Abstract

There are two competing views of mineral depletion, described as the fixed stock paradigm and the opportunity cost paradigm. Under the opportunity cost paradigm, mineral depletion is deemed essentially a matter of economics and availability a function of price. Long-term trends in real mineral prices suggest few problems of availability. The paper, however, argues that some of the factors that have kept prices down historically, notably economies of scale, low-cost energy and the opening out of new mineral provinces, may be losing their force, and even going into reverse. It also poses the question whether what is in the ground is the real issue anyway or whether in fact the ultimate constraint on minerals availability lies in the capacity of the planet to absorb the environmental by-products of mineral exploitation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The issue of depletion is a recurring theme in the history of mineral production. This is unsurprising given the non-renewable nature of the product being recovered. Nonetheless, the degree of interest in the matter does have a tendency to ebb and flow with the price cycle. The commodity booms of the 1960s and 1970s helped stimulate a fierce debate on the subject, a debate perhaps best remembered now by the controversy surrounding the landmark study, The Limits to Growth. (Meadows et al. 1974) The more recent commodities boom, that of the 2000s, had a similar effect, prompting concerns amongst mineral-consuming nations about the long-term availability of certain economically important minerals and encouraging claims that the production of hard mineral commodities, might, like oil, be approaching some sort of ‘peak’. Given that this more recent boom was believed to be substantially the result of rapidly expanding demand for minerals from emerging market economies—a process that it must be assumed still has some way to run—it is reasonable to ask the question whether the remaining mineral resources are going to be adequate to support a population of around 9 billion people in the year 2050.

The article starts with a discussion of two competing theories of depletion. Using the preferred theory, it then considers the empirical evidence about long-run mineral availability and some of the limitations of this evidence. It is suggested that there is reason to believe that the historical experience may not represent a reliable guide to the future. In the final section, the question is posed as to whether, in focussing on resource depletion as means to gain an understanding of future mineral availability, we are actually focussed on the right issue. It may just turn out that the ultimate constraint on mineral resource development is not the availability of resources in the ground but the capacity of the planet to absorb the environmental by-products of their exploitation, or at least the willingness of the population to tolerate the associated costs. Throughout, the discussion is on hard minerals and particularly metals.

Two views of depletion

There are broadly two ways of thinking about depletion: the fixed stock paradigm and the opportunity cost paradigm (Tilton 2003, 2006).

As the label implies, under the fixed paradigm mineral resources are deemed to be a fixed stock. Adherents start out from the observation that the earth is finite, and there must therefore be a fixed amount of minerals. As these minerals are mined, so what remains diminishes, and one day the stock is used up. Some sense of when this might happen can be obtained by comparing the stock with the yearly draw on the stock (the flow).

Although this may appear something of a caricature, one frequently encounters examples of this sort of thinking. It is essentially the thinking behind ‘peak’ minerals, the idea that constraints imposed by the physical availability of minerals will inevitably result in mineral production reaching a peak and then declining. The idea was originally advanced by M. King Hubberd in relation to oil, but it has more recently come to be applied to hard minerals, too. One recent study found that out of 57 mineral commodities tested, 11 showed clear signs of having already experienced production peaks. These included lead, potash, phosphate rock and zirconium (Bardi and Pagani 2007). The analysis was conducted, it should be noted, without any explicit reference to price effects.

The same sort of thinking is also implicit in the notion of a ‘static life index’. It is not uncommon in the literature on resources to find tables in which data on reserves or resources have been divided through by annual production to give an indication of remaining life expectancy. In Table 1, which is based on reserves data from the US Geological Survey, it can be seen that such an exercise can result in reserve life expectancies of anything from a couple of decades to several hundred years.

This approach has some fundamental, and fairly obvious, shortcomings. For a start, the computation of ‘reserves life’ takes no account of the fact that many mineral commodities can be recycled, or that, in their uses, they can be substituted for, or rendered unnecessary, by technological change. Considering resources data, as opposed to the reserves data shown in Table 1, life expectancies for some commodities can be so long as to be meaningless. There is also the awkward fact that the cost of producing a commodity would naturally rise to ensure rationing and conservation long before it was exhausted physically.

