Abstract

Background

Drug lag in Japan has greatly decreased over the past decades; however, new instances of drug lag have appeared along with changes in the circumstances of oncology drug development. We aimed to investigate the factors associated with the approval lag for new oncology drugs between Japan and the United States (US) over the past decade by comparing approval dates and modalities, lead indications, approval types, and phase I strategies for earlier approval in Japan.

Method

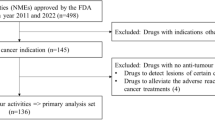

We descriptively evaluated the characteristics of 117 new oncology drugs approved in either Japan or the US from January 1, 2011, to December 31, 2020.

Results

Seventy-one drugs were approved in Japan, 112 in the US, five only in Japan, and 46 only in the US. Interestingly, new oncology drugs were predominantly developed by the top 20 pharmaceutical companies in Japan; however, the opposite was true for drugs that were not yet approved in Japan. However, no clear trend was observed in the relationship between drug lag and the studied factors, except for the phase I strategy. There was a numerical but clear trend in which a higher percentage of phase I multiregional clinical trials (MRCTs) in the drug development strategy was observed for drugs with earlier approval in Japan.

Conclusion

Participation in global drug development during the early stages, such as during phase I MRCTs, is one of the keys to successfully minimizing this new instance of drug lag in Japan.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Drug lag is the delay in the time required for drug approval in Japan. It has been recognized as a serious issue in recent decades. It is a critical issue especially in the context of life-threatening conditions such as cancers because patients miss more effective therapies or lose the opportunity to access novel therapies [1,2,3,4,5]. Drug lag has been actively investigated for a couple of decades and is mainly attributed to two components: delay in review by the health authority and development by the company. Recently, drug lag in Japan has greatly decreased owing to the efforts of health authorities, the Ministry of Health, Labor, and Welfare, and the Pharmaceuticals and Medical Devices Agency (PMDA), and pharmaceutical companies. Health authorities have implemented several measures to shorten the review period, harmonize pharmaceutical regulations with global circumstances, and motivate pharmaceutical companies. Companies, especially subsidiaries of global pharmaceutical companies, have routinely adopted a global simultaneous development strategy in the late phase of development in Japan [6,7,8,9].

In addition to the enormous progress in our understanding of cancer biology, the nature of phase I trials conducted during the drug development process has drastically changed. Phase I trials in the oncology drug have changed from trials merely investigating tolerability to those optimizing dose regimens, exploring preliminary efficacy, and identifying target molecules/populations through the use of biomarkers [10,11,12,13]. Therefore, a development strategy in Japan that involves participation in global development at an earlier phase has become increasingly important. More than half of the sources of pharmaceutical innovation come from emerging biopharma. Emerging biopharma is often highlighted in dealmaking with big pharmaceuticals and is becoming diverse, for example, the emergence of Chinese biopharmaceutical companies [14,15,16]. Previous studies highlighted the relationship between the development start lag and approval timing of oncology drugs in Japan [5, 17]. Phase I multiregional clinical trials (MRCTs) have become more common in Japan as a component of the great changes that have occurred in the circumstances of drug development in oncology. However, the relationship between drug lag and phase I MRCT in Japan (MRCT-JP) has rarely been investigated.

In this context, we aimed to investigate the factors associated with drug lag in new oncology drugs between Japan and the United States (US) over the past decade, from a drug development strategy perspective. We compared the regulatory approval dates of new oncology drugs in Japan and the US over the past decade and explored the relationship between approval timing and phase I development strategy. We also evaluated the relationship between approval timing and drug profile, including modality, lead indication, marketing authorization holder (MAH), and approval type. Based on these data, we attempted to identify the key factors for earlier approval of new oncology drugs in Japan.

