Abstract

In this paper, we investigate market- and time-consistent valuation of life-insurance liabilities, which are long-dated by nature. To obtain a market- and time-consistent value, the “two-step market evaluation” introduced by Pelsser and Stadje (Math Finance 24:25–65, 2014) is used to evaluate a hybrid payoff with underlying hedgeable financial and (partially) unhedgeable actuarial risks. The resulting time-consistent and market-consistent (TCMC) price captures the dynamics of the risk drivers over the lifetime of the contract. We show that the EIOPA standard-formula for the risk-margin is not time-consistent, and we construct a time-consistent version of the risk-margin that captures the extra uncertainties from the process dynamics. EIOPA’s standard-formula for the Risk-Margin is compared to the TCMC price for a simple unit-linked contract and we show that the effects of time-inconsistency are increasing with maturity and are significant for long-dated contracts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Life-insurance companies and pension funds have very long-dated liabilities in their books. People start to save from age 25 and, with an average life expectancy of 85 years, a life-insurance or pension liability can consist contractual obligations that can last up to 95 years in the future. To provide a sense of the magnitude: approximately 20% of the NPV of the liabilities’ cash flows can be attributed to cash flows beyond 30 years. Most of these very long-dated contracts are not (actively) tradable in the market (non-market risks); therefore, no other contracts can be used to hedge these risks. A life-insurance or pension contract is a “hybrid” financial and actuarial payoff with significant exposure to market risks, such as interest rates, equities, and inflation.

Actuarial pricing operators typically ignore the hedging mechanisms available in financial markets, and evaluate the payoff in a “static” way through a one-period valuation, ignoring the stochastic evolution at intermediate time-points. On the other hand, classical financial pricing accounts for the evolution of the risk until maturity in a “dynamic” manner but usually ignores the unhedgeable risks. This dynamic valuation is needed to capture a payoff’s “path-dependent” nature in a broad range of traded financial contracts. From a theoretical perspective, as the long-dated contract is exposed to hedgeable financial risks and non-hedgeable actuarial risks, the market for such liabilities is incomplete. The standard risk-neutral pricing machinery breaks down in that case as it is no longer possible to construct a perfect replicating portfolio to hedge all risks. Therefore, a pricing framework that explicitly includes non-hedgeable (actuarial) risks and remains market-consistent is necessary, while the hedgeable financial prices are still consistent with risk-neutral pricing.

In a incomplete market setting, one seeks to extend arbitrage-free pricing operators to the larger space of (partially) unhedgeable contracts. Utility-indifference (and duality) methods, automatically induce market consistency. The paper by Hodges and Neuberger [26] is frequently cited as the root idea of the utility-indifference pricing literature. The big challenge in implementing utility-difference pricing methods is that it is very difficult to obtain explicit results. Musiela and Zariphopoulou [35] compute explicit results to for the indifference premium through an exponential utility function. A related branch of the literature extends arbitrage-free pricing operators using (local) risk-minimization techniques and the related notion of minimal martingale measures; see Föllmer and Schweizer [23], Schweizer [42], Delbaen and Schachermayer [15], and Møller [34]. A rich duality theory has been developed that makes deep connections between utility maximization and risk minimization over the martingale measures; see Cvitanic and Karatzas [12] and Kramkov and Schachermayer [28].

To obtain a more explicit characterization of time-consistent and market-consistent valuations, Pelsser and Stadje [37] introduce a method called Two-Step Evaluation. They prove that, under mild technical conditions, any market- and time-consistent pricing operator can be represented as a two-step market evaluation. Intuitively, the two-step evaluation can be characterized as:

-

First step: Conditional on a financial risk driver, applies an actuarial pricing operator on the general (hybrid) payoff (position) and turns it into a function of only financial risk that, through the structure, is perfectly hedgeable;

-

Second step: Applies conditional expectations under a unique equivalent martingale measure \(\mathbb {Q}\) that reflects a no-arbitrage argument for the hedgeable part of the general position.

Several researchers have investigated the construction of time-consistent risk measures. See Cheridito et al. [10], Rosazza Gianin [39], and Artzner et al. [2] for general ideas on dynamic risk measures, and Peng [38], Frittelli and Gianin [24], Maccheroni et al. [32], Bion-Nadal [7], and Barrieu and El Karoui [6] for time consistency in continuous time. More specifically, Jobert and Rogers [27] showed that a time-consistent price could be constructed using a backward iteration that sticks the shorter one-period static price operators to each other over a more extended period. Although the real re-valuation of liabilities occurs forward, the compatible pricing method can reflect this property in a backward valuation manner, starting from maturity. Therefore, the contracts must be priced backward by re-valuating the payoff value in middle times and reach the price at \(t=0\). In recent work, Salahnejhad and Pelsser [40] used the method of Jobert and Rogers [27] to find the continuous-time limit of well-known actuarial premium principles under time-consistency. In addition, Pelsser and Stadje [37] proved that for finitely many stopping times \(\tau \in [0, T]\) of the underlying actuarial process, time-consistency, and market-consistency imply that every evaluation (including actuarial premium principles) must admit a representation of the two-step market evaluation. The result is stable even when the insurance process follows a jump-diffusion process, and jumps occur only at finitely many predictable times. An applied framework for the two-step actuarial valuation for different alternative pricing methods, including time-consistent valuation, and application on a toy example of participating pension contract is explained in Salahnejhad Ghalehjooghi and Pelsser [41].

In some recent developments on the market-consistent valuation Dhaene et al. [19] defined a one-period framework of “fair valuation” as being both market-consistent (mark-to-market for hedgeable claims) and actuarial (mark-to-model for unhedgeable part). Fair valuation then becomes a hedge-based method that, based on the traded assets in the market, provides the best hedge in the first step and gives the actuarial value of the remaining unhedged claim in the second step. They show that the fair hedge-based valuation is identical to the two-step actuarial valuation in Pelsser and Stadje [37]. Assa and Gospodinov [3] studied the market-consistent valuations in imperfect markets and showed that market-consistency of the type defined in this paper is only well-defined in a perfect market. They showed that market-consistency is strongly connected to hedging and all market-consistent evaluators are a kind of “best-estimate” that two-step valuations can represent. In a pair of papers Delong et al. [16] and Delong et al. [17] developed the one-period fair valuation into multi-period setting by backward iteration of the discrete-time one-period operator and provided a continuous-time limit of the market-consistent actuarial price. Finally, Deelstra et al. [13] rearrange the market-consistent valuation in a three-step method by decomposing the contingent payoff into a financial hedgeable part, a diversifiable actuarial part, and then eventually a non-hedgeable residual part. The interested readers may also consult Barigou and Dhaene [5], Barigou et al. [4] and Chen et al. [9].

In Europe, the European Insurance and Occupational Pension Authority (EIOPA), in connection with the Solvency II framework, requires market-consistent valuation for life-insurance liabilities, that includes market information related to the liability as well as an explicit loading for non-market risks. The market-consistent actuarial valuation integrates the financial and actuarial pricing methods and considers both hedgeable and unhedgeable risks, including their interactions and dynamic pricing of a combined payoff.

This paper makes the following contributions. First, we provide an applied implementation of the market-consistent actuarial price using the two-step valuation method. We note that the EIOPA standard-formula for computing the risk-margin is not time-consistent. We therefore implement in our calculations a time-consistent extension of the risk margin to quantify the cost of “time-inconsistency” of the EIOPA standard-formula. To illustrate our approach, we price a simple unit-linked contract without guarantee. We show that the gap between the best-estimate and the time-consistent EIOPA price is significant for long-dated contracts. Finally, whereas most studies assume independence between financial and actuarial risks, we also investigate the impact a non-zero correlation on the pricing of contracts.

