Abstract

This paper examines the possibility that market failures may be explained by predatory information flows between sellers and buyers when they act in dysfunctional relationships characterized by predator–prey dynamics and a behavioral pattern we define as “financial spinning.” The Global Financial Crisis serves as an example, among many others. It involved predatory mortgages and heavy securitization, and illustrates the fact that some sellers of toxic products (individuals and corporations) may have strong incentives to get buyers-prey to become disconnected from their financial needs, goals, and preferences, while accumulating debt. This may happen even in the context of a knowledge economy, and may lead the market towards failure. Computer-driven trajectory exploration based on learning-factored Lotka-Volterra equations shows that the predatory, noxious information is beneficial to sellers-predators but only up to a point. Consumers, for their part, are not always willing or able to receive sufficient information, which would otherwise allow them to protect themselves. Our approach may also guide corporations’ efforts towards improving their customer relationships, social image, and community participation. We contribute to the use of Lotka-Volterra equations and trajectory exploration in the context of predatory asymmetry of information at the interpersonal, sellers-buyers level, of spinning and of market failure.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Financial markets have faced failures across centuries and countries. This includes the eighteenth century French-based Mississippi Bubble, the 1929 Crash, the Asian financial crisis of 1997, the Global Financial Crisis (GFC) that plagued the world economy from 2007 to 2009 (Sornette, 2017), and, of course, the ongoing Bitcoin drama (Huang et al., 2019). The rise of the knowledge economy since the last century has done little to alleviate market frictions, quite the contrary. More knowledge signifies greater innovation and a growing need for more fine-tuned organizational structures, which foster stronger knowledge-based societies capable of being even more innovative (Dubina et al., 2012).

Amid the flow of knowledge, markets and corporations present at times moral hazard and questionable behaviors (Brunnermeier & Sannikov, 2014; Gheorghiu, 2013). At the core of most financial upheavals, speculation runs high: investors lose track of proper risk assessment and seek quick access to wealth, by whatever means, including recourse to deceit (Brunnermeier & Pedersen, 2009). This disconnect on the part of the investors from their initial financial needs, goals, and preferences is what has been coined as “financial spinning” (Mesly, 2020), a behavior aggravated by the fact that sellers feed consumers with meaningless and/or untrue information. In chasing the information that can help fulfill their misguided ambitions, consumers spin their wheel of fortune oblivious to how quickly they are taking on unsustainable debt loads. When spinning, consumers-prey cannot maintain ongoing, efficient relationships with their sellers-predators, something that would benefit the financial ecosystem, because they accumulate debt, which eventually kicks them out of the active market. When too many consumers and sellers engage in spinning, the effect may be too large for the market to handle, causing its failure.

This conceptual paper proposes that consumers-prey’s ignorance (or obliviousness to risk) in unruly financial markets dominated by various dysfunctional agents — key conditions prevailing during the Global Financial Crisis (GFC) in the USA (2007–2009) — serves the interest of sellers-predators by keeping their aggregation to a manageable level. Market failure starts with interpersonal buyer–seller relationships, and possibly with principal-agent relationships, which grow to form aggregates that respond to predator–prey dynamics. When predatory information (designed to get other market agents to spin) reaches a tipping point, the system crashes. On the other hand, when a sufficient number of consumers-prey become discerning or experienced, they can outsmart the strategies of uncaring sellers-predators aimed at getting them to spend blindly as much as possible, irrespective of the risk of engaging in a debt trap (Miles, 2015). In the end, as exemplified during the 2007–2009 subprime crisis, corporations suffer from consumers’ abuse — and a similar pattern surfaced recently in the Robinhood-Reddit-GameStop wave (Haggerty, 2021). In the latter case, some large banks involved in short-selling suffered at the hands of a multitude of small investors (who shared information intensely on the Reddit platform, a good amount of it hype) when the shares of GameStop rose unexpectedly. GameStop share value was of USD 2.57 on April 3, 2020; as of January 15, 2021, it rose to USD 35.50 and culminated at USD 347.51 on January 27, 2021. Within 2 weeks, it fell to USD 52.40.

Our research question therefore is: “Can we understand better the link between learning, financial spinning and predation, and market failure in markets that are affected by failure-inducing factors?” Answering this could open the door to developing a more general understanding of market dynamics pending further research and potentially help governments to prepare more adequately for market frictions.

We organize this paper as follows: in the following section, we discuss the known sources of market failure (market failure factors). We then introduce our conceptual model. In the third section, we propose its mathematical basis via Lotka-Volterra equations and examine possible stylized market trajectories and analyze in part the results through the lens of the GFC. In the conclusion, we discuss the pros and cons of fostering rationality-rationed (information-starved) consumers in financial markets.

Known Factors of Market Failure

The predominant market failure factors (MFFs) acknowledged in the literature include the role of externalities, market inconsistencies (sometimes reduced to “market power”), information asymmetry, market agents’ shortcomings, and predatory dynamics (Fligstein & Roehrkasse, 2016).Footnote 1

Externalities

Generally, a first cause of failure is thought to be externalities, which include international trade imbalances or exchange rate conditions. At times, they may infringe on domestic markets’ efficiency, thus requiring government intervention. As such, markets do not fail: policies do (Hetzel, 2012). Under this lens, market failure amounts to the inability of regulators to manage them given external pressures. Governments combat externalities with such well-established means as interest rates, laws, loans, tariffs, and taxes.

Internal Market Inconsistencies

Internal market inconsistencies are a second well-acknowledged cause of market failure. In short, discrepancies in the distribution of power, and, to a larger extent, of wealth among social classes, lead to clashes, inefficient use of resources, and potentially social unrest, not to mention the sentiment of social injustice that may fuel speculation in an attempt to make up for past financial suffering (van Treeck, 2014). Governments fight imbalances through protectionist measures, social welfare programs, trade wars, and so forth.

Asymmetry of Information

The third known cause of market failure consists of information asymmetry, which unduly challenges many standard equilibrium models and generates suboptimal outcomes, monopolies being a case in point. Market agents — buyers and sellers or principals and agents alike — exchange formally and informally using bits of information. These bits can be beneficial or malevolent; they may be exchanged to help the other market agents or to lure them. The more the consumers spin aimlessly and blindly, the more they can be taken advantage of. When buyers and sellers engage contractually, they accept that institutions and laws governing the information they trade ensure their own benefits. In doing so, the sellers assume the burden of disclosure while the consumers take on the burden of assimilating bits of information. In neoclassical economics, these burdens are seldom overwhelming (behavioral economics does not consider them burdens per se but simply as limitationsFootnote 2).

Imperfect information feeds systemic market ills amid significant uncertainty, complexity and insufficient technical means — all hindering market agents’ decisions (Chakravarti, 2017). In financial markets, price alone plays an outsized and often solitary informative role, when, in fact, investments often require an in-depth (often-overwhelming) analysis of the market forces at play (Gheorghiu, 2013). Furthermore, much empirical research has shown that prices regularly deviate from the intrinsic values of the products they represent (Solow et al., 2012). Governments can tackle information asymmetry by improving access to protective institutions, policing business behaviors (Lunn, 2015), and requiring accurate financial and accounting disclosure.

Market Agents’ Shortcomings

For acute market dysfunction to occur, it is not enough to point to macro-factors, such as exchange rates. Ultimately, it is necessary to go the root causes of those macro-factors: the individual decision-makers or institutional actors, such as governments and regulatory authorities, who rely on imperfect information (Manconi et al., 2010) and inevitably suffer from shortcomings. Back in the 1970s, Fama’s Efficient Market Hypothesis (EMH) cast the traditional pillars of economic theory in these terms (simplified for the purposes of this paper): market agents are perfectly rational and they act to increase the social utilitarian value of their investments. Also, they exert self-control and present no cognitive and information processing flaws (Fishbein & Ajzen, 1975) and they retain all necessary information at all times, which thereby makes market prices efficient (not to say that the market cannot be efficient despite human limitations — Smith, 2003). The idealized market agents are also able to make “informed decisions about financial planning, wealth accumulation, debt, and pensions” (Lusardi & Mitchell, 2014, p. 6). They are supposed to be altruistic to some degree, are experts in their own rights (Alba & Hutchinson, 1987), are exempted from transaction or information costs (Biggart & Delbridge, 2004), are free of ill intentions, and purchase methodically (Bettman et al., 1998). However, numerous studies have cast doubt on these assumed traits and qualities (Delong et al., 1990). Even if both aggregates — sellers and buyers — have full access to information, weigh the pros and cons of their various investments according to their preferences (Becker, 1976; Camerer et al., 2003), and rely in part on experience (Keynes, 2006; Lucas, 1981), things may still go awry.

