Abstract

The Indian banking sector can take advantage of the proliferation of smartphones as well as the government’s encouragement of cashless transactions to accelerate the use of mobile and online banking. The purpose of this study is to understand the initial acceptance of mobile banking by existing online banking users. Few studies have focused on online banking users’ behavioural intention to use similar services (such as mobile banking) in India. To this end, a theoretical model was developed using the technology acceptance model, which was extended to cover the adoption factors that influence users of online banking to use mobile banking. These adoption factors comprise perceived ease of use, perceived security, mobile self-efficacy, social influence and customer support. The dependent variable is customers’ behavioural intention to use mobile banking. A partial least squares structural equation modelling analysis was used to test the theoretical model with sample data from 420 online banking customers of various public, private, foreign and co-operative banks in India. The study found that the adoption factors had a significant impact on customers’ behavioural intention to use mobile banking. The findings of this study provide insight into digital banking channels, contribute to existing research on digital banking adoption and will educate banks and financial institutions on the adoption of mobile banking in India.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The internet and the wireless revolution have changed the way individuals communicate and interact. In relation to banks, technology has transformed how banks function and deliver banking services. The tremendous growth of information and communication technology, wireless technology and mobile devices has led to customers visiting bank branches less frequently. They now conduct most of their banking operations online. Smartphones, disruptive technologies such as AI and chatbots and voice-based payments are replacing physical banking with digital banking experiences. Online banking and mobile banking are two prominent digital banking channels that allow banking customers to conduct financial transactions at their convenience. Online banking (e-banking or Internet banking) uses the internet as a channel through which to offer banking products to customers via a website (Khan and Mahapatra 2009). Barnes and Corbitt (2003) defined mobile banking as “a channel whereby the customer interacts with a bank via a mobile device, such as a mobile phone or personal digital assistant.” Mobile banking is not an add-on to internet banking but rather a digital alternative to more traditional banking channels (Püschel et al. 2010). Mobile banking can reach a wider number of people due to the penetration of smartphones.

The Indian banking sector can take advantage of the proliferation of smartphones and the government’s encouragement of cashless transactions to accelerate the use of mobile and online banking. Mobile banking users exceeded 1.75 billion in 2019 around the world, and an emerging country like India has witnessed significant growth (Juniper Research 2019). In order to promote digital transactions, the Indian government has asked all Indian banks to provide mobile banking facilities to all their customers by the end of 2020. Mobile banking in India is presently a bank-led model implemented by the Reserve Bank of India (RBI)—the regulatory authority of banking in the country. To encourage the use of mobile banking, the RBI has removed daily transaction limits. This type of banking has great potential for India’s rural areas, where there is a general scarcity of bank branches. Most of India’s rural population uses smartphones to access the internet owing to the availability and affordability of these devices. Hence, banks, telecom service providers, and the RBI can avail great opportunities through mobile banking for the unbanked populations of rural India (IBEF 2019). India is forecasted to be ahead in growth with regard to digital transaction value as compared to China and the USA by 2023 (KPMG 2019).

Among the 640 million active banking customers in India, only 12% use online and mobile banking (BCG 2019). It is expected that in 2020, roughly 150 million urban banking customers will actively use both online and mobile banking due to improved technological infrastructure (e.g., internet connectivity, smartphone penetration and improved digital payment resources) (BCG 2019). However, as per the BCG CCI digital banking survey (2016), 56% of respondents were dissatisfied with their mobile banking experience and 48% were unhappy with their online banking experience. The reasons behind the low levels of adoption and high levels of dissatisfaction with online and mobile banking channels are lack of awareness of and trust in these banking channels, lack of transparency of the channels and inadequate security measures.

Though banks have a tremendous opportunity to build a large customer base through digital customers, if they do not address customer experiences of digital banking channels, they will lose their customer base to competitors such as mobile wallet providers. Mobile banking adoption is still in the emergent stage in India, whereas online banking has surpassed this stage. Internet penetration through smartphones is very high compared to the penetration and usage of the internet on computers (InMobi 2019). Previous studies have explored online and mobile banking adoption in both developed and emerging economies (Bharti 2016; Tran and Corner 2016; Oruç and Tatar 2017; Hamidi and Safareeyeh 2019). In relation to conducting banking transactions, it has been found that mobile banking has not reached a level of maturity globally and has a low adoption and diffusion rate, especially in emerging economies (Cruz et al. 2010; Tran and Corner 2016; Hassan and Wood 2020; Shankar et al. 2020). Thus, numerous studies have explored online banking customers’ intention to use mobile banking (Laforet and Li 2005; Cruz et al. 2010; Harris et al. 2016; Danyali 2018). However, few studies have addressed this phenomenon in India specifically.