Finally, and most fundamentally, reserves and resources are dynamic concepts. The stock of minerals that they represent is a function of advancing knowledge about geology, the technologies that are available for the recovery of useful products from them, and the price people are prepared to pay for them. The evidence of history is that reserves grow apace with production, which is to say mineral reserves are being proven up as fast as they are being used. There is some logic in this. Mining and exploration companies will generally only prove up reserves for which they can foresee a practical use. Accordingly, the life expectancy of most minerals has remained broadly unchanged over the 60 or so years for which we have data (Fig. 1).

Metal reserves life, 1940s to present. Values have been taken towards the end of the decade indicated. Data for 1980s and 1990s are ‘reserves base’ data. Source: USGS (various)

This same process can, incidentally, be observed at work at an individual mine level, too. Table 2 shows the reserves of the former Rio Tinto mine, Palabora Copper, in the Northern Transvaal, South Africa, when it was started up in 1966. The second column shows the reserves as of 2003, a time when operations were being transferred underground to recover ore from beneath the original open pit. Over the intervening period, the amount of copper expected to be recovered from the mine during its life had grown three and a half times, this as a result of improved knowledge of the geology and improved work practices, which permitted the working of lower ore grades. This is by no means unusual. Another Rio Tinto mine, Bingham Canyon in the state of Utah, the largest copper mine in the USA, has been worked for over 100 years, and the company is still finding new reserves there.

The second way of thinking about depletion is termed the opportunity cost paradigm. Under this, the availability of mineral commodities is assessed not in absolute terms but in terms of the sacrifice that society must make for more of a mineral commodity. In a market economy, we measure this with price. What we spend on one product is not available to us to spend on another, and what we spend on our chosen product is not available to be spent on anything else.

Under the opportunity cost paradigm, depletion is deemed an economic concept rather than a geological one and minerals’ availability a function of costs and prices. It can be represented schematically as a cumulative availability curve (CAC), a plot of total quantity of mineral available at various prices over time (Fig. 2). Such curves may be used to describe how the exploitation of a mineral typically starts with the lower cost (higher grade) materials, which are relatively limited in nature (point PQ). As demand rises (from D to D 1) and these resources are worked off, so costs and prices increase (to P 1). As it does so, so the amount of material available at these prices also substantially increases (to Q 1).

The problem with this representation is that we do not have the data that would allow us to draw up such a chart on any sort of reliable basis, to convert, in effect, a conceptual CAC into a meaningful quantified long-run supply curve. We only have short run supply curves to work with, and these capture only a small part of the total available resource. Moreover, we cannot be sure that the long-run supply curve does not suffer from significant discontinuities and inconsistencies. Tilton, for example, citing Skinner, points out that the cost of producing copper would rise dramatically were we ever to reach the point where we needed to recover copper from silicates rather than from sulphides or oxides (Tilton 2003, 2006). Nor can it necessarily be presumed that the highest grade and lower cost deposits always get to be worked first. Uranium production in the 1940s and 1950s came from high-cost resources that became uneconomic with subsequent lower cost discoveries.

Notwithstanding these limitations, the cumulative supply curve remains a useful way to think about resources longer term. It does, however, need to be recognised that the curve has a tendency to move around; to flex up and down. With the development of new technologies, lower grades of ore and different types of deposits become amenable to exploitation, and the availability of mineral at any particular price point increases. At the same time, there is a raft of factors that can push the curve higher, including increased input costs such as energy, labour or royalties, diminishing the availability of mineral at any given price point. There are also factors that are difficult to incorporate into this model of depletion but which nonetheless may be extremely important to mineral availability in the shorter term. Notable amongst these is the matter of access to resources which are known to exist, which may be governed by political restrictions or environmental regulation, a point discussed later.

