Abstract

We analyse the financing of R&D activity in Italy, using data at firm level that cover a wide range of sources of financing, such as internal funds, bank loans and access to financial markets. Our analysis shows the importance of relationship lending in fostering innovative activities. The relation between innovative firms and their main bank tends to be relatively long lasting, permitting the bank to reduce information asymmetry, while low credit concentration is a common feature among these firms, presumably allowing them to attenuate hold-up problems. Nonetheless, firms that rely on bonds and outside equity financing tend to have a higher propensity to invest more in R&D, suggesting that relationship lending is only a partial substitute for access to stock and bond markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

From the seminal paper of King and Levine (1993) onwards, a large body of empirical literature has studied the contribution of finance to growth, drawing on Schumpeter’s writings on the microeconomics of innovation. There is a wide consensus that financial constraints represent one of the main obstacles inhibiting R&D activities, due to the asymmetric information between the entrepreneur and the financier, the high uncertainty of the innovation process and the extreme skewness of its returns; therefore, a well-functioning financial system (both markets and financial institutions) has the potential to spur innovation and economic growth (see the reviews of O’Sullivan 2004; Levine 2005; Hall and Lerner 2009; Kerr and Nanda 2014). The topic of innovation financing also represents a link between the fields of entrepreneurship and finance (Audretsch et al. 2016). In fact, information asymmetry is particularly pronounced for both new ventures, due to the difficulty faced by entrepreneurs in conveying the quality of their ideas to outside financers, and for innovation activities, even when accomplished by established corporations.Footnote 1

As regards to financing sources, early research emphasized the importance of internal resources and public equity markets to finance innovation. However, more recent work has highlighted the role of bank finance, showing that the latter is somewhat common for innovating firms (Herrera and Minetti 2007; Robb and Robinson 2014; Chava et al. 2013; Cornaggia et al. 2013). Using Italian data, in this paper we investigate whether tight relationships between firms and banks may favour innovation investments. A priori, the theoretical literature does not provide an undisputed reply to this research question. Banks could mitigate information asymmetries by establishing long-lasting relationships with innovative firms. However, when the firm is informationally captured, the lending bank is in a position to extract an additional rent or threaten to deny new funds because of its low substitutability (hold-up) (Sharpe 1990; Rajan 1992). Furthermore, banks may not have the skills to evaluate new technologies and tend to discourage these investments (Rajan and Zingales 2003; Atanassov et al. 2007).

The case of Italy appears to be interesting in this regard, provided that the country is historically characterized by being a bank-oriented economy rather than a market-based one, and bank debt is the main source of external finance. Furthermore, the Italian economy has experienced a period of stagnant growth, even before the global crisis of 2008–2009, also due to its lower propensity to innovate (Bugamelli et al. 2012). We use a unique dataset that combines several sources of data on R&D expenditure at firm level and on many aspects of its financing. Using the Bank of Italy’s survey on manufacturing firms with at least 50 employees (INVIND), we draw information on research and development (R&D) expenditure in the 2003–2009 time span. From balance sheet data (Cerved), we obtain information on internal funds (cash flow) and leverage ratios. Using data from Italy’s Central Credit Register (Centrale dei rischi), we build specific indices on the type of relationship with the lending banks, such as the length of the bank-firm relation and the degree of concentration of outstanding bank debt.

Our results show the relevance of relationship banking in financing innovative activities. Long-lasting relations with the main bank are important in easing financial constraints and favouring the decision to carry out R&D. However, innovative firms tend to have not only longer relationships with the main bank but also a low concentration of outstanding debt among lending banks. We argue that this framework could be adopted in order to enhance bank’s information on the firm, while the firm attenuates the information capture by spreading its debt among many banks. In any event, access to financial markets (stock and bond markets) appears to be very important for financing of innovation. From a policy view, our results indicate that a bank-oriented economy like Italy’s can tap growth opportunities by steering the financial system in the direction of more highly developed financial markets, where different types of investors, such as venture capitalists and business angels, could ease financing constraints on innovative firms and new ventures.

The paper is organized as follows. Section 2 discusses the theoretical and empirical literature. Section 3 presents the data. The econometric analyses are reported in Sects. 4 (the models adopted) and 5 (the estimation results). Section 6 concludes.

2 Literature review

There is a wide consensus in the literature that financial constraints represent one of the main obstacles inhibiting R&D activities, also due to asymmetric information between the entrepreneur and the financier.Footnote 2 Thus, entrepreneurs often resort to internal sources.Footnote 3

Consistently with theoretical predictions, the empirical literature shows a positive correlation between R&D and cash flow. More in detail, Hall (1992) finds a positive elasticity between R&D and cash flow in a large sample of US manufacturing firms. Himmelberg and Petersen (1994) have extended this result to small firms in high-tech industries; similar evidence were documented also for French firms by Mulkay et al. (2001), for British and German firms by Bond et al. (2006), and for Italian firms by Ughetto (2008). Brown et al. (2009) show that US firms relied heavily on cash reserves to smooth R&D spending during a period characterized by boom and bust in stock market returns.Footnote 4

According to Allen and Gale (1999), when there are different opinions among investors (as for more innovative initiatives) projects are more likely to be financed if firms have direct access to stock markets, where the financiers participate to the upside potential of the company.

