Abstract

This paper addresses the impact of the Covid-19 lockdown on the warehousing of perishable items facing demand-side shocks, mainly those with selling price and product quality dependent demand, for example, fresh fruits, meats, vegetables, packed foods, etc. Along with demand-side issues, such an inventory system consumes a significant amount of energy in terms of freshness, increasing carbon tax and dwindling the firm's total profit. We formulate two-warehouse inventory models of perishables items using the first-in-first-out (FIFO) dispatching policy under two different Covid-19 lockdown scenarios. The two-warehouse system primarily consists of an owned warehouse (OW) and a rented warehouse (RW). Two different lockdown scenarios are considered as; (i) the lockdown during the consumption of goods in OW and (ii) the lockdown during the consumption of goods in RW. The demand rate is assumed to decline and surge by a finite volume as lockdown is forced and relaxed. The proposed models help in assessing the impact of lockdown on (i) product quality, (ii) product cost, (iii) inventory level, (iv) freshness keeping efforts, (v) investment in green technologies, and (vi) carbon cap and trade policy. We determine the above six parameters to maximize the firm's total profit. The key findings of this model suggest that yield is primarily affected due to carbon cap and trade policy, lockdown period, item price, backlogging, and variation in the holding costs in OW and RW. These models may assist the small, medium, and large firms involved in perishable or cold supply chains to assess the effect of Covid-19 like disruption and take corrective measures to maximize their profit.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Covid-19 pandemic has forced the world towards extraordinary situations, where public health got affected due to the SARS-COV-2 virus, followed by several other issues like disruption, inflation, and isolation. These issues have significantly impacted the global supply chain network causing enormous economic losses. The perishable food industry is among those sectors that faced financial loss during the pandemic. However, along with financial losses, the pandemic has also reflected the vulnerability of the present global supply chain network that requires enormous and impactful mitigation. As food is considered the basic need for human beings, it was believed that the pandemic would not affect the demand for these items. But unfortunately, it has caused a significant change in its demand pattern due to the closure of hotels, restaurants, and caterings services and a surge in its demand in supermarkets (Amjath-Babu et al. 2020; Hobbs 2020). Such a situation was first reported in Italy from 23rd February to 29th March 2020. During this period, the demand for pasta, rice, canned, packed, and frozen foods has increased.

In contrast, the demand for fresh food such as fresh meats, vegetables, and seafood has decreased significantly (Bracale and Vaccaro 2020). This change in demand pattern is due to the strict lockdown imposed by the government resulting in the closure of hotels, restaurants, and public ceremonies that causes a decrease in demand for fresh foods (Amjath-Babu et al. 2020) and hence a massive loss for the industry (Mor et al. 2020). The decrease in demand is primarily caused due to the shorter self-life as the quality of these items starts diminishing with time. Within a brief period, they become obsolete and wasted, creating an economic loss for the organization (Hertog et al. 2014). Such products require proper refrigeration facilities such as cold storage and warehousing to increase their self-life and reduce wastage (Rana et al. 2021b). From here, it's understood that the preservation efforts for these items put immense pressure upon warehousing activities that involve intensive usage of man, power, and machine. The situation becomes even more challenging when the warehouses face lockdown scenarios, especially those who had procured the items before lockdown (Bochtis et al. 2020). Because the lockdown periods are indefinite, the procured perishable items are stored in the warehouse for a prolonged duration (Rana et al. 2021b). Due to this, the holding cost of the warehouse increases, causing an increase in the selling price of the items and reducing total profit. So to increase the yield, it becomes essential to optimize the factors, such as order quantity, cycle time, selling price, carbon cap and trade tax, and total costs.

The Covid-19 pandemic affected the performance of business and supply chains. However, the entities present in the supply chain network, such as cold storage facilities or warehouses, were utterly clueless about specific issues such as the amount of inventory to be maintained, freshness keeping effort to be applied, impact of carbon taxation on cost, and the magnitude of profit amid the demand disruption due to Covid-19 pandemic. The current literature has very little mathematical work on perishable inventory models amid the Covid-19 pandemic considering sustainability. Therefore we propose two mathematical models that will replicate the issues and challenges faced by the warehouses during demand-side shocks caused due to Covid -19 pandemic and provide a mathematical solution for the problem. This study will help mitigate the warehouse's problems with numerical examples and figures and guide the warehouse managers in similar situations in the future. The main contribution of this paper is:

-

The existing literature deals with the theoretical aspect of the pandemic, but this paper deals with the mathematical part.

-

The mathematical model helps find the exact amount of losses faced by the warehousing companies that are hard to get through the theoretical models.

-

This mathematical model provides a resilient solution for the problems stated above with exact numbers, graphs, and figures that is hard to get from the theoretical models.

-

This mathematical model deals with the effect of demand-side shocks upon the perishable inventory. The inventory in stock stimulates the selling price, profit, freshness keeping effort, carbon cap and trade policy, and green technology investment. These factors or parameters have never been considered together in previous works.

We present an intuitive causal diagram (Fig. 1) indicating the cause-effect relationships of the various parameters proposed in the inventory models. Here (+ve) and (-ve) symbols define the direct and inverse proportionality of the causal and effect parameters. This representation consists of four different loops showing the impact of various factors on the firm’s profit. These loops are; energy efficiency loop (1–2-3–4-5), quality dependent demand loop (1–2-3–7-9–5), deterioration control loop (1–2-3–7-8–9-5) and the freshness-effort dependent demand loop (6–7-9–10). The energy efficiency loop shows that investment in green technology led to decreased energy consumption and carbon emission, increasing the firm’s profit. The quality-dependent demand loop describes the impact of inventory quality on-demand and eventually on profit. Thus the profit can only be increased using an efficient energy system that can maintain the item quality. The deterioration control loop illustrates the positive effect of controlling the deterioration rate of the items using energy-efficient technology. The freshness-effort-dependent demand loop defines the positive increase in the demand rate, while an increased level of freshness effort is given to the inventory system.

We also acknowledge the remarkable work of Rana et al. (2021a) predicting the impact of demand disruption during the Covid-19 lockdown on total system cost while considering a finite decline and surge in demand as the lockdown is forced relaxed, respectively. However, we feel that the demand as a function of quality and selling price makes the scenario more practical. Additionally, the consideration of using energy-efficient technology to maintain the freshness of the inventory is the need of the hours to attain a certain level of sustainability. Therefore we assume extending the work of Rana et al. (2021a) considering the impact of quality, selling price, and, more importantly, the carbon emission reduction to increase the firm’s average profit even in a problematic scenario like the Covid-19 pandemic.

This paper is as organized as follows. Section 2 recalls the relevant literature and research gaps in the body of knowledge. Key assumptions and notations are listed in Sect. 3. Section 4 reflects the mathematical model development. Finally, the sensitivity analysis is given in Sect. 5, and Sect. 6 contains discussion followed by the conclusion.

2 Literature review

The Covid-19 pandemic has severely affected the world due to domestic and cross-border restrictions upon the movement of people and disruption in the global supply chain network (Guan et al. 2020). The disruption caused due to pandemic has posed several issues and challenges as follows;

-

i.

The household demand for essential goods such as foods and medicine has increased, whereas the demand for non-essential goods has decreased (Chowdhury et al. 2021). The sudden spike in demand is due to changes in the purchasing habit of the customers (Hobbs 2020), such as panic buying behavior with the fear of unavailability of these items in post-pandemic situations (Yuen et al. 2020). This increase in demand has resulted in partial shortages of these products in the market (Deaton and Deaton 2020).

-

ii.

The drop in demand for non-essential items results from a fall in people's purchasing power as most of them have lost their jobs during the pandemic. Therefore they prefer to spend their saved money on essential items rather than spending it on non-essential ones (Chiaramonti and Maniatis 2020).

-

iii.

Due to cross-border shutdowns and travel restrictions, the earnings of restaurants and hotels have decreased as they were dependent on tourism industries for their revenue generations. Moreover, the shutting down of the tourism industry during the pandemic has caused several terminations of their employees and salary cut downs. Therefore, it has resulted in the lowering of the income of people (Majumdar et al. 2020).

-

iv.

The unexpected variations in demand and disturbance in the supply chain have produced several problems in decision making and forecasting (Gunessee and Subramanian 2020) for businesses with long-term objectives and goals.

-

v.

The transportation and logistics management got affected due to disruption in air, land, and water transportation. As a result, international trade faces significant losses (Govindan et al. 2020).

-

vi.

The Covid-19 norms such as social distancing and isolation have declined the interactions among the various supply partners creating a state of ambiguity and loss in their collaborative efforts (Baveja et al. 2020).

