Abstract

Cost-of-illness (COI) studies often include the ‘indirect’ cost of lost production resulting from disease, disability, and premature death, which is an important component of the economic burden of chronic conditions assessed from the societal perspective. In most COI studies, productivity costs are estimated primarily as the economic value of production forgone associated with loss of paid employment (foregone gross earnings); some studies include the imputed value of lost unpaid work as well. This approach is commonly but imprecisely referred to as the human capital approach (HCA). However, there is a lack of consensus among health economists as to how to quantify loss of economic productivity. Some experts argue that the HCA overstates productivity losses and propose use of the friction cost approach (FCA) that estimates societal productivity loss as the short-term costs incurred by employers in replacing a lost worker. This review sought to identify COI studies published during 1995–2017 that used the FCA, with or without comparison to the HCA, and to compare FCA and HCA estimates from those studies that used both approaches. We identified 80 full COI studies (of which 75% focused on chronic conditions), roughly 5–8% of all COI studies. The majority of those studies came from three countries, Canada, Germany, and the Netherlands, that have officially endorsed use of the FCA. The FCA results in smaller productivity loss estimates than the HCA, although the differential varied widely across studies. Lack of standardization of HCA and FCA methods makes productivity cost estimates difficult to compare across studies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

How to accurately estimate productivity costs in economic studies of chronic conditions is a highly debated topic. |

The human capital approach is the predominant method used to estimate productivity costs, but it has been criticized for overestimation of productivity losses. The friction cost approach, which focuses on short-term replacement costs, is used in an estimated 5–8% of COI studies. |

Estimates of the economic burden of chronic conditions are generally much lower when the friction cost approach is used, but that varies depending how the two approaches are implemented. Lack of standardization hinders comparability of productivity cost estimates. |

1 Introduction

Cost-of-illness (COI) studies measure the economic burden of disease in monetary units. The COI approach, which was developed in the USA in the late 1950s and early 1960s [1,2,3], allows researchers to estimate the amount of money that could potentially be saved or gained if a disease were to be entirely avoided [4,5,6]. COI studies can include both direct medical expenditures and the “indirect” cost of lost production that results from the premature death, disability, disease, or injury of affected individuals. Some COI studies also include the monetary value of informal care, which is classified as a direct cost in some studies and as an indirect cost in others. Few COI studies attempt to assign a monetary value to the “intangible” costs of pain and suffering [6]. In welfare economics, such costs can be quantified using willingness-to-pay estimates for subsequent inclusion in cost–benefit analyses, which may also be quantified via quality-adjusted life-years (QALYs) [7].

In many COI studies, productivity cost estimates are restricted to lost paid employment. Other studies also include the value of nonmarket production (unpaid household services—including informal care—and volunteer work) foregone due to death or disability [8]. Lost market productivity can include both short-term absence from work (absenteeism) and reduced productivity while at work (presenteeism), although relatively few studies attempt to measure the latter. Studies vary in terms of which productivity costs are included; some may focus on costs due to mortality, whereas others focus on work absences due to acute morbidity.

According to a 2016 review, a slight majority of COI studies published during 2005–2014 included both direct and indirect costs [9]. Limiting the economic burden to just direct costs can substantially underestimate the economic burden of a chronic condition; often productivity costs exceed the magnitude of direct costs [10, 11]. The estimation of indirect costs, also commonly referred to as productivity costs or losses [12], can be contentious [4, 13]. Because of the use of a wide range of methods and assumptions [8, 14], it can be challenging to compare estimates of the sum of direct and productivity costs; estimates restricted to direct costs are more comparable [15].

Although the focus of this paper is on COI studies, a limited number of cost-effectiveness analyses (CEAs) also include productivity costs. A systematic review of economic evaluations of expensive hospital drugs published during 1998–2009 found that 9% included productivity costs [11]. Similarly, an unpublished tabulation from the Tufts CEA Registry of 2732 cost-utility analyses published during 2013–2016 found that 221 (8%) included productivity costs.Footnote 1 That percentage is likely to increase in the future, following the recent recommendation of the Second US Panel on Cost-Effectiveness in Health and Medicine in 2016 to include productivity costs in societal-perspective CEAs [16]. That was in contrast to a previous US recommendation that productivity costs not be included in CEAs, out of a concern for potential double-counting of the effects of morbidity on productivity and QALY estimates [12].

In this paper, we review and critique the friction cost approach (FCA), a relatively novel method, to valuing productivity costs in COI studies based on the short-term costs incurred by employers in replacing a lost worker, including temporary substitutes, and recruiting and training a replacement. We then compare this approach to the traditional method to value productivity costs in COI studies, the gross human capital approach (HCA). After discussing the pros and cons of each approach, we review empirical applications of the FCA in the COI literature. For studies that reported both FCA and HCA estimates of productivity costs, we discuss sources of variability in estimates.

2 Methods Commonly Used to Value Productivity Costs

2.1 Friction Cost Approach

Beginning in 1992, economists in the Erasmus Group in the Netherlands presented the FCA as an alternative to the HCA. Koopmanschap and colleagues argued that when unemployment is high the indirect costs due to work absence estimated with the FCA may be lower than with the HCA if the following occurs: (i) diminishing marginal returns to labor (i.e., the individual’s marginal productivity is decreasing); (ii) short-term absences can be replaced by internal labor reserves; (iii) the individual can make up for the loss of production when he or she returns to work; and (iv) non-urgent jobs can be cancelled [17,18,19,20,21]. The premise of the FCA is that employees who leave can be readily replaced, either by someone who is already employed or an unemployed individual [22]. From the employer perspective, the relevant factor is the length of time it takes to recruit and train a replacement worker [23]. If individuals who leave the work force due to long-term illnesses or death are replaced by someone currently unemployed, the only additional resource costs are the productivity lost while a replacement worker is found plus costs to the firm of replacing the worker [24]. The loss of productivity incurred during the friction period, the time it takes to replace a worker and train their replacement, is often assumed to be 80% of gross production because of the elasticity of production with regard to labor time [8, 19]. Further, from the societal perspective, if the new employee was previously employed, the initial vacancy creates a chain of vacancies each with their own friction period [23, 25]. Johannesson and Karlsson [26] suggested that the friction costs would need to be measured for all the friction periods created by a vacancy due to long-term absence and disability.

To fully estimate productivity costs using the FCA, information is said to be needed on: (i) when a friction period begins, (ii) the length of a friction period, (iii) an estimate of production loss, with a particular focus on the elasticity of production [19], (iv) the costs of searching and training replacement workers and (v) medium-term macro-economic effects [27]. However, few FCA studies incorporate all of these costs. Of 46 FCA analyses published during 1996–2013, only four studies considered macroeconomic effects and nine studies reported elasticity adjustment factors [27].

