Abstract

We estimate the impact of natural disasters on financial development proxied by private credit. We employ a panel fixed effects estimator as our main estimation tool on a country level panel data set of natural disasters and other economic indicators covering 147 countries for the period from 1979 to 2011. We find that companies and households get deeper into debt after a natural disaster. This effect is stronger in poorer countries whilst the effect is weaker in countries where agriculture is more important. The magnitude of per capita credit varies across countries regardless of their per capita income. Hence, the real impact of disasters on credit as a share of prevailing per capita credit is country specific as well as time specific. Our findings are robust to alternative estimators, specifications, samples and data. Private credit is only one dimension of financial development and financial markets are less well developed in poor countries which are more vulnerable to disasters. Thus, the immediate impact of natural disasters is better interpreted as households getting (further) into debt rather than as financial development, but we find longer term impacts too that indicate an expansion of credit availability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Natural disasters are inherently destructive, disruptive and costly in the short run, and may hamper economic growth too. Vice versa, poorer countries, and particularly financially underdeveloped countries are more vulnerable to natural disasters. This paper contributes to the study of the nexus of disasters and growth by estimating the impact of natural disasters on financial development.

The literature on the impact of natural disasters on economic growth is as yet inconclusive. Natural disasters are seen as a major impediment for global development efforts (UNISDR 2002) and the resolution dated 18 February 2009 adopted by the United Nations General Assembly (UN General Assembly 2009) stresses the fact that the impacts of natural disasters heavily hinder the achievement of internationally agreed development targets. Sometimes negative effects of natural disasters not only escalate poverty and deprivation in the short run but also drive poor households into long-term poverty, triggering poverty traps (Carter et al. 2007).

Although natural disasters are considered as negative for growth in general (Felbermayr and Gröschl 2014; Raddatz 2007; Strobl 2012), some literature suggest a positive correlation between natural disaster frequencies and economic growth (Albala-Bertrand 1993; Dacy and Kunreuther 1969; Skidmore and Toya 2002).

The level of financial development plays a key role. Specifically, in the recuperation subsequent to a disaster, it is necessary to have quick and unconstrained access to finances for immediate and smooth recovery. If the recovery investments bring in better and advanced technology, it not only ensures the speedy recovery but also paves the way for a higher economic growth. Insurance claims, own savings, aid and grants from the government and third parties, third party investments and indebtedness are the means to meet this financial need. There is a higher propensity to save in disaster vulnerable countries like Japan (Skidmore 2001). As Tol and Leek (1999) point out required finances can be acquired through assistance (credit or aid), savings or insurance. In reducing economic damages caused by disasters, a strong financial sector is therefore important (Toya and Skidmore 2007). As Gignoux and Menéndez (2016) highlight, it is possible to reconstitute publicly and privately owned infrastructure capital if there are well-functioning financial markets. If finances are readily available, it facilitates the speedy recovery which in turn enhances the development and regaining of the pre-disaster economic growth.

Countries with higher levels of domestic credit better able to withstand and endure natural disasters without affecting their economic output much (Noy 2009). McDermott et al. (2014) find that natural disasters have a significant negative contemporaneous impact on economic growth which is mitigated by higher credit.

This raises the question whether natural disasters also affect financial development of an economy. Klomp (2014) highlights that natural disasters increase the likelihood of banks’ default. Apart from this piece of work, which focuses on bank Z-scores and not on financial development per se, we do not find any other study in the existing literature which explores the impact of natural disasters on financial development. Hence, we probe the relationship between natural disasters and financial development.

In such an analysis one cannot completely rule out the endogeneity between financial development and the impact of natural disasters. For instance, Von Peter et al. (2012) find that negative macroeconomic impact of natural disasters is mainly derived through uninsured losses. When the insurance rate is high, economic damages associated with disasters tend to be low.

Accordingly, in this paper we explore whether there is any impact of natural disasters on financial development proxied by credit, if so in which direction and in what magnitude and how it depends on other economic factors. At a broader level, financial development can be defined as the improvement in the quality of five key financial functions: (1) producing and processing information about possible investments and allocating capital based on these assessments; (2) monitoring individuals and firms and exerting corporate governance after allocating capital; (3) facilitating the trading, diversification, and management of risk; (4) mobilizing and pooling savings; and (5) easing the exchange of goods, services, and financial instruments (Čihák et al. 2013, p. 9). Čihák et al. (2013) highlight level of access to, depth, efficiency and stability of financial institutions and markets. They present a 4 × 2 matrix of financial system characteristics and compile panel data which can be used as proxies for financial development. However, credit availability to the real sector by domestic banks as a percentage of GDP is used most in the literature. Its wide data coverage, and the vital role played by private credit may be the reasons for this.

We also use private credit as proxy for financial development in our analysis. This measure reflects the extent to which households and companies depend on the banking system for their financial needs and the magnitude of financial intermediation facilitated by the banking system in return (Giuliano and Ruiz-Arranz 2009). Private credit can be considered as a reliable source to meet immediate financial requirement in the recovery phase of a disaster, especially for low-income countries where private savings rate and insurance penetration are considerably low. We acknowledge that private credit is only one dimension, i.e. financial depth of financial development which has many facets as discussed above. Further, poor countries are more vulnerable to natural disasters and suffer disproportionately from disaster damages as opposed to rich countries. As financial markets are less well developed in low-income countries, the role played by formal credit in disaster consequences might be small, therein. Section 5 discusses alternative indicators of financial development, but data availability is problematic. We are therefore compelled to use credit measure as the main proxy for financial development in our analysis.

Empirical Analysis

Data

The source of natural disaster data for this study is EM-DAT, the International Disaster Database maintained by the Centre for Research on the Epidemiology of Disasters (CRED) at the Université Catholique de Louvain in Brussels, Belgium (Guha-Sapir et al. 2014). The EM-DAT database contains inter-alia data on world-wide natural disasters occurred since 1900. Over 13,000 natural disaster events occurred in about 220 countries from 1900 to 2014 are reported in the database. As per the database, from 1979 to 2011, the period on which the instant study is focused for the reasons of data quality and availability, over 10,000 natural disaster events have occurred in 219 countries affecting more than six billion people.

