Abstract

We investigate the effectiveness of target date mutual funds (TDMF) performance relative to naive self-directed target date portfolios and identify which variables are related to positive performance. Overall, we find target date mutual funds do not outperform naive strategies but find several characteristics which are associated with positive Sharpe and Treynor ratio performance. When comparing TDMF to naive strategies, we find alpha, volatility, assets, dividend yield and turnover are positive and significant coefficients, while beta is negative and significant. Variables such as Morningstar rating and expense ratio are not significant, and puzzling given fees on TDMFs are typically higher than other funds. Investors are choice architects will be interested in the results as both are in some ways responsible for making good retirement investment choices. The paper also identifies the difficulty in using tools developed for all equity mutual funds to measure the unique aspects of TDMFs, specifically the glide path.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Mutual funds, which were originally marketed as low-cost investment vehicles to efficiently achieve diversification, have evolved to represent almost every facet of the active and passive investing world. A relatively new and unexplored investment innovation is the target date mutual funds (TDMF), which have exploded in popularity, where assets under management (AUM) have eclipsed $790 billion according to Investment Company Institute (Thorton 2016) in just a few years of being offered to the public. TDMFs are funds which match an investors duration to retirement to a preset allocation between equity and bonds, thereby matching the assumed change in risk tolerance as investors age. The major innovation of these products is the passive nature of the reallocation over time, which is called the glide path. The glide path defines the rate at which these funds change their allocation from equities to bonds over the lifetime of the investor. The focus of this paper is to analyze how these funds perform relative to passive benchmarks and provide useful information for choice architects to select the best TDMFs to help investors achieve their retirement goals.

Target date retirement funds are an investment product being marketed as an inexpensive product designed to achieve retirement goals without active management, which results in lower management fees. Rather than a manager being responsible for researching and selecting individual securities to create a portfolio with a positive risk–return relationship, a TDMF will allocate assets between an equity and bond fund following a preset formula. The inefficiency of individual security selection and efficiency of using index funds following a preset formula based on age for allocation can theoretically result in a preferred investment product with lower fees for investors.

TDMF can also be viewed as an innovation which further allows investors to passively invest in a portfolio which remains as close to the efficient frontier as possible throughout an investor’s lifetime. The search for long-term returns without an increase in risk has long been the ultimate goal for those creating diversified investment portfolios. Modern Portfolio Theory from Markowitz (1952) was the first to offer methods to increase long-term returns without increasing risk, and many others have created more refined procedures in recent times. For example, Poterba et al. (2006) stress the importance of asset allocation in retirement savings.

Even though TDMFs are a recent innovation in financial services, several papers have addressed their effectiveness and validity. Tang and Lin (2015) find the glide path, which is the rate at which a fund changes allocation between equities and bonds, to be a significant source of underperformance. Bodie (2015) explores several aspects of life cycle investing along with Sexauer et al. (2012) who explore the difficulty of establishing a benchmark for TDMFs. Arnott et al.(2013) evaluate weaknesses with glide paths, and Pfau (2010) stress the positives of changing allocation as the investors’ age increases. (Bodie et al. 2007), Bodie and Treussard (2007) and Bodie et al. (2010) explore many aspects of TDMFs and their varied impacts on retirement savings.

A somewhat dangerous development in retirement savings is the use and possible misuse of a default option without proper information or consultation. Employee retirement plans often provide a default option, which can drastically impact the future value of retirement savings for many individuals. Default decisions in investing have been explored by numerous studies and are generally persistent and difficult to change once made. Choi et al. (2003) and Madrian and Shea (2001) confirm the persistence of default decisions even when new information is provided. Mitchell and Utkus (2012) find investors choose TDMF without default, and investors will switch to TDMF when introduced, but also find defaults have a potent impact on outcomes. This is very important finding in that the worse the initial decision, the less likely it is that an investor will change the decision. Defaults, therefore, ignore the reality that a wide spectrum of risk–return profiles exists for individual savers and mistakenly assumes that all savers retain a similar risk tolerance. Benartzi and Thaler (1999) also find strong loss aversion in decision-making regarding retirement accounts, and Huberman and Sengmueller (2004) find changes are rare once initial selections are made regardless of new information.