The FCA has been criticized for not considering the value of leisure or household production because this approach assumes no welfare loss or cost when someone who is unemployed becomes employed [28]. Brouwer et al. [24] proposed a scenario in which an unemployed person takes the place of a disabled worker and earns the same income, with no change in either total output or leisure time. However, it is unlikely individuals receive the same utility of leisure when sick as when healthy [21]. The seminal FCA papers suggested that studies which estimate indirect costs using the FCA should also incorporate the imputed value of nonmarket production using data from time-surveys and patient questionnaires [8, 11, 17, 19].

The FCA has been debated since its inception. Critics have questioned the idea that work could be made up by sick workers upon return to work or internal labor reserves unless firms were not maximizing profit [26]. Nyman in 2012 asserted that the FCA is justified if “sufficient unemployment exists to replace the ill worker by another who voluntarily agrees to work for a wage rate that reflects the gain in productivity” [29]. However, that argument ignores the “chain of vacancies” previously suggested. That idea is not explicitly in the operational layout of the FCA, but it is part of the justification for FCA being the “upper bound” of short-term cost estimates of disease [19]. Another criticism is that the shadow price of labor in the FCA is assumed to be zero due to chronic unemployment [30]. Lastly, there is concern with the choice of friction period, which varies from study to study [8].

The operationalization of the friction period has been based on the time it takes to post and fill vacancies for permanent workers [20, 31,32,33]. However, if a person is on temporary sick leave, their position is not vacant and it is not clear how one could appropriately define the length of the friction period for short-term or even long-term absences. The friction period presumably begins at the point an employer decides to begin trying to replace a worker who is on long-term sick leave, not when the worker first took sick leave. However, researchers using the FCA typically cap the length of time at which loss of productivity from workers on short-term leave is counted at the same friction period used for permanent departures. That assumption would make logical sense if employers treat workers on short-term sick leave the same as those who quit their jobs, i.e., posting their positions within 2 weeks after the person goes on sick leave. However, that assumption seems implausible.

2.2 Human Capital Approach

In the HCA, productivity costs associated with premature death are calculated as the loss of productivity estimated as the present value of future economic production over the expected remaining lifetime for someone of a given age and sex [34]. Similarly, morbidity costs are calculated as the value of lost productive time due to acute illness and short- and long-term disabilities. Future market production is typically projected based on labor force participation and employment rates, life table survival probabilities, and hourly gross earnings, generally categorized by age and sex or age alone. Contrary to what some experts assert [35], the HCA does not assume full employment but instead takes into account the proportions in each age group that are employed. Likewise, despite a misconception that the HCA, as used in COI studies, assigns higher values to people with higher incomes [36], most applications of the HCA use statistical averages, not individual incomes [37, 38].

The rationale for the HCA is that the withdrawal of an individual’s labor due to premature death or permanent disability results in a loss to society of that individual’s future production. It is standard practice in the HCA to estimate gross earnings, which includes payroll taxes and other employer-paid benefits, i.e., the full cost of employee compensation [38,39,40]. The theoretical justification for using total employer compensation per worker as a proxy for individual productivity is marginal productivity theory, according to which employers equate the marginal cost of employee time with the expected marginal contribution to output [41]. Some researchers find it simpler to use reported hourly earnings (wages and salaries), excluding benefits, to estimate productivity losses [42,43,44]. Studies taking the latter approach generate lower estimates relative to studies using estimates of total employer compensation.

Time spent in unpaid work can be valued in the HCA using either the individual’s own or imputed wage (opportunity cost method) or the average wage paid to workers performing similar services (replacement cost or proxy good method) [45,46,47]. Standard US references on average productivity by age and sex use the replacement cost method to value unpaid work [37, 39]. It should be noted that European analyses typically restrict HCA estimates to loss of paid work.

The application of the HCA in public health in the United States can be traced to a 1961 publication by Weisbrod [48] that calculated the present value of expected future productivity to value averted deaths from disease prevention. Productivity was calculated as the sum of average earnings by age and sex and the imputed value of unpaid household services produced by women. The inclusion of unpaid household work reduced the very large gap in HCA valuations of male and female deaths that resulted from the use of market earnings [48, 49]. Subsequent US analysts have generally included the imputed value of household production by individuals of both sexes when valuing premature mortality. In contrast, researchers outside the USA often incorrectly equate the HCA with market production, i.e., paid work [35]. Restricting HCA estimates to market productivity may be reasonable for estimates of the costs of short-term disability [50, 51]. However, if economic evaluations that are intended to be conducted from the societal perspective exclude unpaid work that seriously devalues the time of demographic groups that provide informal care and services to others. That is an important limitation of HCA estimates in studies conducted in much of the world.

A major limitation of the standard HCA from the viewpoint of economic theory is that it does not take account of the costs of developing and maintaining a stock of human capital, such as education and personal consumption. Grosse and Krueger [52] reviewed the historical development of human capital approaches. They noted that the net HCA, which subtracts the cost of developing and maintaining a stock of human capital, is consistent with human capital theory. Although Weisbrod estimated both gross earnings and earnings net of personal consumption, the former has generally been followed by health economists who use the HCA [48, 52]. Other fields of economics (such as forensic economics) have more commonly used a net HCA [52]. The Second Panel recently recommended that societal-perspective CEAs subtract future personal consumption from future earnings [16], which is equivalent to a net HCA.

3 Applications

Both approaches have been utilized to value productivity losses in COI and CEA studies, especially the HCA. A systematic review of cost-utility analyses published through 1997 found that of 20 studies that included productivity costs, 18 used the HCA and two used the FCA [53]. We were unable to identify any subsequent comparable published systematic review of unselected CEAs that examined types of productivity cost methods used. A systematic review by Krol et al. of economic evaluations of treatments for depressive disorders in adults published during 1997-2008 found that of 87 studies, 30 estimated productivity costs as part of the numerator, six using the FCA and 24 using the HCA [54]. Another systematic review of CEAs of treatments for major depression that were published during 2000–2010 found that 14 of 37 studies included indirect costs [55]. Of those, 11 used the HCA, two used the FCA (both of which were included in the review by Krol et al.), and one, which was restricted to the elderly, included only nonmarket productivity.

