Abstract

This paper compares unit and ad valorem taxes using a New Keynesian dynamic stochastic general equilibrium model. We show that the ad valorem tax increase is superior to the unit tax increase with respect to the comparative statics, while is equivalent to under the log-linear setting, even when price stickiness and monopolistic competition are present.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many advanced countries introduce unit or specific as well as ad valorem taxes as value-added taxes. U.S. and Canadian states, most of EU countries and Japan apply an ad valorem consumption tax in addition to using unit taxes on goods such as gasoline, liquor and tobacco. Concurrently, when the government increases consumption taxes, some firms increase product prices more than the tax increase; that is, firms engage in price gouging.

This paper compares unit and ad valorem taxes using the New Keynesian dynamic stochastic general equilibrium (DSGE) model. Producer price stickiness follows the previous research of Forni et al. (2009) and Iwata (2011). We show that the ad valorem tax increase is equivalent to the unit tax increase, even when price stickiness and monopolistic competition are present.

Previous literatures have investigated the welfare effect of unit or ad valorem tax is more efficient in realizing objectives, e.g. Suits and Musgrave (1953), Delipalla and Keen (1992), Blackorby and Murty (2007, 2013), Häckner and Herzing (2016), Weyl and Fabinger (2013), Adachi and Fabinger (2017) and Wang and Chou (2018). These studies show that the ad valorem tax is superior to the unit tax.Footnote 1 This study expands on the relevant literature by using the DSGE model to compare unit and ad valorem taxes. Our result shows not only the comparative statics at the steady states, but also the comparative dynamics which analyzes the log-linear (i.e. first-order) approximation of model.

The remainder of this paper is organized as follows: Sect. 2 outlines the study model. Section 3 compares the two tax schemes using welfare criteria. Section 4 concludes.

2 The model

We explain the detail of the DSGE model to compare unit and ad valorem taxes. This study sets the sticky price using the DSGE model following Calvo (1983) and does not include physical capital. Consistent with the general DSGE model, intermediate firms face monopolistic competition and can change the producer price with probability 1 − ρ, while maintaining its price with probability ρ. The government distributes lump-sum transfers using both unit and ad valorem taxes of final good, that is, an increase in the unit or ad valorem tax results in only the substitution effect.Footnote 2 We set the lifetime utility as a separate function as follow:

where \(c_{t}\) is consumption, β is discount factor, σ is relative risk aversion, \(l_{t}\) is labor supply, and λ is the inverse of labor supply elasticity.

2.1 Levying two consumption taxes

The government levies two consumption taxes: ad valorem tax \(\tau_{t}\) and unit taxes \(T_{t}\), and pays a lump-sum transfer \(V_{t}\) to households. Therefore, we define the government budget constraint as follow:

where \(P_{P,t}\) is the producer price. Since lump-sum transfer and unit tax are the nominal variables, we refine the above equation, substituting the consumer price \(P_{C,t} = \left( {1 + \tau_{t} } \right)P_{P,t} + T_{t}\);

where \(v_{t} = \frac{{V_{t} }}{{P_{C,t} }}, t_{t} = \frac{{T_{t} }}{{P_{C,t} }}\).

Since resource constraint is \(y_{t} = c_{t} ,\) we can rewrite \(v_{t} = \frac{{\tau_{t} + t_{t} }}{{1 + \tau_{t} }}y_{t} .\)

2.2 Log-linearized model

We show the log-linearized DSGE model, which obtains equilibrium conditions (^ represents the percentage deviation from the steady state), as follows:

where yt is the output, it is the nominal interest rate, \(\pi_{C,t}\) is the gross inflation rate of consumer prices including tax, \(\pi_{P,t}\) is the gross inflation rate of producer price excluding tax, ρ is the probability that firms retain their original producer price, τt is the ad valorem tax rate at period t, τ is the steady state ad valorem tax rate, \(t_{t}\) is the real unit tax revenue on consumer price \(P_{C,t}\),Footnote 3t is the steady state real unit tax rate, and ϕy ≧ 0 and ϕπ > 1 follow the parameters of the Taylor rule.Footnote 4

Equation (1) is the New Keynesian IS curve, Eq. (2) is the New Keynesian Phillips curve, Eq. (3) represents the relationship between consumer and producer prices, and Eq. (4) follows the Taylor rule. The government budget constraint is shown as follows:

In this model, \(\hat{y}_{t} , \hat{\pi }_{P,t}\) and \(\hat{\pi }_{C,t}\) are control variables and \(\hat{\tau }_{t}\) and \(\hat{t}_{t}\) are pre-determined variables.

In order to obtain analytical solutions of the model, we distinguish two cases of permanent price increases resulting from unit or ad valorem taxes.

