Abstract

This paper is the first to identify and classify nearly all investment instruments held by equity funds by investigating their portfolio holdings. This enables us to analyze the effects of long and short exposures from different complex instruments including short sales, options and futures but also previously neglected derivatives like warrants and units on funds’ risk, performance and other characteristics. These analyses are of general interest, especially in the light of ongoing discussions regarding further regulation of complex instrument use by mutual funds. Our empirical analyses document that on average more than 40% of funds use complex instruments. However, relative to their total assets, funds’ average exposure from such positions is very small with values below 2%. Consequentially, the effects of instruments are often weaker than suggested by previous research or even show opposite directions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction and literature overview

This is the first study to identify and classify almost all types of trivial and complex investment instruments used by mutual funds. This enables us to shed new light on the effects of the combined use of such instruments on funds’ risk, performance and other characteristics. Overall, the use of complex instruments is widespread among mutual funds with over 40% of funds using some instrument at some point. However, the magnitude in terms of actual exposure is very small even in the extremes. Consequentially, while confirming some of the results of previous research, our results suggest that the reported effects are actually much weaker in economic and statistical terms. Some of our results even contradict previous research.

Our work offers four specific extensions to previous research of mutual funds’ use of complex instruments. First, using an extensive holdings dataset for 2707 US domestic equity mutual funds and a very detailed identification algorithm, we identify and classify 34 different types of investment instruments used by these funds. Those include long and short equity, different types of bonds and other funds, cash and a broad range of derivatives and other nonlinear investments with different types of underlying. Our final identification covers practically all (> 99.50%) of the reported fund holdings. Thus, we know exactly how the portfolio of each fund is constructed. Second, as we classify all complex instruments, we provide evidence on the effects of previously neglected instrument types, especially warrants and units, which we find are more popular among mutual funds than, e.g., options and swaps. Third, previous research has usually investigated the influence of options, futures, short selling or security lending on funds separately. By considering all instrument types, we are able to show also potential combined effects. Fourth, previous research measured complex instrument use mostly with crude indicator variables. Contrarily, we consider the exact exposure funds obtain with each instrument.

Equity mutual funds invest their money in various securities including equities, bonds or other funds with a trivial (linear and unlevered) payoff profile as well as complex (nonlinear and/or levered) instruments like futures, options, and other derivatives. Previous research has already investigated how funds’ complex investments influence fund characteristics, especially risk and performance. For instance, Chen (2011) and Aragon and Martin (2012) show significantly lower risk for hedge funds if they use derivatives. However, hedge funds are not regulated by the SEC and are therefore less restricted in their use of derivatives.Footnote 1 Natter et al. (2017) show that bond mutual funds increase their interest rate risk by using interest rate futures. However, bond funds show a very different risk exposure compared to equity funds. Therefore, we cannot transfer these findings directly to equity mutual funds.

Most existing studies covering US equity mutual funds use derivative information based on mandatory semiannual N-SAR filings to the SEC.Footnote 2 Therefore, their research models mostly include indicator variables rather than the magnitude of the investment. Reasons for funds to use derivatives are widespread, e.g., using hedging option strategies such as covered calls and protective puts to lower their risk while selling options to gain option premium (Natter et al. 2016). Rohleder et al. (2017) show that funds may use futures or options to manage flow risk. One of the most recent studies regarding the nonlinear investments of mutual funds investigates the influence of allowance of leverage, derivatives and illiquid securities on different fund characteristics (Calluzzo et al. 2019).

One of the few studies using holdings information is conducted by Cici and Palacios (2015). They focus solely on option usage, distinguishing long and short call and put options. Despite using holdings, however, they condense option usage into indicator variables while ignoring the levels of funds’ option exposures. They do not find any significant differences in performance for funds using options except for funds writing puts, which is the least popular of the four types according to their and our findings. Their identification process for option positions is similar to ours but less accurate. They identify only 250 funds, about 10% of their sample, as option users, while we can identify over 19% of our sample funds as option users.

Chen et al. (2013) examine 323 equity mutual funds during the period from 1994 to 2016, which exhibit significant abnormal returns when selling equities short. In contrast, funds that lend securities instead of selling them (short) underperform otherwise similar funds according to Evans et al. (2017). Elton et al. (2018) show that some funds invest in other actively managed funds and that these funds underperform when investing within the fund family. Similarly, Sherrill et al. (2017) show that around 38% of all actively managed mutual funds hold exchange-traded funds (ETFs) in their portfolio and that funds excessively investing in these passive investments underperform.