Several aspects of the retirement choice shortfalls have also been investigated, further exemplifying how important good defaults are in the decisions making the process for retirement accounts. Huberman and Jiang (2006) and Benartzi and Thaler (2002) both found that increasing the number of investing options does not increase the utility or returns to investors. Additional choices may, in fact, increase the probability that uninformed investors will stick with the default choice, regardless of potential costs. Bhattacharya et al. (2012) find those who most need advice do not seek it, and (McKenzie and Liersch 2006) find that defaults can be construed as a recommendation. Costs of poor defaults can vary from fund to fund, but Cohen (2009) found these default costs, when company stock is selected, to be 1.75% per year. These costs are extremely detrimental to retirement holdings as future gains are lost due to higher fees and lower performance in early years. Given the above studies have determined defaults are important and TDMF are routinely identified as default investments, providing evidence on how to choose the correct TDMF is a key area of research.

Previous research related to TDMFs has investigated the internal structure of the TDMFs; the importance of portfolio construction and persistence of default investment choices are for portfolio performance. This paper provides choice architects a template to compare TDMFs to a portfolio an unsophisticated investor can create with little or no training. TDMFs are primarily marketed to retail investors without significant investment training or time to devote to investigating investment products, and a simplified comparison is a useful tool in evaluating these investment products.

Target date mutual funds have grown in popularity among individual investors and within company-sponsored retirement accounts like few other products in recent history. We provide an introductory analysis of these new products, identify characteristics that indicate over- and underperformance, provide some theoretical justification for the existence, popularity and continued adoption of TDMFs, but also uncover the need to develop new tools to evaluate these unique investment products. As TDMF attracts an ever-larger piece of the investment pie, we believe the analysis of these products should garner more attention and this paper serves as a useful contribution to this new area of research.

A unique aspect of the TDMF is the feature that an investor can decide at time 0 to invest in a TDMF and the investment will rebalance on a regular basis far out into the future when the investor is nearing or past retirement at time 35+ years. This feature is a glide path which shifts assets in the fund from equity to bonds over time to adjust for lower-risk tolerance as investors progress toward retirement. This feature is very attractive to investors who fear making a decision or lack the knowledge to make an educated choice. The glide path provides an easy solution for progression toward investment-related decision fatigue. Glide paths are currently a closely guarded secret among investment companies and may be not be revealed.

To investigate the performance of TDMFs, below hypothesis will be tested. TDMF is primarily marketed to small retail investors, and comparing performance to simple naive strategies is the most realistic benchmark with this goal in mind. The first hypothesis is to determine whether TDMFs will outperform a naive passive portfolio any investor can replicate during the enrollment period. We create two naive portfolios, matched sample, and 60:40 constant mix to compare the performance of TDMFs. The 60:40 is a portfolio constructed of 60% equity and 40% bonds, and matched sample assumes an investor matches the equity and bond percentage observed in each TDMF upon enrollment.

TDMFs performance will not be different from 60:40 or matched sample portfolios (simulated portfolios).

Sharpe and Treynor ratios are used as performance measures to determine which TDMF characteristics are significant in positive relative performance. Given the number of TDMF created in such a brief time, this may lead a novice investor to believe that these funds must be successful at providing positive risk-adjusted returns. If TDMFs are utilized as default investments, novice investors may incorrectly assume this is a recommendation and performance should be positive relative to a naive portfolio. If, however, there is a performance difference between the TDMF and simulated funds, we will explore the source of the performance difference by regressing the following variables on the difference between the Sharpe and Treynor ratios for the TDMF and simulated funds.

We also included time dummy variables for the tech bust from 2000 to 2002 and housing bust for 2008 and 2009 to control for potential adverse market conditions and to determine whether relationships are being driven by these two-recent traumatic market time periods.

