southern part of Sri Lanka along the Belt and Road Initiative (BRI). This maneuver not only managed traffic levels but also ensured optimal service for cargo vessels. Such actions underscore the pivotal role of the Port of Colombo in the broader regional maritime landscape. As mentioned by Haralambides and Merk (2020), the main feature of a hub port is its location near the main shipping routes, as well as connections to large population and production centers. Therefore, the PoC is a best-case study for examining connections to production centers.

Source: Based on Notteboom et al. (2024)

Strategic Location of the Port of Colombo.

Figure 3 demonstrates the container throughput of the PoC from 1991 to 2023. Throughput has increased over the years, with a slight leveling off in 2019 due to COVID-19 and its impact on trade. Table 5 presents the descriptive statistics of the dependent and the seventeen independent variables chosen to specify our forecasting model.

Source: Authors, based on data from Clerkson shipping Intelligence (Clarksons 2023)

Container Traffic at the Port of Colombo.

The average annual container throughput at PoC in the period 1991 to 2023 stood at 3.517 million TEU, with a range from a minimum of 0.683 million to a maximum of 7.249 million. Analyzing production center merchandise export statistics reveals China as the world’s biggest exporter, followed by the USA and Germany. Regarding trade with South Asia, data show that the USA imports more than China from this region (Table 5). In South Asia, China records the highest import flows, while her maximum export flow heads towards the USA. Beyond South Asia, China’s imports originate predominantly from Europe and Central Asia followed by trade with the Middle East and North America.

4.2 Statistical tests and econometric results

Following tests on stationarity, before modeling for identifying the long-run relationships among the trade flows, we tested for normality of data series and multicollinearity among exogenous variables. Jarque–Bera statistics indicated no significant deviations from normal distribution across all series, further supported by skewness and kurtosis values ranging between + 3 and − 3 (Table 5). We identified the existence of multicollinearity among variables, first through the correlation coefficients and then through the Granger Causality test. The correlation test results (Table 6) showed that there is a strong significant (P = 0.00) linear association between all independent variables and the dependent variable (TEU), and there is a strong significant correlation (r > 0.8, P = 0.00) among the independent variables and TEU of the PoC.

To identify causality of variables with TEU, the Granger causality test was used and the results are shown in Table 7.

Based on the results of the Granger Causality test, out of the 17 variables examined, 10 variables exhibited significant Granger causality towards TEU, notably China (TMC), Germany (TMG), and the USA (TUSA). Exports from China, Germany, and the USA to South Asia also exhibited significant Granger causality towards TEU. Further analysis revealed that trade flows from China, including exports to Africa, the Middle East, North America, and the UAE, as well as China’s imports from Europe and Central Asia, displayed significant Granger causality towards TEU at the Port of Colombo. These findings underscore the intricate relationship between international trade dynamics and container throughput at the Port of Colombo, highlighting the influence of major production centers and key trade routes on port activity.

After filtering variables according to the Granger Causality test, further analysis was carried out to identify short- and long-run relationships.

Figure 4 demonstrates a linear association between TEUs and the considered variables, while the total merchandise exports of China have a greater association than the other variables.

Based on Fig. 5, exports from South Asia to the USA exhibit a stronger linear association with the throughput of Colombo, compared to exports from Germany and China.

Further, China’s imports from Europe and Central Asia exhibit a strong linear association with TEU of PoC (Fig. 6). Following diagnostic test results, scenarios-based modeling of trade flows was carried out.

4.2.1 Scenario 1: VECM model with China as a production center merchandise trade flow

The modeling results of China’s merchandise exports to the rest of world demonstrated a highly significant long-run relationship (the coefficient of ECT is negative and statistically significant; P = 0.0064) with the throughput of PoC (Table 8). Furthermore, past variations in TEUs have a persistent influence on current changes in throughput (0.5781 with P = 0.0053) with a positive relationship between the variation in TMC and in TEUs, implying that an increase in China’s merchandise exports leads to an increase in PoC throughput (1.0464), and a decrease in China’s merchandise exports in the previous period leads to an increase in throughput in the current period (− 1.1269). The negative coefficient of Error Correction Term (0.255247) suggests that if the system deviates from its long-run equilibrium by one unit in the previous period, it will be corrected by approximately 0.255247 units in the current period. When the above model is modified to incorporate uncertainties stemming from the COVID-19 pandemic and the financial crisis as external shocks, neither of these variables influences significantly the modeling results of PoC throughput (Table 9).

