Abstract

This paper examines the impact of severe natural disasters on the US corporate credit market, highlighting the different responses to short-term versus long-term disasters. Using Jordá local projections, our analysis shows that short-term disasters, such as severe storms and tropical cyclones, increase the probability of corporate defaults without causing significant financial tightening by institutional investors. In contrast, long-term disasters, such as droughts and wildfires, lead to increased corporate default risks and financial tightening. This difference in investor reactions can be attributed to the greater uncertainty about the financial health of firms caused by long-term disasters compared to short-term disasters. The damage from long-term disasters is spread over time and can last for years, making them less adequately covered by insurance and less likely to receive timely government aid than short-term hazards. These findings underscore the need for comprehensive insurance products for long-term catastrophes and increased government support for long-term recovery efforts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change poses an unprecedented threat to our world, with far-reaching consequences across various economic sectors. As global temperatures rise and weather patterns become more erratic, the frequency and intensity of natural disasters are expected to increase (IPCC, 2021). Understanding the economic impacts of these disasters is key to developing effective policy responses. While substantial research has focused on the transition risks associated with the transition from a high-emissions world to a low-carbon society (Battiston et al., 2017, for instance), fewer studies have examined physical risks. Physical risks refer to the potential loss of financial asset value due to climate- and weather-related events, such as natural disasters (Aglietta & Espagne, 2016).

Natural disasters, such as severe storms, tropical cyclones, droughts or wildfires, can have a devastating effect on households and businesses, leading to asset destruction, business disruption and significant financial losses (Batten et al., 2016). These events not only disrupt the financial health of the affected entities but also spread to financial markets (ibid). However, these effects are often studied by looking at natural disasters collectively (Ivanov et al., 2022) or by focusing on specific events, such as the 2005 hurricane season (Chavaz, 2016), without distinguishing between different types of disasters.

To the best of our knowledge, no study has investigated how the response of the corporate credit market differs according to the type of natural disaster, in particular between long-term and short-term disasters. This distinction is important because different disasters have different patterns and characteristics that are unlikely to have the same impact on credit markets. For example, tropical cyclones cause significant immediate destruction of assets, leading to severe business disruption and financial difficulties (SBCS, 2018). In contrast, droughts cause less immediate damage but have a substantial financial impact on agricultural activity and create high levels of uncertainty for local economies (Rippey, 2015).

Therefore, to properly assess the physical risks inherent in the US corporate credit market, it is crucial to determine whether different types of natural disasters present varying levels of credit risk. This paper aims to fill this gap. By using Jordá local projections, we examine the impact of both short-term disasters, such as severe storms and tropical cyclones, and long-term disasters, such as droughts and wildfires, on US corporate credit spreads. Our study period spans from January 1990 to December 2019. Our results suggest that short-term disasters increase the probability of corporate defaults, but do not lead to significant financial tightening by institutional investors. In contrast, long-term catastrophes are associated with increased corporate default risk and tighter financial conditions.

Several mechanisms can explain this difference in institutional investor response. Short-term disasters, such as severe storms and tropical cyclones, have shorter durations and recovery periods than long-term disasters. Short-term disasters last from a few hours to a few days, with a recovery process that usually starts immediately after the disaster and can last from months to a few years (Kates et al., 2006). In contrast, long-term disasters such as droughts and wildfires can last for months, with underlying damage spreading over time, resulting in a prolonged recovery process that can last from years to decades. For example, after a severe drought, there are long-lasting negative effects on soil quality, which adversely affect crop productivity and require large investments in soil restoration. These disasters also cause long-term damage to water resources and lead to significant environmental degradation. It can take decades to restore biodiversity to pre-disaster levels (Clark et al., 2016).

Given the high level of uncertainty surrounding long-term disasters, they often benefit from less insurance coverage and less government assistance than short-term disasters. The insurance industry has developed comprehensive products for short-term events such as windstorms and floods, but few products are designed to protect against long-term losses. This disparity is well illustrated by the SwissRe Institute’s 2024 report. The report shows that over the past 40 years, the global share of insured losses has been around 37% for tropical cyclones, 28% for severe storms, just 4% for wildfires and only 1.5% for droughts. The same applies to US federal disaster programmes. The Federal Emergency Management Agency (FEMA) provides most individual and public assistance when a disaster is declared a "major disaster". However, to be declared as such, the disaster must be designated as a "major disaster" by the President and exceed the capacity of state and local governments to address it FEMA (2011). Therefore, by design, short-term disasters are far more likely to benefit from this federal assistance than long-term disasters. Since 1980, only the 1998 drought, the most damaging drought in US history (NCEI, 2021), has benefited from the major disaster declaration programme, compared to approximately 1,000 severe storms (FEMA, 2024).

As a result, the relatively quick recovery from short-term natural disasters, supported by insurance coverage and government aid, prevents a significant deterioration in investor sentiment towards the credit market. Investors remain confident in the ability of damaged companies to recover from the shock, preventing a significant tightening of financial conditions. In contrast, the high uncertainty surrounding long-term disasters, coupled with the lack of insurance coverage and government support, makes institutional investors more cautious, leading them to tighten financial conditions. This financial tightening heightens macroeconomic risks, creating the potential for a negative feedback loop involving lower investment, employment and overall economic output.

The insights gained from this analysis are numerous. Initially, one might assume that the most striking and damaging natural disasters generate the highest risk to the US corporate credit market. However, this analysis demonstrates that it is the long-term disasters that have the greatest impact. Consequently, this result underscores the importance of developing better insurance products for long-duration disasters. Furthermore, it is imperative to enhance federal support programmes for long-term disasters that address not only immediate recovery but also long-term costs. Additionally, raising public awareness and providing incentives for businesses to invest in climate-resilient infrastructure is crucial to mitigating this risk.

The paper is organised as follows: Section 1 reviews the relevant literature. Section 2 introduces the natural disaster database. Section 3 describes the empirical variables and model. The results are detailed in Section 4. Section 5 covers the robustness checks. Finally, Sect. 6 concludes the paper and discusses policy implications.

2 Literature review

2.1 Theoretical literature

To gain a comprehensive understanding of the transmission channels between severe natural disasters and the credit market, it is crucial to analyse the theoretical literature in this field.Footnote 1

Firstly, Dietz et al. (2016) examined the impact of climate change on financial asset values. Their findings demonstrated that a significant portion of climate-related risks lies in the tails of the distribution. For instance, the climate Value at Risk (VaR) corresponding to the 99th percentile accounts for up to 16.9% of global financial assets, equivalent to $24.2 trillion.Footnote 2 The identified transmission channels include the destruction of capital assets, such as buildings and infrastructure, due to severe natural disasters. This destruction leads to a decrease in the return on capital assets, labour productivity, and knowledge productivity, ultimately resulting in reduced output. In addition, Bovari et al. (2018) have demonstrated that climate change can inflict significant damage on the economy, compelling the private sector to seek leverage to offset production and capital asset losses. This mechanism exacerbates the threat to financial stability. Dafermos et al. (2018) provided theoretical work that is closely related to our study. They analysed how the financial structures of firms and banks respond to climate change. Their results show that climate and weather events cause economic contraction and capital destruction, which affect firms’ profitability and liquidity. As a result, firms’ default rates increase, leading to higher bank leverage ratios and lower capital adequacy ratios. This leads to increased credit rationing, perpetuating a negative feedback loop that undermines economic growth and exacerbates business challenges.

2.2 Empirical literature

Building on the theoretical foundation established thus far, we now turn to the empirical literature investigating these transmission channels. This entails an examination of the impact of severe natural disasters on financial health and the credit market.

Empirical studies have demonstrated that companies frequently experience a decline in their financial well-being following a natural disaster. For instance, Hong et al. (2019) have shown that drought negatively affects the profitability of food companies. Keerthiratne and Tol (2017) have found that companies are more indebted in the aftermath of natural disasters. Park et al. (2013) demonstrated that the 2011 earthquake in Japan disrupted company supply chains, resulting in shortages and production stoppages across various sectors.