Data

We search Bloomberg database for target date mutual funds with specific target years from 2035 to 2050. To ensure a sizable portion of the portfolio contain equities, we will only include retirement funds which have retirement dates 20 years in the future, so the nearest date in our sample will be TDMF for 2035 and continue to retirement date 2050. This will reduce the sample size, but create a more robust analysis regarding equity investments. Method to construct data sample is contained in Appendix A.

This study explores two different methods to building a naive yet effective target date retirement strategy; matched sample and 60:40 constant mix fixed at the time of enrollment. One positive aspect of investing in TDMFs is the fixed nature which does not require an investor to update or trade her account over time. We also carry this assumption for our simulated portfolios, thereby eliminating transaction costs for the investor. Matched sample is created by taking the exact equity to bond portfolio of each TDMF and building a portfolio of funds with an exact equity/bond comprised of SPY and TLT. For example, T Rowe Price Retirement Fund 2035 currently has an equity weight of 81.5% and bond/cash weight of 18.5. We create a portfolio of 81.5% SPY and 18.5% TLT for comparison.

The 60:40 portfolio is SPY and TLT in a straight 60:40 portfolio throughout the comparison periods to represent a naive investor may create on her own. The effectiveness of these two different methods of target date investing will be analyzed and potential, costs and benefits of each method will be explored in depth.

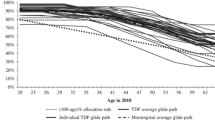

Target date mutual funds are a combination of passive index investing combined with time variant risk adjustment as risk aversion increases as the time to retirement decreases. As an example, we provide the performance of the Wells Fargo Dow Jones Target 2040A ticker STFRX in Fig. 1. At the time of data collection, the mutual fund consisted of 83.24% equities, 2.94% corporate bonds, 0.22% municipal bonds, 5.55% government bonds and 5.3% cash. This investment will slowly decrease the equity holdings to a lower level and increase bond investments as the time to retirement decreases.

In general, funds with longer (shorter) time horizons will carry a higher (lower) percentage of equity investments. For example, WFQAX a different Wells Fargo TDMF, which is set for a retirement date in 2050, 10 years further out than STFRX contains a slightly higher level of equity weighting of 88.23%, which will usually result in a higher level of volatility and return compared to the shorter duration TDMFs. This transition from equity to bond investments as duration increases is the glide path, which is currently a closely guarded secret for most mutual target date providers. TDMFs continue to evolve and adjust their goals and parameters as these investment vehicles are adopted by a greater number of investors with a wider range of risk and return expectations.

The dependent variable for regression analysis will be the difference between TDMFs, simulated portfolios’ Sharpe and Treynor ratios. The differences will be regressed against mutual fund-specific characteristics in the following regression models. Independent variable descriptions are provided below and collected from various sources which represent the values at the end of the year 2013.

where

-

Sharpe = Sharpe ratio from July 29, 2002, to December 31, 2013, using daily returns for mutual funds and simulated portfolios. Holding period return of TLT was used to calculate the risk-free rate.

-

Sharpe = (portfolio return − risk-free rate)/standard deviation

-

Treynor = Treynor ratio from July 29, 2002, to December 31, 2013 using daily return for mutual funds, and simulated portfolios. Beta was calculated by using SPY as market and TLT as the risk-free rate.

-

Treynor = (portfolio return − risk-free rate)/portfolio beta relative to SPY

-

Alpha = risk-adjusted performance relative to S&P 500 provided by Charles Schwab.

-

Assets = assets under management as of December 31, 2013.

-

Beta = the estimated slope coefficient of regressing TDMF returns on SPY returns.

-

Dividend yield = 12-month trailing income distributions provided by Morningstar.

-

Equity = percentage of target date fund assets held in equities.

-

Expense ratio = expense ratio provided by Morningstar.

-

Morningstar rating = Morningstar mutual fund rating.

-

PE ratio = PE ratio provided by Morningstar.

-

Sector holding = percentage of assets held in one investment category provided by Morningstar.

-

Turnover = portfolio turnover provided by Morningstar.