According to consumer learning theory (Mehta et al., 2004) and its more recent iterations (Cleeren et al., 2013), consumers do not always have access to necessary information and receive instead cumbersome bits of information. This is compounded by the fact that some households have limited understanding of elementary economic concepts (van Rooij et al., 2011), thus impeding their capacity to gauge the risks and particular features of financial products, including toxic ones. As stated by Chakravarti (2017, p. 1114), “The three reasons why information is available only in imperfect form to decision-makers are the presence of uncertainty, complexity and the limited cognitive capabilities of human agents, and the existence of hidden or asymmetric information.” To make matters worse, information avoidance actually invites market agents to favor selfish or immoral behaviors: that is, moral hazard (Dana et al., 2007).

Behavioral finance also challenges some of the traditional tenets about fully functional market agents when considering recent market failures that have marred economies worldwide. Market agents are not machines, devoid of biases, emotions, mental heuristics, and weaknesses. Instead, they harbor hidden motivations that transcend their good will. From this perspective, market agents and their shortcomings are an intricate component of market failures, because, by spinning, they become inefficient, invest poorly, and mismanage resources. Fisher and Statman (2000), for example, argue that investors’ cognitive errors lead them to assume that market timing is easy, when in fact the evidence indicates it is the opposite. As a result, investors wrongly estimate their chances of success and thereby drive markets — if their miscalculations are sufficiently numerous — towards collapse.

Predatory Dynamics

Researchers have acknowledged that emotions (including negative ones) do indeed influence market agents (Angie et al., 2011). The latter may brood underlying dark hazardous motives, including predatory utility maximization (Huck et al., 2019). In other ways, consumers at times can also fall for “predatory victimization” (Deliema et al., 2019). This drives them to rely on faulty heuristics and biases that blur their judgments (Chaiken, 1980; Kahneman & Tversky, 1979) and poor habits. They can then act with limited self-control (Helweg-Larsen & Shepperd, 2001). When this becomes common enough across a population, it may actually promote market frictions and inefficiencies (Abreu & Brunnermeier, 2003; Aguilera & Vadera, 2008). This worsens in deviant markets where incentives to go around regulations, such as excessive bonuses for aggressive traders, prevail (Allen & Gate, 1999; Graafland & van de Ven, 2011). It is also likely where “sweetheart deals” encourage exuberance seeking (Shiller, 2005; Ben David, 2011) and where the desire for quick profit supersedes the practice of proper risk assessment (Dallery & van Treeck, 2011; Hoffmann et al., 2012).

Moral hazard, defined as “the failure to either behave diligently or in good faith at any point in the exchange” (Ericson & Doyle, 2003, p. 11), is embedded in such predatory markets. In other words, one must look at predator–prey dynamic (which inevitably carries moral hazard) as a potential source of market failure. This dynamic works based on exchanging (partial) information resources. These can be manipulated to mesmerize the prey and get them to stop evaluating investment risks properly, thus causing them to spin. Factors that fuel such predatory mechanism include the abuse of information asymmetry, of course, and creating artificial growth conditions (e.g., as a consequence of which the Department of Housing and Urban Development policies pressured government-sponsored enterprises — such as Fannie Mae and Freddie Mac — to offer easy credit) (Glaeser et al., 2008). They also include a regulatory laissez-faire strategy and allowing unjustified tax breaks (Krugman, 2009; Rajan, 2010; Stiglitz, 2003). They encompass resorting to risk hiding tactics, such as securitization (Corneil & McNamara, 2010), and setting up networks (accounting, banking, credit ratings, insurance, lobbying, etc.) that benefit only a few (Sama & Shoaf, 2005; Scherbina, 2013) but penalize the majority. Hill and Kozup (2007) clarify this further when assessing the subprime/predatory mortgage mayhem of 2007–2009. The latter was precipitated by, “consumer loans with any or all of the following characteristics: aggressive and deceptive marketing, lack of concern for the borrower’s ability to pay, high interest rates and excessive fees, unnecessary provisions that do not benefit the borrower… large prepayment penalties, or faulty underwriting…” (p. 29). The authors highlight the fact that some market agents targeted vulnerable people who were tricked by disadvantageous contracts (p. 40) and exploited through incomplete disclosure, leading them to make “irrational choices” (p. 32). Indeed, subprime mortgage lenders-predators built on the opportunity to seek the most vulnerable borrowers-prey, including the naïve and gullible, low-income dwellings (Iacoviello, 2008), minorities, uneducated individuals, those eager to make up for past pains by acquiring present assets (Roy & Kemme, 2012), and the elderly (Yoon et al., 2005). Wells Fargo used a similar strategy in the USA, resulting in its CEO, John Gerard Stumpf, resigning in 2016 over fake customers’ accounts.

In summary, at least five factors seem to jeopardize the stability of markets: externalities; internal market inconsistencies; asymmetry of information; market agents’ shortcomings: and predatory dynamics. These serve as market cues for the sellers and buyers. When they are deemed to play in their favor, both market agents resume their “games” of selling and buying, with one eventually becoming the predator and the other one the prey. For example, a market cue could be that internal market inconsistencies develop, such as lax regulations and poor law enforcement. The seller-predator will perceive this as an opportunity to deploy his/her predatory tactics towards the targeted buyers-prey. Eventually though, the market cues will foster the significant rise of dysfunctional behaviors such as spinning, which will lead the market towards failure.

We focus next on the phenomenon of spinning, which we assume is the result of the interplay of these cues turned dysfunctional, or, put differently, of market failure factors (MFFs).

The Financial Spinning Model

An emerging strand of literature refers to consumers having left behind their original goal of building a sound financial mattress for themselves in favor of spinning, which involves spending time, energy, and effort on activating a “wheel of misfortune” (Mesly et al., 2020) — a mounting debt — for the sake of mere maintenance. The concept recognizes the debilitating role of routinized behaviors and habits (Reckwitz, 2002), which implies a numbness towards risk assessment, lower price sensitivity (Blackwell et al., 2006), and simplified conative processes (Howard & Sheth, 1969). With so many barriers to good judgment present, consumers are that much more susceptible to heavy, aggressive (and at times misleading) communications, such as sweet deal advertisements (Akerlof & Shiller, 2009). These actions weaken the consumers-prey, making them more susceptible to spin. Indeed, market agents make more mistakes when in a weakened position (Starcke & Brand, 2012).

Predatory Dynamics and Financial Spinning

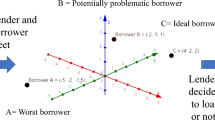

Some economists have used, albeit timidly, predatory mechanisms and standard Lotka-Volterra (LV) equations in an attempt to explain market agents’ behavior in financial markets (Crookes & Blignaut, 2016; Goodwin, 1967; Samuelson, 1971). These equations are vastly used in biology and ecology and have proved to accurately describe the interactions between predators and prey. Over the decades, the Harvard Business Review has carried articles on the usefulness of resorting to predator–prey models (Moore, 1993). Modeling human behaviors using this framework is currently in vogue (Dejuán & Dejuán-Bitriá, 2016; Ditzen, 2018; Henry, 2012; Zhang, 2012), but only occasionally in conjunction with the dynamic system concepts of aggregates and flows (Skott & Ryoo, 2008), except, for example, for the works of authors such as Huck et al. (2019). The latter find that LV dynamics, as expressions of predator–prey interactions, seem to have taken place during the GFC, at least in the USA. Mesly et al. (2018) describe how mutual deceit develops by arguing that market agents trade two kinds of behaviors: avoiding regulations one way or the other (e.g., tax avoidance, free riding) and buying/selling toxic products. Their model can be illustrated with market-agents predatory dynamics, as follows (Fig. 1).

