Abstract

This paper deals with deterministic dynamic pricing and advertising differential games which are stylized models of special durable-good oligopoly markets. We analyze infinite horizon models with constant price and advertising elasticities of demand in the cases of symmetric and asymmetric firms. In particular, we consider general saturation/adoption effects. These effects are modeled as transformations of the sum of the cumulative sales of all competing firms. We specify a necessary and sufficient condition such that a unique Markovian Nash equilibrium for such games exist. For two classes of models we derive solution formulas of the optimal policies and of the value functions, and we show how to compute the evolution of the cumulative sales of each firm. The analysis of these games reveals that the existence of the Nash equilibrium relies on the possibility to separate a component, which is specific for each firm, from a [market] component, which is the same for all firms. The common factor is a function of the decreasing untapped market size. The individual factor of each firm reflects its individual market power and has an impact on equilibrium prices; each such coefficient depends on the price elasticities, unit costs, arrival rates, and discount factors of all competing companies. Formulas for these coefficients reveal how equilibrium prices depend on the number of competing firms, and how the entry or exit of a firm affects the price structure of the oligopoly.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In survey articles, Mahajan et al. [15], [16, 17], and Peres et al. [20] have emphasized the importance of normative results for product growth models of durable-goods and nondurable ones in oligopolistic markets. Since the ’70s a number of models of advertising competition have been proposed, and optimal advertising policies have been derived, see, for example, the series of papers by G. Erickson spanning almost thirty years, e. g. [4, 5] and references therein, the many papers by G. Fruchter, see [6] and [7] to cite but a few, and the various contributions by S. Sethi and co-authors, e. g. [21, 23] and [13]. The recent review article by Huang et al. [11], and the books by Dockner et al. [2] and by Jørgensen and Zaccour [12] provide rich bibliographies and excellent accounts of many of the accomplishments in this research area. The papers by Teng and Thompson [24] and by Dockner and Feichtinger [1] are classical papers which analyze models of dynamic advertising combined with dynamic pricing in a competitive environment. The papers [13, 23] and [4] are recent articles where optimal marketing-mix strategies in dynamic competitive markets are analyzed; for further references see the bibliographies of the articles and books referred to above. The article [13] by Krishnamoorthy et al. is most important for the present manuscript.

In [13], the authors analyze a deterministic dynamic duopoly game. They study a cumulative sales model with particular dynamics and objective function. The authors show how the competing firms should dynamically adjust their advertising spending and how they should [dynamically] set their prices. The specific model is an extension of the monopoly problem analyzed in [23]. The infinite horizon duopoly game takes into account the evolution of cumulative sales of two brands/firms of a product category. As far as the demand function is concerned, they analyze the case, when the demand depends linearly on \(p\), and the case with constant price elasticity. In the case with constant price elasticity, the dynamics of each brand of their model is specified by, \(i=1,2\),

where \(x_i(t)\) denotes the cumulative sales of firm/brand \(i\), \(N\) is the category potential, \(w_i(t)\) denotes the advertising effort of firm \(i\), \(u_i\) the effectiveness of its advertising activity, and \(p_i(t)\) the price it sets for one unit of its product. The parameter \(\varepsilon _i\), \(i=1,2\), is the price elasticity of demand of product \(i\). The factor \(\sqrt{N-x_1(t)-x_2(t)}\) describes a particular friction (inertia) of the market.

Each firm chooses its advertising and price to maximize its discounted infinite horizon profit, where the profit rate is \(e^{-r_it}((p_i(t)-c_i)\dot{x}_i(t)-k_i w_i(t)^2)\), and \(r_i\) is the discount rate of firm i, \(c_i\) is the marginal cost of production of firm \(i\), \(k_i w_i(t)^2\) is the cost of firm’s \(i\) advertising, and \(k_i\) is a (positive) factor of proportionality.

If marginal costs are positive, Krishnamoorthy et al. determine the feedback Nash equilibrium strategies of both players and they derive analytical expressions of their optimal advertising and pricing policies. This particular duopoly game suggests several interesting research questions. For example, even in the case of a duopoly it is not clear whether or not a Nash equilibrium exists if the marginal cost of one of the players is zero. Thus, the question of existence and uniqueness of an equilibrium in the case of many firms, where some firms have marginal cost zero, is a natural one. Furthermore, for asymmetric market situations it is not at all clear how the entry or exit of a firm to the market will affect the price equilibrium. Specifically, the impact of the number of competing firms on equilibrium prices, should such prices exist, is most important for practical applications. Moreover, even for the duopoly problem considered by Krishnamoorthy et al. it is not obvious how the optimal market share of each firm develops over time. These questions and related ones have motivated our research and will be answered in Sects. 3 and 4.

In this paper, we extend the model for the particular duopoly game to two [more general] classes of differential games with (i) any finite number of heterogeneous firms and (ii) more general dynamics; further details will be given below. The basic setting of both classes of extended dynamic games is closely related to the monopoly model proposed in [23], which was generalized in [10]. In the case of an oligopoly, it is assumed that each firm is selling its brand of a [category] durable-good and is facing a [constant] brand-specific elasticity of demand. The rate of sales of each firm is postulated to be multiplicative in its price, in [its] advertising effort—a power expression—and involves two additional terms: a [constant] firm-specific arrival intensity factor and a factor which depends on the total sales of all brands. The latter, which is the same for all firms, reflects the way the companies compete in the market. A general system function makes it possible to capture varied adoption and saturation effects and allows the modeling of different [direct] network externalities.

The models of both classes are primarily motivated by marketing applications, for example, the evolution of the market share of the premium car segment of each of the three main competitors in Germany. However, the models are also related to dynamic oligopoly games studied in the context of extracting and pricing natural resources, e. g. petroleum, copper, etc., see [8], [14] and references therein. The brands/firms within a product category should be equated with different crude-oil producing countries/regions, or types of petroleum characterized by their specifications, e. g. West Texas Intermediate and Brent Blend (low sulfur crudes), or Oman Crude (high sulfur content); the size of the untapped market of a category of a specific good corresponds to the known reserves of the commodity.

Both classes of oligopoly models to be analyzed in this paper are closely related to the monopoly model analyzed in Helmes et al. [10], see also [9]. The oligopoly models differ from the monopoly model as far as the following aspects are concerned. In the competitive case, we only consider infinite horizon problems. Moreover, we have to restrict ourselves to time-independent arrival intensities in order to be able to prove the existence of a unique Nash equilibrium. On the other hand and in contrast to [10], each firm is assigned a [constant] nonnegative unit cost.

It turns out that the number of firms with zero unit costs and the characteristics of these firms determine whether or not a Markovian Nash equilibrium of the differential game exists. The equilibrium result is a corollary to a tailor-made existence theorem of solutions (in the positive orthant of \(\mathbb {R}^n\)) of a special nonlinear system of \(n\) equations. We prove the existence and uniqueness of a solution of a particular system of equations determined by the differential game assuming that a fundamental condition holds true. Inspired by the expression “tragedy of the commons,” we call this necessary and sufficient condition “the condition of the commons.” The term refers to the fact that not “too many” firms should have access to a free nonrenewable resource. The condition is satisfied in any monopoly market; in an oligopoly market the condition is satisfied should all companies have positive marginal costs, or if a fair number of price insensitive customers are attracted by the products of firms with zero unit costs. In the special case of homogeneous firms with zero marginal costs the condition is equivalent to a bound on the number of competing companies. This bound depends on the price elasticity of demand, and on a ratio associated with advertising costs and advertising effectiveness, see Sect. 2.2 for details.

We shall derive explicit solutions for both classes of differential games referred to above. Models of Class I (zero unit-cost models) are characterized by general adoption/friction functions—cf. [10] for the case of a monopolist—but a special market structure. The market environment is supposed to be such that all firms face an identical price elasticity of demand and have zero variable unit costs. Typical applications of such situations include, for example, selling digital goods, end-of-year sales of retail fashion goods, or the situation of car-dealers at the end of a model year. More generally, situations when \(n\) competing firms are selling a fixed number of similar assets, and costs are sunk, can be cast as a Class I model. The sales of digital goods nicely fit the model assumptions, since a typical customer does not need more than one copy of a movie, of a song or a piece of software. Thus, like with durable-goods, there is typically no repurchasing and the market potential depletes over time.

The second class of models (Class II) extends the particular problem analyzed by Krishnamoorthy et al. and includes their problem as a special case. We consider the situation of any finite number of competing firms. We allow for (fixed) unit costs and allow that all other firm-specific characteristics, e.g., price elasticities, financing rates, arrival rates, etc., differ as well. In contrast to Case I models friction/system functions are restricted to special saturation functions of power type. This class of system functions includes the square root function which is traditionally considered in the literature, cf. [4], [5] and [13]. An important special case which we can also handle is a linear system function. It characterizes a pure pricing model with a linear friction term. A pure pricing model assumes customers to arrive due to intrinsic motives. The general advertising-and-pricing model postulates the necessity of an extrinsic stimulus which might be costly. Paying for commercials to inform and attract customers, and to boost arrival rates this way, is the prototypical example of (explicit) advertising expenses. Paying higher rent to set up shop at a prime location is an example of (implicit) advertising costs.

