Abstract

Traditional risk assessments use asset losses as the main metric to measure the severity of a disaster. Here, an expanded risk assessment is proposed based on a framework that adds “socioeconomic resilience” — that is, the ability of affected households to cope with and recover from disaster asset losses — and uses “wellbeing losses” as its main measure of disaster severity. Using a new agent-based model that represents explicitly the recovery and reconstruction process at the household level, this risk assessment provides new insights into disaster risks in the Philippines. Its first conclusion is the close link between natural disasters and poverty. On average, estimates suggest that almost half a million Filipinos per year face transient consumption poverty due to natural disasters. Nationally, the bottom income quintile suffers only 9% of the total asset losses, but 31% of the total wellbeing losses. As a result of the disproportionate impact on poor people, the average annual wellbeing losses due to disasters in the Philippines is estimated at US$3.9 billion per year, more than double the asset losses of US$1.4 billion. The second conclusion is the fact that the regions identified as priorities for risk-management interventions differ depending on which risk metric is used. While cost-benefit analyses based on asset losses direct risk reduction investments toward the richest regions and areas, a focus on poverty or wellbeing rebalances the analysis and generates a different set of regional priorities. Finally, measuring disaster impacts through poverty and wellbeing impacts allows the quantification of the benefits from interventions like rapid post-disaster support and adaptive social protection. While these measures do not reduce asset losses, they efficiently reduce their wellbeing consequences by making the population more resilient.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Philippines is by some measures among the most disaster-affected countries in the world. The 100 million residents of the Philippines, along with their homes and livelihoods, are exposed to a wide variety of disasters, including typhoons, earthquakes, floods, storm surges, and tsunamis. Small, geographically limited events occur frequently across the 2,000 inhabited islands in this middle-income country; and asset losses can reach into the billions–with additional untold human costs–when major storms and earthquakes affect densely populated urban areas.

On November 8, 2013, Super Typhoon Yolanda (internationally referred to as Typhoon Haiyan) made multiple landfalls in the Eastern, Central, and Western Visayas regions of the Philippines (cf. Fig. 2 on page 8), claiming nearly 6,300 lives and directly affecting more than 16 million individuals across nine regions. At least 1.1 million homes were damaged or destroyed, and the government estimated total losses at US$2.2 billion ( 95 billion), making Yolanda the most costly hurricane to affect the Philippines to date. Since Yolanda, various regions of the Philippines have been affected by numerous wind, earthquake, and flood events, both large and small.

95 billion), making Yolanda the most costly hurricane to affect the Philippines to date. Since Yolanda, various regions of the Philippines have been affected by numerous wind, earthquake, and flood events, both large and small.

As these statistics make clear, the consequences of disasters in the Philippines extend beyond the replacement costs of destroyed assets — or asset losses. Disasters have well-documented consequences for social and economic development agendas and outcomes, including especially inequality, agriculture, education, and health (Catane et al. 2012; Yonson 2018; Yonson et al. 2018; Blanc et al. 2016; Yi et al. 2015; Huigen and Jens 2006; Dawe et al. 2009; Yumul et al. 2011). Despite this growing body of research, risk assessments still typically adopt asset losses as a singular metric of disaster impacts.

This approach limits the development of disaster risk management (DRM) strategies that can be integrated into larger development agendas, especially poverty reduction, because asset losses obscure the relationship between disaster risk and poverty. By definition, wealthy individuals have more assets to lose, and their various discretionary expenditures can far exceed the total value of others’ housing, or livelihoods. At the same time, asset losses do not measure many dimensions of disaster impacts that accrue to the poor: while they may have very little to lose, they also lack the resources and instruments to recover and rebuild destroyed assets–and, critically, to maintain consumption through income shocks. When disasters occur, the poor are more likely than the wealthy to forego consumption of food, health, or education in order to finance their recovery, and to take longer to recover.

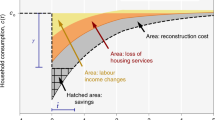

For these reasons, DRM strategies that seek to minimize asset losses, do not address the needs of the poor, even when there are small, cost-effective interventions to build their resilience to disasters. To correct this bias, the initial Unbreakable report introduced the concept of wellbeing losses. Wellbeing losses are proportional to traditional asset losses, but they also account for people’s socioeconomic resilience, including (1) their ability to maintain their consumption for the duration of their recovery, (2) their ability to save or borrow to rebuild their asset stock, and (3) the decreasing returns in consumption–that is, the fact that poorer people are more affected by a $1 reduction in consumption than richer individuals.

The analysis presented in this paper builds upon and expands the approach proposed in the initial GFDRR flagship report. It uses a new agent-based model, subnational hazard information, and household survey data to examine the consequences of natural disasters on individuals and households. This analysis provides a multi-metric assessment of disaster risks at the regional level, using: (1) traditional asset losses; (2) poverty incidence and gaps; (3) wellbeing losses; and (4) socioeconomic resilience. Wellbeing losses provide a balanced estimate of disaster impacts on the welfare of diverse households, and socioeconomic resilience measures the ability of the population to cope with and recover from asset losses. This broad perspective is intended as a demonstration of how wellbeing losses can be measured at subnational level, and to contribute to the development of poverty-integrated DRM strategies at regional level in the Philippines. The approach is replicable at any level of spatial resolution allowed by data.

The first conclusion of this analysis is the close link between natural disasters and poverty in the Philippines, and this connection goes both ways. First, natural disasters are a cause of poverty: on average, estimates suggest that almost half a million Filipinos per year face transient consumption poverty due to natural disasters. And in several regions throughout northwestern Luzon, the number of individuals pushed by disasters into extreme poverty represents at least 20% of chronic subsistence incidence. In these places, cost-effective investments in mitigation of disaster impacts on the poor could complement and strengthen poverty reduction campaigns.

This link between disasters and poverty goes both directions, as poverty magnifies the impact of natural hazards by making people more vulnerable, or less resilient, to shocks. Due to many financial and social recourses available only to the wealthy, wellbeing losses are concentrated among the poorest residents of each region. Nationally, the bottom income quintile suffers only 9% of the national asset losses, but 31% of the total wellbeing losses. On average, the poorest quintile suffers from wellbeing losses that are 1.5 times larger than average individual loss in the country. Overall, the average annual wellbeing losses due to disasters in the Philippines is estimated at US$3.9 billion per year (3.3% of household expenditures), more than double the asset losses of US$1.4 billion (1.3% of household annual expenditures).

A second conclusion is that priority interventions — both in spatial terms (where to act?) and sectoral terms (how to act?) — are highly dependent on which metric for disaster severity is used. The most important interventions will focus around Manila if asset losses are used as the main measure of disaster impacts, while regions like Bicol become priorities in terms of poverty incidence and wellbeing losses. And the least resilient region — the one that would struggle the most if it was affected by a disaster — is the poorest, ARMM. Further, one needs to use regional averages with care: our results show that the poorest people in the richest regions are almost as vulnerable as the poorest people in the poorest regions. An important consequence of these findings is that the choice of the metric used in risk assessments is not a technical question, but a political choice with significant implications for which interventions are desirable.

Finally, the third conclusion of this work is that new metrics of disaster impacts — including poverty headcount, poverty gap, and wellbeing losses — can be used to quantify the value of interventions currently outside the traditional risk-management toolbox. Asset-informed risk-management strategies primarily focus on protection infrastructure, such as dikes, and the position and condition of assets, for instance with land-use plans or building norms. Wellbeing-informed strategies can utilize a wider set of available measures, such as financial inclusion, private and public insurance, disaster-responsive social safety nets, macro-fiscal policies, and disaster preparedness and contingent planning. Even if they do not reduce asset losses, these measures can bolster communities’ socioeconomic resilience, or their capacity to cope with and recover from asset losses when they occur, and reduce the wellbeing impact of natural disasters.