The 2018 Small Business Credit Survey, conducted in the United States following the 2017 natural disasters, including hurricanes Matthew, Harvey, and Irma, also revealed several key points. The report indicated that firms damaged by these disasters reported significantly greater revenue losses and employment gaps than unaffected companies. Furthermore, firms that were damaged were more likely to encounter financial difficulties, with notable challenges in paying operational expenses, accessing credit, and reimbursing their debts compared to undamaged companies (ibid). Consequently, affected companies exhibited a higher risk of default and experienced greater funding gaps (ibid).

Therefore, in response to natural disaster shocks, banks and institutional investors may tighten their financial conditions due to the increased risk of corporate defaults. However, there is no consensus in the literature on this point. Some authors do find credit tightening towards companies after a natural disaster, while others do not. Garmaise and Moskowitz (2009) found a 22% reduction in commercial real estate loans after the 1990 California Earthquake. In contrast, Ivanov et al. (2022) demonstrated that banks responded to the surge in credit demand in disaster-stricken areas not by tightening credit in the affected regions but by reducing lending in unaffected areas. Cortés and Strahan (2017) identified analogous results for mortgage lending. Also, Schüwer et al. (2019) have demonstrated that banks did not tighten their financial conditions in the aftermath of Hurricane Katrina. Instead, banks protected themselves from the increasing risk of corporate default by selling these loans on the secondary market and increasing their investment in government securities. Chavaz (2016) also noted the securitization of high-risk corporate loans during the 2005 hurricane season. Finally, an increase in non-performing loans following a natural disaster can have a detrimental effect on banks’ balance sheets. Özsoy et al. (2020) found that banks affected by droughts experience a loss of asset quality and an increase in risk compared to unaffected banks.

In summary, theoretical studies indicate that severe natural disasters significantly impact financial markets by causing asset destruction and reducing output (Dietz et al., 2016; Bovari et al., 2018; Dafermos et al., 2018). Empirical research corroborates these findings, indicating that natural disasters have a detrimental impact on firms’ financial health, increase default rates, and disrupt supply chains (Hong et al., 2019; Keerthiratne & Tol, 2017; Park et al., 2013). However, there is debate regarding banks’ responses to business credit in the aftermath of natural disasters. Some researchers have reported a tightening of business credit (Garmaise & Moskowitz, 2009). Others have presented mixed results (Ivanov et al., 2022; Cortés & Strahan, 2017), while some have suggested that there is no credit crunch but rather an increase in the securitisation of disaster corporate loans (Schüwer et al., 2019; Chavaz, 2016).

This paper examines the diverse responses of institutional investors, such as banks, to different types of natural disasters. There is no intuitive reason to assume that investors would react uniformly to various types of disasters. Moreover, studies that do not observe credit tightening following a disaster often focus on hurricane events (Schüwer et al., 2019; Chavaz, 2016). However, hurricanes exhibit a distinct pattern compared to other disasters, such as long-duration events like droughts. Furthermore, the impact of droughts on the banking system has been sparsely studied, with Özsoy et al. (2020) being the only notable study to date. Therefore, understanding how investor responses vary across different types of disasters is crucial for accurately assessing associated risks and formulating effective policies. This represents our contribution to the literature.

3 Natural disaster database overview

This section introduces the selected natural disaster database and presents relevant descriptive statistics.

3.1 The NOAA national centers for environmental information (NCEI)

We have selected the NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters database 2021 as our natural disaster database. This database focuses on the United States and identifies all-natural disasters that resulted in economic losses exceeding $1 billion. Covering the period from 1980 to 2021, the dataset includes 143 severe storms, 56 tropical cyclones, 35 floods, 29 droughts, 19 wildfires, 19 winter storms, and 9 freezes (Table 1).Footnote 3

Each entry in the database contains key information, including the start and end dates of the disaster, a brief summary of the event, the number of deaths, and the estimated CPI-adjusted (or unadjusted) losses. The nature of these losses encompasses a range of elements, including "physical damage to residential, commercial, and government/municipal buildings, material assets within a building, time element losses (i.e., business interruptions), vehicles, boats, offshore energy platforms, public infrastructures (i.e., roads, bridges, buildings), and agricultural assets (i.e., crops, livestock, timber)." (Smith & Matthews, 2015, p. 1).

This database draws on a wide range of public and private sources, including but not limited to the National Weather Service, the Federal Emergency Management Agency (FEMA), state emergency management agencies, media reports, and insurance industry estimates (NCEI, 2021). The database focuses on natural catastrophes with losses exceeding $1 billion (CPI-adjusted). This threshold effectively captures a significant portion of the losses caused by such events, accounting for over 80% of total losses (ibid).Footnote 4

Furthermore, focusing on severe natural disasters is consistent with the practices observed in both natural disaster databases and empirical research. For instance, the global EM-DAT database only includes disasters that meet certain criteria, such as a minimum number of deaths, affected people, emergency declarations, or requests for international assistance (EM-DAT, 2024). In empirical studies, researchers often apply stringent criteria to select the most severe natural disasters for analysis. For instance, Cortés and Strahan (2017) concentrated on disasters where governors declared a "state of emergency" with a formal request to FEMA, whereas Dessaint and Matray (2017) focused solely on hurricanes that caused more than $5 billion in direct damages (adjusted for inflation).

Finally, one of the key strengths of the NCEI database, when compared to other databases such as SHELDUS or EM-DAT, is its corrections for "accounting bias" in loss estimates, as well as the provision of confidence intervals for disaster losses. These corrections, estimated by Smith and Matthews (2015) using Monte Carlo simulations, account for underestimates of total losses due to differences in data sources, methodologies, and event categorizations. For instance, the NCEI database reduces the underestimation of losses by approximately 10-15% of total losses (Smith & Katz, 2013).

To better understand the characteristics and scope of this database, we now turn to descriptive statistics.

3.2 Descriptive statistics

Firstly, Table 1 reveals several noteworthy findings. It is important to distinguish between the frequency of disasters, the total economic losses they cause, and the losses per disaster. With regard to frequency, severe storms are the most prevalent events, with 143 incidents resulting in economic losses exceeding $1 billion (CPI-adjusted). The next most common type of disaster is tropical cyclones, which have occurred 56 times, followed by floods (35 events) and droughts (29 events). However, in terms of total economic losses (2021 CPI adjusted), tropical cyclones lead, causing an estimated $1,148 billion in damages. Severe storms are in second position, accounting for $331 billion, with droughts not far behind at $285 billion. In addition, a more in-depth analysis reveals a more nuanced perspective when assessing the cost per event. Severe storms are the least costly, with an average loss per event of $2.31 billion. In contrast, tropical cyclones remain the most expensive natural disaster, with an average loss of approximately $20.50 billion per event. The next most costly disasters are droughts, which have an average cost of $9.8 billion per event. Wildfires follow at $6.3 billion per event, while floods have an average cost of $4.7 billion per event.

Secondly, with regard to the dynamic occurrence and associated damages of natural disasters, as illustrated by Figs. 1 and 2, it can be observed that there has been a significant surge in the number of severe natural disaster events. For instance, the number of reported disasters increased from 29 events in the 1980 s (1980–1989) to 123 events in the 2010 s (2010–2019) (Table 2 in Appendix). This accelerating trend can be attributed to three primary factors: climate change, increased exposure (i.e., values at risk of potential loss), and increased vulnerability (i.e., where and how we build) (NCEI, 2021).

Source NCEI (2021)

Number of US severe natural disasters (1980-2021).

Source NCEI (2021)

Economic losses from US severe natural disasters (1980-2021) in billions of 2021 CPI-adjusted dollars.

Regarding climate change, anthropogenic climate change is a significant contributing factor to the recent surge in severe natural disaster events (NCEI, 2021). The observed rise in global temperatures has led to notable alterations in weather patterns, resulting in an increase in the frequency and/or intensity of hurricanes, wildfires, floods, and heat waves (IPCC, 2021). For example, the Atlantic hurricane season has witnessed an increase in the number of Category 4 and 5 hurricanes (NASA, 2022), such as Hurricanes Harvey, Irma, and Maria, which caused extensive damage to coastal regions and resulted in billions of dollars in losses. Consequently, the costs of tropical cyclones have increased exponentially from the 1980 s (1980–1989) to the 2010 s (2010–2019), with a factor of 11 (Table 2 in Appendix). Furthermore, climate change has intensified the frequency and duration of wildfires in regions such as the western United States (NOAA, 2022). Longer droughts, coupled with warmer temperatures and reduced snowpack, create optimal conditions for wildfires to spread rapidly, destroying homes, livelihoods, and ecosystems (ibid). The costs of fire damage have increased exponentially over time, from $11 billion in the 1990 s (1990–1999) to $62 billion in the 2010 s (2010-2019).

