Abstract

Most decisions concerning (self-)insurance and self-protection have to be taken in situations in which (a) the effort exerted precedes the moment uncertainty realizes, and (b) the probabilities of future states of the world are not perfectly known. By integrating these two characteristics in a simple theoretical framework, this paper derives plausible conditions under which ambiguity aversion raises the demand for (self-)insurance and self-protection. In particular, it is shown that in most usual situations where the level of ambiguity does not increase with the level of effort, a simple condition of ambiguity prudence known as decreasing absolute ambiguity aversion (DAAA) is sufficient to give a clear and positive answer to the question: Does ambiguity aversion raise the optimal level of effort?

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Prevention is defined by the Handbook of Insurance as a “risk-reducing activity that takes place ex-ante, i.e. before the loss occurs” (Courbage et al. 2013). As risk is defined through the size and probability of the potential loss, this activity can either impact the size of the potential loss, its probability or both. Ehrlich and Becker (1972) were the first to study these risk management tools, referred to as self-insurance and self-protection, and used to deal with the risk of facing a monetary loss when market insurance is not available. In both situations, a decision maker (DM) has the opportunity to undertake an effort to modify the distribution of a given risk. In particular, the self-insurance effort (also called loss reduction) corresponds to the amount of money invested to reduce the size of the loss occurring in the bad state of the world, while the self-protection effort (also called loss prevention) is the amount invested to reduce the probability of suffering from the loss. Examples of such efforts may be found in many every day life situations as well as in many different economic fields. From the installation of an airbag system in a car, a sprinkler system in a house, or investments in adaptation efforts to fight global climate changeFootnote 1 in the case of self-insurance, to the attendance of driving safety lessons, the installation of a burglar system, or investments in mitigation effortsFootnote 2 in the case of self-protection.

Though these models have received a great deal of attention in the recent literature, it is worth noting that they have, until now, generally been studied only in simple one-period, two-state settings remaining in the expected utility framework (see Courbage et al. 2013 for a recent overview). Although these relatively simple monoperiodic models were well adapted to understand the key properties of the self-insurance/self-protection tools in situations of risk, they appear too restrictive to describe a large number of important issues in at least three aspects. First, there are many situations requiring self-insurance or self-protection in real life, in which the decision to make an effort and the realization of uncertainty do not take place at the same time (consider for instance the examples above). A long period of time may pass between these two events, leading to the necessity of taking intertemporal considerations into account and building multi-period models. The second limitation is that most of the models studied in the literature remain in the expected utility framework, and are, therefore, unable to deal with other kinds of uncertainty besides risk.Footnote 3 In many real-life problems, however, the nature of the uncertainty considered cannot be limited to risk since the probabilities associated with the realization of uncertain events cannot always be objectively known. In these kinds of situation, ambiguity plays a central role, and the attitude that agents generally manifest towards it (ambiguity aversion) needs to be taken into account.Footnote 4 This is not the case of the subjective expected utility theory, that assumes ambiguity neutrality. Therefore, it is important to consider alternative models when considering problems in the presence of deeper uncertainty. Finally, the third limitation usually shown by the models proposed in the literature is the restriction to the case of Bernoulli distribution of outcomes (notable exceptions are the models proposed by Meyer and Meyer (2011) and Alary et al. (2013)). In reality, however, there are many situations in which the good and bad states are not necessarily unique. A DM may be willing to self-insure or self-protect a loss even if he does not know exactly what this loss will be. A generalization to a multi-state model is, therefore, necessary to study these cases.

To illustrate these three points, consider the case of a young man, who faces the risk of developing heart disease when he is older, but who can choose in his youth whether or not to practice sport as a preventive measure. Sport is costly, but can either reduce the probability of heart disease with which a potentially important but uncertain loss is associated (self-protection), or can reduce the severity of a disease that develops with a fixed probability (self-insurance).Footnote 5 While it is clear that many years may separate the moment at which the effort decision is taken and the moment at which the uncertainty is realized, additional difficulties in such a situation, is that at the time the decision is taken of doing sport on a regular basis or not, both the probability of developing a heart disease at old age, and the probability of suffering from a bigger or smaller loss in case of heart disease are unknown.Footnote 6

In this paper, I present models of self-insurance and self-protection that are able to overcome the above-mentioned limitations. Each model takes the form of a simple two-period model where preferences are represented by the model Klibanoff et al. (2005, 2009) (KMM) developed to deal with ambiguity.Footnote 7 The timing of the decision process is simple: in the first period, a DM chooses the level of effort he wants to exert to affect either the probability of being in a set of states that are considered as bad in the second period, or to affect the level of wealth in these states. Using this setting, I derive the conditions under which ambiguity aversion raises the demand for insurance, self-insurance and self-protection. In particular, I show that when the effort is undertaken during the first period, ambiguity aversion tends to have a positive impact on the demand for (self-)insurance and self-protection. However, as for the study of risk attitude in which risk aversion alone is not sufficient to guarantee a higher level of prevention [since risk prudence is also needed (Menegatti 2009)], I show that the extra condition of ambiguity prudence attitude is also needed to observe this positive impact. Contrary to the conflicting results obtained in the one-period settings (Eeckhoudt and Gollier 2005), the close relationship that is achieved between prudence and prevention in the two-period setting is then re-established in the presence of ambiguity.

This paper, hence, constitutes both an extension of the research on self-insurance and self-protection under ambiguity initiated by Snow (2011) and Alary et al. (2013)Footnote 8 in the sense that it goes from the study of the one- to the two-period problem, but also of Menegatti (2009) as it allows for non-neutral ambiguity attitudes. Overall, it also constitutes an extension of the existing literature on self-insurance and self-protection in the sense that it considers multiple states of the world, and does not restrict ambiguity to be concentrated on only one state of nature. Except that the results concerning self-insurance under ambiguity are shown to be easily extended to the two-period case, the particular interest of this approach is that it enables to treat the situations in which the effort of self-protection goes together with a decrease in the degree of ambiguity. Indeed, it appears more natural in many situations that self-protection would reduce both risk and ambiguity (think for example the security, climate change and health examples in which the effort not only decreases the average probability of loss, but also its range of possible values). In that sense and contrary to the results obtained in Alary et al. (2013), this paper enables to give, for most usual situations, a clear answer to the question: Does ambiguity aversion raise the optimal level of effort?

The remainder of this paper is organized as follows. In Sect. 2, I introduce the simple two-period model under ambiguity by studying the problem of full insurance. Then in succession, I analyze the willingness to pay (Sect. 3) and the optimal effort (Sect. 4) for self-insurance and self-protection. Section 5 concludes the paper.

2 Full insurance in the two-period model

The generalized prevention model I present involves ambiguity: probabilities of the second period final wealth are not objectively known, instead they consist of a set of probabilities, depending on an external parameter \(\theta \) for which the decision maker (DM) has prior beliefs.Footnote 9 Ambiguity may, therefore, be interpreted as a multi-stage lottery: a first lottery determines the value of parameter \(\theta \), and a second one determines the size of second period wealth. The second period wealth \(\tilde{w}_2(\theta )\) is a random variable with distribution \(F(w_2,\theta )\), where \(F(w_2,\theta )\) denotes the probability of second period wealth being smaller than \(w_2\) conditional on \(\theta \). In the time-separable model, the intertemporal welfare under Klibanoff et al. (2005, 2009) representation is as follows:

where \(w_i\) is the exogenous wealth in the beginning of period \(i=1,2\), u represents the period vNM utility functions, \(\beta \in [0,1]\) is the discount factor,Footnote 10 \(\phi \) represents attitude towards ambiguity, \(\mathrm {E}_\theta \) is the expectation operator taken over the distribution of \(\theta \), conditional on all information available during the first period, and \(\mathrm {E}\) is the expectation operator taken over \(w_2\) conditional on \(\theta \): \(\mathrm {E}u(\tilde{w}_2(\theta ))=\int u(w_2)dF(w_2,\theta )\). The function \(\phi \) is assumed to be three times differentiable, increasing, and concave under ambiguity aversion, so that the \(\phi \)-certainty equivalent in Eq. (1) is lower in that case than under ambiguity neutrality, characterized by a linear function \(\phi \) Footnote 11:

In that sense, an ambiguity averse DM dislikes any mean-preserving spread in the space of conditional second period expected utilities.