In addition to the analytical results to be derived, the dependence of profits, of prices, etc., on arrival rates, price elasticities, marginal costs, and the number of competing firms will also be illustrated by looking at numerical examples. These (simple) numerical studies complement the general theorems which comprise explicit formulas of value functions and of optimal marketing-mix policies, as well as sensitivity results.

Besides the marketing application, e.g., in the car industry mentioned above, there are numerous other [similar] applications which arise in different industries, and for which the models of either Class I or Class II are applicable. For example, selling life insurance, homeowners insurance or work-disability insurance to specific cohorts of customers is just another such application. The evolution of sales of cigarette brands is a classical example of an oligopoly market where the sales dynamics are well described by models of Class II, and for which the results of our analysis, see Sect. 4, nicely fit observations: prices [without taxes] are fairly stable over the years, but advertising is dynamic. The [light] beer market is a more recent example of that kind.

A collection of formulas and abbreviations to which we shall regularly refer to is given in an Appendix. Technical proofs, especially the lengthy proof of Lemma 1, and some additional tables related to the numerical study described in Sect. 3 are all relegated to the Appendix. A Table of variables and parameters which are pertinent to the model description, see Sect. 2, can be found at the beginning of the Appendix.

2 The Deterministic Oligopoly Model

In this section, we precisely describe the adoption models with (constant) isoelastic demand functions which will be analyzed in the sequel. Let \(p_i>0\) denote a price to be set by firm \(i\), \(i=1,2,\ldots ,n\), and \(w_i\geqslant 0\) the advertising effort (per unit of time) by a firm. Let \(x_i(t)\) be the (accumulated) sales of company \(i\) by time \(t\), and let \(x(t):=\sum _{j=1}^n x_j(t)\). Thus, \(x(t)\) represents the number of all customer who have adopted a brand of a product category by time \(t\). Let \(N\in \mathbb {R}^+\) be the number of potential customers in the market, and let \(y(t)=N-x(t)\); \(y(t)\) is the numberFootnote 1 of all customers who have not yet adopted the product at time \(t\). The value \(y=N\) indicates that no unit of any brand has yet been sold; if \(y(0)=N\), then \(x(0)=0\). Throughout, we assume the rate of sales \(\lambda _i\) of each firm \(i\) is of the form, \(0<y\), \(\psi :(0,N)\rightarrow \mathbb {R}^+\),

and \(\lambda _i\) equals zero if \(y=0\). The arrival intensity vector \(\mathbf {u}=(u_1,u_2,\ldots ,u_n)\) has positive components, while the vector \(\varvec{\varepsilon }\) of price elasticities of the different firms has components \(\varepsilon _i\) which are bigger than 1. The nonnegative advertising elasticity \(\delta \geqslant 0\) is assumed to be the same for all firms. The property that all arrival rates \(u_i\) are positive is a fundamental assumption of the market models to be considered. The assumption implies that each firm has a loyal group of customers, and no matter how large a company’s product price will be, there will always be some buyers. Moreover, each firm has its individual discount parameter \(r_i>0\) and unit cost \(c_i\geqslant 0\).

The nonnegative real-valued function \(\psi \) captures adoption and saturation effects. Typical examples of \(\psi \) are power functions \(y^b\), \(b\) positive or negative, the Bass function \(\psi (y)=\Omega y+\Gamma y(1-y)\), \(\Omega ,\Gamma \geqslant 0\), and variants thereof. For Class I models, we allow for general functions \(\psi \); they only have to satisfy a minor technical condition, s. Lemma 2. Advertising cost functions are assumed to be of the form \(k_iw_i^a\), where \(k_i>0\), and \(a\) is a fixed (common) parameter larger than \(\delta \). We prefer the parametrization \((\delta ,a)\), \(0\leqslant \delta <a\), over a 1-dimensional parametrization given by \(\delta /a\). This way, the different interpretations of the control value \(w\), i.e., \(w\) represents the control effort like in [13], or \(w\) represents the amount spent on advertising (per unit of time) as in [19], can be dealt with in a unified way. The special case \(\delta =1\) and \(a=2\) is treated in [13]. As far as the mathematical formulas are concerned, s. below, only the ratio \(\delta /a\) matters. Observe, should \(a\) be less than or equal to \(\delta \), then the cost of advertising spending \(w_i^a\) would grow at the same rate or more slowly (in \(w_i\)) than the factor \(w_i^\delta \) of \(\lambda _i\), the \(i\)-th rate of sale, and revenue would tend to infinity. The firm-specific proportionality parameters \(k_i\) can be interpreted as effectiveness factors of individual advertising campaigns, or as tax multipliers (surcharges or discounts).

We postulate that each firm decides on its price and advertising rate by exploiting the common knowledge \(\mathbf {x}(t):=(x_1(t),\ldots ,x_n(t))\) and the values of all parameters of the model. At each time point \(t\), \(0\leqslant t<\infty \), each firm \(i\), \(i=1,2,\ldots ,n\), chooses a positive price \(p_i(t)\) and a non-negative advertising rate \(w_i(t)\). The choice of control values is further restricted as described below. For each pair \(\big (p_i(t),w_i(t)\big )\), the state of the game \(\mathbf {x}(t)\) evolves according to a system of differential equations of the form,

for abbreviation, we will sometimes denote the right hand side of (2) by \(\lambda _i(t)\).

The objective of each firm is to maximize its discounted profit \(J_i\) which depends on its choice of \(\big (p_i(t),w_i(t)\big )\) and on the evolution of the whole market (which depends on the activities of all players):

To be able to identify optimal policies of each firm, we shall restrict the maximization of (3) to the class of admissible policies. From now on, control policies \(\big (p_i(t),w_i(t)\big )\), \(0\leqslant t<\infty \), \(i=1,2,\ldots ,n\), will be called admissible iff there exists vector-valued functions \(\Phi _i=\mathbb {R}^n\times [0,\infty )\rightarrow \mathbb {R}^2\), which are a Markovian Nash equilibrium for the dynamic game (2) and (3); see [2], p. 86, for all details and specificities of the definition. Furthermore, we assume that all integrals which involve the feedback policies are well defined and finite. To simplify notation, we shall write \(p_i(t,\mathbf {x})\) and \(w_i(t,\mathbf {x})\) for the coordinate functions of any Markovian Nash equilibrium \((\Phi _1,\ldots ,\Phi _n)\). In [2], Section 4.2, a set of sufficient conditions for an equilibrium to exist is described. These conditions, see [2], Theorem 4.1, will be verified for the problems under consideration.

For any possible state \(\mathbf {x}\in \mathbb {R}^n\), \(0\leqslant x_j\) and \(x:=\sum _{j=1}^n x_j\leqslant N\), let \(W_i(\mathbf {x})\) denote the largest discounted profit of player \(i\) when the infinite horizon game starts at \(\mathbf {x}\). To identify a solution of the differential game, see [2] pp. 92, we are looking for equilibrium strategies \(\left( p_j^*(\mathbf {x}),w_j^*(\mathbf {x})\right) _{1\leqslant j\leqslant n}\), and bounded functions \(W_i(\mathbf {x})\) such that the system of partial differential equations, \(x<N\), \(i=1,2,\ldots ,n\),

together with the boundary conditions \(W_i(\mathbf {x})=0\), if \(x=N\), has a solution. The structure of the rates \(\lambda _i\), and the identity \(y=N-\sum _{j=1}^n x_j\), \(0\leqslant y\leqslant N\), suggests that solutions \(W_i(\mathbf {x})\) are of a special form: subject to given functions \((p_j^*(y),w_j^*(y))\), \(j=1,2,\ldots ,n\), \(V_i'(y):=\frac{dV_i}{dy}(y)\),

where the functions \(V_i(y)\) satisfy the system of ordinary differential equations, \(y>0\),

together with the boundary conditions \(V_i(0)=0\). Note, if (5) holds, then \(\frac{\partial W_i}{\partial x_j}(\mathbf {x})=-V_i'(y)\) for all \(i\) and \(j\). In the sequel, we shall verify that under appropriate conditions, the system (6) has a unique solution \((V_i(y))_{1\leqslant i\leqslant n}\), and so does (4).