Empirical evidence

In spite of its shortcomings, the opportunity cost paradigm still provides the most meaningful basis for the evaluation of depletion. With price serving as the key indicator of availability, the issue is distilled down to a race between the price-increasing effects of depleting the better quality resources and the price-reducing effects of technology and innovation.

The beauty of this approach is that it allows us to test empirically who is winning the race and whether resources are becoming scarcer or more abundant with time. If prices are declining over time, then this provides prima facie evidence that a commodity is becoming more abundant. If they are rising, then this would suggest that the commodity is becoming scarcer.

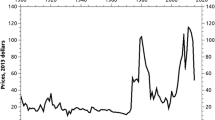

A lot of work has been done by researchers on this over the years, and while outcomes inevitably differ according to commodity, time period and the price deflator used, there is little evidence suggesting that mineral commodity prices in real constant dollar terms have risen over time. Figure 3 shows the prices of some major metals since 1900. Although the experience naturally varies between metals, the general tendency in prices between 1900 and 2000 is, if anything, downwards, substantially so in the case of aluminium. As regards the upturn in prices since 2000, whether this is simply a rather large cycle or whether it heralds something of longer term significance is the subject of much debate and a matter we will come back to.

Real metal prices since 1900. Note on sources: Price data for recent years are from the London Metal Exchange; from earlier years from Schmitz (1979). Price deflator from 1929 onwards is US GDP deflator from US Bureau of Economic Analysis; CPI for earlier years

The application of the opportunity cost paradigm to the matter of mineral depletion suggests that scarcity is not inevitable and has not hitherto been much of a problem. The evidence is that availability can increase over time and in fact appears to have done so in the past for many mineral products. The threat we face, if such there is, comes not from physical depletion but from higher costs and prices, which could curtail demand. The effects of depletion, which expresses itself in this way (i.e. through higher prices), will, however, likely be gradual, allowing time for society to respond and adjust.

Drivers of the trend

Using the opportunity cost paradigm as the basis for our thinking, history would suggest that we would not appear to have much of a problem. Despite the inevitable ups and downs of the market, the evidence is that advances of technology have enabled mankind to offset the effects of depletion and to keep real costs and prices on a level or declining trend. That this will always remain the case is the view of technological optimists such as Julian Simon (1981), and, based on the available history, it is hard to say they are wrong.

The past provides few examples of commodities which have faced inexorable increases in costs and prices. The mining industry is well organised to respond to shortages and to bring on new supply, albeit with delays—sometimes long ones—since this is a highly capital intensive industry. Equity-funded exploration companies are highly incentivised to go out and find new resources, and there are financial markets that specialise in providing finance to these companies. Meanwhile, larger companies look for deposits where they can bring their development and operational capabilities to bear. In response to the recent boom in mineral commodity prices, the industry has been investing at record levels, as Fig. 4 shows. Note that this figure covers capital expenditure (excluding exploration) on nonferrous and precious metal projects by publicly quoted mining companies. If investment in iron ore, coal, diamonds and uranium is added in, the total spend is likely roughly to double.

With regard to some of the minerals deemed by the governments of mineral-consuming countries to be ‘critical’, activity has been frenetic. There are said to be over 400 rare earth projects undergoing evaluation, involving 280 companies in 40 countries (Kingsnorth 2012). There are over 100 lithium projects undergoing evaluation, even if one can be fairly certain that the vast majority of these will never achieve production (Mining Journal 2011).

Moreover, the industry has been enormously successful over very many years in increasing productivity and driving down costs through a whole variety of means: bigger and better machinery, improvements in extraction and process technologies, the adoption of better work practices and the application of information and communication technologies.

To the extent that mineral supply is too slow to respond to increases in demand and prices are temporarily forced upwards, then this can provide the market with an automatic stabiliser and help stretch out available resources. Price rises incentivise increased efficiency of mineral use amongst consuming industries and encourage the search for cheaper substitutes. Some of the reduction in demand resulting from this may reverse when supply increases and prices come back down, but efficiency improvements underpinned by technological development are likely to prove longer lasting or even permanent. Quite probably such incremental improvement in materials’ use and the dampening effects on mineral demand have been an important factor historically in helping to forestall adverse developments on the supply side.