-

vii.

The pandemic has also caused inevitable production disruptions due to labor, material, and logistics (Leite et al. 2021). In addition, it results in backlogging (Richards and Rickard 2020) of goods. Furthermore, some inflation reports have also been recorded in some places. (Armantier et al. 2021).

-

viii.

The lockdown situation caused due to pandemic in the early 2020s caused price uncertainty wheat and maize, creating food insecurity (“COVID-19 Pandemic–Impact on Food and Agriculture,” (2019); Id and Khatun 2021).

-

ix.

The lockdown scenario has resulted in the closing of hotels, restaurants, and public ceremonies (Brinca et al. 2020; Hobbs 2020; Končar et al. 2021), causing a fall in demand for foods items that have affected the income of the farmers, who were the primary producers. Further, the travel restriction during the pandemic has prevented the farmers from getting into the open market, driving them towards lower crop productivity. Additionally, a sudden decline in demand has aroused significant challenges for the industries dealing with food products. At the same time, this situation put immense pressure upon the warehouses, especially those who have procured the items before lockdown. They must keep their products fresh for the indefinite lockdown periods (Bochtis et al. 2020). The entire production chain of perishable products, from crop yield to fertilizers, has been affected during the initial pandemic. The travel restriction prohibits the agricultural workforce from traveling during the harvesting season, resulting in lower crop productivity (Fortuna and Foote 2020) resulting in a sharp decline in crop productivity and the sale of fertilizers and pesticides, causing an enormous loss for this industry (Jámbor et al. 2020).

Lessons from the epidemic/pandemic outbreaks

Epidemics and pandemics have existed among humans for centuries. Even though the world has witnessed several infections from 2000–10, including SARS (severe acute respiratory syndrome), H1N1, and the Covid-19, such events posed an extensive public health issue that directly or indirectly affected the organizations’ efficiency and responsiveness, causing severe monetary losses (Guan et al. 2020). Due to the Covid-19 pandemic, international trade has decreased from 13%-32%, as per the report given by World Trade Organization in the mid-2020s (WTO 2020). Hence, organizations strive to achieve resiliency to tackle such shocks (Ivanov and Dolgui 2021). In this regard, several researchers have studied the pandemics and their impacts in their research. For example, Rayburn et al. (2004) have studied the effects of the SARS epidemic upon the business sector, electronic sectors, airlines sectors, and investment sector. Shan and Zhang (2004) studied the impact of SARS on the blood supply chain system in Beijing. Also, Qiu et al. (2017) studied the H1N1 epidemic's impact on public health, economy, society, and security. However, the present literature is confined only to the theoretical aspects of outbreaks. Hence, the resilient techniques available in current literature got overshaded during Covid-19 pandemic scenarios.

Limited research is focused on the mathematical models on pandemic's effect upon the perishable food supply chain that results in severe crisis during the Covid-19 pandemic (Chowdhury et al. 2021; Rana et al. 2021b). However, the Covid-19 pandemic has presented a scenario where the stock availability of perishable goods collapses (Amjath-Babu et al. 2020) with a sudden increase in its demand along with a change in purchasing habits of the customers (Brinca et al. 2020) and shortages of products and raw materials (Toffolutti et al. 2020). These scenarios resulted from governments policies on containing the spread of the virus, such as border shutdown, lockdown of markets, restriction on vehicle movements, quarantines, and containment zones (Ghosh et al. 2020), which causes multidimensional impact upon the supply chains, and affects the international trade network.

Research question 1:

How to design a resilient mathematical model for perishable items when the supply chain is facing disruption due to the COVID-19 pandemic?

Change in food consumption, demand patterns, and behaviors of consumers during and after COVID-19

Managing the perishable food supply chain is challenging because of its demand uncertainty and shorter shelf-life. The demand uncertainty coupled with the rate of deterioration results in a large-scale reduction in its commercial value and shortages in the retail chain market (Yang et al. 2017). Also, these items were wasted due to a lack of proper preservation (Zhu and Krikke 2020). In Italy, demand for these items decreases as customers know the preservation efforts required to maintain these inventory. Hence, demand for perishable items decreased during the disruption period (Bracale and Vaccaro 2020). Further, such products failed to reach their customers on time due to logistic restrictions, creating many unsatisfied customers and compelling them to think about alternative strategies such as stockpiling or hoarding (Sterman and Dogan 2015). In China, the production and distribution channels were disrupted during the outbreak, resulting in the customers accumulating the essential food items. In Canada, the stockpiling of these items was reported along with customers’ panic purchasing behavior at the supermarkets, just after the lockdown was relaxed. This was caused due to the fear of unavailability of these items in the post-pandemic period (Hobbs 2020). The pandemic has also changed the priority pyramid of purchasing foods items by the customers; previously, the priority pyramid from high to low was taste, price, nutritional value, appearance, convenience, safety, origin, fairness, tradition, naturalness (Lusk and Briggeman 2009). During the pandemic, the price has become the priority, followed by nutrition, and along with it, new priorities have also been added, like storage (Ellison et al. 2020). Several researchers have contributed their effort upon the customers' purchasing behaviour, like Richards and Rickard (2020) studied the impact of COVID-19 upon customers buying behavior and further classified into short-term impacts like hoarding, stockpiling and long term impacts like e-commerce, online ordering. Eger et al. (2021) studied the changes in demand patterns of the different age groups of customers during the Covid-19 pandemic. Limited research is available on mathematical aspect of perishable inventory that poses the following research question.

Research question 2:

How to integrate the issue of demand uncertainty caused due to behavioral change in customers in a mathematical model concerning price and profit?

Food losses and warehousing problems during the COVID-19 pandemic

The Covid-19 disruption caused massive uncertainty in demand and production, resulting in significant food losses as there was a decrease in the movement of trucks by 30% compared to the pre-lockdown period, which results in delays in transportation and refrigeration, causing food loss (Iyer 2020). Additionally, the sudden closure of the hotels, restaurants, hostels, and prohibitions in public ceremonies causes shrinkage in demand for such items (Brinca et al. 2020; Končar et al. 2021; Amjath-Babu et al. 2020). A few researchers have addressed this issue. For example; Abhishek et al. (2020) studied the effect of lockdown upon the food supply chain in India, Cappelli and Cini (2020) provided the method to overcome the shortages of food in the market by strengthening the local producers, Quayson et al. (2020) provided a digitalized solution for the problem of food losses during the pandemic, and Di Vaio et al. (2020) used artificial intelligence systems in Agri-Food system to reduce the food wastage during the pandemic. Still, the current literature fails to predict the number of food losses in warehouses as improper warehousing is also one of the critical reasons for food loss, as reported by the Ministry of Consumer Affairs India. Approximately 1550 tonnes of food grain has been wasted in FCI (food corporation India) owned warehouses since May 2020 (Vikram 2020), which lead to shortages and inflation of perishable products in the market (Pothan 2020). This issue has somewhat been controlled, owing to private players in the market, such as e-commerce and NGOs, providing an adequate warehousing facility (Iyer 2020). However, the suppliers, manufacturers, retailers, and distributors with an appropriate warehousing model under Covid-19 like disruption can predict the ordering quality, profit, and food losses in the warehouses. Rana et al. (2021b) has formulated the mathematical model for two warehouse inventory system, where perishable items face Covid-19 pandemic-like disruption. Singh et al. (2020) shows the importance of warehouses in perishable food distribution system during the Covid-19 pandemic. Still these models focus on formulating the inventory system of perishables during the Covid-19 pandemic, but it fail to address the sustainability and quality issues associated with it.

Research question 3:

How to prevent food losses during the Covid-19 pandemic and quantify its resilience in price, profit, and quantity?

Research question 4:

How the food losses be reduced using warehousing operations, as warehouses are integral parts of the supply chain?