The right-hand side of expression (2) corresponds to the second period welfare obtained by an ambiguity neutral individual who evaluates his welfare by considering the risky second period wealth \(\tilde{w}_2\) with cumulative distribution \(\bar{F}\) such that

In that sense, an ambiguity neutral individual is nothing but a Savagian expected utility maximizer.

As for the single-period model, the study of willingness to pay (WTP) P for risk elimination under ambiguity is straightforward.Footnote 12 In this case, it corresponds to the amount an individual is ready to pay in period 1 to escape the uncertainty in period 2, and is defined as follows:

If the individual were ambiguity neutral, he would be ready to pay \(P_0\) defined by \(u(w_1-P_0)+u(\mathrm {E} \tilde{w}_2)=u(w_1)+\mathrm {E}u(\tilde{w}_2)\) to eliminate the same risk. Using inequality (2), we can then see that P is always higher than \(P_0\) under ambiguity aversion in the two-period model. As in the single-period model, ambiguity averse individuals are, therefore, ready to pay a higher premium for risk elimination, since the elimination of the risk automatically eliminates the ambiguity attached to this risk. This extra premium is the two-period version of the ambiguity premium.Footnote 13

3 Willingness to pay under ambiguity

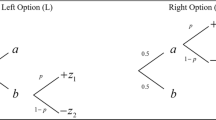

Extending the work of Alary et al. (2013) (AGT hereafter), I now re-examine the willingness to pay (WTP) for infinitesimal prevention in the context of a two-period model. Contrary to the above-mentioned authors, however, I do not restrict ambiguity to be concentrated on only one state of nature (which is precisely the one affected by the prevention effort). Instead, I assume that the states of the world in second period may be separated into two different categories: the good and the bad states, and that ambiguity may affect different parts of the model. The good and the bad states differ by the presence of an uncertain loss affecting the latter, and against which the DM is willing to self-insure or self-protect. Ambiguity may then be concentrated on the type of states (i.e. whether it is a good or a bad state), on the good states, or on the bad states of the world. If it is concentrated on the type of states, the probability to be in the bad states is given by \(p(\theta )\), the probability to be in the good states by its complement \(1-p(\theta )\), and the distributions in each of these types of states are unambiguous: \(\tilde{w}_2^b\sim B(w_2)\) in the bad states, and \(\tilde{w}_2^g\sim G(w_2)\) in the good states, where B and G are both cumulative density functions. Going back to the airbag or driving lessons examples, this will for example be the case if the probability of having a car accident is ambiguous. On the contrary, if ambiguity is concentrated on either the bad or the good states, the second period wealth is, respectively, \(\tilde{w}_2^b(\theta )\sim B(w_2,\theta )\), or \(\tilde{w}_2^g(\theta )\sim G(w_2,\theta )\), and the probabilities to be in each type of states are p and \(1-p\). The situation with ambiguity concentrated on the bad states corresponds for example to the case in which the probability of having a car accident is known, but the severity of the damages is ambiguous: conditional on having an accident, the damages may be bigger or smaller, depending on multiple factors that cannot be controlled (think for example to the speed or the skills of the second conductor involved in the accident).Footnote 14 Observe that this notation generalizes both the standard two-state framework usually studied in the prevention literature (when the distributions in the bad and good states are degenerate lotteries: \(w_2^b=w_2-L\), and \(w_2^g=w_2\)), and the AGT’s setup in which ambiguity is concentrated on a particular state. From now on, I also assume, without loss of generality, that \(\theta \) may be ranked in such a way that p is increasing in \(\theta \) when ambiguity is concentrated on the type of states, and that \(\mathrm {E} u(\tilde{w}_2^b)\) and \(\mathrm {E} u(\tilde{w}_2^g)\) are decreasing in \(\theta \) if ambiguity is concentrated on the bad or good states of the world.

3.1 Self-insurance

Self-insurance in a two-period world is a risk management tool thanks to which an individual has the opportunity to exert an effort today to reduce the cost of a loss affecting the bad states of nature tomorrow. By letting \(P(\epsilon )\) denote the willingness to furnish this effort to increase by \(\epsilon \) the wealth in these states such that the level of welfare is not altered, we have:

Totally differentiating this equation with respect to \(\epsilon \) and evaluating it at \(\epsilon =0\) leads to

so that the marginal WTP for self-insurance of an ambiguity neutral individual (\(\phi '\equiv \) constant) is:

An ambiguity averse individual has thus a higher marginal WTP to insure outcomes in the bad states if \(P'(0)>P'_N(0)\). To compare Eqs. (4) and (5), I use the following lemma and its corollaries:

Lemma 1

(Berger 2014) Let \(\phi \) be a three times differentiable function reflecting ambiguity aversion. If \(\phi \) exhibits strict DAAA (Decreasing Absolute Ambiguity Aversion) then \(\mathrm {E}\phi '\{\tilde{x}\} >\phi '\left\{ \phi ^{-1}\left\{ \mathrm {E} \phi \{\tilde{x}\}\right\} \right\} \).

Corollary 1

If \(\phi \) exhibits CAAA (Constant Absolute Ambiguity Aversion), then \(\mathrm {E}\phi '\{\tilde{x}\} = \phi '\left\{ \phi ^{-1}\left\{ \mathrm {E} \phi \{\tilde{x}\}\right\} \right\} \).

Corollary 2

If \(\phi \) exhibits strict IAAA (Increasing Absolute Ambiguity Aversion), then \(\mathrm {E}\phi '\{\tilde{x}\} < \phi '\left\{ \phi ^{-1}\left\{ \mathrm {E} \phi \{\tilde{x}\}\right\} \right\} \).

Whether absolute ambiguity aversion is decreasing or increasing refers to the notion of ambiguity prudence attitude (Gierlinger and Gollier 2008; Berger 2014). It is stronger than a condition on the sign of \(\phi '''\) (note that \(\phi \) being DAAA implies \(\phi '''>0\)) given that the intertemporal utility (1) is evaluated using a \(\phi \)-certainty equivalent rather than a simple \(\phi \)-valuation.

Ambiguity aversion raises the marginal WTP for insurance in the bad states of the world if

and the individual has an ambiguity prudent attitude (i.e. he exhibits DAAA). Condition (6) then becomes \({\mathrm {cov}}_{\theta } (\phi '\{\mathrm {E} u(\tilde{w}_2(\tilde{\theta })\} , p(\tilde{\theta })) > 0\), if ambiguity is concentrated on the type of states, in which case (since p is assumed to be increasing in \(\theta \), and because \(\phi '\) is decreasing under ambiguity aversion), we only need \(\mathrm {E}u(\tilde{w}_2 (\theta ))\) to be decreasing in \(\theta \). Decomposing this expression into:

therefore, enables us to see that the only condition needed is that the expected utility obtained in the good states of the world (\(\mathrm {E}u(\tilde{w}_2^g)\)) is higher than the one obtained in the bad states (\(\mathrm {E} u(\tilde{w}_{2}^b)\)). On the contrary, if ambiguity is concentrated on the bad states of the world, condition (6) becomes \({\mathrm {cov}}_{\theta } (\phi '\{\mathrm {E} u(\tilde{w}_2(\tilde{\theta })\} , \mathrm {E}u'(\tilde{w}_2^b(\tilde{\theta }))) > 0\). Given that \(\mathrm {E}u(\tilde{w}_2 (\theta ))=p\mathrm {E}u(\tilde{w}_2^b (\theta ))+(1-p)\mathrm {E}u(\tilde{w}_2^g)\), it becomes clear that this covariance will be positive if and only if \(\mathrm {E}u(\tilde{w}_2^b (\theta ))\) and \(\mathrm {E}u'(\tilde{w}_2^b (\theta ))\) are anti-comonotonic in \(\theta \).Footnote 15 In particular, this will be the case under a set of restrictive conditions described in Gierlinger and Gollier (2008). Finally, in the case in which ambiguity is concentrated in the good states of the world, the covariance condition (6) is null, and the effect of ambiguity aversion on the WTP to insure against the realization of bad outcomes exclusively depends on the DM’s ambiguity prudence attitude. The following propositions summarize these results.

