Abstract

In this interdisciplinary, conceptual article with implications in marketing financial products and services, we study real estate and capital markets characterized by a predatory paradigm and economic agents’ dark financial profiles (DFPs). These are estimated by three orthogonal components—disconnection, irrationality, and deceit. We identify the best interactional patterns of borrower-lender profiles, ones that expectedly minimize the risk of default. We resort to discretized, predator–prey Lotka–Volterra equations where lenders act as predators and borrowers as prey, incorporating market trends and learning effects. To mathematically operationalize our framework, we use combinatorics with high, medium, and low levels of the three components of DFPs. We find 27 salient lender-borrower interactional scenarios and observe three different patterns: explosive, conducive, and implosive. Our theoretical findings indicate that equal (ir)rationality (in financial terms) between lenders and borrowers is a necessary but insufficient condition to maintain harmonious, long-term relationships. We use eutectic theory to map the agents’ profiles by introducing another variable: Expected return [E(Rp)] versus risk [σ], using the Capital Asset Pricing Model (CAPM) as a base. We find six market segments: the inactive predators and prey, the loose, the greedy, the vulnerable, and the stable. We identify the optimal combination of borrowers–lenders interaction under risk, given market trends and learning effects. We propose a path for future research that would see the application of analytical tools such as factor analysis, k-means clustering algorithm, χ2 and non-parametric Kruskal–Wallis and Dunn’s multiple comparison tests to verify differences among the hypothesized segments.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the real estate or capital markets, lenders—such as investment or mortgage bankers, routinely negotiate high-stakes financial products with borrowers they either do not know or know little about. These borrowers represent a risk of default (Veld and Veld-Merkoulova 2008). Yet, the borrowers may also feel uncertain about the lenders’ level of empathy for and understanding of (connection to) their financial needs, goals, and preferences. High-stakes, intangible financial products, such as mortgages and risky investments, raise the tension between these economic agents as there is often more to lose, than for tangible products (Castellano and Cerqueti 2018), such as durable goods (e.g., a car). Their value stems not from their use, as is the case of consumer goods, but from the dividends they are expected to bring, their future resale that is subject to market volatility, or the guarantees of revenues they will bring, such as in the case of life insurance coverage, if and only if certain conditions are met (e.g., absence of foul play).

In the present article, which is anchored in the analyses of problems of social interactions of an economic nature, we assume that economic agents (seen as homo rapax rather than homo economicus), operate in an environment marred by predatory intentions whereby the sellers may be perceived as “predators” and the borrowers as “prey” (or vice-versa). This scenario is at times referred to as a predatory paradigm, which jeopardizes the stability of the economy (Frame et al. 2008). In such dysfunctional market conditions, the potential for abuse is omnipresent, even more so because financial products display technological and procedural complexity (Bollinger and Yao 2018), characteristics that may weaken lay investors’ ability to deal with them. Negotiations may be subject to push efforts that drive borrowers out of their comfort zone, exposing the lack of consideration by the lenders for the borrowers’ initial financial needs, goals, and preferences (Rapp et al. 2014). Peer-to-peer lending is an example where the risk of interactions going wrong is significant (Herzenstein et al. 2011).

Our research question is: “What are the theoretical optimal borrower-lender profile combinations given market trends, learning, and risk?” Our variables of interest (VOIs), which we explain in this article, are: learning, expected return vs. risk, with disconnection, irrationality, deceit, together considered, according to the Mesly and Huck 2022’s model, as a one-factor construct called the dark financial profile (DFP). Deviant economic (rapax) agents, such as the ones we examine in this paper, challenge standard techniques for solving issues raised by the general equilibrium macroeconomic models, in part because of their seemingly stochastic behaviors. To address this difficulty, our approach advocates the use of positional maps, a traditional marketing tool, jointly with combinatorics and eutectic analyses. These characteristics make our proposed approach quite unique, as this has never been done, to the best of our knowledge. We argue that data analytics will be valuable in operationalizing our proposed model for many reasons: collecting, analyzing, consolidating, and interpreting large databases can provide insights for constructs that would otherwise remain undiscovered (the DFP and disconnection being examples as they occur at the sub-conscious level). Proper segmentation in the area discussed in this paper (finance) could assist in optimizing returns on marketing investments and providing more accurate, tailored offers to potential borrowers. Banks typically have large databases that are gold mines for marketers eager to decipher potential segments (Al-Weshah 2017). Indeed, developing a psychological map of potentially dysfunctional borrowers constitutes a high-value, useful, and pragmatic proposition. Misjudging borrowers’ capacity to reimburse a loan may have negative impacts on the finances of lending institutions (Tang 2010) or lending Internet network participants. Answering our question may ameliorate the outcome of business transactions and raise lenders’ profits, in addition to stabilizing the economy when such effort is applied to the entire community of borrowers and lenders. Doing so offers policy insights into the psychosocial agent-level precursors and conditions for market efficiency; evidently, banks should judiciously implement and maintain policies and marketing campaigns that ensure their lenders do not foster borrowers’ DFPs and that borrowers are meticulously chosen and adequately serviced.

In the next section, we define our constructs in consideration of an overview of the literature relevant to our VOIs. Expanding on this premise and acknowledging the role of learning, we resort to discretized Lotka–Volterra equations, which are widely used in predatory-prey dynamics. We run combinatoric analyses and focus on 27 different interactional patterns of lenders and borrowers facing each other at three different levels (high, moderate, and low) of the three DFP components (disconnection, irrationality, and deceit). We then use eutectic science to map the resulting scenarios to find the equilibrium point in a real estate or capital market that stretches between low and high risk. We discuss the six segments we unveil through our multi-angle analysis. We conclude by showing how our model can become a useful marketing tool in the financial/banking sector.

Constructs definitions and literature review

We clarify in this section the meaning of the VOIs as we set them to develop our model.

Predatory paradigm

Over the decades, academics have steadily demonstrated the role of overly speculative behaviors, as encouraged by market forces (Barber and Odean 2001; Baker and Wurgler 2007). Easy access to credit, at times coupled with expansionary economic periods, attracts borrowers who think they can beat the capital or real estate market odds or ride the wave of profit-generating investments without due regard to the vicissitudes of the financial world (Del Negro and Otrok 2007; Song and Thakor 2010). However, the thrill of winning in a casino-like market (Bossaerts et al. 2019), and dreams of wealth tend to blind borrowers. The latter initially regret not having jumped on the market bandwagon that promised to make them money quickly (Seiler et al. 2012), and then get on it based on over-borrowing. Capozza and Van Order (2011) discuss how lenders may resort to risk-hiding techniques because of their advanced access to better information. Using FICO scores,Footnote 1 they observe discontinuities in default behaviors and find that in the predatory 2007–2009 subprime market plagued by poor lending standards, lenders possessing better information offered sub-quality loans, and hence ran the calculated risk of a higher likelihood of default. Similarly, borrowers did at times try to deceive lenders to secure a loan (Bianco 2008).

