Abstract

Owing to the ease and efficiency of contactless communication between intelligent devices, near-field communication (NFC), a wireless communication technology, is attracting the attention of customers. In today’s world, NFC is useful for mobile payment apps, electronic ticketing, access control, and authorization. Despite the widespread adoption of NFC technology, quite little is known about how to analyze its adoption with typical technology acceptance methods. Furthermore, there is an insufficient adoption of NFC technology in Africa. Therefore, this study provides a bird's-eye view of NFC technology, encompassing both the worldwide adoption models and the African market ecology. We conclude that this technology offers significant advantages over the status quo in areas such as mobile payment systems, public transit, event tickets, and medical care applications. Due to the significant smartphone penetration in South Africa, Nigeria, and Kenya, we select these nations to model the impact and downsides of adopting NFC in sub-Saharan Africa. Reports from the facts presented in this article about smartphone penetration rate, industrial acceptance, etc., show that NFC is finding useful applications on the African continent and has the potential to revolutionize various sectors of the African economy. The time is right for NFC to take off in Africa for mobile payments and other useful applications. Interestingly, the scope of this assessment extends beyond just the influence of NFC technology in Africa; it will also be useful to researchers, industry experts, product manufacturers, and NFC investors everywhere across the globe.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

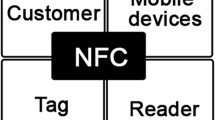

Wireless communication technologies have, since their inception, gradually improved how we use our smart phones and internet of things (IoT) devices making communication between two devices easier and faster and introducing great flexibility in the usage of these devices [1]–[3]. For example, some standard wireless technologies are 5G, 4G, 3G, Wi-Fi [4], Bluetooth, ZigBee, barcodes, and radio frequency identification (RFIDs) [5,6,7]. More specifically, radio frequency identification technologies (RFIDs), since their inception in the 1980s, have gained traction among the contemporary wireless technology protocols due to important features such as short working range, minimal power consumption, and the ease in establishing connections between active and passive devices (reader and tag, respectively) [8]–[10]. These features enable RFIDs outperform other shorter range technologies like Bluetooth and barcodes, which require extra time to establish a connection between two actively enabled devices [11]. A unique type of RFID technology is the near field communication technology (NFC) [12].

Near field communication (NFC) is a non-contact short-range wireless communication technology that allows devices to communicate within 4–10 cm proximity using inductive coupling [13]. Precisely, NFCs operate using a very-low power quasistatic magnetic field at a frequency of 13.56 MHz, making them fall in the industrial, scientific, and medical (ISM) band with a data transfer rate of 106 to 424 kbits/s and almost zero power dissipation [14]. Besides, while RFIDs are more suitable for industrial use like inventory tracking, NFCs are ideal for consumer-centric applications. For this reason, NFCs are generally adopted in mobile payment systems, smart ticketing, in-vehicular communication, access control and authorization, agricultural management, identification, location-based services, information supply, and network access [15]. For instance, instead of using debit or credit cards, a user may perform secure transactions using contactless cards or, more interestingly, their NFC-enabled mobile devices or smartphones [16, 17]. According to the research statistics of Blue Bite, these possibilities have exponentially increased the global adoption of NFC technology [18].

Despite this massive adoption of NFC technology globally, Africa currently lags in growth touching NFC support [19]. This slow growth owes to: (1) the slow penetration of smartphones into African countries, (2) the limited adoption of NFC technology by companies and merchants in Africa, and (3) the limited awareness of the use of this technology among consumers. Interestingly, there has been a sudden jolt in smartphone penetration into sub-Saharan Africa in recent times. GSMA intelligence 2020 reports that smartphone usage in sub-Saharan Africa should rise from 50% in 2020 to 65% in 2025, with Nigeria, South Africa, and Kenya projected to lead the mobile market by 2025 [20]. Therefore, these countries are perfect models to understudy the successful adoption of NFC technology in Africa. They can be considered case studies to observe how NFC technology can influence sub-Saharan Africa as a continent.

In this study, we examine different areas of applications of NFC technology. Additionally, we examine the global adoption of NFC technology using different technological acceptance models such as the technology acceptance model (TAM); diffusion of innovation (DOI); unified theory of acceptance and use of technology (UTAUT); strengths, weaknesses, opportunities, and threats-analytical hierarchy process (SWOT-AHP); and artificial neural networks (ANN). Following this, we consider the current state and posterity of NFC-based applications in Africa. Furthermore, we consider the potential impact of this technology in sub-Saharan Africa with a binocular focus on Nigeria, South Africa, and Kenya as case studies. A layout of the survey is presented in Fig. 1. We make the following contributions to this survey;

-

1.

We present a comprehensive theoretical background of NFC technology.

-

2.

We highlight the adoption of NFC technology in mobile payment systems, healthcare systems, and ticketing schemes.

-

3.

We present a survey on customer perception, intention, adoption, and continued use of NFC technology using diverse technological acceptance models on a global scale.

-

4.

We present a comprehensive discussion on the adoption of NFC technology in the African market using Nigeria, South Africa, and Kenya as suitable case studies.

-

5.

We consider the future of NFC adoption in banking schemes, medical applications, and transportation systems.

This survey is organized as follows; section presents related works and contributions. Next section considers the theoretical background of near field communication (NFC) technology and provides a detailed description of certain key areas of application of NFC technology, particularly in Africa. Additionally, we survey the customer perception, intention, adoption, and continued use of NFC Technology on a global scale. Following section presents a discussion on the current state of NFC adoption in Africa. Next section highlights the future of NFC technology in the African market. Following section presents the lessons from this study. Next section presents open issues and future research directions for NFC technology. In the last section, an appropriate conclusion is drawn.

Related Work and Contributions

Several works of literature have surveyed NFC technology, current trends, issues, applications, and future possibilities of the technology. For example, Ok et al. [21] reviewed the current benefits and possible future directions of NFC services in the academia and industry. In particular, the research pointed out NFC modes as essential factors required to investigate NFC applications. To investigate NFC technology more thoroughly, the work in [22] presented an overview of NFC technology from a technical perspective. Specifically, the authors reviewed the RFID and NFC technology's working principles and concepts, including security schemes. Further, Rahul et al. [23] investigated NFC technology modes of operation, applications, current vendors, and security measures. Busold et al. [24] investigated NFC issues, capabilities, and applications in vehicle anti-theft security systems. Additionally, Hamzah et al. [15] reviewed several applications of NFC technologies. In [12], Singh considered NFC an alternative to RFID in libraries. Specifically, this research discusses NFC as a key tool in advancing the traditional library system. Chandrasekar and Dutta [13] considered recent developments in near field communication and reviewed NFC usage with sensors.

Our survey considers existing research on NFC applications and the global adoption of the technology analyzed using developed models on the customer’s intention and adoption of use. Precisely, we consider models such as TAM, DOI, UTAUT, SWOT-ANN, etc., and present the implications and limitations of the relevant literature. Furthermore, we present NFC applications and the posterity of its adoption in the African space. A compilation of related works, their limitations, and our significant contributions are presented in Table 1.

NFC Technology

Technical Background

NFC technology is a short-range wireless technology used to communicate between two NFC-enabled devices that could be active or passive [14]. Communication is established via Inductive coupling utilizing a frequency of 13.56 MHz with a maximum data transfer speed of 424 kbits/s [32]. NFC technology's working range spans between 1 and 4 cm of NFC-enabled devices [33]. The active device could be a reader or writer, while the passive device could be a tag or card. An active device has its internal power source and can generate its alternating electromagnetic field by passing a current through the antenna’s loops [34–37]. The passive device does not have an internal power source and uses the field generated by the active device to power itself [2, 38]. Active devices can read, share, or transmit data to another NFC-enabled device, while passive devices can hold information and bytes of data without an internal power source. Communication is such that the active device generates an electromagnetic field, which the passive device uses to power itself and subsequently respond to the request from the active device [39–42]. NFCs operate in three modes—reader/writer (active and passive) mode, card emulation, and peer-to-peer mode [43], all based on ISO/IEC 18092 NFC-1, ISO/IEC 14443, and ISO 15693 standards [1, 24], as shown in Tables 2 and 3.

NFC Technology Implementation in Various Applications Areas

Near-field communication has found useful applications in diverse areas of human endeavor outperforming other wireless communication technologies. In this section, we take a close look at the application of NFC in specific areas such as changing the face of mobile payment schemes with security analysis; in tourism; developing innovative medical and wearable devices; and in chemical and biochemical areas. We present possibilities, limitations, and drawbacks as reviewed in diverse literature to realize a holistic view of NFC technology applications in diverse areas.