Atanassov et al. (2007) draw the attention to the role of bond markets. They assume that firms with more innovative projects tend to rely on arm’s length financing, which allows greater independence to managers. On the contrary, less-innovative firms, whose projects are easier to evaluate, give less discretion to managers, and bank borrowing is prevalent.Footnote 5 In their empirical analysis on a large panel of US companies from 1974 to 2000, Atanassov et al. (2007) find that companies relying more on outside equity or bond financing receive a larger number of patents, compared to other firms. They interpret this evidence as a signal that banks are less able to evaluate new technologies and therefore discourage investment in innovation. Also, Rajan and Zingales (2003) highlight that in relationship-based financing, the lender may not have the necessary skills to properly evaluate innovative technologies; thus, their close monitoring might discourage such investments. Similar findings are reported by Blass and Yosha (2003) and Aghion et al. (2004): these studies, using data for Israel and the UK, respectively, show that large, listed innovative firms tend to finance their activity by issuing shares.

However, more recently, the literature has reconsidered the potential role of bank finance for innovation (Herrera and Minetti 2007; Robb and Robinson 2014; Chava et al. 2013; Cornaggia et al. 2013). Banks may play a role by reducing informational asymmetries, thanks to a better knowledge of firm’s prospects, gathered through repeated interactions over time. In relationship-based lending, the bank invests to gather information on the quality of the borrower. This investment is especially valuable for small and opaque firms without direct access to financial markets (Boot 2000; Berger and Udell 2006).

However, a tight credit relationship can expose the firm to the risk of being “informationally captured” by the bank: the lending bank may cross-subsidize initial lower interest rates with future higher profits (hold-up) (Sharpe 1990) or can threaten not to provide additional funds to the borrowing firm (Rajan 1992). Innovative firms face more-severe hold-up problems, because the prospects of R&D investments are generally more informationally opaque, and new financiers are difficult to find (Rajan and Zingales 2001; Rajan 2012). Hence, firms may spread their outstanding debt on a larger number of lending banks to cope with this hold-up problem (Ongena and Smith 2000). They might want to decrease the credit concentration to assure themselves against liquidity shocks by the main bank, since a fund withdrawal by the main bank is difficult to offset for opaque and risky firms (Detragiache et al. 2000).

Besides, due to the ease of imitation of inventive ideas, firms are reluctant to reveal their innovative ideas to the marketplace. Thus, they could have a strategic preference not to disclose information (Bhattacharya and Chiesa 1995; von Rheinbaben and Ruckes 2004). In the model put forth by von Rheinbaben and Ruckes (2004), for example, if a firm discloses confidential information to lenders, these can more precisely evaluate its risk, thus reducing interest rate, but at the cost of hampering firm profitability, since the information may be revealed to rival firms: the model predicts a U-shaped relation between innovativeness and the number of bank-lending relationships. As there is substantial cost to revealing information, the quality of the signal the bank can extract about a potential project is lower (Anton and Yao 1998). As a whole, the effects of banks information on innovativeness are a priori ambiguous.

Moving from these theoretical insights, in the past 10 years the empirical literature on innovation financing has investigated the role of banks, generating new findings that have questioned some long-held beliefs. In particular, there is growing evidence that bank debt is an important source of finance for firms engaged in innovation, particularly for larger firms with tangible and intangible assets to pledge as collateral (Chava et al. 2012, 2013; Cornaggia et al. 2013; Mann 2014; Robb and Robinson 2014). Some analyses are based on Italian data.Footnote 6 In particular, Herrera and Minetti (2007) find that banks’ information (proxied by the length of credit relationships) fosters firms’ innovation. Benfratello et al. (2008) show that banking development (captured by the evolution in bank branch density) affects the probability of process innovation, particularly for firms that are small and operating in high-tech industries or in sectors more reliant on external finance. Alessandrini et al. (2010) document that small and medium-sized enterprises (SMEs), located in provinces where the local banking system is functionally distant, introduce fewer innovations, while the market share of large banks exerts only a slightly positive effect on firms’ propensity to innovate.

This set of researches constitutes a valuable benchmark for evaluating our analysis; at the same time, we differentiate from them for a number of aspects, concerning data and research purpose. About data, we dispose of more-detailed information on bank-firm relations, even if our sample does not include small firms (those with fewer than 50 employees) and miss other sources of innovation finance, such as business angels, venture capital, crowdfunding and government grants.Footnote 7 Consistent with the data, our main goal consists in a broader evaluation of the contribution of relationship banking on innovation financing; we are also able to compare the role of relationship banking with respect to the direct access to financial markets, a debated policy issue in Italy.

3 Data and stylized facts

The data set considers firm-level data, obtained from the Bank of Italy’s Survey on Investment by Manufacturing Firms (INVIND). This is an open panel of nearly 2000 Italian manufacturing firms with at least 50 employees (Banca d’Italia 2009). The questionnaire collects a wide range of information: year of foundation, location, sector of activity, employment, sales (domestic and foreign), investments, etc. It reports also quantitative information on firms’ yearly R&D expenditure.

Balance sheet data are drawn from official records filed to the Italian Chambers of Commerce and reported by Cerved Group. These firm-level data have been matched with the statistics from the Italian Credit Register (Centrale dei Rischi), which reports data on credit lines granted by every bank that lends to the selected firms.

After merging these sources, the sample consists of around 1800 firms and nearly 5400 observations between 2004 and 2009. It is an unbalanced panel (INVIND is an open panel, albeit it tends to be stable over time), with an average of three observations for each firm.

