Abstract

The purpose of this contribution is to shed light on the role of agglomeration economies as drivers of firm exit in Italy over the period 2002–2010. The analysis is based on a firm level dataset that merges firm characteristics with administrative data, allowing us to consider variables related to the geographical context at the province level. We attempt to address a missing link in agglomeration studies: the analysis of the relationship between agglomeration economies and individual firm performance. To take the multidimensional structure of the data into account, in addition to multivariate logit discrete models, we apply a Multilevel Analysis, which allows us to simultaneously model spatial and firm heterogeneity. Our results for the overall sample show that higher specialization (non-linearly) and diversification economies (within industries) play an important role in lowering firm exit risk, while district specialization increases the probability of firm failure. In order to further explore firm heterogeneity, we also compare the exit behaviour of multinational and national firms to check whether they have different agglomeration premia. The multilevel analysis suggests that national firms benefit from specialization and diversification economies but are more at risk of exit in urban areas and industrial districts. By contrast, foreign multinationals have higher agglomeration premia than Italian firms in urban and in district areas but do not benefit from specialization economies. In addition to this, the region and province variance explain only up to 4 % of the total variance in the exit rates, leaving most of the explanatory power to unobserved firm heterogeneity. This confirms the importance of carrying out a firm level analysis of exit performances and geographical factors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The purpose of this contribution is to shed light on the role of agglomeration economies as drivers of firm survival in Italy over the period 2002–2010. We analyse agglomeration economies related to the geographical context by using a multidimensional analysis at the firm, industry and province levels. This enables us to explore a missing link in the agglomeration literature: the study of the relationship between agglomeration economies and individual firm characteristics.

The analysis is based on a firm level dataset that merges firm characteristics with administrative data to include variables related to the geographical context and agglomeration economies. Our unbalanced micro-panel data set is made up of 742,939,000 observations concerning Italian manufacturing corporate firms disaggregated by sector and 103 provinces over 2002–2010, built by matching different data sources (primarily the AIDA dataset, in addition to the ISTAT 2001 “Italian Industrial census”, yearly series of “Provincial Accounts”, and the “Movimprese Archive” by Unioncamere). We distinguish the role of firm level variables (age, size, productivity, labour cost, capital intensity, internationalization mode) from those that are context-related (agglomeration indicators, internationalization, innovation, death rates and start up rates in the province) and industry-related (concentration, scale economies, export intensity) and test firms’ propensity to exit.

Firm survival/mortality is one of the most debated issues in industrial organization (see the seminal papers by Dunne et al. 1988; Audretsch 1991; Santarelli and Vivarelli 2007); however, the determinants of the spatial differences in the rates of new enterprise creation and business failure have been left largely unanalysed. Examining Italy, some papers have focused on new venture creation at the regional level (Audretsch and Vivarelli 1996; Carree et al. 2008) and others on death rates at the province level (Santarelli et al. 2010; Cainelli et al. 2012, 2013).Footnote 1

Our analysis comes in the wake of these seminal studies, and its novelty is threefold. First, we fill a gap in the literature by bringing together three different dimensions: the firm, industry and province specific determinants of firm mortality. The empirical studies on agglomeration use aggregated data, with province or region as the basic reference unit. This spatial aggregation provides limited insight into the effects of agglomeration economies on firm performance as the information on the variance between firms is lost when aggregated regional-level data are used.

The second novelty of this paper is that in order to address the multidimensional structure of the data, we check for the robustness of the multivariate logit analysis by performing a Multilevel Analysis (Snijders and Bosker 2012). The application of multilevel models allows us to exploit the potential of the data when variables are related to different dimensions (firms, provinces, and regions in our case). Following this estimation methodology, we measure the contribution to the variance the data provide at different levels of aggregation by taking into account both the micro level, relative to the firm, and the macro level referring to the firm’s geographical location (province and region). This allows us to estimate how much of the unexplained firm-level heterogeneity is due to firm-specific factors as opposed to the spatial economic and business differences.

The third novelty of the analysis is that we explore the different agglomeration premia for three firm categories: foreign investors in Italy, domestic firms investing abroad, and domestic non-multinationals.Footnote 2 This is in line with the recent empirical literature relying on firm level data that confirms the heterogeneity hypothesis and the models of Melitz and Helpman et al. (2004), showing significant differences between international and domestic firms (Bernard and Sjöholm 2003; Wagner 2011; Mayer and Ottaviano 2007).Footnote 3 This heterogeneity is also likely to affect the behaviour of multinational firms with respect to local economies.

The probability of firm exit is modelled in our analysis as a function of different variables related to agglomeration economies: (1) arising from urban local labour systems and population density (urbanization economies) and available to all local firms (Acs et al. 2007); (2) due to the spatial concentration of firms in the same industry (Glaeser et al. 1992); (3) related to local production systems (industrial districts); (4) stemming from related variety, i.e., from the agglomeration of firms in different but related industries, as this should favour knowledge spillovers, namely Jacobs externalities (Jacobs 1969); and (5) due to “unrelated” variety and arising from the spatial concentration of firms belonging to different and non-complementary industries, which allows a risk diversification effect (Frenken et al. 2007). Agglomeration economies and positive or negative spillovers are captured by studying firms that belong to the same province, our spatial reference unit (corresponding to NUTS 3 European classification), which is better able to catch the local spillovers on firm performance than other levels such as region or city.

Several reasons enticed us to more deeply investigate the role of agglomeration economies in Italy. First, they are an important determinant of firm growth, a channel for acquiring technology and play a crucial role in Italy. The country hosts a specific type of localization economy: the industrial districts (IDs) (Becattini 1990; Dei Ottati 1994), traditionally a source of positive externalities. There is still a high degree of spatial concentration of industrial activity in Italy, which hosts 101 out of 141 specialized clusters identified in Germany, France and Italy by Alampi et al. (2012). However, there are reasons to question whether these clusters of production are still an important source of positive externalities and sustain territorial and firm performance in Italy. Over the recent economic crisis, industrial demography has shown strong heterogeneous effects across different locations with some locations experiencing a long term decline marked by increasing productivity gaps, rising regional firm mortality and unemployment and loss of competitiveness on the international markets (Di Giacinto et al. 2012). These types of effects have deeply affected the district areas. Several recent empirical studies have shown that the competitive advantages associated with the informal systems of socio economic relations in the IDs and the benefits of territorial proximity in general seem to have weakened over the last decade as a result of several dramatic changes. First, due to the structural changes experienced in Italy in recent decades, there has been a progressive tertiarization of the economy. Further, the specialization of most of the industrial districts in Italy refers to low, medium low and medium high tech sectors. The poor specialization in high tech sectors for a country like Italy, which is close to the technological frontier, is one of the main reasons behind its loss of competitiveness, in view of the technological catch-up of emerging economies sharing similar specializations (particularly China and Eastern European countries, and more recently their Asian competitors such as Thailand and Vietnam). In addition to the changing international competitive scenario, the upsurge of delocalization and the prolonged economic crisis have been undermining the health of IDs. As a matter of fact, district firms do not show the resilience they had in the past (CENSIS 2010; Bugamelli et al. 2009; Iuzzolino and Micucci 2011; Cainelli et al. 2012; Alampi et al. 2012).

The remainder of the paper is organized as follows. The next section (Sect. 2) provides an overview on the literature hypotheses and empirical evidence with regard to the factors that may determine the survival of businesses. Section 3 introduces the data. Section 4 describes the estimation procedure, as well as the basic definitions of the variables and the expected signs. The results of the empirical analysis are presented in Sect. 5. In Sect. 5.1, we check for heterogeneity between national and multinational firms with respect to external economies. The final Sect. 6 concludes.