Predatory market conditions develop when regulations become lax while the economy overheats. In the case of the 2007–2009 Global Financial Crisis (in the US especially), millions of individuals lost their life savings, major financial institutions failed (e.g., Lehman Brothers), and ghost assets (e.g., houses) followed market crashes across continents. In the US alone, lenders suffered from 20 to 40% losses on loans through defaults and foreclosures (Jones and Sirmans 2015, 2019). The Paulson Plan—the Troubled Asset Relief Program—allocated US$700 billion to stabilize the banking industry (Couch et al. 2011) and tackle the crisis. This highlights the fact that the financial services industry occupies a large share of economic activity (8% of US GDP) that cannot be abandoned to market hazards, and the importance of efficient, trust-based lender-borrower negotiations (Hain et al. 2019). Misevaluating the risk that borrowers represent, or hiding the risk through dubious processes such as securitization, are socially very costly, hence the importance of anticipating and palliating consumers with high DFPs in the early stages of negotiations. To secure long-term, mutually beneficial relationships, both borrowers and lenders (banks or other financial organizations) must remain vigilant because of the intangibility, potential toxicity, and volatility of financial products, and the accompanying market uncertainty (Maas and Graf 2008). As borrowers start losing touch with (disconnect from) their initial needs, goals, and preferences (for example, because of a contagious frenzy in the market), they increasingly make sub-optimal decisions (such as paying higher than justified broker fees—Siebert and Seiler 2022), which leads them to resort to deceitful behaviors in their attempts to gain more and/or to access credit and reduce their mounting debts. However, as debt keeps mounting, the borrowers feel the pressure, panic, and find themselves neither able to fulfill their needs, nor stick to their financial goals or favor their financial preferences. This leads them to make even more sub-optimal decisions; they then may resort to lying, because this seems to be the only way out in a web of inefficient, lenient regulations and controls. This dynamic, we argue, forges DFPs.

This is not to suggest that all lender-borrower relationships are either completely honest or completely deceitful, but simply serves to point out that at least some of them may harbor dubious motives and easily turn sour. Counterproductive behaviors may be encouraged by shrewd marketing campaigns that attempt to boost relentless consumption and by booming market conditions. Shultz and Holbrook (2009) note that there are, “ways that marketing has been (mis)used to take advantage of economically, culturally, and doubly vulnerable consumers that are both multifarious and well known, not to mention deplorable.” (p. 125).

Dark financial profile

Mesly and Huck (2022) show that academics and practitioners can evaluate the lender and borrower psychological makeups using three parameters: disconnection, irrationality, and deceit. They anchor their study in the literature on consumer behavior and present the notion of feedback mechanisms involving debt. They orthogonally regroup disconnection, irrationality, and deceit under the concept of the Dark Financial Profile, which we summarize in Fig. 1.

The Dark Financial Profile (DFP) in action. The lender must evaluate the Dark Financial Profile that the unknown borrower represents before deciding to grant a loan or not. The Dark Financial Profile is on the bottom left diagonal and consists of a narrow-minded, perhaps arrogant borrower who appears to be hiding facts. the X = [dis]connected; Y = [ir]rational; and Z = [dis]honest

The lender considers the borrower using three parameters and reflects:

-

1.

Is this borrower disconnected or else grounded (which would be good news)?

-

2.

Is this borrower irrational or rational (which, again, would be preferable and less risky)? and

-

3.

Is this borrower deceitful or honest (which, again, would be good news)?

In Fig. 1, the X ([dis]connected), Y ([ir]rational) and Z ([dis]honest) axes are spread between two types of borrowers, representing two extremes: the ideal ones (stable) and the worst ones (unpredictable, the “loose”). The ideal borrower, from a lender’s point of view, is grounded, rational, and honest. Figure 1 forms eight different Dark Financial Profiles, which we set out in Table 1, with each representing a particular challenge to the lender (even a perfect client could be seen as dubious, as the lender may doubt that such a rare occurrence exits for real).

At the most desirable end of the spectrum, borrowers are considered as stable personalities, according to psychology. Mikulincer and Shaver (2007), based on the works on stable personalities by Bowlby (1973), state that, “A large body of literature finds that secure people engage in positive, […] and tension-reducing interpersonal behavior.” (p. 279). This signals that stable profiles represent less risky borrowers. They most likely display a mature, efficient response to the natural ups and downs of business relationships. They are focused. They are well balanced behaviorally, emotionally, and intellectually (Todorov and Engell 2008). They maintain their relationships longer, display little hostility, and are not geared towards conflict. They have a strong sense of attachment towards others and enjoy a positive vision of the world. As opposed to anxious, defensive, or escaping personalities, they display little or no signs of hysteria, impulsivity, paranoia, or similar personality disorders, or approximations thereof (Plutchik and Platman 1975). Hostile, predatory individuals (those with high DFPs) exploit whatever available resources or means they find given the appropriate incentives and display lower levels of trust and cooperation (Roseboom et al. 2007).

As can be expected, a lender facing a borrower who displays high levels of each one of these “dark” characteristics would not be at ease lending money. The risk would be too great unless there was a large incentive to ignore it (e.g., a bonus for achieving sale objectives or foreknowledge that the risk of default can be hedged or passed on to other market actors in the form of profitable credit default swaps).

Disconnection

The concept of disconnection was first introduced in consumer behavior theory in 2020 by Mesly but started to gain ground early in the 90’s in psychology. Many factors may motivate consumers to forego their initial commitment to meet their bundle of needs, goals, and preferences (Peltier et al. 2016), including lack of financial knowledge, information mishandling, pressure from their social groups of reference and shortages of resources (financial, intellectual, and social)—Bargh and Williams 2006. These factors may promote impulsive or compulsive purchases. Academics have partly explained this using materialistic values (Verplanken and Sato 2011), noting also that anxiety rises due to the resulting debt. Anxiety, a painful emotion, is sometimes compounded by sentiments of guilt and regret, so that consumers attempt to ignore it, and thus disconnect further from their somber reality (Desarbo and Edwards 1996).

Consumers who are unable to anchor themselves will likely make erroneous decisions (Lisjak and Lee 2014); however, correcting the latter entails a sacrifice that may be too challenging (Rawn and Vohs 2011). As consumers with DFPs lose touch with their reality, including with their initial financial goals, they hamper their capacity to adapt and to properly assess market threats and opportunities, as in the case of natural selection (Kenrick et al. 2010). They thus act to their own detriment by accumulating additional debt. These borrowers/consumers may tend to isolate themselves, a situation that further compromises their chances of recovery. As their predicament worsens, they become more anxious, may feel resourceless, and hence may rely on deception to access funds they desperately need from lenders. This is in line with numerous studies that have demonstrated that such consumers may adopt maladaptive, unhealthy, if not financially harmful behaviors (Baumeister and Heatherton 1996).