Sustainability issues in the food supply chain during the COVID-19 pandemic

The sustainability in producing and distributing perishables items is an essential concern for an industry (Li et al. 2014; Kaipia et al. 2013). The products reaching the retail store late shorten the remaining self-life of the product and increase the issue of the saleability of these items (Mena et al. 2011). The reduction in sales for these items and their implications on energy consumption to keep these products fresh causes a substantial impact upon the environment (Yang et al. 2017) and climate change. In recent years, the supply chain network of these products faced a Covid-19 pandemic disruption, due to which the sustainability concerns have adversely been affected. As per Naidoo and Fisher (2020), one-third of seventeen sustainable goals, adopted by the united nations, to be achieved by 2030, has been delayed due to the pandemic, and among these, goal no 13: “Climate action” has been put under a “threat” category. In this regard, some researchers have contributed their effort, such as Sharma et al. (2021) formulated a mathematical model for allocating vehicles between warehouses at different locations under the Covid-19 pandemic scenario considering carbon emission from the transportation of vehicles. Gelles (2020) published the article concerning the transportation and warehousing problem of Covid-19 vaccines at the temperature of -80 °C, considering various obstacles, such as carbon emission. Nozari et al. (2022) studied the impact of uncertainty in demand of medical equipment using the Neutrosophic Fuzzy Programming method to model for multi depot vehicle routing under Covid-19 pandemic to facilitate warehouses and production units in routing vehicles to hospitals. Pani et al. (2020) evaluated the acceptance value of the Autonomous Robot Delivery (ADR) for delivering perishable items under the Covid-19 scenario. One of the objectives of ADR is to reduce carbon emission, which occurs during transportation. All the research works discussed have shown the sustainability concerns during transportation of vehicles, but none of them has highlighted this issue in inventory management amid COVID-19 like scenario; hence we derive the following research question given sustainability of the perishable inventory as:-

Research question 5:

How to bring sustainability in the warehousing activities when the supply chain faces Covid-19 pandemic disruptions?

Several mathematical, analytical, and theoretical models concerning perishable and non-perishable items have been classified in Table 1.

After a comprehensive literature review, we found that none of the papers have considered the parameters, including selling and quality-based demand, and carbon cap and trade policy amid Covid-19 pandemics like disruption to maximize the firm’s average profit for a two warehouse storage system. Therefore a mathematical model has been formulated considering these parameters to help answer the research question discussed in RQ1 to RQ5.

3 Assumptions and notations

3.1 Assumptions

-

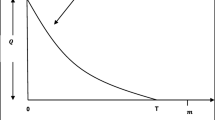

The demand rate D(b, Q,θ) is a function of selling price b and the quality parameter Q (Q defines the effect of quality on the item demand: Q > 0) (Jaggi et al. 2015; Yang et al. 2020) as shown in Fig. 2. Generally, the selling price of items rises when the supply side is disrupted, like in the COVID-19 pandemic situation (Akter 2020), petroleum prices, exchange rate.

$${D}_{o}=k{b}^{-e}$$(1)$$D\left(b,Q,\theta \right)={D}_{o}-Q\theta$$(2)where k is the scale parameter (k > 0), e is price elasticity (e > 0), and θ is the deterioration rate \(\left(0<\theta \le 1\right)\).

-

Inflation is constant as the inventory is stored in the warehouse for a short period.

-

The planning horizon is considered infinite, as it has been assumed that cycle time (T) replicates itself countless times for the prospect.

-

The replenishment rate is instantaneous as it has been assumed that there is no inventory building up time or the lead time is zero.

-

For ease of calculation, the deterioration rate is assumed to be constant for both warehouses. (0 < θ < 1).

-

The storage capacity of the OW is finite, whereas the RW has infinite storage capacity.

-

The holding cost per unit item per unit time is higher in RW than OW since the rented warehouse is assumed to have a better preservation facility as professional warehousing companies run it.

-

The shortages are permitted, the unfulfilled demands are partially backlogged. The backlogging rate is inconsistent and changes accordingly with the waiting time for the next replenishment. It means that the longer the waiting time, the less will be the backlogging rate. The waiting time for the partially backlogged products is described as \({e}^{-H\left(T-t\right)}\), here H(> 0) represents the backlogging parameter, and (T-t) represents the waiting time of customers.

-

The freshness-keeping effort is directly proportional to carbon emission.

-

The Carbon Cap and Trade Policy (Mishra et al. 2020) has been considered to attain sustainability of the system. Carbon dioxide gas is the leading cause of environmental destruction worldwide, so it becomes essential to reduce its emission as far as possible. Switching to green technology is a way to minimize energy consumption that eventually may reduce emissions. Hence we consider an investment in green technology (Mishra et al. 2020). We also assume the emissions from inventory deterioration and packaging postponement activities (Richards 2017).

-

A carbon cap and trade policy are established for a sustainable inventory model to control carbon emissions and have good economic growth. The formulas and cost estimation for this are described (Mishra et al. 2020).

$$Amount\ of\ emission\left(CE\right)=\frac{Ac}{t}+{e}_{2}W\left(t\right)+\Delta f{e}_{3}W\left(t\right)+\left(u+V\right)D$$(3)$$Cost\ of\ emission=\beta \left(M-CE\left(1-\alpha \left(1-{e}^{-jC}\right)\right)\right)$$(4)

Here, \(CE\left(1-\alpha \left(1-{e}^{-jC}\right)\right)\) denotes the drop in carbon emission after investment in greener technologies C. The emission cost is indicated by \(\beta \left(M-CE\left(1-\alpha \left(1-{e}^{-jC}\right)\right)\right)\). Manufacturer’s carbon emission is less than the permitted cap M when \(\beta \left(M-CE\left(1-\alpha \left(1-{e}^{-jC}\right)\right)\right)>0,\) thus the manufacturer can sell this reduced carbon quantity to generate revenue. In case the manufacturer’s carbon emission is more significant than permitted cap M when \(\beta \left(M-CE\left(1-\alpha \left(1-{e}^{-jC}\right)\right)\right)<0,\) the manufacturer must purchase the carbon permits from other producers, leading to an increase in the cost of emission.

3.2 Notations

Following notations are used in the modeling of inventory policy.

\({W}_{r}\left(t\right),{W}_{o}\left(t\right)\) | Inventory level at time t in RW and OW | \({t}_{L}\) | The time at which the lockdown starts |

\({\mathrm{W}}_{\mathrm{F}}\) | Quantity per replenishment | \({t}_{o}\) | The time at which the lockdown is relaxed |

\({P}_{F}\) | The maximum stock level at the beginning of the cycle | \(CE\) | Carbon emission(Kg/year) |

\(E\) | Ordering cost per order | \(M\) | Annual carbon emission cap (Kg/Year) |

\(U\) | Storage limit in OW | \(j\) | Efficiency of Green technology in carbon emission shrinkage |

\(L\) | Storage limit in Rented warehouse | \(\alpha\) | Fraction of carbon emitted after green technology investment |

\(\theta\) | Deterioration rate(decrease in quantity/time) | \(\beta\) | Carbon tax(tax/year) |

\(r\) | Rate of discount | \(C\) | Capital investment in green technology (investment/year) |

\(i\) | Rate of inflation | \({A}_{c}\) | Carbon discharged in association with setup cost (Kg/Year) |

\(R\) | The net discount rate of inflation | \(Q\) | Parameter of quality (change in demand/quality) |

\(B\) | Unit Purchasing cost of item | \(\Delta\) | Inventories in-operative |

\(b\) | Unit selling cost of item | \({e}_{2}\) | Carbon emitted from inventory (kg/year) |

\(D\left(b,Q,\theta \right)\) | Rate of demand | \({e}_{3}\) | Carbon emitted from inventory obsoleted (kg/year) |

\(X,Y\) | Holding cost of items in owned and RW, respectively (per item per unit time) | \(f\) | Load of unusable inventory in the warehouse |

\(J\) | Per Unit shortage cost per time | \(V\) | Influence of carbon emission on the location because of inventory (kg/year) |

\({J}_{L}\) | Per unit lost sale cost per time | \(u\) | Emission due to manufacturing (kg/year) |

\(H\) | Backlogging parameter | \(\gamma\) | Back-ordered stock out time in percentage. (%) |

\(T\) | Cycle time | \(Z\left(t\right)\) | Level of shortage at time t |

\({t}_{1}\) | The time when the inventory in OW reaches zero | \({\Delta d}_{1}\) | Increase in demand after uplifting the lockdown or due to panic purchasing behavior of the customers |

\(\Delta d\) | Decline in demand due to lockdown | \({t}_{2}\) | The time when the inventory in RW reaches zero |

\(AP\left(b,{P}_{F}\right)\) | Average profit | ||

4 Mathematical model development

This paper deals with the two different lockdown scenarios in which the entire supply chain gets disrupted due to the COVID-19 pandemic. We consider a two-warehouse inventory system with FIFO dispatching policy. As the lot arrives, the backlog is fulfilled first; then, the remaining inventory occupies their space in OW with a finite storage capacity, and RW possesses infinite storage capacity. The unfulfilled demands consider partial backlogging, and the backlogging rate depends on the customer’s waiting time. The model considers carbon cap and trade policy to raise sustainability concerns. A constant inflation rate has been taken into account, as it gives the real-time value of money.