EM-DAT classifies natural disasters into sub-groups, namely, biological, climatic, hydrological, geophysical, meteorological and extraterrestrial disasters. Each natural disaster sub-group contains data on relevant types and sub-types of natural disaster events.

For a natural disaster to enter into the EM-DAT database, at least one of the setout criteria needs to be fulfilled, i.e., reported death toll of 10 or more, 100 people reported affected, a call for international assistance or the declaration of state of emergency. As highlighted by Miao and Popp (2014), these are arbitrary thresholds. There is a tendency for national governments to exaggerate the disaster damage in reporting as a strategy for attracting external aid, especially in developing countries (Noy 2009). Still, EM-DAT is the source of data that has been used widely in disaster literature.

The EM-DAT database contains disaster outcomes measured as the number of total deaths, number of people affected (injured, became homeless, displaced or affected otherwise) and the total monetary damage caused by a disaster. The economic data may be gathered by the individuals who attend the affected area primarily with the intention of providing medical care and physical aid. Therefore, they may lack the expertise to estimate of the economic loss. Of the numbers of people killed and affected, the preferred variable is the number of people affected. In some instances, even a severe disaster may not kill as shown by Gassebner et al. (2010), Cavallo and Noy (2011) and Klomp (2014). Hence, in this study, the number of people affected by natural disasters in a country year is chosen as the variable of interest. Accordingly, our analysis is limited to disasters where there are reported affected population. Following Noy (2009), the disaster variable is normalized as the “percentage of population affected”.

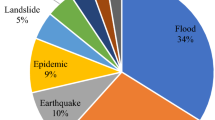

There are 2712 country-years with at least one disaster. On average, disasters affect 3.6% of the population in a country-year and the maximum percentage of population affected by natural disasters in a single country-year surpasses 150%. Hydrological disasters are the most common natural disaster. However, climatic disasters affect the highest percentage of population, with meteorological disasters next in line. See Table 1.

The number of people affected by a disaster depends on the nature of the disaster as well as on the underlying socio-economic status and disaster management strategies of the affected economy, leading to endogeneity in models that quantify the economic impact of natural disasters (Kellenberg and Mobarak 2008; McDermott et al. 2014; Sen 1983; Tol and Leek 1999). In order to reduce the endogeneity problem, while Noy (2009) and Klomp (2014) develop a count disaster measure, McDermott et al. (2014) construct a binary disaster variable imposing a threshold of 0.5% on the fraction of population affected to capture only the relatively severe disasters in the model. As a robustness check, McDermott et al. (2014) carry out their analysis using a binary disaster variable constructed without imposing any such threshold. They admit the fact that the binary variable reduces the variation of data and the explanatory power of the model. In spite of this they opt for a binary disaster variable as it reduces not only the influence of measurement error in disaster data on the analysis but also the possibility of results are being driven by outliers at the upper bound of the disaster data distribution. However, by doing this they equalize minor disaster events which affect a very few individuals with severe disaster events which affect hundreds of thousands of people. Further, it can be argued that the imposition of an arbitrary threshold to segregate large disasters would cause biases in the estimates. Yet, it is not less common in disaster studies to adopt such decision rules to isolate severe disasters to include in the model. For instance, Becerra et al. (2014) and Klomp (2014) deploy such decision rules to limit their investigation to major disasters. Exploring disaster effects on bank solvency, Klomp (2014) limits his sample to 170 severe disasters which caused highest economic damage and the time period from 1997 to 2010 in quantifying the impact of natural disasters on bank Z score which reflects banks’ distance to default.

Since there is a clear trade-off in using a binary disaster variable with or without a decision rule, the current analysis employs a continuous disaster variable, namely the percentage of population affected by natural disasters in a country year. Nevertheless, as a supportive identification strategy and a robustness check, the baseline model is run using a binary disaster variable with various thresholds to segregate severe disasters in constructing the disaster dummy, as more fully described later on, to see whether it derives consistent results.

This paper explores the impact of natural disasters on financial development. A widely used private credit measure is chosen to proxy financial development given its broad data coverage in space and time, although it only measures the depth of financial institutions.

Data on private credit by deposit money banks as a percentage of gross domestic product (GDP) are obtained from the Global Financial Development Database, an open data source of the World Bank constructed by Čihák et al. (2013) covering 205 economies from 1960 to 2011. They have constructed said credit variable using the International Financial Statistics (IFS) published by the International Monetary Fund (IMF). It is defined as the domestic private credit to the real sector by deposit money banks as percentage of GDP. Accordingly, private credit does not include credit issued to governments, government agencies and public enterprises, and credit issued by central banks. This credit measure is used to construct the dependent variable of our model, i.e., private credit per capita. We use per capita credit, rather than credit per GDP, because per capita GDP is included in the regression model as a key explanatory variable. We thus avoid GDP being present on both sides of the equation. Furthermore, the variation in private credit per GDP the data may be due to the variation either in credit per se or in GDP; and both may vary in response to a natural disaster. The use of per capita private credit also resolves this issue. The measure of private credit as a percentage of GDP is converted to constant 2005 US dollar per capita credit using constant 2005 US dollar GDP data, thus accounting for dollar inflation over time. The analysis is repeated using purchasing power parity (PPP) constant 2005 US dollar per capita credit, accounting for price differences across countries.

The level of credit depends on the level of income as that determines credit necessity and credit worthiness. Accordingly, the natural log of the output based real GDP per capita of the current year enters the regression along with its interaction with the disaster variable as regressors. Constant 2005 US dollar per capita GDP and PPP constant 2005 US dollar per capita GDP are calculated using relevant data contained in the World Bank’s World Development Indicators and the Penn World Tables (PWT) Version 8.0 database (Feenstra et al. 2013), respectively.