2 Literature review

The theory on agglomeration economies argues that positive knowledge spillovers are more likely to occur if firms are located in the same area, as geographical proximity encourages the diffusion of ideas and technology due to the concentration of customers and suppliers, labour market pooling, worker mobility, and informal contacts (Greenstone et al. 2010). Technology transfer (intra and inter industry knowledge spillovers) may occur via vertical linkages (along the supply chain) and horizontal linkages (collaboration among firms, imitation); however, agglomeration may also trigger stronger competition, which may prompt the reallocation of resources towards more productive firms.

The theory surrounding agglomeration economies and spillover effects mainly identifies two types of externalities: localization (or specialization) economies and diversification economies. The localization economies may rise from industry specialization available to the local firms within the same sector (the Marshall-Arrow-Romer or MAR externalities) and by the emergence of the intra-industry transmission of knowledge (Glaeser et al. 1992) as firms learn from other firms in the same industry (Porter 1998). These economies explain the development of industrial districts (ID).

Unlike localization economies, however, Jacobs (1969) economies indicate that the diversity of industries and knowledge spillovers across geographically close industries promote innovation and growth via inter-industry knowledge spillovers (Acs et al. 2007). The latter reflects external economies passed to enterprises as a result of the large-scale operation of the agglomeration, independent of the industry structure. For instance, relatively more densely populated areas are more likely to house universities, industry research laboratories and other knowledge generating facilities.

In the recent analyses of diversification, the role of related and unrelated variety is debated (Frenken et al. 2007; Boschma and Iammarino 2009; Antonietti and Cainelli 2011; Cainelli and Iacobucci 2012). These contributions start from the argument that the transmission of knowledge requires a common and complementary competence base, i.e., it is not variety per se that matters, but the geographic concentration of firms in different but complementary or related industries. The presence of unrelated variety may be viewed more like a portfolio strategy to protect a region from external shocks in demand or technology that hit only one or a few sectors (such as oil price shocks, a trade war, an innovation, China competition) (Attaran 1986; Frenken et al. 2007; Cainelli et al. 2012).

Overall, we may say that the death or survival of firms may be influenced positively by both intra-industry and inter-industry knowledge spillovers. There are different potential sources of spillovers for firm survival that occur when a region is specialized in a few sectors (localization economies), diversified into a large variety of sectors (Jacobs externalities), and located in an area with larger cities and population density (urbanization economies). In principle, all three types of agglomeration economies may produce spillovers on survival, although the sources and transmission mechanisms are likely to be different. The impact of localization economies is expected to originate from similar firms producing similar products; hence, the crucial mechanism is expected to be via product and process innovation, which should have positive effects on firm survival. A low risk diversification applies to specialization economies, however, which might determine a downside effect on firms’ survival at a certain point (Cainelli et al. 2012). This is attributed to the fact that excessive specialization in a certain sector may expose the firms in a local system to a stronger competitive pressure and also to the risk of organizational inertia, thus possibly increasing their mortality. Hence, a non-linearity of specialization may occur (overspecialization). Jacobs externalities are expected to facilitate radical innovation and product innovation, which is likely to spur the creation of new markets, new ideas and employment more than productivity increases (Frenken et al. 2007). We might consider related variety able to generate relatively more Jacobs externalities as knowledge spills over primarily between firms selling related products; thus, economies arising from variety should be stronger between subsectors. In turn, unrelated variety measures the extent to which a region is diversified in very different types of activities that might have a positive effect due to the risk diversification argument (Frenken et al. 2007).

There are no clear-cut predictions concerning the role of clustering of activities in a district on survival. IDs are spatial agglomerations of mostly small and specialized firms, performing complementary activities and embedded in a network of social and economic relations of trust, co-operation and competition (Becattini 1990; Sforzi 2009). On the one hand, the strong inter-firm production linkages in the clustered areas facilitate inter-firm credit relationships and risk-sharing; on the other hand, they may act as a contagion mechanism in the event of a crisis (Battiston et al. 2007; Gallegati et al. 2008; Cainelli et al. 2012). Moreover, other vulnerability factors are associated with the higher local competition and selection of these conglomerations of overlapping firms, especially in terms of the cost of resources (e.g. labour). The predictions regarding the effect of urbanization economies are also mixed due to the strong competition/selection effect in urban contexts.

Spatial agglomeration effects have been largely investigated in the regional growth and urban development studies (Glaeser et al. 1992; Henderson et al. 1995). These economies have been found to be an important source of both positive and negative externalities.

The literature on firm birth and death also provides mixed conclusions on the role of agglomeration forces. Keeble and Walker (1994) find positive effects of urban agglomeration on new firm death rates. Controlling for human capital, Acs et al. (2007) find that new-firm survival rates are negatively related to service sector specialization and positively to all-industry intensity. Fritsch et al. (2010) also identify a significant increase in the hazard rates for all German manufacturing businesses in the 1992–2005 period in agglomerated areas with a rather specialized regional industry structure. Conversely, Fotopoulos and Louri (2000) find relatively lower levels of new firm death rates as a result of localization economies. The literature on Italy (Audretsch and Vivarelli 1996; Carree et al. 2008; Santarelli et al. 2010; Cainelli et al. 2012) considers different sources of agglomeration economies. Carree et al. (2008) investigate firm entry, exit and net entry in Italian provinces and attempt to explain how unemployment impacts these market dynamics in six different sectors, controlling for several regional factors, including the effects of districts and large cities. They find that belonging to an ID increases the risk of exit in manufacturing, whereas being in a large city reduces it. Different conclusions are reached by Santarelli et al. (2010), who note that the presence of industrial districts is able to reduce the exit rates, especially in some manufacturing sectors (Food and Clothing, Commerce and Transport). Cainelli et al. (2012) study the role of many different sources of agglomeration economies in affecting firm mortality at the province level and find that the intensity of urbanization economies, industry specialization and a high variety of specialization patterns all reduce firm mortality in the provinces, while the industrial district degree is not able to reduce firm exit rates. Huiban (2011), examining a panel of French plants, finds that the survival rate depends on plants’ spatial location. In particular, it is easier to create new plants in urban areas like the Paris region, but easier to survive in rural areas. Examining a German manufacturing sector, Strotmann (2007) finds a higher risk of firm exit in highly agglomerated regions. De Silva and McComb (2012) find that firm density in the same industry reduces mortality rates only over large distances, while it increases when firms are densely located. Finally, Renski (2011) finds that regional industrial diversity positively affects new firm survival in several sectors and particularly in the more knowledge-intensive ones.

The studies above generally investigate the effect of agglomeration on firm entry and exit at the region, province or city level, but there is quite a scant literature that studies this effect at the firm level. This level of observation is essential, however, as geographical differences may be due to location characteristics (e.g., agglomeration economies) or may simply be caused by differences in business and economic composition. A location may grow rapidly due to the concentration of large firms rather than to the localization of externalities. Hence, the agglomeration of more productive firms may simply be the result of a spatial selection and sorting process in which more productive firms are drawn to denser, more competitive and better endowed economic areas (Baldwin and Okubu 2006). Such endogeneity problems undermine inferences about firms using cities or regions as the lowest unit of analysis. Hence, it is crucial to try to detect in empirical analysis whether firm exit is due to agglomeration economies by controlling for all of the firm ex ante characteristics and for differences in local business and economic composition (Milgram-Baleix 2009; Martin et al. 2011).