Mobile Payment Schemes

Mobile payment systems consist of one of the most promising usages of NFC technology globally. For example, Ondrus and Pigneur [45] assessed the usage of NFC technology for future mobile payment systems using a multi-actor multi-reactor approach. The results of this research revealed that NFC payment schemes perform well given the required criteria for a successful mobile payment scheme, such as universality, simplicity, interoperability, security, etc., as given by Carr [46]. Furthermore, NFC mobile payment systems promise to proffer solutions to the limitations of standard mobile payment systems such as short message service (SMS), unstructured supplementary service data (USSD), wireless application protocol (WAP), and interactive voice response (IVR) [45]. Some literature has proposed different NFC payment techniques. For instance, Kadambi et al. [47] developed a mobile payment solution for multiple payments using NFC technology with secure end-to-end transactions. The payment scheme integrates mobile devices with existing Point-of-Sale payment solutions using payment authorization tokens. Although tokenization addresses security concerns in user data protection, there are still issues concerning accessing card number data when a payment card is swiped or used to complete a transaction. Additionally, Rodrigues et al. [48] developed an NFC-based mobile payment scheme called MOBIPAG for payments, ticketing, and couponing. A critical drawback of the proposed payment scheme is the unfavorable user experience caused by communication failure in certain situations. In [49], Rehman and Coughlan proposed an NFC-based mobile payment scheme for Pakistani-based mobile transactions with authentication done via pin exchange between the user and the bank. This scheme could thus create an unfavorable user experience and previous security issues. In addition, Pourghomi, Qasim, and Ghinea [50] proposed a cloud-based NFC payment scheme to target mobile network operators. However, cloud computing technology is vulnerable to cyber-attacks because user data is transferred to distant servers for processing. Olufemi et al. [51] developed an NFC-based shopping payment scheme. In this research, security issues were not investigated. Table 4 shows some mobile payment schemes based on NFC technology.

NFC technology is gradually establishing itself in the mobile payment scheme globally. However, certain drawbacks can slow down its acceptance amongst consumers, such as security concerns and user experience. Security is a major issue when making mobile payments and consumer ease of use of the payment scheme. We investigate the consumer acceptance of NFC using different technology acceptance models.

Ticketing Schemes

NFC techniques are being adopted in diverse ticketing applications. For instance, Chaumette et al. [56] investigated and compared two user-oriented NFC-based event ticketing applications. Specifically, the authors develop an offline and online e-ticketing system for transportation and events management. Overall, both systems are compared in user experience, security, economic aspects, reliability, and speed. Further, Saminger et al. [57] developed a new approach to develop an NFC-based ticketing system using the reader/writer mode instead of the contemporary card emulation or peer-to-peer mode. The proposed method offers the advantage of implementing lightweight protocols compatible with existing mobile phones. To address the challenge of financial cost and complexity, Ivan and Balag [58], proposed an NFC-based mobile ticketing system for transportation applications. The proposed system is then compared with existing e-ticketing systems such as Oyster and U’Go. However, the performance of the system was not rigorously evaluated owing to the limitation in the amount of data and users. Widmann et al. [59] proposed an NFC-based electronic fare management scheme to change the public transportation system. A critical drawback in adopting this scheme is the unavailability of the card emulation mode support in most user devices, security concerns and communication failure. In addition, Nasution et al. [60] investigated an NFC-based mobile train ticketing scheme. Although prototyped, the scheme poses to create a fast and user-friendly ticketing experience. However, Security issues are not given adequate consideration, a key concern in NFC technology applications. Table 5 presents different NFC-based ticketing applications.

NFC technology has been successfully implemented in diverse transport ticketing systems such as trains, buses and ships. However, Security and, in some cases, ease of use and sometimes governmental interference pose drawbacks to fully accepting these ticketing schemes globally.

Medical Schemes

Medical applications are a major sphere where NFC technology finds useful applications, particularly in wearable electronics [67]. An et al. [68] surveyed NFC-based wearable devices, pointing out that NFC technology is a next-generation communication technology for wearable electronics owing to its compatibility, high security, miniaturization, and low power usage. Kassal et al. [69] developed a smart biosensor bandage shifting the acute/chronic wound care paradigm to time-based management. The smart bandage was based on the electrochemical detection of uric acid (U.A.) as the primary generic physiological indicator correlating with wound severity. The sensor was designed to send data to the server via NFC. Jeong et al. [70] extended NFC-enabled wearable research to develop a stretchable liquid metal system to monitor human motion using a biocompatible gel-like GalnSn sensor, showing the future potential of NFC-wearable technology as the human-robotic interface for prosthetics. Kim et al. [71] developed a low-power consumption wearable device based on NFC technology. The authors introduced a battery-less active optoelectronic system functioning entirely wireless with magnetic inductive coupling and near-field communication schemes for multicolor light emissions and detection. It allowed precise measurement of the skin's optical properties to detect coloration, vascular disease, and environmental detection based on color-responsive materials. The research shows up to 30% uniaxial strain. Therefore, possible to design optimized soft and conformal wearable lamination on the skin. This technology can be used to monitor heart rate through backscatter light measurement from an infrared. In addition, Freudenthal et al. [72] investigated the possibility of adopting NFC technology to provide convenient and effective low-power distribution and communications in medical devices. This scheme is particularly useful when implanting RFID into patients but, if corrupted, could be harmful to the patient. Hence, reliability is a major parameter to be considered in NFC-based medical schemes. Table 6 presents some NFC-based medical system schemes.

NFC technology is finding useful applications in the medical sector, particularly in the powering of implantable devices powered by NFC radio frequency. However, corruption of the device is also a key issue of concern which could be detrimental to the health of the patient [81]. This poses a drawback for the successful adoption of NFC in the medical environment.

Customer's Perception, Intention, Adoption, and Continuance of Use of NFC Technology

This section investigates consumers' intent, acceptance, and continuance of NFC technology on a Universal scale. Several models have been developed and recommended to address NFC adoption and the continuance of its use. These include the Unified Theory of Acceptance and Use of Technology (UTAUT), Technology Acceptance Model (TAM), TAM model 2 (TAM2), Theory of Planned Behavior (TPB), Diffusion of Innovation (DOI), and Theory of Reasoned Action (TRA). We review these models and provide research implications following our study.

The TAM Approach

The Technology Acceptance Model (TAM), developed by Davis [82], focuses on pursuing better measures for predicting and explaining the consumer acceptance of information technology [83]. The Model adopts two key metrics, Perceived usefulness and Perceived Ease of Use, in predicting and explaining the acceptance of information technology. Perceived usefulness describes the extent to which a person admits the system facilitates work performance. In contrast, perceived ease of use describes the extent to which the system would be effortless. Consequently, to study the degree of consumer acceptance of NFC technology, some literature has adopted this model to examine diverse areas of NFC technology applications. Although the TAM approach is simple and popular, it is necessary to integrate additional variables such as perceived security, trust, general complexity, etc., to improve its predictive power [84].

Hong et al. [85], examined the factors that influence NFC-based payment adoption in China. Specifically, this study was performed using the TAM approach. Precisely, the research utilized perceived ease of use and perceived usefulness as the two main parameters to evaluate the user’s intention to use the technology. From the evaluation method, the authors recommend that NFC-based payment operators should pay additional attention to developing multi-functional systems, which conventional payments cannot perform. Further, Xiaodie et al. [86], considered the determinants that influence the behavioral intention to use NFC-based mobile payment schemes in the Chinese space. More specifically, the study adopted the TAM method to investigate the emergence of Apple pay in China. From the evaluation results, perceived usefulness and trust are observed as the significant factors that propel the behavioral intention to use Apple Pay in the Chinese mobile service space.

Luarn and Juo [87] investigated the acceptance of NFC technology for making mobile payments using the TAM model in Taiwan. The research integrated trust with the standard perceived usefulness and ease of use metrics to predict the subscriber’s behavioral intentions regarding the NFC-based mobile payment scheme. The survey results reveal that trust in the firm does not influence the subscriber’s behavioral intention; it indirectly influences the subscribers’ trust in the technology. Although the model-fit indices exceed the acceptance levels in previous research, the study has certain limitations. The study only engaged 476 mobile network subscribers, which is quite low and consequently reduces the confidence in the overall performance of the proposed model. In addition, the scope of the survey is limited only to mobile network subscribers rather than general consumers.