2.1 Optimality Conditions

The Bellman equations (4) yield optimality conditions which the equilibrium (feedback) pricing and advertising decisions \(p_i^*(y)\) and \(w_i^*(y)\) of each firm \(i\) have to satisfy. Taking partial derivatives with respect to \(p_i\) and \(w_i\) of the function showing up on the \(i\)-th right hand side of (6), simple algebra yields a formula of \(p_i^*(y)\) in terms of \(\varepsilon _i\), \(c_i\), and \(V_i'(y)\), see (23); the formula of \(w_i^*\) in feedback form is given by (24). The formula of \(w_i^*\) involves \(\psi \), \(p_i^*\) and the parameters \(\varepsilon _i\), \(a\), \(\delta \), \(k_i\), and \(u_i\). We shall see in Subsection 2.2, cf. formulas (9), (10) and (14), that \(V_i'\) is positive for all \(i=1,\ldots ,n\). From now on, we use the abbreviating notation \(\lambda _i^*(y):=\lambda _i\left( p_i^*(y),w_i^*(y),y\right) \), \(0<y\leqslant N\), where \(p_i^*(y)\) and \(w_i^*(y)\) are the equilibrium pricing and advertising policies. The optimality conditions imply that a dynamic Dorfman-Steiner identity holds for each firm. The classical Dorfman-Steiner theorem provides the theoretical underpinning of the empirical fact (see Schmalensee [22]) that in different markets (monopoly, oligopoly) advertising strategies of firms are very often based on a constant percent of sales rule; for more details and additional references see Dockner and Feichtinger [1].

Proposition 1

For the oligopoly problem described in Sect. 2.1, a Dorfman-Steiner identity holds for each firm, \(i=1,2,\ldots ,n\):

i. e. optimal advertising expenditure and revenue are pointwise proportional.

Proof

The identities (7) are an immediate implication of (23) and (24). \(\square \)

Since the Dorfman-Steiner identity holds for every \(y\in (0,N)\), we can evaluate (7) along the optimal trajectory \(y(s)\), \(0\leqslant s<\infty \). This way, for any \(t\geqslant 0\), we easily prove identities which connect the accumulated revenue (from \(t\) onwards) \(\bar{U}_i(t)\),

with the production/purchasing cost \(\bar{C}_i(t)\) and the accumulated advertising expenditure \(\bar{W}_i(t)\), see Proposition 2; the last two quantities are defined by

and \(\bar{V}_i(t)=\bar{U}_i(t)-\bar{W}_i(t)-\bar{C}_i(t)\) holds true. For the two classes of models described in the Introduction, we shall derive explicit expressions for \(\bar{V}_i(t)\) and \(\bar{C}_i(t)\), see Sects. 3 and 4. Employing the following proposition, we shall then obtain explicit expressions for the important characteristics \(\bar{U}_i(t)\) and \(\bar{W}_i(t)\).

Proposition 2

Let \(y(s)\) denote the optimal path of (category wide) unsold items, \(0\leqslant s<\infty \). For any \(i\), \(i=1,2,\ldots ,n\), and \(t\geqslant 0\),

-

(i)

\(\bar{W}_i(t)/\bar{U}_i(t) = \delta /(a\cdot \varepsilon _i)\),

-

(ii)

\(\bar{W}_i(t) = \frac{\delta }{a\varepsilon _i-\delta } \Big (\bar{V}_i(t)+\bar{C}_i(t)\Big )\), and \(\bar{U}_i(t) = \frac{a\varepsilon _i}{a\varepsilon _i-\delta } \Big (\bar{V}_i(t)+\bar{C}_i(t)\Big )\).

In the sequel, in order to shorten some expressions we shall use the following abbreviations throughout the paper. For each firm \(i\), \(i=1,2,\ldots ,n\), let

see also (26), and let \(\eta _i=\eta _i(k_i,a,\delta ,\varepsilon _i,u_i)\) be the constants defined by (27). Except for sensitivity studies, the explicit formula of \(\eta _i\) will not be important. However, it is useful to remember that \(\eta _i\) is increasing in the intensity parameter \(u_i\) and is decreasing in \(k_i\).

We shall call the parameter \(\gamma _i\) the leveraged (due to advertising) price elasticity of demand of firm \(i\). If the price is decreased by 1%, then the demand will increase by \(\sim \gamma _i\)%. Note, \(\gamma _i\) is larger than \(\varepsilon _i\)! Thus, for each firm \(i\), the parameter \(\gamma _i\) quantifies the benefit of [informative] advertising.

2.2 Fundamental Results

Using the expressions for the equilibrium strategies \(w_i^*(y)\) and \(p_i^*(y)\) in terms of derivatives of the value functions \(V_i(y)\), see (23) and (24), the Bellman equations (4) turn into a system of 1st order nonlinear differential equations. This system, together with the [natural] boundary conditions \(V_i(0)=0\) for each \(i\), determines the value functions \(V_i\). The system can be written as, \(0<y\leqslant N\), \(i=1,2,\ldots ,n\), \(V_i'=V_i'(y)\), \(\psi =\psi (y)\), etc.,

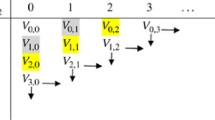

To solve (8), we look for solutions \(V_i\) which are given as the product of a firm specific factor \(\alpha _i\) and a function \(\beta (y)\) which is common to all firms:

The constants \(\alpha _i\) are assumed to be positive numbers, and \(\beta \) is a positive increasing differentiable function of the variable \(y\), the untapped market size. The common factor \(\beta (y)\) reflects the value of a market of size \(y\). The number \(\alpha _i\) quantifies the market power of each firm \(i\).

The separable “Ansatz” implies that the constants \(\alpha _i\) and the function \(\beta \) have to satisfy the system of equations (28). To identify both factors, we will first prove two lemmas. The first one, Lemma 1, characterizes the solution of a special nonlinear system of algebraic equations, see (10) below. The solution values are the numbers \(\alpha _i\). Lemma 2 characterizes the function \(\beta (y)\). The proofs of both results will be given in the Appendix.

Lemma 1

(i) For positive variables \(\alpha _i\), let \(z_i:=(\gamma _i-1)\eta _i(c_i+\alpha _i)^{-\gamma _i}\), \(i=1,2,\ldots ,n\), and \(Z:=\sum _{i=1}^nz_i\). The system of equations in the unknowns \(\alpha _i\), \(i=1,2,\ldots ,n\),

which is equivalent to \(\left( \frac{1}{\gamma _i-1}\cdot \frac{c_i+\alpha _i}{\alpha _i}+1\right) z_i-r_i=Z\), has a unique positive solution vector \(\varvec{\alpha }^*=(\alpha _i^*)_{1\leqslant i\leqslant n}\) if and only if the “condition of the commons”,

holds true.

(ii) Let \((n+1)\) companies compete against each other, cf. the model description at the beginning of this section. Let the condition of the commons be satisfied for the enlarged system of Eq. (10), i.e., we consider a system like (10) with \(n+1\) equations and an additional variable. Let \(\varvec{\alpha }^*(n)\), \(\varvec{\alpha }^*(n+1)\) resp., denote the unique positive solution vector of the system with \(n\) equations, \(n+1\) equations resp. Then, for \(i=1,...,n\),

If the condition of the commons is violated for the oligopoly market with \(n\) firms, then no equilibrium exists for the market with \((n+1)\) firms, no matter what the characteristics of the entering firm might be.

(iii) Let \(c_i=0\), \(i=1,2,\ldots ,n\), and assume \(n-1<\sum _{j=1}^n \gamma _j^{-1}\). Then, there are explicit expressions of the unique solution values \(\alpha _i^*\) of (10), see (41).

In the general case, \(c_i\geqslant 0\), \(i=1,2,\ldots ,n\), the unique positive solution vector \(\varvec{\alpha }\) of (10) can be computed as described in Steps 1 – 3, see (13). To this end, define \(n\) real-valued functions \(f_i\) on the positive line, \(i=1,2,\ldots ,n\), \(f_i(\xi ):= \left( \frac{c_i}{\xi +\gamma _i}\right) \eta _i(c_i+\xi )^{-\gamma _i}-r_i\), \(\xi >0\). Moreover, without loss of generality, we select the function \(f_1\) for our analysis, and use \(\alpha _1\) as the pivoting variable. For any positive number \(\xi \) and \(j=1,2,\ldots ,n\), let \(\alpha _j>0\) denote the unique positive solution value of the equation \(f_j(\alpha _j)=f_1(\xi )\), see Appendix; we call the function \(\hat{\alpha _j}(\xi ):=\alpha _j\) the \(j\)-th reaction function. Then,

-

Step 1 Determine the reaction functions \(\hat{\alpha _j}(\xi )\) for \(j=1,\ldots ,n\), \(\xi >0\).

-

Step 2 Solve the 1-dimensional equation (in the positive unknown \(\alpha _1\)):

$$\begin{aligned} f_1(\alpha _1) = \sum _{j=1}^n (\gamma _j-1)\eta _j(c_j+\hat{\alpha }_j(\alpha _1))^{-\gamma _j}. \end{aligned}$$(13)Let \(\alpha _1^*>0\) denote the unique solution of (13).

-

Step 3 For \(j=2,\ldots ,n\), compute \(\alpha _j^*:=\hat{\alpha }_j(\alpha _1^*)\). The vector \(\varvec{\alpha }^*:=(\alpha _1^*,\alpha _2^*,\ldots ,\alpha _n^*)\) is the unique positive solution of (10).

An explanation of the construction and the details of the proof are given in the Appendix.

