Abstract

There is an ongoing trend of deregulation and integration of electricity markets in Europe and North America. This change in market structure has naturally affected the interaction between agents and has contributed to an increasing commoditization of electric power. This paper focuses on one specific market, the Iberian electricity market (MIBEL). In particular, we assess the persistence of electricity prices in the Iberian market and test whether it has changed over time. We consider each hour of the day separately, that is, we analyze 24 time series of day-ahead hourly prices for Portugal and another 24 series for Spain. We find results consistent with the hypothesis that market integration leads to a decrease in the persistence of the price process. More precisely, the tests detect a break in the memory parameter of most price series around the year 2009, which coincides with a significant increase in the integration of the Portuguese and Spanish markets. The results reinforce the view that market integration has an impact on the dynamics of electricity prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A sound electricity market that meets demand and assures competitive prices is crucial to promote economic growth and sustain social welfare. Electricity is different from other commodities because it is not storable at a commercial large scale. The adjustment of demand and supply must be instantaneous, which causes the resulting market price to be very sensitive to unexpected shocks in the demand or supply schedules. On the supply side, the generation of electricity may be disturbed by many events, including power plants going off-line due to unexpected technical problems, or changes in weather conditions (particularly relevant for wind and solar power generation). On the demand side, the factors that may disturb the consumption of electricity include large changes in temperature.

The effect of such shocks on prices depends on the size of the electric power system. In small isolated systems, any disturbance may lead to a large price change. For example, the loss of one generation unit may lead to a large price increase if the remaining number of available units is relatively small. In contrast, in larger power systems the same shocks should be accommodated more easily. For example, if one power plant becomes unavailable, it is more likely that there will be cheap spare capacity in some of the many other units of a large system. Therefore, the enlargement of the electricity system, through a deeper economic and physical integration of neighboring markets, should lead to prices becoming less sensitive to unexpected shocks in the demand or supply of electricity.

There is an ongoing trend of deregulation and integration of electricity markets in Europe and North America. This change in market structure has naturally affected the interaction between agents and has contributed to an increasing commoditization of electric power. In Europe in particular, as individual national markets move toward a single integrated European market, we should expect, according to our hypothesis, that electricity prices become more resilient to disturbances in the demand or generation functions.

This paper focuses on one specific market, the Iberian electricity market (MIBEL). Portugal and Spain have been liberalizing their electricity sectors since the 1990s. Market coupling between Portugal and Spain started in 2007, with one single exchange (OMIE) centralizing the spot power trading for the two countries. The degree of integration between the two countries has increased since then, that is, prices have become more similar, due to two factors. First, the transmission system operators (REN in Portugal and REE in Spain) have been increasing the physical interconnection capacity between the two countries. Second, there has been an increase in renewable energy generation, which has a less appreciated effect on market integration through the reduction in residual demand. MIBEL has thus been evolving from two mostly independent markets to a strongly integrated single market. Furthermore, MIBEL can be seen as an almost isolated system, as the interconnection capacity between Spain and France represents a very small fraction of the total MIBEL capacity (see also Bosco et al. 2010). It is thus possible to clearly identify the integration stages of MIBEL, which makes this market a good setting to study the effects of market integration on the properties of electricity spot prices. (Sect. 2 provides further details on the structure of MIBEL and discusses these effects in detail).

Herein, we assess the persistence of electricity prices in the Iberian market and test whether it has changed over time. Analyzing the persistence of electricity prices is meaningful in that it helps to understand the impact of shocks to prices. The more persistent the price series is, the longer lasting the effects of shocks will be, thus preventing the series from returning to any defined level. In contrast, if prices are strongly mean reverting, the effects of shocks will fade away quickly. In this respect, there is widespread evidence of long memory in electricity prices (see Weron 2002; Haldrup and Nielsen 2006; Koopman et al. 2007; Alvarez-Ramirez and Escarela-Perez 2010; Haldrup et al. 2010, among others).

Furthermore, it has been observed that economic and financial variables may display changes in persistence, switching from less to more persistent behavior, or vice versa (see, for instance, McConnell and Perez-Quiros 2000; Herrera and Pesavento 2005; Cecchetti et al. 2006; Halunga et al. 2009; Kang et al. 2009; Martins and Rodrigues 2014). In particular, we analyze whether electricity price persistence has changed with the Iberian market integration. According to our hypothesis, as MIBEL becomes more integrated, prices should become less persistent. In a more integrated market, one would expect a faster absorption of shocks which translates in a smaller persistence of prices.

We focus on the persistence of day-ahead electricity price time series by analyzing their memory parameter. We consider each hour of the day separately, that is, we analyze 24 time series of day-ahead hourly prices for Portugal and another 24 series for Spain. By conducting the recently proposed test of Hassler and Meller (2014), we search for breaks in persistence. Bearing in mind that estimation uncertainty is always present in empirical work, we provide confidence intervals for the memory parameter for the periods before and after the break date. Furthermore, as the break date is also not determined with certainty, we extend the approach of Elliott and Müller (2007) to compute confidence intervals for the break date. To the best of our knowledge, this is the first study that formally assesses the presence of a break in the persistence of electricity prices.