Political institutions play a vital role in disaster mitigation, which is at least to some extent a public good. Plumper and Neumayer (2010) argue that the polity2 variable from the Polity IV Project is the most appropriate and popular measure of a country’s political regime. Polity2 indicates openness of a country’s political institutions. In the Polity IV database, the democracy indicator (democ), which varies on an eleven-point scale (0–10), represents the institutionalized democracy of a state. It depends on 3 elements which cover the democratic rights of citizens and the constraints on the executive in exercising its powers. Similarly, the institutionalized autocracy indicator (autoc), also an eleven-point scale (0–10), measures the institutionalized authoritarianism of the regime of a country. These two scales democ and autoc do not share any contributor categories in common. The value of polity2 is obtained by subtracting the autocracy (autoc) from the democracy variable (democ). It ranges between +10 (strongly democratic) and −10 (strongly autocratic).

A country that heavily relies on agriculture, especially rainfed agriculture, can be expected to be particularly vulnerable to natural disasters, such as droughts, floods, and storms. Both the destruction of cultivations and livestock and the disruption of transport and trade would affect the demand for credit and creditworthiness. As such, agriculture share of the economy together with its interaction with disaster variable is included in the benchmark specification.

Data on the share of agriculture as a percentage of GDP and other controls such as inflation, government consumption as a percentage of GDP, share of trade as a percentage of GDP, net official development assistance (ODA) received as a percentage of gross national income (GNI), financial sector rating, lending interest rate, private savings rates and insurance penetration are taken from the World Bank’s World Development Indicators. Data on resources of countries are obtained from the Wealth of Nations data series maintained by the World Bank.

The sample consists of 147 countries during 1979 to 2011. The panel is unbalanced. With the inclusion of more control variables sample size decreases due to non-availability of data. Post estimation summary statistics for the variables used in the baseline analysis are provided in Table 2.

Empirical Model

We employ a panel regression estimator with country and year fixed effects as the main estimation strategy in our analysis. Fixed effects estimator is chosen since country and year fixed effects control for time-invariant country heterogeneity and time-variant shocks that simultaneously affect all the countries, respectively. This reduces any potential endogeneity issue. The Hausman test shows that the fixed effects estimator is preferred to the random effects estimator. Furthermore, country-fixed effects also arrest any selection biases which may arise due to over representation of poor countries in the disaster data distribution as a result of their higher vulnerability to disasters (McDermott et al. 2014). Year fixed effects capture the effects of time-varying factors common to all countries such as the global business cycle, global technological advancement and world-wide economic and financial crises. Time-fixed effects are jointly significant. Errors are clustered at country-level as natural disasters are not evenly distributed across countries and also to obtain robust standard errors as a remedial measure for heteroscedasticity. Given the constraints on availability and reliability of data, the analysis is restricted to the time period 1979–2011. The baseline model covers 147 countries.

The panel regression equation of the baseline model is as follows;

Credit per capita valued at constant 2005 US$ in country i for year t is the dependent variable. A lagged credit term is included as an explanatory variable because it can reasonably be assumed that the current credit level is heavily determined by its past level and to defend the existence of autocorrelation in the regression. However, as by construction lagged dependent variable and error term are correlated, one may argue that the use of a lagged dependent variable in the fixed effects estimator poses a serious econometric problem. Such use can cause negative biases on estimates for positive coefficients in short panels with small time periods. To overcome this issue the best remedy would be the use of a valid instrument variable, however, it is very hard to find such an instrument. As McDermott et al. (2014) show this is a serious concern only in the event the panel is short. They claim that the issue is being addressed by using a long panel of 29 years and they support their findings with consistent results obtained in dynamic panel estimators. Ours is an even lengthier panel of 33 years. We also get consistent results using System GMM. We obtain consistent results even when the specification is modelled without including the lagged dependent variable but including only disasters, logged GDP per capita and disaster-income interaction with and without further control variables as specified under the robustness checks.

Dis is our variable of interest: Disaster measured as the percentage of population affected due to all the natural disasters occurred in a single country year. As the percentage of population affected increases, it can be expected the private credit to rise as a result of higher demand for financing aimed at recovery, reconstruction and rehabilitation in the aftermath of a natural disaster. As private credit availability is an indicator of financial development, a positive coefficient on the disaster variable would establish positive effects of disasters on financial development, although it may also indicate people getting into debt after a disaster.

GDP is the logged GDP per capita in constant 2005 US$. It is included in the model as the level of credit clearly depends on income level. Demand for and the availability of credit are different in poor and rich economies. In poor countries, dependency on private credit appears to be much higher in the recovery phase of a natural disaster in that the private savings rate and insurance penetration are substantially lower.

The disaster variable is interacted with per capita GDP. We expect that a higher income reduces the need for debt-financing the recovery, because of higher savings and greater insurance cover. If so, the interaction term would be negative.

The share of agriculture in GDP and its interaction with disasters are included in the bench mark specification to capture the effect of economic structure beyond development. As a country’s preparedness and management strategies for natural disasters depend on the political will and institutions of that country, we include polity2 as a control variable. Terms θ i and θ t are the country and year fixed effects, respectively; ϵ it is the independently and identically distributed error term.

When using a longer panel, one has to be careful because non-stationarity might give rise to spurious results as suggested by Nelson and Plosser (1982). As one can suspect a unit root in the credit data, we estimate the model using various approaches: levels, levels with lagged dependent variable, long averages, first differences, and first differences with first differences in the controls. The key results are robust.

To show our original results are not driven by outliers, we repeat our regressions removing alternatively and jointly observations at the lower and upper bounds of the credit distribution and at the upper bound of the disaster distribution.

For identification, we assume that disasters are exogenous to credit. Although borrowed money can be used to fund protection against natural disasters, the probability is remote that contemporaneous credit affects vulnerability to disasters as it takes a long time for credit to be converted into effective and defensive disaster impact preventive or mitigating projects. The disaster exogeneity assumption is adopted by other disaster papers including Noy (2009), Raddatz (2007), Ramcharan (2007) and Skidmore and Toya (2002). If the exogeneity assumption does not hold, then the best solution to avoid reverse causality would be to employ a valid instrument. However, it is extremely difficult to find such an instrument (Noy 2009).

