Abstract

Uninsurance and underinsurance represent a major policy challenge. A key reason why agents make mistakes might be ascribed to the ambiguity affecting insurance decisions. This paper investigates self-insurance decisions when the probabilities of loss are ambiguous and ambiguity is generated by different sources. We present a model and a set of lab experiments to address two main research questions: are buyers willing to pay more in presence of ambiguity with respect to risk? Is the willingness to pay affected by the source of ambiguity? After measuring subjects’ willingness to pay for insurance when losses are risky, we relate the probability to face losses both to ambiguous events that are context-related (‘external’ sources of ambiguity), and to events that regard the individual ability (‘internal’ sources of ambiguity). We show that subjects’ willingness to pay for insurance depends on the specific source of ambiguity, being lower than willingness to pay in case of risk when the source of ambiguity is internal and decision-makers exhibit overconfidence.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The number and percentage of citizens who have no insurance from any private or public source at all is extremely high, in both developed and developing countries (e.g. Farley and Wilensky 1985; Link and McKinlay 2010; Magge et al. 2013; Saltzman 2021). As emphasized by the Geneva Association, (2019, p. 3), “Contrary to general belief, protection gaps are not limited to developed and emerging countries but are also common in advanced economies. A customer survey of The Geneva Association in seven mature economies revealed that people widely understand the fundamental notion of insurance and its vital role in the economy and society. However, people have deep misperceptions about the insurance industry and its products. Addressing this disconnect will be vital to encouraging a wider adoption of insurance in mature economies”. Underinsurance, or having insurance that does not adequately meet an individual’s needs, is a problem affecting an estimated 25 million adults in the U.S. (Schoen et al. 2011).

Uninsured and underinsured people living with the danger of financial ruin in case of a major negative event (like a serious illness or a natural disaster) represent a key public concern. Not only uninsured victims may incur severe losses affecting their future wellbeing; general taxpayers may be forced to share the costs of recovery (Kunreuther 1984; Baker and Siegelman 2013). A further critical issue with uninsurance and underinsurance concerns strategic decision-making: living in an area with many uninsured or underinsured people may translate in higher insurance premiums, reducing individuals’ demand for insurance, and vice versa.

Societies are thus faced with suboptimal protection levels, and practitioners, academics and policymakers “are struggling to come up with plausible explanations which could inform corporate and public decision-making” (The Geneva Association 2019, p. 3). Among the factors underlying uninsurance, behavioral biases affecting the perception of the value of insurance and the way consumers process information are increasingly under the lenses as possible explanations of why individuals, households and firms buy less insurance than is economically beneficial to them (e.g. Cutler and Zeckhauser 2004). A central element in this respect is the complex decision process faced by potential insurance buyers. People typically decide to buy insurance to protect their wealth or well-being (like, for instance, health) in situations that do not involve risk only, but ambiguity or “Knightian uncertainty” (Knight 1921). Ambiguity is defined as “uncertainty about probabilities” (Ellsberg 1961) or as “a state of mind in which the decision maker perceives difficulties in estimating the relevant probabilities” (Camerer and Weber 1992). Since the demand for insurance has been shown to persistently depart from the predictions based on the expected-utility framework (Schlesinger 1997), the role of ambiguity in shaping insurance choices deserves specific attention. Furthermore, whereas most financial assets’ risk is related to the marketplace, insurance has a “personal nature” (Schlensinger 2013, p. 2) since it involves a contract contingent on individuals’ own personal wealth changes.

The aim of this paper is to explore the effects of ambiguity sources on individuals’ insurance choices, finding a rationale for the high levels of underinsurance emerging from the empirical evidence. The outcome relevant to the agent well-being is often multidimensional, thus different sources of risk (e.g. health status, the environment, and so on) interact and affect insurance decisions (Eeckhoudt et al. 2005). Analogously, ambiguity has multiple sources (e.g. Abdellaoui et al. 2011): it can derive from the ignorance on own features or performance, or depend on the lack of information about the context where the decision-maker makes her choice. When the probabilities of incurring a loss are ambiguous, an individual’s insurance decision turn to be affected (also) by own perception on the probability of loss, and this perception is likely to be biased by over (under)-confidence. This might exacerbate problems of asymmetric information, such as moral hazard and adverse selection, and shape the level of premium and the performance of insurance markets (Hogarth and Kunreuther 1989). Although the effects of ambiguity on market outcomes are considerable and have been studied extensively (see for instance Rigotti and Shannon 2005; Easley and O’Hara 2009), the insurance market still represents an unexplored environment to study in this aspect, with very few exceptions.

We therefore believe that the relationship between ambiguity, confidence and insurance decisions deserves further attention. In this paper, insurance decision are first addressed from a theoretic point of view, in order to enlighten a set of predictions on agents’ behavior. Then, these decisions are reproduced in a lab experiment where subjects earn money by completing a real-effort task and face the chance to lose it with an ambiguous probability. We present subjects with ten scenarios differing on the source of the ambiguity, and relate the probability to incur in losses both to events that depend on the situation and thus are ‘external’ to the individual, and to events that regard the individual performance in a task, i.e. to ‘internal’ sources of ambiguity. We consider risk as a benchmark, since risk refers to a situation where the probability of loss is known. Then, we allow for four forms of ambiguity. The first two are related to ambiguity on own capabilities: subjects have to estimate the probability of their success with respect to competitors in two competence-based task where we vary their degree of confidence by considering a task where subjects self-select into, and a task which is the same for all competitors. As third type of ambiguity, we consider ambiguity à la Ellsberg, where there is no information about the probability of loss. Finally, we allow for ambiguity based on the Bingo Blower, where subjects could see the balls moving inside a machine called Bingo Blower, and have a rough idea of the relative proportions of each color, but could not be sure of the probability of getting a ball of a particular color. Finally, we elicit subjects’ willingness to pay for self-insurance in case of full vs. partial insurance coverage.

The first research questions we address is the following: is the individual’s willingness to pay for insurance affected by the specific source of ambiguity, being it “internal” and related to own characteristics, or “external” and dependent on the environment? Cases of insurance decisions depending on internal ambiguity are health insurance, professional liability insurance, or car insurance, where individuals ground their insurance decisions on the evaluation of their own characteristics or “type” and, as such can be biased by over or (under)-confidence. On the other hand, insurance can protect against “external” negative events like thefts, or natural disasters that might occur independently from their own features, and for which individuals may have large difficulties in providing an estimation, at a point that their decision can be assimilated to a decision under unknown probabilities.

Our second concern is related to the effects of choosing full or partial coverage. Is the willingness to pay for insurance decreasing/increasing in the level of coverage, or is it unaffected? A difference in behavior determined by the extent of coverage could reflect whether subjects’ decisions are motivated by mechanisms like loss aversion.

Our results show that individuals’ willingness to pay for self-insurance is lower in case of ambiguity than in case of risk, but only when the probability of loss depends on their own performance (“internal” ambiguity). More specifically, for overconfident subjects the willingness to pay is lower than in case of risk and in case of external sources of ambiguity. This finding is consistent with the high frequency of underinsurance observed in domains like health insurance, or even car insurance that has become compulsory precisely to prevent this problem (as shown by Camerer and Lovallo 1999, driving ability is the typical characteristic where the majority of people think to be “better than average”). Since insurance companies have more realistic evaluation of clients’ performance (and can diversify across clients), there is room for exploiting the consequences of widespread overconfidence for those who are able to reshape their clients’ biased judgements.

Interestingly, our findings enlighten that having full or partial coverage does not affect the willingness to pay for self-insurance in case of “internal” ambiguity, reflecting subjects’ attention to avoid losses, more than compensating marginal ambiguity costs and marginal insurance benefits.