We find results consistent with the hypothesis that market integration leads to a decrease in the persistence of the price process. More precisely, the tests detect a break in the memory parameter of most price series around the year 2009, which coincides with a significant increase in the integration of Portuguese and Spanish markets (as described in Sect. 2). The memory parameter decreases from an average value (across all series) of 0.8 before the break date to an average value of 0.45 after the break date. These results constitute strong evidence of a noteworthy reduction in electricity price persistence implying a substantial change in the speed of absorption of shocks to the electricity market. The results reinforce the view that the Iberian market integration had an impact on the way the electricity market operates.

The remainder of the paper is organized as follows. Section 2 provides a detailed description of the Iberian market integration process, Sect. 3 describes the econometric methodology pursued, Sect. 4 discusses the data and the empirical results, and finally, Sect. 5 concludes.

2 Overview of market integration and its impact on price dynamics

The Iberian market (MIBEL) is just one example of a larger trend of market integration. We start by describing this broader context of market integration and the expected impact on the persistence of electricity prices. We then focus on MIBEL, discussing in detail how MIBEL has become more integrated over time. In addition to interconnection capacity, renewables have also played an important role.

2.1 Global trend of electricity market integration

The electricity sectors around the world underwent major changes over the recent past and are still changing. In many countries and regions, well-established monopolies have been progressively replaced by deregulated markets fostering price competition and promoting market transactions and efficiency. At the same time, there has been a trend toward integrating neighboring electricity markets, with the goal of increasing competition and security of supply, and also to accelerate the de-carbonization of the power sector. Integration usually involves a “market coupling” mechanism, which results in the same electricity price in two adjacent markets during the hours when there is enough transmission capacity between the two markets.

One of the first electricity markets to be liberalized was the UK in 1990. The first multinational integrated market, the Nord Pool, was formed by Norway, Sweden, Finland, and Denmark during the 1990s and later joined by the Baltic countries of Estonia, Latvia, and Lithuania. The Central Western European (CWE) region has followed the same trend of deregulation and integration. Market coupling between Belgium, France, and the Netherlands started in 2006, and in 2010 between Germany, Austria, and France. A pan-European market coupling project, the so-called Price Coupling of Regions, has been deployed since 2014, now including most of Northern, Central Western, and Southwestern European countries, and accounting for around 85% of European power consumption.Footnote 1 In fact, the whole European Union is moving toward a single integrated European electricity market.

In the USA, deregulation started in 1992, but has been evolving at different paces across the country. Today, there are several liberalized regional markets, with each market encompassing one or more states. One example of a large competitive integrated market is the PJM Interconnection, which covers 13 states in the East coast plus the District of Columbia.Footnote 2 However, many states still have non-competitive regulated markets, operated by state-owned utilities.

2.2 The potential effect of integration on electricity prices

Our main hypothesis is that when two electricity markets become more integrated, the price series should become less persistent. In other words, shocks to prices should have shorter effects, that is, the memory of the price series should decrease. For an intuitive justification of why this should be the case, consider the following examples.

As a first example, consider the case where a base load power plant unexpectedly goes off-line and becomes unavailable for a few days. In an extreme case with two completely separated markets, this event would lead to a price increase in the affected region due to the more expensive peak units that would have to replace the off-line plant, and this shock to prices would likely persist for several days until the plant is repaired. In the other extreme case of two strongly integrated markets, the lack of one power plant in one region could be cheaply compensated by small ramp ups in several units in the other region. Thus, the price shock would be both smaller and less persistent.

As a second example, consider an abnormal peak in demand and a resulting increase in price. Suppose that this increase in demand requires dispatching a peaking hydropower plant at full capacity over a long period. The water in the reservoir drops to low levels, which leads the plant to withdraw from the market in the following periods to preserve water. In separated markets, the peak-hour prices would likely remain high for some time, as the following peak consumptions would probably have to be met by other less efficient and more expensive peaking units (e.g., diesel generators). In contrast, in a larger integrated market, it is more likely that less expensive generators would be available in the following peak periods, thus quickly returning prices to normal levels.

2.3 The integration of the Iberian electricity market

We test our hypothesis on the Iberian electricity market (MIBEL). This market was created in July 2007, when Portugal and Spain joined their electricity markets. Since then, firms on both sides of the border submit their bids to sell or buy in a common pool, which is cleared through a standard non-discriminatory auction. The market operates in a fully liberalized, competitive setting. As long as the transmission capacity is sufficient, the price is the same in both markets, i.e., there is market coupling.