2 Time-consistent and market-consistent valuation

This section briefly recaps the general framework for time-consistent and market-consistent valuation of insurance products and pension liabilities. We consider a class of contracts whose payoffs are contingent on the evolution of hedgeable financial risk(s) combined with unhedgeable (or partially hedgeable) actuarial risk(s). First, we introduce the appropriate valuation operators in a one-period setting and extend the framework to a multi-period setting in which we construct a pricing operator that is time-consistent. Then, we show that the EIOPA standard-formula for the risk-margin is not time-consistent, and we construct a time-consistent version of the risk-margin that captures the extra uncertainties from the process dynamics.

2.1 Setup and assumption

As a general setting, we start with \((\Omega , \mathscr {F}, \mathbb {P})\) as the underlying probability space with the filtered \(\sigma\)-algebra \(\mathscr {F}_t\) defined on the time index t varying on the finite interval [0, T]. Given the hybrid nature of the payoff, we model the information flow using two separate \(\sigma\)-algebras consisting of \((\mathscr {F}^S_t)_{t\ge 0}\) for the financial information and \((\mathscr {G}^A_t)_{t\ge 0}\) for the actuarial information that the insurance company or the pension fund has available at time t. Essentially, we aim to achieve an actuarial value conditional on the actuarial information represented by \(\mathscr {G}^A\), which is generated through the actuarial risk process(es) but not its financial value. We only use financial information to capture information on the traded financial risks in pursuit of market-consistency. Hence, we price the contract with respect to \(\mathscr {G}^A\) and call the possible price/valuation operator “\(\mathscr {G}^A\)-conditional.”

We denote the information flow of both risk categories at time t by \(\mathscr {G}_t = \sigma (\mathscr {G}^A_t \cup \mathscr {F}^S_t)\), where \(\mathscr {G}\subset \mathscr {F}\). However, later, given the required form of the valuation operator, we might need to use other versions of \(\mathscr {G}\) where \(\mathscr {G}^A\) and \(\mathscr {F}^S\) have a different time-index representing the information flow in different points of time.

Suppose we have two stochastic processes \(x_t\) as hedgeable pure financial risk and \(y_t\) as non-traded (partial or) unhedgeable insurance risk. The general payoff \(G(x_T,y_T) \in L^2(\mathscr {F})\) is a mixed derivative of the financial and insurance risks in an incomplete market, whereas \(G^S(x_T) \in L^2(\mathscr {G})\) is a pure financial claim for which \(L^2\) exhibits the space of the bounded random variables on the probability space. Let \(\Pi _{\mathscr {G}}: L^2(\mathscr {F}) \rightarrow L^2(\mathscr {G})\) be the \(\mathscr {G}\)-conditional pricing operator.

We assume that the financial market is complete and arbitrage-free, which means that all risks conditional on actuarial information \(\mathscr {G}^A\), only depend on financial risks and can be hedged by trading in continuous time. As a numéraire asset, we select the money-market account \(B(t) = e^{\int _0^t r_s \, ds}\), where the risk-free interest rate process \(r_t\) can be stochastic and is adapted to the financial filtration \(\mathscr {F}_t\). Hence, using the Fundamental Theorems of Asset Pricing (see, e.g., Delbaen and Schachermayer [14]), there exists a unique martingale measure \(\mathbb {Q}_{\mathscr {G}}\) for the financial risk process that is equivalent to \(\mathbb {P}_{\mathscr {G}}\), such that the relative prices of all assets divided by the money-market account B(t) are martingales. For the remainder of this paper, we denote all payoff and price-variables in “discounted” terms, i.e. expressed in values relative to the numéraire asset B(t). Hence, we can express the (discounted) price of a pure financial claim \(G^S\) as

In contrast, as actuarial risk is not (entirely) hedgeable, we cannot use a replicating portfolio argument for insurance derivatives. Of course, many actuarial premium principles have been proposed in the context of pure actuarial risks. Most actuarial premium principles are a non-linear function of discounted loss and impose an extra risk premium (also called “Risk Loading”) on the “Best-Estimate” of future insurance losses. In itself, a risk loading is a risk measure that plays the role of a buffer to cover the possible deviation of future losses from what is expected from the best-estimate of the losses. Both best estimate and risk loading are calculated under the real-world measure \(\mathbb {P}\). This postulates that actuarial pricing is an economic decision under uncertainty, whereas financial pricing is normally based on the risk-neutral valuation built using an equivalent martingale measure that utilizes a conditional expected value under a risk-adjusted underlying process. Goovaerts and Laeven [25] discussed the no-arbitrage argument for the actuarial pricing operators for pure insurance risks and the securitized version of the insurance products.

As a reasonable pricing method, if we add a pure financial claim to a given general payoff \(G(x_T, y_T)\), we expect that the pure financial part of the portfolio should be priced consistently with arbitrage-free pricing. Note that, although we assume that the market containing only financial payoffs \(G^S\) is complete, the market given by general \(\mathscr {F}\text {-measurable}\) payoffs G is incomplete. Moreover, the payoffs replicable by perfectly liquid assets do not carry risks more than the market risk. We formalize this concept in the following definition.

Definition 2.1

An actuarial pricing operator \(\Pi _{\mathscr {G}^A}\) conditional on the actuarial information \(\mathscr {G}^A\) is market-consistent if, for any financial derivative \(G^S(x_T)\) and any general claim \(G(x_T, y_T)\), we have

The market-consistency definition postulates that, given the actuarial information, the actuarial price of a general payoff plus a pure financial payoff equals the actuarial price of the general payoff plus the arbitrage-free price of the pure financial payoff. This definition establishes a generalized notion of “translation invariance” for the \(\mathscr {G}\)-conditional valuation operator with respect to the pure financial risk. This implies that if any hedgeable risk exists (even in the payoff G), it must be hedged through a market-consistent valuation. Hence, a market-consistent valuation cannot be improved through hedging. A similar representation of the market-consistency can be found in Kupper et al. [29] or Malamud et al. [33].

2.2 Two-step actuarial valuation in a one-period setting

Pelsser and Stadje [37] proposed that the market-consistent value of a contingent payoff can be constructed using a two-step market evaluation method. Under this method, the price is developed by splitting the no-arbitrage financial price operator, \(\mathbb {E}^\mathbb {Q}\) (which prices a hedgeable pure financial payoff), and an actuarial valuation operator, \(\Pi ^\mathbb {P}\) (which prices a general (partially) unhedgeable payoff). We call this operator a “two-step actuarial operator”, or simply a “two-step operator” or “two-step valuation”.

In a one-period setting, to value the mixed position \(G(y_T, x_T)\) at time \(t<T\), a conceptual representation of the two-step actuarial operator is defined as followsFootnote 1:

Definition 2.2

A \(\mathscr {G}^A\)-conditional actuarial operator \(\Pi _{\mathscr {G}^A}: L^2(\mathscr {F}) \rightarrow L^2(\mathscr {G}^A)\) is a two-step market evaluation if for a \(\mathscr {G}\)-conditional pricing operator \(\Pi _{\mathscr {G}}: L^2(\mathscr {F}) \rightarrow L^2(\mathscr {G})\)

where \(\mathscr {G}= \sigma (\mathscr {G}^A \cup \mathscr {F}^S)\) contains both financial and actuarial information.