Materials and Methods

We identified new oncology drugs approved either in Japan or in the US from January 1, 2011, to December 31, 2020, by reviewing the PMDA and the US Food and Drug Administration (FDA) website, and this review was performed on April 1, 2021. Only the initial approvals for new oncology drugs were considered, and supplemental approvals (indication expansion or new formulation) and biosimilars were excluded from the analysis. Data sources were primarily reviewed documents from the PMDA and FDA databases to assess the approval date, modality, lead indication, MAH, and approval type (conditional early approval [CEA] in Japan and accelerated approval [AA] in the US). Cell therapy, viral therapy, vaccines, hormone therapy, radioactive therapy, or non-treatment drugs (diagnostic drugs and supportive care) were excluded from the analysis. MAHs were classified into two groups to evaluate the impact of company’s business size on the development strategy: the top 20 pharmaceutical companies (Pfizer, Roche, Novartis, Johnson & Johnson, Merck & Co., Sanofi, AbbVie, GlaxoSmithKline, Takeda, Bristol-Myers Squibb/Celgene, AstraZeneca, Amgen, Gilead Sciences, Eli Lilly, Bayer, Novo Nordisk, Teva, Boehringer Ingelheim, and Biogen, based on drug sales in the fiscal year 2019) and others.

Phase I clinical trials (phase I or phase I/II trials) for the targeted oncology drugs that were sponsored by pharmaceutical companies in Japan or the US and of which trial locations included Japan, were identified through the database, Trialtrove®, by Informa PLC. The trial start date and strategy (MRCT-JP or single national clinical trial in Japan [SNCT-JP]) were then retrieved. Only trials that started before the date of initial approval in either Japan or the US were included. Trials conducted to investigate the pharmacokinetics, drug-drug interactions, human bioequivalence/bioavailability, and QT/QTc, post-trial access/patient access trials, those with pediatric (< 18 years old) patients, and those with multiple primary tested drugs were excluded. Trials sponsored by non-industry bodies, including academia, government, cooperative groups, or nonprofit organizations, were also excluded. A total of 683 trials, including 36 MRCT-JP and 111 SNCT-JP, were included in the analysis.

The approval dates of the drugs in Japan and the US were compared, and the numbers and percentages of drugs by modality, lead indication, MAH type (top 20 pharmaceutical companies or others), approval type, and phase I strategy (with or without MRCT-J) were summarized by approval status in Japan.

Results

From January 1, 2011, to December 31, 2020, a total of 117 new oncology drugs were approved in Japan or the US (Table 1 and Fig. 1, and Online Resource 1). The modalities of the 117 drugs included 23 (20%) monoclonal antibodies, nine (8%) antibody–drug conjugates, 83 (72%) small molecules with 52 (44%) kinase inhibitors, and two (2%) others (one fusion and one recombinant protein); 72 drugs were approved for the treatment of solid tumors, and 47 for the treatment of hematologic malignancies as the lead indication.

Distribution of the approval dates of new oncology drugs in Japan and the US. The approval dates for each drug in Japan and the Unites States (US) are plotted. Approved indications are depicted in closed circles: drugs used to treat solid tumors are indicated in light blue, and those used to treat hematologic malignancy are indicated in orange. Drugs approved only in one country (Japan, n = 5 or the US, n = 46) are displayed at the edge of each axis with open circles. The dashed line indicates the simultaneous time points.

Seventy-one drugs were approved in Japan, and 112 drugs were approved in the US, of which 66 were approved in both Japan and the US, five only in Japan, and 46 only in the US (Fig. 1). Among the 66 drugs approved in both countries, 58 drugs were approved in the US earlier than in Japan with a median (interquartile range [IQR]) of 821 (198.75–1387) days, while eight drugs were approved in Japan earlier than in the US with a median (IQR) of 119.5 (54–530.5) days. With respect to approval type, three drugs (3%) were approved in Japan under CEA and 49 (42%) were approved in the US under AA. The number of phase I trials in the program that started before the earlier date of approval in either the US or Japan (median [range]) was 2.8 [1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19]).

To explore the factors associated with drug lag in Japan, we descriptively evaluated trends between approval status in Japan (only in Japan, earlier in Japan, later in Japan, or not yet approved in Japan) and drug characteristics (Table 2). Among the drugs approved in Japan (n = 71), 68% were small molecules, 59% were approved for the treatment of solid tumors, and 69% were developed by the top 20 pharmaceutical companies. While 35% were approved as AA in the US, only 4% (three drugs; cetuximab sarotalocan, entrectinib, and trastuzumab deruxtecan, all for solid tumors) were approved under CEA in Japan, and three out of four drugs were approved only or earlier in Japan. No clear trend between approval status and factors was observed, except for the lead indication; earlier approval in Japan was more associated with drugs with indications for the treatment of solid tumors. All drugs approved only in Japan were developed by domestic Japanese companies, including those emerging.