These tendencies may continue, and many are of the view that they will. The technological optimists have a lot of good arguments, and a lot of history, on their side. However, there are one or two reasons for believing that the trends of the past may not necessarily be a sound guide to the future. Or to put in another way, it is just possible that some of the factors that have driven costs and prices down in the past may be losing their force. If this suggestion proves to be well founded, then it raises the question as to whether the upsurge of prices at the beginning of this century shown in Fig. 3 is necessarily wholly cyclical and therefore reversible.

The limitations of history

Three of the key factors driving down costs and prices in the past have been economies of scale, cheap energy and the opening out of large new mineral provinces. Note than many of the examples here relate to copper albeit that the implications of the analysis are believed to have wider relevance.

Let us starting with economies of scale. Unquestionably, one of the principal drivers of lower costs in mining over the past century has been economies of scale. As mines have got steadily bigger, so miners have been able to deploy bigger equipment and to spread their fixed costs over a larger output. This has enabled them to offset, and indeed sometimes more than offset, the effects of declining ore grades. Figure 5 shows the effect at work in copper production. Back at the start of this figure, in 1970, only 20 % of global copper production came from mines having a mill throughput of 10 million tonnes a year or more. By 2000, this share had risen to 80 %. (Humphreys 2001) Why this is important is illustrated by Fig. 6, which shows how unit costs of production at the mill varied with mine size in 2011, at the time Fig. 5 was produced.

Copper production by mine size, in million tonnes ore/year. Source: Humphreys (2001)

It seems unlikely that these trends will persist into the future. The scale of mines is dictated by the scale of the ore bodies, and we are simply not finding bigger and bigger ore bodies. Indeed, there is some evidence that newly discovered ore bodies are getting smaller as well as lower in grade, as Fig. 7, based on work by SNL Metals Economics Group, suggests.

Copper discoveries: ore body grade and size. Source: Chender (2012)

In addition, we may be seeing diminishing returns with respect to the equipment, which can be used in mining. As Fig. 8 shows, in the 1960s, the largest trucks in use in the mining industry had a carrying capacity of 27 tonnes. By the late 1990s, the biggest trucks had a carrying capacity of 310 tonnes, an 11-fold increase. It is hard to believe that the next 30 years will bring another 11-fold increase in truck size. The same observation might be applied to other forms of mineral transportation, which have seen dramatic improvements in recent years, including rail haulage capacity and dry bulk shipping for iron ore and coal.

Energy is a second factor. Mining and mineral processing are highly energy-intensive processes, and energy is a material element of costs, accounting for between 15 and 30 % of cash operating costs for metal production. For the 100 years leading up to the 1970s, energy prices, as represented by oil, declined. Although the commodity boom of the 1970s saw them spike upwards, they declined again during the 1980s and 1990s. This was important to the direct costs of mining. However, it was also important indirectly, too, since lower energy costs encouraged increased mechanisation and contributed to capital-labour substitution, thus incidentally further reinforcing the benefits of economies of scale. Going into the twenty-first century, the direction of energy prices is rather uncertain although it seems unlikely that they are destined to trend downwards. While US shale gas may currently be bucking the trend, oil and coal have been subject to many of the same sorts of upwards cost pressures that the production of metals has been experiencing as well potentially as having to deal with rising costs of emission controls.

The third factor concerns what is described here as ‘new mineral provinces’. The downward trend in mining costs has been associated with, and facilitated by, the opening up of major mineral-rich areas. The downwards trend in iron ore prices was boosted by the opening up of the vast iron ore deposits of the Pilbara region of Western Australia in the 1960s and by those of the Amazon Basin in Brazil in the 1980s. Downwards pressure on copper prices was doubtless created by the opening up of large new deposits to investors in Chile, Peru and Indonesia in the 1980s and 1990s.