-

Volatility = standard deviation of daily returns.

-

Tech bust = dummy variable of being equal to 1 if TDMF enters in the sample during technology bubble burst year 2000–2002; otherwise, it is equal to zero.

-

Housing bust = dummy variable of being equal to 1 if TDMF enters in the sample during housing bubble burst year 2008–2009; otherwise, it is equal to zero.

Glide path

One weakness of this analysis is the assumption that the glide path, adjustment from equity to bonds, funds follow throughout the year follow can have a significant impact on performance measures. The above statistical tools were designed to evaluate more standard investment vehicles of mutual funds or equity funds, but not specifically designed for a hybrid security like a TDMF with their unique features. Tools specifically designed to evaluate the unique features of TMDFs will be developed soon, but above tools are currently the best available to answer the hypotheses proposed.

Alpha

Alpha measures the ability of fund manager to select individual securities. Given the wide range of index investment options available coupled with the long-term nature of TDMF, finding a positive or negative relationship between performance and alpha would be interesting. If positive alpha is found, managers should most likely transfer their skills to more aggressive short-term trading vehicles and not on long-term focused TDMF. If negative alpha is negatively related to performance, TDMF funds should not be engaging in much more than index allocation.

Assets

Larger funds have a distinct advantage over smaller funds in economies of scale in delivering TDMF to customers, but how aggressive are the larger funds in passing on the savings to customers is up for debate. If this coefficient is positive and significant, this would lead retirement administrators to only choose larger funds which are the most cost-effective in delivering these products to clients. Given the higher costs of running retirement accounts, the size factor may be much more relevant and powerful variable compared to other non-retirement investments. We do not evaluate the endogeneity of the “which came first, the performance or the size” in this study.

Beta

We include beta relative to the ETF representing the S&P 500, SPY, as an alternative measure of risk to determine whether managers of TDMF are delivering on returns in excess of a passive index fund. For most investors, retirement funds represent a passive investment, which is not meant to be managed, traded or used for speculative purposes. Measuring beta as it relates to differences between the Sharpe and Treynor ratios and how they differ from naive TDMF investing will give us more insight into the nature of performance differences between naive and TDMFs.

Dividend yield

Time and again, dividends have proven to be a reliable source of returns over sustained periods of time and we expect this to hold true with TDMFs. Large dividend yields will signal the health of underlying equities owned by the fund and provide some buffer to returns during periods of extreme variance of volatility, which appear to be more frequent. We hypothesize that the dividend coefficient will be positive and significant for the TDMF analysis.

Equity

Equity is the percentage of equity held by the fund at the end of each year. According to Hsu et al. (2015), low equity should be preferred due to lower risk, but this lower risk may result in lower returns relative to index benchmarks.

Expense ratio

The first and most obvious variable that may negatively impact performance is net expense ratios impact of TDMFs. Net expense ratio was collected for each fund and assumed this was the fees charged for the duration of the study. Fees for mutual funds and especially for default retirement funds are a very important issue and can drastically reduce or eliminate any positive performance. If fees are negative and significant for TDMF performance, a cap on default TDMF fees should be implemented to reduce the damage these fees harm investor returns. If the higher fees are justified by a better risk-adjusted return, the fees coefficient will be insignificant and no action will be necessary.

Morningstar rating

The exact nature of Morningstar ratings is difficult to determine, but we can estimate the effectiveness of the ratings ex-post. Due to the recent nature of TDMFs and the mixing of two distinct asset groups (bonds and equities), we hypothesize it will be years before Morningstar will be able to develop a reliable measuring technique for this asset class. We do not expect to see a significant relationship for the Morningstar coefficient but include to serve as a potential control variable.

PE ratio

PE ratio is explored to investigate whether managers are taking more risk within these mutual funds to generate returns. Two index funds constructed of the same assets, but in different concentrations or firms with different PE ratios could result in very different returns and performance. Due to the opaque nature of many of the glide paths that TDMF follows and exact investments held throughout the year, detailed information on how the funds are constructed is needed for further analysis. PE ratio can reveal the level of risk inherent in these funds at year end, even though many TDMFs are marketed as low-risk alternatives to index or managed funds. PE ratios may oscillate between different values throughout the year and between funds; therefore, we do not expect to find significant results with this variable.