The purpose of this study is to identify whether current online banking customers intend to use mobile banking in India and which factors influence their adoption of this form of banking. Banks are permitted to offer mobile banking services (through SMS, USSD, or mobile banking applications) in India. The accelerating growth of mobile phones and broader coverage of mobile networks have made mobile banking an acceptable platform for every customer segment in India. Existing bank customers who use online banking would also prefer to use mobile banking due to the specific feature of the mobile device of being “on-the-go” and anywhere and anytime. Hence, it is essential to understand the current online banking users’ intention towards mobile banking. The results of this study will provide an insight into the expectations of digital banking customers. This study will also enable banks to devise strategies to promote the adoption and improvement in customer experiences in both mobile and online banking. The study’s findings can be subsequently used to promote mobile banking in both rural and urban regions in India.

Theoretical background and hypotheses development

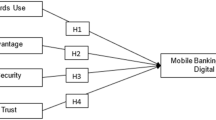

The theoretical framework of this research is based on the technology acceptance model (TAM) (Davis 1989). The main strength of this model is that it can be used to evaluate customers’ desire to use all types of information technology and/or information systems. It states that the willingness of an individual to use technology is specific to the information system (IS) context and consists of five constructs—perceived usefulness, perceived ease of use, attitude, intention to use and actual use. Researchers have extended the TAM model by adding additional constructs and combining it with other theories, examining other mediators or determining the antecedents to perceived usefulness and perceived ease of use. Mobile banking is a new, cutting-edge and complex technology-enabled information system. Thus, to understand customers’ behavioural intention to use mobile banking, this study extended the TAM model by applying the constructs of perceived ease of use (Davis 1989), self-efficacy (Bandura 1986), social influence (Venkatesh et al. 2003), perceived security and customer support. Existing banking customers are likely to try out a new digital banking channel, such as mobile banking, if it is easy to use and they are confident they have the required skills to use it. To ensure use, mobile banking apps should also be secure and impervious to threats, such as device theft, phishing attacks, spyware and data leakage. When trying out a new banking channel, mobile banking customers typically seek out the opinions of others, look for more information about the said channel, rely on their bank for support and expect promotions. Previous studies have highlighted the importance of factors such as ease of use, self-efficacy, security and social influence for the adoption of mobile banking (Koksal 2016; Tran and Corner 2016; Zhang et al. 2018; Giovanis et al. 2019). The proposed theoretical model and research constructs formulated for the present study are shown below (Fig. 1).

Mobile self-efficacy

Mobile banking is a technology-enabled digital banking channel where technical expertise for using the mobile banking app is required. Mobile self-efficacy beliefs play a key role in a new user trying out this channel. Self-efficacy is defined as the “conviction that one can successfully execute the behaviour required to produce the outcomes” (Bandura 1977). Bandura goes on to say that “expectations of self-efficacy determine whether coping behaviour will be initiated, how much effort will be expended, and how long it will be sustained in the face of obstacles and aversive experiences” (Bandura 1977). Existing research has identified the influence that self-efficacy belief has on behavioural intentions (Jeong and Yoon 2013; Mutahar et al. 2018). Customers will only use a mobile banking service when they feel confident and believe themselves to have the necessary technical skills to do so. Hence, the following hypotheses are proposed.

H1

Mobile self-efficacy belief has a significant influence on customers’ behavioural intention to use mobile banking.

H1a

Mobile self-efficacy belief has a significant influence on customers’ perceived ease of use of mobile banking.

Perceived ease of use

Perceived ease of use is defined by Davis (1989) as “the degree to which a person believes that using a particular system would be free of effort.” Customers of internet banking expect mobile banking to be similar. Mobile banking apps that have clear and simple interfaces will encourage banking customers to try out mobile banking channels. Prior studies have shown that perceived ease of use significantly influences users when deciding to use a new information system (Hanafizadeh et al. 2014; Mortimer et al. 2015; Mutahar et al. 2018). Mobile banking systems should be simple and easy to use. Hence, the following hypothesis is proposed.

H2

Perceived ease of use has a significant influence on customers’ behavioural intention to use mobile banking.