To get a first understanding of the importance of Lemma 1, and to have an economic interpretation of the quantities \(z_i\), choose \(\delta =0\), \(a=1\), and let all \(c_i\) be positive. Jumping ahead, cf. Theorem 4 in Sect. 4, we define \(p_i:=\frac{\varepsilon _i}{\varepsilon _i-1}(c_i+\alpha _i)\). Then, see formulas (23) and (24), \(z_i=u_ip_i^{-\varepsilon _i}\), and \(z_i\) is the demand/output rate of firm \(i\) should it set its price as defined above. Later on, see Sect. 4, we shall elaborate on this observation.

The next lemma is about the market size value \(\beta \), cf. (9). The lemma characterizes \(\beta \) as the solution of a particular Bernoulli differential equation. It is a slight extension of Lemma 3.1 in [10].

Lemma 2

Let \(\psi (y)^{1/(\varepsilon -1)}\) be a nonnegative integrable function on \([0,N]\). The solution of the Bernoulli differential equation, \(0<y<N\),

and \(\beta (0)=0\), is given by \(\beta (y)=B(y)^{(\gamma -1)/\gamma }\), where

If \(\psi (y)\) is positive on \((0,N)\) then \(\beta (y)\) and \(B(y)\) are strictly increasing functions of \(y\). Furthermore, if \(\psi '(y)\psi (y)^{-\frac{\varepsilon }{\varepsilon -1}}B(y)\leqslant 1-\delta /a\), then \(\beta (y)\) is concave. If \(\psi (y)=1\), i. e. in the case of no demand learning effects/externalities, this condition is always satisfied and \(\beta (y)=y^{(\gamma -1)/\gamma }\).

Proof

See Appendix; expressions (29) are equivalent formulations of (14). \(\square \)

In Sects. 3 and 4, we will be using Lemma 1 and Lemma 2 to solve special cases of the oligopoly problem described in this section. In contrast to dynamic advertising games analyzed by Prasad and Sethi [21] and Erickson [4, 5], where value functions of all players are linear in the state variable(s), the classes of dynamic games under consideration lead to nonlinear value functions, see formula (9).

3 A Special Market Structure but a General Adoption Function

In this section, we shall consider models with general adoption functions \(\psi \), where \(\psi ^{1/(\varepsilon -1)}\) is positive and integrable on \((0,N)\), but we assume that (i) all unit costs are zero, (ii) the price elasticities of all firms are identical, i. e. \(\varepsilon _i\equiv \varepsilon >1\), and (iii) condition (11) is satisfied. Dynamic games with evolution Eq. (2), which satisfy these properties, will be called Case I models.

For Case I models, the system (28) separates into an algebraic system of equations and a differential equation; exploit (41), (30) and the Bernoulli differential Equation (29). If all unit costs are zero and \(\varepsilon _i\equiv \varepsilon \), the solution of the algebraic system (10) is given by

Obviously, the values \(\alpha _i^*\) are independent of \(\psi \). In the symmetric case, i. e. all firms have the same characteristics, \(u_i\equiv u\), \(k_i\equiv k\), and \(r_i\equiv r\), \(i=1,2,\ldots ,n\), all \(\alpha _i^*\) are equal to the value \(\alpha _n^{sym}\), where

The value \(\alpha _n^{sym}\) is positive iff \(n<1+1/(\gamma -1)\), cf. (11). This inequality imposes an upper bound on the number of firms such that an equilibrium point exists. Expressed differently, if \(n\) is given, then the inequality \(\gamma <n/(n-1)\) imposes an upper bound on the elasticity \(\varepsilon \) in order that an equilibrium exists, viz. \(\varepsilon <1+(1-\delta /a)/(n-1)\). Hence, if the unit cost of (homogeneous) firms is zero, a Markovian Nash equilibrium of the game with \(n\) firms exists if and only if consumers are not “too” price sensitive. In the case of a monopoly, i. e. \(n=1\), the condition \(n<1+1/(\gamma -1)\) is always satisfied.

Furthermore, for Case I models there is an explicit expression of each value function \(V_i(y)\) as a product of the solution \(\beta (y)\) of the differential Eq. (29), and \(\alpha _i^*\). The two factors are defined by (14) and (16). Using the optimality conditions (23) and (24), one obtains a formula of the optimal category rate of sales \(\lambda ^*(y)\). Thus, we are able to compute and characterize the evolution of the untapped market \(y(t)\). Expressions of the individual rates and accumulated sales of each firm are implied by these formulas. The proof of the next result is given in the Appendix, see also Lemma 2.

Theorem 1

For Case I models, the equilibrium rate of sales \(\lambda ^*(y)\) in feedback form is

The equilibrium \(y\)-trajectory satisfies the equation

where \(B^{-1}\) denotes the inverse function of \(B\). For each firm \(i\), \(i=1,2,\dots ,n\), its equilibrium rate of sales equals

The accumulated sales (up to time \(t\)) of each firm are given by, \(x_i(0)=0\),

Expressions (15) and (16) together with Theorem 1, yield solution formulas of the value functions and the equilibrium strategies in feedback form, as well as in open-loop form, i. e. as functions of time, for each firm. The next theorem is a collection of such formulas. The straightforward proofs of the various formulas are based on the optimality conditions (23) and (24), and the characterization of each value function \(V_i\) as the product of the number \(\alpha _i^*\) and the function \(\beta \).

Theorem 2

For Case I models, let \(y(t)\) denote the optimal \(y\)-path given by (17). The value function (in feedback form) of each firm \(i\), \(i=1,2,\ldots ,n\), is given by

in the time-domain, it is described by

The optimal prices are

The optimal advertising rates are (see (25) for the definition of \(\theta _i\))

The optimal rates of sales are

For Case I models, see Theorem 2, a firm’s value function \(\bar{V}_i(t)\) and its optimal advertising rates \(\bar{w}_i(t)\) are exponentially decreasing functions of \(t\). The evolution of the optimal price paths \(\bar{p}_i(t)\) is determined by a product of three terms: the first factor is a company’s market power \(\alpha _i^*\); the second factor is an exponentially increasing function of time, and the third factor is a power expression of the adoption function evaluated along the optimal path \(y(t)\). Optimal advertising paths only depend on \(\psi \) via the potential \(B\) and the initial value \(y(0)\). Optimal price paths explicitly depend on \(\psi \) and the optimal path \(y(t)\). Thus, for Case I models dynamic prices are the major driving forces of the oligopolistic market. For such models, since \(\bar{C}_i(t)=0\), Proposition 2, when combined with the explicit formulas of the value functions \(\bar{V}_i(t)\), yields explicit formulas of the evolution of each firm’s specific revenue trajectory \(\bar{U}_i(t)\) and expenditure function \(\bar{W}_i(t)\). Like in a monopoly market, in an oligopoly market, depending on the structure of \(\psi \), optimal pricing strategies of the companies can be skimming policies, market penetration policies, or a combination of both principles, i.e., penetration pricing followed by a long period of declining prices. Like in Helmes et al., detailed [numerical] analyses are possible for different system functions \(\psi \). In particular, studies of the classes of power functions, Bass-functionals, von Bertalanffy dynamics, and NUI-models, cf. [3], provide insight into the many different ways that sales of firms can evolve in an oligopoly, and these studies show the interplay of firms’ pricing and advertising policies.

Next, we shall study how the market power and other important characteristics of firms depend on changes in a firm’s parameter values \(r_i\) (its discount value, which reflects its financing cost), \(u_i\) (the arrival rate), and \(k_i\) (the proportionality factor of advertising expenses). Moreover, we analyze how changes in a competitor’s parameter values influence the output characteristics of a rival firm. The general results, see Table 1, follow from sensitivity results for \(z_i\) and \(Z\) to changes in the parameter values. For Case I models, the values \(z_i\) and \(Z\) are independent of \(\eta _i\), see (27), (37) and formula (16). Hence, for Case I models, \(z_i\) and \(Z\) do not depend on \(u_i\) and \(k_i\) but only depend on \(r_i\). However, the market power values \(\alpha _i\), and thus the value functions \(V_i\) depend on \(u_i\).

The starting point of sensitivity studies is Theorem 2. Table 1, s. below, is a summary of our calculations. In Table 1, entries “\(+\)”, “\(-\)” and “\(0\)” indicate that the quantity of a column is monotone increasing (\(+\)), is monotone decreasing (\(-\)) or is independent of the parameter of a particular row; a question mark “?” indicates that no general statement is possible. For example, if the rate \(r_i\) increases (all else equal), i. e., the financing cost of company \(i\) goes up, then its market power \(\alpha _i^*\) will decrease. In such a situation, the firm’s optimal marketing strategy is to lower prices \(p_i^*(y)\) but to increase advertising spending \(w_i^*(y)\). This way, the company accelerates the growth of its market share.

