Abstract

This paper characterizes the pricing decisions in a two-echelon supply chain composed of one manufacturer and two retailers. A Stackelberg structure is supposed between the two echelons with a manufacturer acting as the leader and two retailers acting as followers in the supply chain. Specifically, both customer demand and manufacturing cost of products are represented as triangular fuzzy variables, and expected value models are developed to discuss the pricing decisions, and the influence of three different types of competitive behavior of the two retailers, namely Stackelberg (Model S), Bertrand (Model B) and Collusion (Model C), using the global cooperation model (Model G) as a reference. Further, a numerical experiment is conducted to illustrate that different types of competitive behavior have different effects on the optimal profits of chain members, where the maximal expected profit of the supply chain system and the manufacturer are all positively associated with the fuzzy degrees of parameters in all three situations, while those of the retailers are associated negatively.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Recently, competition among supply chain members has gained an increasing attention from both academic research and businesses [1]. Supply chain performance is closely related to the competitive behavior of supply chain members, and different types of competitive behavior can also affect the pricing strategies of supply chain members [2]. Therefore, it is necessary to investigate how different competitive behaviors of supply chain members can influence their pricing decisions and supply chain performance. In this paper, we study different competitive behaviors of duopolistic retailers with a manufacturer acting as the Stackelberg leader in a two-echelon supply chain.

In the actual management of a supply chain, there are various kinds of uncertainty [3], which are usually associated with the manufacturing cost, customer demand and so on. Although many researchers have adopted traditional probabilistic or deterministic concepts to explore the uncertain parameters of closed-loop supply chains [5,6,7], the fuzzy theory which is originally proposed by Zadeh [8] and stems from the fact that a lot of information based on people’s decision-making is possibilistic in nature [9] is an alternative method for the uncertainty environment. In particular, some critical parameters mentioned above influence by many factors (e.g., innovation cost, season factor and market turbulence), and they cannot be accurately estimated or even fluctuate sometimes. What is more, the effective data are difficult to obtain or only few of them can be acquired, which makes the research methods of probability distribution cannot be available. In these conditions, decision makers will judge with their own intuition and experience to make a rough estimate. Hence, these important parameters are usually characterized as “low cost” or “high cost,” “large market base” or “small market base” and so on [4]. And many researchers [10,11,12,13,14] have utilized the fuzzy theory in decision-making problems. At the same time, some researchers [2, 15] have applied the theory successfully for supply chain uncertain decisions.

The competitive behavior of two retailers in a supply chain poses interesting questions with regard to the supply chain decisions. The goal of this paper is to analyze the effects of different types of competitive behavior of retailers in a supply chain and fuzzy environment. In practice, we find that large manufacturers (e.g., Apple and Huawei), which have the absolute power, often choose two or more different retailers to sell their products. Based on a real industry environment and existing literature, we establish three models to address three different types of competitive behavior of two retailers: (1) Stackelberg competitive behavior (Model S), (2) Bertrand competitive behavior (Model B) and (3) Collusion behavior (Model B). Further, the model where all members of the supply chain develop global cooperation (Model G) is selected as the reference model, which we use to contrast the optimal outcomes of all other models to analyze the potential factors of inefficiencies.

Therefore, we mainly discuss the following research questions:

-

1.

How are supply chain members’ optimal decisions and channel performance affected by the competitive behavior modes of the two retailers?

-

2.

Which mode of competitive behavior of the two retailers is the most beneficial from the perspective of the supply chain system?

-

3.

How do fuzzy degrees of parameters influence supply chain members’ optimal decisions and channel performance?

The paper is organized as follows. We review literature in Sect. 2. In Sect. 3, we develop four models. In Sect. 4, we analyze the optimal results of suitable numerical experiments. Finally, we present some conclusions and possible future research directions in Sect. 5.

2 Literature Review

There are several streams of literature related to the paper, and we provide a brief overview of them below. First, this paper is relevant to literature on pricing decisions in supply chains [16,17,18,19,20,21,22,23]. For example, Choi [16] exhibits a supply chain which consists of a retailer and two manufacturers, and investigates the effect of different channel power structures on pricing decisions. Hua et al. [18] address the pricing behavior of a manufacturer and a retailer and the impact of the delivery lead time. Zhu [20] develops a Stackelberg game to analyze supply chain pricing strategies and capacity with a price and lead-time sensitive demand, and compares to a decentralized chain without a capacity decision. Liu et al. [22] use a game theoretical approach to explore the influence of collection competition on the pricing and reverse channel choice decision problems in a closed-loop supply chain with three options of dual recycling channels. Giri et al. [23] characterize a duopoly market with two manufacturers producing two complementary products to investigate the optimal pricing strategies of the two manufacturers. Demand functions assumed in majority of the above literature are influenced by the retail price. In our model, we also adopt the same assumption, but the main difference is that we solve the problem under fuzzy conditions and analyze the impact of the fuzzy degrees of parameters.