A framework of market spinning and failure based on consumers-seller predatory relationships. Note: The left side portrays the psychological map of an uncanny seller-predator acting in a dysfunctional market heading towards failure through spinning. He/she meets his/her victim through an exchange of information when they negotiate a factual or verbal contract, with the seller-predator trying to ration the rationality of his/her prey. As can be inferred, both normal market cycles and spinning can occur in such a portrayal of market agents’ interactions. We will attempt to replicate this figure mathematically in the next section

Figure 1 reads as follows: a seller-predator interacts with a buyer-prey by way of exchanging bits of information, some of which are predatory (meant to lure). The seller-predator has a keen interest in limiting the amount of valuable information the buyer-prey has access to, so that the latter does not make a fully informed purchasing decision. Being more than simply opportunistic, the seller-predator tricks him/her into buying at an unreasonable price in unreasonable quantities. Hence, the seller-predator rations the rationality of the buyer-prey, who is then rationed (rationally rationed) by this action and possibly by his/her own incapacity or lack of motivation to access valuable information. The same motivation drives both agents: an appetite for predatory maximization (gain as much as possible from the other agent, to the latter’s detriment, to earn money as fast as possible, at the lowest operating cost possible). This develops in a reckless market, one where laissez-faire prevails (and thus, where abuse goes unpunished). As the market agents’ needs, goals, and preferences become pressing (e.g., with the hot market prior to the GFC) and as market cues seem to play in their favor at that moment, both agents feel increasingly confident they can beat the market odds and deceive the other agents. Rationality serves as a mediating variable (in inline with “System 2” as per Kahneman, 2011), meaning that not all decisions to deceive are purely rational; they may actually be purely emotional (“System 1”).

This is replicated many times over and spreads among larger aggregates of market agents. As some agents obtain what they want through deception, they borrow money (with inadequate collaterals, the market being poorly regulated) to gain even more from the market — a gambling of sorts — not realizing they are increasingly caught in a debt trap (trapped exuberance). At first, the exuberance due to accumulation of wealth is rewarding, thus encouraging further spinning, but it will soon amount to an insurmountable debt load. The exchange of information between the two market agents hypothetically follows LV equations: at times, sellers-predators have more valuable bits of information than buyers-prey, and at other times, the reverse is true. In Fig. 1, predatory information plays a quintessential role. It is to the best advantage of the short-term thinking sellers-predators to keep customers in the dark (rationed rationality being encouraged through keeping information unattainable) with respect to the risk of a debt trap. Much to their bewilderment, GFC customers who “foraged” for their own predators, that is, for lenders and providers of predatory mortgages (or financing in general), ended up on the losing end of the relationship (of their contractual agreement). To survive and be successful in the competitive and booming housing market they willingly engaged in, some consumers-prey had to choose the least threatening sellers-lenders-predators, while trying to deceive these agents by falsifying their financial statements (Bianco, 2008). However, the sellers-predators were also playing a game of deception, in particular by voluntarily accepting shaky mortgages and by developing risk-hiding tactics (e.g., RIPO 105 by Lehman Brothers) and products. This entire cupid framework spun repeatedly, and led to what the economists call “spillover effects,” culminating in a market crash.

The Devastated Mind of the Spinning Consumer

Consumers/investors with rationed rationality, that is, with little access, capacity, or willingness to acquire valuable information, are at a disadvantage on many fronts. As previous literature has well established, “Households with low financial literacy are less likely to own risky assets directly” (Bucher-Koenen & Ziegelmeyer, 2014, p. 2215). Consumers who have lost faith in the market or with limited cognitive capabilities face higher costs of acquiring market information, thus worsening their debt trap and making themselves even more vulnerable (Bucher-Koenen & Ziegelmeyer, 2014). Being strongly influenced by others, they are subject to a contagion effect, but not necessarily in ways that serve their interests (Duflo & Saez, 2003). They are more prone to panic and thus do not enjoy the beneficial effects of long-term investments (Lee & Andrade, 2011). They make sub-optimal decisions by missing valuable, telling information, including less salient clues (Almenberg & Karapetyan, 2014) and hence are poor at timing the market and at benefiting from “rebalancing according to a CAPMFootnote 3 prescription” (Guiso & Viviano, 2015, p. 1375). They are more prone to a “home bias” and limit the diversification of their portfolios (Hoechle et al., 2017). They exhibit low self-control so that astute financiers are more likely to trick them (Holtfreter et al., 2008). They may be oriented towards wealth and status, which makes them responsive to lures put forth by predators-sellers (Kim, 2013). They may self-protect inadequately (e.g., by not seeking valid information) to avoid, naively enough, the cost of such activity (Sévi & Yafil, 2005). Finally, under ambiguity (which is a common occurrence in the market, especially when it is dysfunctional), they shy from rationality, thus worsening their conditions (Lee, 2016) yet may be reluctant to acquire too much (technical, complex) information, leading them to choose poorer alternatives (Hadar et al., 2013). Hence, consumers with limited literacy suffer from an information paradox in elaborate financial markets: they need sophisticated information but are repulsed by it one way or the other.

Illustrating Financial Spinning Via Lotka-Volterra Equations

We now discuss the mathematical basis used to illustrate financial spinning and provide the different outcomes (trajectories) that markets may face.

Mathematical Basis

Assuming predator–prey dynamics and based on the previous discussion, we illustrate how (in exceptional financial markets such as the GFC), it is most rewarding for sellers-predators to first limit (ration) the rationality of their buyers-prey (that is, to keep them in the dark). Should the buyers-lenders-prey realize they are being deceived and eventually outsmart their sellers-predators, they will likely gain a market advantage. As an example, the GFC debacle occurred when buyers of all sizes — individuals and institutions — realized how toxic the products they bought were, panicked, and ran for a prompt exit. One agent gaining a significant enough (predatory) edge in terms of information asymmetry, signals a dysfunctional market that is headed for failure. In a similar way, the recent above-mentioned Robinhood-Reddit-GameStop spike has caused some large investors to suffer from their short-selling strategies in the face of thousands of small investors acting on the GameStop shares based on numerous, fast-paced, Internet exchanges of unreliable sources of information. Interestingly, in this case, it is the small investors who assumed the role of predators against the large firms, as opposed to what was the case in the GFC.

In the wild, predation refers to aggregates (populations) of predators chasing and killing prey in an efficient way, so that the population of prey never becomes extinct, thus leading to ecosystem equilibrium. Many academics render this dynamic by Lotka-Volterra equations (LV), which express predatory relationships, as opposed to other types of relationships, such as competition and complementarity (Gotelli, 1995; Song & Thakor, 2010, p. 1021). The equations are as follows:

and

where:

-

α and ϒ are the growth and extinction rates of prey and predators respectively, and

-

β and δt are predator–prey interaction parameters that must be determined.

By growth, we mean that buyers-prey flock the booming market. This includes existing buyers who want to buy more of what they already have and new buyers who do not want to miss developing, hot opportunities. By extinction, we refer to the sellers-predators who retire or go out of business. The variable β stands for the harm done to the prey by the predators. The efficiency rate δt expresses the gains made by the predators from absorbing the prey (i.e., how good predators become from learning how to lure their prey). For the purposes of the present paper, we focus solely on the δ parameter (hence, the reference to δt), which we explain in detail further below. These LV equations are useful in the wild; however, their replication in the human realm requires some adjustments, if only because in the wild, predation occurs between two different species in an ecosystem topped by a super predator in the food chain.

Developing our framework addressing dysfunctional markets similar to the GFC market in the USA, we set the following conditions. First, we posit that the economic/financial system concerns the same species (market agents) that need each other to survive, and that can mix and exchange roles as circumstances change. We also assume that the market evolves around a narrow and localized range of investment opportunities (houses in this case).Footnote 4 In such a market, only a limited number of sellers and buyers resort to predatory behaviors and potentially host harmful intentions. Others may simply be gullible, with no hidden agendas. Additionally, dysfunctional sellers and buyers are in constant negotiation loaded with deceitful efforts to gain an information advantage over the other. These agents are probably less risk-averse than the rest of the population; motivated by greed, they negotiate while withholding information when that serves their interest. Finally, in many cases, consumers-prey are rationally rationed, which is, of course, a paradigm departure from traditional economic theory and from the Efficient Market Hypothesis (EMH — Fama, 1970) discussed above but in line with behavioral finance theory.