Higher arrival rates \(u_i\) guarantee larger market power \(\alpha _i^*\); higher arrival rates also suggest higher prices and increased advertising spending. Since the values \(z_i\) are independent of \(\eta _i\), optimal (feedback) rates of sales \(\lambda ^*\) and \(\lambda _i^*\) are not affected by changes of \(u_i\) or \(k_i\).

The ambiguous results (s. both questions marks in the \(w_i^*\)- column) are due to the fact that the first two factors of the formula of \(w_i^*\), cf. Theorem 2, are reacting in opposite directions to changes of \(u_i\), and \(k_i\), respectively. For instance, if \(u_i\) is increasing, then the first factor \(\theta _i^a\) is increasing, while the second factor \(\alpha _i^{*1-\gamma _i}\), since \(\gamma _i>1\), will be decreasing. Hence, there is no definite result for all parameter constellations.

The following example illustrates Theorem 1 and Theorem 2. We choose the Mansfield functional \(\psi (y)=y/N (1-y/N)\), \(N=100\), as a particular adoption model, cf. [18]. This \(\psi \) function captures situations when consumers are either not very well informed about a new product or are somewhat reluctant to buy the product right from the start. This adoption function is a special Bass model with innovation coefficient 0 and imitation coefficient 1. Sales increase due to word-of-mouth. In the example, we assume that firms only differ by their arrival rates, \(u_1=20\), \(u_2=30\), and \(u_3=40\). Note, condition (11) is satisfied and, recall (16), \(\alpha _i^*\) is not affected by \(\psi \).

Example 3.1

Let \(\psi (y)=y/N(1-y/N)\), \(N=100\), \(n=3\), \(\varepsilon =1.2\), \(\delta =1\), \(a=2\), \(c=0\), \(k=1\), \(r=0.1\) and \(\mathbf {u}=(20, 30, 40)\).

Figures 1 and 2 show the evolution of various characteristics of the dynamic game of a Case I model, namely the evolution of sales, of market shares and accumulated profits; Fig. 1 also shows optimal price paths. If the financing costs of all firms are identical, i.e., \(r_i=r\), Fig. 1a illustrates the remarkable fact that the optimal rates of sales of all companies are the same, cf. formula (39); observe, the number of yet uncommitted customers decreases exponentially at rate \(Z\). The individual gains \(\bar{G}_i(t):=\bar{V}_i(0)-e^{-rt}\bar{V}_i(t)\), together with \(\bar{V}_i(t)\), are shown in Fig. 1b. The optimal price paths and optimal advertising rates are shown in Fig. 2.

All graphs of Figs. 1 and 2 clearly show the impact the arrival rate \(u_i\) has on profit and the pricing options of a firm. Since in many applications the arrival rate is related to the location of a business, the graphs illustrate the mantra in marketing: location, location, and location! A higher arrival rate of a firm implies higher prices, higher revenues, and increased market power, but also intensified advertising compared to the advertising levels of other rival firms.

Example 3.1 also illustrates the influence of the adoption function \(\psi \). The optimal price paths of all firms are closely related to the properties of \(\psi \), see Fig. 2a. In case of the special function \(\psi (y)=y/N(1-y/N)\) a market penetration pricing strategy is advised to be used. Such a strategy jump-starts sales and boosts the “word-of-mouth” momentum. Furthermore, if the market is saturated and the adoption effect is small, then optimal prices should go down. In the case of monopoly markets, additional examples and further management recommendations are discussed in [10].

4 Heterogeneous Unit Costs and Price Elasticities, but a Special Class of Adoption Functions

In this section, we consider a second class of \(n\)-player differential games. This class is characterized by the property that the \(\psi \)-function belongs to a special class of power functions, \(\psi (y)=y^{(a-\delta )/a}\), \(0\leqslant \delta <a\); it captures a (new) product adoption with a special saturation effect. The intensity functions \(\lambda _i\) are again given by (1), and each firm \(i\), \(i=1,2,\ldots ,n\), is characterized by individual parameters \(c_i\geqslant 0\), \(\varepsilon _i>1\) and positive values \(r_i\), \(u_i\), and \(k_i\). If condition (11) holds, we call this class of differential games Case II models. Recall, if all \(c_i\), \(i=1,2,\ldots ,n\), are positive, then the condition of the commons (11) is always satisfied no matter how many companies are competing for customers.

The special parameter choice \(n=2\), \(a=2\) and \(\delta =1\) specifies the duopoly model analyzed in [13]. Case II models also include the pure pricing model with a linear adoption function \(\psi (y)=y\) as a very special case. The pure pricing model can be parameterized choosing \(\delta =0\) and any positive value \(a\). This choice of parameter values implies \(w^*=0\) for all firms \(i\), \(i=1,2,\ldots ,n\).

For Case II models, to find solutions for (8) we try, see [13] and also [10], the linear “Ansatz”, \(i=1,2,\ldots ,n\),

Since \(\psi \) is a very special power function, the coupled system of ODEs (8) simplifies and reduces to the identities

Since \(y\) is a common factor of all three terms of (20), Lemma 1 can be applied. It guarantees a unique positive solution of (20). In the special case of \(n\) symmetric firms, the algebraic system (20) collapses to one equation in one unknown,

In the case of a monopoly, i. e. \(n=1\), equation (21) becomes

If \(c=0\), we obtain the formula \(\alpha ^{mon}=(\eta /r)^{1/\gamma }\), and we have an explicit expression of the value function

see [23] and [10]. In the general case with heterogeneous firms, we are able to numerically compute the solution values \(\alpha _i\) of (20), cf. Steps 1 – 3 in Section 2.2. Moreover, the very special dependence of the value functions \(V_i(y)\) on \(y\), see (19), when combined with the formulas of the optimal feedback controls \(p_i^*\) and \(w_i^*\), see (23) and (24), makes it possible to compute the optimal rates of sales \(\lambda _i^*(y)\) and the accumulated rate \(\lambda ^*(y)\). Hence, the evolution of the category sales can be easily computed, see the following theorem and its proof in the Appendix.

Theorem 3

For Case II models, we have, \(i=1,2,\ldots ,n\), \(0\leqslant t<\infty \),

For Case II models, the rates of sales \(\lambda _i^*(y)\) and \(\lambda ^*(y)\) are linear functions of the untapped market share \(y\). Using the feedback formulas of the optimal controls and Proposition 2, we obtain the evolution of all other quantities of interest of such models.

Theorem 4

For Case II models, we have, \(i=1,2,\ldots ,n\), \(0\leqslant t<\infty \),

Proof

All formulas follow from Theorem 1 and Proposition 2 once the necessary optimality conditions (23) and (24) are combined with (19). \(\square \)

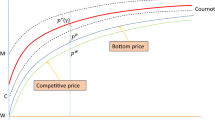

When combined with Lemma 1, the previous two theorems show that in an asymmetric oligopoly market with (special) externalities the structure of optimal prices and the value function of each agent are the same as in the case of a duopoly, cf. [13]. If the condition of the commons hold, then optimal prices are constants and the value functions are linear in the cumulated sales of all firms. A crucial difference between the two market environments - the case of a duopoly and a general oligopoly - is the surcharge that the competing firms can impose on top of the basic mark-up \(c_i\varepsilon _1/(\varepsilon _i-1)\). More firms imply lower surcharges, i.e., lower equilibrium prices. On the other hand, should companies exit the market, then an existing equilibrium will prevail, but prices will go up! These most relevant facts all follow from Lemma 1 (ii). Furthermore, taking the quotient of cumulative sales of two rivals \(i\) and \(j\) shows that in equilibrium this ratio is independent of time, and equals the ratio of the corresponding growth coefficients \(z_i/z_j\).

For a market of homogeneous firms, there are simplifications and refinements of all the results; in particular, there are refined results for the problems of entering firms and exiting firms.

Proposition 3

For symmetric Case II models, the following properties hold:

-

(i)

If \(u_i(n)=u(n)=u\), \(i=1,\ldots ,n\) (more firms attract more customers), then \(\eta (n)=\eta \), \(\alpha _n^{sym}\) is decreasing and \(z_n^{sym}\) is increasing in \(n\). Moreover, \(Z(n)=nz_n^{sym}\) increases super-linearly in the number of competing firms.

-

(ii)

If \(u(n)=u/n\), \(u>0\) fixed (the customer base is equally shared by all firms), then the product \(\eta (n)n^{a/(a-\delta )}\) is independent of \(n\), and \(\alpha _n^{sym}\) is decreasing in \(n\).

-

(iii)

If \(u(n)=u/n\), then the quantity \(Z(n)\) is given by the formula,

$$\begin{aligned} Z(n) = n(\gamma -1)\eta (n)\left( c+\alpha _n^{sym}\right) ^{-\gamma }. \end{aligned}$$(22)If \(\delta =0\), then \(Z(n)\) is increasing in \(n\). If \(\delta >0\), then \(Z(n)\) will be decreasing for large values of \(n\).