Irrationality

The concept of irrationality lies behind the actions of lenders and borrowers refusing, consciously or not, to acknowledge the risks associated with their ongoing negotiations. While scholars in both economics and marketing have often considered that consumers (and borrowers) act rationally and in good faith (Colander et al. 2009), in debilitating market circumstances, however, some borrowers may get carried away and embrace “irrational exuberance” (Hain et al. 2019; Shiller 2005). This leads them to disregard risks (Dallery and van Treeck 2011), and engage in reckless borrowing, often by relying on shaky collaterals, frantically seeking lenders’ approval (Mian and Sufi 2009). Miscreant lenders may try to minimize the nuggets of information they provide to borrowers, who may fall into the trap of borrowing beyond their means. Factors that contribute to this irrationality include eagerness to build wealth, limited financial education, low income (Iacoviello 2008; Roy and Kemme 2012), naivety, and poor financial literacy.

Deception

Deception in the marketplace, including in the banking industry, is not a new phenomenon (Boush et al. 2015). Research has claimed that borrowers lie to get what they want but cannot afford (DePaulo et al. 1996; Andrade and Ho 2009). Even worse, they feel good for having obtained what they longed for, even by using deceitful means (Argo et al. 2011; Sengupta et al. 2002). Misstatements during the Global Financial Crisis, as an example, amounted to almost 25% of all messages. Such malevolent opportunities increase as regulations become lax. When people—lenders and borrowers alike—can rationalize their abusive behaviors and are not held accountable for the financial distress they cause, they see no reason not to persevere with their mischief (Huang et al. 2017). However, fraud or misleading behaviors may tarnish the initial positive expectations that market agents have toward one another (Crosno et al. 2020).

Risk

We discuss risk in this paper from the perspective of the well-established Capital Asset Pricing Model (CAPM), illustrated in Fig. 2.

The capital market line (CML)Footnote 2 shows a positive trend that expresses the fact that lay or professional investors will logically expect more returns [E(Rp)] on their portfolio of investments p as market risk [σ] increases (Sharpe 1964).Footnote 3 The steeper the slope of this line, the more optimistic economic agents are, thinking they can benefit from high returns while minimizing risk. Sound investors will want to diversify their portfolio as productively as possible (Markowitz 1952). Past the point where the C-shape, so-called efficient frontier curve touches the capital market line, the investor must borrow. We are only concerned by this point as it extends to the right, since we deal with borrowers. Figure 2 reflects the tenets of the Efficient Market Hypothesis (EPH) by Fama (1970): in short, investors are rational, sufficiently informed, and pay no or small transactions fees. In our framework, these assumptions do not hold; they are their antithesis.

Learning

In this article, learning refers to the specific knowledge prey and predator accumulate, to either escape from or prowl on the other (Mesly et al. 2022a, b), whether this is achieved for survival of the individual or the society (the latter, as defined by the Social Learning Theory by Bandura 1977). In our model, we encompass individual and social learning as one construct. Learning has been used in various economic models to explain partial or general equilibria and why they are reached or not (Salmon 2001), but with various levels of success even with the use of advanced technological tools (Dutting et al. 2019.)

Mathematical deployment of our economic-segmentation model

Discretized Lotka–Volterra equations with market trends and learning

To operationalize Fig. 1, we develop a mathematical expression of the Dark Financial Profile using a variation of Lotka–Volterra equations (LV). LV equations are powerful and describe well the interplay between market agents with various degrees of power of one over the other (as is the case in our study); they have long been used to various degrees in assessing market economic dynamics (Kamimura et al. 2011). Notably, it was used in economy by Nobel-prize winner Paul Samuelson (1971) and in various articles that address dynamic systems since then (e.g., Prasolov 2016; Wijeratne et al. 2009). We depart from past modelling effort by setting up three scenarios for each parameter O (disconnection), R (irrationality), and D (deceit), with one agent acting as the predator and the other as the prey. For example, we can have oprey < < Opred, Opred = oprey, and oprey > > Opred.

Applying combinatorics, the number of possible ways of choosing r combinations from n possible choices is given by:

Thus, the number of possible psychological profiles for lenders is equal to: Possible values of O ⋅ Possible values of R ⋅ Possible values of D = (3C1) · (3C1) · (3C1) = 27. Similarly, there are 27 possible profiles for borrowers. Hence, when considering interactions between lenders and borrowers with different profiles, the total number of possible combinations = Number of lenders with DFPs ⋅ Number of borrowers with DFPs = (27C1) · (27C1) = 729 combinations. Fortunately, for reasons that will become more evident after we develop the detailed discretized Lotka–Volterra equations incorporating lender and borrower profiles, only a much smaller subset of this universe of combinations is of interest. Given the above assumptions, and for different combinations of lender and borrower profiles, for low (0), medium (0.5), and high (1) levels of the three DFP parameters—O, R, and D for lender and borrower separately, we set the discretized Lotka–Volterra set of equations in the general form:

where xt = population of prey at time t; yt = population of predators at time t; α = growth rate of prey (newcomers from existing population, immigration); β = predation rate = extinction rate of prey due to interaction with predators; ϒ = decay rate of predators (exits from business, emigration), and; δ = growth rate of predators due to interaction with prey.

For these LV equations, our assumptions are as follows:

-

1.

Economic agents (borrowers and lenders) are characterized by three psychological constructs: disconnection (O), irrationality (R), and deceit (D);

-

2.

Economic agents live in a world where their standard of living improves noticeably over time, hence the introduction of a market trend in our discretized LV equations [xt-1 +] for prey and [yt-1 -] for predators;

-

3.

Economic agents most influential factor on the DFP is learning;

-

4.

Irrationality involves a time factor and, with it, a learning experience, whereas O and D can be spontaneous;

-

5.

The Lotka–Volterra parameters (predation rate, predator efficiency) are functions of the difference between the values of O, R, D for predators and prey. For example, predator efficiency is proportional to (Dpred – dprey) and to (Opred – oprey);

-

6.

The order of the predator and prey terms is determined by the theoretical expectations that predator efficiency goes up with the deceit of the predators (Dpred), down with the deceit of the prey (dprey), up with the disconnection of the prey (oprey) (since the prey is more vulnerable on account of this disconnection), and down with the disconnection of the predators (Opred) (since disconnection could weaken the ability of the predators to take advantage of the prey);

-

7.

As such, both the predator and prey DFP components play out in each of the Lotka–Volterra equation to determine the final system dynamics;

-

8.

Both Rpred and rprey affect the predation rate over time;

-

9.

Dpred and dprey affect predation rate and predator efficiency;

-

10.

We refer to “DLV” as the discretized LV equations that include a market trend and a learning component.

We incorporate the effects of learning (defined as improvement in all skills pertinent for the prey to escape its predator and for the predator to feed on its prey; in other words, those skills endogenous to that particular predator–prey pair) by letting the predation rate vary with time as follows:

where β0 = initial predation rate at time t = 0; θ = learning rate of predator (rate of acquisition of prey entrapment skills); τ = learning rate of prey, or the rate of acquisition of prey’s avoidance skills against predators, which suggest innovative/creative knowledge (Dubina et al. 2012), and; t = time.