Kigozi et al. in a systematic review of economic studies published during 1996–July 2013 that mentioned the FCA in the title, abstract, or key words identified 26 CEAs [27]. The use of FCA in CEAs was most commonly reported in interventions targeting lower back pain, rheumatoid arthritis, or major depression. Nine of the 26 CEAs were cost-utility analyses, all published between 2002 and 2010, roughly one per year [27]. During 2013–2016, approximately 50 cost-utility analyses were published annually, which included productivity costs.1 That systematic review evidently missed a large number of relevant studies published during that time period that used the FCA. Of the six FCA analyses included in the systematic review by Krol et al. that was based on full-text searches of economic evaluation studies [55], just three were identified in the Kigozi systematic review that only searched on the title, abstract, or key words.

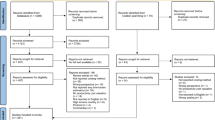

To identify FCA applications in COI studies published as research articles in journalsFootnote 2 we searched two databases using the terms “economic burden,” “cost of illness,” and “friction cost” in publications from January 1995 through December 2015. We conducted a structured review relying on titles, keywords, and abstracts in PubMed, and a full-text search using Google Scholar. As the previous paragraph indicates, full-text searches are essential to comprehensively identify studies that used the FCA. Using the full-text search, we found a total of 64 full COI studies that included both direct medical costs and productivity costs and 15 partial COI studies that only assessed productivity costs that utilized the FCA either as a primary tool to evaluate productivity losses or as a sensitivity analysis for comparison with HCA estimates (Appendix Tables A1 and A2). Of the 64 full COI studies, just 11 studies were also detected through the structured search of PubMed. In June 2018 we repeated the search for full COI studies published from January 2016 through December 2017. We identified an additional 16 full COI studies that mentioned friction cost, for a total of 80 studies (Table A1).Footnote 3

In order to calculate a denominator of the total annual number of COI studies that include productivity costs, we searched in Google Scholar for a 6-month period (April–September 2016) using the terms “economic burden” or “cost of illness” and “productivity costs” or “productivity losses” or “indirect costs.” The relatively short time limit for that search was due to the large number of full texts that had to be manually reviewed. We found 69 studies during a 6-month period that evaluated both direct medical costs and productivity losses. That equates to an annualized total of 138 full COI studies for 2016. Twelve full COI studies, published during 2016, reported productivity cost estimates using the FCA (Table A1), which is 8% of the 138 full COI studies published that year. However, just four studies were published during the preceding and following years, for an average of seven studies per year, implying 5%. Therefore, we propose that roughly 5–8% of full COI studies, that included both medical and productivity costs, utilized the FCA, either alone or jointly with the HCA.

The majority of the 80 full COI studies that used the FCA (75%) focused on chronic conditions, e.g., arthritis, stroke, shoulder and neck pain, schizophrenia, psoriasis, substance abuse-related conditions, cancer, multiple sclerosis, heart disease, and obesity (Table A1). For example, productivity costs in stroke patients were estimated in South Korea, Netherlands, United Kingdom, and Australia [56,57,58,59], and two studies examined productivity costs in multiple sclerosis [60, 61].

Almost half (35) of the 80 full COI studies in Table A1 that utilized the FCA to estimate productivity losses also utilized the HCA, of which 26 reported comparable FCA and HCA estimates for at least a portion of productivity costs. Those 26 studies are summarized in Table 1, along with 12 partial (productivity loss only) COI studies of the 15 studies listed in Table A2. Whereas 24 of 64 full COI studies published during 1995–2015 reported sufficiently comparable FCA and HCA estimates to be included in Table 1, just two of 16 studies published during 2016–2017 met the same criteria. Eleven of the other 14 studies reported only FCA estimates.

We calculated ratios of HCA to FCA cost estimates after standardizing for comparable cost components. Several studies reported costs that in our opinion should not have been included in the FCA approach. For example, one study compared the sum of a HCA estimate of presenteeism and a FCA estimate of absenteeism to the sum of a HCA estimate of presenteeism and absenteeism with a reported cost ratio of 1.9 [62]. Comparing the HCA and FCA absenteeism estimates alone, the adjusted ratio was 5.6 (Table 1).

Several studies that did not consistently apply FCA methods were excluded from Table 1, as noted in Table A1. For example, one study reported that FCA and HCA mortality costs were almost identical [63], which would be plausible only if life expectancy was the same length as the friction period, i.e., 90 days. Another study applied the FCA to mortality costs and the HCA to unemployment costs [64]. Multiple studies did not report comparable HCA and FCA estimates. In one, each set of estimates was stratified differently [59]. Another study reported combined estimates of paid and unpaid work that were attributed to the FCA [65]. One study claimed to have used the FCA to estimate premature mortality and a modified HCA to estimate morbidity, while another study did not report the FCA estimate [66, 67]. One excluded partial COI study reported age-specific productivity loss estimates for both approaches but did not present weighted average estimates [68].

It should be noted that the costs reported in Table 1 reflect our understanding of what should be included in HCA and FCA estimates. For example, Raciborski et al. in the text reported total HCA and FCA costs that included direct medical costs and informal care costs in addition to productivity costs [69]; only the productivity cost estimates are reported in Table 1.

All 38 studies listed in Table 1 calculated smaller productivity cost estimates with the FCA, but the relative magnitudes varied widely. Three studies reported HCA estimates less than twice as large as FCA estimates, whereas nine reported HCA/FCA ratios of 19 or more. Comparison of the types of productivity costs included in those two sets of studies as well as the conditions assessed can illuminate some of the key drivers of differences in estimates. The three studies with HCA/FCA ratios < 2 all measured short-term sick leave [70,71,72]. Other studies that only assessed short-term sick leave likewise typically reported modest HCA/FCA cost ratios [73]. Conversely, all nine studies that reported ratios ≥ 19 included productivity costs from either premature mortality or long-term disability in the HCA estimates.

Most studies that included mortality costs reported substantially higher ratios of HCA estimates to FCA estimates than studies that only quantified the economic cost of morbidity. Of 12 studies that included mortality, the HCA/FCA ratio ranged from 2.3 to 6.5 in four studies and from 19 to 72 in eight studies. In contrast, only two of the other 26 studies reported a ratio greater than 19, which is discussed below. Of the six studies in Table 1 that addressed the burden of cancers, the four that included mortality costs had HCA/FCA ratios that were mostly between 24 and 48 [31, 33, 74, 75], whereas the two studies that only considered morbidity costs had ratios of 2.6 and 3.9 [76, 77]. The fact that four studies that included mortality costs reported HCA costs less than tenfold higher than FCA estimates likely reflects at least in part the focus of those studies on conditions or exposures with low mortality rates among working-age adults, specifically obesity [73, 78, 79], injuries [80], and smoking [81].

