Abstract

Mothers in the United States use a combination of employment, public transfers, and private safety nets to cushion the economic losses of romantic union dissolution, but changes in maternal labor force participation, government transfer programs, and private social networks may have altered the economic impact of union dissolution over time. Using nationally representative panels from the Survey of Income and Program Participation (SIPP) from 1984 to 2007, we show that the economic consequences of divorce have declined since the 1980s owing to the growth in married women’s earnings and their receipt of child support and income from personal networks. In contrast, the economic consequences of cohabitation dissolution were modest in the 1980s but have worsened over time. Cohabiting mothers’ income losses associated with union dissolution now closely resemble those of divorced mothers. These trends imply that changes in marital stability have not contributed to rising income instability among families with children, but trends in the extent and economic costs of cohabitation have likely contributed to rising income instability for less-advantaged children.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The economic standing of women and their children declines sharply in the wake of divorce. Since the 1980s, a large body of literature has estimated declines in women’s household incomes ranging from 23 % to 40 % one year after a divorce (Avellar and Smock 2005; Bianchi and McArthur 1991; Duncan and Hoffman 1985; Galarneau and Sturrock 1997; Hoffman 1977; Holden and Smock 1991; Mott and Moore 1978; Peterson 1996; Seltzer 1994; Smock et al. 1999; Weiss 1984; Weitzman 1985; but see McKeever and Wolfinger 2001). The economic losses associated with divorce have negative implications for adult and child well-being, including poorer psychological and physical health, lower academic achievement, and more behavioral problems (see Amato 2000; McLanahan et al. 2013 for reviews). In the early twentieth century, few marriages ended in divorce, so these negative effects were confined to a small segment of the population. By the close of the twentieth century, however, over 40 % of children experienced parental divorce (Schoen and Canudas-Romo 2006). If we add children living with unmarried parents to these estimates, parental union dissolution is now a near-modal experience for American youth (Andersson 2002). Because nonmarital childbearing and divorce are more common among groups disadvantaged by virtue of their race and socioeconomic status, scholars have argued that union dissolution has contributed both to rising inequality and to the reproduction of inequality across generations (Bramlett and Mosher 2002; McLanahan 2004; McLanahan and Percheski 2008).

Since the mid-twentieth century, however, large-scale transformations within labor markets and public safety net programs may have altered the economic impact of union dissolution. Maternal labor force participation has grown markedly, increasing women’s contributions to household income and, perhaps, their ability to alter their labor supply in response to a divorce. Some government transfer programs, such as cash welfare (AFDC/TANF), have become less-generous safety nets; others, such as food stamps (SNAP) and the Earned Income Tax Credit (EITC), have expanded. Child support enforcement regulations have strengthened, and private social networks remain an important source of instrumental support.

Prior research has not examined whether the economic consequences of union dissolution have changed as a result of these large-scale changes in employment-based, public, and private safety nets. Virtually all previous work has studied the economic effects of divorce for a single cohort of women or at a single point in time, and the vast majority of this work has considered only marital dissolutions (see Avellar and Smock 2005 for an exception to the latter point). This article addresses these gaps in the literature by using multiple panels of the Survey of Income and Program Participation (SIPP) to track changes in the economic consequences of dissolution from the 1980s through the 2000s, a period encompassing dramatic changes in labor markets and government transfer programs. We track changes in the short-term economic consequences of marital and cohabitation dissolution, and examine changes in how mothers use employment and public and private transfers to buffer the economic shock of a relationship dissolution.

Background

Marital and nonmarital relationships in the United States are uniquely unstable relative to other industrialized nations. By age 15, 35 % of children born to married parents and 78 % of children born to unmarried cohabiting parents have witnessed their parents’ unions dissolve (Andersson 2002). The stability of marriages and cohabitations declined during the twentieth century, before starting to level off in recent decades (Goldstein 1999; Raley and Bumpass 2003). The probability that a marriage would end in divorce increased steadily through 1990, when about 45 % of marriages were predicted to end in divorce (Schoen and Canudas-Romo 2006). After 1990, divorce rates continued to rise for older couples but leveled off for younger couples (Kennedy and Ruggles 2014). Cohabitation has also become slightly less stable since the 1980s (Bumpass and Lu 2000), but this trend has stalled in recent decades for cohabiters with children (Kennedy and Bumpass 2011; Musick and Michelmore 2012).

The Economic Effects of Union Dissolution

Most prior research on the economic effects of union dissolution has examined changes in mothers’ and fathers’ household incomes after divorce within a single cohort. This work has found that mothers experience significant drops in household income following a divorce, and a substantial number fall into poverty. Estimates of the decline in women’s household income one year after divorce range from 23 % to 40 % (Bianchi and McArthur 1991; Duncan and Hoffman 1985; Galarneau and Sturrock 1997; Hoffman 1977; Holden and Smock 1991; Mott and Moore 1978; Smock et al. 1999; Weiss 1984; Weitzman 1985; but see McKeever and Wolfinger 2001). Although initial incomes differ, income losses from divorce are similar in proportional terms for higher- and lower-income households and across racial/ethnic groups (Bianchi et al. 1999; Smock 1994).

The economic effects of divorce are less severe for men, although researchers have identified more heterogeneous effects for men than they do for women. Whereas some studies reported substantial gains for men after marital dissolution (Smock 1994), others reported small short-term gains (Galarneau and Sturrock 1997), and still others reported modest losses, particularly when the wife was the primary breadwinner (McManus and DiPrete 2001).

Couples who cohabit are significantly less likely to pool their incomes, have less-traditional gender role ideologies, and have lower levels of commitment than married couples do (Kenney 2004; Smock 2000). These differences, combined with the lower average socioeconomic standing of cohabiters relative to married couples, suggest that the economic costs of dissolution may be lower for cohabiting women than they are for married women. Most studies have examined only marital unions or pooled marital and nonmarital unions together in the same analysis, but in a notable exception, Avellar and Smock (2005) examined the economic consequences of cohabitation and marital dissolution separately using data from the 1982 to 1994 waves of the National Longitudinal Survey of Youth-1979 Cohort (NLSY-79). They found that income losses associated with cohabitation dissolution were indeed smaller than losses following marital dissolution (33 % vs. 58 %, respectively). Because married women had higher predissolution incomes but lost more than cohabiting women, the levels of absolute income for married and cohabiting women were similar after the dissolution.

Three studies that draw conclusions about trends over time provide an important foundation for the current article. First, Smock (1993) examined changes in the economic cost of divorce for an older cohort of women who divorced in the late 1960s to mid-1970s (from the National Longitudinal Survey of Young Women, 1968–1978) and a younger cohort of women who divorced in the 1980s (from the NLSY-79). Smock found that although married women were working more in the younger cohort, the economic cost of divorce was large and changed little between the 1970s and the 1980s. Second, McKeever and Wolfinger (2001) analyzed the National Survey of Families and Households (NSFH), examining changes in income for married women in the first wave (1987–1988) who divorced by the second wave (1992–1994). They found a 14 % drop in median per capita household income and, comparing their results with results from studies of older cohorts that used different data sets (which found income declines of around 40 %), concluded that the economic costs of dissolution declined between the 1960s and the 1980s. Third, McKeever and Wolfinger (2005) compared trends in divorced and married women’s incomes over time (rather than comparing incomes for the same women before and after divorce) using data from the 1980–2001 Current Population Surveys (CPS). Although marital disruption still left divorced women at a disadvantage relative to married women, their incomes rose during the period, leaving them better-off financially in an absolute sense. This was largely attributable to the fact that the population of divorced women became older, had more work experience, and had fewer young children during this period, all of which likely made it easier for them to support themselves after the divorce.