3 Data

We draw our dataset from different sources. Our main information comes from the commercial data provider Aida (by Bureau Van Dick), which provides the balance sheet data.Footnote 4 We also use the “2001 Italian Industrial census” of the Italian National Statistical Institute (ISTAT), the yearly series of “Provincial Accounts” (Conti Provinciali) from ISTAT, the “Movimprese Archive” of the Italian Chamber of Commerce (Uniocamere) and data from the Italian Patent Office.Footnote 5 The analysis is restricted to the manufacturing sector. Further information on international activities, such as FDI, exports and imports at the industry level are drawn from aggregate databases by Eurostat and ISTAT.

We cleaned the dataset by excluding firms that reported negative values on value added, sales, and cost of labour and those with missing values on sales. The number of employees is missing from the balance sheet data for approximately 30 % of our sample, and we therefore adopted a procedure for imputing missing data: the Multiple Imputation by Chained EquationsFootnote 6 (MICE) procedure.Footnote 7

We build an unbalanced data panel of 742,939 observations for the manufacturing sector (Table 1), disaggregated by firm, sector and province, covering 9 years (from 2002 to 2010) and including both new and incumbent firms. The sample collects balance sheet data for 98,839 firms (of these, 64,465 are present in all years and 92,375 are present in 2010) and permits a wide coverage of Italian manufacturing corporate enterprises, representative of firm distribution by size, geographical area and sector. Table 2 describes our sample divided by firm size, geographical areas, Pavitt sectors and district in the provinces for three types of firm ownership statuses: domestic non-multinationals, multinational foreign, and multinational domestic.

According to the figures, the sample is primarily made of small firms (i.e., firms with less than 50 employees account for more than 88 percent of total firms). Domestic non-multinationals (NMNEs) represent the largest percentage of Italian firms (more than 98 percent). The number of both domestic and foreign MNEs is rather low (1.4 percent and 0.5 percent of the total sample). The geographical distribution of the sample is stable throughout the period considered and strongly reflects the industrial characteristics of Italy, confirming a high geographical heterogeneity and a high polarization of the sample in terms of territorial areas: more than 63.2 percent of firms are located in the north.

It is fairly common for the sampling of the dataset to not ensure the data are representative at the regional level. This is a common if rarely mentioned problem in studies on agglomeration. We attempt to minor this problem using macro data to measure agglomeration. The externality of these indicators reduces the potential selection bias of our sample. Detailed geographical (by region) and sectorial (by Ateco 2007) distributions for the period considered are presented in Tables 3 and 4, respectively. We find a high concentration of firms in Lombardia, Emilia Romagna, Veneto and Tuscany. The distribution by sectors is quite persistent and strongly unbalanced towards supplier-dominated and scale-intensive sectors (42 and 31 percent respectively). The most represented sectors in our sample are metal products (25 %), textile, clothing and leather (13 %), machinery (11 %), food (7 %), while oil and pharmaceuticals are of very little importance.

To check whether the regional distribution of our sample is consistent with ISTAT data, and hence representative, we applied Stata’s prtest to the distribution of two groups: our sample from AIDA and the ISTAT universe. We checked both the z value and the confidence interval to see whether we should reject the null hypothesis of no significant differences across the two samples. We did not reject the H0 hypothesis in any of the tests we performed. The test results are reported in the last three columns of Table 3.

To further check for the significance of the difference in the sectorial and ownership distribution of our sample, we also applied Stata’s prtest to two group distributions: our sample from AIDA and the ISTAT universe of foreign and domestic multinationals by sector. We used the prtest for the difference in proportions to test whether the two groups Foreign Multinationals and Domestic Multinationals differ in their distribution by sector with respect to the Istat data. The results of these tests are reported in the last six columns of Table 4. Both the z value and the confidence interval indicate we should not reject the null hypothesis that the two groups do not significantly differ in their distribution in all sectors with two exceptions: Pharmaceuticals, where we reject the null hypothesis and the difference is significant at the 5 % level for Foreign Multinationals and at 1 % for Domestic Multinationals, and Other Manufacturing Goods, where we reject the null hypothesis for domestic Multinationals at the 1 % level.

The quantile map in Fig. 1 portrays the pattern of firm localization in our sample, displaying the spatial distribution across NUTS-3 regions. Strong firm agglomeration reflecting the presence of both industrial districts and urbanized areas is clear. Economic activity is highly concentrated in northern Italy but there is also an important firm presence in the Adriatic area, while the south hosts a much lower share of firms. These figures match quite well with the peculiarity of the Italian production structure where the geographical distribution of firms is historically characterized by a persistent socio-economic dualism between the more advanced north and centre and the backward and less industrialized south.

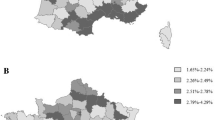

In Fig. 2, two quantile maps identify both the magnitude of the firms’ propensity to exit and the provinces where higher firm exit rates are located, distinguishing the period before (2002–2007) and after the crisis (2008–2010). The procedure we adopt to identify firm exit is based on considering a firm to have exited if its legal status variable in the AIDA dataset is failure, liquidation, or bankruptcy. We consider the time of exit as the time when a firm enters a liquidation or bankruptcy process.Footnote 8 Exitit = 1 in the year when the firm exits and 0 in all prior years, and the firm is missing in the years following its exit.Footnote 9

Figures 2a, b both show pronounced differences in the death rates at the province level, which strongly suggests the importance of local factors and a high degree of spatial correlation. Particularly high death rates are found in the Campania region around Naples, in Sicily (spread almost equally across the provinces), Calabria (with some bright areas), Abruzzo (almost entirely), and Apulia (Gargano). As shown in Map 2a, from 2002 to 2007, the south is characterized by the highest firm exit rates. Conversely, the regions located in eastern area of the north-central region seem to exhibit the lowest firm exit rates. In Map 2b, we note that the 2008 crisis has caused a general increase in the firm exit rates but less provinces fall in the highest percentile in the south wth respect to the years before the crisis. This is probably due to correspondingly lower firm entry rates. For example, the decision to create a new business is more prudent after the crisis, with the result that only firms with a higher probability of survival are created. Map 2b also confirms, however, that after the crisis, the south exhibits the highest firm exit rate.

4 Estimation methodology

4.1 The models

We examine domestic firms’ probability of exit:

where subscripts i, j, k, and t denote “firm” “industry” “province” and “time”. Hence, the exit of firm i in industry j in province k at time t is related to: γijkt−1 a vector of firm characteristics (all lagged except for ownership); \(\theta_{{{\text{jt}} - 1}}\) a vector of industry characteristics (all lagged); \({\text{K}}_{{{\text{jkt}} - 1}}\) a vector of province/industry characteristics (lagged if the variable is time variant).

Variable descriptions and their summary statistics are described in Sect. 4.2 and reported in Tables 5 and 6.

In terms of empirical strategy, we first estimate the determinants of firm exit using a pooled logit modelFootnote 10 including agglomeration indicators and other variables. This specification is subsequently used as a benchmark against multilevel alternatives.

The logit model specification of exit decision function is given by:

where Exitijkt is the dependent binomial variable, which takes the value of 1 in the year a firm exits and 0 for all previous years, and \({\text{X}}_{\text{ijkt}} = \left( {\gamma_{{{\text{ijkt}} - 1}} ,\theta_{{{\text{jt}} - 1}} ,{\text{K}}_{{{\text{jkt}} - 1}} } \right)\) and Λ ( ) is the logistic distribution.Footnote 11

The regressions are performed clustering standard errors at the province level (103 units), which is the lowest geographical unit considered in the analysis. Hence, the error term is composed of an idiosyncratic component and a component specific to the province k. Standard errors are also adjusted for heteroskedasticity. The period is 2002–2010. Dummies for the crisis years (to capture the business cycle), technology (OECD taxonomy), geographical areas (North-East, North-West, Centre, South, Isles) or regions, and sector fixed effects are added.