The paper is organized as follows. Section 2 presents the literature on insurance under ambiguity and the role of overconfidence in this domain. Section 3 illustrates the model, whereas the experimental design and procedure are described in Sect. 4. Section 5 summarizes the results, Sect. 6 provides a discussion and Sect. 7 concludes.

2 Related Literature

This paper considers decision making in insurance-type problems with ambiguous loss probabilities. Ambiguity has a tremendous impact on financial decisions in general, and insurance decisions do not represent an exception (e.g. Cabantous 2007; Cabantous et al. 2011; Hogarth and Kunreuther 1989, 1992; Kunreuther et al. 1984). The negative events we can insure against hardly entail known probabilities: since Ellsberg (1961)’s seminal work, there is considerable experimental evidence showing that people treat ambiguous probabilities differently than known probabilities. The conventional wisdom suggests that individuals tend to prefer well-specified probabilities with respect to ambiguous ones. However, in case of events involving losses, subjects might be ambiguity seeking when the probabilities of losses are small (Einhorn and Hogarth 1985, 1986; Hogarth and Einhorn 1990); people have been shown to exhibit ambiguity aversion for likely gains and unlikely losses, and ambiguity seeking behavior for unlikely gains and likely losses (Baillon and Bleichrodt 2015).

The behavioral consequences of ambiguity attitude affect both the demand and the supply of insurance, shaping either the magnitude of premiums offered by underwriters or the willingness to buy and/or pay for insurance. When it comes to insurance demand, which represents our focus in this paper, the most common effect of ambiguity averse (seeking) behavior is that an expected utility maximizer would use a more pessimistic (optimistic) distribution of the beliefs with respect to risk. Di Mauro and Maffioletti (1996, 2001) use a second-bid auction mechanism where experimental subjects face a series of “markets” where they can lose their endowment. In their paper, subjects are asked to place a bid to purchase the right to self-insure (reduce the probability loss to zero) or self-protect (reduce the loss to zero, given the probability of the loss). Results show that self-protection is significantly higher than self-insurance in few experimental conditions. Interestingly, the impact of ambiguity is weak: bids in case of ambiguous probabilities are not statistically different from risky bids.

The effects of different sources of ambiguity on insurance behavior has been largely neglected in the literature. Among the very few contributions on the topic, Cabantous and Hilton (2006)’s paper deals with different sources of ambiguity in the following sense: the ambiguity in the probabilities of loss can derive from a disagreement or conflict about the probability of loss, or from an imprecise forecasts on the probabilities of loss. Their result shows that subjects charge higher premium in the former case, exhibiting not only ambiguity aversion, but also conflict aversion. Bajtelsmit et al. (2015) focus on negligence liability insurance and suggests that the source of ambiguity surrounding liability losses may explain over or underinsurance: distinguishing among possible sources of ambiguity could explain the existence of a flourishing liability insurance market in the United States. Insurance demand may be explained by ambiguity regarding one’s own risk type (Bajtelsmit and Thistle 2008), the process of the pooling mechanism (DeDonder and Hindriks 2009), and the risk of momentary lapses in judgment by oneself or others (Bajtelsmit and Thistle 2013). Although not explicitly categorized in these terms by the authors, these sources of ambiguity can be classified as “internal”, i.e. related to the subject’s own characteristics or “type”, or “external”, i.e. dependent on the context, as we do in this paper. In a recent work, Cagno and Grieco (2019) consider a set of ambiguity settings to explore the interaction between confidence and ambiguity attitudes in individual decision-making about lotteries.

The seminal work by Heath and Tversky (1991) has emphasized almost thirty years ago that individuals’ attitude towards ambiguity is strongly dependent on the way how the decision-maker perceives the relevant context, especially when her knowledge in some domain is involved. A large literature demonstrates that people are usually overconfident and that, in particular, they are overconfident about the precision of their knowledge (see Odean 1998, for an overview). The psychology literature also suggests a tendency to attribute positive outcomes to own internal characteristics and negative outcomes to external factors: overconfidence may be engendered by the so-called “self-serving attribution bias”, i.e. the overestimation of the role attributed to internal characteristics as contributing factors to better performance. When own characteristics or choices are involved, people may be particularly resistant to downward revision of own self-appraisal (e.g. De La Ronde and Swann 1993; Taylor and Brown 1988). The theory of cognitive dissonance, going back to Festinger (1957), argues that people experience stress when confronted with information that challenges overconfident beliefs, and thus try to avoid facing such belief-changing information, causing overconfident beliefs to persist (Malmendier and Taylor 2015). In a related vein, Köszegi (2006) points out that people are more averse to self-relevant information when they hold high beliefs about themselves, especially for dimensions along which they have uncertain knowledge. If the decision maker is satisfied with her present beliefs, she might decide to protect her self-image by avoiding any information that may challenge those beliefs.

To the best of our knowledge, these insights have never been applied to the investigation of insurance decisions. We will describe the specificities of our setup in the next section.

3 Our Setup

We introduce a model and a set of experiments where we study individuals’ willingness to pay for self-insurance when probabilities of loss are ambiguous and the sources of ambiguity are related to the subject’s personal features or to contextual variables. The way we elicit individuals’ willingness to pay for insurance when probabilities of loss are known or vague follows Di Mauro and Maffioletti (1996, 2001). Our design relies on the same second-bid auction mechanism à la Vickrey (1961) used in Di Mauro and Maffioletti (2001) that represents an incentive mechanism able to induce truthful revelation of participants’ subjective evaluation. With respect to other mechanisms like BDM (Becker et al. 1964) auctions, it is more suitable for our purpose of addressing subjects’ (over)confidence because it consists of a game in which a participant interacts with other players, instead of placing subjects in a situation of individual choice. Our design differs in several ways. First, the endowment is not fixed and exogenous, but depends on subjects’ performance on two previous tasks. Second, we focus on self-insurance only. Third, and most importantly, we compare subjects’ willingness to pay insurance when ambiguity have different sources.

As in Cagno and Grieco (2019)’s framework, ambiguity is shaped by the context and/or by the decision-maker’s characteristics and we partly rely on their experimental design for what concerns the way different ambiguity sources are generated in the lab. Our model will assume that the decision-maker’s perception of the probability of incurring a loss is biased by the (over)confidence emerging in the presence of internal ambiguity when the individual is confronted with information that calls existing beliefs on herself into question.

3.1 The Model

We consider an agent with wealth \(W\) who faces the risk of losing an amount \(L\in (K,W)\), where \(K\) is the deductible. We denote by \(p\) the objective probability of incurring the loss: with no ambiguity, the agent knows the value of \(p\); in the presence of ambiguity, she is uncertain about its value.

Through self-insurance, the agent can reduce the amount of loss to \(K\ge 0\) by paying a nonnegative amount \(x\), where \(c\left(x\right)\) denotes the cost she is willing to pay. Let \(L\left(x\right)=l\left(x\right)+K\) indicate the loss amount, with \(l\left(x\right)\)being a decreasing function of \(x\). The parameter \(K\ge 0\). reflects the type of insurance coverage the company offers and assumes value equal to 0 in case of full coverage. We assume that partial coverage implies that the agents faces part of the loss no matter how much she would pay for insurance (\(K>0\)). In fact, in case of partial coverage the subject loses \(K\) if the negative event occurs, because the reimbursement occurs only for an amount that exceeds the deductible \(K.\) We depart from the typical assumption that lower deductible plans command higher premiums (e.g. Cutler and Zeckhauser 2004).