Variability in the ratio of HCA to FCA estimates can also depend in part upon whether long-term disability costs are considered. For conditions that severely restrict employment in working age adults, the HCA/FCA ratio may be as high for morbidity costs as for mortality costs. For example, an Australian study of productivity costs associated with coronary heart disease estimated the HCA/FCA ratio to be 113 for morbidity costs (dominated by early retirement) and 30 for mortality costs [82]. Likewise, early retirement from the work force among Dutch adults with multiple sclerosis accounted for 92% of HCA productivity costs; the HCA/FCA ratio for morbidity costs was 22 [61]. On the other hand, for conditions that either have high mortality rates, affect older populations, or infrequently prevent affected individuals from continuing to work, inclusion of long-term disability costs may have a more modest, but still important effect on the HCA/FCA cost ratio. For example, of the four studies in Table 1 that addressed back pain, the one that considered only short-term disability had a cost ratio in the range of 1.3–1.6 [72] whereas the other three studies had cost ratios of 3.1 [83], 5.6 [62], and 3.4–9.0 [84].

Another cause of variation across studies in the HCA/FCA cost ratio is the length of the friction period, which varies from 6 weeks to 6 months among studies in Table 1. Use of a relatively long friction period has the effect of minimizing the difference between FCA and HCA estimates of costs of short-term sick leave. Examining two studies of rheumatoid arthritis, one study that used a 58-day friction period reported a HCA to FCA ratio of 6.3 [85]. The other study, which used a 6-month friction period, reported a 1.5–1.6 ratio [71]. Two studies either varied the friction period based on individual reported sick days [86] or did not report a friction period [87].

Although the FCA does not explicitly consider the value of household production, the seminal FCA studies do suggest estimates of indirect costs should also estimate the imputed value of nonmarket production using data from time-use surveys and patient questionnaires. Thirteen of 80 full COI studies included estimates of nonmarket production (Table A1). This was generally reported as part of HCA estimates. Also, four of 15 partial COI studies included nonmarket production (Table A2).

Five of 38 studies in Table 1 reportedly included the value of nonmarket production in HCA estimates of productivity costs. One study that included nonmarket production in their reported total productivity losses did not report nonmarket production separately and it is unclear whether that was included just in the HCA estimates or also in the FCA estimates [80]. Another study did not actually attempt to measure nonmarket productivity but instead used gross domestic product (GDP) per capita as a proxy for total productivity [77]. Since nonmarket production is not counted in GDP, we have classified that study as not including nonmarket production. The remaining three studies, all of which included nonmarket production in the HCA estimates, reported moderately elevated HCA/FCA ratios, of 7.2 [86], 5.9–12 [88], and 9.8–16 [89].

4 Discussion

The wide disparity in estimates of relative productivity costs calculated using the FCA and HCA has several implications. First, there appears to be little standardization in the use of these methods among the observed studies. We cannot draw generalizations about the overall use of HCA methods in economic evaluations since we only included studies that used the HCA in comparison with the FCA. We can state that we observed little standardization across studies in the application of the FCA. Many studies that met our search criteria were excluded from Table 1 because we considered the FCA estimates to be problematic, as noted in the previous section.

A second implication is that the ratio of FCA to HCA productivity cost estimates can vary depending on the health conditions and patient age groups included in the study. For time-limited conditions such as acute illness or injury, FCA and HCA estimates are likely to be relatively similar, especially if analysts use a short time horizon. In contrast, COI or CEA studies involving conditions for which there is substantial mortality or permanent work disability among working age adults will generally yield much larger productivity cost estimates if they use the HCA. A study population dominated by people over 65 years of age will produce less of a disparity between the methods because there are fewer working years to measure as opposed to a study looking at younger adults. For example, a comparison of age-specific HCA and FCA estimates of productivity costs attributable to premature mortality from smoking in the USA calculated that HCA estimates were 15–20 times higher for deaths at working ages and only twice as high for adults ages ≥ 65 years [68]. That study included nonmarket as well as market production; studies that exclude nonmarket production calculate little or no productivity costs at older ages using either method [59]. Further, studies typically show less difference in productivity costs for women than men, due to the fact that more women stay out of the workforce to care for dependents, although studies that take into account household productivity reduce the gender disparity in productivity costs [39].

Analysts may choose to use either the HCA or the FCA, depending on whether they want a high or low cost estimate. For example, a societal perspective CEA study of rheumatoid arthritis treatments estimated an incremental cost-effectiveness ratio for therapy with infliximab versus prednisone of €22,000 per QALY using the HCA, which was considered “acceptable,” whereas using the FCA resulted in an estimated net cost of €131,000 per QALY, which was “too high” [25]. Payers may have an incentive to prefer the FCA, since its use could lead to fewer therapies being classified as cost-effective from the societal perspective, and conversely industry and advocates might prefer the use of the HCA.

Geographic differences in the use of the FCA in large part reflect national variations in health economic guidelines. Of the 80 full COI studies in our sample that used the FCA, 51 came from Canada, Germany, and the Netherlands, the three countries which as of 2012 had officially endorsed the FCA [29]. In particular, the largest number (n = 28) were from the Netherlands.Footnote 4 Even more starkly, a systematic review of economic evaluation studies using the FCA found that almost two-thirds (30 of 46) took place in the Netherlands, of which three were COI studies [27]. A systematic review of economic evaluations of treatments for depressive disorders found that five of six studies using the FCA were conducted in the Netherlands, compared with just one of 24 studies using the HCA; the remaining FCA study was published in Belgium [54].

In the Netherlands, the FCA is officially endorsed as the “best approximation of the real costs to society.”Footnote 5 A cross-national COI project on multiple sclerosis conducted in nine European countries noted, “this method of calculation (friction cost method) is advocated and mandatory in The Netherlands. We have used the human capital theory in this study, except for The Netherlands, where we have used both” [90]. Guidelines can change over time; whereas the official Canadian guideline of 1997 endorsed the HCA, the 2006 guideline recommended the FCA [91]. Similarly, a German guideline that endorsed the FCA on the grounds that “no full employment exists in industrialized countries” and “open positions can typically be refilled within a relatively short period of time” was subsequently published in 2008 [92].

Other European countries (Austria, Denmark, France, and Norway) have been reported to have unofficial pharmacoeconomic guidelines that affirm use of the FCA, alone or in combination with the HCA [93]. Nyman indicated that France is indifferent between methods and Austria prefers the HCA but accepts the FCA [29]. In general, European health economists may be sympathetic to the FCA because of the identification of the HCA with neoclassical economics: “Europeans, with relatively high unemployment rates and strong institutional forces affecting the labor market, are more likely to question the usefulness of neo-classical economic theory. Americans, with low unemployment rates and weak institutions, find the neo-classical model more useful” [94].