The growth rate of predators is a function of the predation rate (since the predators’ survival and growth are dependent on the energy derived from feeding on the prey), and this relationship could be expressed as:

where λ = predator efficiency.

So that:

The effects of buyer and lender disconnection, irrationality, and deception, are incorporated by adjusting the predator–prey interaction-related terms from the earlier equations (Eqs. 6 and 7) in many ways. For disconnection, its effects are modeled by influencing the predator efficiency or ability of the predator (lender) to exploit the prey (borrower) to enhance survival or reproduction fitness (Eq. 8):

where λ0 = predator efficiency in the absence of O, R, D differentials between predators and prey; Disconnection of predator = O; Disconnection of prey = o; Deception by predator = D, and; Deception by prey = d.

For Deception, we correlate its effect by attaching it to β, the extinction rate of prey due to the interactions with the predators, which includes learning (or lack thereof):

For irrationality, we further stipulate that it has the following inhibitory effect on learning:

where Irrationality of predator = R; and Irrationality of prey = r.

In other words, deception affects the prey, as we assume it expresses the strategy used by the predator to lure it. A predator advantage in being deceitful over the prey (d < < D) leads to a higher β, which, again, is the extinction rate of prey due to interaction with predators. Finally, disconnection is tied to deception and the predator’s efficiency λ. More disconnection on the part of the prey (o > > O) increases the effect of the deceitful actions taken by the predator (d > > D), as the prey overestimates its abilities to outsmart the predator, lowers its guard and hence becomes more vulnerable to being deceived by the predator.

The fact that the various discretized Lotka–Volterra terms are functions of the relative difference between the DFP parameters (disconnection, irrationality, deception) for predator and prey rather than their absolute values allows us to simplify the combinatorics space that needs to be investigated. Instead of accounting for all possible low, medium, and high values of O, R, and D separately for predator and prey, we can focus instead on the predator–prey relative differences between each parameter. In other words, the total number of relevant combinations for each of the DFP parameters now reduces to 3 when considering the predators and prey interacting together. As per the preceding mathematical expressions, upper case (O, R, D) represents the predator parameters and lower case (o, r, d) represents prey parameters. The combinatorics space now reduces to 3 ⋅ 3 ⋅ 3 = 27 the possible combinations of interactions between predator and prey profiles.

Combinatorics-based scenarios

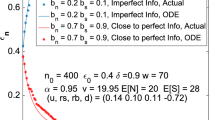

Combinatorics refers to the science of distilling a complex mathematical structure into simple attributes and developing from this a deeper understanding of the original structure (Yu 2016) —a tool that seems ideal for assessing the DFP. Combinatorics is useful to tackle an impressive breadth of problems by enumerating, constructing, optimizing, and modeling all possible arrangements or configurations associated with finite systems. Three different cases emerge from our mathematical expressions: an explosive case, a stable/conducive case, and a diminishing/implosive one. In the first instance, the pattern regroups 15 scenarios that highlight mutually destructive relationships between the lender and the borrower. Replicated through the entire population of these agents, this leads to an explosive market. (Fig. 3).

In the second set of patterns (2nd row), there are six mutually beneficial relationships, conducive to a well-balanced market. (See the Appendix). The best interaction takes place in the scenario whereby the lender and borrower agreeing to two of the three criteria (disconnected: o = O) and irrationality (r = R), while the lender keeps the upper hand on the capacity to deceive (d < < D). This may sound counter-intuitive but, after all, the lender is the one who decides to lend the money: it is to the lending institution’s advantage to be a better liar than the borrower-prey, otherwise it could be fooled and end up losing money. This turns out to be rather Machiavellian: recall that dysfunctional markets are filled with ill-intentioned agents who seek maximum selfish benefits, at the lowest costs possible, regardless of the morality of their behavior. The mutually beneficial pattern presents a stable upward trend that denotes that both agents benefit from the relationship and improve their financial condition over time, suggesting Pareto efficiency.

The last set of patterns (3rd row) occurs when the oscillations diminish for both agents, meaning that they have fewer interactions with time, which, replicated throughout the entire market, will lead to a stalled economy, with no benefits to either agent.

Overall and according to our framework, the lender has six possibly acceptable scenarios out of 27, so that its probability of making a mistake (choosing a dysfunctional borrower who would derail the relationship) is 21/27 or 78%, which we feel is considerable. The probability of finding the right “candidate” borrower is roughly 22% (6 out of 27) and that of finding a perfect one is 4% (1 out of 27)—see the Appendix).Footnote 4

Several conditions of pragmatic importance for stable, mutually beneficial market equilibria are noteworthy in the discretized Lotka–Volterra combinatorics modeling results. First, one of the most important prerequisites is that the lenders and borrowers should have comparable levels of irrationality (i.e., r = R). Second, under the above condition of equal irrationality (r = R), when lenders are far more deceptive than borrowers (d < < D), equilibria are possible, irrespective of the relative values of disconnection between lender and borrower (o = O, o > > O, o < < O). Third, when lenders and borrowers are equally matched with respect to irrationality (r = R) and deception (d = D), borrowers need to be at least as disconnected as the lenders (o ≥ O). Lastly, when borrowers are overwhelmingly deceptive with respect to lenders (d > > D), equilibrium is possible only when borrowers are excessively disconnected (o > > O) in addition to possessing equal (ir)rationality (r = R).

Eutectic

Eutectic is the science that explains the fusing of at least two materials (such as lead and tin) at the lowest possible temperature, thus creating a specific alloy that has characteristics of its own. Adapted to our model, the alloy is the best possible combination between two elements (lenders and borrowers or predators and prey) at the minimal amount of risk possible. Having expressed our model through the DLV equations and combinatorics, we now position the three scenarios (explosive, implosive, conducive) on a map by introducing the variable of market risk (σ). To do this, we resort to the science of eutectic.

We set the following conditions and definitions:

-

1.

A liquid state (L) is a behavioral state whereby economic agents have not set financial habits, thus making their behaviors highly volatile and unpredictable. We call this group of economic agents the Loose segment;

-

2.

A crystalized state (S) is a behavioral state whereby economic agents display set financial habits (such as savings consistently, investing in low-risk funds, etc.) that make them stable and predictable. We call this group the Stable segment;

-

3.

A portion of the overall population is liquid, and another portion is crystalized;

-

4.

A portion of the population of predators is inactive (IPred or the segment of Inactive Predators); they are present in the market but do not, for the time being, participate in it;

-

5.

Likewise, a portion of the population of prey is inactive (IPrey or the Inactive Prey segment); they are dormant, injured, distracted, uninterested, etc.;

-

6.

Borrowers (prey) and lenders (predators) wish to find the best possible conditions for their encounter given the change in expected returns [∂E(Rp)] over the change in risk [∂σ], which is the slope of the CML in Fig. 2. As mentioned above, these changes indicate how eager economic agents are to become rich as fast as possible;

-

7.