Felbermayr and Gröschl (2014) present a new disaster database called ifo GAME Data. Their measures are purely based on the physical intensities of disasters making them exogenous to the economic condition of a country. We use GAME data as an alternative database to check validity of our findings.

Following McDermott et al. (2014) we construct a binary disaster variable, using various thresholds. A binary variable is less subject to potential reverse causality. We do this as a robustness check, as with a continuous disaster variable as we can be more precise in quantifying disaster effect on private credit.

Apart from binary disaster variable following Fomby et al. (2013), we construct an impact variable which scales to the size of the disaster, but eliminates the smallest disasters. This approach reduces the weight of the distribution of disasters from being clustered around the very many, very minor disasters.

Following (Noy 2009) we weigh our disaster measure in terms of the onset month. There is a likelihood for disasters which occurred in earlier months of the year to cause a bigger impact in the same year than disasters which occurred in later months.

We check against omitted variable bias by adding more control variables, such as macro stability, magnitude of the government spending, foreign links, which can be expected to have an influence on per capita credit. The inclusion of additional control variables is done at different stages. Firstly, we add main control variables one by one to the baseline model and subsequent to each addition, an interaction term of that control with the disaster variable is included so that their impact on the baseline model can be observed clearly. These main control variables are inflation which controls for macroeconomic stability of the country, government expenditure as a percentage of GDP and the trade share which reflects the degree of trade openness. Secondly, we control for other factors which seem to either stimulate or hinder private credit in connection with disasters, by using simple variant models of the baseline specification. Accordingly, we control for financial sector regulation using CPIA (Country Policy and Institutional Assessment) financial sector rating, non-life insurance premia volume as a share of GDP, lending interest rate, share of resource rent (including rent received on coal, oil gas, iron ore and minerals such as gold, silver, copper, etc. but not including rent on forestry) within the GDP, and share of forestry rent as a percentage of GDP and net official assistance received as a percentage of gross national income.

Apart from the panel fixed effect regression, different estimators are used, namely, ordinary least squares (OLS), quantile regression, and system generalized method of moments (GMM); see Arellano and Bond (1991), Arellano and Bover (1995), Blundell and Bond (1998) and Roodman (2009a and b).

We measure per capita credit and GDP constant 2005 US$ and so account for inflation. To control for differences in living standards we repeat the analysis using per capita credit and GDP measured in purchasing power parity (PPP) constant 2005 US dollars. We also rerun the regression using logged credit variable.

To eliminate any potential cross-sectional dependence given the spatial nature of disasters data, we use Driscoll-Kraay errors (Driscoll and Kraay 1998) as they are robust to general forms of spatial dependence.

We further explore the impact of different categories of natural disasters on private credit and we also run our regression for different geographical regions.

Finally, we ascertain the impact of natural disasters on other measures which proxy for financial depth, access, efficiency and stability.

Results

Results of the baseline model are given in Table 3. We restrict attention to the marginal effect of natural disasters on private credit. Disasters show a significant positive effect on contemporaneous credit. However, this positive effect is dampened down by higher income. It appears that the disaster-agriculture interaction also yields a negative coefficient suggesting that the positive impact of disasters on credit is further mitigated by higher share of agriculture in the economy. However, as this interaction is significant only at the 10% level, we ignore it for the time being.

A zero marginal effect of disasters on credit is seen in a country with an average per capita GDP of constant 2005 US$ 1941 (standard deviation 1016) per year. Table A.1 in the Online Appendix gives the impact for selected countries, evaluated at the country average over time. In a low income country like Burkina Faso, a one percentage point increase in the percentage of population affected by natural disasters will on average increase the contemporaneous per capita private credit by $8.33Footnote 1 or 17%.Footnote 2 However, in a high income country like Australia, when the disaster affected percentage of population increases by one percentage point, the contemporaneous per capita credit falls by $12.42 or 0.06%. Notwithstanding the fact that both countries have similar values for average population affected (2.3% and 2.8%, respectively) due to natural disasters, they see a divergent impact on private credit. Table A.2 in the Online Appendix shows the impact evaluated using 2011 figures.

Figure 1 shows the absolute change in per capita credit, due to a one percentage point increase in the percentage of population affected by disasters in a single year, varies with per capita income, evaluated using 2011 data. Figure A.1 in the Online Appendix shows this effect as a percentage of prevailing per capita credit. Figure A.2 in the Online Appendix shows the same on a map.Footnote 3 It appears that when it comes to credit, low income countries gain more from disasters compared to their rich counterparts.

Robustness Checks

No Lagged Dependent Variable

We run the fixed effects estimator without the lagged dependent variable to address any concern about attenuation or Nickel bias. As above, we observe a positive effect of disasters on per capita private credit, which is moderated by disaster income interaction. These results hold also in the presence of control variables. See Table A.3 in the Online Appendix. Explanatory power falls substantially in the absence of the lagged dependent variable, as apparent from the R2; recall that credit per capita is a stock variable.

Unit Root

Instead of using credit per capita in its level as the dependent variable, we use the first difference of credit per capita, again with a fixed effects estimator. In the base model, the lagged dependent variable is indistinguishable from unity. As shown in Table 4, this yields results consistent with those above.

As a next step, we take the first difference of the explanatory variables, except for the disaster variable and per capita income. Table A.4 in the Online Appendix shows the results, again consistent with those above.

Medium-Term Effects of Disasters on Credit

By averaging our annual data over five year and ten year periods, we ascertain the effect of disasters on credit in the medium-term. Results for the fixed effects panel estimator using five-year and ten-year averages are presented in Tables 5 and A.5 in the Online Appendix, respectively.