Equation (2), however, makes no effort to accommodate for the potential (and likely) heterogeneity that may arise at the k-level: all of the geographical factors are assumed to have an identical impact on the firm’s exit performance across provinces, and all firms are assumed to have identical intercepts. Such standard regression models make unsuitable assumptions about the variance–covariance structure assuming independence of the observations and zero intra-class correlation, while the performances of the firms working in the same province are likely to be positively correlated, as they share several unobserved factors at the local level.

To take the role of the context into account, we apply a multilevel approach that allows us to explicitly model the potential hierarchical nature of the problem using a pair of linked models that disentangle the effect of individual and context variables. This allows us to group observations in homogeneous geographical areas and thus to take geographic clustering into account and estimate the “spatial” variability of both exit and our independent variables, finding more efficient estimates of the coefficients and their standard errors (Maas and Hox 2004; Snijders and Bosker 2012).Footnote 12 The adoption of multilevel analysis has several advantages. As shown in recent studies, it allows the simultaneous consideration of the micro and the macro dimensions of the data and engenders a better understanding of why firms within agglomerations are more likely to perform similarly. Second, it distinguishes between heterogeneity due to individual-specific components and heterogeneity due to spatial factors, whose influence may operate in terms of both mean and slope effects. In addition, these models account more properly for unobserved heterogeneity due to the inclusion of random (together with fixed) coefficients (Alcacer et al. 2013). Furthermore, van Oort et al. (2012) show that multilevel analysis can contribute to solve the “agglomeration-performance ambiguity” in that it controls for the circular process that links the performance of firms and locations.

Our micro-level analysis of exit allows us to estimate how much of the observed firm-level heterogeneity is due to factors observed or unobserved at the firm-level (firm-specific factors), as opposed to the factors observed or unobserved at the higher level in the spatial hierarchies. Given the peculiar nature of our data, we model them according to a structure in which the firms are nested in a hierarchical structure with the region at the top, followed by the province, both of which are likely to affect the exit performance.

We draw from a recent literature that applies multilevel models to exploit the potential of the data when variables are related to different dimensions and account for the nexus of agglomeration and firm performance (Fazio and Piacentino 2010; Raspe and van Oort 2007, 2011; van Oort et al. 2012; Giovannetti et al. 2013, Sanfilippo and Seric 2014; Aiello and Ricotta 2014; Aiello et al. 2014, 2015; Srholec 2010, 2015).

In our case-study, there are four potential levels: firm, province, sector, and region. Because the multilevel approach ensures reliable estimations only when the group-size is at least 20,Footnote 13 sectors cannot be identified as a level because our analysis is carried out using 13 sectors.Footnote 14 Hence, we restrict the data hierarchy to three levels (firms, provinces and regions), and the sector-effect is addressed by fixed-effects.

We first run a null or empty model (without explanatory variables) and then a general model. The null model is:

γ000 is the average of the overall population, U0KR + V00R are the random effects at the group level, namely the province level and regional level, respectively, and \(\varepsilon_{\text{ijKR}}\) is the random effect at the firm level.

The random variables are assumed to have a mean of 0 (the mean of YijKR is already represented by γ000), to be mutually independent and to have a variance of \(\tau_{{ 0 {\text{KR}}}}^{2} ,\tau_{{ 0 0 {\text{R}}}}^{2} \quad {\text{and}}\quad \sigma^{2}\). In the second step, we estimate the significance of the variances using a likelihood ratio test. Because the null hypothesis is rejected, a territorial effect at the local level exists, and therefore, a multilevel model is appropriate. Hence, we proceed to estimate a more general multilevel model.

Following Snijders and Bosker (2012), by grouping the three levels, it is possible to obtain the following estimating equation of firm exit by a multilevel model, which can be written as:

where: i = firms; K = province; R = Region; YijKR = exit (binary condition); γ000 is the fixed intercept at the first or firm level; U0KR is the random intercept for level two (provinces); V00R is the random intercept for level three (regions); \(\gamma_{\text{x00}} {\text{x}}_{\text{ijKR}}\) are the coefficients at first level; \(\gamma_{000} + \gamma_{\text{x00}} {\text{x}}_{\text{ijKR}}\) is the fixed part of the model; xS is the dimension of firms in terms of the number of employed; \(\gamma_{{{\text{x}}^{\text{S}} {\text{KR}}}}\) is the coefficient for the xS variable for slope of level two (i.e., we adopt a random slope model as we consider the intercept of the model to vary randomly across provinces; we also consider random variations in the spatial slope of size); ɛ ijKR is the residual or error component.

The higher level residuals U0KR + V00R can be regarded as residuals at the group levels (province and region) or group effects that are left unexplained by the fixed part of the model. Because residuals, or random errors, contain those parts of the variability of dependent variable that are not modelled explicitly as a function of the explanatory variables, this model contains unexplained variability at three nested levels (firm, province and region).Footnote 15 This partition of unexplained variability over the various levels is the essence of hierarchical random effects models. These three terms of the equation report the random coefficients, both i.i.d. with mean zero and constant variance (Snijders and Bosker, 2012).

We estimate:

We define \({\text{z}} = \gamma_{000} + {\text{U}}_{{ 0 {\text{KR}}}} + {\text{V}}_{{ 0 0 {\text{R}}}} + \gamma_{\text{x00}} {\text{x}}_{\text{ijKR}} + \gamma_{{{\text{x}}^{\text{s}} {\text{KR}}}} {x}^{{{\text{S}} }}\) and use a logistic transformation defined as \(\pi_{\text{ijKR}} = \varLambda \left( {\text{z}} \right) = (\frac{{{ \exp }({\text{z}})}}{{1 + { \exp }({\text{z}})}})\). Λ (z) is called the logistic transformation of z and is the cdf of a logistic distribution. We can re-arrange Λ (z) to obtain an expression with z on the right hand side. This leads to:

π/(1 − π) is referred to as the odds that y = 1 and log[π/(1 − π)] is the log-odds, also known as the logit or logistic model.

4.2 The variables and the expected sign

We estimate the probability of firm “failure” (exit dummies) between 2002 and 2010 controlling for a wide set of firm, sector and province characteristics. A detailed description of all of the firm, industry and province level variables is provided in Table 5, which also gives indications of the expected signs.Footnote 16

The key variables of interest are the phenomena of geographical proximity at the province level. Agglomeration economies measured by different indicators related to the geographical context are identified by five main sources:

-

1.

Urbanization economies, which create external economies available to all local firms arising from urban size and density. We measure them using two indicators: population density in 2002–2010 (number of inhabitants per square kilometre) and a dummy for the presence of Urban Local Labour Systems in 2002–2010 (sll_urb).

-

2.

Industrial Districts measured by the districtualization degree of the province in 2001 (ind_dist_sforzi), measured by the number of workers employed in a Local Labour System (provided by Istat, based on Sforzi classification), divided by the total manufacturing employment in the province in 2001; a dummy if the firm belongs to the same sector of specialization of the District in 2002–2011 (dist_sett_sforzi)Footnote 17;

-

3.

Specialization economies measured by the normalized Balassa index of sector specialization in the province in 2001 (normalbalassa) to capture the knowledge spillovers arising from localization economies.Footnote 18 We also adopt the variable squared to check for potential non linearity of the specialization effects (normalbalassa2).

-

4.

Jacobs externalities based on the agglomeration of firms in different but related industries and measured by the index of intra-industry variety (H).

-

5.

Diversification or unrelated variety (un_var) measured by the spatial concentration of firms belonging to different and non-complementary industries.