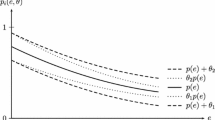

To capture ambiguity on the probability of incurring the loss, we represent the agent’s beliefs about the possible values of this probability by a second-order probability distribution \(\phi \left(\pi \right)\), where \(\pi\) indicates the agent’s belief on the probability \(p\) of incurring the loss. The peculiarity of this model is assuming \(\pi\) to depend on the source of ambiguity. In particular, we want \(\pi\) to account for the subject’s confidence. When the probability of incurring the loss is related to the agent’s characteristics and/or decisions, the agent’s self-appraisal might be involved. Because self-appraisal is often resistant to downward reconsideration, a confident agent may systematically underestimate the probability of loss in order to eliminate the behavioral sources of dissonance between her self-appraisal and her responsibility in determining a negative outcome, for instance by self-selecting in an unfavorable situation.

We follow Snow (2011) in assuming that, for each value of \(\pi\), the agent’s expected utility is evaluated by an increasing function \(\alpha\) that captures ambiguity attitude: the agent is ambiguity averse under the assumption that \(\alpha\) is concave, ambiguity neutral when \(\alpha\) is linear, and ambiguity seeking when \(\alpha\) is convex. We denote with \({E}_{ \phi }\left[ .\right]\) the agent’s expectation with respect to the second order probability distribution \(\phi \left(\pi \right)\). The agent chooses x to maximize

where \({W}_{L }=W-c\left(x\right)-l\left(x\right)-K\)is wealth in the state when the loss is incurred, and \({W}_{NL}=W-c\left(x\right)\) is wealth in the non-loss state. We assume that increasing self-insurance is always beneficial in the sense that \({c}^{{\prime}}\left(x\right)+{l}^{{\prime}}\left(x\right)<0\) when L(x) > 0, and that L″(x) ≥ 0 and c″(x) > 0 so that expected utility conditional on π is a concave function of \(x\) for any risk-averse or risk-neutral decision maker. Partial coverage implies that, no matter her choice of \(x\), the agents incurs a loss \(K\)>0. In the absence of ambiguity, \({E}_{ \phi }\left[ \pi \right]=p\). When ambiguity is in place, we assume

where \(\gamma \ge 1\) captures the confidence bias that causes the agents to underweight her probability of incur a loss and \(\gamma =1\) represents the case of an unbiased rational agent, as in Gervais and Odean (2001).

In the presence of ambiguity and with an ambiguity averse agent, the marginal value of self-insurance is

where \(\text{u}\left({\uppi }\right)=\pi U\left({W}_{L}\right)+\left(1-\pi \right)U\left({W}_{NL}\right)\)is the expected utility conditional on the perceived probability \({\uppi }\) and \(g\left(\pi \right)= -\pi {U}^{{\prime}}\left({W}_{L}\right){(c}^{{\prime}}+l^{\prime})-(1-\pi \left)U^{\prime}\right({W}_{NL})c^{\prime}\)is the marginal effect on \(\text{u}\left({\uppi }\right)\) of an increases in \(x\). Since Eq. (1) is concave, when expression (3) is higher than the optimal self-insurance is higher for ambiguity averse agents in the presence of ambiguity than in its absence, while the opposite holds if (2) is negative, thus departing from self-insurance as predicted by a von Neumann-Morgenstern expected utility.

Given \({c}^{{\prime}}\left(x\right)+l\left(x\right)<0\), the marginal value of self-insurance, \(g\left(\pi \right)\), increases as \(\pi\) increases. With no ambiguity (\(\pi =p)\), the expected value of utility \(U\) depends linearly on \(p\), thus \(g\left(p\right) = 0\).

If the agent is overconfident (\(\gamma >1\)), the perceived probability of incurring a loss is lower than the one in a risky situation (\(\pi < p\)), thus a marginal increase in self-insurance above the optimal level reduces utility \(u\left(\pi \right)\). On the other hand, an underconfident agent suffers the ambiguous situation and perceives the probability of incurring a loss as “higher” than the objective probability \(p\) (\(\pi > p\)): in this case, an increase in self-insurance increases utility. The opposite is true for ambiguity seeking agents (when \(\alpha\) is convex).

Equation (3) shows that:

-

1.

the optimal willingness to pay \(x\) depends on how the agent perceives the probability to incur a loss (\(\pi\));

-

2.

if the agent is ambiguity averse, the higher the confidence bias \(\gamma\), the lower the perceived probability to incur a loss and the lower the willingness to pay for insurance; if the agent is ambiguity seeking, the lower the confidence bias \(\gamma\), the higher the perceived probability to incur a loss and the lower the willingness to pay for insurance;

-

3.

the optimal willingness to pay \(x\) does not depend on the deductible \(K\).

The next sections will provide an experimental test of these predictions.

3.2 The Experiment

3.2.1 Experimental Design

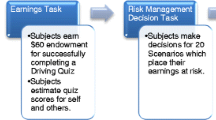

Our experimental design is made of two stages. In the former, the subjects perform two real effort tasks (multiple-choice questionnaires) and are faced with a set of choices aimed at eliciting in an incentive-compatible way their attitude towards ambiguity of different sources. In the latter, we elicit their willingness to pay for insurance in ten scenarios where the probability to incur a loss is ambiguous. We present two treatments: “high perceived competence” (henceforth “HIGH”) and “low perceived competence” (henceforth “LOW”) that differ only for how Questionnaire A in Stage 1 is assigned to the subject (more details below). The main features of the experimental design are summarized in the flow chart In Fig. 1.

To provide a rationale for the experiment, we briefly describe here the two stages and postpone the details to Appendix A1.

In Stage 1 (“Questionnaires Stage”), subjects take part into two different general knowledge, multiple-choice questionnaires. The former (Questionnaire A) is assigned to the subject according to a ranking she made among four questionnaires on different topics (Sport, Showbiz, History, and Literature). In Treatment HIGH, the subject receives the questionnaire she ranked as first (i.e. the favorite) among the four topics; in Treatment LOW, the subject receives the questionnaire she ranked as last (i.e. less appreciated) among the four topics. To avoid strategic behavior, the subjects are informed about the use we would made of their ranking only after they made it. The latter questionnaire (Questionnaire B) is compulsory and equal for all participants.

Before reading and answering the questions, we collect a set of measures of overconfidence relying on Moore and Healy (2008)’s classification. Subjects are asked to assess their ex-ante estimation of their ability in both questionnaires and of the ex-ante perceived degree of competition in the selected Questionnaire A (i.e. how many subjects in the session chose that particular questionnaire among the possible four). After the end of each questionnaire, individuals are asked to provide their ex-post estimation of her own ability and perceived ex-post placement in both questionnaires. Subjects’ ambiguity attitudes are captured in an incentive-compatible way by asking subjects to bet on their estimations or choose between pairs of lotteries.

Each pair of lotteries involves a risky (50–50) lottery and an ambiguous lottery. As in Ellsberg (1961), the 50–50 risky lottery works as a benchmark to measure ambiguity aversion. In fact, in Ellsberg’s two-color problem, subjects were faced with an urn with 50 red and 50 black balls (the risky urn) and another with 100 balls in an unknown combination of red and black balls (the uncertain or ambiguous urn). People were defined as ambiguity averse when they preferred to bet on the risky urn, regardless of the winning color. We thus elicit trade-offs between series of pairs of lotteries presenting contrasts between the 50–50 risky lottery and four alternative ambiguity lotteries. We follow Chakravarty and Roy (2009)’s methodology, which is aimed to capture an ambiguity aversion indicator revealed by the switch from the 50–50 risky lottery to ambiguous ones. Their methodology is consistent with the theory of smooth ambiguity, proposed by Klibanoff et al. (2005), which enables to distinguish between attitudes towards risk and towards ambiguity.