2.3 Ad valorem tax case (t = 0)

Using the undetermined coefficient method, we obtain solutions of the model at period t = 2 and later, with government tax rate remaining constant, i.e., \(\hat{\tau }_{t + 1} = \hat{\tau }_{t} = \hat{\tau }_{t - 1}\) as follows:

where \(\Delta \equiv \left( {1 - \beta } \right)\varphi_{y} + \left( {\sigma + \lambda } \right)\alpha \left( {\varphi_{\pi } - 1} \right), \alpha \equiv \frac{{\left( {1 - \rho } \right)\left( {1 - \beta \rho } \right)}}{\rho }.\)

At period t = 1, we obtain the initial policy function as followsFootnote 5:

where \(\chi_{\tau } \equiv - \frac{\tau }{{\left( {1 + \tau } \right)\Delta }}\left[ {\sigma + \varphi_{y} + \varphi_{\pi } \left( {\sigma + \lambda } \right)} \right]^{ - 1} \left[ {\alpha \sigma \left( {\varphi_{\pi } - 1} \right) + \left( {1 + \alpha } \right)\varphi_{\pi } \Delta + \alpha \varphi_{y} \left( {\beta \varphi_{\pi } - 1} \right)} \right]\).

2.4 Unit tax case (τ = 0)

Similar to the case with the ad valorem tax, we obtain the solution of the model at period t = 2 and later using the undetermined coefficient method, as followsFootnote 6:

At period t = 1, the government increases the ad valorem tax rate as follows:

where \(\chi_{t} \equiv - \frac{t}{{\left( {1 - t} \right)\Delta }}\left[ {\sigma + \varphi_{y} + \varphi_{\pi } \left( {\sigma + \lambda } \right)} \right]^{ - 1} \left[ {\alpha \sigma \left( {\varphi_{\pi } - 1} \right) + \left( {1 + \alpha } \right)\varphi_{\pi } \Delta + \alpha \varphi_{y} \left( {\beta \varphi_{\pi } - 1} \right)} \right].\)

3 Comparing with two taxes

3.1 Tax revenue setting

In this section, we compare the two taxes from the viewpoint of efficiency, that is, we use a welfare comparison between tax collections. Specifically, the government implements a permanent increase in the ad valorem or unit tax rates. To compare these two tax schemes, we use the same present value of tax revenue as follows:

where \(v_{\tau ,t}\) is the tax revenue from the ad valorem tax increase and \(v_{t,t}\) is the tax revenue from the unit tax increase. Using Eq. (18), we obtain the following equation at period t ≧ 2:

As for the initial period (t = 1), we obtain the same equation as Eq. (19).

3.2 Comparative statics

Before discussing about the comparative dynamics, we evaluate the welfare at steady states of both unit and ad-valorem tax collections. We can evaluate the welfare using consumption at the steady state.

For obtaining analytical solution of the welfare comparison, we set σ = λ=1 in this subsection.Footnote 7 We obtain the same tax revenue condition and the consumption of unit (\(c_{u}\)) or ad-valorem tax (\(c_{a}\)) as follows:

Comparing with above two consumptions, we see that ad-valorem tax is superior to unit one at steady state.

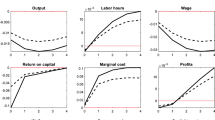

3.3 Comparative dynamics

A second-order approximation of the welfare function (equal to the household’s utility function) around the steady state is as follows:

where \(U_{C} y = c^{1 - \sigma } = \left[ {\frac{{\left( {\theta - 1} \right)\left( {1 - t} \right)^{2} }}{{\theta \left( {1 + \tau } \right)^{2} }}} \right]^{{\frac{1 - \sigma }{\sigma + \lambda }}}\) and θ is the price elasticity of intermediate goods (\(\frac{\theta }{\theta - 1}\) is the gross markup rate).

We show the welfare functions under two tax rules as follows:

where \(U_{0,\tau }\) and \(U_{0,t}\) are the welfare functions when the ad valorem tax (Eq. 21) and unit (Eq. 22).

Substituting Eqs. (19) into (22), we can see that Eq. (21) equals Eq. (22). This concludes that ad valorem tax is equivalent to unit tax in the DSGE model, that is, the qualitative and quantitative effects are the same under equivalent tax revenue collections when initial tax rates are zero (t = τ = 0).Footnote 8 Blackorby and Murty (2007) show that unit tax is equivalent to ad valorem tax in monopolistic markets at general equilibrium with 100% profit tax; that is, the tax-adjusted profit is zero. This study is similar to Blackorby and Murty (2007), with the exclusion that profit remains present. A reasonable explanation for this difference is the absence of monopolistic competition, that is, the parameter of θ.