Social influence

Social influence refers to the way in which an individual changes their behaviour based on the opinions of others in relation to said behaviour. Venkatesh et al. (2003) present subjective norms as forms of social influence that are derived from well-known theories of IS. Customers typically seek opinions from others about a new product or service and, as mobile banking represents a novel technological product for existing internet banking customers, they will typically seek out the opinions of others who have already used the service. Existing studies concerning mobile and internet banking have highlighted that social influence is an essential predictor of intention to use (Tan and Lau 2016; Tarhini et al. 2016). Hence, the following hypothesis is proposed.

H3

Social influence has a significant influence on customers’ behavioural intention to use mobile banking.

Perceived security

Extant literature has highlighted the influence of the security of online banking adoption on customers’ behavioural intention to use it (Sathye 1999; Wang et al. 2003; White and Nteli 2004; Pikkarainen et al. 2004; Cheng et al. 2006). Safety concerns in relation to mobile banking play a major role in its adoption as a service (Zhang et al. 2018). A mobile device that enables banking services poses various security threats, and customers may feel insecure using mobile banking if it does not have adequate security measures. Hence, the following hypothesis is proposed.

H4

Perceived security has a significant influence on customers’ behavioural intention to use mobile banking.

Customer support

Customer support is support offered in the form of guidelines, FAQs, help pages and personal assistance (Zeithaml et al. 2002; Santos 2003). As mobile banking is a digital banking channel for all customers, even existing ones, customers expect assistance and prompt service before and after using the service. Existing studies have also highlighted that customer support plays a major role in terms of initial acceptance of the service (Lin 2013; Ghani et al. 2017; Rahi and Ghani 2019). Hence, the following hypotheses are proposed.

H5

Customer support has a significant influence on customers’ behavioural intention to use mobile banking.

H5a

Customer support has a significant influence on the perceived security of mobile banking.

Research methodology

This study utilised a positivist research perspective, as it is quantifiable. The study used a quantitative method of data collection through a structured questionnaire to collect responses from existing online banking customers. The target respondents were Indian banking customers from the public sector, private sector, co-operative banks and foreign banks. The sample was collected throughout India and consisted of metro, urban and rural populations. This research used convenience sampling, one of the non-probability sampling methods, to select participants. In India, it is forbidden to disclose customer identities as per the guidelines of the Reserve Bank of India (RBI). In the absence of customer lists, it was challenging to reach banking customers who used online banking services. Given the lack of availability of a comprehensive banking customer list and the time and cost of collecting responses from each individual customer, this study used convenience sampling for collecting responses using the survey questionnaire. Earlier studies on mobile adoption from both developed and developing countries also used convenience sampling as the data collection approach (Chiu et al. 2017; Zhang et al. 2018). The aim of the study was explained to the respondents and participation was voluntary. They were informed that the sample of responses would be used only for this research. A qualifying question (“Do you use online banking?”) was used to identify respondents who used online banking services. Another question (“If available, do you have the resources necessary to use mobile banking?”) was asked to ascertain the willingness of customers to use mobile banking. A total of 500 questionnaires were distributed using a combination of self-administered methods and e-mailing the authors’ personal contacts. The hard copies of the questionnaire were distributed using the researcher’s personal contacts residing in various locations in India. A Google form was created of the questionnaire and distributed through the researcher’s personal contacts. Responses from customers who did not use online banking were discarded, thus leaving 420 responses with a response rate of 84%. The sample size is robust and in line with the considerations of Nunnally (1978), as cited in Hinkin (1998).

Survey-based research is susceptible to common method bias where respondents fill out survey questionnaires by themselves (Podsakoff et al. 2003). Harman’s single-factor test was conducted to examine the study’s common method bias (CMB). An exploratory factor analysis was conducted on all items of the measured constructs, and the results showed that more than one factor with an eigenvalue greater than one was extracted and no single factor accounted for a significant variance. Hence, CMB was not a concern in this study.

Variable measurement

The theoretical constructs used in this study were measured using the validated items from a previous research (Table 1). The adapted items were rephrased to better suit the needs of the current study. Likert scales were used to measure the responses, as these scales are widely used in marketing and social science research (Garland 1991). The present study used a 7-point Likert scale ranging from 1 to 7 (where 1 = strongly disagree and 7 = strongly agree) to measure the theoretical constructs. A total of 16 items were developed to capture the factors that influence adoption.