There are two more segments: the Greedy measured by IPred + L, and the Vulnerable, measured by Prey + L;

-

8.

The order of the VOI is always O, R, D (or o, r, d);

-

9.

When o < < O, we assign the value 1, when o = O, we assign the value 0, and when o > > O, we assign the value − 1(we do so to simplify the text in the appendix). For example, the best combination or eutectic point being o = O, r = R, d < < D, this is represented by (0,0,1);

-

10.

The value k is the ratio of predatory behaviors (DFPpred that manifest themselves through behaviors) to prey behaviors. Its ideal market value has been fixed at 1.3 in past research (Mesly 2015).

Performing a eutectic analysis, we obtain Fig. 4.

Mapping the interactions of the DFPs of Predators and Prey (one should note that the shapes of the curves will vary depending on the market conditions and the overall psychological profile of borrowers and lenders). We can view this figure as a positioning map of market segments along the market type (bullyish or bearish) in Y and k in X

Figure 4 reads as follows.Footnote 5 The real estate or capital market is composed of all predators and prey, including those inactive (IPred, IPrey), those crystalized (set in their stable financial habits) in the area S, and those liquid (who are highly volatile and not set in financial habits, and thus unpredictable) in the area L. In the area IPred, under low market risk conditions (below the horizontal line, which we name the tipping line), predators become less ambitious (k diminishes) as risk augments, because they do not see their opportunity yet. However, past the tipping line, where the market starts to heat up considerably and where a predatory paradigm takes place, the more the market turns bullish, the fewer inactive predators there are, meaning that they enter the market, for example, through risky and heavy speculation (in the flipping houses market during the GFC, for example). The same logic applies to prey.

As discussed, the horizontal (tipping) line starts at point A to the left, which is the point in Fig. 2 where the CML meets the efficient frontier curve, that is, the point from which borrowing starts. Five of the mutually beneficial scenarios are below the tipping line; the sixth one is the eutectic point right on it, making it very sensitive to market conditions. In the area S, both borrowers and lenders are stable and set in their financial habits (thus, they are predictable), which is conducive to mutual trust. In the area Pred + L (the greedy), a certain number of predators are engaged with liquid prey; it contains the 15 combinations we identified under the explosive scenarios (see Appendix) as they are listed using the (1,0,− 1) code described above. Note that these interactional patterns cannot be ordered hierarchically according to the market state (bullish or bearish); they occur stochastically within their area of influence (e.g., the area IPred + L). In the area Prey + L (the vulnerable), a certain number of prey interact with some “liquid” predators and dispose of the six implosive scenarios found in the combinatorics analysis. Expectedly, there are constant movements in the marketplace between the various states of the economic agents: inactive, liquid (loose), and crystalized (stable).

We set the eutectic point as the best “alloy” that our combinatoric analysis found, at (0,0,1). It is 30% to the left of the middle, vertical line that splits the graph in two equal parts, reflecting the value of 1.3 (in line with past research—Mesly 2015) and with the fact that out of three components forming the DFP (that is O with approx. 33% of total DFP, R with 33%), and D with 33%), one predominates: deception, with d < < D. The eutectic point is the point of equilibrium given (1) the change in the CML versus the change in risk; (2) that there is a market trend that signifies that what has been learned can be used for future endeavors; (3) that predators and prey learn to deal with each other over time.

One way of reading Fig. 4 is to see the Pred + L line as the supply curve by the predators (their offer to the prey to engage in certain interactional patterns) and the Prey + L curve as the demand curve by the prey (the types of interactions with the predators that the prey contemplates).

The map that we present in Fig. 4 constitutes a positioning map, a standard tool in market analysis. Lenders who can measure the degree of disconnection, irrationality, and deception from a borrower through a test can, estimating the level of market risk, position the borrower along that map. Table 2 reviews the means of tabulating the results of a potential test administered to borrowers, so that their interactions with their lenders can be positioned on the eutectic map.

Discussion and conclusion

Our article advocates that one can draw an approximate psychological map of borrowers (or lenders) according to three parameters that seem to be recurrent in negotiations over high-stakes financial products: (1) disconnection from needs, goals, and preferences (NGPs); (2) the mental narrowing of data collection, analysis and use; and (3) deceit. We indicated that we must take into consideration learning to draw a more complete picture of economic agents and we assumed they interact to improve their standards of living, hence the trend we introduced in the LV equations (see Eqs. 2 and 3). We obtained three patterns, which we classified as explosive, conducive, and implosive. We positioned the 27 combinatorics results using a eutectic approach to consider the role of expected return vs. market risk (the slope of the CML as an additional VOI). We thus have been able to obtain a snapshot of the lenders-borrowers’ interactions and nail down the point of equilibrium, which is their optimal interactional pattern.

Ethical consideration

Our study has significant implications within the context of a predatory economic paradigm, complementing recent studies on the subject and those discussed in the above sections. The first study, conducted by Mesly et al. (2022), delved into a comprehensive analysis of scientific articles spanning a century, across the top 14 economic journals. It underscored a critical issue: economic predation has been a recurrent topic, but it has often lacked precise and consistent definitions. In some cases, it remained undefined altogether.

The second article, authored by Mesly and Huck in 2023, explores the concept of the predatory paradigm in contrast to the humanistic and standard economic paradigms. This research highlights the fundamental disparities between them. In this landscape, our present study makes a substantial contribution by positioning the DFP phenomenon at the opposite end of the economic spectrum where the humanistic approach stands. Indeed, our findings suggests that individuals engaged in DFP activities operate on the fringes of the legal system while remaining concealed within the realm of conventional economic activities. To put it plainly, they tend to disregard ethical considerations, as they often resort to deception as a means to attain their financial objectives.

Theoretical implications

Our findings indicate that equal (ir)rationality between lenders and borrowers is a necessary but insufficient condition to maintain harmony and long-term relationships: this alone, we find, deserves further research, as a large part of finance assumes that market agents are fully rational. Ninety-six percent of relationships are prone to problems, with only 4% representing an ideal: this finding should also motivate further research because of its implication regarding market equilibria, a theme at the heart of economic theory. Most notably, the best set-up between lenders and borrowers is one whereby their levels of (dis)connection and (ir)rationality are equal, but where the lender keeps the upper hand on deceit (with k = 1.3). This implies that when one looks at relationships, one must allow for flexible thinking and accept that not all transactions are perfect, quite the contrary. Furthermore, even the eutectic point is imperfect, in the sense that it is very sensitive to the switch between bullish and bearish market conditions. Our analysis combines three mathematical tools—differential LV equations, combinatorics, and eutectic, and merges concepts from various disciplines: finance (the CAPM), economy (market behavior), psychology (economic agents’ behaviors), and engineering (eutectic).