Table 1 reports the composition of the dataset by size (number of employees), sector of activity (based on the Pavitt technological classification), export propensity, localization and age. Table 2 shows the definition of the variables.

In our sample, most firms are medium sized (less than 250 employees) and operate in low-tech industries (71 % of the firms being part of the supplier-dominated or the scale-intensive sectors according to the Pavitt classification). Almost 20 % of the sample refers to highly export-oriented firms (more than two-thirds of their production are exported), while another 28 % exports more than one-third of the production. Firms are fairly aged: only 5 % of the observations refer to firms less than eight years old.

As Italy is characterized by strong territorial differences, both in the productive and in the financial structure, it is important to control for the location of firms. To this end, we use a set of dummies for geographical areas (North-West, North-East, Centre, South) and the type of local labour system (large metropolitan areas, defined as local labour systems with more than one million inhabitants; industrial districts, defined according to the Sforzi-Istat methodology (Istat 2005); other non-agglomerated areas).

We use two alternative (even if related) variables in order to measure R&D activity.Footnote 8 The first is a dummy (Drd) equal to 1 if a firm invests in R&D expenditures (R&D propensity), catching the occurrence of the phenomenon, irrespective to its amount (extensive margin). The second catches the intensity of these investments, and it is computed by the ratio between the amount of R&D investments and the number of employees (intensive margin).

Table 1 reports the frequency of R&D expenditure and the average R&D investment per employee. Half of the sample performs R&D, with an investment equal to, on average, 2000 euros per employee.

There is positive correlation between R&D and size: 69 % of very large firms (more than 500 employees) perform R&D, against 44 % of small firms (fewer than 250) and 59 % for medium ones (250–500 workers). The same is true for the level of investment: large firms invest in R&D, nearly 5400 euros per employee, against 1500 for smaller firms.

Both R&D propensity and intensity increase substantially with export levels. The sector of activity is important, too. Of science-based firms, 72 % carry out research, and they invest more than 7860 euros per employee. These figures are respectively 46 % and 1077 for low-tech firms. Older and younger firms show fewer clear-cut differences, albeit younger firms (less than eight years old) invest noticeably more than the average.

Among the main controls, a firm’s location is especially interesting, as spill-over effects are among the main sources of innovation that the theory has enlightened. Based on our data, R&D is frequently carried out by firms located in agglomerated areas, especially in metropolitan areas. Both the occurrence and the level of R&D activity are lower in the South.

Table 3 reports the composition of the sample according to variables that describe the type of financing and relationship with the banking system.

Firms may finance the innovative activity using internal funds. In the empirical analysis, we use the ratio of cash flow on total sales (cash flow) to control for this feature. To finance its R&D activity, a firm may engage in relationship-based financing with one or few lending banks. All the firms in our sample have a lending relationship with at least one bank. Relationship-based lending is a somewhat-complicated concept to measure, due to its multidimensional nature. To describe the type of relationship established between borrowing firms and lending banks, we adopt two main variables regarding the duration of the relationship with the main bank and the credit concentration. The main bank is assumed to be the bank that has the highest share over total outstanding bank debt of the firm. The length of the relationship with this bank is computed, starting from 2000. As a robustness check, we consider also a dummy for relationships longer than 5 years (the median value in the sample) instead of the continuous variable, which mitigates the possible truncation problems.

The second variable is the Herfindahl concentration index of bank debt among all the lending banks (Herfindahl). This index, commonly used in the empirical research, should catch whether the firm has spread its debt among many banks or it has concentrated it towards just one bank. Typically, firms tend to spread their bank debt among intermediaries to avoid hold-up problems or to assure against liquidity shocks by the main bank. The size of the main bank is also considered (bank size). We control also for the role of bank loans on overall financing, considering the ratio between bank debt and the book value of debt towards financial intermediaries and private investors, with the exclusion of equity financing. We take into account also the composition of the credit lines that the bank has granted to the firm, according to their maturity (short-term debt).

Finally, the firm may resort to financial markets by issuing bonds or equity. We introduce a dummy for the access to financial markets, which is equal to one if the firm is listed or has issued bonds (financial markets), zero otherwise. Unfortunately, we do not have more information on this point, such as the amount of bond issued or new capital raised. As a matter of fact, we have too few observations in the sample (just 87 firms are listed, and around 190 have issued bonds) to infer a compelling result on the variable.

Higher cash flows seem to improve slightly the R&D propensity and, even more, the intensity of investments. The frequency of R&D is increasing with the length of the relationship with the main bank. However, the investment levels are higher at the two boundaries, when the length of the lending relationship is either very short or very long, even if the differences are limited. Credit concentration index is inversely related to the occurrence of R&D and positively to the level of R&D investments. Last, the access to financial markets (listed firms or with public debt outstanding) is accompanied with higher R&D activity, both in terms of propensity and intensity. Nonetheless, this evidence could be explained also by the size of the firms, generally larger for listed companies, and therefore, these aspects should be controlled by a proper multivariate analysis.

Table 4 shows the main statistics for the variables used in the empirical analysis, which are always considered with a 1-year lag with respect to R&D in order to limit potential endogeneity problems.