Our review of the use of the FCA in COI studies and the comparison of FCA to HCA estimates has limitations. One is that because we focused on the application of FCA methods in COI studies, our review is less informative on how FCA methods have been applied in CEA studies. Another limitation is that we did not consider the potential inclusion of productivity losses in other types of economic evaluations, e.g., cost–benefit analysis.

Our use of Google Scholar for automated full-text searches is both a limitation and a strength. One limitation is that searches of that type may be less replicable. Another is that the quality of publications in that database may be more heterogeneous. On the other hand, use of full-text searching allowed us to identify many more studies than found in a traditional structured systematic review. Kigozi et al. identified 15 COI studies that estimated productivity costs using the FCA published during 1996–2013 [27]; using full-text searching we found 51 COI studies published during the same period. The four additional years of data (2014 and 2017) in our search resulted in 32 additional publications using our search criteria, but no additional publications using the Kigozi et al. criteria applied to PubMed.

A final limitation relates to the FCA and HCA methods themselves. A large literature in health economics has discussed the conceptual limitations of those approaches. We suggest that alternatives warrant consideration. Ironically, perhaps the greatest limitation of the HCA is its lack of consistency with the neoclassical economic theory of human capital. With particular regard to HCA estimates of the present value of future productivity loss as a result of premature death, if gross earnings represent a return to a stock of human capital, it is logically correct to subtract the value of personal consumption that is required to maintain human capital in the long run [52]. An analogous approach has recently been proposed by the US Second Panel [16]. The Second Panel recommends the inclusion of the present value of both gains in economic productivity and future costs, both medical and nonmedical (net resources consumed), of individuals who survive longer as a result of a treatment. The combination of productivity costs and future costs is analogous to a net HCA. The details of how to operationalize either net HCA or the future costs approach of the Second Panel still need to be worked out.

A disadvantage of any new approach to COI or CEA methods is that it could render the results of studies less comparable to findings from studies using previously recommended methods. That same point applies more broadly to the Second Panel recommendation of a broader conceptualization of the societal perspective in CEA [95]. Comparability of estimates from multiple studies is essential for the synthesis of economic evidence. However, the lack of consensus on how to quantify productivity costs, and even lack of standardization of applications specific FCA and HCA methods has resulted in wide disparities in estimates of avoided indirect costs. That disparity has led some analysts to concentrate on estimates of direct medical costs, which are generally more comparable [15]. The disadvantage with that is that estimates restricted to medical costs underestimate the broader societal economic impact of conditions that are associated with disability as well as spillover effects on family members [16].

5 Conclusion

Information on productivity losses is crucial to fully estimate the economic burden of chronic conditions and help identify the necessary resources to support healthy aging [10]. The HCA has been used to evaluate productivity costs in the vast majority of published health economics studies, including more than 90% of COI studies. That is true of health economics studies conducted in most parts of the world, although a few countries (Canada, Germany, and the Netherlands) officially recommend use of the FCA in place of the HCA [29]. That remains the case despite criticisms of the HCA by advocates of the FCA, who allege overestimation of productivity losses by the HCA. Conversely, critics of the FCA argue that the assumption of a highly elastic labor supply may be unrealistic. That debate seems unlikely to be resolved.

Studies that apply the FCA typically produce considerably smaller estimates of productivity losses than studies using the HCA [8, 15]. Although we are skeptical of the FCA criticisms of the HCA, we recognize that HCA estimates have other limitations. On the one hand, traditional HCA estimates of mortality costs may overstate the loss to society of net human capital since they do not take into account the costs of maintaining the stock of human capital. On the other hand, HCA estimates of productivity costs that assign no monetary value to time outside of paid employment understate the magnitude of societal costs from ill health. Such studies implicitly devalue the lives of women and other groups that disproportionately engage in unpaid work on behalf of other people. Further, the exclusion of pain and suffering as well as spillover effects on the wellbeing of family members implies that productivity cost estimates, whether calculated using the HCA or FCA, underestimate the welfare costs of premature death and disability.

Notes

Personal communication, Peter Neumann, March 26, 2018.

CEA studies were excluded.

The review of partial COI studies was not similarly updated due to time constraints.

This number excludes one study that looked at the entire European Union, and another study examining 29 countries worldwide. Both of these studies included the Netherlands and Germany.

References

Mushkin SJ, Collings FD. Economic costs of disease and injury. Public Health Rep. 1959;74:795–809.

Weisbrod BA. Economics of Public Health. Philadelphia: University of Pennsylvania Press; 1961.

Rice DP. Estimating the cost of illness. Am J Publ Health. 1967;57(3):424–40.

Larg A, Moss JR. Cost-of-illness studies. Pharmacoeconomics. 2011;29(8):653–71.

Finkelstein E, Corso P. Cost-of-illness analyses for policy making: a cautionary tale of use and misuse. Expert Rev Pharmacoecon Outcomes Res. 2003;3(4):367–9.

Tarricone R. Cost-of-illness analysis: what room in health economics? Health Policy. 2006;77(1):51–63.

Olsen JA, Smith RD. Theory versus practice: a review of ‘willingness-to-pay’ in health and health care. Health Econ. 2001;10(1):39–52.

Krol M, Brouwer W. How to estimate productivity costs in economic evaluations. Pharmacoeconomics. 2014;32(4):335–44.

Onukwugha E, McRae J, Kravetz A, Varga S, Khairnar R, Mullins CD. Cost-of-illness studies: an updated review of current methods. Pharmacoeconomics. 2016;34(1):43–58.

Wang G, Grosse SD, Schooley MW. Conducting research on the economics of hypertension to improve cardiovascular health. Am J Prev Med. 2017;53(6 Suppl 2):S115–7.

Krol M, Papenburg J, Tan SS, Brouwer W, Hakkaart L. A noticeable difference? Productivity costs related to paid and unpaid work in economic evaluations on expensive drugs. Eur J Health Econ. 2016;17(4):391–402.

Gold MR, Siegel, Gold MR, Siegel JE. Cost-effectiveness in health and medicine, first edn. New York: Oxford Univ Press; 1996.

Segel JE. Cost-of-illness studies—a primer: RTI-UNC Center of Excellence in Health Promotion Economics; 2006.

Zhang W, Bansback N, Anis AH. Measuring and valuing productivity loss due to poor health: a critical review. Soc Sci Med. 2011;72(2):185–92.

Joensuu JT, Huoponen S, Aaltonen KJ, Konttinen YT, Nordstrom D, Blom M. The cost-effectiveness of biologics for the treatment of rheumatoid arthritis: a systematic review. PLoS ONE. 2015;10(3):e0119683.