A series of papers related to supply chain management consider two-echelon distribution systems with different competitive behaviors of supply chain members [1, 24,25,26,27,28,29]. For example, Lau et al. [24] analyze pricing and inventory decisions in a supply chain assuming different two competitive retailers’ behavior cases (Cournot, Collusion and Stackelberg). Wu et al. [25] apply the game theory to investigate pricing decisions in a supply chain consisting of non-cooperative members assuming different competitive behavior. Cao et al. [26] characterize a coordination mechanism where production demands and costs are simultaneously integrated in a supply chain consisting of one manufacturer and multiple Cournot competing retailers. Roy et al. [28] consider a two-echelon supply chain that contains two Bertrand competing retailers and one manufacturer. Luo et al. [29] study a supply chain with two differentiated brands manufacturers considering different competitive models (e.g., Stackelberg game, Nash game). However, in these articles, authors only discuss the horizontal competitive behavior of supply chain members without considering decisions in a fuzzy environment.

Recently, research on supply chains with uncertainty has started using the fuzzy theory, mainly focusing on coordination, inventory policy, supplier selection and pricing problems. Giannoccaro et al. [30] and Wang and Shu [31] analyze an inventory management policy based on the fuzzy theory in a supply chain. Chen et al. [32] and Kumar et al. [33] provide a fuzzy decision-making method to tackle the question of how to choose suitable suppliers in a supply chain. Literature on pricing decisions is rich [2,3,4, 15, 34]. Zhao et al. [3], for example, develop models in a supply chain using the game theory and characterize the manufacturing cost and customer demand as fuzzy variables. Shen and Zhu [34] apply fuzzy theory (type-1 fuzzy numbers)Footnote 1 to investigate a two-echelon supply chain problem with uncertain variables. Yang and Xiao [4] analyze a green supply chain influenced by governmental interventions under fuzzy uncertainty. Different from the above research, we consider pricing decisions in a two-echelon supply chain with two competitive retailers and a manufacture, where the manufacturing cost and customer demand are triangular fuzzy variables, and three types of competitive behavior of duopolistic retailers (i.e., Collusion, Bertrand and Stackelberg competition) are considered.

Our paper is closely related to Yang and Zhou [1], Sang [15] and Wei and Zhao [2]. Yang and Zhou [1] explore the influence of three different types of competitive behavior of two retailers (Cournot, Collusion and Stackelberg) on the optimal decisions of the supply chain members. Different from this article, our work considers the manufacturing cost and demand function as triangular fuzzy variables. Sang [15] presents a supply chain consisting of one manufacturer acting as the Stackelberg leader and two competitive retailers in a fuzzy decision situation and develops models to study competitive behavior (Cournot and Stackelberg) of the two retailers. Wei and Zhao [2] analyze the impact of six expected value models with triangular fuzzy variables on three pricing strategies of duopolistic manufacturers (i.e., cooperation, Stackelberg competition and Bertrand competition) in a supply chain. Compared to these two articles, we consider three different types of competitive behavior of two competitive retailers (i.e., Collusion, Bertrand competition and Stackelberg competition). All three types of competitive behavior are investigated in supply chain literature; however, these three scenarios have not been compared. In this work, using the same research framework, we compare these three different types of competitive behavior of duopolistic retailers in a fuzzy environment. To the best of our knowledge, this paper is the first to address this problem.

3 The Model

We consider a supply chain consisting of a manufacturer and two retailers. The manufacturer produces new products and sells them to the two retailers, determining the wholesale prices, and taking advantage of his own resources to achieve the maximization of his profit. With the manufacturer acting as the Stackelberg leader and the two retailers exhibiting different competitive behavior in the supply chain, we develop fuzzy mathematical models to explore optimal decisions of every supply chain member from the perspective of expect profit maximization.

We summarize the notations in the following table (Table 1).

According to McGuire and Staelin [35] and Wei and Zhao [2], the consumer linear demand function decreases with the price of the product itself, and increases with the competitor’s price. Accordingly, the demand for the retailer \(i\)’s product can be characterized as

The parameters \(\tilde{a}_{i}\), \(\tilde{\gamma }\) and \(\tilde{\beta }\) are fuzzy numbers, where \(\tilde{a}_{i}\) denotes the market base of the retailer \(i\) \((i = 1,2)\), and \(\tilde{\gamma }\) and \(\tilde{\beta }\) indicate the sensibility of each retailer’s market demand with respect to the competitor’s price and its own price, respectively.

\(\tilde{q}_{i}\) and \(p_{i} - w_{i}\) should be nonnegative. According to Zhao et al. [3], Pos{·} is a possibility measure, and for an fuzzy event A, Pos{A} represents the possibility that A will occur. Therefore, \({\text{Pos}}(\{ \tilde{a}_{i} - \tilde{\beta }p_{i} + \tilde{\gamma }p_{3 - i} < 0\} ) = 0\) and \({\text{Pos}}(\{ p_{i} - w_{i} < 0\} ) = 0\).

The modeling assumptions show as follows:

-

A1. All activities of the supply chain members occur within a single period.