The model retains its validity criteria, as evidenced by the coefficient values of the uncertainty variables COVID (P: 0.3655 > 0.05) and FC (P: 0.7547 > 0.05). The modeling results show a persistent influence of past variations on the current changes in TEUs, indicating a strong feedback mechanism within the global trade network. The positive relationship between changes in China’s merchandise exports and TEUs underscores the symbiotic nature of trade dynamics, whereby an increase in China’s exports tends to stimulate demand for shipping services, reflected in the rise in TEUs handled at the port. Our findings suggest that while external shocks may temporarily disrupt trade flows, the underlying relationship between China’s merchandise exports and global trade remains robust. The ability of the model to accommodate uncertainty variables underscores its adaptability in capturing the evolving dynamics of international trade and their influence on the hub port.

4.2.2 Scenario 2: VECM model with Germany’s merchandise trade flow

The modeling results of Germany’s exports to the rest of the world demonstrated an insignificant long-run relationship (the coefficient of ECT is negative and but statistically insignificant; P = 0.25) port throughput (Table 10). Therefore, modeling was carried out to identify any short-run relationships (Table 11).

The TEU coefficient suggests that, ceteris paribus, a one-unit increase in the lagged value of TEU leads to a 1.03018 unit increase in the current period’s TEUs. This indicates a positive autocorrelation effect, meaning that the past year values of TEU have a persistent influence on the current volumes of TEU. However, longer period demonstrates insignificant relationship. The coefficient of TMG indicates that a one-unit increase in the current period’s total merchandise exports of Germany results in a 1.2447 unit increase in TEUs, ceteris paribus. This suggests a positive relationship between variations in Germany’s merchandise exports and PoC throughput, implying that an increase in Germany’s exports tends to lead to an increase in TEUs. Instead, a one-unit increase in the lagged value of TMG leads to a − 0.9537 unit decrease in the current period’s TEU, holding other variables constant. This indicates an inverse relationship between variations in Germany’s merchandise exports from the previous period and current PoC throughput. This suggests that a decrease in Germany’s exports in the previous period tends to lead to an increase in PoC TEUs in the current period. Holding the model validly criteria the same, the inclusion of COVID-19 and the 2008–9 financial crisis in the model showed insignificant results. The modeling results only demonstrated short-run relationship between changes in Germany’s merchandise exports (TMG) and the PoC TEUs, highlighting both direct and inverse relationships. A one-unit increase in current TMG results in a substantial increase in TEUs, reflecting the interconnectedness between Germany’s export activities and global trade flows. Conversely, a decrease in Germany’s exports of the previous period correlates with an increase in TEUs in the current period. This suggests a compensatory effect whereby fluctuations in German exports cause shifts in shipping demand. Within the scope of the analyzed data, these external shocks do not exert any discernible impact on the relationship between TEUs and Germany’s merchandise exports.

4.2.3 Scenario 3: VECM model with USA’s merchandise trade flows

The coefficient of 0.559990 underscores a compelling observation whereby a mere one-unit rise in the previous period’s D(TEU) leads to a 0.59990 unit increase in the current period’s D(TEU). This suggests a lingering impact of historical shifts on present TEU dynamics (Table 12). Additionally, the coefficient of 1.5333 highlights an intriguing correlation whereby each unit increase in USA’s total merchandise exports triggers a robust 1.5333 units surge in D(TEU), signifying a positive association between TUSA and TEUs. Conversely, the coefficient of − 1.7719 unveils a noteworthy contrast whereby a one-unit escalation in the lagged TUSA results in a significant − 1.7719 unit decline in the current D(TEUs), indicating an inverse relationship between TUSA and TEUs. Moreover, the Error Correction Term (ECT) coefficient of − 0.15716 sheds light on the model’s adaptive prowess that a one-unit deviation from equilibrium in the prior period is rectified by approximately 0.15716 units in the current period, showcasing the VECM’s resilience in maintaining equilibrium.