Sector holding

This variable represents the percentage of equity held in one group of industries. It is possible that some TDMFs are holding funds concentrated in one industry and creating an unbalanced portfolio creating extra risk which is not rewarded with higher returns. Concentration in one industry may cause returns to be extreme in one direction or another, reducing diversification over a long-time period. It is important for these long-term investments to maintain a healthy diversification among industries and failure to do so may cause a reduction in both Treynor and Sharpe ratios compared to benchmark ETFs and simulated group.

Turnover

Turnover is an especially crucial factor in TDMF returns due to the long-term nature of these investments and the fact that they are required to adjust allocations over time to match the changes in risk appetite as an investor ages. Some turnover in these funds is required, but beyond periodic rebalancing for shifts in risk preference as investors glide toward a retirement date should not be excessive. If turnover is found to be negative and significant, then TDMF is being used as trading vehicles by brokerage firms rather than long-term investment vehicles for investors. Immediate action would need to be undertaken to reduce the turnover of these funds or remove them from a default possibility. Finding positive turnover would be an interesting finding, indicating funds are able to generate some value executing their own glide path.

Volatility

TDMF in the strictest sense should not exhibit volatility, especially compared to the naive portfolios of SPY and TLT in this study. A positive and significant relationship between performance and volatility would indicate the TDMF is obtaining performance due to small incremental increases in risk, relative to naive strategies. Finding a positive or negative relationship for this coefficient would signal TDMF is much more than passive investments and possibly active investments in passive clothing.

We also included time dummy variables for the tech bust from 2000 to 2002 and housing bust for 2008 and 2009 to control for potential adverse market conditions and to determine whether relationships are being driven by these two-recent traumatic market time periods. During the data collection process of this paper, a lack of ETF target date funds was discovered where only 5 ETFs were available to investors at data collection stage of this paper.

New funds with different objectives to meet target date retirements are being created almost every week. To reduce the sample size and only include those which are most likely for individual investors to invest in, a TDMF screening process was followed. From the Morningstar, balanced equity type with retirement dates from 2035 to 2050 is included. Only funds which are ranked by Morningstar and only shares of each target date fund from each company are included. Descriptive statistics for this group of TDMF are provided in Table 1.

Table 1 contains the descriptive statistics for each target date retirement group from 2035 to 2050. Groups are an equally weighted by assets and time as several TDMFs of different AUM and maturity are included to create the sample. One of the most interesting statistics from this Table 1 is the similar equity percentages among target date funds with maturities ranging from 2035 to 2050. Given the wide range of the differences between the duration until retirement, a larger difference in equity holdings would be expected, especially for investors with over 30 years before retirement date.

Weaknesses of analysis

International equity investments and the glide path are two aspects of TDMFs which are difficult to impossible for a naive investor to replicate. The ability to include international equities is unfortunately not available in all retirement accounts, for example, the State of Mississippi Optional Retirement Program offers TDMF but not a corresponding international index fund or mutual fund to replicate this exposure. For simplicity and robustness, we create portfolios that all naive investors can replicate in a retirement account, which all include some equity investment and bond investment. The glide path is another aspect that is unique to TDMFs and in most cases, a closely guarded secret of most TDMF providers. Even if glide paths of all TDMFs were publicly available, it would be very difficult for a naive investor to replicate this strategy, which is not the focus of this paper.

Table 2 contains the correlation coefficients between the independent variables in the study which reveals most coefficients cause regression to suffer from multi-collinearity issues. Highest correlation is between the Morningstar and assets at .351 and between Morningstar and equity as a percentage of holdings at .411 and is unlikely to contaminate results.