We vary the source of ambiguity for the ambiguous lottery in each pair, presenting four possibilities: bet on a random draw from an unknown urn à la Ellsberg (where the probabilities are unknown), bet on a random draw from a Bingo-Blower (where the actual probability to draw the selected color is 50%, but the probability is not known to subjects), bet on their own relative performance of in Questionnaire A (where the probability of success reflects the subject’s relative performance in Questionnaire A), bet on the relative performance of in Questionnaire B (where the probability of success reflects the subject’s relative performance in Questionnaire B). The order of the pairwise choices was randomized. Figure 2 below portrays the Bingo Blower used during the experiment. As shown, the Bingo Blower is a rectangular-shaped, glass-sides box located in the room where the experiment takes place. Inside the glass walls there was a set of pink, yellow, and blue balls in continuous motion being moved about by a jet of wind from a fan in the base, with the number of yellow balls (20) that equals the sum of pink (12) and blue balls (8). The objective probability of ejecting a yellow ball is thus 50%.

Stage 2 (“Insurance Stage”) elicits individuals’ willingness to pay for self-insurance after informing subjects about the tokens they earned. We present subjects with ten different scenarios where the tokens collected in the previous three stages can be all lost with a probability that differs according to the scenario. This probability can be known (50%) or ambiguous: ambiguity can derive from the four sources used in Stage 1 (a random draw from an unknown urn à la Ellsberg, a random draw from a Bingo-Blower, the relative performance of in Questionnaire A, the relative performance of in Questionnaire B). Five of the ten scenarios reflect the case of full coverage, where subjects can be fully refunded in case of loss; the other five refer to partial coverage, where subjects are only partially refunded in case of loss (and pay a strictly positive deductible). We both randomized the order between full and partial coverage scenarios, and the order of the five scenarios of each type.

3.2.2 Experimental Procedure

Subjects were recruited via ORSEE (Greiner 2004). We ran nine computerized sessions with 135 participants in total (nine sessions with 15 subjects each). We had four sessions of 15 subjects (60 subjects in total) for treatment HIGH, and five sessions of 15 subjects (75 subjects in total) for treatment LOW. Participants were undergraduate students, with 50% males. We employed a between-subjects design: no individual participated in more than one session. In each session, the participants were paid a 5€ show-up fee, plus their earnings from the experiment (with average earnings equal to 17.31€, show-up fee included). At the beginning of each session, participants were welcomed and, once all of them were seated, the instructions were handed to them in written form before being read aloud by one experimenter. Instructions are presented in Appendix A2. Sixty-three per cent of subjects classified the experiment as “easy”: this result confirms that participants were able to understand the instructions and most of them did not have trouble during it; this is also indirectly confirmed by the fact that all sessions lasted one hour with no delays.

4 Results

4.1 Overview

We start by presenting the experimental results by observing that subjects were distributed quite homogeneously across the four topics available for the competence-based questionnaire (Questionnaire A). For what concerns the first choice (i.e. their preferred topic), which were relevant in treatment HIGH, 21% of subjects selected Sport, 32% Showbiz, 16% History, and 31% Literature. On the other hand, the last choice (i.e. their least preferred topic), which were relevant in treatment LOW, saw 38% of them selecting Sport, 17% Showbiz, 8% History, and 37% Literature.

For what concerns Questionnaire A, we find a significant difference in actual performance between treatments. In treatment HIGH (where the Questionnaire A assigned is the favorite one), subjects’ average score is significantly higher than in treatment LOW (where the Questionnaire A assigned is the one ranked as last): the average scores are 10.98 vs. 8.90: Mann–Whitney–Wilcoxon two-tailed test: z = 3.753: p < 0.001. We thus succeeded in introducing two selection procedures that lead to significant differences in average performance. As expected, there is no significant difference in Questionnaire B scores across treatments (10.76 vs. 11.31, Mann-Whitney-Wilcoxon two-tailed test: z = − 0.942: p = 0.346).

Let us turn to the comparison between scores in the competence-based (Questionnaire A) and no-competence questionnaire (Questionnaire B) in terms of actual performance and confidence. In treatment HIGH, there is no significant difference between Questionnaire A and Questionnaire B scores (average score: 10.98 vs. 10.76: t-test: t = 0.553, p = 0.582). This suggests that the choice of the topic in Questionnaire A has a simple effect: subjects are not more competent, but just feel more competent ex-ante than in Questionnaire B. This is true either in absolute terms (average ex-ante overestimation: 1.733 vs. − 0.786: t-test: t = 3.658, p < 0.001) or in relative terms (average ex-ante placement: 54.67% of subjects declare to be “better than average” in Questionnaire A vs. 41.33 in Questionnaire B: t-test: t = − 1.737, p = 0.021). On the contrary, in treatment LOW (where the Questionnaire A assigned is the less preferred) subjects’ average score in Questionnaire A is significantly lower than score in Questionnaire B (average score: 8.98 vs. 11.31: t-test: t = 4.826, p < 0.001). In both questionnaires A and B, subjects are very well calibrated in predicting their performance ex-ante in absolute terms (average ex-ante overestimation: − 0.05 vs. − 0.50: t-test: t = 0.609, p = 0.544).

After completing the questionnaires, subjects are asked again to predict their score: the overestimation observed in Questionnaire A in treatment HIGH disappears and the difference in overestimation between the Questionnaires A and B vanishes (average ex-post overestimation: − 1.00 vs. − 0.733: t-test: t = − 0.543, p = 0.588). In treatment LOW, the difference stays non-significant (average ex-post overestimation: − 0.300 vs. − 0.883: t-test: t = − 0.998, p = 0.322). These findings suggest that experience has a positive role on shaping confidence: after directly engaging in the task, subjects update their beliefs and learn to assess their competence more precisely, also in situation where they exhibited ex-ante overconfidence.

Subjects update their beliefs correctly: indeed, there is no effect of the perceived performance in Questionnaire A on the preference for betting on their performance or on risk, with subjects who expected to be better than average that behaved in the same way than subjects who thought to be worse than average (Mann-Whitney-Wilcoxon two-tailed test: z = − 0.162, p = 0.871). Nonetheless, subjects prefer to bet on their relative performance in Questionnaire A than betting on risk: subjects on average prefer the ambiguous lottery - where the probability to win corresponds to their relative performance (measured by the percentile) in Questionnaire A - than risk (t-test: t = 2.056, p = 0.041). Furthermore, the percentage (66%) raises to 71% among subjects who rank better than the average (t-test: t = 4.060, p = 0.001). Interestingly, there is no difference between treatments HIGH and LOW: subjects prefer to bet on their own performance not only when they feel confident (treatment HIGH) but also when the assigned questionnaire topic is the one they ranked as the least preferred (treatment LOW) (Mann–Whitney–Wilcoxon two-tailed test: z = − 0.162, p = 0.872). A possible explanation is that, when facing uncertain outcomes, subjects prefer to win because of their own ability than because of chance, in line with the findings on the self-attribution bias illustrated in Sect. 2. Not only subjects become overconfident because they attribute success to own ability and failure to external causes, as the literature shows: our result reveals that subjects do prefer to engage in situations where success can be attributable to own ability, although this is not increasing their chances to win.