Despite the model’s robustness, incorporating critical variables such as those pertaining to COVID-19 and 2008–9 financial crisis (Table 13) lacks statistical significance (coefficient 66,614 for COVID-19; P = 0.7385 and 56,804 for FC; P = 0.6437). This suggests the absence of control effects from external shocks on the relationship between TUSA and TEUs, underscoring the model’s independence from extraneous influences.

The coefficients pertaining to the USA’s Total Merchandise Export (TUSA) unveil intriguing correlations. A unit increase in TUSA triggers a robust surge in D(TEU), emphasizing the positive association between US export activities and global shipping demand. However, the model also reveals a noteworthy contrast, with a one-unit escalation in lagged TUSA resulting in a significant decline in the current D(TEU), indicating an inverse relationship between TUSA and TEU. This suggests a complex interplay of factors influencing US export and import dynamics and their impact on global trade flows. This showcases the model’s robustness in accurately depicting the long-term relationship between TUSA and PoC throughput. The model is independent from extraneous influences and capable of discerning the underlying drivers of global trade dynamics.

4.2.4 Scenario 4: VECM model with China, Germany, and USA trade flows to South Asia

The coefficient of 0.273355 for D[TEU(-1)] is not statistically significant, suggesting that the lagged value of D(TEU) does not exert a significant influence on the current period’s D(TEU) (Table 13). Conversely, D(South Asia to China (Export)) exhibits a highly significant coefficient of 58.78331, indicating a strong positive relationship between changes in South Asia’s exports to China and changes in TEUs. However, D(South Asia to Germany (Export)) and D(South Asia to USA (Export)) both have coefficients of 40.94570 and − 28.66709, respectively, which are not statistically significant, suggesting that changes in South Asia’s exports to Germany and to the USA do not significantly impact TEUs. The Error Correction Term (ECT) coefficient of − 0.3531 is statistically significant, indicating the presence of a correction mechanism towards equilibrium. This implies that deviations from the long-run equilibrium in the previous period are corrected by approximately 0.3531 units in the current period. Overall, while South Asia’s exports to China play a significant role in influencing the volume of TEUs, exports to Germany and the USA do not demonstrate statistically significant effects, and the model exhibits a corrective mechanism to maintain equilibrium over time (Table 14).

Despite the model’s robustness, incorporating critical variables such as those pertaining to COVID-19 and the financial crisis (Table 15) lacks statistical significance their coefficients (− 210,332 for COVID-19, P = 0.2881; − 2187for FC, P = 0.1423). This suggests the absence of control effects from external shocks on the relationship between South Asian exports to China, Germany, and USA and the volume of TEUs, underscoring the model’s independence from extraneous influences.

The results highlight the significant role of South Asia’s exports to China in influencing global shipping demand, while exports to Germany and the USA show less pronounced effects. The model’s corrective mechanism ensures equilibrium in trade dynamics over time, enhancing its reliability in forecasting long-term trends. Additionally, the model’s independence from external shocks underscores its robustness in capturing the underlying drivers of global trade dynamics, providing valuable insights for policymakers and stakeholders in navigating the complexities of the global economic landscape.

4.2.5 Scenario 5: VECM model with China’s trade flows to main shipping region associated with the PoC

The coefficient of 0.24811 for D(TEU(-1)) is not statistically significant, indicating that the lagged value of D(TEU) does not exert a significant influence on the current period’s D(TEU) (Table 16). Conversely, significant coefficients are observed for various trade flows: D(China to Africa (Export)) exhibits a highly significant coefficient of 58.78331, suggesting a substantial impact of China’s exports to Africa on the volume of TEUs. Similarly, D(China from Europe and Central Asia (Import)) and D(China to Middle East and North America (Export)) both display significant coefficients of 9.9143 and − 12.9624, respectively, indicating notable effects of trade flows from these regions on TEU. Moreover, D(China to UAE (Export)) shows a significant coefficient of − 64.5215, implying a considerable influence of China’s exports to the UAE on TEU. The Error Correction Term (ECT) coefficient of − 0.3383 is also statistically significant, suggesting the presence of a correction mechanism towards equilibrium. This implies that deviations from the long-run equilibrium in the previous period are corrected by approximately 0.3383 units in the current period. Additionally, after incorporating dummy variables for COVID-19 and the financial crisis, the model’s validity remains intact. Notably, the dummy variable for the financial crisis (FC) is significant in the long-run model, highlighting its substantial impact on the relationship between the trade variables (Table 17).