We follow the methodology that has specifically been applied in the context of related and unrelated diversification both at the firm (Jacquemin and Berry 1979) and regional levels (Attaran 1986; Frenken et al. 2007; Cainelli et al. 2012), which all adopt entropy measures. Unrelated variety per province is indicated by the entropy of the two-digit distribution; related variety is indicated by the weighted sum of the entropy at the five-digit level within each two-digit class. We compute entropy measures using employment data, which are available at the five-digit level and at the geographical NUTS-3 level (i.e., at province level) from the Census of Industry and Services conducted by ISTAT (Italian National Institute of Statistics) in 2001.

Our model also includes firm and industry level variables. Individual variables are related to consider firm size,Footnote 19 age, productivity, capital intensity, labour cost, and technology intensity.Footnote 20 These variables unambiguously give rise to an expected reduction in the hazard. We also control for the role of FDI in line with models of international trade with heterogeneous firms. The expected relationship between the status of domestic and foreign multinationals (foreign multinational, domestic multinationals) and firm survival is ambiguous. They are the most productive group of firms (see Wagner 2011 for a detailed survey; see also Altomonte et al. 2012). Counter arguments have been investigated for foreign and domestic MNEs, however, which, having an international production network, can move production facilities easily between different countries (the “footloose behaviour” hypothesis).

Industry level controls are related to measure industry concentration, scale economies, and export intensity. The expected results for all of the industry specific determinants are quite ambiguous. The degree of openness of a certain sector (export_ateco07share) can work against its internal competitive pressure (Fritsch et al. 2010) but can also increase its exposition to international demand shocks (Cainelli et al. 2012). MES is the minimum efficient scale for each industry. Following Comanor and Wilson (1967), we measured the MES by the average value of shipments of the largest establishments producing more than 50 percent of industry shipments divided by industry shipments (3-digit Nace). Theoretically, the expectation of the effect of the MES on firm survival is also ambiguous. Industries with a larger MES are expected to have higher price–cost margins and thus a higher probability of firm survival. The MES should exert a positive influence on the hazard rate, however, because the output of new firms is typically less than the MES level (Audretsch 1991). The Herfindahl–Hirschman index (herind00) measures market concentration, which is defined as the sum of the squares of the market shares of all firms within a particular industry at the 5-digit NACE level. The expected effect of market concentration is not so clear-cut. On the one hand, the price level is more likely to be elevated above the long-run average cost at the minimum efficient scale (MES) level of output in concentrated industries. This may facilitate the survival of suboptimal scale firms, which is what typical entrant firms are. On the other hand, firms in highly concentrated markets may be subject to fierce aggressive behaviour by rivals, which may reduce their chances of survival. A high level of innovative activity in an industry may make entry more risky; consequently, the effect on new firm survival should be negative (Audretsch 1991). The chance of survival may, however, depend on a firm‘s ability to develop specific capabilities, which can be improved by investing in R&D (Esteve-Perez et al. 2008). Due to these contradicting effects and empirical results, business survival in science based Pavitt clusters (pavitt_1, pavitt_2, pavitt_3) and in high tech classes (tech1_2) (OCSE taxonomy), where there are more R&D-intensive industries, is also a priori unclear.

The context variables taken into account at the province level, in addition to the agglomeration indicators, are the intensity of export, outsourcing, and innovation.

Table 6 provides the descriptive statistics for the explanatory variables listed above and included in our estimates. We consider the entire sample as well as samples disaggregated according to different types of global engagement (being foreign multinationals or domestic multinationals) to account for the superior characteristics of globally engaged firms with respect to domestic non-multinational firms. As in Helpman et al.’s (2004) model, more globalized firms are larger and more productive and foreign firms outperform domestic firms in productivity levels and in many other dimensions (higher size, age, productivity).

5 Estimation results

In this section, we begin by studying the average sensitivity of Italian firms’ exit to the agglomeration indicators described above.

The multilevel is to be preferred as estimation methodology given the structure of our data. In order to choose which multilevel model we should adopt, we performed different multilevel estimates. Table 7 displays the variance of the different levels obtained.

We estimate an Empty model (Model 1), i.e., without any explanatory variables, from which the variances of the lower and higher level error terms are retrieved. This model considers the random-intercept equation in which the second and third level is formed by the 20 regions and 103 provinces. It allows us to evaluate how much of the variation in outcomes might be attributable to unobserved factors operating at each level. In Model 2 of Table 7, we add firm size to the multilevel null model and consider it as a source of randomness in the slope. In Model 3, we only add firm level variables without considering any context-related explanatory variables; thus, Model 3 refers to the estimations of a multilevel model considering all covariates at the firm level and with randomness in the intercepts and in the slope obtained by the size interacted with the province level. Finally, we estimate Model 4 by adding all of the covariates. This is the specification of the multilevel random slope model that we consider our preferred specification and will be the multilevel estimate presented in Table 8.Footnote 21

The residuals variance, the variance of the second level intercepts at province and regional level, and the random slopes for the multilevel model are also shown in Table 7.

Table 7 also reports the variance at each level of the model, which is given by the intra-class correlation coefficient (ICC) for our three levels (firms, regions and provinces) in the four different multilevel models. The VPC is the decomposition of the different ICC across levels.

At the province level, the variance component is measured as follows:

where the numerator includes the level-specific variance at the province level and the denominator the total variance, i.e., including the variance at the firm, province and regional level.

A first result to be discussed refers to the likelihood-ratio test. This compares the logit multilevel model with the standard logit regression and, being highly significant, supports the use of a multilevel model.Footnote 22

From Table 7, our results in the empty model estimation demonstrate that the residual random intercepts (region and provinces) and the slope variances are much smaller than the variance at the firm level in all of the different models. Then, firm-specific factors are the dominant source of firm exit unexplained heterogeneity. If variability at the higher level is modelled through region and province alone, as in Model 1, the region and province location explains 1 and 1.55 % of the total exit variance, respectively, and the rest (97.45 %) is due to firm-features (Model 1). When using Model 2, we find that 0.59 % of the unexplained variation in exit lies at the regional level and 1.8 % at the province level. In Model 3, 5.36 % of the unexplained variation in exit lies at the regional level and 1.45 % at the province level. In the last model (4), 3.90 % of the variability of exit probability is due to regional spatial variations and only 0.11 % to the province level, i.e., the share of the variance of firms’ exit affected by the province in which firms operate decreases as expected when we introduce covariates at the province level in the model.

We would have expected province variations to be more relevant; however, in other studies, firm heterogeneity in TFP is also mainly explained by unobserved firm specificities. In Aiello et al. (2014), the NUTS3 region-effect explains less than 5 % of firm TFP heterogeneity observed in Europe in 2006. In Fazio and Piacentino (2010), the dispersion of labour productivity across firms in Italian provinces, measured in the year 2005, shows a spatial mean effect of 5 %.

The covariance intercept-slope is negative in all of the regressions. This means that size has a negative effect on exit. Thus, higher survival tends to be achieved more often by the increased survival of smaller firms, than by the increased survival of bigger firms.

In Table 8, we present different specifications of the impact of agglomeration economies on firm exit. In the first column, the results have been obtained by only considering the agglomeration variables through a logit model with clustered standard errors, industry and region dummies and a dummy for the crisis. Then, logit estimates are run by adding individual, industry, and province controls to the agglomeration variables. The significance of the agglomeration indicators does not change with the exception of the variable unvar, which becomes insignificant. In the last two columns of Table 8, we report the results of the full model estimated by multilevel analysis.Footnote 23 Based on our previous analysis in Table 7, we adopt a multilevel random slope model as our preferred model. Hence, in the following, we will restrict our comment on the results of this estimation.