4 The econometric strategy

To analyse the firm’s research activity, we should consider separately the propensity to perform the R&D activity (extensive margin) and the decision on how much to invest (intensive margin). The idea behind the model is that the firm first decides whether to do R&D or not according to an unknown profit function. Then, it chooses the level of investment intensity. Therefore, our explanatory variables may influence differently the probability to undertake and the level of the investment in R&D.

4.1 Extensive margin

To analyse the firm’s propensity to carry out research, the dependent variable is defined as a dummy, equal to 1 if the firm has invested in R&D in the year of observation or in the previous year; 0 otherwise. Since the dependent variable is discrete, a probit model is considered in the estimates.Footnote 9 Further, the existence of individual differences across firms should be addressed. The existence of panel information allows disentangling the individual behaviour from the average. Since fixed-effect models are problematic in a non-linear setting, at this stage, we consider only a random-effect model, where the error term consists in a time-invariant individual component and a residual. Therefore, the propensity to carry out research is estimated by means of a probit model, with random effects to catch firm heterogeneity ui, according to the following specification:

where Φ is the normal cumulative distribution function, and ui is the random disturbance characterizing the ith firm and constant through time, independent from the error term eit and from the regressors. In the estimates the errors are corrected for clustering for firms.

The regressors Xit-1 are the set of variables that describe the type of external financing the firm has undertaken. These are: the cash flow, the relationship-lending variables (the length of the relation with the main bank and the concentration of outstanding bank-debt among the lending banks), the share of bank loans over total financing, the maturity of the outstanding bank loans (share of short term bank loans over total banks loans) and the access to financial markets. We also add controls for the size of the main bank. Fit-1 are a set of controls for the firms’ characteristics. These are: size, age, leverage, the composition of the labour force (i.e., the share of white collars over total workers as a proxy of human capital) and export propensity, as the share of exported production over total sales. Ci are dummies—essentially time-invariant in our sample—to control for the localization of the firm (metropolitan areas, industrial districts, macro-regions), the sector of activity, according to the Pavitt taxonomy, and group membership.

4.2 Intensive margin

We consider a specification where the dependent variable measures the intensity of the R&D activity, and it is equal to the (log) of expenses in R&D over the number of employees of the firm.

At this stage, we need to address the potential selection problem, which may bias our results (Hall et al. 2009). As stated before, half of the sample has reported zero R&D investments. It is sensible to assume that firms report a positive R&D investment only when it is higher than a certain threshold and is otherwise censored to zero. Furthermore, firms may not report any R&D investment, as long it is performed informally or jointly with other activities within the productive process rather than in a specialized department (such as a technical laboratory) with a separate accounting. In the former case, data are difficult to gather or even to estimate for survey purpose. Some characteristics of the firm, such as its dimension or sector of activity, may influence ex ante the organization of the research activity. In this framework, OLS would be inconsistent, either considering only strictly positive information or allowing censored observations to be set to zero (Wooldridge 2002). We address this issue by using a model with sample selection (Heckman 1979).

Yet, the selection problem is even worse because of the panel dimension in our data. The approach in the literature is: (i) to estimate the selection equation with a year-by-year probit model, where the dependent variable is a dummy equal to 1 if the firm had a positive R&D expenditure in year t, and 0 otherwise; (ii) to insert the selection variable (the inverse Mills ratios), computed for each observation in each time period from the probit model, in the intensity equation, where the R&D expenditure is the dependent variable (Wooldridge 1995; Jones and Labeaga 2003). Therefore, the model we consider is:

where \(y_{2}^{*}\) is observed if y 1 = 1 and

where 1(.) is equal to 1 if the relation inside the brackets is true. The main variable \(y_{2it}^{*}\) is observed only if the first equation is verified. This model can be estimated by considering a year-by-year reduced form for the probit variable y 1it , and thereby constructing the selection term \(\lambda_{it}\) for every i and t that is added as a new regressor in the investment equation. In the estimates, the errors are corrected for clustering for firms.

To identify the first step in order to construct the selection term \(\lambda_{it}\), we use alternatively two different variables. From the survey, and referring to the year 2000, we have the information about the share of sales that the firm produces and sells under its own company brand: we assume that a firm that brands its own products should perform some research, as opposed to a firm that produces and sells on commission to other firms and, most likely, follows their instructions and design. This intuition is corroborated by two side estimates that show that this variable is significant in influencing R&D propensity, but it has no effect on the level of R&D investment (see the next section). As an alternative identification strategy, firms were asked in 2004 whether they have a separated engineering unit within the firm. We assume this variable should be correlated to the propensity to perform the R&D in the following years without affecting the level of R&D investments. Again, the variable has an impact on R&D propensity, but it does not affect R&D investments (see the next section).

5 The econometric results

Table 5 shows the results for the probability to perform the Research and Development activity inside the firms (extensive margin). It reports the marginal effects computed at the average for each variable. Since the likelihood ratio test for poolability (ρ = 0) is always rejected, we dismiss the single probit model (column 1 in Table 5) and rather focus on the probit model with random effects (columns 2 and 3).

When considering the level of R&D investments, first, we inspect the significance of our identification variables (Table 6). The two variables are both highly significant in the estimates of the probability to perform R&D (probit estimates in columns 1 and 3). On the contrary, they show no impact on the level of investments (columns 2 and 4); this latter result supports the exclusions needed to identify the Heckman model. Tables 7 and 8 report the estimates for the intensity of R&D investments, defined as (log) R&D expenses over total employees (intensive margin), where we add the inverse Mills ratios, computed for each observation and estimated by the probit model for each year. In Table 7, the instrumental variable in the first step is the sales with the company’s brand over total sales in 2000. In Table 8, we use the existence of an engineering unit within the firm as an instrument. In the second step, we consider both random and fixed effects at firm level.