China’s exports to Africa, Europe and Central Asia, the Middle East, North America, and the UAE demonstrate notable effects on TEU levels, highlighting the importance of these trade relationships in shaping global shipping demand. These findings underscore the interconnectedness of trade flows and seaborne transport, where shifts in trade patterns have tangible implications for shipping activities. The financial crisis also significantly impacted the variation of TEUs at the Port of Colombo (PoC) in this model. The significant Granger causality relationship with TEUs shows the importance of global trade patterns in shaping port activity. Additionally, the findings highlight the significance of exports from these production centers to South Asia, indicating the region’s role as a vital market for goods transported through the PoC. Delving deeper into specific trade flows, our results show that exports from China to Africa, the Middle East, North America, and the UAE, alongside China’s imports from Europe and Central Asia, exert a significant influence on TEUs at the PoC. This emphasizes the interconnectedness of trade routes and the port’s function as a transshipment hub facilitating trade across multiple regions. The financial crisis notably influenced this category, as the model deals with trade flows involving some countries affected by the financial crisis of 2008/2009.

5 Discussion and policy implications

The efficient movement of goods from production centers to demand points relies heavily on maritime transportation. Transshipment ports play a crucial role in maritime supply chains (MSC), being crucial nodes that connect these links, particularly in relay networks which interconnect regions in container trade flows. A port’s capacity is essential for maintaining a competitive edge and expanding market share. Investing in new port capacity should be justified by increasing demand for port services; yet, demand forecasting in such a competitive environment is challenging due to its unpredictability and fluctuations. Port capacity planning requires sophisticated analytical approaches to match cargo flow projections and future demand estimations with the development and acquisition of suitable infrastructure (Parola et al. 2021). Forecasting models are subject to epistemic uncertainty due to model and parameter uncertainties (Eskafi et al. 2021). External shocks, such as the COVID-19 outbreak, exemplify volatile conditions, creating uncertainty in cargo flows and thus complicating decision-making for port development projects (Notteboom and Haralambides 2020). Therefore, forecasting models provide valuable insights into port services demand, and soft computing models have gained attention for capturing both linear and nonlinear relationships between input data and port throughput (Munim and Schramm 2021).

Our study finds that transshipment demand is influenced not only by trade flows from production centers but also by the global trade passing through the port. Any disruption at a transshipment port can impact significantly the entire MSC, highlighting the need for stable port operations. Deciding on transshipment capacity involves the use of forecasting techniques to align with fluctuating demand. The literature suggests that China, the USA, and Germany are dominant production centers globally (WTO 2023; UNCTAD 2022). The econometric model developed in this paper, using data from a case transshipment hub port and other influential variables, demonstrates that variability in throughput can be explained by merchandise exported globally by these production centers. International trade flows from these centers to South Asia, leveraging the strategic location of the Port of Colombo (PoC) as a transshipment hub, show a significant association with TEUs at PoC. Cointegration tests and VECM models reveal a long-term association between China’s merchandise exports and PoC throughput, suggesting that PoC can expect higher TEU volumes with China’s economic growth. Thus, expanding PoC’s containerized cargo capacity helps enhance its competitive position in the region.

The PoC serves several submarkets as a transshipment hub. Given India’s status as a major exporter in South Asia and its exclusion from the Belt and Road Initiative (BRI), PoC plays a critical role in connecting Indian subcontinent ports to global shipping networks. Upgrading PoC to a global hub is therefore highly advantageous for the region. The modeling results indicate that external shocks, such as economic crises and the COVID-19 pandemic, did not significantly influence PoC’s international trade flows, except for the financial crisis of 2008–9.

According to the five-scenario analysis, the PoC’s throughput demonstrates a long-term econometric relationship with China’s global merchandise flows and South Asian exports to China. Furthermore, the volume of TEUs at the PoC has a long-run relationship with China’s imports to Europe and Central Asia and exports to the Middle East, North America, and the UAE. These relationships remain strong despite the financial crisis and the COVID-19 pandemic. This analysis demonstrates the PoC’s strength in building international trade links between port regions and China, a major production center. Upgrading the PoC by enhancing its capacity to handle increased volumes can further solidify its position as a key player in Indian Sub-continent and global trade, thereby supporting regional economic growth.