Nevertheless, climate change alone does not fully account for the surge in billion-dollar disasters. Increased exposure and vulnerability of the population to natural hazards have compounded the impact of these events (NCEI, 2021). Regarding exposure, rapid urbanization and population growth have led to the expansion of residential and commercial buildings into high-risk areas, such as floodplains and wildfire-prone regions (ibid). Consequently, a greater number of individuals and resources are exposed to severe natural disasters, thereby increasing their economic impacts. Regarding vulnerability, it is a significant concern when building codes are inadequate or lack the ability to mitigate the impact of extreme events. Low-income households and marginalized communities frequently bear the brunt of natural disasters due to their restricted access to resources, support networks, and insurance (Hallegatte & Walsh, 2021).

In summary, this section has presented several descriptive statistics regarding severe natural disasters in the United States. Notably, the occurrence of billion-dollar disasters has increased over time. This rise can be attributed to three main factors: climate change, greater population exposure, and heightened vulnerability. In the following section, we will present the empirical variables and the model.

4 Model framework

4.1 Empirical variables

Prior to an in-depth examination of the Jordá local projection method, it is necessary to review the variables used in the model. The model aims to analyse the impact of a natural disaster shock on the US corporate credit market. The key variables in this analysis are: (i) the exogenous shock variable, represented by the natural disaster variable; (ii) the endogenous variables, which include the corporate credit spread and the mortgage spread; (iii) and the control variables, which ensure the model is properly specified.

For the shock variable, we use NCEI data on economic losses from severe natural disasters, expressed in billions of US dollars and adjusted to the 2021 CPI. These data have been converted into a monthly time series, where zero values indicate the absence of natural disaster losses (Fig. 8 in Appendix). Natural disasters vary in duration; some last less than a month, such as freezes, severe storms, tropical cyclones, and winter storms, while others, like droughts, floods, and wildfires, extend over several months. For long-term disasters, the total economic losses are evenly distributed across the affected months. For example, the 2012 US drought generated $41.4 billion in economic losses over the year, so the monthly losses are calculated as $41.4 billion divided by 12. While this method assumes a uniform distribution of losses, which may not always be accurate, data limitations prevent more precise assumptions. In cases of simultaneous natural disasters, we aggregate the corresponding losses to ensure a comprehensive assessment of the economic impact. Additionally, we split the natural disaster variable into two sub-series: one for short-term disasters (less than a month) and one for long-term disasters (more than a month) (Fig. 9 in Appendix). In the model, the natural disaster variables are expressed as \(log+1\). This logarithmic transformation allows the series to have a distribution close to the Gaussian while handling zero values.

Regarding the endogenous variables (Fig. 10 in Appendix), we use the company credit spread variable developed by Gilchrist and Zakrajsek (2012). This series is widely used in monetary policy literature to analyse the impact of policy shocks on corporate credit markets (Miranda-Agrippino & Rey, 2020; Gertler & Karadi, 2015). This corporate bond credit spread, hereafter the "GZ credit spread," is constructed using "secondary market prices of senior unsecured bonds issued by a representative sample of US non-financial firms" (Favara et al., 2016). The GZ credit spread provides insight into the default risk of individual firms (estimated GZ credit spread) and their access to external finance (Excess Bond Premium).Footnote 5 The series is freely available on Favara et al. (2016)’s FEDS Notes. Additionally, we include the mortgage credit spread for comparison purposes. Following the methodology described by Gertler and Karadi (2015), this spread is derived by subtracting the 30-year Conventional Mortgage spreads from the 10-year US Treasury Securities. It is a major indicator of the cost of housing finance and is obtained from the Federal Reserve Bank of St. Louis (FRED). Both credit spread variables are expressed in levels in the model.

Finally, in order to accurately estimate our model, we have included several control variables that have been demonstrated to have a significant impact on the credit market (Fig. 12 in Appendix). These include the log of US industrial production, the log of the US consumer price index, and the 1-year Treasury bond yield. The 1-year Treasury bond yield serves as the monetary policy indicator. This selection of variables aligns with Gertler and Karadi (2015). For a comprehensive review of the literature on the determinants of credit spreads, we direct the reader to Davies (2008).

The study period spans from January 1990 to December 2019. To ensure the reliability of our analysis, we exclude periods of high volatility in the credit markets unrelated to natural disasters. Specifically, we exclude the 1980 s, marked by a significant recession triggered by the Federal Reserve’s tightening to address rising inflation (Federal Reserve History, 2013), and the period after 2019, marked by the global pandemic crisis and the "Great Lockdown." Despite these exclusions, we have a substantial dataset, totalling 360 observations, to ensure the convergence of our estimates. Table 3 in the Appendix displays descriptive statistics for all variables.

4.2 Model specification

We employ Jordà (2005) local projection method to estimate the impact of natural disaster shock on the US credit market. This approach involves performing Ordinary Least Squares (OLS) regression for each horizon h. The horizon h is fixed to 24 months, thus to 2 years following the shock. The linear model is formulated as follows:

for \(h = 0,1,2,...,24\); \(t = 1,...,360\); \(p = 2\); and \(s = 2\).

The endogenous variables y are the GZ credit spread and the mortgage spread. The variable shock refers to the identified shock from natural disaster losses (\(log+1\)). The vector x consists of control variables, including the log of industrial production, the log of the consumer price index (CPI), and the 1-year Treasury bond yield.

The coefficients of the lagged endogenous variables are denoted by \(\beta ^{h}_{j}\), where \(j = 1, \ldots , p\). Similarly, the coefficients of the lagged control variables are denoted by \(\gamma ^{h}_{k}\), where \(k = 1, \ldots , s\). The use of lag operators helps address the issue of serial autocorrelation in the series. In our model, the number of lags is set to two for both the endogenous and control variables, as determined by the Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC). The maximum number of lags is fixed at twelve, equivalent to a full year. Robustness checks have been conducted to validate the choice of lags, and the results remain consistent regardless of the lag selection (see Sect. 5).

In addition, \(\delta ^{h}\) is the coefficient that quantifies the response of y at time \(t+h\) to a shock at time t. Simply put, it measures the response of the GZ credit spread (or mortgage spread) to a shock from the natural disaster variable at h months following the disaster. Thus, the impulse response functions are constructed as a sequence of \({\hat{\delta }}^{h}\) estimates for each horizon (Ramey & Zubairy, 2018).Footnote 6 Regarding the identification strategy, Jordà (2023) highlights that the OLS is consistent as long as the shock variable is exogenous given the explanatory variables. In our case, it seems reasonable to assume that the losses resulting from a natural disaster in t do not depend on macroeconomic variables such as the corporate and household credit spread in \(t-j\), with \(j=1,...,p\).

Finally, \(\alpha ^{h}\) is the constant of the model, and \(\epsilon\) represents the error terms. As highlighted by equation 1, the residuals of local projections exhibit a moving average structure, generating serial correlation and affecting the construction of standard errors. To address this issue, Jordà (2005) proposed applying the Newey-West correction to the standard errors. Consequently, we apply this correction to our standard errors.

The advantages of local projections are numerous compared to the Structural Vector Autoregression (SVAR) model. Local projections are easily estimated with a model that offers flexibility Jordá (2023). Specifically, we have been able to estimate the response of credit spreads to a shock from a natural disaster by specifying this variable as fully exogenous, which would not have been feasible in the case of a VAR model. Additionally, local projections provide a direct estimate of the impulse response function, meaning that standard errors do not require the delta method or simulation-based approaches (ibid). Furthermore, this methodology is less sensitive to misspecification than the SVAR model, as each impulse response function coefficient is estimated using a separate regression. Unlike the VAR model, local projections do not require stationary variables (ibid). Moreover, local projections remain robust to the persistence of the data and the estimation of impulse responses over long horizons (which is not the case for an autogressive model) (Olea & Plagborg-Møller, 2021). However, the primary limitation of local projections is that, because this method is less restrictive than a VAR model, the estimates lose some efficiency (ibid). As a robustness test, we compare our results with those from an SVAR model (see, Sect. 5).