Safety Net Strategies

Men and women can take steps to mitigate the economic effects of union dissolution that come from losing a partner’s income: they may alter their labor supply, obtain cash assistance from government programs, or draw on economic resources from their social networks. Large-scale changes in maternal labor force attachment and government cash transfer programs may have altered their ability to use these sources to cushion the economic losses of union dissolution.

Labor Force Participation

Maternal labor force participation has more than tripled since the 1960s, when less than 20 % of married women with children under age 6 were in the labor force; this percentage skyrocketed to over 70 % by 2012 (Bureau of Labor Statistics 2013; Desai et al. 1989). Households with two working adults are now the modal family context, characterizing just over one-half of households with children in 2010 (Western et al. 2012). The gender pay gap for employed women relative to men has declined since the 1970s (despite a potential stall in recent years), and women and mothers are more likely to work full-time and year-round today than they were in the past (Blau and Kahn 2007; Cohen and Bianchi 1999).

If women’s earnings became a larger share of household income and a partner’s income constituted a smaller share, dissolution might yield smaller declines in women’s household incomes, at least in proportional terms. In addition, stronger labor force attachment may make it easier for women to increase their labor supply in anticipation of, or response to, dissolution—although increasing labor supply postdissolution raised women’s household incomes only slightly during the 1980s, when most studies estimated this (Duncan and Hoffman 1985; Mott and Moore 1978; Peterson 1989; Stirling 1989; Weiss 1984). This strategy is available only to women who work part-time, however, so it may be less available as a postdissolution adjustment strategy given that women’s predissolution labor supply has increased since the 1980s. For some women, increasing labor supply may be a problematic strategy for other reasons. For example, if childcare is unaffordable or the union dissolution prompts a residential move away from one’s job, this may lead women to reduce rather than increase their labor supply in response to a dissolution.

The Public Safety Net

Given the correlation between family structure and poverty, single mothers are the disproportionate beneficiaries of means-tested government cash transfer programs in the United States (Dye 2008). These programs constitute a public safety net that mothers may draw on to buffer the economic losses of union dissolution. Cash transfer programs—such as cash welfare (AFDC/TANF), the Earned Income Tax Credit (EITC), and Supplemental Security Income (SSI)—have undergone dramatic contractions and expansions since the 1980s. Cash welfare benefits—first through AFDC and later through TANF—became considerably less generous (Moffitt et al. 1998), and the introduction of the block grant system replete with diversions, sanctions, and time limits under the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 reduced TANF caseloads and enrollment rates substantially (Parrott and Sherman 2006). Difficulties enrolling and maintaining eligibility have made TANF an even weaker safety net program than it was in the past, as evidenced most recently by the fact that caseloads barely rose during the 2008 recession (Pavetti et al. 2013).

The declining generosity of AFDC/TANF has been offset, at least in part, by the expanding eligibility and generosity of other cash transfer programs. The EITC, for low- to moderate-income workers, imparts a large cash transfer through the tax code that benefits primarily custodial parents; this refundable federal tax credit could be as large as $5,372 for a family with two children in 2013. Following expansions in the 1980s and 1990s, the EITC is now the largest antipoverty program in the nation: it lifted almost 9.5 million adults and 5 million children out of poverty in 2011 (Marr et al. 2013). The EITC is not the only cash transfer program to expand in recent decades. The SSI rolls—means-tested cash assistance for disabled children and adults—have also expanded dramatically since the 1970s (Daly and Burkhauser 2003), driven by expanded disability definitions and state actions to transfer eligible recipients from TANF to the SSI caseloads (Wamhoff and Wiseman 2006). Near-cash, in-kind transfers—such as food stamps, housing subsidies, and subsidized medical insurance—may also have helped to offset the declining generosity of TANF.

The cash transfer programs described here are potential resources that custodial parents—particularly low-income ones—can draw on to cushion some of the income loss associated with union dissolution (Teachman and Paasch 1994). The declining generosity of TANF benefits has been at least partly (and, perhaps, fully) offset by other cash and in-kind transfer programs that boost the incomes of single parents. Because of these potentially offsetting trends, it is unclear whether the public safety net has become a more or less effective cushion in the wake of union dissolution than it was in the past.

In addition to government transfer programs, the government enforcement of child support laws—which regulate cash transfers from noncustodial to custodial parents—were strengthened in the wake of the 1984 Child Support Enforcement Amendments, the 1988 Family Support Act, and the 1996 PRWORA. This legislation required states to withhold child support obligations from fathers’ paychecks (first for fathers delinquent on payments, and later for all fathers), strengthen paternity establishment requirements, and standardize support order formulas (Cancian and Meyer 1996; Garfinkel et al. 2003). As a result, instances of paternity establishment, child support awards to unmarried mothers, and total child support transfers to mothers have increased (Freeman and Waldfogel 2001). Because of this, we expect that mothers’ receipt of child support in the wake of a union dissolution has increased over time.

The Private Safety Net

Single parents also rely on social networks—relatives, friends, and romantic partners—as informal sources of cash and in-kind assistance in times of need (Edin and Lein 1997; Harknett 2006; Henly et al. 2005; Stack 1974), including after a union dissolution. Although cash and in-kind resources from networks play an important role in making ends meet (Edin and Lein 1997), researchers have found that financial transfers are scarcer across the social networks of low-income households, and the amounts—both relative and absolute—tend to be small (Harknett 2006; Jayakody 1998; Roschelle 1997). Lower-income families are, however, more likely to reside in extended-family households—with parents, boyfriends, or other relatives—than more-advantaged families (Beck and Beck 1989; Henly 2002; Stack 1974), and shared living arrangements are an important economic coping mechanism. Indeed, moving in with a new romantic partner (through marriage or cohabitation) can return women’s incomes to close to predissolution levels (Duncan and Hoffman 1985; Holden and Smock 1991; Morrison and Ritualo 2000; Nestel et al. 1983; Peterson 1989; Smock et al. 1999; Stirling 1989). Shared living arrangements have become more common in recent decades (Mykyta and Macartney 2011). However, no study that we know of has examined whether cash transfers from social networks have become a larger or smaller fraction of households’ financial resources over time. Thus, it is unclear whether the private safety net has become a more- or less-important economic cushion following a union dissolution.

The Present Study

Given large-scale changes in the labor market and government transfer programs, the present study asks how the economic costs of union dissolution have changed over time. We contribute to existing research in several ways. First, we use multiple panels of data to track changes in the economic cost of dissolution across a longer period than any prior study—from the 1980s through the 2000s—which, as outlined earlier, is a period of dramatic change in labor markets and government transfer programs. Second, building on prior work that examined the consequences of cohabitation dissolution for a single cohort (Avellar and Smock 2005), we track these changes for both marital and cohabitation dissolutions, making ours the first study of the changing economic costs of cohabitation and allowing us to assess the changing relative economic costs of ending marriages and cohabitations. Third, building on McKeever and Wolfinger’s (2005) findings from repeated cross-sections of divorced women, we examine changes in the use of particular economic coping mechanisms: employment, government transfer programs, and private safety nets following dissolution. We compare whether married and cohabiting parents differ in their use of these strategies to mitigate the economic costs of dissolution. To explore whether the use of these safety net strategies varies by socioeconomic status, we also examine trends separately for more- and less- educated mothers. Finally, we use monthly income data to shed light on fine-grained, short-run temporal income dynamics to examine how household income changes in anticipation of, and in response to, a union dissolution.