The paper contributes to the strategic planning of transshipment ports by providing a robust forecasting technique. Understanding future container throughputs is crucial for port authorities and stakeholders in making informed decisions related to infrastructure development, resource allocation, and capacity planning. By integrating international trade flows from global production centers, the paper acknowledges the interconnectedness of global trade networks (Dragan et al. 2021). This approach recognizes that container throughputs at transshipment ports are influenced by the dynamics of international trade, and a forecasting model that considers these factors provides a more accurate representation of future port activities. Furthermore, accurate forecasting enables transshipment ports to optimize their operational efficiency. With a better understanding of future container throughputs, ports can plan their operations more effectively, reduce congestion, optimize resource allocation, and enhance overall performance (Gosasang et al. 2018; Chen et al. 2023a, b).

Finally, the paper adds to the body of knowledge in port management, logistics, and international trade forecasting. The findings of this research have practical implications for the efficient and resilient management of transshipment ports amid dynamic global trade scenarios, particularly for a single transshipment hub serving an entire port region. These insights inform strategic investments, foster robust trade partnerships, and support the continuous adaptation necessary for maintaining a competitive edge in the global maritime network.

The paper presents several significant implications for transshipment hubs, particularly those strategically located along major maritime routes serving both regional and international markets. Our study suggests that port managers can estimate the demand for the services of a transshipment hub by analyzing trade flows from global production centers and the international maritime network, considering the port’s pivotal role within relay and hub-and-spoke networks. The use of Granger causality is invaluable for identifying causal relationships between variables. This acts as a variable reduction method, isolating variables that are causally related to the dependent variable. The process facilitates the application of the Engle–Granger two-step procedure, which incorporates different lag terms as part of a machine learning approach to develop the optimal model. This methodology aims to reduce forecasting errors, maintain validity, and enhance the precision of demand forecasts. Ultimately, it informs strategic decisions on infrastructure development and capacity planning, ensuring that ports remain competitive and responsive to dynamic global trade conditions.

6 Conclusions

The demand for transshipment hub-port capacity is intricately linked to the trade dynamics of global production centers. Understanding and adapting to the changing dynamics of such centers is crucial for effective port management and for ensuring the resilience of maritime supply chains. The paper presents the results of an econometric forecasting model for a transshipment port, considering international trade flows from global production centers and explicitly addressing the uncertainties inherent in the world trade environment. China exerts a profound and enduring influence on the Port of Colombo, particularly in facilitating outbound trade flows, notably as a key transshipment hub within the Indian subcontinent. The port’s trade dynamics are intertwined with Chinese production networks, serving as a crucial channel for goods destined for global markets. Notably, the port’s reliance on Chinese manufacturing surpasses that of other major production centers, such as the USA and Germany. It is worth emphasizing that despite India’s substantial size and its role as a feeder market for the Port of Colombo, its impact on the port’s throughput growth remains relatively modest. Additionally, the relationship between production flows from the production center and the transshipment port traffic is more sensitive to financial crises.

The paper contributes to the existing body of knowledge in port demand modeling in several ways. First, the study re-emphasizes the critical role of transshipment ports as strategic nodes in global supply chains in the existing literature and brings about a novel perspective in research, focusing on transshipment ports and the impact of global trade dynamism, influenced by major production centers. Second, unlike previous studies, our research incorporates a comprehensive demand forecasting methodology that considers international trade dynamics between production centers and foreland nations, providing a more thorough perspective on demand prediction for transshipment hubs. Third, in its modeling design, we employ the Granger causality test to identify 17 trade directions that have a causal impact on the selected transshipment hub. This systematic approach to causality provides a robust foundation for predicting demand. Next, we develop a demand forecasting model of a transshipment hub, related to merchandise exports from global production centers, using the Engle–Granger causality test. This model incorporates trade flows between the hub’s region, major production centers, and other countries along major shipping routes. Fifth, the model developed with two key economic disruptions explains the impact of exogenous shocks to port traffic, adding a layer of realism and adaptability to forecasting. Sixth, the model utilizes advanced time series analysis techniques to capture the uncertainties and dynamics of trade flows while incorporating multiple variables, including merchandise exports, regional trade, and trade flows along major shipping routes, ensuring a multifaceted analysis that aligns with real-world complexities. Lastly, the empirical validation and practical relevance of the model offer practical insights for port authorities and stakeholders to make informed decisions regarding port planning, development, and operations based on robust demand forecasts.