Among the drugs not yet approved in Japan (n = 46), 78% were small molecules, 65% were approved for the treatment of solid tumors, and only 39% were developed by the top 20 pharmaceutical companies. Only two drugs have been developed by domestic Japanese companies. Fifty-two percent of these were approved as AA in the US. No clear trend between drug characteristics and approval timing was observed; however, importantly, 67% of unapproved drugs in Japan were developed by MAH rather than the top 20 pharmaceutical companies.

Notably, there was a numerical trend between approval status in Japan and the Phase I strategy in the program. Drugs with phase I MRCT-JP accounted for 50% of the drugs that were approved in Japan within 1 year of their approval in the US and 13% of the drugs approved in Japan 1 year later and within 3 years of their approval in the US, while only 9% of the drugs were approved in Japan more than 3 years after their approval in the US. For the 46 drugs approved only in the US, the number of drugs with phase I MRCT-JP was 11%. For 66 drugs approved in both Japan and the US, the difference in approval date between Japan and the US (median [IQR]) was 145 (44.25–211.5) days for drugs with MRCT-JP (n = 18) and 964 (330–1498.75) days for drugs without MRCT-JP (n = 48), indicating that approval was earlier in the US (Fig. 2).

Distribution of approval dates in Japan and the US by Phase I strategy. The approval date (diamond) in Japan (orange) and the Unites States (US) (light blue), start date of the first multiregional clinical trial with Japan (MRCT-JP) (open circle, green), and first MRCT-JP started before the earlier date of approval, either in the US or Japan, are plotted for the drugs approved in Japan (n = 66). Drugs with MRCT-JP (n = 18, upper panel) and those without MRCT-JP (n = 48, lower panel) are separately plotted in the order of approval date in Japan.

Discussion

Here, we showed that the approval lag in oncology drugs between Japan and the US still exists, and earlier participation of Japan in the global development program could be one of the key factors in shortening this lag. Between 2011 and 2020, 55 drugs were approved in both Japan and the US. Almost all drugs were approved earlier in the US than in Japan. A decrease in drug lag has been reported in previous studies; however, 46 drugs approved by the FDA have not yet been approved in Japan. There seems to be a new or potential drug lag in Japan, as pointed out in previous studies [9, 18, 19].

Modality and lead indication did not exhibit any trends related to approval timing and status in Japan and the US; approximately 70% were small molecules and approximately 60% were approved for the treatment of solid tumors. The top 20 pharmaceutical companies predominantly developed new oncology drugs in Japan. However, the situation was the opposite for drugs not yet approved in Japan. Emerging biopharmaceutical companies in the US and/or other countries have been actively developing new oncology drugs in the US, and they do not have their businesses or subsidiaries in Japan [14,15,16]. This may be one of the root causes of the drug lag in Japan. As scientific progress in oncology occurs, breakthrough therapies or precision medicines that target molecularly or pathologically defined populations with higher efficacy are needed and have been developed for patients with cancer. Thus, the target population tends to be much smaller than that of conventional drugs. Previous studies have identified that the persistent drug lag for therapies targeting minor cancers is caused by developmental delays [20,21,22]. Moreover, the role of phase I trials in the development course has drastically changed. Phase I trials have changed from merely investigating tolerability to enabling dosage determination, confirming preliminary efficacy, evaluating biomarker strategies, or assessing more innovative designs, such as umbrella studies/platform studies. Notably, drug approval based on the results of a phase I trial data alone has been reported. In this context, emerging biopharmaceutical companies are actively developing drugs via these approaches for such small populations [10,11,12,13, 23,24,25].

Accelerated approval has been utilized in the US. The CEA in Japan is a recently introduced system compared to the AA in the US. The purpose of CEA is similar to that of AA with an additional scope, that is, to promote the research and development of innovative pharmaceutical products in Japan, aiming at their early practical application. To date, there have been a limited number of drugs approved under CEA; however, Japanese domestic companies, have successfully obtained the first approval of innovative medicines in the world through innovative development strategies with phase I or I/II trials. The top 20 pharmaceutical companies also leveraged these frameworks in their development strategies, suggesting that the Japanese market is still attractive when an effective development strategy is implemented.