-

A2. The fuzzy parameters \(\tilde{a}_{i}\), \(\tilde{\beta }\) and \(\tilde{\gamma }\) are nonnegative and mutually independent. The parameters \(\tilde{\beta }\) and \(\tilde{\gamma }\) satisfy the condition that \(E[\tilde{\beta }] > E[\tilde{\gamma }]\), which denotes that each product market demand is more sensitive to variations of its own price compared to the competitor’s price.

-

A3. The manufacturer and the two retailers share perfect information regarding the cost structures and the market demands of other channel members.

Next, we explore optimal decisions with game theory to obtain maximal expect profit in four different competitive scenarios.

3.1 Stackelberg Model: Model S

This subsection analyzes competition among all channel members. The manufacturer, who is strong and has the absolute power, acts as the Stackelberg leader in the supply chain, and the two retailers having much lower power also play in the Stackelberg game. Without loss of generality, we suppose that retailer 1 is the Stackelberg leader. The decision structure of the supply chain is a dual-Stackelberg game. The manufacturer first decides the wholesale prices \(w_{1}\) and \(w_{2}\), then the retailer 1 decides the retail price \(p_{1}\), and, finally, the retailer 2 decides the retail price \(p_{2}\). In order to obtain the expected profits of all channel members, the objective function is formulated as follows:

The manufacturer’s profit is

The retailer \(i\)’s profit is

The profit function of the entire supply chain system can be written as follows:

We resolve the game using backward induction to ensure a subgame perfect equilibrium. The following propositions express the subgame perfect equilibrium.

Proposition 1

In Model S, for a given retailer \(1\) ’s decision \(p_{1}\) and manufacturer’s decisions \(w_{1}\) and \(w_{2}\) , retailer \(2\) ’s optimal decision \(p_{2}^{{S^{ * } }}\) is

under the condition that

Proof

It follows from Eqs. (1) and (3) for \(i = 2\) that

Then, the first- and second-order partial derivatives of \(E[\pi_{r2} ]\) with respect to \(p_{2}\) are

According to Eq. (8), there is an optimal retail price \(p_{2}^{{S^{ * } }}\) that maximizes \(E[\pi_{r2} ]\).

By setting Eq. (7) equal to zero, we can easily obtain as Eq. (5). Then, by substituting \(p_{2}^{{S^{ * } }}\) into Pos\(( {\{ {\tilde{a}_{2} - \tilde{\beta }p_{2}^{{S^{ * } }} + \tilde{\gamma }p_{1} < 0} \}} )\) = 0, the condition is fulfilled.

Proposition 2

In Model S, for given manufacturer’s decisions \(w_{1}\) and \(w_{2}\) , by substituting \(p_{2}^{{s^{ * } }}\) into the retailer \(1\) ’s response function, the retailer \(1\) ’s optimal retail price \(p_{1}^{{S^{ * } }}\) is

when

Proof

According to Eqs. (1) and (3) for \(i = 1\), we have

Therefore, the first- and second-order partial derivatives of \(E[\pi_{r1} ]\) with respect to \(p_{1}\) are

Accordingly, Eq. (12) indicates that there is an optimal retail price \(p_{1}^{{S^{ * } }}\) that makes \(E[\pi_{r1} ]\) optimal.

By setting Eq. (11) equal to zero, we can easily obtain Eq. (9), and then by substituting \(p_{1}^{{S^{ * } }}\) into Pos\(( {\{ {\tilde{a}_{1} - \tilde{\beta }p_{1}^{{S^{ * } }} + \tilde{\gamma }p_{2}^{{S^{ * } }} < 0} \}} )\) = 0, the condition is fulfilled.

Proposition 3

Under the conditions that \(A_{1} E[\tilde{\gamma }] + A_{2} > (A_{4} - 2E[\tilde{\beta }]E^{2} [\tilde{\gamma }])\tilde{c}_{{0^{ + } }}^{U}\) and \(A_{1} A_{4} + 2A_{2} E[\tilde{\beta }]E[\tilde{\gamma }] > A_{3} (A_{4} - 2E[\tilde{\beta }]E^{2} [\tilde{\gamma }])\tilde{c}_{{0^{ + } }}^{U}\), the optimal wholesale prices \(w_{1}^{{S^{ * } }}\) and \(w_{2}^{{S^{ * } }}\) are

where

Proof

Using Eqs. (1) and (2), the expected profit \(E[\pi_{m} ]\) can be expressed as

Therefore, the first- and second-order partial derivatives of \(E[\pi_{m} ]\) with respect

to \(w_{1}\) and \(w_{2}\) are

From Eqs. (18), (19) and (20), the Hessian matrix is

Using the assumptions \(E[\beta ] > 0\) and \(E[\tilde{\beta }] > E[\tilde{\gamma }]\), \(H_{1}\) is negatively definite; therefore, \(E[\pi_{m} ]\) is jointly concave in \(w_{1}\) and \(w_{2}\). Hence, there are optimal wholesale prices \(w_{1}^{{S^{ * } }}\) and \(w_{2}^{{S^{ * } }}\) to make \(E[\pi_{m} ]\) optimal.