The questionnaire was presented to academics and practitioners in the field of IS and marketing in order to evaluate their perceptions of the topic of the study and assess the questionnaire’s measurability and context. The questionnaire was also pre-tested by collecting responses from five internet banking customers and five non-internet banking customers to check its wording, sequencing and completeness. Based on the feedback from respondents, the sequencing of the questionnaire was modified, ambiguous questions deleted and some of the wording changed. The feedback thus improved the clarity, relevance and consistency of the questionnaire. The multi-item scale was tested for reliability and validity. The mobile banking adoption scale was then shown to a panel of experts to judge the appropriateness of the scale, thus establishing its content validity.

The primary data collected from the questionnaire were tabulated and analysed using the Statistical Package for Social Sciences, version 24.0. Structural equation modelling (SEM) was used to test the theoretical model, and partial least squares (PLS)-SEM path modelling was used to measure the relationship between the constructs and test the conceptual model. Smart PLS 3 software was used (Ringle et al. 2015) to examine the theoretical model. As the study was exploratory in nature and as the aim was to identify the key constructs that predict mobile banking adoption, PLS-SEM was more suitable than covariance-based SEM (CB-SEM) (Hair et al. 2011).

Findings

The user profiles of the 420 respondents were studied. Most of the users were male (75%), which is consistent with previous studies on online and mobile banking usage (Laforet and Li 2005; Laukkanen and Mika 2008) (Table 2). In total, 43.81% of respondents regularly used online banking, while 36.43% used online banking on an occasional basis. In total, 19% of respondents were willing to try out a new form of banking such as mobile banking and 44% were somewhat interested in trying out a new form of banking.

Measurement model analysis

The reliability of the theoretical constructs was assessed by computing the composite reliability of each latent construct. The recommended value of the composite reliability coefficient was above 0.70 (Hair et al. 2006). The composite reliability obtained for each construct (Table 3) was above the cut-off point of 0.70. Average variance extracted (AVE) is a measure complementary to the composite reliability and reflects the overall amount of variance in the indicators accounted for by the latent construct (Hair et al. 2006). The AVE value of a construct should exceed 0.50 (Hair et al. 2006). The AVE obtained for the constructs exceeded the cut-off point of 0.50 (Table 3).

The validity of the measurement model was established by estimating the convergent validity and discriminant validity. The convergent validity of the measurement model is estimated by calculating the composite reliability of each construct and the average variance extracted by each construct. The composite reliability of all constructs was above the recommended value of 0.70, and the average variance extracted exceeded the cut-off point of 0.50 (Fornell and Larcker 1981). Hence, the convergent validity of the measurement model was established.

The discriminant validity was assessed by comparing the shared variance between the constructs and the average variance extracted from the individual constructs (Fornell and Larcker 1981). The results (Table 4) revealed that the shared variance between the constructs was lower than the average variance extracted from the individual constructs. Hence, the discriminant validity of the measurement model was established.

Assessment of structural model

PLS-SEM with a non-parametric bootstrapping method with 5000 samples was used to test the theoretical model. The path coefficients are given in Table 5. Perceived ease of use, perceived security, mobile self-efficacy and social influence were significant, with a p value of < 0.01 (hypotheses H1–H4), thus indicating that these constructs had a significant impact on the behavioural intention to use mobile banking. Among constructs that influenced mobile banking usage, perceived security emerged as the highest predictor (β = 0.442, p = 0.000), followed by perceived ease of use (β = 0.173, p = 0.000). Mobile self-efficacy had a significant influence on perceived ease of use (β = 0.562, p = 0.000) and, similarly, customer support had a significant influence on perceived security (β = 0.562, p = 0.000). However, customer support was not significant (p = 0.324) and did not directly influence the theoretical model.

The R2 value obtained during the structural model analysis (Fig. 2) represents the proportion of total variation in the dependent variable accounted for by the independent variables. The R2 values obtained were 0.554, 0.316 and 0.316 for behavioural intentions, perceived ease of use and perceived security, respectively. The R2 value obtained was 0.554, thus implying that mobile self-efficacy, perceived ease of use, social influence and perceived security together explained 55.4% of the variation in the dependent variable of behavioural intention to use mobile banking.

Stone–Geisser’s Q2 value (Geisser 1974; Stone 1974) was computed to validate the predictive relevance of the model by running a blindfolding technique with an omission distance of eight. The Q2 value obtained for the endogenous variable of behavioural intention was 0.388, which was greater than zero, thus indicating that the model had predictive relevance.