Dutot [84] developed an extended TAM approach to investigate the factors influencing the adoption of NFC technology for mobile payment in France. The TAM approach is extended to include key factors that concern mobile payments, such as trust, perceived security, and technology availability in addition to the standard TAM metrics (perceived usefulness and ease of use). The proposed model is tested using a combined structural equation modeling (SEM) and Partial Least Square (PLS) approach with 320 smartphone users. The results reveal a 30% variance in NFC technology adoption, which shows strong support for NFC in making mobile payments. However, the research is limited by the number of users engaged in the survey. In addition, factors such as cost, compatibility, and interoperability are not incorporated in the model, which are key factors that influence mobile payment adoption.

Han et al. [88] researched the determinant of NFC reuse intention and perception in Tourism in Korea. The authors noted that NFC information quality and organization support greatly influenced expo-visitors satisfaction with NFC. The study further proved that customer satisfaction generates continuous vitality backing NFC use in tourism expo loyalty. Tan et al. [89] adopted an extended TAM approach to investigate the acceptance of NFC-based mobile payment schemes in Malaysia. The model integrates four constructs: personal innovativeness in information technology, social influence, perceived risk, and perceived financial cost to the standard TAM metrics in determining the degree of NFC mobile payment schemes. The data were collated from 156 users and analyzed using structural equation modeling and multi-group analysis. The study results revealed that NFC-based mobile payment methods are only marginally adopted in Malaysia.

Unified Theory of Acceptance and Use of Technology (UTAUT)

UTAUT was proposed by Vankatesh et al. [90] and adopted to explain information technology acceptance and use. The model adopts four constructs, which are gender, age, experience, and voluntariness, to predict the acceptance of information technology [91]. Some literature has adopted the UTAUT approach in explaining and predicting the acceptance of NFC technology for different applications. Boes et al. [92] adopted the UTAUT model to explore the various determinants that influence the acceptance of NFC Smart Posters for Tourism in Salzburg, Austria. The UTAUT model adopted in the study was extended to include a perceived trust for security and privacy concerns and perceived quality. The constructs used in this study include perceived effort expectancy, perceived performance expectancy, perceived trust, social influence and perceived quality. The results of this study show that unawareness is one of the key factors that affect the acceptance of this technology. In addition, the intention of use of NFC smart posters is greatly influenced by the usefulness and quality while social influence and effort expectancy contribute little to the adoption of the technology. The limitation of this study is that only one smart poster is examined and age, gender and experience, which are key constructs, were omitted. Khalilzadeh et al. [93] examined the factors that influence the adoption of NFC-based mobile payments using an extended UTAUT model in North America. The model integrated the UTAUT model with the TAM model and tested the design using the SEM on an empirical data provided by 412 restaurant customers. The results of the study show that risk, security and trust on the customer’s intention to use the NFC-based mobile payment scheme.

Diffusion of Innovation (DOI)

The DOI theory is based on the dimensions of diffusion, such as innovation, communication channels, social systems, and time. The model entails five constructs, which are relative advantage (RA), compatibility (CA), complexity (CL), observability (OB), and trialability (TR) [94]. The DOI model can explain a 49–87% variance in adoption [95]. Balachandran and Tan [96] proposed a regression model using DOI to predict the adoption of NFC technology for mobile payment in Malaysia. The proposed model adopted five constructs replacing trialability and observability with three constructs, namely, amount of information (AOI), perceived financial resources (PFR), and variety of services (VOS). The study results revealed that CL, CA, AOI, VOS, and PFR greatly influence the intention of adopting NFC-based mobile payment. The results of this research cannot be generalized because the data used were only gathered from consumers who own a smartphone. Voges [97] carried out a study of NFC adoption in the German Market using the DOI approach. The study aims to answer the question of whether NFC multi-application platforms are accepted and diffuse into the German Market. The results of this study revealed that a multi-application platform is accepted, the NFC-based technology is only viable when used in combination with a smartcard.

SWOT-AHP Approach

Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis is a model often adopted to evaluate an organization, a plan, a project, or a business. It is a simple but powerful tool for evaluating the internal factors (strengths and weaknesses) of a plan and the external factors (opportunities and threats) [98]. To address the basic drawback of SWOT Analysis, touching on the limitation in quantitative computation, Mehmood et al. [99] complemented the SWOT analysis with the analytical hierarchy process (AHP) to address this drawback. The SWOT-AHP is adopted to investigate the adoption of NFC as a means of mobile payments in the Italian economy. The study results show an optimistic prospect of NFC adoption and acceptance. The findings from 23 qualitative questionnaires filled by Italian telecom experts with adequate NFC knowledge concluded that the positive factors (strengths and opportunities) outweigh the negative factors (weaknesses and threats). The limitation of this research concerns the incorporation of only one Telecommunication Company, which reduces the confidence in the results.

Artificial Neural Networks (ANN) Approach

ANN is a brain-inspired model that explains linear and non-linear relationships in a given data set. Leong et al. [94] extensively evaluated the determinant factors influencing NFC-enabled mobile credit cards’ adoption as a contactless payment method. The research entailed using an extended TAM model to include trust, psychological science, and behavioral control theories. SEM-ANN and multi-group analysis were subsequently used to examine different determinants such as social influence, personal innovativeness, trust, etc. Structural equation modeling (SEM) evaluated the causal relationship to extract significant factors fed as the artificial neural networks (ANN) [100]. The model consistently captured the relationship between predictors and collectors with a root mean square of error (RMSE) range of 0.1071–0.1128 in the training dataset and 0.1020–0.1055 in the test dataset. The research results revealed that Perceived ease of use and perceived usefulness have a significant and direct influence on the consumer’s intention. However, the research results are limited to Malaysia, and the number of users who participated in the study was low (300). Last, a detailed summary of the usage of the models mentioned above is given in Table 7.

Research Implications from Models Studied

We present some research implications from the comprehensive study of different models developed to understudy consumer perception, adoption, intention, and continuance of the use of NFC technology. These implications may be used as important guidelines to improve the penetration of NFC technology in any region.

-

1.

Security is a major concern in adopting NFC technology for applications such as mobile payment schemes, transport ticketing schemes, etc. Consumers are wary of the security of their user data and privacy and thus require effectively secure platforms to trust NFC-based payments or ticketing. Thus, security should be given enough attention when developing a payment or ticketing scheme in any region, Africa inclusive.

-

2.

NFC technology adoption is also greatly influenced by consumers’ perception of ease of use. Thus, NFC-based schemes should be designed and developed to be user-friendly and innovative. In addition, the time to secure transactions should be minimized to prevent a bad consumer experience.

-

3.

Awareness of NFC technology is also a key factor that influences consumer adoption. Meticulous research reveals many consumers are not aware of the technology. Thus, social influencers may be employed to increase the awareness of the technology while network operators and financial institutions emphasize usefulness and reliability.

-

4.

The unavailability of NFC-supported smartphones discourages NFC application providers. Hence, mobile phone developers should invest in NFC technology support on their Smartphones to encourage users and NFC technology industries.

-

5.

An agreement should be reached between governmental institutions, software developers [101], and financial institutions regarding standards to improve the user experience when using NFC-enabled technologies for diverse applications.

Current State of NFC Applications in Africa

Over the years, the world has experienced a remarkable increase in the number of NFC enabled smartphones as can be observed in Fig. 2. However, NFC support in Africa is the slowest when compared to other continents of the globe as displayed in Fig. 3. Particularly, the African continent has experienced a gradual adoption of NFC technology in different areas such as mobile payment schemes, ticketing applications, and transport systems. This section reviews the different areas of application where NFC technology is being adopted in key countries like South Africa, Nigeria, and Kenya.

The number of NFC-enabled cellular devices and non-NFC-enabled cellular devices with a global perspective from 2014 to 2020. From the delineation, we may observe that there is a considerable increase in the amount of NFC-enabled devices compared to non-NFC-enabled devices. This shows that NFC communication technology applications are experiencing remarkable growth all over the world

A continental perspective to NFC support between 2015 and 2018. It can be observed that NFC support has increased in every continent with Africa experiencing the slowest percentage growth. This owes to the slow penetration smartphones in Africa, the limited adoption of NFC technologies by companies and merchants, and the limited awareness of the use of this technology

Nigeria is the most populous country in Africa, with 206 million and 170 million mobile internet subscriptions as of 2020 (Statistica reports). This makes Nigeria the country with the highest mobile market in sub-Saharan Africa. Interestingly, several companies in Nigeria are fast integrating NFC technology into their business schemes. Some include the United Bank of Africa, Payattitude, Farepay, Sanwo, etc. This Industry acceptance of NFC would influence the Nigerian economy's diverse sectors such as Banking, Transportation, and even Shopping. One of the leading applications of NFC Technology is in making mobile payments. Mobile payments could be made using contactless cards or NFC Enabled Smart Phones running a payment application such as Google Wallet, Samsung Pay, Apple Pay, Android Pay, etc. In order to perform a payment transaction using contactless cards, the Card is brought within the range of the POS Reader field, and a transaction is made. This technique makes payment easier and faster than the contemporary EMV (Europay, Master, and Visa) cards, which require the Card to be inserted into the POS machine and authentication to be made before a transaction payment is completed. Also, NFC-based Smartphones running mobile payment applications make this process even easier. Here, it avoids the user from carrying different cards everywhere, which could get misplaced and even stolen. The Smart Phone emulates a contactless card (Card emulator mode), and the transaction is made with just one tap when brought in proximity to the NFC-enabled POS device. NFC-enabled mobile payment scheme prevents long queues at the payment terminal and promotes a good customer experience.