When the prices are the same in both markets at all times, we say that the markets are perfectly integrated. Hence, one can consider that market integration has increased when an increase in the number of hours of market coupling is observed.

Figure 1 shows the fraction of hours during which the Portuguese and Spanish markets are coupled.Footnote 3 At the beginning of MIBEL, from 2007 until the end of 2008, markets were coupled only during a small fraction of the time (around 32% of the daily hours). In contrast, since 2009 markets have been coupled most of the time (around 84% of the daily hours). In particular, in the first quarter of 2009 an impressive increase in the duration of market coupling is observed, i.e., an increase from 32 to 75% of the hours. MIBEL is thus an interesting setting to study the effect of market integration on prices because we can identify a clear, almost discrete, significant increase in the degree of integration.

Additionally, MIBEL is also an interesting setting because it is a relatively small isolated system, in the sense that the interconnection with France can only provide a very small fraction of the consumption in MIBEL. For example, the average load in MIBEL during November 2014 (the end of our sample period) was 24,459 MW, while the nominal interconnection capacity between Spain and France was 1400 MW. We can thus analyze the integration between Portugal and Spain, while safely ignoring electricity exchanges with other markets.

2.4 Factors behind MIBEL’s integration

Before proceeding to the formal econometric test of our hypothesis, we first analyze the underlying factors that caused the increase in MIBEL’s integration. The only constraint on coupling is the actual physical cross-border power transmission capacity, which can become congested if too much power is assigned to it. In that case, the auction is redone considering split markets, with an extra buy bid on the exporting side and an extra sell offer on the importing side, both with a size equal to the transmission capacity and a price equal to the exporting country’s final price. The day-ahead prices in the two countries become different for that particular hour when the interconnection is congested.

Figure 1 also shows the fraction of hours when there is market splitting, either due to exhaustion of the transmission capacity from Spain to Portugal or in the other direction. The most common case is by far splitting due to exhaustion of the transmission capacity from Spain to Portugal (i.e., Portugal is importing), which results in market-clearing prices being higher in Portugal. Hence, to understand the trend of increasing market coupling described above, we focus on the reasons that allowed for a reduction in the hours when Portugal exceeded its import capacity.

We argue that the growth of market coupling is due to two main factors. The first and more obvious factor is an increase in the nominal cross-border physical transmission capacity. Market splitting produces a congestion rent, which is kept by the TSOs to support precisely the enlargement of cross-border capacities and the integration of MIBEL. The first enlargement was in December 2009, when two lines were replaced by more modern ones (220 kV), followed by further increases in December 2010 with the addition of an eighth 400 kV line and replacement of two older 220 kV lines.Footnote 4

The second factor is less obvious in the sense that the effect comes through a reduction in the number of hours when the efficient market outcome would be to transfer energy from Spain to Portugal in excess of the transmission capacity, i.e., a reduction in splitting with Portugal importing. This factor is the growth in renewable energy power in Portugal, most notably wind.

In order to promote a transition to more sustainable energy sources, the Portuguese government created a “Special Regime,” which basically consists of a feed-in-tariff and dispatch priority for produced electricity. This remuneration scheme has been very effective in attracting investments, and the last few years have seen a determined growth in installed capacity from renewable sources. As detailed in Fig. 2, wind generation increased from less than 10% of demand in 2007 to around 24% of demand in 2013. Considering also other “Special Regime” producers (combined heat and power, run-of-river, and solar PV), the total amount of renewable energy increased from around 20% of demand in the beginning of the market to close to 50% in 2013.Footnote 5

The fact that “Special Regime” production has dispatch priority implies a reduction in the fraction of demand that is left and needs to be satisfied in the market, that is, the residual demand decreases. The result is that the “remaining” market becomes more integrated: Since there is an increase in the ratio of Portuguese import capacity to residual demand, the same transmission capacity can accommodate more Spanish bidders (relative to the actual Portuguese residual demand) before being forced to uncouple. In other words, renewable generation under the “Special Regime” has an indirect influence on market coupling by decreasing the amount of power that is actually traded in the market. Note that there is an interesting paradox here. As the fraction of renewables and other generation with dispatch priority increase, markets become more integrated in the sense that the price is the same in both markets more often. However, the market itself becomes smaller, that is, there is a reduction in the amount of generation that undergoes economic competition in the day-ahead MIBEL pool.

In addition to these two factors that contributed to market coupling growth, there is also a third factor of a more seasonal nature—large dam hydropower generation. Hydropower, although not subject to the special regime conditions, plays nevertheless an important role in the coupling of the markets. Hydropower has two important characteristics. First, given available water, it is dispatchable, that is, the plant can choose when to produce. Second, since hydropower has no variable fuel costs, the producer can freely chose the price at which to offer the electricity.