Proof

(i) Note, the left hand side of (21) is a decreasing function in the variable \(\alpha _n^{sym}\). Hence, if the right hand side increases, i.e., more firms are competing against each other, then the solution of Eq. (21) moves to the left, and the first claim follows. If \(\alpha _n^{sym}\) is decreasing in \(n\), it follows by definition, see (20), that \(z_n^{sym}\) is increasing.

(ii) This time, \(\eta \) depends on \(n\) and, by definition, see (27),decreases in \(n\). Taking this property into account, we can repeat the arguments of the proof of (i). Since \(z_n^{sym}:=(\gamma -1)\eta (n)(c+\alpha _n^{sym})^{-\gamma }\), formula (22) immediately follows.

(iii) Using (22) and the relationship that \(\eta (n)n^{a/(a-\delta )}\) is constant, we deduce the properties of \(Z(n)\). \(\square \)

For the case of symmetric firms, the results (ii) and (iii) of Proposition 3 are most important. They show, for instance, that the optimal equilibrium price and the value of each firm decrease with the number of competing firms should increased competition erodes the customer base of each firm, i.e., \(u(n)=u/n\).

The following two examples illustrate these theoretical results and properties which are typical for Case II models. Example 4.1 highlights how the number of competing firms \(n\) affects optimal prices, profits, etc., in such a case, see, in particular, the second coloumn and the last one of Table 2. Table 3 illustrates part (iii) of Proposition 3, in particular, the non trivial impact advertising has on market share if the number of competitors is increasing. The saturation function used in both examples has been considered by Sethi et al. [23] in the case of a monopoly, but only for the special case that the unit cost \(c\) is zero, see also Helmes et al. [10]. As nicely explained by Sethi et al. [23], this special \(\psi \) function is a reasonable approximation of a Bass functional. The second example, cf. Example 4.2, illustrates the case of asymmetric oligopolies.

Example 4.1

Let \(\psi (y)=\sqrt{y}\) and \(\delta =1\), \(a=2\). We study how several companies rival for \(N=100\) “batches” of customers. Tables 2 and 3, see below, illustrate—for Case II models—how variations of the parameters affect optimal prices, profits, etc., of each firm. We choose the following symmetric situation as a benchmark for our analysis: \(\varepsilon =1.8\), \(c=10\), \(k=1\), \(r=0.1\) and \(u(n)=30/n\), \(n\) the number of competing firms. Note, since the customer base is fixed the arrival rate of customers of each firm decreases with the number of firms competing in the market.

The values of \(a\), \(\delta \), and \(\varepsilon \) imply the leveraged price elasticity of demand \(\gamma \) to be 2.6. The choice \(u(n)=30/n\) assumes the fixed arrival intensity of shoppers, 30, to be equally split among all firms. Hence, if a price \(p\) and an advertising rate \(w\) are chosen, then the initial rate of sales facing a monopolist equals \(30p^{-2.5} w\sqrt{100}\). Should, instead, 10 brands compete in the market, then this rate drops to a meagre \(3p^{-2.5} w\sqrt{100}\) for each brand. Example 4.1 is representative of market situations where an increasing number of competing firms does not stimulate the shopping behavior of customers; gas stations are a well-known example.

Before analyzing how the equilibrium varies with the number of brands, it is instructive to exploit Theorem 4 and formula (21) in the case of a monopoly. If \(n=1\) and \(\psi (y)=\sqrt{y}\), the monopoly price will be \(\frac{\varepsilon }{\varepsilon -1}c\) plus the additional mark-up \(\frac{\varepsilon }{\varepsilon -1}\alpha ^{mon}\), where \(\alpha ^{mon}\) satisfies the equation \(\alpha ^{mon}=10\eta (10+\alpha ^{mon})^{-1.6}\), and \(\eta :=(25/3)^2\cdot 2.25^{-1.6}=18.97\), cf. (27). Thus, \(\alpha ^{mon}=3.0956\), \(\varepsilon c/(\varepsilon -1)=22.5\) and the monopoly price \(p^{mon}\) equals \(29.47\). If the number of firms \(n\) is increasing, then the solution value \(\alpha _n^{sym}\) – as a function of \(n\) – will converge to 0, cf. Proposition 3, and the optimal price approaches \(\varepsilon c/(\varepsilon -1)=22.5\).

Table 2 illustrates the dependence of profits \(V_n^{sym}=\alpha _n^{sym} N\), revenues \(\bar{U}_n^{sym}\), production costs \(\bar{C}_n^{sym}\), advertising spending \(\bar{W}_n^{sym}\), and market prices \(\bar{p}_n^{sym}\) (last column of Table 2) on \(n\). The numbers show that these quantities might drop substantially if more firms enter the market and the (fixed) number of consumers is spread equally among all firms.

Table 3 illustrates how the speed of sales, determined by \(Z(n)\), see Theorem 3, depends on the number of competing firms and on the parameter \(\delta \), \(\delta \in \{0,\,0.2,\,1\}\). The case \(\delta =0\) corresponds to the pure pricing model. It follows from Proposition 3 (iii) that in the case of a pure pricing model, \(Z(n)\) is monotone increasing in the number of competing (symmetric) firms. If \(\delta >0\), \(Z(n)\) is either a unimodal function (increasing, then decreasing) or a monotone decreasing function. Formula (22) reveals that, if \(\delta >0\), the postulated asymptotic behavior of \(Z(n)\) follows from the fact that \(\alpha _n^{sym}\) decreases to zero, should \(n\) converge to infinity.

The total producers surplus \(nV_n^{sym}\) decreases in \(n\), and the rate of decrease is significantly larger, if \(\delta \) is big. Thus, if advertising is possible, then competition is more intense compared to situations without advertising.

Next, we will study the case of heterogeneous firms.

Example 4.2

Let \(\psi (y)=\sqrt{y}\), \(\delta =1\), \(a=2\), \(N=100\), and \(n=3\). If not chosen otherwise, the parameters \(\varepsilon =1.8\), \(c=10\), \(k=1\), \(r=0.1\), and \(u=10\) are the ones of the reference model, see. below.

Tables 4, see. below, and Tables 6, 7, 8 and 9, see Appendix, illustrate different scenarios of a 3-firm competition characterized by the saturation effect \(\sqrt{y}\). Each table illustrates the dependence of quantities like profit \(V_i\), revenue \(U_i\), etc., on variations of just one of the five characteristics \(u_i\), \(\varepsilon _i\), \(c_i\), \(r_i\), and \(k_i\). In all scenarios, Firm 2 represents the reference model, while Firm 1 always enjoys a competitive advantage over the other two firms. Firm 3 is always the one with a handicap.

For example, see Table 4, the price elasticity of Firm 1, \(\varepsilon _1=1.7\), is smaller than \(\varepsilon _2=1.8\) and \(\varepsilon _3=1.9\). The smaller elasticity value 1.7, compared to 1.8 and 1.9, could be due to many reasons, e. g. a stellar image of the brand, good quality reputation, a product with special and attractive features, etc. The arrival intensities at all three locations are the same, \(u_1=u_2=u_3=10\). If not chosen differently, we use the parameters specified above, see Example 4.2; \(n=3\) will be norm.

In the case of Example 4.2 with different elasticities, the firm with the smallest elasticity value will experience the highest profit, see Fig. 3, and will charge the highest price, cf. Fig. 4a. However, Firm 1 will spend more on advertising than its competitors do; it is trying to attract many shoppers to be turned into profitable buyers. Firm 3, at the other end of the spectrum, will set a low price, and its profit, 23.03, is less than a third of the profit of the top brand.

The study of different elasticities describes a typical oligopoly market consisting of a high quality firm, an average quality firm and a discounter. We observe three different (optimal) price levels and matching decreasing advertising expenditures. As expected, the high quality (or very reputable) firm experiences the largest profit as a result of the lowest price elasticity. However, other numerical examples show that the market shares of firms also critically depend on the (relative) magnitude of the production costs. For small values of \(c\), the firm facing the smallest price elasticity will still set the highest price, but Firm 3, the one with the “handicap”, might be gaining the biggest share of the market. Such parameter settings and solutions correspond to oligopoly markets where the top brand only sells a small number of high quality products, whereas a “discounter,” following a low price strategy, captures most of the market. The business results of the “in between” firm, Firm 2, are usually—as to be expected—somewhere in between the two extremes.

The impact of variations of arrival rates \(u_i\), of unit costs \(c_i\), of discount rates \(r_i\), and variations of advertising efficiency coefficients \(k_i\) are summarized in the Appendix, see Tables 6–9.

Remark 1

Case II models arise in many different applied contexts. Due to the non trivial relationship between market power values \(\alpha _i\) and market shares \(z_i/Z\), different phenomena can be observed, see. above. Many such phenomena, for instance, long terms market shares of duopolies/triopolies, can be explained by properly chosen parameter settings. Numerical studies reveal the nontrivial interplay of such (parameter) asymmetries. Such studies can be used to calibrate model parameters when analyzing specific market situations.