In summary, we employ Jordá’s local projection method due to its numerous advantages over a standard SVAR model. In particular, the flexibility of the local projections model allows us to specify the natural disasters variable as fully exogenous, which is not feasible in an SVAR specification. However, one refinement of the model would have been to analyse our study question with more spatial granularity using a panel methodology. Unfortunately, we are constrained by data availability. In particular, we are unable to obtain the expected default data for companies and institutional investor sentiment towards the corporate credit market at the state level. Despite this limitation, the use of federal data allows us to demonstrate that credit risks generated by a natural disaster extend beyond the borders of the affected state and have a federal impact.

5 Results

In this section, we present the results of our models following a sequential strategy. First, we analyse the corporate credit spread’s response to a natural disaster shock. Next, we investigate whether the observed significant and positive effect of a natural disaster shock on the corporate credit spread is due to an increase in expected corporate defaults or a deterioration in investor sentiment towards the credit market. Finally, we assess whether these effects hold for both short-term and long-term natural disasters.

5.1 Impact of severe natural disasters on corporate credit spread

As illustrated in Fig. 3, a natural disaster shock leads to a significant increase in the corporate credit spread, which persists for approximately five months before beginning to decline. A similar effect is observed in the mortgage spread, with the magnitude of the response being comparable to that of the corporate credit spread.

Our findings align with existing literature, indicating that severe natural disasters cause substantial damage to corporate (household) balance sheets through capital destruction and operational disruptions (Batten et al., 2016). As a result, firms experience higher default rates, which elevate credit risks (ibid). The devastating hurricanes Harvey, Maria, and Irma in 2017 provide a stark example. In their aftermath, 40% of small businesses in the affected areas reported losses (SBCS, 2018). Among these, 45% incurred asset losses between $1,000 and $25,000, while 19% suffered losses exceeding $25,000. Consequently, these firms struggled to cover operating costs and meet debt payments. The increased risk of defaults made it more challenging for them to secure credit compared to their unaffected counterparts (ibid).

IRF - Impact of Severe Natural Disasters on Corporate Credit Spread. Note The black line represents the Impulse Response Function (IRF) as per Jordà (2005). The IRF is estimated using local linear projections with the Newey-West correction and two lags. The lag selection is based on information criteria (AIC and BIC), with a maximum of twelve lags considered. The blue shaded area indicates the 90% confidence interval. The time horizon is two years (24 months)

5.2 Factors contributing to the rise in corporate credit spreads

Our previous findings have shown that natural disasters lead to an increase in corporate credit spreads. To gain deeper insights, we aim to investigate the underlying transmission channels driving this effect. Specifically, we will examine whether the significant rise in corporate credit risk stems primarily from an increase in expected corporate defaults due to deteriorating balance.

Following the approach of Gilchrist and Zakrajsek (2012), we decompose the GZ corporate credit spread into two components: (1) the estimated GZ credit spread and (2) the Excess Bond Premium (EBP).

Where \(S_t^{GZ}\) is the GZ corporate credit spread, \({\hat{S}}_t^{GZ}\) is the estimated GZ credit spread, and EBP is the Excess Bond Premium. Their mathematical definitions are detailed in Section C., and the corresponding variables are plotted in Fig. 11. Both can be found in the Appendix.

The estimated GZ credit spread is an indicator of the expected corporate defaults, while the Excess Bond Premium (EBP) gauges investor sentiment towards corporate credit risk. According to Gilchrist and Zakrajsek (2012, p. 1700), the EBP "represents the variation in the average price of bearing exposure to U.S. corporate credit risk above and beyond compensation for expected default."

The economic interpretation of EBP is contingent upon the expected corporate defaults. If investor sentiment towards corporate credit risk deteriorates significantly (an increase in EBP) while the expected defaults remain stable, it may indicate an overreaction by institutional investors. For instance, after a severe natural disaster, investors might anticipate an increase in corporate defaults even though the actual probability remains unchanged. This is particularly true if insurance covers most of the disaster losses. Conversely, if investor sentiment towards the credit market deteriorates (an increase in EBP) while, at the same time, the risk of corporate default rises, this may suggest that both real and financial disruptions are impacting investor willingness or capacity to extend new credits. Consequently, this may result in tighter financial conditions (Favara et al., 2016).

As illustrated by Fig. 4, our empirical analysis supports this second interpretation. A natural disaster significantly increases the default risk of companies, which, in turn, deteriorates investor sentiment towards the credit markets, leading to tighter financial conditions. Specifically, the expected corporate default rate rises significantly for up to two months following a severe natural disaster, followed by a significant increase in the EBP from the second to the fourth month. Additionally, it appears that the magnitude of investor reactions is slightly greater than the increase in the expected default rate of companies.

Regarding this finding, the existing literature is heterogeneous. For example, Garmaise and Moskowitz (2009) observed a reduction in commercial real estate loans following the 1990 California earthquake. Ivanov et al. (2022) reported mixed results, indicating that banks increased their lending in disaster-affected areas while simultaneously reducing their credit supply in undamaged zones. Conversely, Schüwer et al. (2019) and Chavaz (2016) demonstrated that banks facilitate lending in affected areas while managing the rising risk through portfolio rebalancing strategies.

IRF - Impact of Severe Natural Disasters on Corporate Default Risk and Investor Sentiment. Note The gz_spread_est variable is a measure of the anticipated default of companies, while the ebp represents investor sentiments towards the corporate credit market. The black line is the Impulse Response Function (IRF) as per Jordà (2005). The IRF is estimated using local linear projections with the Newey-West correction and two lags. The lag selection is based on information criteria (AIC and BIC), with a maximum of twelve lags considered. The blue shaded area indicates the 90% confidence interval. The time horizon is two years (24 months)

A potential explanation for this discrepancy could lie in the type of natural disasters analysed. There is no intuitive reason to assume that investors react similarly to different types of natural disasters. Most authors who did not find evidence of credit tightening focused on Hurricane Katrina (Schüwer et al., 2019; Chavaz, 2016). However, hurricanes exhibit a distinct pattern compared to other disasters, such as long-duration events like droughts. Long-duration disasters cause long-lasting damage and are surrounded by high uncertainty regarding their effects on economic activities and the time required to restore damaged biodiversity. Understanding whether and how investor responses vary across different types of natural hazards is crucial for accurately assessing associated risks and formulating effective policies.

5.3 Differences in credit risk between long- and short-term severe natural disasters

To analyse how different types of natural disasters impact the corporate credit spread, we use sub-series of our natural disaster variable, categorising them as short-term (less than a month) and long-term (more than a month). Short-term natural disasters include freezes, severe storms, tropical cyclones, and winter storms. Long-term natural disasters encompass droughts, flooding, and wildfires.

IRF - Impact of Short- and Long-Term Severe Natural Disasters on Corporate Credit Spread. Note The black line represents the Impulse Response Function (IRF) as per Jordà (2005). The IRF is estimated using local linear projections with the Newey-West correction and two lags. The lag selection is based on information criteria (AIC and BIC), with a maximum of twelve lags considered. The colour-shaded area indicates the 90% confidence interval. The time horizon is two years (24 months)

Figure 5 demonstrates interesting results that align with our expectations. Severe natural disasters have different impacts on the corporate credit spread depending on the type of disaster. Long-term natural disasters lead to a significant increase in corporate credit spreads for approximately seven months. Conversely, we do not find a significant effect on credit spreads in response to short-term natural disasters. We suspect this lack of significance is driven by the EBP variable rather than the expected default variable. This result would suggest that while short-term disasters generate a rise in expected corporate defaults, institutional investors do not respond by tightening their financial conditions. This point will be investigated further. Additionally, both short-term and long-term natural disasters generate a significant increase in the mortgage spread. The magnitude of this effect is higher for short-term disasters compared to long-term ones like droughts, which is intuitive as short-term disasters typically cause more immediate housing damage.