4.1 Model for Scenario 1

Scenario 1 focuses upon the cycle time (0, T). Here the quantity ordered is WF, (WF = PF + D(T-t2)) upon which the PF quantity enters into the inventory systems after meeting all the previous backlogs D(T-t2). Out of available inventory, PF, U units are kept in OW and the remaining L = PF-U units in RW. During (0, tl), the quantity in OW gets reduced due to the combined effect of demand and deterioration, i.e., \(D\left(b,Q,\theta \right)={D}_{o}-Q\theta\). The Demand D(b, Q, θ) is given as

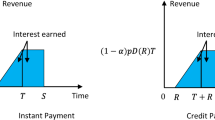

Figure 3 graphical represents Scenario 1.

The governing equation of the inventory depletion in both the warehouses is given by

With boundary condition, Wo(0) = U, the inventory level during (0, tL) is given by,

We consider the function D(b, Q, θ) is continuous in time interval (0, T). Therefore during (tL, to) the inventory level is given as,

Similarly, during (to, t1) the inventory level is obtained as,

And using boundary condition \({W}_{o}\left({t}_{1}\right)=0\), the time when the OW gets completely vacated is given by,

As the OW becomes empty, the inventory is dispatched from the RW. The inventory depletion occurs due to the effect of deterioration. Therefore the inventory level in RW in the interval (0, t1) with boundary condition Wr (0) = L is,

For the time interval (t1, t2), the inventory level is obtained as

And using the boundary condition Wr(t2) = 0, the time when the RW gets completely vacated is given by

At t = t2 the inventory in both the warehouses exhausts completely, and shortages start building up during the interval t2 to T. As assumed, some fraction of deficiencies that are \({e}^{-H\left(T-t\right)}\) and the remaining are lost. Hence the backlogging during the interval (t2,T) with boundary condition Z(t2) = 0 is given by

Now the Present value of various costs during the interval 0 to T is found. These are as follows: (See Appendix C for expressions and solutions of Eqs. (15–22)).

-

(a)

Present value of the ordering cost

$$CO=ordering\ cost\ per\ order$$(15) -

(b)

Present value of the holding cost in RW is

$$\begin{array}{l}{CH}_{RW}=holding\ cost\ in\ RW\ during\left(0,{t}_{1}\right)\\\qquad\qquad+\;holding\ cost\ in\ RW\ during\ \left({t}_{1},{t}_{2}\right)\\\qquad\qquad-\;cost\ of\ emission\ in\ RW\ during\ \left(0,{t}_{1}\right)\\\qquad\qquad-\;cost\ of\ emission\ in\ RW\ during\ ({t}_{1},{t}_{2})\end{array}$$(16) -

(c)

Present value of the holding cost in OW is

$$\begin{array}{l}{CH}_{OW}=holding\ cost\ in\ OW\ during\ \left(0,{t}_{L}\right)\\\qquad\qquad+\;holding\ cost\ in\ OW\ during\ \left({t}_{L},{t}_{o}\right)\\\qquad\qquad+\;holding\ cost\ in\ OW\ during\ \left({t}_{o},{t}_{1}\right)\\\qquad\qquad-\;cost\ of\ emission\ in\ OW\ during\ \left(0,{t}_{L}\right)\\\qquad\qquad-\;cost\ of\ emission\ in\ OW\ during\ \left({t}_{L},{t}_{o}\right)\\\qquad\qquad-\;cost\ of\ emission\ in\ OW\ during\ ({t}_{o},{t}_{1})\end{array}$$(17) -

(d)

Present value of backlogging cost is

$$SC=backlogging\ cost\ during\ the\ time\ interval\ ({t}_{2},T)$$(18) -

(e)

Present value of opportunity cost owing to lost sale is

$$OP=opportunity\ cost\ during\ the\ time\ interval\ \left({t}_{2},T\right)$$(19) -

(f)

Present value of the purchasing cost is

$$PC=\left(Purchasing\ cost/item\right)\times quantity\ per\ replenishment$$(20) -

(g)

Present value of the sales revenue is

$$\begin{array}{l}SR=unit\ selling\ price(demand\ during\ \left(0,{t}_{L}\right)\\\quad\quad\;\;+\;demand\ during\ \left({t}_{L},{t}_{o}\right)\\\quad\quad\;\;+\;demand\ during\ \left({t}_{o},{t}_{1}\right)\\\quad\quad\;\;+\;demand\ during\ \left({t}_{1},{t}_{2}\right)\\\quad\quad\;\;+\;demand\ during\ ({t}_{2},T)\end{array}$$(21)

The average profit in the complete cycle (0,T) is given by,

Solution technique

The aim is to maximize the total profit with the following conditions (Rana et al. 2021b):

Algorithm for scenario 1

The following algorithm is adopted to solve the profit equation using MATLAB® software.

-

Step 1: Initialize the input parameters.

-

Step 2: Initialize the number of items entering the inventory system [WF] and selling price per unit of item [b].

-

Step 3: Input value of \({P}_{F}\) and b. For example \(\left[182\le {P}_{F}\le 200\right]\) and [\(15\le b\le 30\)].

-

Step 4: Execute step 5 to step 11 for all the values of ‘i', here 1 ≤ i ≤ length (b).

-

Step 5: Execute Step 6 to Step 11 for all values of 'j,' here 1 ≤ j ≤ length (PF,).

-

Step 6: Calculate the number of items stored in RW L (j).

-

Step 7: Calculate the demand rate D(i, j).

-

Step 8: Calculate the inventory at any time t in RW & OW.

-

Step 9: Calculate \({t}_{1}\left(i,j\right)\) and \({t}_{2}\left(i,j\right)\).

-

Step 10: Calculate sales revenue and costs.

-

Step 11: Calculate the average profit.

-

Step 12: Identify the maximum average profit.

-

Step 13: Identify the number of goods in the system and the price per unit resembling the most significant average profit value (Fig. 4).

4.2 Model for Scenario 2

Scenario 2 focuses upon the time interval (0, T). Here the quantity ordered is WF (WF = PF + D (T-t2)) upon which the PF quantity enters into the inventory systems after meeting all the backlogs D (T-t2). The quantity PF enters into the inventory systems upon which the U units are kept in an OW and the remaining L = PF-U units kept in an RW. From 0 to tL, the quantity in OW gets reduced due to the combined effect of demand and deterioration., i.e., \(D\left(b,Q,\theta \right)={D}_{o}-Q\theta\). The Demand D(b, Q, θ) is given as

The graphical representation of scenario 1 has been shown in Fig. 5.

The governing equation of the inventory depletion in both the warehouses is given by

With boundary condition, Wo(0) = U, the inventory level during (0, tL) is given by

We consider the function D(b, Q, θ) is continuous in the time interval (0, T). Therefore during (tL, t1) the inventory level is given as

Using boundary condition \({W}_{o}\left({t}_{1}\right)\)=0, when the OW gets completely vacated is given by,

As the OW becomes empty, the inventory is dispatched from the RW. The inventory depletion occurs due to the effect of deterioration. Therefore the inventory level in RW in the interval (0, t1) with boundary condition Wr (0) = L is

For the time interval (t1,to), the inventory level is obtained as

During (t2, to), the inventory level is given as

And using the boundary condition Wr(t2) = 0, the time when the RW gets completely vacated is given by

At t = t2 the inventory in both the warehouses exhausts completely, and shortages start building up during the interval t2 to T. As assumed, some fraction of shortages that are \({e}^{-H\left(T-t\right)}\) is backlogged exempting the remainings are lost. Hence the backlogging during the interval (t2,T) with boundary condition Z(t2) = 0 is given by

Now the present value of various costs during the interval 0 to T are determined as follows; (See Appendix D for expressions and solutions of Eqs. (33–40)).