Our work can be extended by exploring additional variables that can mediate trade flows, such as trading agreements, transport costs, and shipping industry dynamics, including port choice selection parameters, to improve the accuracy of predictions in the context of transshipment ports and global trade flows. Furthermore, research focused on transforming a transshipment port into a global hub, particularly in strategic locations that play a crucial role in maritime supply chains, by connecting with the world’s major production centers, is essential for further study. This would enhance understanding of the port’s strategic importance and its potential to bolster global trade connectivity.

References

Baştuğ, S., H. Haralambides, E. Akan, and K. Kiraci. 2023. Risk mitigation in service industries: A research agenda on container shipping. Transport Policy 141: 232–244. https://doi.org/10.1016/j.tranpol.2023.07.011.

Brooks, C. 2014. Introductory econometrics for finance, 3rd ed. Cambridge: Cambridge University Press.

Chang, C.-W., M.-H. Hsueh, C.-N. Wang, and C.-C. Huang. 2023. Exploring the factors influencing the impact of the COVID-19 pandemic on global shipping: A case study of the baltic dry index. Sustainability 15 (14): 11367.

Chen, W., J. Chen, J. Geng, J. Ye, T. Yan, J. Shi, and J. Xu. 2023a. Monitoring and evaluation of ship operation congestion status at container ports based on AIS data. Ocean & Coastal Management 245: 106836. https://doi.org/10.1016/j.ocecoaman.2023.106836.

Chen, Y., J. Xu, and J. Miao. 2023b. Dynamic volatility contagion across the Baltic dry index, iron ore price and crude oil price under the COVID-19: A copula-VAR-BEKK-GARCH-X approach. Resources Policy 81: 103296. https://doi.org/10.1016/j.resourpol.2023.103296.

Choi, M.J., S. Hwang, and H. Im. 2022. Cross-border trade credit and trade flows during the global financial crisis. International Review of Economics & Finance 82: 497–510. https://doi.org/10.1016/j.iref.2022.07.012.

Chou, C.-C., C.-W. Chu, and G.-S. Liang. 2008. A modified regression model for forecasting the volumes of Taiwan’s import containers. Mathematical and Computer Modelling 47 (9): 797–807. https://doi.org/10.1016/j.mcm.2007.05.005.

Clarksons. 2023. Shipping Intelligence Network. Retrieved 17th August from https://www.clarksons.net.cn/n/#/portal

Cong, L.-Z., D. Zhang, M.-L. Wang, H.-F. Xu, and L. Li. 2020. The role of ports in the economic development of port cities: Panel evidence from China. Transport Policy 90: 13–21. https://doi.org/10.1016/j.tranpol.2020.02.003.

Cullinane, K., and H. Haralambides. 2021. Global trends in maritime and port economics: The COVID-19 pandemic and beyond. Maritime Economics & Logistics 23 (3): 369–380. https://doi.org/10.1057/s41278-021-00196-5.

Dickey, D.A., and W.A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74 (366a): 427–431. https://doi.org/10.1080/01621459.1979.10482531.

Dragan, D., A. Keshavarzsaleh, M. Intihar, V. Popović, and T. Kramberger. 2021. Throughput forecasting of different types of cargo in the Adriatic seaport Koper. Maritime Policy & Management 48 (1): 19–45. https://doi.org/10.1080/03088839.2020.1748242.

Du, P., J. Wang, W. Yang, and T. Niu. 2019. Container throughput forecasting using a novel hybrid learning method with error correction strategy. Knowledge-Based Systems 182: 104853. https://doi.org/10.1016/j.knosys.2019.07.024.

Enders, W. 2014. Applied econometric time series, 4th ed. Hoboken: Wiley.

Engle, R.F., and C.W.J. Granger. 1987. Co-integration and error correction: representation, estimation, and testing. Econometrica 55 (2): 251–276.