Mediation analysis

In order to assess the mediation effect in the theoretical model, the bootstrapping method in PLS-SEM was used. This method does not make any assumptions regarding the sampling distribution and works well with small sample sizes (Hair et al. 2013). Variance accounted for (VAF) was used with the following equation (Hair et al. 2013) to examine the mediation analysis.

If the VAF value is less than 0.2, there is no mediation. If the value is greater than or equal to 0.2 and less than or equal to 0.8, then there is partial mediation. If the value is greater than 0.8, then there is full mediation (Hair et al. 2013).

The VAF value was calculated (Table 6) to ascertain the mediation effect of the variable perceived ease of use on the relationship between mobile self-efficacy and behavioural intention to use mobile banking systems. The VAF value obtained was 0.37, which indicates that perceived ease of use partially mediated the relationship between mobile self-efficacy and behavioural intentions. The mediation effect of perceived security on the relationship between customer support and behavioural intention led to a VAF value of 1.21, thus indicating full mediation. Perceived security fully mediated the relationship between customer support and behavioural intention to use mobile banking systems.

Discussion

The objective of the current study was to explore the behavioural intention of current online banking customers in India in relation to the adoption of mobile banking. Previous studies have corroborated that mobile banking adoption is still in the emergent stage all over the world, so further studies must be conducted to understand mobile banking adoption for existing online banking customers (Laforet and Li 2005; Cruz et al. 2010; Harris et al. 2016; Danyali 2018).

This study extended the TAM model using the additional constructs of mobile self-efficacy, social influence, perceived security and customer support. The integrated model of this study showed strong empirical evidence to predict customers’ behavioural intention to use mobile banking systems, with an R2 value of 0.554. The empirical result shows that the integrated model has a high level of explanatory power in terms of customers’ behavioural intention to use mobile banking systems. In this theoretical model, perceived security and perceived ease of use were strong predictors of behavioural intention. These were followed by the predictors social influence and mobile self-efficacy. Perceived security ranked as the highest predictor of behavioural intention to use mobile banking. Customers of online banking and mobile banking face various security threats, including online fraud, identity theft, phishing, malware and viruses. Online and mobile banking should have robust security mechanisms that enhance the trust and confidence of customers. Previous research has also highlighted the importance of security with regard to the intention to use mobile banking (Shankar and Kumari 2016; Bhatt and Bhatt 2016; Zhang et al. 2018). In this study, it was also found that perceived ease of use significantly influenced online banking customers in terms of using mobile banking. Easy and simple mobile banking apps motivate customers to use mobile banking, as they can conduct financial transactions on the move. Previous studies have also pointed out that perceived ease of use influences customers’ use of new digital banking channels, such as mobile banking (Hanafizadeh et al. 2014; Mortimer et al. 2015; Mutahar et al. 2018).

Social influence was a primary predictor of the behavioural intention to use mobile banking. Awareness plays a significant role in the adoption of new digital banking channels when monetary transactions are involved. Customers feel confident if they know that their friends and family use mobile banking, which is in line with the findings of previous studies (Tan and Lau 2016; Tarhini et al. 2016). Mobile self-efficacy beliefs significantly influenced customers’ intention to use mobile banking. Prior research on mobile banking adoption also found this to be the case (Alalwan et al. 2015; Koksal 2016). The use of mobile banking increases when online banking customers have sufficient confidence in the mobile banking system. This study also revealed that mobile self-efficacy beliefs significantly influenced the perceived ease of use of mobile banking. It is apparent that when a customer is confident in using mobile banking, their perceptions regarding the ease of the system will also increase.

In this study, customer support did not influence customers’ behavioural intention to use a mobile banking system, but it significantly influenced their security perceptions. This may be because the mobile device is a personal gadget and therefore using mobile banking apps might not require assistance. Regarding security threats of mobile apps, customers require technical assistance and support when using them. Hence, perceived security fully mediated the relationship between customer support and behavioural intention to use mobile banking.

Study implications

The results of the current study will help academics and practitioners explain, understand and elucidate the status of mobile banking and formulate appropriate strategies to expedite the use of mobile and internet banking. The theoretical implications of this study are as follows: The study extended the TAM model in the context of mobile banking. Prior studies have argued that extending the original TAM model by adding additional constructs from related models improves the explanatory power (Khasawneh 2015; Koksal 2016; Baabdullah et al. 2019; De Leon 2019). This study empirically proved in the mobile banking context that the explanatory power of the TAM model is improved by adding the constructs social influence, mobile self-efficacy and perceived security. Previous studies have extensively studied the factors affecting the intention to use mobile banking. However, few studies have accurately explored online banking customers’ intention to use mobile banking in India. This study also established a relationship, which has not been addressed in previous studies, between customer support and perceived security. The current study is likely one of the few studies to explore online and mobile banking in India.

