Abstract

This study examines the asymmetric relationship between India volatility index (India VIX) and stock market returns, and demonstrates that Nifty returns are negatively related to the changes in India VIX levels, but in case of high upward movements in the market, the returns on the two indices tend to move independently. When the market takes sharp downward turn, the relationship is not as significant for higher quantiles. This property of India VIX makes it a strong candidate for risk management tool whereby derivative products based on the volatility index can be used as a tool for portfolio insurance against worst declines. We also find that India VIX captures stock market volatility better than traditional measures of volatility including ARCH/GARCH class of models. Finally, we test whether changes in India VIX can be used as a signal for switching portfolios. Our analysis of timing strategy based on change in India VIX exhibits that switching to large-cap (mid-cap) portfolio when India VIX increases (decreases) by a certain percentage point can be useful for maintaining positive returns on a portfolio.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Volatility index, also called as VIX, is often referred to as investors’ fear gauge, mainly because it measures stock market perceived volatility, both up-side and down-side. When VIX level is low, it implies that investors are optimistic and complacent rather than fearful in the market, which connotes investors perceiving no or low potential risk. On the contrary, a high VIX reading suggests that investors perceive significant risk and expect that the market would move sharply in either direction. It is largely believed that the stock price volatility is caused solely by random arrival of new information relating to the expected returns from the stock. Others attribute the cause of volatility largely to trading. Research suggests that volatility is far larger during the trading hours than when the exchange is closed (Fama 1965; French 1980). The hypothesis that volatility is mainly caused by the new information is questionable and it is largely attributed to trading itself (French and Roll 1986). Further research provides evidence of volatility caused by a host of factors, including information contained in news, financial performance of organizations, and even investor behavior. Empirical evidence on the flow of information contained in macroeconomic news and other public information having a direct impact on stock return volatility is documented widely in financial economics literature [see, for example, Ross (1989), Andersen and Bollerslev (1998), and Andersen et al. (2006)]. Other studies examine the effect of private information such as the information revealed through informed and liquidity motivated traders, their orders and any imbalances in their trades in securities markets, on the volatility of security prices [Brandt and Kavajecz (2004), Evans and Lyons (2008), and Jiang and Lo (2011) among others]. Another dimension of the source of stock market volatility is traced back to the development of behavioral economics and finance that assumes that investors are not perfectly rational and that their irrational and sentiment-based decisions affect the stock price movements (Daniel et al. 2002). Investor sentiment being one of the sources of potential stock price volatility has also been studied in the context of the noise trader model (of De Long et al. 1990) in order to examine the effect of noise trader risks on stock returns [Lee et al. (1991), Neal and Wheatley (1998), and Baker and Wurgler (2006) among others].

Our study examines the performance of India VIX as a sophisticated measure of stock market volatility compared to traditional measures. Specifically, we examine the asymmetric effect of India VIX in the Indian stock market and test whether it captures spot volatility better than standard measures of stock price volatility. We also examine whether volatility index can be used as an appropriate instrument for market timing and risk management. We contribute to the existing volatility-return relationship literature by providing evidence on the asymmetric relationship between volatility index and stock returns and supplement our results from linear regression with quantile regression for testing this relationship.

Our analysis shows that India volatility index (India VIX) is a superior estimate of realized volatility in stock market returns, compared to traditional volatility measures and there is asymmetric relationship between India VIX and stock returns. We further provide evidence on employing changes in India VIX as a signal for switching portfolios to ensure positive returns. Derivative products based on India VIX can be a tool for portfolio insurance against risk and India VIX can be successfully used for formulating trading strategies.

The remaining of the paper is organized as follows. Section “Theoretical background” focuses on the theoretical background and literature explaining volatility-return relationship. In “Hypotheses and methodology”, section we discuss the hypotheses and methodology used, and the sample, data and measurement of variables are explained in “Data and measurement of variables” section. In “Results”, section the results of the analysis are discussed and “Conclusion” section summarizes the findings and brings out the practical implications of the study.

Theoretical background

Our study focuses on three major issues as follows. First, whether India VIX reflects the true underlying risk aversion of investors in the Indian stock market. India VIX essentially documents the level of market anxiety during the ups and downs of the stock market and it would provide useful benchmark information in assessing the degree of market turbulence being experienced. Second, we attempt to evaluate the volatility index for potential uses in spot and derivative markets, for the purpose of risk management and for devising efficient and profitable trading strategies. As Goldstein and Taleb (2007) put it, if we express volatility in a particular way, substituting one measure for another will lead to a consequential mistake. This makes our concern of testing India VIX as a true market sentiment indicator more relevant and worth investigating. Finally, we narrow our focus on the issue whether India VIX could be used as an instrument for market-timing in the stock market.

Volatility index and stock market returns

Many prior studies in financial economics literature have dealt with the relationship between volatility index and stock market returns. Intuitively, when expected market volatility rises (declines), investors in the market demand higher (lower) expected rate of returns on stocks and consequently, stock prices go up (falls down). This linkage suggests a simple framework of proportional relationship between changes in volatility index and variations in market index returns. Whaley (2009) argues that increased demand to buy index affects the level of the volatility index, and thus, it is expected to observe that the change in the volatility index rises at a higher absolute rate when the stock market falls than when it rises. Empirical evidence supports the volatility index to be more a barometer of investors’ fear of the downside than it is a barometer of investors’ excitement (greed) in a market rally.

There is evidence for a large negative contemporaneous correlation between changes in volatility index and changes in returns on market index (see, for example, Flemming et al. 1995). Studying the volatility index (earlier known as VXO) in US market, Giot (2005a) reports that expected returns are positive (negative) following an extremely upward (downward) movement in the volatility index, implying that an overshooting volatility index indicates oversold markets. Some other major studies examining the properties of volatility index (either VXO or VIX) also report similar findings. Dash and Moran (2005) state that the volatility index, VXO, is negatively correlated with hedge fund returns, and this correlation is asymmetric in nature. While Guo and Whitelaw (2006) show that market returns are positively related to implied volatility, Blair et al. (2002) in their earlier study find that VXO is able to explain almost all relevant information about the expected realized volatility of index returns. Volatility index also tends to show an asymmetrical response to positive and negative returns on market index. Evidence of negative and asymmetric relationship has been provided in the VIX and S&P 100 index (Whaley 2000), VXN and Nasdaq 100 index (Simon 2003; Giot 2005b), FTSE/ASE 20 index and Greek volatility index (Skiadopoulos 2004), and KOSPI and KIX in the Korean stock market (Ting 2007). There is, however, some contra-evidence as well. While Dowling and Muthuswamy (2005) report no asymmetric relationship between the volatility index and market index returns in Australian market, Frijns et al. (2010) provide mixed evidence for the same. Similarly, Siriopoulos and Fassas (2012) find no statistically significant asymmetric evidence for many volatility indices including VIX, VXN, and Montreal volatility index.

Sarwar (2012) examines the efficiency of the CBOE VIX as an investor fear gauge with respect to stock market indices from a group of developing nations, which includes BOVESPA (Brazil), AK&M composite index (Russia), SENSEX (India), and Shanghai SE composite index (China). His study reports a strong negative contemporaneous relation between changes in VIX and stock market index returns in all the markets, albeit the evidence in case of the Indian stock market was found significant only during the period of 1993–1997. But it is noteworthy that this relationship was examined using CBOE VIX as a measure of investor fear gauge in local markets (such as Brazil, Russia, India and China), which otherwise is not a convincible argument.