Focusing on our variables of interest in Table 8, the results show that being located in highly specialized areas and in areas with a high level of variety within sectors translate into positive externalities. It seems that in the Italian case, there is still a relevant and positive impact of specialization, unlike what emerges in the study of Fritsch et al. (2010) for Germany. We, however, find evidence of a non-linear effect of specialization. Our results are in line with the findings for Italy by Cainelli et al. (2012), which show a significant U-shaped relationship between the death rate in the Italian provinces and industry specialization. We find no evidence, however, that agglomerations of firms in larger and more productive cities determine their higher chance of survival. This result may seem surprising, as the denser a province’s population, the more easily firms should be able to find facilities that help support their activities and resist negative events (i.e., training and education, infrastructure, credit). As shown in a large body of literature, however, firms benefit from proximity to large markets, but cities suffer from congestion and agglomeration diseconomies (Krugman 1991). This is also consistent with the evidence that firms and workers based in larger cities enjoy a productivity premium, but the benefits accruing to firms operating in areas with intense activity, like urban areas, are strongly based on a selection process via a competition effect (Melitz and Ottaviano 2008; Combes et al. 2012). In previous studies, mixed evidence regarding the role of urbanization economies on firm survival was found. Cainelli et al. (2012) find a negative impact on firm death rates at the province level, while Fritsch et al. (2010) find a positive one.

We also find no significant evidence regarding the positive impact of district economies. This is quite unexpected as most of the models that analyse agglomeration economies and a vast body of specific literature depict IDs as efficient local clusters of production, spurring a positive “district effect” on firm performance. In our results, a positive and significant impact on exit is found for the dummy that indicates whether the firm produces in the sector of specialization of the district.

Other context related variables return the expected results. We find a strong negative nexus between exit and innovation measured by patents per active firm in the province, which is consistent with the literature. The coefficient of the variable representing the death rate in the province is positive and significant in any specification, in line with other studies (Cainelli et al. 2012).

As far as control variables at the firm level are concerned, the results are quite in line with a priori expectations. Larger firms are less likely to exit than smaller ones and the same is true for firms with greater experience, but we find evidence of a non-linear relationship between exit and firm age. Another stylized fact from the literature, i.e., that firms with low levels of productivity are more likely to exit, is confirmed by our results. The coefficient measuring the labour cost reports a positive sign, which is in line with previous research that higher wages controlling for productivity increase the risk of failure. Furthermore, we confirm that the nexus internationalization-exiting holds true for foreign firms, which are more likely to exit the market than national firms, but domestic MNEs have the same chance of survival. Previous research found similar results (Ferragina et al. 2012). The dummy for firms belonging to a medium–high technology sector is also negative and significant. The dummy for the crisis years is positive and highly significant.

Our estimations also include some measures at the industry level. First, in line with the Schumpeterian view that industries with monopolistic competition and market concentrations carry higher externalities, we observe positive effects on survival deriving from higher industry concentration. Conversely, our results show that firms in industries with a higher minimum efficient scale level face a higher risk of exit. Corresponding to studies by Audretsch and Mahmood (1995) and Görg and Strobl (2003), the negative effect of this variable may be explained by the fact that firms may not easily achieve an efficient production scale and may suffer a cost disadvantage vis-à-vis the most efficient firms in the market. At the province level, the province innovation rate in terms of patents has a negative and significant sign.

Building upon the results of the multilevel model, we can derive the predicted propensity to exit for each province for the entire sample and represent it on a map (Fig. 3). The predicted propensity to exit by our benchmark model shows a deep divide between Italy’s south and north. Differences among provinces are analysed by examining the random effects (empirical Bayes residuals) (Fig. 4). We note that beyond a clear divide, in both the north and south there are provinces which over-perform and others which under-perform with respect to the estimated exit rates. The residuals show all of the provincial-level factors that have not been observed. Provinces may have positive or negative residuals (dark and light grey, respectively, in Fig. 4). Specifically, positive values show the presence of unobserved contextual factors that increase the propensity to exit, and vice versa, negative values. This graphic representation allows us to highlight firms that over-perform (under-perform) with respect to the province context. In other words, in those provinces, firms have on average a higher (lower) propensity to exit than expected. Among the provinces with positive residuals, a handful are located in southern Italy (Napoli, Cosenza, Taranto, Brindisi, Palermo, Olbia, Sassari) in addition to some provinces in northern Italy such as Asti, Alessandria, La Spezia and central Italy (Pesaro and Urbino, Teramo, Firenze, Arezzo). Provinces with negative residuals instead show a lower propensity to exit than predicted by the model. Among these, we find provinces in northern Italy such as Grosseto, Savona, and Roma, as well as in southern Italy, such as Avellino and Foggia.

5.1 Comparing agglomeration premia for different types of firms

In this section, we check for possible asymmetries among types of firms in terms of their reaction to local agglomeration in order to further investigate the local determinants of firm survival. In Table 9, we present the results of our logit estimates for three subsamples: national firms, foreign multinationals, and domestic multinationals.Footnote 24 In Table 10, we estimate a logit and a multilevel model in which we measure the interplay between firm multinational status and agglomeration economies using interacting variables built by using the agglomeration indicators and the dummies for the subsamples of multinational domestic and foreign firms.

Multinationals that adopt global sourcing, outsourcing, and networking strategies are less dependent on local economies: they are less reliant on local capital markets and less dependent on input sourcing from local upstream firms and on local markets for their sales, being generally more export intensive than domestic firms (Godart et al. 2012). Thanks to better resources and global connections, however, they may be better able to exploit local knowledge externalities and enhance their success in highly agglomerated areas where both internal and external competition has become more intense.

We see in the logit disaggregated estimate in Table 9 that the role of agglomeration economies is quite different across the three firm categories. In particular, urbanization economies of the provinces measured by the population density increases the exit of non-multinational firms, while these forces do not have a significant impact on the firm mortality of foreign and domestic multinational firms. A second insight is provided by the coefficients of the proxy of localization economies, i.e., the normalized Balassa index of specialization. We find no impact for multinationals, whether domestic or foreign; however, the variable is highly significant for non-multinational firms, confirming the expectation that Marshallian externalities remain crucial for less internationalized firms and are conducive to a reduction of their firms’ exit rate. However, we find non-linear effects of specialization on domestic firms. A third and important finding comes from the results related to the district areas. We find that the survival chances are only higher in highly districtualized provinces for foreign multinationals, whereas no evidence is found of a lower exit risk for domestic firms, whether national or multinational, if they are located in these areas. These findings may depend on higher competition for the ID’s local resources: the pressure on the local resources plays a role and may counterbalance the positive role of IDs highlighted in the literature.

With respect to the firm level variables, exit behaviour across firm types is quite similar. It is generally confirmed that the probability of exit is lower for relatively larger businesses (in terms of employee classes), older (non-linearly up to a certain point), more productive firms with higher capital intensity and lower labour costs (however, the result does not hold for foreign firms). Looking at industry variables, many variables return significant coefficients for the national firms sample only. For non-multinational firms, economies of scale deter firm survival, while lower competition (hence higher concentration) decreases the exit risk. The innovation rate of the province in terms of trademarks has a positive coefficient, while a negative and significant sign is found for innovation measured by patents. The coefficient of the offshoring variable is negative and significant, and the dummy for firms that belong to a medium–high technology sector is also negative and significant. The dummy for the crisis years is positive and highly significant; however, these variables are not significant for the multinational subsamples.

Focusing on the multilevel estimations provided in the last two columns of Table 10, we observe that they confirm and add further information to the evidence obtained by the logit model shown in Table 9 for the disaggregated sample and in the first column of Table 10 for the interaction estimates. More specifically, the results of the multilevel analysis in the last column of Table 10 confirm that foreign multinationals have better survival prospects if they are located in industrial districts and urban areas. On the contrary, national firms face an increase in the exit risk if they are localized in urban areas and industrial districts. National firms gain a lower chance of exiting due to both specialization and intra-industry variety; i.e., they benefit from Jacobs externalities measured by intra-industry variety (complementarities between industries at the province level).