Data and Method

Data and Sample

We use data from multiple panels of the Survey of Income and Program Participation (SIPP), starting with the 1984 panel and ending with the 2004 panel (which concludes in 2007).Footnote 1 The SIPP is a nationally representative survey designed to provide comprehensive information about the sources of income and government program participation of individuals and households in the United States on a subannual basis. The survey is designed as a series of national panels, each lasting three to four years. Together, the panels provide almost-continuous coverage of the U.S. household population since 1984. Unlike other longitudinal surveys, each panel draws a new nationally representative sample, which allows us to model change in nationally representative dissolution cohorts over time, rather than focusing on a single cohort (for which age and period effects are confounded).Footnote 2

In each SIPP panel, every member of the household aged 15 or older was interviewed every four months and asked about their sources of income for each of the previous four months. This provides detailed information on types and changes in monthly income for each person in the household. All household members aged 15 and older were interviewed directly if possible or by proxy response from another household member otherwise. The SIPP imputes item—and person—nonresponse in all waves (Westat 2001: chapter 4). A household roster indicates the relationship of each household member to the household head and monthly changes in the household roster are assessed at each survey. The SIPP follows all original sample members (who are present at the first survey wave) regardless of where they move in subsequent survey waves (unless they are institutionalized, in military barracks, or abroad), and they follow all children (under age 15) of these original sample members if they continue to live with an original sample member. The SIPP also surveys new individuals who live in households with original sample members over the course of the panel; these new individuals are not followed after they stop living with an original sample member.

In this article, we focus on union dissolutions among households with children and thus construct an analytic subsample of households with children of original sample members who are designated the household reference person or the spouse of a household reference person in at least one survey wave of the panel.Footnote 3 We follow this subset of households with children starting at the survey wave the child enters the sample until the child turns 18 or stops living with an original sample member.Footnote 4 Because most children live with their mothers following a union dissolution and because of the different labor market prospects of men and women, we further restrict the sample to households where children remain living with the female householder/spouse after dissolution; thus we exclude children who live with their fathers after dissolution as well as children who move out of the household and live with neither parent.Footnote 5 These sample restrictions result in a final analytic sample of 12,646 married households with children that experience parental divorce during the time of a SIPP panel and 3,249 cohabiting households with children that experience an end in their parents’ cohabiting union during the time of a SIPP panel.

Measures

Family Structure and Dissolution

In each month of the SIPP, we determine the household family structure by identifying adults living in the same household as the child and classifying them as (a) parent/household head, (b) spouse of the household head, or (c) unmarried partner of the household head. We use this information for a measure of family structure at each wave, in which households are coded as “married” if a spouse of the household head is listed on the household roster. “Cohabiting” households are identified in two ways. In the 1996 and later panels, the SIPP asked directly about the presence of an unmarried partner of the household head. In the pre-1996 panels, their presence was inferred using the adjusted “persons of opposite sex sharing living quarters” (POSSLQ) criteria, which identifies a cohabiting partner as an adult who is the opposite sex of the household head and not in a related subfamily (Casper and Cohen 2000).Footnote 6 Finally, households are coded as “single parent” if there is no spouse or cohabiting partner living with the household head.

We identify a marital dissolution as occurring in the month in which a child’s family structure changes from married to any other household type and either a separation or a legal divorce occurred.Footnote 7 We identify cohabitation dissolution as occurring in the month in which one of the cohabiting partners no longer lives in the household with the child.Footnote 8 After we identify the month in which a cohabiting or marital dissolution occurred, we create a measure of time for each monthly observation that identifies the number of months before and after the dissolution.Footnote 9

Household Income and Income Components

Total monthly household income is measured in each month by calculating the sum of the SIPP-generated total person income measures for each adult member of the household. To this, we add two transfers that are not captured by the SIPP: the value of the EITC and the cash value of housing subsidies (we describe these in more detail later). We adjust for household size and economies of scale by controlling for the square root of household size, which approximates the European Union-Statistics of Living Conditions, Luxembourg Income Study (LIS), and Canberra definitions employed by most rich nations (Kenworthy and Smeeding 2013). As a result, our measure of the economic consequences of dissolution adjusts for changes in household size and economies of scale. We adjust all income measures for inflation monthly to 2012 dollars using the Personal Consumption Expenditures Price Index (PCEPI).

We also disaggregate total household income into several components to determine how earnings, government transfers, and private transfers change before and after a union dissolution. Table 4 in the appendix provides a complete list of income sources included in each of these measures.Footnote 10 First, we create monthly measures of male householder/partner earned income and female householder/partner earned income from wages, salaries, or self-employment. Second, we create a measure of monthly government cash transfers that pools government cash transfers received by all household members. The SIPP does not collect information on the amount of money received from the EITC, one of the largest government cash transfers, so we use data from the SIPP to estimate annual earned income, tax filing status, and qualifying children. We then use that information to estimate the amount of the EITC using the National Bureau of Economic Research (NBER) TAXSIM program (Feenberg and Coutts 1993; Hotz and Scholz 2003). Over one-half of EITC claimants receive their refund in February (LaLumia 2013); thus, we apply the EITC refund amounts to household incomes in the February following each tax year.Footnote 11

To this measure of government cash transfers, we add measures of near-cash, in-kind transfers from food stamps and housing subsidies because these two programs reach large segments of the population and have substantial effects on material well-being.Footnote 12 Because the value of food stamps was measured directly in the SIPP but the cash value of housing assistance was not, we follow conventions used in the construction of the Supplemental Poverty Measure (SPM) to estimate the cash value of housing subsidies (Johnson et al. 2010). For respondents who reported that they lived in a public housing project or that they paid lower rent because the federal, state, or local government paid part of the cost, we estimate the cash value of the housing subsidy in the months they received it by taking the difference between the average monthly Fair Market Rent (FMR) in a respondent’s state of residence that year (FMR is typically 40 % of the average rent), and 30 % of the monthly household income (the rent payment required by most housing assistance programs).Footnote 13 This estimate represents the cash value of the housing subsidy, or the amount of additional rent the respondent would have to pay to rent their housing unit in the absence of the subsidy. Thus, our measure of government cash transfers includes all government sources of income reported in the SIPP plus the estimated value of the EITC and housing assistance.Footnote 14

We further disaggregate household income with a measure of the amount of child support and/or alimony received each month. This includes custodial parents’ reports of formal and informal cash support payments from noncustodial parents, but it does not include the cash value of in-kind support. Additionally, we created measures of income from private social network sources, including private cash transfers from friends or relatives, new partner income for partners who enter the household following a union dissolution,Footnote 15 and other adult income for adults in the household other than the householder and the spouse/partner; this mainly included other relatives, such as siblings and parents of the householder, but also a small number of nonrelatives.Footnote 16

Method

The SIPP has the advantage of collecting monthly income data but the disadvantage of having panels lasting only several years, so we track changes in household income during the 12 months prior to a union dissolution and the 12 months following the dissolution.Footnote 17 This allows us to observe fluctuations in income that occur in the year prior to and the year after the dissolution, adjusting for changes in the size of the household. To assess how union dissolution is related to changes in the monthly incomes of mothers and their children, we estimate the median percentage change in monthly household income relative to monthly income one year (i.e., 12 months) prior to the dissolution:

where p it is the proportional difference between monthly household income for household i in month t and monthly household income for household i at t = –12, or 12 months prior to the dissolution; and t ranges from –12 (months before the dissolution) to 12 (months after the dissolution). We translate these raw differences into a proportional change in income by dividing them by the absolute value of monthly household income at t = –12, or 12 months prior to dissolution (our base month) to calculate a proportional change. Thus, our results refer to the change in monthly household income that has occurred since one year prior to the dissolution, with positive values indicating growth in household income and negative values indicating declines in household income. We include household size as a control variable in all models to adjust for changes in household size.Footnote 18

We then estimate changes in this proportional household income measure as a function of time, tracking time as the number of months before and after the union dissolution. Because this proportional change measure is sensitive to extreme positive outliers—going from a low income in one month to a higher income in the next can result in very large proportional changes in income—we estimate the median percentage change in household income rather than the mean (Smock 1993). We do this by estimating the quantile regression:

where τ equals .50 (the median) for household i in month t, α is the intercept (month 12 prior to dissolution), B is a vector of month dummy variables 11 months to 1 month prior to dissolution, D is a dummy variable indicating the month of dissolution, and A is a vector of month dummy variables 1 to 12 months after dissolution. We include month dummy variables to allow for a flexible functional form rather than imposing one on the data.