In the Indian context, Kumar (2012) and Bagchi (2012) studied India VIX and its relationship with the Indian stock market returns. While Kumar (2012) shows the negative association between India VIX and stock market returns and presence of leverage effect significantly around the middle of the joint distribution, Bagchi (2012) constructs value-weighted portfolios based on beta, market-to-book value, and market capitalization parameters and reports a positive and significant relationship between India VIX and the returns of the portfolios.

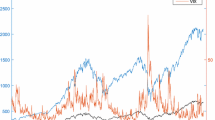

When we plot India VIX, VIX (of S&P 500 Index) and Nifty index, it can be seen that there exists asymmetric relationship between India VIX and the Nifty index movement; India VIX and the VIX are moving in tandem except at times when India VIX is visibly more volatile than or moving in contrast to the VIX (see Fig. 1). We, therefore, examine the relationship between India VIX and the Nifty index.

Implied and realized volatility

Volatility in assets’ expected returns being a crucial input attracts much attention, both from academic researchers and practitioners alike. In financial markets, volatility in returns are estimated using several approaches, including model-based estimation techniques such as conditional volatility models of ARCH/GARCH family, and model-free measures of implied volatility such as CBOE VIX or India VIX.

Literature suggests that various implied volatility measures subsume substantial information, mainly information contained in historical returns data, and use the same for estimating volatility. Fleming (1998) and Jiang and Tian (2005) report the efficiency of implied volatility measures in reflecting such information, but Becker et al. (2006) find weak evidence and state that S&P500 implied volatility index does not completely subsume a diverse set of information. In a follow-up study, they find that such implied volatility measures do not reflect information beyond volatility persistence as captured by model-based volatility estimators that are relevant for forecasting the degree of total volatility. Becker et al. (2009) state that previous studies on relationship between implied volatility and forecasts of the level of total volatility have completely ignored the fact that volatility may be generated from both continuous diffusion and discontinuous jump processes in price. Using the jump components of S&P 500 volatility, they find that the VIX both subsumes information relating to past jump contributions to total volatility and reflects incremental information pertaining to future jump activity.

Many empirical studies have captured the relationship between measures of implied volatility and realized volatility in stock markets. Poon and Granger (2003) provide a comprehensive review of work related to forecasting volatility. Comparing the implied volatility index with historical volatility, Dowling and Muthuswamy (2005) find that implied volatility measure is not a robust estimator of volatility compared to historical volatility measure, but Frijns et al. (2010) find contrary evidence and state that volatility index contains important information about realized volatility in Australian market. Corrado and Miller (2005), Maghrebi et al. (2007), and Banerjee and Kumar (2011) find that implied volatility measures, VIX, KOSPI volatility index and India VIX are sufficiently good predictor of realized volatility in S&P 100 index (USA), KOSPI 200 index (Korea), and Nifty index (India) markets, respectively. Similar evidence is provided for VIX and S&P 500 and Nasdaq 100 indices. Siriopoulos and Fassas (2012) examine predictive power of 12 volatility indicesFootnote 1 to find that even if implied volatility measure is biased, it does a better job than historical realized volatility measures. In the context of the Indian stock market, although Kumar (2012) provides evidence of implied volatility measure (India VIX) as an unbiased estimator of future realized volatility, his study uses only one measure of implied volatility i.e. India VIX and one measure of historical volatility. The results, however, cannot be generalized for other measures of volatility. We, therefore, examine this issue with multiple volatility measures.

Our study differs from the earlier attempts in several ways. First, instead of relying on a single volatility measure, we use multiple measures for both implied and realized volatility in Nifty index returns. For comparing India VIX performance in capturing the actual volatility, we use conditional volatility measures as well as ex-post integrated volatility measure. Also, for realized volatility estimates, we use standard deviation of returns, daily variance estimates, and realized volatility estimates (following McAleer and Medeiros (2008)). Second, we adopt various criteria to test the efficiency of volatility estimates. Our criteria include root mean square error (RMSE), mean absolute error (MAE), and mean absolute percent error (MAPE). Finally, and more importantly, we examine whether changes in India VIX can be used for trading strategies in stock markets. Theoretically, we show that India VIX can be a good tool for portfolio insurance against risk. We also empirically test its use in timing strategy based on size and percentage change in India VIX.

Hypotheses and methodology

We first examine the efficiency of India VIX in explaining the realized volatility computed using various traditional measures, vis-à-vis other measures of conditional volatility such as the ones from ARCH/GARCH class models. We further study the relationship of India VIX with stock market returns with respect to the CNX Nifty index. Mainly, we test the following hypotheses:

-

(a)

Model-free estimator of implied volatility, India VIX, does not capture the realized volatility in the Nifty returns compared to other measures of conditional volatility from the class of ARCH/GARCH models.

-

(b)

The India VIX has no significant asymmetric relationship with the Nifty returns.

Also, we study the potential implications of India VIX for trading in spot and derivative markets.

We use mainly regression-based approach to study India VIX and its association with the Nifty returns. Using daily data from the National Stock Exchange (NSE), we first examine the statistical properties of India VIX in order to ascertain its dynamics with stock market returns and its asymmetric relationship with the Indian stock market in general. We also need to ascertain the information content of India VIX as predictor of stock price volatility and its performance vis-à-vis other traditional measures such as standard deviation, and other realized volatility measures. In the present study, we use two measures of conditional volatility to compare the India VIX performance with, namely GARCH(1,1)-based conditional volatility measure and EGARCH conditional volatility measure. We examine how each of Nifty index, India VIX and other traditional measures of stock volatility are correlated with each other, and whether they are similar and if not, which one captures spot volatility better. For examining India VIX-Nifty return relationship, we also use quantile regression approach for robust estimation.

Data and measurement of variables

Our study aims to test a wide spectrum of relationship between the India VIX, stock market returns, and several historical volatility measures. In this section, we present data sets used in the study and stylized facts about the data. We use financial time series data with non-overlapping observations on the following variables for a period spanning from March 1, 2009 through November 30, 2012:

-

(i)

India volatility index (India VIX): India VIX measures market expectations of near-term volatility which connotes the rate and magnitude of changes in prices and a widely recognized proxy of risk, and computed by NSE based on the order book of Nifty options. For this, the best bid-ask quotes of near and next-month Nifty options contracts which are traded on the F&O segment of NSE are used. It is believed that higher India VIX levels, higher the expected volatility and vice versa (NSE 2007). In this paper, we use daily closing values of India VIX over the sample period.

-

(ii)

NIFTY: The CNX Nifty index (NIFTY) consists of 50 stocks representing 23 sectors of the economy, and represents about 66.85 % of the free float market capitalization of the stocks listed on the NSE (at the end of June 2014). At the same time, trading in the Nifty stocks comprises of more than 50 % of the total traded value of all stocks on the NSE. We use daily closing value of the Nifty index as a measure of market index, and would expect it to be inversely related to the India VIX. The Nifty is negatively correlated (−0.830488) with the India VIX. We anticipate the negative relationship as higher volatility in the market would reflect negative sentiment of investors and there could be lower trading, leading to less trading volume and lowering index. On the other hand, a low volatility value could mean boosting investor sentiment and higher trading participation in the market. Hence, the Nifty index and India VIX are inversely related (as can be seen in the Fig. 1).