The findings of the study have implications for banks, financial institutions, technology developments and security experts. Banks should improve the service quality of online banking with a secure website, comprehensive instructions, user-friendly interface and prompt customer service. The improvement in service quality through increased responsiveness, efficiency and credibility automatically leads to customer satisfaction with online banking services, thus giving individual banks a competitive advantage. An adequate system of customer support, a precise web interface and a robust security framework will increase customer satisfaction with online banking. Among the adoption factors of mobile banking, perceived security is ranked as the highest, followed by perceived ease of use. Online and mobile banking face many security threats. Thus, technological advancements in these channels should ensure adequate security mechanisms to avoid payment and wireless security issues, device theft and data breaches. Banks can attract existing customers to mobile banking by offering them incentives and credit points. Banks should spread awareness of these new channels through various media platforms to increase the use of mobile banking.

Limitations and future directions

The limitations of the present study and their implications for future research are as follows: The first limitation is that most of the sample was derived from metro regions, while the intention to use online and mobile banking may differ in rural areas. Second, convenience sampling was used as the sampling method, so the generalisability of the findings is low. Future research should measure the service quality of mobile banking and link this to customer satisfaction, which will help accelerate the usage of mobile banking.

Conclusion

Mobile banking is an emerging service that is not yet widely adopted in India, and there is a need to determine the adoption factors that influence consumers to use it. To address this research need, the study identified these factors and their influence on the acceptance of mobile banking services. The present study developed a research framework to understand the factors that contribute to online banking users’ intention to use mobile banking. The factors identified to provide a comprehensive view of the key drivers influencing mobile banking usage intentions and the elements that should be considered to increase usage. Through the specification of these relationships, the study addresses a significant gap in the extant research.

References

Alalwan, A., Y. Dwivedi, N. Rana, B. Lal, and M. Williams. 2015. Consumer adoption of Internet banking in Jordan: Examining the role of hedonic motivation, habit, self-efficacy and trust. Journal of Financial Services Marketing 20(2): 145–157.

Baabdullah, A.M., A.A. Alalwan, N.P. Rana, P. Patil, and Y.K. Dwivedi. 2019. An integrated model for m-banking adoption in Saudi Arabia. International Journal of Bank Marketing 37(2): 452–478.

Bandura, A. 1977. Self-efficacy: Toward a unifying theory of behavioral change. Psychological Review 84(2): 191–215.

Bandura, A. 1986. Social foundations of thought and action. Upper Saddle River, NJ: Prentice-Hall.

Barnes, S., and B. Corbitt. 2003. Mobile banking: Concept and potential. International Journal of Mobile Communications 1(3): 273.

BCG. 2019. Encashing on Digital: Financial services in 2020. The Boston Consulting Group, Facebook.

Bharti, M. 2016. Impact of dimensions of mobile banking on user satisfaction. The Journal of Internet Banking and Commerce 21(1): 1–22.

Bhatt, A., and S. Bhatt. 2016. Factors affecting customers adoption of mobile banking services. The Journal of Internet Banking and Commerce 21(1): 161.

Chen, L. 2008. A model of consumer acceptance of mobile payment. International Journal of Mobile Communications 6(1): 32.

Cheng, T., D. Lam, and A. Yeung. 2006. Adoption of internet banking: An empirical study in Hong Kong. Decision Support Systems 42(3): 1558–1572.

Chiu, J.L., N.C. Bool, and C.L. Chiu. 2017. Challenges and factors influencing initial trust and behavioral intention to use mobile banking services in the Philippines. Asia Pacific Journal of Innovation and Entrepreneurship 11(2): 246–278.

Compeau, D., and C. Higgins. 1995. Computer self-efficacy: Development of a measure and initial test. MIS Quarterly 9(2): 189.

Cruz, P., L.B.F. Neto, P. Munoz-Gallego, and T. Laukkanen. 2010. Mobile banking rollout in emerging markets: Evidence from Brazil. The International Journal of Bank Marketing 28(5): 342–371.

Danyali, A.A. 2018. Factors influencing customers’ change of behaviors from online banking to mobile banking in Tejarat Bank, Iran. Journal of Organizational Change Management 31(6): 1226–1233.

Davis, F.D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13: 319–340.