We incorporate the effects of learning (defined as improvement in all skills pertinent for the buyer-prey to escape a given particular seller-predator and for the seller-predator to feed on that particular buyer-prey, as we consider those skills endogenous to that particular predator–prey pair) by letting the predation efficiency δ vary with time (hence, we use δt). This predation efficiency reveals the fact that the predators learn how to gain a predatory information advantage over time, thus increasing their capacity to bait their prey. We opted for this mathematical expression to adjust it to Fig. 1 where rationality is an expression of information use (and thus learning). LV equations are particularly flexible and permit us to illustrate how market spinning could possibly develop. For the sake of argument, we propose to define the predation efficiency rate δ as follows:

where

-

δ0 is the initial value of δ, that is, the accumulated knowledge with respect to predation at time t = 0;

-

Lt is the learning rate (Lt > 0);

-

t denotes time;

-

S represents the different states in terms of learning (or, put differently, rationed rationality), with (S = − 1, 0, 1), as follows:

-

S = − 1 reflects the learning acquired by the prey, by which they know better how to protect themselves against their predators’ predatory attempts (the predators can no longer ration the rationality of the prey)

-

S = 0 meaning no learning at all (no acquisition of new predatory information)

-

S = 1 reflects the learning acquired by the predators (the prey is rationally rationed)

-

o

So that, for all predators, active and inactive, we have:

$$d(y_t)/d(t)=-\Upsilon y_t+\delta_0\cdot (1+L_t)^{t.S}\cdot x_ty_t$$(4)

-

o

The LV mathematical function shows the debilitated aggregate of sellers-predators acting in a dysfunctional market heading towards failure through the various moments of spinning. The aggregate of the predators meets that of the victim through an exchange of information when they negotiate a factual or verbal contract, by which they learn to better prowl or protect against predation. This learning can be to the advantage of the prey aggregate (S = − 1), non-existent (S = 0), or to the advantage of the predator aggregate (S = 1). Because xt (which belongs to the prey aggregate) is included in the function of the predator aggregate, there is a constant adaptation between the two aggregates, as it is sensitive to their learning advantage or lack thereof. More particularly, the predator efficiency δt denotes the probability of conversion of the energy derived from “feeding” on the buyers-prey into an increase in the sellers-predators aggregate, taking into consideration the energy required for “reproduction” (reproducing deceitful behaviors) and other energy use and loss factors during the sellers-predators’ lifecycle (active career). By energy, we mean the drive or intensity with which the sellers-predators go after their customers-prey (for example, by paying for expensive advertisement). By feeding, we refer to the money made to the detriment of that aggregate of customers-prey (e.g., bonuses or commissions earned through deceptive contracts, those that provide full, unfair advantage of asymmetry of information, say, by hiding risk). By reproduction, we mean the capacity of a single seller-predator to repeat his/her mischievous actions and expand them to other buyers-prey, and even to train or encourage emerging sellers-predators. By loss factors, we address occasional losses that sellers-predators incur through the course of their deceitful actions, for example, when expanding more advertising money than is gained from such effort or when outsmarted by some consumers-prey.

Spinning Market Trajectories

We illustrate the proposed, learning-sensitive formulae by using computer simulation. This is a useful way to analyze consumer behaviors, especially when one cannot replicate market conditions (such as the ones prevailing during the long-past GFC). It is actually the only way to get around that problem. As stated by Dew et al. (2020, p. 55), “The modeling of dynamic phenomena is central to marketing research. Marketers are interested in understanding the evolution of consumer perceptions, preferences, and response sensitivities, as well as the success and failure of different brands over time.” Certainly, various authors in the area of economics note that dynamic systems express well the LV framework (Crookes & Blignaut, 2016; Nasritdinov & Dalimov, 2010). Simulations are also useful when examining games that market agents play such as predator–prey ones, and are part of a “flourishing new field of market design” (Samuelson, 2016, p. 121). We now present five possible stylized scenarios or trajectories that express how spinning develops from the interplay between the sellers-predators and their buyers-prey (all parameters used are reported in Appendix 2). We used the Runge–Kutta method (RK4) (Butcher, 2008), a technique especially useful to approximate the solution of ordinary differential equations the likes of LV equations. For clarity purposes, the modeling choice was adopted to illustrate simplified, stylized trajectories. The parameter of the learning rate (L), via the predation efficiency rate at time t (δt), was the key focus. This choice, applied to certain trajectories, rendered predator oscillations stable and allowed for maneuvering the prey oscillations consequently.

We now discuss the five different trajectories that result from the mathematical expression of spinning that we used: (1) stable oscillations (absence of spinning); (2) convergence spinning; (3) wild spinning by consumers-prey; (4) spinning sellers; and (5) delayed spinning. The last three involve learning by one market agent to the detriment of the other.

First Trajectory: Stable Oscillations (Absence of Spinning)

In the first trajectory, oscillations are stable over time, reflecting the fact that while a predator–prey dynamic exists, it seems conducive to the market ecosystem surviving over the long term, as it should ideally be (Fig. 2).

In Fig. 2, each market agent — predators and sellers — makes mutually efficient use of learningFootnote 5 (L), or, in other words, does not impose excessive rationing of rationality or does not suffer from excessive rationed rationality. In this case, economic cycles operate smoothly. There is no spinning as we define it: market agents do not disconnect from their initial financial goals, needs, and preferences. Quite the contrary: they go back to their initial conditions over time, as reflected by a stable loop (the egg shape on the right). Sellers and consumers maintain a sustainable confidence level. In such a scenario, there may be no need for immediate government intervention: the market seems to self-regulate, and to do so efficiently. However, there may be cases whereby cycles could reach extreme levels, thus harming consumers and inviting government interventions to smoothen the economic cycles. Going back to Fig. 1 (in our core model, on the left- and right-hand sides), this first trajectory indicates that the sellers and buyers do not enter in the overconfidence/r-rationality/deceit loop that could cause market failure.

Second Trajectory: Convergence Spinning

In the second trajectory, predators and prey tend to converge (Fig. 3).

Figure 3 reflects the fact that populations of predators and prey stabilize and that populations have become fully acquainted with one another, and have full knowledge about each other, which seems to be unrealistic. There are fewer and fewer oscillations; convergence occurs. This suggests that consumers’ financial needs and objectives display no desire for excessive improvement (e.g., greed or predatory utility maximization), which seems illusionary, since economies grow over time. This situation could be acceptable from the point of view of consumers’ benefits, but it omits their propensity to desire more (their financial goal). It disregards their drives to improve their living conditions, to compete with other consumers, and to get excited with market opportunities. It also denies the possibility of sellers’ and consumers’ growing overconfidence. In that sense, this is a form of spinning as consumers disconnect from the dynamic forces of their needs (e.g., greed) and goals. This stalled market is reminiscent of the post-GFC and may well lead to government intervention to stimulate the economy, suggesting that consumers end up worse off over time. Going back to Fig. 1 (our core model, on the left- and right-hand sides), this second trajectory indicates that the buyers’ and sellers’ needs, goals, and preferences do not become excessive (as situation typical of post-crisis markets).

In both the first and second trajectories, there is no learning. The next three trajectories involve learning.

Third Trajectory: Wild Spinning by Consumers-Prey

The third market trajectory displays advantageous learning by the entire prey aggregate (existing and potential) (Fig. 4).

In this third trajectory, for the same number of predators, the number of all prey (existing and potential) increases exponentially. This means that the prey have learned to become efficient in the economic ecosystem and manage to escape the predators by better understanding their predatory tactics. Predators end up not being able to catch up with the exponential growth of the prey and hence to secure long-term survival of said ecosystem. This time, consumers’ spinning occurs: the prey move further away from their initial financial needs, objectives, and preferences as exuberant goals kick in. This situation, of course, spells disaster. Excessive growth of the prey population can be interpreted as consumers’ thirst for further financial gains or overconfidence in obtaining those gains, suggesting they will engage a debt trap. This calls for government intervention, for example, by way of raising interest rates. This market trajectory for all prey (existing and potential) is exemplified in the years leading to the GFC. Going back to Fig. 1 (our core model, on the right-hand side), this third trajectory indicates that the buyers engage more fully in the overconfidence/r-rationality/deceit loop than the sellers.