The Nigerian Mobile Market has seen a gradual adoption of NFC-based payment schemes. In 2014, a Bangalore-based mobile service provider, Ikaaz, partnered with Nigerian-based FCMB Bank to provide NFC Based payment options using NFC tags and Ikaaz NFC Enabled mobile POS. Subsequently, in 2015, Nigerian-based payment provider Unified Payments partnered with six banks (Access, UBA, Skye, Zenith, Diamond, and First Bank). This provides an NFC-based payment solution, PayAttitude using a Chip and pin enabled tag type device and an NFC Enabled POS device. In 2015, UBA issued over 3 million contactless cards to revolutionize their e-payment scheme using NFC Technology. Furthermore, by 2017, a Nigerian-based payment solution provider, Sanwo, developed an NFC-based payment system using NFC stickers, wristbands, and cards. In 2021, owing to the COVID-19 pandemic, the First Bank of Nigeria developed a virtual payment card using NFC technology. Besides these, Samsung, iPhone, Huawei, Xiaomi, and HTC can use Samsung Pay, Apple Pay, and Android Pay, respectively.

Owing to the population of people in Nigeria, there usually exists huge traffic of people at ATM points all over the Nation. Cash withdrawals are the most common usage of ATM units in Nigeria. This traffic of people is primarily due to the current process of making ATM Withdrawals, which entails a slow method of inserting the master or visa card and following some required promptings before cash withdrawals can be made. This process could take from 2 min to about 10 min for those who are not adept with the ATM, thereby creating a long queue of people. NFC Technology may be effective in proffering lasting solutions to this problem by developing NFC-based ATM units. In 2020, First Bank of Nigeria, in partnership with Hyosung ATM OEM, launched their NFC-based ATM called FastTrack ATM, which is the first of its kind. With the FastTrack ATM, users may perform quick cash withdrawals with their contactless cards or NFC Enabled Smart Phones.

Furthermore, bus rapid transport (BRT) was launched in Lagos, Nigeria, in 2008 to address congestion, air pollution, and road accidents that were on the increase. However, there have been issues with congestion at BRT terminals since their inception due to the slow purchase of tickets and slow validation of tickets by personnel before transit can be made. To address this concern, NFC Technology is currently being adopted to avoid long queues owing to slow ticket purchases, thereby informing a good customer experience. In 2018, a Nigerian-based payment solution provider, Farepay, developed a contactless card to replace sellers' contemporary purchasing tickets method that may not be available. This Card operates using NFC technology and is currently being adopted by Lagosians making transportation easier and faster.

South Africa has also seen a gradual adoption of NFC-based services, with Samsung and Huawei (NFC-enabled devices) dominating the mobile market. Samsung pay was launched in 2018 in partnership with South African-based payment solution provider, Zapper, which launched Huawei pay in 2020 to make mobile payments. Besides, South African-based payment solutions provider Wallet Factory developed an NFC-based contactless card to make mobile transactions using Google Pay or Apple Pay. Although South Africa is still dominantly a cash-based economy, South African-based banks (Standard Bank, Nedbank, Absa bank, Sabric, and FNB) quickly integrate NFC technology into their POS terminals and develop contactless cards. For product identification, South African-based solutions provider, Taggable, developed NFC stickers for products that could be highly useful in Shopping malls. In transportation, a British-based company, Aconite, 2011 announced a partnership with Proxama in bringing NFC ticketing to the South African transport system.

In 2012, in partnership with Kenyan-based Equity bank, Google launched an NFC-based payment scheme, Bebapay, for cashless transit payments in Kenya. More recently, Safaricom launched an NFC-based mobile payment system called m-Pesa to enhance payment transactions in the Nation. A summarized table of the implementation of NFC-based applications in Africa using South Africa, Kenya, and Nigeria as case studies is described in Table 8.

Impact of NFC Technology in Africa

NFC Technology adoption largely depends on NFC Enabled Smart Phones' availability, Industry acceptance and integration of the technology into their products and schemes, and the general awareness of the communication technology among the general populace [27]. For example, the 2018 Scentiamobile continental report showed that NFC Support growth was observed to be highest in continents with high iPhone usage (Oceania and North America (80%)) and lowest in continents with low iPhone usage (Africa and South America (50%)) [19]. According to world statistical data carried out by Scentiamobile, Africa experienced only a 5% increase in NFC support growth between 2015 and 2018. This slow growth primarily owes to (1) the slow penetration of Smartphones into African Countries, (2) slow industry acceptance and integration of this technology owing to implementation cost and (3) limited awareness of NFC Technology among the general populace. Informa Telecoms and Media reported that in 2011, the percentage of smartphones relative to mobile phones in Africa was just 3%, showing smartphones' slow penetration rate [116]. Interestingly, GSMA Intelligence 2020 reports have shown that Africa fast records a high smartphone penetration rate. South Africa, Nigeria, and Kenya have a good penetration percentage and will lead the mobile market by 2025 [20]. The availability of NFC Enabled Smart Phones promises to increase the percentage of NFC adoption in Sub-Saharan Africa.

NFC-Enabled Smartphone Usage in Sub-Saharan Africa

GSMA intelligence carried out an understudy of the mobile economy of sub-Saharan Africa, in 2020. This study reveals that the average percentage of smartphones in Africa will rise from 44% in 2019 to 65% in 2025, as shown in Fig. 4 [20]. Figure 4 presents the percentage of smartphones in Africa's different regions (Ethiopia, EAC, ECCAS, ECOWAS, and SADC). In addition, as described in Fig. 2, the top five brands of smartphones are presented with Samsung leading in all quarters except the last quarter. Interestingly, Samsung and Huawei have successfully integrated NFC chips into their products. By 2015, all Samsung devices incorporated NFC chips and successfully ran applications like Samsung Pay for mobile payments (Card Emulation Mode) and Android Beam to exchange media and documents between two NFC-enabled Smart Phones (Peer-to-Peer Mode). Also, since 2017, Huawei has integrated NFC chips into their devices, thereby making them capable of running Android Pay and Android Beam. Furthermore, two smartphone brands, iPhone and Xiaomi, which have embedded NFC chips, gradually increase the African Mobile Market. These facts further validate the suitability of Africa for future NFC adoption.

The percentage of smartphones in Africa's different regions (Ethiopia, EAC, ECCAS, ECOWAS, and SADC). In addition, the top five brands of smartphones are presented, with Samsung leading in all quarters in 2019. These statistics reveal how fertile the African space is for the adoption of NFC applications in diverse applications

Possible Future Applications of NFC in Africa

In the Banking Sector

Owing to the population of people in Nigeria, there usually exists huge traffic of people at ATM points all over the Nation. Cash withdrawals are the most common usage of ATM units in Nigeria. This traffic of people is primarily due to the current process of making ATM Withdrawals, which entails a slow method of inserting the master or visa card and following some required promptings before cash withdrawals can be made. This process could take from 2 min to about 10 min for those not adept with the ATM, thereby creating a long queue of people. NFC Technology may be effective in proffering lasting solutions to this problem by developing NFC-based ATM units. In 2020, First Bank of Nigeria, in partnership with Hyosung ATM OEM, launched their NFC-based ATM called FastTrack ATM, the first of its kind. With the FastTrack ATM, users may perform quick cash withdrawals with contactless cards or NFC Enabled Smart Phones. Interestingly, South African banking institutions adopt NFC technology in their ATM units. First National Bank (FNB), since 2018, has been rolling out NFC-enabled ATMs to make cash withdrawals easier and faster.

Shopping

Nigerian Shopping malls are also experiencing congestion owing to the population of Nigeria. This congestion is due to the slow process of validating the product information at the POS unit before payment can be made, causing very long queues and discouraging customer experience. NFC Technology may address this concern, because products may be embedded with NFC stickers containing the necessary product information. Subsequently, users may use their NFC-enabled smartphones to retrieve this information (Product type and cost) using the Reader/Writer mode of NFC. Payments may then be made at the POS terminal without creating any delays in validation using NFC-enabled readers. There is no such application in Nigeria, thereby creating an open area for research.