-

(iii)

Low volatility index (LVX): The CNX low volatility index (LVX) is a measure of the performance of the least volatile securities listed on the NSE. Out of top 300 companies ranked on the basis of average free-float market capitalization and aggregate turnover in the last six months, a group of top 50 securities which have remained least volatile are selected to be included in the LVX. This index moves in tandem with and, therefore, has a high positive correlation with the Nifty index (0.913628), whereas it is significantly negatively correlated with the India VIX (−0.873644) and the CBOE VIX (−0.525834). We would anticipate an inverse relationship between LVX and India VIX because higher LVX would imply that top 50 securities trading on the NSE has low volatility, hence low uncertainty about the top trading stocks. This in turn would mean a low India VIX value.

The descriptive statistics for all the three indices relating to our study, namely the India VIX, CNX Nifty index (NIFTY), and CNX LVX, along with Nifty index returns (NIFTYRET), over the sample period are reported in the Table 1a below.

The statistics related to the Nifty index returns show that the Nifty index maintains a small positive average return during the sample period, with the standard deviation of daily return of 1.4 %. The kurtosis value of the returns series (as well as other series in consideration) is higher than 3, the kurtosis of the Gaussian distribution. We can, however, say that the kurtosis values of India VIX and LVX series are closer to normal. The Jarque–Bera statistics of the distribution are much higher than any critical value at conventional confidence levels over the sample period.

Literature suggests that the presence of autocorrelation in the financial time series is inconsistent with the weak form of market efficiency hypothesis and, therefore, puts forth a serious issue in modeling volatility directly from daily returns (Pandey 2005). Table 1b presents correlation between variables under consideration. We also note that India VIX is significantly negatively correlated with the NIFTY and LVX, implying an adverse relationship between the variables.

-

(iv)

Realized volatility

The financial economics and microstructure literature talk about several measures of returns volatility. In our study, we employ two traditional measures of unconditional realized volatility as follows:

-

(a)

Daily variance estimator (RVOL1): Traditionally, the unconditional volatility of an asset return series is estimated using close-to-close returns as follows:

$$ \sigma^{2} = \frac{1}{n}\sum {\left\{ {\ln \left( {P_{t} } \right) - \ln \left( {P_{t - 1} } \right)^{2} } \right\}} , $$(1)where P i is the closing price of the day and n is the number of trading days used to estimate the volatility over a month. This estimate of daily volatility is assumed as a proxy of realized volatility and used in our study to compare with other measure of volatility.

-

(b)

Realized volatility estimates (RVOL2):

Our study also employs another measure of realized volatility of the Nifty index return series. Following McAleer and Medeiros (2008), we compute the average daily returns variance by summing all the squared returns over a certain period (as assumed earlier, number of trading days in a month), rather than calculating the squared daily returns. The methodology for estimating the realized volatility can be expressed mathematically as follows:

$$ {\text{RVOL}}2_{t} = \sum\nolimits_{i = 0}^{{n_{t} }} {r_{t, i}^{2} } . $$(2)The realized variance thus calculated is a consistent estimator of the integrated variance when there is no microstructure noise. Since our study employ daily data, we expect very little microstructure noise in our sample. The integrated variance is considered as the measure of true daily volatility (Andersen et al. 2003).

-

(a)

Table 2 presents the descriptive statistics of the two proxies of realized volatility in the Nifty index returns over the sample period.

From the statistics reported in the table above, we see that although the average daily volatility estimated by models RVOL1 and RVOL2 are quite different (with significantly different standard deviations), their distribution are pretty similar in nature (as exhibited by skewness, kurtosis, and Jarque–Bera statistics). We in our study use these two measures along with standard deviation of daily Nifty returns as proxies of realized volatility for further analysis.

-

(V)

Conditional volatility measures

For examining the efficiency of India VIX in explain the underlying volatility vis-à-vis other volatility measure, we consider conditional volatility measures which are widely used in academic literature. Literature suggests that the return series of an index exhibits ARCH effect over the period. We, therefore, use following two models for measuring conditional volatility in the Nifty index series:

-

(a)

Symmetric conditional volatility measure (GARCHVOL): The first measure of conditional volatility is the GARCH(p,q) model which is the most-used model in the ARCH family. The approach estimates the symmetric conditional volatility of a financial time series that is the Nifty index return series in our case. For GARCH(p,q) modeling, we estimate the conditional mean μ t of our daily return series r t using a simple time series model, such as a stationary ARMA(p,q) model as follows:

$$ \begin{gathered} r_{t} = \mu_{t} + \varepsilon_{t} , \mu_{t} = \emptyset_{0} + \sum\nolimits_{i = 1}^{p} {\emptyset_{i} r_{t - i} } - \sum\nolimits_{j = 1}^{q} {\theta_{j} \alpha_{t - j} } \hfill \\ \varepsilon_{t} = Z_{t} \sqrt {h_{t} } , \hfill \\ \end{gathered} $$(3)

-

(a)

where the shock (or mean corrected return) ε t represents the shock or unpredictable return, and p, q are non-negative integers. Z t is a white noise such that (μ = 0, σ 2 = 1) and h t is the conditional variance of ε t . This conditional variance can further be modeled in a GARCH(p,q) process as follows:

where \( \alpha_{0} > \, 0, \, \alpha_{i} \ge \, 0, \, \beta_{j} \ge \, 0; \)

Empirical evidence supports that a simple GARCH(1,1) process can be fitted adequately in many time financial series (Sharma et al. 1996). Hence, we employ a simple GARCH(1,1) model to measure the symmetric conditional volatility of the Nifty index return series.Table 3a shows descriptive statistics for three measures of conditional and integrated volatility, namely volatility estimates using GARCH and EGARCH approaches, and es post integrated estimates of volatility. The results obtained from the GARCH/EGARCH model are presented in the Table 3b below. We see that the sum of ARCH and GARCH coefficients (α and β respectively) estimated by our model is significantly less than 1 which implies that the volatility is mean reverting. However, the volatility during the sample period remained less spiky (lower α) and highly persistent (higher β) during the period covered in our study.We also run ARCH LM test up to 5 lags in order to test whether our GARCH(1,1) model adequately captures the persistence in the Nifty index return volatility and to test whether there is no ARCH effect left in the residuals obtained from the model. We find that the standardized residuals do not further exhibit any ARCH effect.

-

(b)

Asymmetric conditional volatility measure (EGARCHVOL): Conditional volatility of a financial time series is believed to be dependent on both the magnitude of error terms or innovations and on its signs, which may result into asymmetry. We test for asymmetric patterns in return volatility and, therefore, estimate an EGARCH(1,1) model for measuring asymmetric conditional volatility in the Nifty index return series. The EGARCH(1,1) estimates are reported in Table 3b. From the statistics presented in the table, we see that the asymmetry term, γ, as well as other coefficients is significant at conventional significance levels. It is also seen that the standardized residuals are non-normally distributed. The ARCH LM test on residuals further connotes that there exists no ARCH effect left after estimating the model.