For what regards the degree of perceived competition, subjects tend to overestimate the number of peers they are competing with in Questionnaire A: 5.29 estimated competitors vs. 2.50 actual competitors (t-test: t = − 12.15, p < 0.001), with no difference across treatments. Although overestimated, competition in Questionnaire A is obviously lower than competition in Questionnaire B, since in the latter subjects compete with all their peers in the session (each session has 15 participants). Furthermore, it is worthwhile noting that in treatment LOW subjects are aware that other participants are asked to bet on their performance in the task they ranked as worst (as they were), so they are experiencing the same difficulties peers had. Similarly, in treatment HIGH subjects know they are competing with peers who self-selected in the preferred task (so very competent ones). Subjects do not neglect the reference group (see the seminal work by Camerer and Lovallo 1999 on the widespread “reference group neglect” attitude) and, on average, assess their relative performance taking into account that competitors were selected in the same way they were. These statistics are summarized in Table 1 below.

For what concerns subjects’ preference for ambiguity vs. risk, in the “no-competence” Questionnaire B our participants on average are indifferent between risk and ambiguity (t-test: t = 0.946, p = 0.345). The percentage of subjects preferring this type of ambiguity (54%) does not change if we restrict the sample to subjects who rank better than the average (t-test: t = 1.418, p = 0.159). There is also no significant difference between subjects who believed to be better than average in Questionnaire B and those who thought to be worse than average (Mann–Whitney–Wilcoxon two-tailed test: z = 0.211, p = 0.833).

When considering ambiguity deriving from external sources (unknown urn à la Ellsberg and Bingo-Blower), subjects prefer on average betting on risk than on ambiguity. When the source of ambiguity is the Bingo-Blower, 61% of subjects prefer betting on a risky 50–50 gamble than betting on the draw of a yellow ball (our Bingo-Blower contained 50%yellow ball and 50% of blue and pink balls) (t-test: t = − 2.546, p = 0.012). Second, when facing the choice between a risky urn and Ellsberg’s urn of unknown composition, 75% of them prefer risk, 9% ambiguity, and 16% are indifferent. This result is consistent with the Bingo Blower resulting a less “suspicious urn” (Ahn et al. 2014) with respect to urns where the probability of drawn a certain color is unknown and perceived as unfavorable by participants. In the Bingo Blower, all the balls can be seen by people outside, but, unless the number of balls is low, the number of balls of differing colors cannot be counted because they are continually moving around: while objective probabilities do exist, subjects cannot know them.

Result 1

In case of pairwise choices between lotteries, subjects prefer “internal” ambiguity to risk when dealing with competence-based tasks, are indifferent between “internal” ambiguity and risk when the task does not involve competence, and prefer risk to “external” ambiguity.

4.2 Insurance Decisions

We now turn to the analysis of insurance choices, when the probability of incurring a loss is risky or ambiguous and the sources of ambiguity are the same used in the pairwise choices between lotteries illustrated above. The table below summarizes the average amount of tokens subjects pay for self-insurance in the ten scenarios.

The amount of tokens invested in insurance ranges on average from 25.7 to 36.7% of the endowment. It is important to recall that, if a loss occurs and the subject has no insurance, subjects will lose all the tokens they earned. Furthermore, subjects are “playing” with tokens they have earned, and not with a pure endowment received with no effort.

Although the literature has emphasized frequent cases of preference reversal when comparing pairwise choices and investment decisions, our findings on subjects’ insurance choices are quite consistent with the results described in the previous section. As shown above, when subjects face pairwise choices, on average they prefer internal ambiguity to risk and risk to external ambiguity. When investing in self-insurance to avoid losses, subjects appear to be equally disturbed by risk and “external” ambiguity (and exhibit similar willingness to pay for insurance) and to prefer “internal” ambiguity to risk (showing lower willingness to pay). Their willingness to pay is shown to depend on the source of ambiguity, as emphasized in prediction (I).

As emerges from Table 2, subjects pay on average the highest amount of tokens in self-insurance against Bingo-Blower ambiguity (labelled as Amb. B.B. in Table 1). The result on Bingo-Blower ambiguity holds both in case of full coverage and in case of partial coverage. In the former case, the average amount (408) is significantly higher than the average amount they invest in case of risk (358) (t-test: t = 2.604, p = 0.005); in the latter, the average amount (466) is significantly higher than the average amount they invest in case of risk (410) (t-test: t = 1.705, p = 0.046). The willingness to pay in case of ambiguity on the composition on an unknown urn à la Ellsberg (labelled as E. Urn in the Table) does not differ significantly from risk. The average amount of invested token with unknown urn is non-significantly different from the average amount in case of risk both in case of full coverage (399 vs. 358, t-test: t = − 1.356, p = 0.177) and in case of partial coverage (425 vs. 410, t-test: t = − 0.666, p = 0.506). We interpret such a high willingness to pay in the Bingo Blower scenario as follows: since the yellow balls are more abundant (20) with respect to pink (12) and blue (8) balls in the Bingo Blower (although being half of the total number of balls), subjects may perceive the probability of incurring a loss as higher than it actually was (50%). Figure 2 above can give an idea of the perceptions our experimental subjects might have had.

Consistently with what emerges with pairwise choices, subjects appear to prefer “internal” ambiguity to risk when ambiguity is related to the competence-based task (Questionnaire A). In fact, the willingness to pay in case of performance in the competence-based task is significantly lower than in case of risk. However, this occurs only in case of the HIGH treatment (288 vs. 358, t-test: t = − 2.086, p = 0.020 with full coverage; 316 vs. 410, t-test: t = − 2.782, p = 0.006 with partial coverage). In the LOW treatment, there is no difference between willingness to pay in case of “internal” ambiguity and in case of risk, both with full coverage (353 vs. 358, t-test: t = 0.080, p = 0.936 with full coverage; 357 vs. 410, t-test: t = 0.965, p = 0.338 with partial coverage). In case of pairwise choices, we observed no significant difference between treatments, suggesting that perceived competence did not play any role in shaping the preference for “internal” ambiguity with respect to risk. On the contrary, when insurance decisions are concerned, we find on average a significantly lower willingness to pay for insurance against losses determined by own performance, but only in treatment HIGH, i.e. when they ensure against a potential loss whose probability is related to a domain where they feel competent on average, in line with prediction (II). In treatment LOW, their willingness to pay is as high as in case of risk.

When considering Questionnaire B, i.e. the no-competence task, we find no significant difference in the willingness to pay between risk and “internal” ambiguity (358 vs. 335, t-test: t = − 0.924, p = 0.356 with full coverage; 410 vs. 373, t-test: t = − 1.368, p = 0.173 with partial coverage). As expected, there is no difference between treatments.

Result 2

In case of insurance decisions, subjects who completed a task where they felt competent exhibit a lower willingness to pay for insurance. When subjects do not feel competent or with no competence-based task, their willingness to pay is the same they exhibit in case of risk. “External” ambiguity is perceived as disturbing as risk or even more threatening than risk: the average willingness to pay in case of ambiguity is not significantly different from risk (unknown urn à la Ellsberg) or higher (Bingo-Blower).

Interestingly, in all the five scenarios the willingness to pay with partial coverage is never significantly different from willingness to pay with full coverage, as predicted by the model in prediction (III). Subjects seem to be more interested in avoiding ending up with zero tokens, than to their expected earnings. In particular, it turns to be even higher in case of risk (358 vs. 410, t-test: t = − 2.090, p = 0.038) and in case of Bingo-Blower ambiguity (408 vs. 465, t-test: t = − 2.144, p = 0.033). In the other cases, the difference is not significant: in case of unknown urn: 398 vs. 425, t-test: t = − 0.880, p = 0.380; in case of Questionnaire A: 324 vs. 338, t-test: t = − 0.606, p = 0.545; in case of Questionnaire B: 335 vs. 373, t-test: t = − 1.628, p = 0.097 in case of Questionnaire B). This finding cannot be due to any” order effect”, since our subjects received the ten scenarios is a randomized sequence. The result seems to suggest that subjects exhibit some “fixed” willingness to pay that reflects their desire not to end up with zero tokens, without much sensitivity to how much is paid.