Transportation

Transportation is also an exciting area where NFC technology may be adopted to make transport easier and faster through NFC-based ticketing schemes [13, 58, 61, 117]. These schemes reduce the bottleneck of congestion often caused by my ticket purchase and verification [118]. The user may use an NFC-enabled card or smartphone to purchase and verify ticket purchases at one tap. A few institutions currently provide NFC-based transport services in Nigeria, Kenya, and South Africa, such as Farepay, Bebapay, Go, George, etc. However, NFC promises to transform the transport system of African Countries gradually.

Healthcare

A significant area of interest in NFC technology adoption is the Health sector [119]. Onyancha [120] reviews the adoption of NFC technology in the Kenyan healthcare system. In the study, the author investigates the adoption of NFC in storing patients' medical data to reduce medical costs and assist doctors in making quick clinical decisions. Jembi Health systems developed a platform (Journey Solutions) that uses NFC cards to allow individuals to carry their medical data to access their medical records. NFC schemes promise to transform the medical space through NFC-based data storage, payment systems, etc.

Lessons Learned This section presents the important lessons learned from the survey on NFC Technology and its impact on African Space. We present lessons learned from NFC technology performance, application, adoption, and acceptance in Africa using South Africa, Nigeria, and Kenya as models.

Lesson one: NFC Technology outperforms other short-range wireless technologies like Bluetooth, Wi-Fi, Zigbee, and QR-codes in that NFC makes communication between two NFC Enabled devices easier and faster at just "one tap" when brought in close proximity. The almost zero power dissipated when using NFC technology makes the technology very attractive for low-power consumer applications such as mobile payments, e-ticketing, smart packaging, etc.

Lesson two: NFC technology is based on RFID technology. An NFC Enabled device's performance depends on the active device's available power, the orientation of the passive device, and the antenna design. The higher the power, the longer the magnetic field's working range with a cost of power dissipation. The more perpendicular the passive device is, the more energy is trapped to power itself to communicate with the active device. Also, the larger the antenna size, the higher the magnetic field's working range, making antenna design a key consideration when developing an NFC-enabled device.

Lesson three: NFC technology is suitable for different applications such as mobile commerce, tourism, transportation, shopping, etc. However, the most widespread use of NFC Technology worldwide, and in Africa, where the technology is currently finding suitable adoption, is for mobile payment transactions opening the door to applications like Samsung pay, Android Pay, Huawei Pay, etc. It is worthy of note that these are fast proliferating in the global mobile commerce space and Africa, primarily due to the COVID-19 pandemic. NFC technology has opened the door to opportunities for banks to develop contactless cards, NFC-based ATM and POS units, etc., for users to make easy and fast transactions at a go.

Lesson four: The global adoption of NFC technology depends on certain important factors such as the security of the technology, the customer’s perceived ease of use, the awareness of the technology, the availability of NFC-enabled devices, and government policies. These factors influence the customer’s perception, intention, adoption, and continued use of the technology.

Lesson five: The Adoption of NFC technology largely depends on the availability of NFC Enabled devices such as contactless cards, NFC Enabled Smart Phones, NFC tags, embedded stickers, wristbands, etc. Without these devices, the adoption rate of the technology would be stringently slow. This is the major cause of the slow growth of NFC technology in Africa. Africa currently lags in the global scale of NFC technology Adoption owing to the slow penetration of smartphones into the continent, the slow adoption of the technology by industries, and the limited awareness of the technology by the individual African. Hence, growth in NFC Enabled devices' proliferation would lead to Growth in technology adoption on the continent.

Lesson six: South Africa, Nigeria, and Kenya are projected to lead the mobile market space in sub-Saharan Africa, making them suitable models to understudy NFC Technology's impact on Africa as a whole. The Smartphone penetration rate in these countries has gradually increased in recent years, accounting for almost the total usage of smartphones in sub-Saharan Africa. Interestingly, the mobile market vendors in sub-Saharan Africa and these countries are Samsung, Huawei, iPhone, etc. They have successfully integrated NFC Technology into most devices, making the market suitable for NFC Adoption. Nigeria currently leads in adopting NFC Technology, closely followed by South Africa and then Kenya.

Lesson seven: NFC-based transactions are vulnerable to security attacks such as denial of service (DoS) attacks, distributed denial of service (DDoS) attacks, phlashing attacks, etc. Hence, this concerns greatly influences the user’s acceptance and trust for the technology. However, not many studies have investigated the possible solutions to these limitations. Moreover, as the wireless communication technology develops, more investigation is required within this area. Nevertheless, some machine learning techniques such as convolutional neural networks (CNNs), long-short term memory (LSTM), etc. are emerging to provide a more convincing solution to this drawback.

Open Issues and Future Research

Since its inception in 2004, NFC Technology has been gradually permeating diverse areas of human life. However, certain issues need to be addressed to facilitate technology usage, particularly in Africa. Some of these issues like security concerns, adoption and acceptance in Africa, implementation cost, medical research, and power and antenna design considerations are presented in Table 9.

Conclusions

This paper presents a comprehensive review of NFC technology, its applications in several areas of human endeavors, its customer perception and acceptance on a global scale, and its impact on the African continent, using Nigeria, South Africa, and Kenya as suitable models owing to their high smartphone penetration rate. Specifically, we provide the customer’s perception, intention, and continuance use of NFC technology on a global scale by understudying different models such as TAM, UTAUT, DOI, SWOT-AHP, and ANN. From these models, we derived important implications detailing the influence of certain factors, such as security, ease of use, awareness, availability of NFC-enabled smartphones, and government policies, on the adoption of NFC technology. Furthermore, the future of NFC technology is considered in mobile payment schemes and medical applications, as a stepping stone to developing the smart cities of the future. Particularly, NFC is a zero power dissipation short-range wireless technology for communicating between two NFC Enabled devices, which may be active and/or passive. The reduced power dissipation, flexibility, and ease of carrying out transactions with just "one tap" make NFC Technology more attractive than other wireless technologies like Wi-Fi, Bluetooth, Zigbee, QR Code, etc. Although NFC technology may be applied in product recognition to retrieve product information from NFC Stickers embedded in products, this could create a better consumer experience at shopping malls, e-Ticketing for transportation, cinema access, football ticket purchase, etc. The most popular use of NFC globally and particularly in Africa is making mobile payments. NFC technology is gradually establishing itself in the African market as a key enabler of mobile payment transactions, which may relegate other payment methods like Debit and credit cards in the nearest future. This work reviews near-field communication penetration in Africa, highlights all application areas, and provides a holistic overview of NFC's potential. This survey presents researchers, NFC developers, industries, and entrepreneurs in Africa with a futuristic perspective on NFC adoption in the African market. Going by the reports from the statistics presented in this paper on population and the number of smart devices, we may conclude that NFC has found a place in Africa. The market is ripe for NFC adoption as a form of payment and other applications. Africa is progressively accepting NFC development initiatives due to the prospect of enhancing the quality of life along social-economic strata. Our future work will examine the impact of NFC adoption in Sub-Sahara Africa, focusing on economic liberation and democratization of government institutions.

Data availability statement

Data sharing does not apply to this review article.

References

Coskun V, Ozdenizci B, Ok K. The survey on near field communication. Sensors (Switzerland). 2015;15(6):13348–405. https://doi.org/10.3390/s150613348.

Adelabu MA, Imoize AL, Obaruakpor U. A concealment technique for missing VoIP packets across non-deterministic IP networks. J Telecommun Electron Comput Eng. 2021;13(3):31–9.

Otuokere TO, Imoize AL, Atayero AA-A. Analysis of sonic effects of music from a comprehensive datasets on audio features. Elektr J Electr Eng. 2021;20(1):43–53. https://doi.org/10.11113/elektrika.v20n1.233.

Etta VO, Sari A, Imoize AL, Shukla PK, Alhassan M. Assessment and test-case study of Wi-Fi security through the wardriving technique. Mob Inf Syst. 2022;2022:7936236. https://doi.org/10.1155/2022/7936236.

Palma D, Agudo JE, Sánchez H, Macías MM. An internet of things example: classrooms access control over near field communication. Sensors (Switzerland). 2014;14(4):6998–7012. https://doi.org/10.3390/s140406998.

Imoize AL, Adedeji O, Tandiya N, Shetty S. 6G Enabled smart infrastructure for sustainable society: opportunities, challenges, and research roadmap. Sensors. 2021;21(5):1709. https://doi.org/10.3390/s21051709.