While it cannot be said that there are no major new provinces to be opened up, it is notable that through the last great boom no major new provinces were identified, despite a huge increase in exploration. No one is turning up monsters, which look like they have the capacity to give costs a large step down. In fact, there is some evidence that mine lives are shortening. Just possibly, the better resources have already been found. Data on exploration strike rates complied by Minex Consulting show that the amount of ore discovered per dollar of exploration spend has declined dramatically. (Fig. 9)

Moreover, the available evidence suggests that the new generation of mines is more costly to develop than those in previous eras. The remaining large ore bodies that we know about tend to be in remote areas and thus to require substantial spending on infrastructure. Some of the existing big mines are, as the next phase in their development, going to have to switch from open cast to underground mining, an inherently higher cost form of mining. For years, the mining industry used as a rule of thumb that a copper mine would cost around US$5,000 a tonne of annual capacity, with the most expensive coming in at around US$7,500. As Fig. 10 shows, the capital costs of the current generation of large copper mines tend to be in the range of US$10,000–20,000/tonne.

Related to this matter of rising capital costs of mines is the matter of political risk. Not only can the management of political risk add significantly to the capital and financing costs of new mines, but in some cases, it can result in the effective sterilisation of high quality reserves. Radetzki has argued that the high oil prices of recent years are more convincingly explained by political interference in the processes of investment than by the production and export constraints imposed by OPEC (Radetzki 2012). It is just possible that something similar is happening with mining.

As a result of the long boom in mineral prices starting 2004, the governments of many mineral-rich countries have been adopting a more assertive attitude towards the mining industry, an assertiveness commonly encapsulated in the notion of resource nationalism. This takes many forms, ranging from increasing taxes and royalties, imposing restrictions on foreign ownership of mining assets, requiring investors to undertake processing domestically as a condition of their licence to operate and, at the extreme, the nationalisation or indigenisation of mining enterprises. Such measures clearly have the capacity to inhibit the flow of investment to the best available resources and thus constitute a potential upward pressure on mineral prices. What we may be looking at here, in effect, is a reversal of the opening out of countries to inward mineral investment experienced through the 1980s and 1990s. It may be a difficult variable to incorporate into economists’ models of depletion but that does not make it less important in the real world.

Of course it is likely that part of what is going on here is cyclical. The capital costs of building a mine obviously rise when there is intense competition for construction services and equipment, as there has been in recent times. The technological optimists will no doubt argue that they will fall back in due course, just as they will argue that the steep rise in mineral prices over the last decade, noted earlier, will wholly reverse in time. A similar case might also be made with regard to resource nationalism. As commodity price weaken cyclically, so government interest in the sector will wither, as it did, for example, in the 1980s in the wake of the last great commodity boom. Some observers talk of a ‘pendulum’ effect.

It is, however, just possible that something has happened to the underlying economics of the industry in the past few years, which has longer lasting implications. We may be more deeply into the depletion of our resources that we had previously thought. It may also be that the resource nationalism of recent year is rooted in some far-reaching structural changes in the industry, which will not be so quickly dissipated. The pendulum may not swing back (Humphreys 2012). This does not mean we face running out of minerals, but it may mean that the upwards pressure on mineral costs is increasing and that we may therefore have to pay more for them in future.

Asking the right question

There is another issue to address and that is the rather fundamental matter of whether—in looking at depletion and resource availability in the terms in which they have been discussed above—we are asking the right question.

Mankind has historically—and understandably—been preoccupied with a fear of scarcity. Concerns about depletion fit this pattern. But what if the real constraints on resource development do not actually lie in what is in the ground, or in our ability to recover minerals cost effectively, but actually lie in the capacity of the planet to absorb the environmental side effects of mining and of the consumption of goods that use mined products? This is a rather big question, too big to address satisfactorily here. It nonetheless deserves a brief airing.

In addition to their obvious impact on resources in the ground, mining activities also have impacts on land use, on water and on the air.

Land use has historically been the most obvious way in which mining has been thought to impact the environment. Mining has intense local effects on the landscape, which is why it is not always popular and why it is heavily regulated. Mining often generates large quantities of solid waste, as rock is removed to get at the mineral-containing ores and as the mineral in the ore is concentrated into a marketable product.