Sanders GD, Neumann PJ, Basu A, Brock DW, Feeny D, Krahn M, et al. Recommendations for conduct, methodological practices, and reporting of cost-effectiveness analyses: second panel on cost-effectiveness in health and medicine. JAMA. 2016;316(10):1093–103.

Koopmanschap MA, Rutten FF. A practical guide for calculating indirect costs of disease. Pharmacoeconomics. 1996;10(5):460–6.

Koopmanschap MA, Rutten FF. The impact of indirect costs on outcomes of health care programs. Health Econ. 1994;3(6):385–93.

Koopmanschap MA, Rutten FF, van Ineveld BM, van Roijen L. The friction cost method for measuring indirect costs of disease. J Health Econ. 1995;14(2):171–89.

Koopmanschap MA, van Ineveld BM. Towards a new approach for estimating indirect costs of disease. Soc Sci Med. 1992;34(9):1005–10.

Liljas B. How to calculate indirect costs in economic evaluations. Pharmacoeconomics. 1998;13(1):1–7.

Birnbaum H. Friction-cost method as an alternative to the human-capital approach in calculating indirect costs. Pharmacoeconomics. 2005;23(2):103–5.

Van den Hout W. The value of productivity in health policy. Appl Health Econ Health Policy. 2015;13(4):311–3.

Brouwer WB, Koopmanschap MA, Rutten FF. Productivity costs measurement through quality of life? A response to the recommendation of the Washington Panel. Health Econ. 1997;6(3):253–9.

Van den Hout W. The value of productivity: human-capital versus friction-cost method. Ann Rheum Dis. 2010;69(Suppl 1):i89–91.

Johannesson M, Karlsson G. The friction cost method: a comment. J Health Econ. 1997;16(2):249–55 (discussion 57–9).

Kigozi J, Jowett S, Lewis M, Barton P, Coast J. Estimating productivity costs using the friction cost approach in practice: a systematic review. Eur J Health Econ. 2016;17(1):31–44.

Weinstein MC, Siegel JE, Garber AM, Lipscomb J, Luce BR, Manning WG, et al. Productivity costs, time costs and health-related quality of life: a response to the Erasmus Group. Health Econ. 1997;6(5):505–10.

Nyman JA. Productivity costs revisited: toward a new US policy. Health Econ. 2012;21(12):1387–401.

Johannesson M, Meltzer D. Some reflections on cost-effectiveness analysis. Health Econ. 1998;7(1):1–7.

Hanly P, Timmons A, Walsh PM, Sharp L. Breast and prostate cancer productivity costs: a comparison of the human capital approach and the friction cost approach. Value Health. 2012;15(3):429–36.

Hanly P, Soerjomataram I, Sharp L. Measuring the societal burden of cancer: the cost of lost productivity due to premature cancer-related mortality in Europe. Int J Cancer. 2015;136(4):E136–45.

Pearce AM, Hanly P, Timmons A, Walsh PM, O’Neill C, O’Sullivan E, et al. Productivity losses associated with head and neck cancer using the human capital and friction cost approaches. Appl Health Econ Health Policy. 2015;13(4):359–67.

Waitzman N, Scheffler RM, Romano PS. The cost of birth defects: estimates of the value of prevention. Lanham: University Press of America; 1996.

Tranmer JE, Guerriere DN, Ungar WJ, Coyte PC. Valuing patient and caregiver time: a review of the literature. Pharmacoeconomics. 2005;23(5):449–59.

Lamsal R, Zwicker JD. Economic evaluation of interventions for children with neurodevelopmental disorders: opportunities and challenges. Appl Health Econ Health Policy. 2017;15(6):763–72.

Max W, Rice DP, Sung H-Y, Michel M. Valuing human life: estimating the present value of lifetime earnings. UCSF: Center for Tobacco Control Research and Education. 2000. https://escholarship.org/uc/item/82d0550k.

Haddix AC, Teutsch SM, Corso PS. Prevention effectiveness: a guide to decision analysis and economic evaluation. 2nd ed. New York: Oxford University Press; 2003.

Grosse SD, Krueger KV, Mvundura M. Economic productivity by age and sex: 2007 estimates for the United States. Med Care. 2009:S94–S103.

Max WPD, Rice DP, Sung H-Y. Michel M. Valuing Human Life: Estimating the present value of lifetime earnings; 2000. p. 2004.

Becker GS. Investment in human capital: a theoretical analysis. J Polit Econ. 1962;70(5, Part 2):9–49.

Trogdon JG, Murphy LB, Khavjou OA, Li R, Maylahn CM, Tangka FK, et al. Costs of chronic diseases at the state level: the chronic disease cost calculator. Prev Chron Dis. 2015;03(12):E140.

Ekwueme DU, Yabroff KR, Guy GP Jr, Banegas MP, de Moor JS, Li C, et al. Medical costs and productivity losses of cancer survivors–United States, 2008–2011. MMWR Morb Mortal Wkly Rep. 2014;63(23):505–10.

Zheng Z, Yabroff KR, Guy GP, Jr., Han X, Li C, Banegas MP, et al. Annual medical expenditure and productivity loss among colorectal, female breast, and prostate cancer survivors in the United States. J Natl Cancer Inst. 2016;108(5):1–9.

Hoefman RJ, van Exel J, Brouwer W. How to include informal care in economic evaluations. Pharmacoeconomics. 2013;31(12):1105–19.

Van den Berg B, Brouwer W, van Exel J, Koopmanschap M, van den Bos GA, Rutten F. Economic valuation of informal care: lessons from the application of the opportunity costs and proxy good methods. Soc Sci Med. 2006;62(4):835–45.

Russell LB. Completing costs: patients’ time. Med Care. 2009;47(7_Supplement_1):S89–S93.

Weisbrod BA. The valuation of human capital. J Polit Econ. 1961;69(5):425–36.

Rice DP. Economic costs of cardiovascular diseases and cancer, 1962: US Department of Health, Education, and Welfare. Division of Community Health Services: Public Health Service; 1965.

Lofland JH, Locklear JC, Frick KD. Different approaches to valuing the lost productivity of patients with migraine. Pharmacoeconomics. 2001;19(9):917–25.

Lofland JH, Pizzi L, Frick KD. A review of health-related workplace productivity loss instruments. Pharmacoeconomics. 2004;22(3):165–84.

Grosse SD, Krueger KV. The income-based human capital valuation methods in public health economics used by forensic economics. J Forensic Econ. 2011;22(1):43–57.

Stone PW, Chapman RH, Sandberg EA, Liljas B, Neumann PJ. Measuring costs in cost-utility analyses. Int J Tech Assess Health Care. 2000;16(1):111–24.