By setting Eqs. (16) and (17) equal to zero, then, we can obtain Eqs. (13) and (14). By substituting \(w_{1}^{{S^{ * } }}\) and \(w_{2}^{{S^{ * } }}\) into Pos\(\left( {\left\{ {w_{i}^{{S^{ * } }} - \tilde{c} < 0} \right\}} \right)\) = 0 (\(i = 1,2\)), the conditions are fulfilled.

3.2 Bertrand Model: Model B

In this subsection, the two retailers’ powers are similar to each other; therefore, the game between the two retailers is a Bertrand game. The manufacturer, who has huge power and wholesales the products to the two retailers to determine the wholesale prices, is the Stackelberg leader in the supply chain, and the two retailers are followers, while they resolve their retail prices individually. The manufacturer first decides the wholesale prices \(w_{1}\) and \(w_{2}\), and then the two retailers simultaneously decide the retail prices \(p_{1}\) and \(p_{2}\), respectively. Under these circumstances, the objective functions of all chain members are the same as in Model S.

We solve the game using backward induction to obtain a subgame perfect equilibrium. The following propositions describe the subgame perfect equilibrium.

Proposition 4

In Model B, for given manufacturer’s decisions \(w_{1}\) and \(w_{2}\) , the two retailers’ optimal retail prices, denoted as \(p_{1}^{{B^{ * } }}\) and \(p_{2}^{{B^{ * } }}\) , are

under the conditions that

Proof

It follows from Eqs. (1) and (3) for \(i = 1,2\) that

Then, the first- and second-order partial derivatives of \(E[\pi_{r1} ]\) and \(E[\pi_{r2} ]\) with respect to \(p_{1}\) and \(p_{2}\) are

According to Eqs. (27) and (28), there are optimal retail prices \(p_{1}^{{B^{ * } }}\) and \(p_{2}^{{B^{ * } }}\) that maximize \(E[\pi_{r1} ]\) and \(E[\pi_{r2} ]\).

By setting Eqs. (25) and (26) equal to zero, we can obtain Eqs. (21) and (22). By substituting \(p_{1}^{{B^{ * } }}\) and \(p_{2}^{{B^{ * } }}\) into Pos\(( {\{ {\tilde{a}_{2} - \tilde{\beta }p_{2}^{{B^{ * } }} + \tilde{\gamma }p_{1}^{{B^{ * } }} < 0} \}} ) = 0\) and Pos\(( {\{ {\tilde{a}_{1} - \tilde{\beta }p_{1}^{{B^{ * } }} + \tilde{\gamma }p_{2}^{{B^{ * } }} < 0} \}} )\) = 0, the conditions are fulfilled.

Proposition 5

Under the conditions that \(B_{1} B_{3} + 2B_{2} E[\tilde{\beta }]E[\tilde{\gamma }] > (B_{3}^{2} - 4E^{2} [\tilde{\beta }]E^{2} [\tilde{\gamma }])\tilde{c}_{{0^{ + } }}^{U}\) and \(B_{2} B_{3} + 2B_{1} E[\tilde{\beta }]E[\tilde{\gamma }] > (B_{3}^{2} - 4E^{2} [\tilde{\beta }]E^{2} [\tilde{\gamma }])\tilde{c}_{{0^{ + } }}^{U}\) , the optimal wholesale prices \(w_{1}^{{B^{ * } }}\) and \(w_{2}^{{B^{ * } }}\) are

where

Proof

Using Eqs. (1) and (2), the expected profit \(E[\pi_{m} ]\) can be expressed as

Hence, the first- and second-order partial derivatives of \(E[\pi_{m} ]\) with respect to \(w_{1}\) and \(w_{2}\) are

Using Eqs. (34), (35) and (36), the Hessian matrix is

Recall that \(E[\tilde{\beta }] > E[\tilde{\gamma }]\), so \(H_{2}\) is negatively definite, and \(E[\pi_{m} ]\) is jointly concave with respect to \(w_{1}\) and \(w_{2}\). Therefore, there are optimal wholesale prices \(w_{1}^{{B^{ * } }}\) and \(w_{2}^{{B^{ * } }}\) that make \(E[\pi_{m} ]\) optimal.

By setting Eqs. (32) and (33) equal to zero, we can obtain Eqs. (29) and (30). By substituting \(w_{1}^{{B^{ * } }}\) and \(w_{2}^{{B^{ * } }}\) into Pos\(\left( {\left\{ {w_{i}^{{B^{ * } }} - \tilde{c} < 0} \right\}} \right)\) = 0, \((i = 1,2)\), the requirements are fulfilled.

3.3 Collusion Model: Model C

In this subsection, the two retailers work as a common corporation and play a Collusion game to maximize the common profit regardless of whose power is stronger, so they determine the two retail prices together. The manufacturer, as the Stackelberg leader in the supply chain, sells products to the retailers, and then the two retailers make a joint decision regarding the two retail prices. The manufacturer first declares the wholesale prices \(w_{1}\) and \(w_{2}\), and then the two retailers set the retail prices \(p_{1}\) and \(p_{2}\) together to reach the maximal profit of the integral company. The manufacturer’s expect profit function is the same as in Eq. (2), and the retailers’ company function is as follows:

We solve the game using backward induction to achieve a subgame perfect equilibrium. The following propositions express the subgame perfect equilibrium.