Table 3 shows the amount of solid material generated per tonne of metal produced. (The data relate to ‘cradle-to-gate’ only, not the metal’s full life cycle.) For iron, the ore of which comes out of the ground with an iron content of anything from 30 to 60 %, the amount of solid waste is relatively modest. But in cases where the ore contains less that 1 % useful recoverable metal, as is typically the case with nickel laterites, then the waste can be very large.

Although there are many parts of the world where people welcome mining, and are prepared to put up with these impacts because of the development opportunities mining brings with it, there are equally high-income parts of the world where people do not feel the cost of having to look at mines and to deal with their waste is one worth paying. This has long been the case in Europe and Japan and is increasingly the case in the USA. In these areas, there is simply too much competition from other land uses. There will likely be opposition to mines, too, near towns, while remote areas often have wilderness properties that people want to see preserved.

Mining and metal production use water at every stage of the production process. Water use is especially heavy at the stage of mineral processing where ores are transformed into concentrates. Coal washing is also very heavy on water. Indicative rates of water use in mining reveal that water use is closely related to the grade of ore mind. With the qualification that water use can vary enormously from project to project, it has been estimated that average water use for copper production is around 172 kL(000 L)/tonne; for gold, 716 kL/kg; for nickel (sulphide), 107 KL/tonne; and for uranium (U3O8), 505 kL/tonne (Mudd 2008) (1,000 L of water is equivalent to 1 tonne).

Over the years, the industry has become much more efficient in its use, and reuse, of water, and for certain processes has been able to employ seawater. It is nonetheless the case that some of the most mineral-rich areas suffer water scarcity. This may inhibit development completely or add significantly to costs. Northern Chile, a major copper producing area, is one of the driest places on earth. Western Australia, the largest iron ore producing area in the world, is also water short. So is northern China, where much of the country’s coal is produced. Waste water from mining can also be problematic. Acidified water from sulphur-containing ore bodies can leach into the ground water and into adjacent river systems if not carefully managed. Waste water from mineral processing has to be stored in special dams until the solids in it settle out. Such dams cannot be constructed in built-up areas or in areas subject to seismic activity.

Then there is the matter of airborne emissions. As already noted, metal production is a highly energy-intensive affair. The energy intensity of metals ranges from a relatively modest 23 GJ/tonne of metal produced in the case of steel to over 211 GJ in the case of aluminium (Table 3), and with energy use come carbon emissions. In some cases, carbon emissions also arise in metal production where carbon is used as a reductant (i.e. a means of removing the unwanted oxygen from the mineral lattice). It is striking in Table 3 to note just how many tonnes of carbon dioxide are produced as a by-product of metal production; just over 2 in the case of steel, between 4 and 6 in the case of copper subject to the technology used, and over 20 in the case of aluminium. (Although, it should be noted, the electrical power in this table is assumed to come from the burning of hard coal, which may not always be the case in practice.) As metal ore grades trend lower with depletion, so more energy is required to be input to recover the metal.

Complicating matters further is the fact that different resource systems interact and are in competition with each other. Last year, the Transatlantic Academy published a report addressing precisely this issue. Figure 11 is taken from that report. The continuous lines on the chart are inputs to one resource system from another; the broken lines are possible substitutes.

The Resource Nexus. All resource systems are interconnected. Source: Andrews-Speed et al. (2012)

Land is a key input to mining, but then so is it to all other resource systems, with which it is therefore required to compete. Pressure on land use for the disposal of consumer waste (landfill) may feed back into the demand for minerals by encouraging reuse and recycling, thereby reducing the call on primary mineral production and energy use. Water is an increasingly stressed resource, and mining will have to compete with food production and domestic usage for the supplies it needs. Clean water can of course be recovered from the oceans but only at the cost of more energy. Because of its energy intensity, development trends in energy production and use clearly have important implications for the future of mineral production. So also will policy initiatives relating to climate change. Then, of course, mining is an important source of energy minerals, notably coal and uranium. Mining is also an important source of minerals for agriculture, notably potash and phosphates.