We organize the remainder of this paper as follows. “Data and methodology” section presents the sample construction and the different performance and risk measures. “The first all-embracing overview of mutual funds’ exposure to complex instruments” section provides the first all-embracing overview of funds’ exposure to complex instruments. “Disentangling the sources of mutual funds’ exposure to risk” section analyzes how the funds’ exposures to the different instruments affects funds’ risk. “The effect of complex instruments on fund performance” section relates complex instrument exposures to funds’ performance. “Complex instruments and other fund, family and management characteristics” section sheds light on the relations between complex instrument exposures and other fund, manager and family characteristics. “Conclusion” section concludes.

Data and methodology

Sample construction

We obtain mutual fund data from two different sources, the Center for Research in Security Prices Mutual Fund Database (CRSP) and Morningstar (MSTAR). We match the databases on share class level using CUSIPs following Pastor et al. (2015) and Berk and van Binsbergen (2015). Both databases are free of survivorship bias. From CRSP, we obtain share class-level monthly returns, monthly total net assets (TNA), further characteristics like turnover and fees as well as fund family information. From MSTAR, we obtain share class-level daily return indices and daily TNA as well as historical manager information. We aggregate all share class-level data on portfolio level using TNA weights and the MSTAR share class portfolio map.

Most importantly, we obtain portfolio-level holdings from MSTAR. Among a wide range of security-level information, the database reports the name, the exposure, the number of shares, the holding type and different identifiers (e.g., ISIN) for each holding position. This distinguishes the MSTAR holdings from most other databases, which only report common stock holdings. The MSTAR holdings data are usually reported monthly or quarterly. To map nonmonthly reports to monthly fund characteristics, we assume that exposures change linearly between consecutive quarterly reports and that funds trade in the middle of the month.Footnote 3

The MSTAR holdings data start in the early 1980s. However, we limit our sample to the period from 1998 to 2015 due to the repeal of the short–short rule under the Taxpayer Relief Act of 1997, which facilitated short-term investments and made derivatives more attractive to mutual funds. Further, we conduct several screens to ensure high data quality. Specifically, we only consider US domestic equity funds according to the CRSP Objective Code. Additionally we exclude all funds with an average over time of less than 80% of exposure in equity. As in Fama and French (2010) we exclude funds before they first surpass a threshold of $5 million TNA to mitigate incubation bias (Evans, 2010). We also exclude funds with less than 24 monthly returns during our sample period. The final dataset contains 2707 funds with 365,893 monthly observations. Summary statistics of the funds’ characteristics are reported in Panel A of Table 1 and are overall in line with the related literature (Rohleder et al. 2017; Natter et al. 2016).

One of the major contributions of this paper is the precise identification and classification of all holdings positions. Therefore, we use the holding type reported by MSTAR, several string searching algorithms as well as manual checks to ensure correct identification and classification. Our approach leads to an identification rate of over 99.5% of the holding positions as reported in Panel B of Table 1.Footnote 4 Over 96% of all held positions are common equity, around one percent is different types of bonds and around another percent are complex investments such as options, futures and repurchase agreements (repos). Around 0.9% of all positions are cash or money market funds. We provide detailed summary statistics on the number of funds’ holdings positions and exposures to these holding types in “The first all-embracing overview of mutual funds’ exposure to complex instruments” section.

Performance and risk measures

We use the monthly standard deviation \(\sigma_{i,t}\) as a measure of the overall risk of the respective fund i in month t. As one of the performance measures, we calculate the Sharpe ratio introduced by Sharpe (1966) following Eq. (1)

where \({\text{ER}}_{i,t}\) is the monthly excess net returnFootnote 5 of fund i over the risk-free rate in month t.

We estimate further measures of performance and systematic risk based on daily returns using the CAPM following Jensen (1968) (Eq. 2), the Fama and French (2010) 3-factor model (Eq. 3) and the Carhart (1997) 4-factor model (Eq. 4). In those models, \({\text{ER}}_{i,d,t}\) is the net fund return of fund i over the risk-free rate on day d within month t, \({\text{ER}}_{Mkt,d,t}\) is the daily market excess return, \({\text{SMB}}_{d,t}\) is the size factor, \({\text{HML}}_{d,t}\) is the value factor, and \({\text{UMD}}_{d,t}\) is Fama and French’s version of the Carhart momentum factor.Footnote 6\(\alpha_{i,t}^{\text{CAPM}}\), \(\alpha_{i,t}^{\text{FF}}\), \(\alpha_{i,t}^{C}\), \(\beta_{Mkt,i,t}^{\text{CAPM}}\), \(\beta_{Mkt,i,t}^{\text{FF}}\) and \(\beta_{Mkt,i,t}^{C}\) are the main parameters of interest and specify our measures of risk-adjusted performance and systematic market risk of fund i in month t.