Result 3

The willingness to pay for insurance is not affected by the level of insurance coverage.

4.3 Regression Analysis

This section provides a further exploration of the determinants of subjects’ insurance choices in case of “internal” ambiguity. Since the non-parametric tests have enlightened a crucial difference between subjects’ behavior when the probability of loss reflects their percentile in the competence-based task (Questionnaire A) with respect to their behavior when the probability of loss reflects their percentile in the no-competence task (Questionnaire B), we compare the results on “internal” ambiguity in the two questionnaires and also account for potential differences between willingness to pay for full and partial coverage.

The non-parametric tests shown above have emphasized the presence of a treatment effect in the presence of insurance decisions that was not at work in the pairwise choices framed in terms of wins: when dealing with losses, subjects who feel competent in a task are willing to pay significantly less for insurance. We can explore this issue further using the information gathered in the first part of the experiment, where we elicit subjects’ (over)confidence in absolute and in relative terms, ex-ante and ex-post. Results are summarized in Table 3.

Table 3 reports OLS estimation of the ratio between the tokens invested in insurance when the probability of loss is risky 50–50 and when the probability of loss is respectively the subject’s percentile in Questionnaire A (columns 1–2) and the subject’s percentile in Questionnaire B (columns 3–4). The ratio represents a proxy for the parameter \(\gamma\) characterized in Eq. (2) and can be thus interpreted as a measure of how the perceived probability of incurring a loss is affected by confidence. Columns 1 and 2 refer to the competence-based Questionnaire A, whereas columns 3 and 4 to the no-competence Questionnaire B. Moreover, columns 1 and 3 refer to full coverage, and columns 2 and 4 to partial coverage.

The regression analysis shows an interesting result that complements the ones emerged in non-parametric tests on the treatment effect: the treatment (HIGH versus LOW) entails a significantly lower willingness to pay for insurance (with respect to risk) for Questionnaire A only for subjects who think they are better than the average, i.e. subjects who overplaced their performance in relative terms. This result holds also once controlling for performance, which we measure by using the actual score in Questionnaire A, that turns out to be negatively and significantly related to the willingness to pay. In case of Questionnaire B, neither placement nor actual performance play any role.

Result 4

In case of insurance decisions, subjects who believe to be “better than the average” show a significantly lower willingness to pay for insurance in the competence-based task. This result holds when controlling for performance and do not depend on the type of coverage.

5 Discussion

Uninsurance and underinsurance are highly widespread in developing and developed countries and represent a major problem for individuals but also for collective welfare. If in some situation governments can make insurance compulsory, there is a set of limitations that prevents these “paternalistic” interventions. Theory-driven experiments as the ones presented in this paper can provide some hints to understand why uninsurance and underinsurance occur in a controlled environment and provide a guidance for stimulating changes in insurance buyers’ behaviors.

The original contribution of this paper consists of shedding light on the role of ambiguity in shaping insurance decisions, and in particular in addressing the effect of the source (internal versus external) of ambiguity on subjects’ willingness to pay. Individuals can insure against a plethora of negative events that are often treated as unique in the literature but differ on several aspects. Some of these occurrences require the subject to evaluate her own characteristics, on which she possibly has more—but potentially biased—information, for instance in presence of overconfident judgements. Others depend on external causes but still entail the need for the subject to estimate the likelihood of the loss. Addressing this difference could lead to a better comprehension of the reasons why people tend to neglect some dangers and to be extremely sensitive to others.

We propose a model that captures the ambiguity on the probability of incurring the loss by representing the agent’s beliefs about the possible values of this probability by a second-order probability distribution. The peculiarity of this model is assuming this probability to depend on the source of ambiguity and account for the subject’s confidence about her ability or characteristics. We test the model predictions through a set of lab experiment where subjects have to reveal their willingness to pay for insuring against events that may cause them incur losses. They face ten scenarios differing on the probability of loss, which can be known or ambiguous. Ambiguity can alternatively depend on their characteristics (namely their ability in two previous tasks) or on events that are unrelated to them. To gather further information, we explore participants’ attitude towards both types of ambiguity also when subjects’ decisions are framed in terms of wins, where they have to choose between pairs of lottery.

Our results show that, both in case of insurance and pairwise choices, individuals prefer “internal” ambiguity to risk, when “internal” ambiguity is related to their performance in a competence-based task where they self-select. It means that they seek ambiguity and do not contrast it by buying insurance when their probability to win or loss depend on their ability in a task where they feel confident. Furthermore, dealing with a no-competence task is perceived like dealing with risk.

Interestingly, whereas in case of pairwise choices, feeling overconfident or underconfident does not play any role in shaping their preference for internal ambiguity versus risk, in case of insurance decisions overconfidence determines a significantly lower willingness to pay. This finding is supported by a regression analysis that enlightens the effect of perceived placement (we rely on the definition of overconfidence in sense of placement, see Moore and Healy 2008) on willingness to pay. The conclusion we draw is that a remarkable reason why people underinsure is their tendency to be too optimistic in evaluating their abilities or characteristics. This might be the case of professional liability, health and car insurance, which are typically mandatory. However, compulsory provisions are generally partial and complemented by voluntary devices: individuals might react by reducing the level of voluntary self-insurance (Ehrlich and Becker 1972), but this depend crucially on their risk attitude (Pannequin et al. 2015).

For what concerns losses that do not depend on the subject’s characteristics but on exogenous events, we observe that, in presence of insurance choices, “external” ambiguity and risk entail a similar level of willingness to pay; with pairwise choices, subjects prefer risk to “external” ambiguity. The message we get is that, in the loss domain, people do not account for their possible imprecision in estimating the probability to lose and treat ambiguity exactly as risk, somehow overestimating their capability to anticipate the correct probability that a negative event would imply. This result is consistent with the phenomena of widespread underinsurance or even uninsurance in case of natural disasters, which subjects treat as case of “measurable risk” with very low probability to occur.

As ancillary research question, we compare willingness to pay for insurance in case of full and partial coverage: if subjects buy insurance, the whole loss is refunded in the former case, or just half of it in the latter, respectively. Surprisingly, although the expected payoff is lower in case partial coverage, we do not find evidence of a lower willingness to pay. This finding is in line with the model prediction that reveals agents’ optimal willingness to pay as not dependent by the deductible level. This result is in line with Pannequin et al. (2014)’s experiment, which shows that individuals do not choose their levels of coverage (insurance and prevention) to equalize the marginal benefits from the two instruments, but follow a mental accounting model where they pursue a strongly stable global amount of coverage across insurance tariffs.

6 Conclusions

This paper investigates individuals’ self-insurance choices through a model and a lab experiment that elicit subjects’ willingness to pay in a set of scenarios differing on the type of uncertainty involved (ambiguity vs. risk) and its source (“internal” vs. “external”). In general, our results provide support to the evidence that the demand for insurance persistently depart from the predictions based on the von Neumann-Morgenstern expected-utility framework. This occurs in a least two aspects. First, we find that individuals do not treat ambiguity as risk, and do not treat ambiguity generated by different sources in the same way. Overall, they appear to be much more disturbed by ambiguity stemming from the context (what we call “external” ambiguity) than by ambiguity related to their performance or traits (“internal” ambiguity). We compare pairwise choices between lotteries involving gains only, and insurance decisions aimed at avoiding losses, finding that a preference reversal occurs in case of internal ambiguity for overconfident subjects. Providing full or partial coverage does not affect the willingness to pay for insurance. Our findings provide a new explanation for the widespread evidence on uninsurance and underinsurance.