Our model is the expression of the supply and demand curves for possible interactions (not of products) for lenders and borrowers, based on a predator–prey dynamic. It enriches previous work on the emerging concept of disconnection, the DFP, and the k value. It is the first time, we believe, that segmentation has been applied to interactional types based on expected returns and risk between lenders and borrowers.Footnote 6 Our analysis suggests that marketing analytics can borrow from other sciences (e.g., engineering) or techniques, such as eutectic, to enrich the level of analysis.

Managerial implications

Our results suggest that consumers with DFP justify some form of policy or regulatory implementation, and that the marketing experts of financial institutions (e.g., in the real estate or capital markets) should become aware of this concept. For unprincipled marketers, however, it may be relatively easy to conceive a promotional package of financial products and services that would infuse target consumers with an exaggerated sense of self (making them feel invulnerable), that would limit access to the information needed for sound investment decisions (reduced learning), and that would contain half-truth statements aimed at misguiding borrowers. This would likely cause debt-building and lead to payment default as borrowers would move inadvertently away from their original financial needs, goals, and preferences. Certainly, vulnerable borrowers can become easy prey to astute lenders and marketers who maximize their own welfare to the detriment of their clients and the market overall.

Our eutectic map shows that there are three areas that concern policy making. The S area does not call for new regulations or changes in marketing strategies; government measures simply need to facilitate transactions between lenders and borrowers by maintaining current regulations, banking infrastructures in good order. Bankers could reward the lenders that establish the most successful, long-term relationships with their customers. The high-risk, moral-hazard plagued area, above the tipping line and to the left of k = 1, justifies that governments develop and implement control measures aimed at reducing the potential for market fraud, deceptive tactics, false advertising, free-riding, and the selling of predatory tools and products such as predatory mortgages. The high-risk area to the right of k = 1 calls for better education among the borrowers and better marketing campaigns aimed at reinforcing their ability to scrutinize the markets to unveil marketing and financial unscrupulous behaviors favored by lenders. Tools that can increase vigilance levels could include TV campaigns informing potential prey of the risk of malevolent scams against the elderly, the poor, or the naïve. In other words, our framework can serve as a base for a well-designed promotional campaign (Trivedi 1999).

Overall, our model suggests that the one means of action needed by government and lending institutions to limit explosive or implosive interactional scenarios, is learning. It is hard to imagine that they could exercise a practical influence on disconnection and deceptive behaviors. However, they can certainly act on irrationality by way of facilitating all aspects of learning, such as information dissemination and education. In short, our model contains the keys to providing remedies to market upheaval depending on which scenario among the 27 proposed is the most active and recurrent.

McKinsey, an international consulting firm, notes that banks are ill-prepared when it comes to market segmentation, even though technology is available: ‘Too many businesses continue to view personalization as either a marketing initiative or an analytics initiative, when it needs to be managed as a joint initiative across the business (…) Despite significant investment in AI, only 8% of banks are able to apply predictive insights from their machine-learning (ML) models to inform campaigns. Although banks know that time to insight matters, just 16% have standard protocols for algorithm development. By codifying, unifying, and centralizing key analytics and supporting processes, these organizations generate 5–15% higher revenue from their campaigns and launch them two-to-four times faster.’ Thus, there is field evidence that our proposal can have far reaching impacts on the lending business.

Another advantage of our profiling map is that researchers could, pending results from market surveys, associate sociodemographic characteristics to each of its segments (e.g., L, S, IPrey). One can imagine, for example, that the Stable segment consists mostly of adults with secure jobs, good education, above-average household income, etc., whereas the vulnerable segment may encompass economic agents with poor education, shaky jobs, of an older age, and so forth. This could help determine which sociodemographic group (e.g., race, age, gender, etc.) is more likely to engage in interactional patterns that are close or far from the eutectic point of equilibrium. On the other hand, banks routinely ask their customers to fill out a questionnaire to assess, for example, their aversion to risk. This nugget of information can easily be included in our model, in which risk plays a key role. Similarly, mortgage lenders often attempt to assess would-be home buyers on their needs, goals, and preferences (NGPs). Using these surveys can provide results that can be incorporated in the concept of disconnection, since it has been primarily developed in consideration of these three dimensions (Mesly 2020).

The consequences of such an understanding are profound because the focus is no longer on financial products, but on interactions, which precede the choice of financial products borrowers are eager to acquire. Thus, our analysis offers a picture of the market before products are placed in it, negotiated and handled, an investigative effort that seems essential to capture the full and complex dynamics of markets.

Accurate algorithms could be developed to better market financial products and assess market risks of default (Bertrand and Weill 2021). Marketers would hence be well equipped to prepare tailored programs to attract and retain the borrowers with the best DFPs. Also, bankers could potentially find the best match between their individual financial service providers and their clients, by considering the likely type of interactions they would develop given their DFP (or absence thereof). Evidently, the aim would be to reach the eutectic point of international equilibrium.

In the case when a banker cannot assess the DFP of the clients, one can use the perception of this clientele by the financial service provider. A financial advisor who perceives a potential borrower as dishonest would have to have the right DFP profile that best deals with that kind of borrower profile. Failing the ability to measure the DFP of these borrowers, this means that the perception of the borrowers can be an indirect, useful tool to match lenders with borrowers to achieve maximum benefits and returns. Should sociodemographic information be associated with such perceptions, estimating the DFP of borrowers is enhanced. A large database containing sociodemographic information on DFPs, for both lenders and borrowers, would be certainly convenient.

Limitations

Since the concept of the DFP is emerging, no official measuring tools have been developed so far, let alone fully tested. This requires at least one article on its own. Our article is merely a door opener, but a necessary one (Lee and Andrade 2011).

Future research

Our analysis calls for longitudinal studies, which are often complex and costly, and which often stretch over lengthy periods. Examining in great depth the three variations of relationships we identified—explosive, conducive, and inward scenarios, supposes accessing market data over time, including in times of crisis, across various market conditions. Again, this entails at least one article on its own. We also argue that this could be achieved by examining these phenomena at both individual and social learning levels.

Another option for future research is to resort to market analytics using a large database. Segmenting using such tools as factor analysis, k-means clustering algorithm, χ2 and non-parametric Kruskal–Wallis and Dunn’s multiple comparison tests, have been used in the past with proven results (Nosi et al. 2014). A recent article by Huck et al. (2022) using a US government database of over 100,000 respondents meant to measure consumer sentiments towards the economy hints at the possibility of finding criteria for segmentation others than socio-demographic information, such as what the authors label “optimism” and propensity for making “forecasting errors”.

Finally, we feel that our model could find extensions using various economic tools such as logit regressions where one could determine whether a DFP set at a certain threshold is present or not, or whether a loan should be granted depending on the tipping line of the market. We propose that our model could find many useful applications in the world of personal and investment banking.

Notes

Developed by the Fair Isaac Corporation to assess credit worthiness.

In marketing, this could be approximated as a life-stage line, as US consumers typically improve their standards of living with age, and tend to invest more accordingly.