Table 2 Panel A shows pooled descriptive statistics for the performance and risk measures. Regarding the magnitude the values are in line with existing literature and not very surprising (e.g., Natter et al. 2016). We further analyze the standard deviations of the performance and risk measures per fund (Panel B) and per period (Panel C). Panel B shows that there is considerable variation within funds on average as well as in the median. The same applies to Panel C, which shows that there is considerable variation between funds on average and in the median.

The first all-embracing overview of mutual funds’ exposure to complex instruments

How to read the reported exposures of the different instrument types

Before discussing the holdings in detail, it is important to provide some intuition about the exposure reported by MSTAR (Morningstar 2007, 2008). For long equity, this exposure is equivalent to the market value. The same logic applies to all other trivial positions like different types of bonds, mortgage-backed securities (MBS), other funds, cash and cash equivalent positions. We expect funds to have higher risk during periods with higher net long exposures in trivial exposure positions. For short equity, the exposure is the negative market value, and we therefore count short equity as a complex instrument with a leverage of minus one.

For levered complex instruments like derivatives, the calculation of the exposure differs by type. The way MSTAR reports specific derivatives relies on the notion of the duplication portfolio, which pairs a position in the underlying with an offsetting cash position.Footnote 7 A simplified interpretation of exposure in general is the potential payment if the contract matured at the time of reporting. Intuitively, this quantity is in line with the resulting payment risk.

In the case of futures and forwards MSTAR reports the economic exposure of the contract based on the price, the size and the number of contracts. The exposure therefore economically represents the future payment obligation of the fund. Units, which have been ignored by previous research, function similar to long futures. MSTAR defines units as “derivatives where the underlying instrument is a security issued by one of the counterparties. The issuer sells the unit to a buyer, who converts the unit for a prearranged amount of the underlying security at a prearranged price and date.”Footnote 8 Funds may buy and sell futures and forwards; however, they may only buy units. We expect that funds show higher risk during periods in which they are net long in futures, forwards and units.

In the case of options, MSTAR reports the delta-adjusted exposure resulting from the duplication portfolio.Footnote 9 Warrants, which have also been ignored by previous research, function similar to options. Warrants are attached to, e.g., preferred stocks or bonds and act as a sweetener for the buyer. Call warrants are written by a company or by a third party, giving the holder the right to purchase a stock, which will be issued in the future, at a predetermined price either on a specific date or during a specified period. Funds may buy and write common call and put options, while they may only buy call and put warrants. We expect that funds show higher risk during periods in which they are long in call options and call warrants as well as short in put options. Similarly, we expect lower risk during periods in which they are long in put options and put warrants as well as short in call options.

For swaps, MSTAR also reports the duplication portfolio, i.e., the underlying bond or stock-equivalent and an offsetting cash position. For repos, MSTAR does not provide precise information on how they specify the exposure. A repo usually includes selling a security to obtain cash and an agreement over the repurchase, which usually takes place after a short time. We assume that MSTAR reports the received cash position. Consequentially, we expect higher risk during periods with long exposures in swaps and short exposures in repos.

Mean exposures of the mutual fund market

Panel A of Table 3 shows the total numbers of holdings positions grouped into all types of trivial and complex vehicles, the mean long and short exposures as well as the mean net exposure reported by all funds during our sample period. As already indicated in Table 1, equity, cash and corporate bonds represent the majority of holdings position. As expected, they are mostly held long and represent the largest contribution to mutual funds’ exposure, with an average of 1.17 billion USD invested in equity, over 11 million USD invested in different types of bonds and over 24 million USD held in cash on average from 1998 to 2015. In addition to actual cash positions, funds hold large cash equivalent exposures through money market funds.Footnote 10 As already reported by Chen et al. (2013) mutual funds engage in short selling of equity far more than one would expect, resulting in an average short exposure of more than one million USD. According to Sherrill et al. (2017) and Elton et al. (2018) mutual funds tend to hold other actively managed funds or ETFs, which we also find in the portfolios of our sample funds with on average of almost 1.9 million USD.