Beyond these policy conclusions, this paper also describes for the first time a model developed to better understand the impacts of natural disasters on Filipino households, and their paths to recovery. The approach starts conventionally, incorporating hazard- and asset-class-specific exceedance curves at the provincial level from the Government of the Philippines Department of Finance Catastrophe Risk Model (DFCRM) (Guin and Saxena 2000; Deanna 2017). However, its primary innovation is the combination of these detailed hazard maps with household survey data–in this case, the 2016 Philippines Family Income & Expenditure Survey (FIES)–to disaggregate expected asset losses among representative households. This step is based on an estimation of households’ asset vulnerability from available household characteristics (i.e., from housing construction materials and condition). The model generates estimates of asset losses, poverty impacts, and wellbeing losses by income quintile and region in the Philippines. Many other population subsets are possible, including ethnicity, head of household gender, education level, and employment sector, limited only by the resolution and representativeness of the hazard and household survey data.Footnote 1

The second main innovation of the model is to explicitly represent disaster reconstruction dynamics at the household level using an agent-based approach in which (1) each household acts rationally to minimize its wellbeing losses, and (2) households interact through firms’ activities and government budgets. The model specifies a unique reconstruction and savings expenditure rate for all households, assuming each optimizes the fraction of income dedicated to repairing and replacing disaster-affected assets, at the expense of immediate consumption. In particular, households close to the subsistence level cannot set aside much of their income to rebuild their assets without experience large wellbeing losses, and will therefore take longer to recover. After extreme events, or among fragile populations, households can become permanently trapped in poverty, generating significant wellbeing losses long after their neighbors have recovered (Carter and Barrett 2006; Dercon and Porter 2014).

With this approach, we are able to develop a detailed country risk profile for the Philippines that identifies sub-national variations in hazard, exposure, asset vulnerability, and socioeconomic resilience. This is intended to be used as an input in DRM prioritization and funding processes at as fine a scale as data allow. We can also assess the benefits of prospective DRM investments and interventions, including not just engineering projects, but also formal and informal risk sharing mechanisms (e.g., post-disaster support and private remittances), in terms of increased resilience and reduced natural disaster impacts on all Filipinos’ lives and livelihoods.

The paper is organized as follows. Section “Asset Losses” provides an overview of asset risk due to wind, precipitation floods, storm surge, and earthquake events in each of the 17 regions. In “Income, Consumption, and Poverty”, we overlay this information with household-level income and asset vulnerability data from the 2015 Family Income and Expenditures Survey (FIES) to develop finely-grained estimates of income and consumption losses to disasters. Based on these results, we estimate the number of households in the Philippines facing transient income or consumption poverty each year due to natural disasters. In “Risk to Wellbeing at the National Level” to “Regional Risk Summary”, we quantify wellbeing risk at the national and regional levels, respectively. In “Poorest Quintile Risk Summary”, we examine specifically the risk to assets and risk to wellbeing of the poorest quintile in each region. Section “Policy Simulations” describes policy simulations, and “Conclusions” presents conclusions. A technical Appendix provides details on the methodology and data, and a discussion of the equations and assumptions underlying the publicly-available model.

Asset Losses

Typically, risk assessments incorporate information on the hazards (the natural occurrence of destructive events); exposure (the value of natural and built assets that could interact with these hazards); and vulnerability (the expected consequences to exposed assets when a destructive event does occur) of the targeted area. Together, these three dimensions describe average annual asset losses in the area of interest (Fig. 1).

Table 1 on the next page displays average annual asset losses, by hazard type, for each region in the Philippines.Footnote 2 Already, we see that disasters in the National Capital Region (NCR, or Metro Manila) and in CALABARZON (region IVA) cost over US$300 million per year, on average. In NCR, these losses are driven primarily by precipitation flooding, while wind events are responsible for over 50% of annual losses in CALABARZON.

Significant differences across regions and disaster type are explained by variations in the hazard, exposure, and vulnerability of each part of the country. For example, while major typhoons can theoretically strike any part of the country, the northeastern coast of Luzon (regions II, IVA, and V) and the Eastern Visayas (region VIII) are the most frequently affected–that is, these islands face elevated typhoon hazard (cf. Fig. 2). Further, all the regions facing asset losses in excess of US$100 million are in mainland Luzon, the wealthiest and most developed part of the country (elevated exposure). By contrast, asset losses in Mindanao, the southernmost island group, comprise just 5% of total losses (inclusive of regions IX, X, XI, XII, XIII, and ARMM). This is due not only to the relative infrequency of major events in Mindanao (low hazard), but also the low density of valuable assets (low exposure) and high poverty (high vulnerability)–particularly outside Davao, the largest city in the island group.

Figure 3 on the following page maps multihazard asset losses, again by region. On the left, expected losses are represented in millions of dollars (as in the rightmost column in Table 1). On the right, the same results are presented as a percentage of each region’s aggregate household consumption (AHC).Footnote 3 Generally, the same regions (i.e., Metro Manila and surrounding parts of Luzon) are highlighted in both representations of asset losses. However, in the map on the right, Cagayan Valley and Bicol (regions II and V, respectively) have replaced NCR and CALABARZON as the most heavily-impacted regions.

The simple comparison in Fig. 3 illustrates an essential insight: different metrics can lead to different disaster risk “hotspots”–and, therefore, priorities. This suggests that asset losses, though conceptually straightforward and easily quantified, do not give a complete picture of disaster impacts in the Philippines. Specifically, both maps in Fig. 3 describe mostly what happens to the wealthiest regions (and, within these regions, the wealthiest households) because they are based on aggregate loss data, and the wealthy have the most to lose. Although asset losses in ARMM (the southernmost islands in the archipelago) total just US$5 million per year, plans for and responses to disasters must in some way account for the 54% poverty rate in ARMM (versus 4% in NCR).

Socioeconomic Resilience Input Data

Clearly, a more spatially disaggregated approach will be required. But moreover, we need to understand–and develop metrics for–the ways in which natural disasters affect the poor. To these ends, this paper presents a distributional analysis, moving from the regional scale to the household level. In the following sections, we examine disaster impacts on household income and consumption, based on insights generated by the merger of the above regional asset loss data with household-level socioeconomic characteristics. Among other results, this novel approach allows researchers and officials to develop estimates of the number of individuals pushed into transient poverty each year by disasters.

Table 2 summarizes the main inputs taken from the FIES survey of household income and consumption in the Philippines. Before applying the socioeconomic resilience framework to integrate all of these factors into a single metric, we can identify several trends in the data, and in some cases anticipate their effects on socioeconomic resilience to disasters.

From a DRM perspective, Metro Manila, or NCR, is distinct in all ways from the rest of the Philippines. Most critically, the population density in the capital region is nearly 21,000 people per square kilometer. This is 25 times greater than in nearby CALABARZON, which is the most populated region and the second most densely populated one (870 persons per square kilometer).

The total household asset value exposed to disasters is over ten times greater in NCR than in ARMM. Asset and population densities are critical considerations for DRM investment decisions, as physical hazards (e.g., wind, flooding, surge, etc.) can only result in catastrophes when they interact directly or indirectly with households and their livelihoods.

Regions are listed by per capita consumption in descending order in Table 2. Household size is inversely correlated with consumption, increasing from 4.2 in Metro Manila, the wealthiest region, to 6.1 in ARMM, the poorest. Both across and within regions, households may become more vulnerable to consumption shocks as the number of dependents increases, due to a greater number of individuals reliant on household income.

Resilience is expected to increase with per capita consumption, as wealthier households have more tools to smooth their consumption–and can in many cases scale back discretionary spending for the duration of their recovery, as necessary. With fewer options, poorer households and communities are more likely to reduce essential consumption streams, including on food, health, and education.