-

(vi)

Ex post integrated volatility measure

We also construct a time-series of integrated volatility following Siriopoulos and Fassas (2012) to compare its performance with the India VIX. This measure of volatility is computed as follows:

$$ {\text{Ex post volatility}}_{t} = \sqrt{\frac{365}{n}} \sum\nolimits_{i = 0}^{n} {r_{i}^{2}}, $$(5)where, r is the daily Nifty returns and n is the number of trading days in a month. This annualized return variance may serve as a proxy for observed integrated volatility in the Nifty returns. Descriptive statistics of our volatility measure ex post volatility is presented in Table 3a above.

Results

In this section, we present the empirical results obtained from our analysis. First, we discuss the efficiency of sample volatility estimates in capturing the realized volatility in stock market. Then, the relationship between India VIX and stock market returns is exhibited and discussed, and finally, we show some potential uses of India VIX and a tool of risk management, including employing timing strategy based on percentage change in India VIX levels.

India VIX and volatility estimates

In this study, we use only two commonly used conditional volatility models from the ARCH/GARCH family to test their performance vis-à-vis traditional and extreme value unconditional volatility measures. We regress each of the realized volatility measures, namely standard deviation of daily Nifty returns (STDEV), daily variance estimator (RVOL1), and realized volatility estimates measured as sum of squared returns over past one month (RVOL2), on the conditional and unconditional measures of implied volatility such as India VIX, GARCH-based conditional volatility measure (GARCHVOL), EGARCH-based conditional volatility measure (EGARCHVOL) and annualized estimates of integrated volatility (Ex post volatility estimate), to see their linear relationships. The regression estimates are presented in Table 4. The results indicate that India VIX as an explanatory variable is associated with our measure of realized volatility–standard deviations of Nifty returns, and the results are statistically significant at the 5 % level. The linear association between India VIX and other measures of realized volatility (i.e. RVOL1 and RVOL2) is statistically significant. When we estimate the regression with GARCH-and EGARCH-based volatility measures, both measures are associated with all the four measures of realized volatility, but the relationship is statistically significant at the 1 % level only in case of GARCH-based volatility. The regression estimates for annualized volatility estimates (Ex post volatility estimate) as explanatory variable are statistically significant at conservative significance level for all measures of realized volatility. Since the regression estimates provide statistically significant (at traditional level) evidence of the efficiency of volatility measures used in our study (India VIX, GARCHVOL, EGARCHVOL, and Ex post volatility estimate), we further evaluate these measures for their comparative performance using various performance criteria.

In order to compare the efficiency of various volatility estimators, we use following finite sample scale-sensitive performance criteria, namely RMSE, MAE, and MAPE.Footnote 2

Results obtained for RMSE, MAE, and MAPE computed for India VIX, GARCHVOL, EGARCHVOL, and Ex post volatility estimate with different measures of realized volatility are presented in Table 5. As evident from the statistics, the EGARCH-based volatility measure has the largest forecast errors followed by the GARCH-based volatility measure, whereas India VIX has the smallest error. The smaller the value of scale-sensitive measures of error, the more accurate is the volatility estimate. In the present study, lower RMSE and MAE associated with India VIX indicate it to be relatively more accurate than the other three volatility estimates, namely GARCH-based volatility measure, EGARCH-based volatility measure and ex-post volatility measure. However, if the magnitude of the data values were different for these volatility measures, then the error statistics might not be valid. All the four measures of volatility estimates here are apparently of the same magnitude with respect to their statistical properties, we can say that the lower error statistic would imply a better volatility estimate. Contrary to MAE, MAPE measures the performance of volatility estimate irrespective of the magnitude of data series, hence eliminates the problem of interpreting the measure of accuracy relative to the magnitude of the volatility values coming from different measures. Our results show a lower MAPE for India VIX which makes it a better volatility estimate compared to other measures under consideration. At the outset, India VIX appears to be a better predictor of realized volatility than GARCH-and EGARCH-based measures of conditional volatility. Annualized volatility measure appears to be better performing but only in explaining the standard deviations of Nifty returns; for other measures of realized volatility, it is again India VIX which captures return volatility better than any other measures. The difference between them is, however, very marginal, yet the model-free measure of implied volatility, India VIX, is the best of them in estimating realized volatility. The superiority of India VIX holds for all measures of realized volatility, be it standard deviation of Nifty returns (STDEV), daily variance estimates (RVOL1) or monthly sum of squared returns (RVOL2).

India VIX and stock market returns

We first examine how the India VIX responds to positive and negative Nifty returns by regressing the change of India VIX (ΔIndiaVIX t ) on positive and negative Nifty returns variables. As documented in Simon (2003), if the underlying index (in our case the Nifty) tends to move upward significantly, investors tend to hold long on calls instead long on stock (which is basically equal to long delta). This shift in preference might cause a higher bidding for call options prices and the implied volatility associated with the same. One of the possible reasons could be that the existence of any such trend would suggest a likelihood of more fluctuations in the underlying index in the future. This trend further increases the expected payout of the options, resulting in implied volatility to be bid higher.

Simon (2003) suggests that the deviation of current price from its moving average typically indicates trends, and it can be used to understand the effect of the direction in trends. Separate variables can be used for each of positive as well as negative deviations, in terms of percentage of the Nifty index from its five-day moving average, and argues that when traders tend to demand options more, the trends becomes stronger leading to a rise in implied volatility. In such situations, the deviation coefficients on positive (negative) deviations would be significantly positive (negative). Following similar approach, we regress the first difference of India VIX (ΔIndiaVIX t ) upon the lagged value of India VIX, contemporaneous Nifty returns, and contemporaneous deviation terms. This approach helps us examine the relationship of Nifty index with implied volatility, and how this relationship evolves on the extent to which implied volatility leads to the deviations in the Nifty index from its recent central tendency. Our estimation takes the form of multiple regression as follows:

where, ΔIndiaVIX t is first difference of the India VIX at time t, IndiaVIX t-1 is the lagged value of India VIX at time t–1, NiftyRet + t and \( {\text{NiftyRet}}_{t}^{ - } \) are positive and negative Nifty returns for same day, and DevMA5 + t and DevMA5 − t are the deviation terms which capture positive and negative percentage digressions of the closing value of Nifty index from its five-day moving average.

Table 6a shows regression results for different models using the entire sample. Model 1 considers only the past value of India VIX level as an economic explanatory variable to capture the changes in India VIX. It is negatively related to the changes in India VIX with 1 % statistical significance level, although it does not have considerable explanatory power as evident from a low R-square value.

Model 2 is identical to Model 1 except that the positive Nifty return has been added as an explanatory variable. We find that the positive Nifty return is significantly positively related to the changes in India VIX at well beyond the 1 % level. Past value of India VIX, however, is not statistically significant. A significant increase in the R-square from Model 1 to Model 2 suggests that the Model 2 is much better in capturing the changes in India VIX than Model 1 is. When we replace the positive Nifty return with negative Nifty return as an explanatory variable along with the past value of India VIX, we find that both variables are negatively related to the changes in India VIX at highly statistically significance level (see Model 3). In addition, the adjusted R-square climbed substantially from 0.1054 to 0.2534. Interestingly, the inclusion of negative Nifty returns renders the past value of India VIX statistically significant. It connotes that negative Nifty return has more explanatory power than positive Nifty return with respect to capturing the changes in India VIX.