5 Conclusions

In this paper, we have developed and analyzed dynamic pricing and advertising oligopoly models for two specific market situations. These models allow us to study the competition for sales of (category) brands by any finite number of firms. The two classes of models generalize and complement the duopoly game analyzed by Krishnamoorthy et al. The formulas of the equilibrium (feedback) pricing and advertising strategies which we have derived offer quantitative insights into the dynamic of the competition for sales in particular oligopoly markets. Specifically, these insights comprise a full understanding of the impact on equilibrium prices of firms entering (the market) or leaving the market. From the point of view of an entering firm, this understanding puts it in the position to evaluate its chances in noncollusive competitive environments. From the point of view of a monopolist or a collusive oligopoly, the firm(s) can calculate and set a model-based limit price to prevent a firm from entering the market. The open-loop versions of our solution formulas make it possible to simply evaluate different scenarios, and predict the evolution of market share, revenue, cost, etc., over time of each company.

The main theoretical result of the paper is the existence of a unique feedback Nash equilibrium of oligopolies with special structure. The existence of such an equilibrium primarily depends on the number of firms, the price elasticity of demand and whether or not the individual marginal costs of competing firms are zero. We give a necessary and sufficient condition, the ’condition of the commons’, for the existence of a unique equilibrium.

Furthermore, we have shown that the value function of each firm depends on a common market factor and a firm-specific coefficient. The market power coefficient reflects the (nontrivial) interplay of the various characteristic parameters of all firms, i.e., brand image, financing, and production costs, as well as technology and location factors. These coefficients can be used to identify and to evaluate competitive strengths and weaknesses of firms for specific applications.

Moreover, sensitivity results were derived. In particular, we have shown how the market power equilibrium is affected by the exit of firms and the entry of new firms. The results explain that the entry of a competitor—in symmetric, as well as asymmetric market situations—leads to lower equilibrium prices and a loss of market power of each firm.

Our analysis also highlights the interplay of dynamic pricing and advertising. Like in the case of a monopoly, in Case I and Case II oligopoly markets price adjustments are synchronized with advertising adjustments, and the benefit of advertisement is quantified by the leveraged price elasticity.

Notes

We assume the number of customers is large enough so that it is a valid approximation to treat \(N\), \(x\) and \(y\) as continuous variables.

References

Dockner EJ, Feichtinger G (1986) Dynamic advertising and pricing in an oligopoly: a Nash equilibrium approach. In: Basar T (ed) Proceedings of the Seventh Conference on Economic Dynamics and Control, Springer, Berlin, pp 238–251

Dockner EJ, Jørgensen S, van Long N, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Easingwood CJ, Mahajan V, Muller E (1983) A nonuniform influence innovation diffusion model of new product acceptance. Mark Sci 2(3):273–295

Erickson GM (2009) An oligopoly model of dynamic advertising competition. Eur J Oper Res 197(1):374–388

Erickson GM (2011) A differential game model of the marketing-operations interface. Eur J Oper Res 211(2):394–402

Fruchter GE (1999) The many-player advertising game. Manag Sci 45(11):1609–1611

Fruchter GE, Kalish S (1998) Dynamic promotional budgeting and media allocation. Eur J Oper Res 111(1):15–27

Harris C, Howison S, Sircar R (2010) Games with exhaustible resources. SIAM J Appl Math 70:2556–2581

Helmes K, Schlosser R (2013) Dynamic advertising and pricing with constant demand elasticities. J Econ Dyn Control 37:2814–2832

Helmes K, Schlosser R, Weber M (2013) Optimal advertising and pricing in a class of general new-product adoption models. Eur J Oper Res 229:433–443

Huang J, Leng M, Liang L (2012) Recent developments in dynamic advertising research. Eur J Oper Res 220:591–609

Jørgensen S, Zaccour G (2004) Differential games in marketing. Kluwer Academic Publishers, Boston

Krishnamoorthy A, Prasad A (2010) Optimal pricing and advertising in a durable-good duopoly. Eur J Oper Res 200:486–497

Ledvina A, Sircar R (2011) Dynamic Bertrand oligopoly. Appl Math Optim 63:11–44

Mahajan V, Muller E (1979) Innovation diffusion and new product growth models in marketing. J Mark 43(4):55–68

Mahajan V, Muller E, Bass FM (1990) New product diffusion models in marketing: a review and directions for research. J Mark 54(1):1–26

Mahajan V, Muller E, Wind J (2000) New product diffusion models. Kluwer Academic Publishers, New York

Mansfield E (1961) Technical change and the rate of imitation. Econometrica 29:741–766

Nerlove M, Arrow KJ (1962) Optimal advertising policy under dynamic conditions. Economica 39:129–142

Peres R, Muller E, Mahajan V (2010) Innovation diffusion and new product growth models: a critical review and research directions. Int J Res Mark 27:91–106

Prasad A, Sethi S P (2003) Dynamic optimization of an oligopoly model of advertising. Working paper. UTD School of Management

Schmalensee R (1972) The economics of advertising. North-Holland, Amsterdam

Sethi SP, Prasad A, He X (2008) Optimal advertising and pricing in a new-product adoption model. J Optim Theory Appl 139(2):351–360

Teng J-T, Thompson GL (1984) Optimal pricing and advertising policies for new product oligopoly models. Mark Sci 3(2):148–168

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

see Appendix Tables 5, 6, 7, 8 and 9

1.1 Collection of Formulas

Optimality conditions:

where

Auxilliary parameters:

Characterization of value functions by ODEs: \(\beta =\beta (y)\), \(\psi =\psi (y)\), etc.

Bernoulli differential equation for \(\beta (y)\) (market effect):

Case I. (Special form of (28)): \(z_j=(\gamma -1)\eta _j\alpha _j^{-\gamma }\),

Proofs

Proof of Lemma 1 We shall subdivide the proof into four main parts, (i) reducing the system of equations to the analysis of a particular nonlinear equation, (ii) existence of a solution of this particular equation, (iii) uniqueness, and (iv) dependence on \(n\). Each part will be subdivided into several steps. In Part 1, we show how the analysis of the system of equations can be reduced to the analysis of a particular nonlinear equation in one unknown. The final part, Part 5, exhibits explicit solution formulas of the components \(\alpha _i\), if all cost parameters are zero.\(\square \)

1.2 Part 1: Reducing the system to one equation

If there is a positive vector \(\varvec{\alpha }=(\alpha _i)_{1\leqslant i\leqslant n}\) such that

then simple algebra shows that \(\varvec{\alpha }\) satisfies the system of equations,

where \(Z:=\sum _jz_j\), and \(z_i\) is defined in Lemma 1, see also (31). We define \(n\) real-valued functions \(f_i\) on the positive real line, \(\xi >0\), \(i=1,2,\ldots ,n\),

If \(\varvec{\alpha }\) satisfies (32), then \(f_1(\alpha _1)=f_2(\alpha _2)=\ldots =f_n(\alpha _n)=Z\). Observe, each function \(f_i\) is strictly monotone decreasing, \(f_i(0+)=+\infty \), and \(\lim _{\xi \rightarrow \infty }f_i(\xi )=-r_i\). We denote the unique root of each \(f_i\) by \(\alpha _i^{(0)}\) and we consider the intervals \((0,\alpha _i^{(0)}]\), \(i=1,2,\ldots ,n\); when \(f_i\) is restricted to this interval, the range of \(f_i\) equals \([0,\infty )\). From now on - without loss of generality - we choose the function \(f_1\) to work with. By definition, for any \(\kappa \geqslant 0\), there is a unique \(\xi \) in \((0,\alpha _1^{(0)}]\) such that \(\kappa =f_1(\xi )\), and, for \(i=2,...,n\), there are unique positive numbers \(f_i^{-1}(f_1(\xi ))=:\chi _i(\xi )\) in \((0,\alpha _i^{(0)}]\) such that

By construction, \(\chi _i(\xi )\) are monotone increasing functions on \((0,\alpha _i^{(0)}]\). We are looking for positive vectors \(\varvec{\alpha }=(\alpha _i)_{1\leqslant i\leqslant n}\) which solve system (32). If \(\varvec{\alpha }\) is positive, then \(\mathbf {z}=(z_j)_{1\leqslant j\leqslant n}\) is a positive vector and \(Z=\sum _j(\gamma _j-1)\eta _j(c_j+\alpha _j)^{-\gamma _j}\) is a positive number; moreover, the values \(f_i(\alpha _i)\) are positive as well. Since \(f_i(\xi )\) is nonpositive whenever \(\xi \geqslant \alpha _i^{(0)}\), any component \(\alpha _i\) of a positive solution vector \(\varvec{\alpha }\) needs to be less than \(\alpha _i^{(0)}\) Table 5.

To find the first component \(\alpha _1\) of a solution \(\varvec{\alpha }\), we define a particular nonnegative monotone decreasing function \(G\) on \((0,\alpha _1^{(0)}]\), namely

If \(\alpha _1\) is the first component of a solution of (32), then the equation \(G(\alpha _1)=f_1(\alpha _1)\) has to be satisfied. We shall verify that the equation \(G(\xi )=f_1(\xi )\) has at least one solution \(\xi >0\). In Part 3, see below, we will show that the equation has exactly one solution. If \(\alpha _1\) is known, then all other components of a positive solution vector \(\varvec{\alpha }\) are given by \(\alpha _j=\chi _j(\alpha _1)\), \(2\leqslant j\leqslant n\).