The equation shows the functional form of the two-step valuation. In the inner step, the \(\sigma \left( \mathscr {G}^A_t, \mathscr {F}^S_T\right)\)-conditional actuarial operator \(\Pi ^{\mathbb {P}}\) is computed, whereas the financial process \(x_T\) is a \(\mathscr {F}^S_T\)-measurable variable. Hence, the only randomness comes from the actuarial risk factor (insurance process) at time T, \(y_T\), conditional on \(\mathscr {G}^A_t\), and \(x_T\) stays constant. Let \(y_t\) and \(x_t\) be stochastic processes with a Markov property. They reflect exclusively all information available at \(\mathscr {G}^A_t\) and \(\mathscr {F}^S_t\), respectively, and are used instead for conditioning. Applying the inner operator, turns the term \(\Pi ^{\mathbb {P}}\left[ G\big (y_T, x_T\big ) ~\big \vert ~ \sigma \left( \mathscr {G}^A_t, \mathscr {F}^S_T\right) \right]\) into the function \(G^S\left( t, T, y_t, x_T \right)\) which is therefore a random variable measurable with respect to \(\sigma \left( \mathscr {G}^A_t, \mathscr {F}^S_T\right)\). Now, applying the outer conditional expectation \(\mathbb {E}^{\mathbb {Q}}\) with respect to \(\sigma \left( \mathscr {G}^A_t, \mathscr {F}^S_t\right)\), the only source of randomness in \(G^S\) is \(x_T\). This shows that the structure of the two-step actuarial evaluation in (3) is well defined.

A simple description of the two-step actuarial valuation in a one-period setting over [t, T] is as follows:

-

In the first (inner) step, we assume that we know all financial information up to and including time T, whereas our knowledge of actuarial information is up to time \(t<T\) (i.e., we know \(y_t\)). We calculate the actuarial value of the payoff \(G(y_T, x_T)\) under the real-world measure \(\mathbb {P}\) given \((y_T, x_t)\).

$$\begin{aligned} \Pi ^{\mathbb {P}}\left[ G(y_T, x_T) \,\Big \vert \, (y_t, x_T) \right] \end{aligned}$$The result of this step turns the general payoff \(G(y_T, x_T)\) into a function exhibited by \(G^S(y_t,x_T)\).

-

Because looking from time, t, \(G^S(y_t, x_T)\) is random only on the financial risk \(x_T\), it can be perfectly hedged given the completeness of the financial market and the no-arbitrage argument. Hence, the second (outer) step can be performed through the conditional expectation under the risk-adjusted measure \(\mathbb {Q}\), when we condition on \(x_t\).

$$\begin{aligned} \mathbb {E}^{\mathbb {Q}}\left[ G^S(y_t, x_T) \,\Big \vert \, (y_t, x_t) \right] \end{aligned}$$Note that the second step is still implemented given the actuarial information provided by \(y_t\).

Hence, in the two-step actuarial valuation, we use both sources of information that we have in hand from \(x_T\) and \(y_T\).

A simplified form of the two-step market valuation for the actuarial operator \(\Pi\) can be defined as follows:

Definition 2.3

Let \(y_t\) and \(x_t\) be Markov processes with respect to \(\mathscr {G}^A_t\) and \(\mathscr {F}^S_t\). A \(\mathscr {G}^A\)-conditional actuarial operator \(\Pi _{\mathscr {G}^A}\) is a two-step operator if

In the inner step, under the actuarial operator \(\Pi\) and conditional on \(y_t\) and \(x_T\), the only randomness is through the actuarial risk process at time T, \(y_T\). Then, applying the outer conditional expectation \(\mathbb {E}^{\mathbb {Q}}\) conditional on \(x_t\), the only source of randomness is \(x_T\). We emphasize that, at each time step or sub-interval, two valuation operators need to be applied.

2.2.1 Two-step operator in a binomial tree

An intuitive exhibition of the two-step method via a binomial discretization of the two-state variables x and y is as follows: At a typical time step \((t, t+\Delta t)\), every state \((x_t, y_t)\) of the payoff at time t will develop to four different states of the world at time \(t+\Delta t\), as follows

We pretend that, first, \(x_t\) evolves and ends in two different states at \(t+\Delta t\). Only then, given each state of \(x_{t+\Delta t}\), does the process \(y_t\) move. The following pattern will be concluded:

where \(q^{\mathbb {Q}}\) is the risk-adjustedFootnote 2 probability of “up” state for financial risk, and p is the probability of the “up” state for actuarial risk. In a two-step valuation, given each state of \(x_{t+\Delta t}\) (i.e., we know whether it is \(x^+\) or \(x^-\)) in the inner step (actuarial valuation step), we perform the actuarial valuation for nodes \(y_{t+\Delta t}^+\) and \(y_{t+\Delta t}^-\). Then, in the outer step (financial valuation step), we have two states of the world that only depend on \(x_{t+\Delta t}\), where we compute the price under binomial risk-neutral probabilities (\(q^{\mathbb {Q}}\)).

2.3 Time-consistency in a multi-period setting

Given the regulatory requirements or reporting purposes, insurance companies and pension funds need to revaluate their liabilities at regular intervals. Suppose we are at time zero and want to value a contingent payoff at time T. At time \(0< s <T\), an economic shock, a non-economic decision, or any other new information may change the state and trend of the financial and actuarial risk drivers. This can significantly affect the value of liabilities and must be considered in the valuation at time zero (present time). We achieve this requirement by constructing a time-consistent and market-consistent pricing operator to price long-term liabilities. This problem becomes highly important in the price/valuation operators, such as the Cost-of-Capital operator, which includes risk measures (VaR) on a one-year scale.

In the sub-sections that follow, we first present the EIOPA risk-margin standard-formula, and show that this is not a time-consistent operator. We then extend the standard-formula to a time-consistent pricing operator.

2.3.1 Risk-margin via the EIOPA standard-formula

EC Delegated Regulation 2015/35 [20] provides the Solvency II standard formula to value the technical provision for insurance liabilities as the sum of the best-estimate and the risk-margin under the cost-of-capital approach. The risk-margin component is an adjustment to cover the uncertainty arising from the unhedgeable part of liabilities and is measured using a one-year \(\mathbb {V}\text {aR}\) of the unexpected loss with a probability threshold q (in Solvency II, equal to 0.995). A small probability \(1-q\) always exists that a risk loading (capital buffer) is needed to compensate for the actual unexpected loss (unhedgeable risk). This “buffer capital” can be provided by external stakeholders, such as company shareholders. In return, capital providers ask for cost-of-capital \(\delta\) to compensate for their investment in a risky position. Therefore, the insurer includes this cost-of-capital as risk loading in price to be paid by the policyholder.Footnote 3 The Solvency II framework advises to set the confidence level of the \(\mathbb {V}\text {aR}\) to \(99.5\%\) and the cost-of-capital to \(6\%\). Suppose we only have the actuarial risk \(y_t\) with payoff \(f(y_T)\) for \(t<T\). The EIOPA risk-margin price at time t for a contract with payoff at time \(T>t\), based on the Solvency II framework consists of the summation of the best-estimate discounted payoff and the summation of the discounted future Solvency Capital Requirement (SCR) for that payoff. The price (\(\Pi _t^{E}\)) is formulated as follows,

where \(h(y_{t+k})\) is the discounted best-estimate of the final payoff given the information available at time \(t+k\) for annual times \(k = 0, 1, 2,..., T-t\).Footnote 4 Therefore, the \(\mathbb {V}\text {aR}\) of the difference between shocked and the best-estimate scenarios

represents the future SCRs for each time step \((t+k-1, t+k)\) given the best-estimate path of y at \(t+k-1\). \(\Pi _t^E\) is the conditional Cost-of-Capital operator with available information at time \(t<T\).Footnote 5