Repos, short-term loans collateralized with financial securities which obligate the fund at a future date to rebuy the respective security, are widespread with over 80,000 positions. The exposure funds obtain with repos is the highest of all complex instruments with an average long exposure of over 5 million USD. Evans et al. (2017) already showed the increased interest of funds in repos, by which they gain short-term cash through lending securities to their repo counterparty.

MBS unlike normal bonds do not have a fixed maturity, as property owners have the right to sell or refinance their property at any time, which creates a more complex risk structure and nonlinear returns. When interest rates fall, property owners might refinance their property taking advantage of the lower cost of financing, resulting in a shortened term to maturity. Therefore, returns on MBS show an option-like character (Huij and Derwall, 2008) similar to short puts. As shown in Table 3, MBS have the third largest complex exposure with more than 1.5 million USD on average during our sample period.

Swaps are not as common as other derivatives with only 4698 total positions and an average net exposure of only 16 thousand USD. Moreover, more than 30% of all swap positions are currency swaps, which are most likely used by funds to hedge currency risks obtained from foreign stocks or bonds.

Funds obtain the second highest complex exposure from futures. Nearly half of the future positions are identified as currency futures, but they only account for 10% of the funds’ total future exposure, indicating that the individual contract size of the currency futures is small. Funds are mostly long in equity futures with an average net exposure of more than 1.3 million USD, while the short exposure is rather small with just over 300 thousand USD on average. Other futures on bonds and commodities or volatility index futures are not very common.Footnote 11

Options are the most used complex instruments with over 140,000 positions of which 93% are equity options. As documented in Panel B we can classify more than 98% of all options as either calls or puts. In total, 66% of all option positions are calls. Funds hold options with an average net short exposure, indicating they mainly use these derivatives to hedge long stock positions or to gain option premium. Funds achieve this net short exposure by writing calls resulting in an average short call exposure of 244 thousand USD. They also buy puts with an average exposure of more than 50 thousand USD, which does also result in a short exposure toward the underlying.

We document over 56,000 total warrant positions, which produce an average long exposure at the same level as the long exposure obtained with options. Furthermore, we identify about 33,000 unit positions with an average long exposure of more than 767 thousand USD.Footnote 12 Existing research like Cici and Palacios (2015), Natter et al. (2016) and Calluzzo et al. (2019) does not take that kind of exposure into account.

Exposure ratios and correlations between the instruments

In the following, we define exposure ratio as the exposure relative to the funds’ TNA to account for differences in fund sizes.

where \(exposure_{i,t,E}\) is the aggregated exposure of fund i in month t obtained by instrument E and \({\text{TNA}}_{i,t}\) is the total net asset.

Table 4 shows summary statistics for the exposure ratios. As expected, the average and median of the long equity exposure ratio are well above 95% while ranging between 65% and 190%. Consequentially, the average and median exposure ratios of the complex instruments are equal or close to zero in most cases. Funds obtain the highest average complex exposure ratio with repos with 0.59%; however, even the 95% percentile is below 4%. All other complex instruments show even lower exposure ratios on average and in each of the reported percentiles. Funds obtain the highest negative exposure with short equity with an average of –0.15% and a minimum of –76.43%. Some funds occasionally make excessive use of complex instruments, but these are rare exceptions as their average exposure is almost negligibly small, which questions the use of crude indicator variables in previous research.

To get an idea of how the exposures of complex investments act together, we next look at the mutual correlations. As we can see in Table 5 they are relatively small, indicating that funds use these instruments rather independently. However, there are some combinations with considerable correlations (i.e., |ρ| > 25%) where the instruments are functionally connected. Most importantly, higher long equity exposure nonsurprisingly correlates negatively with the exposures from short equity, bonds, MBS, other funds and cash. Moreover, higher exposure from short calls, i.e., less negative exposure, correlates positively with the exposure from short puts, which is also economically intuitive as these instruments speculate for opposite market developments.

Development of instrument use and exposure ratios over time

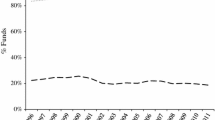

Figure 1 Panel A plots the percentage of funds using specific instruments over time. On average, around 40% of all funds use some types of complex instrument during a given month. Around 20% of the funds use repos, but the percentage has steadily declined since its last highpoint in 2002. Warrants and units are widespread among funds with more than 9% (6%) of all funds using warrants (units). In total, 5% of all funds are invested in long equity futures and less than 1% in short equity futures, while on average only 2% of all funds are short selling stocks. Overall, most of the using percentages are relatively stable over time but on a low level.