Table 3 shows important performance shortcomings of TDMF compared to the 60:40 and matched portfolios. Only 37% of the TDMFs outperform the 60:40 split and only 20% outperform the target date matched sample. Given the wide-ranging use of these funds as default investments, this is a dangerous policy given most of these funds can easily be beaten by a simple strategy nearly any investor can replicate with index alternatives in retirement offerings.

Figure 2 also records the underperformance of the entire sample of TDMF over time and further casts doubt on these investments as primary default investment alternatives. A troubling development is the outperformance of TDMF during the run-up to the financial crises relative to the naive portfolios. The very investors who are most likely to stick with the default investments are the ones with the least investment experience and potentially could sell equities if a “managed account” was doing so poorly during difficult market periods.

Cumulative holding period returns a time series of the cumulative holding period returns for TDMFs, the simulated 60:40 equity to bond split portfolio and the simulated, matched equity to bond split portfolio. Daily returns from July 29, 2002, to December 31, 2013, are used to determine holding period return

A naive investor could mimic any one of the above target date funds by merely buying SPY and some bond fund, in this case TLT, and gradually rebalancing as retirement date nears according to yearly mutual fund report provided by all TDMFs. To create a simulated naive portfolio, we use the average of each mutual fund target date group equity percentage to determine the equity percentage of our simulated strategy. The equity percentage is invested and held in SPY during the time period, and the remaining balance is invested in TLT and mid-term Treasury bond ETF. One simulated portfolio is created for each target date retirement date of 2035, 2040, 2045 and 2050. For example, at the end of each year, a naive investor could locate the mutual fund fact sheet for a TDMF and determine the exact equity to bond percentage. An investor could allocate 70.5% into an index equity fund and 29.5% into a bond index fund and achieve the same investment performance, without a glide path, from a naive portfolio compared to a TDMF. The above strategy would bypass all fees and management done within the TDMF.

Table 4 shows the differences in Sharpe and Treynor ratios between the TDMFs, and the two simulated portfolios are not significant. With a simple matching strategy or a simple 60:40 split, an investor is not better off investing in TDMFs. Given the high costs of these funds, this is not a positive piece of information for the future of TDMFs. The simulated portfolios on average have higher Sharpe and Treynor ratios, but these differences are not significant. This test reveals that on average, investors would be better off investing in a simple 60:40 portfolio or choice architects could provide a sample equity to bond allocation model using a low-cost equity and bond index as a preferred retirement investment product to current TDMFs.

Given target date funds are widely available in retirement accounts and unlikely to disappear anytime soon, it is prudent to develop some techniques to maximize the effectiveness of a flawed decision. Regression results provide some valuable information for retirement choice architects.

Tables 5, 6, 7 and 8 presented at the end of the paper report the results of several regressions using alternative models. Regression 1 in each exhibit is a univariate regression with results reported for each variable and regressions 2–6 report results for various models to determine the robustness of findings. Summation results for each variable will be discussed below.

Positive

Several independent variables are positive and significant in explaining performance differences between TDMFs and simulated portfolios. Alpha (89%), assets (61%), dividend yield (56%), turnover (47%) and volatility (74%) are positive and significant with the percentage of regression where each coefficient is significant. The significance of several of these coefficients is not surprising; alpha, assets and dividend yield coefficients are expected to be positive and significant, while turnover and volatility may not be as obvious.

Active trading is traditionally accepted to be detrimental to your wealth, yet when it comes to TDMFs, performance is positively related to turnover. Active trading, whether within stocks or within weightings measured or part of the glide path, measured by turnover, is associated with positive performance for TDMFs. Although the exact nature of glide paths has yet to be determined, the sample in this study finds that more active gliding, measured through turnover, results in better TDMF performance. Volatility, especially in retirement accounts, is probably best to avoid, but in the case of TDMF, volatility results in positive performance. This is also valuable information for investors, as many may view volatility as a negative and sell at precisely the wrong time.

The presence of positive performance coefficients gives retirement choice architects a template to determine which TDMFs across all retirement dates outperform naive strategies investors could create on their own.