The base value of the price is still the one-period discounted best-estimate of the payoff at time T, \(h(y_t)\). The summation term over annual time-steps from \(t+1\) until maturity T can be interpreted as follows. For each time-step, we consider the one-year \(\mathbb {V}\text {aR}\) along the best-estimate path of y. Hence, the \(\mathbb {V}\text {aR}\)-operator is conditioned on \(\mathbb{B}\mathbb{E}(y_{t+k-1})\). Using this projected value of \(y_{t+k-1}\) at each time step as a starting point, we then consider the impact of a 99.5% worst-case shock in non-market risks \(y_{t+k}\) on the best-estimate of the payoff at time \(t+k\), represented by \(h(y_{t+k})\). This is the projected buffer-capital for time \(t+k\). Over this buffer-capital, we must pay the cost-of-capital \(\delta\) to capital providers. The sum of all these discounted cost-of-capital payments is the “EIOPA Risk-margin”. Equivalently, this formulates the risk measurement as follows: over the valuation period [t, T] for each point in time \(t+k \le T\), we take the best-estimate value of the underlying risk driver in one year earlier, \(t+k-1\), as the available information. Based on that, we calculate the \(\mathbb {V}\text {aR}\) of the difference between the one-year shocked and best-estimate payoff reference to the best estimate underlying risk as the SCR in that one year.

2.3.2 Time-inconsistency of the EIOPA standard-formula

Although the EIOPA risk-margin formula is calculated in a multi-period setting, it is not a time-consistent pricing operator. It considers the uncertainty arising from non-market risks \(y_T\) on the best-estimate price. However, there exists a “second-order” effect, that is, the uncertainty arising from the non-market risks \(y_T\) on future buffer capital. Therefore, EIOPA’s Risk-margin pricing operator ignores the “capital-on-capital” effect that a time-consistent operator does take into account.

To illustrate this point, we consider the example from Pelsser [36]. Suppose there is a two-year product with a payoff \(e^{b W_y(2)}\) where \(W_y(t)\) is the standard Brownian motion at time t. The best-estimate path is given by \(\mathbb {E}_t[e^{b W_y(2)} | W_y(t)=0] =\) \(e^{\mathchoice{{\textstyle {\frac{1}{2}}}}{{\textstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}} b^2(2-t)}\) for \(t=0,1,2\). A one-year 99.5% worst-case shock on \(W_y(t)\) is given by an increase in value to \(W_y(t) + 2.58\). Hence, the Value-at-Risk in year t is approximated by applying the one-year shock to the best-estimate path as \(e^{\mathchoice{{\textstyle {\frac{1}{2}}}}{{\textstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}} b^2(2-t)}(e^{2.58 b}-1)\). Finally, the EIOPA standard-formula for the price for this two-year product would be calculated as

where we have set interest rates equal to zero, for ease of exposition. For \(b=50\%\) and \(\delta =6\%\), we obtain a price of 1.62.

A disadvantage of the “best-estimate path method” is that the dynamics of the risk driver y(t) are entirely ignored for the \(\mathbb {V}\text {aR}\) calculation. If we move one year ahead in time, then the risk driver will be at the value y(1), which will differ from the best estimate value \(\mathbb {E}[y(1)]\). Hence, the EIOPA standard-formula for the product’s price at time \(t=1\) is based on a different best-estimate path than the calculation at \(t=0\). Therefore, the standard-formula prescribed by EIOPA is not time-consistent.

To obtain a time-consistent version of the EIOPA pricing operator, we use a backward-induction method. Given the payoff at \(T=2\), we can calculate the price at time 1 conditional on the value of \(W_y(1)\) as

This expression can be simplified to

Given the price at time 1, which is now an explicit function of \(W_y(1)\), we can calculate the time-consistent price at \(t=0\). This leads to the formula

If we take again \(b=50\%\) and \(\delta =6\%\), we obtain a price of 1.72.

When we compare the price (6) of the EIOPA standard-formula with the time-consistent price (7), then we immediately see the effect of the best-estimate path approximation. In (6) one adds the terms \(\delta (e^{2.58b}-1)\) and \(\delta e^{\mathchoice{{\textstyle {\frac{1}{2}}}}{{\textstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}} b^2} (e^{2.58b}-1)\) to the price \(e^{\mathchoice{{\textstyle {\frac{1}{2}}}}{{\textstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}} b^2 2}\). Whereas the time-consistent method explicitly takes the “capital-on-capital” effect into account by multiplying the price \(e^{\mathchoice{{\textstyle {\frac{1}{2}}}}{{\textstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}}{{\scriptscriptstyle {\frac{1}{2}}}} b^2 2}\) twice with the factor \(\bigl (1 + \delta (e^{2.58b}-1) \bigr )\).

2.3.3 Time-consistent valuation

Under a time-consistent price operator, if position A is riskier than position B at some point of time, it is guaranteed to be riskier at any point of time prior to that point. Therefore, if \(\rho _t\) denotes the price of A and B at time t, under time-consistency for \(T>0\), \(\rho _T(A) > \rho _T(B)\), and then \(\forall t<T\), \(\rho _t(A) > \rho _t(B)\). As a result, the value of the time-T liability at time zero should equal the price obtained as if we value the liability at a middle time \(0< s <T\), and then value the time-s value of the liability at time zero. This property can be translated as the following:

Definition 2.4

A conditional valuation operator \((\Pi _t)\) is time-consistent if and only if, for all \(0 \le t < s \le T\) and any measurable non-negative payoff f(y(T)),

This “recursive” form of the time-consistency definition constructs the time-consistent actuarial operator in a multi-period setting. Time-consistency is a generalization of the “no-arbitrage” arguments widely discussed in the financial pricing literature and is constructed by the “tower property” of the conditional expectation operator,Footnote 6 which can now be extended to non-linear operators. A formal definition of the time-consistency can be found in Follmer and Penner [22], Cheridito and Stadje [11], and Acciaio and Penner [1].

We apply the time-consistency property to the two-step actuarial valuation to expand market-consistency, at least in a finite number of points, over the entire period [0, T] in a dynamic setting. We are interested in preserving the market-consistency for all possible middle points in the valuation period. This can be achieved by applying the “Backward Iteration” method proposed by Jobert and Rogers [27] to the two-step operator. Suppose the valuation period [0, T] is divided into a set of sub-intervals. In that case, backward iteration constructs a time-consistent valuation by connecting and re-valuating the one-period valuation (in our case, the two-step actuarial valuation) over the sub-intervals in a backward manner, starting from T. See Salahnejhad and Pelsser [40] for an overview of how time-consistency can be obtained for well-known actuarial premium principles via the backward iteration method. For the two-step actuarial valuation, the idea is generally described as follows.

Suppose we would like to value a time-T payoff at time zero. The representation in Eq. (4) does not necessarily imply that the two-step actuarial valuation must be applied in a one-period valuation setting over (0, T). We divide the time interval [0, T] using a discrete set of points \(\{0,\Delta t, 2\Delta t,..., T-\Delta t, T\}\) into a number \(n = \frac{T}{\Delta t}\) of sub-intervals of the form \((t, t+\Delta t)\). The backward iteration procedure starts from time T over the last sub-interval \((T-\Delta t, T)\) to value the payoff \(G(T, x_T, y_T)\) at time \(T-\Delta t\). Using the backward iteration method, we calculate the price process of a contract at time \(0 \le t < T\), where the price at \(t+\Delta t\) for any t is considered as a new payoff. Let the one-period \(\mathscr {G}\)-conditional actuarial price at time \(T-\Delta t\), be denoted by \(\pi (T-\Delta t, x, y)\) and for simplicity take \(\Delta t= 1\).