In times of abundant water in Portugal, hydropower will tend to enter the market at a very low price, which has an effect similar to other renewable generators, thus also contributing to a decrease in imports into Portugal. This effect can be seen by comparing Figs. 1 and 2. An increase in hydropower production generally leads to an increase in the amount of hours during which the market is coupled and, in some quarters, it even leads to Portugal increasing its exports to the point of splitting the market to its benefit. In particular, the first two quarters of 2010 stand out from the previous quarters as being particularly strong in hydro production.

The increase in nominal transmission capacity together with the increase in renewable power generation clearly moved MIBEL toward a deeper integration state which could have led to changes in the persistence of the price processes.

3 Testing for breaks in persistence

To illustrate the methodology used to investigate possible persistence changes in the electricity prices, \(p_{t}\), consider that \(p_{t}\) is generated by a fractionally integrated process with no break, such as,

where \(\left\{ p_{t}\right\} \) are the electricity prices, L denotes the usual lag operator, d and \(\theta \) are real values, and \(\left\{ \varepsilon _{t}\right\} \) is a stationary and invertible short-memory process integrated of order zero, I(0), such that \(\varepsilon _{t}:=\sum _{k=0}^{\infty }\gamma _{k}\xi _{t-k},\) in which \(\xi _{t}\) is a zero mean white noise innovation and \(\sum _{k=0}^{\infty }\gamma _{k} < {\infty }\) and different from zero (which follows from the I(0) property of \(\varepsilon _{t}\)). For a pre-specified value d, typically the aim is to test the null hypothesis that \(\left\{ p_{t}\right\} \) is fractionally integrated of order d, denoted as FI(d), i.e., testing \(H_{0}:\theta =0\) against \(H_{1}:\theta \ne 0.\) The standard unit-root case, \(d=1,\) is nested as a particular case in this generalized context.

Hence, to implement the test procedure proposed by Breitung and Hassler (2002) and Demetrescu et al. (2008), consider \(\left\{ \varepsilon _{t,d}\right\} \) a series resulting from differencing \(\left\{ p_{t}\right\} \) under the null hypothesis, namely \(\varepsilon _{t,d}:=\left( 1-L\right) ^{d}y_{t},\) where the fractional difference operator, \(\Delta ^{d}:=\left( 1-L\right) ^{d}\), is characterized by the formal binomial expansion:

Moreover, given \(\{ \varepsilon _{t,d}\} \), define the filtered process \(x_{t-1,d}^{*}:=\sum _{j=1}^{t-1}j^{-1}\varepsilon _{t-j,d}\,,\)\(t=2,\ldots ,T. \) The particular form of \(\{ x_{t-1,d}^{*}\} \), characterized by an harmonic weighting of the lags of \(\{ \varepsilon _{t,d}\} , \) results from the expansion of \(\log ( 1-L) ^{d}\) which features the partial derivative of the (Gaussian) log-likelihood function of \(\{p_{t}\}\) under the null hypothesis. As a result, \(\{x_{t-1,d}^{*}\} \) is core in the construction of regression-based LM-type tests.

Hence, given the variables \(( \varepsilon _{t,d},x_{t-1,d}^{*}) ^{\prime }\) introduced previously, we consider the following auxiliary regression in order to determine whether \(H_{0}:\phi =0\) holds true:

where following Demetrescu et al. (2008) the K lags of the dependent variable, \(\varepsilon _{t-i,d},\)\(i=1,\ldots ,K,\) are included to accommodate the short-memory properties of the series, i.e., to provide serial correlation free residuals. Furthermore, for the choice of K, Demetrescu et al. (2008) recommend the use of Schwert (1989), i.e., \(K:=\left[ 4(T/100)^{1/4}\right] .\)

Breitung and Hassler (2002) and Demetrescu et al. (2008) show that the squared t-statistic for \(H_{0}:\phi =0\) given the OLS estimate \(\widehat{\phi }\) from (3), denoted \(\hbox {LM}_\mathrm{LS}\) in the sequel, is asymptotically equivalent to the LM test for \(H_{0}:\theta =0. \) The LM test was shown to be efficient under Gaussianity by Robinson (1994) and Tanaka (1999).

Under \(H_{0}:\phi =0\), \(x_{t-1,d}^{*}\) is (asymptotically) stationary and admits the causal representation \(x_{t-1,d}^{*}=\sum _{j=0}^{t-1}\varphi _{j}v_{t-j-1}\), where \(\{\varphi _{j}\} _{j\ge 0}\) is a square (but not absolutely) summable sequence independent of the value of d, and \(\hbox {LM}_\mathrm{LS}\) is asymptotically Chi-squared distributed with one degree of freedom, denoted \(\chi _{(1)}^{2}.\) Under the sequence of local alternatives \(\phi =c/\sqrt{T}\), \(c\ne 0,\) the general characterization \(\varepsilon _{t,d}=( c/\sqrt{T}) x_{t-1,d+\theta }^{*}+\varepsilon _{t}+o_{p}(1)\) holds true (Tanaka 1999; Demetrescu et al. 2008; Hassler et al. 2009) and it follows that \(x_{t-1,d}^{*}=x_{t-1,d+\theta }^{*}+( c/\sqrt{T}) \sum _{j=1}^{t-1}j^{-1}x_{t-1-j,d+\theta }^{*}+o_{p}(1) ,\) with \(x_{t-1,d+\theta }^{*}=\sum _{j=0}^{t-1}\varphi _{j}v_{t-j-1}.\) As a result, \(\phi =c/\sqrt{T}\) captures the extent and the direction of the departure from the null, with positive (negative) values of \(\phi \) indicating larger (smaller) orders of integration than d. Hence, testing the fractional integration hypothesis on the basis of (3) ensures non-trivial power against local alternatives, see Demetrescu et al. (2008).