Proposition 6

In Model C, for given manufacturer’s decisions \(w_{1}\) and \(w_{2}\) , the retailers’ retail prices \(p_{1}^{{C^{ * } }}\) and \(p_{2}^{{C^{ * } }}\) are

under the conditions that

Proof

It follows from Eq. (37) that

Then, the first- and second-order partial derivatives of \(E[\pi_{r} ]\) with respect to \(p_{1}\) and \(p_{2}\) are

Using Eqs. (43), (44) and (45), the Hessian matrix is

Using the assumptions \(E[\beta ] > 0\) and \(E[\tilde{\beta }] > E[\tilde{\gamma }]\), \(H_{3}\) is negatively definite; therefore, \(E[\pi_{r} ]\) is jointly concave with respect to \(p_{1}\) and \(p_{2}\), and there are optimal retail prices \(p_{1}^{{C^{ * } }}\) and \(p_{2}^{{C^{ * } }}\) that maximize \(E[\pi_{r} ]\).

By setting Eqs. (41) and (42) equal to zero, we can obtain Eqs. (38) and (39). By substituting \(p_{1}^{{C^{ * } }}\) and \(p_{2}^{{C^{ * } }}\) into Pos\(\left( {\left\{ {\tilde{a}_{2} - \tilde{\beta }p_{2}^{{C^{ * } }} + \tilde{\gamma }p_{1}^{{C^{ * } }} < 0} \right\}} \right) = 0\) and Pos\(\left( {\left\{ {\tilde{a}_{1} - \tilde{\beta }p_{1}^{{C^{ * } }} + \tilde{\gamma }p_{2}^{{C^{ * } }} < 0} \right\}} \right) = 0\), the conditions are fulfilled.

Proposition 7

If the conditions are \(C_{1} E[\tilde{\beta }] + C_{2} E[\tilde{\gamma }] > (E^{2} [\tilde{\beta }] - E^{2} [\tilde{\gamma }])\tilde{c}_{{0^{ + } }}^{U}\) and \(C_{1} E[\tilde{\gamma }] + C_{2} E[\tilde{\beta }] > (E^{2} [\tilde{\beta }] - E^{2} [\tilde{\gamma }])\tilde{c}_{{0^{ + } }}^{U}\), the optimal wholesale prices \(w_{1}^{{C^{ * } }}\) and \(w_{2}^{{C^{ * } }}\) are

where

Proof

Using Eqs. (1) and (2), the expected profit \(E[\pi_{m} ]\) is

Therefore, the first- and second-order partial derivatives of \(E[\pi_{m} ]\) with respect to \(w_{1}\) and \(w_{2}\) are

Using Eqs. (51), (52) and (53), the Hessian matrix is

Using the assumptions \(E[\beta ] > 0\) and \(E[\tilde{\beta }] > E[\tilde{\gamma }]\), \(H_{4}\) is negatively definite; therefore, \(E[\pi_{m} ]\) is jointly concave with respect to \(w_{1}\) and \(w_{2}\). Hence, there are optimal wholesale prices \(w_{1}^{{C^{ * } }}\) and \(w_{2}^{{C^{ * } }}\) that make \(E[\pi_{m} ]\) optimal.

By setting Eqs. (49) and (50) equal to zero, we can obtain Eqs. (46) and (47). Then, by substituting \(w_{1}^{{C^{ * } }}\) and \(w_{2}^{{C^{ * } }}\) into Pos\(\left( {\left\{ {w_{i}^{{C^{ * } }} - \tilde{c} < 0} \right\}} \right)\) = 0, \((i = 1,2)\), the requirements are fulfilled.

3.4 Global Cooperation Model: Model G

In this subsection, all chain members participate in global cooperation, so that they determine the retail prices together. In such a situation, the objective function that maximizes the total profit is the same as in Eq. (4).

Proposition 8

If the conditions are

the optimal retail prices \(p_{1}^{{G^{ * } }}\) and \(p_{2}^{{G^{ * } }}\) are

where

Proof

Using Eqs. (1) and (4), the expected profit \(E[\pi_{T} ]\) can be expressed as

Then, the first- and second-order partial derivatives of \(E[\pi_{T} ]\) with respect to \(p_{1}\) and \(p_{2}\) are

Using Eqs. (59), (60) and (61), the Hessian matrix is

Using the assumption \(E[\tilde{\beta }] > E[\tilde{\gamma }]\), \(H_{5}\) is negatively definite; therefore, \(E[\pi_{T} ]\) is jointly concave with respect to \(p_{1}\) and \(p_{2}\). Hence, there are optimal retailer prices \(p_{1}^{{G^{ * } }}\) and \(p_{2}^{{G^{ * } }}\) that make \(E[\pi_{T} ]\) optimal.