Proposition 1

In the two-period model of self-insurance, ambiguity aversion

-

(i)

raises the marginal WTP to self-insure bad states of the world when ambiguity is concentrated on the type of states (good or bad), if the individual manifests CAAA or DAAA, and the expected utility reached in the good states of the world is higher than the one reached in the bad states,

-

(ii)

raises (resp. leaves unchanged, reduces) the marginal WTP to self-insure bad states of the world when ambiguity is concentrated on the good states, if the individual manifests DAAA (resp. CAAA, IAAA).

Proposition 2

(Gierlinger and Gollier 2008) In the two-period model of self-insurance, ambiguity aversion raises the marginal WTP to self-insure bad states of the world when ambiguity is concentrated on the bad states, if the individual manifests CAAA or DAAA and one of the following conditions holds:

-

1.

u exhibits constant absolute risk aversion.

-

2.

The set of risky second period wealth in the bad states of the world \((\tilde{w}_2^b(\theta _1),\dots ,\tilde{w}_2^b(\theta _n))\) can be ranked according to first-order stochastic dominance (FSD), and u is increasing and concave.

-

3.

The set of risky second period wealth in the bad states of the world \((\tilde{w}_2^b(\theta _1),\dots ,\tilde{w}_2^b(\theta _n))\) can be ranked according to second-order stochastic dominance (SSD), and u is increasing, concave and exhibits prudence.

The insight this result provides is analogous to the one resulting from the study of willingness to pay for an increase in second period wealth in a Kreps and Porteus (1978)/Selden (1978) model. When the second period wealth in a bad state is considered, raising \(w_{2}^b\) has a positive impact on the conditional second period expected utilities \(\mathrm {E}u(\tilde{w}_2 (\theta ))\), which is valuable for any individual with \(\phi '>0\). However, this raise in \(w_{2}^b\) comes with a cost: an effort that has to be furnished in advance (period 1). In the Kreps–Porteus/Selden model, we know that risk aversion raises the marginal WTP for an increase in second period wealth, provided that the individual is prudent. This condition is only satisfied in that context if the individual manifests decreasing absolute risk aversion (DARA). Given the similarity between Kreps–Porteus/Selden and KMM models, it is not surprising that ambiguity aversion is not any more sufficient in guaranteeing that the marginal WTP to self-insure bad states increases. An additional condition analogous to prudence is needed. Non-increasing absolute ambiguity aversion is this extra condition in the presence of ambiguity.

3.2 Self-protection

The second tool that may be used to deal with the presence of uncertainty in the second period is self-protection: an individual has the opportunity to undertake an effort today, in order to alter the probability of being in one of the bad states tomorrow. In this subsection, I examine the effect of ambiguity aversion on the marginal willingness to furnish a self-protection effort in the context of a two-period model.

Proceeding as before, I denote by \(P(\epsilon )\) the WTP today for a reduction \(\epsilon \) in the probability of being in a bad state tomorrow, such that the intertemporal level of welfare is not modified.Footnote 16 Furthermore, following AGT, I assume that the degree of ambiguity is not altered by the change of p, which means that p is equally affected for any value of \(\theta \), and the distributions of second period wealth conditional on being on each type of states remain identical. Mathematically, \(P(\epsilon )\) is defined as follows:

As before, we say that ambiguity is concentrated on the type of states if \(B(w_2,\theta )=B(w_2)\) and \(G(w_2,\theta )=G(w_2)\) for all \(\theta \), that it is concentrated on the bad states if \(p(\theta )=p\) and \(G(w_2,\theta )=G(w_2)\), and that it is concentrated on the good states if \(p(\theta )=p\) and \(B(w_2,\theta )=B(w_2)\). Totally differentiating expression (7) with respect to \(\epsilon \) and evaluating it at \(\epsilon =0\) yields:

Assuming again that the expected second period wealth in the good states is higher than in the bad states (i.e. that self-protection aims to reduce the probability of less desirable states) so that the marginal WTP is positive, it may be shown that the marginal WTP to self-protect bad states is higher under ambiguity aversion when ambiguity is concentrated on the type of state if:

According to Lemma 1, this will be the case if the individual exhibits DAAA, while under CAAA, the marginal WTP in that case remains the same under ambiguity aversion. When ambiguity is concentrated on the bad states, both DAAA and CAAA are sufficient to observe a strictly higher marginal WTP since \({\mathrm {cov}}_{\theta } (\phi '\{p \mathrm {E} u(\tilde{w}_2^b(\tilde{\theta }))+(1-p)\mathrm {E} u(\tilde{w}_2^g), -\mathrm {E}u(\tilde{w}_2^b(\tilde{\theta })))\) is always negative under ambiguity aversion. Finally, when ambiguity is concentrated on the good states of the world, we also have that \({\mathrm {cov}}_{\theta } (\phi '\{p \mathrm {E} u(\tilde{w}_2^b)+(1-p)\mathrm {E} u(\tilde{w}_2^g(\tilde{\theta })), \mathrm {E}u(\tilde{w}_2^g(\tilde{\theta })))\) is negative, so that the marginal WTP for self-protection is always lower under ambiguity aversion if the individual manifests IAAA or CAAA. These results prove the following proposition.

Proposition 3

In the two-period model of self-protection, ambiguity aversion

-

(i)

raises (resp. leaves unchanged, reduces) the marginal WTP to self-protect bad states of the world when ambiguity is concentrated on the type of states (good or bad), if the individual manifests DAAA (resp. CAAA, IAAA), and the expected utility reached in the good states of the world is higher than the one reached in the bad states,

-

(ii)

raises the marginal WTP to self-protect bad states of the world when ambiguity is concentrated on the bad states, if the individual manifests CAAA or DAAA,

-

(iii)

reduces the marginal WTP to self-protect bad states of the world when ambiguity is concentrated on the good states, if the individual manifests IAAA or CAAA.

In the case of ambiguity concentrated on the type of state, these results are different than the ones obtained in the single period model, in which ambiguity aversion reduces the marginal WTP to self-protect a bad state of the world under DARA (Proposition 3 in AGT). The intuition here is similar that the one made before: as the effect of self-protection on the probability of being in the bad type is identical for any value of \(\theta \), and since the conditional distributions of wealth in the good and bad states are not modified, raising p has a positive and equal impact on conditional second period expected utility \(\mathrm {E}u(\tilde{w}_2(\theta ))\) for all values of \(\theta \). Due to the introduction of ambiguity aversion, the cost of this increase is paid in the first period so that the extra condition of DAAA is needed to observe a raise in the marginal WTP for self-protection. When ambiguity is concentrated on either the bad or the good states, the effect of ambiguity aversion on the marginal WTP only depends on the ambiguity prudence attitude of the individual.