However, given the focus of this paper, as an alternative to (1) we consider instead the more general approach proposed by Hassler and Meller (2014, p. 656), which considers a process with \(m+1\) regimes. In particular, we consider that the persistence of electricity prices may change over time, i.e., that electricity prices are generated as,

where \(t=T_{j-1}+1,\ldots ,T_{j},\)\(j=1,\ldots ,m+1,\)\(T_{0}=0,\)\(T_{m+1}=T\) and \(\theta _{j}\) denotes the shift in persistence occurring at the \(j\mathrm{th} \,break.\) Thus, the null hypothesis of no breaks is \(H_{0}:\theta _{1}=\cdots =\theta _{m}=0.\)

The test regression suggested by Hassler and Meller (2014) corresponds to (3) but is augmented with a set of break dummies, \(D_{t}(\lambda _{j})\), such as,

where the break dummies used in (5) are defined as,

Remark

Note that the implementation of the test requires that d is either known a priori or that it is estimated before testing for a break. Hassler and Meller (2014, p. 662) point out that the latter approach will potentially result in fractional misspecification when computing the differences, but that the use of test regression (5) through the estimates of \(\phi \) significantly different from zero will account for the misspecification of d. This conclusion is supported by their Monte Carlo simulation results (please see Hassler and Meller (2014, pp. 662–663))

However, given that the true break fractions are not known, \(\lambda _{j}\) may not necessarily correspond to the true break fraction \(\lambda _{j}^{0}.\) The multiple change analysis is then performed based on Bai and Perron’s (1998) methodology.

It is also important for the empirical applications to assume that each sample segment has a minimal length determined by a trimming parameter \(\varepsilon >0,\) i.e.,

The limiting distributions of the tests depend on the trimming considered, and Bai and Perron (2003) recommend the usage of \(\epsilon =0.15\) in order to have better size properties in finite samples. In this paper, and following Hassler and Meller (2014), we also consider a trimming parameter of \(\epsilon =0.15\) and make use of the critical values in Bai and Perron (2003).

The F-statistics \(F(\lambda _{1},\ldots ,\lambda _{m})\) for testing \(H_{0}:\psi _{1}=\cdots =\psi _{m}=0\) in (5) are computed for all possible break points subject to,

Hence, the persistence change test statistic is thus the maximum across all F statistics,

which can easily be determined by a grid search for moderate sample sizes and small m. For large m, Bai and Perron (2003) recommend a dynamic programming approach. Critical values are available for up to \(m=9.\) For \(m=1\), this corresponds to a max-Chow test in line with Andrews (1993). The candidates for breaks are the arguments maximizing \(\sup F(m)\) [or equivalently the arguments minimizing the sum of squared residuals from (5)],

A further important feature that will also prove useful in the empirical application next is the computation of confidence intervals for the break dates. To set up the confidence intervals, we follow the approach of Elliott and Müller (2007) and compute (5) over \(\lambda \in (0.15, 0.85)\). In other words, we run test regression (5) with the dummy variable defined for all possible dates \([\lambda T]\), with \(\lambda \in (0.15, 0.85)\). Thus, defining \(F(\lambda )\) as the test statistic for \(H_{0}:\psi =0\) we define the break date confidence interval as follows. For each \(F(\lambda ) > CV_{1-\alpha }\) for \(\lambda \in (0.15, 0.85)\), we include a break date in the \(\alpha \) level confidence set and exclude it otherwise, where \(CV_{1-\alpha }\) is the level \((1-\alpha )\) critical value of the \(F(\lambda )\) statistic.

4 Empirical analysis

In this section, we apply the econometric methodology described in Sect. 3 to the hourly electricity prices in Portugal and Spain. For both countries, we present the value of the test statistic (6) along with a statistical significance assessment as well as the corresponding break date. We also report the persistence of hourly electricity prices for the sample periods before and after the break date as well as for the whole sample.