Quantile regression is similar to ordinary least squares (OLS) regression except that it minimizes the sum of the absolute residuals instead of the sum of squared residuals and estimates conditional medians instead of conditional means (Koenker 2005). Thus, Eq. (2) estimates the median change in household income in each month for one year before and one year after a dissolution, relative to month 12 (one year) prior to dissolution. We estimate a conditional quantile regression, which estimates the median from the conditional distribution of the dependent variable, or among respondents who have the same values on the independent variables. The conditional quantile is inappropriate for answering research questions about unconditional distributions (e.g., see Killewald and Bearak 2014), but our research question is about a conditional distribution—one that estimates medians for mothers who have the same family size and who are in the same month before or after dissolution. To assess whether the economic consequences of union dissolution differ for married and cohabiting mothers, we estimate separate models for marital and cohabitation dissolution. If households contain cohabiters at the start of the observation period (one year prior to dissolution) and they subsequently marry, they remain in the cohabiting sample.

To assess whether the economic consequences of dissolution have changed over time, we pool across SIPP panels for each decade. The 1980s include the 1984, 1985, 1986, 1987, and 1988 panels; the 1990s include the 1990, 1991, 1992, 1993, and 1996 panels; and the 2000s include the 2001 and 2004 panels. We pool across decades rather than estimate a separate equation for each SIPP panel for parsimony and because it yields sample sizes of cohabiters large enough for reliable and precise estimates, particularly in the early panels of the SIPP, when the survey samples were smaller and cohabitation was less common.Footnote 19 We first estimate separate regressions for the 1980s, 1990s, and 2000s, and we then estimate a pooled equation that combines all decades and includes interactions between the monthly dummy variables and decade dummy variables (1990s and 2000s relative to 1980s) to test whether the monthly coefficients change significantly across decades. Positive signs on the coefficients of the interaction terms indicate that the economic cost of dissolution has declined over time; negative signs on the coefficients indicate that the economic cost of dissolution has grown. We estimate bootstrapped standard errors for our quantile regressions (Mooney and Duval 1993).Footnote 20

Results

Table 1 reports the descriptive statistics for family structure and household income separately for married and cohabiting households in each decade. Eighty-one percent of children in the SIPP lived in a married-parent family during the course of a calendar year in the 1980s, while only 74 % did during the 2000s. In contrast, children’s exposure to cohabitation increased, with just 5 % living in a cohabiting household during the course of a year in the 1980s and 8 % doing so by the 2000s. Children living in married-parent families were significantly less likely to experience a parental dissolution than children living in cohabiting households, with just 7 % experiencing marital dissolution but 20 % experiencing cohabitation dissolution in the 2000s. Consistent with national trends, the stability of marriages among those in this sample changed little over this period, and cohabitations involving children became more stable.

Table 1 also reports monthly household income and income components 12 months before and after the dissolution. Married households that divorced had higher mean monthly household incomes than cohabiting households that dissolved, although household incomes grew over time for both groups and the differences between them were smaller after adjusting for household size. Fathers’ earned income was the largest component of total household income for both groups, followed by mothers’ earned income, and both grew on average over time. In contrast, average monthly government transfer income was larger for cohabiting households than for married households, reflecting greater disadvantage among cohabiting parents. Child support/alimony income one year prior to dissolution was also larger for cohabiting households than for married households, as cohabiters were more likely to have children for whom they received child support (either from ex-partners or current partners). Private transfer income, other adult income, and income from other sources were uncommon and the amounts received were modest for both married and cohabiting households.

Household Income Dynamics When Unions Dissolve

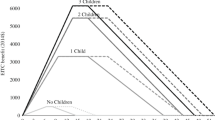

Table 2 shows the results of quantile regressions of the median percentage change in monthly household income before and after a union dissolution, relative to monthly income 12 months prior to the dissolution. Panel A shows results for divorces that occurred in the 1980s, 1990s, and 2000s, respectively, and they are summarized graphically in Fig. 1. In the 1980s, the household incomes of married mothers with children grew by about 15 % in the 12 months leading up to a divorce. In the month of the divorce, however, the median mother saw a drop in income of about 40 % and experienced very little recovery of that income in the year following the divorce.

Predivorce incomes evolved in a similar way during the 1990s, growing by about 8 % prior to the divorce. The median postdivorce income declined by the same amount as it did in the 1980s, dropping by about 40 % in the month of the dissolution. However, the median household income recovered significantly more in the year following the divorce in the 1990s than it did in the 1980s, with one-year postdivorce monthly incomes about 30 % lower than they were before the divorce (relative to 40 % lower in the 1980s). This pattern continued in the 2000s, when monthly incomes grew slightly during the year prior to the divorce and postdivorce incomes recovered more than they did in the 1980s, ending about 30 % lower than they were before the divorce. Taken together, these results suggest that the economic consequences of divorce, although still substantial, declined between the 1980s and the 2000s.

Panel B of Table 2 and Fig. 2 show results for cohabiting mothers. In the 1980s, cohabiting household incomes grew considerably—by over 25 %—in the four months prior to dissolution. This growth was less extensive in subsequent decades, at 10 % in the 1990s and not at all by the 2000s. Income losses following cohabitation dissolution grew considerably over time. In the 1980s, cohabiting mothers saw an income decline of almost 20 % in the month of dissolution but recovered completely one year after the dissolution. The economic losses following cohabitation dissolution grew in the following two decades, and by the 2000s, mothers’ household incomes declined by about 45 % in the month of the cohabitation dissolution and recovered only about 15 percentage points of that loss by one year after the dissolution.

In sum, the short-run economic consequences of divorce declined for mothers and children, with monthly household incomes 42 % lower one year after divorce in the 1980s and just 33 % lower by the 2000s. In contrast, the economic consequences of cohabitation dissolution worsened over time. In the 1980s, household incomes had returned to predissolution levels one year after the dissolution, but by the 2000s, they remained 30 % lower. As a result, the economic consequences of cohabitation dissolution and divorce have converged over time and were remarkably similar in the 2000s.

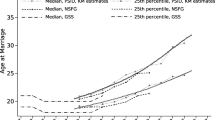

Educational Differences in the Consequences of Dissolution

Because socioeconomic differences between married and cohabiting parents are large (Smock 2000), we next examine whether the diverging trends that we identified for married and cohabiting mothers were attributable to socioeconomic differences between the two groups. Table 3 presents quantile regressions separately for mothers with no more than a high school diploma, some college, or at least a four-year college degree at the time of the dissolution. Although college-educated mothers start out with considerably higher predissolution incomes than less-educated mothers, the economic consequences of dissolution are large for all regardless of education in the 1980s: household incomes declined by over 40 % immediately after the divorce and remained that large one year later. Since the 1980s, however, the trend toward smaller economic consequences of divorce was experienced only by less-educated mothers (those with some college or less), and not by highly educated mothers (with four-year college degrees or more). By the 2000s, divorced mothers with a high school diploma or less had household incomes 34 % lower, mothers with some college had incomes 36 % lower, and college-educated mothers had incomes 42 % lower one year postdivorce. To summarize, the economic consequences of divorce were large for both more- and less-educated married mothers and improved the most since the 1980s for less-educated married mothers.