We are now in a position to construct a time-consistent valuation operator for the EIOPA risk-margin valuation \(\Pi _t^{E}\) in (5). The resulting time-consistent and market-consistent pricing operator for a general payoff \(G(y_T, x_T)\) has the following form:

with the inner step operator

where for the annual time-points \(k = 0, 1, 2,..., T-t\),

is the best-estimate final payoff conditioned on the actuarial information at time \(t+k\).Footnote 7

In the inner step, we first calculate the best-estimate value of the payoff given the discounted value of the financial risk \(x_T\) and actuarial risk \(y_t\). Then, for each year k, we add the summation of the one-year \(\mathbb {V}\text {aR}\) values of the difference between the shocked and best-estimate payoff \(h(y_{t+k}, x_T)\), conditional on the known discounted financial state variable \(x_T\) and the best-estimate value of the underlying actuarial process one year earlier, i.e. \(\mathbb{B}\mathbb{E}(y_{t+k-1})\). In fact, at each point in time \(t+k\), we look forward to the final payoff and consider its best-estimate given the actuarial information at \(t+k\). Each \(\mathbb {V}\text {aR}\) value is basically calculated using a \(99.5\%\) shock on the underlying actuarial risk for one year, given its best-estimate one year earlier, \(t+k-1\). The output of the inner step is again, by construction, a payoff that depends only on \(x_T\) as the source of randomness and is valuated by the conditional expectation under the risk-adjusted measure \(\mathbb {Q}\), given \(x_t\).

For every time step \(\Delta t= 1\), we implement a backward iteration of the valuations in Eqs. (9) and (10) for all sub-intervals \((t, t+1)\), to obtain the time-consistent market-consistent price at time zero under the EIOPA formula.

2.3.4 Time-consistency risk premium

Different operators may offer different prices for the same contingent payoff. Suppose we exhibit the one-period actuarial value of the risk at time t by \(\Pi _t\), and the time-consistent actuarial valuation driven by the backward iteration by \(\Pi _t^{\text {TC}}\). Both operators are constructed using the same valuation operators, and all other parameters are equal. The possible fundamental difference between these two prices is only the result of enforcing the time-consistency property mentioned in Definition 2.4. We call this price difference the “Time-Consistency Risk Premium” (TCRP) and show it as

In case there exists an analytical solution for the time-consistent actuarial value (by the continuous-time limit of the time-consistent operator when \(\Delta t\rightarrow 0\)), \(k^{\text {TC}}\) can also be obtained analytically. In applications, practitioners use an approximations of the time-consistent price (e.g., they work with \(\Delta t= \text {one year}\)) that gives an approximated TCRP: \(\hat{k}^{\text {TC}} (t, T) = \hat{\Pi _t^{\text {TC}}} - \Pi _t\).

3 Application to a unit-linked contract

We provide some insights into the time-consistent and market-consistent EIOPA risk-margin price for a simple unit-linked contract where equity and mortality are the underlying financial and actuarial risk drivers, respectively. Each policyholder of the cohort age x participates in the contract by buying a unit at start time \(t=0\). We assume that the contract has no guarantee. The payoff is the product of the financial and actuarial risks

where T is the maturity date, \(S_T\) is the discounted value of the investment asset, and \(N_x(T)\) is the number of survivors of the original cohort who reach age \(x+T\). We assume that \(N_x\) is known at the start of the contract. At maturity, the market value of the investment asset will be paid to survivors. If \(N_x(T) = \mathbbm {1}_{T_x \ge T}\), the contract is specialized for an individual of age x, with the remaining lifetime random variable \(T_x\). Typically, in unit-linked contracts, T is the retirement age minus current age.

3.1 Risk drivers

Suppose in the payoff function in (12), \(\tilde{S}_T\) is a financial risky asset in the market following geometric Brownian motion (GBM)

where \(\alpha\) is the excess expected return on the asset, \(\sigma _S\) is the constant volatility, and \(\tilde{W}_t\) is a standard Brownian motion defined on filtration \(\mathscr {F}^S_t\) on the time interval [0, T] under the real-world measure \(\mathbb {P}\). Furthermore, \(r_t\) represents the risk-free instantaneous interest rate in the market and is a stochastic process adapted to \(\mathscr {F}^S_t\). Based on \(r_t\), the money-market account given as \(B_t = \exp \left( \int _0^t r_s \textrm{d}s \right)\). Let \(S_t = \frac{\tilde{S}_t}{B_t}\) be the discounted asset price process,

In the complete market assumption, under the unique equivalent martingale measure \(\mathbb {Q}\), the relative price process \(S_t\) is a martingale \(\textrm{d}S_t =\sigma _S\, S_t\, \textrm{d}W_t\), where \(W_t\) denotes a \(\mathbb {Q}\)-Brownian motion.

For the actuarial risk, we denote the survival and death probability of (x) using  and

and  , respectively. The deterministic force-of-mortality of an individual aged x at time t is defined as

, respectively. The deterministic force-of-mortality of an individual aged x at time t is defined as  .Footnote 8

.Footnote 8

To study the evolution of the survival probability  as a stochastic process at time t, we use the model introduced by Lee and Carter [30]. In the Lee–Carter model, for age x and calendar year t, the stochastic force-of-mortality, \(\mu _x(t)\), is

as a stochastic process at time t, we use the model introduced by Lee and Carter [30]. In the Lee–Carter model, for age x and calendar year t, the stochastic force-of-mortality, \(\mu _x(t)\), is

where \(\kappa _t\) is the general level of mortality, \(\alpha _x\) is the average age-specific mortality, and \(\beta _x\) is the age-specific sensitivity of the mortality to a change in \(\kappa _t\). \(\kappa _t\) is a latent process to model the longevity trend,

with the solution \(\kappa _t = \kappa _0 + \mu _\kappa t + \sigma _\kappa W^\kappa _t\), \(\kappa _0=0\) and \(W^ \kappa\) a standard Brownian motion under measure \(\mathbb {P}\). The best-estimate for \(\kappa _t\) process at time zero is \(\mathbb {E}(\kappa _t) = \kappa _0 + \mu _\kappa t\).

The Lee–Carter model based on the realized mortality rates of the past calendar years calibrates the parameters \(\alpha _x\) and \(\beta _x\).Footnote 9 Then the future force-of-mortality can be projected for individual (x). In that sense, \(t>0\) is the notation for future time.

Conditional on \(\kappa _t\), the remaining lifetime the policyholders are assumed to be independent. Moreover, the force-of-mortality of an individual of age \(x+t\) at future time t is given by

Note that the parameters \(\alpha , \beta : \mathbb {R}_+\rightarrow \mathbb {R}\) are piecewise constant on the intervals \([t,t+1)\). This means that for all \(u \in [0, 1)\), \(~\mu _{x+u}(t+u) = \mu _x(t)\). As we valuate the price of the product for a group of participants, let \(N_x(t)\) denote the cohort of policyholders of age \(x+t\) at time t. We assume that the death events of the group members are independent. Then, conditional on \(\kappa _t\) and \(N_x(t)\), \(N_x(t+1)\) has a binomial distribution with parameters \(N_x(t)\) and success probability

Note that \(\kappa _t\) is the underlying process of the remaining lifetime random variable \(T_x\). Moreover, for the Lee–carter model, we define actuarial filtration as \(\mathscr {G}^A_t = \sigma \left( \{T_x\le s\}, \kappa _s, s\le t\right)\), where \(\kappa _s\) is part of the information set. We only focus on systemic risk, where the idiosyncratic mortality risk should be a second-order effect compared with the effect of a longevity trend. This assumption could be motivated by observing the realized mortality tables.