Krol M, Papenburg J, Koopmanschap M, Brouwer W. Do productivity costs matter?: the impact of including productivity costs on the incremental costs of interventions targeted at depressive disorders. PharmacoEcon. 2011;29(7):601–19.

Zimovetz EA, Wolowacz SE, Classi PM, Birt J. Methodologies used in cost-effectiveness models for evaluating treatments in major depressive disorder: a systematic review. Cost Eff Resour Alloc. 2012;10(1):1.

Dewey HM, Thrift AG, Mihalopoulos C, Carter R, Macdonell RA, McNeil JJ, et al. Lifetime cost of stroke subtypes in Australia findings from the North East Melbourne Stroke Incidence Study (NEMESIS). Stroke. 2003;34(10):2502–7.

Saka Ö, McGuire A, Wolfe C. Cost of stroke in the United Kingdom. Age Ageing. 2009;38(1):27–32.

Van Eeden M, van Heugten C, van Mastrigt G, van Mierlo M, Visser-Meily J, Evers S. The burden of stroke in the Netherlands: estimating quality of life and costs for 1 year poststroke. BMJ Open. 2015;5(11):e008220.

Kang H-Y, Lim S-J, Suh HS, Liew D. Estimating the lifetime economic burden of stroke according to the age of onset in South Korea: a cost of illness study. BMC Public Health. 2011;11(1):646.

Murphy N, Confavreux C, Haas J, König N, Roullet E, Sailer M, et al. Economic evaluation of multiple sclerosis in the UK, Germany and France. Pharmacoeconomics. 1998;13(5):607–22.

Kobelt G, Berg J, Lindgren P. Costs and quality of life in multiple sclerosis in The Netherlands. Eur J Health Econ. 2006;7(2):55–64.

Wieser S, Horisberger B, Schmidhauser S, Eisenring C, Brügger U, Ruckstuhl A, et al. Cost of low back pain in Switzerland in 2005. Eur J Health Econ. 2011;12(5):455–67.

Lakic D, Tasic L, Kos M. Economic burden of cardiovascular diseases in Serbia. Vojnosanit Pregl. 2014;71(2):137–43.

Chang SM, Cho S-J, Jeon HJ, Hahm B-J, Lee HJ, Park J-I, et al. Economic burden of schizophrenia in South Korea. J Korean Med Sci. 2008;23(2):167–75.

Konnopka A, Bödemann M, König H-H. Health burden and costs of obesity and overweight in Germany. Eur J Health Econ. 2011;12(4):345–52.

Goeree R, Farahati F, Burke N, Blackhouse G, O’Reilly D, Pyne J, et al. The economic burden of schizophrenia in Canada in 2004. Curr Med Res Opin. 2005;21(12):2017–28.

Ehrnborg C, Hakkaart-Van Roijen L, Jonsson B, Rutten FF, Bengtsson B-Å, Rosen T. Cost of illness in adult patients with hypopituitarism. Pharmacoeconomics. 2000;17(6):621–8.

Menzin J, Marton JP, Menzin JA, Willke RJ, Woodward RM, Federico V. Lost productivity due to premature mortality in developed and emerging countries: an application to smoking cessation. BMC Med Res Methodol. 2012;12(1):1.

Raciborski F, Kłak A, Kwiatkowska B. Indirect costs of rheumatoid arthritis. Reumatologia. 2015;53(5):268–75.

de Kinderen RJ, Evers SM, Rinkens R, Postulart D, Vader CI, Majoie MH, et al. Side-effects of antiepileptic drugs: the economic burden. Seizure. 2014;23(3):184–90.

Eriksson JK, Johansson K, Askling J, Neovius M. Costs for hospital care, drugs and lost work days in incident and prevalent rheumatoid arthritis: how large, and how are they distributed? Ann Rheum Dis. 2015;74(4):648–54.

Becker A, Held H, Redaelli M, Strauch K, Chenot JF, Leonhardt C, et al. Low back pain in primary care: costs of care and prediction of future health care utilization. Spine. 2010;35(18):1714–20.

Dee A, Callinan A, Doherty E, O’Neill C, McVeigh T, Sweeney MR, et al. Overweight and obesity on the island of Ireland: an estimation of costs. BMJ Open. 2015;5(3):e006189.

Ortega-Ortega M, Oliva-Moreno J, de Dios Jiménez-Aguilera J, Romero-Aguilar A, Espigado-Tocino I. Productivity loss due to premature mortality caused by blood cancer: a study based on patients undergoing stem cell transplantation. Gac Sanit. 2015;29(3):178–83.

Oliva J, Lobo F, López-Bastida J, Zozaya N, Romay R. Indirect costs of cervical and breast cancers in Spain. Eur J Health Econ. 2005;6(4):309–13.

Luengo-Fernandez R, Leal J, Gray A, Sullivan R. Economic burden of cancer across the European Union: a population-based cost analysis. Lancet Oncol. 2013;14(12):1165–74.

Serrier H, Sultan-Taieb H, Luce D, Bejean S. Estimating the social cost of respiratory cancer cases attributable to occupational exposures in France. Eur J Health Econ. 2014;15(6):661–73.

Lal A, Moodie M, Ashton T, Siahpush M, Swinburn B. Health care and lost productivity costs of overweight and obesity in New Zealand. Aust N Z J Public Health. 2012;36(6):550–6.

Neovius K, Rehnberg C, Rasmussen F, Neovius M. Lifetime productivity losses associated with obesity status in early adulthood. Appl Health Econ Health Policy. 2012;10(5):309–17.

Van Beeck EF, van Roijen L, Mackenbach JP. Medical costs and economic production losses due to injuries in the Netherlands. J Trauma Acute Care Surg. 1997;42(6):1116–23.

Neubauer S, Welte R, Beiche A, Koenig H-H, Buesch K, Leidl R. Mortality, morbidity and costs attributable to smoking in Germany: update and a 10-year comparison. Tobacco Control. 2006;15(6):464–71.

Zheng H, Ehrlich F, Amin J. Productivity loss resulting from coronary heart disease in Australia. Appl Health Econ Health Policy. 2010;8(3):179–89.

Hutubessy RC, van Tulder MW, Vondeling H, Bouter LM. Indirect costs of back pain in the Netherlands: a comparison of the human capital method with the friction cost method. Pain. 1999;80(1–2):201–7.

Wenig CM, Schmidt CO, Kohlmann T, Schweikert B. Costs of back pain in Germany. Eur J Pain. 2009;13(3):280–6.

Ekwueme DU, Weniger BG, Chen RT. Model-based estimates of risks of disease transmission and economic costs of seven injection devices in sub-Saharan Africa. Bull World Health Organ. 2002;80(11):859–70.