De Leon, M.V. 2019. Factors influencing behavioural intention to use mobile banking among retail banking clients. Jurnal Studi Komunikasi 3(2): 118–137.

Fornell, C., and D.F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50.

Garland, R. 1991. The mid-point on a rating scale: Is it desirable. Marketing Bulletin 2(1): 66–70.

Geisser, S. 1974. A predictive approach to the random effect model. Biometrika 61(1): 101–107.

Ghani, M.A., S. Rahi, N.M. Yasin, and F.M. Alnaser. 2017. Adoption of internet banking: extending the role of technology acceptance model (TAM) with e-customer service and customer satisfaction. World Applied Sciences Journal 35(9): 1918–1929.

Giovanis, A., P. Athanasopoulou, C. Assimakopoulos, and C. Sarmaniotis. 2019. Adoption of mobile banking services. International Journal of Bank Marketing 37(5): 1165–1189.

Hair, J.F., R. Anderson, R. Tatham, and W. Black. 2006. Multivariate data analysis. 6th ed. Upper Saddle River, NJ: Prentice Hall.

Hair, J., C. Ringle, and M. Sarstedt. 2011. PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice 19(2): 139–152.

Hair, J.F., C.M. Ringle, and M. Sarstedt. 2013. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning 46(1–2): 1–12.

Hamidi, H., and M. Safareeyeh. 2019. A model to analyze the effect of mobile banking adoption on customer interaction and satisfaction: A case study of m-banking in Iran. Telematics and Informatics 38: 166–181.

Hanafizadeh, P., M. Behboudi, A. Abedini Koshksaray, and M. Jalilvand ShirkhaniTabar. 2014. Mobile-banking adoption by Iranian bank clients. Telematics and Informatics 31(1): 62–78.

Harris, M., K.C. Cox, C.F. Musgrove, and K.W. Ernstberger. 2016. Consumer preferences for banking technologies by age groups. International Journal of Bank Marketing 34(4): 587–602.

Hassan, H.E., and V.R. Wood. 2020. Does country culture influence consumers’ perceptions toward mobile banking? A comparison between Egypt and the United States. Telematics and Informatics 46: 1–14.

Hinkin, T. 1998. A brief tutorial on the development of measures for use in survey questionnaires. Organizational Research Methods 1(1): 104–121.

Hong, S., and K. Tam. 2006. Understanding the adoption of multipurpose information appliances: The case of mobile data services. Information Systems Research 17(2): 162–179.

IBEF. 2019. Banking. India Brand Equity Foundation.

InMobi. 2019. The changing face of the Indian mobile user 2019 Mobile Marketing Handbook, Inmobi.

Jayawardhena, C. 2004. Measurement of service quality in internet banking: The development of an instrument. Journal of Marketing Management 20(1/2): 185–207.

Jeong, B.K., and T.E. Yoon. 2013. An empirical investigation on consumer acceptance of mobile banking services. Business and Management Research 2(1): 31–40.

Juniperresearch.com. 2019. Mobile banking users to exceed 1.75 billion by 2019, representing 32% of the global adult population. [online] https://www.juniperresearch.com/press-release/digital-banking-pr1. Accessed 20 March 2019.

Khalifa, M., and K.N. Shen. 2008. Drivers for transactional B2C m-commerce adoption: Extended theory of planned behavior. Journal of Computer Information Systems 48(3): 111.

Khan, M.S., and S.S. Mahapatra. 2009. Service quality evaluation in internet banking: an empirical study in India. International Journal of Indian Culture and Business Management 2(1): 30–46.

Khasawneh, M.H.A. 2015. A mobile banking adoption model in the jordanian market: An integration of TAM with perceived risks and perceived benefits. Journal of Internet Banking and Commerce 20: 128.

Koksal, M. 2016. The intentions of Lebanese consumers to adopt mobile banking. International Journal of Bank Marketing 34(3): 327–346.

KPMG. 2019. Fintech in India—Powering mobile payments. KPMG.

Laforet, S., and X. Li. 2005. Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing 23(5): 362–380.

Laukkanen, Tommi, and Pasanen Mika. 2008. Mobile banking innovators and early adopters: How they differ from other online users? Journal of Financial Services Marketing 13(2): 86–94.

Lin, H.F. 2013. Determining the relative importance of mobile banking quality factors. Computer Standards and Interfaces 35(2): 195–204.

Luarn, P., and H.H. Lin. 2005. Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior 21(6): 873–891.