IRF - Impact of Short- and Long-Term Severe Natural Disasters on Corporate Default Risk and Investor Sentiment. Note The black line represents the Impulse Response Function (IRF) as per Jordà (2005). The IRF is estimated using local linear projections with the Newey-West correction and two lags. The lag selection is based on information criteria (AIC and BIC), with a maximum of twelve lags considered. The colour-shaded area indicates the 90% confidence interval. The time horizon is two years (24 months)

Therefore, the model is re-estimated by decomposing the corporate credit spread variable into its two components (Fig. 6). First, we observe that natural disasters significantly increase corporate default risk for both short-term and long-term disasters. For short-term natural disasters, the impact on expected corporate defaults is statistically significant for a period of two months. In contrast, long-term natural disasters result in a significant increase in the probability of corporate default between the second and third months, and again between the fourth and eighth months. This latter finding is attributable to the varying durations of long-term natural hazards. For instance, events such as floods and wildfires typically persist for two to four months, while droughts and prolonged wildfires can last for more than six months.Footnote 7

Secondly, the responses of institutional investors to a natural disaster vary depending on whether the disaster is short-term or long-term. After a natural disaster lasting several months, the expected default rate of businesses increases, and investor sentiment towards the credit market deteriorates. This, in turn, leads to tighter financial conditions, with the EBP rising significantly between the second and fourth months after the shock. Conversely, while short-term natural disasters do increase corporate default risks, they do not cause a deterioration in investor sentiment towards the credit market. In other words, disasters like hurricanes or severe storms do not result in credit tightening for the affected companies.

To better understand this result, the next section will discuss the different mechanisms that could explain the heterogeneity in investor reactions to short-term and long-term natural disasters.

5.4 Explaining the disparate investor responses to short-term and long-term disasters

The difference in investor reaction to short-term and long-term natural disasters is primarily driven by the duration and extent of the disruption, the effectiveness of insurance coverage, government aid, and the perceived stability of the market. Short-term disasters result in a faster recovery and more stable investor sentiment than long-term disasters. Long-term hazards lead to prolonged financial stress, increased default risks, and a significant tightening of financial conditions. These points are developed on below.

5.4.1 Duration and recovery periods

Short-term natural disasters, such as tropical cyclones or severe storms, cause immediate but short-lived disruption compared to long-term catastrophes. Rapid response efforts help mitigate the expected increase in business failures and financial risks. In contrast, long-term catastrophes lead to prolonged periods of disruption, placing a sustained financial burden on companies for several years. The extended impact increases the risk of corporate failure as companies face ongoing operational disruptions, reduced revenues, and high recovery costs.

To illustrate this point, let us consider several examples. Among short-term catastrophes, severe storms, and tropical cyclones are the most frequent hazards. Recovery periods for severe storms are generally quite short, lasting a few months. For example, after the May 2019 tornadoes, residents in Missouri, Ohio, and Kansas began rebuilding within four to six months, depending on their insurance status (Lee & Yan, 2022). For tropical cyclones, the recovery period is longer than for severe storms, often lasting several years. Following Hurricane Katrina, the costliest hurricane in US history, the emergency phase lasted about one and a half months, with a restoration period of about nine months (Kates et al., 2006). The main recovery phase lasted about two years after the event and then began to slow down (ibid). Therefore, while short-term disasters can be very damaging, most of the recovery takes place within months to a few years after the event.

However, in the case of long-term disasters, the recovery period can extend from several years to decades. Some long-term disasters can last for an entire year, far exceeding the duration and sometimes the recovery period of short-term events.

For instance, severe droughts have significant and lasting impacts on various sectors, particularly agriculture. They cause severe financial burdens by leading to widespread crop failures, such as corn and soybeans, increasing their prices and reducing their exports (Adonizio et al., 2012). As a result, farmers experience significant income losses and may be forced to reduce their herds (Rippey, 2015). For example, the US 2012 drought led to a 10% increase in corn prices and a 27% increase in soybean prices over the year, resulting in a 13 to 15% reduction in livestock inventories in certain states (Rippey, 2015; U.S. Bureau of Labor Statistics, 2012). The economic impacts are long-term, with farmers facing lower incomes, higher irrigation costs, and increased investment in soil recovery and replanting (Medellín-Azuara et al., 2016). Prolonged droughts deplete soil moisture and degrade soil quality, reducing agricultural productivity long after the drought has ended (Ciais et al., 2005). Beyond agriculture, droughts increase food poverty among vulnerable households (Boyer et al., 2013) and deplete water resources, affecting municipal supplies, industry, and ecosystems (Medellín-Azuara et al., 2016). In addition, droughts cause environmental degradation, leading to vegetation loss, and habitat destruction (Clark et al., 2016). All of these impacts can take years or decades to reverse.

5.4.2 Insurance coverage and governmental assistance

In addition to the duration and recovery period, insurance coverage and government aid also explain the difference in investor response between short-term and long-term natural disasters. Indeed, short-term disasters are more likely to be covered by insurance policies and government aid than long-term disasters. Consequently, in the case of short-term disasters, the financial burden on firms is partially alleviated, which reduces the likelihood of defaults and thus reassures investors.

Let us examine these two points more closely. On the insurance side, the industry has developed comprehensive products specifically tailored for short-term disasters such as windstorm damage or flooding. By contrast, long-term catastrophes such as droughts are often more difficult to insure effectively due to their diffuse impact and less immediate visibility. This disparity is notably highlighted by the SwissRe Institute in its 2024 report. The report shows significant heterogeneity in insured losses depending on the type of disaster. Over the past 40 years, the global share of insured losses has been approximately 37% for tropical cyclones, 28% for severe storms, a mere 4% for wildfires, and only 1.5% for droughts.

Focusing on droughts in the United States, drought losses are mainly covered by the Federal Crop Insurance Program (FCIP). While this program undoubtedly plays a crucial role in helping farmers manage physical risks, it does not cover all losses. In fact, no insurance policy provides 100% coverage for all losses, primarily to avoid excessive risk-taking by subscribers (CRS, 2022). The FCIP covers losses of crop yield and revenue (ibid) but does not account for additional costs that droughts can cause, such as the future decrease in crop productivity. Moreover, even though the insurance premiums for this program are subsidised by the federal government, farmers must pay an increasing proportion of the premiums for higher levels of coverage (CRS, 2022). Farmers also have to pay administrative fees per crop per county (ibid). Consequently, data show that farmers are likely to purchase less FCIP coverage in areas where premiums are higher, which tends to correspond to regions with a higher risk of crop loss (ibid). This suggests that even with government subsidies, the cost of premiums can be a barrier to obtaining adequate coverage.

In terms of existing federal programs designed to provide short and long-term assistance following natural disasters, most of the funding is allocated to short-term hazards. The Federal Emergency Management Agency (FEMA) manages three main types of declarations that determine the level of assistance provided: major disaster, emergency, and fire assistance - the latter specifically focused on wildfires.

Major disaster declarations offer more comprehensive assistance, including both immediate emergency measures and long-term recovery efforts. In contrast, emergency declarations and fire management assistance are primarily aimed at providing immediate assistance and services. From 1980 to 2021, there were 1,854 major disaster declarations. However, most of these declarations were for short-term hazards: 921 for severe storms, 410 for floods, 262 for tropical storms, 53 for wildfires, and only one for drought (FEMA, 2024). This data highlights that relatively few major disaster declarations are deployed for long-term disasters such as wildfires and droughts, with the exception of floods. Wildfires are usually supported through the "fire management assistance program", which covers immediate costs such as firefighting, but not long-term costs such as reforestation, habitat restoration, and infrastructure repair.

In summary, as the recovery process from short-term disasters tends to be quite rapid, supported by insurance coverage and government aid, investor sentiment towards the credit market does not deteriorate significantly. Investors remain confident in the market’s ability to bounce back quickly, preventing a significant tightening of credit. However, in the case of long-term disasters, the impact unfolds over time with greater uncertainty. As a result, investors become increasingly concerned about the long-term financial health of the affected companies. This leads to a deterioration in credit market sentiment and ultimately to a tightening of credit.