-

(a)

Present value of the ordering cost is

$$CO=ordering\ cost\ per\ order$$(33) -

(b)

Present value of the holding cost in RW is

$$\begin{array}{l}{CH}_{RW}=holding\ cost\ in\ RW\ during\ \left(0,{t}_{1}\right)\\\qquad\qquad+\;holding\ cost\ in\ RW\ during\ \left({t}_{1},{t}_{o}\right)\\\qquad\qquad+\;holding\ cost\ in\ RW\ during\ \left({t}_{o},{t}_{2}\right)\\\qquad\qquad-\;emission\ cost\ in\ RW\ during\ \left(0,{t}_{1}\right)\\\qquad\qquad-\;emission\ cost\ in\ RW\ during\ \left({t}_{1},{t}_{o}\right)\\\qquad\qquad-\;emission\ cost\ in\ RW\ during\ ({t}_{o},{t}_{2})\end{array}$$(34) -

(c)

Present value of the holding cost in OW is

$$\begin{array}{l}{CH}_{ow}=holding\ cost\ in\ OW\ during\ \left(0,{t}_{L}\right)\\\qquad\qquad+\;holding\ cost\ in\ OW\ during\ \left({t}_{L},{t}_{1}\right)\\\qquad\qquad-\;emission\ cost\ in\ OW\ during\ \left(0,{t}_{L}\right)\\\qquad\qquad-\;emission\ cost\ in\ OW\ during\ ({t}_{L},{t}_{1})\end{array}$$(35) -

(d)

Present value of backlogging cost is

$$SC=backlogging\ cost\ during\ the\ time\ interval\ ({t}_{2},T)$$(36) -

(e)

Present value of opportunity cost owing to lost sale is

$$OP=opportunity\ cost\ during\ the\ time\ interval\ \left({t}_{2},T\right)$$(37) -

(f)

Present value of the purchasing cost is

$$PC=\left(Purchasing\ cost/item\right)\times quantity\ per\ replenishment$$(38) -

(g)

Present value of the sales revenue is

$$\begin{array}{l}SR=unit\ selling\ price(demand\ during\ \left(0,{t}_{L}\right)\\\quad\quad\;\;+\;demand\ during\ ({t}_{L},{t}_{1})\\\quad\quad\;\;+\;demand\ during\ ({t}_{1},{t}_{o})\\\quad\quad\;\;+\;demand\ during\ ({t}_{o},{t}_{2})\\\quad\quad\;\;+\;demand\ during\ ({t}_{2},T))\end{array}$$(39)

The total profit in the complete cycle (0, T) is given by,

4.2.1 Solution technique

The aim is to maximize the total profit, therefore,

The profit maximization is done using MATLAB software (Rana et al. 2021a) (Fig. 6). The algorithm for this is given in Sect. 4.1.

4.3 Numerical Illustration of the scenarios

This section explains the change in average profit caused due to demand disruption. The input parameters provided here has been derived from the past literature works of (Jaggi, et al. 2015; Rana et al. 2021a; Mishra et al. 2020).

Input parameters

\(k=200000\), \(e=2\), \(\Delta d=120\), \(\Delta {d}_{1}=80\), \(E=150\), \(U=100\), \(X=1\), \(Y=1\), \(R=0.06\), \(T=3\), \(H=0.05\), \(J=2\), \(B=12\), \({A}_{c}=60\), \({e}_{2}=4\), \(f=0.6\), \(\Delta=0.2\), \({e}_{3}=3\), \(u=40\), \(V=60\), \(\beta =0.33\), \(M=900\), \(\alpha=0.2\), \(j=0.8\), \(C=1.6\)

Output parameters for Scenario 1

\(\left({t}_{L}=0.2,{t}_{O}=0.5\right)\), \({t}_{1}=0.5\), \({t}_{2}=0.80\), \(b=30\), \({W}_{F}=264.61\), \({P}_{F}=182\), \(Profit=833.53\)

Output parameters for Scenario 2

\(\left({t}_{L}=0.2,{t}_{O}=0.7\right)\), \({t}_{1}=0.65\), \({t}_{2}=0.96\), \(b=30\), \({W}_{F}=236.76\), \({P}_{F}=182\), \(Profit=591.54\)

For the analysis of the model, the output parameters for both scenarios are as follows. The time for complete depletion of items in OW and RW is represented by t1 and t2 selling price of the items by b, quantity per replenishment by WF, the maximum stock level at the beginning of the cycle by PF, and finally, the average profit by ‘profit’. When comparing the scenarios, the profit in scenario 1 is more than scenario 2 since the quantity per replenishment (WF) is more in scenario 1 than in scenario 2 (WF in Scenario 1: 264.61, Scenario 2: 236.76). The difference in the replenishment quantity is due to the backlogging rate, which is more in scenario 1. So due to the shorter lockdown duration (Scenario 1: 0.3(to-tL) compared to Scenario 2: 0.5(to-tL)), the time for complete depletion of good in OW and RW t2 in less in scenario 1 than 2 (t2 in Scenario 1: 0.80 and Scenario 2: 0.96) and due to fixed cycle time, the quantity backlogged in scenario 1 becomes more and hence more profit. Apart from this, after clearing all the "PF" backlogs, the warehoused items are the same in both scenarios. Additionally, this difference in profit is due to the rise in the holding cost. The holding cost includes the freshness keeping efforts applied on the items, and freshness keeping effort is proportional to emission cost, as per the assumption. As the lockdown period is smaller in scenario 1, the amount of freshness keeping effort required is less, resulting in lower emission cost. This is a FIFO model, where good is first stored in OW, and after complete depletion of goods in OW, the items get evacuated from RW. In scenario 1, the lockdown period starts (tL). It ends (to), when the items were depleting from OW (Do-Qθ-Δd), the RW does not face the lockdown scenario despite that it experiences the panic buying behavior of the customers in which the demand suddenly increases (Do –Qθ + Δd1). Due to a sudden increase in demand (Δd1), the depletion rate in RW increases, hence the storage duration (t2) of items in RW decreases, and the duration of application of freshness keeping effort decreases. Resulting in a decrease in the holding cost in RW (CHRW) and an increase in average profit (AP). In scenario 2, due to longer lockdown period (lockdown period, Scenario 1: 0.3 (to-tL) and Scenario 2: 0.5(to-tL)), the latter part of the OW (t1-tL) and initial part of the RW (to-t1) experiences the lockdown. As the RW experiences the lockdown, therefore the storage duration of items in RW(t2) increases, increasing freshness keeping effort, increase in holding cost(CHRW) and decrease in average profit, as shown in the numerical example (profit in Scenario 1: 833.53 and Scenario 2: 591.54). From this example, the difference in t2 – t1 is more in scenario 2 than 1, proving that items are stored for a greater time in RW. Though OW and RW experience the costs associated with freshness keeping effort, the costs of RW prove to be a game-changer because the holding cost per unit item per time in RW(Y/item/time) is greater than of OW(X/item/time), as per the assumptions. The consideration of carbon cap and trade tax imposed upon the warehouses for reducing carbon emission associated with freshness keeping effort is important as it brings sustainability issue in the mathematical model.

A detailed explanation of all the input and output parameters is shown in Sect. 5 (sensitivity analysis). The numerical example provides optimum selling price values and inventory levels, as depicted in Figs. 4 and 6. In addition, the numerical analysis helps us answer all five research questions as asked in Sect. 2.

5 Sensitivity analysis

Sensitivity analysis examines the model behavior by using different parameters such as holding (X) cost in OW, and RW (Y), discounted rate of inflation (R), scaling parameter of demand (K), price elasticity (e), deterioration rate (θ), the efficiency of green technology(j), carbon tax(β) and capital invested in greener technology (C).

-

Table 2 shows that for scenarios 1 and 2, keeping the holding cost in OW constant and increasing the holding cost of RW, there is a decrease in profit. When the holding cost of RW is kept constant and increasing the holding cost of OW, then there is a decrease in profit.

-

A threshold point in Table 2 denotes the shift of higher value of average profit from scenarios 1 to 2 amid the lockdown.

-

From Table 3, for Scenarios 1 & 2, as the scaling parameter increases, keeping price elasticity constant, there is an increase in ordering quantity; hence, the profit increases. Conversely, when the price elasticity increases, keeping the scaling parameter stable, there is a decrease in order quantity; thus, the profit decreases.

-

It is recommended from Table 3 that price w.r.t demand should be more elastic to mitigate the problem caused due to the increased lockdown period.

-

The backlogging parameter decreases or increases in backlogging rate, the profit increases. As seen in Table 4 scenarios 1 & 2.

-

The backlogging rate should be lower as higher backlogging does not make any notable difference in profit caused due to increases in the lockdown period.

-

In scenarios 1 & 2 of Table 5, the net discounted rate of inflation increases than a decrease in profit. This happens because inflation results in a reduction in customers' purchasing behavior.

-

In scenario 1, when the deterioration rate increases, there is a slight increase in order quantity but the profit decreases. As the order quantity increases, the carbon tax also increases, and hence profit decreases. Still, in scenario 2, there is a slight increase in order quantity and profit due to a decrease in carbon tax as the firm adopts green technology (Table 6).

-

From scenarios 1 & 2 of Table 7, it is seen that as the carbon tax increase, the profit decreases for the same order quantity. The increase in carbon tax significantly affects scenario 2 as it has a more extended lockdown period, as shown in Table 7.

-

The effect of efficiency of green technology w.r.t profit is shown in Table 8. In scenarios 1 & 2 of Table 8, for the same order quantity, an increase in the efficiency of green technology increases the average profit.