The inverse Mills ratios are significant in the estimates with random effects, thus calling for the Heckman selection model (even if only slightly in some specification). Yet, they lose their significance when we consider fixed-effect models (columns 2 and 4 in Tables 7 and 8): most likely, because of the inertia in the R&D decision, the inverse Mill ratio has a low variance across time; hence, its significance is strongly reduced when fixed effects are used. This is true also for most of the variables, which pinpoint mainly structural characteristics of the firm and have a low time-variance.

5.1 Financial factors

In our results, financial factors proved very important in affecting innovative activity. Cash flow has a strong positive impact on the level of investments for the whole sample (Tables 7 and 8), with semi-elasticity around 0.46 (0.43 in the fixed-effect model). Considering one standard deviation increase in cash flow (equal to 0.12, Table 4), the level of R&D per capita increases by 5.5 %.Footnote 10 However, the same variable is not significant in affecting R&D propensity, suggesting that internal sources are not enough to undertake this type of investment, and external finance is needed. Yet, the strong pro-cyclical effect of this variable on the level of investment confirms the importance of financial frictions in conditioning R&D activity.

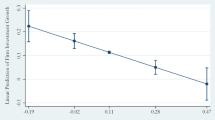

As far as relationship lending is concerned, an increase in the length of the relationship has a statistically detectable positive effect, both on the propensity to perform R&D and the level of R&D investments: one standard deviation increase in the length of the relationship improves the probability to perform R&D activity by 4.2 percentage pointsFootnote 11 and the level of R&D investments by 5.9 %; this latter result holds true also considering fixed effects at firm level. These findings, in line with Herrera and Minetti (2007), are consistent with the hypothesis that a tight credit relationship with the main bank helps assuring external funds to cover the seed and development phase of the innovative process and enhances R&D investments in the following years.

Less-concentrated debt seems common among firms with a higher research propensity, even though, in the random estimates, the variable is significant only for smaller firms. On the other hand, the credit concentration variable is not significant in the intensity estimates, apart from a slightly positive effect (at the 10-percent level) only in the random-effect model for the whole sample (column 1 in both Tables 7 and 8). Therefore, after the initial decision is made, then the impact of the variable is strongly reduced or absent.

These results are consistent with an insurance motivation (Detragiache et al. 2000). The reasoning is as follows. A reduction of credit supply by the main bank could have a strong negative impact on a firm deeply engaged in innovative activities and related investments. For these firms, switching costs are prohibitive, and a decrease in credit granted may end up in the firm exiting from the market. As a consequence, it is reasonable for the firm to maintain a long-term relationship with the main bank and, at the same time, to spread the credit lines among many intermediaries before starting a research project. In this manner, the possible negative shocks on credit supply from the main bank—both because of an autonomous decision by the bank or as a consequence of delays or negative outcomes of the research project—could be (at least partially) compensated by increasing credit lines with other banks with which the firm already has a credit relationship (Ongena and Smith 2000). Besides, this result is also consistent with the idea that firms have a strategic preference not to disclose too much information by increasing the number of lending banks (Bhattacharya and Chiesa 1995; von Rheinbaben and Ruckes 2004).

Both the share of bank lending on external finance and that of the short term over total loans are never statistically significant. The differences in the size of the main bank are weak, but they show that a relationship with a large bank (the benchmark) tends to favour R&D activity.

Finally, direct access to financial markets relaxes financial constraints and favours R&D activity. The effect is economically relevant: starting from an estimated average propensity to perform R&D around 45 % in the whole sample, the expected probability is 13 percentage points higher for firms that have issued bonds on financial markets or are listed.Footnote 12 This effect is further reinforced for smaller firms (with fewer than 250 workers), for which the average estimated propensity to perform R&D is around 35 %, and the impact of the variable rises to 21 percentage points. The results on the intensity of R&D investments point in the same direction, but they are not significant, with the exception of small firms (fewer than 250 employees), for which the impact is very strong (20 %).

Overall, financial factors appear to be important, especially for SMEs. Our results point to a crucial role of relationship lending, both in the initial phase, when the firm has to decide whether or not to invest in a risky activity such as R&D, and in the level of R&D investment decision, when R&D investments are substantially enhanced.Footnote 13

5.2 Other controls

The estimates confirm the usual correlation between R&D and firm size. Larger firms are more likely to perform R&D, even if the variable is not significant in the investment equation. Similar results are found for export performance: for the whole sample, an increase in one standard deviation in exports over total sales improves the expected probability to perform R&D by 8.4 percentage points and the R&D expenditure by 5 %. Our proxy of human capital does not affect R&D propensity, but it is significant in the investment equation, with a 9.7 % increase in R&D intensity following one standard deviation increase in the share of white collars over total employment. The coefficients of Leverage, Age and Group are never significant.

R&D is more frequent and the investment larger in high- and medium-tech industries. The estimated propensity is higher by 24 points among Specialized suppliers and by 37 points among Science-based firms, with respect to the benchmark (Supplier-dominated firms). The expenses increase by 28 % for Specialized suppliers and by 46 % for the Science-based firms. The latter is the highest increase in the estimates, which means that total expenses are now around 2900 euros per employee. The effect is similar for firms of up to 250 employees.