The well-established formula is: E(Rp) = Rf + β · (ERm − Rf) where: E(Rp) = expected return of the investment portfolio, Rf = risk-free rate, β = beta of the investment, ERm = expected market return, (ERm − Rf) = market risk premium.

These numbers are like the well-known Pareto 80–20 ratio.

Note that the model cannot go beyond the limits set by the semi-dotted vertical lines all around the figure. For example, on the far left, the excess of k will lead to too many predatory behaviors, which will eventually mean the death of all the prey, which are the predators’ source of survival. On the far right, as k approaches zero, the population of predators is overwhelmed by the growth of the prey behaviors, which will exhaust all resources that sustained the prey’s lives. At both extremes, the economic ecosystem crashes.

Of note, borrowers are not consumers, at least not until they buy a product. Hence, this article is about borrowers’ behaviors, not consumers’ behaviors.

References

Al-Weshah, G. 2017. Marketing intelligence and customer relationships: Empirical evidence from Jordanian banks. Journal of Marketing Analytics 5 (3/4): 141–152.

Andrade, E.B., and T..-H.. Ho. 2009. Gaming emotions in social interactions. Journal of Consumer Research 36 (4): 539–552.

Argo, J.J., D.W. Dahl, and K. White. 2011. Deceptive strategic identity support: Misrepresentation of information to protect another individual’s public self-image. Journal of Applied Social Psychology 41 (11): 2753–2767.

Baker, M., and J. Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21 (2): 129–151.

Bandura, A. 1977. Social learning theory. Englewood Cliffs: Prentice-Hall.

Barber, B.M., and T. Odean. 2001. Boys will be boys: Gender, disconnected, and common stock investment. The Quarterly Journal of Economics 116 (1): 261–292.

Bargh, J.A., and E.L. Williams. 2006. The automaticity of social life. Psychological Science 15: 1–4.

Baumeister, Roy F., and Todd F. Heatherton. 1996. Self-regulation failure: An overview. Psychological Inquiry 7 (1): 1–15.

Bertrand, J., and L. Weill. 2021. Do algorithms discriminate against African Americans in lending? Economic Modelling 104: 105219.

Bianco, K. 2008. The subprime lending crisis: Causes and effects of the mortgage meltdown. New York: Wolters Kluwer Law and Business.

Bollinger, B., and S. Yao. 2018. Risk transfer versus cost reduction on two-sided microfinance platforms. Quantitative Marketing & Economics 16 (3): 251–287.

Bossaerts, P., S. Suzuki, and J.P. O’Doherty. 2019. Perception of intentionality in investor attitudes towards financial risks. Journal of Behavioral and Experimental Finance 23: 189–197.

Boush, D.M., M. Friestad, and P. Wright. 2015. Deception in the Marketplace: The psychology of deceptive persuasion and consumer self-protection. New York: Routledge.

Bowlby, J. 1973. Attachment and loss. Separation: Anxiety and anger, vol. 2. New York: Basic Books.

Capozza, D.R., and R. Van Order. 2011. The great surge in mortgage defaults 2006–2009: The comparative roles of economic conditions, underwriting and dark financial profile. Journal of Housing Economics 20 (2): 141–151.

Castellano, R., and R. Cerqueti. 2018. A theory of misperception in a stochastic dominance framework and its application to structured financial products. IMA Journal of Management Mathematics 29 (1): 23–37.

Colander, D., H. Föllmer, A. Haas, M.D. Goldberg, K. Juselius, A. Kirman, T. Lux, and B. Sloth. 2009. The financial crisis and the systemic failure of academic economics. Critical Review 21 (2–3): 249–267.

Couch, J.F., M.D. Foster, K. Malone, and D.L. Black. 2011. An analysis of the financial services bailout vote. CATO Journal 31 (1): 119–128.

Crosno, J., R. Dahlstrom, and S.B. Friend. 2020. Assessments of equivocal salesperson behavior and their influences on the quality of buyer-seller relationships. Journal of Personal Selling and Sales Management 40 (3): 161–179.

Dallery, T., and T. van Treeck. 2011. Conflicting claims and sense of fairness adjustment processes in a stock-flow consistent macroeconomic model. Review of Political Economy 23 (2): 189–211.

Del Negro, M., and C. Otrok. 2007. 99 Luftballons: Monetary policy and the house price boom across US states. Journal of Monetary Economics 54: 1962–1985.

DePaulo, B.M., D.A. Kashy, S.E. Kirkendol, M.M. Wyer, and J.A. Epstein. 1996. Lying in everyday life. Journal of Personality and Social Psychology 70 (5): 979–995.

Desarbo, W.S., and E.A. Edwards. 1996. Typologies of compulsive buying behavior: A constrained clusterwise regression approach. Journal of Consumer Psychology 5 (3): 230–262.

Dubina, I.N., E.G. Carayannis, and D.F.J. Campbell. 2012. Creativity economy and a crisis of the economy? Coevolution of knowledge, innovation, and creativity, and of the knowledge economy and knowledge society. Journal of the Knowledge Economy 3 (1): 1–24.

Dutting, P., Z. Feng, H. Narasimhan, D. Parkes, and S.S. Ravindranath. 2019. Optimal auctions through deep learning. In International conference on machine learning, 1706–1715. https://arxiv.org/abs/1706.03459

Fama, E. 1970. Efficient capital markets: A review of theory and empirical work. Journal of Finance 25 (2): 383–417.

Frame, S., A. Lehnert, and N. Prescott. 2008. A snapshot of mortgage conditions with an emphasis on subprime mortgage performance. Federal Reserve. http://www.federalreserveonline.org/pdf/mf_knowledge_snapshot-082708.pdf.

Hain, J.S., B.N. Rutherford, and J.F. Hair Jr. 2019. A taxonomy for financial services selling. Journal of Personal Selling and Sales Management 39 (2): 172–188.

Herzenstein, M., S. Sonenshein, and U.M. Dholakia. 2011. Tell me a good story and I may lend you money: The role of narratives in peer-to-peer lending decisions. Journal of Marketing Research (JMR) 48: S138–S149.

Huang, Y., G. Kou, and Y. Peng. 2017. Nonlinear manifold learning for early warnings in financial markets. European Journal of Operational Research 258 (2): 692–702.

Huck, N., O. Mesly, and K. Afawubo. 2022. Who understands the US housing market? Applied Economics Letters. https://doi.org/10.1080/13504851.2022.2128174.

Iacoviello, M. 2008. Household debt and income inequality, 1963–2003. Journal of Money, Credit and Banking 40 (5): 929–965.

Jones, T., and G.S. Sirmans. 2015. The underlying determinants of residential mortgage default. Journal of Real Estate Literature 23 (2): 167–206.

Jones, T., and G.S. Sirmans. 2019. Understanding subprime mortgage default. Journal of Real Estate Literature 27 (1): 27–52.