3.4 Case in zero lower bound

Some countries; e.g. Japan, U.S. and EU, face on the situation under zero lower bound (ZLB) which the nominal interest rate is stuck zero. Eggertsson (2011) analyzes the income and consumption tax multiplier in DSGE model under ZLB. That is, log-linearized nominal interest rate is stuck \(\hat{i}_{t} = - \frac{1 - \beta }{\beta }\) and the rest of the model remains. Therefore, we obtain the same result in Sect. 3.3 under ZLB.

4 Conclusion

This paper compares unit and ad valorem taxes using the New Keynesian DSGE model. We show that price markup causes differences between unit and ad valorem taxes under comparison with steady states, while we find that the increase in ad valorem tax is independent of that in unit tax under log-linear transition dynamics.

Additional researches can expand the findings in this study. For example, we can apply the new open economy macroeconomic model, as used by Corsetti and Pesenti (2009), to consider external channels as well as traded and non-traded goods, which further analyze the effects of tariffs. Tariff analysis considers both unit and ad valorem taxes. In addition, higher order approximation may apply; e.g. Schmitt-Grohé and Uribe (2004). These, however, are topics for future research.

Notes

We assume the single stage taxation, which is applied in U.S. and Canadian states.

τ and t represent the steady state values.

ϕπ > 1 ensures local stability (the Taylor principal).

Similar to the case in ad valorem, this case also satisfies \(\hat{t}_{t + 1} = \hat{t}_{t} = \hat{t}_{t - 1} .\)

We see that the level of consumption which maximizes the utility is one.

If initial tax rates are positive and satisfy the tax revenue equivalence of steady state, the result is same as the case in comparative statics.

References

Adachi, T., & Fabinger, M. (2017). Multi-dimensional pass-through, incidence, and the welfare burden of taxation in oligopoly. Mimeo.

Blackorby, C., & Murty, S. (2007). Unit versus ad-valorem taxes: Monopoly in general equilibrium. Journal of Public Economics,91, 817–822.

Blackorby, C., & Murty, S. (2013). Unit versus ad-valorem taxes: The private ownership of monopoly in general equilibrium. Journal of Public Economic Theory,15, 547–579.

Bui, D. (2018). Fiscal policy and national saving in emerging Asia: Challenge or opportunity? Eurasian Economic Review,8, 305–322.

Calvo, G. (1983). Staggered prices in utility maximization framework. Journal of Monetary Economics,12, 383–398.

Corsetti, G., & Pesenti, P. (2009). The simple geometry of transmission and stabilization in closed and open economy. NBER international seminar on macroeconomics 2007 (pp. 65–116). Chicago: University of Chicago Press.

Delipalla, S., & Keen, M. (1992). The comparison between ad-valorem and specific taxation under imperfect competition. Journal of Public Economics,49, 351–367.

Eggertsson, G. (2011). What fiscal policy is effective at zero interest rate? NBER Macroeconomic Annual,2011, 59–112.

Forni, L., Monteforte, L., & Sessa, L. (2009). The general equilibrium effects of fiscal policy: Estimates for the Euro area. Journal of Public Economics,93, 559–585.

Häckner, J., & Herzing, M. (2016). Welfare Effects of Taxation in Oligopolistic Markets. Journal of Economic Theory,163, 141–166.

Iwata, Y. (2011). The government spending multiplier: Insights from Japan. International Finance,14, 231–264.

Schmitt-Grohé, S., & Uribe, M. (2004). Solving dynamic stochastic general equilibrium models using a second-order approximation to the policy function. Journal of Economic Dynamics and.Control,28, 755–775.

Suits, D., & Musgrave, R. (1953). Ad valorem and unit versus compared. Quarterly Journal of Economics,67, 598–604.

Wang, K., Chou, P. (2018). Specific versus ad valorem taxes in the presence of cost and quality differences. International Tax and Public Finance25, 1197–1214.

Weyl, G., & Fabinger, M. (2013). Pass-through as an economic tool: Principles of incidence under imperfect competition. Journal of Political Economy,121(3), 528–583.

Acknowledgements

I gratefully acknowledge Go Kotera, Tomohito Okabe and Hiroaki Hayakawa. Financial support from the Japanese Ministry of Education, Culture, Sports, Science and Technology (No. 16K17135) is grateful acknowledge.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hiraga, K. Unit versus ad valorem tax comparisons in a simple New Keynesian dynamic stochastic general equilibrium model. Eurasian Econ Rev 9, 459–466 (2019). https://doi.org/10.1007/s40822-018-0120-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-018-0120-6