Outliers

To ensure that results are not driven by potential outliers, we remove observations at the top and bottom of the credit and disaster data distributions. Specifically, we remove the top and bottom 10% and then 20% of the credit distribution which brings down the range to 31–21,956 and 78–8,696, respectively, from original range of 0.845–163,982. With respect to disasters, we remove 27 and then 55 observations with highest percentage of population affected which brings down the range of disasters to 0–56% and 0–38%, respectively, from 0 to 118%. We also remove Tsunami year 2004; and 2004 and 2005 together as the Tsunami took place at Christmas. Tables A.6 and A.7 in the Online Appendix and Table 6 show the results, which are consistent with those above.

Alternative Database, Ifo GAME Data

We use two alternative disaster indices namely ‘indexla’ and ‘disindexla’ constructed by Felbermayr and Gröschl (2014). These indices are clearly exogenous to economic and financial development. Indexla is the sum of physical intensity measures of disasters happened in a specific country in a specific year weighted by land area of the affected country. Disindexla is further weighted by respective inverse sample standard deviations. Table 7 shows results of the regressions using these disaster indices. Using the ifo GAME disaster data we again find a positive impact of disasters on private credit mitigated by higher income, supporting our original findings.

Additional Controls

As a further robustness check, control variables are included. See Tables A.8 and A.9 in the Online Appendix. The addition of controls leads to consistent results and so does not invalidate the findings above. When controlling for inflation, government expenditure, international trade, financial sector rating, non-life insurance, lending interest rate, resource rent and forestry rent, the results for the disaster variable and its interaction with income do not change. However, the variables of interest lose significance in the presence of foreign aid. This may well be because foreign aid increases in response to natural disasters.

Alternative Estimators

We re-estimate the model using system GMM, ordinary least squares (OLS), and quantile regressions to test whether they yield consistent results.

Results of the baseline model using alternative estimation methods are presented in Table 8 (Columns 1–3). The results are consistent across the alternative estimators. Quantile regression also yields consistent results at all percentiles; see Table A.10 in the Online Appendix.

Purchasing Power Parity

All results above use market exchange rates. This may be misleading as this unit of measurement does not accurately reflect standards of living. Therefore, we repeat our exercise using per capita credit and GDP measured in purchasing power parity (PPP) constant 2005 US$ by employing output-based real GDP data from the Penn World Tables Version 8.0. We also apply logarithmic transformation to our credit variable. Table A.11 in the Online Appendix shows the results, which are consistent with those above.

Cross-Sectional Dependence and Geographical Regions

Given that there might be cross-sectional dependence in disaster data due to spatial nature of disasters, we use Driscoll and Kraay (1998) errors to overcome any such issue (Column 4 of Table 8). Yielded coefficients are precisely identical to the base model’s coefficients suggesting that our analysis does not suffer from cross-sectional dependence.

Splitting the sample by region, we get consistent results only for Asia and East Asia & Pacific. See Tables A.12 and Table A.13 in the Online Appendix.

Disaster sub-Groups

The impact of all disasters is dominated by climatic and meteorological disasters (in EM-DAT’s classification). See Table A.14 in the Online Appendix.

We run our baseline specification for different disaster sub-groups. As expected from the descriptive statistics, results for climatic disasters are very similar to the results for all disasters. Our main findings also hold for biological and geophysical disasters. However, although we get the same signs above for the variables of interest for hydrological disasters, results are insignificant for hydrological and meteorological disasters. See Table A.15 in the Online Appendix.

As one can argue that biological disasters are completely different from other disasters, we re-estimate our baseline specification across alternative estimators after dropping biological disasters. As apparent from Table A.16 in the Online Appendix, results are very similar to the original.

Binary Disaster Variable

Following McDermott et al. (2014), we run our baseline fixed effects estimator using a binary disaster variable, which is zero for disasters that below a threshold and one for disasters above. This restricts the variable of interest to the presence or absence of a disaster in a given country year, ignoring for the magnitude of the disaster. By doing this we reduce potential endogeneity, as it is unlikely that credit could control the occurrence of disasters. The binary disaster variable of course contains much less information than the continuous one.

We use different thresholds to identify severe disasters. The results are consistent results with the above with respect to the sign regardless of the threshold. Effects become significant for thresholds of 5.5% or higher. See Table A.17 in the Online Appendix. Without the disaster-agriculture interaction, which is never significant, disasters and the income-disaster interaction are significant at a 1% threshold. See Table A.18 in the Online Appendix.

Impact Disaster Variable

We construct a disaster impact dummy variable following Fomby et al. (2013). These do not yield results consistent with our baseline specification. However, when the model includes only impact variable, lagged credit and logged GDP per capita as controls, the sign on the coefficient of impact variable is consistent. See Tables A.19 and A.20 in the Online Appendix.

Weighed Disaster Variable

Following (Noy 2009) we weigh our disaster measure in terms of the onset month. With weighed disaster data we do not get significant results but signs on the coefficients are consistent with those above. It is to be noted that by using formula Weighed Disaster = Disaster ∗(12 − Onset Month)/12 for each disaster event, we remove data on a substantial number of events which occurred in the month of December, and EM-DAT does not report onset month for more than 100 events. See Table A.21 in the Online Appendix.

Granger Causality

The use of binary variable does not completely rule out any potential feedback or reverse causality. We therefore test for Granger causality. We first restrict the sample to disasters in January because annual credit cannot have a large influence on the disasters already occurred in January. As a placebo test, we restrict the sample to disasters in December as their effect on annual credit has to be small. We repeat this exercise with disasters in the first two months of the year and the final two months of the year. We find insignificant results for the initial months of the year and significant ones for the year end, suggesting reverse causality. However, when we examine the effects of disasters by month, we see significant results only for the months of February and December. Annual credit cannot affect vulnerability to disasters at the start of the year, while a disaster at the end of the year cannot affect annual credit. We find both, that is bidirectional causality in Granger’s sense of the word.

Alternative Measures of Financial Development

Private credit represents only the depth of financial institutions. Using our baseline model and the fixed effects estimator, we consider alternative indicators of financial development. We cannot use all measures suggested by Čihák et al. (2013) because of an insufficient number of observations. Most of these data are available only from 2000 or 2003 onwards.