Fourth Trajectory: Spinning Sellers

In the fourth trajectory, predators learn to prowl better for their prey, targeting them even more skillfully. The predator population (aggregate) oscillates around the same flat trend, but they need fewer prey over time, suggesting they are more aggressive and extract more of each prey (Fig. 5):

In this fourth trajectory, the prey shy away from their initial financial needs, goals, and preferences in the sense that they can no longer defend themselves when facing increasingly aggressive predators. The predators-sellers manage to extract more and more out of each prey, causing consumers increasing immediate or delayed financial distress and subduing their overconfidence. Eventually, there will be close to no prey left, which is an impossible situation: sellers cannot survive without buyers. This system does not benefit consumers (as it limits their choices and threatens them with unfair prices) and makes inefficient use of resources. It suggests a powerful use of deception by the predators-sellers to the detriment of their prey-customers. This trajectory, too, calls for eventual government intervention. The GFC exemplifies what is displayed here. During the early years of 2000, the market saw an increase in consumer demand. Likely, buyers were credit-wise sound and could support their debt load. This resembles the fourth trajectory (consumers’ learning efficiency advantage: consumers’ explosive spinning) before the herding of high-risk borrowers, who joined in as motivated to the appeal of fast and considerable financial gains (the Bitcoin recent waves being again a point in case — Gurdgiev & O’Loughlin, 2020). This influx of financially weak, overzealous prey allowed some predators to take full advantage of them, eventually to extract selfishly from them maximum gains and benefits, thus driving them all towards the fourth trajectory (predators’ learning efficiency advantage: sellers’ spinning). In being deprived of their financial capacities, at times ruthlessly, some prey had no choice but to disconnect from their initial financial needs, goals, and preferences, as these were no longer realistic or achievable. This is what we coin “sellers’ spinning”. Sellers, too, eventually can end up in a dire situation, as there are nearly no prey left. Going back again to Fig. 1 (our core model, on the left-hand side), this fourth trajectory indicates that the sellers engage more fully in the overconfidence/r-rationality/deceit loop than the buyers.

Fifth Trajectory: Delayed Spinning

In the fifth and last trajectory, predators become so efficient that, at a certain point, they manage to “kill” their buyers-prey at an accelerated pace, not giving them the chance to renew their aggregate (population) or even to pretend to respond to their financial needs (Fig. 6).

This trajectory conceptually starts from the same situation as the second trajectory (convergence spinning), with the difference that this time the predators are integrating learning for their sole benefit. First, as in convergence spinning, consumers believe they are heading for fair, stable, and mutually beneficial relationships with the sellers. However, unbeknownst to the customers-prey, the predators-sellers manage to numb them, lowering their level of vigilance, to extract the maximum out of them, and very quickly so. As such, it is an accelerated sellers’ spinning, with extensive levels of deception. Only after the fact do the consumers-prey realize in what dire situation they are. Going back to the GFC, this translates as follows: the naive consumers accumulated subprime mortgages, thinking they were “in for the money” (arrow #1 in the right panel of Fig. 6). Some predators hid the risk, did not reveal the possibility of sudden increases in interest rates upon mortgage renewal past the teasing period, and encouraged borrowers to borrow even more. Some borrowers, probably overconfident, were then under the impression that the system was working in their favor (arrow #2). This suggested to them that they were converging towards a stable equilibrium with their lenders/sellers. The delayed effect caused by the sellers’ hidden agenda breaks through thereafter (arrow #3). In short, the toxicity of the system was in place from the beginning, kept worsening, still unbeknownst to the naïve consumers and perhaps to some naïve predators, and eventually came to the surface.

Technically, this spinning behavior drives the market towards extinction and it is unsustainable. Furthermore, short of populations (aggregates) of prey, existing predators (e.g., smaller lenders during the GFC) have no choice but to go after other predators in order to survive, thus creating a hierarchy of predators, with the most powerful ones on top of the others (e.g., those which had carefully anticipated the market turnaround). A fundamental tenet of predator–prey interactions is that ecosystems must survive. Hence, the market had no choice, to ensure survival, but to develop such survival conditions, and to keep prey afloat to a minimal level. For example, the Paulson Plan during the GFC awarded some major banks billions of rescue dollars. We coin this a “delayed spinning market.” This condition severely limits the purchasing power of the consumers-prey. Obviously, the latter cannot even dream of fulling their financial needs. Disconnection from their initial needs, goals, and preferences is forced upon them by remorseless sellers-predators, very suddenly so. Going back to Fig. 1 (our core model, on the right-hand side), this fifth trajectory indicates that the buyers’ population becomes nearly extinct (in reality, prey population’s extinction would necessarily lead to predator population’s extinction).

Conclusion

While common sense would dictate that the economic system should remain along the first trajectory with stable oscillations as long as it stays functional, history shows that this only lasts so long. Indeed, market agents are driven by dark behavioral forces that include or else generate overconfidence, rationed rationality, and use of deception. In other words, some market agents, including consumers, become greedy and overzealous. This pushes the markets outside of their most economically sound course, suggesting possible government intervention. In the last three trajectories, the consumers’ learning is deficient given the market conditions.

Theoretical Implications

Based on our findings, we can further define consumer spinning as a behavioral phenomenon in which consumers engage in counter-productive exchanges of information and unequal rates of learning. The predators-sellers may benefit for a short time from inducing consumer spinning, whereby consumers are taken to the wrong path with dubious, misleading, and incomplete information. Baited consumers end up losing track of their initial goals and needs — they disconnect — and recklessly engage in borrowing and spending, spinning their wheel of misfortune as they accumulate debt.

We suggested that, subject to further studies, the “information contract” that exists between sellers-predators and buyers-prey emulates Lotka-Volterra curves. Each set of agents — sellers and buyers — whether corporate or individuals, are blind to risk and move in a market of unmonitored predatory utility maximization; each molds its own level of overconfidence and develops tactics to fool the other, in order to maximize short-term gains. This relationship builds around an exchange of information (information contract), which implies learning, or lack thereof. When the sellers-predators are able to hide risk from the buyers-prey, they in effect utilize information asymmetry in a predatory manner, inviting these buyers-prey to spin what will become their wheel of misfortune. Their tricks, however, will serve them for only so long. Eventually, market forces, such as regulators’ intervention, will attempt to palliate increasing market frictions (e.g., inflation, supply shortages, etc.) to prevent market failure.

Then, when buyers-prey outsmart their sellers-predators (whom they had initially chosen because they were the ones lending them the money), their population soars to the detriment of these sellers-predators, a counter-intuitive phenomenon in standard LV dynamics. This, too, eventually causes market failure. During the GFC, the entire predator–prey mechanism came at a cost. Consumers-prey spun their wheel of misfortune because they were not willing to measure risk with the proper information or else were denied access to such information. Only when both agents use information in a non-predatory manner can the market guarantee relative stability and promote improved living conditions. In other words, our model suggests that governments can prevent market failure by ensuring a fair balance of information flow between consumers and sellers, notwithstanding that they must also deal with externalities and power imbalances.

Managerial Implications

The seeds of market failure are present in any market; moreover, market failure really points to government failure. Economists originally conceived of market failure as a normative explanation to justify government intervention, which then evolved into a diagnostic tool frequently used by policy analysts to determine its shape and mode of implementation (Zerbe Jr. & McCurdy, 1999). Governments understand that the increased possibility of market failure follows a historic path. Events in the preceding months or years as well as interactions between investors cause prices to deviate or inflate, indicating a bubble that will inevitably burst (Sornette, 2017). Governments and regulatory bodies can act on many macro-economic factors, such as the interest rates, yet can hardly interfere at the interpersonal level between speculators of all kinds. Some of the seeds of market failure are out of reach.

We further argue that governments cause markets to fail by being lenient in the way they treat externalities (and public goods), predatory information, and social dichotomies. Again, because one cannot get rid of these possible ailments, and because governments are imperfect, markets brood their own potential for failures. Market agents depend on their governments to update market regulations, ensure and enforce proper and independent monitoring (authorizations, examinations, registrations, standardizations, and surveillance), encourage diversification, promote safety and accountability, and in democracies, to allow and guarantee private ownership (Trimbath, 2015). However, things rarely run that smoothly: dysfunctionality occurs, and these are not only the making of governments at the macroscopic level, but also of sellers and buyers at the interpersonal level. In other words, markets are ecosystems where predator–prey dynamic takes place between various aggregates. Hence, the absence of proper management of the forces that govern markets (or put differently, of the MFFs), such as that of externalities, class inequalities, and predatory information, is what causes market failure. Accountability falls mostly not on the “natural” laws of the market, but on the governments. The burden that sellers must carry by sharing sufficient valid information and the burden that consumers must carry by assimilating and adequately using information may exceed their capacity. Governments have the responsibility to alleviate these burdens through better education and market controls.