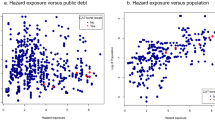

5.4.3 A correlation analysis

To complete this analysis of the transmission channels, we conduct a correlation analysis. The purpose of this analysis is to test whether long-term natural disasters indeed lead to higher corporate default risks and tighter financial conditions than short-term disasters.

The correlation plot confirms this statement. Figure 7 shows that the correlation coefficients between the long-term natural disaster variable and the expected corporate default and EBP variables are higher than those for the short-term disaster variable. Specifically, the correlation between long-term disasters and the probability of business default is 0.24, which is significant at the 5% level. The correlation between the investor sentiment variable and long-term disasters is lower, with a coefficient of 0.11, but still significant at the 5% level.

6 Robustness

Several robustness tests are conducted to ensure the reliability of the results. First, the consistency of the results obtained using Jordá’s local projection (LP) method is verified. Our analysis demonstrates that the results are robust across different lag choices and study periods (Figs. 13 and 14, respectively, in Appendix). Second, the robustness of the results is tested by applying an alternative model, specifically an SVAR framework, which yields comparable outcomes (Figs. 15 and 16, in Appendix). However, as the time horizon is extended, the two sets of impulse response functions exhibit an increasing discrepancy. This discrepancy can be attributed to the superior long-term forecasting performance of the LP method compared to the SVAR model (Olea & Plagborg-Møller, 2021).

In computing the SVAR model, the variables are the same as in the local LP model. The endogenous variables are the natural disaster variables, the corporate credit spread and the mortgage spread. The exogenous variables include industrial production (\(\Delta (log)\)), the consumer price index (\(\Delta (log)\)) and the 1-year Treasury yield. In addition, we include a dummy variable to capture the effect of crises. This specification was not necessary for the LP model because we corrected the residuals using Newey-West’s correction for autocorrelation and heteroskedasticity. Besides, since an autoregressive model requires stationary series, we apply the difference operator to the log of industrial production and the log of the CPI, both of which are integrated of order one. We do not find a unit root at 5% for the other variables.Footnote 8 Regarding the identification of the SVAR model, the main assumption is that the natural disaster variable is weakly exogenous. Therefore, this variable is only influenced by its own lagged values and a constant. Additionally, the Cholesky decomposition places the natural disaster variable first, followed by the corporate credit spread and then the mortgage spread. This order assumes that natural disasters have a contemporaneous effect on financial credit spreads, but financial credit spreads do not have a contemporaneous effect on natural disasters. Finally, the number of lags was determined on the basis of information criteria that indicated the use of two lags. The forecasting horizon is consistent with the LP model and covers 24 months. The confidence intervals for the VAR model have been estimated using bootstrapping with 1,500 replications, and the impulse response functions represent the responses to a standard deviation shock.

7 Conclusion and policy discussion

Since climate change threatens our world as we know it today, understanding its effects on various economic sectors is crucial for implementing effective response policies. A significant body of research has examined the transition risks associated with moving from a high-emission world to a low-carbon society. However, fewer studies have focused on the physical risks, that is, the risks of climate events such as natural disasters on financial assets. These events are often considered globally rather than as distinct occurrences with unique characteristics. This paper addresses this limitation by analysing how the US business credit market reacts to severe natural disaster shocks and how responses vary depending on the type of disaster. In particular, we examine differences in institutional investor reactions to short-term disasters like severe storms, tropical cyclones, and freezes versus long-duration disasters like droughts, wildfires, and extended flooding.

By implementing Jordá local projections, we find that severe natural disasters result in a rise in US corporate credit spreads. This increase is driven by heightened corporate default risk and a decline in investor sentiment toward the credit market. Natural disaster shocks cause asset destruction and business interruptions, leading to reduced income and profits for companies. As a result, the expected defaults of companies increase, undermining institutional investor confidence in the corporate credit market and leading to tightened financial conditions.

Our results align with existing literature, although there are mixed findings regarding US banks’ responses to damaged companies following natural disasters. Some studies find evidence of credit tightening, while others do not. Investor reactions may vary depending on the type of natural disaster, its duration, extent, insurance coverage, and governmental aid. We show that short-term disaster shocks raise the probability of corporate default but do not trigger financial tightening by institutional investors. However, long-duration disasters such as droughts or wildfires increase the risk of corporate defaults, prompting financial tightening by institutional investors.

Several mechanisms explain this result. Short-term disasters such as severe storms or tropical cyclones have shorter durations and recovery compared to long-term disasters. Typically, the recovery process for short-term disasters takes several months to a few years. In contrast, long-duration disasters can take years or even decades to recover from. For instance, droughts impose long-lasting stress on farmers’ financial security through decreased crop productivity, income, and increased investment in soil recovery. Additionally, droughts deplete water resources and cause severe environmental degradation, requiring years for full recovery.

Besides, short-term disasters benefit from higher insurance coverage and more substantial government aid compared to long-term disasters. The insurance industry has developed comprehensive products tailored for short-term disasters, such as wind and flood damage. Conversely, long-term disasters are often more challenging to insure efficiently due to their diffuse impact and less immediate visibility. Federal programmes also tend to grant more assistance for short-term disasters than for long-term hazards. Severe storms and tropical cyclones often cause immediate and significant asset destruction, prompting substantial emergency responses from the government.

As a result, damages caused by short-term disasters tend to be restored relatively quickly with the support of insurance coverage and government aid. Consequently, investor sentiment towards the credit market does not deteriorate significantly. Investors remain confident in the ability of companies to recover swiftly, preventing substantial financial tightening. However, the damages caused by long-duration disasters are prolonged, difficult to predict, poorly insured, and inadequately supported by federal programmes. These factors create high uncertainty about the long-term financial health of companies, leading investors to tighten their financial conditions. Additionally, tightening borrowing conditions increases macroeconomic risks, potentially creating a negative feedback loop. This can exacerbate negative effects on companies, which in turn negatively impacts employment, consumption, and overall economic output.

We derive several policy implications from our results. Although long-term disasters generally generate fewer economic losses than short-term disasters, they pose greater macroeconomic risk due to the tightening of financial conditions. To alleviate this effect, policies could encourage the insurance industry to create more comprehensive products for long-duration disasters. With regard to droughts, which are largely covered by the FCIP program, the federal government could increase its subsidies for crops most vulnerable to climate change by offering greater premium coverage. In addition, the U.S. government could establish programmes specifically designed to facilitate recovery from long-term disasters with prolonged economic disruptions. For example, FEMA’s wildfire management programme could be expanded to address not only immediate post-fire needs, but also long-term recovery efforts such as reforestation and habitat rehabilitation. Increasing public awareness about the risks associated with natural disasters and how to mitigate them is also essential. Even for short-term disasters like tropical cyclones, significant insurance gaps exist. After the 2017 disasters, many companies had insurance against flooding but lacked coverage for business interruption, which was the main source of losses for companies (SBCS, 2018). Finally, offering tax incentives or subsidies for businesses that invest in climate resilience measures, such as improved infrastructure and sustainable practices, can help reduce the impact of natural disasters.

Notes

For an comprehensive and detailed overview of climate-related risks to financial assets, we refer readers to the review by Campiglio et al. (2023).

This result corroborates the seminal work of Weitzman (2012), which demonstrated that the standard damage functions result in significant underestimations of the welfare losses associated with climate change, particularly when catastrophic damages interact with fat-tailed uncertainty.

It is important to note that the recorded number of disasters or losses may fluctuate slightly as a result of regular updates to the database.

In this paper, the term "severe natural disaster" is employed to refer to natural disasters that generate high economic losses. Indeed, severe disasters are defined as events that result in large losses, in terms of the number of lives, financial capital, or environmental quality (Stephenson, 2008).

These two variables will be defined later in the paper.

This method diverges from the standard approach to constructing impulse response functions in a VAR model. The latter method traces the effect of a shock to one of the error terms on the current and future values of all endogenous variables in the system (Lütkepohl, 2005, Sect. 2.3.2).