4.1 Data

We collect day-ahead hourly spot prices for the MIBEL wholesale electricity market from July 1, 2007 (the market starting day), until December 8, 2014, corresponding to 2728 observations for each hour. The data include prices for both Portugal and Spain. When there is enough transmission capacity between the two markets, the prices are the same, that is, there is market coupling. Otherwise, the markets split and each country trades at a different price. Hence, we analyze the Portuguese series independently from the Spanish ones.

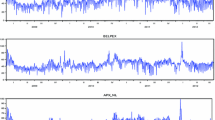

As in most markets, the auction in MIBEL sets an independent price for each hour of the day. Therefore, we study each of the 24-hourly price series in each country (see Figs. 3, 4). An alternative approach would be to average prices for some hours of the day (e.g., nighttime versus daytime), but that would require a somewhat arbitrary classification of the hours. By looking at each hourly price separately, we are able to obtain a more detailed characterization of the data.

Since the average electricity price varies across the week and throughout the year due to changes in electricity demand, weekly and yearly seasonality is addressed using weekday \((d_{i,}\)\(i=1,\ldots ,7)\) and monthly \((m_{k},\)\( k=1,\ldots ,12)\) dummy variables. Hence, the adjusted price series is computed as

where \(p_{t}^{*}\) is the observed electricity log price series, \(\widehat{c}\) corresponds to the estimate of the intercept, and \(\widehat{\phi }_{i},\)\( i=2,\ldots ,q,\) and \(\widehat{\psi }_{k},\)\(k=2,\ldots ,12,\) to the slope parameter estimates of the weekday and monthly regressors.Footnote 6

Given the sample size, the lag order, K, of the test regression is set to 9 according to the rule proposed by Schwert (1989). We have also consider test statistics robust to heteroscedasticity as suggested by Demetrescu et al. (2008).

4.2 Empirical results

4.2.1 Prices in the Portuguese market

Table 1 displays the results for the Portuguese case. We find that for all hours there is a statistically significant persistence break. The break date is always determined to have occurred in the year of 2009, which is consistent with the discussion in Sect. 2 documenting a strong increase in market integration in 2009.

Furthermore, the break occurred earlier for the nighttime hours of low demand (from 2:00 to 6:00) than for the daytime hours of peak demand (from 7:00 to 20:00). This result is also consistent with the discussion in Sect. 2. During the night, not only total demand is naturally low, but also wind generation is typically stronger. Hence, the ratio of transmission capacity to residual demand will be particularly high during these hours. The market should thus couple more often during nighttime periods. Hence, the fact that the memory breaks occur earlier for nighttime prices is also consistent with our hypothesis that higher integration leads to lower price memory.

Table 1 also presents the estimates for the memory parameter, before and after the break, while Fig. 5 displays the corresponding confidence intervals. Before the break date, electricity prices presented a memory parameter d, ranging from 0.68 up to 0.92. In contrast, after the break, most electricity prices become substantially less persistent (the memory parameter decreases on average 0.35). Furthermore, the reduction is slightly higher for nighttime hours (0.36) than for daytime hours (0.33).

One should highlight that restricting the analysis to the full sample memory estimates would be misleading. By allowing for a break in the memory parameter, one can detect persistence changes stemming from the deepening of the Iberian market integration which enhance the understanding of the electricity price behavior.

4.2.2 Prices in the Spanish market

Table 2 and Fig. 6 report the corresponding results for Spain. We find a statistically significant break for most hours. Only in a small number of hours (from 10:00 to 13:00 and from 22:00 to 24:00), do we not reject the null hypothesis of no break in memory at the 5% significance level. In the case of Spain, most of the breaks occurred in the second half of 2009. Nonetheless, the breaks occurred earlier for most nighttime prices, similarly to the Portuguese case.

Likewise in Portugal, the decrease is slightly higher for nighttime hours (0.34) than for daytime hours (0.30). The average reduction in the memory parameter after the break is 0.32, which is slightly lower than the one recorded for the Portuguese case, which suggests that the impact of the Iberian market integration was slightly higher in the latter case. Such a result may reflect the fact that the Portuguese market is smaller than the Spanish market and therefore potentially more influenced by the market integration process.

As in the Portuguese case, looking at the full sample can be misleading. In fact, although before the break date, prices presented a memory parameter ranging from 0.66 to 0.87, after the break, we find that most prices present substantially lower persistence.

4.3 Robustness analysis

The results of the previous section indicate that most break dates occurred in 2009 for both Portugal and Spain, the year where we also observe a strong increase in market integration between the two countries. To further stress this point, we pursue a procedure similar to the one proposed by Elliott and Müller (2007) to construct confidence intervals for the break dates, as described in Sect. 3. Figure 7 presents confidence intervals for the break dates for both cases with a confidence level of 95%. The figure clearly reinforces the finding that there has been a clustering of break dates in 2009. Furthermore, there is a substantial overlap of intervals for Portugal and Spain for any given hour, which suggests that one cannot discard the idea that the breaks occurred simultaneously in both markets.