Our framework outlines the importance of learning and the role of rationing rationality and of being rationally rationed. In fact, our model (Fig. 1) shows that there is only one psychological construct on which government can exercise an influence. Governments cannot easily affect consumers’ financial needs/goals/preferences, overconfidence, deceitful behaviors, or exuberance. They may, however, play a significant role in rationality, through education. This emphasizes the need to act in favor of proper educational programs with respect to finance and financial behaviors. Since corporations, institutions like banks, and regulatory bodies form the bridges between the individual interactions between sellers and buyers of all sizes, they too have a role in understanding their possible dysfunctional behaviors. Hence, they too bear some responsibility in ensuring that the market avoids failure, for example, by educating these market agents and by advising and reporting to their governments. A 2015 Consumer Financial Protection Bureau report (CFPB, 2015) states that the objective of financial education is to promote consumer financial well-being, yet it recognizes the limited and disappointing effect of financial education on financial behaviors (Fernandes et al., 2014). Furthermore, theory acknowledges that conscious and unconscious (and at times dark) forces drive consumers’ behaviors, making it harder to assume corporate responsibilities and attempt to fulfill the consumers’ needs (Martin & Morich, 2011).

Contributions

We make noteworthy contributions to existing concepts in consumer behavior and marketing theory in exploring connections to the phenomenon of market failure, predation, and financial spinning. Our proposed stylized model presents occasional risk-evasive consumer behaviors, marked by overconfidence and various levels of learning within the predatory pairs of sellers-buyers. It potentially explains how contagion, a term economists favor when discussing the GFC, took place: by way of learning (including learning bad investment habits) and mutual influence. As herding (contagion) turns into swarming and then stampeding, markets end up crashing. We leverage the notion of bounded rationality by incorporating it in a consumer predatory framework. In particular, it is not so much the fact that market agents have limited mental or intellectual capabilities that matters (no one is perfect after all), but rather that sellers-predators ration the rationality (e.g., by withholding or downplaying risk information) of their buyers-prey, who thus suffer rationed rationality. We also view asymmetry of information (learning rate) with the same lens. It is not the fact that sellers enjoy better access to more valuable information than the buyers (which is why after all they are sellers and, in an honest context, providers of valuable information in the best interest of their clients) that counts. Rather, it is the fact that asymmetry is used to lure the other market agents into a debt trap.

We also indicate that dysfunctional agents interacting in a dysfunctional market build their own debt by selfishly pursuing their interests by spinning their wheel of misfortune. We suggest that the US GFC market illustrates the phenomenon of spinning in some of its various forms. During financial spinning, a distorted consumer ethos takes hold, driving market agents to lose their anchor in their initial financial needs, goals, and preferences, and to disregard sound investment practices, being lured to spin a wheel of fortune that is, in fact, a wheel of misfortune as it hides an increasing debt load. The lack of proper market regulations versus risk hiding fosters greed, which may fuel market failure. Furthermore, we explain different market trajectories that have the advantage of illustrating the market ecosystem while including its psychological underpinning. Notably, we showed four forms of detrimental spinning: convergence spinning, consumers spinning, sellers spinning, and delayed spinning.

Limitations

Evidently, we could not go back in time and recreate the conditions that prevailed during that critical period (2007–2009) but that was not necessary, and would have probably served no purpose because too many uncontrollable variables would have tarnished whatever conclusions we could have reasonably drawn. With a parsimonious but not overly simplistic model, and with a limited number of parameters selected to show vastly different trajectories, we were able to present the potential actions of dysfunctional agents in maladjusted markets. We do not claim that all market agents are deceitful or unable to learn: our overall analysis concentrates on a fraction of the population in exceptional circumstances.

Path to the Future

The multidisciplinary approach of this paper represents an effort to combine elements of economics, consumer behavior, and marketing. This holds promise for further understanding of the markets and for protecting consumers’ rights. Judicious extensions of this work include analyses of much more complex dynamical systems and dimensions, beyond asymmetry of information and learning. We believe this research and further such studies could pave the way to better consumer education and protection by giving it a new, more to-the-point perspective (Gaganis et al., 2020). Perhaps the “ostrich effect” (Karlsson et al., 2009) can be avoided more realistically when bad news comes. Government-sponsored educational programs, or those developed by private investment firms for that matter, could probably improve simply by better understanding how risk hiding leads to persistent moral hazard, culminating in a population explosion of buyers-prey. Market failure may be partially avoided by taking such steps. This knowledge serves the interests of corporations that wish to act as responsible citizens. Not all organizations are aware that they may inadvertently create clients-prey; perhaps, finding a more suitable equilibrium in the relationships among market participants can lead to a more ethical society, which companies would benefit from, as this would better their public image.

Notes

Appendix 1 provides the main economic models attempting to explain/understand market failure by various scholars with their shortfalls.

Indeed, the expression “burden” is mostly used in a legal context, such as “burden of proof,” or in an accounting framework. We use the term burden to assign the weight of responsibility that some consumers bear when acting as consumers. This is exemplified, for example, in the context of bio-responsible purchasing or when dealing with the burden of taxes (Cunningham, 2002).

CAPM: Capital Asset Pricing Model, used extensively to approximate the expected rate of return of an asset (Levy, 2010).

The absence of substitutes and of geographical expansion renders the debt trap consumers-prey fall in that much more lethal.

This applies to all predators (active and inactive) and all prey (real and potential).

References

Abreu, D., & Brunnermeier, M. K. (2003). Bubbles and crashes. Econometrica, 71(1), 173–204.

Aguilera, R. V., & Vadera, A. K. (2008). The dark side of authority: Antecedents, mechanisms, and outcomes of organizational corruption. Journal of Business Ethics, 77(4), 431–449.

Akerlof, G. A., & Shiller, R. J. (2009). Animal spirits: How human psychology drives the economy, and why it matters for global capitalism. Princeton University Press.

Akerlof, G., & Shiller, R. (2016). Manipulation and deception as part of a phishing equilibrium. Business Economics, 51(4), 207–221.

Alba, J. W., & Hutchinson, J. W. (1987). Dimensions of consumer expertise. Journal of Consumer Research, 13(4), 411–454.

Allen, F., & Gale, D. (1999). Bubbles, crises, and policy. Oxford Review of Economic Policy, 15(3), 9–18.

Almenberg, J., & Karapetyan, A. (2014). Hidden costs of hidden debt. Review of Finance, 18, 2247–2281.

Angie, A. D., Connelly, S., Waples, E. P., & Kligyte, V. (2011). The influence of discrete emotions on judgement and decision-making: A meta-analytic review. Cognition and Emotion, 25(8), 1393–1422.

Becker, G. S. (1976). The economic approach to human behavior. University of Chicago Press.

Ben-David, I. (2011). Financial constraints and inflated home prices during the real estate boom. American Economic Journal: Applied Economics, 55–87.

Bernanke, B. (2013). The Federal Reserve and the financial crisis. Princeton University Press.

Bettman, J. R., Luce, M. F., & Payne, J. W. (1998). Constructive consumer choice processes. Journal of Consumer Research, 25(3), 187–217.

Bianco, K. (2008). The subprime lending crisis: Causes and effects of the mortgage meltdown. Wolters Kluwer Law & Business.

Biggart, N. W., & Delbridge, R. (2004). Systems of exchange. Academy of Management Review, 29(1), 28–49.

Blackwell, R. D., Engel, J. F., & Miniard, P. W. (2006). Consumer behavior (10th ed.). South Wester.

Brunnermeier, M. K., & Oehmke, M. (2012). Bubbles, financial crises, and systemic risk. NBER Working Papers 1–90.

Brunnermeier, M. K., & Pedersen, L. H. (2009). Market liquidity and funding liquidity. Review of Financial Studies, 22(6), 2201–2238.

Brunnermeier, M. K., & Sannikov, Y. (2014). A macroeconomic model with a financial sector. American Economic Review, 104(2), 379–421.

Bucher-Koenen, T., & Ziegelmeyer, M. (2014). Once burned, twice shy? Financial Literacy and Wealth Losses during the Financial Crisis. Review of Finance, 18, 2215–2246.