4 Optimal effort under ambiguity

In this section, I examine the impact of ambiguity aversion on the optimal prevention in the two-period model. The general form of the decision maker’s problem is given by:

where \(U(e,\theta )=p(e,{\theta })\mathrm {E}u(\tilde{w}_{2}^b(e,\theta )) +\left[ 1-p(e,{\theta })\right] \mathrm {E} u(\tilde{w}_{2}^g(\theta ))\) is the second period expected utility, conditional on the parameter \(\theta \). Notations remain the same as before, with e representing the level of effort needed to self-insure or self-protect the set of bad states of the world.Footnote 17 The decision problem (10) is a problem of self-insurance when \(p(e,\theta )=p(\theta )\) for all levels of effort e, and a problem of self-protection when \(\tilde{w}_{2}^b(e)=\tilde{w}_{2}^b\) for all e. Moreover, for any of these two situations, ambiguity may be concentrated on either the type of states (when \(\tilde{w}_{2}^b(e,\theta )=\tilde{w}_{2}^b(e)\), and \(\tilde{w}_{2}^g(\theta )=\tilde{w}_{2}^g\) for all \(\theta \)), on the bad states (when \(p(e,\theta )=p(e)\), and \(\tilde{w}_{2}^g(\theta )=\tilde{w}_{2}^g\) for all \(\theta \)), or on the good states (when \(p(e,\theta )=p(e)\), and \(\tilde{w}_{2}^b(e,\theta )={\tilde{w}}_{2}^b(e)\) for all \(\theta \)). Finally, I assume that \(p(e,\theta )\) and \(w_{2}^b(e)\) are differentiable in e and are such that \(p_{e}(e,\theta )\equiv \frac{\partial p(e,{\theta })}{\partial e}\le 0\), and \(\frac{\partial w_{2}^b(e,\theta )}{\partial e}\ge 0\) for all \(\theta \) since the self-protected or self-insured states are considered as unfavorable. Notice that under KMM specification, the concavity of u and \(\phi \) does not guarantee that the maximization problem (10) is convex, so additional assumptions are needed for the programme’s solution to be unique. These conditions are summarized in the following proposition.

Proposition 4

The maximization programme of a two-period self-insurance or self-protection problem under ambiguity as described by (10) is convex if:

-

function \(\phi \) has a concave absolute ambiguity tolerance: \(-\phi '(U)/\phi ''(U)\) is concave in U,

and

-

\(w_{2}^b(e,\theta )\) is concave in e in the self-insurance case: \(\partial ^2 w_{2}^b(e)/\partial e^2\le 0\) for all \(\theta \), or

-

\(p(e,\theta )\) is convex in e in the self-protection case: \(\partial ^2 p(e,\theta )/\partial e^2\ge 0\) for all \(\theta \).

Proof

Relegated to the Appendix. \(\square \)

In line with the risk theory literature, concave absolute ambiguity tolerance is a property verified by the most widely used specifications in the ambiguity literature. In particular, it is satisfied by the families of constant relative ambiguity aversion (CRAA): logarithmic and power functions, of constant absolute ambiguity aversion (CAAA): exponential functions, and of quadratic functions.

In the special case of ambiguity neutrality, problem (10) becomes a simple two-period problem in the (subjective) expected utility framework. It consists in finding the level of effort e that maximizes:

The optimal level of effort \(e^*\) chosen by an ambiguity averse individual is the solution of the first-order condition (FOC):

where \(U_e(e,\theta )={\partial U(e,\theta )}/{\partial e}\). The first term of this expression represents the marginal cost of effort and the second represents the marginal benefit of self-protection or of self-insurance.

Ambiguity aversion raises the optimal level of effort if the FOC of problem (10) evaluated at \(e^*\) is positive. This is the case if:

The interpretation of this condition is simple: as ambiguity only affects variables during the second period, the marginal cost of effort, which takes place in the first period, is unaffected, and the condition indicates that the marginal benefit of protection or insurance must be higher under ambiguity aversion.

Using Corollary 1, we then see that under CAAA, condition (12) is equivalent to:

Moreover, Lemma 1 tells us that condition (12) is always satisfied under DAAA if condition (13) holds. As \(\phi '\) is a decreasing function under ambiguity aversion, using the covariance rule, the condition, therefore, becomes:

Proposition 5

Ambiguity aversion raises the optimal level of effort in a two-period model as the one described by (10) if \(U(e^*,{\theta })\) and \(U_e(e^*,{\theta })\) are anti-comonotonic and the individual manifests DAAA or CAAA, where \(e^*\) is defined by (11).

Analogously, using Corollary 2 it is possible to state:

Corollary 3

Ambiguity aversion reduces the optimal level of effort in a two-period model as the one described by (10) if \(U(e^*,{\theta })\) and \(U_e(e^*,{\theta })\) are comonotonic and the individual manifests IAAA or CAAA, where \(e^*\) is defined by (11).

4.1 Self-insurance

I now investigate the conditions under which this proposition holds in the case of self-insurance. In this case, remember that the individual has the opportunity to make an effort e in the first period to increase his wealth to \({\tilde{w}}_{2}^b(e,\theta )\) in the insurable bad states of the world in the second period. The conditional second period expected utility in the case of self-insurance is given by:

Since p is assumed to be increasing in \(\theta \) when ambiguity is concentrated on the type of states, it is clear that \(U(e^*,\theta )\) decreases with \(\theta \) if \(\mathrm {E} u({\tilde{w}}_{2}^b(e^*))< \mathrm {E} u({\tilde{w}}_2^g)\), and increases with \(\theta \) otherwise, while \(U_e(e^*,\theta )=p(\theta )\mathrm {E} \Big [u'({\tilde{w}}_{2}^b(e^*))\frac{\partial {\tilde{w}}_{2}^b(e^*)}{\partial e}\Big ]\) is increasing in \(\theta \) under the assumption that self-insurance raises revenues in bad states of the world. Combining this result with Proposition 5 proves the following Proposition:

Proposition 6

In a two-period model of self-insurance in which ambiguity is concentrated on the type of states, ambiguity aversion raises the optimal level of self-insurance under DAAA or CAAA if the expected utility reached in the good states of the world \(\mathrm {E} u({\tilde{w}}_2^g)\) is higher than the one reached in the bad states \(\mathrm {E} u({\tilde{w}}_{2}^b(e^*))\).

This result generalizes and extends to a two-period framework the results obtained by Snow (2011), in the particular case of a world with two states: a loss (i.e. bad) and a no-loss (i.e. good) state. Under this assumption, the second period wealth is \(w_{2}^b(e^*)=w_2-L(e^*)\) if an insurable loss L occurs, and is \(w_2^g=w_2\) in the no-loss state. Snow’s (2011) results showing that ambiguity aversion increases the optimal level of self-insurance are, therefore, easily extended to a two-period world if the individual manifests CAAA or DAAA.

Similarly, if the loss function has the particular form: \(L(e)=L-ke\), it is also possible to interpret the results in the context of a standard coinsurance problem where the premium e is paid in first period and for each dollar of which the insured agent receives an indemnity \(k>0\) if the loss occurs. In this case, ambiguity aversion raises the insurance coverage rate if the individual manifests non-increasing ambiguity aversion. This result is the two-period version of Corollary 1 in Alary et al. (2013) and is synthesized in the following corollary:

Corollary 4

In the standard coinsurance problem with two states in which the insurance premium is paid in first period and uncertainty is realized in second period, ambiguity aversion raises the insurance coverage rate if the individual exhibits DAAA or CAAA.