Location in large metropolitan areas seems relatively important to enhance the propensity to undertake innovative activity, especially among firms with fewer than 250 workers, even though the impact is weaker on R&D investments. The location inside industrial districts, on the other hand, seems to have a positive effect, but the variable is never statistically significant. These findings are in line with previous theory and evidence. Duranton and Puga (2001) have highlighted the role that metropolitan areas play in fostering innovation: diversified urban environments facilitate research and experimentation of new ideas. Fantino et al. (2015) show, for the Italian case, that the distance from top research centres, usually located in the largest cities, is one of the most important factors in fostering the innovativeness of firms, especially of SMEs (in the form of knowledge-transfer agreements with universities). Research is frequent in the North-East (+21 percentage points in the propensity equation), rare in the South (−25 percentage points), with respect to the North-West (the benchmark). The differences in the investment equation are not significant.

6 Concluding remarks

Severe asymmetric information problems make it difficult for innovative firms to obtain external finance. In this paper, we analyse the contribution of external finance to innovation in Italy, in particular, evaluating the role of bank finance. In fact, in a bank-centred economy, like Italy’s, the role of banks is pervasive, while the financial markets are underdeveloped by comparison with other advanced countries.

Using an extremely detailed dataset of about 1800 manufacturing firms, enriched with data on their lending banks, we document that internal sources are relevant in financing innovation, thus corroborating one of the main predictions of the Pecking Order Theory. At the same time, the recourse to bank finance is common for R&D-intensive firms. We show that these firms tend to have a peculiar relationship with the banking system: they maintain close relations with their main bank, strengthened by repeated interaction over time, but they also spread their debt among many intermediaries. This particular credit relationship might be adopted in order to reduce information asymmetries (thanks to longer duration), while attenuating hold-up problems (via a lower credit concentration).

However, while our analysis underlies the importance of relationship-based lending for the financing of R&D activities, it also shows that relationship lending is only a partial substitute for access to financial markets. In fact, firms issuing debt and equity on the market tend to have a strikingly higher propensity to perform R&D than firms without access to financial markets. From a policy perspective, our results suggest that innovation activity in Italy could be stimulated by steering the financial system in the direction of more highly developed financial markets, where different types of investors (banks, venture capital funds and business angels, crowdfunding) coexist and cooperate to ease financing constraints of innovative firms.

Notes

As underlined by Audretsch et al. (2016), in the past, entrepreneurship and finance were usually considered as separate fields: on the one hand, entrepreneurial finance was primarily referred to early stage financing mechanisms, often supplied by the entrepreneur’s personal wealth or network; on the other hand, corporate finance literature often focused on publicly traded firms. However, the evolution of both the real economy and academic research has put in contact the two fields, given that agency problems and information asymmetries were recognized crucial for both of them. The difference mainly rests on the contractual solutions adopted to tackle these issues (the role of venture capital being more relevant among entrepreneurial firms than in large, established corporations). Therefore evidence gathered analysing the financing of innovation in established firms may inform the field of entrepreneurial finance: as highlighted by the above-mentioned authors, “new ways to finance entrepreneurial ventures may emerge at the crossroads between private and public equity”. See also Cumming and Vismara (2016).

In their review, Kerr and Nanda (2014) summarize the reasons why financing R&D projects should be distinct from financing other types of projects: (i) the innovation process is inherently uncertain; (ii) the fact that the return from the innovation process is extremely skewed and standard ways of evaluating projects are therefore very difficult; (iii) the innovator knows more about the project than the financier; (iv) firms engaged in innovation have a high percentage of intangible assets, and innovation is therefore an activity that cannot be easily collateralized.

Even if the relevance of the internal sources is consistent with the predictions of the Pecking Order Theory (POT), the POT is not fully suited to describe the financing process of innovations. In fact, while the POT may be thus synthetized: (i) internal sources, (ii) debt, (iii) new equity, in order to finance innovations, the recourse to stock markets should be preferable to debt finance and, in particular, to bank finance.

Gorodnichenko and Schnitzer (2010), using a broad sample of firms located in Eastern Europe and Commonwealth of Independent States, find that financial constraints restrain the ability of domestically owned firms to innovate and export and hence to catch up to the technological frontiers. For Europe, other analyses (Mohnen and Roller 2005; Savignac 2006; Mohnen et al. 2008) confirm that insufficient finance inhibits firm innovativeness. Magri (2007) emphasizes the difficulties encountered by small innovative firms. For a general review, see also Hall and Lerner (2009).

See also the discussion in Lerner et al. (2011).

However, the role of business angels, venture capital and crowdfunding is scarce in Italy, when compared to other industrialized Countries.

Based on the formulation of the question in the survey, R&D expenditures include services, both internally made and bought from external suppliers (make and buy); expenditures for vocational training are not included.

With discrete dependent variables, the standard linear probability model (LPM) estimated by OLS is inefficient: heteroscedasticity determines biased standard errors and erroneous hypothesis testing; furthermore, LPM can bring to predicted probabilities outside the 0–1 range.

Since the dependent variable is in logs, the coefficients represent semi-elasticities: a unity increase in the cash flow variable raises the dependent variable by 0.45 (45 %). We consider a standard deviation in the regressor, which is the classical variation used in the literature to perform sensibility tests. The result is equal to one standard deviation times the coefficient and percent, which corresponds to: 0.12 × 0.46 × 100 = 5.52.