Model 4 considers along with the lagged valued of India VIX, positive returns on Nifty index and positive deviations of Nifty index from its five-day moving average as economic explanatory variables. The inclusion of a moving average term is attributed to examine the trend in asset price movements. As discussed earlier, the coefficient on positive percentage deviation from moving average is expected to be positive. Our results reveal that the moving average term is positively and significantly related to the changes in India VIX level. However, similar to results from earlier models, past value of India VIX and positive Nifty return are negatively related with changes in India VIX at 5 and 1 % significance levels, respectively. We also note that adding the moving average term has increased the adjusted R-square value from 0.1074 (in Model 2, without moving average term) to 0.1830 (in Model 4, with moving average term).

Model 5 is again identical to Model 4 except that we use negative Nifty return and negative deviation of Nifty from its 5-day moving average instead of positive returns and deviations (used in Model 4). We find that apart from past value of India VIX being statistically negatively related to the changes in India VIX level, negative Nifty return is also negatively related to the changes in IVIX level, and is highly statistically significant (well beyond 1 % level). As expected, negative deviation of Nifty index from its five-day moving average is negatively related to the changes in India VIX. Also, it is evident from a high R-square (0.2650) that negative return and deviation jointly with past value of India VIX have significant explanatory power.

Regression estimates through Model 6 considers data over the entire sample period and suggest that India VIX is mean reverting. All the economic explanatory variables considered in the model jointly have the highest explanatory power (R-square being largest at 0.3124). It is evident from the results that an increase (decrease) in volatility index is related to a subsequent decrease (increase) in the Nifty index which is statistically significant at the 1 % level. The coefficient values of positive and negative Nifty returns suggest a significant directional impact on India VIX, that is higher positive Nifty returns are associated with greater declines in India VIX, whereas higher negative Nifty returns are associated with greater India VIX increases. The coefficients of both positive and negative Nifty returns are significant at the 1 % significance level. The results suggest that a unit per cent decline in the Nifty returns may lead to about 42 percentage point increase in India VIX, while a similar increase in the Nifty returns can lead India VIX to an 84 % point decline. t-statistics support the results which imply that India VIX responds in equal and in opposite directions to positive and negative Nifty returns.

With respect to other variables in our multiple regression model estimate, both positive and negative deviation terms of either direction have statistically significant impact on India VIX (at 5 and 1 % levels, respectively). These results indicate that a unitary percentage point change in both positive and negative deviation terms are related to an increase in India VIX, to the extent of about 0.003 and 0.009 %, respectively. It is, therefore, evident from the results that while positive Nifty index returns are influencing India VIX adversely, stronger positive Nifty trends affect India VIX positively.

Our results from the multiple regression estimates support the fact that any positive returns by themselves tend to reduce fear in the market and change investor sentiment to positive node. It is, however, interesting to note that the negative shocks in India VIX are mitigated by the positive returns to the extent of positive deviations. Simon (2003) suggests one possible explanation for this behavior that the trend exhibited by the index leads to a higher demand for the associated options because of gamma, which drives the options deltas to move in favor of buyers for calls. That negative Nifty returns are associated with negative deviations of the Nifty implies that any negative trend in stock prices underpins the effect of negative returns and India VIX increases even more. Assessing only the p-values associated with the independent variables suggests that these five independent variables are statistically significant at 1 and 5 % levels. The magnitude of t-statistics provides a mean to judge relative importance of the independent variables, namely lagged India VIX levels, positive and negative Nifty returns, and positive and negative deviation of Nifty. From the statistics provided in Table 6a, we can say that negative Nifty returns appears to be the most significant explanatory variable, followed by positive nifty returns, negative deviation of Nifty from its 5-day moving average and then positive deviation of Nifty from its 5-day moving average. This is in contrast to what is usually perceived: the relation between rate of change in India VIX should be proportional to the rate of return on the Nifty index. Our finding connotes an asymmetric relationship between the two. In a nutshell, our model is able to explain much of the variation of the daily India VIX change.

We also test the association between the Nifty index returns and the LVX returns (LVXRet) to see if it confirms the hypothesis that low volatility adds to higher Nifty returns. The results are presented in Table 6b. Here Model 1 shows that past return on (LVX is negatively and significantly related to the current level of the index return, implying a mean-reverting characteristic of returns on LVX. When we introduce the positive Nifty return as an explanatory variable in Model 2, we find that it is positively related to returns on LVX and highly statistically significant (well beyond 1 % level). This positive association is supported by high positive correlation between the two indices.

Model 3 is identical to Model 2 except that positive Nifty return is replaced with negative Nifty return. The relationship does not change much, rather Model 3 exhibits lower explanatory power compared to Model 2 (as revealed by lower adjusted R-square of 0.7548 in Model 3 against adjusted R-square of 0.7964 in Model 2). Therefore, it can be said that the LVX return is explained better with positive Nifty return as explanatory variable than with negative Nifty return.

We introduce the deviations terms as moving average terms along with positive and negative Nifty returns in Model 4 and Model 5, respectively, in order to examine the effect of trends in Nifty on the LVX returns. Contrary to what we found earlier with positive and negative Nifty returns as explanatory variables in Models 2 and 3, here we find that Model 5 with negative Nifty returns and negative deviations from its 5-day moving average has higher explanatory power with substantially large adjusted R-square of 0.8401 (against that of 0.3505 in Model 4). As expected, moving average term is negatively related to the LVX returns in Model 5 with high significance (well beyond 1 % level).

In Model 6, we consider all economic explanatory variables for the entire sample and find that this model has the highest explanatory power with adjusted R-square of 0.8554 (highest among all the six models in consideration). Specifically, we find that low volatility is actually associated with the Nifty index in a diagonally opposite way as the India VIX is related to it. Results indicate that an increase (decrease) in LVX returns is not significantly associated with a subsequent decrease (increase) in the index. The coefficient values of positive and negative Nifty returns suggest a significant directional impact on the LVX returns, which imply higher positive Nifty returns are associated with greater advances in the LVX returns, whereas higher negative Nifty returns are associated with greater declines in LVX returns. The coefficients of both positive and negative Nifty returns are significant at the conventional significance level. t-statistics support the results which imply that the returns on LVX responds in equal and in opposite directions to positive and negative Nifty returns.

With respect to other variables in our multiple regression model estimates, both positive and negative deviations terms have statistically significant impact on the LVX returns at conventional significance level. It can be inferred from the results that while positive Nifty index returns are influencing the LVX returns positively, stronger positive (and negative as well) Nifty trends affect the LVX returns negatively.

We further show how India VIX reacts to the extreme Nifty returns over the sample period (see Table 7a) exhibits the ten highest daily percentage losses of the Nifty, averaging to 3.89 %, the average India VIX change (reducing nominally by 0.11 %) and average India VIX level during the sample period, that is 39.54 %. In Table 7b), we exhibit the ten highest daily percentage Nifty gains, averaging to 5.24 %, the reduction in India VIX by an average of 2.64 %, reaching to an average level of 37.99 %.

These results show that India VIX moves in opposite directions in response to large positive and negative Nifty returns. One possibility could be that the directionality of the volatility index (in our study, India VIX) is consistent with how the actual volatility of the underlying spot index returns (in our case, the Nifty returns) responds to returns, both in positive and negative directions. Alternatively, this directionality may be driven by the dynamics of options trading, particularly by fluctuations in the demand for the specific risk associated with buying options (Simon, 2003).