When ambiguity is concentrated on the bad states of the world, the situation is more complex, as we already realized when studying the willingness to pay. Since we assumed, without loss of generality, that \(\mathrm {E} u({\tilde{w}}_2^b(e^*,\theta ))\) was decreasing in \(\theta \), we automatically know that it is also the case for \(U(e^*,\theta )\). The question is, therefore, to know whether \(U_e(e^*,\theta )=p\mathrm {E}\big [u'({\tilde{w}}_2^b(e^*,\theta )) \frac{\partial {\tilde{w}}_2^b (e^*,\theta ) }{\partial e}\big ]\) is increasing or decreasing in \(\theta \). They key element is to understand how the expected marginal benefit of effort evolves with \(\theta \). If the effort furnished increased the second period wealth exactly the same way in all the bad states of the world as it was the case in the section studying the willingness to pay, \(\frac{\partial {\tilde{w}}_2^b(e^*,\theta ) }{\partial e}\) would be constant and we could use the conditions of Proposition 2 to obtain a result. On the contrary, if self-insurance does not uniformly affect the different bad states of the world, \(\frac{\partial {\tilde{w}}_2^b(e^*,\theta ) }{\partial e}\) is not anymore constant, and we need an extra condition to sign the effect of ambiguity aversion on self-insurance.

Proposition 7

In the two-period model of self-insurance in which ambiguity is concentrated on the bad states of the world, ambiguity aversion raises the optimal level of self-insurance if the individual manifests DAAA or CAAA, the marginal benefit of self-insurance is higher for higher losses, and one of the following conditions holds:

-

1.

The set of risky second period wealth in the bad states of the world \(({\tilde{w}}_2^b(e^*,\theta _1),\dots ,{\tilde{w}}_2^b(e^*,\theta _n))\) can be ranked according to first-order stochastic dominance (FSD), and u is increasing and concave.

-

2.

The set of risky second period wealth in the bad states of the world \(({\tilde{w}}_2^b(\theta _1),\dots ,{\tilde{w}}_2^b(\theta _n))\) can be ranked according to second-order stochastic dominance (SSD), and u is increasing, concave and exhibits prudence.

Proof

Relegated to the Appendix. \(\square \)

To illustrate this Proposition consider the following example.

Example 1

Imagine a situation in which there are two possible losses: a small loss \(L_1\) and a big loss \(L_2\) (with \(L_1<L_2\)). Conditional on suffering from a loss, the probability to be confronted to \(L_1\) is given by \(\pi (\theta )\), so that the second period expected utility, conditional on \(\theta \) is given by: \(U(e,\theta )=p\pi (\theta )u(w_2-L_1(e))+p(1-\pi (\theta )) u(w_2-L_2(e))+(1-p)u(w_2)\). In this case, it is possible, without loss of generality, to rank the different \(\theta \) such that \(\pi (\theta _1)\ge \dots \ge \pi (\theta _n)\), so that \(U(e,\theta )\) is decreasing in \(\theta \). Similarly, \(U_e\) may be written as: \(U_e(e,\theta )=p[u'(w_2-L_2(e)(-L_2'(e))-\pi (\theta )(u'(w_2-L_2(e)(-L_2'(e))-u'(w_2-L_1(e)(-L_1'(e))) ]\), and it is, therefore, straightforward to see that it will be increasing in \(\theta \) if \(-L'_2(e)>-L'_1(e)\).

Finally, when ambiguity is concentrated on the good states of the world, \(U_e(e^*,\theta )=p\mathrm {E} [u'({\tilde{w}}_{2}^b(e^*))\frac{\partial {\tilde{w}}_{2}^b(e^*)}{\partial e}]\) is independent of \(\theta \), so that expression (13) holds with an equality, and the change in the optimal effort due to ambiguity aversion entirely depends on the ambiguity prudence attitude as stated in the following Proposition.

Proposition 8

In the two-period model of self-insurance in which ambiguity is concentrated on the good states of the world, ambiguity aversion raises (resp. leaves unchanged, reduces) the optimal level of self-insurance if the individual manifests DAAA (resp. CAAA, IAAA).

4.2 Self-protection

I now consider the problem of self-protection: the effect of effort is to reduce the probability \(p(e,\theta )\) of being in bad states of the world. Conditional second period expected utility takes the form:

As before, and without loss of generality, I assume that \(p(e^*,\theta )\) is increasing in \(\theta \), when ambiguity is concentrated on the type of states, and that both \(\mathrm {E}u({\tilde{w}}_{2}^b(\theta ))\) and \(\mathrm {E} u({\tilde{w}}_{2}^g(\theta ))\) are decreasing in \(\theta \) in the cases of ambiguity concentrated on either bad or good states. In consequence, \(U(e^*,\theta )\) is always a decreasing function of \(\theta \) when the self-protected states are the undesirable (or bad) ones in the sense that \(\mathrm {E} u({\tilde{w}}_{2}^g)>\mathrm {E} u({\tilde{w}}_{2}^b)\). From Proposition 5 and Corollary 3, a sufficient condition to observe a higher (resp. lower) level of effort under DAAA (resp. IAAA) or CAAA than under ambiguity neutrality in the self-protection model becomes that the marginal benefit of effort \(U_e(e^*,\theta )=-p_{e}(e^*,\theta ) \big [\mathrm {E} u({\tilde{w}}_{2}^g(\theta ))-\mathrm {E} u({\tilde{w}}_{2}^b(\theta ))\big ]\) is increasing (resp. decreasing) in \(\theta \). It is easy to see that since \(p_e(e)\) is negative, \(U_e(e^*,\theta )\) will be increasing in \(\theta \) when ambiguity is concentrated on the bad states, and decreasing in \(\theta \) when ambiguity is concentrated on the good states of the world, so that we can directly sign the results. On the contrary, when ambiguity is concentrated on the type of states, the key element is how \(-p_{e}(e^*,{\theta })\) evolves with \(\theta \), or alternatively how the degree of ambiguity is affected by a change in the level of effort. If the degree of ambiguity is not altered by a change in the level of effort, as it was the case in the section studying the willingness to pay, \(p_{e}(e^*,{\theta })\) is independent of \(\theta \) and the covariance of expression (13) is equal to zero. In this case, an individual manifesting strict DAAA will always choose a higher level of self-protection under ambiguity aversion, while an individual manifesting CAAA will self-protect in exactly the same way, and an individual manifesting strict IAAA will self-protect less than an ambiguity neutral agent. If on the contrary, the degree of ambiguity decreases with the level of effort exerted as it seems natural in many situations,Footnote 18 \(p_{e}(e^*,{\theta })\) is decreasing in \(\theta \) so that there exists an additional incentive for an ambiguity averse decision maker to raise self-protection. Therefore, it is clear that in this situation, non-increasing absolute ambiguity aversion raises the optimal level of effort. Finally, in the more implausible case where effort increases the level of ambiguity as in AGT, \(p_{e}(e^*,{\theta })\) is increasing in \(\theta \) and the ambiguity prudence attitude effect is not anymore sufficient to raise optimal self-protection. In that case, an ambiguity imprudent attitude would lead to a lower self-protection level. The following propositions summarize these results:

Proposition 9

In the two-period model of self-protection in which ambiguity is concentrated on the type of states (good or bad), ambiguity aversion leads any individual exhibiting

-

(i)

DAAA to raise his optimal level of self-protection if effort decreases or does not affect the degree of ambiguity

-

(ii)

IAAA to reduce his optimal level of self-protection if effort increases or does not affect the degree of ambiguity

-

(iii)

CAAA to raise (resp. leaves unchanged, reduce) his optimal level of self-protection if effort decreases (resp. does not affect, increases) the degree of ambiguity

Proposition 10

In the two-period model of self-protection in which ambiguity is concentrated on the bad (resp. good) states of the world, ambiguity aversion leads any individual exhibiting DAAA (resp. IAAA) or CAAA to raise (resp. reduce) his optimal level of self-protection.