By setting Eqs. (57) and (58) equal to zero, we can obtain Eqs. (54) and (55). Then, by substituting \(p_{1}^{{G^{ * } }}\) and \(p_{2}^{{G^{ * } }}\) into \({\text{Pos}}\left( {\left\{ {p_{i}^{{G^{ * } }} - \tilde{c} < 0} \right\}} \right) = 0\) and \({\text{Pos}}\left( {\left\{ {\tilde{a}_{i} - \tilde{\beta }p_{i}^{{G^{ * } }} + \tilde{\gamma }p_{3 - i}^{{G^{ * } }} < 0} \right\}} \right) = 0\), \((i = 1,2)\), the requirements are fulfilled.

4 Numerical Example

In the previous section, we have analyzed uncertainty issues closely related to the supply chain assuming different types of competitive behavior of duopolistic retailers. The results of these models are quite complex, since they involve fuzzy numbers, especially with \(\alpha\)-pessimistic and \(\alpha\)-optimistic values. It is difficult to conduct comparative analysis of the results. Accordingly, we analyze the influence of the fuzzy degree of each parameter on the above optimal results in four different decision scenarios using numerical calculations.

The following data used for the numerical simulations are very similar to those of Wei and Zhao [2] and Zhao et al. [3]. Under the uncertainty, the manager determines the critical parameter according to the experts’ experiences. Considering the relationship between triangular fuzzy numbers and linguistic expressions, the data on the price elasticity, market base and unit manufacturing cost are exhibited in Table 2.

4.1 Comparison of the Optimal Results for the Four Different Models

Consider the case that the unit manufacturing cost \(\tilde{c}\) is high, the market base \(\tilde{a}_{1}\) is medium, the market base \(\tilde{a}_{2}\) is medium, the price elasticity \(\tilde{\beta }\) is very sensitive, and the price elasticity \(\tilde{\gamma }\) is very sensitive. Based on Table 2, \(\tilde{c}\) = (12, 15, 20), \(\tilde{a}_{1}\) = (1300, 1500, 1600), \(\tilde{a}_{2}\) = (1100, 1300, 1400), \(\tilde{\beta }\) = (70, 80, 90), and \(\tilde{\gamma }\) = (45, 55, 70). According to the definition from Zhao et al. [3], the expected values of these fuzzy numbers represent as follows:

The \(\alpha\)-optimistic and \(\alpha\)-pessimistic values of \(\tilde{c}\), \(\tilde{a}_{1}\), \(\tilde{a}_{2}\), \(\tilde{\beta }\), \(\tilde{\gamma }\) represent as follows:

The corresponding results for comparison and analysis are shown in Tables 3 and 4.

Form Tables 3 and 4, the following results can be obtained:

-

1.

The optimal expected profit of the whole system in the Collusion model is the lowest, being far below the other three models, followed by the Stackelberg and then the Bertrand models, while the global cooperation model has the highest total profit. It is clear that the profit of the whole system in the Collusion model shows the highest losses. Compared to this model, the other two competitive models have a large advantage in terms of the optimal expected profits of the whole system.

-

2.

The optimal expected profit of the manufacturer in the Bertrand model is higher than that in the Collusion model, which demonstrates that the competitive behavior of the retailers has impact on the manufacturer’s profit. With regard to the optimal expected profits of the retailers in the Stackelberg model, retailer 1 has a significantly higher profit than retailer 2, because retailer 1 acts as the Stackelberg leader. In the Bertrand model, the optimal expected profit of retailer 1 is much larger than that of retailer 2.

-

3.

The optimal wholesale prices of the two products in the three different models are the same. It is easily to see that the optimal wholesale prices have nothing to do with the competitive behavior of the retailers. The optimal retail prices in the model of global cooperation are lowest, and in the Collusion model they are highest, leading to a larger disadvantage for customers. The conclusions indicate that it is necessary for the government to take some measures to intervene the Collusion game.

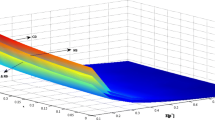

4.2 The Influence of Changes in the Fuzzy Degree of the Parameter \(\tilde{\beta }\) in the Three Different Models

In this subsection, we explore the impact of the fuzzy degree of the parameter \(\tilde{\beta }\) on the optimal expected profits and optimal prices in the Bertrand, Stackelberg and Collusion models. The optimal expected profits and optimal prices in these three models for different values of the fuzzy degree of parameter \(\tilde{\beta }\) dropping are shown in Tables 5, 6, 7, 8, 9 and 10. The parameters are the same as the values above except for the parameter \(\tilde{\beta }\), \(\tilde{c}\) = (12, 15, 20), \(\tilde{a}_{1}\) = (1300, 1500, 1600), \(\tilde{\gamma }\) = (45, 55, 70) and \(\tilde{a}_{2}\) = (1100, 1300, 1400).

From Tables 5, 6, 7, 8, 9 and 10, we can reach the following conclusions.

-

1.

The optimal expected profits of the whole system and the manufacturer decrease when the fuzzy degree decreases in these three models. This indicates that the higher uncertainty in parameters with higher risks, the higher income is obtained. The optimal expected profits of the retailers increase when the fuzzy degree of the parameter \(\tilde{\beta }\) decreases in these three scenarios.

-

2.

The optimal wholesale prices and retail prices slightly change when the fuzzy degree of the parameter \(\tilde{\beta }\) decreases in these three scenarios.