Preliminary examination of sample dataset suggests that the distribution of data series is leptokurtic as are most financial time series, hence we are more interested in using different measures of central tendency and statistical dispersion in order to obtain a more comprehensive picture of the relationship between our sample variables. We, therefore, seek to employ quantile regression which captures the conditional quantile functions instead of conditional mean functions as in ordinary least square methods.Footnote 3 Quantile regression provides more robust results against outliers in the response measurements (Koenker and Hallock 2001). Similar to Kumar (2012), we would use quantile regression to examine the relationship between India VIX, and the Nifty index.

We begin with the standard quantile regression approach as follows. Let us assume the τ-th conditional quantile function of volatility index as,

where IndiaVIX t is India VIX at time t, and NiftyRet t is the return on the Nifty index at time t. The parameter γ(τ) captures the effect of returns of Nifty index at the τ-th quantile of the conditional distribution of India VIX. We can estimate the above model by solving the followings:

where ρ τ (u) is the standard quantile regression check function (see Koenker and Bessett 1982; Koenker 2005). The resulting estimator obtained from the Eq. (8) would be what we refer to as the pooled quantile regression estimator.We estimate the following quantile regression model to test the relationship between returns on the India VIX and the Nifty index for different quantile starting from q = 0.1 to q = 0.9:

where, IndiaVIXRet t is returns on India VIX, NiftyRet + t and NiftyRet − t are positive and negative returns on the Nifty index, respectively.Footnote 4

We expect the coefficients of both NiftyRet + t and NiftyRet − t to be negative and statistically significant if returns on the India VIX and returns on the Nifty index are negatively related, as shown in earlier analysis. The symmetric relationship can be ascertained if the coefficient of NiftyRet + t is smaller than that of NiftyRet − t (i.e. α 1 < α 2). Quantile regression estimates are produced in Table 8.

The results from quantile regression model support our previous findings. The major findings can be reconciled as followed:

-

(i)

The sign of the slope coefficients is in confirmation to the expectations at all quantiles. Our findings indicate that the relationship between returns on volatility index and the Nifty index is significantly negative in either direction, particularly around the center of the distribution (i.e.at the quantile 0.5), which is consistent with previous studies employing traditional regression models (Flemming et al. 1995; and Whaley 2009, among others) as well as our previous findings obtained from multiple regression estimates.

-

(ii)

The constant term is statistically significant in all quantile except at q = 0.6 and 0.7, at the 1 % level, which violates the stylized facts of volatility. Volatility across the markets exhibits the mean reverting trends, and therefore, should not display any significant trend. Our study confirms the presence of a statistically significant trend, similar to the evidences provided by Siriopoulos and Fassas (2012) for multiple markets, and Kumar (2012) for Indian market.

-

(iii)

The relationship is statistically significant (at the 1 % level) at all quantiles, except in a few cases where the relationship is found insignificant. The relationship holds more for market declines than for upward movements. In cases of negative Nifty returns, the effect is sharper for higher quantiles. We, thus, provide evidence of the presence of statistically significant leverage effect in both the left and right tails, where left tail has domination over right tail.

-

(iv)

Our results also imply that when market declines sharply, the changes in the market is significantly associated with the changes in the volatility; similarly the returns on India VIX contribute to the upward movements in Nifty returns, but with less vigor. We, therefore, report that a portfolio with some component of India VIX would not get adversely affected in sharp upward movements in the stock market as India VIX may not fall significantly. But independence on the right tail at higher quantiles (q = 0.7, 0.8, and 0.9) suggests that smaller gains from upward market movements would not be sufficient to cover up the losses caused by the volatility.

-

(v)

The results indicate that the effect of negative Nifty returns on the volatility is more significant than the effect of positive returns of similar degree. We earlier discuss this relationship between positive and negative returns on the Nifty index and India VIX. Our quantile regression estimates confirms those findings.

India VIX and timing strategy

In this section, we explore whether India VIX can be used for employing timing strategies with respect to trading in stock market. Theoretically, capital market equilibrium allows, under the assumption of constant risk aversion of investors, the market risk premium to be positively related to the variance of the market portfolio (Merton 1980), which implies that any excess returns on the market portfolio over risk-free rate should be positively related with the risk of the market portfolio. Taking this argument further, French et al. (1987) state that since the market risk premium is positively correlated to expected volatility (a measure of risk), future discount used to value a security would also increase in case of any unexpected increase in market volatility. This further decreases the stock prices. In a nutshell, any unexpected increase in volatility is likely to be related to unexpected negative stock returns.

Based on the foregoing theoretical arguments, we assume the changes in volatility as the main driving force for a time-varying risk premium and, following the approach of Copeland and Copeland (1999), examine the timing strategies based on size. This proposed strategy suggests that an investor shift her portfolio consisting of small-cap stocks to a portfolio of large-cap stocks when implied volatility goes up; otherwise following a decline in implied volatility levels. This economic explanation for this strategy is given in the original study as follows:

“…In general, small-cap stocks earn higher return than large-cap stocks (Basu 1983; and Fama and French 1992), but we believe that small-cap stocks perform better when expected volatility decreases and large-cap stocks perform better when expected volatility increases.” (Copeland and Copeland, op. cit.)

For the purpose of exploring the relationship between timing strategy based on the India VIX and size of portfolios, we undertake the CNX Nifty index futures as a proxy for large-cap portfolio, and the Nifty Midcap 50 index as a proxy for mid-cap portfolio (due to paucity of data, we use mid-cap index futures as mid-cap portfolio instead of small-cap one as suggested in the literature; small-cap portfolio proxy is being worked upon). These two indices are chosen as representative portfolios under an assumption that futures contracts written on these two indices are highly liquid and tradable at extremely low costs. Daily returns on the CNX Nifty futures index and the Nifty Midcap 50 futures index are regressed on the percentage change in India VIX. The percentage change in India VIX is defined as the difference between India VIX at time t and the 75-day (about 3 months) historical moving average of India VIX divided by the 75-day historical moving average of India VIX, taking the mathematical representation as follows:

The sample for testing this relationship consists of daily data from November 2009 through November 2012, as daily data on IndiaVIX is available for this period only. After adjustment for 75-day historical moving average, our sample consists of 697 observations. We then regress the difference in returns on Nifty futures index and the Nifty midcap futures index on the percentage change in IndiaVIX, based on the following regression:

where, \( R_{Nifty, t} \) is returns on the Nifty futures index at time t, \( R_{Midcap, t} \) is returns on the Nifty Midcap futures index at time t, and α, β, and ε are the intercept, the slope coefficient, and the normally distributed random error term at time t, respectively. Results from the regression of the difference of future returns on large-and mid-cap portfolio and percentage change in India VIX is presented in Table 9. Our results indicate a statistically significant relationship between current percentage change in IndiaVIX levels and the difference between the rates of future returns (for different holding periods) on index futures contracts on the CNX Nifty index (representing large-cap portfolio) and CNX Nifty Midcap 50 index (representing mid-cap portfolio).