Panel B shows the average absolute exposure ratio for the observed instruments over time. Despite the fact that the usage of complex instruments is widespread among funds, the average exposure to complex instruments is rather small with less than 2%. The highest average exposure ratio derives from repos but follows a similar declining pattern than the percentage of funds using repos seen in Panel A. The exposure ratios from long futures, units as well short equity are quite high compared to other complex investments. We can also observe that the relative exposure from short calls increased since end of 2000s, most probably due to their hedging character, which became more interesting in times of the financial crisis. Overall we conclude that the average exposure is rather small, for most complex instruments less than 0.5%, and relatively stable over time.

Disentangling the sources of mutual funds’ exposure to risk

As indicated in introduction and literature review, there is ongoing interest among regulators and researchers in the effects that complex instruments have on various fund characteristics. We run regressions following Eq. (6) where riski,t is one of the risk measures described in “Performance and risk measures” section, e.g., the market risk from the CAPM, the FF, the Carhart models or the standard deviation as a measure for the overall risk. We include size, expenses, turnover, age, flow, family size and average manager tenure as controlsi,t,j.

Most importantly, we simultaneously include the absolute value of different exposure_ratiosi,t,E considering equity long, bonds, funds, cash, short sales, MBS, repos, futures, call and put options, warrants, units and unidentified positions. For futures and options, we distinguish long and short exposure positions, while we consider the net exposure ratio for all other less popular instruments. In total, we therefore consider 16 different exposure variables that reflect the entire investment spectrum of each fund.

We consider two types of regression models. First, Panel A of Table 6 reports the results of fund-fixed effects panel regressions with 2D-clustered HAC consistent standard errors to examine the influence of the different exposure within funds. Second, Panel B reports the results of monthly Fama and MacBeth (1973) regressions (FMB) with FMB standard errors to analyze the cross-sectional differences between the funds.Footnote 13

The results in Panel A show that a one percentage point (pp) deviation of funds’ equity long exposure ratio from their mean translates into a 0.53 pp (0.56 pp, 0.55 pp) deviation from the funds’ mean CAPM (FF, Carhart) betas. A one pp deviation from the funds’ mean exposure in other funds (mostly ETFs and other open-end mutual funds) has a similar effect as long equity, as it relates to a deviation of approximately 0.6 pp from the funds’ mean market betas. Long futures, long calls, warrants and short puts also show significantly positive betas, all in line with economic intuition due to their long exposure and all with coefficients higher than that of long equity due to their (possibly) levered nature. Short equity shows a significant and negative coefficient of – 0.98 on CAPM beta (– 0.69 on FF and – 0.68 on Carhart market beta), which is unsurprising considering short positions expose the fund to the underlying in an inverse relation. Further exposure ratios with negative and significant coefficients are repos, short futures, short calls and long puts, for which the coefficients are different to the coefficient of the equity short sales, in spite of their levered nature. The negative coefficients of short calls and long puts are in line with funds using covered calls and protective puts to hedge their portfolio risk which is in line with Cici and Palacios (2015) or Natter et al. (2016). The results in column 4 for the standard deviation show similar directions for most exposure ratios; however, fewer of the coefficients are statistically significant. Overall, the results for the fund-fixed effects regressions are consistent with economic intuition.

The FMB regression in Panel B only considers the cross-sectional relations between risk and exposure ratios. The signs of the coefficients are mostly in line with those in Panel A, e.g., funds with on average higher exposure ratio in long equity have also a higher market beta. The relation is nearly 1:1 with coefficients between 0.98 for the CAPM and 0.93 for Carhart. Long futures, long calls and short puts are further variables with high and positive coefficients due to their nature of speculating for positive market trends with leverage. Similarly, short equity, short calls and long puts have highly negative cross-sectional coefficients as funds using these instruments speculate for negative market trends and have an overall levered nature. The cross-sectional R2s are very high with values between 0.46 for the Carhart market beta and 0.57 for the funds’ total risk.