Imoize AL, Ibhaze AE, Atayero AA, Kavitha KVN. Standard propagation channel models for MIMO communication systems. Wirel Commun Mob Comput. 2021. https://doi.org/10.1155/2021/8838792.

Ilie-zudor E, Kemény Z, Egri P, Monostori L. The Rfid technology and its current applications, no. September 2012. 2006. pp. 29–36. http://igor.xen.emi.sztaki.hu/~zudor/Publications/RFID_technologyandapplications.pdf.

Renuka K, Janani RP, Lakshmi Narayanan K, Kannan P, Santhana Krishnan R, Harold Robinson Y. Use of near-field communication (NFC) and fingerprint technology for authentication of ATM transactions. In: Intelligent sustainable systems. Springer; 2022. pp. 415–26.

Mitrovic N, Đorđević M, Veljković S, Danković D. NFC enabled Wi-Fi managging system for ESP32 based IoT system. E-bus Technol Conf Proc. 2022;2(1):57–60.

Ajani TS, Imoize AL, Atayero AA. An overview of machine learning within embedded and mobile devices—optimizations and applications. 2020;21(13):1–44.

Singh NK. Near-field communication (NFC): an alternative to RFID in libraries. Inf Technol Libr. 2020. https://doi.org/10.6017/ITAL.V39I2.11811.

Chandrasekar P, Dutta A. Recent developments in near field communication: a study. Wirel Pers Commun. 2020;116(4):2913–32. https://doi.org/10.1007/s11277-020-07827-9.

Kang SG, Song MS, Kim JW, Lee JW, Kim J. Near-field communication in biomedical applications. Sensors (Switzerland). 2021;21(3):1–18. https://doi.org/10.3390/s21030703.

Hamzah ML, Desnelita Y, Purwati AA, Rusilawati E, Kasman R, Rizal F. A review of Near Field Communication technology in several areas. Espacios. 2019;40(32).

Schamberger R, Madlmavr G, Grcchenia T. Components for an interoperable NFC mobile payment ecosystem. In: 2013 5th international work near field communication. NFC 2013. 2013. https://doi.org/10.1109/NFC.2013.6482440.

Pungjunun K, Yakoh A, Chaiyo S, Siangproh W, Praphairaksit N, Chailapakul O. Smartphone-based electrochemical analysis integrated with NFC system for the voltammetric detection of heavy metals using a screen-printed graphene electrode. Microchim Acta. 2022;189(5):1–12.

Bite B. NFC usage and statistics for 2020.

Scientiamobile. Near field communication support has come a long way NFC support by operating NFC support by continent. 2019. https://www.scientiamobile.com/near-field-communication-support-has-come-a-long-way/.

G. Intelligence. The mobile economy Sub-Saharan Africa 2020. 2020. pp. 1–41.

Ok K, Coskun V, Aydin MN, Ozdenizci B. Current benefits and future directions of NFC services. In: ICEMT 2010—2010 international conference education management technology proceedings. 2010. pp. 334–8. https://doi.org/10.1109/ICEMT.2010.5657642.

Motlagh NH. Near field communication (NFC)—a technical overview Naser Hossein Motlagh near field communication (NFC) a technical overview master’s thesis for the degree of Master of Science in Technology submitted for inspection, Vaasa, 28th of May 2012, no. November. 2015. https://doi.org/10.13140/RG.2.1.1232.0720.

Rahul A, GKG, UKH, Rao S. Near field communication (NFC) technology: a survey. Int J Cybern Inform. 2015;4(2):133–44. https://doi.org/10.5121/ijci.2015.4213.

Busold C, et al. Smart keys for cyber-cars: Secure smartphone-based NFC-enabled car immobilizer. In: Proceedings of the third ACM conference on data and application security and privacy. 2013. pp. 233–42.

Hussein A, Mohammad R. Near field communication. Secur Smart Embed Dev Platf Appl. 2012. https://doi.org/10.1007/978-1-4614-7915-4_15.

Vibhor S, Preeti G, Prashant K. Near field communication. IEEE Perv Comput. 2013;10(3):4–7. https://doi.org/10.1109/MPRV.2011.55.

Arcese G, Campagna G, Flammini S, Martucci O. Near field communication: technology and market trends. Technologies. 2014;2(3):143–63. https://doi.org/10.3390/technologies2030143.

Olenik S, Lee HS, Güder F. The future of near-field communication-based wireless sensing. Nat Rev Mater. 2021;6(4):286–8. https://doi.org/10.1038/s41578-021-00299-8.

Kulkarni RD. Near field communication (NFC) technology and its applications, vol. 1. 2021.

S. Chabbi, N. El Madhoun, L. Khamer, Security of NFC banking transactions: overview on attacks and solutions. In: 2022 6th cyber security network conference CSNet 2022. 2022. https://doi.org/10.1109/CSNet56116.2022.9955600.

Liu Y, Wang Z, Xu J, Ouyang C, Mu X, Schober R. Near-field communications: a tutorial review. IEEE Open J Commun Soc. 2023;1:1–48. https://doi.org/10.1109/OJCOMS.2023.3305583.

Bouklachi M, Biancheri-Astier M, Diet A, Le Bihan Y. NFC/RFID patch coil curvature effect and shielding for medical applications wirelessly powered. IEEE J Radio Freq Identif. 2020;4(2):107–14. https://doi.org/10.1109/jrfid.2019.2963401.

Muriira L, Kibua N. Near field communication (NFC) technology: the future mobile money service for Kenya. Int J Comput ICT Res. 2012;6(1):73–83.

Scidà A, et al. Application of graphene-based flexible antennas in consumer electronic devices. Mater Today. 2018;21(3):223–30. https://doi.org/10.1016/j.mattod.2018.01.007.

Lantada AD, Bris CG, Morgado PL, Maudes JS. Novel system for bite-force sensing and monitoring based on magnetic near field communication. Sensors (Switzerland). 2012;12(9):11544–58. https://doi.org/10.3390/s120911544.

Strömmer E, Hillukkala M, Ylisaukko-Oja A. Ultra-low power sensors with near field communication for mobile applications. IFIP Int Fed Inf Process. 2007;248:131–42. https://doi.org/10.1007/978-0-387-74899-3_12.

Kurnaz Ç, KorunurEngiz B. Measurement and evaluation of electric field strength in Samsun City Center. Int J Appl Math Electron Comput. 2016;4(1):24–24. https://doi.org/10.18100/ijamec.271016.

Imoize AL, Ajibola OA, Oyedare TR, Ogbebor JO, Ajose SO. Development of an energy-efficient wireless sensor network model for perimeter surveillance. Int J Electr Eng Appl Sci. 2021;4(1).

Agbinya JI. Investigation of near field inductive communication system models, channels and experiments. Prog Electromagn Res B. 2013;49:129–53. https://doi.org/10.2528/PIERB12120512.

Phang S, Ivrlac MT, Gradoni G, Creagh SC, Tanner G, Nossek JA. Near-field MIMO communication links. IEEE Trans Circuits Syst I Regul Pap. 2018;65(9):3027–36. https://doi.org/10.1109/TCSI.2018.2796305.

Mikki S, Sarkar D, Antar Y. Near-field cross-correlation analysis for MIMO wireless communications. IEEE Antennas Wirel Propag Lett. 2019;18(7):1357–61.

Trivino-Cabrera A, Aguado Sánchez JA. A review on the fundamentals and practical implementation details of strongly coupled magnetic resonant technology for wireless power transfer. Energies. 2018. https://doi.org/10.3390/en11102844.

Alzahrani A, Alqhtani A, Elmiligi H, Gebali F, Yasein MS. NFC security analysis and vulnerabilities in healthcare applications. In: IEEE Pacific RIM conference communication computing signal processing—Proceedings. 2015. pp. 302–5. https://doi.org/10.1109/PACRIM.2013.6625493.

Cerruela García G, Luque Ruiz I, Gómez Nieto M. State of the art, trends and future of bluetooth low energy, near field communication and visible light communication in the development of smart cities. Sensors (Switzerland). 2016. https://doi.org/10.3390/s16111968.

Ondrus J, Pigneur Y. An assessment of NFC for future mobile payment systems. In: Conference Proceeding—6th Int. Conf. Manag. Mob. Business, ICMB 2007. pp. 43–9. https://doi.org/10.1109/ICMB.2007.9.

Carr M. Mobile Payment systems and services: an introduction. Mob Paym Forum. 2007;1–12.

Kadambi KS, Li J, Karp AH. Near-field communication-based secure mobile payment service. In: ACM international conference proceeding series. 2009. pp. 142–51. https://doi.org/10.1145/1593254.1593276.