Negative

Beta was the only variable in the study to consistently result in negative regression coefficients, with 45% of regression having a negative and significant beta coefficient. Higher beta indicates a fund is more sensitive to overall market moves and possibly only using other index funds to achieve these returns as opposed to funds which select individual securities to generate returns. Regardless of the reason, TDMF with high beta results in lower performance and should be avoided to populate retirement accounts.

Mixed

A puzzling result of this paper is the findings of the equity coefficient, which was both positive and negative and significant depending on performance measure and somewhat agrees with Hsu et al. (2015). The Sharpe ratio matched sample regressions resulted in 6 out of 6 coefficients which were negative and significant, while all other regression types result in positive and significant coefficients. The results were not economically significant and overall, inconclusive in determining which TDMF to choose. Percentage of equity does not provide any useful information in determining which TDMF to choose.

Originally, this paper was motivated by the high fees associated with the TDMFs, which were default options in the Texas retirement plan and is expected to be negative and significant. The expense ratio was only significant in 13% of regressions and positive once and negative once. Contrary to fundamental financial advice, fees are not a useful variable to consider when investing in a TDMFs, or detrimental to long-run performance.

Other

Morningstar, PE ratio and sector holding are not significant variables in performance differences between naive strategies and TDMFs. These variables were included as control variables and are also widely available to all investors, but should not be used to determine which TDMF to include in retirement accounts.

Tech and housing bust

These dummy variables were included to control for two very dramatic investing time periods in US markets during the sample period. Both variables were positive and significant, tech bust in 3 out of 4 regressions and housing bust in 2 out of 4 regressions. This is evidence that TDMFs provide some positive timing or management during extreme market time periods and further bolster their inclusion as an investment alternative in retirement accounts.

Conclusion

Target date mutual funds were created to help navigate this difficult decision among choice architects and individual investors with a wide variance in risk tolerance, investment goals and financial literacy. TDMFs as far as AUM have been extremely successful, but the performance of these investments has been unclear. This paper answers whether this product innovation is a step in the right direction or just another marketing idea with very little innovation to offer investors. The preliminary answer is a little of both. Target data mutual funds do not outperform or underperform simple 60:40 strategies or a matched sample naive TDMF portfolio. We find that alpha, volatility, assets, dividend yield and turnover are positive and significant in explaining performance differences, while beta is negative and significant. Variables such as Morningstar rating and expense ratio are not significant.

The findings of this study will help individuals and retirement choice architects make more informed and suitable decisions to help individual investors achieve their retirement goals. The development of tools specifically designed to evaluate TDMFs is also identified as an area for future research and measuring TDMFs are a combination of stocks and bonds with unique features of a glide path which provide measurement challenges not present in bond, stock or mutual fund performance analysis.

References

Arnott, R., K. Sherrerd, and L. Wu. 2013. The Glidepath illusion and potential solutions. The Journal of Retirement 1 (2): 13–28.

Bhattacharya, U., A. Hackethal, S. Kaesler, B. Loos, and S. Meyer. 2012. Is unbiased financial advice to retail investors sufficient? Answers from a large field study. Review of Financial Studies 25 (4): 975–1032.

Benartzi, S., and R.H. Thaler. 1999. Risk aversion or myopia? Choices in repeated gambles and retirement investments. Management Science 45 (3): 364–381.

Benartzi, S., and R.H. Thaler. 2002. How much is investor autonomy worth? The Journal of Finance 57 (4): 1593–1616.

Benartzi, S., and R. Thaler. 2007. Heuristics and biases in retirement savings behavior. The Journal of Economic Perspectives 21 (3): 81–104.

Bodie, Z. 2011. The long-run risk of stock market investing: Is equity investing hazardous to your client’s wealth? In CFA institute conference.

Bodie, Z. 2015. Thoughts of the future: Life-cycle investing in theory and practice. Financial Analysts Journal 71 (1): 43–48.

Bodie, Z., R. Fullmer, and J. Treussard. 2010. Unsafe at any speed? The designed-in risk and target date glide paths. Journal of Financial Planning 23 (3): 42–48.