Code availability

The experiments have been programmed in z-tree. The software code is available upon request.

References

Abdellaoui M, Baillon A, Placido L, Wakker P (2011) The rich domain of uncertainty: source functions and their experimental implementation. Am Econ Rev 101:695–723

Ahn D, Choi S, Gale D, Kariv S (2014) Estimating ambiguity aversion in a portfolio choice experiment. Quant Econ 5(2):195–223

Baillon A, Bleichrodt H (2015) Testing ambiguity models through the measurement of probabilities for gains and losses. Am Econ J Microecon 7(2):77–100

Bajtelsmit V, Thistle P (2008) The reasonable person negligence standard and liability insurance. J Risk Insur 75(5):815–823

Bajtelsmit V, Thistle P (2013) Mistakes, negligence, and liability. Working Paper

Bajtelsmit V, Coats JC, Thistle P (2015) The effect of ambiguity on risk management choices: an experimental study. J Risk Uncertain 50(3):249–280

Baker T, Siegelman P (2013) Behavioral economics and insurance law: the importance of equilibrium analysis. Faculty Scholarship at Penn Law, 655

Becker G, DeGroot M, Marschak J (1964) Measuring utility by a single-response sequential method. Behav Sci 9:226–232

Cabantous L (2007) Ambiguity aversion in the field of insurance: Insurers’ attitude to imprecise and conflicting probability estimates. Theor Decis 62(3):219–240

Cabantous L, Hilton D (2006) De l’aversion à l’ambiguïté aux attitudes face à l’ambiguïté: les apports d’une perspective psychologique en économie. Revue Economique 57(2):259–280

Cabantous L, Hilton D, Kunreuther H, Michel-Kerjan E (2011) Is imprecise knowledge better than conflicting expertise? Evidence from insurers’ decisions in the United States. J Risk Uncertain 42(3):211–232

Camerer C, Lovallo D (1999) Overconfidence and excess entry: an experimental approach. Am Econ Rev 89(1):306–318

Camerer C, Weber M (1992) Recent developments in modeling preferences: uncertainty and ambiguity. J Risk Uncertain 5(4):325–370

Chakravarty S, Roy J (2009) Recursive expected utility and the separation of attitudes towards risk and ambiguity: an experimental study. Theor Decis 66(3):199–228

Cutler DM, Zeckhauser R (2004) Extending the theory to meet the practice of insurance. Brookings-Wharton Pap Financ Serv 1:1–53

De Donder P, Hindriks J (2009) Adverse selection, moral hazard, and propitious selection. J Risk Uncertain 38:73–86

De La Ronde C, Swann WB (1993) Caught in the crossfire: positivity and self-verification strivings among people with low self-esteem. Self-Esteem 147–165

Di Cagno D, Grieco D (2019) Measuring and disentangling ambiguity and confidence in the Lab. Games 10:9

Di Mauro C, Maffioletti A (2001) The valuation of insurance under uncertainty: does information about probability matter? Geneva Pap Risk Insur Theory 26(3):195–224

Di Mauro C, Maffoletti A (1996) An experimental investigation of the impact of ambiguity on the valuation of self-Insurance and self-protection. J Risk Uncertain 13(1):53–71

Easley D, O’Hara M (2009) Ambiguity and nonparticipation: the role of regulation. Rev Financ Stud 22:1817–1843

Eeckhoudt L, Gollier C, Schlesinger H (2005) Economic and financial decisions under risk. Princeton University Press, Princeton

Ehrlich I, Becker GS (1972) Market insurance, self-insurance, and self-protection. J Polit Econ 80(4):623–648

Einhorn HJ, Hogarth RM (1985) Ambiguity and uncertainty in probabilistic inference. Psychol Rev 92(4):433

Einhorn HJ, Hogarth RM (1986) Judging probable cause. Psychol Bull 99(1):3

Einhorn HJ, Hogarth RM (eds) (1990) Insights in decision making: a tribute to Hillel J. Einhorn. University of Chicago Press

Ellsberg D (1961) Risk, ambiguity, and the Savage axioms. Quart J Econ 75(4):643–669

Farley PJ, Wilensky GR (1985) Household wealth and health insurance as protection against medical risks. Horizontal equity, uncertainty, and economic well-being. University of Chicago Press

Festinger L (1957) A theory ofcognitive dissonance, vol 2. Stanford University Press

Gervais S, Odean T (2001) Learning to be overconfident. Rev Financ Stud 14(1):1–27

Greiner B (2004) The online recruitment system orsee 2.0-a guide for the organization of experiments in economics. University of Cologne, Working Paper Series in Economics, 10(23):63–104

Heath C, Tversky A (1991) Preference and belief: Ambiguity and competence in choice under uncertainty. J Risk Uncertain 4(1):5–28

Hogarth RM, Kunreuther H (1989) Risk, ambiguity, and insurance. J Risk Uncertain 2:5–35

Hogarth RM, Kunreuther H (1992) Pricing insurance and warranties: ambiguity and correlated risks. Geneva Pap Risk Insur Theory 17:35–60

Klibanoff P, Marinacci M, Mukerji S (2005) A smooth model of decision making under ambiguity. Econometrica 73(6):1849–1892

Knight FH (1921) Risk, uncertainty and profit. Hart, Schaffner and Marx, New York

Köszegi B (2006) Ego utility, overconfidence, and taskchoice. J Eur Econ Assoc 4(4):673–707

Kunreuther H (1984) Causes of underinsurance against natural disasters. Geneva Papers on Risk and Insurance, pp 206–220

Link CL, McKinlay JB (2010) Only half of the problem is being addressed: underinsurance is a big problem as uninsurance. Int J Health Serv 40(3):507–523

Magge H, Cabral HJ, Kazis LE et al (2013) Prevalence and predictors of underinsurance among low-income adults. J Gen Intern Med 28:1136–1142

Malmendier U, Taylor T (2015) On the verges of overconfidence. J Econ Perspect 29(4):3–8

Moore DA, Healy PJ (2008) The trouble with overconfidence. Psychol Rev 115(2):502

Odean T (1998) Volume, volatility, price, and profit when all traders are above average. J Finance 53:1887–1934

Pannequin F, Corcos A, Montmarquette C (2014) Insurance and self-insurance: Beyond substitutability, the mental accounting of losses. In: 41st seminar of the European group of risk and insurance economists (EGRIE), pp 15–17

Pannequin F, Corcos A, Montmarquette C (2015) Compulsory insurance and voluntary self-insurance: substitutes or complements? A matter of risk attitudes. Mimeo

Rigotti L, Shannon C (2005) Uncertainty and risk aversion in financial markets. Econometrica 73:203–243

Saltzman E (2021) Managing adverse selection: Underinsurance versus underenrollment. RAND J Econ 52(2):359–381

Schlesinger H (1997) Insurance demand without the expected-utility paradigm. J Risk Insur 19–39

Schlesinger H (2013) The theory of insurance demand. In: Dionne G (ed) Handbook of insurance. Springer, New York

Schoen C, Doty MM, Robertson RH, Collins SR (2011) Affordable care act reforms could reduce the number of underinsured US adults by 70%. Health Aff 30(9):1762–1771

Snow A (2011) Ambiguity aversion and the propensities for self-insurance and self-protection. J Risk Uncertain 42(1):27–43

Taylor SE, Brown JD (1988) Illusion and well-being: a social psychological perspective on mental health. Psychol Bull 103:193–210

The Geneva Association (2019) Underinsurance in mature economies reasons and remedies. Kai-Uwe Schanz, Author

Vickrey W (1961) Counter speculation, auctions, and competitive sealed tenders. J Finance 8–37

Funding

D. Di Cagno has been supported by the Department of Economics and Finance, Luiss Guido Carli.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have declared that no competing

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Detailed Description of the Experimental Design

This section illustrates the details of the experimental design. Subjects are randomly assigned to two treatments (HIGH and LOW); in both treatments, subjects will be involved in a one-shot game composed by the two stages described below. The experimental currency we use is called “token”: each token is worth 0.01 euros.