In this case, we consider a discrete change of the dummy variable from 0 to 1, and the impact corresponds to the marginal effect reported in the table.

While our analysis focuses on the role of banks and relationship lending, it is more demanding to discuss the equilibrium amount of financing from inside and outside sources; in fact, these quantities are determined by both the supply and the demand of different types of sources (Cosh et al. 2009). It is hard to believe that firms can freely choose between alternative capital providers: in the presence of obstacles due to information asymmetries, entrepreneurs may in fact simply seek capital where it is most plentiful. Cosh et al. (2009) find that rejection rates are lower in credit markets than from other sources of capital, thus suggesting that financing choices owe to supply considerations as well as demand considerations. As acknowledged by Robb and Robinson (2014), it is challenging to separate supply and demand in the absence of some quasi-experiment.

References

Aghion, P., Bond, S., Klemm, A., & Marinescu, I. (2004). Technology and financial structure: are innovative firms different? Journal of the European Economic Association, 4, 277–288.

Alessandrini, P., Presbitero, A. F., & Zazzaro, A. (2010). Bank size or distance: what hampers innovation adoption by SMEs? Journal of Economic Geography, 10, 845–881.

Allen, F., & Gale, D. (1999). Diversity of opinion and financing of new technologies. Journal of Financial Intermediation, 8, 68–89.

Anton, J.J., & Yao, D.A. (1998). The sale of intellectual property: strategic disclosure, property rights, and incomplete contracts, working paper, The Wharton School, University of Pennsylvania.

Atanassov, J., Nanda, V., & Seru, A. (2007). Finance and innovation: the case of publicly traded firms, working paper, University of Michigan.

Audretsch, D., Lehmann, E., Paleari, S., & Vismara, S. (2016). Entrepreneurial finance and technology transfer. Journal of Technology Transfer, 41(1), 1–9.

Banca d’Italia (2009). Indagine sulle imprese industriali e dei servizi, Supplementi al Bollettino Statistico - Indagini campionarie, 38, luglio.

Benfratello, L., Schiantarelli, F., & Sembenelli, A. (2008). Banks and innovation: Microeconometric evidence on Italian firms. Journal of Financial Economics, 90, 197–217.

Berger, A. N., & Udell, G. F. (2006). A more complete conceptual framework for SME finance. Journal of Banking & Finance, 30, 2945–2966.

Bhattacharya, S., & Chiesa, G. (1995). Proprietary information, financial intermediation, and research incentives. Journal of Financial Intermediation, 4, 328–357.

Blass, A. A., & Yosha, O. (2003). Financing R&D in mature companies: An empirical analysis. Economics of Innovation and New Technology, 12(5), 425–447.

Bond, S., Harho, D., & Van Reenen, J. (2006). Investment, R&D and financial constraints in Britain and Germany. Annales d’Economie et de Statistique, Bol, 79–80, 1–28.

Boot, A. (2000). Relationship banking: what do we know? Journal of Financial Intermediation, 9, 7–25.

Brown, J. R., Fazzari, S. M., & Petersen, B. C. (2009). Financing innovation and growth: Cash flow, external equity, and the 1990s R&D boom. Journal of Finance, 64(1), 151–185.

Bugamelli, M., Cannari, L., Lotti, F., & Magri, S. (2012). Il gap innovativo del sistema produttivo italiano: radici e possibili rimedi. Questioni di Economia e Finanza—Occasional Paper, No. 121.

Chava, S., Chong, X., & Nanda, K.V. (2012). Funding innovation: the role of lender expertise and control rights. University of Miami, School of Business, working Paper.

Chava, S., Oettl, A., Subramanian, A., & Subramanian, K. V. (2013). Banking deregulation and innovation. Journal of Financial Economics, 109(3), 759–774.

Cornaggia, J., Mao, Y., Tian, X., & Wolfe, B. (2013). Does banking competition affect innovation? Journal of Financial Economics, 115(1), 189–209.

Cosh, A., Cumming, D., & Hughes, A. (2009). Outside entrepreneurial capital. Economic Journal, 119, 1494–1533.

Cumming, D.J., & Vismara, S. (2016). De-segmenting Research in Entrepreneurial Finance. Venture Capital. An International Journal of Entrepreneurial Finance. doi:10.2139/ssrn.2740453.

Detragiache, E., Garella, P., & Guiso, L. (2000). Multiple versus single banking relationships: theory and evidence. Journal of Finance, 55, 1133–1161.

Duranton, G., & Puga, D. (2001). Nursery cities: Urban diversity, process innovation, and the life cycle of products. The American Economic Review, 91(5), 1454–1477.

Fantino, D., Mori, A., & Scalise, D. (2015). Collaboration between Firms and universities in Italy: the role of a firm’s proximity to top-rated departments. Italian Economic Journal, 1(2), 219–251.

Ferri, G., & Rotondi, Z. (2006). Does finance matter in the respecialization of Italy’s industrial districts? In G. Bracchi a & D. Masciandaro (Eds.), XI report on the Italian financial system (pp. 397–433). Milan: Rosselli Foundation - Bancaria Editrice.

Giannetti, C. (2009). Relationship lending and firm innovativeness. Tilburg University, Discussion Paper, No. 2009/08.