In the following two subsections, we implement the market-consistent price of the payoff in (12) using the EIOPA standard-formula and time-consistent pricing operators.

3.2 Numerical implementation

We provide the numerical method of the market-consistent and time-consistent valuation for the simple unit-linked contract under the EIOPA risk-margin method. We adopt customized versions of the least square Monte Carlo (LSMC) method and calculate the conditional operators during the valuation period.

To illustrate the challenges for computing a time-consistent price, we make the following considerations. Suppose we to compute the value for a 30-year product with annual time-steps. When we implement a trinomial tree, we start the simulation at time zero with only three scenarios for each underlying process \(\kappa _t\) and \(S_t\). For a non-recombining tree after 30 steps, there are \(3^{30} \approx 2 \times 10^{14}\) scenarios for each risk driver at maturity. If \(S_T\) and \(\kappa _T\) are dependent, we have to make \((3^{30})^2 \approx 4 \times 10^{28}\) calculations in the first step. The same calculation has to repeat in the backward iteration. For the EIOPA price, as we move only on the best-estimate scenario of the underlying risk driver, the previously noted number decreases. However, we still must repeat the projections and calculations for different time steps.

Another technique for this type of valuation is constructing a recombining trinomial tree. \(S_T\) and \(\kappa _T\) are discretized into a finite number of states at maturity, both in their particular boundary region. Suppose each underlying process is divided into 1000 states (i.e., scenarios) at time T and each time-t state is connected to the next state at time \(t+1\) with three nodes. In the two-step valuation at each first time and risk driver (one in the inner step and another in the outer step), there are 1000 trinomial computations. By moving backward over 30 years, \(10^6\) computations for each time step will be repeated, which accumulates to \(3 \times 10^7\). In a low dimension (e.g., two-factor model), the finite difference method can achieve the result in a reasonable time. However, the calculation is not feasible in a higher dimension with a portfolio of assets and liabilities.

A useful method to decrease the calculation volume in the backward iteration is the Least-Square Monte-Carlo (LSMC), which was proposed and used by Carriere [8] and Longstaff and Schwartz [31] to price different types of American options. The method is widely used in the dynamic valuation of the contingent claims and payoffs using path-dependent risk drivers. LSMC postulates that the conditional expectation of the payoffs can be calculated using the cross-sectional information of the underlying risk drivers (i.e., state variables).

Using LSMC, the conditional expectation of any general payoff \(G(T, S_T, \kappa _T)\) can be obtained through a series of basis functions of \(S_T\) and \(\kappa _T\) as

where \(e_m(x)\) denotes different types of basis functions, such as Polynomials (\(1, x, x^2,...\)) or Fourier bases (\(1, \cos (x), \cos (2x),...\)). The target function \(f(S_T, \kappa _T)\) at (18) represents the expected value as the summation of the series of the basis functions e. The function f can be approximated through the summation of a finite number of terms (K) in the series, that in fact, turns it into a regression line with basis functions as regressors (or independent variables):

The fitted value estimates the conditional expectation and can be used to estimate conditional expectations for different forms of G.

3.2.1 Computing the conditional VaR

We turn to the calculation of the EIOPA risk-margin price. Recalling (10), the EIOPA price contains a series of one-year conditional \(\mathbb {V}\text {aR}\)’s given information one year earlier. Under each \(\mathbb {V}\text {aR}\) operator, there is also a conditional expectation of the payoff, \(f\left( S_T, N_x(t+k)\right) = \mathbb {E}^\mathbb {P}\left[ S_T \times N_x(T) ~\Big \vert ~ S_T, N_x(t+k) \right]\), given the risk at time \(t<T\). Since the survival probability distribution (and, accordingly, \(N_x(t)\), distribution) is unknown, the quantile’s theoretical value is not known either. In order to numerically calculate the conditional \(\mathbb {V}\text {aR}\), a simple solution would be to re-simulate the underlying risk driver from each given state. This means that in (10), we should renew the simulation of \(\kappa _{t+k}\) and the number of survivors for every \(\mathbb{B}\mathbb{E}(\kappa _{t+k-1})\), and then calculate the appropriate quantile. Doing so imposes a high simulation process load that affects the efficiency of the numerical scheme. The same fact holds for the conditional expectation \(f\left( S_T, N_x(k)\right)\).

A more efficient calculation of these conditional operators is using the LSMC. To estimate h in (10), we stand at time t and use N scenarios of the pair \((S_t, \kappa _t)\) over the finite number of points \(t+1, t+2,..., t+k, T\). At time T, we calculate the payoff \(S_T \times N_x(T)\) (alternatively, \(S_T \times \mathbbm {1}_{T_x>T}\) for an individual policy). Note that in the Lee–Carter model, \(N_x(T)\) is not only a function of \(\kappa _T\) but also a function of all previous values of \(\kappa _t\) for \(t\le T\). Therefore, at each point in time t, conditioning on \(N_x(t-1)\) (which contains information on all \(\kappa\) values up to and including \(t-1\)) as an underlying risk driver is more accurate than conditioning on \(\kappa _{t-1}\). Therefore, for every \(k = \{1, 2,..., T-t\}\), we obtain an estimation of the conditional expected payoff f by using \(N_x(t+k)\) in the basis function instead of \(\kappa _{t+k}\), as follows

where, given N scenario sequences of the underlying risk drivers, the coefficient vector \(\widehat{\textbf{a}}^{\{k\}}\) is estimated under the least square argument as follows

where \(G_i\), \(S_T(i)\), and \(N_x^{(i)}(t+k)\), respectively, are the ith realizations of payoff G and state variables \(S_T\) and \(N_x(t+k)\).

To calculate the conditional \(\mathbb {V}\text {aR}\), we suppose that for short periods (a one-year horizon), the expected number of survivors is approximately normally distributed. Hence, the conditional q-quantile can be approximated by its mean and standard deviation. Regarding each k, the q-quantile must be conditioned on the best estimate of \(\kappa _{k-1}\). We should calculate the standard deviation of \(\left( N_x(k) \Big \vert \mathbb{B}\mathbb{E}(N_x(t+k-1))\right)\). We compute the LSMC estimators of the conditional mean and second moment of \(N_x(t+k)\) as follows

which gives \(\text {Std-Dev}\left( N_x(t+k) ~\Big \vert ~ \mathbb{B}\mathbb{E}(N_x(t+k-1))\right) = \sqrt{E2 - (E1)^2}\). Finally, based on the value in (10), the estimation of the conditional \(99.5\%\)-quantile is

Note that in Eq. (12), the random payoff G is a non-decreasing real-valued function of the underlying random variables \(S_T\) and \(N_x(t)\). Since (the estimation of) the expected value of the non-decreasing G, is also non-decreasing, the left or right-continuous function f and \(\mathbb {V}\text {aR}\) operator are interchangeable based on Theorem 1 in Dhaene et al. [18].Footnote 10

This formula measures the difference between the conditional expected payoff at time \(t+k\) given a \(99.5\%\) shock to \(N_x(t+k)\) and the same value without a shock. The shock references the best-estimate of the actuarial driver one year earlier, at \(t+k-1\); \(\mathbb{B}\mathbb{E}(N_x(t+k-1))\). This value estimates the conditional value-at-risk for the future SCR in year \(t+k\). We use (10) to calculate the summation of these values for each \(t+k\) over the valuation period as the total risk margin. Finally, for each year \(t+k\), we take the average over the \(S_T\) values conditional on \(S_0\) and obtain the financial mean under the \(\mathbb {Q}\) measure, which is counted as the outer step in the two-step valuation.