As a general trend, poverty incidence and severity (i.e., poverty gap) increase as one moves south in the Philippines, from the Luzon island group in the north, to the Visayas group in the center of the archipelago, and finally to the southernmost island group, Mindanao. Socioeconomic resilience decreases with deepening poverty, and this is true not just for individual households, but also for communities: dynamic and wealthy economies will be able to cope with and recover from their collective losses more easily than areas that were stagnant or impoverished even before the disaster.

The “Vulnerability” column in Table 2 describes the average fraction of assets lost by disaster-affected households, when a disaster occurs. Each household surveyed in the FIES is categorized as fragile, moderate, or robust based on its durability of construction and its condition. We use this value as an estimate of the vulnerability of all the assets on which that household relies for income. This is based on the assumption that people living in fragile homes use makeshift assets, unpaved roads, and inadequate infrastructure, etc., to make their living. Average asset vulnerability increases from 12-15% throughout Luzon to 17-20% in Mindanao.

The “Social transfers” column describes the average fraction of household consumption funded by transfers, including public assistance and private remittances. We do not see a clear relationship between social transfers and income (noting that the former may be underreported in the FIES); neither is there an obvious relationship between consumption and the value of savings. Nevertheless, we expect that greater transfers and savings help to increase socioeconomic resilience to disasters: the former, as an income stream not exposed to physical hazards, and the latter as a tool for coping when disasters inevitably occur.

Early warning helps communities to secure their belongs as possible, and to evacuate if necessary, in advance of an approaching hazard. Particularly in a country that is affected by several major typhoons per year, early warning is essential to minimizing loss of life and property. In this model, households considered to receive early warning are those that report owning a cell phone, computer, television, or radio, or that have access to the internet.

Income, Consumption, and Poverty

In this section, we present the main insights generated by the union of the DFCRM with the FIES, focusing on how households’ socioeconomic characteristics can mitigate or magnify the impact of disasters. Asset losses are disaggregated to the household level on the basis of the socioeconomic characteristics discussed above. At the regional scale, and in the absence of more detailed data, we assume that all households in a given region are equally likely to be affected by a disaster when it occurs (uniform exposure). The technical details of the asset loss disaggregation are discussed in the technical Appendix to this report.

Income Losses

When disasters damage or destroy the assets on which individuals rely for their livelihood, households incur income losses. Across the socioeconomic spectrum, these assets can include not only privately-owned shops or fields, but also somebody else’s factory, and public buildings and infrastructure. Although the replacement value of each of these asset classes can be measured in pesos, their respective impacts on household consumption can be very different. For example: it matters very much to each household whether it is their home or a public hospital that gets destroyed. When entire communities are affected, some households may receive extraordinary public assistance or remittances to supplement their regular income while they rebuild. These and other socioeconomic characteristics manifestly influence household recovery pathways. Therefore, income losses are a useful metric of disaster impacts insofar as they can inform DRM policies that respond to socioeconomic effects.

To provide a historical example: when Super Typhoon Yolanda made landfall in the Eastern Visayas (region VIII), it caused an estimated US$1.4 billion in damages to that region alone. In terms of asset losses, then, Yolanda was a roughly 100-year typhoon (including damage from wind, storm surge, and precipitation flooding) in the region. Following our discussion, it is important to understand how these losses were distributed among the affected population, and the size and duration of consequent income losses in the region.

The top panel of Fig. 4 on page 17 illustrates the expected impact of a Yolanda-like wind event on individual incomes in the Eastern Visayas region. The black outline indicates the regional income distribution as reported in FIES, while the red histogram illustrates the expected income distribution immediately following a Yolanda-like event in the region. This distribution shows a mode around US$350 per person, per year, with nearly 40% of the population living below the poverty line. The large bar on the right shows the number of people with incomes higher than US$2,500 per year; the poverty and subsistence lines are indicated by the dotted lines around US$350 and US$450 per year, respectively. For this Yolanda-like event, the wind destruction alone is expected to push over 160,000 individuals into income poverty in Eastern Visayas, and over 170,000 below the subsistence income level (4% of the regional population).

Expected impact of Yolanda-like (100-year) hurricane on per capita income (top) and consumption (bottom) in the Eastern Visayas (region VIII). Income losses take into account the lost productivity of disaster-affected assets, while consumption losses additionally include reconstruction costs, post-disaster support, and savings

Consumption Losses

Already, income losses represent an important step beyond asset losses, and are interesting as a conceptually straightforward input for poverty-informed DRM investment portfolios.Footnote 4 However, they still do not take into account a range of characteristics and coping mechanisms that can mitigate or exacerbate the effects of disasters on individual households. For example, we have not yet accounted for the reconstruction costs that directly-affected households (and, through taxation, even those not directly affected) must pay to rebuild their assets after a disaster. Further, many households have some amount of savings to be used in case of a disaster, and wealthier households may benefit from formal and informal post-disaster transfers (Townsend 1995; Morduch 1995). The net effect of these costs and resources determine households’ consumption losses, or the gap between their initial and post-disaster consumption, for the duration of their recovery.

The red histogram in the bottom panel of Fig. 4 represents the household consumption distribution in the Eastern Visayas region immediately after a Yolanda-like hurricane in the region. After accounting for reconstruction costs and precautionary savings, the event is expected to generate a net increase of 177,000 individuals whose consumption is below the poverty line (4% of the regional population), and over 230,000 below the subsistence line (cf. Fig. 4). At the other end of the distribution, we note that there is no longer a discernible difference between pre- and post-disaster consumption for households whose pre-disaster income is at least US$2,500 (compare to income losses). This suggests that the poor struggle to cope with lost income, while the wealthy are able to use savings and other instruments to maintain their consumption, even when they are affected by large disasters.

Multihazard Risk and Chronic Poverty

On average, inclusive of all hazards and regions, we estimate that almost half a million Filipinos per year face transient consumption poverty due to natural disasters. This is equivalent to 2.2% of national poverty incidence, though the sub-national results indicate significant regional variation (cf. Table 3 on the following page). For example, in several regions throughout northwestern Luzon, including NCR, Cagayan Valley, CALABARZON, and Central Luzon, the number of individuals pushed into subsistence represents at least 20% of subsistence incidence, as measured by FIES. Although we do not model economic growth or other pathways out of poverty, these results indicate that exposure to natural disasters may be a major driver of extreme poverty in certain regions of the Philippines. In these areas, disaster risk management strategies can be a highly efficient tool to decrease poverty and subsistence incidence, either by reducing asset losses, or by enhancing households’ abilities to maintain consumption as they recover from a disaster.

Figure 5 on page 21 maps the annual consumption poverty impacts of multihazard exposure in each region. The map on the left indicates disaster-related poverty incidence as a percentage of the total population in each region, while the map on the right describes disaster-related poverty incidence relative to the FIES estimate of chronic poverty in each region. Comparing these perspectives, we see that, as a multiannual average, the large majority of Filipinos pushed into transient poverty each year are in Luzon. This is not a surprising result, as the elevated frequency of hazards and high population and asset densities in the capital and surrounding regions should be expected to create strong DRM-poverty interlinkages. Interestingly, we see in the map on the right that disasters have the largest effect, as a fraction of chronic poverty incidence, within Metro Manila. This result is reflective of both the low baseline poverty rate in the capital (4%), and the great potential for major catastrophes there. It suggests that disasters may be a major driver of residual poverty in the capital region.