1.3 Part 2: Existence (a necessary and sufficient condition)

To prove existence of a positive value \(\alpha _1\), we shall employ the Intermediate Value Theorem. To be specific, we verify that (a),

i. e. the graph of \(f_1\) lies above the graph of \(G\) in a neighbourhood of zero, and (b), \(G\) dominates \(f_1\) for large values \(\xi \). The last statement is obvious, since

To see that \(f_1\) dominates \(G\) in a neighbourhood of zero we observe that \(\lim _{\xi \rightarrow 0}\chi _j(\xi )=0\), \(j=1,2,\ldots ,n\). This last property follows from the fact that \(\lim _{\xi \rightarrow 0}f_j^{-1}(f_1(\xi ))=0\). The behavior of \(G\) in a neighborhood of zero depends on how many cost coefficients \(c_j\) are positive. If all \(c_j\) are positive, then \(G(0+)\) is finite, while \(f_1(0+)=\infty \). If there is at least one parameter \(c_j\) which is equal to zero, then \(G(0+)=\infty \). To see that \(G\) stays below \(f_1\), we analyze the quotient of both functions \(G\) and \(f_1\). Applying l’Hopital’s rule, we obtain

To streamline the expression on the right hand side of the last equation, we introduce the abbreviation \(\xi _j:=\chi _j(\xi )=f_j^{-1}(f_1(\xi ))\). Taking the derivatives of all functions \(f_j\), simple algebra yields

If \(\xi \) converges to zero, we obtain

Let \(J_0:=\{j|c_j=0, j=1,...,n\}\) and \(H:= \sum _{j\in J_0}(1-1/\gamma _j)\). Next, we consider the following two cases: \(H\geqslant 1\) and \(H<1\). In the first case, the fact that the sum is greater or equal to one, together with (37), implies, \(\xi >0\),

Thus, the (negative) slope of \(G\) is steeper than the (negative) slope of \(f_1\). Since \(G\) dominates \(f_1\) in a neighborhood of \(\alpha _1^{(0)}\), and \(G'(\xi )\leqslant f_1'(\xi )<0\), the difference between \(G\) and \(f_1\) will always be positive on \((0,\alpha _1^{(0)}]\). Hence, if \(H\geqslant 1\), there will never be a solution of (31). On the other hand, (37) implies that the condition of the commons, \(H<1\), is necessary and sufficient for a solution of \(G(\xi )=f_1(\xi )\) to exist. Observe that the strict inequality and (37) imply \(G\) to be dominated by \(f_1\) in a neighborhood of zero. Together with (35), at least one positive solution \(\alpha _1\) exists. Recall, if all unit cost coefficients \(c_j\) are positive, then the condition of the commons is always satisfied.

1.4 Part 3: Uniqueness

Assume the condition of the commons holds true. Part 2 implies that there is at least one solution of the equation

Since the graph of \(f_1\) starts above the graph of \(G\) and ends below it, the number of intersections of the two functions is odd. Should there be more than one solution of (38), then the functions \(G\) and \(f_1\) intersect at least 3 times and, by the Mean Value Theorem, the functions have to have the same slope at two different locations. To see that this last statement contradicts (36), we distinguish between the following two possibilities, (i) all \(c_j\) are zero, and (ii) there is at least one positive \(c_j\). If all \(c_j\) are zero, then \(G'(\xi )/f_1'(\xi )=\sum _{j=1}^n(1-1/\gamma _j)\), and the slopes of \(f\) and \(G\), at any \(\xi \), are never the same if a solution of (38) exists.

Should there be at least one positive cost coefficient, say \(c_l\), then \(G'(\xi )/f_1'(\xi )\) is strictly monotone increasing, and there can be only one location where the slopes are the same. To see that the ratio \(G'/f_1'\) is a strictly monotone increasing function, observe that each denominator of the terms of the right hand side of (36) is decreasing in the variable \(\xi _j=\chi _j(\xi _1)\), and the term involving the variable \(\xi _l\) is strictly decreasing in \(\xi _l\). Moreover, \(\chi _j(\xi _1)\) is monotone increasing in \(\xi _1\). Hence, the ratio \(G'(\xi _1)/f_1'(\xi _1)\) is a strictly increasing function too. Thus, the uniqueness of a positive solution \(\alpha _1\) of (38), as well as the uniqueness of a positive solution vector \(\varvec{\alpha }\) of (31) follows.

1.5 Part 4: Dependence on the number of firms

If there are \(n+1\) equations of the form (10), we shall add one additional function \(f_{n+1}\) to the family of functions \({f_1,...,f_n}\), cf. (33). Notice that in Part I of the existence proof, we are free to choose any element of \({f_1,...,f_{n+1}}\) to be used for the construction of the solution \(\varvec{\alpha }^*(n+1)\); w.l.o.g. we will choose \(f_1\) for both systems of equations. Observe, the function \(G\), see (34), is isotone in the number of equations, i.e., \(G\) based on \(n+1\) terms dominates the sum with only \(n\) terms. Thus, \(\alpha _1(n+1)<\alpha _1(n)\). Since the functions \(\chi _j\), \(j=2,...,n\), are strictly monotone increasing, the claim follows.

1.6 Part 5: Explicit Solution Formulas (all unit costs \(c_j\) are zero)

To conclude, we display the explicit solution of equation (32) if all \(c_j=0\). If all cost coefficients are zero, (32) simplifies, and we get \(Z=f_i(\alpha _i)=\gamma _i \eta _i\alpha _i^{-\gamma _i}-r_i= \frac{\gamma _i}{\gamma _i-1} z_i-r_i\). This system of equations is equivalent to the system

Taking the sum of all \(z_i\), we obtain

Since all \(c_i=0\), using the definition of \(\alpha _i\) in terms of \(z_i\), see above, and using (39) and (40), we can express the unique solution value \(\alpha _i\) in terms of the parameter \(u_i\), \(k_i\), and all \(r_j\), \(\gamma _j\), \(j=1,2,\ldots ,n\):

\(\square \)

Proof of Lemma 2 Elementary calculations show that \(\beta (y)=B(y)^{1-1/\gamma }\) is a solution of the Bernoulli Eq. (14), see Lemma 2. The facts that \(\beta \) and \(B\) are increasing functions are an immediate consequence of formula (13). It remains to show that \(\beta (y)\) is concave on \([0,N]\), if the condition \(\psi '(y)\psi (y)^{\frac{-\varepsilon }{\varepsilon -1}}B(y)<\frac{1-\delta }{a}\) holds true. Since \(\beta '(y)=B(y)^{-\frac{1}{\gamma }}\psi (y)^{\frac{1}{\varepsilon -1}}\psi '(y)\), the second derivative of \(\beta \) is given by \(\beta ''(y)=\frac{-1}{\gamma -1}\,B(y)^{\frac{-1-\gamma }{\gamma }}\psi (y)^{\frac{2}{\varepsilon -1}}+B(y)^{\frac{-1}{\gamma }}\frac{1}{\varepsilon -1}\,\psi (y)^{\frac{2-\varepsilon }{\varepsilon -1}}\psi '(y)\), and the assertion follows. \(\square \)

Proof of Theorem 1 By definition, see Sect. 2.1, \(\dot{y}=-\lambda \), where \(\lambda =\sum _{i=1}^n \lambda _i\). Using the optimality conditions (23) and (24), we obtain

Taking the sum of all \(\lambda _i^*(y)\), we obtain

Since the Bernoulli differential equation (14) can be equivalently written as

elementary transformations yield the formula of \(\lambda \). To see (17), evaluate (42) along an optimal trajectory \(y(t)\). Multiplying (42) by \(\beta '(y(t))\) yields the differential equation

Since \(y(0)=N\), we obtain the formula \(\beta (y(t))=\beta (N)e^{-Zt}\). Since \(B\) is strictly increasing, (17) follows. Since \(-\frac{\dot{y}}{Z}=\frac{\beta (y)}{\beta '(y)}\), cf. (42), integrating the individual rates \(\lambda _i^*(y(t))\) yields the accumulated sales of each company

\(\square \)

Proof of Theorem 3 It follows from the proof of Theorem 1 that, \(1\leqslant i\leqslant n\),

Taking the sum of the individual rates of sales implies

The solution of this elementary differential equation is \(y(t)=e^{-Zt}N\).

When integrating the individual rates \(\lambda _i^*(y)\) we get

\(\square \)

Rights and permissions

About this article

Cite this article

Helmes, K., Schlosser, R. Oligopoly Pricing and Advertising in Isoelastic Adoption Models. Dyn Games Appl 5, 334–360 (2015). https://doi.org/10.1007/s13235-014-0123-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-014-0123-1