The effect of complex instruments on fund performance

The results in the preceding section show that the exposures to various complex investments have the economically expected effects on the riskiness of US domestic equity funds. Less intuitive are the expectations regarding the effects of the complex instruments on funds’ performance. To get an idea of these effects, we run regressions similar to Eq. (6) but replace risk as independent variable with the performance measures introduced in “Performance and risk measures” section, i.e., the Sharpe ratio and the alphas from the CAPM, the FF and the Carhart models.

Panel A of Table 7 reports the results for panel regressions with fund-fixed effects. Consistent with expectation, deviations from the funds’ mean long equity exposure ratios have no significant effect on performance. The same applies to higher cash exposure ratios which should not be rewarded with higher performance by the used models. In line with Natter et al. (2016) we find that funds with more than usual written options show higher performance most probably due to the option premium they earn. Further, funds deviating from their usual long put exposure reduce their performance, in line with the hedging nature of the instruments. Contrarily, funds show lower risk-adjusted performance when increasing their long call exposure which may reflect the premium funds have to pay or the fact that the additional, levered risk is not adequately compensated by a higher return.

A higher than usual exposure of repos relates to lower risk-adjusted performance which is in line with existent literature on security lending (Evans et al. 2017). We contradict the finding of Chen et al. (2013) as we show that higher than usual short equity positions decrease funds’ Sharpe ratio as well as risk-adjusted performance. This might result from the exact consideration of the level of the short positions rather than the simple usage via crude indicator variables and from controlling for all other potential sources of exposure. Overall, the impact of complex instruments on performance is very small or has no significant impact which is not surprising given the low average investment volume in relation to their TNA.

In the cross-sectional Fama/MacBeth regressions documented in Panel B, we only find significantly higher risk-adjusted performance for funds with increased investments in short futures and short puts. All other instruments show inconsistent and insignificant coefficients.

Complex instruments and other fund, family and management characteristics

Fund characteristics

Previous studies mostly concentrate on relating funds’ risk and performance to their usage of specific instruments like options, short sells or security lending. To provide new insights, this section is dedicated to relating funds’ exposures to various fund characteristics. Therefore, we run regressions similar to Eq. (6) replacing the independent variable with fund characteristics like the expense ratio, turnover, log TNA and funds’ flow risk.

With regard to the expense ratio, the fund-fixed effects regression in Table 8 Panel A shows that deviating positively from the mean exposures of most instruments leads to the above average expenses. The only exceptions are short futures, short calls and units, which show negative and significant coefficients. Funds engaging more intensively in complex instruments are more expensive over time as well as in the cross section, according to Panel B. Potential reasons could be higher salaries for more experienced managers (Chevalier and Ellison 1999) and higher costs for risk management systems necessary to monitor the complex exposures.

With regard to turnover, Panel A shows that funds which trade more actively also engage more intensively in repos, MBS, warrants and units. Li and Zhang (2011) show that short-term returns on derivative warrants are higher than for options. In combination with their higher liquidity, this makes them more interesting for managers who trade more frequently, which is a possible explanation for the differences between options and warrants regarding the influence on the funds’ turnover. According to Panel B management activity overall positively relates to complex instrument use, which could also be linked to more actively trading funds being more expensive as shown in the previous paragraph.

With respect to fund size (log TNA), Panel A shows mostly insignificant coefficients. However, funds using more than usual MBS and units are shrinking, which is in line with funds generally becoming larger over time while using less MBS and units as shown in Fig. 1. On the other hand, deviating from usual short futures and long call exposures is related to growth, which may be related to such instruments becoming more popular over time. In the cross-sectional view in Panel B, the results are in line with Natter et al. (2016) showing that option users are bigger. Moreover, funds having a higher exposure to short equity are larger as well, making it easier for the fund to cover the short position.

Column 4 reports results for the mean absolute daily flow, which is a regular measure of flow risk.Footnote 14 Rohleder et al. (2017) find that funds may be able to manage or mitigate flow risk by using options and futures based on simple indicator variables from regulatory N-SAR reports. According to Panel A, deviations from mean flow risk do not relate to higher exposures in any of the complex instruments except for a higher exposure in short calls. Further, in Panel B, funds with higher flow risk have higher exposure to repos compared to other funds. We might conclude that funds use repos to gather short-term cash to fulfill investors’ unexpected redemptions.

Management and family characteristics

After looking at the relations between complex instrument use and various fund characteristics, we look at similar relations at manager and fund family level. Therefore, we run regressions following Eq. (6) replacing the independent variable with the average tenure of the managers and the number of managers managing the fund, the size of the fund family as well as the number of funds managed by the family.