There were not enough college-educated cohabiting mothers in the 1980s SIPP panels to conduct a comparable subgroup analysis for cohabiters with some college or four-year degrees, but when we restrict the cohabiting sample to cohabiting mothers with a high school diploma or less, the quantile regression results are substantively and statistically similar to the results for the full sample: the economic consequences of cohabitation dissolution were modest in the 1980s and grew considerably over time. Thus, the diverging trends for married and cohabiting mothers—declining consequences of divorce for married mothers but worsening consequences for cohabiting mothers—cannot be attributed solely to socioeconomic differences between the two groups because the consequences of divorce for the least-educated married mothers have improved, while the opposite is true for the least-educated cohabiting mothers.

Income Sources

What accounts for the declining economic consequences of divorce and the growing economic consequences of cohabitation dissolution? Figure 3 shows the monthly average earnings for married and cohabiting parents before and after relationship dissolution in the 1980s and in the 2000s. In the 1980s, married and cohabiting mothers had similar average earnings, but married husbands had substantially higher earnings than cohabiting fathers, which meant that cohabiting mothers’ earnings contributed a larger relative share of predissolution household income. As a result, the loss of a partner’s income resulted in larger absolute and relative drops in household income for married mothers than for cohabiting mothers. Divorce also resulted in a modest short-term decline in women’s earnings in both the 1980s and 2000s, which women started to regain in the following year. By the 2000s, married mothers’ earnings had grown substantially and constituted a larger share of predissolution household income than in the 1980s, which partly explains why the economic consequences of divorce have declined for them. Cohabiting mothers’ earnings did not grow as much, relative to married mothers or to their cohabiting partners, so their earnings constituted a smaller share of predissolution income in the 2000s than in the 1980s; this partly explains why the economic consequences of dissolution grew for them.

Figure 4 displays trends for government transfers (panel a), child support (panel b), and network income (panel c). In the 1980s, married mothers received little additional money from government transfers in the wake of divorce. This situation had changed by the 2000s, when mothers received almost $200 additional dollars per month, on average, from government transfers in the wake of a divorce. Because they were more economically disadvantaged than their married counterparts, and because the eligibility rules for some transfer programs exclude cohabiting partners’ incomes, more than one-half of cohabiting mothers received cash transfers while in their cohabiting unions, and the fraction who received government transfers after dissolution changed little. They also saw little growth in government transfer income over time.

Child support payments make up a smaller fraction of monthly household income, but married mothers saw income from child support payments increase in the wake of a divorce between the 1980s and 2000s. Cohabiting mothers again received more from child support than married mothers did predissolution, but they saw little growth in child support in the wake of a cohabitation dissolution.

Finally, income from social networks—via private transfers or shared living arrangements—grew substantially in the wake of both marital and cohabitation dissolution in the 1980s, and this trend became even more pronounced by the 2000s, suggesting that the private safety net became a more important economic coping strategy. In supplemental analyses, we observed that most of this growth was due to the increased likelihood that mothers lived with another (nonromantic) adult. This suggests that mothers were increasingly likely to enter shared living arrangements in response to a relationship dissolution. The fraction of mothers with income from a new partner also increased steadily in the months following the dissolution, but this changed little over time. Private cash transfers from friends and family that were recorded in the SIPP were quite uncommon.

Robustness Checks

We analyzed the robustness of our findings to a range of alternative model specifications. Our substantive findings about trends over time hold for measures of calendar time other than decade dummy variables, including a linear year interaction term and dummy variables for each SIPP panel. Our findings are also similar if we measure income on a quarterly basis rather than monthly, if we use a household-size adjusted income measure instead of including household size as a control, and if we use children as the unit of analysis rather than the household. The results are also robust to both direct and indirect (adjusted POSSLQ) measures of cohabitation in the later SIPP panels when both are available, and they are consistent when we use either a balanced or an unbalanced panel. Finally, our conclusions hold, and are actually even more pronounced, if we use a measure of household income that excludes the estimated EITC and housing subsidy values. For married households, excluding the EITC and housing subsidies makes postdissolution declines in household income even larger, and makes the declining economic consequences of divorce over time more apparent. For cohabiting households, excluding the EITC and housing subsidies also makes postdissolution declines in household income even larger, but the growth in economic consequences over time remains the same.

Taken together, these findings suggest that the declining economic consequences of divorce are primarily attributable to rising relative maternal earnings and the increased likelihood of receiving child support, government transfers, and private network income after divorce. In contrast, the growing short-run economic losses from cohabitation dissolution are primarily attributable to the fact that cohabiting mothers did not see growth in earnings and did not receive more government transfers or child support in the wake of dissolution as did married mothers, in part because many already received these transfers prior to dissolution. Cohabiting women became more likely to share living arrangements with romantic partners or other adults after dissolution, but this strategy has not offset the fact that their earnings declined relative to married mothers’ earnings.

Discussion

In this article, we examined trends over time in the short-run economic consequences of marital and cohabitation dissolution among mothers. We found that the short-run economic consequences of divorce declined, with household incomes 42 % lower one year after divorce in the 1980s but only 33 % lower by the 2000s. In contrast, the economic consequences of cohabitation dissolution worsened over time. In the 1980s, household incomes were about the same one year after dissolution, but by the 2000s, they were 30 % lower. As a result, the economic consequences of cohabitation dissolution became more similar to the economic consequences of divorce over time and were quite similar by the 2000s. These trends were not driven solely by socioeconomic differences between married and cohabiting mothers: we observed declining economic consequences for less-educated married mothers but growing economic consequences for less-educated cohabiting mothers.

These findings are consistent with the literature on the economic consequences of union dissolution that used survey samples from the 1970s and 1980s to identify large income declines—on the order of 30 % to 40 %—for a single cohort following a divorce (Bianchi and McArthur 1991; Duncan and Hoffman 1985; Galarneau and Sturrock 1997; Hoffman 1977; Holden and Smock 1991; Mott and Moore 1978; Smock et al. 1999; Weiss 1984; Weitzman 1985) and smaller economic declines following cohabitation dissolution (Avellar and Smock 2005). These studies conducted with older samples and single cohorts, however, missed the declining economic consequences of divorce since the 1980s and the concomitant growth in the economic consequences of cohabitation. Our results are also consistent with the cross-sectional trends in divorced women’s improved economic well-being observed by McKeever and Wolfinger (2005).

What explains these trends? Earnings for married mothers grew relative to husbands’ earnings over time, reducing the proportional loss in household income associated with a husband’s departure. As a result, divorced women’s economic well-being improved during the 1980s and 1990s (McKeever and Wolfinger 2005), partly because of expansions in maternal labor force participation and partly because of the growing selectivity of marriage. As marriage rates declined and women entered marriage at older ages, the marriage premium—the income advantage for married mothers relative to single mothers—grew (McKeever and Wolfinger 2005; McLanahan 2004). The composition of the cohabiting population changed as well: rates of childbearing within cohabiting unions grew, and divorced mothers increasingly repartnered through cohabitation rather than remarriage (Bumpass and Lu 2000). As a result, the growing cohabiting population includes couples who likely would have married in the past—particularly at the lower end of the economic distribution, where marriage rates have declined and nonmarital fertility rates have grown the most (McLanahan 2004). Taken together, these trends in the composition of the married and cohabiting populations may partly explain why the economic consequences of marriage have declined and why the consequences of cohabitation now resemble those of marriage.