It is not possible in any manner to plug all the different measures of financial development in our model as they are, given their nature and measurement units. To see the impact of natural disasters on various financial development indicators, it is necessary to employ proper estimation strategies on relevant variables for appropriate sub-samples with respect to space and time. For instance, exploring disaster effects on bank solvency, Klomp (2014) limits his sample to highest economic damage causing 170 severe disasters and time period from 1995 to 2010 in quantifying the impact of natural disasters on banks’ distance to default.

Thus, it is obvious that all the indicators of financial development would not give rise to consistent results in our model. Nevertheless, as apparent from Table A.22 in the Online Appendix we find strongly consistent results for liquid assets to deposits and short term funding (%) which represents financial stability.

This indicator is the ratio of the value of the liquid assets of banks which can be easily convertible to cash, to their total deposits and short term borrowings. Higher value for this ratio represents higher liquidity and financial stability as banks are in a position to meet their immediate financial obligations without trouble. As in the case for private credit, natural disasters significantly increase the liquidity of banks reflecting their ability to meet disaster affected parties’ immediate need for finances. However, higher per capita income moderates this effect as it lessens the need for borrowing.

As apparent from Tables A.23 – A.26 in the Online Appendix, some other financial indicators too yield consistent results at least with respect to the signs on the coefficients of the variables of interest. Table A.23 contains regression results with respect to disaster variable and its interaction with income on other indicators which represent financial depth. Financial depth is not a financial function itself but a proxy to reflect the magnitude of overall services extended by the financial system (Čihák et al. 2012, p. 8). Deposit money bank’s assets as percentage of GDP (gfdd_di_02) appears to increase with contemporaneous disasters but decrease when income is high. This is obvious as credit disbursed by banks constitutes part of banks’ assets. Nonetheless, this is not true when it comes to assets of non-bank financial institutions (gfdd_di_03) that do not accept transferable (demand) deposits as apparent from negative sign on the disaster coefficient. Natural disasters seem to increase demand, time and saving deposits in deposit money banks and other financial institutions as a share of GDP (gfdd_di_08). This can be the case as banks can attract more deposits by offering a higher interest rate to finance their disaster related credit which can be offered at even higher rate to desperate parties at the receiving end. Volumes of life and non-life insurance premium (gfdd_di_09 and gfdd_di_10) are reduced by natural disasters. Insurers may be reluctant to accept risks in the presence of contemporaneous disasters. Further, it is to be noted that insurance penetration is lower in poor countries which are more prone to disasters. Stock market capitalization as represented by total value of all listed shares in a stock market exchange as a percentage of GDP (gfdd_dm_01) tends to decrease with natural disasters indicating adverse impact of such events on corporate sector. Nevertheless, increased total value of all traded shares in a stock market exchange as a percentage of GDP (gfdd_dm_02) due to natural disasters may be an indicator of shareholders’ attempt to recover financial needs through disposal of shares, or reflect investors’ worries about profits and dividends. Outstanding domestic private and public debt securities as a percentage to GDP (gfdd_dm_03 and gfdd_dm_04) significantly decrease with natural disasters and more so when the income is low. Bond holders may be resorting to early redemption to finance disaster recovery as and when needed. A puttable bond vests the right upon holder to force the issuer to repay the bond prematurely. Total value of outstanding international debt issues both public and private, as a share of GDP (gfdd_dm_07) would be likely to decline as the credit rating of a country rapidly deteriorate after a natural disaster.

When financial access is considered, number of bank accounts per 1000 adults (gfdd_ai_01) and number of commercial bank branches per 100,000 adults (gfdd_ai_02) tend to rise in the presence of natural disasters (see Table A.24). This reflects the positive response from both demand and supply side after a natural disaster as financial inclusion should be expanded to reach disaster recovery related financial requirements. In line with the impact of natural disasters on stock market as mentioned afore value of all traded shares outside of the largest ten traded companies as a share of total value of all traded shares in a stock market exchange (gfdd_am_01) tend to increase whilst value of listed shares outside of the ten largest companies to the total value of all listed shares (gfdd_am_02) tend to decrease with natural disasters owing to similar reasoning. Total amount of domestic non-financial corporate bonds and notes outstanding to total amount of domestic bonds and notes outstanding, both corporate and non-corporate (gfdd_am_03) seems to increase with disasters, maybe highlighting the active role played by the corporate sector over the non-corporate sector by raising liquid funds to finance disaster recoveries.

Regression results of indicators for financial efficiency are summarized in Table A.25. We observe an increase in the accounting value of bank’s net interest revenue as a share of its average interest bearing assets (gfdd_ei_01), the difference between lending rate charge by banks on loans to the private sector and the deposit interest rate offered by commercial banks on deposits with three-month tenure (gfdd_ei_02) and bank’s income that has been generated by non-interest related activities such as trading gains, fees, commissions and other operating income as a percentage of total income (gfdd_ei_03) because increased disaster related credit raises interest income, interest differential as well as fees, commission and other activity income including valuation and evaluation income. Operating expenses of a bank as a share of the all assets held (gfdd_ei_04) decreases as it can be assumed that banks operate with existing administrative resources in handling higher demand for disaster related credit whilst increased credit expands the asset base. Maybe for the same reason, commercial banks’ after-tax net income to yearly averaged total assets (gfdd_ei_05) appears to decline. However, as natural disasters do not necessarily increase equity of banks in the manner they increase interest and other income, commercial banks’ after-tax net income to yearly averaged equity (gfdd_ei_06) increases. Since this impact does not depend on income tax we observe a similar reaction with respect to commercial banks’ pre-tax income to yearly averaged total assets (gfdd_ei_09) and commercial banks’ pre-tax income to yearly average equity (gfdd_ei_10). Total value of shares during the period divided by the average market capitalization for the period (gfdd_em_01) increases, maybe due to increased trading and reduced capitalization, as stated earlier.