Eskafi, M., M. Kowsari, A. Dastgheib, G.F. Ulfarsson, G. Stefansson, P. Taneja, and R.I. Thorarinsdottir. 2021. A model for port throughput forecasting using Bayesian estimation. Maritime Economics & Logistics 23 (2): 348–368. https://doi.org/10.1057/s41278-021-00190-x.

Feng, H., M. Grifoll, and P. Zheng. 2019. From a feeder port to a hub port: The evolution pathways, dynamics and perspectives of Ningbo-Zhoushan port (China). Transport Policy 76: 21–35. https://doi.org/10.1016/j.tranpol.2019.01.013.

Gavalas, D., T. Syriopoulos, and M. Tsatsaronis. 2022. COVID–19 impact on the shipping industry: An event study approach. Transport Policy 116: 157–164. https://doi.org/10.1016/j.tranpol.2021.11.016.

Gosasang, V., T.L. Yip, and W. Chandraprakaikul. 2018. Long-term container throughput forecast and equipment planning: The case of Bangkok Port. Maritime Business Review 3 (1): 53–69. https://doi.org/10.1108/MABR-07-2017-0019.

Granger, C.W.J. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37 (3): 424–438. https://doi.org/10.2307/1912791.

Guo, L., A.K.Y. Ng, C. Jiang, and J. Long. 2021. Stepwise capacity integration in port cluster under uncertainty and congestion. Transport Policy 112: 94–113. https://doi.org/10.1016/j.tranpol.2021.08.011.

Haralambides, H.E. 2017. Globalization, public sector reform, and the role of ports in international supply chains. Maritime Economics & Logistics 19 (1): 1–51.

Haralambides, H.E. 2019. Gigantism in container shipping, ports and global logistics: A time-lapse into the future. Maritime Economics & Logistics 21 (1): 1–60.

Haralambides, H.E., and Merk, O. 2020. The Belt and Road Initiative: Impacts on global maritime trade. International Transportation Forum. Retrieved from https://www.itf-oecd.org/sites/default/files/docs/belt-road-initiative-maritime-trade-flows_1.pdf

Huang, X., Y. Wang, and L. Zhang. 2022. Extended container transport hub network design considering port disruptions and congestions in the post-pandemic era. Journal of Marine Science and Engineering 10 (6): 795.

IMF. 2023. The global economic recovery 10 years after 2008 financial crisis. International Monetary Fund. Retrieved 17th August from https://www.imf.org/en/Publications/WP/Issues/2019/04/26/The-Global-Economic-Recovery-10-Years-After-the-2008-Financial-Crisis-46711

Jiang, M., J. Lu, Z. Qu, and Z. Yang. 2021. Port vulnerability assessment from a supply Chain perspective. Ocean & Coastal Management 213: 105851. https://doi.org/10.1016/j.ocecoaman.2021.105851.

Johansen, S., and K. Juselius. 1990. Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52 (2): 169–210.

Kavirathna, C.A., S. Hanaoka, T. Kawasaki, and T. Shimada. 2021. Port development and competition between the Colombo and Hambantota ports in Sri Lanka. Case Studies on Transport Policy 9 (1): 200–211. https://doi.org/10.1016/j.cstp.2020.12.003.

Koyuncu, K., L. Tavacioğlu, N. Gökmen, and U.Ç. Arican. 2021. Forecasting COVID-19 impact on RWI/ISL container throughput index by using SARIMA models. Maritime Policy & Management 48 (8): 1096–1108. https://doi.org/10.1080/03088839.2021.1876937.

Li, T., L. Xue, Y. Chen, F. Chen, Y. Miao, X. Shao, and C. Zhang. 2018. Insights from multifractality analysis of tanker freight market volatility with common external factor of crude oil price. Physica a: Statistical Mechanics and Its Applications 505: 374–384. https://doi.org/10.1016/j.physa.2018.02.107.

Michail, N.A., and K.D. Melas. 2022. COVID-19 and the energy trade: Evidence from tanker trade routes. The Asian Journal of Shipping and Logistics 38 (2): 51–60. https://doi.org/10.1016/j.ajsl.2021.12.001.

Munim, Z.H., C.S. Fiskin, B. Nepal, and M.M.H. Chowdhury. 2023. Forecasting container throughput of major Asian ports using the Prophet and hybrid time series models. The Asian Journal of Shipping and Logistics 39 (2): 67–77. https://doi.org/10.1016/j.ajsl.2023.02.004.