Stage 1 (“Questionnaires Stage”). Subjects will face two questionnaires or tasks. Questionnaire A is assigned according to a ranking the subject submits and can deal with one among four topics (sport, showbiz, history, and literature). Questionnaire B is a general knowledge task that is compulsory and equal for everybody. To avoid strategic behavior, subjects are asked to provide a ranking of the topics before knowing how the specific Questionnaire A will be assigned to them. Both questionnaires involve twenty multiple-choice questions with four possible answers, where only one is correct. To ensure subjects put proper effort in picking the correct answer, both questionnaires are monetarily incentivized: they will earn a certain 40 tokens for each correct answer. Since they are supposed to order the topics of Questionnaire A according on their perceived competence in the four topics, we can consider Questionnaire A as a “competence-based” (high or low, according to the treatment) task and Questionnaire B as a “no-competence” task. We elicit subjects’ beliefs about their competence in answering both the questionnaires (on a 0–20 scale, being 20 the maximum score they can reach) before they face them. This answer captures subjects’ ex-ante self-evaluation of competence in absolute terms (ex-ante “estimation” in the competence-based task and in the no-competence task). Furthermore, since the number of other subjects completing the same questionnaire is unknown, and with it the number of peers the subject’s performance will be compared to, for Questionnaire A subjects have to guess how many participants in the session chose the same questionnaire they received. This is to identify the number of expected competitors. For both (incentivized) guesses, they earn W1 and W2 tokens (both W1 and W2 are set equal to 50 tokens) respectively if they are correct or they over/underestimate the correct number of 1 unit.

Subjects have then to evaluate their absolute performance in the questionnaire of type A (ex-post “estimation” in the competence-based task) they selected: the closer to the effective score their prediction is, the higher number of tickets they receive for taking part into a lottery called “Alpha”. Subjects can choose between playing lottery Alpha - where all the tickets earned by the participants in the session are pulled together, only one wins W3 and the others get zero - or another lottery (Beta) where they win both W3 or zero with probability 1/n where n is the (fixed) number of participants in the session (including also the ones who did not choose Lottery Beta). This choice identifies subjects’ preference for internal ambiguity (based on relative precision) in the competence-based task with respect to risk. W3 is set equal to 200 tokens, based on our conjecture that we had sessions of 15 subjects and subjects were equally likely to choose one of the four questionnaires A.

Second, subjects have to evaluate their absolute performance in the task of type B (ex-post “estimation” in the no-competence task) and choose between betting on the correctness of their answer (they win if they over/under estimate of one correct answer at the maximum) or on a 50/50 lottery. In both lotteries, they win W4 or get zero. This choice identifies subjects’ preference for internal ambiguity (based on placement) in the low-competence task with respect to risk.

Third, subjects have to guess whether their score in task B is higher, equal or lower than the average score in the session. They earn W5 if they are correct. This guess identifies subjects’ ex-post placement in the no-competence task. Both W4 and W5 are set equal to 50 tokens.

Fourth, subjects have to estimate the composition of an unknown urn à la Ellsberg and choose between betting on it or on a 50/50 lottery, earning W6 if right. This choice captures subjects’ preference for external ambiguity (based on an exogenous source) with respect to risk. W6 is set equal to 50 tokens.

Fifth, subjects have to estimate the number of yellow balls in the Bingo-Blower and choose between betting on the correctness of their answer (they win if they over/under estimate of one ball at the maximum) or on a 50/50 lottery. In both lotteries they win W7 or get zero, with W7 equal to 50 tokens. This choice captures another subjects’ preference for external ambiguity (based on an exogenous source, this time the Bingo-Blower) with respect to risk.

Stage 2 (“Insurance Stage”). Subjects receive a feedback on their earnings in Stage 1. Then, they are presented with ten possible scenarios where they take part in lotteries that can determine the loss of their whole endowment, i.e. the amount of money they have earned in the first three stages of the experiment.

In scenarios 1 to 5, subjects can avoid the risk of incur the loss of their endowment by buying insurance: they have to reveal their willingness to pay by stopping a clock showing a price increasing from zero tokens to their endowment according to a second-bid auction à la Vickrey (as in Di Mauro and Maffioletti, 1996; 2000). The five scenarios differ on the probability to loss the endowment, that is: (1) unknown (purely ambiguous lottery); (2) equal to 50% (risky lottery); (3) equal to the probability to draw a non-yellow ball in the Bingo-Blower (ambiguity lottery based on Bingo-Blower); (4) equal to one minus the subject’s percentile in Questionnaire A; (5) equal to one minus the subject’s percentile in Questionnaire B. The five scenarios are presented to subjects in a randomized order.

In scenarios 6 to 10, subjects are presented with the same probabilities of incurring in losses but they can pay to have half of their endowment refunded. The aim is contrasting full insurance coverage (scenarios 1 to 5) to partial insurance coverage (scenarios 6 to 10). As above, the scenarios are presented to subjects in a randomized order. To avoid any priming effect between full or partial coverage, we made a double randomization. First, we randomized the order between full coverage scenarios and partial coverage scenarios. Second, we randomize the order between the scenarios 1–5 and 6–10 (1–5 and 6–10 are just labels used here for sake of simplicity, but do not reflect any implementation order).

At the end of Stage 2, the computer randomly selects one of the ten scenarios to count, selecting any scenario with equal chance: Cox et al. (2014) show that this mechanism of payment effectively elicits subjects’ true preferences by limiting the influence of confounding factors such as wealth effects and cross-task contamination.

1.2 Experimental Instructions

Good morning, thank you for participating in this experiment. You are taking part into a study on economic decisions. During the experiment, you can, depending on your decisions and on other participants’ decisions, earn a considerable amount of money in addition to the 3 euros you will receive anyway. The answers you give and the choices you make will be totally anonymous. The experimenters will not be able to associate your choices and your answers to your name.

During the experiment you cannot communicate with other participants (otherwise you would be excluded from the experiment) and you should be very careful in reading the instruction that will appear on your screen and will be read out by one of the experimenters. If you have any questions, please ask the experimenters.

Your earnings will be calculated in tokens; each token will be converted in euros at the following ratio: 1 token = 0,01 euros.

At the end of the experiment, you will be asked to fill a short questionnaire; afterwards, we will proceed with the payment, that will occur in cash.

The experiment consists of 2 stages.

In Stage 1, you will be asked to take part into two Questionnaires (A and B). Each questionaire will be made of 20 multiple-choice answers. Before and after the questionnaire, you will be asked to make some evaluation on them.

In Stage 2, you will be asked to invest the earnings you made in the previous stage. You will be presented with ten different scenarios: after a brief description of each scenario, you will have to made your investment choice. Before starting Stage 2, you will be informed about your earnings (in tokens).

You will receive more detailed instructions before completing each step. Please feel free to ask any question or clarification once needed.

Enjoy!

Rights and permissions

About this article

Cite this article

Di Cagno, D., Grieco, D. Insurance Choices and Sources of Ambiguity. Ital Econ J 9, 295–319 (2023). https://doi.org/10.1007/s40797-022-00193-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40797-022-00193-4