Although the economic consequences of cohabitation dissolution resemble those of marital dissolution, our examination of income sources reveals important differences between married and cohabiting parents. The relative earnings of cohabiting mothers did not rise as it did for married mothers, and the safety net operates differently for cohabiting and married mothers in the wake of a union dissolution. Married mothers became more likely to receive child support and government transfers in the wake of a divorce, which helped to offset some of the loss of their husbands’ earnings. Although these programs served as safety nets during cohabitation, they offered little extra cushion for cohabiting mothers in the wake of a dissolution.Footnote 21 Future research should consider in more detail the specific government transfer programs that married and cohabiting mothers draw on to buffer against relationship instability as well as how expansions and contractions of these programs have affected their material well-being.

In the 1980s, when maternal labor force participation was lower, we found that both married and cohabiting mothers increased their labor supply in the few months prior to dissolution, perhaps in anticipation of it. As more mothers entered (and stayed) in the workforce during the 1990s and 2000s, they were less likely to increase their earnings prior to dissolution because more of them were already working. The dissolution itself disrupted labor supply temporarily for some mothers, however. Such disruptions may occur if mothers can no longer afford childcare or if they had to move after dissolution; such hypotheses about the short-term dynamics of dissolution and maternal labor supply are ripe areas for future research, in contrast to the longer-term consequences of divorce that researches have typically examined (e.g., McKeever and Wolfinger 2005). We examined mothers’ labor supply indirectly through their earnings, and a fuller examination of labor supply on the extensive and intensive margins should also be considered in future research. Although married and cohabiting mothers’ labor force participation did not differ markedly, their average earnings did, and married mothers’ relative contributions to household income grew far more than cohabiting mothers’ did.

Our analyses have several limitations that should be considered when interpreting the results. For both groups, we examined relative changes in household incomes before and after a dissolution; even if relative declines in household income grew for cohabiting mothers and their children, their absolute standards of living—measured by the level of their income rather than the change in their income—were higher in the 2000s than they were in the 1980s. We examined trends for married and cohabiting households with children, and these trends may not be the same for households without children. In addition, we provided a descriptive portrait of trends over time, but these are not causal effects of dissolution; our results describe population-level experiences and are likely attributable in part to differential selection into marriage or cohabitation over time, as we described earlier, as well as selection on who dissolves unions. Another limitation is that our panel of 2000 data extends only until 2007. We excluded the later years of the decade because of the recession, so our results may not hold during recessionary periods. Finally, our results describe average changes (measured by medians and means). Future research might explore in more detail the heterogeneous consequences of union dissolution that occur at different points in the distribution of household income or for different types of households.

The results of this study have implications for research on trends in income instability. First, we found little evidence that trends in the incidence or economic consequences of divorce have contributed to rising income instability. Marriages became slightly more stable over time, and the economic consequences of divorce, albeit large, have declined since the 1980s. In contrast, we found that more children live in cohabiting households, which are less stable than married households, and that the economic losses associated with cohabitation dissolution have increased over time. As a result, trends in the extent and economic costs of cohabitation dissolution may have contributed to rising income instability in this subset of the population. Because cohabiting households with children tend to be more disadvantaged socioeconomically than married households, the trends described here would play a larger role in explaining income volatility at the lower end of the income distribution.

These findings also have implications for theories about the meaning of cohabitation. In part, our research supports prior work showing that cohabiting couples have lower levels of commitment and are less certain about the future of their unions (Kenney 2004; Smock 2000). We found little association between cohabiting women’s labor supply and government transfers before and after a union dissolution, which suggests that cohabiting mothers are not specializing in domestic labor as married women might; their lack of response to dissolution suggests that perhaps they were more prepared for such an event. We did find, however, that the economic consequences of cohabitation dissolution have grown and that patterns of behavior for cohabiting parents have broadly become more similar to those for married parents. Taken together, these findings suggest that cohabitation may increasingly play an economic function more similar to marriage, at least among cohabitations that involve children.

Notes

We exclude the 2008 panel of the SIPP because it covers the recession; an analysis of how the costs of union dissolution changed during the recession is important but beyond the scope of the current article, which focuses on long-term trends.

The trade-off is that each panel of the SIPP is relatively short, and we observe households for only several years (as opposed to decades), so we can assess only short-term economic consequences of union dissolution, not long-term consequences that might unfold decades after dissolution.

Thus, our sample does not include households with children who are not the children of the household reference person or his/her spouse, such as children of other adult relatives in the household. For households that contain two or more children at some point during the panel, we randomly select one child in the household so that the household is represented in the sample only once.

About one-half of households that experienced a dissolution were not observed for the full 12 months before and after the dissolution. As a robustness check, we also estimated our models with a balanced panel that included only households with observations for the full period. The results were statistically and substantively the same, so we retained the larger unbalanced panel for the analyses.

A growing number of children live in father-only families or in shared-custody arrangements, and it would be interesting to examine the economic consequences of dissolution for them as well. Unfortunately, their numbers in the SIPP are too small to provide reliable estimates of trends over time, so we exclude them from the analysis.

In a tiny fraction of cases (<2 %), more than one household member meets the POSSLQ criteria. In these cases, we select the POSSLQ person who was closest in age to the household reference person. Adjusted POSSLQ tends to overstate the extent of cohabitation because it counts romantic partners as well as opposite-sex roommates. However, because the extent of this overcounting has remained relatively constant over time (Casper and Cohen 2000), it will not bias our conclusions about trends over time. In supplemental analyses, we created an adjusted POSSLQ measure for the post-1996 panels as well; the results we present herein are robust to either the POSSLQ or the unmarried partner definition of cohabitation.

We do not rely on the retrospective date of divorce survey questions, for which the SIPP has been criticized because of high rates of imputation (Kennedy and Ruggles 2014); we observe the divorces as they happen.

Because there is no direct question about whether a cohabiting romantic relationship ended, cohabitation dissolution is inferred based on whether the person still lives in the household (not the romantic status of the relationship).

For a small sample of cases, we observe multiple marriages or cohabitations during a SIPP panel; for these cases, we include only the first observed marriage or cohabitation in our sample. We capture information about subsequent relationships and partners in our measures of postdissolution social network income.

The SIPP topcodes each income measure to preserve confidentiality; see Westat (2001: appendix B) for more information on specific topcode values for each measure.

If we do not observe a household for a full tax year prior to the first observation of a February, we estimate annual income based on the average monthly earned income during the portion of the year that we do observe them. Our approach assumes a 100 % take-up rate of the EITC, which overstates actual receipt, but take-up rates of the EITC are quite high—more than 80 %—relative to other transfer programs (Berube 2005).

Ideally, we would have liked to include the cash value of subsidized medical assistance from Medicaid and other sources, but the appropriate way to assign a cash value to medical benefits is hotly debated, with no agreed-upon convention (see, e.g., Wolfe 1998).

FMR rates are published by the U.S. Department of Housing and Urban Development (HUD) every calendar year and vary based on the number of bedrooms. We estimate the number of bedrooms for which a family is eligible using HUD guidelines for eligibility that are based on the number and sex of adult and child family members. FMR values are released for each metropolitan area, but the metropolitan locations of households are not publically available in the SIPP. The SIPP does report the state of residence, however; thus, we estimate a state-level FMR by calculating a population-weighted average FMR based on the FMRs and population sizes of all metropolitan areas in the state. In a small number of cases, the SIPP does not release the exact state of residence but groups several states into clusters for confidentiality purposes. In these cases, we construct an FMR for the state cluster rather than for an individual state. If the implicit cash value of the subsidy is negative (which occurs if 30 % of the household’s income is greater than the FMR), we assign the cash value of the subsidy to be 0.

In our sample, the estimated EITC and housing subsidies accounted for about 3.6 % of household income, on average, and 17.2 % of total government transfer income.