3.3 Numerical results

We compute the EIOPA standard-formula price and compare it with the time-consistent price to measure the extra time-consistency risk-premium (TCRP). The discounted expected value (by the tower property) is always time- and market-consistent. Thus for practitioners, another interesting comparison is between the best-estimate and the time-consistent price to obtain the risk loading in the time-consistent setting. The parameters are as follows: initial asset price \(S_0 = 100\), volatility \(\sigma _S = 15 \%\), initial age \(x=50\), initial cohort \(N_x = 1000\), and Lee-Carter model parameters as \(\kappa _0 = - 24.5637\), \(\mu _\kappa = - 0.8089\), and \(\sigma _\kappa = 1.473\).Footnote 11 The discount curve is based on 30-year annual zero rates released by the European Central Bank (ECB) in January 2, 2006. The rates are calculated from the prices of the AAA-rated euro area central government bonds.Footnote 12

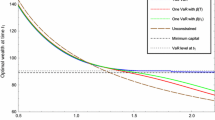

Figure 1 presents the result of the market-consistent price for a cohort of age \(x = 50\), displaying the best-estimate, EIOPA standard-formula, and time-consistent EIOPA price over different maturities \(T \in \{1, 2,..., 30\}\). A \(n=100\) simulations each with \(N=1000\) scenario are performed. The discounted asset and mortality risks are assumed to be independent. All prices decrease when maturity increases, while the difference between these market-consistent prices is negligible for short-term liabilities, whereas, for the longer term (15 years and longer maturities), the gap widens. Both EIOPA standard-formula and time-consistent prices measure the unhedgeable uncertainty related to the projected mortality on top of the best-estimate value. The longer the maturity, the bigger the gap (the risk loading), reflecting the more uncertain estimation. Moreover, the time-consistent price dominates the EIOPA price, where the difference is the capital-on-capital effect and increases for long-dated contracts. If we divide the best-estimate price by \(S_0 = 100\), the result shows the expected survivors for the cohort of age \(x=50\) under the Lee-Carter model, from 997.2 for \(T=1\) to 681.1 for \(T=30\). This means that the 30-year survival probability for a 50-years old individual is approximately 31.89%.

The gap between the best-estimate and the time-consistent price or EIOPA risk-margin price is the actuarial risk-loading and cannot be hedged under the market-consistent valuation. Figure 2 illustrates the market-consistent risk-loading for EIOPA risk-margin and Time-consistent price as a percentage of the best-estimate price. The risk-loading will vary for different parameters, especially the actuarial risk drivers. With the chosen set of parameters, the risk-loading for maturities earlier than 15 years remains negligible. For the longer maturities, it starts to increase sharply, and in 30-years maturity, it reaches around \(8.74\%\) for the EIOPA risk-margin and more than \(17.03\%\) for the Time-consistent price.

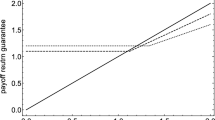

We also study the effect of the dependence between mortality/longevity and equity risks on the market-consistent contract price for the different maturities. We choose four different levels of the correlation between \(\kappa _t\) and \(S_t\) as \(\rho = \{0, 0.50, 0.75, 1\}\), where \(\rho = 0\) shows independence and \(\rho = 1\) shows perfect hedging for actuarial risk attributable to the dynamics of financial risk in the complete market. In Fig. 3, for each correlation level (in graphs \((a) - (d)\)), we provide the values of the three different prices previously discussed for the cohort of age \(x=50\) along different maturities.

In general, all prices illustrate that a larger correlation results in a higher market-consistent price. This relationship reflects the extra price attributable to the covariance in the price dynamics. Moving from the independent risks (\(\rho = 0\)) to a perfectly hedgeable position (\(\rho = 1.00\)), the market-consistent prices for a 30-year unit-linked contract increase by 40.64, 30.50, and \(19.98\%\), respectively, for the best-estimate, EIOPA, and time-consistent values. The price increase is the result of three different effects. The first price-increasing effect is due to a change in the drift of financial risk in the \(\mathbb {Q}\) measure. The second effect is the covariance effect that also increases the price. The third effect is eliminating uncertainty as measured by the \(99.5\%\)-quantile (risk-margin) that reduces the price. While the (absolute value of the) correlation increases, the drift adjustment and covariance effect (the first two effects) move against the uncertainty elimination effect (the third effect) and eventually wins out to increase the overall market-consistent actuarial price.

Figure 3 shows that both EIOPA standard-formula and time-consistent prices converge to the best estimate price when the correlation increases. This fact can be seen by observing the gap for the 30-year maturity in the sequence of graphs (a) to (d) in Fig. 3. Especially in a perfect hedge situation, when \(\rho = 1\), both prices correspond precisely to the best-estimate price for all maturities (Graph (d)) because no unhedgeable risk remains in the payoff. This adjusted best-estimate price has a different drift and dynamics relative to the original best-estimate price with \(\rho =0\). Therefore, we could show that for two different price operators (EIOPA and time-consistent prices), when financial and actuarial risks are perfectly correlated, the market-consistent price perfectly hedges actuarial risk based on the information for financial risk in the complete market.

The effect of the dependence/correlation between the mortality/longevity and equity risks on the market-consistent actuarial value when the best-estimate, EIOPA risk-margin and time-consistent prices are compared over different maturities (\(T = 1, 2,..., 30\)) for a cohort of age \(x=50\). The correlation levels are \(\rho = \{0, 0.50, 0.75, 1\}\)

4 Summary and conclusion

In this paper, we provide an applied implementation of the market-consistent actuarial price using the two-step valuation method. We show that the EIOPA standard-formula for computing the risk-margin is not time-consistent, and we implement in our calculations a time-consistent extension of the risk margin to quantify the cost of “time-inconsistency” of the EIOPA standard-formula. To illustrate our approach, we price a simple unit-linked contract without guarantee. Both the EIOPA standard formula and time-consistent pricing operator measure the unhedgeable uncertainty related to the projected mortality on top of the best-estimate value. Our calculations show that the gap between the standard-formula and the time-consistent EIOPA price increases with maturity and is significant for long-dated contracts.

Notes

Also called the “risk-neutral” probability.

The EIOPA Technical Specification [21] and in specific articles https://www.asf.com.pt/NR/rdonlyres/359F79DF-586C-42D0-8064-97811541C23F/0/A__Technical_Specification_for_the_Preparatory_Phase__Part_I_.pdf released by the European Insurance and Occupational Pension Authority (EIOPA) provides advice and formulations on the calculation of the risk-margin on top of the best-estimate for long-term liabilities in a multi-period setting.

A one-year discount should be applied to the pay-off \(h(y_{t+k})\) under \(\mathbb {V}\text {aR}\) operator.

Note that all \(y_t\) values may also be represented by the “discounted” quantities relative to the money-market account process B(t) defined in Sect. 3.1 with which the discount factors can be taken off from the formula.

Note that the conditional expectation is time-consistent.