-

The capital invested in greener technologies w.r.t profit is shown in Table 9. In scenario 1 & 2 of Table 9, an increase in capital invested in greener technologies helps in increasing the average profit.

-

6 Discussion

As per the sensitivity analysis presented in Tables 2–9, the average profit of an organization is majorly affected due to the demand disruption period. In the disrupted period, the depletion rate of items in the warehouse decreased that compels the warehouses to lay additional freshness keeping effort upon the inventory items resulting in a surge in the carbon tax and a decrease in average profit–the outcomes of the present study help in obtaining specific theoretical and managerial implications as follows.

6.1 Implication for theory

This section explains the proposed models' contribution to the operation management of two warehouses during the pandemic lockdown period. First, the outbreak of the Covid-19 virus forced the Governments to impose certain restrictions on the movement of people; such limits led to a significant decrease in demand for foods items by a finite volume (Δd) due to which the average profit declines, as shown in Fig. 7c-d. Conversely, as the spread of infection is under control, the lockdown-like restrictions have eased that trigger the panic buying of the foods items with the fear of its unavailability during post-pandemic scenarios. This leads to a demand shock by a finite volume Δd1, and the firm’s average profit increases, as shown in Fig. 8e-f. Additionally, such an unforeseen increase in demand after lockdown results in the inventory build-up as the unfulfilled demands of the customer are backlogged. The backlogging parameter decreases the average profit as it depends upon the waiting time of the customers, as shown in Fig. 7a-b. During the lockdown period, the organization's primary challenge is maintaining the quality of the food items by increasing the freshness keeping effort. Due to this, the emission of carbon increases, followed by a carbon tax as per Fig. 8e-f. As shown in Table 9, certain investments can be made in green technology solutions to minimize carbon emission and maximize productivity. Examples of such solutions are solar panels, LED lighting, air separators, heat pump, rainwater recovery, CO2 for cooling, IOT based energy optimization technologies, etc. The reduction in carbon emission caused due to green technology investment helps the organization increase its average profit (Fig. 8c-d). Further, the cycle time should be less, as a slight increase in it can drastically increase carbon emissions as shown in Fig. 7g and decrease the average profit as presented in Fig. 8a-b.

6.2 Implications for manager

The findings from the proposed model provide important implications for the managers that may assist in developing a sustainable business environment amid pandemic-driven disruptions. First, the model suggests controlling the holding cost wisely according to the order quantity. A rise or decline in holding charges in OW and RW can give a threshold point at which the average profit decreases irrespective of the lockdown period. The price elasticity increases the order quantity but reduces the average profit. The reduction in profit is caused due to increase in order quantity which increases carbon emissions and hence the emission cost. Therefore in an extended lockdown period, it is recommended by the model to minimize the order quantity as per the constant price elasticity of demand. The backlogging should be minimum as the increase in backlogging does not significantly increase average profit.

Additionally, carbon emission should be kept at a minimum in an extended lockdown period, as it drastically decreases the average profit. Finally, the capital investment that helps achieve greener technology's efficiency should be kept as low as possible. Unfortunately, though this factor helps reduce the emission cost, it fails to make any significant difference in average profit due to such a devastating lockdown-like scenario.

6.3 Limitations and further research directions

The proposed models deal with certain limitations such as, these models will work only when; the lockdown period is shorter than the cycle time; a single type of inventory is stored in warehouses OW and RW; the deterioration rate of the item is constant; carbon emission is from inventory stored in warehouses only OW and RW; the dispatching policy is FIFO. However, this study gives bounteous opportunities for future research work. For example, these models can be studied with other inventory parameters like variable deterioration rates such as Weibull distributed deterioration and numerous demand patterns such as deterministic and probabilistic demands. Further, the effect of cross perishability, trade credit, and LIFO dispatching policy can be studied by incorporating such parameters into the present models. The amalgamations of these parameters will give a more realistic approach to this study, and hence the organization can become more capable of dealing with disruptions and shocks.

7 Conclusion

This paper presents a study of the perishable inventory model under the Covid-19 pandemic like disruption, carbon cap, trade policy, and backlogging. In this study, two scenarios have been considered with different lockdown periods. This study finds critical insights: as the lockdown period increases, the cost of maintaining the perishable goods in the warehouse increases, and the profit decreases. The increase in the cost is due to the increases in preservation effort as the products are kept in the warehouse for a more extended period. The preservation effort is increased to keep the deterioration rate under control. As the preservation effort increases, the requirement of power also increases, due to which the carbon tax increases and hence the profit decreases. In scenario 1 the carbon tax imposed is less because of the shorter lockdown period; therefore, the preservation effort is insignificant. In scenario 2 the carbon tax imposed is more due to the extended lockdown period; hence the profit decreases. The carbon tax plays a decisive role in this study; the profit margin mainly depends upon the amount of carbon emitted by the warehouses. Therefore, the warehouses should reduce carbon emissions by investing in greener technologies.

References

Abhishek BV, Gupta P, Kaushik M, Kishore A, Kumar R, Verma S (2020) India’s food system in the time of covid-19. Econ Pol Wkly 55(15):12–14.

Akter S (2020) The impact of COVID-19 related ‘stay-at-home’ restrictions on food prices in Europe: findings from a preliminary analysis. Food Secur 12(4):719–725. https://doi.org/10.1007/s12571-020-01082-3

Amjath-Babu TS, Krupnik TJ, Thilsted SH, McDonald AJ (2020) Key indicators for monitoring food system disruptions caused by the COVID-19 pandemic: Insights from Bangladesh towards effective response. Food Secur 12(4):761–768. https://doi.org/10.1007/s12571-020-01083-2

Armantier O, Koşar G, Pomerantz R, Skandalis D, Smith K, Topa G, van der Klaauw W (2021) How economic crises affect inflation beliefs: Evidence from the Covid-19 pandemic. J Econ Behav Organ 189:443–469. https://doi.org/10.1016/j.jebo.2021.04.036

Baveja A, Kapoor A, Melamed B (2020) Stopping Covid-19: A pandemic-management service value chain approach. Ann Oper Res 289(2):173–184. https://doi.org/10.1007/s10479-020-03635-3

Bochtis D, Benos L, Lampridi M, Marinoudi V, Pearson S, Sørensen CG (2020) Agricultural Workforce Crisis in Light of the COVID-19 Pandemic. Sustainability. https://doi.org/10.3390/su12198212

Bracale R, Vaccaro CM (2020) Changes in food choice following restrictive measures due to Covid-19. Nutr Metab Cardiovasc Dis 30(9):1423–1426. https://doi.org/10.1016/j.numecd.2020.05.027

Brinca P, Duarte JB, Faria-e-Castro M (2020) Is the COVID-19 pandemic a supply or a demand shock? Econ Synop 31. https://doi.org/10.20955/es.2020.31

Cappelli A, Cini E (2020) Will the COVID-19 pandemic make us reconsider the relevance of short food supply chains and local productions? Trends Food Sci Technol 99:566–567. https://doi.org/10.1016/j.tifs.2020.03.041

Chiaramonti D, Maniatis K (2020) Security of supply, strategic storage and Covid19: Which lessons learnt for renewable and recycled carbon fuels, and their future role in decarbonizing transport? Appl Energy 271:115216. https://doi.org/10.1016/j.apenergy.2020.115216

Chowdhury P, Paul SK, Kaisar S, Moktadir MA (2021) COVID-19 pandemic related supply chain studies: A systematic review. Transp Res E Logist Transp Rev. https://doi.org/10.1016/j.tre.2021.102271

Deaton BJ, Deaton BJ (2020) Food security and Canada’s agricultural system challenged by COVID-19. Can J Agric Econ 68(2):143–149. https://doi.org/10.1111/cjag.12227

Di Vaio A, Boccia F, Landriani L, Palladino R (2020) Artificial Intelligence in the Agri-Food System: Rethinking Sustainable Business Models in the COVID-19 Scenario. Sustainability. https://doi.org/10.3390/su12124851

Eger L, Komárková L, Egerová D, Mičík M (2021) The effect of COVID-19 on consumer shopping behaviour: Generational cohort perspective. J Retail Consum Serv 61:102542. https://doi.org/10.1016/j.jretconser.2021.102542

Ellison B, McFadden B, Rickard BJ, Wilson NL (2020) Examining Food Purchase Behavior and Food Values During the COVID-19 Pandemic. Appl Econ Perspect Policy. https://doi.org/10.1002/aepp.13118