4.3 The Influence of Changes in the Fuzzy Degree of the Parameter \(\tilde{\gamma }\) in the Three Models

When the fuzzy degree of the parameter \(\tilde{\gamma }\) declines, we observe changes in the optimal expected profits and optimal prices in the Bertrand, Stackelberg and Collusion models. The parameters are \(\tilde{c}\) = (12, 15, 20), \(\tilde{a}_{1}\) = (1300, 1500, 1600), \(\tilde{a}_{2}\) = (1100, 1300, 1400) and \(\tilde{\beta }\) = (70, 80, 90).

From Tables 11, 12, 13, 14, 15 and 16, we can obtain the following results:

-

1.

The fuzzy degree of the parameter \(\tilde{\gamma }\) has a slightly positive effect on the optimal expected profits of the total system and the manufacturer with the fuzzy degree increasing in these three models. The optimal expected profits of the retailers increase when the fuzzy degree of the parameter \(\tilde{\gamma }\) decreases in the three scenarios.

-

2.

Changes in the optimal wholesale prices and retail prices are not clear when the fuzzy degree of the parameter \(\tilde{\gamma }\) decreases in the three scenarios.

5 Conclusion

In the study, we develop game-theoretical models to analyze a one-manufacturer–two-retailers supply chain where the duopolistic retailers adopt different types of competitive behavior (i.e., Stackelberg, Bertrand and Collusion) and a global cooperation. Based on observations in practice, four models are addressed in competitive behavior scenarios with numerical analysis, and we compare the optimal results obtained in the four decision scenarios and study the influences of changes in fuzzy numbers’ degrees. We express the conclusion that the global cooperation model is optimal with respect to the profit of the supply chain system and the retail prices. With regard to the optimal profits of the chain system and the manufacturer in the three competitive behavior models, the Bertrand model leads to the highest profits, followed by the Stackelberg and Collusion models. In terms of the retailers’ optimal profits, the Stackelberg competition model is better than the Bertrand competition model. A decrease in the fuzzy degree of the two price elasticities leads to a decrease in the optimal profits of the whole system and the manufacturer together with the optimal wholesale prices and retail prices, while the optimal profits of the two retailers increase.

Inevitably, some limitations exist in the paper. Firstly, according to the assumptions that the fuzzy numbers, such as the market capacity and the interaction between the product prices, are mutually independent, we can extend to consider the factors of mutual influence among these three parameters. Secondly, the manufactured costs and demands are symmetrical, and there is a new trend to tackle over the case of asymmetric information. Thirdly, we have adopted type-1 fuzzy numbers to characterize the uncertainty, and future research can try to introduce type-2 fuzzy numbers to solve this problem.

References

Yang, S.L., Zhou, Y.W.: Two-echelon supply chain models: considering duopolistic retailers’ different competitive behaviors. Int. J. Prod. Econ. 103(1), 104–116 (2006)

Wei, J., Zhao, J.: Pricing decisions for substitutable products with horizontal and vertical competition in fuzzy environments. Ann. Oper. Res. 242(2), 505–528 (2016)

Zhao, J., Tang, W., Zhao, R., Wei, J.: Pricing decisions for substitutable products with a common retailer in fuzzy environments. Eur. J. Oper. Res. 216(2), 409–419 (2012)

Yang, D., Xiao, T.: Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J. Clean. Prod. 149, 1174–1187 (2017)

Giri, B.C., Bardhan, S., Maiti, T.: Coordinating a three-layer supply chain with uncertain demand and random yield. Int. J. Prod. Res. 54(8), 1–20 (2015)

Cardoso, S.R., Barbosa-Póvoa, A.P., Relvas, S., Novais, A.Q.: Resilience metrics in the assessment of complex supply-chains performance operating under demand uncertainty. Omega 56(1), 53–73 (2015)

Kaya, O., Bagci, F., Turkay, M.: Planning of capacity, production and inventory decisions in a generic reverse supply chain under uncertain demand and returns. Int. J. Prod. Res. 52(1), 270–282 (2014)

Zadeh, L.A.: Fuzzy sets. Inf. Control 8(3), 338–353 (1965)

Zadeh, L.A.: Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. 1, 3–28 (1978)

Guo, S., Yu, L., Li, X., Kar, S.: Fuzzy multi-period portfolio selection with different investment horizons. Eur. J. Oper. Res. 254(3), 1026–1035 (2016)

Xu, Z., Liao, H.: A survey of approaches to decision making with intuitionistic fuzzy preference relations. Knowl. Based Syst. 80(5), 131–142 (2015)

Peng, J., Wang, J., Wu, X., Zhang, H., Chen, X.: The fuzzy cross-entropy for intuitionistic hesitant fuzzy sets and their application in multi-criteria decision-making. Int. J. Syst. Sci. 46(13), 2335–2350 (2015)

Qin, J., Liu, X., Witold, P.: Hesitant fuzzy maclaurin symmetric mean operators and its application to multiple-attribute decision making. Int. J. Fuzzy Syst. 17(4), 509–520 (2015)