A total of 29 droughts have been recorded in the database, with seven lasting for six months and twelve extending over a year. However, it should be noted that the percentage of dryness can vary significantly from one month to another and from one location to another. For instance, during the 2012 drought, dry weather conditions persisted in parts of the western United States for nearly every month. Notable reductions in precipitation were observed in the Intermountain Basin from April to July, while the Southwest experienced dry conditions from April to June and again from October to November. The Rockies were similarly affected from March to November (NCEI, 2012) In terms of wildfires, 19 significant wildfire events were recorded, with seven occurring over a six-month period and one spanning the entire year. The latter event was the 2018 Western wildfires, which were particularly destructive. In total, California experienced 8,527 wildfires in 2018, burning approximately 1.9 million acres, which is nearly 2% of the state’s area. These fires were the deadliest and costliest on record, with significant incidents including the Camp Fire, Mendocino Complex Fire, Carr Fire, and Woolsey Fire (Wang et al., 2021).

More specifically, we first applied standard unit root tests using the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests. These tests indicated the absence of a unit root for all series at the 5% significance level, except for the variables ’gz_spread’ and ’gz_spread_est’, which gave mixed results. Due to the strong heteroskedasticity observed in these two variables during the 2008 crisis, we applied the Zivot and Andrews test. This test allows for the detection of a unit root and, at the same time, the endogenous identification of a structural break. The 2008 crisis was identified as the break and both credit variables were found to be stationary at conventional significance levels. Results are available upon request.

References

Adonizio, W., Kook, N., & Royales, S. (2012). Impact of the drought on corn exports: paying the price. U.S. Bureau of Labor Statistics 1, 1–7. https://www.bls.gov/opub/btn/volume-1/impact-of-the-drought-on-corn-exports-paying-the-price.htm.

Aglietta, M., & Espagne, E. (2016). Climate and finance systemic risks, more than an analogy? The climate fragility hypothesis. Working Papers CEPII research center.

Batten, S., Sowerbutts, R., & Tanaka, M. (2016). Let’s talk about the weather: the impact of climate change on central banks. Bank of England Working Paper, p. 38. https://doi.org/10.2139/ssrn.2783753.

Battiston, S., Mandel, A., Monasterolo, I., Schütze, F., & Visentin, G. (2017). A climate stress-test of the financial system. Nature Climate Change, 7, 283–288. https://doi.org/10.1038/nclimate3255

Bovari, E., Giraud, G., & Mc Isaac, F. (2018). Coping with collapse: A stock-flow consistent monetary macrodynamics of global warming. Ecological Economics, 147, 383–398. https://doi.org/10.1016/j.ecolecon.2018.01.034

Boyer, J., Byrne, P., Cassman, K., Cooper, M., Delmer, D., Greene, T., Gruis, F., Habben, J., Hausmann, N., Kenny, N., Lafitte, R., Paszkiewicz, S., Porter, D., Schlegel, A., Schussler, J., Setter, T., Shanahan, J., Sharp, R., Vyn, T., … Gaffney, J. (2013). The U.S. drought of 2012 in perspective: A call to action. Global Food Security, 2, 139–143. https://doi.org/10.1016/j.gfs.2013.08.002

Campiglio, E., Daumas, L., Monnin, P., & Von Jagow, A. (2023). Climate-related risks in financial assets. Journal of Economic Surveys, 37, 950–992. https://doi.org/10.1111/joes.12525

Chavaz, M. (2016). Dis-integrating credit markets: diversification, securitization, and lending in a recovery. Bank of England Working Paper, pp. 1–56https://doi.org/10.2139/ssrn.2843683.

Ciais, P., Reichstein, M., Viovy, N., Granier, A., Ogée, J., Allard, V., Aubinet, M., Buchmann, N., Bernhofer, C., Carrara, A., Chevallier, F., De Noblet, N., Friend, A. D., Friedlingstein, P., Grünwald, T., Heinesch, B., Keronen, P., Knohl, A., Krinner, G., … Valentini, R. (2005). Europe-wide reduction in primary productivity caused by the heat and drought in 2003. Nature, 437, 529–533. https://doi.org/10.1038/nature03972

Clark, J. S., Iverson, L., Woodall, C. W., Allen, C. D., Bell, D. M., Bragg, D. C., D’Amato, A. W., Davis, F. W., Hersh, M. H., Ibanez, I., Jackson, S. T., Matthews, S., Pederson, N., Peters, M., Schwartz, M. W., Waring, K. M., & Zimmermann, N. E. (2016). The impacts of increasing drought on forest dynamics, structure, and biodiversity in the United States. Global Change Biology, 22, 2329–2352. https://doi.org/10.1111/gcb.13160

Cortés, K. R., & Strahan, P. E. (2017). Tracing out capital flows: How financially integrated banks respond to natural disasters. Journal of Financial Economics, 125, 182–199. https://doi.org/10.1016/j.jfineco.2017.04.011

CRS (2022). Federal crop insurance program support for natural disasters. Congressional Research Service , pp. 1–3. https://crsreports.congress.gov/product/pdf/IF/IF11924.

Dafermos, Y., Nikolaidi, M., & Galanis, G. (2018). Climate change, financial stability and monetary policy. Ecological Economics, 152, 219–234. https://doi.org/10.1016/j.ecolecon.2018.05.011

Davies, A. (2008). Credit spread determinants: An 85 year perspective. Journal of Financial Markets, 11, 180–197. https://doi.org/10.1016/j.finmar.2007.10.002

Dessaint, O., & Matray, A. (2017). Do managers overreact to salient risks? Evidence from hurricane strikes. Journal of Financial Economics, 126, 97–121. https://doi.org/10.1016/j.jfineco.2017.07.002

Dietz, S., Bowen, A., Dixon, C., & Gradwell, P. (2016). ‘Climate value at risk’ of global financial assets. Nature Climate Change, 6, 676–679. https://doi.org/10.1038/nclimate2972

EM-DAT (2024). The international disaster database. Centre for research on the epidemiology of disasters (CRED). https://www.emdat.be/.

Favara, G., Gilchrist, S., Lewis, K.F., & Zakrajšek, E. (2016). Recession risk and the excess bond premium. FEDS notes. https://www.federalreserve.gov/econresdata/notes/feds-notes/2016/recession-risk-and-the-excess-bond-premium-20160408.html.

Federal Reserve History (2013). Recession of 1981–1982. By Tim Sablik, Federal Reserve Bank of Richmond. Federal Reserve History. https://www.federalreservehistory.org/essays/recession-of-1981-82.

FEMA (2011). Disaster declaration process - Fact sheet. https://www.fema.gov/pdf/media/factsheets/dad_disaster_declaration.pdf.

FEMA (2024). Data visualizations: Disaster declarations for states and counties. Federal Emergency Management Agency. https://www.fema.gov/data-visualization/disaster-declarations-states-and-counties.

Garmaise, M. J., & Moskowitz, T. J. (2009). Catastrophic risk and credit markets. The Journal of Finance, 64, 657–707. https://doi.org/10.1111/j.1540-6261.2009.01446.x

Gertler, M., & Karadi, P. (2015). Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics, 7, 44–76. https://doi.org/10.1257/mac.20130329

Gilchrist, S., & Zakrajsek, E. (2012). Credit spreads and business cycle fluctuations. American Economic Review, 102, 1692–720.

Hallegatte, S., & Walsh, B. (2021). Natural disasters, poverty and inequality: new metrics for fairer policies, in: The Routledge Handbook of the Political Economy of the Environment. 1 ed.. Routledge, pp. 111–131. https://doi.org/10.4324/9780367814533-10.

Hong, H., Li, F. W., & Xu, J. (2019). Climate risks and market efficiency. Journal of Econometrics, 208, 265–281. https://doi.org/10.1016/j.jeconom.2018.09.015

IPCC (2021). Climate change 2021: The physical science basis. Contribution of working group I to the sixth assessment report of the intergovernmental panel on climate change. In: Masson-Delmotte V., Zhai P., Pirani A., Connors S. L., Péan C., Berger S., Caud N., Chen Y., Goldfarb L., Gomis M.I., Huang M., Leitzell K., Lonnoy E., Matthews J. B. R., Maycock T. K., Waterfield T., Yelekçi O., Yu R., Zhou B. (Eds.). Cambridge University Press. https://doi.org/10.1017/9781009157896.