Rodrigues H, et al. Mobipag: Integrated mobile payment, ticketing and couponing solution based on NFC. Sensors (Switzerland). 2014;14(8):13389–415. https://doi.org/10.3390/s140813389.

Rehman S, Coughlan J. An efficient mobile payment system based on NFC technology. World Acad Sci Eng Technol. 2013;7(78):1695–8.

Pourghomi P, Qasim M, Ghinea G. A proposed NFC payment application. Int J Adv Comput Sci Appl. 2013;4(8):173–81. https://doi.org/10.14569/ijacsa.2013.040824.

Raphael Olufemi A, Abiodun Boluwade R, Oluwasefunmi Busola F, Temitayo Elijah B. Mobile commerce model taking advantage of a near field communication (NFC). Rev Comput Eng Res. 2020;7(2):62–72. https://doi.org/10.18488/journal.76.2020.72.62.72.

Google. Google Wallet. 2013. https://wallet.google.com/files/payment-methods.html.

Verizon. Everything you need to know about softcard mobile wallet. In: Everything you need to know about self-confidence. https://www.verizon.com/about/news/vzw/2014/02/everything-you-need-to-know-softcard-app.

Dias J, Matos JN, Oliveira ASR. The charge collector system. Procedia Technol. 2014;17(November):130–7. https://doi.org/10.1016/j.protcy.2014.10.220.

Ahamad SS. A novel NFC-based secure protocol for merchant transactions. IEEE Access. 2022;10:1905–20. https://doi.org/10.1109/ACCESS.2021.3139065.

Chaumette S, Dubernet D, Ouoba J, Siira E, Tuikka T. Architecture and comparison of two different user-centric NFC-enabled event ticketing approaches. In: Lecture Notes in Computer Science (including subseries lecture notes in artificial intelligence and lecture notes in bioinformatics), vol. 6869 LNCS, no. August. 2011. pp. 165–77. 2011. https://doi.org/10.1007/978-3-642-22875-9_15.

Saminger C, Grunberger S, Langer J. An NFC ticketing system with a new approach of an inverse reader mode. In: 2013 5th international work near field communication NFC 2013, 2013. https://doi.org/10.1109/NFC.2013.6482448.

Ivan C, Balag R. An initial approach for a NFC M-ticketing urban transport system. J Comput Commun. 2015;03(06):42–64. https://doi.org/10.4236/jcc.2015.36006.

Widmann R, Grünberger S, Stadlmann B, Langer J. System integration of NFC ticketing into an existing public transport infrastructure. In: Proceedings—4th international work near field communication. NFC 2012. 2012. pp. 13–8. https://doi.org/10.1109/NFC.2012.14.

Nasution SM, Husni EM, Wuryandari AI. Prototype of train ticketing application using near field communication (NFC) technology on android device. In: Proceedings of 2012 international conference system engineering technology. ICSET 2012. 2012. https://doi.org/10.1109/ICSEngT.2012.6339362.

Ely Kurniawan D, Fatulloh A, Cahyono Kushardianto N. Ship ticketing system using near field communication (NFC) and SMS gateway for Batam Island Transportation. 2018. pp. 32–8. https://doi.org/10.4108/eai.23-4-2018.2277600.

Imoize AL, Mekiliuwa SC, Omiogbemi IM-B, Omofonma DO. Ethical issues and policies in software engineering. Int J Inf Secur Softw Eng. 2020;6(1):6–17.

Imoize AL, Mekiliuwa SC, Omiogbemi IM-B. Recent trends on the application of cost-effective economics principles to software engineering development. Int J Inf Secur Softw Eng. 2020;6(1):39–49.

Hargude R, Kamthe A, Badgujar V. NFC based intelligent bus ticketing system. Int J Sci Res Sci Technol. 2020;7(2):283–7. https://doi.org/10.32628/ijsrst207213.

Ferreira MC, Dias TG, Falcao J, Cunha E. Anda: an innovative micro-location mobile ticketing solution based on NFC and BLE technologies. IEEE Trans Intell Transp Syst. 2022;23(7):6316–25. https://doi.org/10.1109/TITS.2021.3072083.

Zadorozhnyi Z-M, Muravskyi V, Shesternyak M, Hrytsyshyn A. Innovative NFC-validation system for accounting of income and expenses of public transport enterprises. Mark Manag Innov. 2022;1(1):84–93. https://doi.org/10.21272/mmi.2022.1-06.

Imoize AL, Babajide AE. Development of an infrared-based sensor for finger movement detection. J Biomed Eng Med Imaging. 2019;6(4):29–44. https://doi.org/10.14738/jbemi.64.7639.

An BW, et al. Smart sensor systems for wearable electronic devices. Polymers (Basel). 2017. https://doi.org/10.3390/polym9080303.

Kassal P, et al. Smart bandage with wireless connectivity for uric acid biosensing as an indicator of wound status. Electrochem Commun. 2015;56:6–10. https://doi.org/10.1016/j.elecom.2015.03.018.

Jeong YR, et al. A skin-attachable, stretchable integrated system based on liquid GaInSn for wireless human motion monitoring with multi-site sensing capabilities. NPG Asia Mater. 2017;9(10):1–8. https://doi.org/10.1038/am.2017.189.

Kim J, et al. Battery-free, stretchable optoelectronic systems for wireless optical characterization of the skin. Sci Adv. 2016. https://doi.org/10.1126/sciadv.1600418.

Freudenthal E, et al. Suitability of NFC for medical device communication and power delivery BT—2007 IEEE Dallas engineering in medicine and biology workshop, DEMBS, November 11, 2007–November 12, 2007. 2007. pp. 51–4.

Costescu A. Medical implant NFC embedded system. 2019. https://www.duo.uio.no/handle/10852/69043.

Khah Razmi NN, Sangar AB. The use of NFC technology to record medical information in order to improve the quality of medical and treatment services. Mod Appl Sci. 2016;10(6):136. https://doi.org/10.5539/mas.v10n6p136.

Deshpande S. Smart implanted NFC-based system to expedite medical treatment. 2018;118(24):1–12.

Ayyar K. NFC based secure mobile health care system. 2018;8(1):72–74. https://doi.org/10.9790/9622-0801057274.

Ayyalraj MK, Appavu Alias Balamurugan S. Patient health description using NFC-tag-M-health. In: Proceeings—2019 amity international conference artificial intelligence. AICAI 2019. 2019. pp. 642–46. https://doi.org/10.1109/AICAI.2019.8701283.

Sutjiredjeki E, Basjaruddin NC, Fajrin DN, Noor F. Development of NFC and IoT-enabled measurement devices for improving health care delivery of Indonesian children. J Phys Conf Ser. 2020. https://doi.org/10.1088/1742-6596/1450/1/012072.

Kristiadi DP, Hasanudin M, Sutrisno S. Mobile application of electronic medical record (EMR) systems using near field communication (NFC) technology. Int J Open Inf Technol. 2021;9(10):68–72.

Ebere O, et al. NFC tag-based mHealth patient healthcare tracking system. In: Proceedings—3rd international conference next generation computing applications NextComp 2022, no. October. 2022. https://doi.org/10.1109/NextComp55567.2022.9932185.

Alabduljabbar R. An IoT smart clothing system for the visually impaired using NFC technology. Int J Sens Netw. 2022;38(1):46–57.

Davis FD. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q Manag Inf Syst. 1989;13(3):319–39. https://doi.org/10.2307/249008.

Anyasi IF, Imoize AL. Information technology and the business communities: a case study of small-scale business enterprises in Nigeria. Res J Appl Sci Eng Technol. 2010;2(1):45–9.

Dutot V. Factors influencing near field communication (NFC) adoption: an extended TAM approach. J High Technol Manag Res. 2015;26(1):45–57. https://doi.org/10.1016/j.hitech.2015.04.005.

Hong-Lei M, Young-Chan L, Dong-Fang R. Examining the influencing factors of NFC (near field communication)—payment adoption in China: the moderating role of personal innovativeness. 2018. pp. 33–40. https://doi.org/10.22678/JIC.2018.16.3.033.

Pu X, Chan FTS, Chong AYL, Niu B. The adoption of NFC-based mobile payment services: an empirical analysis of Apple Pay in China. Int J Mob Commun. 2020;18(3):343. https://doi.org/10.1504/ijmc.2020.107145.

Luarn P, Juo W-J. The role of trust in technology within the TAM in the context of NFC mobile payment. J Inf Optim Sci. 2010;31(4):875–96. https://doi.org/10.1080/02522667.2010.10700000.