We further test for trading strategy based on percentage change in India VIX levels. Precisely, we maintain the percentage changes in India VIX as a signal to switch between the large-and mid-cap portfolios. When India VIX increases, we shift our portfolio to large-cap one, and when it decreses, we shift to mid-cap portfolio. We test for percentage change in India VIX level at 10, 20, 30, 40, 50, −10, and −20 % levels. For holding periods, we consider only 1, 2, 3 and 10 days of holding period, for computation of expected future returns on portfolio. The statistics are provided in Table 10.

Results indicate that a large-cap portfolio yields positive cumulative returns in 17 out of 20 cases. We find that switching portfolio based on 10 % change in India VIX gives negative returns in two cases (one in 1-day holding period and another in 10-day holding period). It is evident that using higher percentage change in India VIX appears to be a useful signal for ensuring positive portfolio returns. Our results are very much similar to that of Copeland and Copeland (op.cit.) in sense that futures on large-cap portfolio tend to outperform futures on mid-cap portfolio during most of the cases. Moreover, in cases of volatility declines, futures on mid-cap portfolio outperform futures on large-cap portfolio in all 8 cases. Copeland and Copeland further confirm the superiority of trading strategy based on portfolio-size compared to the one based on style, citing Fama and French (1992), who demonstrate that firm size and beta are highly correlated. The correlation between firm’s beta and size is supposed to be greater than the correlation between firm’s beta and style. Due to limitations associated with data availability, we only tested the trading strategy based on portfolio size, and not on the style.

Conclusion

In this study, we compare India VIX with other traditional measures of stock price volatility such as conditional volatility estimates using ARCH/GARCH models. For realized volatility estimates also, we considered three different measures such as standard deviation of historical returns, daily variance estimates, and monthly sum of stock returns. Employing the linear regression model and RMSE, MAE, and MAPE criteria, we find that India VIX is a better predictor of realized volatility than measures of conditional volatility. Annualized volatility measure appears to be better performing but only in explaining the standard deviations of Nifty returns; for other measures of realized volatility, it is again India VIX which captures return volatility better than any other measures. The difference between them is, however, very marginal, yet the model-free measure of implied volatility, India VIX, is the best among them in estimating realized volatility. The superiority of India VIX holds for all measures of realized volatility, be it standard deviations of Nifty returns, daily variance estimates or monthly sum of squared returns.

Our results demonstrate a statistically significant negative relationship between the stock market returns and volatility. Using regression estimations approach and quantile regression methodology, we show that the returns on the CNX Nifty index are negatively related to the changes in the India VIX levels, but in case of high upward movements in the market, the returns on the two indices tend to move independently. When the market takes sharp downward turn, the relationship is not as significant for higher quantiles. This attribute of India VIX makes it a strong candidate for risk management tool whereby derivative products based on the volatility index can be used as a tool for portfolio insurance against worst declines. Derivatives on volatility, when launched, are supposed to provide the investors an opportunity to invest in a separate asset class which would carry high diversification attributes.

Finally, we tested whether India VIX can be used for timing strategy in the stock market. We took the futures on the CNX Nifty index and CNX Nifty Midcap 50 index as proxy for large- and mid-cap portfolios, respectively, and examined the relationship between the difference in daily returns on the two portfolios and percentage change in India VIX. We find evidence that a higher percentage change in India VIX can be used as a signal to switch between large-and mid-cap portfolios to ensure positive portfolio returns. We conclude that, India VIX can be used as a tool for portfolio insurance against risks caused by steep downward movements in the market and it can also be used as an indicator for market timing.

Notes

The list of volatility indices included in the study is as follows: CBOE volatility index (VIX), Nasdaq volatility index (VXN), DJIA volatility index (VDX), Russel 2000 volatility index (RVX), Deutsche volatility index (VDAX), AEX volatility index (VAEX), BEL 20 volatility index (VBEL), CAC 40 volatility index (VCAC), FTSE 100 volatility index (VFTSE), SWX volatility index (VSMI), Dow Jones EURO STOXX 50 volatility index (VSTOXX), and Montreal exchange volatility index (MVX).

The first criterion, RMSE, measures the differences between the values estimated by a model, say volatility estimated by the GARCHVOL, and the actual values (of realized volatility). Being a scale-dependent measure of accuracy, it compares different estimation errors within a dataset, and serves to aggregate the residuals into a single measure of estimation efficiency. The second one, MAE, is also used to measure how close the implied volatility estimates are to the eventual realized volatility. It is an average of the absolute error of estimation. Finally, mean absolute percent error indicate the estimation accuracy in percentage terms. These criteria are measures of efficiency which are less likely to be affected by the presence of outliers in data set.

Quantile regression is a statistical technique intended to estimate, and conduct inference about, conditional quantile functions. Just as classical linear regression methods based on minimizing sums of squared residuals enable one to estimate models for conditional mean functions, quantile regression methods offer a mechanism for estimating models for the conditional median function, and the full range of other conditional quantile functions. By supplementing the estimation of conditional mean functions with techniques for estimating an entire family of conditional quantile functions, quantile regression is capable of providing a more complete statistical analysis of the stochastic relationships among random variables.

\( {\text{NiftyRet}}_{t}^{ + } \) is NiftyRett if returns on the Nifty index is positive, else 0; and \( {\text{NiftyRet}}_{t}^{ - } \) takes the value of NiftyRet t if returns on the Nifty is negative, else 0.

References

Andersen TG, Bollerslev T (1998) Answering the Skeptics: yes, standard volatility models do provide accurate forecasts. Int Econ Rev 39(4):885–905

Andersen TG, Bollerslev T, Diebold FX, Labys P (2003) Modeling and forecasting realized volatility. Econometrica 71(2):529–626

Andersen TG, Bollerslev T, Christoffersen PF, Diebold FX (2006) Practical volatility and correction modeling for financial markets risk management. In: Carey M, Schultz R (eds) Risk and financial institutions. University of Chicago Press for NBER, Chicago

Arrow Kenneth (1965) Aspects of the theory of risk banking. Yrjö Jahnssonin Säätiö, Helsinki

Bagchi D (2012) Cross-sectional analysis of emerging market volatility index (India VIX) with portfolio returns. Int J Emerg Mark 7(4):383–396

Baker M, Wurgler J (2006) Investor sentiment and the cross-section of stock returns. J Financ 61(4):1645–1680

Banerjee A, Kumar R (2011) Realized volatility and India VIX. WPS No. 688, Indian Institute of Management Calcutta

Basu S (1983) The Relationship between Earnings’ yield, market value, and the return for NYSE common stocks: further evidence. J Financ Econ 12(1):129–156

Becker R, Clements AE, White S (2006) On the informational efficiency of S&P 500 implied volatility. North Am J Econ Financ 17(2):139–153

Becker R, Clements AE, McClelland A (2009) The jump component of S&P 500 volatility and the VIX index. J Bank Financ 33(6):1033–1038

Blair JB, Poon SH, Taylor SJ (2002) Forecasting S&P 100 volatility: the incremental information content of implied volatilities and high frequency index returns. J Econ 105(1):5–26

Brandt M, Kavajecz Kenneth A (2004) Price discovery in the U.S. treasury market: the impact of order flow and liquidity on the yield curve. J Financ 59:2623–2654

Copeland MM, Copeland TE (1999) Market timing: style and size rotation using the VIX. Financ Anal J 55(2):73–81