These maps indicate natural disaster-related increases in the number of Filipinos expected to face poverty or subsistence for any duration each year. At left, map colors indicate new poverty incidence as a percentage of regional population. At right, map colors indicate new poverty incidence as a percentage of regional poverty rate (inclusive of subsistence)

Socioeconomic Characteristics and Disaster Recovery Dynamics

Both asset losses and the foregoing poverty-focused analysis characterize the status of households in the instant after a hazard has occurred, and provide useful insights into how governments and other first responders should target humanitarian relief. However, two households starting from the same initial conditions can follow very different recovery pathways. After asset losses are assessed, one household may be able to fund its recovery due to an insurance payout or a surge in remittances, while another becomes mired in poverty. In contrast to asset losses, income and consumption losses can help design policies that address the temporal dimensions of disaster impacts. Of the estimated half million Filipinos pushed into transient consumption poverty by disasters each year, some 25,000 will still be in poverty 10 years later.

Returning to the Yolanda-like event, Fig. 6 on page 23 maps the expected time to recover 90% of the assets destroyed when a 100-year wind event strikes each region. Unsurprisingly, the map indicates that Metro Manila and surrounding parts of Luzon are the quickest to recover. In other words, although disasters are more frequent, costlier, and push more individuals into transient poverty in Luzon than elsewhere, these regions’ economies can also be expected to achieve relatively rapid and inclusive recoveries. When major disasters occur outside these areas, recovery is expected to proceed more slowly (and, in some cases, not at all), and disaster strategies seeking to minimize recovery times should focus on providing innovative post-disaster support outside of Luzon. Notably, this modeling result is largely independent of initial asset losses, as it is instead a proxy for the overall socioeconomic resilience of each region.

Our modeling concludes that disaster costs can persist for large groups of people long after official recovery efforts have concluded, and this effect has been documented after some large-scale disasters in other countries (Dercon and Porter 2014; Carter and Barrett 2006; de Janvry et al. 2006; Caruso 2017). In most cases, however, these groups should be difficult to detect in aggregate economic data because they are much poorer than the average household. Socioeconomic heterogeneity could also help explain why some studies have found long-term impacts of disasters on growth (Hsiang and Jina 2014; Noy 2009; Klomp and Valckx 2014), while others have not (Skidmore and Toya 2002; Kocornik-mina et al. 2016; Bertinelli and Strobl 2013; Cavallo et al. 2013).

By measuring disasters in terms of poverty and recovery times, we can identify those groups that are least likely to recover. In some regions, the link between disaster losses and chronic poverty is strong enough that risk management can further anti-poverty objectives, and vice-versa. This may already be an actionable result, but poverty headcounts do not provide insight into how households already in poverty (nor those whose income does not drop below the poverty line) are impacted by disasters. This is an important limitation, as the goal of this analysis is to motivate inclusive and integrative DRM strategies, to inform investment decisions that do not discount disaster-related costs to the welfare of any households. This is why we now introduce the concept of wellbeing losses, which can be used to measure disaster impacts on all households, without creating a bias toward the richest or the poorest ones.

Risk to Wellbeing at the National Level

The foregoing has shown that, even if disaster-affected households suffer identical asset losses, their consumption losses and recovery time will vary according to their socioeconomic status and the resources available to them. Poverty-integrated DRM strategies should account for the insurance, savings, remittances, and public support that help some households to smooth the consumption shocks, but not others. Even after accounting for these differences, however, $1 in consumption losses can have very different consequences for individual households, depending on their income. In particular, while rich households will be able to spend down their savings or scale back their discretionary consumption, poorer households will often have to cut on essential consumption, including food, health, and education. This can threaten their long-term prospects, as well as the development of their community.

Given finite governmental budgets, DRM strategies should attempt to balance the interests of the poor and the wealthy, and wellbeing losses are constructed to do precisely this. In this analysis, wellbeing losses are calculated from consumption losses, using a classical constant relative risk aversion welfare function. This operation translates the value of a household’s consumption into a measure of welfare, at each point in its individual recovery. The metric measures the value derived from a given level of consumption. Decreasing marginal returns reflect the fact that small consumption shifts (in either direction) deliver greater value to the poor, than to the wealthy.Footnote 5 In other words, the difference in the wellbeing generated by $1 of consumption is a simple proxy for the continuum from survival consumption (the very first units of consumption that have the largest impact on wellbeing) to luxury consumption (which enhances total welfare less and less, the larger it grows).

As a metric of disaster impacts, wellbeing losses integrate each household’s consumption losses over the duration of its recovery, giving more weight to consumption losses accruing to the poor. In other words, $1 in wellbeing losses describes the same amount of value, or welfare, for all households, though this value corresponds to greater asset losses for the wealthy than for the poor. In this way, wellbeing losses account for socioeconomic differences among households. They correct for the pro-wealthy bias inherent in asset losses without relying on conceptually simpler, but inadequate binary thresholds like the poverty line. Most importantly, they capture more fully the costs of disasters and the benefits of prospective DRM investments than do asset losses. Given poverty-integrated DRM as a policy goal, wellbeing-informed strategies will be not only more equitable, but also more cost-effective than asset-informed strategies.

As discussed in “Asset Losses” on page 9, we estimate annual asset losses to households from natural hazards (inclusive of hurricanes, precipitation floods, storm surge, and earthquakes) in the Philippines at over US$1.4 billion ( 72 billion, cf. Table 4 on page 29), equivalent to 1.3% of household annual expenditures. Wellbeing losses are much higher, at US$3.9 billion (

72 billion, cf. Table 4 on page 29), equivalent to 1.3% of household annual expenditures. Wellbeing losses are much higher, at US$3.9 billion ( 193 billion; 3.3% of household expenditures) per year. In other words, if DRM assessments in the Philippines took into account households’ variable capacities to cope with and recover from disasters–that is, their socioeconomic resilience–the impact of disasters would be valued at (equivalent to) a decrease in national consumption by almost US$4 billion.Footnote 6

193 billion; 3.3% of household expenditures) per year. In other words, if DRM assessments in the Philippines took into account households’ variable capacities to cope with and recover from disasters–that is, their socioeconomic resilience–the impact of disasters would be valued at (equivalent to) a decrease in national consumption by almost US$4 billion.Footnote 6

Socioeconomic Resilience to Disasters

The analysis has moved from asset to income, consumption, and wellbeing losses, incorporating additional relevant household-level socioeconomic characteristics at each stage. To summarize these developments, we return to the traditional risk-assessment framework (cf. 1 on page 6). The three conventional components (i.e., hazard, exposure, and vulnerability) can be used to measure tangible destruction, set insurance premiums, and rightsize disaster relief budgets. This is to say, these three layers are sufficient inputs for asset-focused DRM strategies. However, they leave unaddressed the essential policy question of whether disaster-affected populations cope with and bounce back from their losses, and how they can be helped to do so.

In response to this gap in the study and practice of DRM, we have added a fourth layer of analysis, called socioeconomic resilience. Defined as the ratio of expected asset losses to wellbeing losses, socioeconomic resilience is independent of asset losses.Footnote 7 Rather, it describes the capacity of households (individually and in aggregate) to deal with asset losses of any magnitude, when they occur.

At the national level, expected asset and wellbeing losses total US$1.4 billion and US$3.9 billion, respectively. Therefore, the wellbeing impact of disaster losses in the Philippines is 170% (\(\frac {3.9}{1.4}\) = 2.7) higher than asset losses. On average, every $1 in asset losses is equivalent to a $2.70 consumption loss, as experienced by a household earning the national average income. Alternatively, we can say that the socioeconomic resilience of the Philippines is 37%.Footnote 8 Although this is an informative result, the national average of socioeconomic resilience belies significant regional variation in the capacity of Filipino households to cope with and recover from disasters.