Bodie, Z., R. Fullmer, and J. Treussard. 2007. Making investment choices as simple as possible, but not simpler. Financial Analysis Journal 63 (3): 42–47.

Choi, J., D. Laibson, B. Madrian, and A. Metrick. 2003. Optimal defaults. The American Economic Review 93 (2): 180–185.

Cohen, L. 2009. Loyalty-based portfolio choice. Review of Financial Studies 22 (3): 1213–1245.

Hsu, J., J. Treussard, V. Viswanathan, and L. Wu. 2015. Two determinants of lifecycle investment success. The Journal of Retirement 2 (4): 14–21.

Huberman, G., and W. Jiang. 2006. Offering choice in 401(k) plans: Equity exposure and number of funds. The Journal of Finance LXI (2): 763–801.

Huberman, G., and P. Sengmueller. 2004. Performance and employer stock in 401(k) plans. Review of Finance 8: 403–443.

Markowitz, H. 1952. Portfolio selection. The Journal of Finance 7 (1): 77–91.

Madrian, B., and D. Shea. 2001. The power of suggestion: Inertia in 401(k) participation and savings behavior. The Quarterly Journal of Economics CXVI (4): 1149–1187.

McKenzie, C., and M. Liersch. 2006. Recommendations implicit in policy defaults. Psychological Science 17 (5): 414–420.

Mitchell, O., & Utkus, S. 2012. Target-date funds in 401(k) retirement plans. NBER Working Paper Series.

Pfau, W. 2010 Lifecycle funds and wealth accumulation for retirement: Evidence for a more conservative asset allocation as retirement approaches. Grips policy research center discussion paper 10–10.

Poterba, J., Rauh, J., Venti, S., & Wise, D. 2006. Lifecycle asset allocation strategies and the distribution of 401(k) retirement wealth. NBER working paper.

Sexauer, S., M. Peskin, and D. Cassidy. 2012. Making retirement income last a lifetime. Financial Analysts Journal 68 (1): 78–84.

Tang, N., and Y.T. Lin. 2015. The efficiency of target date funds. Journal of Asset Management 16 (2): 131–148.

Treussard, J. 2007. The non-monotonicity of value-at-risk and the validity of risk measures over different horizons. The ICFAI Journal of Financial Risk Management 4 (1): 7–18.

Thorton, N. 2016. Target-date fund assets post another all-time high in Q1” http://www.benefitspro.com/2016/06/27/target-date-fund-assets-post-another-all-time-high.

Acknowledgements

Yi gratefully acknowledges research support from the McCoy College Development Foundation at Texas State University.

Author information

Authors and Affiliations

Corresponding author

Appendix 1: data and sample construction

Appendix 1: data and sample construction

We search target date mutual funds from Bloomberg and other sources and initially found 234 TDMFs. After deleting missing equity weights, return distributions, and fund identifiers, we are left with 171 TDMFs. After including target dates of 2035, 2040, 2045 and 2050 only, we are left with 144 TDMFs after dropping 24 TDMFs with 2055 target date and 3 TDMFs with 2060 target date.

In this study, we create two simulated portfolios using SPY and TLT. The first simulated portfolio is created by assuming 60% of capital invested on SPY and the rest of capital invested on TLT. Each TDMF is matched by this 60:40 simulated portfolio. The second simulated portfolio is created by assuming we invest on SPY by simulating each TDMF’s specific equity position and invest the rest of capital on TLT.

Note that TLT starts trading on July 29, 2002. Therefore, those TDMFs existed before TLT’s first trading date enter our sample on July 29, 2002, to be consistent with dates covered by the simulated portfolios. In addition, some TDMF which were introduced more recently into the market enter our sample after July 29, 2002, and each TDMF within the same target data may have different starting dates. As a result, there are 144 TDMF-simulated portfolio observations.

Rights and permissions

About this article

Cite this article

Johnson, W.F., Yi, HC. Do target date mutual funds meet their targets?. J Asset Manag 18, 566–579 (2017). https://doi.org/10.1057/s41260-017-0054-7

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-017-0054-7