Yu, S.M., Wang, J., Wang, J.Q.: An interval type-2 fuzzy likelihood-based MABAC approach and its application in selecting hotels on a tourism website. Int. J. Fuzzy Syst. 19(1), 1–15 (2016)

Sang, S.: Optimal models in price competition supply chain under a fuzzy decision environment. J. Intell. Fuzzy Syst. 27(1), 257–271 (2014)

Choi, S.C.: Price competition in a channel structure with a common retailer. Mark. Sci. 10(4), 271–296 (1991)

Yue, J., Austin, J., Wang, M.C., Huang, Z.: Coordination of cooperative advertising in a two-level supply chain when manufacturer offers discount. Eur. J. Oper. Res. 168(1), 65–85 (2006)

Hua, G., Wang, S., Cheng, T.C.E.: Price and lead time decisions in dual-channel supply chains. Eur. J. Oper. Res. 205(1), 113–126 (2010)

Hsieh, C.C., Chang, Y.L., Wu, C.H.: Competitive pricing and ordering decisions in a multiple-channel supply chain. Int. J. Prod. Econ. 154(4), 156–165 (2014)

Zhu, S.X.: Integration of capacity, pricing, and lead-time decisions in a decentralized supply chain. Int. J. Prod. Econ. 164, 14–23 (2015)

Shafiee-Gol, S., Nasiri, M.M., Taleizadeh, A.A.: Pricing and production decisions in multi-product single machine manufacturing system with discrete delivery and rework. OPSEARCH 53(4), 873–888 (2016)

Liu, L., Wang, Z., Xu, L., Hong, X., Govindan, K.: Collection effort and reverse channel choices in a closed-loop supply chain. J. Clean. Prod. 144, 492–500 (2017)

Giri, R.N., Mondal, S.K., Maiti, M.: Bundle pricing strategies for two complementary products with different channel powers. Ann. Oper. Res. (2017). https://doi.org/10.1007/s10479-017-2632-y

Lau, A.H.L., Lau, H.S.: Effects of a demand-curve’s shape on the optimal solutions of a multi-echelon inventory/pricing model. Eur. J. Oper. Res. 147(3), 530–548 (2003)

Wu, C.H., Chen, C.W., Hsieh, C.C.: Competitive pricing decisions in a two-echelon supply chain with horizontal and vertical competition. Int. J. Prod. Econ. 135(1), 265–274 (2011)

Cao, E., Wan, C., Lai, M.: Coordination of a supply chain with one manufacturer and multiple competing retailers under simultaneous demand and cost disruptions. Int. J. Prod. Econ. 141(1), 425–433 (2013)

Jena, S.K., Sarmah, S.P.: Price competition and co-operation in a duopoly closed-loop supply chain. Int. J. Prod. Econ. 156(5), 346–360 (2014)

Roy, A., Sana, S.S., Chaudhuri, K.: Optimal pricing of competing retailers under uncertain demand-a two layer supply chain model. Ann. Oper. Res. (2015). https://doi.org/10.1007/s10479-015-1996-0

Luo, Z., Chen, X., Chen, J., Wang, X.: Optimal pricing policies for differentiated brands under different supply chain power structures. Eur. J. Oper. Res. 259(2), 437–451 (2017)

Giannoccaro, I., Pontrandolfo, P., Scozzi, B.: A fuzzy echelon approach for inventory management in supply chains. Eur. J. Oper. Res. 149(1), 185–196 (2003)

Wang, J., Shu, Y.F.: Fuzzy decision modeling for supply chain management. Fuzzy Sets Syst. 150(1), 107–127 (2005)

Chen, C.T., Lin, C.T., Huang, S.F.: A fuzzy approach for supplier evaluation and selection in supply chain management. Int. J. Prod. Econ. 102(2), 289–301 (2006)

Kumar, D., Singh, J., Singh, O.P.: A fuzzy logic based decisionsupport system for evaluation of suppliers in supply chain management practices. Math. Comput. Model. 58(11–12), 1679–1695 (2013)

Shen, J., Zhu, K.: Uncertain supply chain problem with price and effort. Int. J. Fuzzy Syst. (2017). https://doi.org/10.1007/s40815-017-0407-x

McGuire, T., Staein, R.: An industry equilibrium analyses of downstream vertical integration. Mark. Sci. 2(2), 161–191 (1983)

Qin, J.D., Liu, X.W., Witold, P.: An extended TODIM multi-criteria group decision making method for green supplier selection in interval type-2 fuzzy environment. Eur. J. Oper. Res. 258(2), 626–638 (2017)

Qin, J.D., Liu, X.W.: Multi-attribute group decision making using combined ranking value under interval type-2 fuzzy environment. Info. Sci. 297, 293–315 (2015)

Acknowledgements

This work is supported by the National Natural Science Foundation of China (Grant No. 71672071).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhong, Q., Wang, Z. & Hong, X. Pricing Decisions in a Fuzzy Supply Chain System Considering Different Duopolistic Retailers’ Competitive Behavior. Int. J. Fuzzy Syst. 20, 1592–1605 (2018). https://doi.org/10.1007/s40815-017-0437-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-017-0437-4