Han H, Park A, Chung N, Lee KJ. A near field communication adoption and its impact on Expo visitors’ behavior. Int J Inf Manag. 2016;36(6):1328–39. https://doi.org/10.1016/j.ijinfomgt.2016.04.003.

Tan GWH, Ooi KB, Chong SC, Hew TS. NFC mobile credit card: the next frontier of mobile payment? Telemat Inform. 2014;31(2):292–307. https://doi.org/10.1016/j.tele.2013.06.002.

Venkatesh V, Morris MG, Davis GB, Davis FD. User acceptance of information technology: toward a unified view. MIS Q Manag Inf Syst. 2003;27(3):425–78. https://doi.org/10.2307/30036540.

Dwivedi YK, Rana NP, Jeyaraj A, Clement M, Williams MD. Re-examining the unified theory of acceptance and use of technology (UTAUT): towards a revised theoretical model. Inf Syst Front. 2019;21(3):719–34. https://doi.org/10.1007/s10796-017-9774-y.

Boes K, Borde L, Egger R. The acceptance of NFC smart posters in tourism. Inf Commun Technol Tour. 2015;2015(March):435–47. https://doi.org/10.1007/978-3-319-14343-9_32.

Khalilzadeh J, Ozturk AB, Bilgihan A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput Human Behav. 2017;70(2017):460–74. https://doi.org/10.1016/j.chb.2017.01.001.

Leong LY, Hew TS, Tan GWH, Ooi KB. Predicting the determinants of the NFC-enabled mobile credit card acceptance: a neural networks approach. Expert Syst Appl. 2013;40(14):5604–20. https://doi.org/10.1016/j.eswa.2013.04.018.

Rogers EM. 17—Rogers 1995 cap 6 plan 5. 1995. pp. 1–26.

Balachandran D, Tan GWH. Regression modelling of predicting NFC mobile payment adoption in Malaysia. Int J Model Oper Manag. 2015;5(2):100. https://doi.org/10.1504/ijmom.2015.072671.

Voges D. NFC—great innovation is on the rise, but the market remains very fragmented. The diffusion of innovation using the example of near field communication (NFC) multi-application platform. 2017. https://pdfs.semanticscholar.org/6386/a35e95c83efc37266ac59d6466102efc9ba4.pdf.

GE, TM. Swot analysis: a theoretical review. 2017. pp. 1–14. https://doi.org/10.17719/jisr.2017.1832.

Mehmood F, Hassannezhad M, Abbas T. Analytical investigation of mobile NFC adaption with SWOT-AHP approach: a case of Italian telecom. Procedia Technol. 2014;12:535–41. https://doi.org/10.1016/j.protcy.2013.12.526.

Kumar RL, Wang Y, Poongodi T, Imoize AL, editors. Internet of things, artificial intelligence and blockchain technology, 1st edn. Switzerland AG: Springer Nature; 2021.

Imoize AL, Idowu D, Bolaji T. A brief overview of software reuse and metrics in software engineering. Int Sci J. 2019;122(February):56–70.

Apanasevic T. Factors influencing the slow rate of penetration of NFC mobile payment in Western Europe. In: Interenational conference mobile bus, no. Icmb. 2013. pp. 1–13.

De Luna R, Gil J, Montoro-ríos F, Liébana-cabanillas F. NFC technology acceptance for mobile payments: a Brazilian perspective. 2017. https://doi.org/10.7819/rbgn.

Cocosila M, Trabelsi H. An integrated value-risk investigation of contactless mobile payments adoption. Electron Commer Res Appl. 2016;20:159–70. https://doi.org/10.1016/j.elerap.2016.10.006.

Ernest L. Study on influential factors of mobile payment systems diffusion in Zambia: a NFC-micro SD perspective. 2016. p. 2016.

Jenkins P, Ophoff J. Factors influencing the intention to adopt NFC mobile payments—a South African perspective. In: CONFIRM 2016 Proceedings, p. paper 45, 2016, [Online]. http://aisel.aisnet.org/confirm2016/45.

Fitriani F, Suzianti A, Chairunnisa A. Analysis of factors that affect nfc mobile payment technology adoption (case study: Telkomsel cash). In: ACM international conference proceeding series, vol. 2017-October. 2017. pp. 103–9. https://doi.org/10.1145/3145777.3145778.

Borowski-Beszta M, Jakubowska M. Mobile payments using NFC technology in the light of empirical research. Torun Bus Rev. 2018;3(17):5–16. https://doi.org/10.19197/tbr.v17i3.311.

Putra EP, Fifilia, Juwitasary H. Trend of NFC Technology for payment transaction. Telkomnika (Telecommun Comput Electron Control). 2018;16(2):795–802. https://doi.org/10.12928/TELKOMNIKA.v16i2.8441.

Prince I, Samuel UE, Jack AE, Kanu C. Current and potential users adoption of mobile payment technology in Nigeria. 2019. https://doi.org/10.35940/ijrte.D7891.118419.

Liébana-Cabanillas F, García-Maroto I, Muñoz-Leiva F, Ramos-de-Luna I. Mobile payment adoption in the age of digital transformation: the case of apple pay. Sustain. 2020;12(13):1–15. https://doi.org/10.3390/su12135443.

Al-Saedi K, Al-Emran M, Ramayah T, Abusham E. Developing a general extended UTAUT model for M-payment adoption. Technol Soc. 2020;62(June):101293. https://doi.org/10.1016/j.techsoc.2020.101293.

Asadi M, Dewi AC, Andy R, Zaman AN. “xtended technology acceptance model (TAM) for ‘Desa Digital’ mobile application users: a literature study. IOP Conf Ser Mater Sci Eng. 2021;1125(1):012054. https://doi.org/10.1088/1757-899x/1125/1/012054.

Almaiah MA, et al. Investigating the effect of perceived security, perceived trust, and information quality on mobile payment usage through near-field communication (NFC) in Saudi Arabia. Electron. 2022;11(23):1–22. https://doi.org/10.3390/electronics11233926.

Zhang Q, Khan S, Cao M, Khan SU. Factors determining consumer acceptance of NFC mobile payment: an extended mobile technology acceptance model. Sustain. 2023;15(4):1–18. https://doi.org/10.3390/su15043664.

Informa. Informa’s Ovum: mobile data services on rise in Africa, no. 633, 2019. https://www.informa.com/media/press-releases-news/latest-news/informas-ovum-mobile-data-services-on-rise-in-africa/.

Ghìron SL, Sposato S, Medaglia CM, Moroni A. NFC ticketing: a prototype and usability test of an NFC-based virtual ticketing application. In: Proceedings—2009 1st international work near field communication. NFC 2009. 2009. pp. 45–50. https://doi.org/10.1109/NFC.2009.22.

Ibhaze AE, Okakwu IK, Akinrelere AT, Imoize AL. An intelligent dispatch system operating in a partially closed environment. Netw Commun Technol. 2019;4(1):26–35. https://doi.org/10.5539/nct.v4n1p26.

Alzahrani KAH, Alnfiai M. Evaluation of NFC-guidable system to manage polypharmacy in elderly patients. Comput Syst Sci Eng. 2022;41(2):445–60.

Onyancha PM. Near-field communication based - model for health information portability. Strat. Univ. p. 107. 2016. https://su-plus.strathmore.edu/bitstream/handle/11071/4852/PaulMorumbwaMSIS2016.pdf?sequence=2.

Acknowledgements

The work of Agbotiname Lucky Imoize is supported by the Nigerian Petroleum Technology Development Fund (PTDF) and the German Academic Exchange Service (DAAD) through the Nigerian-German Postgraduate Program under Grant 57473408.

Funding

This work was carried out under the IoT-enabled Smart and Connected Communities (SmartCU) Research Cluster of Covenant University. The research publication is also sponsored by Covenant University Centre for Research, Innovation, and Development (CUCRID), Covenant University, Ota, Nigeria.

Author information

Authors and Affiliations

Contributions

The manuscript was written through the contributions of all authors. SKH was responsible for the conceptualization of the topic; article gathering and sorting were carried out by SKH, and ALI; manuscript writing and original drafting and formal analysis were carried out by SKH, ALI, TSA, AA; writing of reviews and editing were carried out by SKH, ALI, TSA; and AA led the overall research activity. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Institutional review board statement

This article does not contain any studies with human participants or animals performed by any authors.

Informed consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hinga, S.K., Imoize, A.L., Ajani, T.S. et al. A Bird’s Eye View of Near Field Communication Technology: Applications, Global Adoption, and Impact in Africa. SN COMPUT. SCI. 5, 290 (2024). https://doi.org/10.1007/s42979-024-02618-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42979-024-02618-6