When it comes to financial stability (see Table A.26), bank Z-score which captures the distance to default of a country’s commercial banking system (gfdd_si_01) decreases with disasters. Following Klomp (2014), we take the logarithm of this ratio of return-on-assets plus equity-asset ratio to standard deviation of return-on-assets. Supporting his findings we also see that disasters reduce the likelihood of bank defaults strengthening financial system stability. Ratio of gross value of defaulting loans (repayments of interest and principal past due by 90 days or more) to gross loans (gfdd_si_02) also reduces with disasters characterizing a healthy financial system. Ratio of bank capital and reserves to total financial and non-financial assets (gfdd_si_03) increases with natural disasters. It is puzzling as to why the financial resources provided to the private sector by domestic money banks as a share of total deposits (gfdd_si_04) decline when we observe an increase in the private credit. Maybe banks attracting more deposits than the disbursed credit as now they are in a position to offer a higher deposit interest rate. The ratio of total bank regulatory capital to its assets held, weighted according to risk of those assets (gfdd_si_05) increases with disasters. Again it is surprising that the provisions to non-performing loans (gfdd_si_07) increase in a scenario of observable decline in non-performing loans. It is rational to see an increase in stock price volatility i.e., the average of the 360-day volatility of the national stock market index as natural disasters unambiguously create an uncertainty in the stock market in the short run.

Conclusion

This paper shows that natural disasters have a significant positive impact on financial development, more specifically on the per capita private credit disbursed by domestic banks. This effect is dampened by higher per capita income. The positive impact of natural disasters on private credit is further mitigated by higher agricultural dependency of the economy. In other words, we find strong evidence that companies and households get deeper into debt after a natural disaster. This effect is stronger in poorer countries. We find some evidence that suggests that the effect is weaker in countries where agriculture is more important.

Nominal change in per capita credit due to an increase in the disaster measure diminishes with higher income. As the percentage of population affected by disasters increases, poor countries with lower per capita income will see an increase in their nominal per capita credit, however, rich countries with higher per capita income will experience a decline in their nominal per capita credit. Nevertheless, given that the magnitude of the per capita credit countries already enjoy differs considerably across countries irrespective of their per capita income, the real impact on credit relies upon the prevailing per capita credit. So, we would conclude that the impact of natural disasters on financial development proxied by credit is country specific as well as time specific.

Our findings are robust to various checks. We get consistent results when we include controls which represent macroeconomic stability, government spending, and trade openness enhancing our baseline specification. Once we control for other relevant factors such as non-life insurance penetration, financial sector regulation, lending interest rate, resource rent and foreign aid while employing baseline model and its slight variants, we yet observe consistent results. Our findings are also robust to alternative estimators. We take various measures to rule out any potential endogeneity issue including the use of system GMM estimator and binary disaster variable. Further, using the ifo GAME disaster data we again find a positive impact of disasters on private credit mitigated by higher income, supporting our original findings. Furthermore, we consider alternative indicators of financial development, and find that, qualitatively, our results carry over.

Private credit is only one dimension of financial development, but our results for other indicators suggest that natural disasters have a broader impact on financial development. Further, as poor countries are more vulnerable to disasters and their financial markets are less well developed, the role played by formal credit in disaster consequences would be small. The immediate impact of natural disasters is better interpreted as households getting (further) into debt rather than as financial development, but we find longer term impacts too that indicate an expansion of credit availability.

With our findings, we hope that relevant policy makers in disaster vulnerable countries would take well informed and well thought decisions with respect to financial inclusion, domestic bank lending, direct credit and related matters in order to enhance financial development.

Any research comes with caveats which should be explored in further analysis. Two stand out. First, we use nationally aggregate data. Changes at the aggregate level are open to misinterpretation and may obscure the actual mechanisms. The analysis here should therefore be repeated with microdata. Second, we find that natural disasters affect financial development. Earlier papers found that financial development affects vulnerability to natural disasters. Our analysis should therefore be repeated with a dynamic model of simultaneous equations. These issues are deferred to future research.

Notes

[35.35-(4.669*ln326)]

(8.33/48*100)

We used the Stata command spmap by Maurizio Pisati. See https://ideas.repec.org/c/boc/bocode/s456812.html

References

Albala-Bertrand J (1993) Political Economy of Large Natural Disasters: With Special Reference to Developing Countries. Oxford University Press, Oxford

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51. doi:10.1016/0304-4076(94)01642-D

Becerra O, Cavallo E, Noy I (2014) Foreign aid in the aftermath of large natural disasters. Rev Dev Econ 18(3):445–460. doi:10.1111/rode.12095

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Carter MR, Little PD, Mogues T, Negatu W (2007) Poverty traps and natural disasters in Ethiopia and Honduras. World Dev 35(5):835–856

Cavallo E, Noy I (2011) Natural disasters and the economy - a survey. Int Rev Environ Resour Econ 5(1):63–102. doi:10.1561/101.00000039

Čihák M, Demirgüç-Kunt A, Feyen E, Levine R (2012) Benchmarking financial systems around the world. World Bank Policy Research Working Paper (6175)

Čihák M, Demirgüč-Kunt A, Feyen E, Levine R (2013) Financial development in 205 economies, 1960 to 2010. Working Paper 18946, National Bureau of Economic Research, Washington D.C

Dacy D, Kunreuther H (1969) The Economics of natural disasters: implications for Federal Policy. The Free Press, New York

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560

Feenstra RC, Inklaar R, Timmer MP (2013) The next generation of the Penn World Table, available for download at www.ggdc.net/pwt

Felbermayr G, Gröschl J (2014) Naturally negative: the growth effects of natural disasters. J Dev Econ 111:92–106. doi:10.1016/j.jdeveco.2014.07.004

Fomby T, Ikeda Y, Loayza NV (2013) The growth aftermath of natural disasters. J Appl Econ 28(3):412–434

Gassebner M, Keck A, Teh R (2010) Shaken, not stirred: the impact of disasters on international trade. Rev Int Econ 18(2):351–368. doi:10.1111/j.1467-9396.2010.00868.x