To illustrate what precedes, consider the following examples.

Example 2

Imagine there are only two states of the world: a bad one in which a loss occurs so that second period wealth is \(w_2-L\) with conditional probability \(p(e,\theta )\), and a good one with no loss: \(w_2\) is obtained with probability \(1-p(e,\theta )\). Consider two particular forms of loss probability functions that are both linear in the ambiguity parameter \(\theta \): \(p^1(e,\theta )=p(e)+\theta \), and \(p^2(e,\theta )=\theta p(e)\).

In the additive case, \(U_e(e^*,{\theta })=-p'(e^*)\big [u(w_2)-u(w_2-L)\big ]\) so that an increase in \(\theta \) has no effect on \(U_e(e^*,\theta )\). The level of self-protection is, therefore, exactly the same for any individual manifesting constant ambiguity attitude.Footnote 19 In particular, an ambiguity neutral individual and a maxmin expected utility maximizer à la Gilboa and Schmeidler (1989) both choose to self-protect precisely the same way. If the individual exhibits DAAA, he will always choose a higher level of protection under ambiguity aversion.

Imagine now that the degree of ambiguity is made smaller when the effort increases in the neighbourhood of \(e^*\). This is the case with the multiplicative form described above, where \(U(e^*,{\theta })=u(w_2)-{\theta }p(e^*)\big [u(w_2)-u(w_2-L)\big ]\) and \(U_e(e^*,{\theta })=-{\theta }p'(e^*)\big [u(w_2)-u(w_2-L)\big ]\). An increase in \(\theta \) has, therefore, a negative impact on U and a positive impact on \(U_e\) so that condition (13) is respected. Figure 1 illustrates the situation when there are two possible values of \(\theta \): \(\theta _1\) and \(\theta _2\), and when the ambiguous loss probability is linear in \(\theta \). As can be seen in Fig. 1, when \(\theta \) increases, from \(\theta _1\) to \(\theta _2\),Footnote 20 different scenarios are possible. In the additive case, the slopes of the two dashed lines are exactly the same for any given level of effort. Ambiguity in this case is constant. On the contrary, for the multiplicative form it is clear that the dotted curve for any given level of effort is steeper with \(\theta _2\) than with \(\theta _1\). Intuitively, this corresponds to a situation in which ambiguity decreases with the effort furnished and condition (13) is, hence, respected.

The intuition behind these two examples is simple. In the absence of ambiguity, we know that a key determinant of the optimal level of self-protection is the slope of p(e) (which determines the marginal benefit of effort). When ambiguity is introduced, the DM does not know exactly in which situation he is: if his prior beliefs are equal, he considers he has one chance out of two to be confronted to a loss with probability \(p(e,\theta _1)\), and one chance out of two to have \(p(e,\theta _2)\). If the individual is ambiguity neutral, this situation does not affect him and the decision is taken by considering the expected law p(e). However, if the agent is ambiguity averse, he will overevaluate the less desirable outcome (i.e. the law \(p(e,\theta _2)\)) and hence take a decision by considering a law somewhere above the line p(e). In the special case of infinite ambiguity aversion, corresponding to the maxmin model of Gilboa and Schmeidler (1989), the DM takes his decision by considering the worst scenario \(p(e,\theta _2)\).

The study of these two particular cases in which the probability is linear in parameter \(\theta \) emphasizes the differences there are between the single and the two-period models. In the single-period model, it is indeed impossible to sign the effect ambiguity aversion has on the optimal prevention, even when the probabilities are linear in the ambiguity parameter. In that situation in particular, the DM will always choose to reduce his demand of self-protection if the probability law is additive (Alary et al. 2013), while he will choose a higher level of protection if the probability law is multiplicative (Snow 2011). This inability to obtain a general result is due to the fact that both the marginal cost and the marginal benefit of self-protection increase under ambiguity aversion. The net effect, therefore, depends on which one is more affected. In the two-period model analyzed in this paper, however, ambiguity aversion only affects the marginal benefit, making it possible to draw general conclusions for the most plausible situations in which increasing the effort does not go along with an increase in the degree of ambiguity.

5 Conclusion

In this paper, I show that ambiguity aversion alone is not sufficient to sign the effect ambiguity has on the decision to (self-)insure or self-protect when two periods are considered. An additional condition defined as ambiguity prudence attitude —or non-increasing absolute ambiguity aversion—is then studied, and it is shown that in most usual situations this condition tends to raise the incentive to undertake an effort (loss reduction or loss prevention) in the first period when non-neutral attitude towards ambiguity is considered. This paper thus enables to sign the effect of ambiguity aversion on (self-)insurance and self-protection under a plausible set of conditions. It is distinguishable from the other recent papers by Snow (2011) and Alary et al. (2013) in which the marginal cost of effort is also affected by ambiguity, and that are, therefore, not able to draw general conclusions because of the conflicting effect ambiguity aversion has on marginal benefit and marginal cost.

Notes

Adaptation is the “process of adjustment to actual or expected climate and its effects. In human systems, adaptation seeks to moderate harm or exploit beneficial opportunities” (IPCC 2014a).

Mitigation is a “human intervention to reduce the sources or enhance the sinks of greenhouse gases”(IPCC 2014b).

This means that the probability distributions are assumed to be known with certainty. In particular, those models implicitly assume the absence of any kind of ambiguity, or equivalently, assume that agents are ambiguity neutral [and, therefore, behave as subjective expected utility maximizers in the sense of Savage (1954)]. Notably exceptions to this are the recent papers by Etner and Spaeter (2010), Snow (2011) and Alary et al. (2013).

As first shown by Ellsberg (1961) and later confirmed by a number of experimental studies (see Trautmann and van de Kuilen 2013 for a survey of this literature), the uncertainty on the probabilities of a random event (called ambiguity) often leads the decision maker to violate expected utility in the sense that it makes him overevaluate the likelihood of the less desirable outcomes.

Imagine for example that doing sport enables to lower recovery costs, thanks to a better physical condition.

Depending on the value of some parameters such as the blood pressure, cholesterol, etc. different institutes will estimate the probability of heart disease very differently, as is illustrated in Gilboa and Marinacci (2011). For what concerns the probability of suffering from a given loss, conditional of heart disease, think for example to the case in which a treatment consisting in surgical operation is available, but with a success rate that is unknown.

While many different models to deal with ambiguity exist in the literature (see Etner et al. 2012 for an excellent survey of these models), I choose to use the KMM model in this paper because it naturally defines the notion of ambiguity neutrality, and because the smoothness of the ambiguity function enables to use the well-developed machinery of the expected utility sequentially.

See also Etner and Spaeter (2010) for an application of these models in the field of health economics.

Imagine that parameter \(\theta \) can take values \(\theta _1,\theta _2,\ldots ,\theta _n\) with probabilities \([q_1,q_2,\ldots ,q_n]\), such that the expectation with respect to the parametric uncertainty is written \(\mathrm {E}_\theta g(\tilde{\theta })=\sum _{j=1}^n q_j g(\theta _j)\).

In what follows, I assume that \(\beta =1\), an assumption that has no impact on the results obtained.

Notice that for simplicity, I assume that \(\phi \) is only defined for non-negative values. Any value inside the second bracket must, therefore, be non-negative, which should not be a problem since any positive affine transformation of u represents the same preferences over risky situations. KMM consider for example the unique continuous, strictly increasing function u with \(u(0)=0\) and \(u(1)=1\) that represents any given preferences.

Berger (2011) defines the uncertainty premium as the combination of both the risk and the ambiguity premia.

Alternatively in the sport example, ambiguity is said to be concentrated on the bad states of the world if the probability of developing heart disease is known, but the probability of success for heart surgery is unknown.