We identify the presence of a new partner either when a person identified as a spouse of the householder enters the household or when a person identified as an unmarried partner (post-1996) or as a POSSLQ (pre-1996) entered the household after the dissolution of the focal (i.e., first) union. This measure also includes income from former spouses/partners if the couple separates and later reunites. This occurs in only a small number of cases and is not sufficiently large to analyze as a separate category. About 4.4 % of married mothers had repartnered by 12 months after the dissolution (4.2 % in 1980s, 5.1 % in 1990s, and 3.2 % in 2000s). About 12.0 % of cohabiting mothers had repartnered by 12 months after the dissolution (9.3 % in 1980s, 11.6 % in 1990s, and 15.0 % in 2000s).

We do not know how resources are pooled among the adults who share a household, so we cannot determine exactly how the other adults pool their income with the householder and her children.

The decision to use a 12-month window before and after the dissolution is the result of a trade-off. The longer we require this window to be, the more cases we exclude because we observe the dissolution too soon or too late in the panel to observe 12 months on either side of it. If we require a shorter window, we can include more cases that meet the criteria, but we do not get as clear a sense of the time trend. Our sample sizes and the precision of our estimates change if we use a longer or shorter time window, but the substantive results are not sensitive to the decision to use a 12-month time frame and do not change if we use a balanced or an unbalanced panel.

We include household size as a control variable rather than using size-adjusted household income as the dependent variable because using a constructed ratio as a dependent variable in a regression analysis implies interactions between the ratio denominator and all the independent variables in the analysis (Smock 1993).

In supplemental analyses, we estimated separate equations for each SIPP panel and found that our conclusions about trends over time were not driven by any single panel.

After 500 repetitions, the standard error values did not change appreciably in different iterations, so we present results for bootstrapped standard errors estimated with 500 repetitions.

Many government transfer programs do not count cohabiting partners’ incomes (or they are not reported even if they should be), so many cohabiting mothers are eligible for cash or in-kind assistance in the form of the EITC, food stamps, and housing assistance, for example. Married mothers are less likely to qualify for such programs because husbands’ incomes are counted in benefit eligibility and are more likely to be reported; as a result, married women become eligible for cash transfer programs upon divorcing, and the expansion of government cash transfer programs, like the EITC, has made this more likely over time.

References

Amato, P. R. (2000). The consequences of divorce for adults and children. Journal of Marriage and Family, 62, 1269–1287.

Andersson, G. (2002). Children’s experience of family disruption and family formation: Evidence from 16 FFS countries. Demographic Research, 7(article 7), 343–364. doi:10.4054/DemRes.2002.7.7

Avellar, S., & Smock, P. J. (2005). The economic consequences of the dissolution of cohabiting unions. Journal of Marriage and Family, 67, 315–327.

Beck, R. W., & Beck, S. H. (1989). The incidence of extended households among middle-aged black and white women: Estimates from a 5-year panel study. Journal of Family Issues, 10, 147–168.

Berube, A. (2005). Earned Income Credit participation—What we (don’t) know. Washington, DC: Brookings Institution.

Bianchi, S. M., & McArthur, E. (1991). Family disruption and economic hardship: The short-run picture for children. Washington, DC: U.S. Government Printing Office.

Bianchi, S. M., Subaiya, L., & Kahn, J. R. (1999). The gender gap in the economic well-being of nonresident fathers and custodial mothers. Demography, 36, 195–203.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women: 1980–2000. Journal of Labor Economics, 25, 393–438.

Bramlett, M. D., & Mosher, W. D. (2002). Cohabitation, marriage, divorce, and remarriage in the United States (Vital and Health Statistics, Series 23). Washington, DC: U.S. Government Printing Office.

Bumpass, L., & Lu, H.-H. (2000). Trends in cohabitation and implications for children’s family contexts in the United States. Population Studies, 54, 29–41.

Bureau of Labor Statistics (2013). Women in the labor force: A databook (BLS Report No. 1049). Washington, DC: Bureau of Labor Statistics.

Cancian, M., & Meyer, D. R. (1996). Changing policy, changing practice: Mothers’ incomes and child support orders. Journal of Marriage and the Family, 58, 618–627.

Casper, L., & Cohen, P. (2000). How does POSSLQ measure up? Historical estimates of cohabitation. Demography, 37, 237–245.

Cohen, P. N., & Bianchi, S. M. (1999). Marriage, children, and women’s employment: What do we know? Monthly Labor Review, 122(12), 22–31.

Daly, M., & Burkhauser, R. V. (2003). The Supplemental Security Income Program. In P. Moffitt (Ed.), Means-tested transfer programs in the United States (pp. 79–140). Chicago, IL: University of Chicago Press.

Desai, S., Chase-Lansdale, P. L., & Michael, R. T. (1989). Mother or market? Effects of maternal employment on the intellectual ability of 4-year-old children. Demography, 26, 545–561.

Duncan, G. J., & Hoffman, S. D. (1985). A reconsideration of the economic consequences of marital dissolution. Demography, 22, 485–497.

Dye, J. (2008). Participation of mothers in government assistance programs: 2004 (Current Population Reports, P70–116). Washington, DC: U.S. Census Bureau.

Edin, K., & Lein, L. (1997). Making ends meet: How single mothers survive welfare and low-wage work. New York, NY: Russell Sage Foundation.

Feenberg, D., & Coutts, E. (1993). An introduction to the TAXSIM model. Journal of Policy Analysis and Management, 12, 189–194.

Freeman, R., & Waldfogel, J. (2001). Dunning delinquent dads: The effect of child support enforcement policy on child support receipt by never married women. Journal of Human Resources, 36, 207–225.

Galarneau, D., & Sturrock, J. (1997). Family income after separation. Perspectives on Labour and Income, 9(2), 18–28.

Garfinkel, I., Huang, C.-C., McLanahan, S. S., & Gaylin, D. S. (2003). The roles of child support enforcement and welfare in non-marital childbearing. Journal of Population Economics, 16, 55–70.

Goldstein, J. (1999). The leveling of divorce in the United States. Demography, 36, 409–414.

Harknett, K. (2006). The relationship between private safety nets and economic outcomes among single mothers. Journal of Marriage and Family, 68, 172–191.

Henly, J. R. (2002). Informal support networks and the maintenance of low-wage jobs. In F. Munger (Ed.), Laboring below the line: The new ethnography of poverty, low-wage work, and survival in the global economy (pp. 179–203). New York, NY: Russell Sage Foundation.

Henly, J. R., Danziger, S. K., & Offer, S. (2005). The contribution of social support to the material well-being of low-income families. Journal of Marriage and Family, 67, 122–140.

Hoffman, S. (1977). Marital instability and the economic status of women. Demography, 14, 67–76.

Holden, K. C., & Smock, P. J. (1991). The economic costs of marital dissolution: Why do women bear a disproportionate cost? Annual Review of Sociology, 17, 51–78.

Hotz, V. J., & Scholz, J. K. (2003). The Earned Income Tax Credit. In P. Moffitt (Ed.), Means-tested transfer programs in the United States (pp. 141–198). Chicago, IL: University of Chicago Press.

Jayakody, R. (1998). Race differences in intergenerational financial assistance: The needs of children and the resources of parents. Journal of Family Issues, 19, 508–533.

Johnson, P. D., Renwick, T., & Short, K. (2010). Estimating the value of federal housing assistance for the supplemental poverty measure (SEHSD Working Paper #2010-13). Washington, DC: U.S. Census Bureau.

Kennedy, S., & Bumpass, L. L. (2011, March–April). Cohabitation and trends in the structure and stability of children’s family lives. Paper presented at the annual meeting of the Population Association of America, Washington, DC.