Corrado CJ, Miller TW (2005) The forecast quality of CBOE implied volatility indexes. J Futures Mark 25(4):339–373

Daniel K, Hirshleifer D, Teoh SH (2002) Investor psychology in capital markets: evidence and policy implications. J Monet Econ 49(1):139–209

Dash S, Moran MT (2005) VIX as a companion for hedge fund portfolios. J Altern Invest 8(3):75–80

De Long JB, Shleifer A, Summers LH, Waldmann RJ (1990) Noise trader risk in financial markets. J Polit Econ 98(4):703–738

Dowling S, Muthuswamy J (2005). The implied volatility of australian index options, accessed from http://www.ssrn.com/abstract=500165. Accessed 17 Oct 2013

Epstein LG, Zin SE (1989) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: a theoretical framework. Econometrica 57(4):937–969

Evans MDD, Lyons RK (2008) How is macro news transmitted to exchange rates? J Financ Econ 88(1):26–50

Fama E (1965) The behavior of stock-market prices. J Bus 38(1):34–105

Fama E, French K (1992) The cross-section of expected stock returns. J Financ 47(2):427–465

Flemming J (1998) The quality of market volatility forecasts implied by S&P 100 index option prices. J Empir Financ 5(4):317–345

Flemming J, Ostdiek B, Whaley R (1995) Predicting stock market volatility: a new measure. J Futures Mark 15(3):265–302

French K (1980) Stock Returns and the Weekend Effect. J Financ Econ 8:55–69

French K, Roll R (1986) Stock return variances: the arrival of information and the reaction of traders. J Financ Econ 17(1):5–26

French K, Schwert GW, Stambaugh R (1987) Expected stock returns and volatility. J Financ Econ 19(1):3–30

Frijns B, Tallau C, Rad-Tourani A (2010) The information content of implied volatility: evidence from Australia. J Futures Mark 30(2):134–155

Giot P (2005a) Implied volatility indexes and daily value-at-risk models. J Deriv 12(4):54–64

Giot P (2005b) Relationships between implied volatility indexes and stock index returns. J Portf Manag 31(3):92–100

Goldstein DG, Taleb NN (2007) We don’t quite know what we are talking about when we talk about volatility. J Portf Manag 33(4):84–86

Guo H, Whitelaw R (2006) Uncovering the risk-neutral relationship in the stock market. J Financ 61(3):1433–1463

Jiang GJ, Lo I (2011) Private information flow and price discovery in the US treasury market. Working paper 2011–5, Bank of Canada

Jiang G, Tian Y (2005) Model-free implied volatility and its information content. Rev Financ Stud 18(4):1305–1342

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–292

Koenker R (2005) Quantile regression. Cambridge University Press, London

Koenker R, Bassett GJ (1982) Robust tests for heteroscedasticity based on regression quantile. Econometrica 50(1):43–61

Koenker R, Hallock K (2001) Quantile regression. J Econ Perspect 15(4):143–156

Kumar SSS (2012) A first look at the properties of India’s volatility index. Int J Emerg Mark 7(2):160–176

Kumar MS, Persaud A (2001) Pure contagion and investor shifting risk appetite: analytical issues and empirical evidence. Int Financ 5(3):401–436

Lee CMC, Shleifer A, Thaler R (1991) Investor sentiment and the closed-end fund puzzle. J Financ 46(1):75–109

Lu YC, Wei YC, Chang CW (2012) Nonlinear dynamics between the investor fear gauge and market index in the emerging taiwan equity market. Emerg Mark Financ Trade 48(1):171–191

Maghrebi N, Kim M-S, Nishina K (2007) The KOSPI200 implied volatility index: evidence of regime switches in volatility expectations. Asia-Pacific J Financ Stud 36(2):163–187

McAleer M, Medeiros MC (2008) Realized volatility: a review. Econ Rev 27(1):10–45

Merton R (1980) On estimating the expected return on the market: an exploratory investigation. J Financ Econ 8(4):323–361

Misina M (2003). What does risk-appetite index measure? Bank of Canada Working Paper 2003/23

Neal R, Wheatley SM (1998) Do measures of investor sentiment predict Returns? J Financ Quant Anal 33(4):523–547

NSE (2007) Computation methodology of India VIX, accessed from http://www.nseindia.com/content/vix/India_VIX_comp_meth.pdf. Accessed 3 April 2013

Olsen RA (1998) Behavioral finance and its implications for stock-price volatility. Financ Anal J 54(2):10–18

Pandey A (2005) Volatility models and their performance in Indian capital markets. Vikalpa 30(2):27–46

Poon SH, Granger C (2003) forecasting financial market volatility: a review. J Econ Lit 41(2):478–539

Pratt John (1964) Risk aversion in the small and in the large. Econometrica 32(1/2):122–136

Ross M (1989) Relation of implicit theories to the construction of personal histories. Psychol Rev 96(2):341–357

Sarwar G (2011) The VIX market volatility index and us stock index returns. J Int Bus Econ 11(4):167–179

Sarwar G (2012) Is VIX an investor fear gauge in BRIC equity markets? J Multinatl Financ Manag 22(3):55–65

Sharma JL, Mouugoue M, Kamath R (1996) Heteroscedasticity in stock market indicator return data: volume versus GARCH effect. Appl Financ Econ 6(4):337–342

Shefrin H (2007) Beyond greed and fear. Oxford University Press, New York

Shiller R (1998) Human behavior and the efficiency of the financial system,” NBER Working Paper No. 6375

Simon DP (2003) The nasdaq volatility index during and after the bubble. J Deriv 11(2):9–24

Siriopoulos C, Fassas A (2012) An investor sentiment barometer: greek volatility index (GRIV). Glob Financ J 23(2):77–93

Skiadopoulos G (2004) The greek implied volatility index: construction and properties. Appl Financ Econ 14(16):1187–1196

Szado E (2009) VIX futures and options: a case study of portfolio diversification during the 2008 financial crisis. J Altern Invest 12(2):68–85

Tarashev N, Tsatsaronis K, Karampatos D (2003) Investors’ attitude towards risk: what can we learn from options? BIS Quart Rev 6:57–66

Ting C (2007) Fear in the Korea stock market. Rev Futures Mark 16(1):106–140

Whaley RE (1993) Derivatives on market volatility: hedging tools long overdue. J Deriv 1(1):71–84

Whaley RE (2000) The investor fear gauge. J Portf Manag 26(3):12–17

Whaley RE (2009) Understanding the VIX. J Portf Manag 35(3):98–105

Acknowledgment

The paper is based on a project initiated and sponsored by the National Stock Exchange of India Ltd. (NSE), and the full report has appeared as the NSE Working Paper WP/9/2013 under NSE Working Paper Series. The financial support from the NSE is gratefully acknowledged. We would like to thank Saumitra Bhaduri, P. Krishna Prasanna, Murugappa Murgie Krishnan, and Narend S. for their constructive comments on earlier versions of the paper. We also thank the Editor and anonymous reviewers for their helpful comments. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chandra, A., Thenmozhi, M. On asymmetric relationship of India volatility index (India VIX) with stock market return and risk management. Decision 42, 33–55 (2015). https://doi.org/10.1007/s40622-014-0070-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40622-014-0070-0