Two random variables X and Y, that are strictly monotonic transformations of a single random variable \(\theta \): \((X,Y)=(f(\theta ),g(\theta ))\), are said to be anti-comonotonic if f is increasing and g is decreasing in \(\theta \), and comonotonic if f and g are both increasing or decreasing in \(\theta \).

Note that the condition \(\epsilon \in [p(\theta )-1,p(\theta )]\) is implicitly assumed for all \(\theta \), in order to guarantee that the probability of being in the bad state belongs to the interval [0, 1].

Remember that \(\beta \) is fixed to unity for simplicity and without altering the final comparative statics results. It should, however, be understood that the higher is the pure rate of time preference (and hence the lower is the discount factor \(\beta \)), the lower is the desire to invest any effort in preventive action if its cost has to be borne in advance.

In the climate change example, the IPCC (2007) report note that the desirability of preventive efforts is measured not only by the reduction in the expected (average) damages, but also by the value of the reduced uncertainties that such efforts yield.

Remember that according to Klibanoff et al. (2005), constant ambiguity attitude is characterized either by linear or exponential function \(\phi \).

Note that in this example, p(e) is the loss probability law considered by an ambiguity neutral agent and that the ambiguity averse DM associates the same prior belief to each value of \(\theta \), in such a way that \(\theta _2=-\theta _1\) in the additive case, and \(\theta _2=2-\theta _1\) in the multiplicative case.

The proof is adapted from Gierlinger and Gollier (2008).

References

Alary, D., Gollier, C., & Treich, N. (2013). The effect of ambiguity aversion on insurance and self-protection. The Economic Journal, 123, 1188–1202.

Berger, L. (2011). Smooth ambiguity aversion in the small and in the large. Working Papers ECARES 2011-020, ULB—Université libre de Bruxelles.

Berger, L. (2014). Precautionary saving and the notion of ambiguity prudence. Economics Letters, 123(2), 248–251.

Courbage, C., Rey, B., & Treich, N. (2013). Prevention and precaution. In Handbook of insurance, pp. 185–204. Springer.

Eeckhoudt, L., & Gollier, C. (2005). The impact of prudence on optimal prevention. Economic Theory, 26(4), 989–994.

Ehrlich, I., & Becker, G. (1972). Market insurance, self-insurance, and self-protection. The Journal of Political Economy, 80(4), 623–648.

Ellsberg, D. (1961). Risk, ambiguity, and the Savage axioms. The Quarterly Journal of Economics, 75, 643–669.

Etner, J., Jeleva, M., & Tallon, J.-M. (2012). Decision theory under ambiguity. Journal of Economic Surveys, 26(2), 234–270.

Etner, J., & Spaeter, S. (2010). The impact of ambiguity on health prevention and insurance. Working Papers of BETA 2010-08, Bureau d’Economie Théorique et Appliquée, UDS, Strasbourg.

Gierlinger, J. & Gollier, C. (2008). Socially efficient discounting under ambiguity aversion. Working Paper.

Gilboa, I. & Marinacci, M. (2011). Ambiguity and the bayesian paradigm. In Advances in economics and econometrics, tenth world congress, Volume 1.

Gilboa, I., & Schmeidler, D. (1989). Maxmin expected utility with a non-unique prior. Journal of Mathematical Economics, 18(2), 141–154.

Gollier, C. (2001). The Economics of Risk and Time. The MIT Press, Cambridge.

IPCC (2007). Framing Issues. In Climate Change 2007: Mitigation. Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change [B. Metz, O. R. Davidson, P. R. Bosch, R. Dave, L. A. Meyer (Eds.)] Cambridge University PressCambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

IPCC (2014a). Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. [Field, C. B. and Barros, V. R. and Dokken, D. J. and Mach, K. J. and Mastrandrea, M. D. and Bilir, T. E. and Chatterjee, M., and Ebi, KL and Estrada, YO and Genova, RC and others]. Cambridge, UK/New York, NY: Cambridge University Press.

IPCC (2014b). Climate Change 2014, Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Summary for Policymakers. Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlmer, C. von Stechow, T. Zwickel and J. C. Minx (Eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2005). A smooth model of decision making under ambiguity. Econometrica, 73, 1849–1892.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2009). Recursive smooth ambiguity preferences. Journal of Economic Theory, 144(3), 930–976.

Kreps, D., & Porteus, E. (1978). Temporal resolution of uncertainty and dynamic choice theory. Econometrica, 46(1), 185–200.

Maccheroni, F., Marinacci, M., & Ruffino, D. (2013). Alpha as ambiguity: Robust mean-variance portfolio analysis. Econometrica, 81(3), 1075–1113.

Menegatti, M. (2009). Optimal prevention and prudence in a two-period model. Mathematical Social Sciences, 58(3), 393–397.

Meyer, D. J., & Meyer, J. (2011). A diamond-stiglitz approach to the demand for self-protection. Journal of Risk and Uncertainty, 42(1), 45–60.

Savage, L. (1954). The Foundations of Statistics (p. 1972). New York: J. Wiley. second revised edition.

Selden, L. (1978). A new representation of preferences over “certain x uncertain” consumption pairs: The “ordinal certainty equivalent” hypothesis. Econometrica, 46(5), 1045–1060.

Snow, A. (2011). Ambiguity aversion and the propensities for self-insurance and self-protection. Journal of Risk and Uncertainty, 42, 27–43.

Trautmann, S., & van de Kuilen, G. (2013). Ambiguity attitudes. Prepared for the Blackwell Handbook of Judgment and Decision Making, edited by Gideon Keren and George Wu, Tilburg University.

Acknowledgments

The author thanks David Alary, Louis Eeckhoudt, Renaud Foucart, Christian Gollier, François Salanié, Nicolas Treich, and Philippe Weil for helpful comments and discussions. The research leading to this paper received funding from the FRS-FNRS and from the European Union Seventh Framework Programme FP7/2007-2013 under Grant agreement no. 308329 (ADVANCE).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 4

This proof is based on the following Lemma, that can be found in Gollier (2001).Footnote 21

Lemma 2

Let \(\phi \) be a twice differentiable, increasing and concave function: \(\mathbb {R} \rightarrow \mathbb {R}\). Consider a probability vector \((q_1,\ldots , q_n) \in \mathbb {R}^n_+\) with \(\sum _{\theta =1}^n q_\theta =1\), and a function \(f: \mathbb {R}^n \rightarrow \mathbb {R}\), defined as

Let T be the function such that \(T(U)=-\frac{\phi '\{U\}}{\phi ''\{U\}}\). Function f is concave in \(\mathbb {R}^n\) if and only if T is weakly concave in \(\mathbb {R}\).

First, remark that programme (10) is convex if

is concave in e.

The proof is given in the case where ambiguity is concentrated on the type of states. The two other cases follow trivially.

Self-insurance \((p(e,\theta )=p(\theta )\) for all levels of e): consider two scalars \(e_1\) and \(e_2\), and let \(U_{j\theta }\) denote the second period expected utility conditional on \(\theta \), for a level of effort \(e_j: U_{j\theta }=p(\theta )\mathrm {E}u({\tilde{w}}_{2}^b(e_j)) +\left[ 1-p(\theta )\right] \mathrm {E} u({\tilde{w}}_{2}^g)\). Under the notations above, \(V(e_j)=f(U_{j1},\ldots ,U_{jn})\). Then, under concavity of u and \(w_{2}^b\), and for any \((\lambda _1,\lambda _2)\in \mathbb {R}^2_+\) such that \(\lambda _1+\lambda _2=1\), we have:

Multiplying the first and the third parts of this chain of inequalities by \(p(\theta )\) and adding \(\left[ 1-p(\theta )\right] \mathrm {E}u({\tilde{w}}_2^g)\) yields:

for all \(\theta \), where \(e_\lambda =\lambda _1 e_1+\lambda _2 e_2\). Because f is increasing in \(\mathbb {R}^n\) if \(\phi \) is increasing, this implies:

On the other side, if \(-\phi '/\phi ''\) is concave, by Lemma 2 we have:

Combining these two results yields \(V(\lambda _1 e_1+\lambda _2 e_2)\ge \lambda _1 V(e_1)+\lambda _2 V(e_2)\) implying that V is concave in e.