Table 9 Panel A shows that funds with a higher than mean exposure ratio in short sales, long puts and short futures, all positions that are associated with a lower market risk, are managed by more experienced managers and have more managers. This is in line with Golec (1996) who shows a negative relation between fund’s risk and the managers’ tenure and by Bliss et al. (2008) and Karagiannidis (2012) who showed that funds managed by a bigger team show significantly less risky portfolio. Investment vehicles, associated with being more of a speculative nature, i.e., long futures or long calls, are used more often in smaller teams or by less experienced managers which we can also confirm over time and in the cross section, according to Panel B.

The family TNA as well the number of funds managed within the family are proxies for the size of the family; therefore, the signs and the significance levels of the different coefficients are mostly the same (at least for Panel A). Funds from bigger families increase their exposure in short sales, repos, short futures and short calls, while all other exposure sources are related to smaller family size. Evans et al. (2017) claim that funds that lend more securities, therefore increase their exposure in repos or short sales, are from larger families, which we can confirm.

Conclusion

Over the last 20 years, there has been a vivid discussion among researchers, practitioners and regulators of how complex investment instruments impact risk and performance of mutual funds and, in extension, if and how mutual funds’ derivative and other nontrivial instrument use should be regulated. Most of the papers contributing to this discussion focus on options, some focus on other instruments like futures, security lending and short selling, but none of them considers all types of instruments at once and previous studies mostly rely on indicator variables. The conclusions from previous research thus range from highly negative to highly positive effects, which may be a result of the incomplete consideration of instrument types as well as of the crudeness of information. We try to overcome both of these limitations by considering the actual exposures of all possible instruments. What we find is that while the use of complex instruments is very popular among mutual funds, consistent with previous research, the actual exposures are almost negligible even in the extremes. Consequentially, the effects of complex instruments on funds’ risks, performance and other characteristics are minor, which helps explain the inconsistent picture painted by previous research.

Notes

As of June 2018, the semiannual form N-SAR was replaced by the annual form N-CEN.

As robustness, we alternatively assume that funds trade at the end of the month. The results remain qualitatively the same.

We make sure by manual checks that we do not miss any positions with complex exposure in the unidentified group. The remaining positions are mostly equity as far as we can tell by their name, but we cannot be 100% certain.

As a robustness check we run our entire analysis with gross returns instead of net returns. The results remain the same.

We obtain the daily market and factor returns from Kenneth French’s data library. (http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html).

MSTAR allows funds to report offsetting cash positions as an aggregate for all derivatives and short positions. However, our perception is that offset positions are only sparsely reported in the dataset and incomplete, which is why we aggregate them under “Cash & offset”.

The duplication portfolio of an option typically consists of a position in the underlying stock, reported as the exposure, and a position in a zero bond, reported as separated offset.

We later aggregate cash, offset positions and money market exposure as “Cash & offset” due to their similarity.

In our empirical analysis later on, we focus on exposure obtained by equity derivatives.

There are 32 positions in units identified as short units, which should not be possible from the perspective of a fund. Due to the low number, we conclude this is due to faulty data and we will not consider these few positions for later research.

In unreported analyses we run panel regressions with time-fixed effects as well as panel regressions with fund- and time-fixed effects. The results to these regressions are qualitatively the same as in our main analysis. To ensure that our results are stable over time, we further split our sample into equally long periods from January 1998 to August 2007 and from September 2007 to December 2015, respectively. However, the results are very similar with few exceptions for both periods.

Unreported results for the standard deviation of daily flows as an alternative measure of flow risk [e.g., Rakowski (2010)] show similar results for both fund-fixed and Fama and MacBeth regressions.

References

Aragon, G.O., and J.S. Martin. 2012. A Unique View of Hedge Fund Derivatives Usage: Safeguard or Speculation? Journal of Financial Economics 105(2): 436–456.

Berk, J.B., and J.H. van Binsbergen. 2015. Measuring Skill in the Mutual Fund Industry. Journal of Financial Economics 118(1): 1–20.

Bliss, R.T., M.E. Potter, and C. Schwarz. 2008. Performance Characteristics of Individually-Managed versus Team-Managed Mutual Funds. The Journal of Portfolio Management 34(3): 110–119.