We also investigated the presence of more than one break in the hourly electricity prices in both countries. Resorting again to the procedure of Hassler and Meller (2014), which in contrast to other procedures also allows for the detection of multiple breaks, we only found strong evidence of one further break for the 21st hour in Portugal (with the break date being 2010-1-1) and for the 7th hour in Spain (with the break date being 2009-11-5). Note that in both cases the break dates are relatively close to the other break dates reported in Tables 1 and 2 and reinforce the finding that there is a cluster of break dates in 2009.

4.4 Further discussion on the implications of the findings

For illustrative purposes, Fig. 8 presents the impulse response function over the first 365 time periods, say days, computed from a simple fractional integrated process \((1-L)^dy_{t} = \varepsilon _{t}I(t\ge 1)\), for \(\varepsilon _{t}\sim nid(0,\sigma ^2)\) with \(d=0.45\) and \(d=0.80\). The choice of \(d=0.45\) and \(d=0.80\) resulted from the empirical application, since as before the market integration the average d across all daily hours was around \(d = 0.8\), which decreased considerably after market integration to \(d=0.45\). We observe that although both are still significant after 365 periods, the impact of a shock when \(d=0.45\) (which corresponds to a stationary long memory process) is much smaller than that resulting when \(d=0.80\) (non-stationary process). Note that the slow decay of the impulse response function observed is an intrinsic feature of these fractionally integrated processes.

Besides the impact in terms of the transmission over time of the shocks to electricity prices, a break in d can also have important implications on the forecasting performance of the models in use (see Weron 2014 for survey). To assess the latter issue, we conduct a Monte Carlo simulation analysis. In particular, we consider the following data generating process for illustrative purposes, \((1-L)^{d_{t}}y_{t}=\varepsilon _{t}, t=1,\ldots ,T\) with \(\varepsilon _{t}\sim nid(0,\sigma ^{2})\) and

where \(t_\mathrm{break}:=\lambda _{0}T\) and \(\lambda _{0}\) is the break fraction considered.

That is, in the simulations we consider a Gaussian fractional integrated process with a change in d of magnitude c at the break date \(t_\mathrm{break}\). Suppose that the forecasting model in use, say a gaussian fractional integrated process, assumes the value of d before the break and is used to forecast during the post-break period. For comparison, let us also consider the same model but with the value of \(d+c\) after the break. This exercise allows us to isolate the impact of the only source of misspecification, in this case d, in terms of forecasting performance. Hence, one can assess how costly ignoring the presence of a break in d can be or, in other words, how large the forecasting gains of taking on board the knowledge that a break has occurred can be.

In the simulations, we consider a sample size of 3000 observations, which is similar to our sample size, and consider 1000 forecasts in the post-break period. As the forecasting horizon may also matter, we consider forecasting horizons of up to 10 time periods. In terms of the change in d, that is c, we address both the case where there is a decrease (\(c<0\)) and the case of an increase (\(c>0\)). We also assess the impact of the size of c in terms of the forecasting behavior. For each case, we compute the average ratio, over 10,000 simulations, between the root mean square forecast error (RMSFE) of the correctly specified model, which considers the value after the break, and the RMSFE of the model that assumes the value before the break. A ratio lower than 1 denotes that the former is better than the latter. The results are presented in Table 3.

From Table 3, one can conclude that the forecasting performance can be significantly affected by the presence of break in d. First, the forecast gains of taking on board the break are higher for shorter forecasting horizons regardless of the size of the break. Naturally, as the forecasting horizon increases, both models tend to deliver the same forecasts and the ratio converges to one. Second, as expected, the larger the size of the break, the more pronounced are the gains. For instance, for \(c=0.1\) the gains are around 1% for one-step ahead forecasts, whereas for \(c=0.5\) the gains attain 43%. Third, the forecasting performance seems to be more sensitive to increases in d than to decreases. Although we still find noteworthy gains in the case of a decrease in d, namely for larger breaks, the gains are higher when there is an increase. This is to be expected given that overdifferencing (when \(c<0\)) leads to an antipersistent process which has an autocorrelation function which dies out quicker than that of a process which is underdifferenced (when \(c > 0\)), see Hassler (2012) for details.

Hence, as discussed earlier, the presence of a break in the memory parameter can change the speed of transmission of the shocks to electricity prices, which can be of particular interest for policymakers and regulators, but can also change models forecasting performance and influence forecasts accuracy which can be of key importance for market participants in fields such as risk management and hedging strategies.

5 Conclusions

The electricity sectors around the world underwent major changes over the recent past and are still changing. In this respect, the Iberian electricity market constitutes a natural case study. In particular, we assess electricity price persistence in Portugal and Spain and whether it has changed with the Iberian market integration. When two electricity markets become more integrated, the price series should become less persistent.