FAO (2019) COVID-19 Pandemic–Impact on Food and Agriculture. Retrieved from http://www.fao.org/2019-ncov/q-and-a/impact-on-food-and-agriculture/en/. Accessed 10 Jul 2020

Fortuna G, Foote N (2020) Seasonal workers, CAP and COVID-19, Farm to Fork. Retrieved from https://www.euractiv.com/section/agriculture-food/news/seasonal-workers-cap-and-covid-19-farm-to-fork/. Accessed 15 May 2020

Gelles D (2020) How to Ship a Vaccine at –80°C, and Other Obstacles in the Covid Fight. The New Yorks Times. Retrieved from https://nyti.ms/32HOf8S. Accessed 1 Jan 2021

Ghosh A, Nundy S, Mallick TK (2020) How India is dealing with COVID-19 pandemic. Sensors Int 1:100021. https://doi.org/10.1016/j.sintl.2020.100021

Govindan K, Mina H, Alavi B (2020) A decision support system for demand management in healthcare supply chains considering the epidemic outbreaks: A case study of coronavirus disease 2019 (COVID-19). Transp Res E Logist Transp Rev 138:101967. https://doi.org/10.1016/j.tre.2020.101967

Guan D, Wang D, Hallegatte S, Davis SJ, Huo J, Li S, Gong P (2020) Global supply-chain effects of COVID-19 control measures. Nat Hum Behav 4(6):577–587. https://doi.org/10.1038/s41562-020-0896-8

Gunessee S, Subramanian N (2020) Ambiguity and its coping mechanisms in supply chains lessons from the Covid-19 pandemic and natural disasters. Int J Oper Prod Manag 40(7/8):1201–1223. https://doi.org/10.1108/IJOPM-07-2019-0530

Hertog MLATM, Uysal I, McCarthy U, Verlinden BM, Nicolaï BM (2014) Shelf life modelling for first-expired-first-out warehouse management. Philos Trans Ser A Math Phys Eng Sci 372(2017):20130306. https://doi.org/10.1098/rsta.2013.0306

Hobbs JE (2020) Food supply chains during the COVID-19 pandemic. Can J Agric Econ 68(2):171–176. https://doi.org/10.1111/cjag.12237

Id GMMA, Khatun MN (2021) Impact of COVID-19 on vegetable supply chain and food security : Empirical evidence from Bangladesh. PLoS ONE 16(3):1–12. https://doi.org/10.1371/journal.pone.0248120

Ivanov D, Dolgui A (2021) OR-methods for coping with the ripple effect in supply chains during COVID-19 pandemic: Managerial insights and research implications. Int J Prod Econ 232:107921. https://doi.org/10.1016/j.ijpe.2020.107921

Iyer P (2020) With strong partnerships across the country, there has been steady improvement in supply chains of essential goods. Retrieved from https://indianexpress.com/article/opinion/columns/coronavirus-lockdown-effect-migrant-labour-essential-goods-stocks-supply-6397380/. Accessed 20 Jun 2020

Jaggi CK, Pareek S, Khanna A, Sharma R (2015) Two-warehouse inventory model for deteriorating items with price-sensitive demand and partially backlogged shortages under inflationary conditions. Int J Ind Eng Comput 6(1):59–80. https://doi.org/10.5267/j.ijiec.2014.9.001

Jámbor A, Czine P, Balogh P (2020) The Impact of the Coronavirus on Agriculture: First Evidence Based on Global Newspapers. Sustainability. https://doi.org/10.3390/su12114535

Kaipia R, Dukovska-Popovska I, Loikkanen L (2013) Creating sustainable fresh food supply chains through waste reduction. Int J Phys Distrib Logist Manag 43(3):262–276. https://doi.org/10.1108/IJPDLM-11-2011-0200

Končar J, Marić R, Vukmirović G, Vučenović S (2021) Sustainability of Food Placement in Retailing during the COVID-19 Pandemic. Sustainability. https://doi.org/10.3390/su13115956

Leite H, Lindsay C, Kumar M (2021) COVID-19 outbreak: implications on healthcare operations. The TQM Journal 33(1):247–256. https://doi.org/10.1108/TQM-05-2020-0111

Li D, Wang X, Chan HK, Manzini R (2014) Sustainable food supply chain management. Int J Prod Econ 152:1–8. https://doi.org/10.1016/j.ijpe.2014.04.003

Lusk JL, Briggeman BC (2009) Food Values. Am J Agr Econ. https://doi.org/10.1111/j.1467-8276.2008.01175.x

Majumdar A, Shaw M, Sinha SK (2020) COVID-19 debunks the myth of socially sustainable supply chain: A case of the clothing industry in South Asian countries. Sustainable Production and Consumption 24:150–155. https://doi.org/10.1016/j.spc.2020.07.001

Mena C, Adenso-Diaz B, Yurt O (2011) The causes of food waste in the supplier–retailer interface: Evidences from the UK and Spain. Resour Conserv Recycl 55(6):648–658. https://doi.org/10.1016/j.resconrec.2010.09.006

Mishra U, Wu JZ, Sarkar B (2020) A sustainable production-inventory model for a controllable carbon emissions rate under shortages. J Clean Prod 256:120268. https://doi.org/10.1016/j.jclepro.2020.120268

Mor RS, Srivastava PP, Jain R, Varshney S, Goyal V (2020) Managing Food Supply Chains Post COVID-19: A Perspective. Int J Supply Oper Manag 2(75):295–298. https://doi.org/10.22034/IJSOM.2020.3.7

Naidoo R, Fisher B (2020) Reset sustainable development goals for a pandemic world. Retrieved from https://www.nature.com/articles/d41586-020-01999-x. Accessed 30 Jul 2020

Nozari H, Tavakkoli-Moghaddam R, Gharemani-Nahr J (2022) A Neutrosophic Fuzzy Programming Method to Solve a Multi- Depot Vehicle Routing Model under Uncertainty during the COVID-19 Pandemic. Int J Eng Trans B Appl 35(2):360–371. https://doi.org/10.5829/ije.2022.35.02b.12

Overby J, Rayburn M, Hammond K, Wyld DC (2004) The China Syndrome: the impact of the SARS epidemic in Southeast Asia. Asia Pac J Mark Logist 16(1):69–94. https://doi.org/10.1108/13555850410765131

Pani A, Mishra S, Golias M, Figliozzi M (2020) Evaluating public acceptance of autonomous delivery robots during COVID-19 pandemic. Transp Res D Transp Environ 89:102600. https://doi.org/10.1016/j.trd.2020.102600

Pothan PE (2020) Local food systems and COVID-19; A glimpse on India’s responses. Food and Agriculture Organization of the United Nations. Retrieved from http://www.fao.org/in-action/food-for-cities-programme/news/detail/en/c/1272232/. Accessed 20 May 2020

Qiu W, Rutherford S, Mao A, Chu C (2017) The pandemic and its impacts. Health Cult Soc 9:1–11. https://doi.org/10.5195/hcs.2017.221

Quayson M, Bai C, Osei V (2020) Digital Inclusion for Resilient Post-COVID-19 Supply Chains: Smallholder Farmer Perspectives. IEEE Eng Manage Rev 48(3):104–110. https://doi.org/10.1109/EMR.2020.3006259

Rana RS, Kumar D, Mor RS, Prasad K (2021a) Modelling the impact of demand disruptions on two warehouse perishable inventory policy amid COVID-19 lockdown. Int J Log Res Appl. https://doi.org/10.1080/13675567.2021.1892043

Rana RS, Kumar D, Prasad K (2021b) Two warehouse dispatching policies for perishable items with freshness efforts, inflationary conditions and partial backlogging. Oper Manag Res. https://doi.org/10.1007/s12063-020-00168-7

Richards G (2017) Warehouse management: a complete guide to improving efficiency and minimizing costs in the modern warehouse, 3rd edn. Kogan Page Publishers, Great Britain and United States

Richards TJ, Rickard B (2020) COVID-19 impact on fruit and vegetable markets. Can J Agric Econ 68(2):189–194. https://doi.org/10.1111/cjag.12231

Shan H, Zhang P (2004) Viral attacks on the blood supply: the impact of severe acute respiratory syndrome in Beijing. Transfusion 44(4):467–469. https://doi.org/10.1111/j.0041-1132.2004.04401.x

Sharma D, Singh A, Kumar A, Mani V, Venkatesh VG (2021) Reconfiguration of food grain supply network amidst COVID-19 outbreak: an emerging economy perspective. Ann Oper Res. https://doi.org/10.1007/s10479-021-04343-2