Self-protection \((w_{2}^b(e)=w_{2}^b\) for all levels of e): in this case, the proof is similar but \(U_{j\theta }\) is now given by \(U_{j\theta }=p(e_j,\theta )\mathrm {E} u({\tilde{w}}_{2}^b)+\left[ 1-p(e_j,\theta )\right] \mathrm {E} u({\tilde{w}}_{2}^g)\), and we exploit the convexity of \(p(e,\theta )\) in e to obtain \(\lambda _1 U_{1\theta }+\lambda _2 U_{2\theta }\le U_{\lambda \theta }\). \(\square \)

Proof of Proposition 7

-

1.

Imagine that the set of risky second period wealth in the bad states of the world can be ranked according to FSD:

$$\begin{aligned} {\tilde{w}}_2^b(e^*,\theta _1) \succeq _{FSD}\dots \succeq _{FSD}{\tilde{w}}_2^b(e^*,\theta _n). \end{aligned}$$(14)From the definition of FSD, this is the case if and only if for every function f weakly increasing, we have:

$$\begin{aligned} \mathrm {E} f({\tilde{w}}_2^b(e^*,\theta _1))\ge \dots \ge \mathrm {E} f({\tilde{w}}_2^b(e^*,\theta _n)). \end{aligned}$$(15)Given that \(u'>0\), it is, therefore, clear that \(U(e^*,\theta )=p\mathrm {E} u({\tilde{w}}_2^b(e^*,\theta ))+(1-p) \mathrm {E} u({\tilde{w}}_2^g)\) is decreasing in \(\theta \), and that \(U_e(e^*,\theta )=\mathrm {E} g({\tilde{w}}_2^b(e^*,\theta ))\) will be increasing in \(\theta \) if and only if g is decreasing. Now remark that this will be the case if, by ordering (without loss of generality) the different bad states such that \(w_{2,s}^b\ge w_{2,s+1}^b\), we have:

$$\begin{aligned} g(w_{2,s}^b(e^*,\theta ))= & {} u'(w_{2,s}^b(e^*,\theta ))\frac{\partial w_{2,s}^b(e^*,\theta )}{\partial e}\nonumber \\\le & {} u'(w_{2,s+1}^b(e^*,\theta ))\frac{\partial w_{2,s+1}^b(e^*,\theta )}{\partial e}=g(w_{2,s+1}^b(e^*,\theta ))\quad \quad \quad \end{aligned}$$(16)for all \(\theta \), and all s. It is then easy to see that inequality (16) will be satisfied if \(u''\le 0\) and \(\frac{\partial w_{2,s}^b(e^*,\theta )}{\partial e}\le \frac{\partial w_{2,s+1}^b(e^*,\theta )}{\partial e}\), meaning that the marginal benefit of self-insurance is higher for higher losses.

-

2.

Imagine that the set of risky second period wealth in the bad states of the world can be ranked according to SSD:

$$\begin{aligned} {\tilde{w}}_2^b(e^*,\theta _1) \succeq _{SSD}\cdots \succeq _{SSD}{\tilde{w}}_2^b(e^*,\theta _n). \end{aligned}$$(17)From the definition of SSD, this is the case if and only if for every non-decreasing, concave function f, we have:

$$\begin{aligned} \mathrm {E} f({\tilde{w}}_2^b(e^*,\theta _1))\ge \cdots \ge \mathrm {E} f({\tilde{w}}_2^b(e^*,\theta _n)). \end{aligned}$$(18)Given that \(u'>0\) and \(u''>0\) under risk aversion, we know that \(U(e^*,\theta )=p\mathrm {E} u({\tilde{w}}_2^b(e^*,\theta ))+(1-p) \mathrm {E} u({\tilde{w}}_2^g)\) is decreasing in \(\theta \). Similarly, \(U_e(e^*,\theta )=\mathrm {E} g({\tilde{w}}_2^b(e^*,\theta ))\) will be increasing in \(\theta \) if and only if \(g'\le 0\) and \(g''>0\). Since we know that \(g(w_{2,s}^b(e^*,\theta ))= u'(w_{2,s}^b(e^*,\theta ))\frac{\partial w_{2,s}^b(e^*,\theta )}{\partial e}\), this will be the case if

$$\begin{aligned}&u'\big (\lambda w_{2,i}^b(e^*,\theta )+(1-\lambda ) w_{2,j}^b(e^*,\theta )\big ) \Bigg [ \lambda \frac{\partial w_{2,i}^b(e^*,\theta )}{\partial e} +(1-\lambda ) \frac{\partial w_{2,j}^b(e^*,\theta )}{\partial e}\Bigg ]\nonumber \\&\quad \le \lambda \Bigg [ u'(w_{2,i}^b(e^*,\theta ))\frac{\partial w_{2,i}^b(e^*,\theta )}{\partial e}\Bigg ]+ (1-\lambda ) \Bigg [ u'(w_{2,j}^b(e^*,\theta ))\frac{\partial w_{2,j}^b(e^*,\theta )}{\partial e}\Bigg ]\nonumber \\ \end{aligned}$$(19)for all \(\theta \), all \(i,j\in s\), and all \(\lambda \in [0,1]\). It is then easy to see that inequality (19) is satisfied with an equality if \(u''= 0\), and with a strict inequality if \(\frac{\partial w_{2,i}^b(e^*,\theta )}{\partial e}= \frac{\partial w_{2,j}^b(e^*,\theta )}{\partial e}\) and the agents exhibits risk prudence: \(u'''>0\). More generally, the risk prudence property implies that:

$$\begin{aligned} u'\big (\lambda w_{2,i}^b(e^*,\theta )+(1-\lambda ) w_{2,j}^b(e^*,\theta )\big )\le \lambda u'\big (w_{2,i}^b(e^*,\theta )\big ) + (1-\lambda ) u'\big (w_{2,j}^b(e^*,\theta )\big ), \end{aligned}$$(20)and it is, therefore, possible to form a chain of inequalities with expressions (19) and (20) to show that g is convex if

$$\begin{aligned}&u'(w_{2,i}^b(e^*,\theta )) \Bigg [ \frac{\partial w_{2,i}^b(e^*,\theta )}{\partial e} - \frac{\partial w_{2,j}^b(e^*,\theta )}{\partial e} \Bigg ]\nonumber \\&\quad \ge u'(w_{2,j}^b(e^*,\theta )) \Bigg [ \frac{\partial w_{2,i}^b(e^*,\theta )}{\partial e} - \frac{\partial w_{2,j}^b(e^*,\theta )}{\partial e} \Bigg ]. \end{aligned}$$(21)A sufficient condition for this expression to be satisfied is, therefore, that \(\frac{\partial w_{2,i}^b(e^*,\theta )}{\partial e}\ge \frac{\partial w_{2,j}^b(e^*,\theta )}{\partial e}\) whenever \(w_{2,i}^b(e^*,\theta )\le w_{2,j}^b(e^*,\theta )\), and vice versa.

\(\square \)

Rights and permissions

About this article

Cite this article

Berger, L. The impact of ambiguity and prudence on prevention decisions. Theory Decis 80, 389–409 (2016). https://doi.org/10.1007/s11238-015-9512-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-015-9512-1