Gignoux J, Menéndez M (2016) Benefit in the wake of disaster: long-run effects of earthquakes on welfare in rural Indonesia. J Dev Econ 118:26–44. doi:10.1016/j.jdeveco.2015.08.004

Giuliano P, Ruiz-Arranz M (2009) Remittances, financial development, and growth. J Dev Econ 90(1):144–152. doi:10.1016/j.jdeveco.2008.10.005

Guha-Sapir D, Below R, Hoyois P (2014) EM-DAT: international disaster database - www.Emdat.Be - Université Catholique de Louvain, Brussels, Belgium

Kellenberg DK, Mobarak AM (2008) Does rising income increase or decrease damage risk from natural disasters? J Urban Econ 63(3):788–802. doi:10.1016/j.jue.2007.05.003

Klomp J (2014) Financial fragility and natural disasters: an empirical analysis. J Financ Stab 13:180–192. doi:10.1016/j.jfs.2014.06.001

McDermott TKJ, Barry F, Tol RSJ (2014) Disasters and development: natural disasters, credit constraints, and economic growth. Oxf Econ Pap 66(3):750–773. doi:10.1093/oep/gpt034

Miao Q, Popp D (2014) Necessity as the mother of invention: innovative responses to natural disasters. J Environ Econ Manag 68(2):280–295. doi:10.1016/j.jeem.2014.06.003

Nelson CR, Plosser CR (1982) Trends and random walks in macroeconmic time series: some evidence and implications. J Monet Econ 10(2):139–162. doi:10.1016/0304-3932(82)90012-5

Noy I (2009) The macroeconomic consequences of disasters. J Dev Econ 88(2):221–231. doi:10.1016/j.jdeveco.2008.02.005

Plumper T, Neumayer E (2010) The level of democracy during interregnum periods: recoding the polity2 score. Polit Anal 18(2):206–226. doi:10.1093/pan/mpp039

Raddatz C (2007) Are external shocks responsible for the instability of output in low-income countries? J Dev Econ 84(1):155–187. doi:10.1016/j.jdeveco.2006.11.001

Ramcharan R (2007) Does the exchange rate regime matter for real shocks? Evidence from windstorms and earthquakes. J Int Econ 73(1):31–47. doi:10.1016/j.jinteco.2006.12.004

Roodman D (2009a) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158. doi:10.1111/j.1468-0084.2008.00542.x

Roodman D (2009b) How to do xtabond2: an introduction to difference and system GMM in Stata. Stata J 9(1):86–136

Sen A (1983) Poverty and famines: an essay on entitlement and deprivation. Oxford University Press, Oxford

Skidmore M (2001) Risk, natural disasters, and household savings in a life cycle model. Jpn World Econ 13:15–34

Skidmore M, Toya H (2002) Do natural disasters promote long-run growth? Econ Inq 40(4):664–687

Strobl E (2012) The economic growth impact of natural disasters in developing countries: evidence from hurricane strikes in the central American and Caribbean regions. J Dev Econ 97(1):130–141. doi:10.1016/j.jdeveco.2010.12.002

Tol RSJ, Leek FPM (1999) Economic analysis of natural disasters. In: Downing TE, Olsthoorn AA, Tol RS (eds) Climate, Change and Risk. Routledge, London

Toya H, Skidmore M (2007) Economic development and the impacts of natural disasters. Econ Lett 94(1):20–25. doi:10.1016/j.econlet.2006.06.020

United Nations General Assembly (2009) Resolution 63/217, Natural disasters and vulnerability, A/RES/63/217. Available from undocs.org/A/RES/63/217

United Nations International Strategy for Disaster Reduction (2002) Report on natural disasters and sustainable development: understanding the links between development, environment and natural disasters. Switzerland, Geneva

Von Peter G, Von Dahlen S, Saxena SC (2012) Unmitigated disasters? New evidence on the macroeconomic cost of natural catastrophes. BIS Working papers, 394, Bank for International Settlements

Acknowledgements

We gratefully acknowledge the funding received from RISES-AM, EU Research Project [Grant No. 603396]. We are thankful to the EM-DAT, the International Disaster Database maintained by the Centre for Research on the Epidemiology of Disasters (CRED) at the Université Catholique de Louvain in Brussels, Belgium for providing natural disaster data for this study. We are grateful to the participants of 2016 Conference of the Royal Economic Society for their helpful comments. We are also grateful to two anonymous referees and the editor for their detailed and constructive comments.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Figure A.1

(DOCX 71 kb)

Figure A.2

(DOCX 97 kb)

Table A.1

(DOCX 38 kb)

Table A.2

(DOCX 38 kb)

Table A.3

(DOCX 38 kb)

Table A.4

(DOCX 42 kb)

Table A.5

(DOCX 40 kb)

Table A.6

(DOCX 38 kb)

Table A.7

(DOCX 37 kb)

Table A.8

(DOCX 41 kb)

Table A.9

(DOCX 40 kb)

Table A.10

(DOCX 37 kb)

Table A.11

(DOCX 37 kb)

Table A.12

(DOCX 46 kb)

Table A.13

(DOCX 38 kb)

Table A.14

(DOCX 44 kb)

Table A.15

(DOCX 37 kb)

Table A.16

(DOCX 38 kb)

Table A.17

(DOCX 40 kb)

Table A.18

(DOCX 39 kb)

Table A.19

(DOCX 36 kb)

Table A.20

(DOCX 36 kb)

Table A.21

(DOCX 36 kb)

Table A.22

(DOCX 36 kb)

Table A.23

(DOCX 38 kb)

Table A.24

(DOCX 45 kb)

Table A.25

(DOCX 46 kb)

Table A.26

(DOCX 46 kb)

Rights and permissions

About this article

Cite this article

Keerthiratne, S., Tol, R.S.J. Impact of Natural Disasters on Financial Development. EconDisCliCha 1, 33–54 (2017). https://doi.org/10.1007/s41885-017-0002-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41885-017-0002-5