Butcher, J. C. (2008). Numerical methods for ordinary differential equations. John Wiley & Sons.

Camerer, C., Isacharoff, S., Loewenstein, G., O’Donoghue, T., & Rabin, M. (2003). Regulation for conservatives: Behavioral economics and the case for asymmetric paternalism. University of Pennsylvania Law Review, 151, 1211–1254.

Chaiken, S. (1980). Heuristic versus systematic information processing and the use of source versus message cues in persuasion. Journal of Personality and Social Psychology, 39(5), 752–766.

Chakravarti, A. (2017). Imperfect information and opportunism. Journal of Economic Issues L, I(4), 1114–1136.

Cleeren, K., van Heerde, H. J., & Dekimpe, M. G. (2013). Rising from the ashes: How brands and categories can overcome product-harm crises. Journal of Marketing, 77(2), 58–77.

Consumer Financial Protection Bureau (CFPB). (2015). Financial well-being: The goal of financial education. http://www.consumerfinance.gov/reports/financial-well-being

Corneil, B. L., & McNamara, S. (2010). Lessons and consequences of the evolving 2007-? Credit Crunch. Aestimatio – The IEB International Journal of Finance 1, 164–181.

Crookes, D. J., & Blignaut, J. N. (2016) Predator–prey analysis using system dynamics: An application to the steel industry. SAJEMS Asset Research NS 19(5), 733–746 733.

Cunningham, L. A. (2002). Behavioral finance and investor governance. Washington and Lee Law Review, 59(3), 767–837.

Dallery, T., & van Treeck, T. (2011). Conflicting claims and equilibrium adjustment processes in a stock-flow consistent macroeconomic model. Review of Political Economy, 23(2), 189–211.

Dana, J., Weber, R. A., & Kuang, J. X. (2007). Exploiting moral wiggle room: Experiments demonstrating an illusory preference for fairness. Economic Theory, 33, 67–80.

Dejuán, Ó., & Dejuán-Bitriá, D. (2016). A predator-prey model to explain cycles in financial-led economies. Accepted for publication.

Deliema, M., Shadel, D., & Pak, K. (2019). Profiling victims of investment fraud: Mindsets and risky behaviors. Journal of Consumer Research, 46, 904–914.

Delong, J. B., Schleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Positive feedback investment strategies and destabilizing rational speculation. Journal of Finance, 45, 379–395.

Dew, R., Ansari, A., & Li, Y. (2020). Modeling dynamic heterogeneity using Gaussian processes. Journal of Marketing Research, 57(1), 55–77.

Ditzen, J. (2018). Cross-country convergence in a general Lotka-Volterra model. Spatial Economic Analysis, 13(2), 191–211.

Dubina, I., Carayannis, E., & Campbell, D. (2012). Creativity economy and a crisis of the economy? Coevolution of knowledge, innovation, and creativity, and of the knowledge economy and knowledge society. Journal of the Knowledge Economy, 3(1), 1–24.

Duflo, E., & Saez, E. (2003). The role of information and social interactions in retirement plan decisions: Evidence from a randomized experiment. Quarterly Journal of Economics, 118, 815–842.

Engle, R., & Ruan, T. (2019). Measuring the probability of a financial crisis. Proceedings of the National Academy of Sciences of the United States of America, 116(37), 18341–18346.

Ericson, R. V., & Doyle, A. (2003). The moral risks of private justice: The case of insurance fraud. Risk and morality. University of Toronto Press Inc.

Fama, E. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383–417.

Fernandes, D., Lynch, J. G., & Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science, 60(8), 1861–1883.

Fishbein, M. A., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Reading, MA, Addison Wesley.

Fisher, K. L., & Statman, M. (2000). Investor sentiment and stock returns. Financial Analysts Journal, 56(2), 16–23.

Fligstein, N., & Roehrkasse, A. F. (2016). The causes of fraud in the financial crisis of 2007 to 2009: Evidence from the mortgage-backed securities industry. American Sociological Review, 81(4), 617–643.

Gaganis, C., Galariotis, E., Pasiouras, F., & Staikouras, C. (2020). Bank profit efficiency and financial consumer protection policies. Journal of Business Research, 118, 98–116.

Gheorghiu, G. (2013). Information asymmetries as the main source of market failure affecting the consumer. Ovidius University Annals, Series Economic Sciences, 13(1), 494–499.

Glaeser, E. L., Gyourko, J., & Saiz, A. (2008). Housing supply and housing bubbles. Journal of Urban Economics, 64, 198–217.

Goodwin, R. M. (1967). A growth cycle. In Feinstein, C. H. (Ed.). Socialism, capitalism and economic growth. Cambridge University Press.

Gotelli, N. (1995). A primer of ecology. Oxford University Press.

Graafland, J. J., & van de Ven, B. W. (2011). The credit crisis and the moral responsibility of professionals in finance. Journal of Business Ethics, 103, 605–619.

Guiso, L., & Viviano, E. (2015). How much can financial literacy help? Review of Finance, 19, 1347–1382.

Gurdgiev, C., & O’Loughlin, D. (2020). Herding and anchoring in cryptocurrency markets: Investor reaction to fear and uncertainty. Journal of Behavioral and Experimental Finance, 25, 100271. https://doi.org/10.1016/j.jbef.2020.100271

Habib, M. M., & Venditti, F. (2019). The global capital flows cycle: structural drivers and transmission channels. European Central Bank working paper 2280. https://www.ecb.europa.eu/pub/research/working-papers/html/index.en.html

Hadar, L., Sood, S., & Fox, C. R. (2013). Subjective knowledge in consumer financial decisions. Journal of Marketing Research L, 303–316.

Haggerty, N. (2021). Will banks be pulled into GameStop uproar? American Banker, 186(25), 6–7.

Helweg-Larsen, M., & Shepperd, J. A. (2001). Do moderators of the optimistic bias affect personal or target risk estimates? A review of the literature. Personality and Social Psychology Review, 5(1), 74–95.

Henry, J. F. (2012). The Veblenian predator and financial crises: Money, fraud, and a world of illusion. Journal of Economic Issues XLV, I(4), 989–1006.

Hetzel, R. (2012). The Great Recession: Market failure or policy failure? (Studies in Macroeconomic History). Cambridge: Cambridge University Press. https://doi.org/10.1017/CBO9780511997563

Hill, R. P., & Kozup, J. C. (2007). Consumer experiences with predatory practices. The Journal of Consumer Affairs, 41(1), 29–46.

Hoechle, D., Ruenzi, S., Schaub, N., & Schmid, M. (2017). The impact of financial advice on trade performance and behavioral biases. Review of Finance, 871–910.

Hoffmann, M., Krause, M. U., & Laubach, T. (2012). Trend growth expectations and US house prices before and after the crisis. Journal of Economic Behavior and Organization, 83(3), 394–409.

Holtfreter, K., Reisig, M. D., & Pratt, T. C. (2008). Low self-control, routine activities, and fraud victimization. Criminology, 46(1), 189–220.

Howard, J. A., & Sheth, J. N. (1969). The theory of buyer behavior. John Wiley & Sons Inc.

Huang, J.-Z., Huang, W., & Ni, J. (2019). Predicting bitcoin returns using high-dimensional technical indicators. The Journal of Finance and Data Science, 5(3), 140–155.

Huck, N., Mavoori, H., & Mesly, O. (2019). The rationality of irrationality in times of financial crises. Economic Modelling. https://doi.org/10.1016/j.econmod.2019.10.033

Iacoviello, M. (2008). Household debt and income inequality, 1963–2003. Journal of Money, Credit and Banking, 40(5), 929–965.

Kahneman, D. (2011). Thinking, fast and slow. Penguin Books.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–292.

Karlsson, N., Loewenstein, G., & Seppi, D. (2009). The ostrich effect: Selective attention to information. Journal of Risk and Uncertainty, 38(2), 95–115.

Keynes, J. M. (2006). The general theory of employment, interest and money. Atlantic Publishers and Distributors (P) Limited.

Kim, H. (2013). Situational materialism: How entering lotteries may undermine self-control. Journal of Consumer Research, 40(4), 759–772.

Kiyotaki, N., & Moore, J. (1997). Credit cycles. Journal of Political Economy, 105(2), 211–248.

Krugman, P. (2009). Reagan did it. International Herald Tribune (June 2).