Hence, our results seem to confirm some studies showing that over the last decade, belonging to an ID did not translate into a competitive advantage (Di Giacinto et al. 2012). Cainelli et al. (2012) also find that the district degree of a province taken alone does not seem to have any impact on the firm exit of its industries. At the same time, previous studies on Italy emphasize the role of foreign investors in highly specialized contexts and stress how FDI location choices have started to target local industrial systems, especially for high value added functions (knowledge or technology sourcing) (Bronzini 2007; De Propris et al. 2005; Mariotti et al. 2010; Menghinello et al. 2010). On a global scale, Dunning (2009) argues that the geographical clustering and networking of related value-added activities is playing an increasing role in the location choices of multinational enterprises.

6 Conclusions

Recent crisis events have strongly influenced firms’ exit outcomes. The variables that affect firm behaviour in survival are difficult to capture in a single standard model because variables are defined at different levels and capture different effects of firm behaviour. To manage this problem, this study uses a multilevel approach that allows us to take into account more complex models and multilevel variables, both firm-related and context-related ones. The latter are particularly taken into account by focusing on the role of local agglomeration economies in addition to innovation, export propensity, offshoring, and the economic endowment of the province where the firm is located. Our empirical analysis has the advantage of being applied to a large panel of firms and stratified by firm characteristics, Italian provinces, industrial sectors, and firm ownership over a long span of time (2002–2010).

The main argument we tested is how agglomeration economies, in addition to industry and firm specific determinants, may provide an explanation for firm failure. We also expected a different impact of all of the local determinants of firm survival for multinational firms with respect to the survival of non-multinational firms.

First, our multilevel model shows that the context variables (province and region-related) influence the firm’s propensity to exit. Hence, both firms’ region and province heterogeneity drive our results; however, region and province explain only up to 4 % of the variance in the overall exit rates. This result suggests that other things being equal, the heterogeneity in firm characteristics explains the largest share of their exit variability. This confirms the importance of carrying out the analysis at the firm level.

With respect to the key questions of our analysis, both using the logit and the multilevel estimation methods, our results confirm the standard relevance of the specialization of Italian local systems for the survival of firms located in Italy. Diversification economies at the province level also significantly increase firm duration if they are within industries and not across industries. For the entire sample, we find that urban density and district specialization increases the probability of exit.

Our further question was aimed at understanding how local economies differently affect firms with different levels of global activities, taking into account the great heterogeneity that exists between firms that perform international FDI and domestic firms that are unable to engage in this type of internationalization. We did find strikingly different exit patterns across firm types with respect to the different sources of external economies. Starting from urbanization economies, for domestic firms we find evidence of a higher exit risk in agglomerated urban areas, measured by the population density. Hence, in Italian manufacturing industries, the chance of survival is a force that should tend to reduce geographical concentration. However, this result is not observed for the multinationals.

Industrial districts also differently influence the exit behaviour of FDI investors and firms not investing abroad. We find no evidence of a positive district effect on the survival of domestic firms. In the case of foreign multinationals, however, we find evidence of a reduction in firm exit due to a higher industrial district degree of the province, even after controlling for the superior characteristics of these firms and for other industry and province variables. Hence, this seems to suggest that foreign firms have the ability to exploit local external economies in the industrial clusters, which translates into higher longevity. This may be due to certain advantages such as having a larger global network and being less dependent on credit restrictions and local markets for supply and demand.

Hence, different global activities also mean different interactions with the socio-economic context in which firms work: domestic firms not involved in FDI are not able to benefit from the social capital that spills over from industrial districts, while foreign multinationals show a higher persistence in terms of survival in such contexts, which confirms the increasing desire of foreign firms to locate close to these knowledge clusters in Italy found in other studies.

Our findings have interesting implications for the assessment of location-based policies. Policy-makers may use this information to adapt the tools of the regional policy to the heterogeneity of Italian firms. The role played by intra-industry variety in the specialization patterns of the Italian provinces suggests a need for strong industrial policies aiming at extending and diversifying the economic activities of a local system. Further, because the concentration of activities in urbanized contexts does not have a positive impact, perhaps due to congestion and transition costs that offset other benefits, this provides a strong support for extending infrastructural policies beyond urban areas as an important tool for promoting firms’ longevity by reducing the costs of polarization. A further important policy implication concerns the impact on firm mortality of the industrial district degree of the provinces that host them. Due to their impact on domestic firms’ mortality, the question arises as to whether IDs have lost their previous comparative advantage.

Further improvement of this study can be attempted at least in three directions. First, firms’ local links deserves deeper analysis by checking for the internal importance of the input–output relationships between firms or industries in the provinces to disentangle knowledge-spillovers from other agglomeration economies (Dumais et al. 2002). Another promising path of research entails a deeper study of the relationships between multinationals and districts. Finally, our results do not consider firms operating in the service sector, which given the progressive tertiaritation of the economy, deserves more investigation in future.

Notes

The variables related to firm internationalization, outward and inward foreign direct investment, which are proxied by Italian multinationals and foreign multinationals dummies, are used to split our sample across firm subsamples. Domestic multinationals are Italian firms with affiliates in foreign countries; foreign multinationals are firms located in Italy whose ultimate beneficial owner is a foreign firm retaining at least 25 percent of shares. We compare these firms to non-multinational domestic enterprises.

Aida collects balance sheet data on almost 90 percent of existing Italian corporate firms. We took the unconsolidated balances, and information thus refers to single firms and not to the consolidated results, as in case of groups. This characteristic is crucial to evaluate the territorial effects.

We considered 103 provinces, which was the number of province in 2002, although in 2010 there were 110. For this reason, the new provinces are attributed to the former province of affiliation. The provinces concerned are Monza from 2007, and Barletta, Fermo, Olbia, Ogliastra, Carbonia, and Campodano from 2009.

Stata's program MICE, written by Patrick Royston, fills in missing values in multiple variables iteratively by using chained equations using a sequence of univariate imputation methods with fully conditional specification (FCS) of prediction equations. The imputed values are generated from a series of univariate models in which a single variable is imputed based on a group of variables. One advantage of the MICE approach is that it does not assume a multivariate normal distribution; thus, it can easily be used to impute a variety of different types of variables (i.e., categorical, counts, etc.). A second advantage of the MICE approach is that, because it estimates a series of univariate models, it can sometimes accommodate larger imputation models than the multivariate normal approach.

We also attempted to fill in the missing values on the employees using the information on the total labour cost, which was almost always available. The method applied by Accetturo et al. (2013) and also adopted by Buccellato and Santoni (2013) consists of taking the median cost per employee per year, sector and province. The number of employees is then derived by the relationship between total labour cost and median cost per employee. Unfortunately, this filling procedure provided us with undervalued imputations of employees in the domestic firms and distorted (overestimated) variables built upon employees (such as productivity for domestic firms).

We rely on the beginning (rather than the end) of these processes as a firm ceases to operate freely on the market once it enters any such process.

We further control for firm status by considering AIDA information on the type of procedure a firm is undergoing. This last piece of information allows us to avoid counting firms with changes in categories due to mergers, acquisitions, or changes in location as exits and ensures that our data represent “true exit”. To accurately identify the timing of any legal cessation of a firm’s activity, we complement these variables by checking the balance sheet data. We also allow for a two-year prior and post exit window to incorporate reporting delays or mismatches between calendar and fiscal years. For example, if a firm began the liquidation process in 2009 but its last reported sales are in 2007, we assume that the firm exited in 2007.