Ivanov, I. T., Macchiavelli, M., & Santos, J. (2022). Bank lending networks and the propagation of natural disasters. Financial Management, 51, 903–927. https://doi.org/10.1111/fima.12388

Jordá, O. (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95, 161–182. https://doi.org/10.1257/0002828053828518

Jordá, O. (2023). Local projections for applied economics. Federal reserve bank of San Francisco, working paper series 2023, pp. 01–35. https://doi.org/10.24148/wp2023-16.

Kates, R. W., Colten, C. E., Laska, S., & Leatherman, S. P. (2006). Reconstruction of New Orleans after Hurricane Katrina: A research perspective. Proceedings of the National Academy of Sciences, 103, 14653–14660. https://doi.org/10.1073/pnas.0605726103

Keerthiratne, S., & Tol, R. S. J. (2017). Impact of natural disasters on financial development. Economics of Disasters and Climate Change, 1, 33–54. https://doi.org/10.1007/s41885-017-0002-5

Lee, J.Y., & Yan, G. (2022). Rebuilding after a Tornado: The Role of Homeowners Insurance in Recovery (Natural Hazards Center Mitigation Matters Research Report Series, Report 11). Natural Hazards Center, University of Colorado Boulder. https://hazards.colorado.edu/mitigation-matters-report/rebuilding-after-a-tornado.

Lütkepohl, H. (2005). New introduction to multiple time series analysis. 1. ed., corr. 2. print ed., Springer.

Medellín-Azuara, J., MacEwan, D., Howitt, R.E., Sumner, D.A., & Lund, J.R. (2016). Economic Analysis of the 2016 California Drought on Agriculture. Center for Watershed Sciences, UC Davis , p. 17. https://cail.ucdavis.edu/2016/08/16/economic-analysis-of-the-2016-california-drought-for-agriculture/.

Miranda-Agrippino, S., & Rey, H. (2020). U.S. monetary policy and the global financial cycle. The Review of Economic Studies, 87, 2754–2776. https://doi.org/10.1093/restud/rdaa019

NASA (2022). A force of nature: hurricanes in a changing climate. NASA. https://science.nasa.gov/earth/climate-change/a-force-of-nature-hurricanes-in-a-changing-climate/.

NCEI (2012). National drought overview. National Centers for Environmental Information (NCEI). https://www.ncei.noaa.gov/access/monitoring/monthly-report/drought/201213.

NCEI (2021). Billion-Dollar weather and climate disasters. NOAA National Centers for Environmental Information (NCEI). https://www.ncei.noaa.gov/access/billions/, https://doi.org/10.25921/stkw-7w73.

NOAA (2022). NOAA and wildfire. National Oceanic and Atmospheric Administration. https://www.noaa.gov/noaa-wildfire.

Olea, J. L. M., & Plagborg-Møller, M. (2021). Local projection inference is simpler and more robust than you think. Econometrica, 89, 1789–1823. https://doi.org/10.3982/ECTA18756

Özsoy, S.M., Rasteh, M., & Yönder, E. (2020). Understanding drought shocks: Bank financial stability and loan performance. Working Paper, pp. 1–44.

Park, Y., Hong, P., & Roh, J. J. (2013). Supply chain lessons from the catastrophic natural disaster in Japan. Business Horizons, 56, 75–85. https://doi.org/10.1016/j.bushor.2012.09.008

Ramey, V. A., & Zubairy, S. (2018). Government spending multipliers in good times and in bad: Evidence from U.S. historical data. Journal of Political Economy, 126, 1–59. https://doi.org/10.1086/696277

Rippey, B.R. (2015). The U.S. drought of 2012. Weather and Climate Extremes 10, 57–64. https://www.sciencedirect.com/science/article/pii/S2212094715300360.

SBCS (2018). 2017 Small business credit survey: Report on disaster-affected firms. Federal Reserve Banks , pp. 1–26. https://www.fedsmallbusiness.org/reports/survey/2018/report-on-disaster-affected-firms, https://doi.org/10.55350/sbcs-20180417. series: Small Business Credit Survey (SBCS).

Schüwer, U., Lambert, C., & Noth, F. (2019). How do banks react to catastrophic events? Evidence from Hurricane Katrina. Review of Finance, 23, 75–116. https://doi.org/10.1093/rof/rfy010

Smith, A. B., & Katz, R. W. (2013). US billion-dollar weather and climate disasters: data sources, trends, accuracy and biases. Natural Hazards, 67, 387–410. https://doi.org/10.1007/s11069-013-0566-5

Smith, A. B., & Matthews, J. L. (2015). Quantifying uncertainty and variable sensitivity within the US billion-dollar weather and climate disaster cost estimates. Natural Hazards, 77, 1829–1851. https://doi.org/10.1007/s11069-015-1678-x

Stephenson, D. B. (2008). Definition, diagnosis, and origin of extreme weather and climate events. In H. F. Diaz, R. J. Murnane (Eds.), Climate extremes and society. 1 ed. Cambridge University Press, pp. 11–23. https://doi.org/10.1017/CBO9780511535840.004.

SwissRe (2024). Sigma - Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks. SwissRe Institute, pp. 1–37. https://www.swissre.com/dam/jcr:c9385357-6b86-486a-9ad8-78679037c10e/2024-03-sigma1-natural-catastrophes.pdf.

U.S. Bureau of Labor Statistics (2012). Will the 2012 drought have a bigger impact on grocery prices than the 1988 drought? Beyond the Numbers: Prices & Spending (U.S. Bureau of Labor Statistics) 1. https://www.bls.gov/opub/btn/volume-1/will-the-2012-drought-have-a-bigger-impact-on-grocery-prices-than-the-1988-drought.htm.

Wang, D., Guan, D., Zhu, S., Kinnon, M. M., Geng, G., Zhang, Q., Zheng, H., Lei, T., Shao, S., Gong, P., & Davis, S. J. (2021). Economic footprint of California wildfires in 2018. Nature Sustainability, 4, 252–260. https://doi.org/10.1038/s41893-020-00646-7

Weitzman, M. L. (2012). GHG targets as insurance against catastrophic climate damages. Journal of Public Economic Theory, 14, 221–244. https://doi.org/10.1111/j.1467-9779.2011.01539.x

Acknowledgements

The author would like to express her deepest gratitude to Elena Dumitrescu, Chouaïb Jouf, Valérie Mignon, Pablo Aguilar Perez, Arthur Thomas and Hamada Saleh for their invaluable contributions, which have greatly improved the quality of this work. She is also deeply grateful to Christophe Hurlin and Céline Gimet, the reviewers of her thesis, for their insightful feedback. In addition, the author expresses her sincere thanks to the ROWE reviewers and editor for their comprehensive and insightful comments, which significantly improved the original manuscript. Finally, she expresses her sincere appreciation to her colleagues for their unwavering support and constructive feedback throughout this process.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that there are no Conflict of interest regarding the publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The author is currently a research fellow at the Banque de France and the Institut Louis Bachelier (ILB). At the ILB, this work is supported by EquipEx Pladifes (ANR-21-ESRE-0036).

Appendices

Appendix

A. NCEI statistical descriptions

See Tables 2, 3 and Figs. 8, 9.

Source NCEI (2021). Note The study period is from January 1990 to December 2019

Economic Losses from US Severe Natural Disasters (1990-2019) in Billions of 2021 CPI-Adjusted Dollars (monthly).

Source NCEI (2021). Note Economic losses are expressed in billions of USD, adjusted for the 2021 consumer price index (CPI)

US Severe Natural Disasters (1980-2021): Short-Run and Long-Run Events.

B. Variables in the model

Sources Gilchrist and Zakrajsek (2012) and FRED. Note The gz_spread represents the corporate credit spread as defined by Gilchrist and Zakrajšek (2012). The mortgage spread is calculated by subtracting the 30-year conventional mortgage spread from the 10-year US Treasury securities. The study period runs from January 1990 to December 2019

Credit Spreads for Households and Corporates.