We consider each hour of the day separately, that is, we analyze 24 time series of day-ahead hourly prices for Portugal and another 24 series for Spain. The empirical findings are consistent with the hypothesis that market integration leads to a decrease in the persistence of the price process. In fact, the results indicate that most break dates occurred in 2009 for both Portugal and Spain, the year where we also observe a strong increase in market integration between the two countries. Furthermore, the results show that memory breaks occur earlier for nighttime than daytime prices. Since electricity demand is typically lower during the night than during the day, the same physical interconnection capacity can account for a larger fraction of the total system load during the night than during the day.

Such findings support the view that the Iberian market integration process had an impact on the price dynamics of electricity prices both in Portugal and Spain. Such knowledge carries noteworthy implications for policymakers and regulators as well as market participants.

Notes

Further details at http://www.epexspot.com/en/market-coupling.

PJM Interconnection is a regional transmission organization that coordinates the movement of wholesale electricity in Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and the District of Columbia.

Price data for both markets are available at www.omip.pt.

Note, however, that the actual capacity of the transmission lines is a function not only of the nominal transmission capacity, but also of several constraints, such as air temperature or the state of the each countries’ own transmission network. Furthermore, the programmed availability of renewable energies also has an effect on the maximum transmission capacity the TSOs make available.

Hourly generation data were provided by REN.

We have also considered the case where a linear trend is included and the results are qualitatively similar.

References

Alvarez-Ramirez J, Escarela-Perez R (2010) Time-dependent correlations in electricity markets. Energy Econ 32:269–277

Andrews DWK (1993) Tests for parameter instability and structural change with unknown change point. Econometrica 61:821–856

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Critical values for multiple structural change tests. Econom J 6:72–78

Bosco B, Parisio L, Pelagatti M, Baldi F (2010) Long-run relations in European electricity prices. J Appl Econom 25:805–832

Breitung J, Hassler U (2002) Inference on the cointegration rank in fractionally integrated processes. J Econom 110(2):167–185

Cecchetti SG, Flores-Lagunes A, Krause S (2006) Has monetary policy become more efficient? A cross-country analysis. Econ J 116(511):408–433

Demetrescu M, Kuzin V, Hassler U (2008) Long memory testing in the time domain. Econom Theory 24:176–215

Elliott G, Müller UK (2007) Confidence sets for the date of a single break in linear time series regressions. J Econ 141(2):1196–1218

Haldrup N, Nielsen MØ (2006) A regime switching long memory model for electricity prices. J Econom 135:349–376

Haldrup N, Nielsen FS, Nielsen MØ (2010) A vector autoregressive model for electricity prices subject to long memory and regime switching. Energy Econ 32(5):1044–1058

Halunga AG, Osborn DR, Sensier M (2009) Changes in the order of integration of US and UK inflation. Econ Lett 102:30–32

Hassler U (2012) Impulse responses of antipersistent processes. Econ Lett 116(3):454–456

Hassler U, Meller B (2014) Detecting multiple breaks in long memory: the case of US inflation. Empir Econ 46:653–680

Hassler U, Rodrigues PMM, Rubia A (2009) Testing for the general fractional integration hypothesis in the time domain. Econom Theory 25:1793–1828

Herrera AM, Pesavento E (2005) The decline in US output volatility: structural changes and inventory investment. J Bus Econ Stat 23(4):462–472

Kang KH, Kim CJ, Morley J (2009) Changes in U.S. inflation persistence. Stud Nonlinear Dyn Econom 13:1–21

Koopman SJ, Ooms M, Carnero MA (2007) Periodic seasonal Reg-ARFIMAGARCH models for daily electricity spot prices. J Am Stat Assoc 102(477):16–27

Martins L, Rodrigues PMM (2014) Testing for persistence change in fractionally integrated models: an application to world inflation rates. Comput Stat Data Anal 76:502–522

McConnell MM, Perez-Quiros G (2000) Output fluctuations in the United States: what has changed since the early 1980s? Am Econ Rev 90:1464–1476

Robinson PM (1994) Efficient tests of nonstationary hypotheses. J Am Stat Assoc 89:1420–1437

Schwert GW (1989) Tests for unit roots: a Monte Carlo investigation. J Bus Econ Stat 7:147–159

Tanaka K (1999) The nonstationary fractional unit root. Econom Theory 15:549–582

Weron R (2002) Measuring long range dependence in electricity prices. In: Takayasu H (ed) Empirical science of financial fluctuations. Springer, Tokyo, pp 110–119

Weron R (2014) Electricity price forecasting: a review of the state-of-the-art with a look into the future. Int J Forecast 30(4):1030–1081

Acknowledgements

We thank REN for providing data on Portuguese power generation. We are also grateful to an Associate Editor and two anonymous referees for useful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pereira, J.P., Pesquita, V., Rodrigues, P.M.M. et al. Market integration and the persistence of electricity prices. Empir Econ 57, 1495–1514 (2019). https://doi.org/10.1007/s00181-018-1520-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1520-x