As we identified, there was a numerical but clear trend of association between a higher percentage of the use of a phase I MRCT-JP during the development strategy and earlier approval in Japan. As a general practice, the patient sample size in studies conducted in a single country may be relatively small owing to the limitations of the trial setting, resulting in the need for additional trials such as phase I SNCT-JP during the entire development course of the product. Even if additional trials are needed, earlier participation in phase I MRCT in Japan provides valuable information, including preliminary safety and/or efficacy, for the development strategy [26,27,28,29]. More importantly, it would open the door to earlier approval in Japan. Timely licensing or partnering activities are other methods of delivering these drugs to patients in Japan. However, even if such approaches were taken, safety and efficacy data obtained from Japanese patients would be needed for Japan to join global development during the confirmatory phase and establish robust clinical datasets for filing. In particular, phase I MRCT-JPs were conducted less frequently for drugs approved in Japan 1 year later than and within 3 years of their approval in the US and for drugs not yet approved in Japan, while phase I SNCT-JPs were conducted for approximately 60% of these drugs (data not shown). The role and properties of phase I SNCT-JP in the development strategy in Japan, in the present situation, need to be investigated in future. In order to increase Japan’s participation in global development strategy at the early stage, i.e., phase I MRCT-JP, further effort by both the health authority and the industry to improve clinical trial circumstances, business attractiveness, and regulatory perspectives would be needed, which would lead to minimize this new drug lag.

This study had some limitations. First, this was a descriptive study covering only new oncology drug approval in either Japan or the US between 2011 and 2020. We did not evaluate the lag in drugs that obtained supplemental approval, including indication expansion or expansion in a treatment line within the same indication, owing to the small sample size. Second, this study covered only phase I trials with a single primary tested drug conducted in Japan or the US, and phase I trials were not evaluated in other countries. Third, we excluded trials conducted by non-industry bodies, including academia, government, cooperative groups, or NPOs, in phase I strategy evaluation and excluded hormone and advanced therapies such as cell therapy, or non-treatment drugs from the analysis. Thus, we could not evaluate the development strategies for innovative therapies that have been actively developed in recent years. There may be a difference from the conventional method in the development strategy for innovative therapies, which requires further investigation.

Conclusions

We descriptively evaluated the characteristics of 117 new oncology drugs approved in Japan and the US between 2011 and 2020. A new instance of drug lag in Japan is now being identified along with changes in the circumstances of oncology drug development. Japan’s participation in global development strategies during the early stage, Phase I MRCT, would be one of the keys to successfully minimizing this new drug lag.

Data availability

The author confirms that all data generated or analysed during this study are included in this published article.

References

Hirai Y, Kinoshita H, Kusama M, et al. Delays in new drug applications in Japan and industrial R&D strategies. Clin Pharmacol Ther. 2010;87(2):212–8.

Honig PK. Recent trends and success factors in reducing the lag time to approval of new drugs in Japan. Clin Pharmacol Ther. 2014;95(5):467–9.

Ohwaki K, Nakabayashi T. Relationship between drug lag and factors associated with clinical trials in Japan. J Clin Pharm Ther. 2014;39(6):649–52.

Ueno T, Asahina Y, Tanaka A, et al. Significant differences in drug lag in clinical development among various strategies used for regulatory submissions in Japan. Clin Pharmacol Ther. 2014;95(5):533–41.

Nakajima K, Dagher R, Strawn L, et al. The relationship between development start lag and approval lag in oncology drug development in Japan. Ther Innov Regul Sci. 2015;49(6):911–9.

Kogure S, Koyama N, Hidaka S. Utilization of the bridging strategy for the development of new drugs in oncology to avoid drug lag. J Clin Pharmacol. 2017;57(11):1479–90.

Maeda H, Kurokawa T. Recent trends for drug lag in clinical development of oncology drugs in Japan: does the oncology drug lag still exist in Japan? Int J Clin Oncol. 2015;20(6):1072–80.

Rokuda M, Matsumaru N, Tsukamoto K. Identification of drug characteristics for implementing multiregional clinical trials including Japan. Clin Ther. 2018;40(2):284–95.

Tanaka M, Idei M, Sakaguchi H, et al. Evolving landscape of new drug approval in japan and lags from international birth dates: retrospective regulatory analysis. Clin Pharmacol Ther. 2021;109(5):1265–73.

Postel-Vinay S, Aspeslagh S, Lanoy E, et al. Challenges of phase 1 clinical trials evaluating immune checkpoint-targeted antibodies. Ann Oncol. 2016;27(2):214–24.