Kennedy, S., & Ruggles, S. (2014). Breaking up is hard to count: The rise of divorce in the United States, 1980–2010. Demography, 51, 587–598.

Kenney, C. (2004). Cohabiting couple, filing jointly? Resource pooling and U.S. poverty policies. Family Relations, 53, 237–247.

Kenworthy, L., & Smeeding, T. (2013). Growing inequalities and their impacts in the United States (GINI Project). Retrieved from http://www.gini-research.org

Killewald, A., & Bearak, J. (2014). Is the motherhood penalty larger for low-wage women? A comment on quantile regression. American Sociological Review, 79, 350–357.

Koenker, R. (2005). Quantile regression. New York, NY: Cambridge University Press.

LaLumia, S. (2013). The EITC, tax refunds, and unemployment spells. American Economic Journal: Economic Policy, 5, 188–221.

Marr, C., Charite, J., & Huang, C.-C. (2013). Earned Income Tax Credit promotes work, encourages children’s success at school, research finds. Washington, DC: Center on Budget and Policy Priorities. Retrieved from http://www.cbpp.org/files/6-26-12tax.pdf

McKeever, M., & Wolfinger, N. H. (2001). Reexamining the economic costs of marital disruption for women. Social Science Quarterly, 82, 202–217.

McKeever, M., & Wolfinger, N. H. (2005). Shifting fortunes in a changing economy: Trends in the economic well-being of divorced women. In L. Kowaleski-Jones & N. H. Wolfinger (Eds.), Fragile families and the marriage agenda (pp. 127–157). New York, NY: Springer.

McLanahan, S. (2004). Diverging destinies: How children are faring under the second demographic transition. Demography, 41, 607–627.

McLanahan, S., & Percheski, C. (2008). Family structure and the reproduction of inequalities. Annual Review of Sociology, 34, 257–276.

McLanahan, S., Tach, L., & Schneider, D. (2013). The causal effects of father absence. Annual Review of Sociology, 39, 399–427.

McManus, P. A., & DiPrete, T. A. (2001). Losers and winners: The financial consequences of separation and divorce for men. American Sociological Review, 66, 246–268.

Moffitt, R., Ribar, D., & Wilhelm, M. (1998). The decline of welfare benefits in the US: The role of wage inequality. Journal of Public Economics, 88, 2227–2258.

Mooney, C. Z., & Duval, R. D. (1993). Bootstrapping: A nonparametric approach to statistical inference. Newbury Park, CA: Sage.

Morrison, D. R., & Ritualo, A. (2000). Routes to children’s economic recovery after divorce: Are cohabitation and remarriage equivalent? American Sociological Review, 65, 560–580.

Mott, F. L., & Moore, S. F. (1978). The causes and consequences of marital breakdown. In F. L. Mott (Ed.), Women, work, and family (pp. 113–135). Lexington, MA: Lexington Books.

Musick, K., & Michelmore, K. (2012, May). Change in the stability of marital and cohabiting unions following the birth of a child. Paper presented at the annual meeting of the Population Association of America, San Francisco, CA.

Mykyta, L., & Macartney, S. (2011). The effects of recession on household composition: “Doubling up” and economic well-being (Social, Economic, and Household Statistics Division Working Paper 2011-04). Washington, DC: U.S. Census Bureau.

Nestel, G., Mercier, J., & Shaw, L. B. (1983). Economic consequences of midlife change in marital status. In L. Shaw (Ed.), Unplanned careers: The working lives of middle-aged women (pp. 109–125). Lexington, MA: Lexington Books.

Parrott, S., & Sherman, A. (2006). TANF at 10: Program results are more mixed than often understood (CBPP report). Washington, DC: Center on Budget and Policy Priorities. Retrieved from http://www.cbpp.org/8-17-06tanf.htm

Pavetti, L. D., Finch, I., & Schott, L. (2013). TANF emerging from the downturn a weaker safety net. Washington, DC: Center on Budget and Policy Priorities.

Peterson, R. R. (1989). Women, work, and divorce. Albany, NY: State University of New York Press.

Peterson, R. R. (1996). A re-evaluation of the economic consequences of divorce. American Sociological Review, 61, 528–536.

Raley, R. K., & Bumpass, L. (2003). The topography of the divorce plateau: Level and trends in union stability in the United States after 1980. Demographic Research, 8(article 8), 245–260. doi:10.4054/DemRes.2003.8.8

Roschelle, A. R. (1997). No more kin: Exploring race, class, and gender in family networks. Thousand Oaks, CA: Sage Publications.

Schoen, R., & Canudas-Romo, V. (2006). Timing effects on divorce: 20th century experience in the United States. Journal of Marriage and Family, 68, 749–758.

Seltzer, J. A. (1994). Consequences of marital disruption for children. Annual Review of Sociology, 20, 235–266.

Smock, P. J. (1993). The economic costs of marital disruption for young women over the past two decades. Demography, 30, 353–371.

Smock, P. J. (1994). Gender and the short-run economic consequences of marital disruption. Social Forces, 73, 243–262.

Smock, P. J. (2000). Cohabitation in the United States: An appraisal of research themes, findings, and implications. Annual Review of Sociology, 26, 1–20.

Smock, P. J., Manning, W. D., & Gupta, S. (1999). The effect of marriage and divorce on women’s economic well-being. American Sociological Review, 64, 794–812.

Stack, C. B. (1974). All our kin: Strategies for survival in a black community. New York, NY: Basic Books.

Stirling, K. J. (1989). Women who remain divorced: The long-term consequences. Social Science Quarterly, 70, 549–561.

Teachman, J., & Paasch, K. (1994). Financial impact of divorce on children and their families. Future of Children, 4(1), 63–83.

Wamhoff, S., & Wiseman, M. (2006). The TANF/SSI connection. Retrieved from http://www.ssa.gov/policy/docs/ssb/v66n4/v66n4p21.html

Weiss, R. S. (1984). The impact of marital dissolution on income and consumption in single-parent households. Journal of Marriage and the Family, 46, 115–127.

Weitzman, L. J. (1985). The divorce revolution. New York, NY: Free Press.

Westat. (2001). Survey of Income and Program Participation user’s guide (3rd ed.). Washington, DC: U.S. Census Bureau. Retrieved from http://www.census.gov/content/dam/Census/programs-surveys/sipp/methodology/SIPP_USERS_Guide_Third_Edition_2001.pdf

Western, B., Bloome, D., Sosnaud, B., & Tach, L. (2012). Economic insecurity and social stratification. Annual Review of Sociology, 38, 341–359.

Wolfe, B. (1998). Incorporating health care needs into a measure of poverty: An exploratory proposal. Focus, 19(2), 29–31.

Acknowledgments

The authors thank Melissa Giangrande and Jessica Powers for superb research assistance, and Lonnie Berger, Marcia Carlson, Rebecca Glauber, Robert Haveman, Daniel Meyer, Rebecca Ryan, Christine Schwartz, Tim Smeeding, and participants at the Institute for Research on Poverty’s Emerging Scholars Conference and the Cornell Inequality Discussion Group for feedback on early drafts of the article. The research was supported by the President’s Council of Cornell Women Affinito-Stewart Grants Program and by Grant No. AE00102 from the U.S. Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE), which was awarded by the Substance Abuse and Mental Health Services Administration (SAMHSA). Its contents are solely the responsibility of the authors and do not necessarily represent the official views of ASPE or SAMHSA.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

ᅟ

Rights and permissions

About this article

Cite this article

Tach, L.M., Eads, A. Trends in the Economic Consequences of Marital and Cohabitation Dissolution in the United States. Demography 52, 401–432 (2015). https://doi.org/10.1007/s13524-015-0374-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-015-0374-5