Fautrel B, Clarke AE, Guillemin F, Adam V, St-Pierre Y, Panaritis T, et al. Costs of rheumatoid arthritis: new estimates from the human capital method and comparison to the willingness-to-pay method. Med Dec Making. 2007;27(2):138–50.

Potapchik E, Popovich L. Social cost of substance abuse in Russia. Value Health Reg Issues. 2014;4:1–5.

Panopalis P, Petri M, Manzi S, Isenberg DA, Gordon C, Jl Senécal, et al. The systemic lupus erythematosus Tri-Nation study: cumulative indirect costs. Arthritis Care Res. 2007;57(1):64–70.

Boonen A, van der Heijde D, Landewe R, Spoorenberg A, Schouten H, Rutten-van Molken M, et al. Work status and productivity costs due to ankylosing spondylitis: comparison of three European countries. Ann Rheum Dis. 2002;61(5):429–37.

Kobelt G, Berg J, Lindgren P, Jonsson B. Costs and quality of life in multiple sclerosis in Europe: method of assessment and analysis. Eur J Health Econ. 2006;7(Suppl 2):S5–13.

Lim ME, Bowen JM, O’reilly D, McCarron CE, Blackhouse G, Hopkins R, et al. Impact of the 1997 Canadian guidelines on the conduct of Canadian-based economic evaluations in the published literature. Value Health. 2010;13(2):328–34.

von der Schulenburg J-MG, Greiner W, Jost F, Klusen N, Kubin M, Leidl R, et al. German recommendations on health economic evaluation: third and updated version of the Hanover Consensus. Value Health. 2008;11(4):539–44.

Knies S, Severens JL, Ament AJ, Evers SM. The transferability of valuing lost productivity across jurisdictions. Differences between national pharmacoeconomic guidelines. Value Health. 2010;13(5):519–27.

Marcotte DE, Wilcox-Gok V. Estimating the employment and earnings costs of mental illness: recent developments in the United States. Soc Sci Med. 2001;53(1):21–7.

Carias C, Chesson HW, Grosse SD, Li R, Meltzer MI, Miller GF, et al. Recommendations of the second panel on cost effectiveness in health and medicine: a reference, not a rule book. Am J Prev Med. 2018;54(4):600–2.

Achelrod D, Blankart CR, Linder R, von Kodolitsch Y, Stargardt T. The economic impact of Marfan syndrome: a non-experimental, retrospective, population-based matched cohort study. Orphanet J Rare Dis. 2014;9(1):1.

Balogh O, Brodszky V, Gulácsi L, Herédi E, Herszényi K, Jókai H, et al. Cost-of-illness in patients with moderate to severe psoriasis: a cross-sectional survey in Hungarian dermatological centres. Eur J Health Econ. 2014;15(1):101–9.

Boonen A, Brinkhuizen T, Landewe R, van der Heijde D, Severens JL. Impact of ankylosing spondylitis on sick leave, presenteeism and unpaid productivity, and estimation of the societal cost. Ann Rheum Dis. 2010;69(6):1123–8.

Borghouts JA, Koes BW, Vondeling H, Bouter LM. Cost-of-illness of neck pain in The Netherlands in 1996. Pain. 1999;80(3):629–36.

Huscher D, Mittendorf T, von Hinüber U, Kötter I, Hoese G, Pfäfflin A, et al. Evolution of cost structures in rheumatoid arthritis over the past decade. Ann Rheum Dis. 2015;74(4):738–45.

Huscher D, Merkesdal S, Thiele K, Zeidler H, Schneider M, Zink A. Cost of illness in rheumatoid arthritis, ankylosing spondylitis, psoriatic arthritis and systemic lupus erythematosus in Germany. Ann Rheum Dis. 2006;65(9):1175–83.

Kaitelidou D, Ziroyanis PN, Maniadakis N, Liaropoulos LL. Economic evaluation of hemodialysis: implications for technology assessment in Greece. Int J Tech Assess Health Care. 2005;21(1):40–6.

Kanters TA, Hagemans ML, van der Beek NA, Rutten FF, van der Ploeg AT, Hakkaart L. Burden of illness of Pompe disease in patients only receiving supportive care. J Inherit Metab Dis. 2011;34(5):1045–52.

Michael MD, Bálint A, Lovász BD, Gulácsi L, Strbák B, Golovics PA, et al. Work disability and productivity loss in patients with inflammatory bowel diseases in Hungary in the era of biologics. Eur J Health Econ. 2014;15(1):121–8.

Minden K, Niewerth M, Listing J, Biedermann T, Schöntube M, Zink A. Burden and cost of illness in patients with juvenile idiopathic arthritis. Ann Rheum Dis. 2004;63(7):836–42.

Ponto KA, Merkesdal S, Hommel G, Pitz S, Pfeiffer N, Kahaly GJ. Public health relevance of Graves’ orbitopathy. J Clin Endocrinol Metab. 2013;98(1):145–52.

van den Wijngaard C, Hofhuis A, Wong A, Harms MG, de Wit GA, Lugnér AK, et al. The cost of Lyme borreliosis. Eur J Pub Health. 2017;27(3):538–47.

Virta L, Joranger P, Brox JI, Eriksson R. Costs of shoulder pain and resource use in primary health care: a cost-of-illness study in Sweden. BMC Musculoskelet Disord. 2012;13:17.

Wacker M, Jörres R, Schulz H, Heinrich J, Karrasch S, Karch A, et al. Direct and indirect costs of COPD and its comorbidities: results from the German COSYCONET study. Respir Med. 2016;111:39–46.

Acknowledgements

The authors thank Anirban Basu and Don Husereau along with two anonymous reviewers for comments on previous versions. The findings and conclusions in this report are those of the authors and do not necessarily represent the official position of the Centers for Disease Control and Prevention.

Author information

Authors and Affiliations

Contributions

J. Pike conducted the literature reviews and extracted the data necessary for analysis. J. Pike wrote the initial manuscript. S. Grosse initiated the project idea. S. Grosse and J. Pike performed numerous quality assurance checks on the data extraction, researched the literature, performed analyses on the data, and edited multiple versions of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

J. Pike and S. Grosse declare that they have no conflicts of interest. No funding/support was used for this study. There are no financial disclosures or conflicts of interests.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Pike, J., Grosse, S.D. Friction Cost Estimates of Productivity Costs in Cost-of-Illness Studies in Comparison with Human Capital Estimates: A Review. Appl Health Econ Health Policy 16, 765–778 (2018). https://doi.org/10.1007/s40258-018-0416-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40258-018-0416-4