McKnight, D., V. Choudhury, and C. Kacmar. 2002. Developing and validating trust measures for e-commerce: An integrative typology. Information Systems Research 13(3): 334–359.

Mortimer, G., L. Neale, S. Hasan, and B. Dunphy. 2015. Investigating the factors influencing the adoption of m-banking: A cross cultural study. International Journal of Bank Marketing 33(4): 545–570.

Mutahar, A., N. Daud, R. Thurasamy, O. Isaac, and R. Abdulsalam. 2018. The mediating of perceived usefulness and perceived ease of use. International Journal of Technology Diffusion 9(2): 21–40.

Nunnally, J. 1978. Psychometric theory. New York, NY: McGraw-Hill.

Oruç, Ö.E., and Ç. Tatar. 2017. An investigation of factors that affect internet banking usage based on structural equation modeling. Computers in Human Behavior 66: 232–235.

Pikkarainen, T., K. Pikkarainen, H. Karjaluoto, and S. Pahnila. 2004. Consumer acceptance of online banking: An extension of the technology acceptance model. Internet Research 14(3): 224–235.

Podsakoff, P., S. MacKenzie, J. Lee, and N. Podsakoff. 2003. Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology 88(5): 879–903.

Püschel, J., J. Afonso Mazzon, C. Mauro, and J. Hernandez. 2010. Mobile banking: proposition of an integrated adoption intention framework. International Journal of Bank Marketing 28(5): 389–409.

Rahi, S., and M.A. Ghani. 2019. Investigating the role of UTAUT and e-service quality in internet banking adoption setting. The TQM Journal 31(3): 491–506.

Ringle, C., S. Wende, and J. Becker. 2015. SmartPLS 3 (Version 3.2. 3). Boenningstedt: SmartPLS GmbH.

Santos, J. 2003. E-service quality: a model of virtual service quality dimensions. Managing Service Quality: An International Journal 13(3): 233–246.

Sathye, M. 1999. Adoption of Internet banking by Australian consumers: An empirical investigation. International Journal of Bank Marketing 17(7): 324–334.

Shankar, A., C. Jebarajakirthy, and M. Ashaduzzaman. 2020. How do electronic word of mouth practices contribute to mobile banking adoption? Journal of Retailing and Consumer Services 52: 101920.

Shankar, A., and P. Kumari. 2016. Factors affecting mobile banking adoption behavior in India. The Journal of Internet Banking and Commerce 21(1).

Stone, M. 1974. Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society. Series B (Methodological) 36(2): 111–133.

Tan, E., and J.L. Lau. 2016. Behavioural intention to adopt mobile banking among the millennial generation. Young Consumers 17(1): 18–31.

Tarhini, A., M. El-Masri, M. Ali, and A. Serrano. 2016. Extending the UTAUT model to understand the customers’ acceptance and use of internet banking in Lebanon. Information Technology and People 29(4): 830–849.

Tran, H.T.T., and J. Corner. 2016. The impact of communication channels on mobile banking adoption. International Journal of Bank Marketing 34(1): 78–109.

Venkatesh, V., and F. Davis. 1996. A model of the antecedents of perceived ease of use: Development and test. Decision Sciences 27(3): 451–481.

Venkatesh, V., and F.D. Davis. 2000. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science 46(2): 186.

Venkatesh, V., M. Morris, G. Davis, and F. Davis. 2003. User acceptance of information technology: Toward a unified view. MIS Quarterly 27(3): 425–478.

Wang, Y.S., Y.M. Wang, H.H. Lin, and T.I. Tang. 2003. Determinants of user acceptance of internet banking: an empirical study. International Journal of Service Industry Management 14(5): 501–519.

White, H., and F. Nteli. 2004. Internet banking in the UK: Why are there not more customers? Journal of Financial Services Marketing 9(1): 49–56.

Zeithaml, V.A., A. Parasuraman, and A. Malhotra. 2002. Service quality delivery through web sites: A critical review of extant knowledge. Journal of the Academy of Marketing Science 30(4): 362–375.

Zhang, T., C. Lu, and M. Kizildag. 2018. Banking “on-the-go”: Examining consumers’ adoption of mobile banking services. International Journal of Quality and Service Sciences 10(3): 279–295.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Singh, S., Srivastava, R.K. Understanding the intention to use mobile banking by existing online banking customers: an empirical study. J Financ Serv Mark 25, 86–96 (2020). https://doi.org/10.1057/s41264-020-00074-w

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41264-020-00074-w