Calluzzo, P., F. Moneta, and S. Topaloglu. 2019. Complex Instrument Allowance at Mutual Funds. https://doi.org/10.2139/ssrn.2938146

Carhart, M.M. 1997. On Persistence in Mutual Fund Performance. The Journal of Finance 52(1): 57–82.

Chen, H., H. Desai, and S. Krishnamurthy. 2013. A First Look at Mutual Funds that Use Short Sales. Journal of Financial and Quantitative Analysis 48(03): 761–787.

Chen, Y. 2011. Derivatives Use and Risk Taking: Evidence from the Hedge Fund Industry. Journal of Financial and Quantitative Analysis 46(4): 1073–1106.

Chevalier, J., and G. Ellison. 1999. Are Some Mutual Fund Managers Better Than Others? Cross-Sectional Patterns in Behavior and Performance. The Journal of Finance 54(3): 875–899.

Cici, G., and L.-F. Palacios. 2015. On the Use of Options by Mutual Funds: Do They Know What They are Doing? Journal of Banking & Finance 50: 157–168.

Elton, E.J., M.J. Gruber, and A. de Souza. 2018. Fund of Funds Selection of Mutual Funds. Critical Finance Review 7(2): 241–272.

Evans, R., M.A. Ferreira, and M. Porras Prado. 2017. Fund Performance and Equity Lending: Why Lend What You Can Sell? Review of Finance 21(3): 1093–1121.

Evans, R.B. 2010. Mutual Fund Incubation. The Journal of Finance 65(4): 1581–1611.

Fama, E.F., and K.R. French. 2010. Luck Versus Skill in the Cross-Section of Mutual Fund Returns. The Journal of Finance 65(5): 1915–1947.

Fama, E.F., and J.D. MacBeth. 1973. Risk, Return, and Equilibrium: Empirical Tests. Journal of Political Economy 81(3): 607–636.

Golec, J.H. 1996. The Effects of Mutual Fund Managers' Characteristics on Their Portfolio Performance, Risk and Fees. Financial Services Review 5(2): 133–147.

Huij, J., and J. Derwall. 2008. “Hot Hands” in Bond Funds. Journal of Banking & Finance 32(4): 559–572.

Jensen, M.C. 1968. The Performance of Mutual Funds in the Period 1945–1964. The Journal of Finance 23(2): 389–416.

Karagiannidis, I. 2012. The Effect of Management Team Characteristics on Risk-Taking and Style Extremity of Mutual Fund Portfolios. Review of Financial Economics 21(3): 153–158.

Li, G., and C. Zhang. 2011. Why Are Derivative Warrants More Expensive Than Options? An Empirical Study. Journal of Financial and Quantitative Analysis 46(01): 275–297.

Morningstar. 2007. Portfolio Reporting Standards for Short Positions and Derivatives. Available at: http://morningstardirect.morningstar.com/clientcomm/morningstar_portfolio_file_template.pdf. Accessed 21 August 2019.

Morningstar. 2008. Shorts and Derivatives in Portfolio Statistics. Morningstar Methodology Paper.

Natter, M., M. Rohleder, D. Schulte, and M. Wilkens. 2016. The Benefits of Option Use by Mutual Funds. Journal of Financial Intermediation 26: 142–168.

Natter, M., M. Rohleder, D. Schulte, and M. Wilkens. 2017. Bond Mutual Funds and Complex Investments. Journal of Asset Management 18(6): 433–456.

Pastor, L., R.F. Stambaugh, and L.A. Taylor. 2015. Scale and Skill in Active Management. Journal of Financial Economics 116(1): 23–45.

Rakowski, D. 2010. Fund Flow Volatility and Performance. The Journal of Financial and Quantitative Analysis 45(1): 223–237.

Rohleder, M., D. Schulte, and M. Wilkens. 2017. Management of Flow Risk in Mutual Funds. Review of Quantitative Finance and Accounting 48(1): 31–56.

Sharpe, W.F. 1966. Mutual Fund Performance. The Journal of Business 39(1): 119–138.

Sherrill, D.E., S.E. Shirley, and J.R. Stark. 2017. Actively Managed Mutual Funds Holding Passive Investments: What do ETF Positions Tell us About Mutual Fund Ability? Journal of Banking & Finance 76: 48–64.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Benz, L., Rohleder, M., Syryca, J. et al. Shedding light on the exposure of mutual funds: Which investments drive mutual fund characteristics?. J Asset Manag 20, 534–551 (2019). https://doi.org/10.1057/s41260-019-00144-2

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-019-00144-2