Munim, Z.H., and H.-J. Schramm. 2021. Forecasting container freight rates for major trade routes: A comparison of artificial neural networks and conventional models. Maritime Economics & Logistics 23 (2): 310–327. https://doi.org/10.1057/s41278-020-00156-5.

Notteboom, T.E., and H.E. Haralambides. 2020. Port management and governance in a post-COVID-19 era: Quo vadis? Maritime Economics & Logistics 22 (3): 329–352. https://doi.org/10.1057/s41278-020-00162-7.

Notteboom, T., H. Haralambides, and K. Cullinane. 2024. (2024) The Red Sea Crisis: Ramifications for vessel operations, shipping networks, and maritime supply chains. Maritime Economics and Logistics 26: 1–20. https://doi.org/10.1057/s41278-024-00287-z.

Notteboom, T., A. Pallis, and J.P. Rodrigue. 2022. Port Economics, Management and Policy. New York: Routledge.

Nowińska, A., and H.-J. Schramm. 2021. Uncertainty, status-based homophily, versatility, repeat exchange and social exchange in the container shipping industry. Journal of Business Research 128: 524–536. https://doi.org/10.1016/j.jbusres.2021.02.021.

Parola, F., G. Satta, T. Notteboom, and L. Persico. 2021. Revisiting traffic forecasting by port authorities in the context of port planning and development. Maritime Economics & Logistics 23 (3): 444–494. https://doi.org/10.1057/s41278-020-00170-7.

Phillips, P.C., and P. Perron. 1988. Testing for a unit root in time series regression. Biometrika 75 (2): 335–346.

Rashed, Y., H. Meersman, C. Sys, E. Van de Voorde, and T. Vanelslander. 2018. A combined approach to forecast container throughput demand: Scenarios for the Hamburg-Le Havre range of ports. Transportation Research Part a: Policy and Practice 117: 127–141. https://doi.org/10.1016/j.tra.2018.08.010.

SLPA. 2023. Sri Lanka Ports. Retrieved from Sri Lanka Ports Authority website: http://www.slpa.lk/operations-and-services/port-services

Strandenes, S.P., and H. Thanopoulou. 2020. Income distribution and bulk cargo demand: Trends and uncertainties. Case Studies on Transport Policy 8 (3): 729–735. https://doi.org/10.1016/j.cstp.2020.05.020.

Tang, S., S. Xu, and J. Gao. 2019. An optimal model based on multifactors for container throughput forecasting. KSCE Journal of Civil Engineering 23 (9): 4124–4131. https://doi.org/10.1007/s12205-019-2446-3.

Toda, H.Y., and T. Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66 (1): 225–250. https://doi.org/10.1016/0304-4076(94)01616-8.

Tsai, F.M., and L.J. Huang. 2017. Using artificial neural networks to predict container flows between the major ports of Asia. International Journal of Production Research 55 (17): 5001–5010.

UNCTAD. 2022. Review of Maritime Transportation 2022.

WITS. 2023. World Integrated Trade Solution. Retrieved from World Bank website: https://wits.worldbank.org/

WTO. 2023. WTO STATS. World Trade Organization. https://stats.wto.org/. Accessed 17 Aug 2023.

Xu, L., S. Yang, J. Chen, and J. Shi. 2021. The effect of COVID-19 pandemic on port performance: Evidence from China. Ocean & Coastal Management 209: 105660. https://doi.org/10.1016/j.ocecoaman.2021.105660.

Zhao, H.-M., H.-D. He, K.-F. Lu, X.-L. Han, Y. Ding, and Z.-R. Peng. 2022. Measuring the impact of an exogenous factor: An exponential smoothing model of the response of shipping to COVID-19. Transport Policy 118: 91–100. https://doi.org/10.1016/j.tranpol.2022.01.015.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mudunkotuwa, R., Ji, M., Peiris, T.S.G. et al. Forecasting throughput at a transshipment hub under trade dynamism and uncertainty in major production centers. Marit Econ Logist (2024). https://doi.org/10.1057/s41278-024-00301-4

Accepted:

Published:

DOI: https://doi.org/10.1057/s41278-024-00301-4