Less and less are we able to talk about the different types of resources in isolation from one another because of these interconnections, and less and less can policies to manage these resources be drawn up without regard to these interconnections. Arguably, this was always the case, but a number of factors render the matter today more pressing and complex than in the past, notably, the scale and rate of ecological change and the emergence of new global players with political weight and ambitious resource-hungry middle classes. Within this context, it seems entirely possible that rising costs from environmental pressures will be increasingly important to mineral production costs, and thus to mineral availability, in the future.

Concluding remarks

To return to the question posed at the start of the paper. Are we going to be able to provide sufficient affordable metals and minerals to support a population of 9 billion people with rising living standards?

In principle, it should be possible, although very probably they will have to pay more for their minerals than they have been required to pay in the past. The minerals are there in the ground, the technologies exist to recover them, the mining industry is organised to develop and manage the projects required and the financial world is perfectly capable of providing the funding. What is less clear is society’s tolerance for the environmental impacts of the increase in mineral production that this effort will entail and the price that society will demand for mitigating these impacts. It is arguably the case that the pressures arising in other resource systems such as water and food will prove bigger challenges for the world than the deteriorating quality of minerals in the ground, but we have very little sense about how the effects of stress in these other resource system will spill over into the minerals domain. However, it does increasingly appear to be the case, as the CEO of BP was recently quoted as saying that ‘the challenges [we face] lie more above the ground than beneath it’ (Dudley 2012). It is thus perhaps towards these issues, rather than the question of whether the world is running out of minerals, that researchers and policy-makers, along with the mining industry, should be directing more of their attention.

References

Andrews-Speed P et al (2012) The global resource nexus: the struggles for land, energy, food, water, and minerals. Transatlantic Academy. http://www.transatlanticacademy.org/publications

Bardi U, Pagani M (2007) Peak minerals. The oil drum: Europe. Posted 15 October 2007. http://Europe.theoildrum.com/node/3086

Chender M (2012) What does the next generation of opportunities look like? SNL Metals Economics Group. Presentation to Mines & Money, London, December 2012

Dudley R (2012), quoted in The Times, 14 June 2012

Humphreys D (2001) Sustainable development: can the mining industry afford it? Resources Policy 27

Humphreys D (2012) Transatlantic mining corporations in the age of resource nationalism. Transatlantic Academy, Washington DC. http://www.transatlanticacademy.org/publications

Kingsnorth DJ (2012) Critical minerals supply security: rare earths. Royal Institute of International Affairs, London, 24 June 2012

Meadows DL et al (1974) The limits to growth: a report for The Club of Rome’s Project on the Predicament of Mankind, Pan Books

Mining Journal (2011) Answering the call. Lithium focus. Mining Journal, 1 July 2011

Mudd GM (2008) Sustainability reporting and water resources: a preliminary assessment of embodied water and sustainable mining. Monash University, Melbourne

Norgate TE et al (2007) Assessing the environmental impact of metal production processes. J Clean Prod 15:838–848

Radetzki M (2012) Politics—not OPEC interventions—explain oil’s extraordinary price history. Energy Policy 46:382–385

Simon JL (1981) The ultimate resource. Princeton University Press, Princeton

Schmitz C (1979) World non-ferrous metal production and prices (1700–1976), Frank Cass & Co., London

Tilton JE (2003) On borrowed time? Resources for the Future, Washington

Tilton JE (2006) Depletion and the long-run availability of mineral commodities. Society of Economic Geologists 12

USGS (2012) Mineral commodity summaries 2012. US Geological Survey

USGS (various) Mineral commodity summaries and minerals yearbook, various editions

Acknowledgements

The author would like to acknowledge the helpful remarks made by two anonymous reviewers.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Humphreys, D. Long-run availability of mineral commodities. Miner Econ 26, 1–11 (2013). https://doi.org/10.1007/s13563-013-0033-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-013-0033-5