Figure 7 maps socioeconomic resilience to disasters at the regional level. Among all regions, Metro Manila (NCR) enjoys the highest resilience (61%). This is due not just to its overall wealth and poverty rate of just 4%, but also to its high degree of financial inclusion and social protection coverage (30% higher than the national average). On the other hand, despite these advantages, wellbeing losses to disasters in the capital region are still 64% (\(\frac {1}{0.61}\) = 1.64) higher than asset losses, and most of these losses still accrue to the poorest residents of the region. On the other end of the resilience ranking, ARMM has the lowest resilience among all regions (15%). Low annual asset losses in ARMM indicate that major events are rare (low hazard) and that the total value of assets in the region is relatively small (low exposure). However, household resilience is very low, and special policies and measures should be implemented to help this and other fragile regions cope when disasters inevitably occur.

In addition to these diagnostics, the extension of the hazard-exposure-vulnerability framework to include socioeconomic resilience has the benefit of expanding the disaster risk management “toolbox.” Conventional risk management strategies seek to mitigate hazards as well as the exposure and vulnerability of assets. This includes engineering and retrofitting, land use planning, early warning systems, and evacuation routes. Other tools (e.g., post-disaster support, financial inclusion, private and public insurance, and sovereign contingent credit) are not easily included in risk assessments because they do not affect asset losses. In a wellbeing-informed framework, however, the benefits of these policy options become obvious and quantifiable: to the degree that they allow households to maintain a healthy degree of consumption while they rebuild, these interventions increase socioeconomic resilience and reduce wellbeing losses to disasters.

Regional Risk Summary

The annual risk to assets, risk to wellbeing, and socioeconomic resilience for each region of the Philippines are summarized in Table 4. In absolute terms, risk to household assets is highest in Metro Manila and in CALABARZON. Asset losses in these two regions total over US$610M ( 30 billion) per year, over 40% of the expected losses in the entire country. The asset and population density in these areas make DRM interventions effective, but also expensive.

30 billion) per year, over 40% of the expected losses in the entire country. The asset and population density in these areas make DRM interventions effective, but also expensive.

When disaster impacts are measured in wellbeing losses (Fig. 8), an alternative set of regional priorities emerges. In particular, Table 4 indicates that Bicol and CALABARZON suffer the greatest losses each year. In absolute terms, CALABARZON suffers the highest wellbeing losses, surpassing US$665 million ( 31 billion) per year, equivalent to 3.4% of AHC in the region. These losses are due to elevated exposure to hurricanes and storm surges (51% and 22% of annual regional asset losses, respectively), which result in major wellbeing losses despite an above average value for socioeconomic resilience (45%) and a low regional poverty rate (just 9%). In Bicol, where asset losses are much lower, wellbeing losses are driven by a very high chronic poverty rate (36%), low household savings (60% of the national average, across all deciles), and low social transfer receipts (75% of national average).

31 billion) per year, equivalent to 3.4% of AHC in the region. These losses are due to elevated exposure to hurricanes and storm surges (51% and 22% of annual regional asset losses, respectively), which result in major wellbeing losses despite an above average value for socioeconomic resilience (45%) and a low regional poverty rate (just 9%). In Bicol, where asset losses are much lower, wellbeing losses are driven by a very high chronic poverty rate (36%), low household savings (60% of the national average, across all deciles), and low social transfer receipts (75% of national average).

Overall, wellbeing losses are less geographically concentrated than asset losses, and this result is indicative of the magnitude of the challenge facing disaster managers in the Philippines. At the same time, it signifies new opportunities to mitigate disaster risk and chronic poverty by investing in socioeconomic resilience outside the most developed parts of Luzon.

Poorest Quintile Risk Summary

Because our results are based on information at the household level, we are able to assess asset and wellbeing losses not just at the regional level, but also for different income groups.Footnote 9 Table 5 on page 31 lists annual asset and wellbeing losses for the poorest quintile in each region. Across all regions, the asset losses of the poorest 20% are US$125 million ( 6.3 billion per year), or just 9% of total asset losses. On the other hand, the wellbeing losses of the poorest quintile give a better sense of their experience of disasters: the wellbeing losses of the poorest quintile are valued at US$1.2 billion (

6.3 billion per year), or just 9% of total asset losses. On the other hand, the wellbeing losses of the poorest quintile give a better sense of their experience of disasters: the wellbeing losses of the poorest quintile are valued at US$1.2 billion ( 61 billion) per year, or 31% of total wellbeing losses. This means that, on average, individuals in the poorest quintile suffer wellbeing losses that are 50% larger than the average individual loss in the country.

61 billion) per year, or 31% of total wellbeing losses. This means that, on average, individuals in the poorest quintile suffer wellbeing losses that are 50% larger than the average individual loss in the country.

Critically, Table 5 shows that variation in regional socioeconomic resilience values decreases significantly when we narrow our focus to the poorest Filipinos. While NCR has the highest overall resilience (61%), the poorest households in the capital have a resilience of only 17%. To wit: on average, the poorest residents of NCR lose on average US$9.50 per person, per year to natural disasters, but this equates to nearly US$60 per person and per year in wellbeing losses (cf. Table 6 on the following page). In terms of disaster impacts and recovery prospects, this result suggests that the poorest Manileños have more in common with the poor in other regions than with their wealthier neighbors. At the other extreme, the socioeconomic resilience of the wealthiest quintile ranges from 54% in ARMM, to 426% in NCR.

This is an important caveat to regional-scale assessments: the aggregate wealth of the capital region does not imply that its poorest residents are well-protected from or resilient to natural disasters. To the contrary, the low resilience of the poor to asset losses, combined with the large contribution of disasters to poverty incidence in the capital region (cf. Table 3 on page 20), suggests that interventions to reduce asset losses and build resilience of the poor could be very effective for reducing disaster exposure and poverty incidence, particularly in Metro Manila and other wealthy cities.

Policy Simulations

The theoretical framework and metrics presented here are not limited to disaster risk diagnostics. They also allow for detailed, poverty-informed cost-benefit analyses of many types of investments to reduce disaster risk, or make the population better able to deal with them. Conventional DRM tools to mitigate exposure and vulnerability can assessed using this framework, but here we will examine cash transfers, as a tool for the government to help disaster-affected population. Although post-disaster cash transfers do not affect asset losses, they do affect the resilience of program beneficiaries, and all of the metrics discussed here (e.g., poverty headcount and gap, reconstruction time, and wellbeing losses) can be used assess their effects. Because the model estimates losses at the household level, it is also possible to examine the distribution of these costs and benefits throughout the population.

Post-disaster Support in the Philippines

Cash transfers are used by governments in many countries to help households cope with and occur from disasters. In developing economies including the Philippines, informal sources of credit are widely used as well. For example, community-based insurance and other risk pooling schemes can provide a small income to households in times of crisis. However, these systems are generally very small, and can be easily overwhelmed in the event of a catastrophe affecting a large fraction of the pool. In these cases, or where community risk sharing does not exist, households often resort to private lenders. In many cases, these lenders’ practices are designed to exploit households in distress, and particularly poor ones–for example, through usurious interest rates.

In the Philippines, the Department of Social Welfare and Development (DSWD) is the lead agency for disaster response within the government’s National Disaster Risk Reduction and Management Plan (NDRRMP). In response to Yolanda, DSWD implemented a variety of SP and social welfare programs: distribution of in-kind relief items, cash transfers (unconditional and conditional), shelter, and community-driven development.Footnote 10 Initially, the emphasis was on food and nonfood items (like mats, blankets, tarpaulins, hygiene kits, and clothing) to meet the immediate and urgent survival needs, plus temporary shelter assistance for displaced households.

After immediate survival needs were addressed, DSWD delivered a number of cash-based response programs, such as Cash for Work, Cash for Building Livelihood Assets, and cash for shelter (Emergency Shelter Assistance)–then transformed into the Core Shelter Assistance Program to rebuild permanent housing. DSWD also temporarily removed all conditionality of the Pantawid Pamilyang Pilipino Program (4Ps), a usually conditional cash transfer program. In addition, at least 45 international humanitarian agencies implemented cash transfers (unconditional and conditional), delivered in art through the 4Ps infrastructure. Four agencies alone distributed around US$34 million, benefiting 1.4 million disaster-affected people.