Kamimura, A., G.F. Burani, and H.M. França. 2011. The economic system seen as a living system: A Lotka-Volterra framework. Emergence: Complexity and Organization 13 (3): 80–93.

Kenrick, D.T., V. Griskevicius, S.L. Neuberg, and M. Schaller. 2010. Renovating the pyramid of needs: Contemporary extensions build upon ancient foundations. Perspectives on Psychological Science 5 (May): 292–314.

Lee, C.J., and E.B. Andrade. 2011. Fear, social projection, and financial decision making. Journal of Marketing Research (JMR) 48: S121–S129.

Lisjak, M., and A.Y. Lee. 2014. The bright side of impulse: Depletion heightens self-protective behavior in the face of danger. Journal of Consumer Research 41 (1): 55–70.

Maas, P., and A. Graf. 2008. Customer value analysis in financial services. Journal of Financial Services Marketing 13 (2): 107–120.

Markowitz, H. 1952. Portfolio selection. Journal of Finance 7 (1): 77–91.

Mesly, O. 2015. Creating models in psychological research. USA: Springer International Publishing.

Mesly, O. 2020. Consumer spinning: Zooming on an atypical consumer behavior. Journal of Macromarketing 41 (2): 25–31.

Mesly, O., and N. Huck. 2022. Dark financial profile leading to debt traps—A theoretical framework. International Journal of Consumer Studies 47 (1): 419–433.

Mesly, O., and N. Huck. 2023. Financial market paradigm shifts and consumer financial spinning. Journal of Economic Issues 23 (4): 1062–1078.

Mesly, O., H. Mavoori, and N. Huck. 2022a. The role of financial spinning, learning, and predation in market failure. Journal of the Knowledge Economy 14 (1): 517–543.

Mesly, O., M.M. Petrescu, and A. Mesly. 2022b. Terminology matters: A review on the concept of economic predation. Journal of Economic Issues 56 (4): 859–987.

Mian, A.R., and A. Sufi. 2009. House prices, home equity-based borrowing, and the US household leverage crisis. NBER Working Paper Series. Working Paper 15283. http://www.nber.org/papers/w15283.

Mikulincer, M., and P.R. Shaver. 2007. Attachment in adulthood–structure, dynamics, and change. New York: The Guilford press.

Nosi, C., A.C. Pratesi, and A. D’Agostino. 2014. A benefit segmentation of the Italian market for full electric vehicles. Journal of Marketing Analytics 2 (2): 120–134.

Peltier, J.W., A.J. Dahl, and J. Schibrowsky. 2016. Sequential loss of self-control: Exploring the antecedents and consequences of student credit card debt. Journal of Financial Services Marketing 21 (3): 167–181.

Plutchik, R., and S.B. Platman. 1975. Personality connotations of psychiatric diagnoses. Journal of Nervous and Mental Disease 165: 418–422.

Prasolov, A.V. 2016. Some quantitative methods and models in economic theory. New York: Nova Science Publishers Inc.

Rapp, A., D.G. Bachrach, N. Panagopoulos, and J. Ogilvie. 2014. Salespeople as knowledge brokers: A review and critique of the challenger sales model. Journal of Personal Selling and Sales Management 34 (4): 245–259.

Rawn, C.D., and K.D. Vohs. 2011. People use self-control to risk personal harm: An intra-interpersonal dilemma. Personality and Social Psychology Review 15 (3): 267–289.

Roseboom, P.H., S.A. Nanda, V.P. Bakshi, A. Trentani, S.M. Newman, and N.H. Kalin. 2007. Predator threat induces behavioral inhibition, pituitary-adrenal activation and changes in amygdala CRF-binding protein gene expression. Psychoneuroendocrinology 32: 44–55.

Roy, S., and D.M. Kemme. 2012. Causes of banking crises: Deregulation, credit booms and asset bubbles, then and now. International Review of Economics and Finance 24: 270–294.

Salmon, T.C. 2001. An evaluation of econometric models of adaptive learning. Econometrica 69 (6): 1597–1628.

Samuelson, P.A. 1971. Generalized Predator-Prey oscillations in ecological and economic equilibrium. Proceedings of the National Academy of Science 68 (5): 980–983.

Seiler, M., V. Seiler, and M. Lane. 2012. Mental accounting and false reference points in real estate investment decision making. Journal of Behavioral Finance 13 (1): 17–26.

Sengupta, J., D.W. Dahl, and G.J. Gorn. 2002. Misrepresentation in the consumer context. Journal of Consumer Psychology 12 (2): 69–79.

Sharpe, W.F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–442.

Shiller, R.J. 2005. Irrational exuberance. New York: Crown Publishing Group, A Division of Random House Inc.

Shultz, C.J., and M.B. Holbrook. 2009. The paradoxical relationships between marketing and vulnerability. Journal of Public Policy and Marketing 28 (1): 124–127.

Siebert, R.B., and M.J. Seiler. 2022. Why do buyers pay different prices for comparable products? A structural approach on the housing market. Journal of Real Estate Finance & Economics 65 (2): 261–292.

Song, F., and A.V. Thakor. 2010. Financial system architecture and the co-evolution of banks and capital markets. The Economic Journal 120: 1021–1055.

Tang, T.-S. 2010. The costs of lead bank–distressed borrower relationships: Evidence from commercial lending in Taiwan. The Service Industries Journal 30 (9): 1549–1563.

Trivedi, M. 1999. Using variety-seeking-based segmentation to study promotional response. Journal of the Academy of Marketing Science 27 (1): 37.

Todorov, A., and A.D. Engell. 2008. The role of the amygdala in implicit evaluation of emotionally neutral faces. Scan 3: 303–312.

Veld, C., and Y.V. Veld-Merkoulova. 2008. The risk perceptions of individual investors. Journal of Economic Psychology 29 (2): 226–252.

Verplanken, B., and A. Sato. 2011. The psychology of impulse buying: An integrative self-regulation approach. Journal of Consumer Policy 34 (2): 197–210.

Wijeratne, A.W., F. Yi, and J. Wei. 2009. Bifurcation analysis in the diffusive Lotka-Volterra system: An application to market economy. Chaos, Solitons and Fractals 40 (2): 902–911.

Yu, J. 2016. Tropical combinatorics and applications. NSF Award Abstract #1600569. https://www.nsf.gov/awardsearch/showAward?AWD_ID=1600569. Accessed 5 Mar 2021.

Acknowledgements

We thank professor Silvester Ivanaj for his assistance in preparing this article.

Funding

The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Summary of the interactional DFP scenarios

Appendix: Summary of the interactional DFP scenarios

See Table 3.

The scenario set by [o = O, r = R, d < < D] offers the best possibility among the six scenarios of the mutually beneficial interactions. Both the lender and the borrower evolve, and they evolve equally and with optimal mutual benefits.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mesly, O., Mavoori, H. Mapping borrowers’ and lenders’ interactions according to their dark financial profiles. J Market Anal (2023). https://doi.org/10.1057/s41270-023-00263-1

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41270-023-00263-1