Lee, C. J., & Andrade, E. B. (2011). Fear, social projection, and financial decision making, Journal of Marketing Research XLVIII, S121–S129.

Lee, J. J. (2016). Ambiguity aversion: Theoretical advances and practical implications. Journal of Marketing, 3(3), 111–172.

Levy, H. (2010). The CAPM is alive and well: A review and synthesis. European Financial Management 16(1), 2010, 43–71.

Lucas, R. E., Jr. (1981). Studies in business-cycle theory. MIT Press.

Lunn, P. (2015). Are consumer decision-making phenomena a fourth market failure? Journal of Consumer Policy, 38(3), 315–330.

Lusardi, A., & Mitchell, O. (2014). The economic importance of financial literacy: Theory and organization. Journal of Economic Literature, 52(1), 5–44.

Manconi, A., Massa, M., & Yasuda, A. (2010). The behavior of intoxicated investors: The role of institutional investors in propagating the crisis of 2007–2008. NBER Working Paper Series Paper 16191. https://www.nber.org/papers/w16191.pdf

Martin, N., & Morich, K. (2011). Unconscious mental processes in consumer choice: Toward a new model of consumer behavior. Journal of Brand Management, 18(7), 483–505.

Mehta, N., Rajiv, S., & Srinivasan, K. (2004). Role of forgetting in memory-based choice decisions: A structural model. Quantitative Marketing and Economics, 2(2), 107–140.

Mesly, O. (2020). Consumer spinning: Zooming in zooming in an atypical consumer behavior. Journal of Macromarketing, 25–31.

Mesly, O., Chkir, I., & Racicot, F.-E. (2018). Predatory cells and puzzling financial crises: Are toxic products good for the financial markets? Economic Modelling, 78, 11–31.

Mesly, O., Nicolas Huck, H., Shanafelt, D. W., & Racicot, F. É. (2020). From wheel of fortune to wheel of misfortune: Financial crises, cycles, and consumer predation. Journal of Consumer Affairs (in print).

Miles, D. (2015). Housing, leverage, and stability in the wider economy. Journal of Money, Credit and Banking, 47(S1), 19–36.

Moore, J. F. (1993). Predators and prey: A new ecology of competition. Harvard Business Review May-June, 75–86.

Nasritdinov, G., & Dalimov, R. (2010). Limit cycle, trophic function and the dynamics of intersectoral interaction. Current Research Journal of Economic Theory, 2(2), 32–40.

Rajan, R. (2010). Fault Lines. Princeton University Press.

Reckwitz, A. (2002). The status of the “material” in theories of culture: From “social structure” to “artefacts.” Journal for the Theory of Social Behaviour, 32(2), 195–217.

Roy, S., & Kemme, D. M. (2012). Causes of banking crises: Deregulation, credit booms and asset bubbles, then and now. International Review of Economics and Finance, 24, 270–294.

Sama, L. M., & Shoaf, V. (2005). Reconciling rules and principles: An ethics-based approach to corporate governance. Journal of Business Ethics, 58, 177–185.

Samuelson, L. (2016). Game theory in economics and beyond. Journal of Economic Perspectives, 30(4), 107–130.

Samuelson, P. A. (1971). Generalized predator-prey oscillations in ecological and economic equilibrium. Proc. Nat. Acad. Sci. U. S. a., 68, 980–983.

Scherbina, A. (2013). Asset price bubbles: A selective survey. International Monetary Fund (IMF) working paper WP13/45, Institute for Capacity Development, 1–40.

Sévi, B., & Yafil, F. (2005). A special case of self-protection: The choice of a lawyer. Economic Bulletin, 4, 1–8.

Shiller, R. J. (2005). Irrational exuberance. Crown Publishing Group, a division of Random House Inc.

Skott, P., & Ryoo, S. (2008). Macroeconomic implications of financialization. Cambridge Journal of Economics, 32(6), 827–862.

Smith, V. L. (2003). Constructivist and ecological rationality in economics. The American Economic Review, 93(3), 465–508.

Solow, R. M., Lo, A. W., & Blinder, A. S. (2012). Rethinking the financial crisis. Russell Sage Foundation.

Song, F., & Thakor, A. V. (2010). Financial system architecture and the co-evolution of banks and capital markets. The Economic Journal, 120, 1021–1055.

Sornette, D. (2017). Stock markets crash: Critical events in complex financial systems. Series: Princeton Science Library. Princeton, New Jersey: Princeton University Press.

Starcke, K., & Brand, M. (2012). Decision making under stress: A selective review. Neuroscience and Biobehavioral Reviews, 36, 1228–1248.

Stiglitz, J. E. (2003). Government failure vs. market failure: Principles of regulation. JES.Govt.Failure.Mkt.Failure%20(1).pdf.

Trimbath, S. (2015). Ten steps to stable financial markets. Spiramus Press.

van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101, 449–472.

van Treeck, T. (2014). Did inequality cause the U.S. financial crisis? Journal of Economic Surveys, 28(3), 421–448

Williamson, O. E. (1981). The economics of organization: The transaction cost approach. American Journal of Sociology, 87(3), 548–577.

Yoon, C., Laurent, G., Fung, H., Gonzalez, R., Gutchess, A., Hedden, T., & Skurnik, I. (2005). Cognition, persuasion and decision making in older consumers. Marketing Letters, 16(3), 429–441.

Zerbe, R. O., Jr., & McCurdy, H. E. (1999). The failure of market failure. Journal of Policy Analysis & Management, 18(4), 558–578.

Zhang, Y. (2012). A Lotka-Volterra evolutionary model of China’s incremental institutional Reform. Applied Economics Letters, 19, 367–371.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Disclaimer

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1. Main economic models attempting to explain/understand market failures

Model | Scholarly authors | Year | Shortfall |

|---|---|---|---|

SRISK | Engle & Ruan | The behavioral aspects of market agents largely ignored | |

Global financial cycle | Habib & Venditti, European Central Bank | Discuss risk aversion, but not speculation | |

Predatory dynamics | Huck et al | No discussion on spinning | |

Animal Spirits | Akerlof & Shiller | Do not anchor opportunistic behaviors in a larger frame that includes business cycles | |

Macroeconomic model | Brunnermeier & Sannikov | Discuss volatility, but not moral hazards generated by market agents | |

Financial accelerator and the role of the Federal Reserve | Bernanke | Does not explain the mathematical link between consumers and suppliers’ behaviors | |

Liquidity spiral | Brunnermeier & Oehmke | Do not address in-depth how toxic products infect markets | |

Bubbles and crashes | Abreu & Brunnermeier | Address rationality but not moral hazard | |

Opportunism and contract theory | Williamson | Opposes trust to opportunistic behaviors in contractual agreements without reference to business cycles | |

Credit cycles | Kiyotaki & Moore | Do not link impatience to speculation |

Appendix 2. List of parameters used in the spinning model

Trajectory | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

Stable oscillations | Spiral/Convergence | Learning, Prey + , oscillations | Learning, Pred + , oscillations | Spiral + Predator learning |

Learning | No | No | Yes | Yes | Yes |

|---|---|---|---|---|---|

S | 0 | 0 | -1 | 1 | 1 |

Α | 0.02 | 0.20 | 0.02 | 0.03 | 0.50 |

Β | 0.003 | 0.010 | 0.003 | 0.003 | 0.020 |

ϒ | 0.03 | 0.08 | 0.05 | 0.05 | 0.20 |

δ (or δ0 if learning) | 0.0010 | 0.0010 | 0.0015 | 0.0015 | 0.0010 |

L | 0.000000 | 0.000000 | 0.000001 | 0.000400 | 0.005000 |

Nb Prey (initial) | 50 | 100 | 19 | 50 | 100 |

Nb Pred (initial) | 10 | 10 | 5 | 10 | 10 |

Nb periods | 1000 | 1000 | 950 | 810 | 1000 |

Time step | 0.100 | 2.000 | 0.001 | 0.010 | 1.000 |

Number of points | 10000 | 500 | 950000 | 81000 | 1000 |

Rights and permissions

About this article

Cite this article

Mesly, O., Mavoori, H. & Huck, N. The Role of Financial Spinning, Learning, and Predation in Market Failure. J Knowl Econ 14, 517–543 (2023). https://doi.org/10.1007/s13132-021-00862-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-021-00862-2