Gorodnichenko, Y., & Schnitzer, M. (2010). Financial constraints and innovation: Why poor countries don’t catch up, NBER working Paper, No. 15792.

Hall, B.H. (1992). Research and development at the firm level: Does the source of financing matter?. NBER working Paper, No. 4096.

Hall, B.H., & Lerner, J. (2009). The financing of R&D and innovation. NBER working paper, No. 15325.

Hall, B. H., Lotti, F., & Mairesse, J. (2009). Innovation and productivity in SMEs: Empirical evidence for Italy. Small Business Economics, 33(1), 13–33.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47, 153–161.

Herrera, A. M., & Minetti, R. (2007). Informed finance and technological change: Evidence from credit relationships. Journal of Financial Economics, 83, 223–269.

Himmelberg, C. P., & Petersen, B. C. (1994). R&D and internal finance: A panel study of small firms in high-tech industries. Review of Economics and Statistics, 76(1), 38–51.

Istat (2005). Distretti Industriali e sistemi locali del lavoro 2001–8° Censimento generale dell’industria e dei servizi. Rome.

Jones, A. M., & Labeaga, J. M. (2003). Individual heterogeneity and censoring in panel data estimates of tobacco expenditure. Journal of Applied Econometrics, 18(2), 157–177.

King, R., & Levine, R. (1993). Finance and growth: Schumpeter might be right. Quarterly Journal of Economics, 108, 717–737.

Lerner, J., Sorensen, M., & Stromberg, P. (2011). Private equity and long-run investment: The case of innovation. Journal of Finance, 66(2), 445–477.

Levine, R. (2005). Finance and growth: theory and evidence. In P. Alghion & S. Durlauf (Eds.), Handbook of economic growth (pp. 865–934). North-Holland: Elsevier Science.

Magri, S. (2007). The financing of small innovative firms: The Italian case. Bank of Italy Occasional Paper, No. 640.

Mann, W. (2014). Creditor rights and innovation: Evidence from patent collateral. University of Pennsylvania, Wharton School Working Paper, No. 1033.

Mohnen, P., Palm, F., van der Loeff, S., & Tiwari, A. (2008). Financial constraints and other obstacles: Are they a threat to innovation activity?, Technical Report No. 006, United Nations University.

Mohnen, P., & Roller, L. H. (2005). Complementarities in innovation policy. European Economic Review, 49, 1431–1450.

Mulkay, B., Hall, B., & Mairesse, J. (2001). Firm level investment and R&D in France and the United States: A comparison. NBER Working Paper No. 8038.

Kerr W.R., & Nanda, R. (2014). Financing innovation. NBER working Paper, No. 20676.

O’Sullivan, M. (2004). Finance and innovation. In J. Fagerberg, D. Mowery, & R. Nelson (Eds.), Handbook of innovation (pp. 240–265). Oxford: Oxford University Press.

Ongena, S., & Smith, D. C. (2000). What determines the number of bank relationships? cross-country evidence. Journal of Financial Intermediation, 9, 26–56.

Rajan, R. (1992). Insiders and outsiders: the choice between informed and arm’s length debt. Journal of Finance, 47(4), 1367–1400.

Rajan, R. (2012). The corporation in finance. NBER Working paper No. 17760.

Rajan, R., & Zingales, L. (2001). Financial systems, industrial structure, and growth. Oxford Review of Economic Policy, 17(4), 467–482.

Rajan, R., & Zingales, L. (2003). Banks and markets: The changing character of European finance, European Central Bank, 2nd Annual Conference.

Robb, A. M., & Robinson, D. T. (2014). The capital structure decisions of new firms. Review of Financial Studies, 27(1), 153–179.

Savignac, F. (2006). The impact of financial constraints on innovation: Evidence from French manufacturing firms. Cahiers de la Maison des Sciences Economiques No. 06042, Université Panthéon-Sorbonne (Paris 1).

Sharpe, S. (1990). Asymmetric information, bank lending and implicit contracts: A stylized model of customer relationships. Journal of Finance, 45(4), 1069–1087.

Ughetto, E. (2008). Does internal finance matter for R&D? New evidence from a panel of Italian firms. Cambridge Journal of Economics, 32(6), 907–925.

von Rheinbaben, J., & Ruckes, M. (2004). The number and the closeness of bank relationships. Journal of Banking & Finance, 28, 1597–1615.

Wooldridge, J. M. (1995). Selection corrections for panel data models under conditional mean independence assumptions. Journal of Econometrics, 68(1), 115–132.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. London: The MIT Press Cambridge.

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors wish to thank Antonio Accetturo, Raffaello Bronzini, Paola Brighi, Andrea Caggese, Luigi Cannari, Francesca Lotti, Massimo Omiccioli, Silvia Magri, Marcello Pagnini, Alessandro Sembenelli, Giuseppe Torluccio, Salvatore Torrisi, Alberto Zazzaro, the participants at seminars held at the Bank of Italy and at the University of Bologna, and two anonymous referees for helpful comments. The authors alone are responsible for any errors. The views expressed in this paper do not necessarily reflect those of the Bank of Italy.

Rights and permissions

About this article

Cite this article

Micucci, G., Rossi, P. Financing R&D investments: an analysis on Italian manufacturing firms and their lending banks. Econ Polit Ind 44, 23–49 (2017). https://doi.org/10.1007/s40812-016-0056-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-016-0056-3