Modeling Post-disaster Support

Here, we do not try to reproduce the very complex response to typhoon Yolanda, but instead we assess the benefit from a very simple post-disaster support system (PDS) provided to the population after a disaster, as an illustrative exercise. In this system, all disaster-affected households receive a uniform cash payout, equal to 80% of the average asset losses suffered by the poorest quintile. This system ensures that poor people are compensated for a large fraction of their losses, and assumes that all affected households are supported, while total costs remain acceptable. The cost of the program is distributed among all households throughout the Philippines via a flat tax on income.

Returning to the Yolanda-like hurricane event: expected wind damage to household assets in the Eastern Visayas region is valued at US$633 million. Wellbeing losses from the same event are valued at US$2,176 million, meaning that the socioeconomic resilience of the region is just 29%.Footnote 11 In Fig. 9 on page 36, we plot per capita asset and wellbeing losses, grouped by income quintile. The figure shows that the richest households lose the most assets, while the poorest households suffer the greatest wellbeing losses.

Asset and wellbeing losses from a 100-year hurricane (wind) event in the Eastern Visayas are shown by quintile. In the left two clusters, asset and wellbeing losses are modeled in the absence of any governmental post-disaster support. The third and fourth clusters show the net cost and expected wellbeing losses, by quintile, of a post-disaster support package in which all affected households receive a uniform payout equal to 80% of the average asset losses of the poorest quintile. Note that post disaster support reduces wellbeing losses without impacting asset losses

In response to this disaster in this location, our idealized post-disaster program disburses a total of US$187 million ( 9.4 billion), distributed uniformly among all affected households.Footnote 12 Note that the flat tax payment mechanism used here effects a net transfer from the top quintile to the bottom four. The two clusters on the right in Fig. 9 show how post-disaster support would reduce wellbeing losses (without having any effect on asset losses), especially for the poorest households, as a result. The first quintile sees its wellbeing losses halved, while the impact of this transfer on the richest quintile is small.

9.4 billion), distributed uniformly among all affected households.Footnote 12 Note that the flat tax payment mechanism used here effects a net transfer from the top quintile to the bottom four. The two clusters on the right in Fig. 9 show how post-disaster support would reduce wellbeing losses (without having any effect on asset losses), especially for the poorest households, as a result. The first quintile sees its wellbeing losses halved, while the impact of this transfer on the richest quintile is small.

Because post-disaster support does not impact asset losses, such programs cannot be subjected to traditional cost-benefit analyses. In this analysis, we see that this version of post-disaster support reduces wellbeing losses by US$916 million, a 42% decrease relative to the nominal simulation. As a result, the socioeconomic resilience of the region increases from 29% to 50%. Based on the cost of this theoretical disbursement (US$187 m.), and using avoided wellbeing losses (US$916 m.) to assess its benefit, we projects a benefit-to-cost ratio of 4.9 for this intervention. More detailed analysis would allow DRM authorities the optimize the costs and benefits of post-disaster support, including more realistic (or actual) limitations on budgeting, targeting, and delivery.Footnote 13

On an annual basis, the cost of the idealized post-disaster program is US$472 million, equivalent to 32% of expected annual losses for all hazards. Overall, the program is expected to reduce wellbeing losses from all disasters by 17%, or US$598 million ( 30 billion), achieving a benefit-cost ratio of 1.3 on average. This benefit-cost ratio is lower than in the previous example because, for any individual event, the benefit-cost ratio depends on who is affected. When a very rich area is affected, the system may redistribute resources from poor (but non-disaster-affected) people to richer (but disaster-affected) people, which reduces the benefit-cost ratio. This system is provided just as an example; the cost of a post-disaster support package could be significantly reduced–and the wellbeing benefits significantly improved–if it were better targeted to benefit only the poorest Filipinos (e.g., by restricting beneficiaries to those in the first quintile).

30 billion), achieving a benefit-cost ratio of 1.3 on average. This benefit-cost ratio is lower than in the previous example because, for any individual event, the benefit-cost ratio depends on who is affected. When a very rich area is affected, the system may redistribute resources from poor (but non-disaster-affected) people to richer (but disaster-affected) people, which reduces the benefit-cost ratio. This system is provided just as an example; the cost of a post-disaster support package could be significantly reduced–and the wellbeing benefits significantly improved–if it were better targeted to benefit only the poorest Filipinos (e.g., by restricting beneficiaries to those in the first quintile).

The impact of post-disaster support systems on disaster recovery and poverty reduction can also be measured. Again using wind damage from a 100-year hurricane event in the Eastern Visayas as an example, Fig. 10 on the next page plots the poverty gap (with only households in the bottom half of the income distribution) as reported in FIES (“pre-disaster”) and immediately after the hurricane hits, with and without post-disaster support. The figure shows that a 100-year hurricane in the region is expected to deepen the poverty gap by 12 percent in the first quintile, from 40% baseline shortfall of the poverty line, to 45%. With the post-disaster support discussed above, the magnitude of the shock decreases to 6%. The benefits of this program are even larger in the second and third income deciles.

The poverty gap, defined for each income decile as the average consumption shortfall of the poverty line. Decile-level results are shown for the Eastern Visayas region as reported in FIES 2015 (“Pre-disaster”) and after a 100-year wind event strikes the region. The post-disaster poverty gap is modeled both in the absence of any governmental post-disaster support (“No PDS”), and with one potential post-disaster support (“PDS”) package, and is calculated only for disaster-affected households

Conclusions

The concept of resilience is used within many disciplines and policy planning processes. Though there are many definitions in practice, all applications include notions of “perturbation” and “recovery.” In the context of DRM, many effective frameworks for building resilience have been developed, but most do not seek to measure resilience directly, as an integrative property of systems (or agents therein) (Tiernan et al. 2019). This can create ambiguity and tradeoffs for policy makers, particularly when their agenda includes multivalent goals, rather than a singular objective function (e.g., average household income, or whole-economy widget production).

This paper has presented the results of a risk assessment based on an expanded framework, which includes in the analysis the ability of affected households to cope with and recover from disaster asset losses and uses “wellbeing losses” as its main measure of disaster severity. This framework adds a fourth component, socioeconomic resilience, to the three usual components of risk assessments (i.e., hazard, exposure, and vulnerability). Like the more familiar components of risk management, socioeconomic resilience can be measured at any degree of spatial resolution, from households to national averages.

Using a new agent-based model that represents explicitly the recovery and reconstruction process at the household level, this risk assessment provides more insight into disaster risk in the Philippines than conventional asset risk assessments. In particular, it shows how the regions identified as priorities for risk-management interventions differ depending on which risk metric is used. While a simple cost-benefit analysis based on asset losses would drive risk reduction investments toward the richest regions and areas, a focus on poverty or wellbeing rebalances the analysis and provides a different set of regional priorities.

In parallel, measuring disaster impacts through poverty and wellbeing implications helps quantify the benefits of interventions that may not reduce asset losses, but do reduce their wellbeing consequences by making the population more resilient. These interventions include financial inclusion, social protection, and more generally the provision of post-disaster support to affected households.

The model and data used in this analysis have many limitations. For instance, the 2015 FIES is only representative at the regional level and does not offer the geolocalization of households. Further, the DFCRM is itself a complex and imperfect modeling exercise. Finally, the model does not represent all coping mechanisms available to households, such as international remittances or temporary migrations. However, even with these limits and simplifications, the introduction of socioeconomic resilience and household characteristics into risk assessments provides useful insights and appears as a promising research agenda.

Notes

In geographical terms, the current version of the FIES is representative only at the regional level. An updated FIES, expected in 2019, will make it possible to perform the same analysis at the provincial level.