Chakiba C, Grellety T, Bellera C, et al. Encouraging trends in modern phase 1 oncology trials. N Engl J Med. 2018;378(23):2242–3.

Mackley MP, Fernandez NR, Fletcher B, et al. Revisiting risk and benefit in early oncology trials in the era of precision medicine: a systematic review and meta-analysis of phase i trials of targeted single-agent anticancer therapies. JCO Precis Oncol. 2021;5:17–26.

Verweij J, Hendriks HR, Zwierzina H, et al. Innovation in oncology clinical trial design. Cancer Treat Rev. 2019;74:15–20.

Mullard A. 2020 FDA drug approvals. Nat Rev Drug Discov. 2021;20:85–90.

Provansal C, Dooley D, Ziogas C. Pharmaceutical innovation sourcing. Nat Rev Drug Discov. 2022;21:627.

Micklus A, Giglio P. Biopharma dealmaking in 2021. Nat Rev Drug Discov. 2022;21:93–4.

Ushijima S, Matsumaru N, Tsukamoto K. Evaluation of drug lags in development initiation, new drug application and approval between Japan and the USA and the impact of local versus multi-regional clinical trials. Pharmaceut Med. 2021;35(4):253–60.

Tanaka M, Idei M, Sakaguchi H, et al. Rationales of delay and difference in regulatory review by Japan, the USA and Europe among new drugs first approved in Japan. Br J Clin Pharmacol. 2021;87(8):3279–91.

Noguchi A, Hanaoka H, Uyama Y. Potential future drug development lag in Japan based on an analysis of multiregional clinical trials in the US, Europe, and East Asia. Ther Innov Regul Sci. 2022;56(3):523–9.

Nakayama H, Matsumaru N, Tsukamoto K. The drug lag and associated factors for orphan anticancer drugs in Japan compared to the United States. Invest New Drugs. 2019;37(5):1086–93.

Yamashita K, Kaneko M, Narukawa M. Regulatory characteristics and pivotal study design of US Food and drug administration approval of drugs for major vs. minor cancer. Eur J Clin Pharmacol. 2019;75(9):1193–200.

Yamashita K, Kaneko M, Narukawa M. A significant anticancer drug approval lag between Japan and the united states still exists for minor cancers. Clin Pharmacol Ther. 2018;105(1):153–60.

Gyawali B, D’Andrea E, Franklin JM, et al. Response rates and durations of response for biomarker-based cancer drugs in nonrandomized versus randomized trials. J Natl Compr Canc Netw. 2020;18(1):36–43.

Adashek JJ, LoRusso PM, Hong DS, et al. Phase I trials as valid therapeutic options for patients with cancer. Nat Rev Clin Oncol. 2019;16(12):773–8.

Li A, Bergan RC. Clinical trial design: past, present, and future in the context of big data and precision medicine. Cancer. 2020;126(22):4838–46.

Hazim A, Mills G, Prasad V, et al. Relationship between response and dose in published, contemporary phase I oncology trials. J Natl Compr Canc Netw. 2020;18(4):428–33.

Jardim DL, Hess KR, Lorusso P, et al. Predictive value of phase I trials for safety in later trials and final approved dose: analysis of 61 approved cancer drugs. Clin Cancer Res. 2014;20(2):281–8.

Corbaux P, El-Madani M, Tod M, et al. Clinical efficacy of the optimal biological dose in early-phase trials of anti-cancer targeted therapies. Eur J Cancer. 2019;120:40–6.

Beinse G, Tellier V, Charvet V, et al. Prediction of drug approval after phase I clinical trials in oncology: RESOLVED2. JCO Clin Cancer Inform. 2019;3:1–10.

Acknowledgements

We would like to thank Editage (www.editage.com) for the English language editing.

Funding

The authors declare no financial support for the research, authorship, or publication of this article.

Author information

Authors and Affiliations

Contributions

Both authors were involved in the drafting and revising of this manuscript.

Corresponding author

Ethics declarations

Conflict of interest

Akio Maki, an employee of Novartis Pharma K. K. Mamoru Narukawa, has nothing to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Maki, A., Narukawa, M. Exploratory Analysis of Drug Lag in New Oncology Drugs Between Japan and the US. Ther Innov Regul Sci 57, 671–677 (2023). https://doi.org/10.1007/s43441-023-00512-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s43441-023-00512-6