Sharma HB, Vanapalli KR, Cheela VRS, Ranjan VP, Jaglan AK, Dubey B, Bhattacharya J (2020) Challenges, opportunities, and innovations for effective solid waste management during and post COVID-19 pandemic. Resour Conserv Recycl 162:105052. https://doi.org/10.1016/j.resconrec.2020.105052

Singh S, Kumar R, Panchal R, Tiwari MK (2020) Impact of COVID-19 on logistics systems and disruptions in food supply chain. Int J Prod Res. https://doi.org/10.1080/00207543.2020.1792000

Sterman JD, Dogan G (2015) “I’m not hoarding, I’m just stocking up before the hoarders get here”.: Behavioral causes of phantom ordering in supply chains. J Oper Manag 39–40:6–22. https://doi.org/10.1016/j.jom.2015.07.002

Toffolutti V, Stuckler D, McKee M (2020) Is the COVID-19 pandemic turning into a European food crisis? Eur J Pub Health 30(4):626–627. https://doi.org/10.1093/eurpub/ckaa101

Vikram K (2020) 1,550 tonnes food grains wasted at FCI godowns during lockdown, says government data. The New India Express. Retrieved from https://www.newindianexpress.com/nation/2020/oct/05/1550-tonnes-food-grains-wasted-at-fcigodowns-during-lockdown-says-government-data-2205893.html. Accessed 27 Oct 2020

WTO (2020) Trade set to plunge as COVID-19 pandemic upends global economy. Retrieved from https://www.wto.org/english/news_e/pres20_e/pr855_e.htm. Accessed 15 Apr 2020

Yang S, Xiao Y, Kuo Y-H (2017) The Supply Chain Design for Perishable Food with Stochastic Demand. Sustainability. https://doi.org/10.3390/su9071195

Yang Y, Chi H, Zhou W, Fan T, Piramuthu S (2020) Deterioration control decision support for perishable inventory management. Decis Support Syst 134:113308. https://doi.org/10.1016/j.dss.2020.113308

Yuen KF, Wang X, Ma F, Li KX (2020) The Psychological Causes of Panic Buying Following a Health Crisis. Int J Environ Res Public Health. https://doi.org/10.3390/ijerph17103513

Zhu Q, Krikke H (2020) Managing a Sustainable and Resilient Perishable Food Supply Chain (PFSC) after an Outbreak. Sustainability. https://doi.org/10.3390/su12125004

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Appendix B

Appendix C

With reference to Eqs. (6–14).

During time interval (0, tL) the OW follows the differential equation

During time interval (tL,to), the OW follows the differential equation

During time interval (to,t1), the OW follows the differential equation

During time interval (0,t1), the RW follows the differential equation

Durring time interval (t2,t1), the OW follows the differential equation

During time interval (t2,T), the backlogging follows the differential equation

The present value of various costs are follows. (With reference to Eqs. (15–22)).

Upon solving \({{\varvec{C}}{\varvec{H}}}_{{\varvec{R}}{\varvec{W}}}\), the solution becomes.

Upon solving \({{\varvec{C}}{\varvec{H}}}_{{\varvec{O}}{\varvec{W}}}\), the solution becomes.

For \({CE}_{1},{CE}_{2},{CE}_{3},{CE}_{4}\) and \({CE}_{5}\) see Appendix A

\({\boldsymbol{SC}}={{\int^{T}_{{t}_{2}}}}-J{e}^{-Rt}\left(Z\left(t\right)\right)dt\), upon solving SC, the solution becomes

\({\boldsymbol{OP}}={e}^{-RT}{{\int^{T}_{{t}_{2}}}}{J}_{L}{D}_{o}\left(1-{e}^{-H\left(T-t\right)}\right)dt\), upon solving OP, the solution becomes

\({\varvec{P}}{\varvec{C}}=B{W}_{F}\), upon solving PC, the solution becomes

Upon solving SR, the solution becomes

\({\varvec{A}}{\varvec{P}}\left({\varvec{b}},{{\varvec{P}}}_{{\varvec{F}}}\right)=\frac{1}{T}\left(SR-OC-{CH}_{RW}-{CH}_{OW}-SC-OP-PC\right),\) substituting the values, the expression becomes

Appendix D

With reference to Eqs. (24–32)

During time interval (0, tL) the OW follows the differential equation

During time interval (tL,t1), the OW follows the differential equation

During time interval (0,t1), the RW follows the differential equation

During time interval (t1,to), the RW follows the differential equation

During time interval (to,t2), the RW follows the differential equation

During time interval (t2,T), the backlogging follows the differential equation

The present value of various costs are follows. (With reference to Eqs. (33–40))

\({\boldsymbol{CH}}_{\boldsymbol{RW}}={{\int^{{t}_{1}}_{0}}}X{e}^{-Rt}{W}_{r}\left(t\right)dt+{{\int^{{t}_{o}}_{{t}_{1}}}}X{e}^{-Rt}{W}_{r}\left(t\right)dt+{{\int^{{t}_{2}}_{{t}_{o}}}}X{e}^{-Rt}{W}_{r}\left(t\right)dt-{{\int^{{t}_{1}}_{0}}}\beta \left(M-{CE}_{1}\left(1-\alpha \left(1-{e}^{jC}\right)\right)\right)dt-{{\int^{{t}_{0}}_{{t}_{1}}}}\beta \left(M-{CE}_{2}\left(1-\alpha \left(1-{e}^{jC}\right)\right)\right)dt-{{\int^{{t}_{2}}_{{t}_{o}}}}\beta \left(M-{CE}_{3}\left(1-\alpha \left(1-{e}^{jC}\right)\right)\right)dt\), upon solving \({{\varvec{C}}{\varvec{H}}}_{{\varvec{R}}{\varvec{W}}}\) the solution becomes

\({{\boldsymbol{CH}}}_{{\boldsymbol{OW}}}={{\int^{{t}_{L}}_{o}}}X{e}^{-Rt}{W}_{o}\left(t\right)dt+{{\int^{{t}_{1}}_{{t}_{L}}}}X{e}^{-Rt}{W}_{o}\left(t\right)dt-{{\int^{{t}_{L}}_{0}}}\beta \left(M-{CE}_{4}\left(1-\alpha \left(1-{e}^{jC}\right)\right)\right)dt-{{\int^{{t}_{1}}_{{t}_{L}}}}\beta \left(M-{CE}_{5}\left(1-\alpha \left(1-{e}^{jC}\right)\right)\right)dt\), upon solving \({{\varvec{C}}{\varvec{H}}}_{{\varvec{O}}{\varvec{W}}}\) the solution becomes

For \({CE}_{1},{CE}_{2},{CE}_{3},{CE}_{4} and {CE}_{5}\) see Appendix B.

\({\boldsymbol{SC}}={{\int^{T}_{{t}_{2}}}}-J{e}^{-Rt}\left(Z\left(t\right)\right)dt\), upon solving SC the solution becomes

\({\boldsymbol{OP}}={e}^{-RT}{{\int^{T}_{{t}_{2}}}}{J}_{L}{D}_{o}\left(1-{e}^{-H\left(T-t\right)}\right)dt\), upon solving OP the solution becomes

\({\varvec{P}}{\varvec{C}}=B{W}_{F}\), upon solving PC, the solution becomes

\({\boldsymbol{SR}}=b\left[{{\int^{{t}_{L}}_{0}}}\left({D}_{o}-Q\theta \right){e}^{-Rt}dt+{{\int^{{t}_{1}}_{{t}_{L}}}}\left({D}_{o}-Q\theta -\Delta d\right){e}^{-Rt}dt+{{\int^{{t}_{o}}_{{t}_{1}}}}\left({D}_{o}-Q\theta -\Delta d\right){e}^{-Rt}dt+{{\int^{{t}_{2}}_{{t}_{0}}}}\left({D}_{o}-Q\theta +\Delta d\right){e}^{-Rt}dt+{{\int^{T}_{{t}_{2}}}}\left({D}_{o}-Q\theta \right){e}^{-RT}{e}^{-H\left(T-t\right)}dt\right]\), upon solving SR, the solution becomes

\({\varvec{A}}{\varvec{P}}\left({\varvec{b}},{{\varvec{P}}}_{{\varvec{F}}}\right)=\frac{1}{T}\left(SR-OC-{CH}_{RW}-{CH}_{OW}-SC-OP-PC\right)\), upon putting the values, the expression becomes

Rights and permissions

About this article

Cite this article

Murmu, V., Kumar, D. & Jha, A.K. Quality and selling price dependent sustainable perishable inventory policy: Lessons from Covid-19 pandemic. Oper Manag Res 16, 408–432 (2023). https://doi.org/10.1007/s12063-022-00266-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12063-022-00266-8