The discount factor is omitted due to use of \(x_t\) as the discounted financial risk driver. Further explanation is in Sect. 3.1

Considering the stochastic evolution of mortality risk through time, a more precise concept is “the remaining lifetime at the beginning of the calendar year t” for which the notation is \(T_{x}(t)\).

In the notation, if we assume the present \(t=0\), the notation t is representative of the past “calendar times” \(\{t_0, t_0 +1, \dots , 0\}\) in the model.

In case the function f is non-increasing, then any probability p under \(\mathbb {V}\text {aR}\) function will be turned into \(1-p\).

These parameters are estimated on the basis of mortality data aggregated for “men and women” of the Netherlands during the calendar years 1960–2006 (47 years).

Accessible via ECB web-page, https://www.ecb.europa.eu/stats/money/yc/html/index.en.html.

References

Acciaio B, Penner I (2011) Dynamic risk measures. Adv Math Methods Fin pp 1–34

Artzner P, Delbaen F, Eber J, Heath D, Ku H (2007) Coherent multiperiod risk adjusted values and bellman’s principle. Ann Oper Res 152(1):5–22

Assa H, Gospodinov N (2018) Market consistent valuations with financial imperfection. Decis Econ Financ 41:65–90

Barigou K, Chen Z, Dhaene J (2019) Fair dynamic valuation of insurance liabilities: merging actuarial judgement with market- and time-consistency. Insur Math Econ 88:19–29

Barigou K, Dhaene J (2019) Fair valuation of insurance liabilities via mean-variance hedging in a multi-period setting. Scand Actuar J 2019(2):163–187

Barrieu P, El Karoui N (2009) Pricing, hedging, and designing derivatives with risk measures. Princeton University Press, Princeton

Bion-Nadal J (2009) Time consistent dynamic risk processes. Stoch Process Appl 119(2):633–654

Carriere J (1996) Valuation of the early-exercise price for options using simulations and nonparametric regression. Insur Math Econom 19(1):19–30

Chen Z, Chen B, Dhaene J (2020) Fair dynamic valuation of insurance liabilities: a loss averse convex hedging approach. Scand Actuar J 0(0):1–27

Cheridito P, Delbaen F, Kupper M (2006) Coherent and convex monetary risk measures for unbounded cadlag processes. Financ Stoch 9(3):369–387

Cheridito P, Stadje M (2009) Time-inconsistency of var and time-consistent alternatives. Financ Res Lett 6(1):40–46

Cvitanic J, Karatzas I (1992) Convex duality in constrained portfolio optimization. Ann Appl Probab 2(4):767–818

Deelstra G, Devolder P, Gnameho K, Hieber P (2019) Valuation of hybrid financial and actuarial products in life insurance: a universal 3-step method. Available at SSRN: https://ssrn.com/abstract=3307061

Delbaen F, Schachermayer W (1994) A general version of the fundamental theorem of asset pricing. Math Ann 300(3):463–520

Delbaen F, Schachermayer W (1996) The variance-optimal martingale measure for continuous processes. Bernoulli 2(1):81–105

Delong L, Dhaene J, Barigou K (2019) Fair valuation of insurance liability cash-flow streams in continuous time: applications. ASTIN Bull 49(2):299–333

Delong L, Dhaene J, Barigou K (2019) Fair valuation of insurance liability cash-flow streams in continuous time: theory. Insur Math Econom 88:196–208

Dhaene J, Denuit M, Goovaerts M, Kaas R, Vyncke D (2002) The concept of comonotonicity in actuarial science and finance: theory. Insur Math Econ 31(1):3–33. Special Issue: Papers presented at the 5th IME Conference, Penn State University, University Park, PA, 23-25 July 2001

Dhaene J, Stassen B, Barigou K, Linders D, Chen Z (2017) Fair valuation of insurance liabilities: merging actuarial judgement and market-consistency. Insur Math Econom 76:14–27

EC Delegated Regulation 2015/35 (2015) Commission delegated regulation (EU) 2015/35. Technical report, European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

EIOPA Technical Specification (2014) Technical specifications for the preparatory phase (part 1). Technical report, European Insurance and Occupational Pensions Authority

Follmer H, Penner I (2006) Convex risk measures and the dynamics of their penalty functions. Stat Decis 24(1):61–96

Föllmer H, Schweizer M (1989) Hedging by sequential regression: an introduction to the mathematics of option trading. ASTIN Bull 18(2):147–160

Frittelli M, Gianin ER (2004) Dynamic convex risk measures, risk measures for the 21st century. Wiley, New York

Goovaerts M, Laeven R (2008) Actuarial risk measures for financial derivative pricing. Insur Math Econom 42(2):540–547

Hodges S, Neuberger A (1989) Optimal replication of contingent claims under transaction costs. Rev Futures Mark 8(2):222–239

Jobert A, Rogers L (2008) Valuations and dynamic convex risk measures. Math Financ 18(1):1–22

Kramkov D, Schachermayer W (1999) The asymptotic elasticity of utility functions and optimal investment in incomplete markets. Ann Appl Probab 9(3):904–950

Kupper M, Cheridito P, Filipovic D (2008) Dynamic risk measures, valuations and optimal dividends for insurance. In: Mini-workshop, mathematics of solvency. Mathematisches Forschungsinstitut Oberwolfach

Lee RD, Carter LR (1992) Modeling and forecasting US mortality. J Am Stat Assoc 87(419):659–671

Longstaff FA, Schwartz ES (2001) Valuing American options by simulation: a simple least-squares approach. Rev Financ Stud 14(1):113–147

Maccheroni F, Marinacci M, Rustichini A (2006) Ambiguity aversion, robustness, and the variational representation of preferences. Econometrica 74(6):1447–1498

Malamud S, Trubowitz E, Wüthrich M (2008) Market consistent pricing of insurance products. ASTIN Bull 38(2):483–526

Møller T (2002) On valuation and risk management at the interface of insurance and finance. Br Actuar J 8(4):787–827

Musiela M, Zariphopoulou T (2004) A valuation algorithm for indifference prices in incomplete markets. Financ Stoch 8(3):399–414

Pelsser A (2011) Pricing in incomplete market. Netspar Panel Paper (25)

Pelsser A, Stadje M (2014) Time-consistent and market-consistent evaluations. Math Financ 24(1):25–65

Peng S (2004) Filtration consistent nonlinear expectations and evaluations of contingent claims. Acta Mathematicae Applicatae Sinica (English Series) 20(2):191–214

Rosazza Gianin E (2006) Risk measures via \(g\)-expectations. Insur Math Econom 39(1):19–34

Salahnejhad A, Pelsser A (2016) Time-consistent actuarial valuation. Insur Math Econom 66:97–112

Salahnejhad Ghalehjooghi A, Pelsser A (2021) Time-consistent and market-consistent actuarial valuation of the participating pension contract. Scand Actuar J 2021(4):266–294

Schweizer M (1995) On the minimal martingale measure and the Föllmer–Schweizer decomposition. Stoch Anal Appl 13(5):573–600

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors are grateful for the constructive and helpful comments and directions given by Prof. Dr. Jan Dhaene (KU Leuven) on this paper.

The research leading to these results has received funding from the European Union Seventh Framework Programme ([FP7/2007-2013] [FP7/2007-2011]) under Grant agreement \(n^\circ\) 289032.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Salahnejhad Ghalehjooghi, A., Pelsser, A. A market- and time-consistent extension for the EIOPA risk-margin. Eur. Actuar. J. 13, 517–539 (2023). https://doi.org/10.1007/s13385-023-00343-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-023-00343-7