Comprehensive asset loss estimates are a direct output of the AIR catastrophe model, a probabilistic model of natural hazards and their interactions with, or impacts on, insurable assets. Starting from event simulations with localized intensity calculations, the AIR model estimates damages and expected losses, taking into account the best available exposure data and policy conditions (Guin and Saxena 2000; Grossi and Kunreuther 2005). However, this analysis is specifically interested in the impacts of disasters on household assets, consumption, and welfare. One issue we face is the difference between the Gross Domestic Income (GDI) derived from national accounts and the aggregated household consumption (AHC) calculated from household surveys. As is well known, the latter tend to report lower incomes and consumption than national accounts (Deaton 1997). In this analysis, we work based on the AHC. Therefore, the expected losses in Table 1 have been scaled by AHC as a fraction of the nominal regional productivity (GRDP), a factor of 0.43 on average (cf. Table 7).

AHC is the total household consumption in each region, as reported in FIES.

We also note that post-disaster income losses should be observable using high-frequency panel surveys in areas recovering from disasters.

Here, the unit of analysis is the households. It would be useful to do it at the individual level, to uncover intra-household distributional effects, linked to gender or age. In the absence of within-household data, we make the strong assumption that pre-disaster consumption and disaster losses are distributed equally per capita within each household.

More precisely, the impact on wellbeing is equivalent to a

193 billion decrease in consumption that would be optimally shared across households in the country and across time. Or it is equivalent to a

193 billion decrease in consumption that would be optimally shared across households in the country and across time. Or it is equivalent to a  193 billion decrease in consumption that would be equally shared across households in the country, if all households had the same income (i.e. if all inequality had disappeared).

193 billion decrease in consumption that would be equally shared across households in the country, if all households had the same income (i.e. if all inequality had disappeared).Socioeconomic resilience is independent of asset losses, except for a threshold effect that occurs when households fall into extreme poverty, and are unable to reconstruct at all. Resulting wellbeing losses can approach infinity, but the effect is rare enough that resilience results are robust against the inclusion or exclusion of these households in this analysis. This will not be true in all countries or contexts, and particularly in the poorest, least developed cases.

This estimate is significantly lower than that from the Unbreakable report, and cannot be directly compared, considering the difference between the models. The difference is explained by the improved consideration of distributional impacts (using the full survey instead of only two categories of households) and the explicit representation of the reconstruction pathway. The difference confirms the need to model the reconstruction pathway in a dynamic manner and to include the impact of short-term consumption drops.

It is also possible to look at different subgroups in the country or at the regional scale (e.g., per occupation, head of household gender, household size, ethnic background or religion, social transfer enrollees), within the limits of the representativeness of the household survey.

A more complete description of the response to Yolanda is provided in the Shock Waves report (Hallegatte et al. 2015).

Here, we report expected asset losses from the 100-year wind event in the Eastern Visayas (a product of the DFCRM, scaled to match AHC), and this represents 45% of the reported US$1.4 billion in losses to Yolanda in the Eastern Visayas. The total value includes damage from precipitation flooding and storm surge (not included in this example), as well as the assets that account for the difference between AHC and nominal GRDP.

Progressive taxation, social insurance-like systems, existing program enrollments and conditionalities, and more complex alternatives can also be modeled.

It is important to note that even if the amount of post-disaster support is equal to asset losses, it does not fully cancel wellbeing losses: indeed, post-disaster support maintains consumption, but consumption losses are larger than asset losses. This result is consistent with intuition: even if people are immediately given in cash the cost of rebuilding their houses and replacing their assets, they would still experience wellbeing losses during the reconstruction period, since assets and houses cannot be replaced instantaneously.

In some countries, it may be necessary or preferable to infer household income from expenditures, whether because incomes are not reported, because consumption is more stable over time, or because the official poverty statistics are calculated from consumption rather than income.

Similarly, the services provided by other assets (e.g., air conditioners, refrigerators) could be added as an additional income that can be threatened by natural disasters.

Administrative costs are not included in the assessment of the cost of the programs. When household data do not include the transfers, then transfers from social programs can be modeled on the basis of the actual disbursement rules that qualify households for participation in each program (eg, PMT score, household number of dependents or senior citizens, employment status, etc.).

Although we assume a flat tax, the model is capable of handling more complicated tax regimes, including progressive taxation.

Since general spending of the government is not explicitly represented in the income ih, the effective capital stock estimated here \(k_{h}^{eff}\) is net of the resources used to finance this general spending through taxes.

Where higher resolution household and disaster loss data are available, it is of course possible to expand Equation 8 to the provincial or sub-regional level.

In exceptional cases where fa exceeds an upper threshold of 0.95, or 95% of households affected, the exposure is capped at 95% and the vulnerability vh is increased to match the asset losses from the AIR model.

This is equivalent to assuming that the government budget is always balanced and that inter-household transfers respond instantaneously to income changes. Other changes in government spending, tax rates, and remittances are represented through the third term of the equation, \({\Delta } i_{h}^{PDS}\), see below.

In addition to the loss of monetary income, this includes the loss in virtual income if the housing services provided by their home or their asset (fridge, fans, air conditioning systems) is also lost.

Even though natural capital “rebuilds itself,” people may have to reduce consumption to allow for accelerated growth.

References

Bertinelli L, Strobl E (2013) Quantifying the local economic growth impact of hurricane strikes An analysis from outer space for the caribbean. J Appl Meteorol Climatol 52(8):1688–1697

Blanc E, Strobl E, Blanc E, Strobl E (2016) Assessing the impact of typhoons on rice production in the philippines. J Appl Meteorol Climatol 55(4):993–1007

Carter MR, Barrett CB (2006) The economics of poverty traps and persistent poverty: an asset-based approach. J Dev Stud 42(2):178–199

Caruso GD (2017) The legacy of natural disasters: the intergenerational impacts of 100 years of disasters in latin America. J Dev Econ 127:209–233

Catane SG, Abon CC, Saturay RM, Mendoza EPP, Futalan KM (2012) Landslide-amplified flash floods—The June 2008 Panay Island flooding, Philippines. Geomorphology 169-170:55–63

Cavallo E, Galiani S, Noy I, Pantano J (2013) Catastrophic natural disasters and economic growth. Review of Economics and Statistics 95(5):1549–1561

Dawe D, Moya P, Valencia S (2009) Institutional, policy and farmer responses to drought: El niño events and rice in the Philippines. Disasters 33(2):291–307

de Janvry A, Finan F, Sadoulet E, Vakis R (2006) Can conditional cash transfer programs serve as safety nets in keeping children at school and from working when exposed to shocks?. J Dev Econ 79(2):349–373

Deanna T (2017) Villacin. a review of philippine government disaster financing for recovery and reconstruction. Technical report, PIDS Discussion Paper Series

Deaton A (1997) The analysis of household surveys: a microeconometric approach to development policy. World Bank Publications

Dercon S, Porter C (2014) Live aid revisited: Long-term impacts of the 1984 Ethiopian famine on children. J Eur Econ Assoc 12(4):927–948

Erman A, Motte E, Goyal R, Asare A, Takamatsu S, Chen X, Malgioglio S, Skinner A, Yoshida N, Hallegatte S (2018) The road to recovery: the role of poverty in the exposure, vulnerability and resilience to floods in Accra. The World Bank

Fleurbaey M, Hammond PJ (2004) Interpersonally comparable utility Handbook of Utility Theory. Springer, Boston, pp 1179–1285

Grossi P, Kunreuther H (2005) Catastrophe modeling: a new approach to managing risk, vol 25. Springer Science & Business Media

Guin J, Saxena V (2000) Extreme Losses from Natural Disastersearthquakes, Tropical Cyclones and Extratropical Cyclones. Applied Insurance Research Inc, Boston