Any standard model for binary dependent variables can be applied to estimate discrete time hazard models (Jenkins 2005). The choice of a discrete model is in line with previous studies (e.g., Greenaway et al. 2008; Zingales 1998). Following the suggestion of an anonymous referee, we attempted to exploit the panel data structure of the sample using a random effect probit. This would allow us to manage firms’ unobserved heterogeneity and weak exogeneity of the right hand-side variables. Because in this case we found no heterogeneity and the errors were not correlated to the exogenous variables, however, we decided to use a pooled logit model instead of the random effects logit model. The ordinary logit should be preferred as it is more efficient (fewer parameters need to be estimated).

We estimated both probit and logit models, but we decided to present only the logit model results. Log-likelihood of probit and logit are quite the same but the logit is preferred as it allows the easier calculation (and interpretation) of the odds ratio and comparison of the results with the multilevel logit model.

As in such a case, the assumption of independence of errors is violated. The multilevel models address such a dependency by splitting the residual into two uncorrelated components: a permanent component, which measures the random deviation of subject i’s mean from β, and an idiosyncratic component, which is specific to each subject across all the dimensions j. Hence, the multilevel approach ensures efficient estimates because it controls for spatial dependence and corrects the measurement of standard errors.

As stressed by Aiello et al (2014), “in order to explain the variability in random coefficients, a ‘sufficient’ number of clusters in the sample is required as otherwise the between group variance will be poorly estimated. … Some authors suggest 20 groups (Heck and Thomas 2000; Rabe-Hesketh and Skrondal 2008), others 30 (Hox 2002) or 50 (Maas and Hox 2004)”. Similar conclusions are also in a recent paper by Bryan and Jenkins (2013), ‘Multilevel Modelling of Country Effects: A Cautionary Tale’, forthcoming European Sociological Review, DOI: 10.1093/esr/jcv059.

We were forced to aggregate some sectors because “exit” is a rare event and we had two small subsamples of domestic and foreign multinationals. In two Ateco 2 digit sectors, for instance, 25 (rubber and plastic) and 33 (medical and precision instruments), we have more than 10000 firms in total but less than 100 firms that exit, too few for our estimation. We could consider separately larger sectors such as textile, clothing and footwear, but other sectors such as coke, rubber, and chemicals, were joined together. We opted to aggregate sectors with less than 100 total exits, including multinationals. Hence, we have re-classified the Ateco 2 digit sectors into 13 sectors. We do not attach the table showing the aggregations, but further details can be provided upon request. For this reason, we could not use the sector as a level in the multilevel model as in recent studies (see Aiello et al. 2015). We thank an anonymous referee for prompting us to clarify this issue.

An important feature of multilevel models is that even in the absence of explanatory variables at higher levels of aggregation, they still perform better than a standard model, which violates the assumption of independence of all observations when data are nested (Rabe-Hesketh and Skrondal 2008).

We performed a correlation matrix among all the variables and carried out the variance inflation factor (VIF) in order to check for multicollinearity. As a rule of thumb, a variable whose VIF value is greater than 10 may deserve further investigation. Tolerance, defined as 1/VIF, is used to check the degree of collinearity. A tolerance value lower than 0.1 is comparable to a VIF of 10, which can be used as a cut-off value. This means that above that threshold, the variable could be considered as a linear combination of other independent variables. The test shows that there is an absence of multicollinearity among the regressors considered. Correlation tables and diagnostics are not included in the paper for the sake of brevity but are available upon request.

The definition introduced by Sforzi (1990) is based on the characteristics of the Local Labour Systems (LLS) in terms of sectorial specialization and concentration of small and medium firms. The Sforzi algorithm excludes the LLS localized in large urban areas and those that are mostly based on large firms. Because we cannot exclude the presence of agglomeration economies in these areas, we have introduced the indicator of urbanization in our estimates.

Localization externalities are measured using a specialization index (SI) after Balassa, calculated using two-digit level employment data for the 103 Italian provinces. We use a standardized SI constrained within the interval (−1, +1) (Paci and Usai 2000).

The size classes are built to avoid classifying most firms as “small” because of the high skewdness of the Italian firms’ distribution.

We also tested value added growth, unit labour cost, labour productivity, export and import propensity, and manufacturing employment share at province level, but they were not included in the final specification either because they were not significant or because they were highly correlated with other regressors.

The variance of the random intercept at the province level is significant in the null model (Model 1), while as expected, the residual random intercept and slope variances in the model with all the covariates (which also includes variables at the province level) are not significant.

The null hypothesis is that \({\text{U}}_{{ 0 {\text{KR}}}} = {\text{V}}_{{ 0 0 {\text{R}}}} = 0\). If the null hypothesis is true, an ordinary regression can be used instead of a cross-classified model.

Results are presented in terms of odd ratios. The odds are the probability that the event occurs divided by the probability that it does not occur. The odd ratio is instead the ratio of two odds, i.e., for a dummy, it is the probability of exit for firms of a given category with respect to firms of the base category. If we consider the ownership status, domestic multinationals have a 4 percent lower exit probability with respect to a non-multinational domestic firm. For continuous variables, we obtain the percentage change in the odds of exit for a one-unit increase of the variable.

We also applied the method version of the logit model developed by King and Zeng (2001) to compute unbiased estimates in a situation where the event to be estimated is rare. This method—the Rare Events Logistic Regression, or ReLogit—estimates the same logit model as the standard logit procedure, but uses an estimator that provides a lower mean square error in the presence of rare events data for coefficients, probabilities, and other quantities of interest. ReLogit estimators in case of rare events are an unbiased estimator. ReLogit was applied to the subsample of foreign firms.

References

Accetturo, A., Di Giacinto, V., Micucci, G., & Pagnini M. (2013). Geography, productivity and trade: Does selection explain why some locations are more productive than others? Temi di discussione (Economic Working Papers) 910, Bank of Italy.

Acs, Z., Armington, C., & Zhang, T. (2007). The determinants of new-firm survival across regional economies. The role of human capital stock and knowledge spillovers. Papers in Regional Science, 86(3), 367–391.

Aiello, F., Pupo, V., & Ricotta, F. (2014). Explaining total factor productivity at firm level in Italy: Does location matter? Spatial Economic Analysis, 9(1), 1–20.

Aiello, F., Pupo, V., & Ricotta, F. (2015). Firm Heterogeneity in TFP, sectoral innovation and location. Evidence from Italy. International Review of Applied Economics, 29(5), 546–571.

Aiello, F. & Ricotta, F. (2014). Firm Heterogeneity in productivity across Europe. What Explains what? Working Papers 201404, Università della Calabria.

Alampi, D., Conti, L., Iuzzolino, G., & Mele, D. (2012). Le agglomerazioni industriali italiane nel confronto internazionale. In M. Omiccioli (a cura di) I sistemi produttivi locali. Trasformazioni tra globalizzazione e crisi. Roma: Carocci.

Alcacer, J., Chung, W., Hawk, A., & Pacheco-de-Almeida, G. (2013). Applying random coefficient models to strategy research: Testing for firm heterogeneity, predicting firm-specific coefficients, and estimating strategy trade-offs. Harvard Business School Strategy Unit Working Paper N. 14-022.

Altomonte, C., Aquilante, T., & Ottaviano, G. I. P. (2012). The triggers of competitiveness. The EFIGE Cross-Country Report. Bruegel Blueprint n. 17.

Antonietti, R., & Cainelli, G. (2011). The role of spatial agglomeration in a structural model of innovation, productivity and export: A firm-level analysis. The Annals of Regional Science, 46(3), 577–600.

Attaran, M. (1986). Industrial diversity and economic performance in U.S. areas. The Annals of Regional Science, 20(2), 44–54.