Hallegatte S, Bangalore M, Bonzanigo L, Fay M, Kane T, Narloch U, Rozenberg J, Treguer D, Vogt-Schilb A (2015) Shock waves: Managing the impacts of climate change on poverty. World Bank Publications

Hallegatte S, Rentschler J, Walsh B (2018) Building back Better: achieving resilience through stronger, faster, and more inclusive Post-Disaster reconstruction. World Bank Group

Hallegatte S, Vogt-Schilb A (2016) Are Losses from Natural Disasters More Than Just Asset Losses? The Role of Capital Aggregation, Sector Interactions, and Investment Behaviors. Policy Research working papers. The World Bank

Hallegatte S, Vogt-Schilb A, Bangalore M, Rozenberg J (2016) Unbreakable: building the resilience of the poor in the face of natural disasters. World Bank Publications

Hsiang SM, Jina AS (2014) The causal effect of environmental catastrophe on long-run economic growth: Evidence from 6,700 cyclones. Technical report, National Bureau of Economic Research

Huigen MGA, Jens IC (2006) Socio-Economic impact of super typhoon harurot in san mariano isabela, the philippines. World Dev 34(12):2116–2136

Klomp J, Valckx K (2014) Natural disasters and economic growth: A meta-analysis. Glob Environ Chang 26(1):183–195

Kocornik-mina A, McDermott TKJ, Michaels G, Rauch F (2016) Flooded Cities. Technical report, Centre for Economic Performance, LSE

Le De L, Gaillard JC, Friesen W (2013) Remittances and disaster: a review. Int J Disast Risk Red 4:34–43

Morduch J (1995) Income smoothing and consumption smoothing. Journal of Economic Perspectives 9(3):103–114

Noy I (2009) The macroeconomic consequences of disasters. J Dev Econ 88 (2):221–231

Skidmore M, Toya H (2002) Do natural disasters promote long-run growth? Econ Inq 40(4):664–687

Tiernan A, Drennan L, Nalau J, Onyango E, Morrissey L, Mackey B (2019) A review of themes in disaster resilience literature and international practice since 2012. Policy Design and Practice 2(1):53–74

Townsend RM (1995) Consumption insurance: An evaluation of risk-bearing systems in low-income economies. Journal of Economic Perspectives 9(3):83–102

Yang D, Choi HJ (2007) Are remittances insurance? evidence from rainfall shocks in the philippines. The World Bank Economic Review 21(2):219–248

Yi CJ, Suppasri A, Kure S, Bricker JD, Mas E, Quimpo M, Yasuda M (2015) Storm surge mapping of typhoon Haiyan and its impact in Tanauan, Leyte, Philippines. Int J Disast Risk Red 13:207–214

Yonson R (2018) Floods and pestilence: diseases in Philippine urban areas. Economics of Disasters and Climate Change 2(2):107–135

Yonson R, Noy I, Gaillard JC (2018) The measurement of disaster risk: An example from tropical cyclones in the Philippines. Rev Dev Econ 22(2):736–765

Yumul GP, Cruz NA, Servando NT, Dimalant CB (2011) Extreme weather events and related disasters in the Philippines, 2004-08: a sign of what climate change will mean. Disastersa 35(2):362–382

Acknowledgments

The authors wish to recognize the work of many colleagues who contributed to this report, including Artessa Saldivar-Sali, Lesley Jeanne Y. Cordero, Adrien Vogt-Schilb, Mook Bangalore, and the World Bank country office in Manila. They also thank the teams at the Philippines’ National Economic and Development Authority and the Philippine Statistics Authority for their contribution to the development of the model and its application to the Philippines. All errors, interpretations, and conclusions are the responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Global Facility for Disaster Reduction and Recovery (GFDRR), World Bank Group

Technical Appendix — Methodology and model description

Technical Appendix — Methodology and model description

This section explains the methodology and describes the model used to translate asset losses into wellbeing losses. The code of the model is freely available, and the reader is invited to refer to the code for the implementation of the principles and equations presented in this section. The household survey data cannot be made available directly, as they need to be requested from the statistical agency of the Philippines.

In all applications, the model assumes a closed national economy. In terms of disaster risks, this means that 100% of household income is derived from assets located inside the country, and that post-disaster reconstruction costs can be distributed to non-affected taxpayers throughout the country, but not outside its borders.Footnote 14

This report picks up and develops the analytical machinery of the original Unbreakable report. Its primary innovation is in its use of the Family Income & Expenditure Survey (FIES) to disaggregate expected asset losses among representative households, resulting in a measurement of asset losses, poverty impacts, and wellbeing losses by income quintile and region in the country. While the remainder of this report offers a detailed description of the methodology we highlight three ways in which this iteration of the Unbreakable analysis is an extension of previous work (Hallegatte et al. 2016; Hallegatte et al. 2018):

Based on national data, the original model could not give insight into spatial heterogeneities in hazard, exposure, or asset vulnerability. This shortcoming limited the practical value of the Unbreakable framework to inform funding decisions at actionable level of spatial detail. The present analysis is based on hazard- and asset class-specific exceedance curves at the provincial level, even though the spatial resolution of the analysis is limited by the representativeness of the available household survey.

The original analysis, used most recently to generate national-level indicators for 149 countries in Hallegatte et al. (2018), divided the population of each country into “poor” and “non-poor” groups. National averages for the characteristics of each group (e.g., income and asset vulnerability; access to early warning and financial institutions; social protection receipts, etc.) are used to estimate their respective asset and wellbeing losses and socioeconomic resilience. Consequently, it was not possible to examine the characteristics that influence socioeconomic resilience within quintiles. In the new iteration, we can examine income and expenditures data for more insight into how best to help the poor cope with disasters.

Formerly, the model assumed exogenously that all households recover at the same pace when they are affected by a disaster. In its current iteration, the model explicitly represents disaster reconstruction dynamics at the household level using an agent-based approach in which each household acts rationally to minimize its wellbeing losses. This optimization specifies each household’s reconstruction and savings expenditure rate, assuming households optimize the fraction of income they dedicate to repairing and replacing their assets. For instance, people close to the subsistence level cannot set aside much of their income to rebuild their assets without experiencing large wellbeing losses, and may therefore take longer to recover. In extreme cases, they may even be trapped in poverty, generating large wellbeing losses going well beyond the few years that follow a disaster (Carter and Barrett 2006; Dercon and Porter 2014). The model also provides a better assessment of wellbeing losses by distinguishing between short-lived deep consumption losses, and more persistent but shallower impacts.

Pre-disaster situation

Population & weighting

The pre-disaster situation in the country is represented by the households described in the Family Income and Expenditure Survey (FIES). We use a per capita weighting (ωh), such that summing over all households in the survey or in an administrative unit (Nh) returns the total population (P):

One essential characteristic of each household is its income (ih). As defined by the FIES, ih combines primary income and receipts from all other sources, including the imputed rental value of owner-occupied dwelling units, pensions and support, and the value of in-kind gifts and services received free of charge. The data recorded in the survey are assumed to capture the household’s permanent income, which is smoothed over fluctuations in income and occasional or one-off expenditures.Footnote 15 It is important to note that the value of housing services provided by owner-occupied dwelling is included in the income data, so that the loss of a house has an impact on income (even though it would not affect actual monetary income).Footnote 16

Social transfers, taxation, and remittances

The enrollment and value of social transfers (\(i_{h}^{sp}\)) are listed in FIES, and the total cost (\(\mathcal {C}_{sp}\)) of these programs to the government is given by a simple sum:Footnote 17

All incomes reported in FIES are assumed to be reported net of the income tax that finances general spending of the government (for infrastructure and other services) and of an additional flat income tax that finances social programs (rate = \(\delta _{sp}^{tax}\)). The rate \(\delta _{sp}^{tax}\) can be estimated with the following equation:Footnote 18